Impact of Structural Oil Price Shock Factors on the Gasoline Market and Macroeconomy in South Korea

Abstract

1. Introduction

2. Literature Review

3. Data and Model

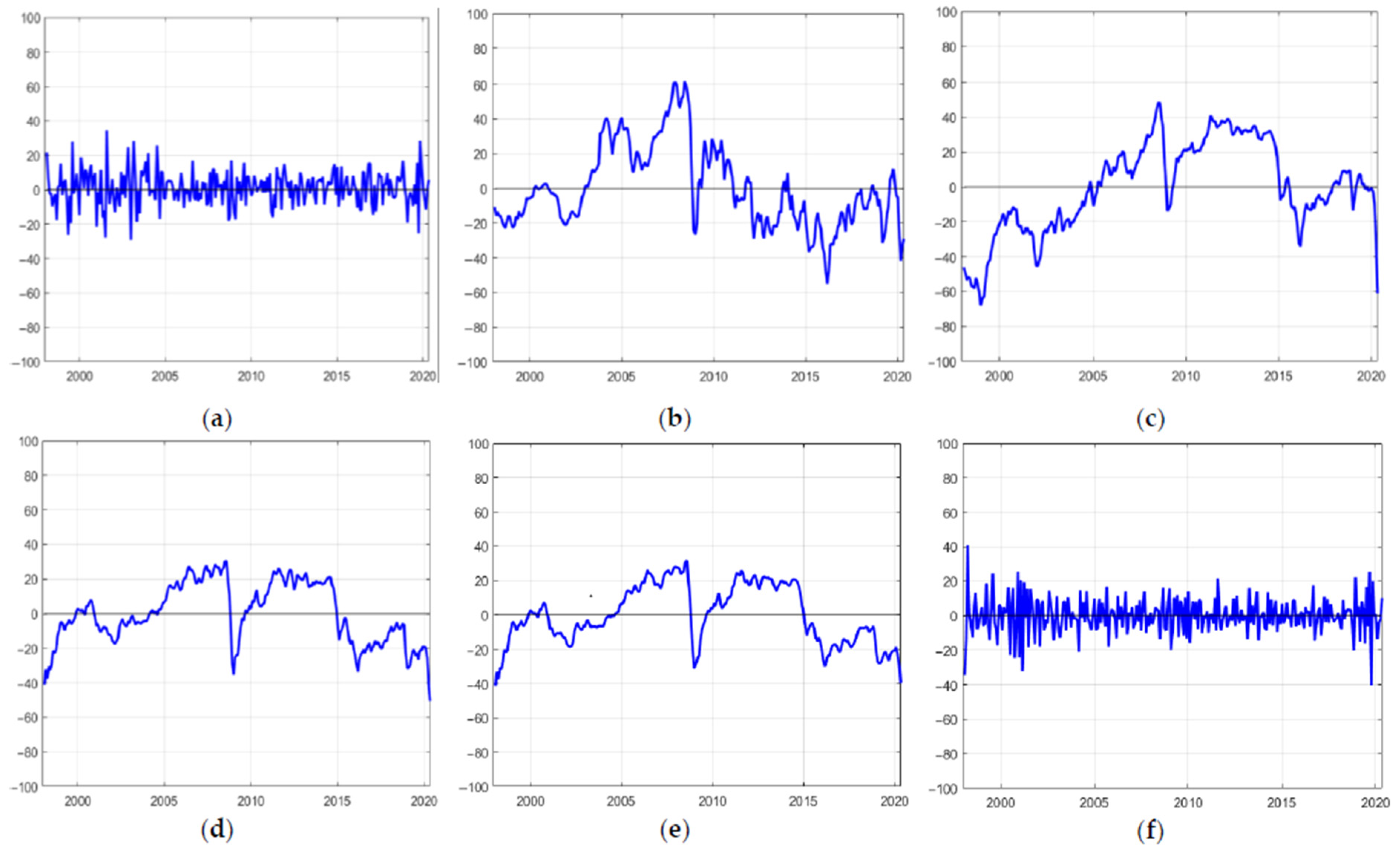

3.1. Data Description

3.2. Model Description and Assumptions

4. Results

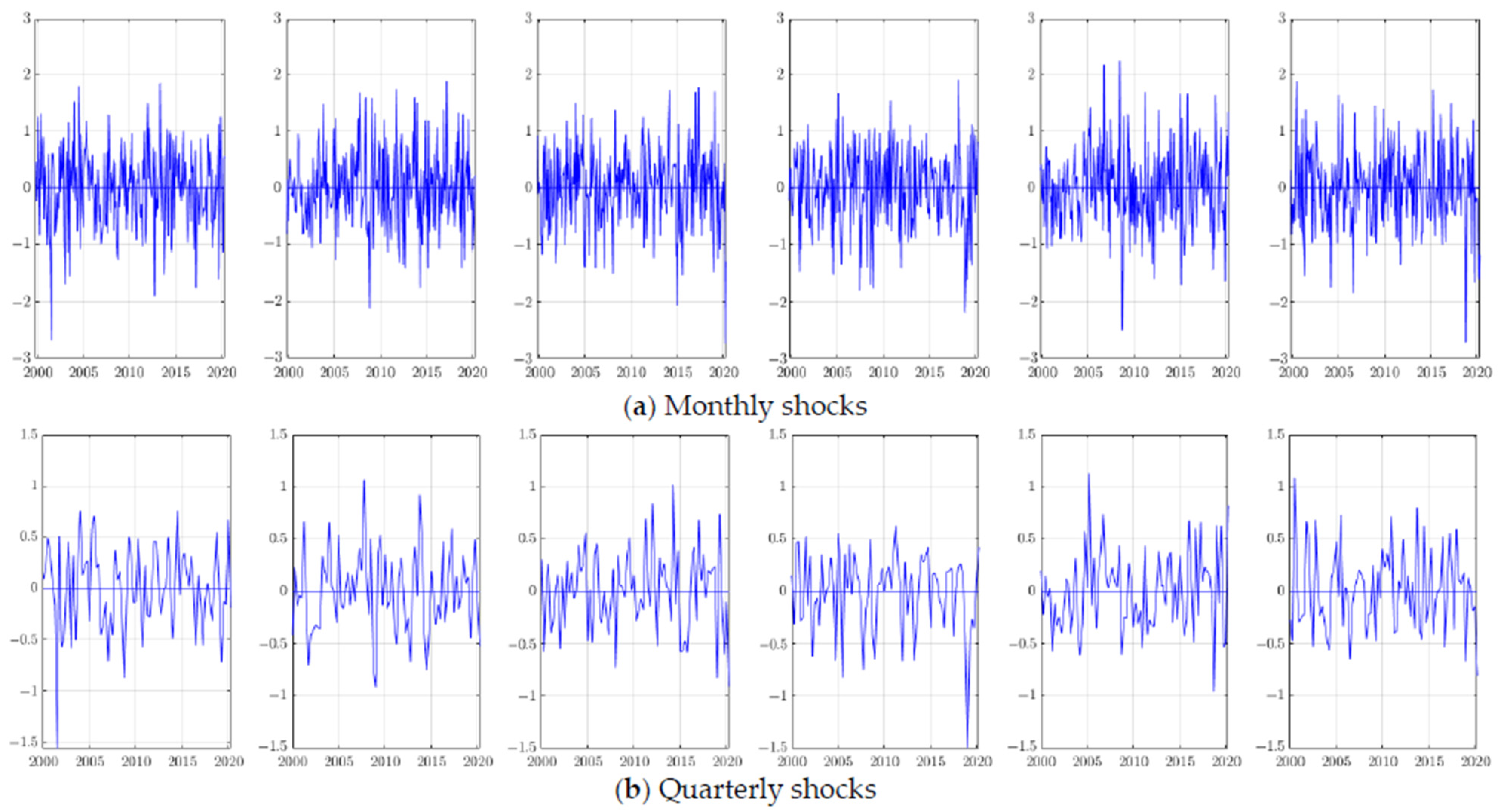

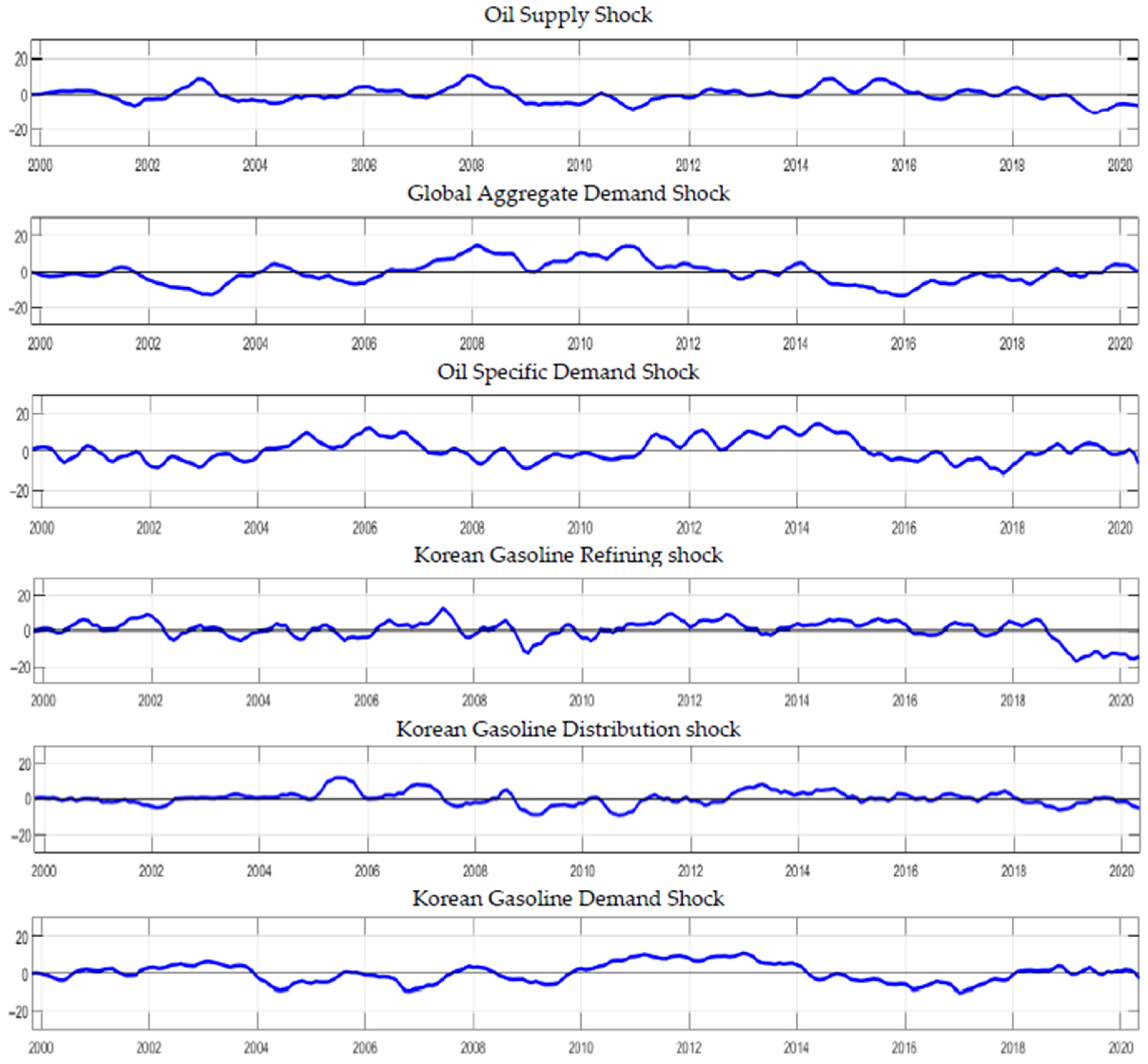

4.1. Decomposition of Structural Oil Price Shock Factors

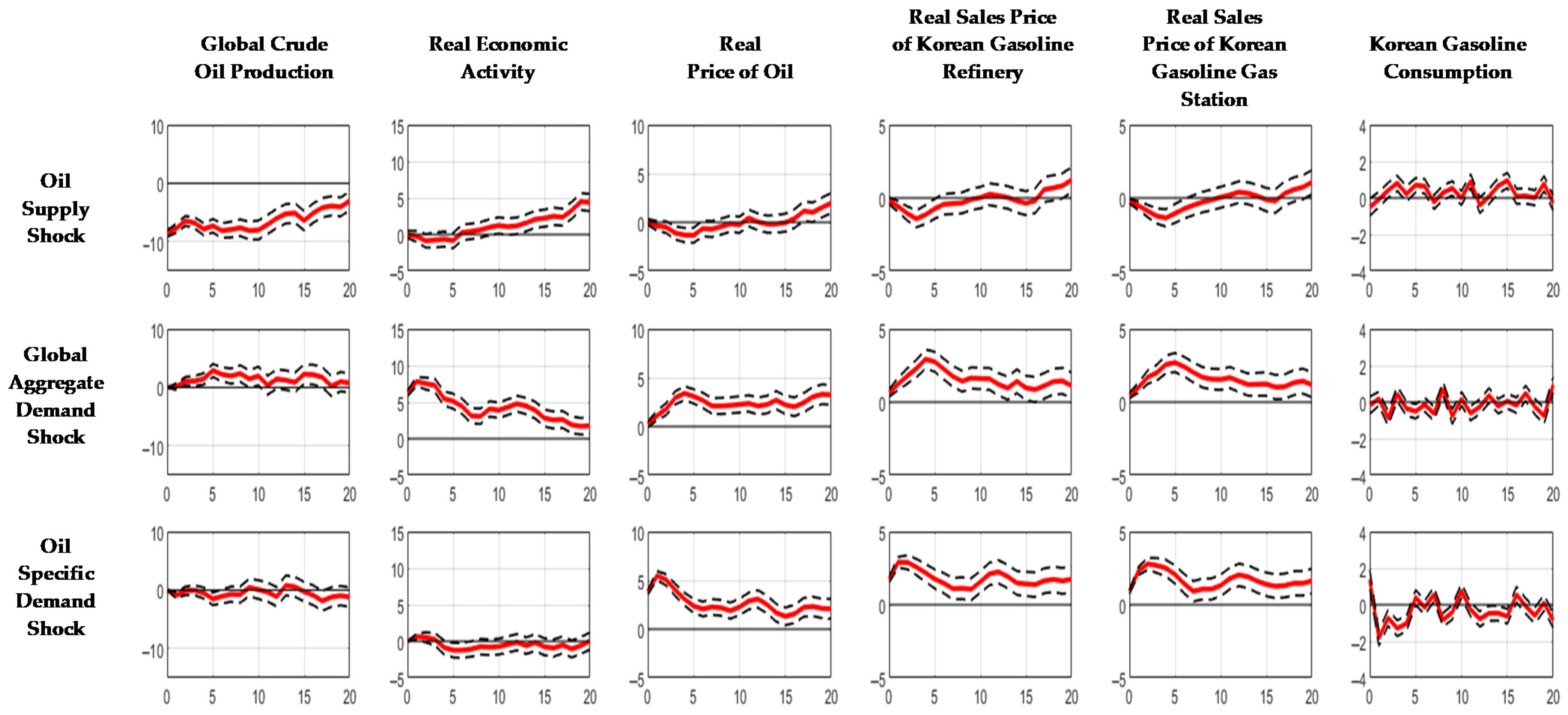

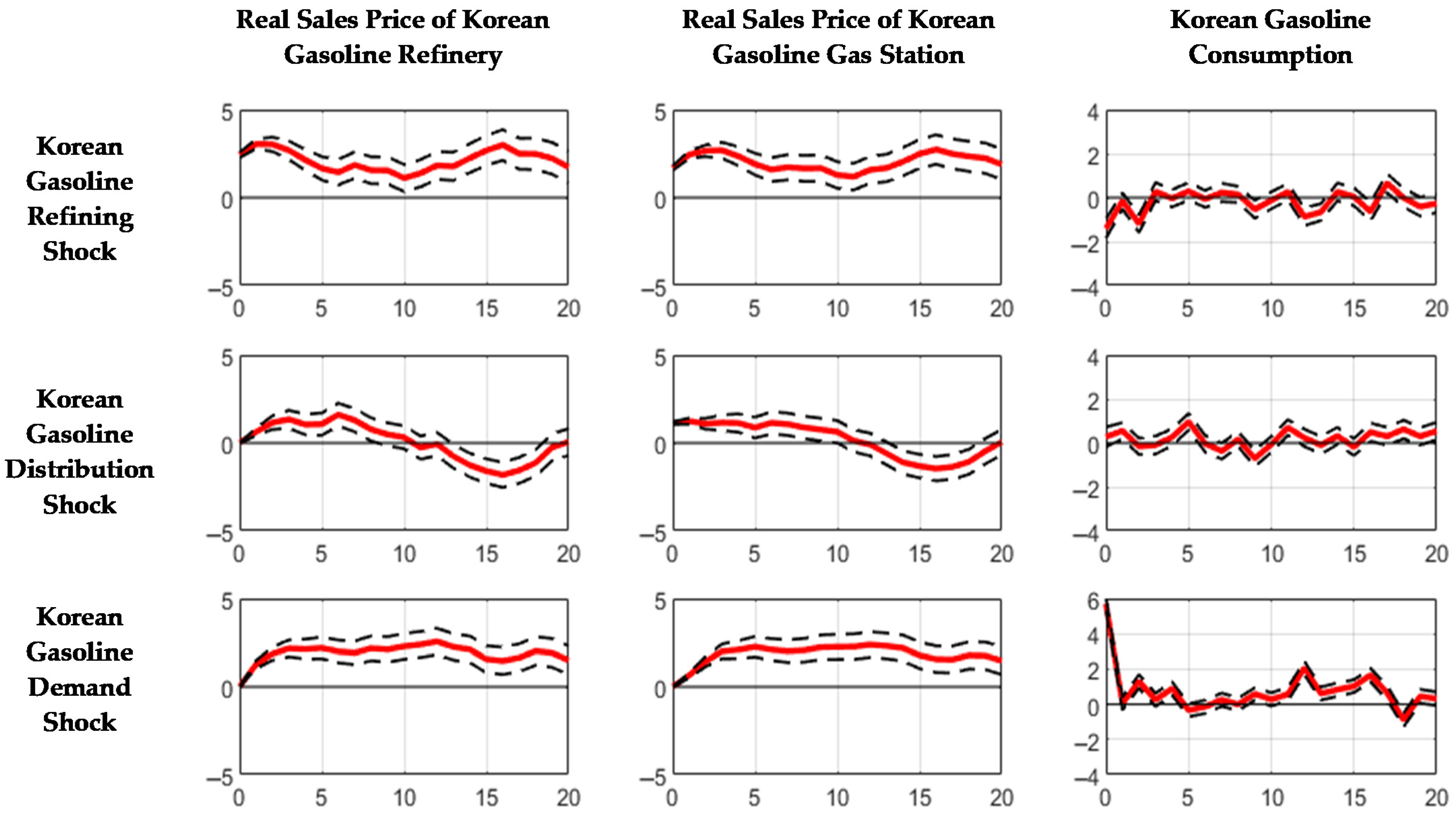

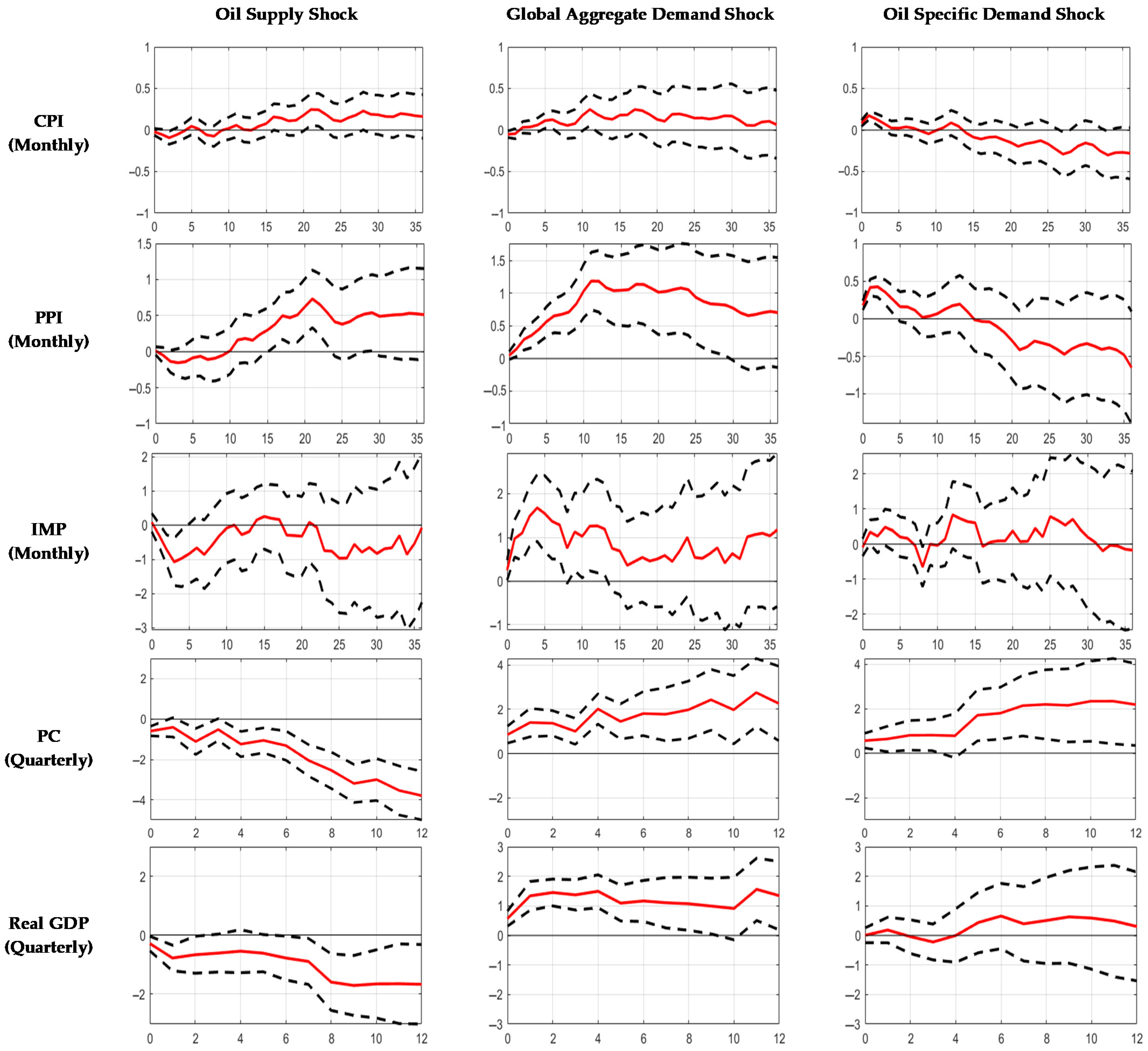

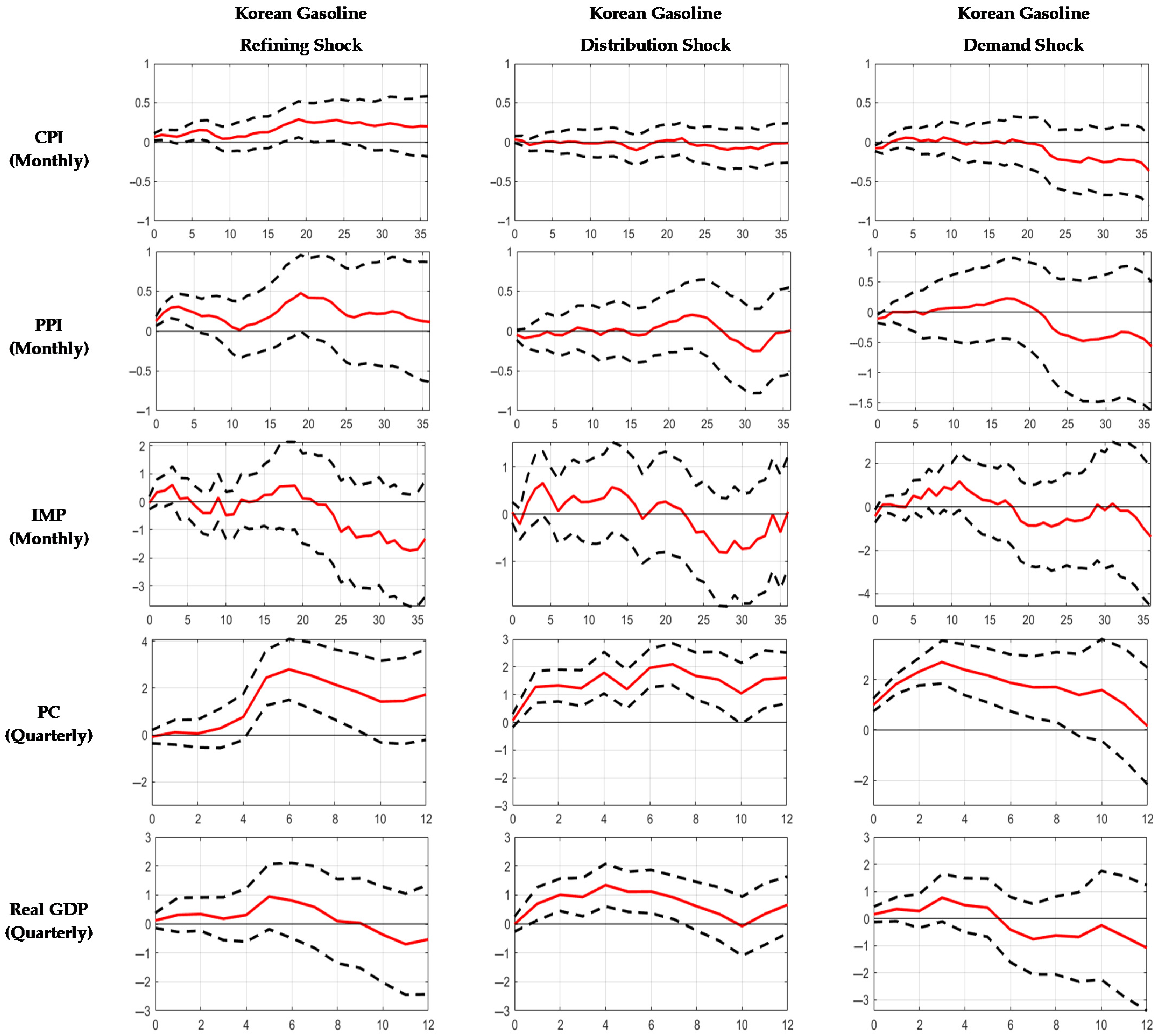

4.2. Impulse Response Analysis in the Global Crude Oil Market and Korean Gasoline Market

4.3. Effect of Structural Oil Price Shock Factors on the Macroeconomy

4.4. Historical Contribution to the Gasoline-Selling Price in Korea

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Van de Ven, D.J.; Fouquet, R. Historical energy price shocks and their changing effects on the economy. Energy Econ. 2017, 62, 204–216. [Google Scholar] [CrossRef]

- Zerrin, K.; Yasemin, D. Macroeconomic Impacts Of Oil Price Shocks: An Empirical Analysis Based On The Svar Models. Rev. Econ. 2017, 69, 55–72. [Google Scholar]

- Dramani, J.B.; Frimpong, P.B. The effect of crude oil price shocks on macroeconomic stability in Ghana. OPEC Energy Rev. 2020. [Google Scholar] [CrossRef]

- Almutairi, N. The effects of oil price shocks on the macroeconomy: Economic growth and unemployment in Saudi Arabia. OPEC Energy Rev. 2020, 44, 181–204. [Google Scholar] [CrossRef]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do gasoline prices respond asymmetrically to crude oil price changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Manning, D.N. Petrol price, oil prices rises and oil price falls: Evidence for the UK since 1972. Appl. Econ. 1991, 23, 1535–1541. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Laskowski, C. Causes for an asymmetric relation between the price of crude oil and refined petroleum products. Energy Policy 2005, 33, 1587–1596. [Google Scholar] [CrossRef]

- Radchenko, S.; Shapiro, D. Anticipated and unanticipated effects of crude oil prices and gasoline inventory changes on gasoline prices. Energy Econ. 2011, 33, 758–769. [Google Scholar] [CrossRef]

- Kuper, G.H. Inventories and upstream gasoline price dynamics. Energy Econ. 2012, 34, 208–214. [Google Scholar] [CrossRef]

- Polemis, M.L.; Fotis, P.N. The taxation effect on gasoline price asymmetry nexus: Evidence from both sides of the Atlantic. Energy Policy 2014, 73, 225–233. [Google Scholar] [CrossRef]

- Hong, W.; Lee, D. Asymmetric pricing dynamics with market power: Investigating island data of the retail gasoline market. Empir. Econ. 2018, 58, 2181–2221. [Google Scholar] [CrossRef]

- Kilian, L. Explaining fluctuations in gasoline prices: A joint model of the global crude oil market and the U.S. retail gasoline market. Energy J. 2010, 31, 87–112. [Google Scholar] [CrossRef]

- Edelstein, P.; Kilian, L. How sensitive are consumer expenditures to retail energy prices? J. Monet. Econ. 2009, 56, 766–779. [Google Scholar] [CrossRef]

- Kilian, L. Not all oil price shocks are alike: Disentangling demand and supply shocks in the crude oil market. Am. Econ. Rev. 2009, 99, 1053–1069. [Google Scholar] [CrossRef]

- Kang, W.; Perez de Gracia, F.; Ratti, R.A. The asymmetric response of gasoline prices to oil price shocks and policy uncertainty. Energy Econ. 2019, 77, 66–79. [Google Scholar] [CrossRef]

- Lippi, F.; Nobili, A. Oil and the macroeconomy: A quantitative structural analysis. J. Eur. Econ. Assoc. 2012, 10, 1059–1083. [Google Scholar] [CrossRef]

- Baumeister, C.; Peersman, G. Time-varying effects of oil supply shocks on the US economy. Am. Econ. J. Macroecon. 2013, 5, 1–28. [Google Scholar] [CrossRef]

- Peersman, G.; Van Robays, I. Oil and the Euro area economy. Econ. Policy 2009, 24, 603–651. [Google Scholar] [CrossRef]

- Peersman, G.; Van Robays, I. Cross-country differences in the effects of oil shocks. Energy Econ. 2012, 34, 1532–1547. [Google Scholar] [CrossRef]

- Kim, D.; Lee, J. Spatial Price Competition in the Korean Retail Gasoline Market. Environ. Resour. Econ. Rev. 2014, 23, 553–581. [Google Scholar] [CrossRef]

- Kim, T. Price Competition and Market Segmentation in Retail Gasoline: New Evidence from South Korea. Rev. Ind. Organ. 2018, 53, 507–534. [Google Scholar] [CrossRef]

- Lim, S.S. Does the government have to increase the flexible tax rate on gasoline to stabilize gasoline price in Korea? J. Consum. Policy Stud. 2009, 36, 43–66. [Google Scholar]

- Hamilton, J.D. Oil and the macroeconomy since World War II. J. Political Econ. 1983, 91, 228–248. [Google Scholar] [CrossRef]

- Mork, K.A. Oil and the macroeconomy when prices go up and down: An extension of Hamilton’s results. J. Political Econ. 1989, 97, 740–744. [Google Scholar] [CrossRef]

- Lee, K.; Ni, S.; Ratti, R.A. Oil shocks and the macroeconomy: The role of price variability. Energy J. 1995, 16, 39–56. [Google Scholar] [CrossRef]

- Hamilton, J.D. This is what happened to the oil price-macroeconomy relationship. J. Monet. Econ. 1996, 38, 215–220. [Google Scholar] [CrossRef]

- Hamilton, J.D. What is an oil shock? J. Econ. 2003, 113, 363–398. [Google Scholar] [CrossRef]

- Balke, N.S.; Brown, S.P.A.; Yucel, M.K. Oil price shocks and the U.S. economy: Where does the asymmetry originate? Energy J. 2002, 23, 27–52. [Google Scholar] [CrossRef]

- Cunado, J.; Pérez de Gracia, F. Do oil price shocks matter? Evidence for some European countries. Energy Econ. 2003, 25, 137–154. [Google Scholar] [CrossRef]

- Edelstein, P.; Kilian, L. The response of business fixed investment to changes in energy prices: A test of some hypotheses about the transmission of energy price shocks. B.E. J. Macroecon. 2007, 7, 7. [Google Scholar] [CrossRef]

- Kilian, L.; Vigfusson, R.J. Are the responses of the U.S. economy asymmetric in energy price increases and decreases? Quant. Econ. 2011, 2, 419–453. [Google Scholar] [CrossRef]

- Kilian, L.; Vigfusson, R.J. Nonlinearities in the oil price-output relationship. Macroecon. Dyn. 2011, 15, 337–363. [Google Scholar] [CrossRef]

- Lee, K.; Jeong, H. An effect of oil price increase on the national income, inflation and monetary policy. RFE 2002, 16, 103–130. [Google Scholar]

- Kim, K.S. Asymmetric impacts of international oil shocks on domestic growth rate and Inflation. EAER 2005, 9, 175–211. [Google Scholar] [CrossRef]

- Kim, K.S. Are Korean recessions affected by oil price shocks? Econ. Anal. 2011, 17, 90–123. [Google Scholar]

- Cha, K. Accounting for crude oil prices: A historical decomposition. KEER 2008, 7, 1–26. [Google Scholar]

- Kim, K.; Yun, S. Asymmetric and nonlinear effects of oil price and exchange rate shocks on consumer price. Int. Econ. J. 2009, 15, 131–152. [Google Scholar]

- Kim, K. Oil price shocks and the macroeconomic activity: Analyzing transmission channels using the new Keynesian structural model. Econ. Anal. 2012, 18, 1–29. [Google Scholar]

- Bernanke, B.S.; Gertler, M.; Watson, M.; Sims, C.A.; Friedman, B.M. Systematic monetary policy and the effects of oil price shocks. Brook. Pap. Econ. Act. 1997, 1997, 91–142. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Do we really know that oil caused the great stagflation? A monetary alternative. NBER Macroecon. Annu. 2001, 16, 137–183. [Google Scholar] [CrossRef]

- Barsky, R.B.; Kilian, L. Oil and the macroeconomy since the 1970s. J. Econ. Perspect. 2004, 18, 115–134. [Google Scholar] [CrossRef]

- Kilian, L. The economic effects of energy price shocks. J. Econ. Lit. 2008, 46, 871–909. [Google Scholar] [CrossRef]

- Segal, P. Oil price shocks and the macroeconomy. Oxf. Rev. Econ. Policy 2011, 27, 169–185. [Google Scholar] [CrossRef]

- Leduc, S.; Sill, K. A quantitative analysis of oil-price shocks, systematic monetary policy, and economic downturns. J. Monet. Policy 2004, 51, 781–808. [Google Scholar] [CrossRef]

- Hamilton, J.D.; Herrera, A.M. Oil shocks and aggregate macroeconomic behavior: The role of monetary policy: A comment. J. Money Credit Bank. 2004, 36, 265–286. [Google Scholar] [CrossRef]

- Carlstrom, C.T.; Fuerst, T.S. Oil prices, monetary policy, and counterfactual experiments. J. Money Credit Bank. 2006, 38, 1945–1958. [Google Scholar] [CrossRef]

- Herrera, A.M.; Pesavento, E. Oil price shocks, systematic monetary policy, and the great moderation. Macroecon. Dyn. 2009, 13, 107–137. [Google Scholar] [CrossRef]

- Lee, J.; Song, J. Nature of oil price shocks and monetary policy. In NBER Working Paper 15306; National Bureau of Economic Research, Inc.: Cambridge, MA, USA, 2009. [Google Scholar]

- Hooker, M.A. What happened to the oil price-macroeconomy relationship? J. Monet. Econ. 1996, 38, 195–213. [Google Scholar] [CrossRef]

- Blanchard, O.J.; Gali, J. The Macroeconomic Effects of Oil Price Shocks: Why Are the 2000s So Different from the 1970s? Economics Working Papers 1045, 2007; Department of Economics and Business, Universitat Pompeu Fabra: Barcelona, Spain, 2008. [Google Scholar]

- Dhawan, R.; Jeske, K.; Silos, P. Productivity, energy prices and the great moderation: A new link. Rev. Econ. Dyn. 2010, 13, 715–724. [Google Scholar] [CrossRef]

- Balke, N.S.; Brown, S.P.; Yucel, M.K. Oil Price Shocks and U.S. Economic Activity: An International Perspective; Working Papers 1003; Federal Reserve Bank of Dallas: Dallas, TX, USA, 2010. [Google Scholar]

- Caldara, D.; Cavallo, M.; Iacoviello, M. Oil price elasticities and oil price fluctuations. J. Monet. Econ. 2019, 103, 1–20. [Google Scholar] [CrossRef]

- Cha, K. A Study on the effects of oil shocks and energy efficient consumption structure with a Bayesian DSGE model. Environ. Resour. Econ. Rev. 2010, 19, 215–242. [Google Scholar]

- Cha, K. Time-varying effects of oil shocks on the Korean economy. Environ. Resour. Econ. Rev. 2018, 27, 495–520. [Google Scholar]

- Bacon, R.W. Rockets and feathers: The asymmetric speed of adjustment of UK retail gasoline prices to cost changes. Energy Econ. 1991, 13, 211–218. [Google Scholar] [CrossRef]

- Lee, Y.I.; Lee, J. Testing for symmetry between domestic and foreign oil price changes. Korean J. Econ. Stud. 2012, 60, 43–66. [Google Scholar]

- Cha, K.C. Rockets and feathers: Response of retail gasoline price to Dubai oil price changes. J. Consum. Policy Stud. 2012, 41, 67–82. [Google Scholar]

- Oh, S.; Choi, G.; Heo, E. A study on the asymmetry and market power in Korean petroleum products market. KEER 2015, 14, 1–25. [Google Scholar]

- Kim, J.W. A study on the asymmetric gasoline price response. JKOS 2017, 22, 65–91. [Google Scholar]

- Chang, D.; Serletis, A. Oil, uncertainty, and gasoline prices. Macroecon. Dyn. 2016, 22, 546–561. [Google Scholar] [CrossRef]

- Aloui, C.; Hkiri, B.; Nguyen, D.K. Real growth co-movements and business cycle synchronization in the GCC countries: Evidence from time-frequency analysis. Econ. Model. 2016, 52, 322–331. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- Bekiros, S.D.; Gupta, R.; Paccagnini, A. Oil price forecastability and economic uncertainty. Econ. Lett. 2015, 132, 125–128. [Google Scholar] [CrossRef]

- Li, S.; Linn, J.; Muehlegger, E. Gasoline taxes and consumer behavior. Am. Econ. J. Econ. Policy 2014, 6, 302–342. [Google Scholar] [CrossRef]

- Van Robays, I. Macroeconomic uncertainty and oil price volatility. Oxf. Bull. Econ. Stat. 2016, 78, 671–693. [Google Scholar] [CrossRef]

- Maghyereh, A.I.; Awartani, B.; Bouri, E. The Directional Volatility Connectedness between Crude Oil and Equity Markets: New Evidence from Implied Volatility Indexes. Energy Econ. 2016, 57, 78–93. [Google Scholar] [CrossRef]

- Silvapulle, P.; Smyth, R.; Zhang, X.; Fenech, J.P. Nonparametric Panel Data Model for Crude Oil and Stock Market Prices in Net Oil Importing Countries. Energy Econ. 2017, 67, 255–267. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G.; Kizys, R. The Effects of Oil Price Shocks on Stock Market Volatility: Evidence from European Data. Energy J. 2014, 35, 35–56. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef]

- Hamdi, B.; Aloui, M.; Alqahtani, F.; Tiwari, A. Relationship between the oil price volatility and sectoral stock markets in oil-exporting economies: Evidence from wavelet nonlinear denoised based quantile and Granger-causality analysis. Energy Econ. 2019, 80, 536–552. [Google Scholar] [CrossRef]

- Bayramoglu, A.T.; Çetin, M.; Karabulut, G. The Impact of Biofuels Demand on Agricultural Commodity Prices: Evidence from US Corn Market. J. Econ. 2016, 4, 189–206. [Google Scholar]

- Adam, P.; Saidi, L.O.; Tondi, L.; Sani, L.O.A. The Causal Relationship between Crude Oil Price, Exchange Rate and Rice Price. Int. J. Energy Econ. Policy 2018, 8, 90–94. [Google Scholar]

- Vu, T.N.; Vo, D.H.; Ho, C.M.; Van, L.T. Modeling the Impact of Agricultural Shocks on Oil Price in the US: A New Approach. J. Risk Financ. Manag. 2019, 12, 147. [Google Scholar] [CrossRef]

- Yang, J.; Kim, Y.; Yu, C.; Lee, D. The estimation on the impacts of oil price increase using energy-macroeconomic model. KEER 2008, 7, 1–41. [Google Scholar]

- Cha, K.; Oh, S. A study on the effects of changes in oil prices and oil taxes on the Korean economy. KEER 2014, 13, 83–119. [Google Scholar]

- Kilian, L. Measuring Global Real Economic Activity: Do Recent Critiques Hold Up to Scrutiny? Econ. Lett. 2019, 178, 106–110. [Google Scholar] [CrossRef]

| Variables | Basic Unit | Transformation |

|---|---|---|

| Consumer Price Index (CPI) | Index | Log difference |

| Producer Price Index (PPI) | Index | Log difference |

| Index of manufacturing production (IMP) | Index | Log difference |

| Real Gross Domestic Product (real GDP) | Seasonal adjustment, billion won | Log difference |

| Private Consumption (PC) | Seasonal adjustment, billion won | Log difference |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, J.; Cho, H.C. Impact of Structural Oil Price Shock Factors on the Gasoline Market and Macroeconomy in South Korea. Sustainability 2021, 13, 2209. https://doi.org/10.3390/su13042209

Lee J, Cho HC. Impact of Structural Oil Price Shock Factors on the Gasoline Market and Macroeconomy in South Korea. Sustainability. 2021; 13(4):2209. https://doi.org/10.3390/su13042209

Chicago/Turabian StyleLee, Jihoon, and Hong Chong Cho. 2021. "Impact of Structural Oil Price Shock Factors on the Gasoline Market and Macroeconomy in South Korea" Sustainability 13, no. 4: 2209. https://doi.org/10.3390/su13042209

APA StyleLee, J., & Cho, H. C. (2021). Impact of Structural Oil Price Shock Factors on the Gasoline Market and Macroeconomy in South Korea. Sustainability, 13(4), 2209. https://doi.org/10.3390/su13042209