Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy

Abstract

1. Introduction

2. Materials and Methods

2.1. Literature Review: Who Prefers Circular Products?

2.2. Methods

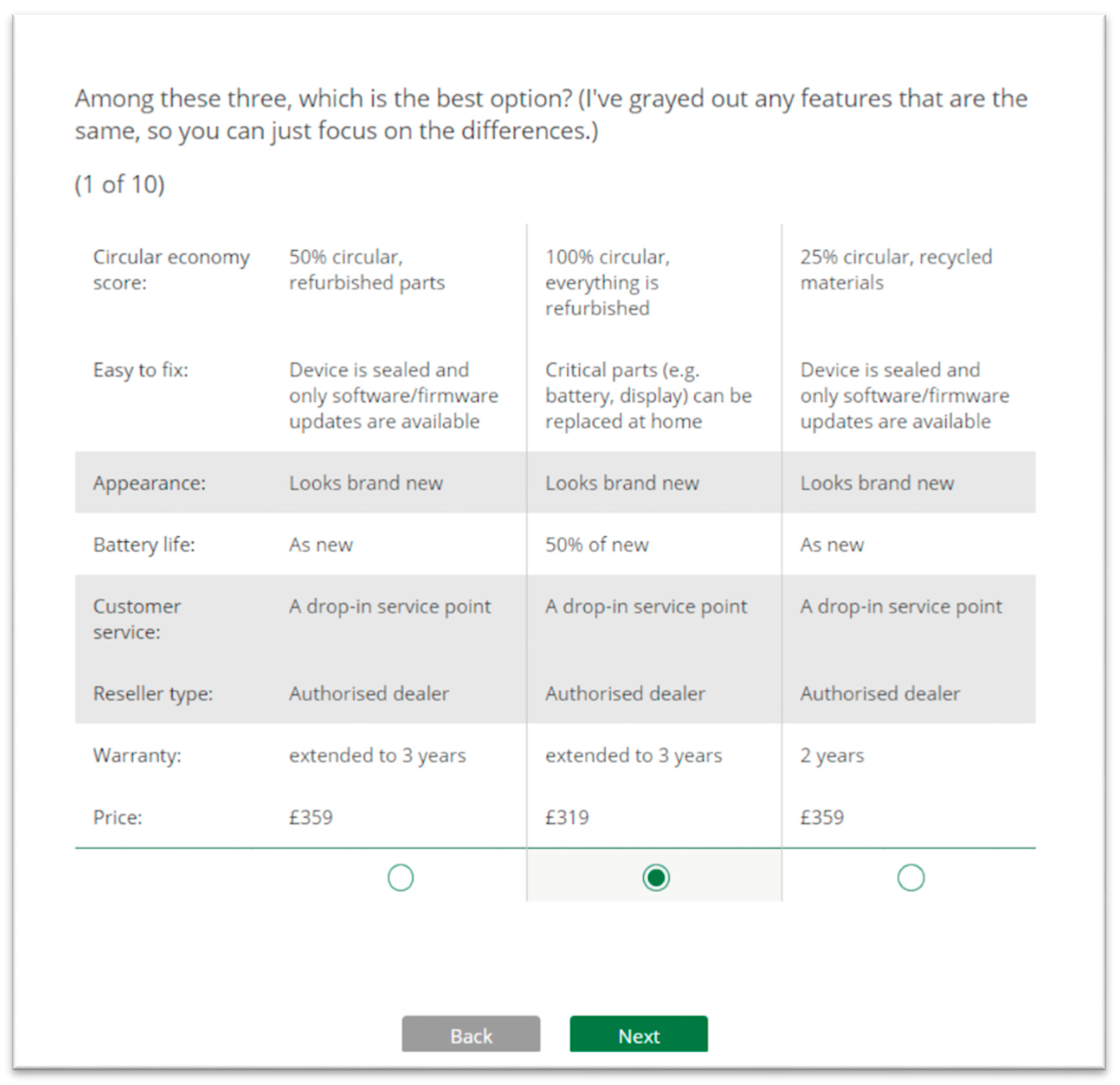

2.2.1. Choice-Based Conjoint

2.2.2. Circular Economy Score

- 0% circular—everything in the product comes from new materials;

- 25% circular—the product contains recycled materials;

- 50% circular—half of the product is made of refurbished/reused parts;

- 75% circular—most of the product is made of refurbished parts;

- 100% circular—the whole product is reused or made of refurbished parts.

2.2.3. Data Collection

2.2.4. Cluster Analysis

3. Results

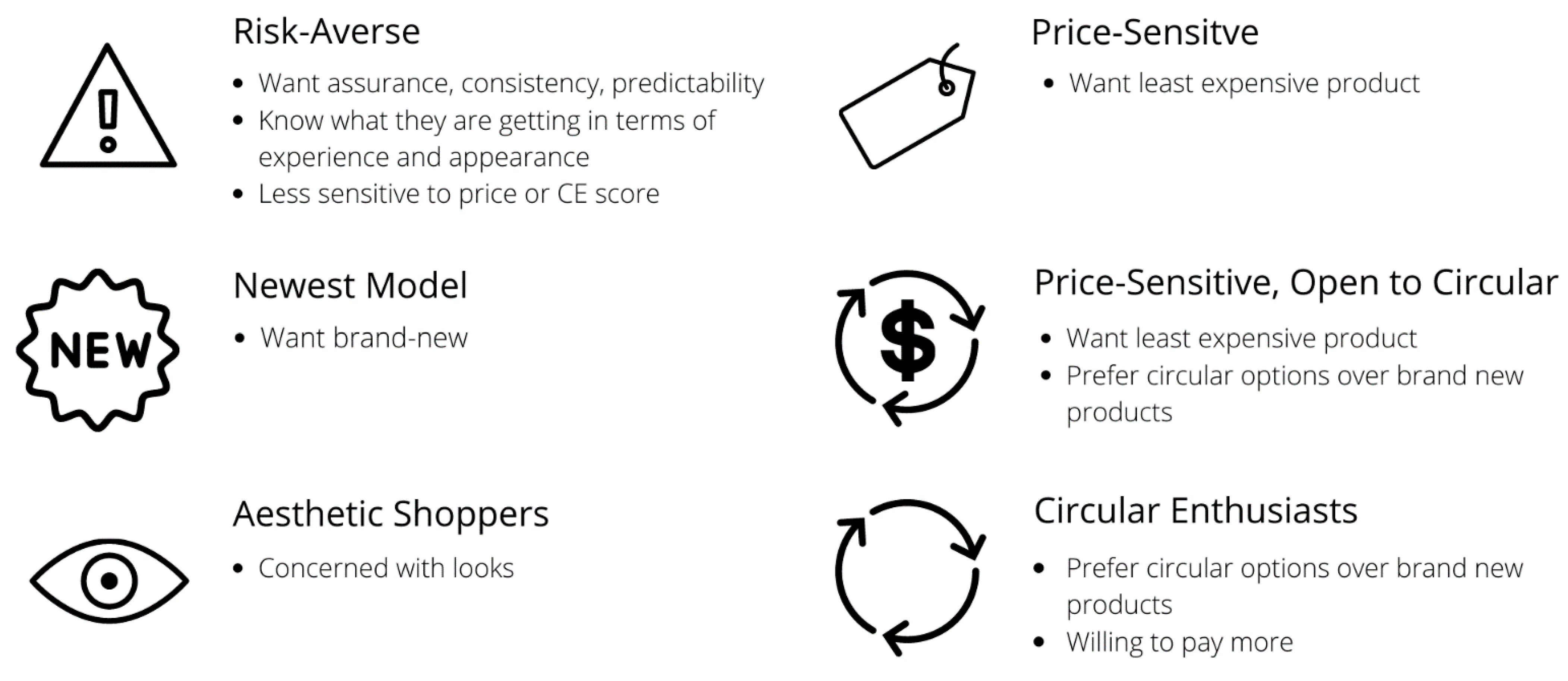

3.1. Customer Segments

3.2. Demographics

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Blomsma, F.; Brennan, G. The Emergence of Circular Economy: A New Framing around Prolonging Resource Productivity. J. Ind. Ecol. 2017, 21, 603–614. [Google Scholar] [CrossRef]

- Korhonen, J.; Nuur, C.; Feldmann, A.; Birkie, S.E. Circular Economy as an Essentially Contested Concept. J. Clean. Prod. 2018, 175, 544–552. [Google Scholar] [CrossRef]

- Nußholz, J.L.K. Circular Business Models: Defining a Concept and Framing an Emerging Research Field. Sustainability 2017, 9, 1810. [Google Scholar] [CrossRef]

- Bocken, N.M.P.; de Pauw, I.; Bakker, C.; van der Grinten, B. Product Design and Business Model Strategies for a Circular Economy. J. Ind. Prod. Eng. 2016, 33, 308–320. [Google Scholar] [CrossRef]

- Ghisellini, P.; Cialani, C.; Ulgiati, S. A Review on Circular Economy: The Expected Transition to a Balanced Interplay of Environmental and Economic Systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Lieder, M.; Rashid, A. Towards Circular Economy Implementation: A Comprehensive Review in Context of Manufacturing Industry. J. Clean. Prod. 2016, 115, 36–51. [Google Scholar] [CrossRef]

- Yuan, Z.; Bi, J.; Moriguichi, Y. The Circular Economy: A New Development Strategy in China. J. Ind. Ecol. 2006, 10, 4–8. [Google Scholar] [CrossRef]

- Camacho-Otero, J.; Boks, C.; Pettersen, I. Consumption in the Circular Economy: A Literature Review. Sustainability 2018, 10, 2758. [Google Scholar] [CrossRef]

- Kirchherr, J.; Piscicelli, L.; Bour, R.; Kostense-Smit, E.; Muller, J.; Huibrechtse-Truijens, A.; Hekkert, M. Barriers to the Circular Economy: Evidence From the European Union (EU). Ecol. Econ. 2018, 150, 264–272. [Google Scholar] [CrossRef]

- Chesbrough, H. Business Model Innovation: Opportunities and Barriers. Long Range Plan. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- Singh, P.; Giacosa, E. Cognitive Biases of Consumers as Barriers in Transition towards Circular Economy. Manag. Decis. 2019, 57, 921–936. [Google Scholar] [CrossRef]

- Potoglou, D.; Whitmarsh, L.; Whittle, C.; Tsouros, I.; Haggar, P.; Persson, T. To What Extent Do People Value Sustainable-Resourced Materials? A Choice Experiment with Cars and Mobile Phones across Six Countries. J. Clean. Prod. 2020, 246, 118957. [Google Scholar] [CrossRef]

- Mugge, R.; Jockin, B.; Bocken, N. How to Sell Refurbished Smartphones? An Investigation of Different Customer Groups and Appropriate Incentives. J. Clean. Prod. 2017, 147, 284–296. [Google Scholar] [CrossRef]

- Harms, R.; Linton, J.D. Willingness to Pay for Eco-Certified Refurbished Products: The Effects of Environmental Attitudes and Knowledge: WTP for Eco-Certified Refurbished Products. J. Ind. Ecol. 2016, 20, 893–904. [Google Scholar] [CrossRef]

- van Weelden, E.; Mugge, R.; Bakker, C. Paving the Way towards Circular Consumption: Exploring Consumer Acceptance of Refurbished Mobile Phones in the Dutch Market. J. Clean. Prod. 2016, 113, 743–754. [Google Scholar] [CrossRef]

- Hirschl, B.; Konrad, W.; Scholl, G. New Concepts in Product Use for Sustainable Consumption. J. Clean. Prod. 2003, 11, 873–881. [Google Scholar] [CrossRef]

- Hazen, B.T.; Overstreet, R.E.; Jones-Farmer, L.A.; Field, H.S. The Role of Ambiguity Tolerance in Consumer Perception of Remanufactured Products. Int. J. Prod. Econ. 2012, 135, 781–790. [Google Scholar] [CrossRef]

- Peschel, A.O.; Grebitus, C.; Steiner, B.; Veeman, M. How Does Consumer Knowledge Affect Environmentally Sustainable Choices? Evidence from a Cross-Country Latent Class Analysis of Food Labels. Appetite 2016, 106, 78–91. [Google Scholar] [CrossRef] [PubMed]

- Teisl, M.F.; Rubin, J.; Noblet, C.L. Non-Dirty Dancing? Interactions between Eco-Labels and Consumers. J. Econ. Psychol. 2008, 29, 140–159. [Google Scholar] [CrossRef]

- Atlason, R.S.; Giacalone, D.; Parajuly, K. Product Design in the Circular Economy: Users’ Perception of End-of-Life Scenarios for Electrical and Electronic Appliances. J. Clean. Prod. 2017, 168, 1059–1069. [Google Scholar] [CrossRef]

- Sønderskov, K.M.; Daugbjerg, C. The State and Consumer Confidence in Eco-Labeling: Organic Labeling in Denmark, Sweden, The United Kingdom and The United States. Agric. Hum. Values 2011, 28, 507–517. [Google Scholar] [CrossRef]

- Ward, D.O.; Clark, C.D.; Jensen, K.L.; Yen, S.T.; Russell, C.S. Factors Influencing Willingness-to-Pay for the ENERGY STAR ® Label. Energy Policy 2011, 39, 1450–1458. [Google Scholar] [CrossRef]

- Vecchio, R.; Annunziata, A. Willingness-to-Pay for Sustainability-Labelled Chocolate: An Experimental Auction Approach. J. Clean. Prod. 2015, 86, 335–342. [Google Scholar] [CrossRef]

- Louviere, J.J.; Flynn, T.N.; Carson, R.T. Discrete Choice Experiments Are Not Conjoint Analysis. J. Choice Model. 2010, 3, 57–72. [Google Scholar] [CrossRef]

- McFadden, D. The Measurement of Urban Travel Demand. J. Public Econ. 1974, 3, 303–328. [Google Scholar] [CrossRef]

- Thurstone, L.L. A Law of Comparative Judgment. Psychol. Rev. 1927, 34, 273–286. [Google Scholar] [CrossRef]

- Gustafsson, A.; Herrmann, A.; Huber, F. Conjoint Measurement: Methods and Applications; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2013; ISBN 978-3-540-24713-5. [Google Scholar]

- Breidert, C.; Hahsler, M.; Reutterer, T. A review of methods for measuring willingness-to-pay. Innov. Mark. 2006, 2, 25. Available online: https://www.businessperspectives.org/index.php/journals/innovative-marketing/issue-111/a-review-of-methods-for-measuring-willingness-to-pay (accessed on 3 November 2021).

- Luce, R.D. Individual Choice Behavior: A Theoretical Analysis; 2012; ISBN 0-486-15339-8. Available online: https://books.google.co.jp/books?hl=zh-CN&lr=&id=ERQsKkPiKkkC&oi=fnd&pg=PP1&dq=.+Individual+Choice+Behavior:+A+Theoretical+Analysis%3B+Courier&ots=2jps0sZ7bo&sig=7g1pKkjjO4i5EW_51V-s2AHpZJI#v=onepage&q=.%20Individual%20Choice%20Behavior%3A%20A%20Theoretical%20Analysis%3B%20Courier&f=false (accessed on 3 November 2021).

- Linder, M.; Sarasini, S.; van Loon, P. A Metric for Quantifying Product-Level Circularity. J. Ind. Ecol. 2017, 21, 545–558. [Google Scholar] [CrossRef]

- Roos Lindgreen, E.; Salomone, R.; Reyes, T. A Critical Review of Academic Approaches, Methods and Tools to Assess Circular Economy at the Micro Level. Sustainability 2020, 12, 4973. [Google Scholar] [CrossRef]

- Linder, M.; Boyer, R.H.W.; Dahllöf, L.; Vanacore, E.; Hunka, A. Product-Level Inherent Circularity and Its Relationship to Environmental Impact. J. Clean. Prod. 2020, 260, 121096. [Google Scholar] [CrossRef]

- Abbey, J.D.; Meloy, M.G.; Blackburn, J.; Guide, V.D.R., Jr. Consumer Markets for Remanufactured and Refurbished Products. Calif. Manag. Rev. 2015. [Google Scholar] [CrossRef]

- Hazen, B.T.; Boone, C.A.; Wang, Y.; Khor, K.S. Perceived Quality of Remanufactured Products: Construct and Measure Development. J. Clean. Prod. 2017, 142, 716–726. [Google Scholar] [CrossRef]

- Vafadarnikjoo, A.; Mishra, N.; Govindan, K.; Chalvatzis, K. Assessment of Consumers’ Motivations to Purchase a Remanufactured Product by Applying Fuzzy Delphi Method and Single Valued Neutrosophic Sets. J. Clean. Prod. 2018, 196, 230–244. [Google Scholar] [CrossRef]

- Bauer, R.; Menrad, K.; Decker, T. Adaptive Hybrid Methods for Choice-Based Conjoint Analysis: A Comparative Study. Int. J. Mark. Stud. 2015, 7, 1. [Google Scholar] [CrossRef][Green Version]

- Cunningham, C.E.; Deal, K.; Chen, Y. Adaptive Choice-Based Conjoint Analysis. Patient Patient-Cent. Outcomes Res. 2010, 3, 257–273. [Google Scholar] [CrossRef]

- Jervis, S.M.; Ennis, J.M.; Drake, M.A. A Comparison of Adaptive Choice-Based Conjoint and Choice-Based Conjoint to Determine Key Choice Attributes of Sour Cream with Limited Sample Size. J. Sens. Stud. 2012, 27, 451–462. [Google Scholar] [CrossRef]

- Kaufmann, S.; Künzel, K.; Loock, M. Customer Value of Smart Metering: Explorative Evidence from a Choice-Based Conjoint Study in Switzerland. Energy Policy 2013, 53, 229–239. [Google Scholar] [CrossRef]

- Shin, H.-S.; Callow, M.; Dadvar, S.; Lee, Y.-J.; Farkas, Z.A. User Acceptance and Willingness to Pay for Connected Vehicle Technologies: Adaptive Choice-Based Conjoint Analysis. Transp. Res. Rec. 2015, 2531, 54–62. [Google Scholar] [CrossRef]

- Orme, B. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research, 2nd ed.; Research Publishers LLC: Madison, WI, USA, 2010. [Google Scholar]

- Chapman, C.N.; Alford, J.L.; Johnson, C.; Weidemann, R.; Lahav, M. CBC vs. ACBC: Comparing Results with Real Product Selection. In Proceedings of the 2009 Sawtooth Software Conference Proceedings, Delray Beach, FL, USA, 25–27 March 2009; Available online: https://sawtoothsoftware.com/resources/technical-papers/cbc-vs-acbc-comparing-results-with-real-product-selection (accessed on 3 November 2021).

- Hunka, A.D.; Linder, M.; Habibi, S. Determinants of Consumer Demand for Circular Economy Products. A Case for Reuse and Remanufacturing for Sustainable Development. Bus Strat. Env. 2021, 30, 535–550. [Google Scholar] [CrossRef]

- Boyer, R.H.W.; Hunka, A.D.; Linder, M.; Whalen, K.; Habibi, S. Product Labels for the Circular Economy: Are Customers Willing to Pay for Circular? Sustain. Prod. Consum. 2020. [Google Scholar] [CrossRef]

- Carson, R.T.; Louviere, J.J.; Anderson, D.A.; Arabie, P.; Bunch, D.S.; Hensher, D.A.; Johnson, R.M.; Kuhfeld, W.F.; Steinberg, D.; Swait, J. Experimental Analysis of Choice. Mark. Lett. 1994, 5, 351–367. [Google Scholar] [CrossRef]

- Allenby, G.M.; Ginter, J.L. Using Extremes to Design Products and Segment Markets. J. Mark. Res. 1995, 32, 392–403. [Google Scholar] [CrossRef]

- Allenby, G.M.; Arora, N.; Ginter, J.L. Incorporating Prior Knowledge into the Analysis of Conjoint Studies. J. Mark. Res. 1995, 32, 152–162. [Google Scholar] [CrossRef]

- Romesburg, C. Cluster Analysis for Researchers; Lulu Press: Morrisville, NC, USA, 2004; ISBN 1-4116-0617-5. [Google Scholar]

- Kanungo, T.; Mount, D.M.; Netanyahu, N.S.; Piatko, C.D.; Silverman, R.; Wu, A.Y. An Efficient K-Means Clustering Algorithm: Analysis and Implementation. IEEE Trans. Pattern Anal. Mach. Intell. 2002, 24, 881–892. [Google Scholar] [CrossRef]

- Johnson, S.C. Hierarchical Clustering Schemes. Psychometrika 1967, 32, 241–254. [Google Scholar] [CrossRef]

- Orme, B.; Johnson, R. Improving K-Means Cluster Analysis: Ensemble Analysis Instead of Highest Reproducibility Replicates. 2008, pp. 1–11. Available online: http://docplayer.net/49036228-Proceedings-of-the-sawtooth-software-conference-march-2009.html (accessed on 3 November 2021).

- Retzer, J.; Alberg, S.; Yuan, J. Achieving Consensus in Cluster Ensemble Analysis. 2009. Available online: https://content.sawtoothsoftware.com/assets/7abd15e0-f082-4bce-be66-d683aa69ebc3 (accessed on 3 November 2021).

- Whalen, K.A. Three Circular Business Models That Extend Product Value and Their Contribution to Resource Efficiency. J. Clean. Prod. 2019, 226, 1128–1137. [Google Scholar] [CrossRef]

- Jiménez-Parra, B.; Rubio, S.; Vicente-Molina, M.-A. Key Drivers in the Behavior of Potential Consumers of Remanufactured Products: A Study on Laptops in Spain. J. Clean. Prod. 2014, 85, 488–496. [Google Scholar] [CrossRef]

- Milfont, T.L. The Effects of Social Desirability on Self-Reported Environmental Attitudes and Ecological Behaviour. Environmentalist 2009, 29, 263–269. [Google Scholar] [CrossRef]

| Mobile Phone (N = 400) | Robot Vacuum Cleaner (N = 400) | |

|---|---|---|

| Mean Age (range) | 37.98 (18, 74) | 38.28 (18, 82) |

| Sex | ||

| male | 112 | 139 |

| female | 288 | 261 |

| Location in the UK | ||

| England | 348 | 354 |

| Scotland | 27 | 25 |

| Wales | 17 | 17 |

| Northern Ireland | 8 | 4 |

| Employment Status | ||

| Full-time employed | 197 | 239 |

| Part-time employed | 112 | 94 |

| Not paid work (e.g., homemaker) | 79 | 63 |

| Job-seeking | 6 | 4 |

| Other | 6 | 0 |

| Student Status | ||

| Yes | 62 | 57 |

| No | 338 | 343 |

| Highest education level attained | ||

| Secondary (GCSE) | 39 | 57 |

| Technical/community college | 44 | 26 |

| High school diploma/A-levels | 87 | 70 |

| Undergraduate (BA, BSc, other) | 126 | 136 |

| Graduate (MA, MSc, Mphil, other) | 48 | 62 |

| Doctorate | 11 | 9 |

| No formal qualifications | 1 | 1 |

| No information provided | 44 | 39 |

| Income (GBP) | ||

| Below 15,999 | 51 | 51 |

| 16,000–29,999 | 82 | 90 |

| 30,000–49,999 | 115 | 125 |

| 50,000–99,999 | 81 | 88 |

| Above 100,000 | 9 | 10 |

| would rather not say | 62 | 36 |

| Attribute | Levels (Description as Appearing in the Survey) |

|---|---|

| Circular economy score |

|

| Easy to fix |

|

| Appearance |

|

| Battery life |

|

| Customer service |

|

| Reseller type |

|

| Warranty |

|

| Price (variant 1, in GBP) |

|

| Price (variant 2, in GBP) | Random prices were drawn from 259–629 range, rounded up to the nearest 9 |

| Experiment 1. Mobile Phones, Fixed Prices | ||||||

|---|---|---|---|---|---|---|

| Group Means | ||||||

| Attributes | Levels | 1 | 2 | 3 | 4 | F-Ratio |

| Aesthetic Shoppers | Price-Sensitive, Open to Circular | Newest Model | Circular Enthusiast | |||

| CE Score (% recirculated content) | 0 (brand new) | 22.89 | −21.04 | 85.79 | −72.80 | 116.75 |

| 25 | 8.79 | 2.61 | 57.87 | −10.78 | 31.63 | |

| 50 | 6.56 | 8.35 | 0.72 | 18.95 | 4.14 | |

| 75 | −19.83 | 6.12 | −66.65 | 23.12 | 67.48 | |

| 100 (total reuse) | −18.41 | 3.96 | −77.73 | 41.50 | 60.25 | |

| Easy to fix | fully reparable | 1.73 | 14.57 | 4.22 | 16.74 | 8.54 |

| critical parts | 9.68 | 10.79 | 9.3 | 17.86 | 2.48 | |

| not reparable | −11.42 | −25.35 | −13.52 | −34.59 | 6.93 | |

| Appearance | scratches | −96.91 | −40.08 | −49.91 | −25.52 | 57.69 |

| looks new | 96.91 | 40.08 | 49.91 | 25.52 | 57.69 | |

| Battery life | 100% | 85.01 | 53.68 | 43.51 | 55.57 | 11.16 |

| 80% | 10.35 | 19.76 | −8.41 | 17.23 | 7.03 | |

| 50% | −95.35 | −73.43 | −35.1 | −72.8 | 8.66 | |

| Customer Service | shop | 5.31 | 5.97 | 6.97 | 9.84 | 1.05 |

| −5.31 | −5.97 | −6.97 | −9.84 | 1.05 | ||

| Reseller type | dealer | 40.82 | 22.56 | 44.13 | 46.47 | 10.26 |

| third-party | −8.28 | −4.88 | −12.3 | −6.29 | 0.48 | |

| auction | −32.53 | −17.68 | −31.84 | −40.18 | 4.14 | |

| Warranty (months) | 36 | 41.33 | 37.89 | 45.29 | 45.80 | 0.9 |

| 24 | 42.03 | 38.87 | 43.66 | 44.53 | 0.58 | |

| 6 | −8.63 | −2.61 | −14.1 | −18.51 | 4.32 | |

| 0 | −74.73 | −74.14 | −74.85 | −71.82 | 0.05 | |

| Price (GBP) | 259 | 30.75 | 107.4 | 37.54 | 49.25 | 106.41 |

| 379 | 18 | 59.75 | 30.9 | 27.55 | 62.54 | |

| 499 | −0.63 | −14.42 | 5.36 | −4.26 | 9.03 | |

| 629 | −48.12 | −152.73 | −73.81 | −72.54 | 110.26 | |

| Group | Cluster Size | 66 | 76 | 17 | 44 | 33.16 |

| Experiment 2. Mobile Phones, Variable Prices | ||||||

| Group Means | ||||||

| Attributes | Levels | 1 | 2 | 3 | 4 | F-Ratio |

| Price-Sensitive | Aesthetic shoppers | Price-Sensitive, Open to Circular | Circular Enthusiast | |||

| CE Score (% recirculated content) | 0 (brand new) | −11.26 | 38.59 | −41.88 | −133.60 | 55.85 |

| 25 | 1.21 | 17.22 | −6.19 | −47.11 | 29.48 | |

| 50 | 6.70 | 2.14 | 10.84 | 23.87 | 7.19 | |

| 75 | 4.51 | −17.99 | 16.44 | 56.38 | 35.28 | |

| 100 (total reuse) | −1.16 | −39.97 | 20.79 | 100.46 | 51.26 | |

| Easy to fix | fully reparable | 8.56 | 2.77 | 13.66 | 17.19 | 4.16 |

| critical parts | 7.24 | 4.87 | 9.89 | 10.61 | 1.25 | |

| not reparable | −15.80 | −7.64 | −23.54 | −27.8 | 5.40 | |

| Appearance | scratches | −45.14 | −78.08 | −45.30 | −5.75 | 14.56 |

| looks new | 45.14 | 78.08 | 45.30 | 5.75 | 14.56 | |

| Battery life | 100% | 38.54 | 79.35 | 53.61 | 13.26 | 23.03 |

| 80% | 15.40 | 12.18 | 23.44 | 16.78 | 2.93 | |

| 50% | −53.94 | −91.52 | −77.05 | −30.05 | 13.75 | |

| Customer Service | shop | 4.41 | 6.16 | 6.72 | 7.16 | 0.23 |

| −4.41 | −6.16 | −6.72 | −7.16 | 0.23 | ||

| Reseller type | dealer | 22.47 | 37.39 | 31.30 | 33.07 | 3.51 |

| third-party | −4.74 | −5.66 | −3.79 | 9.64 | 2.53 | |

| auction | −17.73 | −31.73 | −27.51 | −42.72 | 4.03 | |

| Warranty (months) | 36 | 16.79 | 47.06 | 52.88 | 38.33 | 32.68 |

| 24 | 25.82 | 41.84 | 50.67 | 27.01 | 16.87 | |

| 6 | 2.75 | −8.16 | −9.48 | 0.11 | 4.28 | |

| 0 | −45.36 | −80.74 | −94.07 | −65.45 | 22.14 | |

| Price (GBP) | 259 | 134.88 | 30.48 | 76.23 | 36.79 | 95.30 |

| 379 | 76.36 | 20.78 | 34.85 | 33.00 | 69.93 | |

| 499 | −16.85 | 5.03 | 0.33 | 19.33 | 21.82 | |

| 629 | −194.39 | −56.29 | −111.41 | −89.13 | 132.68 | |

| Group | Cluster Size | 78 | 55 | 55 | 9 | 37.11 |

| Experiment 3. Robot Vacuum Cleaner, Fixed Prices | ||||||

| Group Means | ||||||

| Attributes | Levels | 1 | 2 | 3 | 4 | F-Ratio |

| Price-Sensitive | Risk-Averse | Price-Sensitive, Open to Circular | Circular Enthusiast | |||

| CE Score (% recirculated content) | 0 (brand new) | −9.64 | 21.83 | −91.05 | −128.09 | 84.79 |

| 25 | 0.81 | 12.92 | −33.9 | −16.82 | 27.58 | |

| 50 | 9.14 | 13.17 | 22.66 | 41.27 | 13.04 | |

| 75 | 0.71 | −20.58 | 41.92 | 47.15 | 57.2 | |

| 100 (total reuse) | −1.02 | −27.34 | 60.37 | 56.48 | 55.46 | |

| Easy to fix | fully reparable | 20.41 | 28.14 | 35.4 | 52.22 | 9.08 |

| critical parts | 9.75 | 5.74 | 8.75 | 15.83 | 2.18 | |

| not reparable | −30.16 | −33.88 | −44.15 | −68.05 | 7.68 | |

| Appearance | scratches | −25.36 | −56.88 | −12.67 | −12.22 | 29.39 |

| looks new | 25.36 | 56.88 | 12.67 | 12.22 | 29.39 | |

| Battery life | 100% | 49.69 | 52.05 | 36.64 | 48.92 | 2.46 |

| 80% | 12.5 | 16.99 | 16.93 | 13.18 | 0.97 | |

| 50% | −62.19 | −69.04 | −53.57 | −62.1 | 1.27 | |

| Customer Service | shop | 1.38 | 5.10 | −0.84 | 6.82 | 1.64 |

| −1.38 | −5.10 | 0.84 | −6.82 | 1.64 | ||

| Reseller type | dealer | 23.64 | 40.09 | 7.98 | 14.89 | 13.1 |

| third-party | −6.2 | −16.14 | −2.08 | −11.45 | 4.59 | |

| auction | −17.44 | −23.95 | −5.9 | −3.45 | 5.2 | |

| Warranty (months) | 36 | 47.26 | 61.14 | 34.5 | 46.8 | 6.75 |

| 24 | 39.37 | 43.49 | 30.14 | 51.02 | 2.54 | |

| 6 | −14.15 | −18.63 | −6.8 | 3.27 | 4.86 | |

| 0 | −72.48 | −86.00 | −57.84 | −101.09 | 5 | |

| Price (GBP) | 259 | 134.15 | 23.83 | 114.11 | 45.11 | 96.13 |

| 379 | 77.01 | 18.53 | 63.55 | 10.47 | 82.09 | |

| 499 | −27.13 | 2.81 | −13.93 | 7.05 | 13.03 | |

| 629 | −184.03 | −45.18 | −163.73 | −62.62 | 139.89 | |

| Group | Cluster Size | 111 | 44 | 42 | 9 | 39.33 |

| Experiment 4. Robot Vacuum Cleaner, Variable Prices | ||||||

| Group Means | ||||||

| Attributes | Levels | 1 | 2 | 3 | 4 | F-Ratio |

| Price-Sensitive, Open to Circular | Risk-Averse | Circular Enthusiast | Price-Sensitive | |||

| CE Score (% recirculated content) | 0 (brand new) | −23.67 | 51.12 | −105.01 | −18.79 | 74.20 |

| 25 | −1.14 | 13.73 | −58.98 | 0.98 | 47.62 | |

| 50 | 4.75 | −7.21 | 20.59 | 8.63 | 10.91 | |

| 75 | 6.12 | −27.87 | 60.99 | −1.18 | 49.16 | |

| 100 (total reuse) | 13.94 | −29.77 | 82.41 | 10.36 | 53.34 | |

| Easy to fix | fully reparable | 25.57 | 20.23 | 23.81 | 27.80 | 1.61 |

| critical parts | 4.03 | −5.16 | 6.73 | 10.72 | 8.15 | |

| not reparable | −29.60 | −15.07 | −30.55 | −38.52 | 8.09 | |

| Appearance | scratches | −15.71 | −37.86 | −16.31 | −16.70 | 10.14 |

| looks new | 15.71 | 37.86 | 16.31 | 16.70 | 10.14 | |

| Battery life | 100% | 25.68 | 54.15 | 38.78 | 41.23 | 9.93 |

| 80% | 10.60 | 3.87 | 19.99 | 13.90 | 6.43 | |

| 50% | −36.28 | −58.02 | −58.77 | −55.13 | 5.81 | |

| Customer Service | shop | 0.27 | 9.78 | 0.80 | 8.62 | 4.68 |

| −0.27 | −9.78 | −0.80 | −8.62 | 4.68 | ||

| Reseller type | dealer | 13.20 | 41.43 | 16.75 | 16.63 | 9.37 |

| third-party | 3.65 | −5.35 | 3.26 | −0.40 | 3.50 | |

| auction | −16.85 | −36.09 | −20 | −16.23 | 5.43 | |

| Warranty (months) | 36 | 25.31 | 57.18 | 27.35 | 58.11 | 27.35 |

| 24 | 29.26 | 40.48 | 30.35 | 51.01 | 12.15 | |

| 6 | −2.72 | −9.85 | −11.41 | −8.96 | 2.82 | |

| 0 | −51.84 | −87.80 | −46.3 | −100.16 | 23.93 | |

| Price (GBP) | 259 | 175.54 | 41.94 | 80.57 | 114.74 | 128.96 |

| 379 | 92.10 | 39.09 | 51.57 | 62.12 | 41.07 | |

| 499 | −41.69 | 11.52 | 2.95 | −0.33 | 44.22 | |

| 629 | −225.95 | −92.54 | −135.08 | −176.52 | 132.21 | |

| Group | Cluster Size | 75 | 39 | 27 | 53 | 43.10 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Boyer, R.H.W.; Hunka, A.D.; Whalen, K.A. Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy. Sustainability 2021, 13, 12348. https://doi.org/10.3390/su132212348

Boyer RHW, Hunka AD, Whalen KA. Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy. Sustainability. 2021; 13(22):12348. https://doi.org/10.3390/su132212348

Chicago/Turabian StyleBoyer, Robert H. W., Agnieszka D. Hunka, and Katherine A. Whalen. 2021. "Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy" Sustainability 13, no. 22: 12348. https://doi.org/10.3390/su132212348

APA StyleBoyer, R. H. W., Hunka, A. D., & Whalen, K. A. (2021). Consumer Demand for Circular Products: Identifying Customer Segments in the Circular Economy. Sustainability, 13(22), 12348. https://doi.org/10.3390/su132212348