Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome

Abstract

:1. Introduction

2. Literature Review

2.1. Price Issues in the Accommodation-Sharing Market

2.2. Price Interactions between Professional and Nonprofessional Decision Makers and Market Outcome

3. A Modeling Framework with Price-Sensitive Customers and Earning-Based Hosts

- Customers arrive at the platform to request rental service and meet the available hosts;

- Professional hosts dynamically set prices to maximize profit per listing he/she provides to the sharing market;

- Nonprofessional hosts accept given price values since they are demonstrated to have inferior dynamic pricing strategies;

- The marginal cost of each unit of service is zero, as Roma et al. (2019) reported it is near to zero;

- For simplicity, both types of hosts provide accommodation services of the same quality;

3.1. The Realized Customer Request Rate,

3.2. The Realized Number of Listings Participating Hosts Provide,

3.3. Problem Formulation

4. The Base Models with Only Professional Hosts or Nonprofessionals on the Supply Side

4.1. The Base Model with Only Nonprofessional Hosts on the Supply Side

4.2. The Base Model with Only Professional Hosts on the Supply Side

4.3. The Extended Models for the Market with Varying Ratios of Professional Hosts over the Market Supply Side

5. Numerical Experiments

5.1. The Experimental Results for the Model with Only Nonprofessional Hosts

5.2. The Experimental Results for the Model with Only Professional Hosts

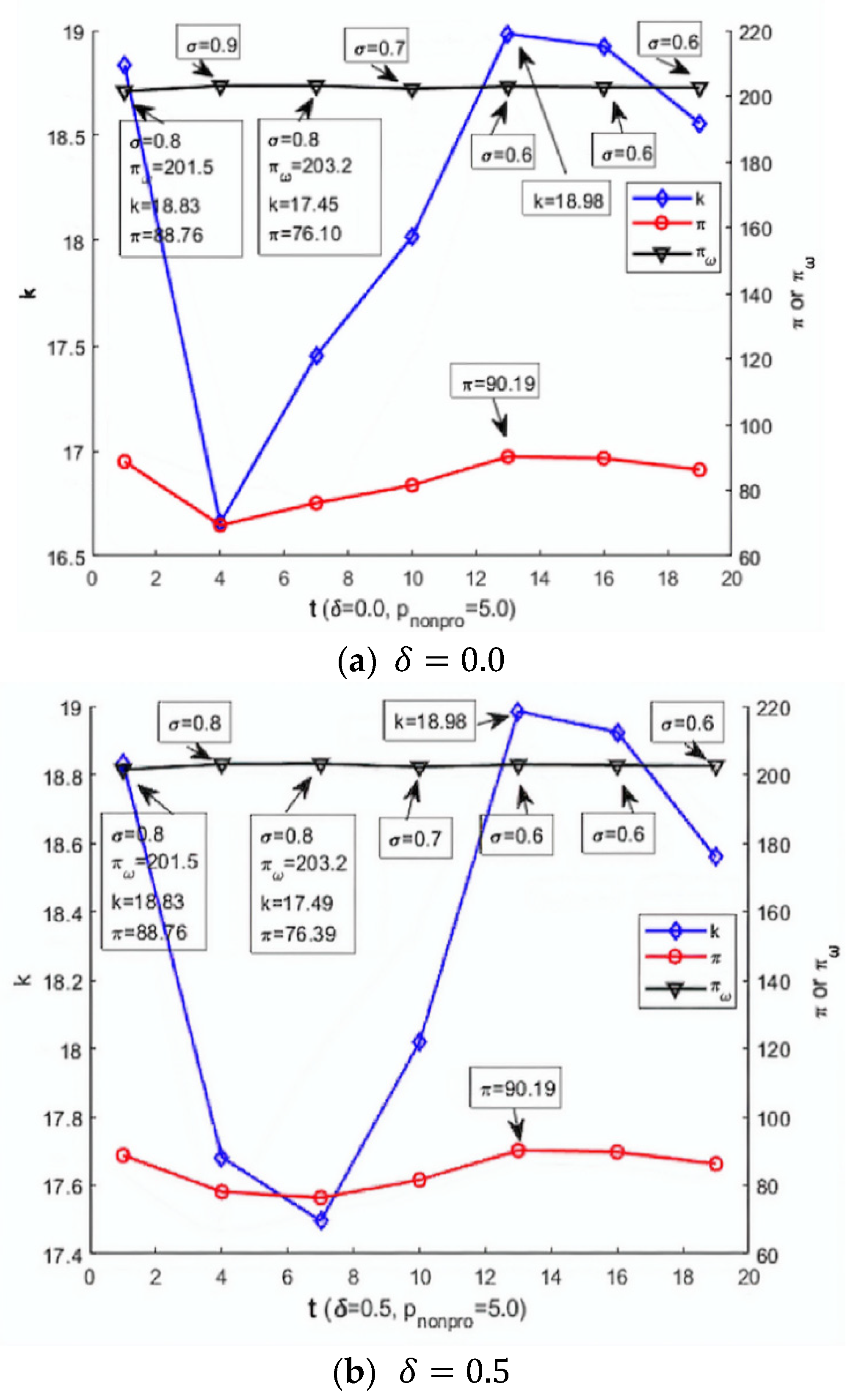

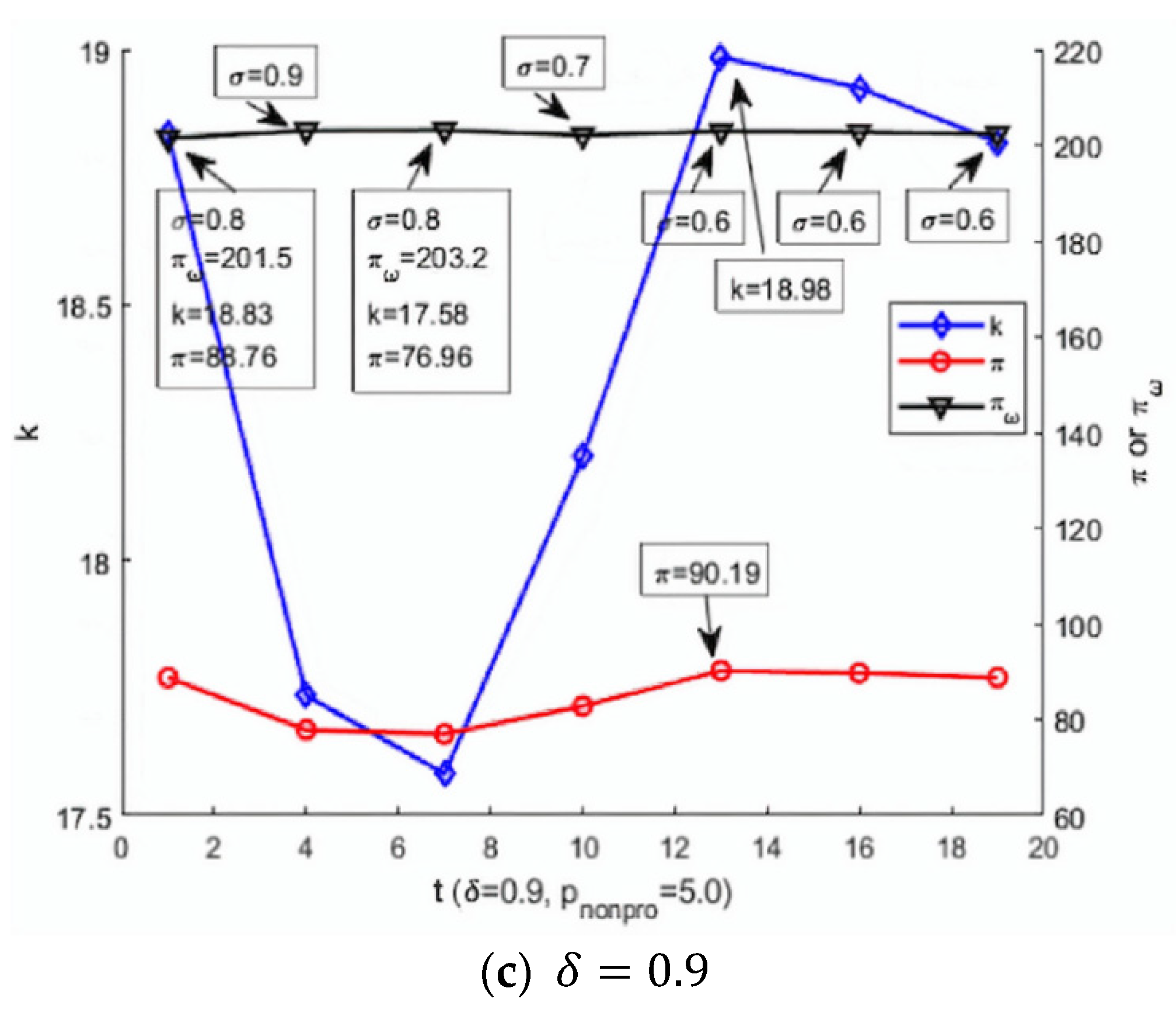

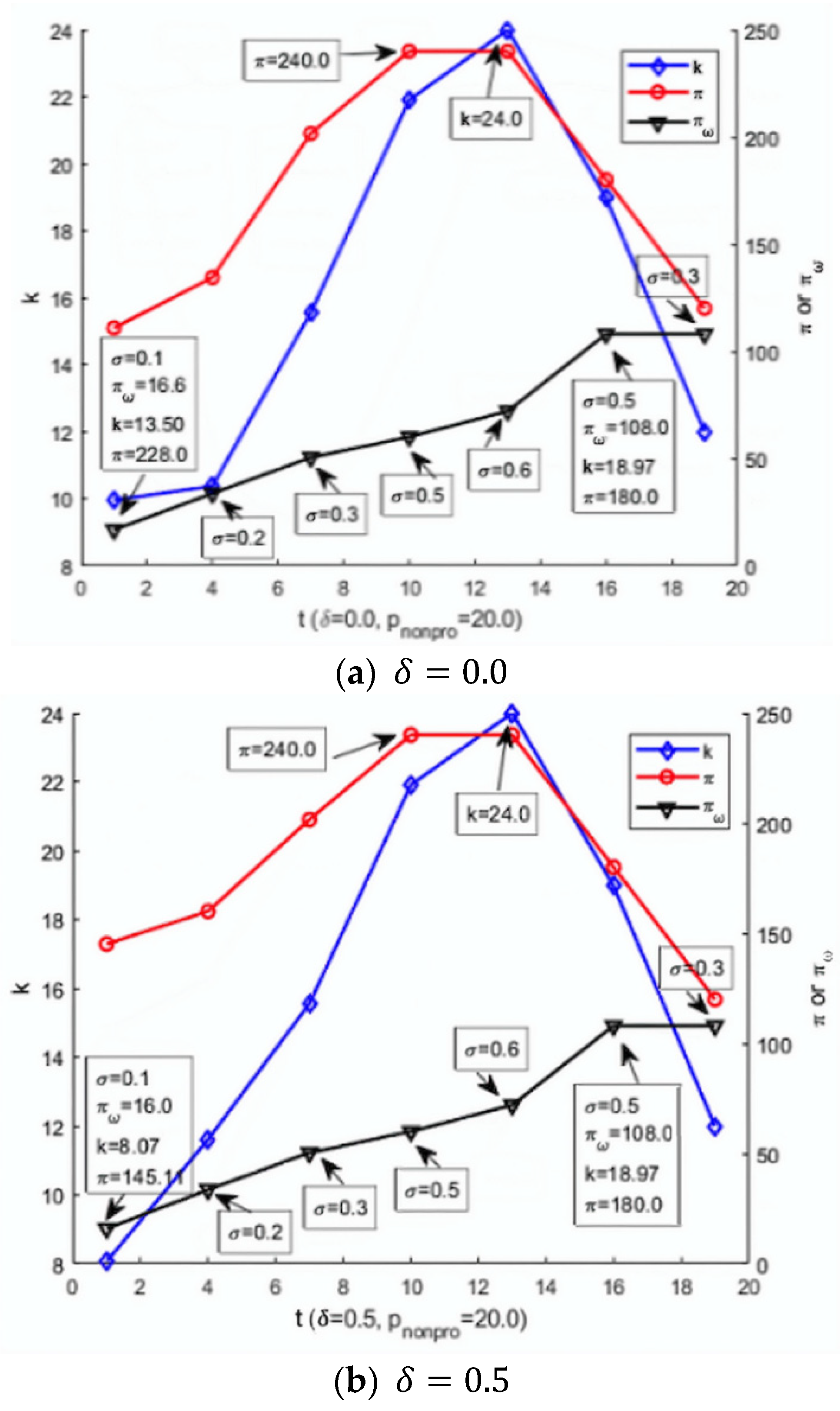

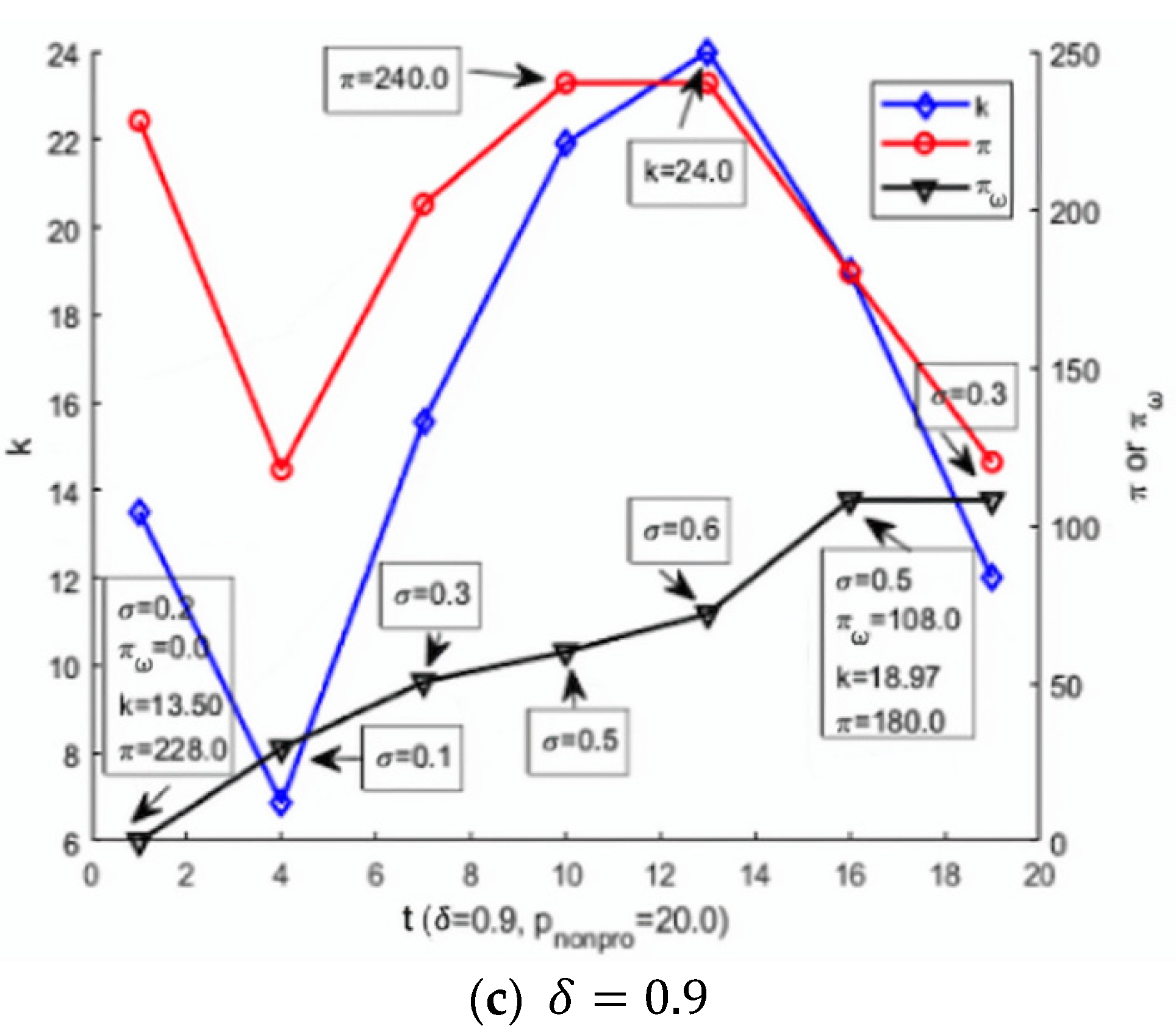

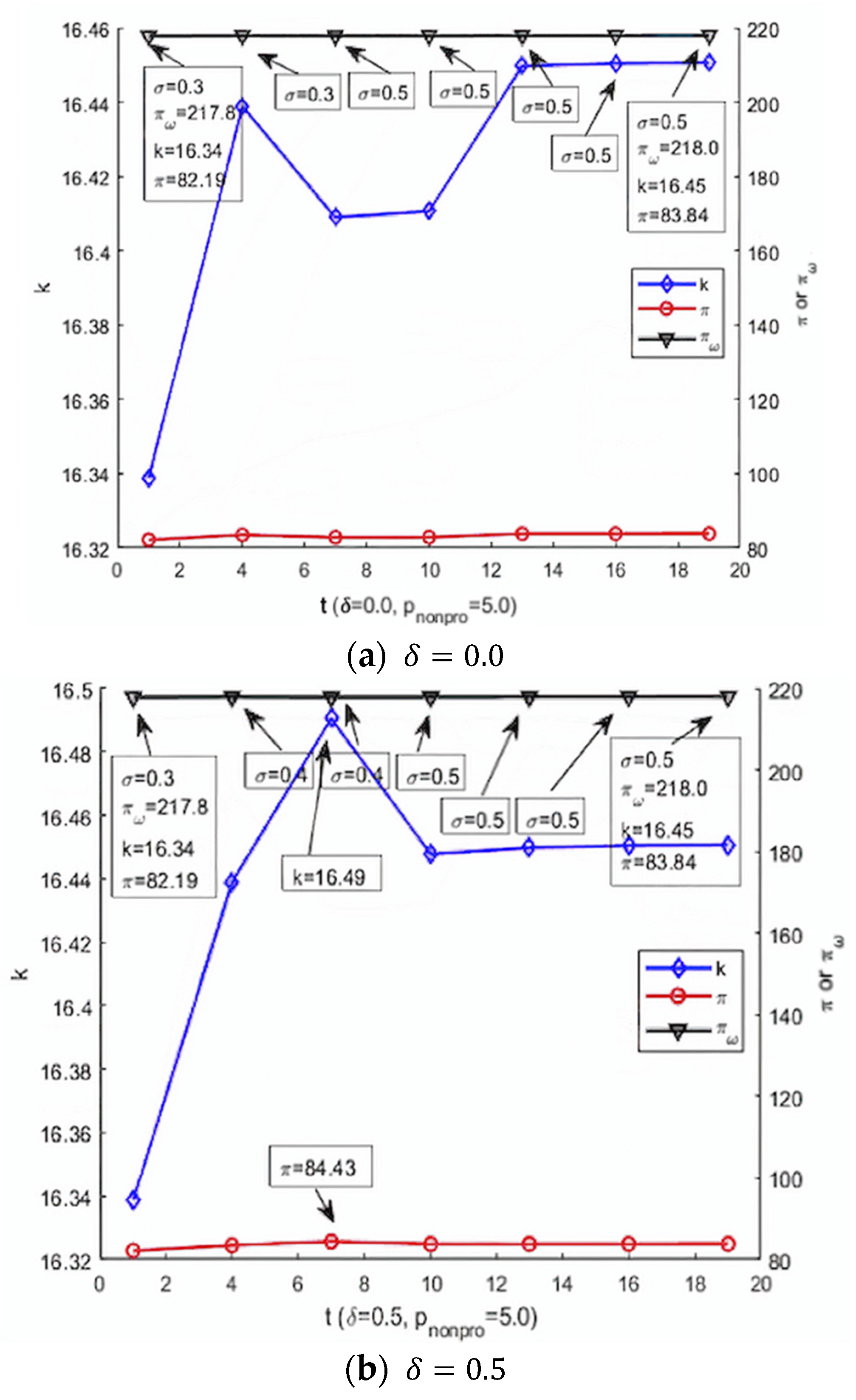

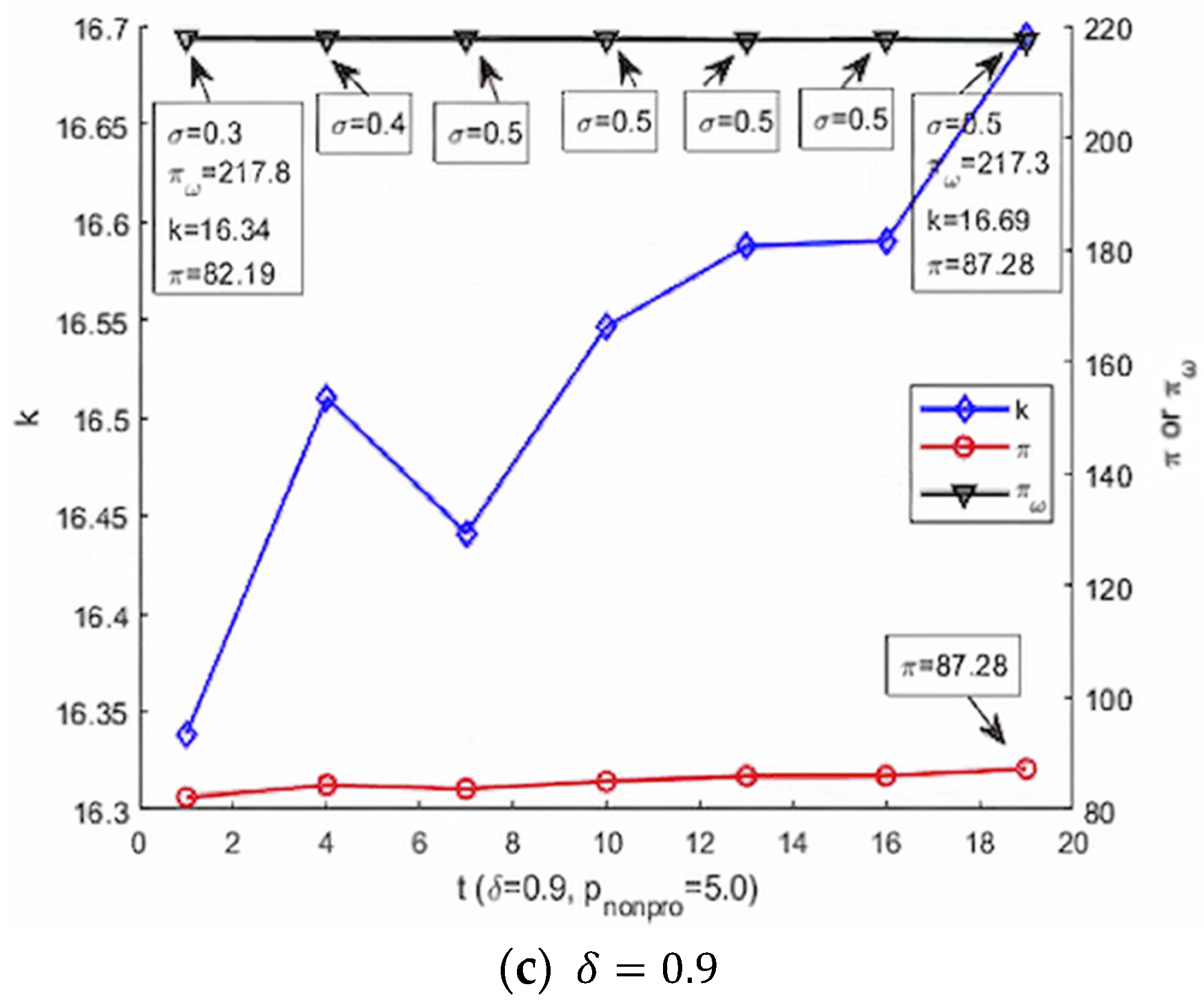

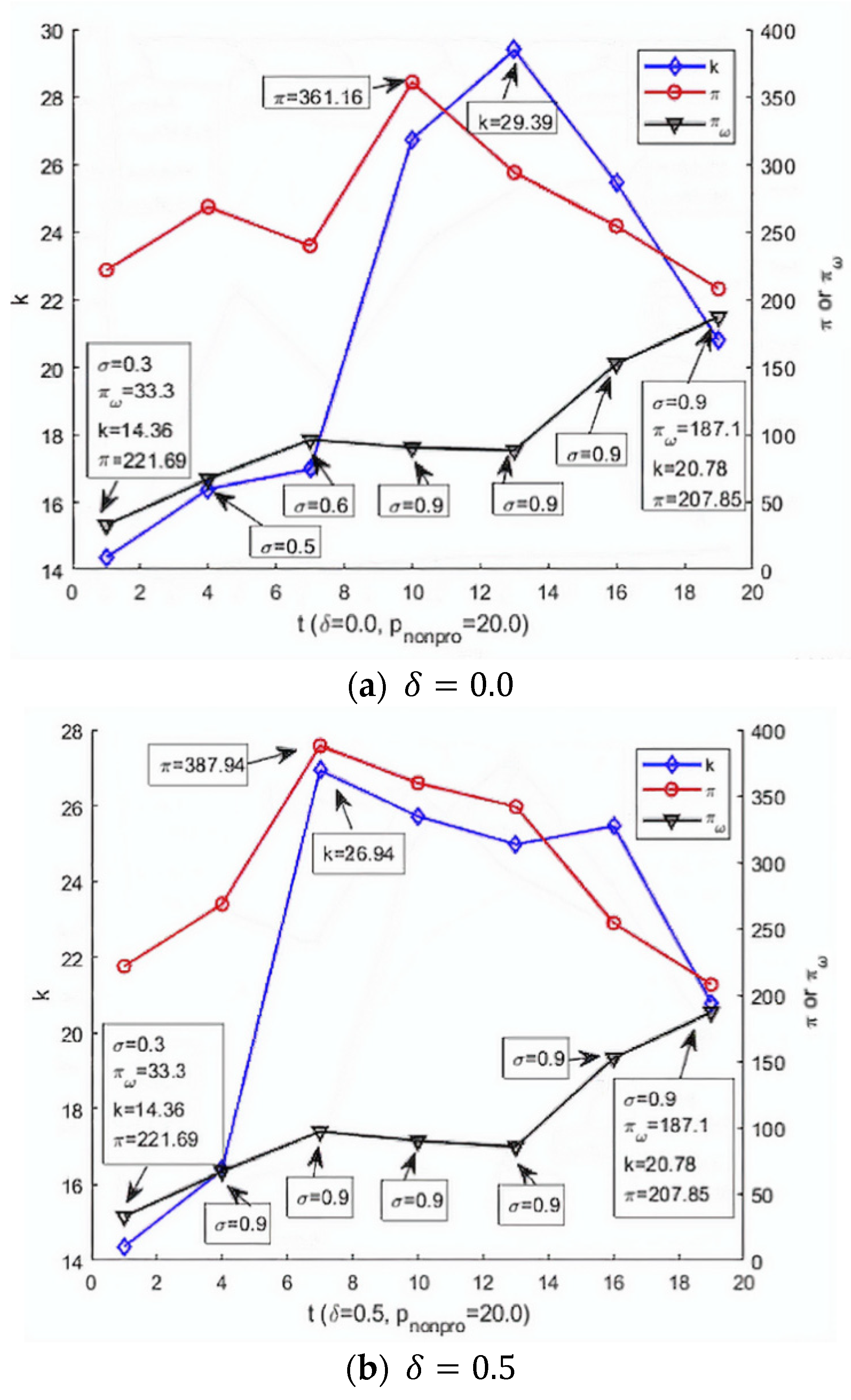

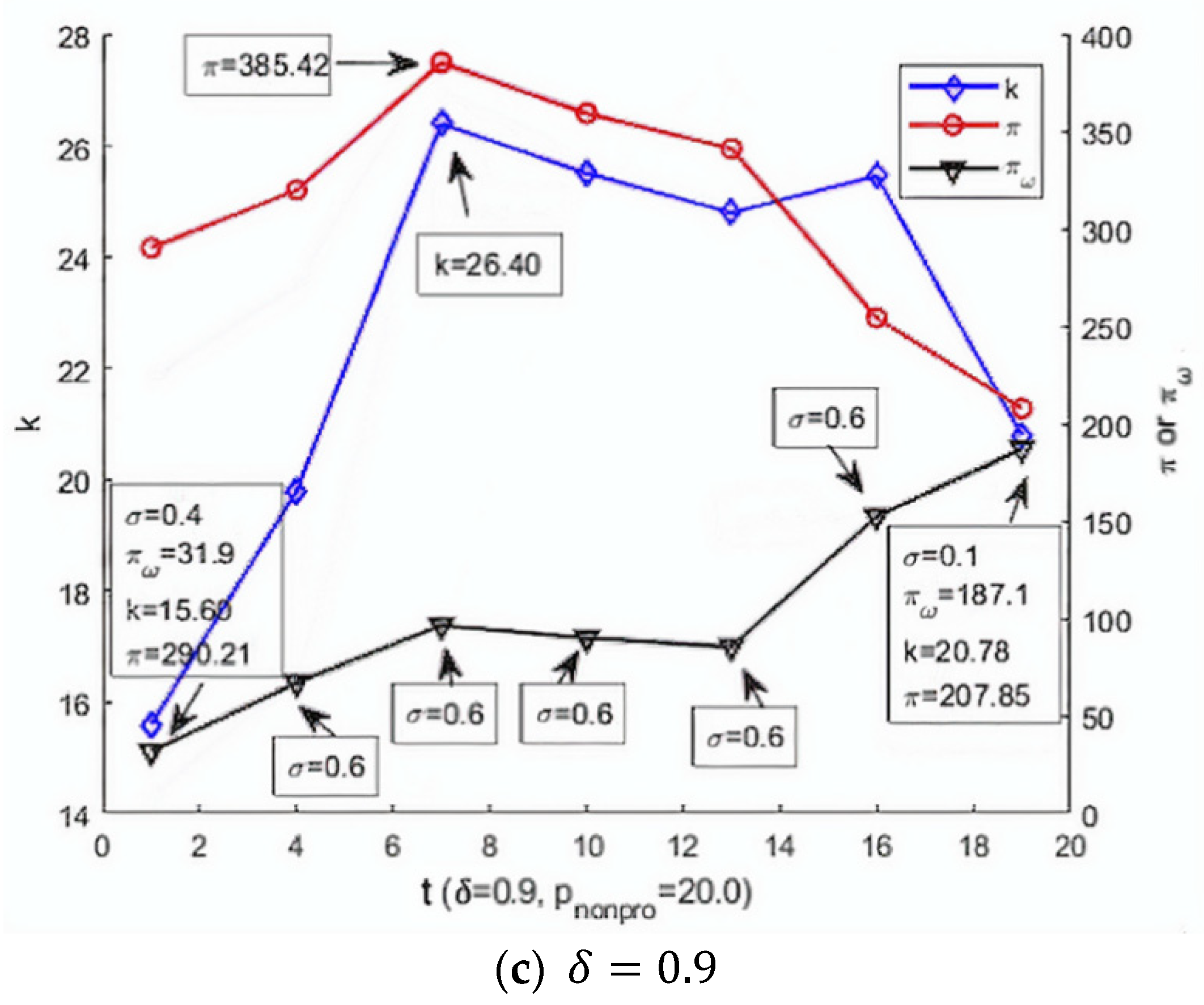

5.3. The Experimental Results for the Extended Model with Varying Ratios of Professional and Nonprofessional Hosts

6. Discussion

6.1. Theoretical Implications

6.2. Practical Implications

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Leoni, V. Stars vs lemons. Survival analysis of peer-to peer marketplaces: The case of Airbnb. Tour. Manag. 2020, 79, 104091. [Google Scholar] [CrossRef]

- Boto-García, D.; Mayor, M.; Vega, P.l. Spatial price mimicking on Airbnb: Multi-host vs single-host. Tour. Manag. 2021, 87, 104365. [Google Scholar] [CrossRef]

- Li, J.; Moreno, A.; Zhang, D.J. Agent Behavior in the Sharing Economy: Evidence from Airbnb. Ross Sch. Bus. Work. Pap. Ser. 2015, 1298, 2015. [Google Scholar] [CrossRef]

- Farajallah, M.; Hammond, R.G.; Pénard, T. What Drives Pricing Behavior in Peer-to-Peer Markets? Evidence from the Carsharing Platform BlaBlaCar. Inf. Econ. Policy 2019, 48, 15–31. [Google Scholar] [CrossRef]

- Ke, Q. Sharing Means Renting? An Entire-marketplace Analysis of Airbnb. In Proceedings of the 2017 ACM on Web Science Conference; Association for Computing Machinery: Troy, NY, USA, 2017; pp. 131–139. [Google Scholar]

- Kwok, L.; Xie, K.L. Pricing strategies on Airbnb: Are multi-unit hosts revenue pros? Int. J. Hosp. Manag. 2019, 82, 252–259. [Google Scholar] [CrossRef]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Yao, L.; Morton, J.; Okumus, F.; Okumus, F. Use of dynamic pricing strategies by Airbnb hosts. Int. J. Contemp. Hosp. Manag. 2018, 30, 2–20. [Google Scholar] [CrossRef]

- Hardy, A.; Dolnicar, S. Types of Network Members. In Peer-to-Peer Accommodation Networks; Goodfellow Publisher: Oxford, UK, 2017. [Google Scholar]

- Gibbs, C.; Guttentag, D.; Gretzel, U.; Morton, J.; Goodwill, A. Pricing in the sharing economy: A hedonic pricing model applied to Airbnb listings. J. Travel Tour. Mark. 2018, 35, 46–56. [Google Scholar] [CrossRef]

- Ractham, P.; Banomyong, R.; Sopadang, A. Two-Sided E-Market Platform: A Case Study of Cross Border E-Commerce between Thailand and China. In Proceedings of the ICEB, Newcastle Upon Tyne, UK, 8–12 December 2019; pp. 475–482. [Google Scholar]

- Javanmard, A.; Nazerzadeh, H.; Shao, S. Multi-Product Dynamic Pricing in High-Dimensions with Heterogeneous Price Sensitivity. In Proceedings of the 2020 IEEE International Symposium on Information Theory (ISIT), Los Angeles, CA, USA, 21–26 June 2020. [Google Scholar]

- Hurley, J.E. Equilibrium in Hotelling’s Model of Spatial Competition; McMaster University: Hamilton, ON, Canada, 1988. [Google Scholar]

- Geertsema, P.; Lu, H. Regulated Price and Demand in China’s IPO Market. J. Econ. Bus. 2019, 106, 105846. [Google Scholar] [CrossRef]

- Volgger, M.; Taplin, R.; Pforr, C. The evolution of ‘Airbnb-tourism’: Demand-side dynamics around international use of peer-to-peer accommodation in Australia. Ann. Tour. Res. 2019, 75, 322–337. [Google Scholar] [CrossRef]

- Brown, D.; Andrew, E. Analyzing Firm Behaviour in Restructured Electricity Markets: Empirical Challenges with a Residual Demand Analysis. Int. J. Ind. Organ. 2021, 74, 102676. [Google Scholar] [CrossRef]

- Masiero, L.; Nicolau, J.L.; Law, R. A demand-driven analysis of tourist accommodation price: A quantile regression of room bookings. Int. J. Hosp. Manag. 2015, 50, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Pham, T.D.; Nghiem, S.; Dwyer, L. The determinants of Chinese visitors to Australia: A dynamic demand analysis. Tour. Manag. 2017, 63, 268–276. [Google Scholar] [CrossRef]

- Hill, D. How much is your spare room worth? Spectr. IEEE 2015, 52, 32–58. [Google Scholar] [CrossRef]

- Karlsson, L.; Dolnicar, S. Someone’s been sleeping in my bed. Ann. Tour. Res. 2016, 58, 159–162. [Google Scholar] [CrossRef]

- Wu, E. Learning in Peer-to-Peer Markets: Evidence from Airbnb. Master’s Thesis, FGV—Fundação Getulio Vargas, Rio de Janeiro, Brazil, 9 May 2016. [Google Scholar]

- Xiao, P.; Kadiyali, V.; Chan, T. Structural Models of Pricing. In Handbook of Pricing Research in Marketing; Edward Elgar Publishing: Camberley, UK, 2009; pp. 108–131. [Google Scholar]

- Casamatta, G.; Giannoni, S.; Brunstein, D.; Jouve, J. Host type and pricing on Airbnb: Seasonality and perceived market power. Tour. Manag. 2022, 88, 104433. [Google Scholar] [CrossRef]

- Teruel-Gutierrez, R.; Maté-Sánchez-Val, M. The impact of Instagram on Airbnb’s listing prices in the city of Barcelona. Ann. Reg. Sci. 2021, 118, 2411–2502. [Google Scholar]

- Chatterjee, D.; Dandona, B.; Mitra, A.; Giri, M. Airbnb in India: Comparison with hotels, and factors affecting purchase intentions. Int. J. Cult. Tour. Hosp. Res. 2019, 13, 430–442. [Google Scholar] [CrossRef]

- Veronica, L.; William, N. Dynamic pricing and revenues of Airbnb listings: Estimating heterogeneous causal effects. Int. J. Hosp. Manag. 2021, 95, 102914. [Google Scholar]

- Lawani, A.; Reed, M.R.; Mark, T.; Zheng, Y. Reviews and price on online platforms: Evidence from sentiment analysis of Airbnb reviews in Boston. Reg. Sci. Urban. Econ. 2019, 75, 22–34. [Google Scholar] [CrossRef]

- Lladós-Masllorens, J.; Meseguer-Artola, A.; Rodríguez-Ardura, I. Understanding Peer-to-Peer, Two-Sided Digital Marketplaces: Pricing Lessons from Airbnb in Barcelona. Sustainability 2020, 12, 5229. [Google Scholar] [CrossRef]

- Roma, P.; Panniello, U.; Nigro, G.L. Sharing economy and incumbents’ pricing strategy: The impact of Airbnb on the hospitality industry. Int. J. Prod. Econ. 2019, 214, 17–29. [Google Scholar] [CrossRef]

- Chen, M.K. Dynamic Pricing in a Labor Market: Surge Pricing and Flexible Work on the Uber Platform. In Proceedings of the 2016 ACM Conference, New York, NY, USA, 24–28 July 2016. [Google Scholar]

- Armstrong, M. Competition in two-sided markets. Rand J. Econ. 2006, 37, 668–691. [Google Scholar] [CrossRef] [Green Version]

- Li, J.; Moreno, A.; Zhang, D. Pros vs Joes: Agent Pricing Behavior in the Sharing Economy. Soc. Sci. Electron. Publ. 2016, 1298. [Google Scholar] [CrossRef]

- Sainaghi, R.; Abrate, G.; Mauri, A. Price and RevPAR determinants of Airbnb listings: Convergent and divergent evidence. Int. J. Hosp. Manag. 2021, 92, 102709. [Google Scholar] [CrossRef]

- Rochet, J.C.; Tirole, J. Platform Competition in Two-Sided Markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef] [Green Version]

- FOLGER, J. Airbnb: Advantages and Disadvantages. Available online: https://www.investopedia.com/articles/personal-finance/032814/pros-and-cons-using-airbnb.asp (accessed on 24 January 2021).

- Juan, A.; Josep, S.; Jorge, G.; Alba, R. Sustainability Commitment, New Competitors’ Presence, and Hotel Performance: The Hotel Industry in Barcelona. Sustainability 2016, 8, 755. [Google Scholar]

- Belarmino, A.; Whalen, E.; Koh, Y.; Bowen, J.T. Comparing guests’ key attributes of peer-to-peer accommodations and hotels: Mixed-methods approach. Curr. Issues Tour. 2017, 22, 1–7. [Google Scholar] [CrossRef]

- Köseoglu, M.A. Conceptual Structure of Lodging-Context Studies: 1990–2016. J. Hosp. Tour. Res. 2019, 43, 573–594. [Google Scholar] [CrossRef]

- Liu, J.; Park, J.; Xie, K.; Song, H.; Chen, W. Effect of Commercial Neighbors on The Online Popularity of Peer-To-Peer Accommodation-Sharing Properties. J. Hosp. Tour. Res. 2020, 44, 780–805. [Google Scholar] [CrossRef]

- Hernández, J.; Bulchand-Gidumal, J.; Suárez-Vega, R. Using accommodation price determinants to segment tourist areas. J. Destin. Mark. Manag. 2021, 21, 100622. [Google Scholar]

| Notation | Description |

|---|---|

| A fixed price rate given exogenously and used by nonprofessional hosts, taking values in {5, 20} in this paper | |

| The price rate selected endogenously by professional hosts to achieve the maximum average expected earning per listing transaction | |

| The ratio of potential professional hosts to the overall potential suppliers in the sharing market | |

| The potential number of customers requesting professional hosts’ accommodation service | |

| The potential number of customers requesting nonprofessional hosts’ accommodation service | |

| The realized number of customers requesting professional hosts’ accommodation service | |

| The realized number of customers requesting nonprofessional hosts’ accommodation service | |

| The potential number of hosts who would participate in providing accommodation service | |

| The realized number of professional hosts who provide accommodation service | |

| The realized number of nonprofessional hosts who provide accommodation service | |

| The average quality level of the accommodation properties offered in the market | |

| A valuation rate with a value ranging from 0 to 1 | |

| The reservation earnings rate each host expects to determine whether to participate in offering accommodation service, ranging from 0 to 1 | |

| The maximum reservation earning rate | |

| The total market transaction value | |

| The total market transaction value for the group of professional hosts | |

| The total market transaction value for the group of nonprofessional hosts | |

| The expected average profit each host (professional and nonprofessional) earns from rental service | |

| The amount of earning professional hosts get by choosing optimal price | |

| The fee rate customers pay to the platform for each listing transaction | |

| The weight parameter the platform firm puts on hosts’ benefit |

| 3.50 | 0.12 | 2.0 | 0.12 | |

| 50.0 | 208.0 | 100.0 | 104.0 | |

| 5.0 | 10.20 | 5.0 | 5.10 | |

| 10.0 | 20.40 | 20.0 | 20.40 | |

| 175.0 | 24.96 | 200.0 | 12.48 | |

| 6.2 | 6.5 | 9.4 | 4.2 | 4.2 | 4.5 | |

| 2.0 | 1.9 | 1.1 | 2.95 | 2.95 | 2.55 | |

| 110.5 | 116.2 | 187.0 | 70.6 | 70.6 | 81.1 | |

| 6.2 | 6.5 | 9.4 | 4.2 | 4.2 | 4.5 | |

| 17.8 | 17.9 | 19.9 | 16.8 | 16.8 | 18.0 | |

| 220.9 | 220.9 | 205.6 | 208.3 | 208.3 | 206.8 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jia, R.; Wang, S. Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome. Sustainability 2021, 13, 12331. https://doi.org/10.3390/su132112331

Jia R, Wang S. Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome. Sustainability. 2021; 13(21):12331. https://doi.org/10.3390/su132112331

Chicago/Turabian StyleJia, Ru, and Shanshan Wang. 2021. "Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome" Sustainability 13, no. 21: 12331. https://doi.org/10.3390/su132112331

APA StyleJia, R., & Wang, S. (2021). Investigating the Impact of Professional and Nonprofessional Hosts’ Pricing Behaviors on Accommodation-Sharing Market Outcome. Sustainability, 13(21), 12331. https://doi.org/10.3390/su132112331