High-Speed Railway Opening and Corporate Fraud

Abstract

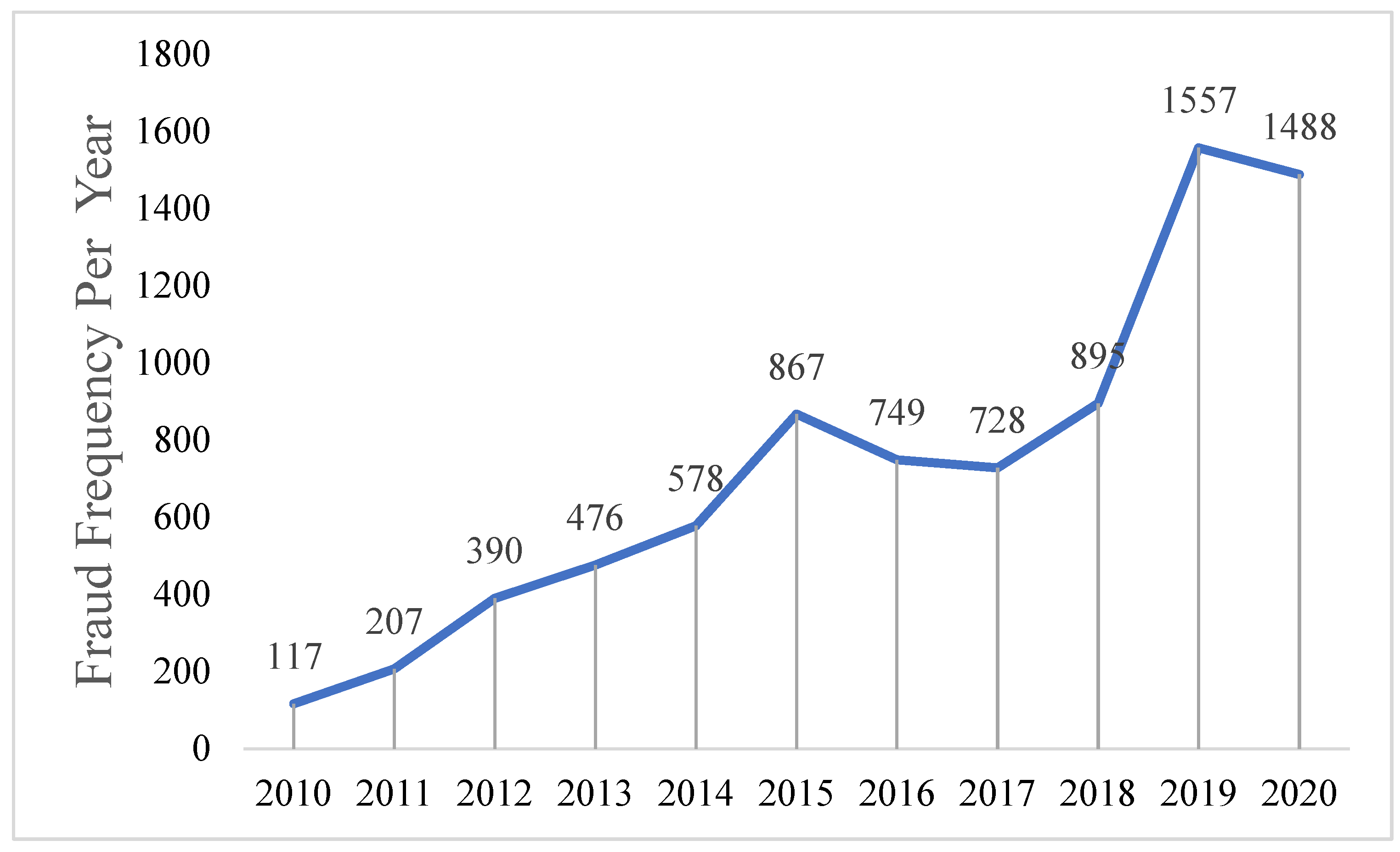

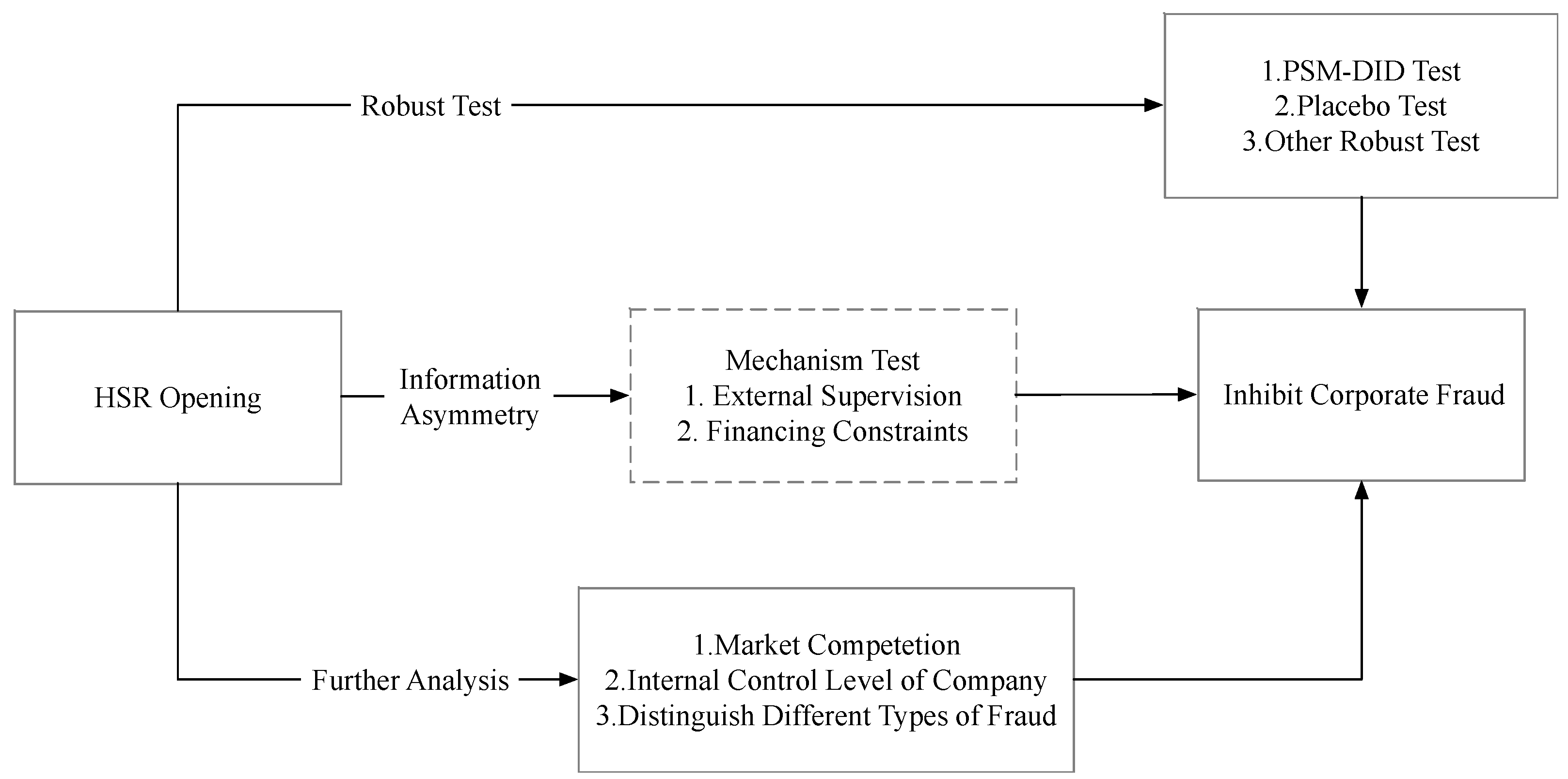

:1. Introduction

2. Literature Review

2.1. The Influence of Geographical Distance on Capital Market

2.2. The Influence of the HSR Opening on Economy

2.3. Factors Influencing Corporate Fraud

3. Theoretical Analysis and Research Hypothesis

4. Research Design

4.1. Sample Data

4.2. Variable Definition

4.2.1. Corporate Fraud

- Fraud. If the company is disclosed to have committed fraud in the current year, it equals 1; otherwise, it equals 0.

- Frequency. The total frequency of fraud by the company in the current year disclosed by the CSRC.

4.2.2. Other Control Variables

4.3. Model Design

5. Empirical Results and Analysis

5.1. Descriptive Statistical Results

5.2. Regression Results

5.3. Robustness Test

5.3.1. PSM-DID Test

5.3.2. Placebo Test

5.3.3. Control the Impact of Other Transport Infrastructure

5.3.4. Firm Fixed Effect

5.3.5. Expand the Sample Range

5.3.6. Eliminate the Influence of Big Cities

6. Analysis of the Impact Mechanism

6.1. External Supervision

6.2. Financing Constraints

- (1)

- For each year of the entire sample, we collected and calculated the following data: the operating net cash flow divided by total assets of the previous period (CFit/Ait−1), cash dividends divided by total assets of the previous period (DIVit/Ait−1), cash holdings divided by total assets of the previous period (Cit/Ait−1), asset-liability ratio (LEVit) and Tobin’sQ (TobinQit). If CFit/Ait−1 is lower than the median, then kz1 equals 1, otherwise, it equals 0; if DIVit/Ait−1 is lower than the median, kz2 equals 1, otherwise, it equals 0; if Cit/Ait−1 is lower than the median, kz3 equals 1, otherwise, kz3 equals 0; if LEVit is higher than the median, kz4 equals 1, otherwise, kz4 equals 0; if TobinQit is higher than the median, kz5 equals 1, otherwise, kz5 equals 0.

- (2)

- Calculating the KZ index. KZ = kz1 + kz2 + kz3 + kz4 + kz5.

- (3)

- We took the KZ index as the dependent variable to regress CFit/Ait−1, DIVit/Ait−1, Cit/Ait−1, LEVit, and TobinQit and estimate the regression of each variable coefficient.

7. Further Analysis

7.1. Market Competition

7.2. Internal Control Level of the Company

7.3. Distinguish Different Types of Fraud

8. Discussion

8.1. Main Findings and Comparison with Other Studies

8.2. HSR Opening and the Sustainability of Capital Market

8.3. Policy Suggestion

8.4. Is China a Particular Framework?

Author Contributions

Funding

Conflicts of Interest

References

- Givoni, M. Development and Impact of the Modern High-speed Train: A Review. Transp. Rev. 2006, 26, 593–611. [Google Scholar] [CrossRef]

- Chen, C.L.; Hall, P. The wider spatial-economic impacts of high-speed trains: A comparative case study of Manchester and Lille sub-regions. J. Transp. Geogr. 2012, 24, 89–110. [Google Scholar] [CrossRef]

- Ahlfeldt, G.M.; Feddersen, A. From periphery to core: Measuring agglomeration effects using high-speed rail. J. Econ. Geogr. 2018, 18, 355–390. [Google Scholar] [CrossRef]

- Shaw, S.L.; Fang, Z.; Lu, S.; Tao, R. Impacts of high speed rail on railroad network accessibility in China. J. Transp. Geogr. 2014, 40, 112–122. [Google Scholar] [CrossRef]

- Jia, S.; Zhou, C.; Qin, C. No difference in effect of high-speed rail on regional economic growth based on match effect perspective? Transp. Res. Part A: Policy Pract. 2017, 106, 144–157. [Google Scholar] [CrossRef]

- Zhao, J.; Huang, J.F.; Liu, F. China High-Speed Railways and Stock Price Crash Risk. Manag. World 2018, 34, 157–168. (In Chinese) [Google Scholar]

- Gao, Y.; Zheng, J. The impact of high-speed rail on innovation: An empirical test of the companion innovation hypothesis of transportation improvement with China’s manufacturing firms. World Dev. 2020, 127, 104838. [Google Scholar] [CrossRef]

- Khanna, V.; Kim, E.H.; Lu, Y. CEO connectedness and corporate fraud. J. Financ. 2015, 70, 1203–1252. [Google Scholar] [CrossRef]

- Abbott, L.J.; Parker, S.; Peters, G.F. Audit committee characteristics and restatements. Audit. A J. Pract. Theory 2004, 23, 69–87. [Google Scholar] [CrossRef]

- Wu, W.; Johan, S.A.; Rui, O.M. Institutional investors, political connections, and the incidence of regulatory enforcement against corporate fraud. J. Bus. Ethics 2016, 134, 709–726. [Google Scholar] [CrossRef]

- Yi, Z.H.; Jiang, F.X.; Qin, Y.H. The Market Competition in Products, the Corporate Governance and the Quality of Information Disclusure. Manag. World 2010, 1, 133–141. (In Chinese) [Google Scholar]

- Loughran, T. The impact of firm location on equity issuance. Financ. Manag. 2008, 37, 1–21. [Google Scholar] [CrossRef]

- Lerner, J. Venture capitalists and the oversight of private firms. J. Financ. 1995, 50, 301–318. [Google Scholar] [CrossRef]

- Coval, J.D.; Moskowitz, T.J. The geography of investment: Informed trading and asset prices. J. Polit. Econ. 2001, 109, 811–841. [Google Scholar] [CrossRef]

- Kalnins, A.; Lafontaine, F. Too far away? The effect of distance to headquarters on business establishment performance. Am. Econ. J.: Microecon. 2013, 5, 157–179. [Google Scholar] [CrossRef] [Green Version]

- Anderson, J.E.; Van Wincoop, E. Trade costs. J. Econ. Lit. 2004, 42, 691–751. [Google Scholar] [CrossRef]

- Malloy, C.J. The geography of equity analysis. J. Financ. 2005, 60, 719–755. [Google Scholar] [CrossRef]

- Kim, K.S. High-speed rail developments and spatial restructuring—A case study of the Capital region in South Korea. Cities 2000, 17, 251–262. [Google Scholar] [CrossRef]

- Wang, X.; Zhang, W. Efficiency and Spatial Equity Impacts of High-Speed Rail on the Central Plains Economic Region of China. Sustainability 2019, 11, 2583. [Google Scholar] [CrossRef] [Green Version]

- Lin, S.; Dhakal, P.R.; Wu, Z. The Impact of HSR on China’s Regional Economic Growth Based on the Perspective of Regional Heterogeneity of Quality of Place. Sustainability 2021, 13, 4820. [Google Scholar] [CrossRef]

- Vickerman, R. High-speed rail in Europe: Experience and issues for future development. Ann. Reg. Sci. 1997, 31, 21–38. [Google Scholar] [CrossRef]

- Willigers, J.; Van Wee, B. High-speed rail and office location choices. A stated choice experiment for the Netherlands. J. Transp. Geogr. 2011, 19, 745–754. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Y.; Chen, S. Are Chinese Executives Rewarded or Penalized by the Operation of HSRs? Sustainability 2021, 13, 11797. [Google Scholar] [CrossRef]

- Uzun, H.; Szewczyk, S.H.; Varma, R. Board composition and corporate fraud. Financ. Anal. J. 2004, 60, 33–43. [Google Scholar] [CrossRef]

- Hu, H.; Dou, B.; Wang, A. Corporate Social Responsibility Information Disclosure and Corporate Fraud—“Risk Reduction” Effect or “Window Dressing” Effect? Sustainability 2019, 11, 1141. [Google Scholar] [CrossRef] [Green Version]

- Dyck, A.; Morse, A.; Zingales, L. Who blows the whistle on corporate fraud? J. Financ. 2010, 65, 2213–2253. [Google Scholar] [CrossRef] [Green Version]

- Huang, S.Y.; Lin, C.-C.; Chiu, A.-A.; Yen, D.C. Fraud detection using fraud triangle risk factors. Inf. Syst. Front. 2017, 19, 1343–1356. [Google Scholar] [CrossRef]

- Lokanan, M.E. A fraud investigation plan for a false accounting and theft case. J. Financ. Crime 2019, 26, 1216–1228. [Google Scholar] [CrossRef]

- Morales, J.; Gendron, Y.; Guénin-Paracini, H. The construction of the risky individual and vigilant organization: A genealogy of the fraud triangle. Account. Organ. Soc. 2014, 39, 170–194. [Google Scholar] [CrossRef]

- Call, A.C.; Kedia, S.; Rajgopal, S. Rank and file employees and the discovery of misreporting: The role of stock options. J. Account. Econ. 2016, 62, 277–300. [Google Scholar] [CrossRef]

- Burns, N.; Kedia, S. The impact of performance-based compensation on misreporting. J. Financ. Econ. 2006, 79, 35–67. [Google Scholar] [CrossRef]

- Kong, D.; Xiang, J.; Zhang, J.; Lu, Y. Politically connected independent directors and corporate fraud in China. Account. Financ. 2019, 58, 1347–1383. [Google Scholar] [CrossRef]

- Adams, R.B.; Ferreira, D. Women in the boardroom and their impact on governance and performance. J. Financ. Econ. 2009, 94, 291–309. [Google Scholar] [CrossRef] [Green Version]

- Choi, J.H.; Kim, J.B.; Qiu, A.A.; Zang, Y. Geographic proximity between auditor and client: How does it impact audit quality? Audit. A J. Pract. Theory 2012, 31, 43–72. [Google Scholar] [CrossRef]

- Petersen, M.A. Estimating standard errors in finance panel data sets: Comparing approaches. Rev. Financ. Stud. 2009, 22, 435–480. [Google Scholar] [CrossRef] [Green Version]

- Zhang, J. Public Governance and Corporate Fraud: Evidence from the Recent Anti-corruption Campaign in China. J. Bus. Ethics 2018, 148, 375–396. [Google Scholar] [CrossRef]

- Cao, G.; Zhang, J. Guanxi, overconfidence and corporate fraud in China. Chin. Manag. Stud. 2021, 15, 501–556. [Google Scholar] [CrossRef]

- Hou, X.; Wang, T.; Ma, C. Economic policy uncertainty and corporate fraud. Econ. Anal. Policy 2021, 71, 97–110. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, W.; Zhou, Z.; Yuan, L. Geographic proximity, information flows and corporate innovation: Evidence from the high-speed rail construction in China. Pac.-Basin Financ. J. 2020, 61, 101342. [Google Scholar] [CrossRef]

- Shen, H.M.; Cheng, X.K.; Yang, M.J. Does the Opening of the High-Speed Rail Increase the Efficiency of the Capital Market? Financ. Rev. 2020, 12, 48–68. (In Chinese) [Google Scholar]

- Zingales, K.L. Do Investment-Cash Flow Sensitivities Provide Useful Measures of Financing Constraints? Q. J. Econ. 1997, 112, 169–215. [Google Scholar]

- Gu, L. Product market competition, R&D investment, and stock returns. J. Financ. Econ. 2016, 119, 441–455. [Google Scholar]

- Chan, K.C.; Arrell, B.F.; Lee, P. Earnings Management of Firms Reporting Material Internal Control Weaknesses under Section 404 of the Sarbanes-Oxley Act. Audit. A J. Pract. Theory 2008, 27, 161–179. [Google Scholar] [CrossRef]

- Meng, Q.B.; Li, X.Y.; Cai, X.Y. Does Corporate Strategy Influence Corporate Frauds. Nankai Bus. Rev. 2018, 21, 116–129. (In Chinese) [Google Scholar]

- Zhang, L.; Zhang, H. Can high speed railway curb tunneling? Evidence from the independent directors’ monitoring effect in China. Pac.-Basin Financ. J. 2021, 67, 101559. [Google Scholar] [CrossRef]

- Du, X.Q.; Peng, M.W. Do High-Speed Trains Motivate the Flow of Corporate Highly Educated Talents? Eco. Manag. 2017, 39, 89–107. (In Chinese) [Google Scholar]

- Ma, G.R.; Cheng, X.M.; Yang, E.Y. How Does Transportation Infrastructure Affect Capital Flows—A Study from High-speed Rail and Cross-region Investment of Listed Companies. China Ind. Econ. 2020, 6, 5–23. (In Chinese) [Google Scholar]

- Didier, T.; Levine, R.; Llovet Montanes, R.; Schmukler, S.L. Capital market financing and firm growth. J. Int. Money Financ. 2021, 118, 102459. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R.; Lundblad, C. Does financial liberalization spur growth? J. Financ. Econ. 2005, 77, 3–55. [Google Scholar] [CrossRef] [Green Version]

| Variable Type | Variable Symbol | The Meaning of Variables and the Measurement Method |

|---|---|---|

| Explained variable | Fraud | Dumb variable, 1 for the corporate fraud of the disclosure in the current year, otherwise 0 |

| Freq | Total number of frauds disclosed by the company in the current year | |

| Explanatory variable | Train | If an HSR opening impacts the listed firm, it is included in the treatment group and equals 1; otherwise, it is the control group, and equals 0 |

| TrainPost | The year of the listed company’s office after the HSR opening is 1, otherwise it is 0 | |

| Control variable | Size | Natural logarithm of a company’s total assets |

| Lev | Year-end total liabilities divide by total year-end assets | |

| Growth | The growth rate of the company’s operating income in the current year | |

| TobinQ | Market value divides total assets in the current year. | |

| Pattern | For listed companies, value 1 for the state-owned firm, and 0 for the non-state-owned firm. | |

| Top10 | The shareholding ratio of top ten shareholders | |

| BigFour | Dummy variable, when the audit institution is the big four accounting firms value 1, otherwise value 0 | |

| Anarpt | Natural log of the number of analysts’ reports in the current year | |

| Turnover | The turnover rate of the company’s stock in the current year |

| VarName | Obs | Mean | SD | Min | Median | Median |

|---|---|---|---|---|---|---|

| Fraud | 22,244 | 0.1220 | 0.3273 | 0.0000 | 0.0000 | 1.0000 |

| Freq | 22,244 | 0.1762 | 0.6573 | 0.0000 | 0.0000 | 38.0000 |

| Train | 22,244 | 0.8427 | 0.3641 | 0.0000 | 1.0000 | 1.0000 |

| TrainPost | 22,244 | 0.6760 | 0.4680 | 0.0000 | 1.0000 | 1.0000 |

| Size | 22,244 | 22.4246 | 1.4972 | 19.9263 | 22.1748 | 27.8520 |

| Lev | 22,244 | 0.4495 | 0.2125 | 0.0542 | 0.4446 | 0.9354 |

| Growth | 22,244 | 0.2125 | 0.4576 | −0.4984 | 0.1296 | 3.0733 |

| TobinQ | 22,244 | 2.0020 | 1.2423 | 0.8756 | 1.5875 | 8.0527 |

| Pattern | 22,244 | 0.4109 | 0.4920 | 0.0000 | 0.0000 | 1.0000 |

| Top10 | 22,244 | 0.5958 | 0.1511 | 0.2413 | 0.6051 | 0.9215 |

| BigFour | 22,244 | 1.9131 | 0.2818 | 1.0000 | 2.0000 | 2.0000 |

| Anarpt | 22,244 | 20.6655 | 24.3440 | 1.0000 | 11.0000 | 116.0000 |

| Turnover | 22,244 | 6.1032 | 0.8216 | 3.8132 | 6.1512 | 7.8238 |

| VarName | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Probit | Logit | Poisson | Nbreg | |

| Fraud | Fraud | Frep | Frep | |

| Train | 0.0711 | 0.1385 * | 0.1048 | 0.0909 |

| (1.6261) | (1.6702) | (1.5800) | (1.0722) | |

| TrainPost | −0.0928 ** | −0.1739 ** | −0.1468 ** | −0.1511 ** |

| (−2.4513) | (−2.4076) | (−2.5078) | (−2.0333) | |

| Size | −0.0216 | −0.0394 | −0.0315 | −0.0339 |

| (−1.3705) | (−1.3288) | (−1.4077) | (−1.1453) | |

| Lev | 0.7295 *** | 1.3996 *** | 1.5009 *** | 1.4484 *** |

| (10.2295) | (10.4903) | (14.8503) | (10.8886) | |

| Growth | 0.0468 ** | 0.0808 * | 0.0812 ** | 0.0827 * |

| (1.9844) | (1.8574) | (2.5503) | (1.9160) | |

| TobinQ | 0.0293 ** | 0.0531 ** | 0.0600 *** | 0.0585 *** |

| (2.5575) | (2.5005) | (3.7685) | (2.7410) | |

| Pattern | −0.2188 *** | −0.4107 *** | −0.2620 *** | −0.3062 *** |

| (−8.1320) | (−8.0536) | (−6.8095) | (−6.0876) | |

| Top10 | −0.4340 *** | −0.8237 *** | −0.6101 *** | −0.6576 *** |

| (−5.4469) | (−5.5616) | (−5.3845) | (−4.3410) | |

| BigFour | 0.2092 *** | 0.4043 *** | 0.4849 *** | 0.4919 *** |

| (4.0012) | (3.9268) | (6.1810) | (4.9692) | |

| Anarpt | −0.0028 *** | −0.0055 *** | −0.0059 *** | −0.0059 *** |

| (−4.8966) | (−4.9058) | (−6.7976) | (−5.3382) | |

| Turnover | 0.0349 * | 0.0624 * | 0.0199 | 0.0372 |

| (1.8884) | (1.8090) | (0.7676) | (1.0751) | |

| Cons | −1.8429 *** | −3.3521 *** | −3.8665 *** | −3.8784 *** |

| (−3.2532) | (−3.2332) | (−4.8706) | (−3.7012) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 22244 | 22244 | 22244 | 22244 |

| PseudoR2 | 0.0506 | 0.0508 | 0.0695 | 0.0462 |

| VarName | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Probit | Logit | Poisson | Nbreg | |

| Fraud | Fraud | Frep | Frep | |

| Train | 0.0700 | 0.1374 | 0.1030 | 0.0901 |

| (1.4735) | (1.5236) | (1.1318) | (1.0343) | |

| TrainPost | −0.0951 ** | −0.1787 ** | −0.1500 ** | −0.1532 ** |

| (−2.3912) | (−2.3644) | (−1.9903) | (−2.1251) | |

| Size | −0.0387 ** | −0.0709 ** | −0.0521 | −0.0592 * |

| (−2.4838) | (−2.4173) | (−1.5374) | (−1.8178) | |

| Lev | 0.7367 *** | 1.4128 *** | 1.5115 *** | 1.4601 *** |

| (9.6131) | (9.8120) | (9.9128) | (10.3058) | |

| Growth | 0.0501 ** | 0.0860 * | 0.0861 * | 0.0913 ** |

| (2.0190) | (1.8697) | (1.9280) | (2.1202) | |

| TobinQ | 0.0230 * | 0.0416 * | 0.0536 ** | 0.0491 ** |

| (1.8855) | (1.8304) | (2.2225) | (2.1390) | |

| Pattern | −0.2255 *** | −0.4224 *** | −0.2689 *** | −0.3177 *** |

| (−7.7854) | (−7.6439) | (−3.6702) | (−4.8925) | |

| Top10 | −0.0044 *** | −0.0084 *** | −0.0062 *** | −0.0068 *** |

| (−5.4719) | (−5.5562) | (−3.1154) | (−4.1081) | |

| BigFour | 0.2094 *** | 0.4055 *** | 0.4791 *** | 0.4863 *** |

| (3.7088) | (3.5706) | (2.8387) | (3.8458) | |

| Anarpt | −0.0028 *** | −0.0054 *** | −0.0059 *** | −0.0058 *** |

| (−4.5641) | (−4.5482) | (−3.8622) | (−4.2823) | |

| Turnover | −0.0000 | −0.0001 | −0.0001 * | −0.0001 * |

| (−1.4011) | (−1.4268) | (−1.7733) | (−1.7531) | |

| Cons | −1.2381 ** | −2.2507 ** | −3.2460 *** | −3.0547 *** |

| (−2.0587) | (−2.0638) | (−2.8220) | (−2.9684) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 22220 | 22220 | 22220 | 22220 |

| PseudoR2 | 0.0504 | 0.0505 | 0.0460 |

| VarName | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Probit | Logit | Poisson | Nbreg | |

| Fraud | Fraud | Frep | Frep | |

| TrainF1 | −0.0178 | −0.0357 | −0.0354 | −0.0473 |

| (−0.4210) | (−0.4360) | (−0.5245) | (−0.5644) | |

| TrainPostF1 | 0.0154 | 0.0330 | 0.0120 | 0.0246 |

| (0.3695) | (0.4064) | (0.1790) | (0.2958) | |

| Size | −0.0219 | −0.0394 | −0.0312 | −0.0347 |

| (−1.3836) | (−1.3277) | (−1.3940) | (−1.1714) | |

| Lev | 0.7342 *** | 1.4088 *** | 1.5100 *** | 1.4593 *** |

| (10.3000) | (10.5656) | (14.9437) | (10.9715) | |

| Growth | 0.0476 ** | 0.0829 * | 0.0826 *** | 0.0837 * |

| (2.0170) | (1.9058) | (2.5954) | (1.9391) | |

| TobinQ | 0.0291 ** | 0.0529 ** | 0.0602 *** | 0.0584 *** |

| (2.5348) | (2.4902) | (3.7801) | (2.7356) | |

| Pattern | −0.2191 *** | −0.4114 *** | −0.2621 *** | −0.3079 *** |

| (−8.1469) | (−8.0648) | (−6.8159) | (−6.1302) | |

| Top10 | −0.4420 *** | −0.8389 *** | −0.6214 *** | −0.6673 *** |

| (−5.5492) | (−5.6644) | (−5.4828) | (−4.4050) | |

| BigFour | 0.2107 *** | 0.4072 *** | 0.4871 *** | 0.4937 *** |

| (4.0317) | (3.9557) | (6.2099) | (4.9886) | |

| Anarpt | −0.0028 *** | −0.0055 *** | −0.0059 *** | −0.0059 *** |

| (−4.9191) | (−4.9400) | (−6.8506) | (−5.3608) | |

| Turnover | 0.0355 * | 0.0637 * | 0.0206 | 0.0376 |

| (1.9195) | (1.8473) | (0.7925) | (1.0853) | |

| Cons | −1.7931 *** | −3.2622 *** | −3.8007 *** | −3.8056 *** |

| (−3.1693) | (−3.1506) | (−4.7965) | (−3.6342) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 22244 | 22244 | 22244 | 22244 |

| PseudoR2 | 0.0504 | 0.0505 | 0.0691 | 0.0459 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | Probit | Logit | Poisson | Nbreg |

| Fraud | Fraud | Frep | Frep | |

| Train | 0.0712 | 0.1376 * | 0.1053 | 0.0937 |

| (1.6256) | (1.6573) | (1.5868) | (1.1037) | |

| TrainPost | −0.0927 ** | −0.1751 ** | −0.1460 ** | −0.1480 ** |

| (−2.4453) | (−2.4183) | (−2.4899) | (−1.9883) | |

| LnAir | −0.0001 | 0.0012 | −0.0008 | −0.0039 |

| (−0.0302) | (0.2420) | (−0.2002) | (−0.7694) | |

| Size | −0.0216 | −0.0395 | −0.0314 | −0.0334 |

| (−1.3699) | (−1.3328) | (−1.4029) | (−1.1293) | |

| Lev | 0.7294 *** | 1.4004 *** | 1.5004 *** | 1.4459 *** |

| (10.2248) | (10.4928) | (14.8424) | (10.8663) | |

| Growth | 0.0468 ** | 0.0806 * | 0.0813 ** | 0.0830 * |

| (1.9846) | (1.8534) | (2.5539) | (1.9217) | |

| TobinQ | 0.0293** | 0.0529** | 0.0601 *** | 0.0592 *** |

| (2.5575) | (2.4930) | (3.7734) | (2.7713) | |

| Pattern | −0.2188 *** | −0.4110 *** | −0.2618 *** | −0.3051 *** |

| (−8.1276) | (−8.0569) | (−6.8026) | (−6.0609) | |

| Top10 | −0.4339 *** | −0.8244 *** | −0.6096 *** | −0.6554 *** |

| (−5.4451) | (−5.5655) | (−5.3797) | (−4.3257) | |

| BigFour | 0.2092 *** | 0.4050 *** | 0.4844 *** | 0.4903 *** |

| (3.9989) | (3.9321) | (6.1727) | (4.9521) | |

| Anarpt | −0.0028 *** | −0.0055 *** | −0.0059 *** | −0.0059 *** |

| (−4.8966) | (−4.9059) | (−6.7979) | (−5.3456) | |

| Turnover | 0.0349 * | 0.0624 * | 0.0199 | 0.0376 |

| (1.8885) | (1.8084) | (0.7676) | (1.0866) | |

| Cons | −1.8429 *** | −3.3513 *** | −3.8674 *** | −3.8872 *** |

| (−3.2533) | (−3.2324) | (−4.8715) | (−3.7091) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 22244 | 22244 | 22244 | 22244 |

| PseudoR2 | 0.0507 | 0.0509 | 0.0693 | 0.0462 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| XtLogit | Xtlogit | XtPoisson | XtPoisson | |

| Fraud | Fraud | Freq | Freq | |

| TrainPost | −0.2518 ** | −0.2449 ** | −0.1495 * | −0.1401 * |

| (−2.4164) | (−2.3444) | (−1.8033) | (−1.6886) | |

| Size | −0.1911 *** | −0.1170 ** | ||

| (−2.7745) | (−2.1565) | |||

| Lev | 1.2393 *** | 1.2754 *** | ||

| (5.1163) | (6.9309) | |||

| Growth | −0.0121 | −0.0464 | ||

| (−0.2461) | (−1.2944) | |||

| TobinQ | 0.0082 | 0.0260 | ||

| (0.2678) | (1.1039) | |||

| Pattern | −0.1387 | −0.1184 | ||

| (−0.7955) | (−0.8835) | |||

| Top10 | −0.1403 | −0.0114 | ||

| (−0.4473) | (−0.0471) | |||

| BigFour | 0.1863 | −0.2482 | ||

| (0.8338) | (−1.5616) | |||

| Anarpt | −0.0016 | −0.0007 | ||

| (−0.9604) | (−0.5655) | |||

| Turnover | 0.1418 *** | 0.1438 *** | ||

| (2.9556) | (4.0374) | |||

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 13044 | 13044 | 13078 | 13078 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | Probit | Logit | Poisson | Nbreg |

| Fraud | Fraud | Frep | Frep | |

| Train | 0.0660 | 0.1418 * | 0.1128 * | 0.0887 |

| (1.5676) | (1.7488) | (1.7256) | (1.0611) | |

| TrainPost | −0.0921 ** | −0.1825 ** | −0.1655 *** | −0.1504 ** |

| (−2.4870) | (−2.5597) | (−2.8451) | (−2.0356) | |

| Size | −0.0193 | −0.0391 | 0.0143 | −0.0515 ** |

| (−1.4749) | (−1.5343) | (0.8587) | (−2.0234) | |

| Lev | 0.1752 *** | 0.4460 *** | 0.1390 *** | 0.9226 *** |

| (4.8960) | (4.6845) | (6.4369) | (7.5651) | |

| Growth | −0.0001 | −0.0002 | −0.0003 | −0.0004 |

| (−0.2457) | (−0.2526) | (−0.2799) | (−0.2756) | |

| TobinQ | −0.0170 *** | −0.0314 ** | −0.0127 *** | 0.0006 |

| (−3.4477) | (−2.2080) | (−3.4668) | (0.0726) | |

| Pattern | −0.2117 *** | −0.4030 *** | −0.2411 *** | −0.3123 *** |

| (−8.1455) | (−8.0732) | (−6.3562) | (−6.2834) | |

| Top10 | −0.0056 *** | −0.0103 *** | −0.0086 *** | −0.0079 *** |

| (−7.4007) | (−7.2119) | (−7.9361) | (−5.3207) | |

| BigFour | 0.2207 *** | 0.4224 *** | 0.4914 *** | 0.4996 *** |

| (4.3023) | (4.1422) | (6.2848) | (5.0552) | |

| Anarpt | −0.0025 *** | −0.0049 *** | −0.0062 *** | −0.0052 *** |

| (−4.8012) | (−4.7343) | (−7.7342) | (−5.0553) | |

| Turnover | −0.0000 | −0.0001 | −0.0001** | −0.0001* |

| (−1.5666) | (−1.5611) | (−2.3367) | (−1.8060) | |

| Cons | −1.2488 ** | −2.2616 ** | −3.6522 *** | −2.8109 *** |

| (−2.4887) | (−2.4105) | (−5.1806) | (−2.9696) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 25088 | 25088 | 25088 | 25088 |

| PseudoR2 | 0.0653 | 0.0652 | 0.0800 | 0.0586 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | Probit | Logit | Poisson | Nbreg |

| Fraud | Fraud | Frep | Frep | |

| Train | 0.0983 ** | 0.1877 ** | 0.1574 ** | 0.1285 |

| (2.0903) | (2.1120) | (2.2185) | (1.4397) | |

| TrainPost | −0.0931 ** | −0.1743 ** | −0.1590 ** | −0.1651 ** |

| (−2.2297) | (−2.2052) | (−2.5050) | (−2.0682) | |

| Size | −0.0064 | −0.0119 | 0.0191 | 0.0212 |

| (−0.3423) | (−0.3431) | (0.7325) | (0.6180) | |

| Lev | 0.6775 *** | 1.2957 *** | 1.3525 *** | 1.2885 *** |

| (8.2269) | (8.4423) | (11.6226) | (8.6086) | |

| Growth | 0.0453 | 0.0801 | 0.0774 ** | 0.0671 |

| (1.6359) | (1.5897) | (2.1172) | (1.3611) | |

| TobinQ | 0.0338 ** | 0.0615 ** | 0.0840 *** | 0.0764 *** |

| (2.5191) | (2.4988) | (4.5937) | (3.1257) | |

| Pattern | −0.1975 *** | −0.3667 *** | −0.2225 *** | −0.2791 *** |

| (−6.3437) | (−6.2787) | (−5.0621) | (−4.8267) | |

| Top10 | −0.3361 *** | −0.6417 *** | −0.3565 *** | −0.4615 *** |

| (−3.6660) | (−3.7897) | (−2.7532) | (−2.7035) | |

| BigFour | 0.1717 *** | 0.3314 *** | 0.4177 *** | 0.4202 *** |

| (2.6046) | (2.6040) | (4.3613) | (3.4147) | |

| Anarpt | −0.0032 *** | −0.0062 *** | −0.0083 *** | −0.0078 *** |

| (−4.7760) | (−4.7753) | (−8.0324) | (−6.0827) | |

| Turnover | 0.0169 | 0.0268 | −0.0069 | 0.0233 |

| (0.7845) | (0.6735) | (−0.2319) | (0.5959) | |

| Cons | −0.5518 | −1.3013 | −3.5016 *** | −3.4924 *** |

| (−0.6424) | (−0.8702) | (−4.0426) | (−2.5965) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 16196 | 16196 | 16196 | 16196 |

| PseudoR2 | 0.0447 | 0.0451 | 0.0663 | 0.0434 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| Research | Fraud | Freq | |

| Train | 0.4855 *** | 0.0735 * | 0.1063 |

| (3.6139) | (1.6802) | (1.6035) | |

| TrainPost | 0.5214 *** | −0.0896 ** | −0.1431 ** |

| (4.5716) | (−2.3652) | (−2.4439) | |

| Research | −0.0057 ** | −0.0062 * | |

| (−2.5396) | (−1.8735) | ||

| Size | −0.0186 | −0.0219 | −0.0317 |

| (−0.3782) | (−1.3894) | (−1.4187) | |

| Lev | −0.6090 *** | 0.7262 *** | 1.4942 *** |

| (−2.6741) | (10.1802) | (14.7815) | |

| Growth | 0.1525 * | 0.0475 ** | 0.0819 *** |

| (1.9298) | (2.0144) | (2.5759) | |

| TobinQ | −0.0191 | 0.0291 ** | 0.0596 *** |

| (−0.5086) | (2.5372) | (3.7468) | |

| Pattern | −0.9702 *** | −0.2241 *** | −0.2681 *** |

| (−11.4968) | (−8.3043) | (−6.9468) | |

| Top10 | −0.4525 * | −0.4340 *** | −0.6089 *** |

| (−1.8005) | (−5.4473) | (−5.3772) | |

| BigFour | −0.4723 *** | 0.2069 *** | 0.4825 *** |

| (−3.1950) | (3.9559) | (6.1480) | |

| Anarpt | 0.0478 *** | −0.0025 *** | −0.0056 *** |

| (27.1543) | (−4.2953) | (−6.3017) | |

| Turnover | 0.5005 *** | 0.0380 ** | 0.0227 |

| (8.5717) | (2.0478) | (0.8735) | |

| Cons | −4.5375 ** | −1.8670 *** | −3.8872 *** |

| (−2.4338) | (−3.2960) | (−4.8969) | |

| Year | Control | Control | Control |

| Industry | Control | Control | Control |

| N | 22244 | 22244 | 22244 |

| AdjR2/PseudoR2 | 0.1401 | 0.0512 | 0.0695 |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| KZ | Fraud | Freq | |

| Train | −0.0077 | 0.0815 * | 0.1064 |

| (−0.2001) | (1.7338) | (1.5160) | |

| TrainPost | −0.0562 * | −0.0945 ** | −0.1529 ** |

| (−1.7453) | (−2.3465) | (−2.4844) | |

| KZ | 0.0150 * | 0.0255 * | |

| (1.6982) | (1.9370) | ||

| Size | −0.0512 *** | −0.0221 | −0.0197 |

| (−3.7355) | (−1.2864) | (−0.8023) | |

| Lev | 7.9829 | 0.6683 *** | 1.3989 *** |

| (127.8542) | (6.4074) | (9.4013) | |

| Growth | −0.9714 | 0.0386 | 0.0548 |

| (−43.4055) | (1.4458) | (1.4757) | |

| TobinQ | −0.0481 *** | 0.0291 ** | 0.0589 *** |

| (−4.5407) | (2.3502) | (3.4414) | |

| Pattern | −0.0696 *** | −0.2449 *** | −0.3555 *** |

| (−2.9822) | (−8.4704) | (−8.4025) | |

| Top10 | −1.1561 *** | −0.2492 *** | −0.4156 *** |

| (−15.4604) | (−2.7498) | (−3.2018) | |

| BigFour | −0.0649 | 0.1733 *** | 0.4906 *** |

| (−1.4994) | (2.8998) | (4.8730) | |

| Anarpt | −0.0088 *** | −0.0026 *** | −0.0055 *** |

| (−17.6518) | (−4.0990) | (−5.7188) | |

| Turnover | −0.0087 | 0.1038 *** | 0.1561 *** |

| (−0.4866) | (4.7993) | (5.0756) | |

| Cons | −0.3381 | −2.2478 *** | −4.9172 *** |

| (−0.8859) | (−3.7298) | (−5.8083) | |

| Year | Control | Control | Control |

| Industry | Control | Control | Control |

| N | 18727 | 18726 | 18727 |

| AdjR2/PseudoR2 | 0.5947 | 0.0549 | 0.0686 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Low Market Competition | High Market Competition | |||

| Fraud | Freq | Fraud | Freq | |

| Train | 0.1131 * | 0.1902 ** | 0.0293 | 0.0288 |

| (1.8772) | (2.0951) | (0.4700) | (0.2988) | |

| TrainPost | −0.1170 ** | −0.2637 *** | −0.0797 | −0.0884 |

| (−2.1804) | (−3.2279) | (−1.5080) | (−1.0526) | |

| Size | −0.0076 | −0.0185 | −0.0011 | 0.0645 ** |

| (−0.4177) | (−0.7570) | (−0.0530) | (2.3468) | |

| Lev | 0.3601 *** | 0.4904 *** | 0.1233 *** | 0.1018 *** |

| (5.1935) | (9.3167) | (2.8653) | (2.6907) | |

| Growth | −0.0000 | −0.0000 | −0.0024 | −0.0044 |

| (−0.1552) | (−0.1230) | (−0.5659) | (−0.5772) | |

| TobinQ | −0.0037 | −0.0198 | −0.0115 * | −0.0067 |

| (−0.5728) | (−1.5248) | (−1.8873) | (−1.1548) | |

| Pattern | −0.1968 *** | −0.1603 *** | −0.2210 *** | −0.3303 *** |

| (−5.4764) | (−3.1712) | (−5.5880) | (−5.5369) | |

| Top10 | −0.4968 *** | −0.4786 *** | −0.5658 *** | −1.1652 *** |

| (−4.5638) | (−3.1298) | (−5.1224) | (−7.2194) | |

| BigFour | 0.2419 *** | 0.4802 *** | 0.1634 * | 0.4184 *** |

| (3.6561) | (5.0252) | (1.9119) | (2.9677) | |

| Anarpt | −0.0028 *** | −0.0073 *** | −0.0022 *** | −0.0042 *** |

| (−3.9481) | (−6.5002) | (−2.6656) | (−3.5246) | |

| Turnover | 0.0298 | −0.0176 | 0.0192 | 0.0422 |

| (1.2333) | (−0.5244) | (0.7319) | (1.0992) | |

| Cons | −2.3585 *** | −4.4030 *** | −1.8640 *** | −5.2646 *** |

| (−3.6344) | (−4.6138) | (−2.7760) | (−5.2431) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 11803 | 11803 | 11210 | 11210 |

| PseudoR2 | 0.0618 | 0.0820 | 0.0441 | 0.0574 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Low Internal Control Level | High Internal Control Level | |||

| Fraud | Freq | Fraud | Freq | |

| Train | 0.1140 * | 0.2093 ** | 0.0422 | −0.0397 |

| (1.8860) | (2.5018) | (0.6453) | (−0.3632) | |

| TrainPost | −0.0995 * | −0.1671 ** | −0.0867 | −0.1469 |

| (−1.8698) | (−2.2682) | (−1.5598) | (−1.5161) | |

| Size | 0.0264 | 0.1117 *** | 0.0093 | 0.0429 |

| (1.2773) | (4.7374) | (0.4602) | (1.2910) | |

| Lev | 0.5406 *** | 0.0993 *** | 0.0981 ** | 0.2235 ** |

| (6.0787) | (4.4825) | (2.0780) | (2.2610) | |

| Growth | −0.0001 | −0.0002 | −0.0001 | −0.0001 |

| (−0.3619) | (−0.3177) | (−0.0709) | (−0.0699) | |

| TobinQ | 0.0148 | 0.0306 *** | −0.0078 | −0.0221 |

| (1.5715) | (2.9902) | (−1.2012) | (−1.5597) | |

| Pattern | −0.2294 *** | −0.1149 ** | −0.1680 *** | −0.3854 *** |

| (−6.2201) | (−2.4092) | (−4.0641) | (−5.7567) | |

| Top10 | −0.3120 *** | −0.4167 *** | −0.4846 *** | −1.0322 *** |

| (−2.8249) | (−2.9294) | (−4.1344) | (−5.5978) | |

| BigFour | 0.3611 *** | 0.8202 *** | 0.0846 | 0.1552 |

| (4.3721) | (7.0773) | (1.1426) | (1.2962) | |

| Anarpt | −0.0002 | −0.0030 *** | −0.0026 *** | −0.0065 *** |

| (−0.2167) | (−2.6469) | (−3.4109) | (−4.9306) | |

| Turnover | 0.0656 ** | 0.0632 * | 0.0207 | 0.0240 |

| (2.5250) | (1.9082) | (0.7804) | (0.5652) | |

| Cons | −2.8562 *** | −6.9188 *** | −2.5079 *** | −4.8601 *** |

| (−3.4477) | (−6.6066) | (−3.1131) | (−3.8279) | |

| Year | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control |

| N | 9368 | 9376 | 12969 | 12969 |

| PseudoR2 | 0.0345 | 0.0436 | 0.0699 | 0.0920 |

| Year | Information Disclosure Fraud | Operation Fraud | Manager Fraud |

|---|---|---|---|

| 2007 | 57 | 5 | 22 |

| 2008 | 38 | 5 | 43 |

| 2009 | 47 | 15 | 74 |

| 2010 | 50 | 9 | 49 |

| 2011 | 74 | 47 | 68 |

| 2012 | 170 | 58 | 87 |

| 2013 | 201 | 81 | 124 |

| 2014 | 241 | 71 | 136 |

| 2015 | 386 | 92 | 243 |

| 2016 | 382 | 77 | 171 |

| 2017 | 359 | 72 | 162 |

| 2018 | 447 | 64 | 164 |

| 2019 | 662 | 141 | 409 |

| 2020 | 642 | 168 | 430 |

| Variable | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| Information Disclosure Fraud | Corporate Fraud | Manager Fraud | ||||

| Freq | Fraud | Freq | Fraud | Freq | Fraud | |

| Train | 0.0125 | 0.0607 | 0.0288 | 0.0940 | 0.1129 * | 0.2317 ** |

| (0.2130) | (0.5641) | (0.3636) | (0.5158) | (1.9305) | (1.9600) | |

| TrainPost | −0.0945 * | −0.1812 * | −0.0706 | −0.1936 | −0.1220 ** | −0.2053 ** |

| (−1.8416) | (−1.8874) | (−1.0314) | (−1.2268) | (−2.4290) | (−2.0053) | |

| Size | −0.0342 * | −0.0079 | −0.0841 *** | −0.1655 ** | −0.0338 | −0.0480 |

| (−1.8918) | (−0.2301) | (−2.7881) | (−2.3902) | (−1.5830) | (−1.1521) | |

| Lev | 0.9894 *** | 2.0819 *** | 0.9758 *** | 2.3333 *** | 0.3636 *** | 0.7434 *** |

| (11.1932) | (13.3219) | (7.3706) | (7.7997) | (3.7596) | (3.9743) | |

| Growth | 0.0202 | 0.0504 | −0.0442 | −0.1534 | 0.0751 ** | 0.1390 ** |

| (0.6806) | (0.9913) | (−0.9141) | (−1.3222) | (2.3966) | (2.3765) | |

| TobinQ | 0.0528 *** | 0.1204 *** | −0.0276 | −0.0704 | 0.0295 ** | 0.0585 ** |

| (3.8022) | (5.0218) | (−1.2006) | (−1.3279) | (2.0073) | (2.1336) | |

| Pattern | −0.1703 *** | −0.3013 *** | −0.1617 *** | −0.4000 *** | −0.2931 *** | −0.5939 *** |

| (−5.0376) | (−4.8986) | (−3.1264) | (−3.3465) | (−7.7505) | (−7.7697) | |

| Top10 | −0.0047 *** | −0.0074 *** | −0.0034 ** | −0.0104 *** | −0.0047 *** | −0.0092 *** |

| (−4.7117) | (−4.1203) | (−2.2673) | (−3.0363) | (−4.3606) | (−4.4356) | |

| BigFour | 0.1620 ** | 0.4840 *** | 0.3252 ** | 0.9659 *** | 0.1949 ** | 0.3947 ** |

| (2.3837) | (3.5844) | (2.5222) | (2.7452) | (2.5596) | (2.5493) | |

| Anarpt | −0.0053 *** | −0.0132 *** | −0.0007 | −0.0021 | −0.0011 | −0.0033 ** |

| (−6.7763) | (−8.3979) | (−0.5664) | (−0.7494) | (−1.3694) | (−2.1201) | |

| Turnover | −0.0001 * | −0.0001 ** | 0.0000 | 0.0001 | −0.0000 | −0.0001 |

| (−1.6935) | (−2.4004) | (0.2441) | (0.8498) | (−1.1464) | (−1.0566) | |

| Cons | −1.8682 *** | −5.2950 *** | −1.8608 ** | −20.1411 | −1.4368 ** | −3.1671 ** |

| (−4.0748) | (−4.7608) | (−2.4083) | (−0.0057) | (−1.9887) | (−2.2246) | |

| Year | Control | Control | Control | Control | Control | Control |

| Industry | Control | Control | Control | Control | Control | Control |

| N | 22244 | 22244 | 22244 | 22244 | 22244 | 22244 |

| PseudoR2 | 0.0646 | 0.0820 | 0.0582 | 0.0625 | 0.0400 | 0.0421 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, C.; Strauss, J.; Zheng, L. High-Speed Railway Opening and Corporate Fraud. Sustainability 2021, 13, 13465. https://doi.org/10.3390/su132313465

Wang C, Strauss J, Zheng L. High-Speed Railway Opening and Corporate Fraud. Sustainability. 2021; 13(23):13465. https://doi.org/10.3390/su132313465

Chicago/Turabian StyleWang, Chen, Jack Strauss, and Lei Zheng. 2021. "High-Speed Railway Opening and Corporate Fraud" Sustainability 13, no. 23: 13465. https://doi.org/10.3390/su132313465

APA StyleWang, C., Strauss, J., & Zheng, L. (2021). High-Speed Railway Opening and Corporate Fraud. Sustainability, 13(23), 13465. https://doi.org/10.3390/su132313465