The Relationship between CFO Compensation and Corporate Sustainability: An Empirical Examination of German Listed Firms

Abstract

:1. Introduction

2. Theoretical Framework and Hypotheses Development

2.1. Corporate Sustainability and CFO Compensation

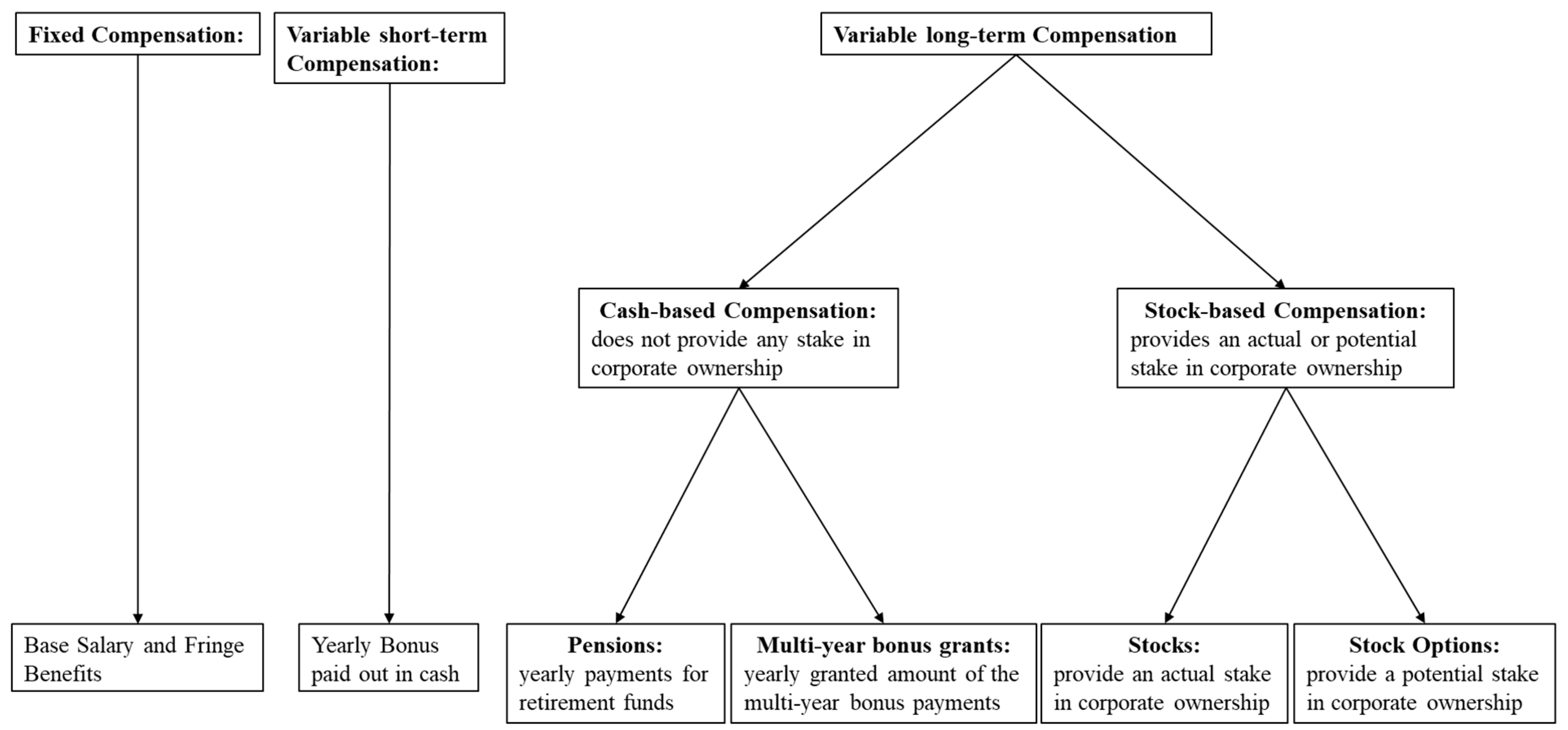

2.2. Classification of CFO Compensation Components and Hypotheses Development

3. Materials and Methods

3.1. Data and Sample Selection

3.1.1. Main Variables

3.1.2. Controls

3.2. Research Methodology

4. Results

4.1. Descriptive Statistics

4.2. Mixed-Effects Regression Results

5. Discussion

5.1. Contributions to Research and Practice

5.2. Limitations and Research Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ho, F.N.; Wang, H.-M.D.; Vitell, S.J. A global analysis of corporate social performance: The effects of cultural and geographic environments. J. Bus. Ethics 2012, 107, 423–433. [Google Scholar] [CrossRef]

- Mahoney, L.S.; Thorn, L. An examination of the structure of executive compensation and corporate social responsibility: A Canadian investigation. J. Bus. Ethics 2006, 69, 149–162. [Google Scholar] [CrossRef]

- McGuire, J.; Dow, S.; Argheyd, K. CEO incentives and corporate social performance. J. Bus. Ethics 2003, 45, 341–359. [Google Scholar] [CrossRef]

- Claasen, D.; Ricci, C. CEO compensation structure and corporate social performance: Empirical evidence from Germany: CEO-Vergütungsstrukturen und Corporate Social Performance. Eine empirische Untersuchung deutscher Unternehmen. Die Betr. 2015, 75, 327–343. [Google Scholar]

- Thomas, A.S.; Simerly, R.L. The Chief Executive Officer and corporate social performance: An interdisciplinary examination. J. Bus. Ethics 1994, 13, 959–968. [Google Scholar] [CrossRef]

- Deckop, J.R.; Merriman, K.K.; Gupta, S. The effects of CEO pay structure on corporate social performance. J. Manag. 2006, 32, 329–342. [Google Scholar] [CrossRef]

- Indjejikian, R.; Matejka, M. CFO fiduciary responsibilities and annual bonus incentives. J. Account. Res. 2009, 47, 1061–1093. [Google Scholar] [CrossRef]

- Chava, S.; Purnanandam, A. CEOs versus CFOs: Incentives and corporate policies. J. Financ. Econ. 2010, 97, 263–278. [Google Scholar] [CrossRef]

- Jiang, J.; Petroni, K.R.; Yanyan Wang, I. CFOs and CEOs: Who have the most influence on earnings management? J. Financ. Econ. 2010, 96, 513–526. [Google Scholar] [CrossRef]

- Burkert, M.; Lueg, R. Differences in the sophistication of value-based Management—The role of top executives. Manag. Account. Res. 2013, 24, 3–22. [Google Scholar] [CrossRef]

- Kutzschbach, J.; Tanikulova, P.; Lueg, R. The role of top managers in implementing corporate sustainability—A systematic literature review on small and medium-sized enterprises. Adm. Sci. 2021, 11, 44. [Google Scholar] [CrossRef]

- Caglio, A.; Dossi, A.; van der Stede, W.A. CFO role and CFO compensation: An empirical analysis of their implications. J. Account. Public Policy 2018, 37, 265–281. [Google Scholar] [CrossRef]

- Beck, D.; Friedl, G.; Schäfer, P. Executive compensation in Germany. J. Bus. Econ. 2020, 90, 787–824. [Google Scholar] [CrossRef] [Green Version]

- Shrivastava, P.; Hart, S. Creating sustainable corporations. Bus. Strat. Env. 1995, 4, 154–165. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strat. Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- van Marrewijk, M. Concepts and definitions of CSR and corporate sustainability: Between agency and communion. J. Bus. Ethics 2003, 44, 95–105. [Google Scholar] [CrossRef]

- Berger, I.E.; Cunningham, P.H.; Drumwright, M.E. Mainstreaming corporate social responsibility: Developing markets for virtue. Calif. Manag. Rev. 2007, 49, 132–157. [Google Scholar] [CrossRef]

- Lueg, R.; Pesheva, R. Corporate sustainability in the Nordic countries—The curvilinear effects on shareholder returns. J. Clean. Prod. 2021, 315, 127962. [Google Scholar] [CrossRef]

- Lueg, K.; Krastev, B.; Lueg, R. Bidirectional effects between organizational sustainability disclosure and risk. J. Clean. Prod. 2019, 229, 268–277. [Google Scholar] [CrossRef]

- Hill, C.W.L.; Jones, T.M. Stakeholder-Agency theory. J. Manag. Stud. 1992, 29, 131–154. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Reprint; Capstone: Oxford, UK, 2002; ISBN 1841120847. [Google Scholar]

- Lozano, R. Envisioning sustainability three-dimensionally. J. Clean. Prod. 2008, 16, 1838–1846. [Google Scholar] [CrossRef]

- Kock, C.J.; Santaló, J.; Diestre, L. Corporate governance and the environment: What type of governance creates greener companies? J. Manag. Stud. 2012, 49, 492–514. [Google Scholar] [CrossRef]

- Lueg, R.; Radlach, R. Managing sustainable development with management control systems: A literature review. Eur. Manag. J. 2016, 34, 158–171. [Google Scholar] [CrossRef]

- Coombs, J.E.; Gilley, K.M. Stakeholder management as a predictor of CEO compensation: Main effects and interactions with financial performance. Strat. Mgmt. J. 2005, 26, 827–840. [Google Scholar] [CrossRef]

- Scott, W.R. Contributing to a Theoretical Research Program. In Great Minds in Management: The Process of Theory Development; Reprinted; Smith, K.G., Hitt, M.A., Eds.; Oxford Univ. Press: Oxford, UK, 2005; pp. 460–484. ISBN 9780199276820. [Google Scholar]

- Berrone, P.; Gomez-Mejia, L.R. Environmental performance and executive compensation: An integrated agency-institutional perspective. AMJ 2009, 52, 103–126. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The stakeholder theory of the corporation: Concepts, evidence, and implications. AMR 1995, 20, 65–91. [Google Scholar] [CrossRef] [Green Version]

- Gray, S.R.; Cannella, A.A., Jr. The role of risk in executive compensation. J. Manag. 1997, 23, 517–540. [Google Scholar] [CrossRef]

- Stanwick, P.A.; Stanwick, S.D. CEO compensation: Does it pay to be green? Bus. Strat. Env. 2001, 10, 176–182. [Google Scholar] [CrossRef]

- Hossain, S.; Monroe, G.S. Chief financial officers’ short- and long-term incentive-based compensation and earnings management. Aust. Account. Rev. 2015, 25, 279–291. [Google Scholar] [CrossRef]

- Balsam, S. An Introduction to Executive Compensation; Academic Press: San Diego, CA, USA, 2002; ISBN 9780080490427. [Google Scholar]

- Hart, S.L. A natural-resource-based view of the firm. AMR 1995, 20, 986. [Google Scholar] [CrossRef] [Green Version]

- Kole, S.R. The complexity of compensation contracts. J. Financ. Econ. 1997, 43, 79–104. [Google Scholar] [CrossRef]

- Jensen, M.C.; Murphy, K.J. Performance pay and top-management incentives. J. Political Econ. 1990, 98, 225–264. [Google Scholar] [CrossRef]

- Rees, W.; Rodionova, T. The influence of family ownership on corporate social responsibility: An International analysis of publicly listed companies. Corp. Gov. Int. Rev. 2015, 23, 184–202. [Google Scholar] [CrossRef]

- Sanders, W.G.; Hambrick, D.C. Swinging for the fences: The effects of ceo stock options on company risk taking and performance. AMJ 2007, 50, 1055–1078. [Google Scholar] [CrossRef]

- Thomson Reuters. Asset4 ESG Data Glossary. Available online: http://extranet.datastream.com/data/ASSET4%20ESG/Index.htm (accessed on 27 February 2020).

- Callan, S.J.; Thomas, J.M. Executive compensation, corporate social responsibility, and corporate financial performance: A multi-equation framework. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 332–351. [Google Scholar] [CrossRef]

- Karim, K.; Lee, E.; Suh, S. Corporate social responsibility and CEO compensation structure. Adv. Account. 2018, 40, 27–41. [Google Scholar] [CrossRef]

- Mehran, H. Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 1995, 38, 163–184. [Google Scholar] [CrossRef]

- Choi, J.; Wang, H. Stakeholder relations and the persistence of corporate financial performance. Strat. Manag. J. 2009, 30, 895–907. [Google Scholar] [CrossRef]

- Hill, C.W.L.; Phan, P. CEO tenure as a determinant of CEO pay. AMJ 1991, 34, 707–717. [Google Scholar] [CrossRef]

- Mishra, S.; Modi, S.B. Positive and negative corporate social responsibility, financial leverage, and idiosyncratic risk. J. Bus. Ethics 2013, 117, 431–448. [Google Scholar] [CrossRef]

- Kennedy, P. A Guide to Econometrics, 5th ed.; MIT Press: Cambridge, MA, USA, 2003; ISBN 0262112809. [Google Scholar]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences, 2nd ed.; Erlbaum: Hillsdale, NJ, USA, 1988; ISBN 9781134742707. [Google Scholar]

- Eisenhardt, K.M. Agency Theory: An assessment and review. AMR 1989, 14, 57. [Google Scholar] [CrossRef]

- Cadman, B.; Vincent, L. The role of defined benefit pension plans in executive compensation. Eur. Account. Rev. 2015, 24, 779–800. [Google Scholar] [CrossRef]

- Al-Shaer, H.; Zaman, M. CEO compensation and sustainability reporting assurance: Evidence from the UK. J. Bus. Ethics 2019, 158, 233–252. [Google Scholar] [CrossRef] [Green Version]

| Number of Firms | Number of Observations | |

|---|---|---|

| Firms listed in the DAX30 and MDAX between 2014 and 2018 | 100 | 500 |

| No ESG data | 2 | 41 |

| CFO change | 0 | 40 |

| No firm, compensation, or pension data | 3 | 103 |

| Negative pension data | 0 | 3 |

| Final data sample | 95 | 313 |

| Variables | Mean | Median | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ESG Score | 63.31 | 68.49 | 19.83 | 16.16 | 94.8 |

| Fixed compensation (thousand €) | 694.52 | 672 | 312.22 | 57 | 2524.75 |

| ST compensation (thousand €) | 583.54 | 440 | 514.70 | 0 | 3469.21 |

| Pensions (thousand €) | 281.67 | 255 | 245.99 | 0 | 1918.06 |

| Bonus grants (thousand €) | 273.86 | 96 | 390.44 | 0 | 2338.00 |

| Stocks (thousand €) | 421.87 | 200 | 493.38 | 0 | 2476.60 |

| Stock options (thousand €) | 84.87 | 0 | 330.86 | 0 | 3830.20 |

| % Fixed compensation | 0.34 | 0.31 | 0.13 | 0.049 | 0.82 |

| % ST compensation | 0.25 | 0.26 | 0.14 | 0 | 0.74 |

| % Pensions | 0.11 | 0.11 | 0.09 | 0 | 0.65 |

| % Bonus grants | 0.12 | 0.07 | 0.14 | 0 | 0.73 |

| % Stocks | 0.15 | 0.12 | 0.15 | 0 | 0.57 |

| % Stock options | 0.03 | 0.00 | 0.11 | 0 | 0.95 |

| ROA | 5.64 | 5.16 | 5.59 | −17.6 | 53.58 |

| Tobin’s Q | 1.70 | 1.35 | 1.02 | 0.77 | 7 |

| CFO Tenure | 5.72 | 4 | 4.05 | 1 | 19 |

| Debt | 100.47 | 64.29 | 145.78 | 0 | 1492.09 |

| Size | 15.84 | 15.77 | 1.64 | 11.11 | 19.28 |

| Ind1 | 0.52 | 1 | 0.5 | 0 | 1 |

| Ind2 | 0.22 | 0 | 0.41 | 0 | 1 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. ESG Score | 1 | |||||||||||||

| 2. Fixed compensation | 0.415 * | 1 | ||||||||||||

| 3. ST compensation | 0.265 * | 0.235 * | 1 | |||||||||||

| 4. Pensions | 0.489 * | 0.481 * | 0.185 * | 1 | ||||||||||

| 5. Bonus grants | 0.082 | 0.176 * | −0.076 | 0.13 * | 1 | |||||||||

| 6. Stocks | 0.385 * | 0.362 * | 0.373 * | 0.407 * | −0.166 * | 1 | ||||||||

| 7. Stock options | −0.037 | −0.05 | −0.069 | −0.046 | −0.005 | −0.095 | 1 | |||||||

| 8. ROA | −0.123 * | −0.181 * | −0.044 | −0.145 * | 0.055 | −0.163 * | 0.208 * | 1 | ||||||

| 9. Tobin’s Q | −0.262 * | −0.174 * | −0.078 | −0.267 * | −0.018 | −0.157 * | 0.028 | 0.407 * | 1 | |||||

| 10. CFO Tenure | −0.07 | 0.102 | −0.06 | 0.093 * | 0.074 | 0.036 | 0.001 | 0.024 | 0.121 * | 1 | ||||

| 11. Debt | 0.114 * | 0.252 * | −0.068 | 0.208 * | 0.02 | 0.076 | −0.067 | −0.245 * | −0.255 * | −0.01 | 1 | |||

| 12. Size | 0.612 * | 0.491 * | 0.376 * | 0.441 * | 0.115 * | 0.373 * | 0.042 | −0.205 * | 0.386 * | −0.158 * | 0.071 | 1 | ||

| 13. Ind1 | 0.208 * | 0.08 | 0.217 * | 0.27 * | 0.037 | −0.041 | −0.089 | 0.075 | −0.106 | −0.11 | −0.172 * | 0.237 * | 1 | |

| 14. Ind2 | −0.152 * | 0.038 | −0.183 * | −0.098 | 0.044 | 0.018 | −0.122 * | −0.123 | −0.063 | 0.148 * | 0.268 * | −0.251 * | −0.551 * | 1 |

| Regression Models | (Full Model) | (Reduced Model) | Difference | Statistical Power |

|---|---|---|---|---|

| Fixed compensation | 0.392 | 0.373 | 0.019 | 0.88 |

| ST compensation | 0.375 | 0.373 | 0.002 | 0.16 |

| Pensions | 0.431 | 0.373 | 0.058 | 0.99 |

| Bonus grants | 0.370 | 0.373 | −0.003 | - |

| Stocks | 0.404 | 0.373 | 0.031 | 0.98 |

| Stock options | 0.375 | 0.373 | 0.002 | 0.19 |

| Variables/Models | Model1 | Model3 | Model5 |

|---|---|---|---|

| Predicted Outcome | +/- | ||

| Fixed compensation | 0.07 (0.068) | ||

| Pensions | 0.16 *** (0.000) | ||

| Stocks | 0.037 * (0.010) | ||

| ROA | 0.156 (0.231) | 0.137 (0.256) | 0.157 (0.226) |

| Tobin’s Q | −0.299 (0.849) | −0.045 (0.977) | −0.416 (0.790) |

| CFO Tenure | 0.020 (0.935) | −0.442 (0.854) | 0.117 (0.628) |

| Debt | 0.000 (0.966) | 0.001 (0.887) | 0.002 (0.578) |

| Size | 5.210 *** (0.000) | 5.046 *** (0.000) | 5.401 *** (0.000) |

| Ind1 | 5.097 (0.182) | 2.967 (0.418) | 5.823 (0.121) |

| Ind2 | 3.184 (0.525) | 2.727 (0.563) | 3.737 (0.434) |

| Constant | −28.628 (0.146) | −24.544 (0.182) | −29.481 (0.125) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Profitlich, M.; Bouzzine, Y.D.; Lueg, R. The Relationship between CFO Compensation and Corporate Sustainability: An Empirical Examination of German Listed Firms. Sustainability 2021, 13, 12299. https://doi.org/10.3390/su132112299

Profitlich M, Bouzzine YD, Lueg R. The Relationship between CFO Compensation and Corporate Sustainability: An Empirical Examination of German Listed Firms. Sustainability. 2021; 13(21):12299. https://doi.org/10.3390/su132112299

Chicago/Turabian StyleProfitlich, Mirko, Yassin Denis Bouzzine, and Rainer Lueg. 2021. "The Relationship between CFO Compensation and Corporate Sustainability: An Empirical Examination of German Listed Firms" Sustainability 13, no. 21: 12299. https://doi.org/10.3390/su132112299

APA StyleProfitlich, M., Bouzzine, Y. D., & Lueg, R. (2021). The Relationship between CFO Compensation and Corporate Sustainability: An Empirical Examination of German Listed Firms. Sustainability, 13(21), 12299. https://doi.org/10.3390/su132112299