Abstract

The EU Green Deal and its impact on economic transformation provoked a slightly forgotten free market vs. market regulation discussion, but in the light of a new context—economic and environmental performance development. The economic shock caused by COVID-19, which transformed economies and societies, intensified this discussion. This article analyses the impact of economic freedom on economic performance and environmental performance in European countries. The article contributes to a gap in the literature, because, to date, research has examined the effects of economic freedom, or some of its components, on economic or environmental measures in groups of nations with a lacking sustainable development context. In addition, the mixed results obtained led to confusion in perceptions and knowledge about the influence and usefulness of economic freedom for economic and environmental performance. We also found mixed results regarding the influence of economic freedom on economic and environmental performance, but the introduction of a new concept—the optimal level of economic freedom—organized the different results into a coherent logical sequence. The paper provides original empirical evidence and specifies the targets of structural reforms. The results are thus useful for policymakers to develop more appropriate and efficient economic freedom.

1. Introduction

The EU Green Deal (2019) and other climate change policies have created new trajectories and challenges for the development of the economies. Pandemics and economic and political shocks (such as COVID-19, the 2008 financial crisis, or Brexit) have also affected the economic development strategies of countries. In this new reality, it has become crucial for economies to rely on fiscal policies and structural reforms [1], which remove obstacles to the efficient allocation of resources and correct potential market failures [2], and comprise policies that improve the institutional and regulatory framework in which firms, households, and governments operate. This indicates that the harmonization among economic freedom or free-market principles, regulatory frameworks, and climate change policies has again become a topical issue and requires new scientific insights in the context of the new reality. Until now, the role of environmental performance in the analysis of economic performance progress through structural reform policies has remained a less significant area of interest.

Economic freedom is defined as government interventions via structural reforms that are made to maintain equilibrium in the light of global changes to economic paradigms [3]. Research confirms the positive relationship between economic freedom and economic growth [4,5,6,7,8,9]. Economic freedom also increases countries’ competitiveness, resilience to shocks, and flexibility [10,11], and enhances employment prospects [12]. Economic freedom has positive short-run effects [13,14], in addition to producing long-run GDP gains [2,9], and enhances capital and labor markets [15,16,17,18,19,20,21], the banking sector [22], product markets [17], investment potential and foreign direct investment [23], business markets and entrepreneurship [17,24,25], and even legislation via the juridical environment [26,27]. Structural estimates indicate that improvements in economic freedom affect the level of real income per capita [28]. In contrast, previous research has also found negative results and concluded that the overall level of economic freedom is not related to economic growth [29], especially in the long run [30]. It is possible to obtain different results using different methods of quantitative analysis, in addition to different model specifications, in terms of changing control variables to prove the robustness of the results [6].

It is widely believed that economic freedom fosters economic development; however, it is difficult to examine the extent to which more market-oriented countries have a better growth performance than countries strongly relying on government control [31]. The Economic Freedom Index and other indices themselves do not aspire to determine which level of economic freedom is optimal. It is the task of researchers to address whether a greater or increasing level of economic freedom contributes to economic growth [6]. The main problem stems from diverse conclusions across countries and over time. There are a number of studies that focus on one country, but very few that study the effects in more than one country over time [32]. Geographical differentiation presents another difficulty. These aspects have not been fully acknowledged and require deeper investigation.

Usually the focus towards the progress of the state liberalization through economic freedom referred to economic outcomes’ estimation. This research article includes the impact of economic freedom on environmental performance. Mostly this area was separately analyzed from the impact estimation towards environmental performance—relating CO2 emissions and economic growth [33,34,35,36]. Our proposed concept investigates economic freedom impact effects on economic and environmental performance as a triple relationship including deeper explanatory variables in economic and environmental outcomes.

Considering the given context, the purpose of this article is to investigate the interaction among economic freedom, economic performance, and environmental performance in European countries. It contributes to the gap in the literature, because results regarding the triple relationship are scarce and mixed. The study aims to aid in the development of more applicable structural reforms in the economic and environmental progress context.

In this article, we use an institutional and market regulation approach to investigate the relationship between regulatory, economic, and environmental areas. We follow previous research that suggests that structural reforms arise from structural shifts in the economy, such as a deindustrialization process and other paradigms [3,37], and have a final effect on economic performance. We define economic freedom as the final outcome of the regulatory process. The changes in the setting of the regulatory area may increase or decrease the freedom levels [38]; therefore, economic freedom is a final estimate that affects the economic and environmental factors within the countries.

The research methods are as follows: a systematic, comparative, and logical analysis of the scientific literature; trend, correlation, and index analysis; and t-distributed stochastic neighbor embedding (t-SNE) clusterization.

The research employs the panel data of the Heritage Index of Economic Freedom and 10 of its components. The indicators of economic performance (nine indicators) and environmental performance (five indicators) employ the data from the International Labor Organization and World Bank databases. The data covers 23 European countries for a period of 14 years (research period 2005–2018). The research panel includes 322 observations.

This paper makes several important contributions. First, it contributes to economic development and policy literature by clarifying the interaction among economic freedom, economic performance, and environmental performance in European countries, in addition to introducing a new concept—the optimal level of economic freedom. Second, it provides original empirical evidence and specifies the targets of structural reforms, which are useful for policymakers to develop more appropriate structural reforms in the economic and environmental progress context.

The paper is organized as follows. Section 2 presents the theoretical analysis of the market regulation impact on economic performance and environmental performance. The section also provides the conceptual framework for analyzing this triple relationship. Subsequently, the data and research methodology, and the empirical research, are presented. The paper ends with a discussion of the results and conclusions.

2. Literature Review

2.1. Traditional Focus on Economic Freedom and Economic Performance

The 2008 financial crisis led many countries in Europe to conduct extensive structural reform programs [32] to achieve economic recovery and growth. Economic disequilibrium, resulting from unnatural causes, should be solved by policy interventions [3] via structural reforms. Such an institutional approach has been already presented in a number of studies of economic development [7,9,19,39] and various rankings, such as the Heritage Index of Economic Freedom (2020), which measure the impact of liberty and free markets and the success of each country’s structural reforms. Countries that are more economically free when entering a crisis are likely to experience substantially smaller crises, measured by the peak-to-trough GDP ratio, and have shorter recoveries to pre-crisis real GDP [11].

The majority of research analyzes the impact of structural reforms or economic freedom on a single area of economic performance. There is a lack of research that analyzes the impact on a wider scope, covering several areas of economic performance. Growth effects [9,40], productivity and capital [38], development differences [7], and how the interactions between regulatory indicators align with labor and product market efficiencies [17,20,41] are the main areas that are used to analyze the effect of economic freedom or structural reforms (see Table 1).

Table 1.

The main economic performance areas of structural reforms.

In recent years, the research into the effects of structural reforms on economic performance has increased, but the main problem stems from diverse conclusions across countries and over time. There are a number of studies that focus on one reform and/or on one country, but very few that study multiple reforms in more than one country over time [32]. Geographical differentiation presents another difficulty. This aspect has not been fully acknowledged.

It is widely believed that market-oriented reforms foster economic development; however, it is difficult to examine to what extent more market-oriented countries have a better growth performance than countries strongly relying on government control [31]. This type of research has increased after organizations such as the Fraser Institute and the Heritage Foundation began to publish an index of economic freedom. Two distinct schools of thought have emerged: first, the causal links between economic freedom and the various economic indicators of growth and development; second, a focus on the nature of the relationship between the degree of democracy; political, civil, and economic freedom; and growth [6].

Major studies that explore the relationship between economic freedom and economic performance are related to economic growth [4,5,6,7,8,9] labor market and migration [15,16,19,21], the credit market [20], the bank sector [22], the product market [17], investment potential and foreign direct investment [23], business markets and entrepreneurship [17,24,25], and even legislation with juridical environment [26,27]. Despite the fact that usually research finds that economic freedom has a positive impact on economic growth, the major studies are related to one area of economic performance, and they lack a systemic thinking approach.

The incorporation of several areas of economic performance to analyze the impact of economic freedom provides a deeper understanding and might shed more light on the present findings. This is consistent with the findings of Carlsson and Lundström [40], who analyzed several components of economic freedom and found that the size of government and freedom to trade with foreigners has a statistically significantly negative effect on growth.

2.2. XXI Century’s Development of Economic Freedom and Interrelationships with Economic and Environmental Outcomes

A strong decision has yet to be reached about the relationship between economic freedom and environmental regulation, which has a direct impact on environmental performance [44]. The free-market ideology rejects the reality of climate change because of a tendency to favor economic freedom. Legislative policies designed to mitigate climate change have regulatory implications, counter to the tenets of a free-market ideology in which unfettered markets or the “invisible hand” are seen to provide the best social and economic outcomes for society [45]. Based on the well-known Kuznets growth stage model, CO2 emissions and other pollutants decrease with the phase of further economic growth. Research has clearly distinguished the other ideology, which stresses the importance of governmental regulations to protect and/or repair the environment via transforming the economy to the post-industrial phase, which reflects the decrease in pollution and the maximization of environmental factors through service-based market structure [33] and environmentally friendly technologies and innovations. Government intervention by regulation is necessary to establish clear minimum requirements and to provide incentives to invest in technologies that target environmental harm [46]. Government spending helps to develop markets for sustainable products. A consensus view does not exist, because the empirical research has provided mixed results. Debate still exists about whether economic freedom increases or decreases countries’ environmental progress. Taylor and Antweiler [47] found that freer trade appears to be good for the environment, and Farzin and Bond [48] concluded that environmental quality is better in politically free countries. Stroup [44] cited Norton (1998), who found that in nations where property rights are strong, various measures of environmental quality are higher than in nations in which property rights are weak. On the other hand, Carlsson and Gable [49] found that economic freedom increases CO2 emissions in both low-income and high-income countries, and Graafland [46] found that corporate environmental responsibility decreases with freedom from government regulation, and companies located in countries with a small government engage less in corporate environmental responsibility than companies located in countries with a big government. However, at the country level, analysis has yet to be conducted including more than just one factor, which would allow monitoring of environmental progress in the direct linkage with economic development and regulation through economic freedom estimates. Many recent CO2 studies have focused on single country analyses rather than panel data across countries, but it is difficult to extrapolate from single country studies to general patterns occurring across a wide range of countries, data, and time periods [33].

The relationship between economic growth and environmental performance has come to the forefront of contemporary issues for both developed and developing countries [50,51]. Determination of high economic growth targets is suspected to trigger worsening environmental quality [52]; nevertheless, the environmental Kuznets curve literature has not yet come to a strong decision about CO2, with some studies showing that it does exist overall, but others discovering different patterns completely [33]. The research provides mixed results regarding economic growth and CO2 emissions, depending on the economic development patterns in the country (low, medium, and high pollution [34], low and high level of development [35]). Economic growth has a negative effect on CO2 emissions in low-growth regimes, but a positive effect in high-growth regimes. CO2 emissions have a significant positive relationship with economic growth for China, Japan, and the USA [51]. Greater carbon dioxide is being released, due to increasing industrial activities without employing environmentally friendly techniques that should enhance environmental quality [36]. Therefore, appropriate and prudent policies are required to control pollution [51,53], in addition to a need for transformation of low-carbon technologies aimed at reducing emissions, increasing sustainable economic growth, and improving societal welfare [36]. Democracy and its associated freedoms provide the conduit through which agents can exercise their preferences for environmental quality more effectively than under an autocratic regime, thus leading to decreased concentrations or emissions of pollution [48]. Economic development modifies the effect of institutional freedom on carbon sinks. Due to the development of an economy, the effect of institutional freedom on environmental protection is greater [35]. Decoupling effects compel this interrelation, especially the concepts of absolute and relative decoupling; the absolute effect determines the GDP growth and reductions in the emissions, whereas relative decoupling denotes partial reductions and GDP growth [54]; notwithstanding the effects of technological progress, a vast impact of this progress depends on governmental policies, which can be derived from freedom effects. Giving consideration to this interrelation between policy, economic growth, and environmental factors, a theoretical problematic aspect relates to sustaining growth, reducing environmental damage through economic freedom reduction in relation to new environmental standards, tax policies, subsidies, and requirements that has an impact on business behavioral development.

The triple relationship between economic freedom, economic performance, and environmental performance has been scarcely analyzed, and this is a new and different approach from that of previous studies. Usually, two-factor analyses dominate. There are few studies with mixed results about the influence of economic freedom on the environmental performance of the country; thus, a knowledge gap exists about the interaction between economic freedom and environmental performance. For OECD countries, greater political freedom tends to increase carbon emissions, a result that suggests that interest groups and industries are placing pressure on governments to reduce regulations relating to pollutants. Increased political freedom has little effect on CO2 emissions for all categories of non-OECD countries, suggesting that the type of government does not matter in regard to reducing these emissions. Joshi and Beck [33] and Carlsson and Gable [49] estimated that more economic freedom increases CO2 emissions in both low-income and high-income countries. The existing results and the variety of factors justify the need for a deeper analysis of the relationship among economic freedom, economic performance, and environmental performance to gain a more nuanced view for policymakers.

Despite the fact that most attention is focused on relations of CO2 emissions and growth, the other relevant areas are less analyzed; still, they are in close association with socio-economic factors and health issues occurring due to air pollution [55]. The energy use is also a substantially important factor, the population growth impacts the demand, and only the propagation of renewable energy use supports environmentally sustainable economic progress; without the impact of supportive governmental programs for renewable energy, the demand is still being sustained through the use of the fossil-based energy system [33,48]. To capture the environmental performance, we enlist several key aspects that allow us to identify the progress in separate areas: health problems; emissions intensity, and energy use. The sequential structure of the environmental performance highlights the interconnectedness of these determinants; for instance, energy consumption and renewable energy leads to emission intensity change, which has a direct approach towards health problems. According to this interconnectedness, we list environmental progress measurement on these indicators:

- Air pollution economic loss: In the long run, the United Nation sustainable development goals agenda estimates that countries incur economic losses due to carbon emissions, and air pollution has direct linkages with environmental policies [55].

- CO2 emissions intensity: Pollution intensity is interrelated with economic freedom factors such as problems with adopting more efficient technologies [33,36]; political freedom allows enhancement of more effective environmental policy [48]; and highly intensive emissions over a long-time horizon, as countries develop more rapidly, may indicate that a country is still in the progress of reaching its full development potential [33].

- Energy consumption from fossil fuel and renewable sources: Decreased energy from fossil fuels and increase in renewable energy use in economically advanced countries defines these countries as sustainably developed and innovative [33].

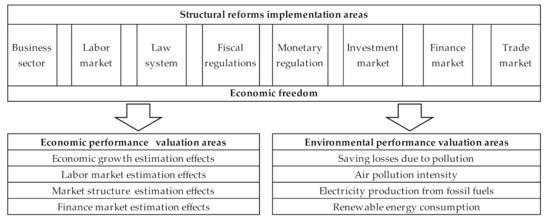

To explain how economic freedom interacts with economic performance and environmental performance, we refer to the Index of Economic Freedom of the Heritage Foundation for the expression of the degree of economic freedom in a country; the common economic performance areas, namely, economic growth, market structure, labor market, and finance market, as used by [9,17,19,38] and [56]; and the common environmental performance areas, namely, economic losses related to pollution, emission intensity, dependency on consumption of fossil fuels, and renewable energy consumption, as used by [33,36,41,55] (see Figure 1).

Figure 1.

Conceptual framework of interaction among economic freedom, economic performance, and environmental performance.

The presented estimation structure of economic freedom’s impact on economic and environmental performance appraises several hypothetical elements about the structure of liberalization from economic, financial, and juridical perspectives and its relation with economic and environmental performance. Modern development theories such as Kuznets environmental stage model [33], steady-state model [57], and the circular economy model [58] comprehend the interrelation of environmental factors alongside economic factors. The majority analysis towards such interrelations focuses on how economic growth could be decoupled from the environment (to reach absolute or relative decoupling), and the minority of the attention is focused on studying interrelations including political elements. By merging economic freedom with economic performance and environmental performance (see Figure 1), we highlight the regulatory role, which is a finite measure to sustain growth and progress in the economy [19], and the conceptual framework related to these interactions provides methodological ground to seek the answer to what economic freedom level is the best to sustain economic progress and environmental benefits.

Although a large amount of research has been conducted about the impact of economic freedom (gained through structural reforms) on the economic performance of countries, the mixed results still raise questions about the importance of the research in this area. The lack of research about the impact of economic freedom on environmental performance also requires further analysis in the context of development. Our proposed conceptual framework is an attempt to shed more light on these triple interactions.

3. Data and Research Methodology

This section presents the methodology used to analyze the interaction among economic freedom, economic performance, and environmental performance, based on trend analysis, correlation analysis, the mathematical–statistical index computation method, and clustering. The research period is 14 years (2005–2018). The units of research are 23 European countries (we excluded some European countries due to missing environmental indicators for the relevant period of 2015–2018); the panel data sample is strongly balanced.

Following [7,38], we used the Index of Economic Freedom of the Heritage Foundation for the expression of the degree of economic freedom in a country. Ten components of economic freedom, namely, property rights, government integrity, tax burden, government spending, business freedom, labor freedom, monetary freedom, trade freedom, investment freedom, and financial freedom, were used. Two components, namely, juridical effectiveness and fiscal health, were eliminated, because the computation of these estimates only began in 2017.

Following the analysis of impact valuation for the economy, and financial and labor markets, by [4,17,18,19], and the analysis of impact valuation for the industrial and service sectors by [3,37], we identified nine economic performance indicators grouped into four valuation areas. Following [33,36,48,49,55], we identified five environmental performance indicators (see Table 2).

Table 2.

Estimation structure of economic and environmental performance.

Descriptive statistics of the data sample (see Table 3) show a wide variety in the analyzed components of economic freedom and indicators of economic performance. Only two indicators, namely, inflation and unemployment, show opposite effects, i.e., a lower value is better. Environmental performance estimates show opposite effects for every indicator, i.e., a lower value is better, with the exception of renewable energy consumption, which shows positive direct effects (the following estimation processes enlisted below, calculated using STATA and R software).

Table 3.

Descriptive statistics of data sample.

All indicators were normalized by using the distance from the minimal and the maximal value method, which allows all values to be assigned to [0;1] interval. We use additional estimations for normalized values that show opposite affections—the lower indicator corresponds to a better result (inflation, unemployment, environmental indicators, except renewable energy usage indicator). The additional computational step for such indicators was performed using mathematical function abs (normalised value—1). This setting allows us to determine higher values as being better than lower values. The mathematical functions of the economic performance index and environmental performance index are presented in Formulas 1 and 2. All sub-indices are equally weighted (wn = 1).

where:

Economic performance-Index = (w1EG_I + w2LM_I + w3MS_I + w4FM_I)/n

Economic performance-Index—economic performance index; EG_I—economic growth sub-index; LM_I—labor market sub-index; MS_I—market structure sub-index; FM_I—finance market sub-index, wi—the weight coefficient; n—number of sub-indices (equal to 4).

All sub-indices were constructed from two or three indicators, which represent the corresponding area (see Table 2). The sub-indices were calculated as average normalized indicator values.

where:

Environmental performance-Index = (w1ELP_I+ w2ELH_I+ w3API_I + w4EDF_I + w5REC_I)/n

Environmental performance-Index—environmental performance index; ELP_I–economic losses from pollution; ELH_I—economic losses related to health due to pollution; API_I—CO2 emissions intensity; EDF_I—electricity production from fossil fuels; REC_I—electricity consumption from renewable sources, wi—the weight coefficient; n—number of indicators (equal to 5).

We used trend analysis between the Index of Economic Freedom of the Heritage foundation, economic performance, and environmental performance based on the average of the sub-indices’ values for 2005–2018. Pearson correlation analysis was preformed between economic freedom, the economic performance index, and the environmental performance index (including sub-indices).

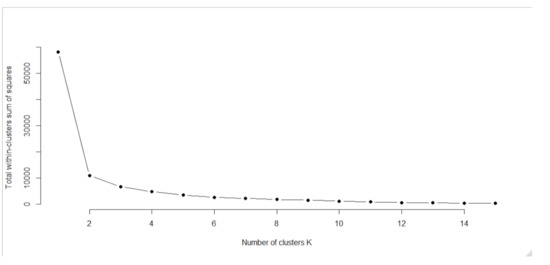

For the clusterization application, we used a t-distributed stochastic neighbor embedding (t-SNE) method, which is based on a machine-learning algorithm, to capture multidimensional data and transfer it into the two-dimensional representation (statistically, it minimizes Kullback–Liebler divergence between the joint probabilities of the low-dimensional embedding and the high dimensional data). T-SNE were made using R library Rtsne with two dimensions; during t-SNE, algorithms’ parameters were set to perplexity = 5 and maximum iterations = 500; K-means was created with cluster library and kmeans function, a number of clusters based on the total within-cluster sum of the square. The clusterization was performed over the entire research period based on the average estimates of the data sample. According to a rule of elbow applied for clusterization, we determined the optimal number of clusters to be four (see Appendix A, Figure A1). We also included the Pearson correlation analysis between the clusters (see Appendix A, Figure A2).

4. Results

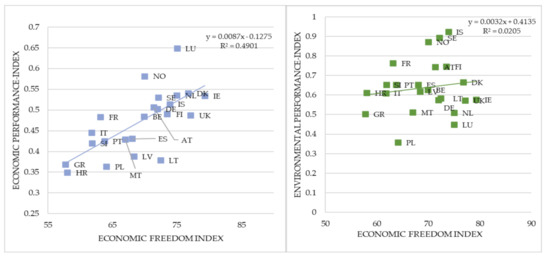

The trend analysis between the index of economic freedom and the economic and environmental performance indices (see Figure 2) indicates a positive relationship between economic freedom and economic performance (R2 = 0.49), but insufficient information (R2 = 0.02) about the relationship between economic freedom and environmental performance in countries of the European region, which may suggest that environmental progress is highly heterogeneous among the countries.

Figure 2.

The trend between the average index of economic freedom, economic performance index, and environmental performance index in 2005–2018.

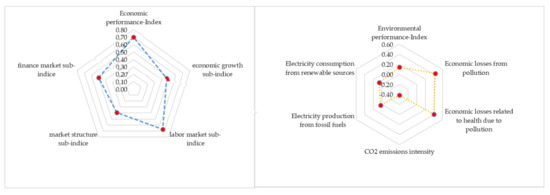

The correlation analysis between the index of economic freedom and economic performance index sub-indices (see Figure 3) shows that that economic performance and its separate areas have a strongly or moderately positive relationship with economic freedom. This means that economic freedom positively increases economic performance in European countries. The finance and labor markets have the strongest relationship with the index of economic freedom.

Figure 3.

Correlations between index of economic freedom, economic performance-index, environmental performance-index, and sub-indices, 2005–2018.

The correlation analysis between the index of economic freedom and environmental performance index sub-indices (see Figure 3) shows that the increase in economic freedom affects separate areas differently. The economic loss from pollution and economic losses related to health due to pollution have a positive relationship—the economic freedom reduces these environmental performance areas. However, electricity consumption from fossil fuels and renewable energy use tend to show no sufficient relationship, and CO2 emission intensity tends to highlight opposite effects, i.e., economic freedom leads to the increase in CO2 emissions. The correlation analysis of 2005–2018 in European countries proves the need for stronger harmonization of economic performance and environmental performance, because economic freedom achieved via structural reforms has a mostly positive effect on economic performance at the expense of environmental performance, namely, an increase in CO2 emissions. This suggests that economic freedom leads companies to increase competitiveness via cleaner production; however, higher economic performance increases consumption and production, and cleaner production does not compensate for the overall decrease in environmental progress.

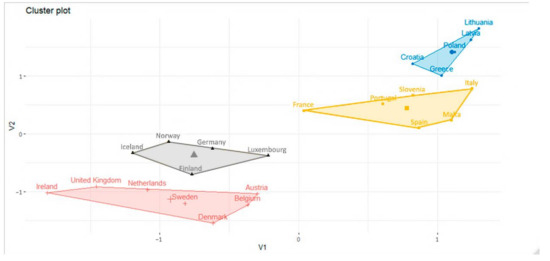

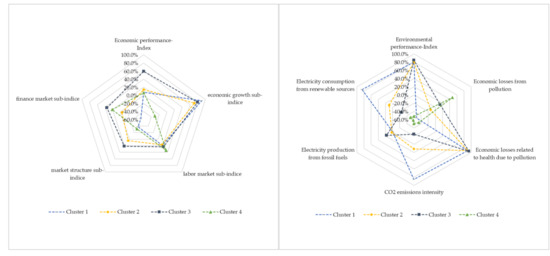

We used clusterization analysis to characterize more deeply the triple interaction among economic freedom, economic performance, and environmental performance. We found four well-separated clusters with similar profiles (see Figure 4); no outliers were determined.

Figure 4.

Clusterization of countries.

Cluster 1 (blue) consisted of five countries: Lithuania, Latvia, Poland, Greece, and Croatia; Cluster 2 (yellow) consisted of six countries: Italy, Slovenia, Malta, Spain, Portugal, and France; Cluster 3 (grey) consisted of five countries: Luxembourg, Germany, Finland, Norway, and Iceland; Cluster 4 (red) consisted of seven countries: Austria, Belgium, Denmark, Sweden, Netherlands, United Kingdom, and Ireland (the graphical representation listed in Figure 4). The estimates of economic freedom, economic performance, and environmental performance (see Table 4) allow identification of countries of Cluster 1 and Cluster 2 as “catching up”, and can be characterized by lower estimates. In contrast, countries of Cluster 3 and Cluster 4 can be labelled as “top performance”, and can be characterized by higher estimates.

Table 4.

Composition of index structures (economic freedom, economic performance, environmental performance) among clusters on average, 2005–2018.

Country characteristics are determined using the average values of the research period 2005–2018: property rights (cluster 1—51.38; cluster 2—68.50; cluster 3—89.45; cluster 4—88.64) and government integrity (cluster 1—45,45; cluster 2—59.65; cluster 3—85.74; cluster 4—82.73) are widely dispersed among the clusters. Based on the balance of fiscal policy (tax burden vs. government spending), cluster 1 is distinguished by moderately unbalanced fiscal policy (low tax burden 75.86 and a moderate level of government spending 45.57, the difference between tax burden and government spending is 66%). Clusters 2–4 are distinguished by a balanced fiscal policy. In clusters 2 and 3, there are relatively lower tax levels and a lower level of government spending, whereas cluster 4 has a higher tax level and higher government spending (the difference between the fiscal balance structure taxes vs. spending is 89% in cluster 2, 79% in cluster 3, and 90% in cluster 4). Business, monetary, trade, investment, and financial freedom estimates are similarly dispersed among the clusters. Labor freedom values among clusters are widely dispersed (cluster 1—56.25; cluster 2—51.17, cluster 3—49.66, and cluster 4—72.60).

The relationships between economic performance and environmental performance in different clusters are in alignment with the Kuznets curve. Higher economically developed countries start to develop environmental factors more rapidly, and the environment improves (environmental degradation decreases) (clusters 1–3). Cluster 4 illustrates the situation in which environmental performance estimates start to decrease. The comparison of the estimates of clusters 3 and 4 illustrates the new threat to the environment: increasing consumption in highly economically developed countries leads to a growing demand for resources (including energy), which is not satisfied fully by recycled resources and renewable sources; this gap is compensated for by the increase in demand for the primary resource. The similar effects are seen by comparing different clusters correlations between economic freedom and economic performance index (see Appendix A, Figure A2) the highest positive impact in economic categories are listed in cluster 3. The same representation of environmental performance index shows similar effects the correlations are the highest in cluster 3. This strongly supports the position that economic freedom fosters economic and environmental performance under a certain level, and above this level, the positive impact of liberal regulatory environment starts to decrease, as we noticed this cluster 3 and cluster 4 parameters decomposition, listed in Table 4.

5. Discussion

We found a significant relationship (correlation 0.70, see Figure 3) between the economic performance index and economic freedom index, and that higher economic progress is followed by a constant appraisal of economic freedom in the countries of clusters 1–3. These findings are aligned with those of [20,38,40,41] and [9], who stressed the positive effect of economic freedom on economic performance estimates. Surprisingly, we did not find this effect in countries of cluster 4, which are characterized by the highest economic freedom level. These findings are aligned with those of [29,30]. We also found a relationship between the components of the environmental performance index and the economic freedom index; from the characteristics of clusters 1–3, we found that higher economic freedom corresponds to higher environmental progress. These findings are aligned with those of [47,48]. We also found that the rate of increase in progress differs, that is, economic freedom progress increases more rapidly than environmental performance. Following [30], economic freedom causes growth in the short run, whereas in the long run this relationship does not show any significance. This suggests that economic performance responds to structural reforms and could be achieved more rapidly than environmental performance, which takes longer to achieve. The achieved economic performance also acts as an input for further economic performance (a self-stimulating economic system), while the environment recovers on its own much more slowly, and some of its elements are unable to recover on their own. Surprisingly, we found a negative correlation between the economic freedom index and the environmental performance index in the countries of cluster 4: the increase in economic freedom is followed by declining environmental performance estimates. These findings are aligned with those of [33,36,46,48,49,55]. Decoupling effects in European union also provides similar characterization by countries [59].

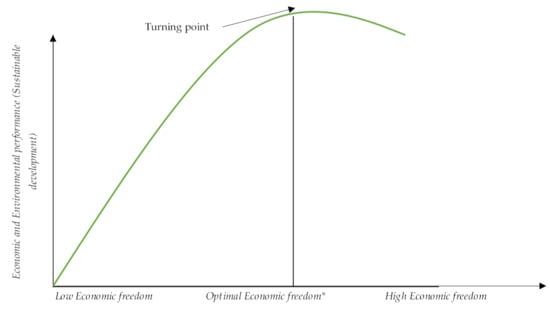

The triple relationship among economic freedom, economic performance, and environmental performance among different clusters of countries is presented in Figure 5.

Figure 5.

The triple relationship among economic freedom, economic performance, and environmental performance among different clusters of countries, 2005–2018.

The results obtained in the empirical study (see Figure 5) allowed us to reach a consensus regarding the mixed results related to the effect of economic freedom on economic and environmental performance, and discussions that emerge between the representatives of free-market and market regulation ideologies (evaluating these discussions in the context of economic development and environmental development as concurrent concepts). The consensus was reached by introducing a new concept, i.e., the optimal level of economic freedom. Although this new concept is, thus far, theoretical, and requires extensive theoretical and empirical research, it also correlates with the Kuznets curve and may clarify the practical applicability of the concept of economic freedom. The research for the optimal level of economic freedom is still scarce. Previous research has investigated the optimal level of separate components of the economic freedom index: Tanzi [60] found the optimal level of public spending relative to GDP is 30%, and Levente [61] stated that there is no single optimum for public spending because it depends on the level of development of the country, which in turn depends on economic freedom. The idea for optimal governance can also be found in the Armey curve, where the optimal size of the government indicates, at which maximum economic growth is reached. The optimal level of economic freedom can be identified as the level of freedom that supports the highest estimates of both economic and environmental performance. Excessive and insufficient economic freedom do not encourage economic performance and environmental performance as concurrent concepts (sustainable development). The optimal level of economic freedom shows the extent to which government regulation via economic freedom has limits that it cannot exceed or, at least, does not exceed. The optimal level of economic freedom suggests that the government cannot seek the highest economic freedom level without limiting its economic–environmental progress performance.

Following the Kuznets and Armey curves, we captured (see Figure 6) the conceptual relationship between economic freedom and economic and environmental performance (sustainable development). The optimal economic freedom level matches a turning point. When the optimal economic freedom level is achieved, the turning point is reached. Beyond the optimal level, economic and environmental performance starts to decrease. The empirical study of this article is not sufficient to allow statements to be made about the rate of decrease in economic and environmental performance after the optimal economic freedom level. However, we can hypothetically pose this question and suggest that, beyond the optimal economic freedom level, the rate of decrease is lower than that rate of increase rates prior to that level. Therefore, even in the conceptual representation, the curve has an asymmetric shape, unlike the Kuznets and Armey curves.

Figure 6.

The conceptual structure of economic and environmental performance in the relationship with economic freedom level. * corresponds to the turning point.

The optimal level of economic freedom can be characterized mostly by the change in fiscal policy elements, namely tax burden and government spending, and from other economic freedom areas related to labor, financial, and investment markets. The importance of these economic freedom elements can be explained by the government intervention to sustain and expand green growth via fiscal policies and restrictions in the markets, because the economically free environment does not promote environmental performance naturally. The interest of the public is sustainable growth; the interest of private equity holders is profit optimization; without any policy interventions countries cannot sustain environmentally beneficial economic progress. The theoretical and empirical application of Kuznets curve, Laffer curve, and Armey curve provides little explanation of what determines optimal income level, the optimal tax rate, or optimal public spending rate. To analyze the optimal level clarification in our research and to be capable of answering the question of what set of economic freedom elements determine the optimal level of economic freedom that sustains the most environmentally beneficial economic performance, only a detailed countries clusterization analysis may provide an explanation towards heterogeneity among the countries, by which similarly relative and absolute decoupling effects are being explained in existing economic–environmental studies [59].

To achieve the best results in practice by implementing structural reforms aimed at increasing economic freedom, it is important to analyze the characteristics and reasons for the triple relationship beyond the optimal level of economic freedom. Why is it that when the optimal level is exceeded, the results start to deteriorate? Is it possible that beyond the optimal level of economic freedom, the system created by the components of economic freedom begins to have less impact? Then the question arises about the cause of the deterioration in economic and environmental performance. Dawson [30] noted that the level of economic freedom is determined by the level of political and civil freedom. Stiglitz [62] argued that deregulation and liberalization trigger financial and economic crises by creating excessive risk-taking behavior and outright fraud. This indicates that high-quality bureaucratic institutions allow the effective implementation of “good regulation” and other government policies [62], but beyond the optimal economic freedom level, the other determinants, for example, market failure and moral hazard, may negatively affect overall performance: the preference for individual welfare deteriorate overall welfare. Stroup [44] noted that political control can hurt the environment on balance, not only in the case of poor and socialist nations, but also in modern democracies. This idea can be supplemented by the conclusion that environmental harm also occurs when there is too much economic freedom, because market failure also leads to environmental problems in a modern democracy.

Therefore, the optimal level of economic freedom is reached when the considerations about collective vs. private control and the question of whether a decrease in governmental control helps or harms economic and environmental performance arise. There is much to lose when economic freedom is high if this freedom starts to work to the advantage of special interests. Stiglitz [62] expressed skepticism that market participants can be trusted to act rationally and argued that relatively tight market regulations are necessary to prevent crises arising from irrational behavior. At the optimal level of economic freedom, rule of law, the size and scope of government, the efficiency of regulations, and the openness of the economy to global commerce are important as the democratic political system achieves efficiency. However, at this level, the moral hazard problem arises. Too much freedom (economic, political, and civil freedom) creates the space for special interests to capture parts of the regulatory regime for their advantage, sometimes to the detriment of the environment [44]. In addition, Stigler (1971), Olson (1965), and Olson, M (1982) noted that government actors and regulators often receive their information from special interests and companies they aim to regulate. By providing biased and incomplete information, special interests can effectively affect regulations to their immediate benefit [11]. Therefore, the high level of a different kind of freedom requires more responsibility and accountability from all economic and political actors for their actions. When economic performance is high and the environment is relatively clean, democracy leaves considerable room for mischief by rent-seekers. When elected officials are not constrained by strong constitutional limits, the democratic political system can be used to transfer rents at the cost of other goods, including environmental quality [44]. Recalling and actively adhering to the principles of sustainable development becomes a crucial aspect when the optimal level of economic freedom is reached, to achieve the maximum economic and environmental performance within a functioning democratic political system. The effects of sustainability should not be ignored in political and business discussions and actions.

6. Conclusions

Although market liberalization and economic freedom often seem like a means to achieve optimal results (economic and, less frequently, environmental), the real results of such regulations may run counter to their stated intentions. The relationship between economic freedom, economic performance, and environmental performance varies depending on the progress level of these concepts. The critical point is at the optimal economic freedom level at which positive interaction among economic freedom, economic performance, and environmental performance becomes negative. At this point, too much freedom may lead to market failure, which is the root of the decrease in economic and environmental performance. Although researchers suggest that tighter governmental controls are the best solution in these situations, we also emphasize the importance of responsibility and accountability of all economic and political actors for their actions as a critical determinant of the continuous effect of economic freedom on economic and environmental outcomes. Sustainable development (both economic and environmental performance) depends on the incentives provided by the economic freedom components, and the level of responsibility and accountability of all economic and political actors for their actions. Structural reforms that are parallel to increasing economic freedom and developing responsibility and accountability (and consciousness) may lead to continued higher levels of environmentally oriented economic development.

The combination of economic freedom with economic performance and environmental performance confirms that regulation is a finite measure to sustain growth and progress in the economy; this proposed framework creates methodological conditions for estimating the economic freedom level in order to sustain economic progress and environmental benefits. Our proposed conceptual framework and empirical investigation allow us to disclose several key statements regarding the interaction among economic freedom, economic performance, and environmental performance in European countries. To characterize the relationship between economic freedom, economic performance, and environmental performance, this relationship should be examined between similar countries according to certain characteristics (for example, clusters of countries). The trend analysis of all 23 countries showed that higher economic freedom is followed by higher economic performance. However, after clustering the countries, in a certain cluster (in our case 4) this relationship was the opposite. Additionally, we did not find any significant relation by trend analysis between economic freedom and environmental performance. After clustering the countries, we found mixed results between economic freedom and environmental performance.

This study has a number of research limitations. The results are specific to the selected sample of countries, which were observed over a defined period and processed based on specific types of quantitative analysis. We analyzed only developed economies of Europe. Furthermore, we analyzed a 14 year period, which is insufficient to identify deeper long-run effects. The empirical research ignores the effect of the possible economic and political crises in individual countries on economic and environmental performance estimates, and this change is not affected by economic freedom.

During the preparation of this article, we found different statements and mixed results, which justify the need for more in-depth research. We identified several future research opportunities. Deeper theoretical and empirical research (including case analysis) of the new concept—the optimal level of economic freedom—is required to answer the questions: under what conditions it is reached; what are the main factors of market failure; and how should market failure be addressed? Analysis of the usefulness of separate components of economic freedom for economic and environmental progress, and deeper analysis of the lagged effects of economic freedom on economic and environmental performance, can be conducted. Determining effective means to increase the responsibility and accountability of all economic and political actors for their actions could supplement our research.

Author Contributions

Conceptualization: J.R., J.B., S.M., and M.L.; methodology: J.R., J.B., S.M., and M.L.; validation: J.R., J.B.; investigation: J.R., J.B., and M.L.; resources: J.R. and J.B.; data curation: J.R. and M.L.; writing—original draft preparation: J.R., J.B., and S.M.; writing—review and editing: J.R. and J.B.; visualization: J.R., J.B., and M.L.; supervision: J.R. and J.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available in a publicly accessible repository that does not issue DOIs Publicly available datasets were analyzed in this study. This data can be found here: [Heritage: https://www.heritage.org; ILO: http://www.ilo.org/global/statistics-and-databases/lang--en/index.htm; WB: https://data.worldbank.org] (accessed on 15 December 2020).

Acknowledgments

The authors would like to thank the editors and anonymous reviewers for their constructive comments and helpful suggestions.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Figure A1.

T-SNE clusterization k-means.

Figure A2.

Correlations in clusters between index of economic freedom, economic performance index, environmental performance index, and sub-indices, 2005–2018.

References

- World Economic Forum. Global Competitiveness Report 2019: How to End a Lost Decade of Productivity Growth? Available online: http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf (accessed on 15 December 2020).

- Papageorgiou, D.; Vourvachaki, E. Macroeconomic effects of structural reforms and fiscal consolidations: Trade-offs and complementarities. Eur. J. Political Econ. 2017, 48, 54–73. [Google Scholar] [CrossRef]

- Neuss, L. The drivers of structural change. J. Econ. Surv. 2019, 33, 309–349. [Google Scholar] [CrossRef]

- Aghion, P.; Farhi, E.; Kharroubi, E. Monetary Policy, Product Market Competition and Growth. Economica 2019, 86, 431–470. [Google Scholar] [CrossRef]

- Asandului, L.; Iacobuta, A.; Cautisanu, C. Modelling Economic Growth Based on Economic Freedom and Social Progress. Eur. J. Sustain. Dev. 2016, 5, 229–238. [Google Scholar] [CrossRef]

- Brkić, I.; Gradojević, N.; Ignjatijević, S. The Impact of Economic Freedom on Economic Growth? New European Dynamic Panel Evidence. J. Risk Financ. Manag. 2020, 13, 26. [Google Scholar] [CrossRef]

- Gassebner, M.; Gaston, M.; Lamla, M.J. The inverse domino effect: Are economic reforms contagious? Int. Econ. Rev. 2011, 52, 183–200. [Google Scholar] [CrossRef]

- Hussain, M.E.; Haque, M. Impact of Economic Freedom on the Growth Rate: A Panel Data Analysis. Economies 2016, 4, 5. [Google Scholar] [CrossRef]

- Haidar, J.I. The impact of business regulatory reforms on economic growth. J. Jpn. Int. Econ. 2012, 26, 285–307. [Google Scholar] [CrossRef]

- De Grauwe, P.; Ji, Y. Structural reforms, animal spirits, and monetary policies. Eur. Econ. Rev. 2020, 124, 103395. [Google Scholar] [CrossRef]

- Bjørnskov, C. Economic freedom and economic crises. Eur. J. Political Econ. 2016, 45, 11–23. [Google Scholar] [CrossRef]

- Rieth, M.; Wittich, J. The impact of ECB policy on structural reforms. Eur. Econ. Rev. 2020, 122, 103361. [Google Scholar] [CrossRef]

- Gomes, S. Euro area structural reforms in times of a global crisis. J. Macroecon. 2018, 55, 28–45. [Google Scholar] [CrossRef]

- Sajedi, R. Fiscal consequences of structural reform under constrained monetary policy. J. Econ. Dyn. Control 2018, 93, 22–38. [Google Scholar] [CrossRef]

- Aarhus, J.H.; Jakobsen, T.G. Rewards of reforms: Can economic freedom and reforms in developing countries reduce the brain drain? Int. Area Stud. Rev. 2019, 22, 327–347. [Google Scholar] [CrossRef]

- Arif, I.; Hoffer, A.; Stansel, D.; Lacombe, D. Economic freedom and migration: A metro area-level analysis. SOEJ 2020, 1–21. [Google Scholar] [CrossRef]

- Égert, B. Regulation, Institutions, and Productivity: New Macroeconomic Evidence from OECD Countries. Am. Econ. Rev. 2016, 106, 109–113. Available online: https://www.jstor.org/stable/43860997 (accessed on 15 December 2020). [CrossRef]

- Cacciatore, M.; Fiori, G. The macroeconomic effects of goods and labor markets deregulation. Rev. Econ. Dyn. 2016, 20, 1–24. [Google Scholar] [CrossRef]

- Duval, R.; Furceri, D. The Effects of Labor and Product Market Reforms: The Role of Macroeconomic Conditions and Policies. IMF Econ. Rev. 2018, 66, 31–69. [Google Scholar] [CrossRef]

- Feldmann, H. Credit Market Regulation and Labor Market Performance around the World. KYKLOS 2006, 59, 497–525. [Google Scholar] [CrossRef]

- Schiantarelli, F. Do product market reforms stimulate employment, investment, and innovation? IZA World Labor 2016, 266. [Google Scholar] [CrossRef]

- Psillaki, M.; Mamatzakis, E. What drives bank performance in transitions economies? The impact of reforms and regulations. Res. Int. Bus. Financ. 2017, 39 Pt A, 578–594. [Google Scholar] [CrossRef]

- Singh, D.; Gal, Z. Economic Freedom and its Impact on Foreign Direct Investment: Global Overview. Rev. Econ. Perspect. 2020, 20, 73–90. [Google Scholar] [CrossRef]

- Angulo-Guerrero, M.J.; Pérez-Moreno, S.; Abad-Guerreroa, I.M. How economic freedom affects opportunity and necessity entrepreneurship in the OECD countries. J. Bus. Res. 2017, 73, 30–37. [Google Scholar] [CrossRef]

- Bennett, D.L. Local institutional heterogeneity & firm dynamism: Decomposing the metropolitan economic freedom index. Small Bus Econ. 2020. [Google Scholar] [CrossRef]

- Kubickova, M. The impact of government policies on destination competitiveness in developing economies. Curr. Issues Tourism 2019, 22, 619–642. [Google Scholar] [CrossRef]

- Xu, G. The role of law in economic growth: A literature review. J. Econ. Surv. 2011, 25, 833–871. [Google Scholar] [CrossRef]

- Kešeljević, A.; Spruk, R. Global distribution and dynamics of economic freedom: Non-parametric approach. Econ. Model. 2013, 33, 560–571. [Google Scholar] [CrossRef]

- Sturm, J.E.; De Haan, J. How robust is the relationship between economic freedom and economic growth? Appl. Econ. 2001, 33, 839–844. [Google Scholar] [CrossRef]

- Dawson, J.W. Causality in the freedom-growth relationship. Eur. J. Political Econ. 2003, 19, 479–495. [Google Scholar] [CrossRef]

- De Haan, J.; Lundström, S.; Sturm, J.E. Market-oriented institutions and policies and economic growth: A critical survey. J. Econ. Surv. Wiley Blackwell 2006, 20, 157–191. [Google Scholar] [CrossRef]

- Campos, N.F.; De Grauwe, P.; Ji, Y. Structural Reforms, Growth and Inequality: An Overview of Theory, Measurement and Evidence. IZA Discussion Papers, No. 11159. Available online: http://hdl.handle.net/10419/174069 (accessed on 15 December 2020).

- Joshi, P.; Beck, K. Democracy and carbon dioxide emissions: Assessing the interactions of political and economic freedom and the environmental Kuznets curve. Energy Res. Soc. Sci. 2018, 39, 46–54. [Google Scholar] [CrossRef]

- Rios, V.; Gianmoena, L. Convergence in CO2 emissions: A spatial economic analysis with cross-country interactions. Energy Econ. 2018, 75, 222–238. [Google Scholar] [CrossRef]

- Lin, B.; Ge, J. Does institutional freedom matter forglobal forest carbon sinks in the face of economic development disparity? China Econ. Rev. 2021, 65, 101563. [Google Scholar] [CrossRef]

- Aye, G.C.; Edoja, P.E. Effect of economic growth on CO2 emission in developing countries: Evidence from a dynamic panel threshold model. Cogent Econ. Financ. 2017, 5, 1379239. [Google Scholar] [CrossRef]

- McMillan, M.; Rodrik, D.; Sepulveda, C. Structural change, fundamentals and growth: A framework and case studies. NBER Working Paper 23378. Available online: http://www.nber.org/papers/w23378 (accessed on 15 December 2020).

- Alexandrakis, C.; Livanis, G. Economic Freedom and Economic Performance in Latin America: A Panel Data Analysis. Rev. Dev. Econ. 2013, 17, 34–48. [Google Scholar] [CrossRef]

- Duval, R. Is there a role for macroeconomic policy in fostering structural reforms? Panel evidence from OECD countries over the past two decades. Eur. J. Political Econ. 2008, 24, 491–502. [Google Scholar] [CrossRef]

- Carlsson, F.; Lundström, S. Economic freedom and growth: Decomposing the effects. Public Choice 2002, 112, 335–344. [Google Scholar] [CrossRef]

- Feldmann, H. Product Market Regulation and Labor Market Performance around the World. LABOUR 2012, 26, 369–391. [Google Scholar] [CrossRef]

- Bourlès, R.; Cette, G.; Lopez, J.; Mairesse, J.; Nicoletti, G. Do product market regulations in upstream sectors curb productivity growth? Panel data evidence for OECD countries. Rev. Econ. Stat. 2013, 95, 1750–1768. Available online: https://www.jstor.org/stable/43554859 (accessed on 15 December 2020). [CrossRef]

- Allen, F.; Gu, X.; Kowalewski, O. Financial crisis, structure and reform. J. Bank. Financ. 2012, 36, 2960–2973. [Google Scholar] [CrossRef]

- Stroup, R.L. Economic Freedom and Environmental Quality. In Proceedings of the Conference Sponsored by the Federal Reserve Bank of Dallas, Dallas, Texas, USA, 23–24 October 2003; pp. 73–93. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.432.5342&rep=rep1&type=pdf#page=77 (accessed on 15 December 2020).

- Rossen, I.L.; Dunlop, P.D.; Lawrence, C.M. The desire to maintain the social order and the right to economic freedom: Two distinct moral pathways to climate change skepticism. J. Environ. Psychol. 2015, 42, 42–47. [Google Scholar] [CrossRef]

- Graafland, J.J. Economic freedom and corporate environmental responsibility: The role of small government and freedom from government regulation. J. Clean. Prod. 2019, 218, 250–258. [Google Scholar] [CrossRef]

- Taylor, M.S.; Antweiler, W.; Copeland, B.R. Is Free Trade Good for the Environment. Am. Econ. Rev. 2001, 94. Available online: http://works.bepress.com/taylor/23/ (accessed on 15 December 2020).

- Farzin, Y.H.; Bond, C.A. Democracy and Environmental Quality. J. Dev. Econ. 2006, 81, 213–235. Available online: https://ssrn.com/abstract=790669 (accessed on 15 December 2020).

- Carlsson, F.; Gable, S. Political and Economic Freedom and the Environment: The Case of CO2 Emissions January 2000. Available online: https://www.researchgate.net/publication/228542880_Political_and_Economic_Freedom_and_the_Environment_The_Case_of_CO2_Emissions/ (accessed on 15 December 2020).

- Kasman, A.; Duman, Y.S. CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Econ. Model. 2015, 44, 97–103. [Google Scholar] [CrossRef]

- Azam, M.; Khan, A.Q.; Abdullah, H.B.; Qureshi, M.E. The impact of CO2 emissions on economic growth: Evidence from selected higher CO2 emissions economies. Environ. Sci. Pollut. Res. 2016, 23, 6376–6389. [Google Scholar] [CrossRef] [PubMed]

- Rusiawan, W.; Tjiptoherijanto, P.; Suganda, E.; Darmajanti, L. System Dynamics Modeling for Urban Economic Growth and CO2 Emission: A Case Study of Jakarta, Indonesia. Procedia Environ. Sci. 2015, 28, 330–340. [Google Scholar] [CrossRef]

- Wen, J.; Hao, Y.; Feng, G.F.; Chang, C.P. Does government ideology influence environmental performance? Evidence based on a new dataset. Econ. Syst. 2016, 40, 232–246. [Google Scholar] [CrossRef]

- Fedrigo-Fazio, D.; Schweitzer, J.-P.; Ten Brink, P.; Mazza, L.; Ratliff, A.; Watkins, E. Evidence of Absolute Decoupling from Real World Policy Mixes in Europe. Sustainability 2016, 8, 517. [Google Scholar] [CrossRef]

- Qureshi, M.I.; Qayyum, S.; Nassani, A.A.; Aldakhil, A.M.; Abro, M.M.Q.; Zaman, K. Management of various socio-economic factors under the United Nations sustainable development agenda. Resour. Policy 2019, 64, 101515. [Google Scholar] [CrossRef]

- Kayongo, A. Micro and Macro Effects of Product Market Reforms: Evidence from Most Recent Research. Available online: https://ssrn.com/abstract=3130211 or http://dx.doi.org/10.2139/ssrn.3130211 (accessed on 15 December 2020).

- Sorrell, S. Energy, Economic Growth and Environmental Sustainability: Five Propositions. Sustainability 2010, 2, 1784–1809. [Google Scholar] [CrossRef]

- Aguilar-Hernandez, G.A.; Dias Rodrigues, J.F.; Tukker, A. Macroeconomic, social and environmental impacts of circular economy up to 2050: A meta-analysis of prospective studies. J. Clean. Prod. 2021, 278, 123421. [Google Scholar] [CrossRef]

- Sanyé-Mengual, E.; Secchi, M.; Corrado, S.; Beylot, A.; Sala, S. Assessing the decoupling of economic growth from environmental impacts in the European Union: A consumption-based approach. J. Clean. Prod. 2019, 236, 117535. [Google Scholar] [CrossRef] [PubMed]

- Tanzi, V. The Economic Role of the State in the 21st Century. Cato J. 2005, 25, 617–638. Available online: https://EconPapers.repec.org/RePEc:cto:journl:v:25:y:2005:i:3:p:617-638 (accessed on 15 December 2020).

- Levente, N. How Does Economic Freedom Influence The Relationship Between Government Size And Convergence? Ann. Fac. Econ. 2015, 1, 623–630. [Google Scholar]

- Stiglitz, J.E. The anatomy of a murder: Who killed America’s economy? Crit. Rev. 2009, 21, 329–339. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).