Causality between Foreign Remittance and Economic Growth: Empirical Evidence from Croatia

Abstract

:1. Introduction

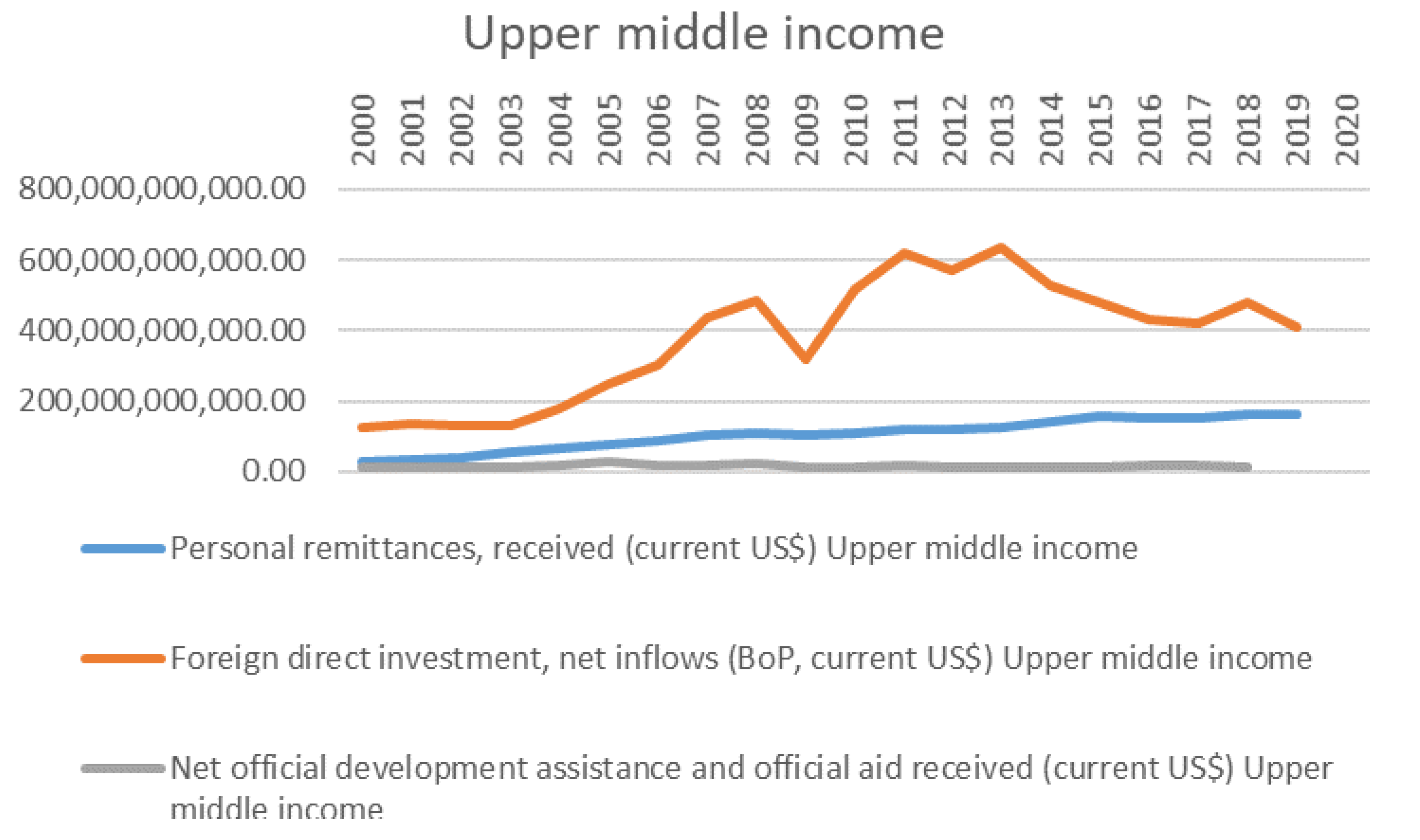

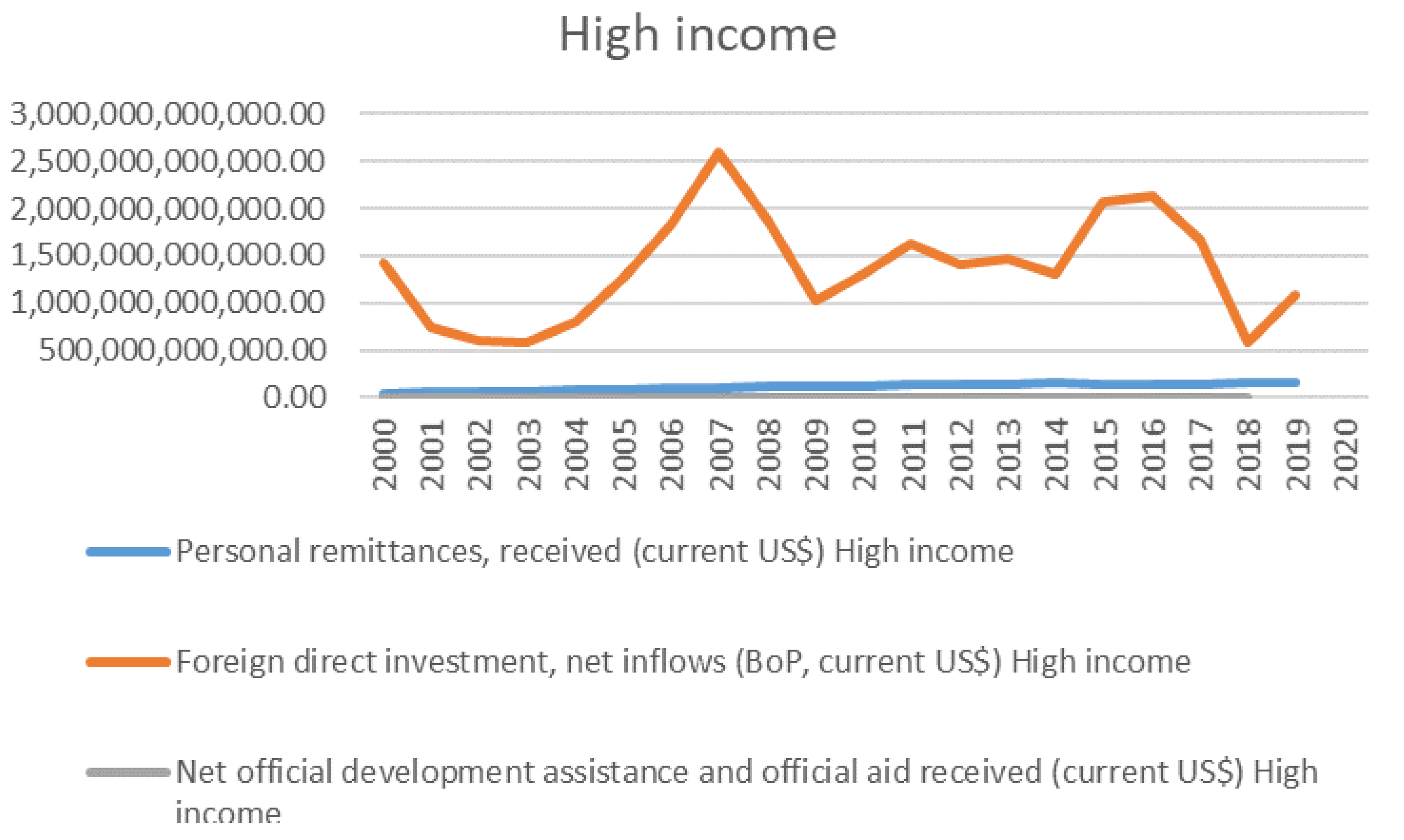

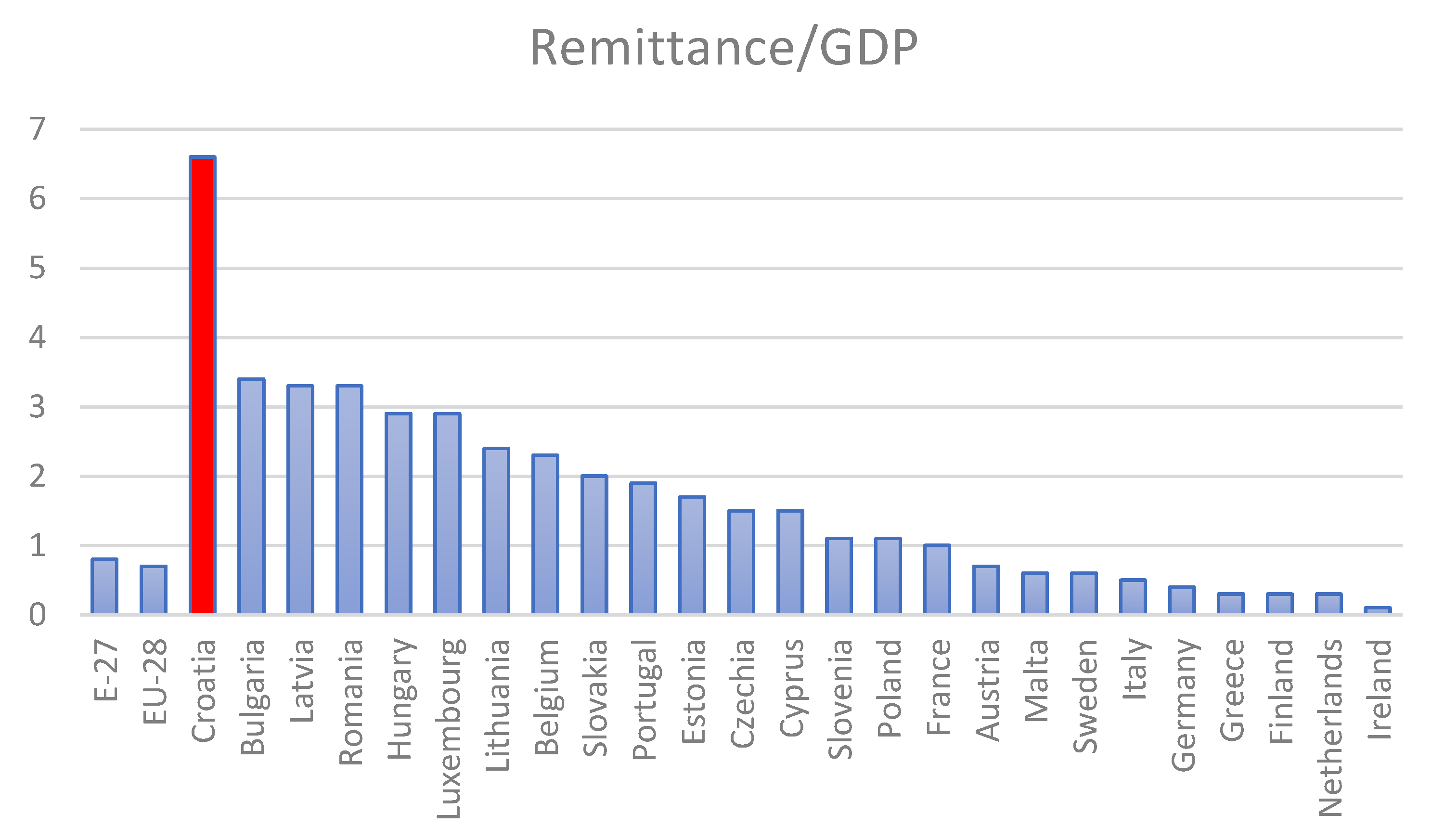

2. Theoretical Background

3. Data and Methodological Framework

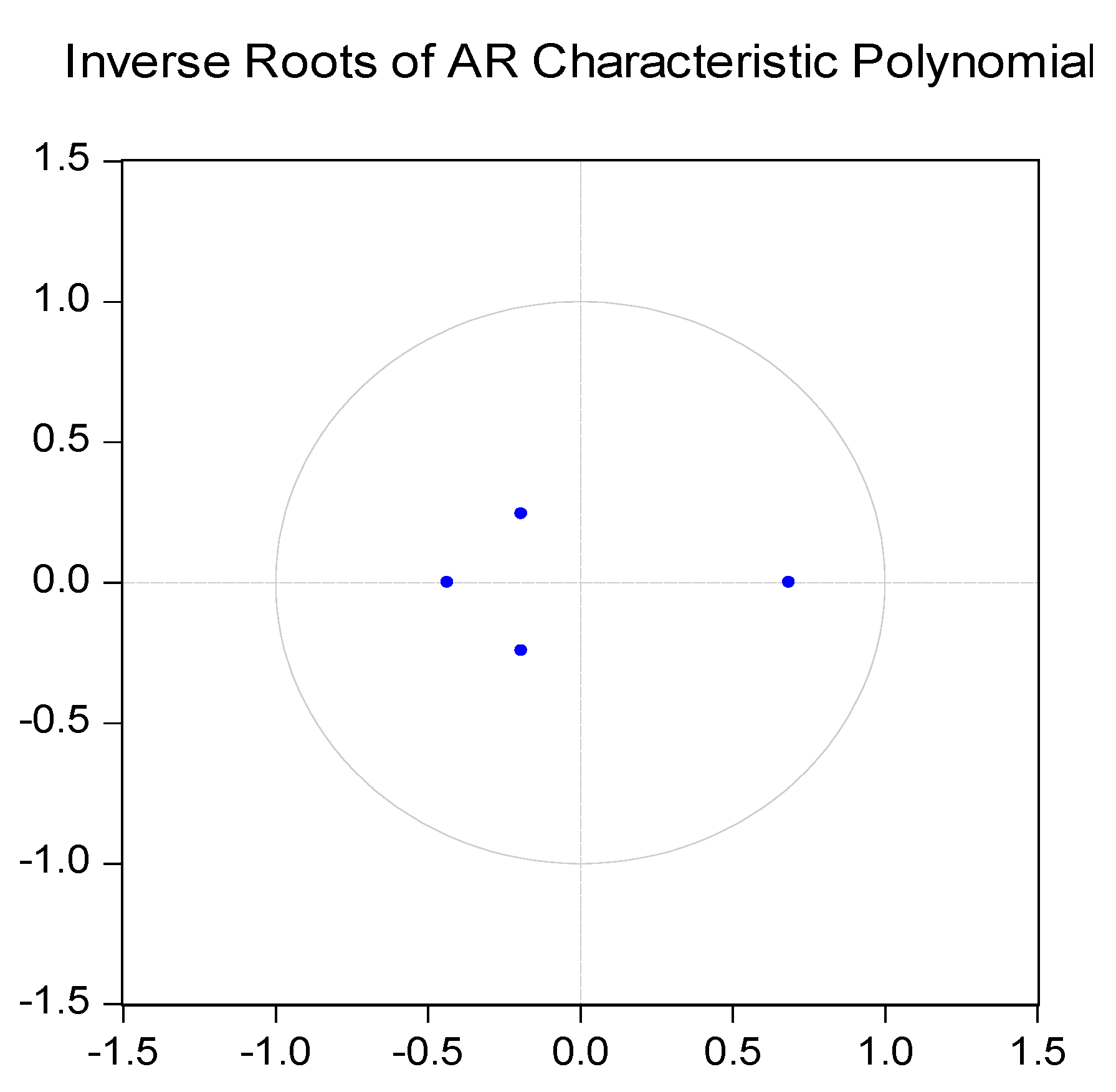

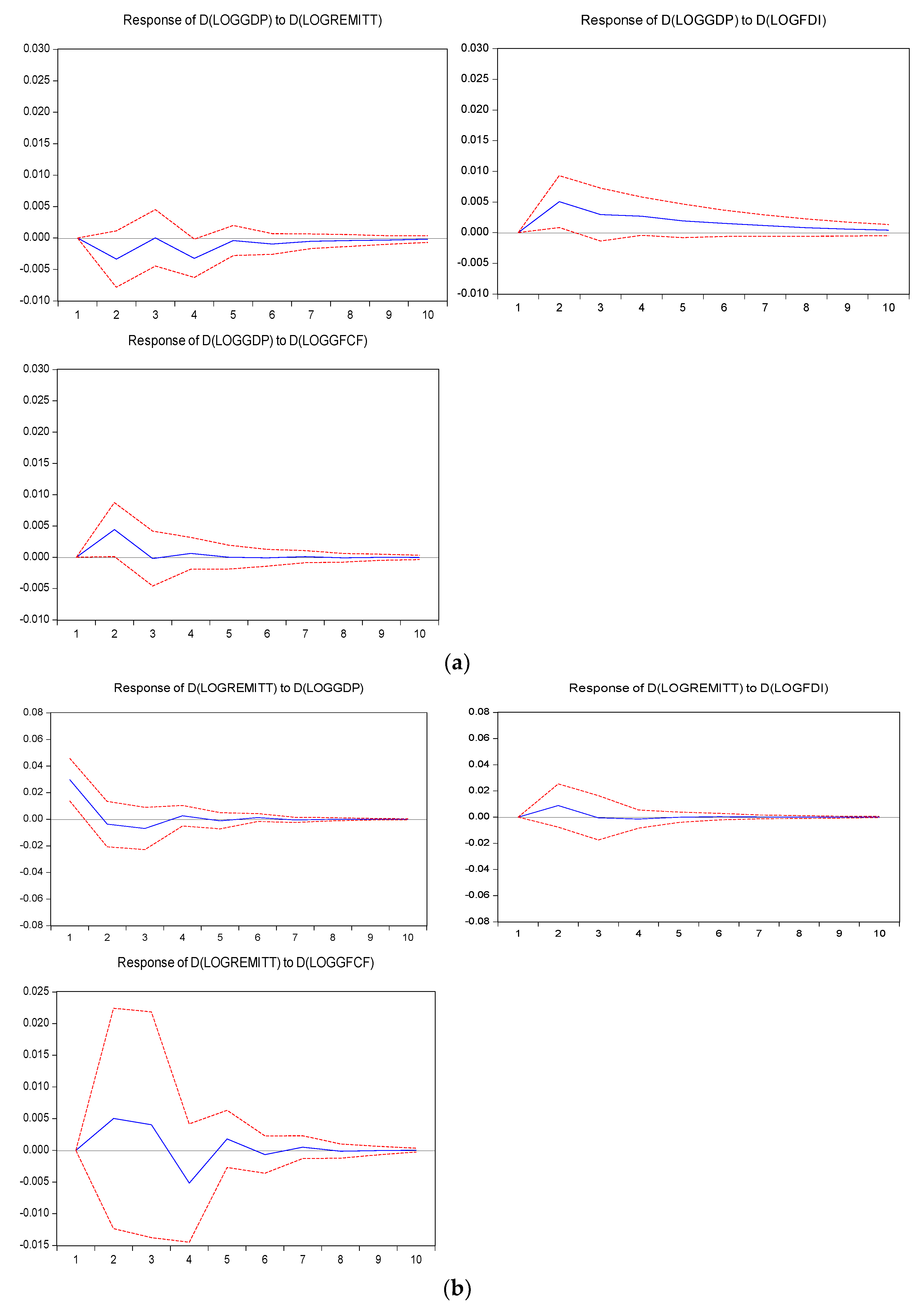

4. Empirical Results

5. Concluding Remarks and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- World Bank. Globalization, Growth, and Poverty: Building an Inclusive World Economy; World Bank Policy Research Report, World Bank and Oxford University Press: Washington, DC, USA, 2002; Available online: https://openknowledge.worldbank.org/handle/10986/14051 (accessed on 3 October 2020).

- Bodvarsson, Ö.B.; Van den Berg, H. The Economics of Immigration, Theory and Policy, 2nd ed.; Springer: New York, NY, USA, 2013. [Google Scholar]

- White, R.; Tadesse, B. International Migration and Economic Integration. Understanding the Immigrant—Trade Link; Edward Elgar Publishing Limited: Cheltenham, UK, 2011. [Google Scholar]

- Alfaro, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. FDI and economic growth: The role of local financial markets. J. Int. Econ. 2004, 64, 89–112. [Google Scholar] [CrossRef]

- Driffield, N.; Jones, C.M. Impact of FDI, ODA and Migrant Remittances on Economic Growth in Developing Countries: A Systems Approach. Eur. J. Dev. Res. 2013, 25, 173–196. [Google Scholar] [CrossRef]

- Jahjah, S.; Chami, R.; Fullenkamp, C. Are Immigrant Remittance Flows a Source of Capital for Development. IMF Work. Pap. 2003, 3, 1. [Google Scholar] [CrossRef] [Green Version]

- Buch, C.M.; Kuckulenz, A.; Le Manchec, M.H. Worker Remittances and Capital Flows; Kiel Working Paper No. 1130; Institute for the World Economy (IfW): Kiel, Germany, 2002. [Google Scholar]

- Giuliano, P.; Ruiz-Arranz, M. Remittances, financial development, and growth. J. Dev. Econ. 2009, 90, 144–152. [Google Scholar] [CrossRef] [Green Version]

- Cocco, F.; Wheatley, J.; Pong, J.; Blood, D.; Rininsland, A. Remittances: The Hidden Engine of Globalization. Financial Times. 20 August 2019. Available online: https://ig.ft.com/remittances-capital-flow-emerging-markets/ (accessed on 10 April 2020).

- Ong, R. World Bank Predicts Sharpest Decline of Remittances in Recent History. World Bank Press Release. 2020. Available online: https://www.worldbank.org/en/news/press-release/2020/04/22/world-bank-predicts-sharpest-decline-of-remittances-in-recent-history (accessed on 2 September 2020).

- UNCTAD. World Investment Report 2020: International Production Beyond Pandemic; UNCTAD: New York, NY, USA; Geneva, Switzerland, 2020. [Google Scholar]

- United Nations. Remittances and The SDGs. Available online: https://www.un.org/en/observances/remittances-day/SDGs (accessed on 1 December 2020).

- Eurostat Database. 2019. Available online: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=File:Inbound_personal_remittances,_2019_(%25_of_GDP).png#filelinks (accessed on 15 April 2020).

- Croatian National Bank. 2021. Available online: https://www.hnb.hr/ (accessed on 15 April 2021).

- Glas, I. The Money Sent by Guest Workers in Croatia Exceeded the Earnings from Foreign Tourists by 23.5 Percent. 2021. Available online: https://www.glasistre.hr/hrvatska/-novac-koji-salju-gastarbajteri-u-hrvatskoj-premasio-zaradu-od-stranih-turista-za-235-posto-749835 (accessed on 10 October 2021).

- Garding, S. Weak by design? Diaspora engagement and institutional change in Croatia and Serbia. Int. Politi Sci. Rev. 2018, 39, 353–368. [Google Scholar] [CrossRef]

- Amuedo-Dorantes, C.; Pozo, S. Remittance Receipt and Business Ownership in the Dominican Republic. World Econ. 2006, 29, 939–956. [Google Scholar] [CrossRef]

- Chami, R.; Ernst, E.; Fullenkamp, C.; Oeking, A. Is There a Remittance Trap? IMF Financ. Dev. 2018, 55, 44–47. [Google Scholar]

- Azizi, S. The impacts of workers’ remittances on human capital and labor supply in developing countries. Econ. Model. 2018, 75, 377–396. [Google Scholar] [CrossRef]

- Hosny, A. Remittance Concentration and Volatility: Evidence from 72 Developing Countries. Int. Econ. J. 2020, 34, 553–570. [Google Scholar] [CrossRef]

- Feeny, S.; Iamsiraroj, S.; McGillivray, M. Remittances and Economic Growth: Larger Impacts in Smaller Countries? J. Dev. Stud. 2014, 50, 1055–1066. [Google Scholar] [CrossRef]

- Ratha, D. The Impact of Remittances on Economic Growth and Poverty Reduction; Policy Brief. No. 8; Migration Policy Institute: Washington, DC, USA, 2013. [Google Scholar]

- Das, A.; Paul, B.P. Openness and growth in emerging Asian economies: Evidence from GMM estimations of a dynamic panel. Econ. Bulletin. 2011, 31, 2219–2228. [Google Scholar]

- Dhungel, K.R. Does remittance in Nepal cause gross domestic product? An empirical evidence using vector error correction models. Int. J. Econom. Financ. Manag. 2014, 2, 168–174. [Google Scholar]

- Olayungbo, D.O.; Quadri, A. Remittances, financial development and economic growth in sub-Saharan African countries: Evidence from a PMG-ARDL approach. Financ. Innov. 2019, 5, 9. [Google Scholar] [CrossRef] [Green Version]

- Leon-Ledesma, M.; Piracha, M. International Migration and the Role of Remittances in Eastern Europe. Int. Migr. 2004, 42, 65–83. [Google Scholar] [CrossRef] [Green Version]

- Catrinescu, N.; Leon-Ledesma, M.; Piracha, M.; Quillin, B. Remittances, Institutions, and Economic Growth. World Dev. 2009, 37, 81–92. [Google Scholar] [CrossRef] [Green Version]

- Gjini, A. The Role of Remittances on Economic Growth: An Empirical Investigation Of 12 CEE Countries. Int. Bus. Econ. Res. J. (IBER) 2013, 12, 193–204. [Google Scholar] [CrossRef] [Green Version]

- Jouini, J. Economic growth and remittances in Tunisia: Bi-directional causal links. J. Policy Model. 2015, 37, 355–373. [Google Scholar] [CrossRef]

- Simionescu, L.N.; Dumitrescu, D. Migrants Remittances Influence on Fiscal Sustainability in Dependent Economies. Amfiteatru Econ. 2017, 19, 640–653. [Google Scholar]

- Ahmed, F.; Hakim, M. The Relationship between Remittances and Economic Growth in Togo: A Vector Equilibrium Correction Mechanism. Glob. Econ. Financ. J. 2017, 10, 1–11. [Google Scholar] [CrossRef]

- Comes, C.-A.; Bunduchi, E.; Vasile, V.; Stefan, D. The Impact of Foreign Direct Investments and Remittances on Economic Growth: A Case Study in Central and Eastern Europe. Sustainability 2018, 10, 238. [Google Scholar] [CrossRef] [Green Version]

- Cismaș, L.M.; Curea-Pitorac, R.I.; Vădăsan, I. The impact of remittances on the receiving country: Some evidence from Romania in European context. Econ. Res. Ekon. Istraž. 2020, 33, 1073–1094. [Google Scholar] [CrossRef]

- Aggarwal, R.; Peria, M.S.M. Do Workers’ Remittances Promote Financial Development? In World Bank Policy Research Working Paper No. 3957; World Bank: Washington, DC, USA, 2006; Available online: https://ssrn.com/abstract=923264 (accessed on 25 April 2020).

- Gupta, S.; Pattillo, C.A.; Wagh, S. Effect of Remittances on Poverty and Financial Development in Sub-Saharan Africa. World Dev. 2009, 37, 104–115. [Google Scholar] [CrossRef]

- Amuedo-Dorantes, C.; Pozo, S. Workers’ Remittances and the Real Exchange Rate: A Paradox of Gifts. World Dev. 2004, 32, 1407–1417. [Google Scholar] [CrossRef]

- Siddique, A.; Selvanathan, E.A.; Selvanathan, S. Remittances and Economic Growth: Empirical Evidence from Bangladesh, India and Sri Lanka’ Department of Economics; Discussion Paper 10.27; University of Western Australia: Perth, Australia, 2010; Available online: https://www.business.uwa.edu.au/__data/assets/pdf_file/0006/1371948/10-27-Remittances-and-Economic-Growth.pdf (accessed on 30 October 2020).

- Jawaid, S.T.; Raza, S.A. Workers’ remittances and economic growth in China and Korea: An empirical analysis. J. Chin. Econ. Foreign Trade Studies 2012, 5, 185–193. [Google Scholar] [CrossRef] [Green Version]

- World Bank Database. Available online: https://data.worldbank.org/ (accessed on 20 April 2020).

| Authors | Sample/Period | Methodology | Results |

|---|---|---|---|

| [6] | 113 countries/1970–1998 | Panel data | The results indicate a negative effect of remittances on economic growth, emphasizing the moral hazard involved in remittances. |

| [26] | 11 countries of Eastern Europe/1990–1999 | Panel data | Positive effect of remittances on economic growth; both directly and indirectly. |

| [8] | 100 developing countries/1975–2002 | OLS regression | Results demonstrate that economic growth is strongly affected by remittances, especially in countries with less developed financial systems. |

| [27] | 162 developing countries/1970–2003 | Panel data | The remittances bias will most probably cause economic growth in the long-term; especially in surroundings where higher quality political and economic policies and institutions are present. |

| [28] | 12 CEE countries/1996–2010 | Balanced panel data | Remittances negatively affect economic growth. |

| [29] | Tunisia/1970–2010 | Autoregressive distributed lag (ARDL) approach | Results point to limited support about long-run causality. However, there is evidence of significant bidirectional causality between remittances and economic growth in the short run. |

| [30] | 74 developing countries/1989–2015 | Regression analysis | Remittances are positively related to economic growth and private consumption expenditure. |

| [31] | Togo/1974–2015 | Vector equilibrium correction method | Results indicate a long-run bidirectional Granger causality between remittances and economic growth. On the other hand, no evidence of short-run causal relationship. |

| [32] | seven countries from CEE/2010–2016 | Panel data | Economic growth is positively affected by remittances. |

| [33] | Romania and 11 CEE countries/1996–2017 | Quantitative analysis by using econometric models | The short-run impact of remittances on GDP was found in CZE and LTU, while a long-run influence was established in six CEE countries (BGR, CZE, EST, HUN, LTU and LVA). |

| Variable | Level | First Difference |

|---|---|---|

| Constant | Constant | |

| loggdp | −2.292968 | −3.832254 *** |

| logremitt | −0.622565 | −11.33219 *** |

| Lag | LogL | LR | FPE | AIC | SC | HQ |

|---|---|---|---|---|---|---|

| 0 | 272.4123 | NA | 1.87 × 10−6 | −7.511453 | −7.448213 | 0 |

| 1 | 278.9771 | 12.58254 | 1.75 × 10−6 | −7.582698 | −7.392976 | 1 |

| 2 | 285.3659 | 11.89031 | 1.63 × 10−6 | −7.649054 | −7.332850 | 2 |

| 3 | 288.1967 | 5.111091 | 1.69 × 10−6 | −7.616575 | −7.173890 | 3 |

| 4 | 293.3681 | 9.049891 | 1.64 × 10−6 | −7.649113 | −7.079947 | 4 |

| 5 | 296.3164 | 4.995716 | 1.69 × 10−6 | −7.619899 | −6.924251 | 5 |

| 6 | 299.4423 | 5.123083 | 1.74 × 10−6 | −7.595620 | −6.773490 | 6 |

| 7 | 299.5422 | 0.158164 | 1.94 × 10−6 | −7.487283 | −6.538673 | 7 |

| Causality | Chi-Sq | p-Value |

|---|---|---|

| gdp => remitt | 0.873135 | 0.6463 |

| remitt => gdp | 2.130258 | 0.3447 |

| Variable | Level | First Difference |

|---|---|---|

| Constant | Constant | |

| loggfcf | −2.460988 | −7.624597 *** |

| logfdi | −2.757498 | −6.350376 *** |

| Causality | Chi-Sq | p-Value | |

|---|---|---|---|

| gdp => remitt | gdp | 0.877709 | 0.6448 |

| fdi | 1.177458 | 0.5550 | |

| gfcf | 0.607318 | 0.7381 | |

| ALL VARIABLES | 3.004699 | 0.8083 | |

| remitt => gdp | remitt | 1.681587 | 0.4314 |

| fdi | 8.675453 | 0.0131 ** | |

| gfcf | 4.379550 | 0.1119 | |

| ALL VARIABLES | 14.64851 | 0.0232 ** |

| Variance Period | Variance Decomposition of gdp | Variance Decomposition of remitt | ||||||

|---|---|---|---|---|---|---|---|---|

| gdp | remitt | fdi | gfcf | remitt | gdp | fdi | gfcf | |

| 1 | 100.00 | 0.00 | 0.00 | 0.00 | 17.18 | 82.82 | 0.00 | 0.00 |

| 6 | 79.40 | 5.20 | 10.84 | 4.55 | 16.32 | 81.09 | 1.38 | 1.22 |

| 12 | 78.86 | 5.29 | 11.33 | 4.52 | 16.32 | 81.08 | 1.38 | 1.22 |

| 18 | 78.85 | 5.30 | 11.34 | 4.52 | 16.32 | 81.08 | 1.38 | 1.22 |

| 24 | 78.85 | 5.30 | 11.34 | 4.52 | 16.32 | 81.08 | 1.38 | 1.22 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Depken, C.A., II; Nikšić Radić, M.; Paleka, H. Causality between Foreign Remittance and Economic Growth: Empirical Evidence from Croatia. Sustainability 2021, 13, 12201. https://doi.org/10.3390/su132112201

Depken CA II, Nikšić Radić M, Paleka H. Causality between Foreign Remittance and Economic Growth: Empirical Evidence from Croatia. Sustainability. 2021; 13(21):12201. https://doi.org/10.3390/su132112201

Chicago/Turabian StyleDepken, Craig A., II, Maja Nikšić Radić, and Hana Paleka. 2021. "Causality between Foreign Remittance and Economic Growth: Empirical Evidence from Croatia" Sustainability 13, no. 21: 12201. https://doi.org/10.3390/su132112201

APA StyleDepken, C. A., II, Nikšić Radić, M., & Paleka, H. (2021). Causality between Foreign Remittance and Economic Growth: Empirical Evidence from Croatia. Sustainability, 13(21), 12201. https://doi.org/10.3390/su132112201