Abstract

Customers increasingly prefer the provision of comprehensive solutions over buying goods and services separately. Whereas researchers have closely studied the servitization of large manufacturers, the situation of small and medium sized firms as well as of services firms has been neglected. In contrast to the one-sided view of servitization, we propose a comprehensive view of hybridity to capture the transformation of firms from pure to hybrid products and to focus on SMEs across a wide range of sectors. Based on a survey of 190 SMEs in a highly industrialized southern German region, we find hybrid firms to be more likely than pure firms—both manufacturing and service firms—to engage in a higher scale and scope of innovation activities, to use absorptive capabilities in the appropriation of external knowledge, and to collaborate with partners in the innovation process. We argue that collaboration offers a sustainable path towards hybridity for SMEs, and that territorial hybridity can be a viable path for regions towards sustainable development.

1. Introduction

The current well-being and future sustainability of firms depends on their ability to innovate and to meet evolving consumer demands [1]. Because customers ultimately seek comprehensive solutions to specific problems that often entail both physical goods, such as commodities, technology, or machinery as well as services, such as training, consulting, software, or maintenance, suppliers increasingly face the challenge to combine goods and services into comprehensive or hybrid products [2,3]. We define a product as the sum of characteristics that satisfy customer needs [4]. Hence, a product is represented as a vector of characteristics, which can include tangible goods as well as intangible services [5].

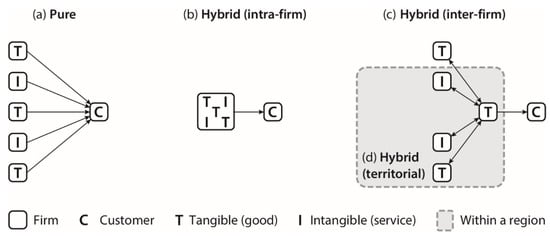

Today, the exclusive provision of goods without the support of product-related services is seen as no longer viable for manufacturers to sustain long-term economic growth and prosperity [6,7]. In such a case, all the transaction effort is passed to the customer who has to purchase all the individual goods and services, which only together fulfil his or her demand, from separate providers (Figure 1a). Therefore, large manufacturers have started to servitize their products by offering not only goods but also product-related services. Today services generate a third of sales in large U.S. manufacturing firms [8], and over 60 percent of all manufacturers in Western countries offer combinations of goods and services [9,10]. Similarly, German, Austrian, and Swiss manufacturers generate up to two thirds of their revenues with product-related services [11].

Figure 1.

A typology of intra-firm, inter-firm, and territorial hybridity.

The notion of servitization refers to a process of integrating value-adding services “into [the] offerings of manufacturers shifting the basis for competition from cost to innovative differentiation” [12], p.1. It is thus a horizontal diversification strategy to preserve customers and spread risks [9]. Researchers have discussed the phenomenon using several terms, such as hybrid offerings [13], servitization [6,14], product-service-systems [15,16], or servitization of manufacturing [17,18,19]. Paiola and Gebauer [20] showed that all these concepts have in common that they effectively look at “the process of creating value by adding services to products” [17,20].

Because of the initial focus on manufacturing firms [6], empirical research has almost exclusively concentrated on manufacturing sectors [14,18,19,20,21,22,23]. In turn, service sectors and small and medium sized firms (SMEs) have been largely neglected. Little is known about how these types of firms respond to complex customer demand. To fill this empirical research gap, we focus on SMEs and aim to look from both ends of pure manufacturing and pure services toward what we call hybrid products and firms. We prefer the term hybridity over servitization to take a comprehensive view across all sectors of the economy and not just manufacturing industries. We argue that hybridity unfolds as a process from two opposite sides: the servitization of manufacturing and the productization of service firms [15]. We purposively choose the term hybridity to include all types of firms that operate somewhere on a continuum between purely tangible goods and purely intangible services [13,24]. Apart from products, scholars use the term “hybridity” to address strategies [25] or as synonym for a product-service system [15]. We explicitly address firms but not in the sense of non-profit and for-profit [26], but rather in relation to their position on the continuum between pure manufacturers and pure service firms.

Hybridization both requires and inspires innovation. On the one hand, pure firms—whether exclusive manufacturers or exclusive service firms—need to absorb and build new competencies that often are not closely linked to existing capabilities and therefore require innovation in processes, technologies, and organization and in interconnecting new and existing competencies to realize value from hybridization. On the other hand, once firms have adopted new sets of capabilities, they draw on more diverse skill sets that enable them to come up with new innovations and raise productivity [14,20,27,28]. In order to better understand the organizational sources and innovative outcomes of hybridity, we take a perspective of dynamic capabilities.

In the context of one regional economy in southern Germany we examine the paths of SMEs toward hybridity by assessing the magnitude of hybridity, and by testing for differences between pure (manufacturing or services) and hybrid firms regarding innovation activities, absorptive capabilities, and inter-firm collaboration. Empirically, our analysis builds on a survey on 190 SMEs in the southern German region of Heilbronn–Franconia.

Our findings suggest that hybrid firms are more likely to innovate across all types of innovation. They are initiators of product, process, and organizational innovations and are not only sources of innovation but also facilitators for the innovation of partners and clients. The higher propensity of hybrid firms to innovate comes along with a higher absorptive capability than in pure firms. We find evidence that regional collaboration can be a viable strategy for hybridization as well as for organizing sustainable regional development. Finally, hybrid SMEs are more frequently involved in cooperation, although extra-regional relations predominate over intra-regional ones.

2. Theory and Hypotheses

2.1. Dynamic Capabilities

The process of organizational hybridization consists of combining and transforming tangible goods and intangible services into hybrid products. This process depends on an organization’s capacity to capture and entangle different sets of competencies and technologies in ways that help adopt and create new competencies, routines, and products in order to meet diverse and changing consumer demands. In this context, the resource-based view of the firm (RBV) serves as a particularly useful analytical perspective to analyze the organizational ability to adopt and convert resources into value-added products. Being established as early as in the 1970s, the RBV aimed to counter the predominance of asset-based thinking. Rather than treating the quality and quantity of resources as sufficient or decisive to account for variations in corporate competitiveness, the RBV puts emphasis on the intra-organizational processes that transform resources into productive outcomes [29,30,31]. Whether a given resource renders higher or lower value-added depends on firm-specific competencies, underlying organizational mental models, and on the specific market conditions [32]. When scholars began to view the RBV as too static approach to account for firms’ responses to changing market environments [33,34,35], they proposed a complementary perspective of dynamic capabilities to capture intra-organizational change, learning, and innovation. In an attempt to unpack the dynamic adaptation and innovation of an organization, this approach distinguishes between operational and dynamic capabilities [36]. Whereas operational capabilities refer to substantive competencies used for the manufacture of goods and the provision of services, e.g., technologies, expertise, patents, or routines, dynamics capabilities refer to those competencies that enable an organization to renew operational capabilities, to unlearn existing and learn new competencies, and to change and adapt to market needs in order sustain competitive advantage [30,37,38]. Dynamic capabilities are defined as abilities of organizations “to integrate, build, and reconfigure internal and external competences” [39], p.516. We argue that a firm’s path to hybridity is contingent on the use of dynamic capabilities to enable the integration of new and additional competencies, renew organizational skill sets, and provide hybrid products [40,41].

Scholars have massively explored the empirical effects of dynamic capabilities in organizations. Their research suggests that dynamics capabilities enhance the absorptive capacity of firms to capture external knowledge which is new to the firm, but not new to the market [42]. This absorption, in turn, depends on a firm’s capabilities to acquire, assimilate, transform, and exploit this knowledge [43]. Especially SMEs, which lack in internal resources vis-à-vis large enterprises, depend on these absorptive capabilities in adopting new knowledge, learning from partners and exploring new opportunities to generate hybrid business models [44]. As a consequence, we conceive firms to meet two key challenges on their way towards hybridity: first, to absorb external knowledge; and second, to convert this external knowledge into innovative hybrid outcomes.

2.2. Hybridity and Innovation

It is difficult to imagine a path to hybridity without innovation. In fact, the relation between innovation and hybridity is likely to be mutually reinforcing. On the one hand, firms need to develop new skills and entangle these with existing competencies to provide hybrid products. On the other hand, a more diversified skill set leverages the potential for firms to recombine from a broader portfolio of existing knowledge into new innovations. Firms need skills to generate and combine both intangible services and tangible goods in-house. Once established, this intra-firm hybridity (Figure 1b) may not only drive profitability but also inspire higher levels of innovativeness for firms to create and develop more complex market offerings [6]. The literature suggests that service firms and manufacturers are engaged in different modes of innovation and R&D activities [45,46]. They also vary in types of innovative outputs and their role during the innovation process. We adopt two alternative typologies to capture different types of innovation outcomes as well as different actor roles in the process of innovation.

First, innovation leads to new or improved products, processes, or marketing and organizational concepts [47]. Whereas service firms tend to develop more often marketing and organizational innovations, manufacturers are more frequent in innovating product and processes [47]. Second, innovation has become an increasingly collaborative process with multiple stakeholders being involved in the process. A restriction to only the owners of intellectual property would hide the importance of enabling actors in the process. Therefore, we distinguish three roles in the innovation process [47]: both service and industrial firms can be the source or innovator, or take the role of a facilitator who enables the innovator to innovate, or be a carrier who circulates new innovations widely within and across industries and regions to speed up timely adoption. Empirical research suggests that manufacturing and service firms differ in the extent to which they engage in these different roles, with manufacturers being more often sources, and service firms figuring more often as facilitators and carriers [5]. If purely manufacturing or services firms undergo a process of hybridization, we infer that they are more likely to also expand their innovation activity across the different types. This proposition motivates two hypotheses:

Hypothesis 1.

Hybrid SMEs are more likely to engage in innovation activity than pure SMEs regarding outcome types of innovation.

Hypothesis 2.

Hybrid SMEs are more likely to engage in innovation activity than pure SMEs across all role types of innovation.

To engage in any kind of innovation, hybrid firms must establish new competences and reconfigure their resources to innovate hybrid products [40,41,48]. Dynamic capabilities can be helpful for precisely this process of innovation and to adapt to new market conditions [33,36,40,43,49]. We particularly focus on absorptive capabilities that we expect to be important for the transformation from purity towards hybridity and innovation and we examine the absorption of extra-firm knowledge, which is new to the firm and has not been generated by the firm itself [42,43]. Together, these capabilities enable firms to access external knowledge, generate solutions by themselves, and adapt to evolving customer demand.

Hypothesis 3.

Hybrid SMEs are more likely than pure SMEs to use absorptive capabilities to transform external knowledge into innovation.

2.3. The Servitization Paradox, Hybridity, and Collaboration

Firms benefit from hybridization in various ways—by raising profits [9,23], by enhancing products [50], by gaining new skills [40], by winning new customers [22], and by implementing digital solutions [27]. Yet, hybridization also comes with challenges. Firms face organizational and cognitive bottlenecks when shifting their strategy towards hybridity [51,52]. This structural shift within organizations is fraught with difficulties and has to surpass what has been labeled the "servitization paradox" [23,53]. As manufacturers begin to invest in services and expand their service portfolio, they gradually raise their profitability up to an intermediate level, where additional costs and frictions in organizational adaptation offset the expected returns. Rather than driving the transition further to realize scale economies, firms may get caught in the trap. Manager and employee commitment decreases, service quality suffers, and revenues stagnate [52]. This paradox poses an even more severe challenge to SMEs that are affected by relatively higher costs and risks in hybridizing their products compared to large businesses [54]. Large firms have more resources than smaller firms [9,55], which offers the slack [56] to mobilize resources and experiment in pursuit of a transition to hybridity. Due to their limited scale and scope, SMEs may adopt alternative strategies of hybridization such as inter-firm collaboration. SMEs can stay specialized on goods or services and use cooperation partners in order to offer hybrid products (Figure 1c). Rather than building all the necessary competences internally, we expect hybrid SMEs to more actively engage in collaboration with partners. Such behavior builds on absorptive capacities (H3) and lowers the risk of entering into the servitization paradox.

Hypothesis 4.

Hybrid SMEs are more likely than pure SMEs to collaborate in innovation.

Researchers have emphasized the potential of hybrid products for sustainability [16]. In this paper, we focus on the potential of hybridity to enhance the sustainable development of firms and regional economies. We conceive sustainability as social and economic actions targeted towards raising present well-being in a way that ensures future long-term economic growth [1]. Sustainable development at the regional level is a collective process including private and public actors [57]. Researchers in regional studies suggest that local cooperation with partner firms offers an opportunity to provide product-service-solutions instead of producing them in-house (Figure 1d) [12,22]. The geographical localization of collaboration—the so-called territorial servitization—may serve as a complementary strategy to offer hybrid products [58,59]. In addition, this type of cooperation helps SMEs to work in a resource-efficient and resource-conserving manner, both economically and in terms of materials. Although the demand for products has been generally increasing and becoming more diverse, researchers investigating sustainability transitions call for alternative systems of goods production and supply with less use of resources [60]. We argue that territorial hybridity can serve as such a strategy to increase sustainability by reducing the carbon footprint of more locally-integrated value-creation. Finally, collaboration, including local collaboration, offers the potential to generate new knowledge, facilitate more efficient forms of innovation, and thereby increase SMEs’ competitiveness in international markets. Despite these benefits, recent research reported certain barriers of territorial inter-firm hybridity, such us the reluctance to collaborate with smaller firms, a mismatch between the firms regarding strategy and organizational structure, or a missing local manufacturing base and industrial know-how [12,54,59,61]. Hence, the magnitude and success of territorial hybridity remains an empirical question to be answered in the geographical context. Because local cooperation saves transaction and transportation costs [62,63,64], we expect that hybrid SMEs preferably engage in local cooperation.

Hypothesis 5.

Hybrid SMEs are more likely than pure SMEs to collaborate with partners located in the same region.

However, if hybrid SMEs fail to collaborate with partners within the region, they will seek complementary partners outside the region. Such outward orientation may negatively affect their loyalty to the home region, and in extreme situations, may make them potentially consider relocation. In what follows, we present a methodology to test our hypothesis on differential behaviors between pure and hybrid SMEs regarding innovation activities, absorptive capabilities, and cooperation in the regional economy of Heilbronn–Franconia, in Baden–Württemberg.

3. Methodology

3.1. Research Context

This research is part of a larger research project on the development of competences in the region of Heilbronn–Franconia, one of the 12 planning regions in the federal state of Baden–Württemberg and located in southern Germany. The region is particularly suited to our research interest because up to 98 percent of its businesses are SMEs [65], and because the region is part of a prosperous regional economy, with the lowest unemployment rates in Germany, above-average (federally and nationally) GDP per capita (38.7 k EUR, 2014), with high growth-rates, or the highest income in a federal comparison. Furthermore, the region has one of the highest national densities in niche-market leaders [66,67] and Germany’s highest R&D intensity [68]. It is dominated by manufacturing sectors, such as automotive, mechanical engineering, and packaging machinery, but lacks in non-technical business services, such as consultancy [69]. The high presence of successful SMEs provides for a suitable sample to examine hybridity.

3.2. Measures

The survey questionnaire included measures to assess our hypotheses on innovation, absorptive capabilities, and cooperation. In addition, we also observed firm characteristics, such as size, ages, and revenues (Table 1):

Table 1.

Operationalization and indicator list.

Hybridity. The degree of hybridity of an SME was defined as the share of revenues from services. This way, we were able to locate each firm’s position on the continuum between pure manufacturer and pure service company. To categorize a firm as "hybrid", we needed to solve a problem of thresholds. Whereas we would overestimate hybridity by considering any mix of revenues from goods and services (e.g., 99%), we would underestimate hybridity by considering only firms in the very middle of the continuum. Therefore, we chose several thresholds of the share of services in all revenues, namely 1–99%, 11–90%, 16–85%, 21–80%, and 26–75%. After testing all our variables for each of the different thresholds, we found the most robust results across all indicators for the following threshold: pure firms were defined as firms having revenue shares of either 90% in manufacturing or in services, whereas hybrid firms obtained between 11% and 90% of revenues from services.

Innovation. We relied on the typologies established by the OECD of innovation outcomes [47] including product, process, and organizational and marketing innovation; and of actor roles in innovation [70], innovator, facilitator, and carrier. Firms can generate different outcomes and perform various roles simultaneously.

Absorptive capabilities. We adopted several established and proven measures of absorptive capabilities from the capability and servitization literature.

Cooperation. Finally, we included two survey items to ask for cooperation during product development (e.g., with clients, suppliers, and other firms) and with external service providers (e.g., R&D, logistics), both regionally and extra-regionally (Table 1).

3.3. Data and Methods

We applied a cross-sectional survey design to test the hypothesized differences between pure and hybrid SMEs in innovativeness (H1, H2, H3) and collaboration (H4, H5), and to assess the magnitude of hybridity as well as the territorial dimension of collaboration in the regional economy of Heilbronn–Franconia. The survey approach was appropriate because the necessary intra-organizational data on SMEs could not be obtained from German official statistics.

To construct the sample, we drew on a commercial database by Deutsche Post (2015) and a register of the regional Chamber of Industry and Commerce to assemble an initial population of 5670 firms from different sectors—services and manufacturing—such as automotive, chemical and plastics processing, consulting, design, and financial services. We purposively selected strategic sectors that were most important for the region. Concretely, all sectors with an above-average multiplier effect or export ratio were included. We contacted executive and production managers in three rounds of reminders between November 2015 and January 2016 to maximize the response rate. As contact information of SMEs was lacking in the commercial database, the regional Chamber of Commerce and Industry supported this survey. Due to data privacy issues, the Chamber only provided the email addresses without further information. It was not possible to identify the entire population of regional firms and to draw the sample randomly. Consequently, the sample was not representative of all SMEs in Heilbronn–Franconia. However, the responses corresponded with the proportional characteristics of the regional population (about 41,700 firms). The variation of firm size was similar to the distribution of the population; the responses covered 12% of manufacturing employees and about 1.2% in the region’s service sectors (6% of all regional employees). In total, 197 firms responded (response rate: 3.8 percent, of which we had to exclude 7 firms because they were not classified as SMEs [73]). We present a first description of our firm sample in Table 2.

Table 2.

Demographic characteristics of the firms.

The questionnaire included a total of 85 questions of different types, including open and closed. Standardized items included dichotomous (no/yes/n.a.), ordinal (5- or 7-point Likert scales), and metric variables (e.g., firm size). All our hypotheses expected differences in proportions of activity between pure and hybrid firms regarding innovation, absorptive capabilities, and cooperation. Because we did not examine causal relations or impact effects, we tested for mean differences using chi2-tests for nominal and ordinal variables, and one-way analysis of variance (ANOVA) for metric variables (interval and ratio) [74].

4. Results

4.1. The Magnitude of Hybridity

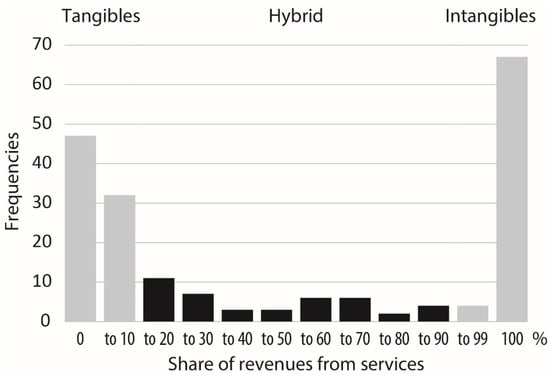

Our analysis shows that half of all surveyed SMEs generated their revenues with a mixture of goods and services. Neither purely industrial nor purely service firms were frequent types of businesses in the region. Only 15% of the firms generated their revenues exclusively with industrial goods, and 35% exclusively with services. According to the operational definition developed above, we identified 21% of the SMEs to be hybrid firms, 42% as manufacturers, and 37% as service firms. Hybrid SMEs were bigger than pure service firms and smaller than pure manufacturers, and they tended to be older than both, but not significantly. Examples for hybrid products in our survey were the production and maintenance of electric equipment or the purchase and configuration of third-party machinery. These findings suggest that the increasing complexity in customer demand has already reached smaller and medium-sized firms. Although the Institut der deutschen Wirtschaft (German Economic Institute) reported that hybridity among German SMEs was still rare in 2011 [75], hybridity has become an important factor for the economic viability of the German economy. Figure 2 displays the frequency distribution of firms across the share of services in overall revenues. The very small number of firms with a balanced distribution of revenues generated by services and goods implies that the process of hybridization develops from both sides of the continuum. It seems unlikely that firms hybridize exclusively from the manufacturing end but also from the service end. We argue that the concept of hybridity captures the increasing transformation from pure firms to hybrid providers more adequately than a manufacturing-biased perspective does.

Figure 2.

The empirical distribution of hybridity across SMEs in Heilbronn–Franconia.

4.2. The Innovation Activity of Hybrid Firms

To examine our first set of hypotheses, we tested for mean differences between hybrid and pure firms with respect to innovation activities. We generally confirmed that hybrid SMEs were more likely to pursue innovation activities than pure SMEs (Table 3). Regarding H1, we found that hybrid firms were significantly more likely to conduct product, process, and organizational innovations than both pure manufacturers and pure service firms. Only in the case of marketing innovation did hybrid firms seem to be less frequently involved than pure firms, although differences were not significant. With the exception of marketing innovation, we therefore found the results consistent with H1. Regarding H2, hybrid firms reported that they were active in the roles of sources as well as facilitators of innovation significantly more frequently than pure firms did (Table 3). Three quarters of hybrid firms claimed to be sources of innovation compared to only 50% (services) and 45% (manufacturing) of the other firms. Moreover, hybrid firms were clearly more likely than pure firms to be facilitators; 60% of hybrids supported the innovation activity of their customers, whereas only 38% (manufacturing) and 40% (services) occupied similar roles. Almost the same differences were found with respect to the role of carriers, yet these were not statistically significant. Altogether, we found the empirical observations to be consistent with H2.

Table 3.

Mean differences in the share of firms pursuing innovation activities (%).

In the next step, we examined whether a stronger engagement in diverse innovation activities also positively affected firm performance. Indeed, hybrid firms had higher revenue growth, more revenues from product innovation, and inferior costs through process innovation. Although the mean differences were not significant, we found that the higher level of innovativeness of hybrid firms compared to pure firms did not depend on firm characteristics such as size, service revenues, revenues, or age.

4.3. The Role of Absorptive Capabilities for Hybridity

To test H3, we compared the share of firms that showed absorptive capabilities (Table 4). The empirical observations in the survey suggested that hybrid SMEs were significantly more likely to engage in three out of four core activities that are proven indicators of absorptive capabilities. First, one third of hybrid firms had imitated products and processes of their competitors to integrate new solutions into the firm. Second, due to the smaller size of SMEs, relatively few firms in the regional sample had conducted a merger or acquisition. Still, with a share of 8%, hybrids reported significantly higher M&A activity than pure firms did. Third, every sixth hybrid SME used registered IP (designs, patents) whose protection had expired, and thus adopted foreign knowledge to improve products and processes. In contrast, their own patenting activity was strikingly low in the region because smaller firms reported aversion to protecting intellectual property because of protection costs and the need for public disclosure [76,77]. The use of up-to-date scientific research is the fourth practice of absorption of external know-how. Our analysis suggests that hybrid and service SMEs more frequent adopt scientific results than do manufacturers (Table 4).

Table 4.

Mean differences in the share of firms having absorptive capabilities (%).

Altogether, these findings are consistent with H3 and confirm the argument that superior levels of innovation activity are based on absorptive capabilities. Hybrid firms need to quickly adapt to and learn from new technologies and solutions outside their organization and transform these into innovations and hybrid products. This suggests that hybrid SMEs develop absorptive capabilities to compensate for the lack of internal organizational slack. Using already existing external knowledge for innovation is more effective—in terms of costs and time—than focusing on generating knowledge in-house [78].

4.4. The Role of Collaboration for Hybridity

Recent research in Heilbronn–Franconia showed that local firms preferred to solve their problems in-house, purposively adopted a model of “closed innovation”, and shied away from cooperation for cost and secrecy concerns [79,80]. Consistent with the qualitative insights obtained in previous research, we found inter-firm collaboration in the innovation process not very prominent in Heilbronn–Franconia. More than three quarters of all SMEs in our survey reported not cooperating during product development. The small number of reported cases of cooperation were with immediate business partners (20 percent of the small number of cooperation relations were maintained with international partners), such as direct clients and suppliers. In the face of a cooperation-averse regional environment, we found hybrid SMEs to be more engaged in inter-firm cooperation than pure firms; compared to 24% (services) and 30% (manufacturing), 38% of hybrid firms worked together with partners in innovation (Table 5). Although the mean differences were not significant, we found evidence that the more hybrid a company, the more likely it was to cooperate. This result was based on a logistic regression model in which we estimated the likelihood of a firm to cooperate as a function of its degree of hybridity. The degree of hybridity refers to the distribution of revenues across services and goods, where 50% of services (manufacturing) indicates maximal hybridity and 100% services (manufacturing) minimal hybridity. The bivariate logistic regression analysis reported a coefficient of r = −0.872 (p < 0.001), which evidenced the fact that cooperation increased as hybridity rose. We thus confirmed H4, that hybrid SMEs more actively engage in collaboration with partners than do pure firms (H4).

Table 5.

Mean differences in the share of firms collaborating with partners (%).

We have argued before that inter-firm hybridity can be a viable strategy for hybridization (Figure 1c). In the next step, we tested H5 to examine whether SMEs exploit the potential of regional collaboration or territorial hybridity (Figure 1d). However, neither cooperation nor the external use of service providers was found to be more regional than in the case of pure firms. Less than one third of all SMEs requested services involved in product development, such as market research or R&D, and the majority were from outside of the region (Table 5). Only administrative services were strongly demanded: tax consultancy (93% of all firms), law consultancy (79%), or software adoption (71%). Similar to collaboration in innovation, the majority of hybrid firms cooperated with service partners located outside the region. These findings suggest that territorial inter-firm hybridity was very limited in the region of Heilbronn–Franconia (Figure 1d). Hence, we could not confirm hypothesis 5. Table 6 summarizes the results of all hypothesis tests.

Table 6.

Results of the hypothesis tests.

The literature on territorial servitization suggests that SMEs often lack potential partners in their home region or the willingness of partners to engage in innovation collaboration; services related to R&D are markedly regionally underrepresented [65]. A considerable number of firms in the region were found to deny inter-firm cooperation because of secrecy concerns [79]. Although our research design did not permit us to evaluate the "matching" qualities or an "adequate organizational fit" between the local firms [59,61], our findings support the conclusion that being co-located did not seem to determine successful cooperation. In addition, the survey conveys that firms reported shortage of skilled labor, especially in services, in Heilbronn–Franconia (Table 5). Such regional conditions may not only constrain regional cooperation and the evolution of territorial hybridity but also deter established SMEs from future investments. It should be seriously evaluated that although only a limited number of SMEs in the survey considered relocating and leaving the region, most of these were hybrid organizations.

Nonetheless, inter-firm hybridity is a strategy for SMEs to compensate for missing internal resources. Cooperation stimulates the recombination and use of existing knowledge between firms and so reduces the costs for building resources internally. Consequently, engaging in cooperation in order to provide hybrid products can be confirmed as a sustainable development strategy for SMEs. Moreover, territorial inter-firm hybridity can further stimulate regional growth through the regionalization of hybrid value creation and thus increase the well-being and sustainability of a regional economy [12,59].

5. Conclusions

Compared with the notion of servitization, the more comprehensive and integrative concept of hybridity—including intangible and tangible products [5,81,82]—indicates that the organizational change and the path towards combining services and goods is accompanied by a higher propensity to innovate, to use absorptive capabilities, to collaborate with partners in innovation, and ultimately to achieve higher competitiveness. We therefore suggest overcoming the conceptual dualism of industry and services, which still predominates many of the empirical studies conducted on servitization [83].

The research design adopted in this study does not support inferences on causal effects of hybridity on innovativeness and regional growth. We expect this association to be interdependent because the process of hybridization both requires innovation to absorb, build, and connect new capabilities, and it inspires new innovations as the capacity for recombination rises with a more diverse portfolio of capabilities in the firm. Given the limitations in our data, we cannot qualify the conditions for or drivers of cooperation of the surveyed firms. Finally, given the character of a regional case study, we cannot generalize the findings for other regions.

Despite these limitations, our results suggest that inter-firm hybridity offers opportunities for SMEs to overcome the paradox of servitization. Rural regions, such as Heilbronn–Franconia, that lack young and highly-skilled labor demand solutions to attract qualified professionals and to support innovative inter-firm cooperation. So far, actors in the region have not been able to exploit the growth potential from regional collaboration [12,58]. Yet territorial hybridity may help attract human capital and the skill sets and technologies necessary to build more integrated regional circuits of hybrid value creation [84,85]. This way, higher levels of regional collaboration may enhance the sustainable effects of inter-firm hybridity on regional economies.

In order to stimulate regional collaboration, policy-makers need to shift their focus from nodal to “linking policies” [86] that raise mutual awareness among potential partners, promote an understanding of the gains from cooperation, and facilitate the emergence of a relational infrastructure that generates the trust necessary to overcome barriers to collaboration. In the case of our study region, regional actors, such as the Chamber of Commerce and Industry or the regional development agency, take important roles in building such a relational infrastructure. Because informal networks are strong within the region [79], policy makers could address regional stakeholders to spread and legitimize best-practices of cooperation. Exchange platforms can provide SMEs with access to potential partners. We know that for the implementation of industry 4.0 or the training of skilled workers, platforms can help to facilitate cooperation [87,88]. Furthermore, exchange between employees from different firms and from different disciplines can lower the barrier to cooperation. From an educational perspective, adjustments in the curricula of vocational training could teach the value of cooperation with (non-technical) partners [80].

Finally, researchers as well as practitioners have sought for effective strategies to promote digital solutions for regional economies. Digitization puts pressure on SMEs but also provides opportunities, such as access to new markets or efficiency gains through standardization [28,89]. The path to hybridity can also foster digitization, as it renders firms more open to developing new business models and to innovating in collaboration [27]. Absorptive capabilities, in particular, help smaller firms to learn from cooperation partners on how to implement new digital business models [44]. Future research should focus on the bottlenecks and enablers of cooperation, and especially regional cooperation, as well as the value-creating processes at the intersection between services and manufacturing.

Author Contributions

All authors have contributed to every part of the article. All authors have read and agreed to the published version of the manuscript.

Funding

Funding by the Pakt Zukunft Heilbronn–Franken gGmbH is gratefully acknowledged.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The survey data presented in this study are not publicly available. Sources of all secondary data, such as official statistics, are included in the text.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Kuhlman, T.; Farrington, J. What is sustainability? Sustainability 2010, 2, 3436–3448. [Google Scholar] [CrossRef]

- Cusumano, M.A.; Kahl, S.J.; Suarez, F.F. Services, industry evolution, and the competitive strategies of product firms. Strateg. Manag. J. 2015, 36, 559–575. [Google Scholar] [CrossRef]

- Gadrey, J. The characterization of goods and services: An alternative approach. Rev. Income Wealth 2000, 46, 369–387. [Google Scholar] [CrossRef]

- Lancaster, K.J. A new approach to consumer theory. J. Political Econ. 1996, 74, 132–157. [Google Scholar] [CrossRef]

- Glückler, J. Services and innovation. In The Elgar Companion to Innovation and Knowledge Creation; Bathelt, H., Cohendet, P., Henn, S., Laurent, S., Eds.; Edward Elgar: Cheltenham, UK; Northampton, MA, USA, 2017; pp. 258–274. [Google Scholar]

- Vandermerwe, S.; Rada, J. Servitization of business: Adding value by adding services. Eur. Manag. J. 1988, 6, 314–324. [Google Scholar] [CrossRef]

- Bryson, J.; Daniels, P. ‘Service worlds: The ‘services duality’ and the rise of the ‘manuservice’ economy’. In Handbook of Service Science; Maglio, P., Kieliszewski, C., Spohrer, J., Eds.; Springer: New York, NY, USA, 2010; pp. 79–104. [Google Scholar]

- Fang, E.; Palmatier, R.W.; Steenkamp, J.-B.E. Effect of service transition strategies on firm value. J. Mark. 2008, 72, 1–14. [Google Scholar] [CrossRef]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2008, 1, 103–118. [Google Scholar] [CrossRef]

- Crozet, M.; Milet, E. Should everybody be in services? The effect of servitization on manufacturing firm performance. J. Econ. Manag. Strategy 2017, 26, 820–841. [Google Scholar] [CrossRef]

- Roland Berger. Evolution of Service; Roland Berger Strategy Consultants: Hamburg, Germany, 2014. [Google Scholar]

- Gomes, E.; Bustinza, O.F.; Tarba, S.; Khan, Z.; Ahammad, M. Antecedents and implications of territorial servitization. Reg. Stud. 2018, 53, 1–14. [Google Scholar] [CrossRef]

- Ulaga, W.; Reinartz, W.J. Hybrid offerings: How manufacturing firms combine goods and services successfully. J. Mark. 2011, 75, 5–23. [Google Scholar] [CrossRef]

- Raddats, C.; Kowalkowski, C.; Benedettini, O.; Burton, J.; Gebauer, H. Servitization: A contemporary thematic review of four major research streams. Ind. Mark. Manag. 2019, 83, 207–223. [Google Scholar] [CrossRef]

- Baines, T.S.; Lightfoot, H.W.; Evans, S.; Neely, A.; Greenough, R.; Peppard, J.; Roy, R.; Shehab, E.; Braganza, A.; Tiwari, A.; et al. State-of-the-art in product-service systems. Proc. Inst. Mech. Eng. Part B J. Eng. Manuf. 2007, 221, 1543–1552. [Google Scholar] [CrossRef]

- Tukker, A.; Tischner, U. New Business for Old Europe: Product-Service Development, Competitiveness and Sustainability; Routledge: Abingdon, UK; New York, NY USA, 2017. [Google Scholar]

- Baines, T.; Lightfoot, H.; Benedettini, O.; Kay, J. The servitization of manufacturing: A review of literature and reflection on future challenges. J. Manuf. Technol. Manag. 2009, 20, 547–567. [Google Scholar] [CrossRef]

- Neely, A.; Benedettini, O.; Visnjic, I. The servitization of manufacturing: Further evidence. In Proceedings of the 18th European Operations Management Association Conference, Cambridge, UK, 3–6 July 2011. [Google Scholar]

- Kastalli, I.V.; Van Looy, B. Servitization: Disentangling the impact of service business model innovation on manufacturing firm performance. J. Oper. Manag. 2013, 31, 169–180. [Google Scholar] [CrossRef]

- Paiola, M.; Gebauer, H. Internet of things technologies, digital servitization and business model innovation in BtoB manufacturing firms. Ind. Mark. Manag. 2020, 89, 245–264. [Google Scholar] [CrossRef]

- Cohen, M.A.; Agrawal, N.; Agrawal, V. Winning in the aftermarket. Harv. Bus. Rev. 2006, 84, 129–138. [Google Scholar]

- Bustinza, O.F.; Gomes, E.; Vendrell-Herrero, F.; Baines, T. Product–service innovation and performance: The role of collaborative partnerships and R&D intensity. RD Manag. 2019, 49, 33–45. [Google Scholar]

- Gebauer, H.; Ren, G.-J.; Valtakoski, A.; Reynoso, J. Service-driven manufacturing: Provision, evolution and financial impact of services in industrial firms. J. Serv. Manag. 2012, 23, 120–136. [Google Scholar] [CrossRef]

- Wong, M.T.N. Implementation of Innovative Product Service Systems in the Consumer Goods Industry. Ph.D. Thesis, University of Cambridge, Cambridge, UK, 2004. [Google Scholar]

- Pertusa-Ortega, E.M.; Molina-Azorín, J.F.; Claver-Cortés, E. Competitive strategies and firm performance: A comparative analysis of pure, hybrid and ‘stuck-in-the-middle’strategies in Spanish firms. Br. J. Manag. 2009, 20, 508–523. [Google Scholar] [CrossRef]

- Holt, D.; Littlewood, D. Identifying, mapping, and monitoring the impact of hybrid firms. Calif. Manag. Rev. 2015, 57, 107–125. [Google Scholar] [CrossRef]

- Martín-Peña, M.L.; Díaz-Garrido, E.; Sánchez-López, J.M. The digitalization and servitization of manufacturing: A review on digital business models. Strateg. Chang. 2018, 27, 91–99. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Van Bockhaven, W. Boosting servitization through digitization: Pathways and dynamic resource configurations for manufacturers. Ind. Mark. Manag. 2017, 60, 42–53. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Blackwell: Oxford, UK, 1959; p. 272. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Bathelt, H.; Glückler, J. Resources in economic geography: From substantive concepts towards a relational perspective. Environ. Plan. A 2005, 37, 1545–1563. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Feldman, M.S.; Pentland, B.T. Reconceptualizing organizational routines as a source of flexibility and change. Adm. Sci. Q. 2003, 48, 94–118. [Google Scholar] [CrossRef]

- Zollo, M.; Winter, S.G. Deliberate learning and the evolution of dynamic capabilities. Organ. Sci. 2002, 13, 339–351. [Google Scholar] [CrossRef]

- Schreyögg, G.; Kliesch-Eberl, M. How dynamic can organizational capabilities be? Towards a dual-process model of capability dynamization. Strateg. Manag. J. 2007, 28, 913–933. [Google Scholar] [CrossRef]

- Teece, D.J. Business models and dynamic capabilities. Long Range Plan. 2018, 51, 40–49. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Kindström, D.; Kowalkowski, C.; Sandberg, E. Enabling service innovation: A dynamic capabilities approach. J. Bus. Res. 2013, 66, 1063–1073. [Google Scholar] [CrossRef]

- Janssen, M.J.; Castaldi, C.; Alexiev, A. Dynamic capabilities for service innovation: Conceptualization and measurement. RD Manag. 2016, 46, 797–811. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Müller, J.M.; Buliga, O.; Voigt, K.-I. The role of absorptive capacity and innovation strategy in the design of industry 4.0 business Models-A comparison between SMEs and large enterprises. Eur. Manag. J. 2020, 1–11, in press. [Google Scholar]

- Miles, I. Research and development (R&D) beyond manufacturing: The strange case of services R&D. RD Manag. 2007, 37, 249–268. [Google Scholar]

- D'Alvano, L.; Hidalgo, A. Innovation management techniques and development degree of innovation process in service organizations. RD Manag. 2012, 42, 60–70. [Google Scholar] [CrossRef]

- OECD/ Eurostat. Oslo Manual 2018. Guidelines for Collecting, Reporting and Using Data on Innovation. The Measurement of Scientific, Technological and Innovation Activities, 4th ed.; OECD Publishing: Paris, France; Luxembourg, 2019. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Deeds, D.L.; DeCarolis, D.; Coombs, J. Dynamic capabilities and new product development in high technology ventures: An empirical analysis of new biotechnology firms. J. Bus. Ventur. 1999, 15, 211–229. [Google Scholar] [CrossRef]

- Guajardo, J.A.; Cohen, M.A.; Kim, S.-H.; Netessine, S. Impact of performance-based contracting on product reliability: An empirical analysis. Manag. Sci. 2012, 58, 961–979. [Google Scholar] [CrossRef]

- Bowen, D.E.; Siehl, C.; Schneider, B. A framework for analyzing customer service orientations in manufacturing. Acad. Manag. Rev. 1989, 14, 75–95. [Google Scholar] [CrossRef]

- Gebauer, H.; Fleisch, E.; Friedli, T. Overcoming the service paradox in manufacturing companies. Eur. Manag. J. 2005, 23, 14–26. [Google Scholar] [CrossRef]

- Martinez, V.; Bastl, M.; Kingston, J.; Evans, S. Challenges in transforming manufacturing organisations into product-service providers. J. Manuf. Technol. Manag. 2010, 21, 449–469. [Google Scholar] [CrossRef]

- Confente, I.; Buratti, A.; Russo, I. The role of servitization for small firms: Drivers versus barriers. Int. J. Entrep. Small Bus. 2015, 26, 312–331. [Google Scholar] [CrossRef]

- Kowalkowski, C.; Gebauer, H.; Kamp, B.; Parry, G. Servitization and deservitization: Overview, concepts, and definitions. Ind. Mark. Manag. 2017, 60, 4–10. [Google Scholar] [CrossRef]

- Szulanski, G. Sticky Knowledge. Barriers to Knowing in the Firm; Sage: London, UK, 2003. [Google Scholar]

- Sotarauta, M.; Horlings, I.; Liddle, J. Leadership and sustainable regional development. In Leadership and Change in Sustainable Regional Development; Sotarauta, M., Horlings, I., Liddle, J., Eds.; Routledge: London, UK; New York, NY, USA, 2012; pp. 1–19. [Google Scholar]

- Bellandi, M.; Santini, E. Territorial servitization and new local productive configurations: The case of the textile industrial district of Prato. Reg. Stud. 2019, 53, 1–10. [Google Scholar] [CrossRef]

- Lafuente, E.; Vaillant, Y.; Vendrell-Herrero, F. Territorial servitization and the manufacturing renaissance in knowledge-based economies. Reg. Stud. 2019, 53, 313–319. [Google Scholar] [CrossRef]

- Köhler, J.; Geels, F.W.; Kern, F.; Markard, J.; Onsongo, E.; Wieczorek, A.; Alkemade, F.; Avelino, F.; Bergek, A.; Boons, F. An agenda for sustainability transitions research: State of the art and future directions. Environ. Innov. Soc. Transit. 2019, 31, 1–32. [Google Scholar] [CrossRef]

- Liu, Y.; Lattemann, C.; Xing, Y.; Dorawa, D. The emergence of collaborative partnerships between knowledge-intensive business service (KIBS) and product companies: The case of Bremen, Germany. Reg. Stud. 2019, 53, 376–387. [Google Scholar] [CrossRef]

- Williamson, O.E. The Economic Institutions of Capitalism. Firms, Markets, Relational Contracting; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Scott, A.J.; Storper, M. (Eds.) Production, Work, Territory: The Geographical Anatomy of Industrial Capitalism; Unwin Hyman: Boston, MA, USA; London, UK, 1988. [Google Scholar]

- Storper, M.; Walker, R. The Capitalist Imperative: Territory, Technology, and Industrial Growth; Basil Blackwell: New York, NY, USA, 1989. [Google Scholar]

- Bundesagentur für Arbeit. Statistik-Service-Südwest; Bundesagentur für Arbeit: Nürnberg, Germany, 2014. [Google Scholar]

- Langenscheidt, F.; Venohr, B. Deutsche Standards. Heilbronn-Franken. Region der Weltmarktführer; GABAL Verlag: Offenbach am Main, Germany, 2011. [Google Scholar]

- Simon, H. Hidden Champions—Aufbruch nach Globalia. Die Erfolgsstrategien der Unbekannten Weltmarktführer.; Campus Verlag GmbH: Frankfurt am Main, Germany, 2012. [Google Scholar]

- Eickelpasch, A. Private R&D not necessarily drawn to areas with high public R&D. Diw Econ. Bull. 2016, 6, 517–526. [Google Scholar]

- Kirchner, P. Kompetenzentwicklung Regionaler Wirtschaft. Fallstudien aus Heilbronn-Franken; Industrie- und Handelskammer Heilbronn-Franken: Heilbronn, Germany, 2019. [Google Scholar]

- OECD. Globalisation and Structural Adjustment. Summary Report of the Study on Globalisation and Innnovaion in the Business Services Sector; OECD: Brüssel, Belgium, 2007. [Google Scholar]

- OECD. Oslo Manual. Guidelines for Collecting and Interpreting Innovation Data; OECD: Paris, France, 2005; p. 164. [Google Scholar]

- Rothaermel, F.T.; Hess, A.M. Building dynamic capabilities: Innovation driven by individual-, firm-, and network-level effects. Organ. Sci. 2007, 18, 898–921. [Google Scholar] [CrossRef]

- European Commission. User Guide to the SME Definition; Publications Office of the European Union: Luxembourg, 2015. [Google Scholar]

- Huber, F.; Meyer, F.; Lenzen, M. Grundlagen der Varianzanalyse: Konzeption. Durchführung. Auswertung; Springer Gabler: Wiesbaden, Germany, 2014. [Google Scholar]

- Lichtblau, K.; Kempermann, H. Stand und Perspektiven von Dienstleistungen in Deutschland– Potentiale der deutschen Dienstleistungswirtschaft. Eine Studie im Auftrag des Bundesministeriums für Wirtschaft und Technologie (BMWi); Institut der deutschen Wirtschaft: Köln, Germany, 2013. [Google Scholar]

- Levin, R.C.; Klevorick, A.K.; Nelson, R.R.; Winter, S.G.; Gilbert, R.; Griliches, Z. Appropriating the returns from industrial research and development. Brook. Pap. Econ. Act. 1987, 1987, 783–831. [Google Scholar] [CrossRef]

- Gallié, E.-P.; Legros, D. French firms’ strategies for protecting their intellectual property. Res. Policy 2012, 41, 780–794. [Google Scholar] [CrossRef]

- Jacobs, J. The Economy of Cities; Random House: New York, NY, USA, 1969. [Google Scholar]

- Glückler, J.; Punstein, A.M.; Wuttke, C.; Kirchner, P. The ‘hourglass’ model: An institutional morphology of rural industrialism in Baden-Württemberg. Eur. Plan. Stud. 2020, 28, 1–21. [Google Scholar] [CrossRef]

- Punstein, A.M.; Glückler, J. In the mood for learning? How the thought collectives of designers and engineers co-create innovations. J. Econ. Geogr. 2020, 20, 543–570. [Google Scholar] [CrossRef]

- Den Hertog, P. Co-producers of innovation: On the role of knowledge-intensive business services in innovation. In Productivity, Innovation and Knowledge in Services; Gadrey, J., Gallouj, F., Eds.; EdwardElgar: Cheltenham, UK; Northampton, MA, USA, 2002; pp. 223–255. [Google Scholar]

- de Vries, E.J. Innovation in services in networks of organizations and in the distribution of services. Res. Policy 2006, 34, 1037–1051. [Google Scholar] [CrossRef]

- Glückler, J.; Schmidt, A.M.; Wuttke, C. Zwei Erzählungen regionaler Entwicklung in Süddeutschland: Vom Sektorenmodell zum Produktionssystem. Z. Für Wirtsch. 2015, 59, 133–149. [Google Scholar]

- Horváth, K.; Rabetino, R. Knowledge-intensive territorial servitization: Regional driving forces and the role of the entrepreneurial ecosystem. Reg. Stud. 2018, 53, 1–11. [Google Scholar] [CrossRef]

- De Propris, L.; Storai, D. Servitizing industrial regions. Reg. Stud. 2019, 53, 388–397. [Google Scholar] [CrossRef]

- Glückler, J. Institutional context and place-based policy: The case of Coventry & Warwickshire. Growth Chang. 2020, 51, 234–255. [Google Scholar]

- Weber, E. Employment and the Welfare State in the Era of Digitalisation. CESIfo Forum 2017, 18, 22–27. [Google Scholar]

- Kagermann, H.; Wahlster, W.; Helbig, J. Securing the future of German Manufacturing Industry: Recommendations for Implementing the Strategic Initiative INDUSTRIE 4.0; Platform Industrie 4.0: Frankfurt am Main, Germany, 2013. [Google Scholar]

- Kowalkowski, C.; Witell, L.; Gustafsson, A. Any way goes: Identifying value constellations for service infusion in SMEs. Ind. Mark. Manag. 2013, 42, 18–30. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).