Carbon Emissions and Brazilian Ethanol Prices: Are They Correlated? An Econophysics Study

Abstract

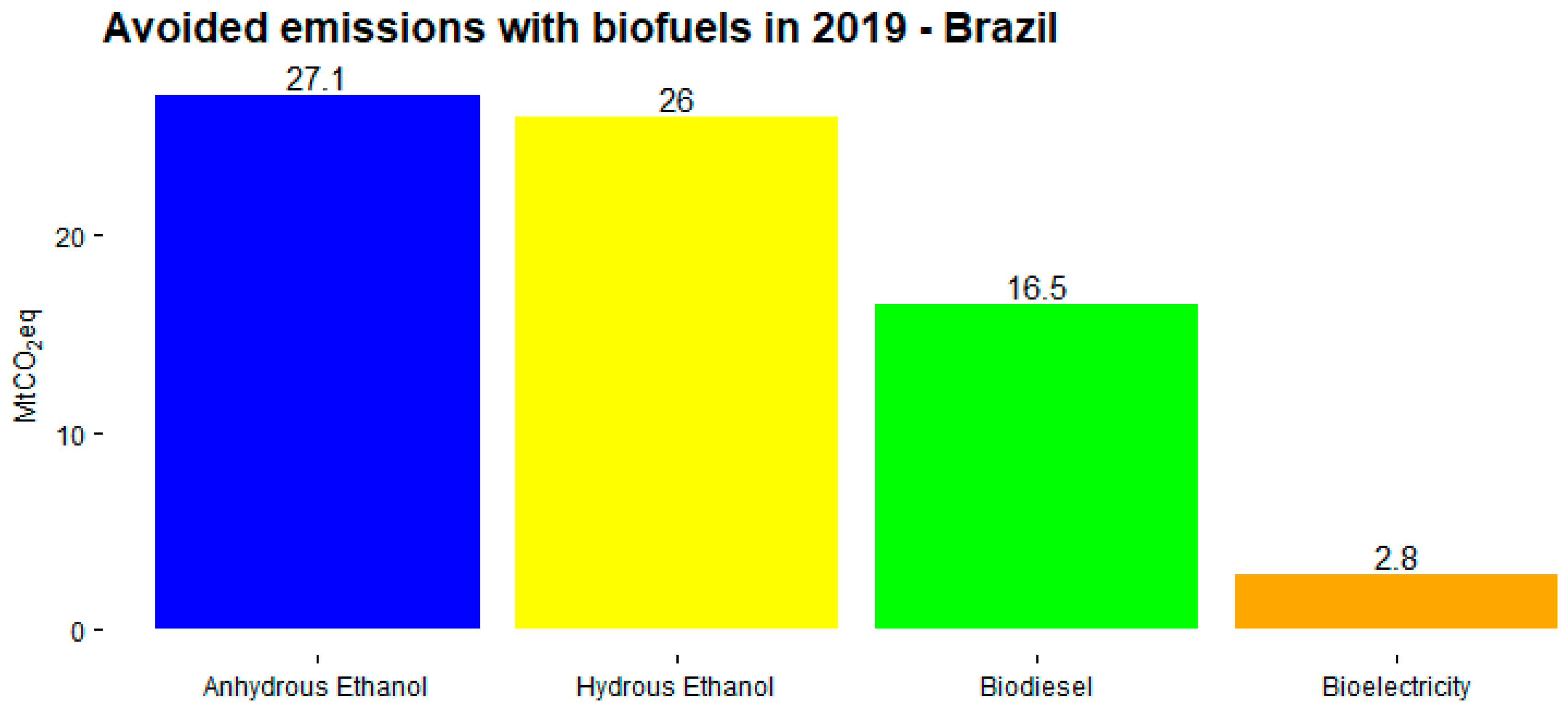

:1. Introduction

2. Brief Literature Review

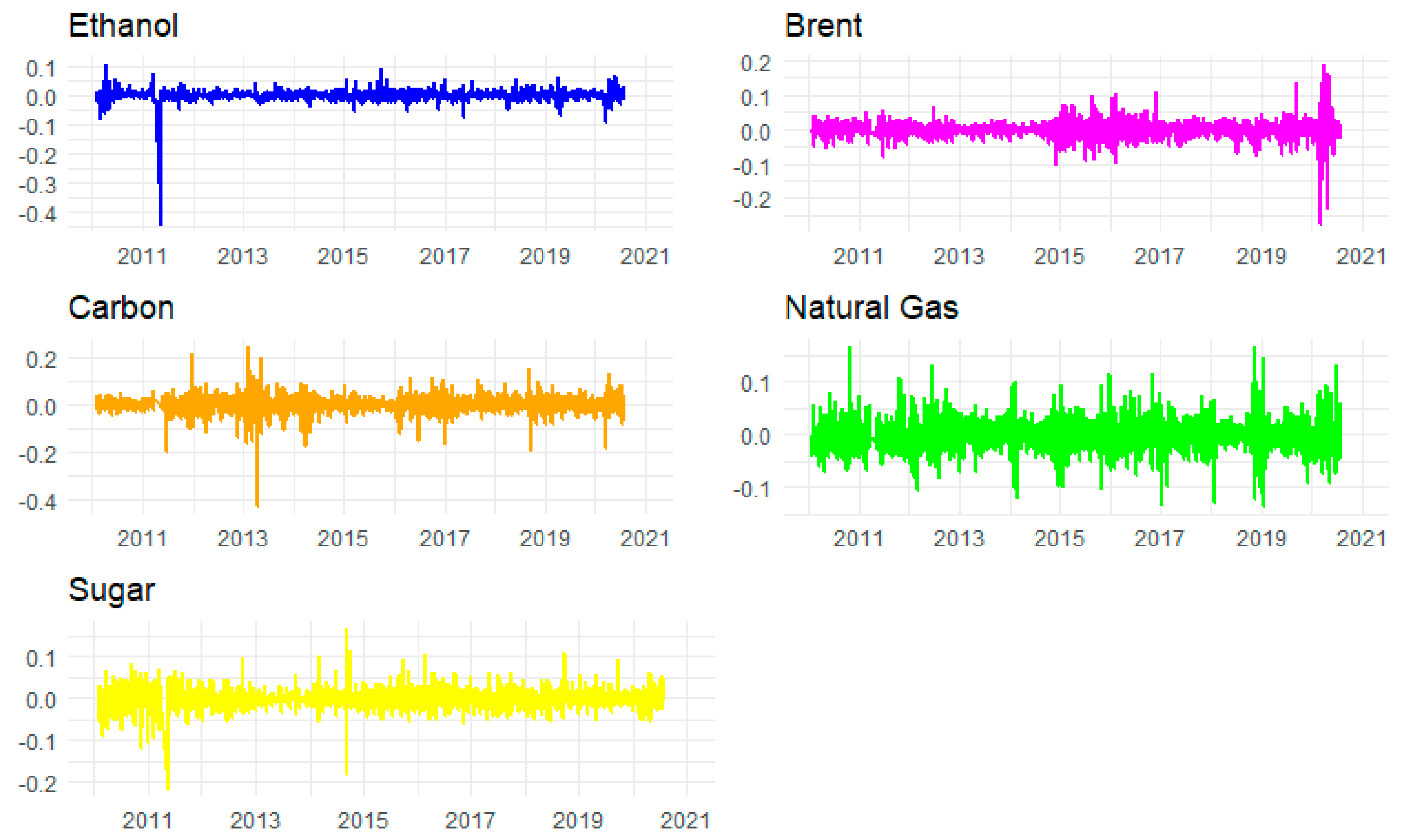

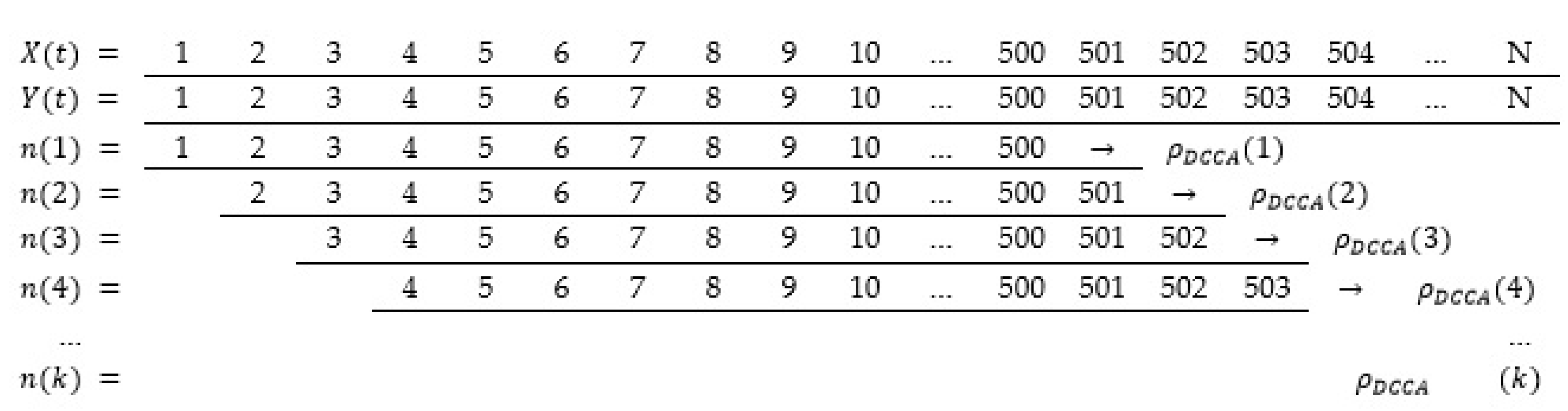

3. Material and Methods

- (i)

- Consider two series and where , with equidistant observations and calculate and .

- (ii)

- Next, we divide the sample in boxes of dimension and so divided into ) overlapping boxes. The purpose of this procedure is to calculate local trends and of each series through ordinary least squares (OLS) and estimate the trend of each box, linear in our case, and the size of each box is in the interval between .

- (iii)

- Subsequently, we calculate the difference between the original series and the estimated trend, in order to obtain a series without trend (detrended), and thus, we calculate the detrended covariance of the residues of each box of both series, which are given by .

- (iv)

- Afterwards, we have the sum of covariance of all boxes of size n, in order to obtain the detrended covariance given by . The process is continued for all lengths of the boxes, in order to obtain an expression for the relationship between DCCA fluctuations as a function of n. More specifically, the purpose is to find a relationship between , where the parameter is the relevant one to evaluate the long-term cross-correlation. If , the series demonstrates a persistent long-term cross-correlation; in the case of , we have anti-persistent behavior, and finally if , there is no relationship between the variables.

- (v)

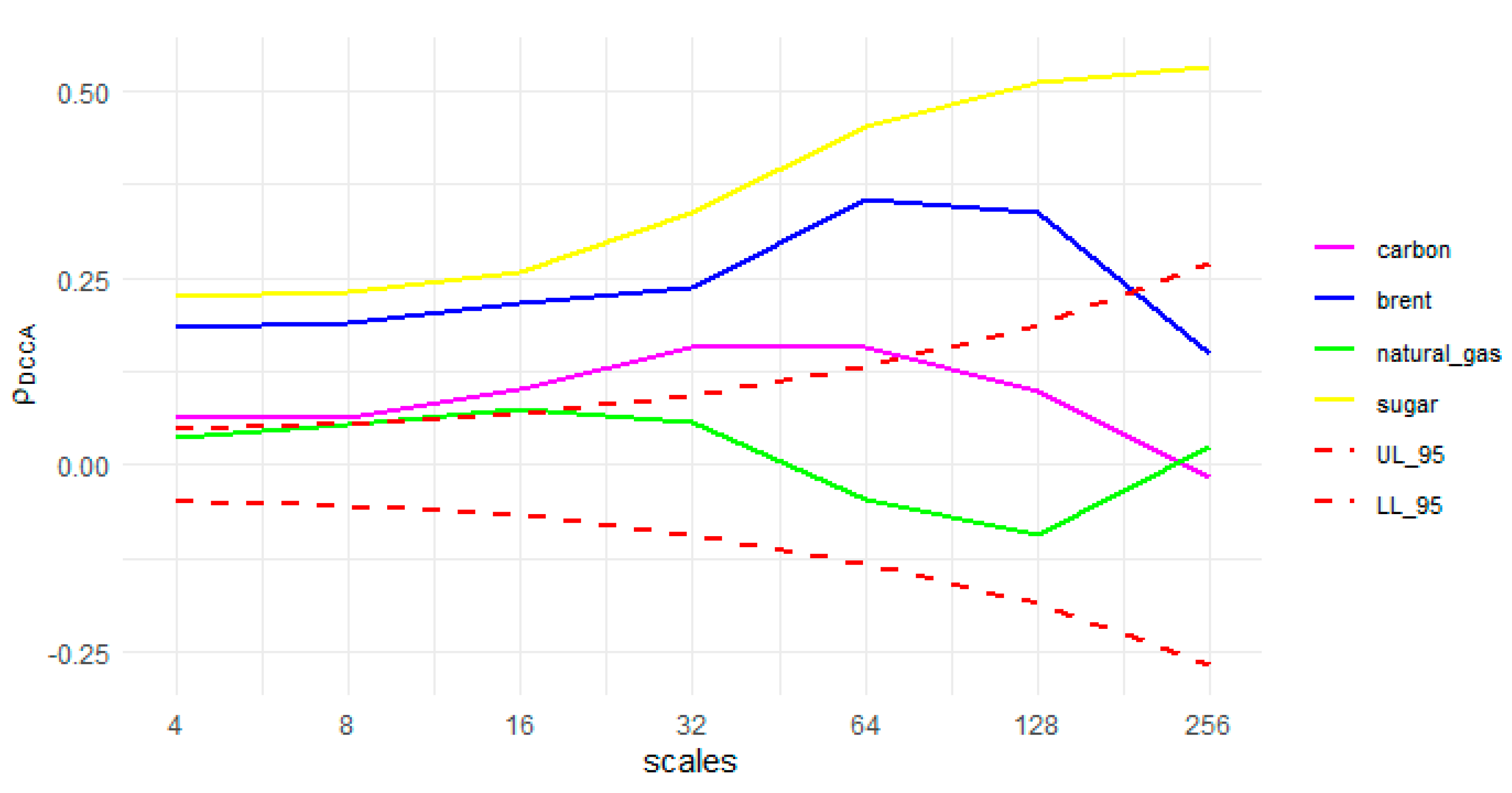

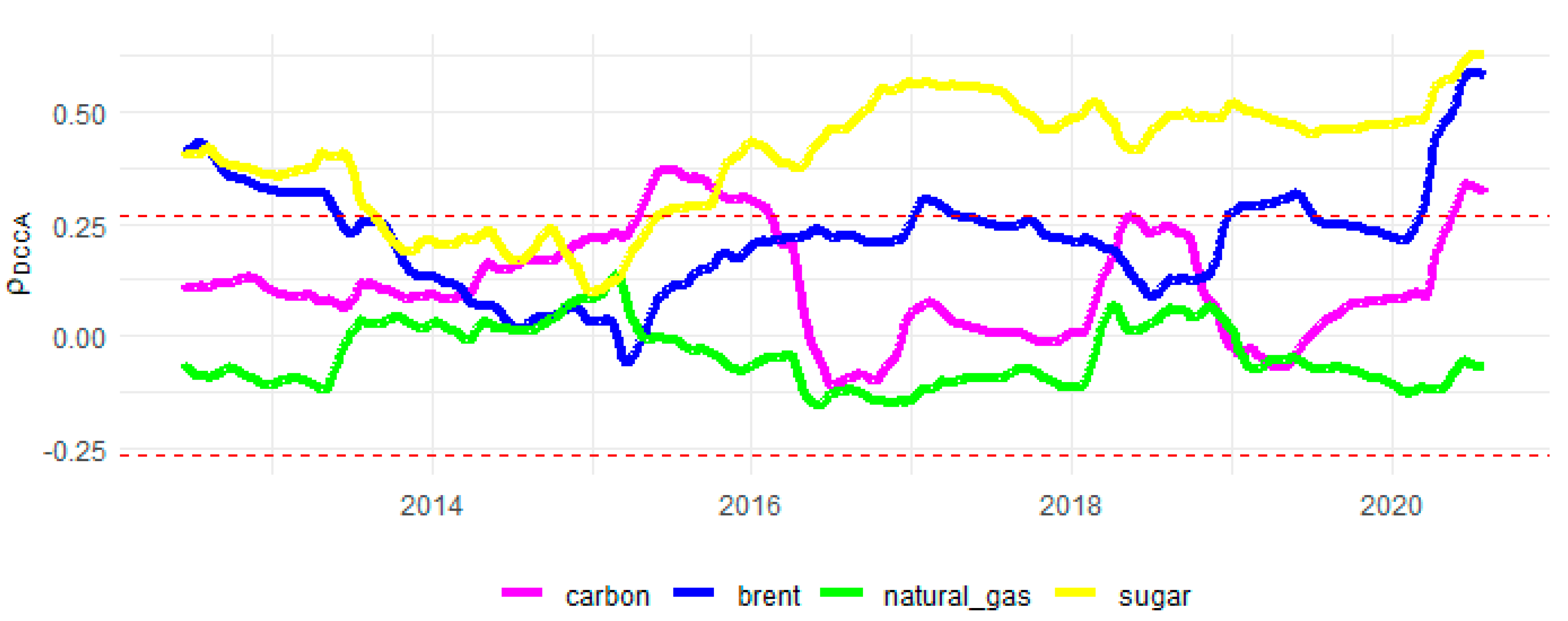

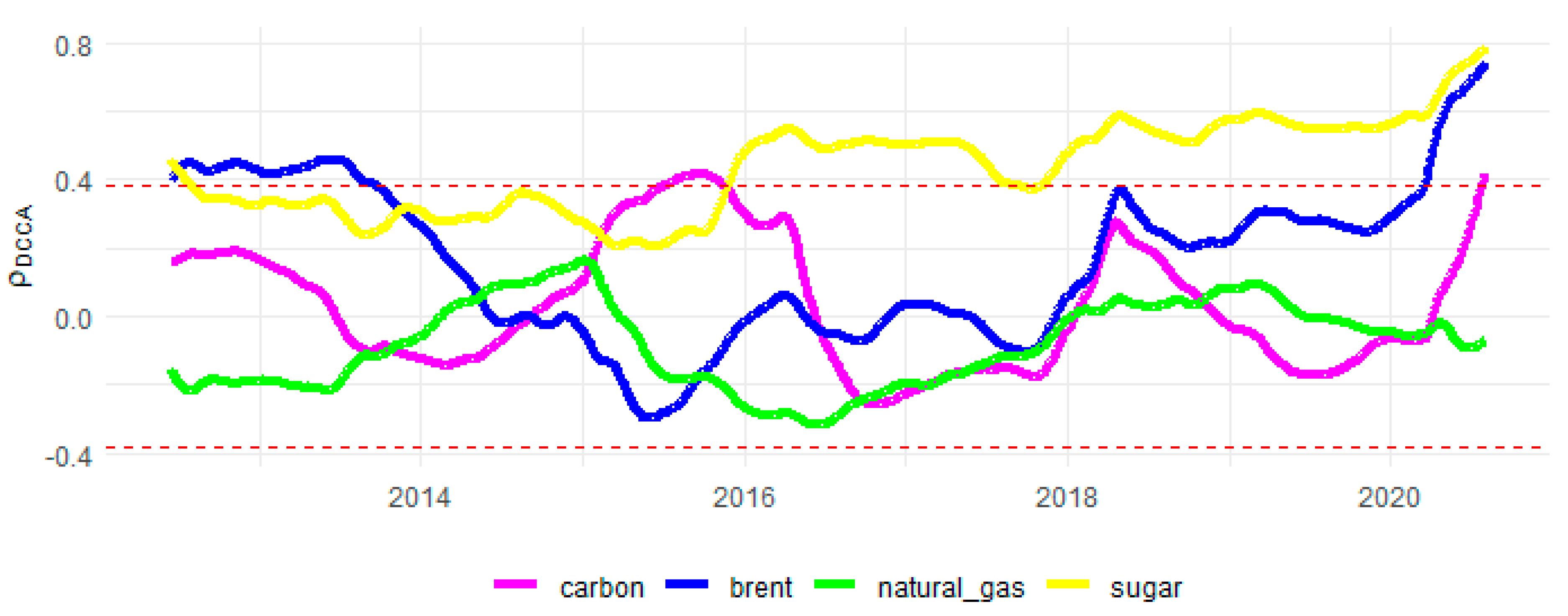

4. Results and Discussions

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Figueira, S.R.F.; Burnquist, H.L.; Bacchi, M.R.P. Forecasting fuel ethanol consumption in Brazil by time series models: 2006–2012. Appl. Econ. 2010, 42, 865–874. [Google Scholar] [CrossRef]

- Janda, K.; Kristoufek, L. The Relationship between Fuel and Food Prices: Methods and Outcomes. Annu. Rev. Resour. Econ. 2019, 11, 195–216. [Google Scholar] [CrossRef]

- David, S.A.; Quintino, D.D.; Inacio, C.M.C., Jr.; Machado, J.T. Fractional dynamic behavior in ethanol prices series. J. Comput. Appl. Math. 2018, 339, 85–93. [Google Scholar] [CrossRef]

- Costa, C.C.; Burnquist, H.L.; Guilhoto, J.J.M. Special safeguard tariff impacts on the Brazilian sugar exports. J. Int. Trade Law Policy 2015, 14, 70–85. [Google Scholar] [CrossRef]

- Santos, J.A.D.; Ferreira Filho, J.B.D.S. Substituição de Combustíveis Fósseis por Etanol e Biodiesel no Brasil e Seus Impactos Econômicos: Uma avaliação do Plano Nacional de Energia 2030. 2017. Available online: http://repositorio.ipea.gov.br/handle/11058/8231 (accessed on 15 July 2020).

- Goldemberg, J. Ethanol for a Sustainable Energy Future. Science 2007, 315, 808–810. [Google Scholar] [CrossRef] [Green Version]

- Coelho, S.T.; Goldemberg, J.; Lucon, O.; Guardabassi, P. Brazilian sugarcane ethanol: Lessons learned. Energy Sustain. Dev. 2006, 10, 26–39. [Google Scholar] [CrossRef]

- IEMA. Inventário De Emissões Atmosféricas Do Transporte Rodoviário De Passageiros No Município De São Paulo; IEMA: Sao Paulo, Brasil, 2020; Available online: http://emissoes.energiaeambiente.org.br/graficos (accessed on 10 September 2020).

- Debone, D.; Da Costa, M.; Miraglia, S. 90 Days of COVID-19 Social Distancing and Its Impacts on Air Quality and Health in Sao Paulo, Brazil. Sustainability 2020, 12, 7440. [Google Scholar] [CrossRef]

- EPE. Empresa de Pesquisa Energética. Análise de Conjuntura dos Biocombustíveis. 2019. Available online: http://www.mme.gov.br (accessed on 15 July 2020).

- EPE. Balanço Energético Nacional 2020: Ano-Base 2019; Empresa de Pesquisa Energética: Rio de Janeiro, Brazil, 2020. Available online: www.epe.gov.br (accessed on 15 July 2020).

- Rosa, L.P.; Oliveira, L.B.; Costa, A.O.; Pimenteira, C.A.; Mattos, L.B. Geração de Energia a partir de resíduos sólidos. In Tolmasquim, M.T (Coord) Fontes Alternativas, 515; Editora Interciência, COPPE, UFRJ: Rio de Janeiro, Brazil, 2003. [Google Scholar]

- MCTI. Fatores de Emissão de CO2 Para Utilizações que Necessitam do Fator Médio de Emissão do Sistema Interligado Nacional do Brasil, Como, por Exemplo, Inventários Corporativos; Ministério da Ciência, Tecnologia e Inovação: Brasília, Brazil, 2020. Available online: www.mct.gov.br (accessed on 15 July 2020).

- BRASIL. Lei n° 13.576, de 26 de Dezembro de 2017. Dispõe sobre a Política Nacional deBiocombustíveis (RenovaBio) e dá Outras Providências; Diário Oficial da União: Brasília, Brazil, 2017. Available online: www.planalto.gov.br (accessed on 15 July 2020).

- Klein, B.C.; Chagas, M.F.; Watanabe, M.D.B.; Bonomi, A.; Maciel Filho, R. Low carbon biofuels and the New Brazilian National Biofuel Policy (RenovaBio): A case study for sugarcane mills and integrated sugarcane-microalgae biorefineries. Renew. Sustain. Energy Rev. 2019, 115, 109365. [Google Scholar] [CrossRef]

- Karp, S.G.; Medina, J.D.C.; Letti, L.A.J.; Woiciechowski, A.L.; de Carvalho, J.C.; Schmitt, C.C.; Penha, R.D.O.; Kumlehn, G.S.; Soccol, C.R. Bioeconomy and biofuels: The case of sugarcane ethanol in Brazil. Biofuels Bioprod. Biorefining 2021, 15, 899–912. [Google Scholar] [CrossRef]

- da Rocha Lima Filho, R.I.; de Aquino, T.C.N.; Neto, A.M.N. Fuel price control in Brazil: Environmental impacts. Environ. Dev. Sustain. 2021, 23, 9811–9826. [Google Scholar] [CrossRef]

- Lee, Y.; Yoon, S.-M. Dynamic Spillover and Hedging among Carbon, Biofuel and Oil. Energies 2020, 13, 4382. [Google Scholar] [CrossRef]

- Dutta, A. Impact of carbon emission trading on the European Union biodiesel feedstock market. Biomass-Bioenergy 2019, 128, 105328. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E. Carbon emission and ethanol markets: Evidence from Brazil. Biofuels Bioprod. Biorefining 2019, 13, 458–463. [Google Scholar] [CrossRef]

- Guedes, E.F.; Zebende, G.F. DCCA cross-correlation coefficient with sliding windows approach. Phys. A Stat. Mech. Appl. 2019, 527, 121286. [Google Scholar] [CrossRef]

- Tilfani, O.; Ferreira, P.; Boukfaoui, E.; Youssef, M. Dynamic cross-correlation and dynamic contagion of stock markets: A sliding windows approach with the DCCA correlation coefficient. Empir. Econ. 2021, 60, 1127–1156. [Google Scholar] [CrossRef]

- Zebende, G. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Phys. A Stat. Mech. Appl. 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Kristoufek, L. Measuring correlations between non-stationary series with DCCA coefficient. Phys. A Stat. Mech. Appl. 2014, 402, 291–298. [Google Scholar] [CrossRef] [Green Version]

- Zhao, X.; Shang, P.; Huang, J. Several fundamental properties of dcca cross-correlation coefficient. Fractals 2017, 25, 1750017. [Google Scholar] [CrossRef]

- Rapsomanikis, G.; Hallam, D. Threshold Cointegration in the Sugar-Ethanol-Oil Price System in Brazil: Evidence from Nonlinear Vector Error Correction Models; FAO Commodity and Trade Policy Research Working Paper, 22; FAO: Rome, Italy, 2006. [Google Scholar]

- Serra, T.; Zilberman, D.; Gil, J. Price volatility in ethanol markets. Eur. Rev. Agric. Econ. 2011, 38, 259–280. [Google Scholar] [CrossRef] [Green Version]

- Kristoufek, L.; Janda, K.; Zilberman, D. Comovements of ethanol-related prices: Evidence from Brazil and the USA. GCb Bioenergy 2016, 8, 346–356. [Google Scholar] [CrossRef] [Green Version]

- Bentivoglio, D.; Finco, A.; Bacchi, M.R.P. Interdependencies between biofuel, fuel and food prices: The case of the Brazilian ethanol market. Energies 2016, 9, 464. [Google Scholar]

- Capitani, D.H.D.; Junior, J.C.C.; Tonin, J.M. Integration and hedging efficiency between Brazilian and US ethanol markets. Contextus 2018, 16, 93–117. [Google Scholar] [CrossRef]

- Dutta, A. Cointegration and nonlinear causality among ethanol-related prices: Evidence from Brazil. GCB Bioenergy 2018, 10, 335–342. [Google Scholar] [CrossRef] [Green Version]

- Cao, G.; Han, Y. Does the weather affect the Chinese stock markets? Evidence from the analysis of DCCA cross-correlation coefficient. Int. J. Mod. Phys. B 2014, 29, 1450236. [Google Scholar] [CrossRef]

- Cao, G.; He, C.; Xu, W. Effect of Weather on Agricultural Futures Markets on the Basis of DCCA Cross-Correlation Coefficient Analysis. Fluct. Noise Lett. 2016, 15, 1650012. [Google Scholar] [CrossRef]

- Wang, G.-J.; Xie, C.; Chen, S.; Han, F. Cross-Correlations between Energy and Emissions Markets: New Evidence from Fractal and Multifractal Analysis. Math. Probl. Eng. 2014, 2014, 197069. [Google Scholar] [CrossRef]

- Paiva, A.S.S.; Rivera-Castro, M.A.; Andrade, R.F.S. DCCA analysis of renewable and conventional energy prices. Phys. A Stat. Mech. Appl. 2018, 490, 1408–1414. [Google Scholar] [CrossRef]

- Fan, X.; Li, X.; Yin, J. Dynamic relationship between carbon price and coal price: Perspective based on Detrended Cross-Correlation Analysis. Energy Procedia 2019, 158, 3470–3475. [Google Scholar] [CrossRef]

- Ferreira, P.; Loures, L.; Nunes, J.; Brito, P. Are renewable energy stocks a possibility to diversify portfolios considering an environmentally friendly approach? The view of DCCA correlation coefficient. Phys. A Stat. Mech. Appl. 2018, 512, 675–681. [Google Scholar] [CrossRef]

- Ferreira, P.; Loures, L.C. An Econophysics Study of the S&P Global Clean Energy Index. Sustainability 2020, 12, 662. [Google Scholar]

- Siqueira, E.L., Jr.; Stošić, T.; Bejan, L.; Stošić, B. Correlations and cross-correlations in the Brazilian agrarian commodities and stocks. Phys. A Stat. Mech. Appl. 2010, 389, 2739–2743. [Google Scholar] [CrossRef]

- Filho, A.N.; Pereira, E.; Ferreira, P.; Murari, T.; Moret, M. Cross-correlation analysis on Brazilian gasoline retail market. Phys. A Stat. Mech. Appl. 2018, 508, 550–557. [Google Scholar] [CrossRef]

- Murari, T.B.; Filho, A.S.N.; Pereira, E.J.; Ferreira, P.; Pitombo, S.; Pereira, H.B.; Santos, A.A.; Moret, M.A. Comparative Analysis between Hydrous Ethanol and Gasoline C Pricing in Brazilian Retail Market. Sustainability 2019, 11, 4719. [Google Scholar] [CrossRef] [Green Version]

- Lima, C.R.A.; de Melo, G.R.; Stosic, B.; Stosic, T. Cross-correlations between Brazilian biofuel and food market: Ethanol versus sugar. Phys. A Stat. Mech. Appl. 2019, 513, 687–693. [Google Scholar] [CrossRef]

- Cavalcanti, M.; Szklo, A.; Machado, G. Do ethanol prices in Brazil follow Brent price and international gasoline price parity? Renew. Energy 2012, 43, 423–433. [Google Scholar] [CrossRef]

- Goldemberg, J.; Schaeffer, R.; Szklo, A.; Lucchesi, R. Oil and natural gas prospects in South America: Can the petroleum industry pave the way for renewables in Brazil? Energy Policy 2014, 64, 58–70. [Google Scholar] [CrossRef]

- Li, B. Pricing dynamics of natural gas futures. Energy Econ. 2019, 78, 91–108. [Google Scholar] [CrossRef]

- Quintino, D.D.; David, S.A. Quantitative analysis of feasibility of hydrous ethanol futures contracts in Brazil. Energy Econ. 2013, 40, 927–935. [Google Scholar] [CrossRef]

- Quintino, D.D.; David, S.A.; Vian, C.E.D.F. Analysis of the Relationship between Ethanol Spot and Futures Prices in Brazil. Int. J. Financ. Stud. 2017, 5, 11. [Google Scholar] [CrossRef] [Green Version]

- Aloui, D.; Goutte, S.; Guesmi, K.; Hchaichi, R. COVID 19’s Impact on Crude Oil and Natural Gas S&P GS Indexes; 2020; SSRN 3587740. Available online: https://halshs.archives-ouvertes.fr/halshs-02613280 (accessed on 18 November 2021).

- Tilfani, O.; Ferreira, P.; El Boukfaoui, M.Y. Revisiting stock market integration in Central and Eastern European stock markets with a dynamic analysis. Post-Communist Econ. 2020, 32, 643–674. [Google Scholar] [CrossRef]

- Tilfani, O.; Ferreira, P.; Dionisio, A.; El Boukfaoui, M.Y. EU Stock Markets vs. Germany, UK and US: Analysis of Dynamic Comovements Using Time-Varying DCCA Correlation Coefficients. J. Risk Financ. Manag. 2020, 13, 91. [Google Scholar] [CrossRef]

- Podobnik, B.; Stanley, H.E. Detrended Cross-Correlation Analysis: A New Method for Analyzing Two Nonstationary Time Series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [Green Version]

- Peng, C.-K.; Buldyrev, S.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Podobnik, B.; Jiang, Z.-Q.; Zhou, W.-X.; Stanley, H. Statistical tests for power-law cross-correlated processes. Phys. Rev. E 2011, 84, 066118. [Google Scholar] [CrossRef] [Green Version]

- David, S.A.; Inácio, C.M.C., Jr.; Quintino, D.D.; Machado, J.A.T. Measuring the Brazilian ethanol and gasoline market efficiency using DFA-Hurst and fractal dimension. Energy Econ. 2020, 85, 104614. [Google Scholar] [CrossRef]

- Reboredo, F.H.; Lidon, F.; Pessoa, M.; Ramalho, J.C. The Fall of Oil Prices and the Effects on Biofuels. Trends Biotechnol. 2016, 34, 3–6. [Google Scholar] [CrossRef] [PubMed]

- Perifanis, T.; Dagoumas, A. Price and Volatility Spillovers Between the US Crude Oil and Natural Gas Wholesale Markets. Energies 2018, 11, 2757. [Google Scholar] [CrossRef] [Green Version]

- Bakker, E. Netherlands Enterprise Agency: 2018. Brazil Determined to Increase Role of Biofuels. Available online: https://www.rvo.nl/sites/default/files/2018/01/brazil-determined-to-increase-role-of-biofuels.pdf. (accessed on 18 November 2021).

- Melo, C.A.; Jannuzzi, G.D.M.; Santana, P.H.D.M. Why should Brazil to implement mandatory fuel economy standards for the light vehicle fleet? Renew. Sustain. Energy Rev. 2018, 81, 1166–1174. [Google Scholar] [CrossRef]

- Uddin, G.S.; Hernandez, J.A.; Wadström, C.; Dutta, A.; Ahmed, A. Do uncertainties affect biofuel prices? Biomass- Bioenergy 2021, 148, 106006. [Google Scholar] [CrossRef]

- Han, H.; Linton, O.; Oka, T.; Whang, Y. The cross-quantilogram: Measuring quantile dependence and testing directional predictability between time series. J. Econ. 2016, 193, 251–270. [Google Scholar] [CrossRef] [Green Version]

- Guedes, E.F.; Silva-Filho, A.M.; Zebende, G.F. GMZTests: Statistical Tests. R package version 0.1.3. 2020. Available online: https://CRAN.R-project.org/package=GMZTests (accessed on 2 July 2021).

| Reference | Period | Main Findings |

|---|---|---|

| Rapsomanikis and Hallam [26] | 2000–2006 | Oil prices determine both sugar and ethanol prices and there is no evidence of causal relationship from oil to ethanol and from ethanol to sugar |

| Serra et al. [27] | 2000–2008 | Evidence of relationship between food (sugar) and fuel (ethanol) in prices and volatilities |

| Kristoufek et al. [28] | 2002–2014 | Evidence of relationship between prices of ethanol and sugar (Brazil) and corn (USA) |

| Bentivoglio et al. [29] | 2007–2013 | Food (sugar) and fuel (gasoline) prices influence ethanol prices, but there is no evidence that ethanol impacts food prices |

| Capitani et al. [30] | 2010–2016 | Weak relationship between ethanol prices (USA and Brazil) |

| Dutta [31] | 2003–2016 | Oil and sugar prices affect Brazilian ethanol prices, but sugar is not influenced by ethanol. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Quintino, D.D.; Burnquist, H.L.; Ferreira, P.J.S. Carbon Emissions and Brazilian Ethanol Prices: Are They Correlated? An Econophysics Study. Sustainability 2021, 13, 12862. https://doi.org/10.3390/su132212862

Quintino DD, Burnquist HL, Ferreira PJS. Carbon Emissions and Brazilian Ethanol Prices: Are They Correlated? An Econophysics Study. Sustainability. 2021; 13(22):12862. https://doi.org/10.3390/su132212862

Chicago/Turabian StyleQuintino, Derick David, Heloisa Lee Burnquist, and Paulo Jorge Silveira Ferreira. 2021. "Carbon Emissions and Brazilian Ethanol Prices: Are They Correlated? An Econophysics Study" Sustainability 13, no. 22: 12862. https://doi.org/10.3390/su132212862

APA StyleQuintino, D. D., Burnquist, H. L., & Ferreira, P. J. S. (2021). Carbon Emissions and Brazilian Ethanol Prices: Are They Correlated? An Econophysics Study. Sustainability, 13(22), 12862. https://doi.org/10.3390/su132212862