The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries

Abstract

1. Introduction

2. Literature Review

2.1. Traditional Focus on Economic Freedom and Economic Performance

2.2. XXI Century’s Development of Economic Freedom and Interrelationships with Economic and Environmental Outcomes

- Air pollution economic loss: In the long run, the United Nation sustainable development goals agenda estimates that countries incur economic losses due to carbon emissions, and air pollution has direct linkages with environmental policies [55].

- CO2 emissions intensity: Pollution intensity is interrelated with economic freedom factors such as problems with adopting more efficient technologies [33,36]; political freedom allows enhancement of more effective environmental policy [48]; and highly intensive emissions over a long-time horizon, as countries develop more rapidly, may indicate that a country is still in the progress of reaching its full development potential [33].

- Energy consumption from fossil fuel and renewable sources: Decreased energy from fossil fuels and increase in renewable energy use in economically advanced countries defines these countries as sustainably developed and innovative [33].

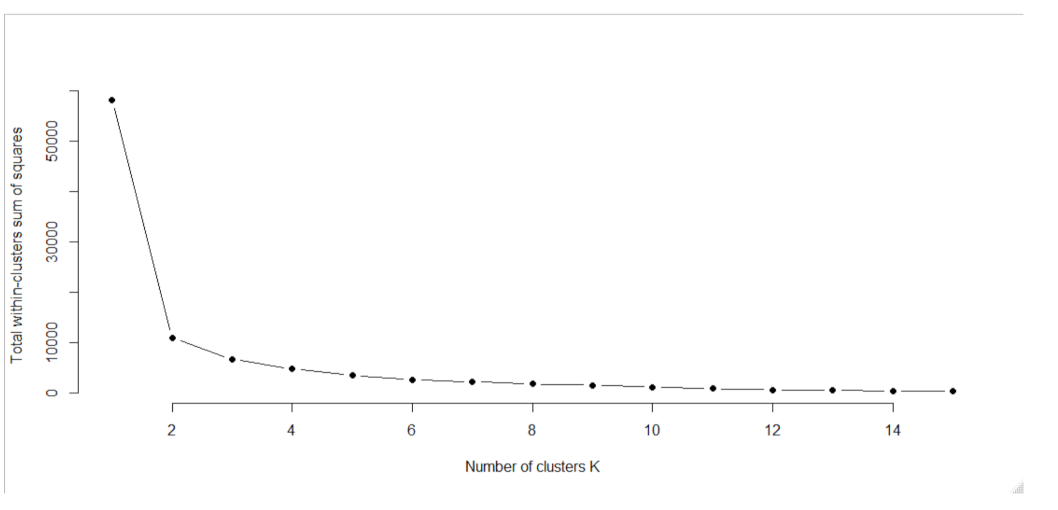

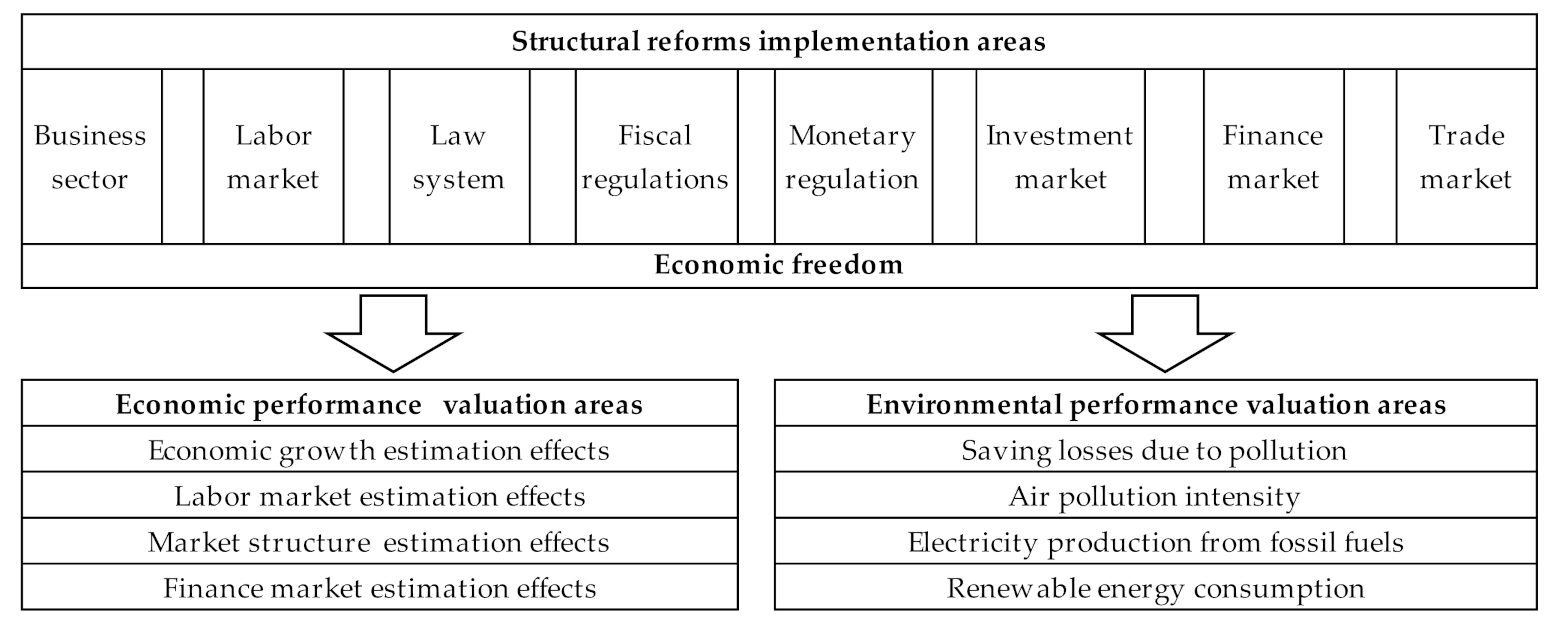

3. Data and Research Methodology

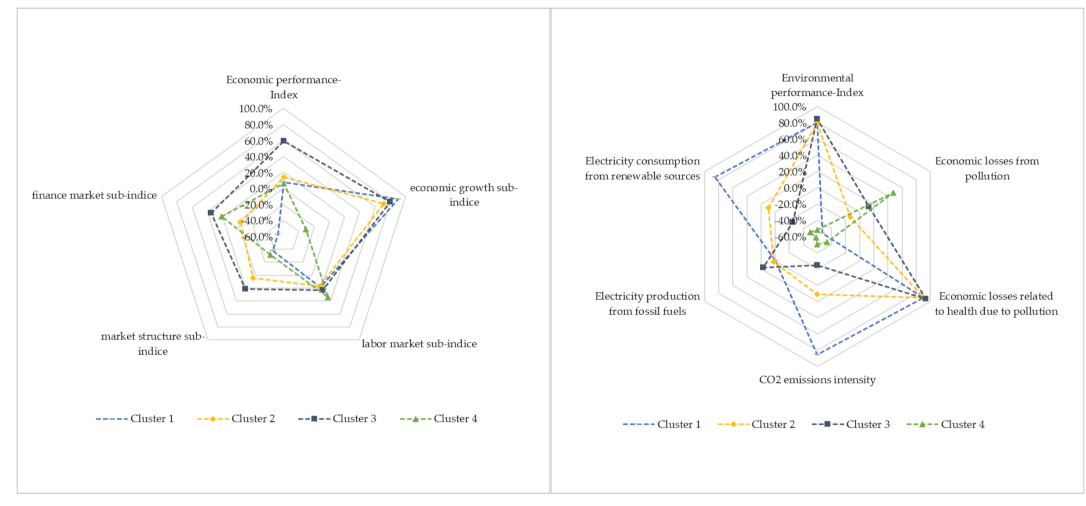

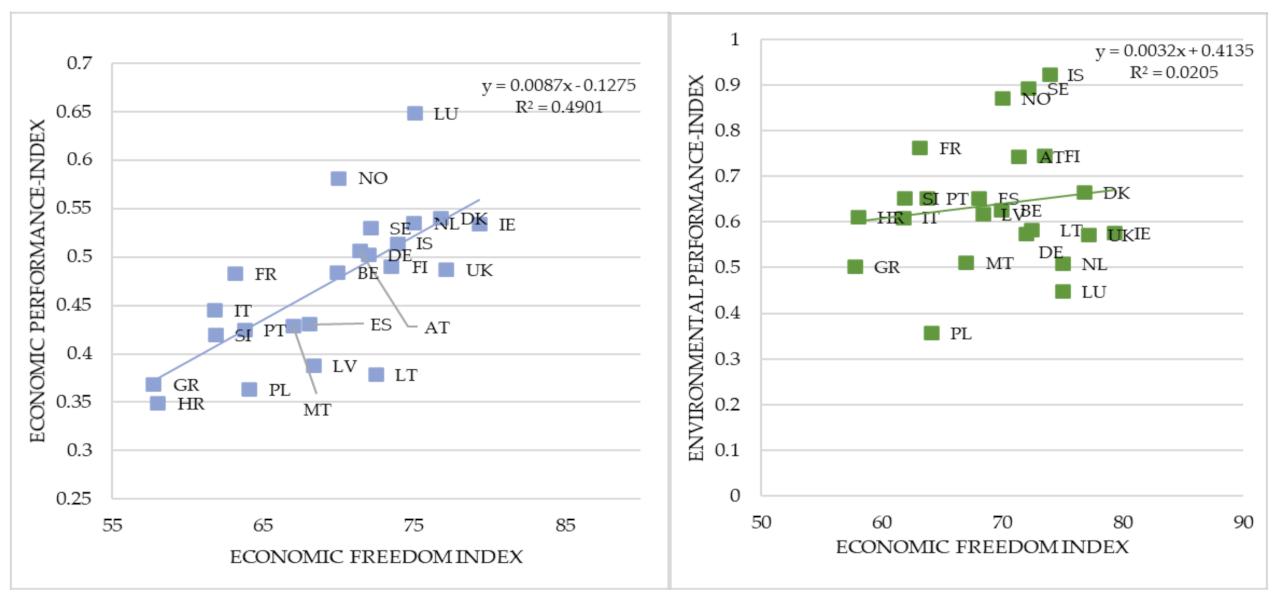

4. Results

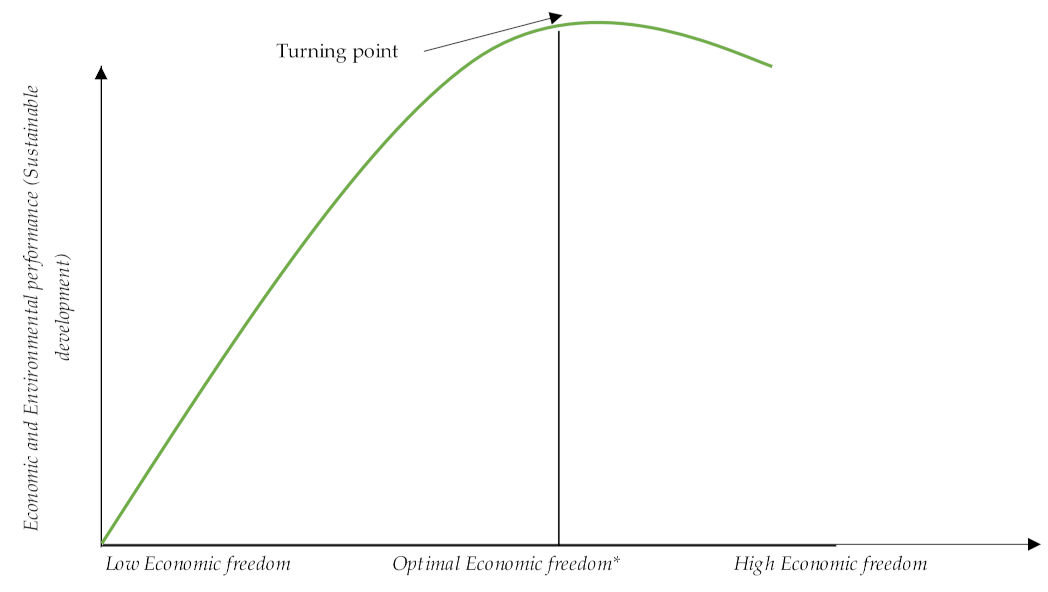

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- World Economic Forum. Global Competitiveness Report 2019: How to End a Lost Decade of Productivity Growth? Available online: http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf (accessed on 15 December 2020).

- Papageorgiou, D.; Vourvachaki, E. Macroeconomic effects of structural reforms and fiscal consolidations: Trade-offs and complementarities. Eur. J. Political Econ. 2017, 48, 54–73. [Google Scholar] [CrossRef]

- Neuss, L. The drivers of structural change. J. Econ. Surv. 2019, 33, 309–349. [Google Scholar] [CrossRef]

- Aghion, P.; Farhi, E.; Kharroubi, E. Monetary Policy, Product Market Competition and Growth. Economica 2019, 86, 431–470. [Google Scholar] [CrossRef]

- Asandului, L.; Iacobuta, A.; Cautisanu, C. Modelling Economic Growth Based on Economic Freedom and Social Progress. Eur. J. Sustain. Dev. 2016, 5, 229–238. [Google Scholar] [CrossRef]

- Brkić, I.; Gradojević, N.; Ignjatijević, S. The Impact of Economic Freedom on Economic Growth? New European Dynamic Panel Evidence. J. Risk Financ. Manag. 2020, 13, 26. [Google Scholar] [CrossRef]

- Gassebner, M.; Gaston, M.; Lamla, M.J. The inverse domino effect: Are economic reforms contagious? Int. Econ. Rev. 2011, 52, 183–200. [Google Scholar] [CrossRef]

- Hussain, M.E.; Haque, M. Impact of Economic Freedom on the Growth Rate: A Panel Data Analysis. Economies 2016, 4, 5. [Google Scholar] [CrossRef]

- Haidar, J.I. The impact of business regulatory reforms on economic growth. J. Jpn. Int. Econ. 2012, 26, 285–307. [Google Scholar] [CrossRef]

- De Grauwe, P.; Ji, Y. Structural reforms, animal spirits, and monetary policies. Eur. Econ. Rev. 2020, 124, 103395. [Google Scholar] [CrossRef]

- Bjørnskov, C. Economic freedom and economic crises. Eur. J. Political Econ. 2016, 45, 11–23. [Google Scholar] [CrossRef]

- Rieth, M.; Wittich, J. The impact of ECB policy on structural reforms. Eur. Econ. Rev. 2020, 122, 103361. [Google Scholar] [CrossRef]

- Gomes, S. Euro area structural reforms in times of a global crisis. J. Macroecon. 2018, 55, 28–45. [Google Scholar] [CrossRef]

- Sajedi, R. Fiscal consequences of structural reform under constrained monetary policy. J. Econ. Dyn. Control 2018, 93, 22–38. [Google Scholar] [CrossRef]

- Aarhus, J.H.; Jakobsen, T.G. Rewards of reforms: Can economic freedom and reforms in developing countries reduce the brain drain? Int. Area Stud. Rev. 2019, 22, 327–347. [Google Scholar] [CrossRef]

- Arif, I.; Hoffer, A.; Stansel, D.; Lacombe, D. Economic freedom and migration: A metro area-level analysis. SOEJ 2020, 1–21. [Google Scholar] [CrossRef]

- Égert, B. Regulation, Institutions, and Productivity: New Macroeconomic Evidence from OECD Countries. Am. Econ. Rev. 2016, 106, 109–113. Available online: https://www.jstor.org/stable/43860997 (accessed on 15 December 2020). [CrossRef]

- Cacciatore, M.; Fiori, G. The macroeconomic effects of goods and labor markets deregulation. Rev. Econ. Dyn. 2016, 20, 1–24. [Google Scholar] [CrossRef]

- Duval, R.; Furceri, D. The Effects of Labor and Product Market Reforms: The Role of Macroeconomic Conditions and Policies. IMF Econ. Rev. 2018, 66, 31–69. [Google Scholar] [CrossRef]

- Feldmann, H. Credit Market Regulation and Labor Market Performance around the World. KYKLOS 2006, 59, 497–525. [Google Scholar] [CrossRef]

- Schiantarelli, F. Do product market reforms stimulate employment, investment, and innovation? IZA World Labor 2016, 266. [Google Scholar] [CrossRef][Green Version]

- Psillaki, M.; Mamatzakis, E. What drives bank performance in transitions economies? The impact of reforms and regulations. Res. Int. Bus. Financ. 2017, 39 Pt A, 578–594. [Google Scholar] [CrossRef]

- Singh, D.; Gal, Z. Economic Freedom and its Impact on Foreign Direct Investment: Global Overview. Rev. Econ. Perspect. 2020, 20, 73–90. [Google Scholar] [CrossRef]

- Angulo-Guerrero, M.J.; Pérez-Moreno, S.; Abad-Guerreroa, I.M. How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. J. Bus. Res. 2017, 73, 30–37. [Google Scholar] [CrossRef]

- Bennett, D.L. Local institutional heterogeneity & firm dynamism: Decomposing the metropolitan economic freedom index. Small Bus Econ. 2020. [Google Scholar] [CrossRef]

- Kubickova, M. The impact of government policies on destination competitiveness in developing economies. Curr. Issues Tourism 2019, 22, 619–642. [Google Scholar] [CrossRef]

- Xu, G. The role of law in economic growth: A literature review. J. Econ. Surv. 2011, 25, 833–871. [Google Scholar] [CrossRef]

- Kešeljević, A.; Spruk, R. Global distribution and dynamics of economic freedom: Non-parametric approach. Econ. Model. 2013, 33, 560–571. [Google Scholar] [CrossRef]

- Sturm, J.E.; De Haan, J. How robust is the relationship between economic freedom and economic growth? Appl. Econ. 2001, 33, 839–844. [Google Scholar] [CrossRef]

- Dawson, J.W. Causality in the freedom-growth relationship. Eur. J. Political Econ. 2003, 19, 479–495. [Google Scholar] [CrossRef]

- De Haan, J.; Lundström, S.; Sturm, J.E. Market-oriented institutions and policies and economic growth: A critical survey. J. Econ. Surv. Wiley Blackwell 2006, 20, 157–191. [Google Scholar] [CrossRef]

- Campos, N.F.; De Grauwe, P.; Ji, Y. Structural Reforms, Growth and Inequality: An Overview of Theory, Measurement and Evidence. IZA Discussion Papers, No. 11159. Available online: http://hdl.handle.net/10419/174069 (accessed on 15 December 2020).

- Joshi, P.; Beck, K. Democracy and carbon dioxide emissions: Assessing the interactions of political and economic freedom and the environmental Kuznets curve. Energy Res. Soc. Sci. 2018, 39, 46–54. [Google Scholar] [CrossRef]

- Rios, V.; Gianmoena, L. Convergence in CO2 emissions: A spatial economic analysis with cross-country interactions. Energy Econ. 2018, 75, 222–238. [Google Scholar] [CrossRef]

- Lin, B.; Ge, J. Does institutional freedom matter forglobal forest carbon sinks in the face of economic development disparity? China Econ. Rev. 2021, 65, 101563. [Google Scholar] [CrossRef]

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5, 1379239. [Google Scholar] [CrossRef]

- McMillan, M.; Rodrik, D.; Sepulveda, C. Structural change, fundamentals and growth: A framework and case studies. NBER Working Paper 23378. Available online: http://www.nber.org/papers/w23378 (accessed on 15 December 2020).

- Alexandrakis, C.; Livanis, G. Economic Freedom and Economic Performance in Latin America: A Panel Data Analysis. Rev. Dev. Econ. 2013, 17, 34–48. [Google Scholar] [CrossRef]

- Duval, R. Is there a role for macroeconomic policy in fostering structural reforms? Panel evidence from OECD countries over the past two decades. Eur. J. Political Econ. 2008, 24, 491–502. [Google Scholar] [CrossRef]

- Carlsson, F.; Lundström, S. Economic freedom and growth: Decomposing the effects. Public Choice 2002, 112, 335–344. [Google Scholar] [CrossRef]

- Feldmann, H. Product Market Regulation and Labor Market Performance around the World. LABOUR 2012, 26, 369–391. [Google Scholar] [CrossRef]

- Bourlès, R.; Cette, G.; Lopez, J.; Mairesse, J.; Nicoletti, G. Do product market regulations in upstream sectors curb productivity growth? Panel data evidence for OECD countries. Rev. Econ. Stat. 2013, 95, 1750–1768. Available online: https://www.jstor.org/stable/43554859 (accessed on 15 December 2020). [CrossRef]

- Allen, F.; Gu, X.; Kowalewski, O. Financial crisis, structure and reform. J. Bank. Financ. 2012, 36, 2960–2973. [Google Scholar] [CrossRef]

- Stroup, R.L. Economic Freedom and Environmental Quality. In Proceedings of the Conference Sponsored by the Federal Reserve Bank of Dallas, Dallas, Texas, USA, 23–24 October 2003; pp. 73–93. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.432.5342&rep=rep1&type=pdf#page=77 (accessed on 15 December 2020).

- Rossen, I.L.; Dunlop, P.D.; Lawrence, C.M. The desire to maintain the social order and the right to economic freedom: Two distinct moral pathways to climate change skepticism. J. Environ. Psychol. 2015, 42, 42–47. [Google Scholar] [CrossRef]

- Graafland, J.J. Economic freedom and corporate environmental responsibility: The role of small government and freedom from government regulation. J. Clean. Prod. 2019, 218, 250–258. [Google Scholar] [CrossRef]

- Taylor, M.S.; Antweiler, W.; Copeland, B.R. Is Free Trade Good for the Environment. Am. Econ. Rev. 2001, 94. Available online: http://works.bepress.com/taylor/23/ (accessed on 15 December 2020).

- Farzin, Y.H.; Bond, C.A. Democracy and Environmental Quality. J. Dev. Econ. 2006, 81, 213–235. Available online: https://ssrn.com/abstract=790669 (accessed on 15 December 2020).

- Carlsson, F.; Gable, S. Political and Economic Freedom and the Environment: The Case of CO2 Emissions January 2000. Available online: https://www.researchgate.net/publication/228542880_Political_and_Economic_Freedom_and_the_Environment_The_Case_of_CO2_Emissions/ (accessed on 15 December 2020).

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Abdullah, H.B.; Qureshi, M.E. The impact of CO2 emissions on economic growth: Evidence from selected higher CO2 emissions economies. Environ. Sci. Pollut. Res. 2016, 23, 6376–6389. [Google Scholar] [CrossRef] [PubMed]

- Rusiawan, W.; Tjiptoherijanto, P.; Suganda, E.; Darmajanti, L. System Dynamics Modeling for Urban Economic Growth and CO2 Emission: A Case Study of Jakarta, Indonesia. Procedia Environ. Sci. 2015, 28, 330–340. [Google Scholar] [CrossRef]

- Wen, J.; Hao, Y.; Feng, G.F.; Chang, C.P. Does government ideology influence environmental performance? Evidence based on a new dataset. Econ. Syst. 2016, 40, 232–246. [Google Scholar] [CrossRef]

- Fedrigo-Fazio, D.; Schweitzer, J.-P.; Ten Brink, P.; Mazza, L.; Ratliff, A.; Watkins, E. Evidence of Absolute Decoupling from Real World Policy Mixes in Europe. Sustainability 2016, 8, 517. [Google Scholar] [CrossRef]

- Qureshi, M.I.; Qayyum, S.; Nassani, A.A.; Aldakhil, A.M.; Abro, M.M.Q.; Zaman, K. Management of various socio-economic factors under the United Nations sustainable development agenda. Resour. Policy 2019, 64, 101515. [Google Scholar] [CrossRef]

- Kayongo, A. Micro and Macro Effects of Product Market Reforms: Evidence from Most Recent Research. Available online: https://ssrn.com/abstract=3130211 or http://dx.doi.org/10.2139/ssrn.3130211 (accessed on 15 December 2020).

- Sorrell, S. Energy, Economic Growth and Environmental Sustainability: Five Propositions. Sustainability 2010, 2, 1784–1809. [Google Scholar] [CrossRef]

- Aguilar-Hernandez, G.A.; Dias Rodrigues, J.F.; Tukker, A. Macroeconomic, social and environmental impacts of circular economy up to 2050: A meta-analysis of prospective studies. J. Clean. Prod. 2021, 278, 123421. [Google Scholar] [CrossRef]

- Sanyé-Mengual, E.; Secchi, M.; Corrado, S.; Beylot, A.; Sala, S. Assessing the decoupling of economic growth from environmental impacts in the European Union: A consumption-based approach. J. Clean. Prod. 2019, 236, 117535. [Google Scholar] [CrossRef] [PubMed]

- Tanzi, V. The Economic Role of the State in the 21st Century. Cato J. 2005, 25, 617–638. Available online: https://EconPapers.repec.org/RePEc:cto:journl:v:25:y:2005:i:3:p:617-638 (accessed on 15 December 2020).

- Levente, N. How Does Economic Freedom Influence The Relationship Between Government Size And Convergence? Ann. Fac. Econ. 2015, 1, 623–630. [Google Scholar]

- Stiglitz, J.E. The anatomy of a murder: Who killed America’s economy? Crit. Rev. 2009, 21, 329–339. [Google Scholar] [CrossRef]

| Economic Performance Impact Area | Structural Reforms Impact Valuation | Results | Researchers |

|---|---|---|---|

| Economic growth | The interactions of economic freedom between the countries on the development context | Empirical study suggests that reforms are contagious and neighboring countries with the same cultural proximity adopt similar policies. | [7] |

| Regulations of product and its impact valuation upon the sectorial performance of productivity | The main study finding from the developed model suggests that regulations towards light changes are followed by a growth in productivity. | [42] | |

| Economic freedom and productivity | Deregulation in business and labor factors leads to a decrease in productivity in the Latin America region; certain liberal focused policies could be beneficial to economic performance. There is a differential effect for the OECD countries block and the Latin America region. | [38] | |

| The effects of labor and product market reforms on the macroeconomic environment | The main results suggest that product market reform increases productivity, but there is a slow materialization of the effects. The labor reforms can have benefits to the economy in expansion times but have negative effects in recessions. | [19] | |

| Monetary policy relationship with product market competition and growth | The main effects suggested by this study are focused upon monetary policy design, which interacts with firms in the euro-area and has a direct effect on the competitiveness and growth of firms. | [4] | |

| Labour market | Credit market regulation impact on labor market performance | The main results of this relation estimation present strong arguments that credit market regulation has a negative effect on employment characteristics; countries with a higher regulation level decrease employment and increase unemployment. | [20] |

| Product market regulation and labor market performance | Stricter product market regulation leads to increased unemployment; the same effect is estimated as a result of credit market regulation | [41] | |

| The macroeconomic effects of goods and labor market deregulation | The developed model shows that labor reforms can produce short-run recessionary effects, even though they are expansionary in the long-run | [18] | |

| Market structure | Regulation and intuitionalism and macroeconomic environment | The main effects of regulatory estimates suggest that there is a positive effect of policies appraising markets openness to multifactor productivity estimates | [17] |

| Financial market | Financial reforms and banking sector activity | The financial system structure reforms impact bond and credit levels; a well-balanced structure of a finance system leads to a more resilient banking sector; financial market systems react differently to economic cycles | [43] |

| Indicator | Valuation Area | Database | Valuation |

|---|---|---|---|

| GDP per person employed (constant 2011 PPP $) | Economic growth estimation effects | International Labor Organization | Economic performance estimates |

| Output per worker (GDP constant 2010 US $)—ILO modelled estimates | International Labor Organization | ||

| Unemployment, total (% of total labor force) (national estimate) | Labor market estimation effects | World bank | |

| Labor force participation rate—ILO modelled estimates (%) Age 15–64 | International Labor Organization | ||

| Services, value added (% of GDP) | Market structure value estimation | World bank | |

| Industry (including construction), value added (% of GDP) | World bank | ||

| Inflation, consumer prices (annual %) | Finance market estimation effects | World bank | |

| Domestic credit provided by financial sector (% of GDP) | World bank | ||

| Gross fixed capital formation (% of GDP) | World bank | ||

| Adjusted savings: carbon dioxide damage (% of GNI) | Economic losses from pollution | World bank | Environmental performance measurement |

| Adjusted savings: particulate emission damage (% of GNI) | Economic losses related to health due to pollution | World bank | |

| CO2 emissions (metric tons per capita) | CO2 emissions intensity | World bank | |

| Electricity production from oil, gas, and coal sources (% of total) | Electricity production from fossil fuels | World bank | |

| Renewable energy consumption (% of total final energy consumption) | Energy consumption from renewable sources | World bank |

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| ECONOMIC FREEDOM 1 | ||||

| Overall Score (graded from 0 to 100) | 69.20 | 6.34 | 51.90 | 82.60 |

| Property Rights (graded from 0 to 100) | 75.46 | 17.12 | 30.00 | 95.00 |

| Government Integrity (graded from 0 to 100) | 69.26 | 17.95 | 33.20 | 97.00 |

| Tax Burden (graded from 0 to 100) | 60.61 | 12.91 | 32.70 | 93.60 |

| Government Spending (graded from 0 to 100) | 33.64 | 16.70 | 0.00 | 70.80 |

| Business Freedom (graded from 0 to 100) | 81.21 | 10.61 | 53.70 | 100.00 |

| Labor Freedom(graded from 0 to 100) | 58.47 | 13.57 | 31.00 | 100.00 |

| Monetary Freedom (graded from 0 to 100) | 81.38 | 4.05 | 67.00 | 90.80 |

| Trade Freedom (graded from 0 to 100) | 85.85 | 2.83 | 65.40 | 89.40 |

| Investment Freedom (graded from 0 to 100) | 76.60 | 12.59 | 50.00 | 95.00 |

| Financial Freedom (graded from 0 to 100) | 68.88 | 12.38 | 40.00 | 90.00 |

| ECONOMIC PERFORMANCE | ||||

| GDP per person employed (constant 2011 PPP $) | 86,058.90 | 33,187.20 | 39,631.28 | 229,260.40 |

| Output per worker (GDP constant 2010 US $) | 89,416.79 | 47,373.06 | 24,583.30 | 259,414.90 |

| Unemployment (% of total labor force) | 8.59 | 4.72 | 2.25 | 27.47 |

| Labour force participation rate (%) | 72.89 | 5.89 | 57.50 | 89.09 |

| Services, value added (% of GDP) | 64.00 | 5.96 | 48.16 | 79.33 |

| Industry (including construction), value added (% of GDP) | 22.62 | 5.53 | 10.52 | 40.29 |

| Inflation, consumer prices (annual %) | 1.98 | 1.98 | −4.48 | 15.40 |

| Domestic credit provided by financial sector (% of GDP) | 139.44 | 52.90 | 38.42 | 298.09 |

| Gross fixed capital formation (% of GDP) | 21.17 | 3.84 | 11.07 | 36.38 |

| ENVIROMENTAL PERFORMANCE | ||||

| Adjusted savings: carbon dioxide damage (% of GNI) | 0.60 | 0.32 | 0.20 | 2.09 |

| Adjusted savings: particulate emission damage (% of GNI) | 0.08 | 0.05 | 0.02 | 0.24 |

| CO2 emissions (metric tons per capita) | 7.54 | 3.39 | 2.95 | 24.82 |

| Electricity production from oil, gas and coal sources (% of total) | 49.34 | 30.03 | 0.01 | 100.00 |

| Renewable energy consumption (% of total final energy consumption) | 22.04 | 18.45 | 0.18 | 77.34 |

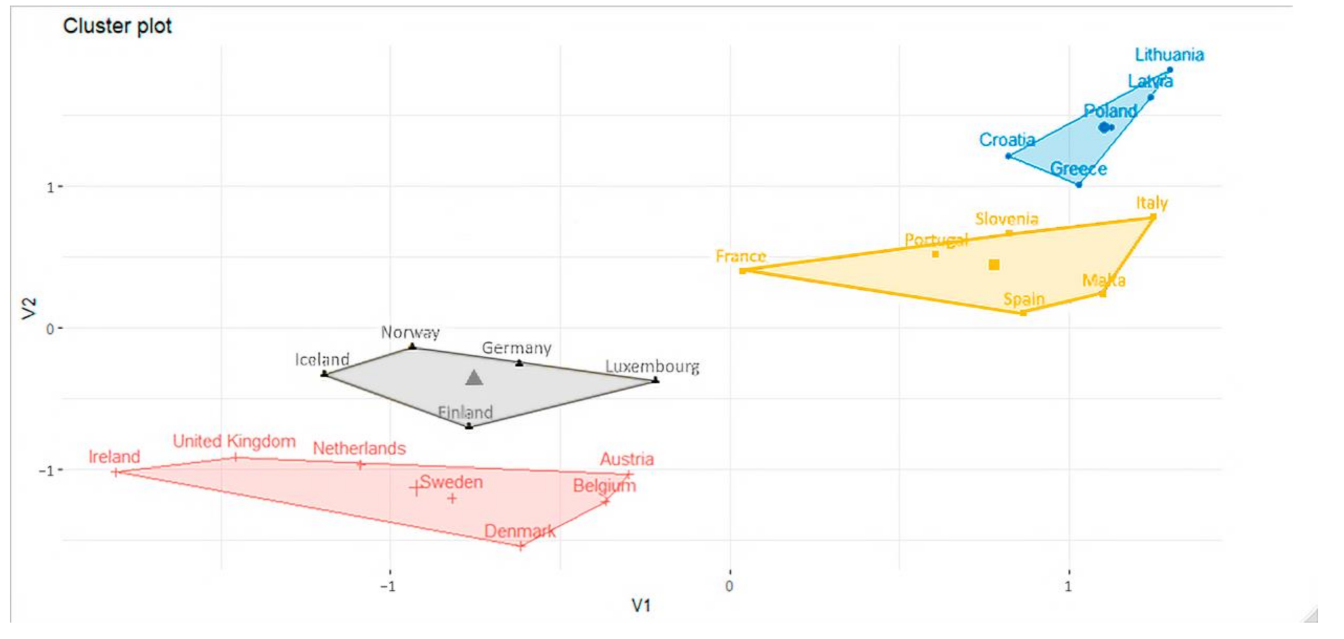

| Indicators | Cluster 1: Croatia, Greece, Latvia, Lithuania, Poland | Cluster 2: France, Italy, Malta, Portugal, Slovenia, Spain | Cluster 3: Finland, Germany, Iceland, Luxembourg, Norway | Cluster 4: Austria, Belgium, Denmark, Ireland, Netherlands, Sweden, United Kingdom |

|---|---|---|---|---|

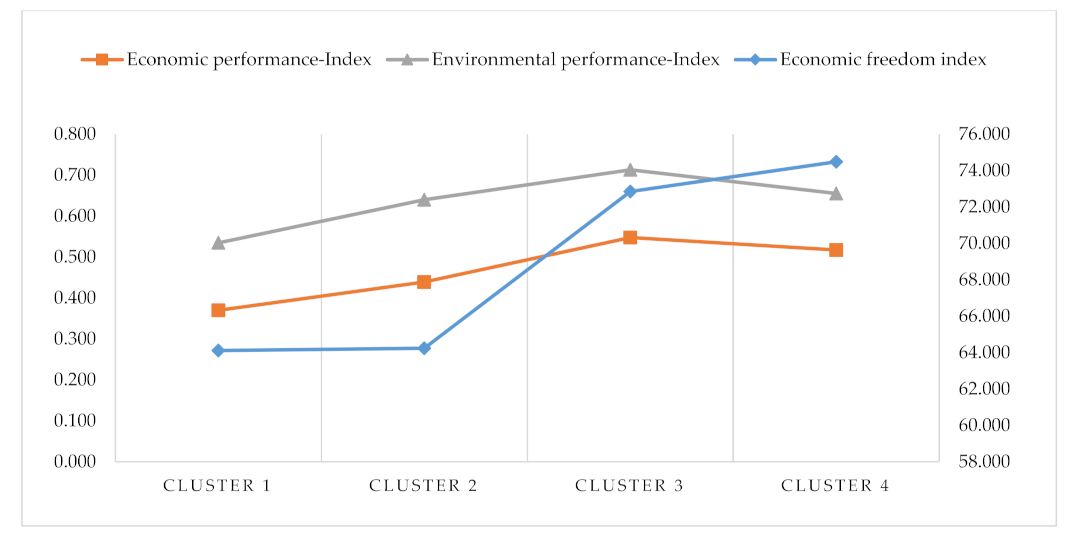

| Economic freedom index | 64.11 | 64.24 | 72.85 | 74.49 |

| Property Rights | 51.38 | 68.50 | 89.45 | 88.64 |

| Government Integrity | 45.45 | 59.65 | 85.74 | 82.73 |

| Tax Burden | 75.86 | 57.68 | 62.88 | 50.62 |

| Government Spending | 45.57 | 30.55 | 35.16 | 26.70 |

| Business Freedom | 70.69 | 77.14 | 87.25 | 87.90 |

| Labor Freedom | 56.25 | 51.17 | 49.66 | 72.60 |

| Monetary Freedom | 79.74 | 81.56 | 81.19 | 82.53 |

| Trade Freedom | 85.25 | 85.34 | 86.58 | 86.21 |

| Investment Freedom | 67.64 | 70.71 | 78.29 | 86.84 |

| Financial Freedom | 62.86 | 61.79 | 69.29 | 78.98 |

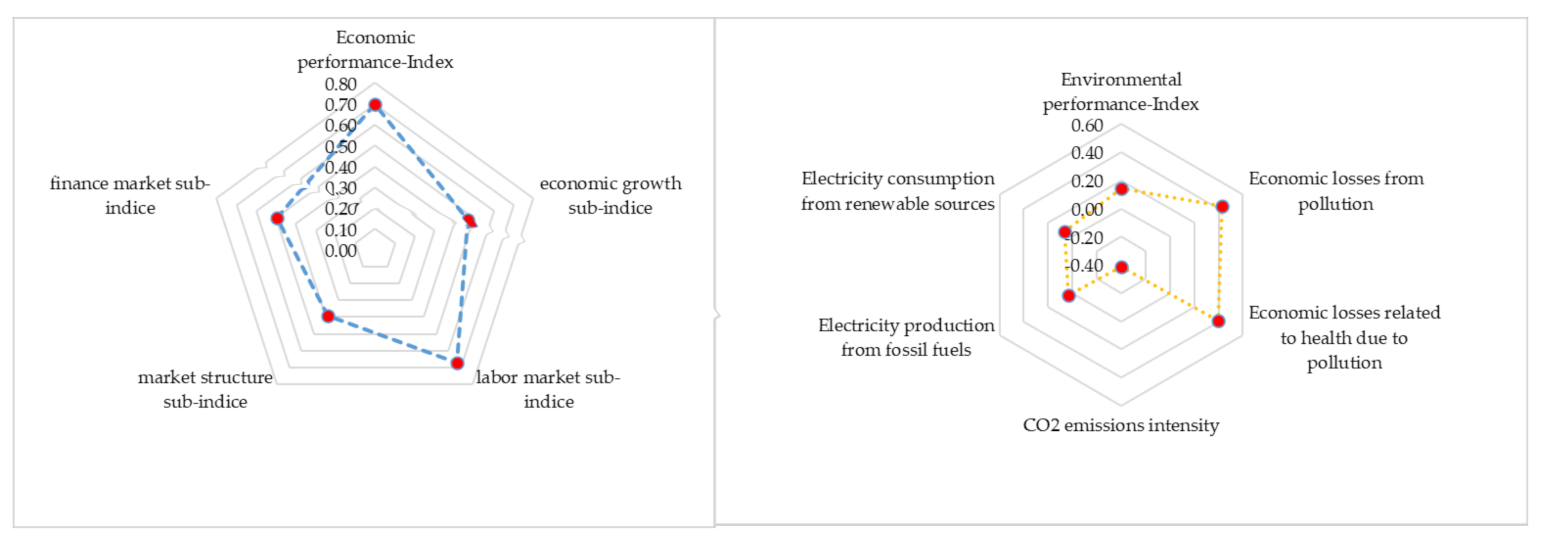

| Economic performance index | 0.37 | 0.44 | 0.55 | 0.52 |

| Economic growth sub-index | 0.07 | 0.20 | 0.44 | 0.32 |

| Labor market sub-index | 0.54 | 0.57 | 0.78 | 0.73 |

| Market structure sub-index | 0.43 | 0.45 | 0.45 | 0.46 |

| Finance market sub-index | 0.44 | 0.53 | 0.53 | 0.56 |

| Environmental performance index | 0.53 | 0.64 | 0.71 | 0.66 |

| Economic losses from pollution | 0.70 | 0.87 | 0.90 | 0.92 |

| Economic losses related to health due to pollution | 0.41 | 0.81 | 0.89 | 0.85 |

| CO2 emissions intensity | 0.88 | 0.86 | 0.63 | 0.77 |

| Electricity production from fossil fuels | 0.39 | 0.48 | 0.66 | 0.50 |

| Electricity consumption from renewable sources | 0.29 | 0.18 | 0.48 | 0.23 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rapsikevicius, J.; Bruneckiene, J.; Lukauskas, M.; Mikalonis, S. The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries. Sustainability 2021, 13, 2380. https://doi.org/10.3390/su13042380

Rapsikevicius J, Bruneckiene J, Lukauskas M, Mikalonis S. The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries. Sustainability. 2021; 13(4):2380. https://doi.org/10.3390/su13042380

Chicago/Turabian StyleRapsikevicius, Jonas, Jurgita Bruneckiene, Mantas Lukauskas, and Sarunas Mikalonis. 2021. "The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries" Sustainability 13, no. 4: 2380. https://doi.org/10.3390/su13042380

APA StyleRapsikevicius, J., Bruneckiene, J., Lukauskas, M., & Mikalonis, S. (2021). The Impact of Economic Freedom on Economic and Environmental Performance: Evidence from European Countries. Sustainability, 13(4), 2380. https://doi.org/10.3390/su13042380