There is a growing call for companies’ sustainability reports to reflect sector-specific ESG indicators [

6,

7,

8,

9,

10]. A sustainability report is a report published by companies to report the impact of their daily operational activities in economic, social, and environmental terms, also highlighting the link between companies’ values, strategies, and governance models with their commitment towards sustainable development [

11]. SR in this regard refers to companies’ communication of its ESG practices to its stakeholders in line with its commitment toward sustainable development. In the same vein, SP in this study is defined as companies’ observable outcomes and tangible progress with respect to ESG activities aimed towards the achievement of the SDGs while improving the quality of life of employees, local communities and society at large with due care for the environment [

12].

2.1. The Environmental, Social and Governance Concept

The environmental, social and governance (ESG) concept is an amalgamation of three distinct disciplines which may overlap with issues in one discipline typically impacting on or being impacted by elements of the other two [

13]. ESG has become a must-have goal for sustainability [

14]. The increasing demand for sustainability has pressured companies to disclose sustainability information about their ESG activities. Companies have optimally integrated sustainable development into their business model, and this is viewed as being more ethical and conscious. Such companies are likely to relate better with environmentally engaged citizens and loyal customers who are also concerned about the environment, health and well-being of their communities [

15].

On the one hand, ESG is being recognised as financially material, especially for highly diversified investors [

16]. Consequently, companies are disclosing material ESG information, even though the specific information that is material may vary across companies and industries [

16]. To this end, ESG has been instrumental in successfully incorporating sustainability into the financial mainstream as listed companies are increasingly ESG-rated [

17,

18]. Investors are factoring ESG screening into decision-making processes and they are bringing their sustainability lens to their investment analysis [

18].

There is emerging evidence that ESG contributes to the long-term financial performance of a company [

19,

20,

21]. This means that if a company wants to focus on long-term profits, practicing pro-ESG actions would reduce risks and increase future profitability. While a good balance between sustainability performance (SP) and SR is important, companies that improve both their ESG performance and disclosure stand to increase financial performance, though ESG performance is more critical in future profitability (the long-term) while ESG disclosure is more important for profits (short-term) [

20]. Companies that report high ESG performance are likely to experience more resilience during both normal and turbulent times [

21].

2.2. The Role of Sustainability Reporting and Consequent Greenwashing

The demand for sustainability reporting (SR) reform has risen significantly and is mainly being driven by a growing consensus between mainstream investors who are beginning to connect sustainability to financial performance. While some companies may have adopted the motto ‘do good and talk about it’, sceptics have criticised this stance pointing to reporting-performance portrayal gaps [

22]. In some instances, sustainability reports have been dubbed “fairy tales” as companies fail to ‘walk their talk’ [

22]. Moreover, some companies have been accused of greenwashing tendencies and as a result they are under increasing pressure to ‘do good’ beyond regulatory obligations and for more than financial benefits [

4]. Unfortunately, SR of which ESG is a subset has been seen as a tool to facilitate greenwashing. ESG is also used strategically to maintain, defend or repair societal legitimacy [

23]. However, companies are striving to prioritise stakeholder demands regarding material aspects of ESG as a form of accountability to maintain a societal license to operate [

22].

According to [

24], the impact of ESG disclosure on profitability, performance, and value cannot be ignored. Reference [

24] immediately cautions that perceived/potential greenwashing behaviour decreases perceived value. In fact, [

24] further states that greenwashing scandals have had serious consequences for companies ranging from the loss of trust and loyalty from consumers, shareholders, socially conscious investors, consumers’ attitudes towards the company leading to revolt against the company.

Nevertheless, in their attempt to address pressure from stakeholders, some unethical managers may tend to resort to using SR as a legitimacy tool to justify a company’s continued existence in society by greenwashing. Greenwashing is a phenomenon that emerged as sustainability’s ‘evil twin’ [

25]. The increasing prevalence of the greenwashing phenomenon casts doubt and scepticism on bona fide sustainability policies thereby undermining the very essence of sustainable development [

25].

2.3. ESG and Different Industries

References [

26,

27,

28] argue that industries/sectors should be responsive to pressures from the local society concerning their license to operate [

29]. Therefore, ESG ratings of industries within the context of a highly regulated setting at the Johannesburg Stock Exchange (JSE) are compared to examine if companies respond to sector-specific sustainability aspects of ESG [

30]. Companies on the JSE may have demonstrated how they have managed to imbed ESG into their operations by aligning their business models with sustainable development.

However, some industries face more public scrutiny than others because of more stakeholder pressures and demand for more transparency and compliance [

6]. In fact, “companies from different industries have different priorities for different stakeholders” [

31] (p.5). This article contributes to the body of knowledge by assessing a renewed analysis of ESG data to determine if companies in different industries respond differently to prioritising ESG-SP activities.

References [

32,

33] pointed out that progressive companies adopt a multi-fiduciary posture by incorporating what stakeholders indicated as a priority in their ESG report to account for diverse stakeholders’ needs and interest [

34,

35]. Companies in dirty industries such as mining and energy are likely to improve sustainability benchmarks and create a win-win model for business and society by addressing environmental and social concerns in ways that increase profitability [

36].

Industry characteristics determine the weights that companies apportion to ESG and this is attributable to the relative importance of ESG factors which vary by sector due to the specificities of the industries [

14]. Reference [

14] posits that while governance issues are generally sector-neutral, social and environment factors are highly sector-relevant. Furthermore, [

14] indicates that ESG weights are varied not only by the industry but also by countries with different environmental, economic, geographic, and political characteristics. According to [

14], current ESG factors do not necessarily take into account country-specific and/or industry-specific management environments [

14]. It is therefore worthwhile to study the ESG criteria based on industrial differences. According to [

14], materiality is different for each country, industry, and company but companies that focus on industry-specific materiality issues have been shown to perform better. While there are sector- and county-specific contextual determinants of ESG they are also largely dependent on national context or history, culture and tradition, as well as factors such as governance gaps, political reform, and socioeconomic priorities [

37]. Moreover, [

37] indicates that powerful external drivers such as regional and global governance must be taken into consideration. Reference [

37] found that while individualised sector-specific prioritised ESG indicators showed that the environmental domain was common; corporate governance appeared the primary focus while the social domain which perhaps reflect the effect of country- and sector-specific needs, was the most variable in Saudi Arabia private-health sector.

Therefore, the content and focus for ESG disclosures are different from one sector to another [

38]. According to [

38], ESG reports need to cater to stakeholders’ needs based on solid materiality matrices relevant for the company and industry in which it operates. Reference [

38] alludes that significant differences with respect to companies’ ESG disclosure are due to different social contexts, country classifications and their stakeholders whereby companies in riskier sectors may use ESG disclosure as a way to show responsibility [

37]. This is in line with [

39]’s assertions that ESG priorities vary by sector in a sense that capital-intensive industries such as coal, oil, natural gas, and chemical are more exposed to environmental problems than labour-intensive industries such as retailing which are more inclined to social problems associated with human rights issues and compliance with international labour standards [

39].

Reference [

7] indicated that ESG reporting is strongly correlated to the sector in which a company operates. This means that a set of common rules for companies that operate in different sectors may be required as companies are impacted differently by external sectorial events as well as negative effects connected to the sector [

40].

Since the materiality of specific ESG factors varies by industry sector, the sector-specific nature of ESG materiality warrants for supplementary ESG disclosures with sector-specific information [

41]. In the same vein, core mandatory disclosures should be supplemented with more flexible, principles-based approaches [

41].According to [

41] ESG screening criteria have increased remarkably over time and ESG investing is now associated with a reduction of stakeholder risk. As a consequence, high ESG ranked funds have less overlap with all other funds than low ESG ranked funds. Reference [

41] found evidence that the relative market value loss of the High ESG ranked funds is lower than the loss experienced by the Low ESG ranked counterparts in the time span with lower volatility [

41].

On the other hand, [

40] examined the role of ESG performance during the market-wide financial crisis, triggered in response to the COVID-19 global pandemic. A combination of core indicators common to all companies, and sector-specific indicators were used to form ESG scores. The study found that among the three dimensions of ESG, governance (G) is the most important, whereas the importance of environmental (E) and social (S) risks vary by sector. Furthermore, high-ESG portfolios remain consistently higher than that of the low ESG group and that high-ESG portfolios generally outperform low-ESG portfolios [

40]. Reference [

42] supports the notion that ESG scores need to be tailored to reflect data that is relevant to its industry sector.

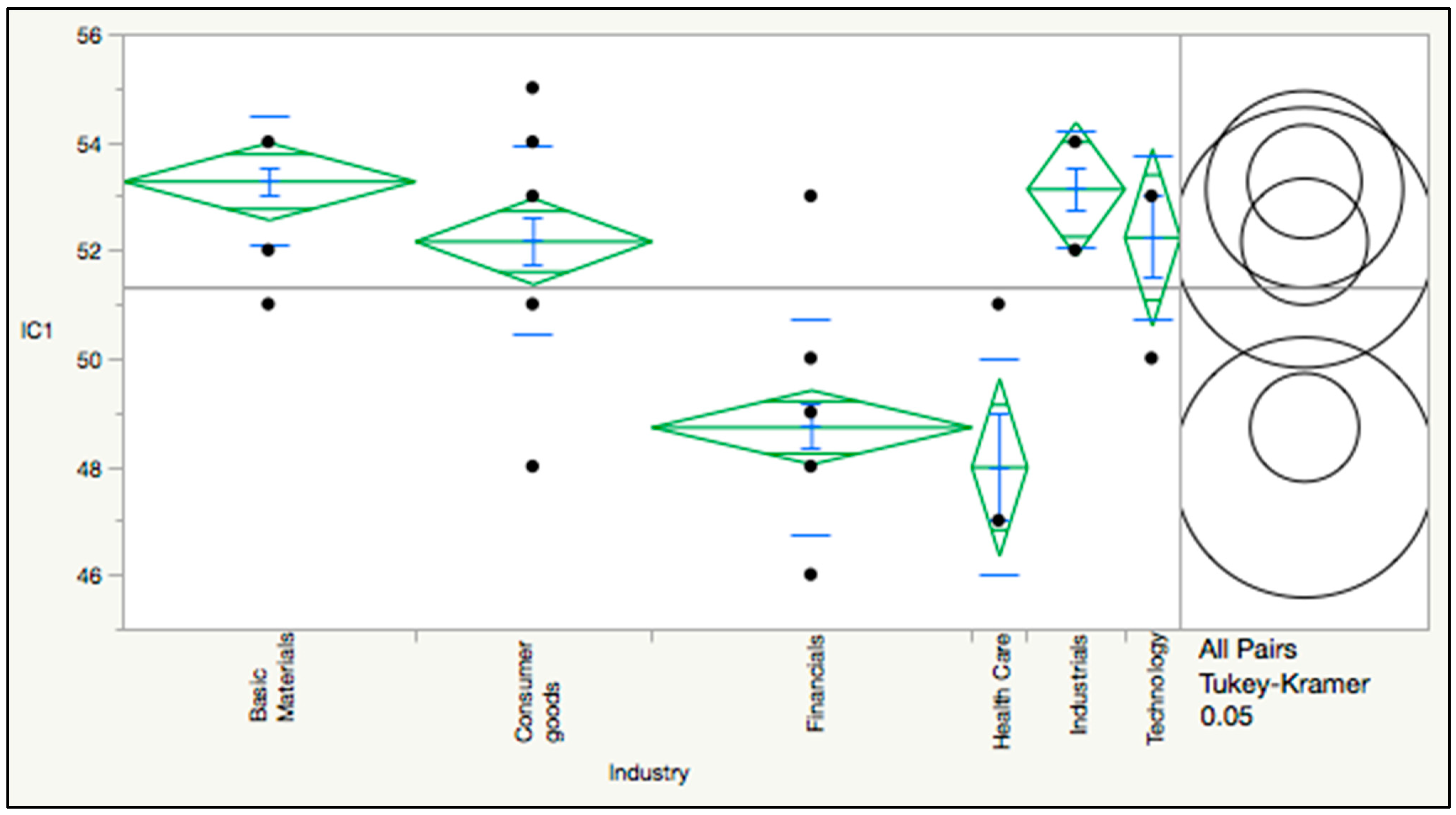

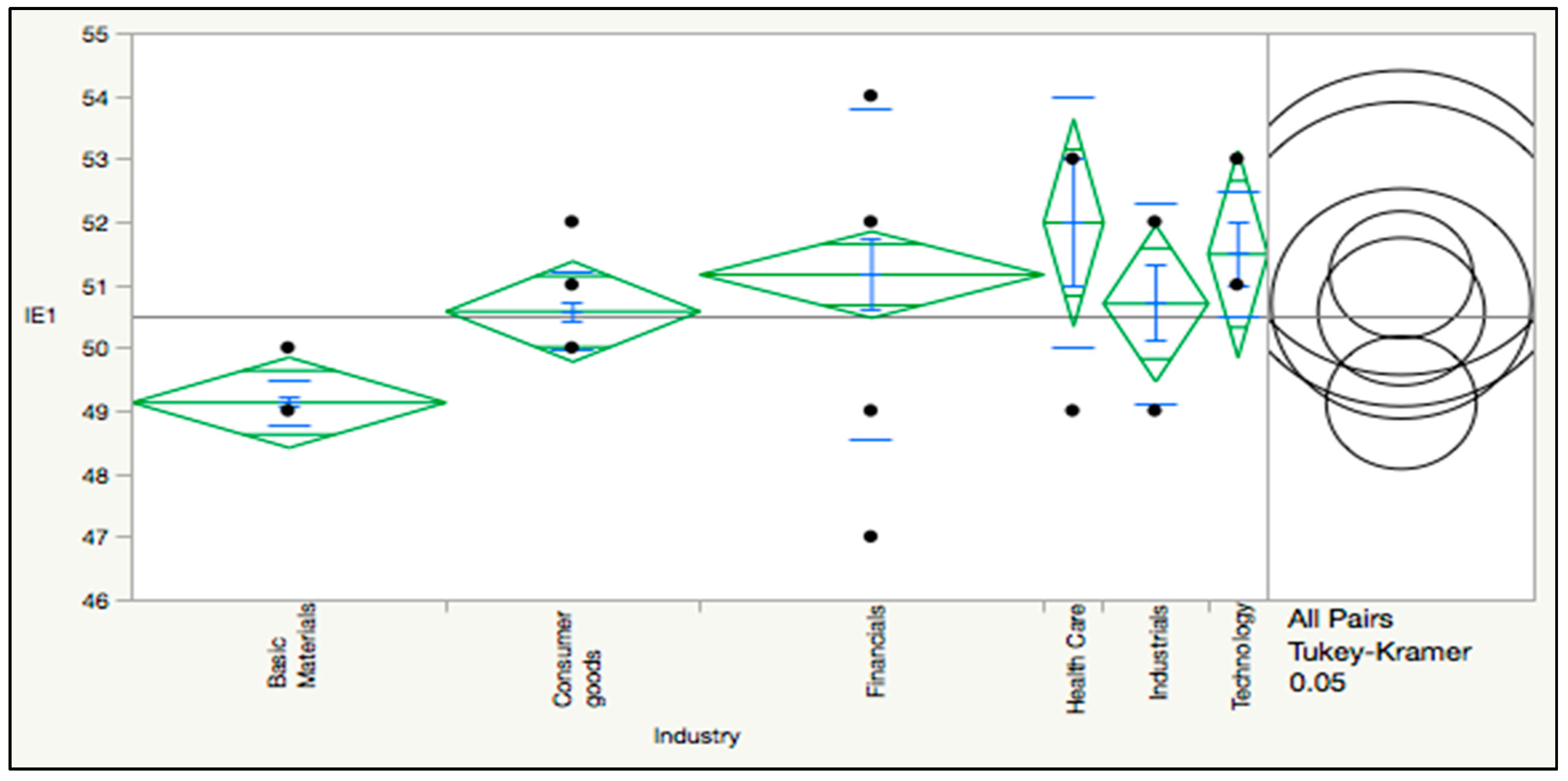

Reference [

43] performed a sector analysis of the 12 sectors represented on the US Dow 30 Index according to their entropy contribution in each of the ESG pillars, relative to each other. The relative performance of each sector to the average sector performance was analysed to determine which sectors communicate ESG well, and which sectors distort the information content of the corresponding ESG measure. The study found that the healthcare, defence, and automotive sectors are conveying unclear messaging within the environmental and social pillar, while the financial, consumer goods, and industrial sectors convey messages very efficiently in these pillars [

43]. Another key finding was that sectors with clear, lean, and flexible governance structures, such as automotive, IT, and travel, are most effective in messaging [

43].

Referene [

31] analysed ESG indicators of 52 companies in the logistics sector worldwide. The results show that the sector does not agree on the materiality of sustainability indicators. Contrary to prior research that found the tendency of companies in the same industry showing compatible patterns in SR, and differences in materiality of sustainability indicators across industries, Reference [

31] found that more than 70% of the indicators, do not exhibit compatible patterns of what logistics companies value as material sustainability indicators. According to [

31] developing sector-specific guidelines on sustainability indicators could enhance clarity and stimulate compatible reporting patterns with regard to material sustainability indicators.

Reference [

14] developed an ESG framework specific to South Korea which is regarded as an emerging country by international rating agencies where ESG is also considered as well-managed. The study therefore factored amongst others; country-specificities such as the level of ESG investment whereby the results show that institutional investors place more importance on environmental and governance factors compared to social factors. According to [

14] ESG weightings should be varied not only by the industry and rating providers but also by countries with different environmental, economic, geographic, and political characteristics [

14].

It is clear that industry effects in ESG reporting requires an industry-sensitive approach to sustainability and that further standardisation may be necessary to level the playing field whilst at the same time considering the sectorial nature of companies’ operations [

44]. Although cross-industry studies may produce results that are generalizable to associated industries, sector-specific studies allow inferences relevant for advancing sector-specific matters [

45]. As such, companies in a specific industry may have greater justification for ESG practices than others and therefore are keener to report the outcomes thereof. Reference [

6] emphasises the importance of sector-customised metrics because such metrics allow companies to track and measure progress. Sector-specific ESG disclosure requirements may be used to supplement standard disclosure items [

45].

2.5. A Case for Regulatory Mechanisms

Empirical studies show that the drive by companies to portray high SP to their stakeholders and regulatory authorities may facilitate greenwashing through manipulation of organisational sustainability data, defiance or avoidance responses to disguise externalities and poor SP [

64,

65,

66,

67,

68,

69,

70]. The greenwashing concept is an umbrella term used to characterise superficial and misleading sustainability information [

71]. However, there are scholars who consider greenwashing for only environmental issues, distinguishing it from the term ‘blue-washing’ which normally stands for social or human rights issues, or ‘pinkwashing’ for health issues for example breast cancer). Other researchers consider greenwashing a social and environmental phenomenon [

72].

Greenwashing here is an expansive term which refers to activities by companies aimed to conceal negative externalities and questionable corporate practices through unsubstantiated self-laudatory claims which are misleading [

73]. Stakeholders can be deceived by sweeping sustainability claims which may not be easy to discern whether a company is making untruthful claims or not [

74]. This points to the growing pressure on policymakers to fill the regulatory vacuum through mandatory disclosures and performance [

75,

76]. Regrettably, the vacuum created a breeding ground for greenwashing which is also perpetuated by a lack of consensus on the measurement of SP. Reference [

77] attributes this vacuum to the ineffectiveness of mandatory performance and lack of universal standards and frameworks.

Reference [

78] found that both concealment and attribution are strategies adopted by manipulative companies to sway the impressions of stakeholders by overstating good news to gain legitimacy. Reference [

78] further explained that concealment may involve obscuring or masking negative externalities and outcomes using corporate rhetoric to persuade stakeholders in a company’s favour, therefore deliberately confusing them with information asymmetry.

2.6. The Johannesburg Stock Exchange (JSE) Listing Requirements

The JSE is the first stock exchange worldwide to introduce a sustainability index measuring companies on sustainability indicators related to ESG practices. The South African experience demonstrates that integrated reporting is not just an academic exercise [

79]. This makes South Africa the most suitable setting for ESG research [

80]. It can be argued that the concept of sustainability and sustainable development finds more resonance in the South African context and that the FTSE/RI Index companies are indeed championing sustainable business practices.

Moreover, stakeholders are incorporating ESG considerations into their benchmarks and investment decisions. The increasing demand for ESG information has been notable as investors want to implement ESG investment strategies, and therefore, the JSE utilises FTSE Russell’s ESG Ratings and data model tools. The data model is customised to cater for companies’ needs with clear definitions and rules for assessing ESG practices.

The model determines the overall rating which is broken down into three (3) underlying pillars namely: environmental, social and governance. Over 300 indicators are individually researched to cater for ESG aspects focusing on key operational issues.

The FTSE Russell’s ESG Ratings and data model is made up of 14 themes viz: biodiversity; climate change; pollution and resources; water security; supply chain: environmental; customer responsibility; health and safety; human rights and community; labour standards; supply chain: social; anti-corruption; corporate governance; risk management; and tax transparency [

81]. The themes are aligned with the UN Sustainable Development Goals (SDGs) and each theme contains about 10 to 35 indicators. An average of 125 indicators are applied per company taking account each company’s unique circumstances and operational issues. The indicators are used to produce a theme score [

81].

Based on the theme indicators, the model allocates a theme score and a theme exposure for each of the 14 themes, following which a cumulative pillar score and cumulative pillar exposure is allocated for each of the three ESGs. Thereafter, a cumulative calculation of the total ESG performance is allocated to produce a company’s ESG rating.

The FTSE/JSE RI Index has been designed to identify South African companies with leading ESG practices. To meet eligibility for FTSE/JSE RI Indices, companies should score a minimum inclusion criteria of a 2.5 overall ESG Rating [

81]. Constituents of the FTSE/JSE RII with an ESG Rating below 2.4 are at risk of removal from the index.

Furthermore, companies listed on the JSE should adhere to King IV™ Governance Code which became mandatory in 2017 [

82]. The JSE amended its listing requirements in May 2017 after the Institute of Directors in Southern Africa (IoDSA) released the final version of King IV™. Under the amendments, listed companies do not have the choice that non-listed companies have—the choice to apply only some of the King Code principles and explain the ones they have not applied. Listed companies must apply all the latest King Code principles.