1. Introduction

The UK’s commitment to become net-zero carbon by 2050 means that new energy efficient homes have a role to play in the transition toward carbon neutrality. Furthermore, issues related to poor housing including health and well-being, affordability and flexibility could be addressed through building resilient homes and communities.

The Government committed to delivering 300,000 homes per year by the mid-2020s to provide for an increasing population and address years of under-supply [

1]. However, at the current rate, only 160,000 homes are built on average each year [

2,

3]. Meanwhile, the UK has passed laws to end its contribution to global warming and bring all greenhouse gas emissions to net-zero by 2050 [

4]. Currently, the residential sector, which comprises approximately 27.6 million homes, accounts for 27% of national energy demand and contributes approximately 15% of greenhouse gas emissions, amounting to 66.9 MtCO

2e [

5,

6,

7]. According to Yeatts et al. [

8], it is projected that building-related greenhouse gas emissions could rise to 21% unless immediate action is taken. Therefore, if the UK is to meet the 2050 target, there must be an urgent transition toward energy efficient, zero-carbon homes and communities [

9].

In order to decarbonise UK housing by 2050, it is clear that existing stock must be retrofitted with improved energy efficiency measures and zero-carbon technologies [

10]. For example, on average, 60% of energy demand from the residential sector comes from space-heating, which can largely be attributed to poor thermal integrity of the building envelope in existing housing stock [

6]. However, whilst existing stock needs desperate improvement, delivering new energy efficient and zero-carbon homes is also imperative in the decarbonisation challenge [

11]. The Energy Saving Trust [

12] calculated that, if just 200,000 homes were to be built each year between 2019 and 2032 without a ‘2050-ready’ homes policy, these would emit 43 million tonnes of avoidable CO

2 emissions between 2019 and 2050. A recent report by the Committee on Climate Change [

9] asserts that it is not prohibitive to build homes to the required design specification so as to meet carbon reduction targets, and it is much cheaper than forcing retrofit later. As well as considering the operational energy impact of homes, the embodied energy impacts of materials used in construction must also be taken into account, which can contribute up to one-fifth of whole-life carbon impacts [

13].

Presently, the mainstream model of speculative housebuilding in the UK is not ready to build homes to the standard necessary to ensure the 2050 net-zero-carbon target is achieved, and current policy and regulations are not fit to support the decarbonisation transition with respect to housing [

5,

12,

14]. Furthermore, the speculative housebuilder model produces homes that are not designed for specific end-users or communities [

14]. On the other hand, group self-build housing presents a bottom-up approach that can provide more environmentally and socially sustainable homes and empowered communities [

15]. However, whilst group self-build housing may be part of the solution, such community-led models are not able to deliver at the scale necessary to meet the decarbonisation challenge [

16]. Their degrees of success vary, with common problems encountered related to finding and buying land, planning, financing, skills gaps and self-governance [

17,

18]. Furthermore, it is difficult to replicate certain approaches due to specific project challenges and different funding mechanisms, often with a reliance on government grants [

19].

This paper focuses on eco self-build community (ESBC) housing, embodied by the 33-home Water Lilies pilot scheme in Bristol, UK. It is argued that ESBC housing is a potentially scalable approach to developing environmentally and socially sustainable community housing that enables residents to design their own homes and decide how their community functions. Water Lilies is a net-zero-carbon scheme that comprises 21 plots for self-finish houses and 9 custom-build apartments.

Figure 1 shows the Water Lilies site plan and

Figure 2 shows a 3D visualisation of the scheme.

For the self-finish houses, residents design the layout of their home with the project architect and the main contractor constructs the building envelope (i.e., foundations, external walls, external windows, external doors, floors, and roof) as designed. Residents complete the fit-out through one or a combination of the following: employ contractors (i.e., builders, electricians, plumbers, etc.), project manage themselves, and DIY [

20].

Figure 3 displays an example layout for plot 6 and an empty plan that the end-users can use to design their own internal layouts. For the custom-build flats, residents can choose from a range of fit-out options provided by the developer, and the homes are completed by a builder contracted by the ESBC housing developer [

21]. Each home is constructed with sustainably sourced timber frame and designed with a high degree of thermal insulation. Furthermore, every home is fully serviced with electricity, water, and fibreoptic broadband from main utilities. The scheme incorporates renewable and clean technology, including solar PV panels connected to a microgrid with a 222 kWh battery for storing and sharing energy, and air source heat pumps for space-heating and hot water [

20].

As shown in

Figure 1, the scheme has a shared garden and community building at the centre of the site with parking underground. The shared garden, community building, and other facilities are jointly owned by the residents through a not-for-profit company, Water Lilies Estate Management Company (WLEMC). WLEMC is made up of members and an elected board of directors, and all members can participate in group decision-making. The purpose of WLEMC is to manage the community assets and maintain them to a high quality in perpetuity to benefit the residents of Water Lilies and the wider community.

As of October 2021, Water Lilies was undergoing construction from the main contractor and the first phase of self-finish houses (plots 2 to 5 on

Figure 1) had been handed over to residents to complete their fit-outs.

Figure 4 is a photograph of the Water Lilies site taken during construction in October 2021. The remaining self-finish houses are expected to be handed over by December 2021 and the custom-build flats (blocks 18, 19, 24, and 25 on

Figure 1) are expected to be complete by February 2022.

The ESBC model of development is led by a specialised developer, Bright Green Futures, and aims to overcome the challenges usually faced in self-build and community-led schemes whilst offering the positive environmental and social benefits [

22]. Prior to this paper, ESBC housing has only been discussed as a potential model of developer-led self-build community housing [

23]. This model has since been formalised through the work of Bright Green Futures. Using the pilot scheme, Water Lilies, as a case study, this is the first paper to discuss ESBCs as a functioning model of developer-led self-build community housing that can deliver social and environmental sustainability and contribute towards the UK’s net-zero-carbon transition. It can be argued that the model is scalable in theory, but for ESBC housing to scale up, the market needs to be understood. Drawing on recent data, this research addresses this gap in knowledge by analysing the current market for ESBC housing and, as a result, identifies the challenges and potential opportunities for growth. Consequently, the core aim of this paper is to address the research question: what are the main factors that influence people’s purchasing decisions with respect to ESBC housing compared to conventional self-build and custom-build housing, and to what extent does the current ESBC development model satisfy the market, using Water Lilies as a case study? This has been broken down into the following more detailed objectives:

Define the key characteristics of ESBC housing and how it differs from speculative housing and various forms of individual and community self-build housing through an extensive literature review, including an investigation of relevant case studies;

Gain an in-depth understanding of the market for ESBC housing by analysing data from potential consumers on the factors influencing their purchase decisions and comparing this to the market for conventional self-build and custom-build housing;

Evaluate the extent to which the ESBC development model satisfies the market and what further development of ESBC schemes is needed to facilitate their future expansion.

To contextualise ESBC housing, the following subsections briefly discuss the literature on speculative housing and forms of grassroots and developer-led self-build, custom-build, and community-led housing. Firstly, it describes how speculative housing can lead to issues with design, construction quality, sustainability, and community because the model prioritises cost and efficiency. It then discusses self-build, custom-build, and forms of community-led housing as alternative models of housing that have the potential to address the problems associated with speculative housing. It further highlights the key barriers that make it difficult for individuals and groups to initiate and complete these types of projects. It provides examples of developer-led self-build, custom-build and community housing schemes which demonstrate that developers may be able to overcome the key barriers to deliver such housing at scale. Finally, it introduces ESBC housing as a developer-led approach to enabling community-led housing that facilitates end-user design flexibility, a sense of community, and net-zero-carbon building in a single development model. Moreover, it describes the development process and design principles that underpin ESBC housing.

1.1. Speculative Housing

The largest speculative housebuilders construct the majority of new homes in the UK—in 2017, speculative housebuilders delivered 63% of all new homes [

24]. As a result, these housebuilders have a great responsibility in shaping the development of homes and communities. The speculative housebuilder model is typically dependent on product and process standardisation [

25] and limits innovation [

26]. Standardisation reduces design fees and labour costs through the use of familiar and repeatable construction methods that do not require further training, and enables planning and building regulations to be achieved more easily on the basis of largely accepted house designs [

27,

28]. Ultimately, this results in a cost-effective and efficient model of development which maximises profits [

27] but can be lacking in terms of design quality [

14,

29], construction quality [

14] and sustainability [

30].

With respect to speculatively built homes, Nash [

31] argues that “homes have no sense of place, do not encourage community spirit and offer extremely low space and design standards.” It has been observed that speculatively built homes, more often on greenfield land, lack ‘character and identity’, and are ‘indifferent to context’ [

29]. Parvin et al. [

14] claim that the speculative housebuilder model leads to a ‘one-size-fits-all design’ because the homes are designed for imaginary end-users, basing their ability to find buyers on local market data. In effect, this model has no input from future homeowners [

32]. Furthermore, the way homes are designed in the UK is not up to speed with changes in lifestyles and the size of family groups, which can manifest as single-parent families, home-working, people living with parents, and aging people with limited mobility [

33]. As household structures and lifestyles have shifted, more varied and flexible house designs are required [

30].

As well as poor design quality, construction quality is also suffering. Parvin et al. [

14] assert that, due to the profit-driven nature of speculative housebuilding, developers seek to design structures that minimise both construction risks and build costs wherever possible, which in turn produces lower quality, lower energy performance homes that have less space and less flexibility. These issues can be exacerbated by economic shocks. For example, the UK housebuilding sector faced shortages in materials, skills, and labour because of the 2008 financial crisis [

3]. According to Callcutt [

34], poor-quality design or construction will be the root of economic and social problems that will be expensive to resolve, with issues beyond the defects themselves. Considering housing represents 59% of the nation’s wealth, producing high-quality housing is vital, otherwise the sector will become a drain on future investment [

34].

Furthermore, Parvin et al. [

14] contend that the speculative housebuilder model isolates end-users as they play no part in the production process and future neighbours are whoever happens to live next-door. A 2019 study by Skipton Building Society [

35] reinforces this claim, showing that, in the UK, 73% of people do not know their neighbours by name and 20% would only interact with them if they needed something. Thus, it seems clear that homes should be designed and constructed to a high quality and created as part of a community where facilities, services and amenity spaces are easily accessible. Moreover, the urban environment should be designed and maintained to a high standard and familiarity and trust between neighbours constitutes a vital local support network.

1.2. Self-Build and Custom-Build Housing

Self-build and custom-build housing are both routes to homeownership where individual buyers and groups are involved in the production of their own homes [

36,

37,

38]. Self-build and custom-build housing not only offer high-income households the opportunity to express free choice, but self-build also offers low-income households the ability to build smaller homes on smaller plots with lower build costs, thus providing an independent living situation and access to the housing market [

39]. According to Ash et al. [

40], 20% to 30% of build costs can be saved through models of self-build procurement, and group projects can save even more due to economies of scale.

Self-build procurement results in the development of homes with greater energy performance because self-builders have a long-term interest in their home and therefore make decisions based on its whole life, considering running costs and comfort [

41]. Furthermore, the distinctive approach of developing self-build and custom-build homes results in greater architectural diversity and homes that are more closely matched with the needs of the occupants [

16].

1.3. Community-Led Housing: Cohousing and Group Self-Build

Cohousing is viewed as a means to achieve sustainable communities that foster meaningful relationships and social interaction as well as enabling low-carbon lifestyles [

42]. Such communities are founded and developed on the basis of particular values, which tend to be focused on solidarity, inclusion, social activism and mutual support, or environmental sustainability [

43]. Cohousing, as a product of its various approaches, can offer common space and shared facilities, collaboration by residents, emphasis on the collective organisation of services, and togetherness and sense of community [

44]. There are key design considerations including; density and layout, the division of public and private space, and the quality, type and functionality of communal space; which are intended to build trust, encourage social interactions, and develop social networks, social rules and norms between residents [

45]. Based on core values and community-orientated design, cohousing can cultivate a sense of community, mutual support and sense of safety [

46].

Furthermore, the dominant opinion within the industry is that group self-build housing is more likely to deliver homes that are energy efficient than speculatively built homes [

15]. It is common for cohousing communities to build with sustainable design and construction principles and techniques, including high levels of insulation, passive solar design, and the use of local construction materials and renewable energy systems [

47].

An advantage of group self-build (or cohousing) over individual self-build developments is that it enables housing schemes of a similar scale to speculative housing projects [

15]. For example, Lilac, Leeds, a 20-home ecological, affordable cohousing community [

19], Springhill Co-housing, Stroud, a 35-home new build cohousing scheme [

48], and Ashley Vale, Bristol, a 39-home self-build community [

23,

49]. In each of these developments, the residents were in some way involved in the planning, design, delivery, and management of their homes and communities.

Yet, whilst group self-build has the potential to provide sustainable communities of a significant scale, it is currently only responsible for a small proportion of new housing in the UK [

15]. Community groups face common barriers and obstacles that stall or halt projects. Key factors include; difficulties in purchasing land and obtaining planning permission, issues with leadership and establishing a management structure, being able to finance equitably, and the initiators of projects leaving before they are complete [

17]. Furthermore, suitable medium-sized and large-sized sites are scarce due to competition from speculative housebuilders pricing out self-builders and local authorities making little provision for these groups [

50]. External risks to community groups also exist, including policy changes, planning delays, contractors facing business difficulties, rising material and labour costs, and opposition to development [

18].

1.4. Demand for Self-Build and Community-Led Housing

The UK Government brought in legislation through the Self-build and Custom Housebuilding Act 2015 in order to mobilise the self-build housing sector by placing a duty on local authorities to keep a register of individuals and associations that wish to acquire serviced plots of land for self- and custom-build housing in their administrative area [

50]. Furthermore, The Housing and Planning Act 2016 requires local authorities to grant sufficient development permissions to meet the demand, as demonstrated in its register [

50].

The UK Government’s 2017 Housing White Paper, ‘Fixing Our Broken Housing Market’, contends that the UK should move towards innovative, diverse and sustainable housing solutions, with a focus on self-build and community-based approaches in their proposals [

2]. This is exemplified by the Council-led 1900-home self- and custom-build Graven Hill development highlighted in

Section 1.5. Furthermore, a Welsh Government initiative, the Self Build Wales scheme, has targeted £210 million investment to remove the barriers and uncertainty involved in self-build, offering applicants self-build development loans that cover 75% of the cost of the plot and all build costs [

51]. The UK Government also set up the Community Housing Fund, which made £163 million available up to March 2020, to boost the output of community-led housing several-fold [

52]. These measures aimed to encourage growth in the self-build and community-led housing sectors and reduce the dependence on major housebuilders to meet the high demand for homes in the UK.

However, the self-build sector only contributes 8% of new homes in the UK [

32]. It is commonplace across many other European countries, with over 80% of homes in Austria developed through self-build and approximately 60% in Belgium, Italy, Sweden, Norway, Germany and France [

53]. Considering 32% of people in the UK are interested in building their own home [

54], it suggests that self-build and custom-build housing could prosper with the right opportunities available. However, 83% of people are unaware of the self-build registers provided by local authorities [

54]. This demonstrates how ineffective current legislative instruments have been in supporting people to take that first step to building their own homes. The community-led housing sector is even smaller, contributing only 0.6% of total housing output in the UK [

55] and delivering approximately 400 units per year in England [

52]. Concurrently, there are more than 750 groups seeking to build [

53] and a variety of organisations that own, manage or develop community schemes including 736 Housing Co-operatives, 113 Self Help Housing Organisations, 29 Development Trusts, 19 Community Land Trusts (CLTs) and 18 Cohousing communities [

56]. There is growth in the community-led housing sector with increasing Government backing and an increasing amount of information and guidance available, through organisations such as Locality, to support community groups and enablers to deliver homes.

1.5. Developer-Led Self-Build, Custom-Build, and Community Housing

There is evidence of developers taking on the major project risks outlined in

Section 1.3 to develop housing where residents participate in the design and management of their communities. For instance, Marmalade Lane is a 42-home developer-led cohousing scheme in Cambridge where the resident group K1 Housing collaborated with developers Town and Trivelhus, and Mole Architects [

57]. The scheme innovates with sustainable pre-fabricated timber panels to create highly energy efficient homes and has communal spaces and facilities designed to foster community spirit and sustainable living [

57]. Furthermore, the residents are members of an estate management company, Cambridge Cohousing Ltd., in Cambridge, giving them a stake in communal areas and enabling them to contribute to the management of the community [

58]. Another example is HomeMade, Heartlands, an upcoming 54-home custom-build development in Cornwall led by Igloo Regeneration, which has planning in place to allow people to buy a plot and choose one of six companies to design their home with and that will build their home to completion [

59]. The customer can choose from six layouts and styles with the option to add extensions and install solar panels and electric car points [

60]. The customers are then involved in the design of the ‘village green’ as a shared community space [

59].

Each of these examples demonstrates that developers can realise socially and environmentally sustainable community housing schemes that enable residents to be involved in the design process and ongoing management of the community. They are not necessarily a replacement for grassroots community-led housing projects; however, such schemes do illustrate more robust and dependable delivery models considering the major barriers that self-builders and community groups face. In many ways, it can be argued that these schemes carry the same benefits to customers in terms of personalised design, sense of community, and sustainable lifestyles. However, there are limitations to the extent customers are involved in the design and build of their homes.

Finally, on a much larger scale, Graven Hill in Bicester is the UK’s first major self-build and custom-build development of 1900 homes being constructed over 10 years [

61]. The scheme is being led by Cherwell District Council (in the form of its own development company) to provide a mixture of homes to match demand, including for self-build and custom-build housing, and to accelerate the pace of local housing delivery [

62]. The local authority was selected as one of eleven ‘Vanguard’ councils funded by the Government to support and enable self- and custom-build housing in order to speed up and diversify housing supply [

63]. The project provides 30% affordable housing, as well as a primary school, community hall, local shops, commercial space, allotments and a renewable energy centre [

62]. Graven Hill appears to be successful in meeting demand for self-build and custom-build housing and generating a significant return and income stream for the local authority [

62]; however, there is little emphasis on community participation and customers do not take ownership of the spaces and facilities on the site.

1.6. Eco Self-Build Community (ESBC) Housing

This research presents eco self-build community (ESBC) housing as a developer-led approach to delivering environmentally and socially sustainable community housing at scale in the UK, which supports the Government’s 2050 net-zero-carbon emissions target and addresses demand for self- and custom-build homes.

1.6.1. History of ESBC Housing

ESBC housing has been developed by Bright Green Futures, following research into the Ashley Vale self-build community project, where residents developed individual plots to form an environmentally and socially sustainable scheme [

23]. The research concluded that ESBC housing could significantly reduce carbon emissions in the UK by enabling low-carbon lifestyles [

23]. Furthermore, analysis demonstrated that developing such schemes could be financially viable for developers despite greater build costs because of the premium people could be willing to pay for this type of home and service [

23]. Lastly, homes could be sold as self-finish and completed, as well as self-build, in order to have a wider appeal in the UK [

23].

1.6.2. ESBC Development Process

This is a model of community housing that operates within mainstream housebuilding practices and returns profits for investment in future schemes without relying on grant funding. The ESBC housing developer expands the role of a mainstream developer, also acting as a community facilitator [

64]. The developer provides self-finish houses and custom-build flats as part of a community development. Self-finish house customers design their homes with flexibility so that it meets their needs and preferences. The developer builds the highly sustainable building envelope, and the customers then complete the fit-out of their homes (i.e., self-finish) through a combination of project management, DIY, and employment of subcontractors [

20]. Custom-build flat customers make design choices with an interior designer contracted by the developer, and their home is constructed by a builder contracted by the developer [

21]. The ESBC developer facilitates workshops to provide support to the community group, covering topics such as sustainable building materials, heating and energy systems, project management, and employing tradespeople [

64]. The developer also establishes an estate management company for the community, which the residents develop as members. As a contract, this may stipulate rules such as a service charge and/or voluntary work for the ongoing maintenance of the community spaces and facilities [

20]. Once the homes are complete and residents move in, ownership of the site and its community assets is transferred to the community.

Table 1 describes the ESBC development process in full. In reality, there is overlap between many of the stages (e.g., marketing and sales may continue throughout project until all the homes are sold).

1.6.3. ESBC Housing Design Principles

In terms of site layout, ESBC schemes follow principles of cohousing design to support community dynamics, such as the inclusion of a community garden, common house and community facilities at the centre of the site, with parking at the periphery or underground to create a safe, traffic-free space [

65]. The common house provides a physical space for group decision-making and a multitude of uses that can also serve the wider community [

65]. Furthermore, schemes are designed to be net-zero carbon: embodied carbon is minimised in materials (such as timber frame) and construction, energy use is minimised through energy efficient and passive solar design, and most energy required by households is generated using on-site renewables and optimised through a micro-grid (where energy cannot be provided by on-site renewables, it is supplied by off-site renewable energy sources) [

66,

67]. The homes have a coherent external appearance, and the use of loadbearing timber frame external walls give self-builders maximum flexibility in the design of their internal layouts.

1.7. Literature Summary

The literature discussed in this section firstly demonstrates that speculative housing is unable to meet people’s needs, deliver quality, or shape socially and environmentally sustainable communities, whereas, grassroots self-build and cohousing drive user-centred design, energy efficiency, sustainable lifestyles, and community building. However, key barriers related to finance, planning, and land are making it difficult to meet demand for such housing in the UK. Furthermore, legislative instruments to mobilise the self-build and custom-build sector have proven to be relatively ineffective so far. This presents an opportunity for developers, that often have the resources and expertise to overcome these barriers and complexities, to innovate and deliver this unmet demand in a scalable way. Marmalade Lane, HomeMade, and Graven Hill demonstrate viable developer-led models of self-build, custom-build, and community development that have recently emerged. However, these examples do not provide a flexible design process, community building workshops, community-centred master planning, community-owned assets, and net-zero-carbon homebuilding to the extent that ESBC housing aims to. In these ways, ESBC housing tries to ensure social and environmental sustainability is delivered and maintained throughout the life cycle of the scheme.

The ESBC development process described in

Table 1 shows a theoretically scalable model of housing. However, it must be proven through the successful delivery and profitability of a pilot scheme such as Bright Green Futures’ ‘Water Lilies’ project. Moreover, there needs to be a market and it needs to be understood in relation to the market for conventional self-build and custom-build housing. This research analyses survey data of people who registered interest in an ESBC scheme (i.e., the market for ESBC housing) to understand the main factors that influence their purchasing decisions and explore how ESBC housing could be developed with this understanding. These data are compared with survey data of people interested in conventional self-build and custom-build housing (i.e., the market for self-build and custom-build housing) to understand how these markets differ. Ultimately, a robust, sustainable business model will be required to scale up ESBC housing, which could be supported by technological innovations and policy mechanisms to improve the cost-effectiveness and feasibility of developments.

2. Methods

To gain a comprehensive understanding of the market for ESBC housing, two surveys were used. Survey 1 was an online survey on Bright Green Futures’ website targeted at people interested in buying a home in the ESBC development, Water Lilies, or a similar future project. This gave people the opportunity to register interest in a plot or home in an ESBC scheme by providing their contact details and responding to a series of questions that aimed to understand their needs and preferences related to this housing solution. Survey 2 was an online survey targeted at the market for conventional self-build and custom-build housing including people that want to design and/or build their own home or are in the process of doing so. By comparing results of the two surveys, factors that might influence buying decisions could be identified and differentiated between each market if they varied significantly, though it is possible that people could be interested in both forms of housing. Thus, the factors that attract consumers to ESBC housing and conventional self-build and custom-build housing would be highlighted.

2.1. Survey Samples

Data were collected in both studies using online surveys. Survey 1 was a website survey, embedded on the website of the ESBC developer, Bright Green Futures. As Sue and Ritter [

68] state, a key advantage of using a website survey is the “ability to collect data from individuals for whom you may not have a sampling frame.” Since previous research had not been undertaken into people interested in ESBC housing, a website survey was considered the most appropriate method to both identify and collect data on a population that was yet to be established. The survey employs non-probability convenience sampling as “a non-systematic approach to recruiting respondents that allows potential participants to self-select into the sample” [

68]. The research is exploratory because it is trying to gain an understanding of a market that has not been investigated previously. Before submitting their survey responses, individuals were made aware of the Privacy Policy where it stated under the ‘Use of Data’ section that their data would be used to conduct research into sustainable housing and communities and that data used for this purpose would be anonymised with all identifiers removed. The faculty research ethics committee at the University of Bristol provided guidance on the exact wording required before the data were collected.

From the perspective of the ESBC housing developer, the priority of the survey was to collect information about potential customers that could be used to contact them regarding any relevant opportunities to purchase a home either in the Water Lilies development or in a future ESBC development. Furthermore, the primary concern of respondents is to express their initial interest and hear about potential opportunities, and thus they intend to complete the survey as quickly as possible. Therefore, the number of questions was kept to a minimum and only those of particular value were asked in order to reduce the risk of respondents ‘quitting midway’ through the survey. This meant that questions gathering personal data, such as those on gender, marital status, and qualifications, were excluded. Moreover, it was deemed that questions of this nature might suggest to potential respondents that the answers provided would be factored into the developer’s decision whether to contact them for sales or not. For example, a question asking for their highest qualification could be interpreted as a means of filtering out people without a university degree, whereas a question asking for their budget is clearly a practical limitation. It is understood that this may have been solved with a statement about the purpose of collecting demographic data, but it was ultimately judged to be a complication for respondents and the need to ensure people completed the survey and maximise the developer’s contact database was prioritised.

Survey 2 was an online survey. This adopted non-probability purposive sampling with the aim of producing a sample that was representative of the population [

69]. In this case, the population being sought was people that were looking to or were in the process of undertaking a self-build or custom-build project. It was not possible to obtain a list of people representative of this population through an organisation and directly contact them. Therefore, expert knowledge was applied instead to non-randomly select a sample of people that represented a cross-section of the population [

69]. Two approaches were used to produce this sample. Firstly, organisations that held contact databases or had followers on social media interested in self-build and custom-build housing were approached to share the survey with their contacts or followers. These included The National Custom and Self-Build Association (NaCSBA), The National Self Build and Renovation Centre (NSBRC), Self Build Wales, Buildstore, Build It Magaizine, SelfBuild & Design Magazine, and Homebuilding and Renovating. Unfortunately, only NaCSBA and SelfBuild & Design shared the survey and the others were unable to share or did not respond to requests. Secondly, a list of groups on Facebook and LinkedIn were identified and the survey was shared on these platforms directly.

It is recognised that a much smaller number of responses was obtained in Survey 2 than Survey 1, and that a greater number of responses collected from a wider range of sources would have added confidence in the level of accuracy in the data shown. However, it is regarded that enough responses were gained to provide a valuable comparison of key differences between responses from the two surveys.

2.2. Survey Design

Survey 1 was developed on WordPress and presented on the Bright Green Futures website, whereas Survey 2 was created using Microsoft Forms and shared with a link. The key questions in Survey 1 were about ‘number of bedrooms’, ‘build methods’, ‘importance of housing aspects’, and ‘budget’. Survey 2 largely mimicked these questions for direct comparison, although phrasing was adjusted where necessary to make them more relevant to a more generic target audience. There were also supplementary questions that sought to provide further understanding to some of these questions. Furthermore, Survey 2 aimed to identify reasons why living in a sustainable home is important to consumers and the additional costs they might be willing to pay for the average ESBC home than the average UK new build and average UK existing home. These questions were included in Survey 2 to explore what the main drivers for living in a sustainable home are and to what extent they influence willingness to pay for a home that would typically be provided in an ESBC housing scheme.

Table 2 shows the question topics selected for analysis in each survey.

In terms of ‘number of bedrooms’, both Survey 1 and Survey 2 gave respondents the option to say if they wanted a studio, 1 bedroom, 2 bedrooms, 3 bedrooms, or 4+ bedrooms.

For each survey, respondents could select one or more build method(s) that they were interested in. Survey 1 included

Purchasing a plot for self-build;

Self-finishing the interior of the home;

Buying a completed sustainable home.

Survey 2, was similar with questions modified to cater for a more self-build audience, and included

Survey 2 included custom-build with the self-finish option and omitted ‘sustainable’ from the completed home option because Survey 2 respondents may not be interested in sustainability, whereas Survey 1 intended to highlight sustainability as a key aspect of the homes provided by ESBC housing.

According to a 2016 survey by the Home Builders Federation [

70], price and location are the most important factors for people looking to buy a home by a considerable margin, with each chosen by 80% of respondents. Behind these two factors, 60% of respondents found off-street parking and a home with a garden to be important [

70]. For each survey in this research, housing aspects were scored in importance on an interval scale from 1 (not important) to 5 (very important), thus showing what people who are interested in ESBC housing and conventional self-build and custom-build housing prioritise, respectively. It can also indicate the potential differences with the mainstream housing market. As ESBC housing offers a range of features not usually considered in mainstream housing development, Survey 1 included aspects specific to ESBC housing, as well as price and location. Survey 2 included aspects relevant to conventional self-build and custom-build housing, many of which were the same or similar as those in Survey 1.

Table 3 shows the aspects chosen for each survey and the reasons for their inclusion/exclusion. It is worth bearing in mind that Survey 2 was designed after Survey 1. Therefore, some aspects were modified for Survey 2 to collect a wider body of evidence in some areas.

Survey 2 sought to improve upon the shortcomings and limitations of Survey 1 by splitting aspects with overlapping considerations (i.e., ‘style and construction quality’ was split into ‘construction quality’, ‘internal appearance/layout’, and ‘external appearance’) and providing greater depth to the analysis of certain housing aspects (i.e., ‘price’ is also considered through the lens of ‘value for money’). It also omitted aspects only relevant to the ESBC housing market (i.e., ‘personal design and participation’ and ‘advice and support for your build’). Furthermore, descriptions of aspects were provided to eliminate potential ambiguity. For example, ‘green lifestyle’ was defined as “low household energy use; sustainable travel choices; waste reduction; recycling” and ‘community spirit’ was defined as “sharing spaces and time with your neighbours; mutual support; local decision-making”.

The way respondents were asked to give their budget differed between Survey 1 and Survey 2. Survey 1 sought to find out what budget range people were categorised by. A shortcoming of this was that there is overlap between the budget ranges (e.g., £200k–£300k and £300k–£400k). However, it can be understood that someone who considered their budget to be £300k, for example, would put themselves in the range of £200k–£300k if they could not possibly afford a home more than £300k and in the range of £300k–£400k if they were able to stretch to pay for a home slightly more expensive than £300k. As Survey 1 was primarily being used for the purpose of grouping large amounts of data and targeting mailouts to different market segments, this approach was deemed suitable. However, if the data were to be collected primarily from a research perspective, it would have taken the same approach as Survey 2. For Survey 2, people were asked to give their budget as a number. This provides more accurate results that could still be grouped subsequently for the purposes of comparison. However, grouping the data for comparison meant that the researcher, not the respondent, would need to decide where to place respondents who gave a budget that fell between two ranges. Therefore, the categories were adjusted to be “up to” a certain figure. In this instance, those who gave a budget of £300k were put in the category “up to £300k”. This means that the data cannot be compared with complete confidence, but it provides an indication of how much people have to spend. Another small difference between the data collected for each survey was that in Survey 1, the lowest budget possible is £150k. This is because the developer does not provide homes for less than this, and therefore it is not in their interest to encourage people to register below the £150k–£200k category since it would give the impression that they can afford a home in an ESBC housing scheme. On the other hand, Survey 2 allowed people to respond with any number because it did not have this limitation.

Survey 2 explored whether living in a sustainable home is important to the market for conventional self-build and custom-build and, if so, for what reasons it is important to them. The reasons that respondents could choose from aimed to cover common aspects associated with housing and sustainability and were reviewed and refined through discussions with academics working in sustainability fields across disciplines. Respondents were asked to select up to three of the statements that were relevant to them. However, it was not possible to make this a restriction using Microsoft Forms, and therefore 7 of the 36 respondents selected more than three statements. These were included in the analysis because it was deemed fair that people may find more than three statements relevant to them.

Survey 2 aimed to explore willingness to pay for a sustainable home. It presented respondents with information about three homes: Home 1, Home 2, and Home 3, and asked them: as a percentage, how much more, if any, they would be willing to pay for Home 1 than Home 2, and Home 1 than Home 3. Home 1 was the “sustainable home” in this case and was based on an average ESBC home. Home 2 was based on an average new build in the UK and Home 3 was based on an average existing home in the UK. Information about the type of home each was based on was not given to respondents so their response would only be influenced by the SAP rating, energy sources, total energy cost, and operational CO

2 emissions (which was contextualised by the approximate equivalent number of flights between London and New York City). All the information on each home type is displayed in

Table 4.

2.3. Data Analysis

Survey 1 responses through the website were stored in the WordPress database and exported to Microsoft Excel. Survey 2 responses were stored in Microsoft Forms and exported to Microsoft Excel for analysis. Duplicates and spam responses in both surveys were identified and removed in Excel before the data were analysed through descriptive statistics, predominantly by comparing percentage responses to different question topics.

3. Results

The results cover the core question topics highlighted in

Section 2. For Survey 1, there were 1719 responses collected between 14 November 2018 and 17 February 2021. Of the 1719 respondents, 647 encountered Bright Green Futures through a search engine, 499 through social media, 360 through word of mouth, 60 through print media, 3 through the radio, and 150 did not specify. For Survey 2, there were 43 responses collected between 10 March 21 and 12 June 21. NaCSBA shared the survey through its Self Build Portal newsletter and Twitter, gaining 13 responses, and SelfBuild & Design Magazine shared it on Facebook and Twitter, gaining 9 responses. A total of 16 responses were gained by sharing the survey on the following Facebook groups: Self Build Home and Community, UK Self Builders, and Self Build and Home Alterations UK. There was one response through the Self Build & Custom Build Club group on LinkedIn and four responses from word of mouth.

Of the 43 respondents, 14 were looking to buy/develop a newly built home now (within the next 12 months), 13 were looking to buy/develop a newly built home in the future (12 months or more), and 16 were in the process of buying/developing a newly built home. For the purposes of the survey, a “newly built home” included self-build, self-finish, custom-build, and new build. There was a relatively even gender split, with 23 male and 20 female. In terms of marital status, 5 were single, 37 were married, in a civil partnership or co-habiting, and 1 preferred not to say. With respect to qualifications, 4 had a GCSE or equivalent, 7 had an A-level or equivalent, 4 had a foundation degree or equivalent, 11 had an undergraduate degree or equivalent, 15 had a Master’s degree or equivalent, 1 had a doctorate, and 1 preferred not to say.

Due to more data being available from Survey 1, respondents are also divided into sub-groups to understand their respective preferences and how they may differ. The response rate was considered too low in Survey 2 for any meaningful analysis of sub-group preferences.

3.1. Number of Bedrooms

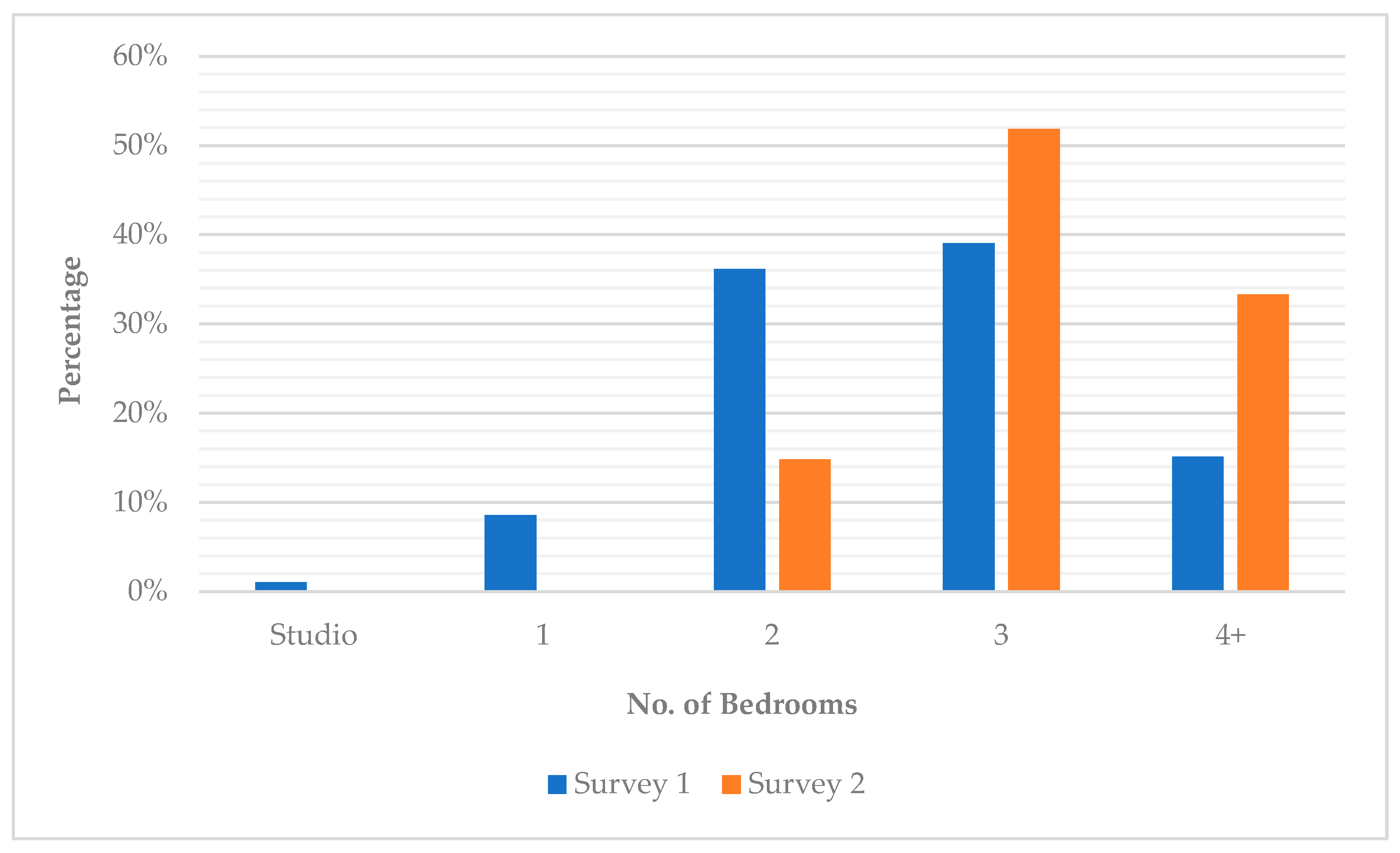

Figure 5 shows that 39% of people interested in ESBC housing wanted 3 bedrooms, closely followed by 36% who wanted 2 bedrooms. A total of 15% of people wanted 4+ bedrooms, 9% wanted 1 bedroom and 1% wanted a studio bedroom. There was less of an even distribution across the number of bedrooms people wanted for the conventional market for self-build and custom-build. A total of 52% of people wanted 3 bedrooms, 33% wanted 4+ bedrooms and 15% wanted 2 bedrooms. None of the respondents wanted 1 bedroom or a studio bedroom. This suggests that the ESBC housing market tends to attract people looking for more of a variety of home sizes, which could include flats and houses. Whereas the market for more conventional self-build and custom-build housing are seeking larger 3-bedroom and 4+ bedroom homes. A further question in Survey 2 shows that 85% were looking for a house, 4% were looking for a flat, and 11% were looking for either a house or a flat. This reinforces the view that the conventional self-build and custom-build market is generally interested in larger houses.

3.2. Build Methods

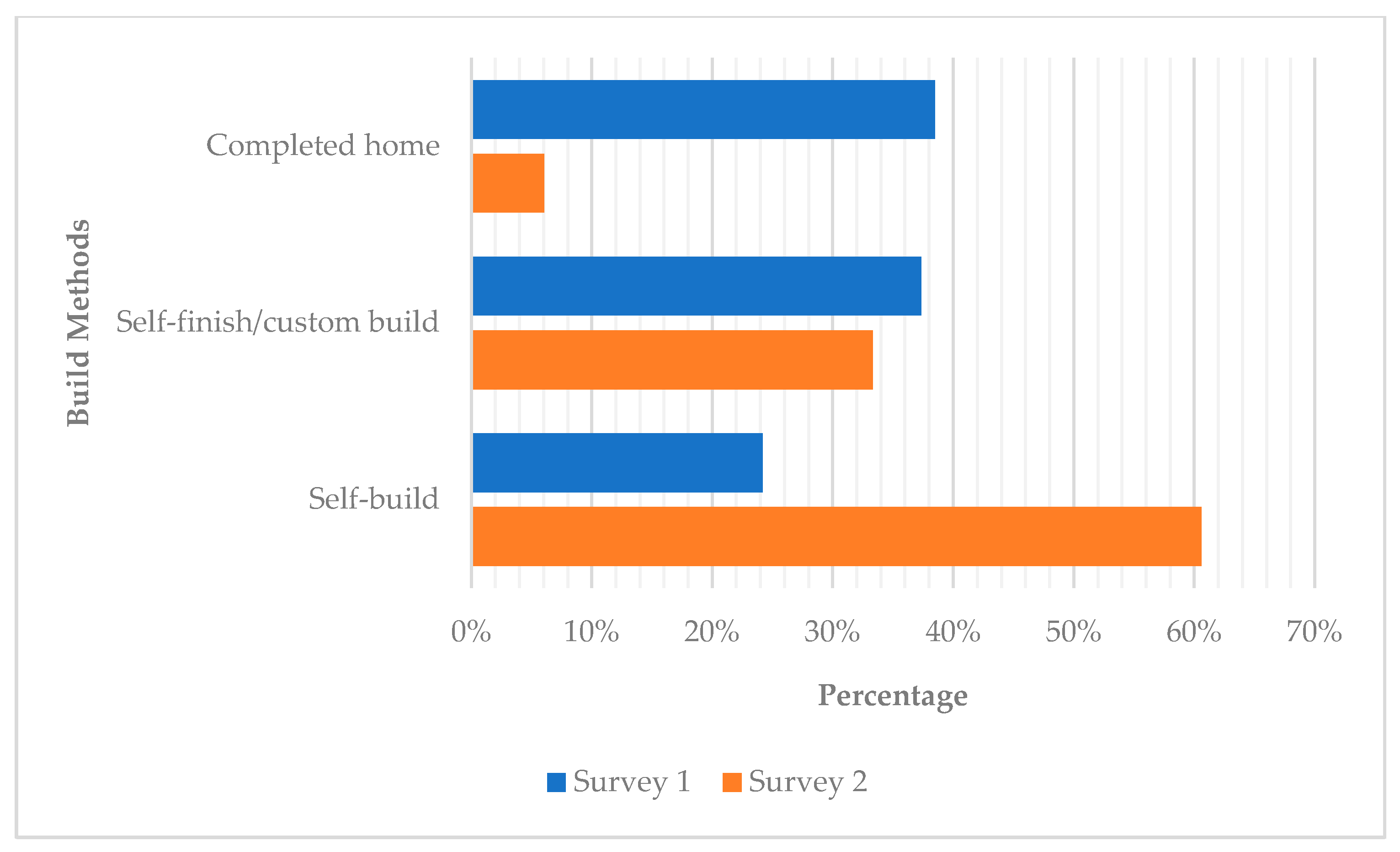

Figure 6 shows the frequency of responses for interest in each build method as a percentage. The results varied significantly between each market surveyed. For Survey 1, the most selected build method was ‘completed home’ with 39%, even though it is not a build route that the ESBC housing developer undertakes but could be commissioned in special circumstances. This compares to ‘self-finish’, which was selected in 37% of responses, and ‘self-build’ selected in 24% of responses, as the least popular build method. In contrast, for Survey 2, ‘self-build’ was by far the most popular build method with 61%, followed by ‘self-finish/custom-build’ with 33% and ‘completed home’ with only 6%.

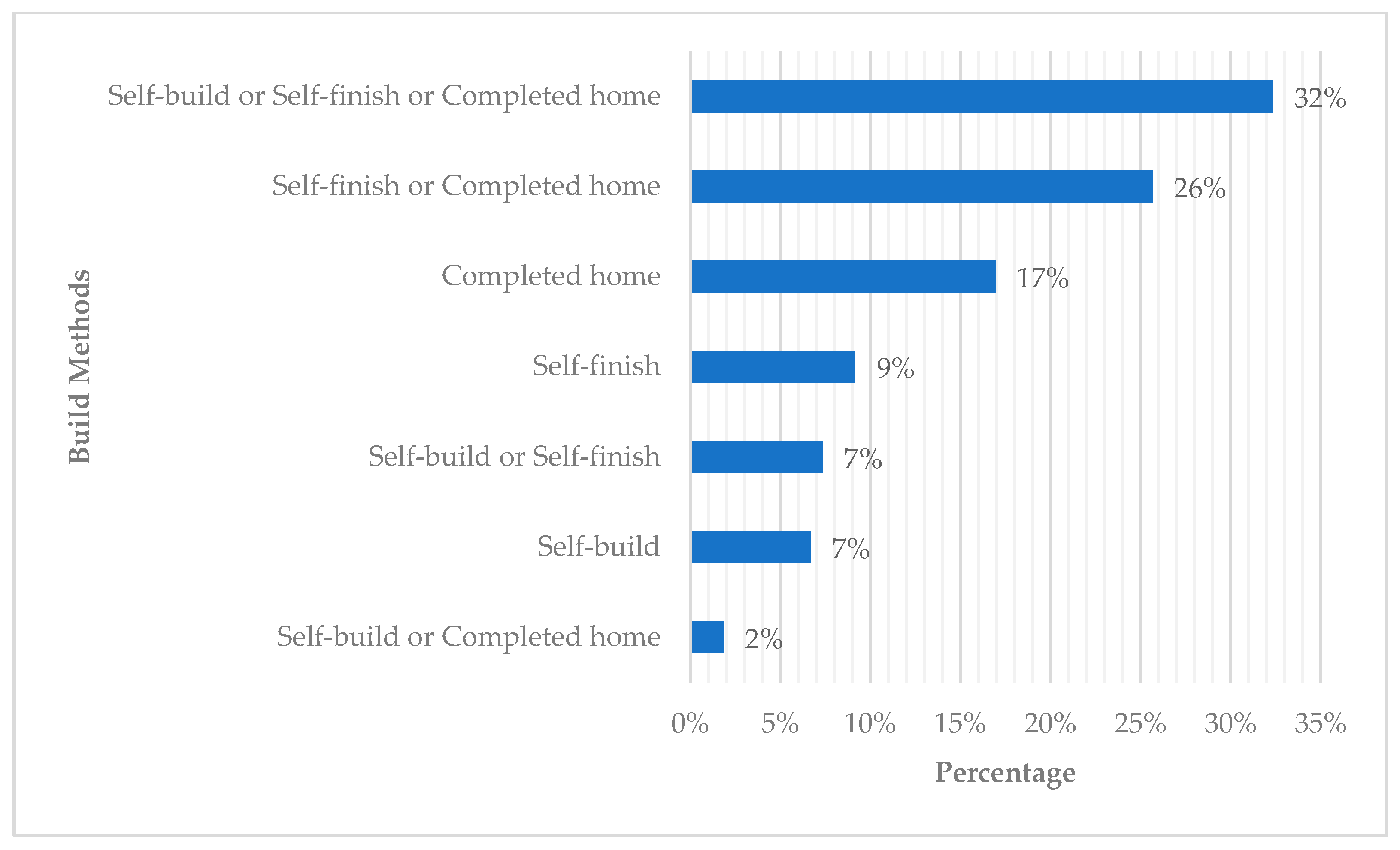

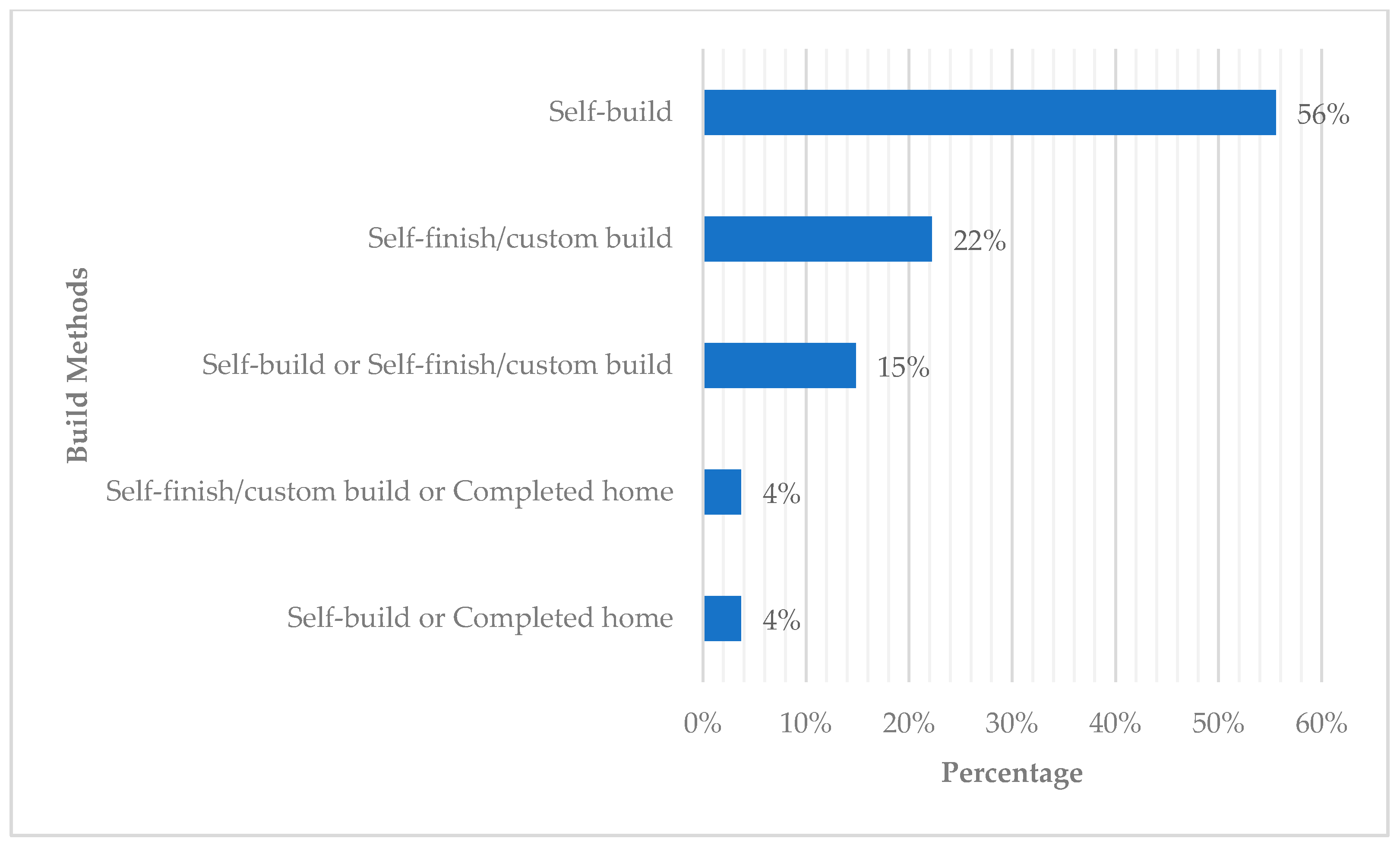

Figure 7 and

Figure 8 show the distribution of specific responses to this question, revealing where people are willing to make compromise on their build method.

Figure 7 shows that in Survey 1, 32% of respondents were interested in every build method and 26% in ‘self-finish or completed home’. ‘Completed home’ was the most selected individual response by 17% of respondents, followed by ‘self-finish’ with 9% and ‘self-build’ with 7%. In contrast,

Figure 8 shows that in Survey 2, 56% of respondents selected ‘self-build’, followed by 22% for ‘self-finish/custom-build. A small proportion of respondents were willing to compromise between two build methods with 15% for ‘self-build or self-finish/custom-build’, and 4% for both ‘self-finish/custom-build or completed home’ and ‘self-build or completed home’.

The results for Survey 1 demonstrate that more than half of the market for ESBC housing is flexible about the build method. This suggests that aspects not related to the design and/or build of homes are appealing to consumers, such as aspects of community and environmental sustainability, which are integral to ESBC housing.

Section 3.3 examines the importance of housing aspects to respondents in detail. In contrast, results from Survey 2 suggest that the conventional market for self-build and custom-build wants to be more involved in the build itself and are committed to a particular method.

3.3. Importance of Housing Aspects

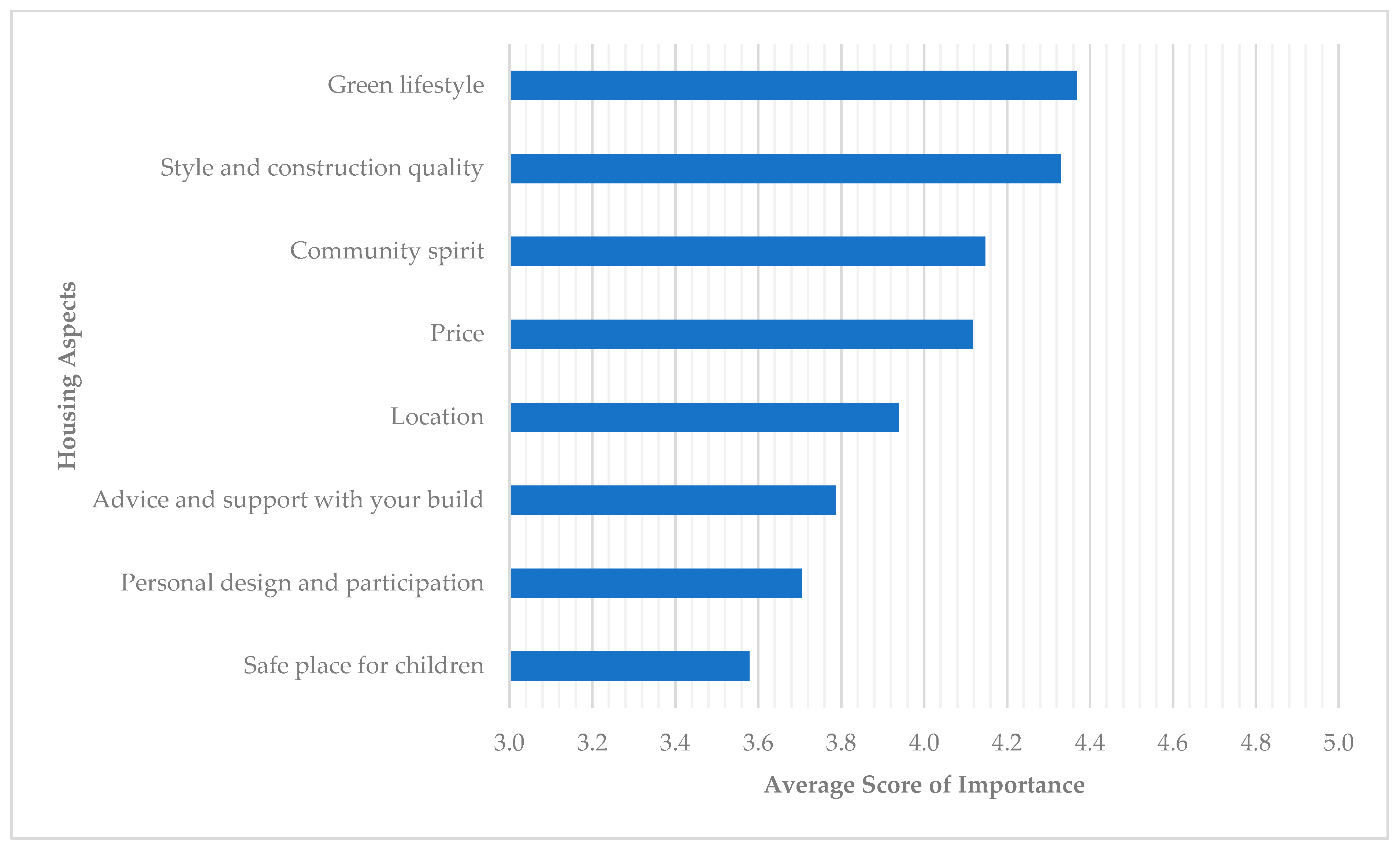

Figure 9 and

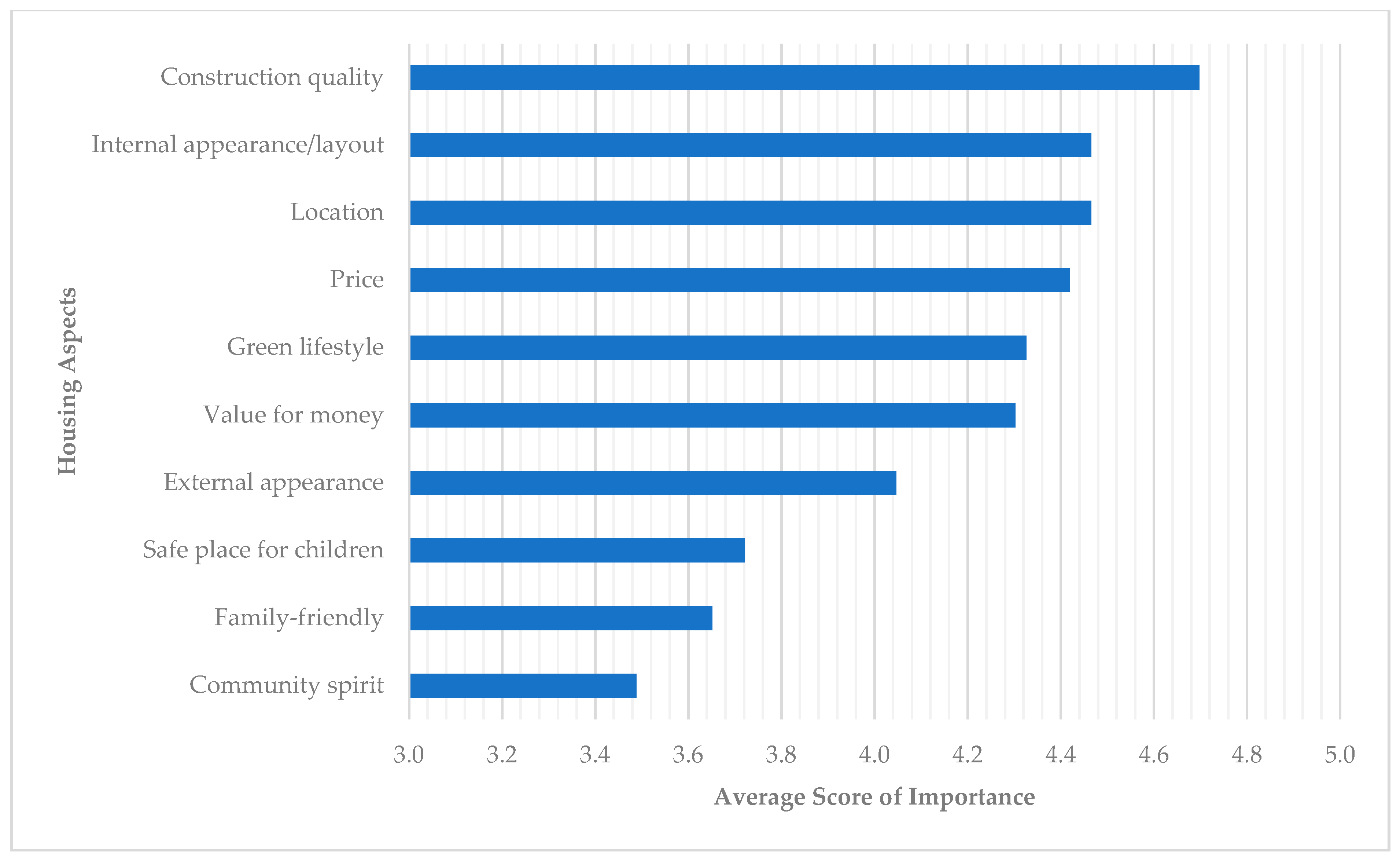

Figure 10 show the average importance of housing aspects to respondents of Survey 1 and Survey 2, respectively.

Figure 9 shows that, for Survey 1, the most important aspect for respondents on average was ‘green lifestyle’, at 4.37. ‘Safe place for children’ was the lowest score on average, at 3.58. Whilst ‘location’ was still relatively important, with a score of 3.94 on average, ‘community spirit’, ‘style and construction quality’, and ‘green lifestyle’, all score above 4 on average. The most important aspects were not the same as those identified in the survey by the Home Builders Federation (2016), which found ‘price’ and ‘location’ to be the most important for people looking for a home. ‘Location’ may not be as important for those interested in ESBC housing because this type of housing is rare in the UK and therefore, people may be aware of the limited opportunities to buy a home in an ESBC development in their desired location. Furthermore, those who completed Survey 1 would have been assuming the location of ESBC homes would be in the Bristol area, whereas this would not necessarily be true for Survey 2. Unexpectedly, the results show that ‘personal design and participation’ was scored 3.71, the second to last priority, despite it being a core aspect of ESBC housing. This is relatively low compared to other core features of ESBC housing, including ‘green lifestyle’ and ‘community spirit’, which scored 4.37 and 4.15, respectively.

Figure 10 shows that, for Survey 2, ‘construction quality’ had the highest average score of 4.7. This was followed by ‘internal appearance/layout’ and ‘location’ with 4.47 each, and ‘price’ with 4.42. ‘Green lifestyle’ had a score of 4.33, which was not much lower than scored in Survey 1, but notably was the fourth priority in Survey 2, rather than the first. Considering 94% of respondents were interested in ‘self-build’ and ‘self-finish/custom-build’, it is logical that ‘internal appearance/layout’ was a priority. ‘Community spirit’ had the lowest average score of 3.49 in Survey 2, compared to 4.15 in Survey 1 where it was the third priority. In fact, when Survey 2 respondents were asked if they would like their newly built home to be part of a cohousing scheme, only 11% said ‘yes’, 37% said ‘no’, and 52% said ‘no preference’. ‘Community spirit’ is not only achieved through cohousing and can be present in conventional housing estates and neighbourhoods. However, because conventional self-build and custom-build is usually in the form of single dwelling builds, this may explain why community was not considered a priority by this market.

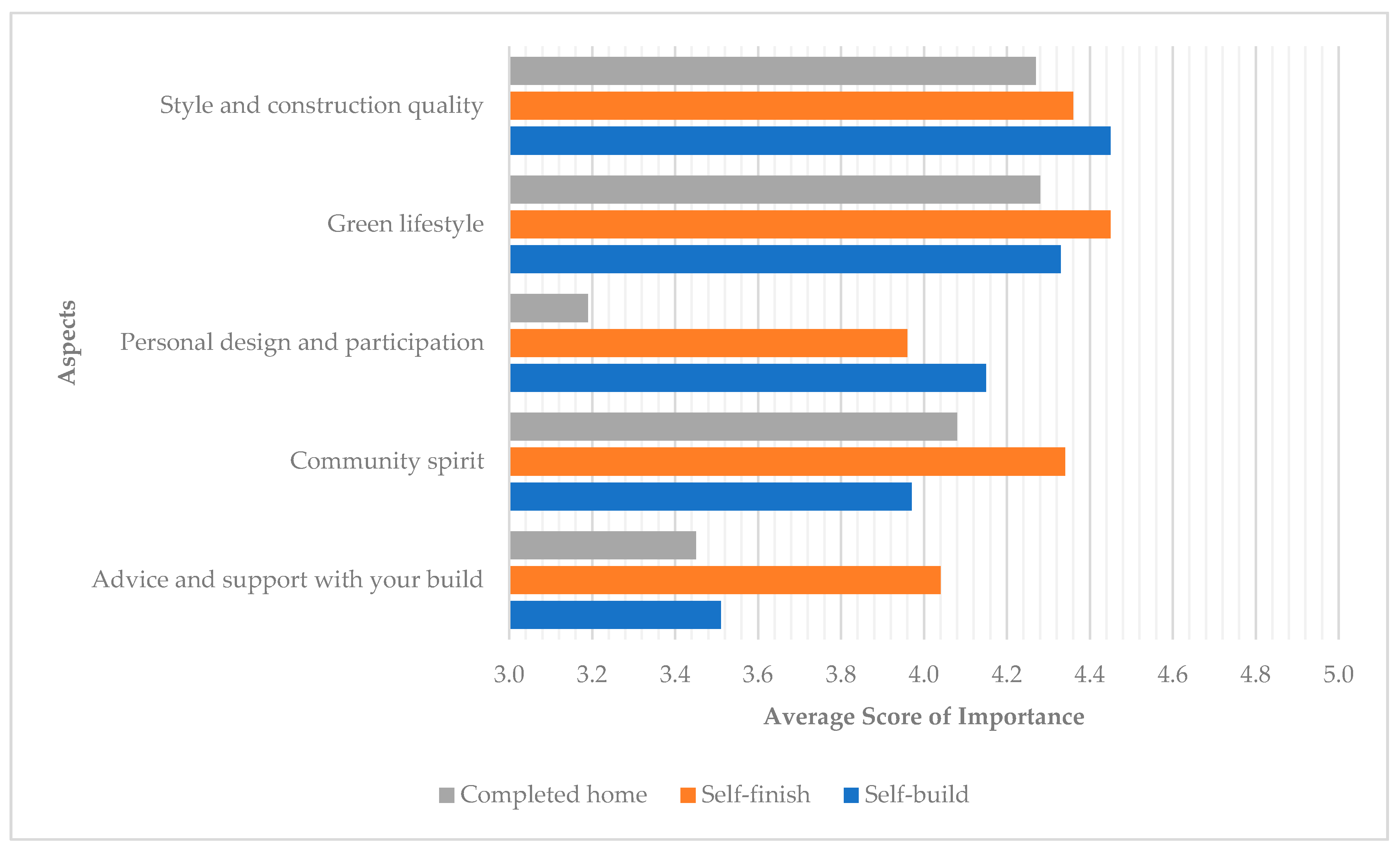

Figure 11 organises the respondents in Survey 1 into sub-groups for those only interested in one build method including ‘self-build’ (108 respondents), ‘self-finish’ (148 respondents), and ‘completed home’ (274 respondents) to demonstrate what aspects are important to different segments of the ESBC housing market. It shows that the average score for ‘personal design and participation’ was much lower for those only interested in a ‘completed home’, who gave it an average score of 3.19, compared to 3.96 in the ‘self-finish’ sub-group, and 4.15 in the ‘self-build’ sub-group. The sub-group for ‘self-finish’ gave ‘advice and support with your build’ an average score of 4.04, whereas those interested in ‘self-build’ appear to be more content taking on greater responsibility themselves, giving it a score of 3.51, and it is a less relevant aspect for those who are interested in a ‘completed home’ who gave it a score of 3.45. The sub-group interested in ‘self-build’ was less interested in ‘community spirit’ than the average respondent, giving it a score of 3.97. This compares to 4.34 in the ‘self-finish’ sub-group and 4.08 in the ‘completed home’ sub-group.

What is particularly striking about the results is that ‘construction quality’ is considered a top priority in both surveys. This suggests that those interested in ESBC schemes and conventional self-build and custom-build housing see these approaches as ways of acquiring a home built to a higher quality. In the case of Survey 1, this could be because the market sees that either high sustainability standards promised in ESBC schemes or participation in the design and/or build will result in high-quality construction. For Survey 2, this could be because of the quality control people have through self-build, self-finish, and custom-build.

3.4. Budget

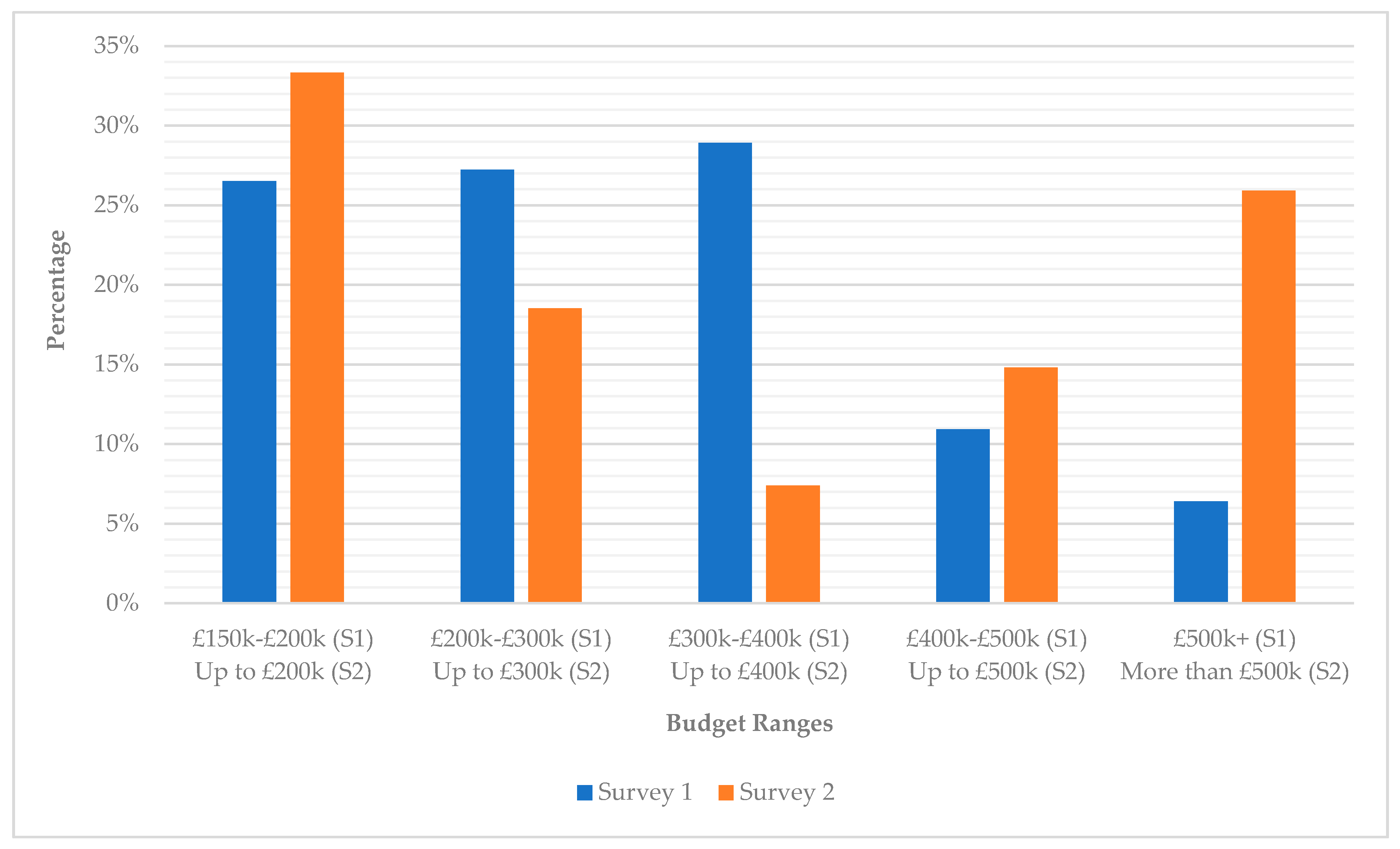

Figure 12 shows the percentage of respondents in each budget range in Survey 1 and Survey 2. The percentage of respondents with budgets up to £300k is relatively similar in each survey: 54% in Survey 1 and 52% in Survey 2. However, there are significant differences between the two surveys for higher budget groups. Survey 1 has 29% in the £300k–£400k range and 11% in the £400k–£500k range, with only 6% of respondents in the £500k+ range. In comparison, Survey 2 has 7% in the “up to £400k” range and 15% in the “up to £500k” range, with 26% of respondents in the “more than £500k” range. This shows that the market for ESBC housing attracts people with a variety of budgets, but a relatively small percentage fall into the top two budget ranges. Whereas a relatively high percentage of the conventional market for self-build and custom-build in Survey 2 have the much higher budgets required for larger homes on larger parcels of land, which can be typical of one-off self-build developments. For Survey 2, most budgets in the “more than £500k” category far exceeded £500k, going as high as £1,100,000. In this budget range, the average percentage of their budget respondents could finance through their own resources was 78%, compared to 50% as an average across all respondents. This suggests that the conventional market for self-build and custom-build have significant capital to spend on their homes upfront, especially those in the higher budget ranges.

3.5. Importance of Sustainability

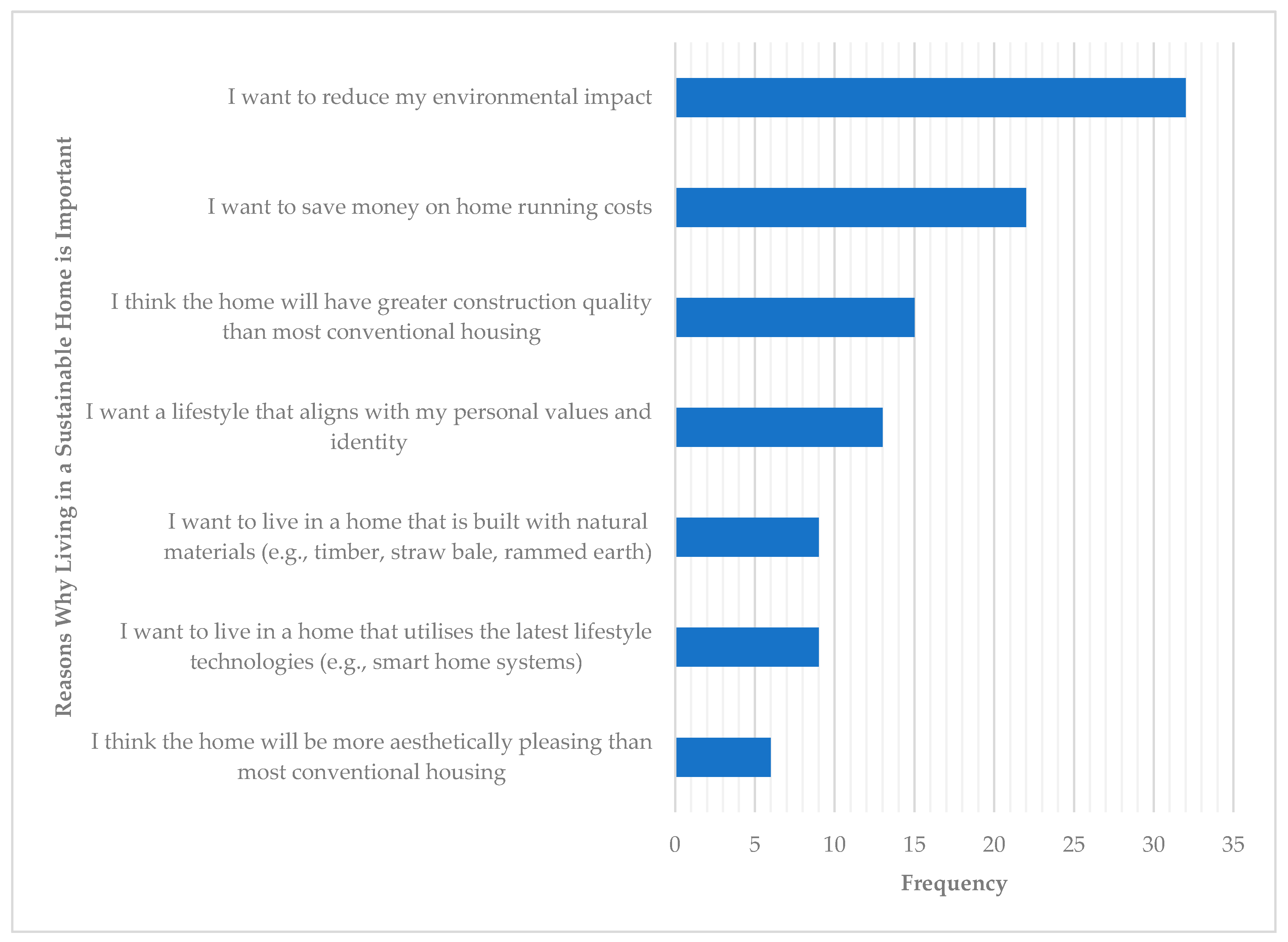

A total of 84% of respondents to Survey 2 said that living in a sustainable home is important to them. As shown in

Figure 13, from these 36 respondents, the statement ‘I want to reduce my environmental impact’ was selected 32 times. This was selected considerably more than any other reason. ‘I want to save money on home running costs’ was selected 22 times. This was followed by ‘I think the home will have greater construction quality than most conventional housing’, which was selected 15 times. This suggests that many people see that a well-constructed home is a sustainable home, and that conventional housing may not be able to deliver this quality. This argument is reinforced in

Section 3.3 where ‘construction quality’ was the most important housing aspect in Survey 2 and ‘style and construction quality’ was the second most important aspect in Survey 1, just behind ‘green lifestyle’. Ultimately, both the market for ESBC housing and the market for more conventional self-build and custom-build housing may perceive their respective routes to housing as being able to deliver high-quality construction and sustainability in a way that conventional housing might not. ‘I want a lifestyle that aligns with my personal values and identity’ was selected 13 times, showing that over one-third of respondents are aware of how their housing choice and values and identity are interlinked. ‘I want to live in a home that is built with natural materials (e.g., timber, straw bale, rammed earth)’ and ‘I want to live in a home that utilises the latest lifestyle technologies (e.g., smart home systems)’ were both selected by one-quarter of respondents, which highlights that interest in sustainable materials and technologies—the actual features of a home—is a key reason why living in a sustainable home is important to some. ‘I think the home will be more aesthetically pleasing than most conventional housing’ was only selected 6 times, which indicates that sustainability is not necessarily seen by many as a driver of aesthetics in a home. However, results in

Section 3.3 show that ‘internal appearance/layout’ was the joint second most important housing aspect in Survey 2, and therefore respondents likely see aesthetic qualities being achieved through design choice offered in self-build and custom-build.

3.6. Willingness to Pay for a Sustainable Home

The data from Survey 2 show that on average, people would spend 27% more on Home 1 (average ESBC home) than Home 2 (average UK new build), and 37% more on Home 1 than Home 3 (average UK existing home). The characteristics of these homes are described in

Section 2.2,

Table 4.

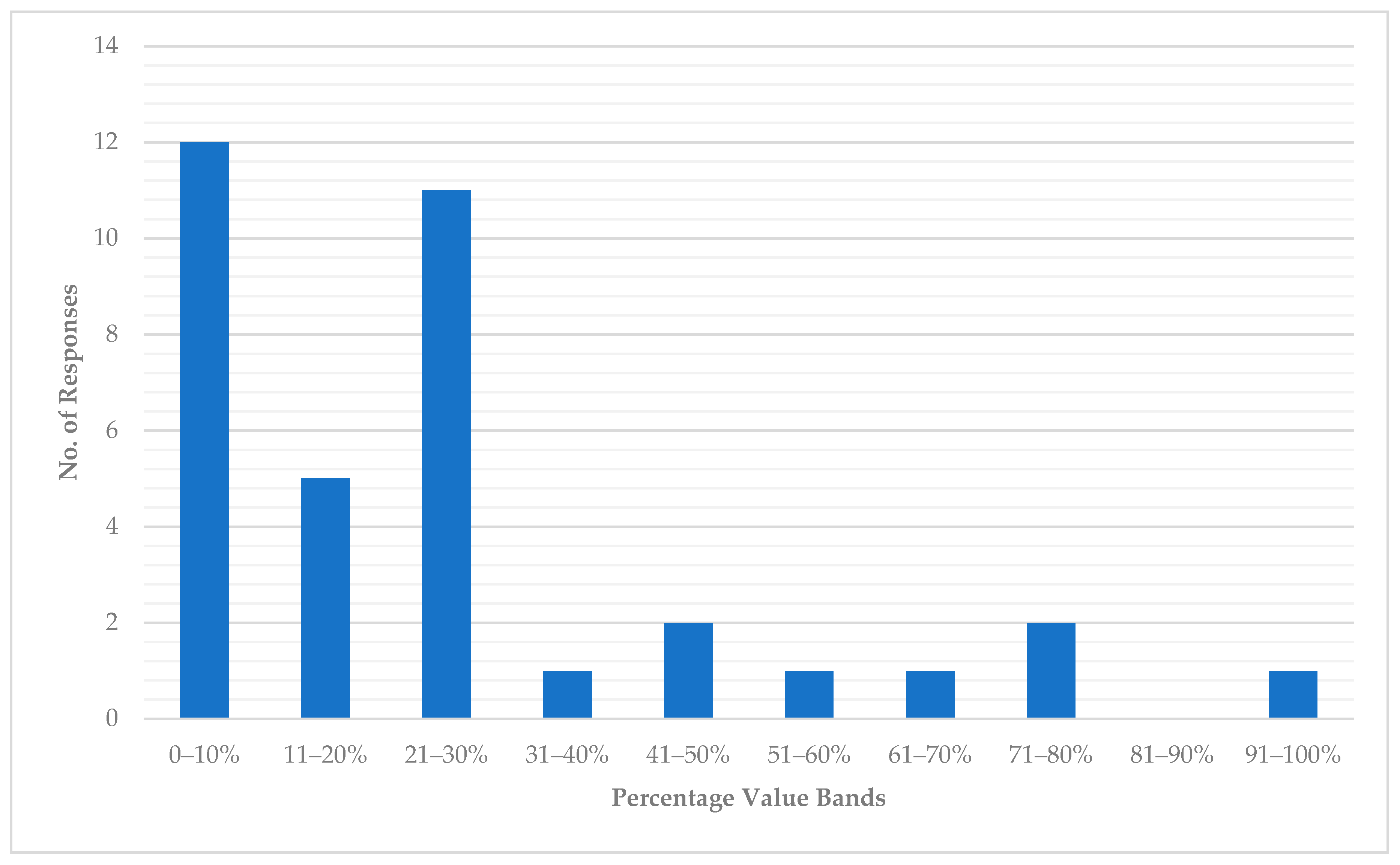

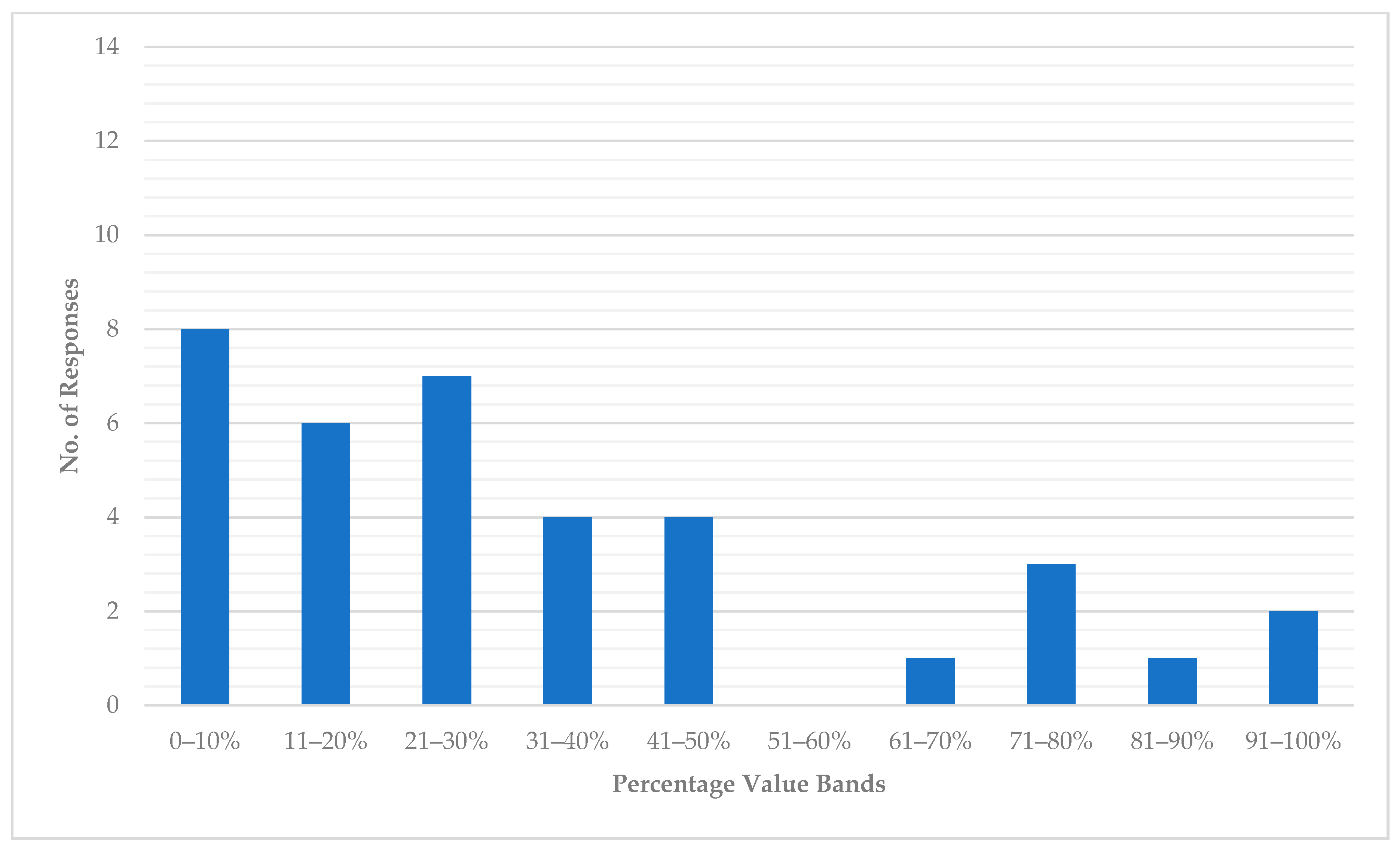

Figure 14 and

Figure 15 show the number of responses in each percentage value band, which represent how much more people would be willing to pay for Home 1 than Home 2 and Home 1 than Home 3.

Figure 14 shows that 12 out of 36 respondents would be willing to spend 0–10% more for Home 1 than Home 2. This falls to 5 respondents in the 11–20% value band and rises sharply up to 11 respondents in the 21–30% value band. The number of respondents drops to 1 in the 31–40% value band and remains low up to the 91–100% value band. This seems to suggest that most people interested in self-build and custom-build would be willing to pay up to 30% more for a highly sustainable home than the current standard of the average new build home in the UK, and some would be willing to spend even more. In comparison,

Figure 15 shows a more even distribution of respondents across the percentage value bands. There are 8 in the 0–10% value band, 6 in the 11–20% value band, 7 in the 21–30% value band, and then it falls to 4 in both the 31–40% value band and 41–50% value band. There are none in the 51–60% value band and a small number across the remaining value bands. This demonstrates that people concerned with living a sustainable home would be willing to pay a significant amount more for one than the typical homes on the market, and this rises when the environmental profile of the alternative worsens. As shown in

Section 3.5, the two most selected reasons why living in a sustainable home is important to respondents were ‘I want to reduce my environmental impact’ and ‘I want to save money on home running costs’. Hence, when presented with information on the operational CO

2 emissions and energy costs for each home type, respondents show they would be willing to pay more for the sustainable home. An analysis of

Figure 14 and

Figure 15 illustrates that people interested in self-build and custom-build put a considerable monetary value on the sustainability of a home and

Section 3.5 suggests the main drivers for this.

4. Discussion

This section discusses the key findings and evaluates the extent to which ESBC housing satisfies the market, using Water Lilies as a case study, and what further development of ESBC schemes is needed to facilitate their future expansion.

As shown in

Section 3.1, ESBC housing attracts people looking for a range of dwelling sizes.

Table 5 illustrates the dwelling types and number of bedrooms in the Water Lilies development. This shows that a variety of dwelling types and sizes are available. Furthermore, the houses enable users to decide the number of bedrooms they want through the self-finish approach. Since 39% were looking for a 3-bedroom home and 15% for a 4+ bedroom home, the scheme accommodates these segments of the market. However, the flats in Water Lilies do not necessarily reflect the potential demand because 9% of the market are looking for a 1-bedroom home, of which there are eight flats, and 36% of the market are looking for a 2-bedroom home, of which there are four flats. On this evidence, compared to the conventional market for self-build and custom-build, which can be seen to attract people seeking larger houses, ESBC housing should continue to offer a range of dwelling sizes and consider providing a greater proportion of 2-bedroom homes in future schemes.

The results from

Section 3.2 show that the market for ESBC housing is largely open to more than one build method, but with a greater preference for purchasing a completed home and self-finish than self-build. In fact, those who selected a single build method: only 7% selected ‘self-build’ and 9% ‘self-finish’ compared to 17% that selected ‘completed home’. ESBC housing does not currently provide completed homes; however, the custom-build approach offered on flats only requires buyers to participate in two design sessions and the home is completed for them. In future schemes, this approach could be replicated for a proportion of houses so that people are still able to benefit from a home designed to their requirements, but without the responsibility of self-finishing. Based on the findings, there is an argument that ESBC housing should provide completed homes. However, this would conflict with the principles of the development model and the important role participating in the design and delivery of one’s home, including supportive workshops, has in creating a sense of community. There is anecdotal evidence to suggest that most of the self-finish buyers in Water Lilies would have preferred to take on less responsibility in the fit-out, which adds weight to the argument that a custom-build route could be provided for houses as well as flats. Therefore, future ESBC housing schemes could explore the provision of self-finish and custom-build houses to cater for different needs and desires.

A key finding from

Section 3.3 was that construction quality is significantly important to both the market for ESBC housing and the conventional market for self-build and custom-build. These findings are reinforced by self- and custom-build consumer survey research by NaCSBA and Building Societies Association, which found that 43% of people thought a benefit of building their own home was ‘the quality of the overall build could be higher than that of a pre-built home’ [

54]. Once the Future Homes Standard comes into effect in 2025 [

74], it will be interesting to see to what extent the requirements to build energy efficient and low-carbon homes will improve the construction quality and sustainability of new build homes and whether this will shift the perception of people who may be looking at ESBC housing as a means of buying a high quality, sustainable home.

However, construction quality and sustainability are not the only aspects attracting people to ESBC housing. The prospect of living in a community is also important to this market and is not widely offered in residential developments in the UK. A sense of community is fostered in ESBC housing by designing community spaces and facilities, delivering community workshops, and establishing an estate management company. This requires the ESBC developer to have skilled personnel to plan and facilitate workshops and it increases overheads for the associated time input. Whilst regulations may force speculative housing to catch up in terms of construction quality and sustainability, it can be argued that providing community-oriented housing to this extent would neither be necessary, given the lack of demand, nor possible to integrate into the standardised and efficient processes of speculative housebuilders [

25]. Therefore, the longer-term strategy for ESBC housing might be to sharpen the focus on social sustainability and develop a scalable approach to delivering aspects that build a sense of community.

Table 6 shows that there is demand for dwellings across every budget range offered in Water Lilies, but there is a potential mismatch in terms of demand for £400k–£500k homes and £500k+ homes with

Section 3.4 showing there was only 11% and 6% of respondents in these budget ranges, respectively. This was not necessarily a problem for Water Lilies because the houses sold out before the cut-off point where internal layouts would become fixed designs. Furthermore, as shown in

Table 6, 14% of properties sold in Bristol between September 2020 and August 2021 cost £500k+, demonstrating a greater demand in the region for homes of this price than reflected by the ESBC housing market. It should also be noted that building highly energy efficient homes and integrating renewable energy technology increases build costs significantly and necessitates higher than average prices to ensure viability. However, if ESBC housing is to provide for a greater proportion of the market in the mid- to low-budget ranges, it would need to offer more homes that they can afford, and which meet their requirements. There is no straightforward solution to providing ESBC housing for a wider social mix because developing net-zero-carbon communities is an essential aim of the model [

66], and this comes at a significant cost. Further research is required into the design and cost-effectiveness of the buildings to explore whether ESBC housing could provide for a greater proportion of the market, whilst balancing sustainability objectives. Additionally, further research could investigate how much people can finance through their own resources for the ESBC housing market. This may suggest ways potential buyers could be financially supported and incentivised to purchase a home.

Furthermore, the evidence from

Section 3.6 shows that people interested in self-build and custom-build are willing to pay more for a sustainable home. This suggests that ESBC housing may still attract potential buyers with homes that are more expensive than the average new build and therefore account for the increased build costs. As shown in

Section 3.5, the main drivers for people being willing to pay more for a sustainable home appear to be that they want to reduce their environmental impact and lowering home running costs. These qualities should be evidenced and promoted in ESBC housing schemes and compared to conventional speculatively built housing to highlight the carbon and monetary savings.