Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers

Abstract

1. Introduction

2. Literature Review

3. Evolutionary Game Model

3.1. Problem Description and Game Strategy

3.2. Model Assumptions and Profit Matrix

4. Evolutionary Stable Strategy Analysis

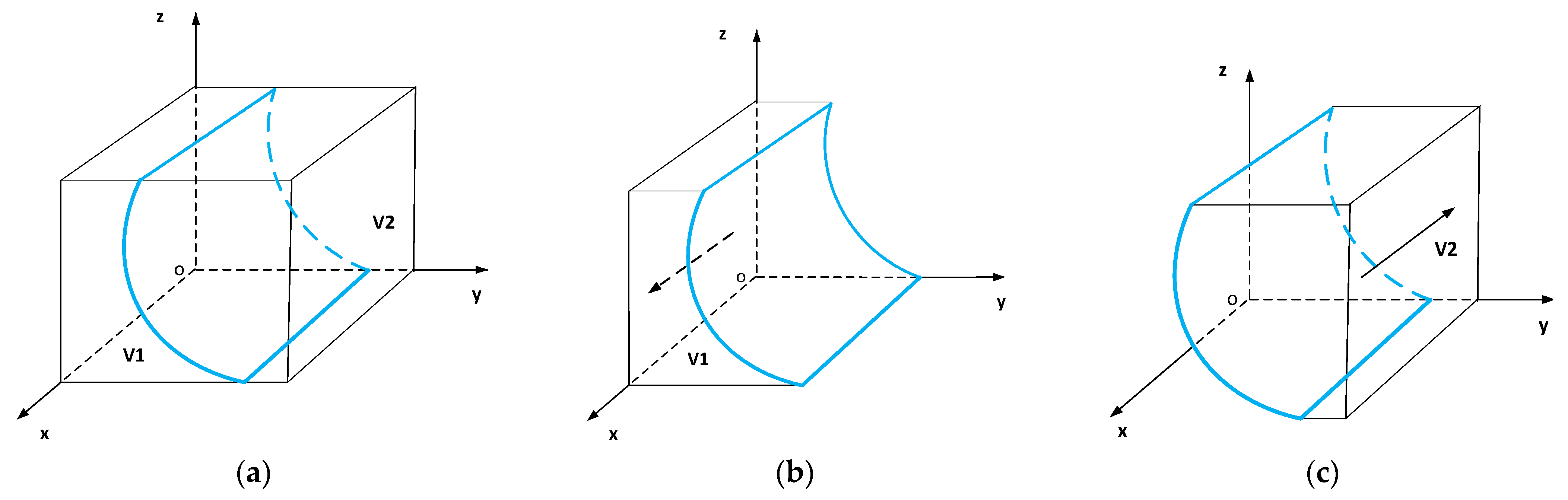

4.1. Strategy Stability Analysis of LSPs

- (1)

- If , , , and , we can see x = 1 is the only ESS, and LSPs will adopt the SI strategy, as shown in Figure 1b.

- (2)

- If , , , and , we can see x = 0 is the only ESS, and LSPs will adopt the TI strategy, as shown in Figure 1c.

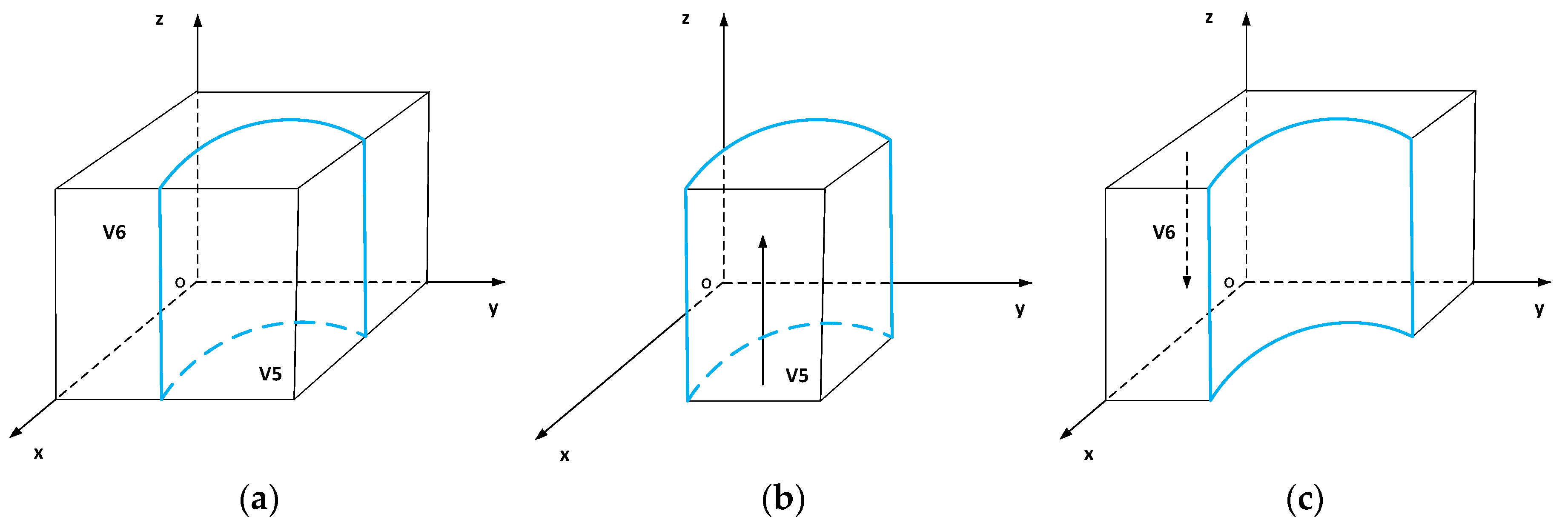

4.2. Strategy Stability Analysis of PSCs

- (1)

- If ,, and , we can see y = 1 is the only ESS, and PSCs will adopt the SI strategy, as shown in Figure 2b.

- (2)

- If ,, and , we can see y = 0 is the only ESS, and PSCs will adopt the TI strategy, as shown in Figure 2c.

4.3. Strategy Stability Analysis of Cs

- (1)

- If , , , and , we can see z = 1 is the only ESS, and Cs will adopt the SSI strategy, as shown in Figure 3b.

- (2)

- If , , , and , we can see z = 0 is the only ESS, and Cs will adopt the STI strategy, as shown in Figure 3c.

4.4. Stability Analysis of Equilibrium Strategy

5. System Simulation Analysis

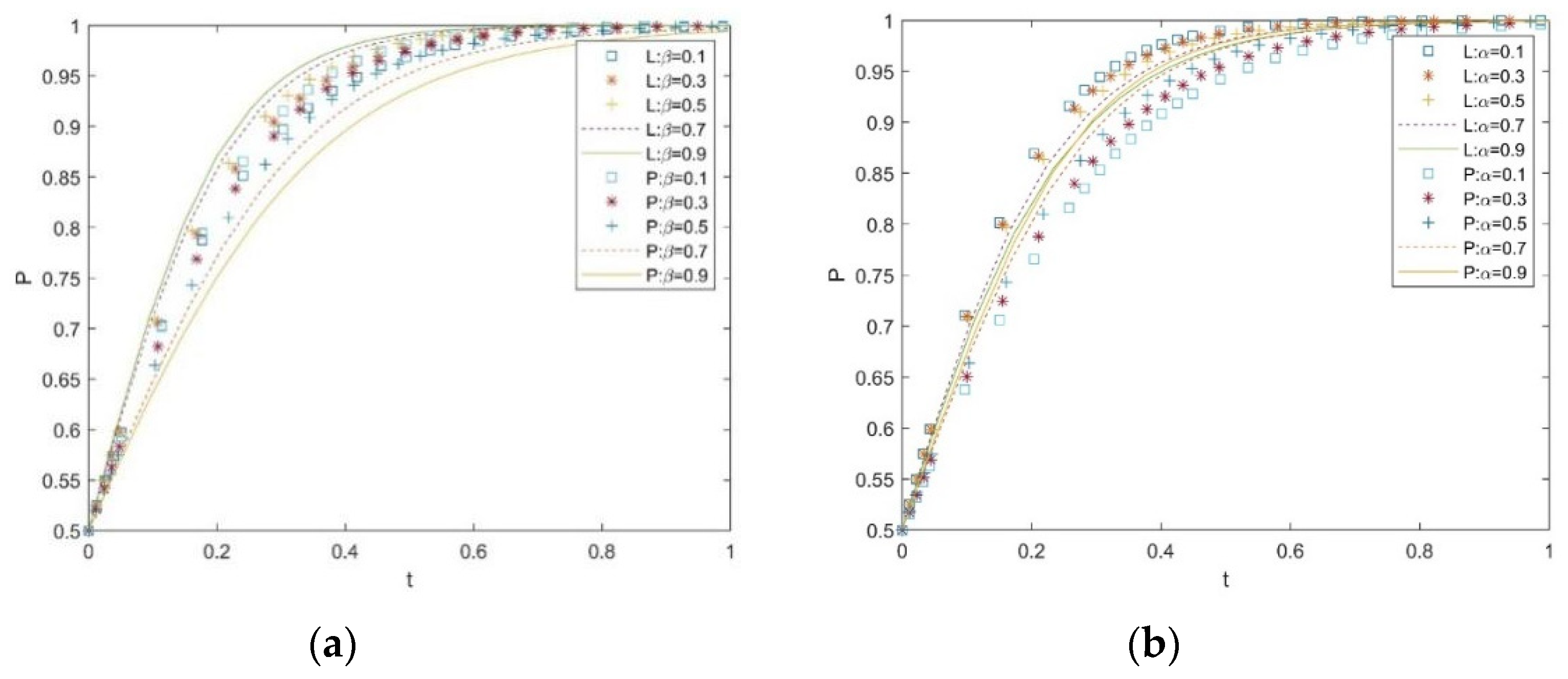

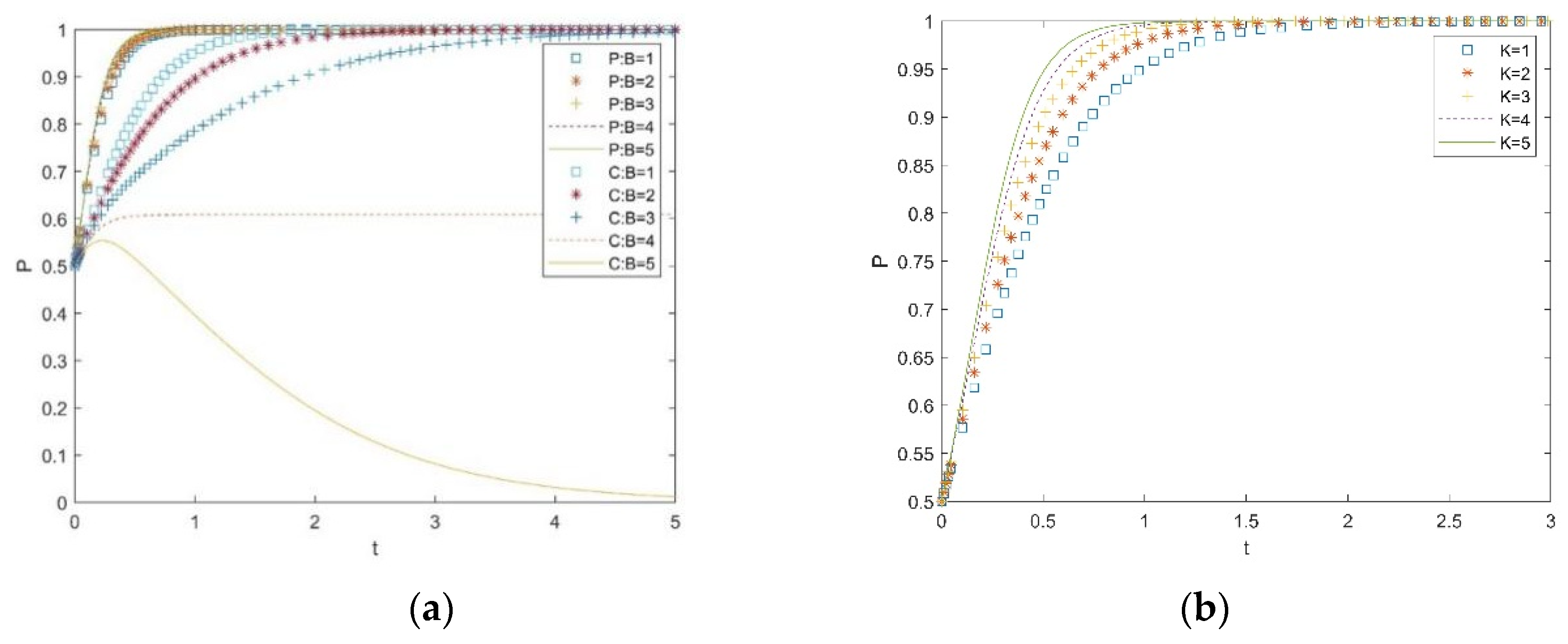

5.1. Impact of and on Evolutionary Outcome

5.2. Impact of on Evolutionary Outcome

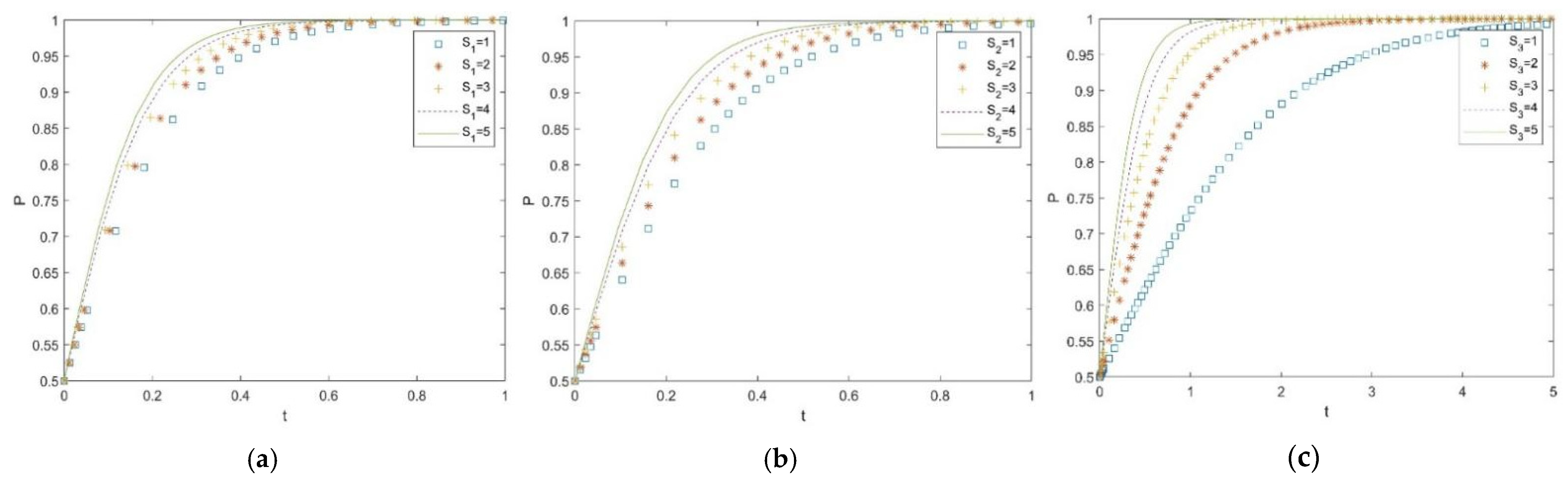

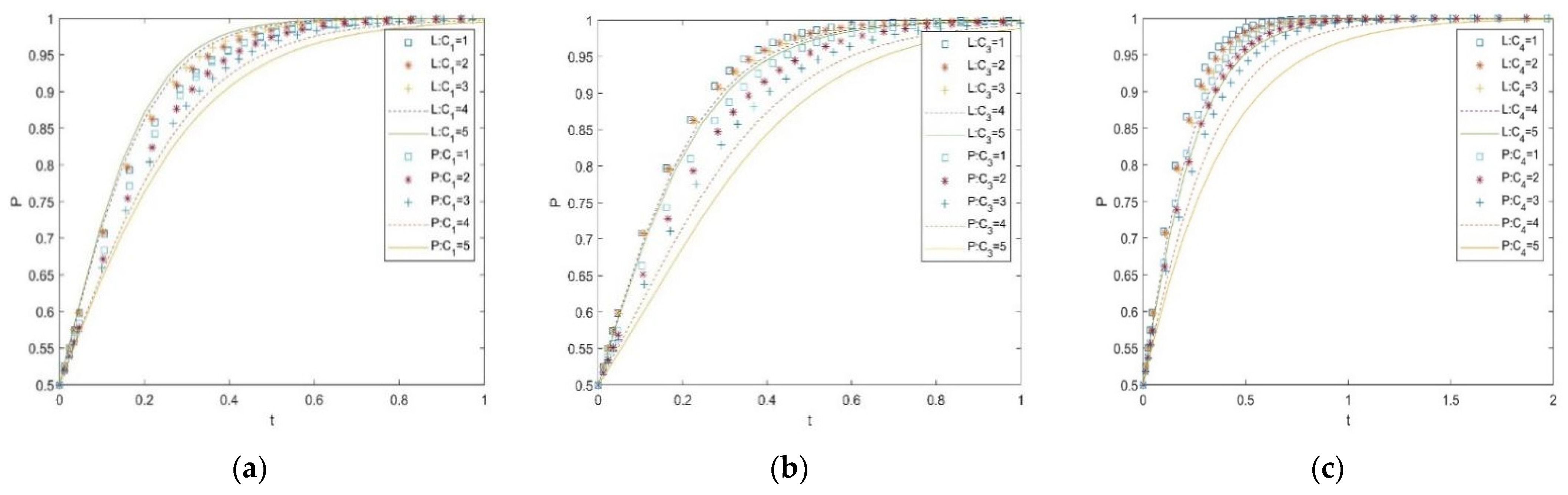

5.3. Impact of and on Evolutionary Outcome

5.4. Impact of , , and on Evolutionary Outcome

6. Conclusions

- (1)

- There are optimal profit allocation coefficients and cost-sharing coefficients that make the system evolve to a stable state of {SI, SI, SSI}. It shows that reasonable profit allocation and cost-sharing mechanisms are foundational, which guarantees the strategic integration between LSPs and PSCs. Therefore, the two companies should establish these mechanisms to ensure the stability of strategic integration.

- (2)

- Operating costs such as integration cost and home delivery cost could inhibit the strategic integration. Therefore, LSPs should take steps to improve Cs’ participation and try to establish a benign interactive relationship between themselves and customers to reduce the cost of strategic integration, such as creating logistics service member points systems, providing self-delivery, and delivery discounts.

- (3)

- The increasing of potential losses in temporary integration plays a positive role in promoting the evolution of the system to an ideal state of {SI, SI, SSI}, which indicates that the potential loss plays a vital role in the choice of strategic behaviors, and it requires the tripartite, especially the two types of enterprises, to establish a reasonable profit and loss evaluation system under different strategies to support scientific behavioral decisions before resource integration.

- (4)

- Higher community premium income is conducive to improving the enthusiasm of Cs supporting strategic integration. Therefore, while providing good logistics services, it is necessary for PSCs to improve the quality of property services through improving service attitudes and service standardization, so as to further improve community premium profits, and then encourage Cs to support strategic integration.

- (5)

- PSCs are more sensitive to the costs and benefits in the resource integration. Consequently, it is of great significance for the government to take measures to guide PSCs to actively participate in the last mile delivery resource integration by reducing their participation costs, such as providing financial subsidies and tax relief.

- (6)

- The three game players’ behavior and decision-making choices affect each other in the last mile delivery resource integration. Therefore, cooperation mechanisms and linkage relationships help to better integrate the last mile distribution resources.

- (7)

- The indirect benefits, such as advertising during their integration, play a positive role. Thus, the relevant regulations should be added in the property service contracts signed with Cs to avoid conflicts between Cs and PSCs by advertising and other acts.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lewis, M.; Singh, V.; Fay, S. An Empirical Study of the Impact of Nonlinear Shipping and Handling Fees on Purchase Incidence and Expenditure Decisions. Mark. Sci. 2006, 25, 51–64. [Google Scholar] [CrossRef]

- Zhou, L.; Lin, Y.; Wang, X.; Zhou, F. Model and algorithm for bilevel multisized terminal location-routing problem for the last mile delivery. Int. Trans. Oper. Res. 2019, 26, 131–156. [Google Scholar] [CrossRef]

- Aized, T.; Srai, J.S. Hierarchical modelling of Last Mile logistic distribution system. Int. J. Adv. Manuf. Technol. 2014, 70, 1053–1061. [Google Scholar] [CrossRef]

- Devari, A.; Nikolaev, A.G.; He, Q. Crowdsourcing the last mile delivery of online orders by exploiting the social networks of retail store customers. Transp. Res. Part E: Logist. Transp. Rev. 2017, 105, 105–122. [Google Scholar] [CrossRef]

- Yang, F.; Yang, M.; Xia, Q.; Liang, L. Collaborative distribution between two logistics service providers. Int. Trans. Oper. Res. 2016, 23, 1025–1050. [Google Scholar] [CrossRef]

- Hinterhuber, A. Can competitive advantage be predicted? Manag. Decis. 2013, 51, 795–812. [Google Scholar]

- He, Y.; Wang, X.; Lin, Y.; Zhou, F.; Zhou, L. Sustainable decision making for joint distribution center location choice. Transp. Res. Part D Transp. Environ. 2017, 55, 202–216. [Google Scholar] [CrossRef]

- Alnaggar, A.; Gzara, F.; Bookbinder, J.H. Crowdsourced delivery: A review of platforms and academic literature. Omega-Int. J. Manage. S. 2021, 98, 102–139. [Google Scholar]

- Wang, X.; Zhan, L.; Ruan, J.; Zhang, J. How to Choose “Last Mile” Delivery Modes for E-Fulfillment. Math. Probl. Eng. 2014, 2014, 1–11. [Google Scholar]

- Elhedhli, S.; Merrick, R. Green supply chain network design to reduce carbon emissions. Transp. Res. Part D Transp. Environ. 2012, 17, 370–379. [Google Scholar] [CrossRef]

- Prajogo, D.; Olhager, J. Supply chain integration and performance: The effects of long-term relationships, information technology and sharing, and logistics integration. Int. J. Prod. Econ. 2012, 135, 514–522. [Google Scholar]

- Panayides, P.M.; So, M. The impact of integrated logistics relationships on third-party logistics service quality and performance. Marit. Econ. Logist. 2005, 7, 36–55. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; Li, N.; Xu, H. A bi-level programming model of resource matching for collaborative logistics network in supply uncertainty environment. J. Franklin. Inst. 2015, 352, 3873–3884. [Google Scholar] [CrossRef]

- Yao, J. Decision optimization analysis on supply chain resource integration in fourth party logistics. J. Manuf. Syst. 2010, 29, 121–129. [Google Scholar] [CrossRef]

- Cao, W.; Zhu, H. Supply Chain Integration Based on Core Manufacturing Enterprise. In International Conference on Computer and Computing Technologies in Agriculture; Springer: Berlin/Heidelberg, Germany, 2010; pp. 14–19. [Google Scholar]

- Shi, X.; Li, L.X.; Yang, L.; Li, Z.; Choi, J. Information flow in reverse logistics: An industrial information integration study. Inform. Technol. Manag. 2012, 13, 217–232. [Google Scholar] [CrossRef]

- Fan, T.; Pan, Q.; Pan, F.; Zhou, W.; Chen, J. Intelligent logistics integration of internal and external transportation with separation mode. Transp. Res. Part D Transp. Environ. 2020, 133, 101806. [Google Scholar] [CrossRef]

- Adams, F.G.; Richey, R.G., Jr.; Autry, C.W.; Morgan, T.R.; Gabler, C. Supply chain collaboration, integration, and relational technology: How complex operant resources increase performance outcomes. J. Bus. Logist. 2014, 35, 299–317. [Google Scholar] [CrossRef]

- Fan, Y.; Zhang, Y.; Song, Z.; Liu, H. Coordination Mechanism of Port Logistics Resources Integration from the Perspective of Supply-Demand Relationship. J. Coastal. Res. 2020, 103, 619–623. [Google Scholar]

- Kim, S.T.; Lee, H.-H.; Hwang, T. Logistics integration in the supply chain: A resource dependence theory perspective. Int. J. Qual. Inno. 2020, 6, 1–14. [Google Scholar] [CrossRef]

- Zhu, H.; Qiu, Y.; Jiang, T. Strategies for adopting unified object identifiers in logistics resource integration environments. J. Discret. Math. Sci. Cryptogr. 2018, 21, 991–1003. [Google Scholar] [CrossRef]

- Yin, C.; Zhang, M.; Zhang, Y.; Wu, W. Business service network node optimization and resource integration based on the construction of logistics information systems. Inf. Syst. E-Bus. Manag. 2019, 18, 723–746. [Google Scholar] [CrossRef]

- Chen, X.; Zhu, X.N. Logistics Infrastructure Network Evaluation Method Research Based on Logistics Resource Integration in Railway Logistics Enterprises. Adv. Mat. Res. 2014, 933, 941–946. [Google Scholar] [CrossRef]

- Cruijssen, F.; Cools, M.; Dullaert, W. Horizontal cooperation in logistics: Opportunities and impediments. Transp. Res. Part E: Logist. Transp. Rev. 2007, 43, 129–142. [Google Scholar] [CrossRef]

- Cruijssen, F.; Bräysy, O.; Dullaert, W.; Fleuren, H.; Salomon, M. Joint Route Planning under Varying Market Conditions. Int. J. Phys. Distrib. Logist. Manag. 2006, 49, 287–304. [Google Scholar] [CrossRef][Green Version]

- Zhou, L.; Baldacci, R.; Vigo, D.; Wang, X. A Multi-Depot Two-Echelon Vehicle Routing Problem with Delivery Options Arising in the Last Mile Distribution. Eur. J. Oper. Res. 2018, 265, 765–778. [Google Scholar]

- Wang, Y.; Peng, S.; Guan, X.; Fan, J.; Wang, Z.; Liu, Y.; Wang, H. Collaborative logistics pickup and delivery problem with eco-packages based on time–space network. Expert Syst. Appl. 2021, 170, 114561. [Google Scholar]

- Archetti, C.; Savelsbergh, M.; Speranza, M.G. The Vehicle Routing Problem with Occasional Drivers. Eur. J. Oper. Res. 2016, 254, 472–480. [Google Scholar] [CrossRef]

- Chen, C.; Pan, S.; Wang, Z.; Zhong, R.Y. Using taxis to collect citywide E-commerce reverse flows: A crowdsourcing solution. Int. J. Prod. Res. 2017, 55, 1833–1844. [Google Scholar] [CrossRef]

- Kafle, N.; Zou, B.; Lin, J. Design and modeling of a crowdsource-enabled system for urban parcel relay and delivery. Transp. Res. Part B Methodol. 2017, 99, 62–82. [Google Scholar] [CrossRef]

- Macrina, G.; Di Puglia Pugliese, L.; Guerriero, F.; Laporte, G. Crowd-shipping with time windows and transshipment nodes. Comput. Oper. Res. 2020, 113, 104806. [Google Scholar]

- Lyapunov, A.M. The General Problem of the Stability of Motion. J. Appl. Mech. 1994, 226–227. [Google Scholar] [CrossRef]

- Selten, R. A note on evolutionarily stable strategies in asymmetric animal conflicts. J. Theor. Biol. 1980, 84, 67–75. [Google Scholar] [CrossRef]

| LSPs | PSCs | Cs | |

|---|---|---|---|

| SSI | STI | ||

| SI | SI | ||

| TI | |||

| TI | SI | ||

| TI | |||

| Equilibrium Points | Eigenvalues and Symbol | Local Stability | ||

|---|---|---|---|---|

| (1,1,1) | Uncertain point | |||

| (1,1,0) | Uncertain point | |||

| (1,0,1) | Uncertain point | |||

| (1,0,0) | Unstable point | |||

| (0,1,1) | Uncertain point | |||

| (0,1,0) | Unstable point | |||

| (0,0,1) | Unstable point | |||

| (0,0,0) | Unstable point | |||

| Equilibrium Point | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stability | Stability | Stability | Stability | |||||||||||||

| (1,1,1) | - | - | - | ESS | - | - | + | Unstable point | - | + | - | Unstable point | + | - | - | Unstable point |

| (1,1,0) | - | - | + | Unstable point | - | - | - | ESS | - | - | + | Unstable point | + | - | + | Unstable point |

| (1,0,1) | - | + | - | Unstable point | - | + | - | Unstable point | - | - | - | ESS | - | + | - | Unstable point |

| (1,0,0) | - | + | + | Unstable point | - | + | + | Unstable point | - | - | + | Unstable point | - | + | + | Unstable point |

| (0,1,1) | + | / | - | Unstable point | + | / | - | Unstable point | + | / | - | Unstable point | - | - | - | ESS |

| (0,1,0) | + | / | + | Unstable point | + | / | + | Unstable point | + | / | + | Unstable point | - | - | + | Unstable point |

| (0,0,1) | + | / | - | Unstable point | + | / | - | Unstable point | + | / | - | Unstable point | + | - | - | Unstable point |

| (0,0,0) | + | / | + | Unstable point | + | / | + | Unstable point | + | / | + | Unstable point | + | + | + | Unstable point |

| Scenario | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario 1 | 4 | 2 | 4 | 2 | 1 | 3 | 2 | 1 | 2 | 1 | 0.5 | 0.5 | 1 |

| Scenario 2 | 4 | 2 | 4 | 2 | 1 | 1 | 5 | 1 | 2 | 4 | 0.5 | 0.5 | 1 |

| Scenario 3 | 4 | 2 | 1 | 2 | 1 | 3 | 2 | 5 | 6 | 1 | 0.5 | 0.5 | 1 |

| Scenario 4 | 1 | 2 | 4 | 1 | 2 | 3 | 1 | 3 | 6 | 0.5 | 0.7 | 0.3 | 1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Chen, Y.; Jing, Y.; Jiang, Y. Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers. Sustainability 2021, 13, 12240. https://doi.org/10.3390/su132112240

Zhou L, Chen Y, Jing Y, Jiang Y. Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers. Sustainability. 2021; 13(21):12240. https://doi.org/10.3390/su132112240

Chicago/Turabian StyleZhou, Lin, Yanping Chen, Yi Jing, and Youwei Jiang. 2021. "Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers" Sustainability 13, no. 21: 12240. https://doi.org/10.3390/su132112240

APA StyleZhou, L., Chen, Y., Jing, Y., & Jiang, Y. (2021). Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers. Sustainability, 13(21), 12240. https://doi.org/10.3390/su132112240