Fiscal Economic Instruments for the Sustainable Management of Natural Resources in Coastal Marine Areas of the Yucatan Peninsula

Abstract

1. Introduction

2. Theoretical Framework and Antecedents

2.1. Budgetary Governance

2.2. FEI Design, Implementation, and Evaluation in the World

2.3. State of the FEI in Mexico and in the Marine-Coastal Areas

2.4. FEI Generated in Marine-Coastal Areas

3. Materials and Methods

3.1. Study Design

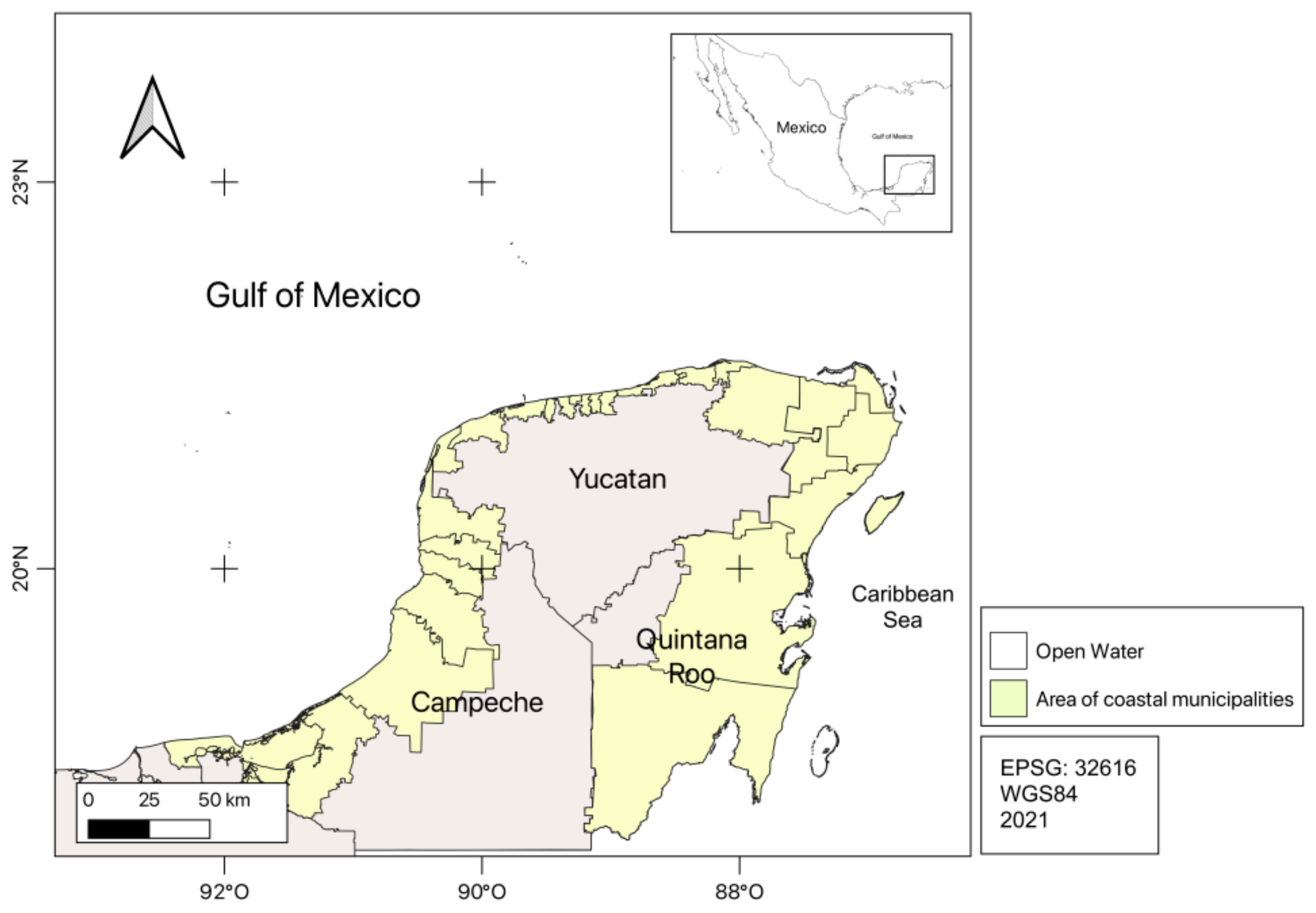

3.2. Study Area

3.3. Data Collection

3.4. Data Processing and Statistical Analysis

4. Results

4.1. Federal Expenditure Budgets in the YP (2007–2018)

4.2. State Expenditure Budgets in the YP (2007–2018)

5. Discussion

5.1. Changes in the Spending of the Federal Budget on Critical Areas of Coastal Regional Development

5.2. Changes in the Spending of the State Budget in the Critical Areas of Coastal Regional Development

6. Conclusions and Policy Implications

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Marshall, N. Conceptual and Operational Understanding of Social Resilience in a Primary Resource Industry. Insights for Optimizing Social and Environmental Outcomes in the Management of Queensland’s Commercial Fishing Industry? Ph.D. Thesis, School of Tropical Environment Studies and Geography James Cook University, Townsville, Australia, October 2005. [Google Scholar]

- Brown, C.; Adame, F.; Buelow, C.; Frassl, M.; Lee, S.; Mackey, B.; McClure, E.; Pearson, R.; Rajkaran, A.; Rayner, T.; et al. Opportunities for improving recognition of coastal wetlands in global ecosystem assessment frameworks. Ecol. Indic. 2021, 126, 107694. [Google Scholar] [CrossRef]

- Bonnet, J.; Coll-Martínez, E.; Renou-Maissant, P. Evaluating sustainable development by composite index: Evidence from french departments. Sustainability 2021, 13, 761. [Google Scholar] [CrossRef]

- Vence, X.; López, S. Taxation for a circular economy: New instruments, reforms and architectural changes in the fiscal systems. Sustainability 2021, 13, 4581. [Google Scholar] [CrossRef]

- Zhou, C.; Xie, H.; Zhang, X. Does fiscal policy promote third-party environmental pollution control in China? An evolutionary game theoretical approach. Sustainability 2019, 11, 4434. [Google Scholar] [CrossRef]

- He, P.; Sun, Y.; Shen, H.; Jian, J.; Yu, Z. Does environmental tax affect energy efficiency? An empirical study of energy efficiency in OECD countries based on DEA and Logit model. Sustainability 2019, 11, 3792. [Google Scholar] [CrossRef]

- OECD. Available online: https://www.oecd.org/env/tools-evaluation/environmentaltaxation.htm (accessed on 4 July 2020).

- O’Connor, D. Applying economic instruments in developing countries: From theory to implementation. Environ. Dev. Econ. 1998, 4, 91–110. [Google Scholar] [CrossRef]

- Secretaría de Hacienda y Crédito Público. Criterios Generales de Política Económica Para la Iniciativa de Ley de Ingresos y el Proyecto de Presupuesto de Egresos de la Federación Correspondiente al Ejercicio Fiscal 2020. Secretaría de Hacienda y Crédito Público. Available online: https://www.ppef.hacienda.gob.mx/work/models/PPEF2020/paquete/politica_hacendaria/CGPE_2020.pdf (accessed on 5 January 2021).

- Breuning, C.; Busemeyer, M. Fiscal austerity and the trade-off between public investment and social spending. J. Eur. Public Policy 2012, 19, 921–938. [Google Scholar] [CrossRef]

- Figueroa, A. Tributos ambientales en México: Una revisión de su evolución y problemas. Boletín Mex. De Derecho Comp. 2005, 38, 991–1020. [Google Scholar]

- Gramkov, C. Green Fiscal Policies: An Armoury of Instruments to Recover Growth Sustainably, Studies and Perspectives Series-ECLAC Office in Basilia, No. 5 (LC/TS.2002/24) (LC/BRS/TS.2019/7); Economic Comission for Latin America and the Caribbean (ECLAC): Santiago, Chile, 2020; p. 56. ISSN 1728-5453. [Google Scholar]

- DOF/08/12/2020. Ley Federal de Derechos. 08 de Diciembre de 2020. 508. Available online: http://www.diputados.gob.mx/LeyesBiblio/ref/lfd.htm (accessed on 4 July 2020).

- Nava-Fuentes, J.; Arenas-Granados, P.; Cardoso-Martins, F. Coastal management in Mexico: Improvements after the marine and coastal policy publication. Ocean Coast. Manag. 2017, 137, 131–143. [Google Scholar] [CrossRef]

- Muñoz-Sevilla, N.; Azuz-Adeath, I.; Le Bail, M.; Cortés-Ruiz, A. Coastal development: Construction of a public policy for the shores and seas of Mexico. In Coastal Management: Global Challenges and Innovations; Krishnamurthy, R., Jonatha, M., Srinivasalu, S., Glaeser, B., Eds.; ELSEVIER Academic Press: Amsterdam, The Netherlands, 2019; pp. 21–38. [Google Scholar] [CrossRef]

- De Andres, M.; Barragan, J.M. Development of coastal cities and agglomerations: Pressure and impacts on coastal and marine ecosystems. In Coastal Cities and Their Sustainable Future; Rodriguez, G.R., Brebbia, C.A., Eds.; WIT Press: Ashurst Lodge, Southampton, UK, 2005; pp. 63–71. [Google Scholar]

- Jiménez-Illescas, A.; Zayas-Esquer, M.M.; Espinosa-Carreón, T.L. Integral Management of the Coastal Zone to Solve the Problems of Erosion in Las Glorias Beach, Guasave, Sinaloa, Mexico. In Coastal Management, Global Challenges and Innovations; Krishnamurthy, R.R., Jonathan, M.P., Srinivasalu, S., Glaeser, B., Eds.; Acad. Press: London, UK, 2019; pp. 141–163. [Google Scholar]

- DOF/12/07/2019. Plan Nacional de Desarrollo 2019–2024. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5565599&fecha=12/07/2019 (accessed on 15 June 2021).

- Estudios Territoriales de la OCDE: Yucatán, México. Organización para la Cooperación y el Desarrollo Económicos. 2008. Available online: http://acervo.yucatan.gob.mx/contenidos/OCDE_Espanol.pdf (accessed on 5 June 2021).

- Sosa-Ferreira, A.P. Condiciones socioeconómicas y vulnerabilidad de la Península de Yucatán. In Cambio Climático en México un Enfoque Costero-Marino; Rivera-Arriaga, E., Azuz-Adeath, I., Alpuche-Gual, L., Villalobos-Zapata, G.J., Eds.; Universidad Autónoma de Campeche-Cetys-Universidad, Gobierno del estado de Campeche: Campeche, Mexico, 2010; pp. 231–261. [Google Scholar]

- Zhou, J.; Shafiq, M.; Adeel, A.; Nawaz, S.; Kumar, P. What is theoretical contribution? a narrative review. Sarhad J. Manag. Sci. 2017, 3, 261–271. [Google Scholar] [CrossRef]

- Rondinelli, D. Governments serving people: The changing roles of public administration in democratic governance. In Publica Administration and Democratic Governance. Governments Serving Citicenz; Rodinelli, D., Ed.; UN Department of Economic and Social Affairs: New York, NY, USA, 2007; p. 359. [Google Scholar]

- Day, S.; O’Riordan, T.; Bryson, J.; Frew, P.; Young, R. Many stakeholders, multiple perspectives: Long-term planning for a future coast. In Broad Scale Coastal Simulation: New Techniques to Understand and Manage Shorelines in the Third Millenniun; Nicholls, R., Dawson, R., Day, S., Eds.; Springer: Berlin/Heidelberg, Germany, 2015; Volume 49, pp. 299–323. [Google Scholar] [CrossRef]

- Tam, J. Long Term PUBLIC Finance Report: An Analysis of Fiscal Sustainability; Money Macro and Finance (MMF) Research Group: Cardiff, UK, 2003. [Google Scholar]

- Schmidt, L.; Prista, P.; Saraiva, T.; O’Riordan, T.; Gómez, C. Adapting governance for coastal change in Portugal. Land Use Policy 2012, 31, 314–325. [Google Scholar] [CrossRef]

- Bagstad, K.; Stapleton, K.; D’Agostino, J. Taxes, subsidies, and insurance as drivers of United States coastal development. Ecol. Econ. 2007, 63, 285–298. [Google Scholar] [CrossRef]

- Miao, Q.; Shi, Y.; Davlasheridze, M. Fiscal decentralization and natural disaster mitigation: Evidence from the United States. Public Budg. Financ. 2021, 41, 26–50. [Google Scholar] [CrossRef]

- Chandran, V.; Rao, R.; Anwar, S. Economic growth and government spending in Malaysia: A re-examination of Wagner and Keynesian views. Econ. Chang. Restruct. 2011, 44, 203–219. [Google Scholar] [CrossRef]

- Kolstad, C. Intermediate Environmental Economics; Oxford University Press: Oxford, UK, 2011; p. 480. [Google Scholar]

- Galán, F. Impuestos Ambientales en México y Experiencias Internacionales: Serie Cuaderno de Investigación en Finanzas Públicas; Senado de la República Instituto Belisario Domínguez: Cuauhtémoc, México, 2019. [Google Scholar]

- Economic Commission for Latin America and the Caribbean (ECLAC). Building a New Future: Transformative, Recovery with Equality and Sustainability (LC/SES.38/3-P/Rev.1); United Nations: Santiago, Chile, 2020; p. 235. [Google Scholar]

- Hayes, T.; Murtinho, F. Communal governance, equity and payment for ecosystem services. Land Use Policy 2018, 79, 123–136. [Google Scholar] [CrossRef]

- Motta, R.; Huber, R.; Ruitenbeek, H. Market based instruments for environmental policymaking in Latin America and the caribbean: Lessons from eleven countries. Environ. Dev. Econ. 1999, 4, 177–201. [Google Scholar] [CrossRef][Green Version]

- Nicolaisen, J.; Hoeller, P. Economics and the environment: A survey of issues and policy options. OECD Econ. Stud. 1991, 16, 7–43. [Google Scholar]

- Gutiérrez, A. El Control de Gestión y los Indicadores para la Medición del Desempeño de las Administraciones Tributarias; Centro Interamericano de Administración Tributaria CIAT: Panama City, Panama, 2009; Volume 22, pp. 1–21. Available online: https://www.ciat.org/Biblioteca/AsambleasGenerales/2009/Espanol/repdominicana43_tema3.1_ortiz_mx.pdf (accessed on 5 June 2020).

- Centro Mexicano de Derecho Ambiental, A.C. (CEMDA). Análisis de Instrumentos Económicos Aplicables a los Gobiernos Locales, para la Financiación de Acciones de Mitigación de GEI en los Sectores Transporte y Energía, Agosto 2016. Available online: https://www.cemda.org.mx/wp-content/uploads/2016/06/Reporte-final-proyecto-instrumentos-econo%CC%81micos-v0.2-_1_.pdf (accessed on 1 October 2020).

- Escalante, R.; Aroche, F. El Caso de México. In Desafíos y Propuestas para la Implementación más Efectiva de Instrumentos Económicos en la gestión Ambiental de América Latina y el Caribe; Comisión Económica para América Latina y el Caribe División de Medio Ambiente y Asentamientos Humanos (Naciones Unidas): Santiago, Chile, 2002; p. 339. [Google Scholar]

- Bárcena, A.; Cimoll, M.; García-Buchaca, R.; Samaniego, J.; Pérez, R. The Climate Emergency in Latin America and the Caribbean: The Path Ahead-Resignation or Arction? ECLAC Books, No. 160 (LC/PUB.2019/23-P); Economic Commission for Latin America and the Caribbean (ECLAC): Santiago, Chile, 2020; p. 357. [Google Scholar]

- Lloret, A.; Domenge, R.; Castro-Hernández, M. Regulatory limits to corporate sustainability: How climate change law and energy reforms in Mexico may impar sustainability practices in mexican firms. Systems 2019, 7, 3. [Google Scholar] [CrossRef]

- Arlinghaus, J.; van Dender, K. The environmental tax and subsidy reform in Mexico. OECD Tax. Work. Pap. 2017, 31, 29. [Google Scholar] [CrossRef]

- Solana-Sansores, L. Efectos sociales, económicos y políticos del cambio climático en las pesquerías mexicanas. In Cambio Climático en México un Enfoque Costero-Marino; Rivera-Arriaga, E., Azuz-Adeath, I., Alpuche-Gual, L., Villalobos-Zapata, G.J., Eds.; Universidad Autónoma de Campeche-Cetys-Universidad, Gobierno del estado de Campeche: Campeche, México, 2010; pp. 305–318. [Google Scholar]

- Ávila-Foucat, S.; Espejel, I. Resiliencia de Socioecosistemas Costeros; Universidad Nacional Autónoma de México: Ciudad de México, Mexico, 2020; p. 175. [Google Scholar]

- SEMARNAT. La Gestión Ambiental en México; Secretaría de Medio Ambiente y Recursos Naturales (SEMARNAT): Ciudad de México, Mexico, 2006; p. 468. [Google Scholar]

- Zárate-Lomelí, D. Instrumentos para la gestión y el manejo de la zona costera de México. In El Manejo Costero en México; Rivera-Arriaga, E., Villalobos, Z.G., Azuz-Adeath, I., Rosado, M.F., Eds.; Universidad Autónoma de Campeche: Campeche, México, 2004; p. 654. [Google Scholar]

- Turner, K.; Schaafsma, M. Coastal zone ecosystem services. From science to values and decision making. Springer Int. Publ. Switz. 2015, 9. [Google Scholar] [CrossRef]

- Álvarez Torres, P.; Díaz de León, A.; Pérez-Chirinos, G.; Aguilar, J.C.; Rosado, R.; Efrén, F.; Cortina, S.; Ibáñez, M.; Brachet, G.; Muñoz-Sevilla, P.; et al. Development of a National Ocean Policy in Mexico. In Routledge Handbook on National and Regional Ocean Policies; Abingdon: London, UK, 2015; pp. 294–310. [Google Scholar]

- Adame, M.; Brown, C.; Bejarano, M.; Herrera-Silveira, J.; Ezcurra, P.; Kauffman, J.; Birdsey, R. The undervalued contribution of mangrove protection in Mexico to carbon emission targets. Conserv. Lett. 2018, 11, e12445. [Google Scholar] [CrossRef]

- Naciones Unidas, Comisión Económica para América Latina y el Caribe. La economía del Cambio Climático en América Latina y el Caribe. Paradojas y Desafíos del Desarrollo Sostenible; Naciones Unidas: Santiago, Chile, 2015; p. 98. [Google Scholar]

- Quero, G.P.; García, S.J.; Chica, R.J. Marine renewable energy and maritime spatial planning in Spain: Main challenges and recommendations. Mar. Policy 2021, 127, 104444. [Google Scholar] [CrossRef]

- Instituto Nacional de Estadística, Geografía e Informática. Producto Interno Bruto 2019. Available online: https://www.inegi.org.mx/temas/pib/ (accessed on 25 February 2021).

- Sumalia, U.; Walsh, M.; Hoareau, K.; Cox, A.; Teh, L.; Abdallah, P.; Akpalu, W.; Anna, Z.; Benzaken, D.; Crona, B.; et al. Financing a sustainable ocean economy. Nat. Commun. 2021, 12, 3259. [Google Scholar] [CrossRef] [PubMed]

- De Alencar, N.; Le Tissier, M.; Paterson, S.K.; Newton, A. Circles of coastal sustainability: A framework for coastal management. Sustainability 2020, 12, 4886. [Google Scholar] [CrossRef]

- Rivera-Arriaga, E.; Espejel-Carbajal, I.; Gutiérrez-Mendieta, F.J.; Vidal-Hernández, L.E.; Espinoza-Tenorio, A.; Nava-Fuentes, J.C.; García-Chavarría, M.; Sosa-López, A. Global Review of ICZM in Mexico. Costas 2020, 1, 179–200. [Google Scholar] [CrossRef]

- Ibarra, P.D. Instrumentos económicos en materia ambiental en México. Revista Enciclopédica Tributaria Opciones Legales Fiscales. 2013, 52, pp. 16–31. Available online: https://doctrina.vlex.com.mx/vid/instrumentos-materia-ambiental-ma-xico-442374490 (accessed on 2 January 2021).

- Centro de Estudios de las Finanzas Públicas. Presupuesto de Egresos de la Federación 2015. Gasto Federalizado LXII.Legislatura Cámara de Diputados. 2015. Available online: http://www.cefp.gob.mx/publicaciones/nota/2015/enero/notacefp0032015.pdf (accessed on 5 January 2021).

- Política Nacional de Mares y Costas de México (PNMCM). Diario Oficial de la Federación. 30 de noviembre de 2018. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5545511&fecha=30/11/2018 (accessed on 4 July 2020).

- Yáñez-Arancibia, A.; Day, J.W.; Twilley, R.R.; Day, R.H. Manglares frente al cambio climático: ¿tropicalización global del Golfo de México? In Cambio Climático en México un Enfoque Costero-Marino; Rivera-Arriaga, E., Azuz-Adeath, I., Alpuche-Gual, L., Villalobos-Zapata, G.J., Eds.; Universidad Autónoma de Campeche-Cetys-Universidad: Campeche, Mexico, 2010; pp. 231–261. [Google Scholar]

- Azuz-Adeath, I.; Rivera-Arriaga, E. Descripción de la dinámica poblacional en la zona costera mexicana durante el periodo 2000–2005. Pap. De POBLACIÓN 2009, 62, 75–107. [Google Scholar]

- Muñoz-Sevilla, N.P.; Azuz-Adeath, I.; Le Bail, M. Institutional barriers for the implementation of climate change adaptation actions in the Mexican coastal zones. IOP Conf. Ser. Earth Environ. Sci. 2018, 167, 1–7. [Google Scholar] [CrossRef]

- Ríos-Granados, G. Tributación ambiental: La contribución por gasto, Instituto de Investigaciones Jurídicas; Universidad Nacional Autónoma de México: Ciudad de México, México, 2010; p. 230. [Google Scholar]

- Quijano-Poumián, M.; Rodríguez-Aragón, B. El marco legal de la zona costera. In El Manejo Costero en México; Rivera-Arriaga, E., Villalobos, Z.G., Azuz-Adeath, I., Rosado, M.F., Eds.; Universidad Autónoma de Campeche: Campeche, Mexico, 2004; p. 654. [Google Scholar]

- Alfie, M. Política Ambiental mexicana. Montañas de Papel, Ríos de Tinta y Pocos Cambios en Cuarenta Años, El Cotidiano. 2016, 200, pp. 200, 209–222. Available online: http://www.redalyc.org/articulo.oa?id=32548630018 (accessed on 25 February 2021).

- Von Gersdorf, H. El proceso presupuestario en Chile: Opciones de reforma. In Un Estado para la Ciudadanía. Estudios para su modernización; Aninat, I., Razmilic, S., Eds.; Centro de Estudios Públicos, CEP: Santiago, Chile, 2018; pp. 533–574. [Google Scholar]

- Toriz, F.G. Análisis del gasto público y el proceso presupuestario en México. Proyecto de Investigación Aplicada. Maestría en Economía y Políticas Públicas. Escuela de Graduados en Administración Pública y Política Pública, Campus Ciudad de México; Instituto Tecnológico y de Estudios Superiores de Monterrey: Monterrey, Mexico, 2006; p. 75. [Google Scholar]

- Naciones Unidas, Comisión Económica para América Latina y el Caribe. Guía Metodológica de Instrumentos Económicos para la Gestión Ambiental. 2015. Available online: https://repositorio.cepal.org/bitstream/handle/11362/37676/S1421003_es.pdf?sequence=1&isAllowed=y (accessed on 1 July 2020).

- Valderrama-Landeros, L.; Rodríguez-Zúñiga, M.; Troche-Souza, C.; Velázquez-Salazar, S.; Villeda-Chávez, E.; Alcántar-Maya, J.; Vázquez-Balderas, B.; Cruz-López, M.; Ressl, R. Manglares de México: Actualización y exploración de los datos del sistema de monitoreo 1970/1980-2015; Comisión Nacional para el Conocimiento y Uso de la Biodiversidad: Ciudad de México, Mexico, 2017; p. 128. [Google Scholar]

- Bautista-Zúñiga, F.; Batllori-Sampedro, E.; Palacio, G.; Ortíz-Pérez, M.; Castillo-González, M. Integración del conocimiento actual sobre los paisajes geomorfológicos de la Península de Yucatán. In Caracterización y Manejo de los Suelos de la Península de Yucatán: Implicaciones Agropecuarias, Forestales y Ambientales; Bautista, F., Palacio, G., Eds.; Universidad Autónoma de Campeche: Campeche, México, 2005; pp. 33–58. [Google Scholar]

- Orellana-Lanza, R.; Espadas-Manrique, C.; Conde-Álvarez, C.; Gray-García, C. Atlas Escenarios de Cambio Climático en la Península de Yucatán. Centro de Investigaciones Científicas de Yucatán, A. C., Consejo Nacional de Ciencia y Tecnología, Centro de Ciencias de la Atmósfera (UNAM), FOMIX Yucatán, SEDUMA Yucatán, Programa de las Naciones Unidas para el Desarrollo; Naciones Unidas: Santiago, Chile, 2010; p. 111. [Google Scholar]

- Gracia, A.; Salas de León, D. Golfo de México, circulación y productividad. Ciencias 2004, 76, 25–33. [Google Scholar]

- Adame, M.; Nájera, E.; Lovelock, C.; Brown, C. Avoid emissions and conservation of scrub mangrove: Potencial for a blue carbon project in the Gulf of California, Mexico. Biol. Lett. 2018, 14, 6. [Google Scholar] [CrossRef] [PubMed]

- Guzmán, N.; Esteves, J.M. Elementos de la vulnerabilidad ante huracanes. Impacto del huracán Isidoro en Chabihau, Yabaín, Yucatán. Política y Cultura 2016, 45, 183–210. [Google Scholar]

- Herrera-Silveira, J.; Comin, F.; Capurro-Filograsso, L. Landscape, Land-Use, and Management in the Coastal Zone of Yucatan Peninsula. In Gulf of Mexico: Origin, Waters, and Biota. Volume 4, Ecosystem-Based Management. Harte Research Institute for Gulf of Mexico Studies Series; Day, J.W., Yáñez-Arancibia, A., Eds.; Texas A&M University Press: College Station, TX, USA, 2013; p. 460. [Google Scholar]

- Herrera-Silveira, J.; Lara-Domínguez, J.; Day, J.; Yañez-Arancibia, A.; Morales-Ojeda, S.; Teutli-Hernández, C.; Kemp, G. Chapter 22-Ecosystem Functioning and Sustainable Management in Coastal Systems with High Freshwater Input in the Southern Gulf of Mexico and Yucatan Peninsula; Elsevier: Amsterdam, The Netherlands, 2019; pp. 377–397. [Google Scholar]

- Yáñez-Arancibia, A.; Day, J. Environmental sub-regions in the Gulf of Mexico coastal zone: The ecosystem approach as an integrated management tool. Ocean Coast. Manag. J. 2004, 47, 727–757. [Google Scholar] [CrossRef]

- Herrera-Silveira, J.; Comin, F.; Aranda-Cirerol, N.; Troccoli, L.; Capurro, L. Coastal water quality assessment in the Yucatan Peninsula: Management implications. Ocean Coast Manag. J. 2004, 47, 625–639. [Google Scholar] [CrossRef]

- Rey, W.; Martínez-Amador, M.; Salles, P.; Mendoza, E.; Trejo-Rangel, M.; Franklin, G.; Ruiz-Salcines, P.; Appendini, C.; Quintero-Ibáñez, J. Assessing different flood risk and damage approaches: A case of study in Progreso, Yucatan, Mexico. J. Mar. Sci. 2020, 8, 137. [Google Scholar] [CrossRef]

- Consorcio de Instituciones de Investigación Marina del Golfo de México y del Caribe, (CIIMAR GOMC). Orientación de Estrategias de Política Pública para la Conservación y uso Sustentable de los Océanos, Mares y Costas de México. Universidad Juárez Autónoma de Tabasco. 2018. Available online: https://ceiba.org.mx/publicaciones/Centro_Documentacion/MaresCostas/180610_CIIMAR_EstrategiasOceanosMaresCostas.pdf (accessed on 5 June 2021).

- Alcántara-Ayala, I. Desastres en México: Mapas y apuntes sobre una historia inconclusa. Investig. Geográficas 2019, 100. [Google Scholar] [CrossRef]

- Conferencias de Cancún sobre Cambio Climático. Libro blanco. Secretaría de Relaciones Exteriores. Available online: https://sre.gob.mx/images/stories/doctransparencia/rdc/5lbcop16.pdf (accessed on 26 September 2021).

- Secretaría de Gobernación (SEGOB). Declaratorias de Desastre Natural Publicadas en el Diario Oficial de la Federación y Número de Municipios Señalados por Entidad Federativa y Tipo de Fenómeno. 2018. Available online: http://dgeiawf.semarnat.gob.mx:8080/ibi_apps/WFServlet?IBIF_ex=D1_DESASTRE00_06&IBIC_user=dgeia_mce&IBIC_pass=dgeia_mce&NOMBREENTIDAD=*&NOMBREANIO=* (accessed on 5 March 2021).

- Azuz-Adeath, I.; Cervantes, O.; Espinoza-Tenorio, A.; Santander-Monsalvo, J. Numeralia de la Costa Mexicana. 2018, 10. Available online: https://www.redicomar.com/wp-content/uploads/2018/11/numeralia-de-la-costa-mexicana.pdf (accessed on 15 July 2020).

- Ortiz-Lozano, L.; Granados-Barba, A.; Solís-Weiss, V.; García-Salgado, M.A. Environmental evaluation and development problems of the Mexican Coastal Zone. Ocean. Coast. Manag. 2005, 48, 161–176. [Google Scholar] [CrossRef]

- Jouault, S.; García de Fuentes, A.; Rivera, T. Un modelo regional de turismo alternativo y economía social en la Península de Yucatán, México. Otra Econ. 2015, 9, 164–176. [Google Scholar] [CrossRef]

- Sanjurjo-Rivera, E. Valoración Económica de Servicios Ambientales Prestados por Ecosistemas: Humedales en México; Instituto Nacional de Ecología: Ciudad de México, Mexico, 2001; p. 45. [Google Scholar]

- García-Bátiz, M. Aplicación de instrumentos económicos en la gestión ambiental de México. In Cuestiones Sociales y Políticas; Pineda-Ortega, P., Ed.; Universidad de Guadalajara: Jalisco, México, 2015; pp. 149–170. [Google Scholar]

- Russell, C.; Powell, P. Choosing Environmental Policy Tools: Theoretical Cautions and Practical Considerations; Inter-American Development Bank: Washington, DC, USA, 1996. [Google Scholar]

- Inter-American Center of Tax Administrations (CIAT), German Agency of International Cooperation (GIZ), International Center for Taxation and Development (CIFD). Information Sources of Tax Administrations in Latin America. Experiences of Argentina, Brazil, Chile, Mexico and Peru. CIAT, 2018, 100. Available online: https://www.ciat.org/information-sources-of-tax-administrations-in-latin-america-experiences-of-argentina-brazil-chile-mexico-and-peru-ciat-giz-ictd-2016-english-version-is-now-available/?lang=en (accessed on 5 October 2020).

- García, A.; Impuestos ambientales: Explicación, ejemplos y utilidad. Centro de Investigación Económica y Presupuestaria, A.C. 2017. Available online: https://ciep.mx/impuestos-ambientales-explicacion-ejemplos-y-utilidad/ (accessed on 15 May 2021).

- DOF/03/03/2008. Acuerdo por el que se Modifica el Convenio de Colaboración Administrativa en Materia Fiscal Federal, Celebrado Entre la Secretaría de Hacienda y Crédito Público y el Gobierno del Distrito Federal y se Suscribe el Anexo No. 1 de dicho Convenio. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5593468& (accessed on 19 May 2020).

- Bezaury-Creel, J.E. Las áreas naturales protegidas costeras y marinas de México ante el cambio climático. In Cambio Climático en México un Enfoque Costero-Marino; Rivera-Arriaga, E., Azuz-Adeath, I., Alpuche-Gual, L., Villalobos-Zapata, G.J., Eds.; Universidad Autónoma de Campeche-Cetys-Universidad, Gobierno del estado de Campeche: Campeche, Mexico, 2010; pp. 689–736. [Google Scholar]

- Azuz-Adeath, I. Procesos y ciclos en la costa. In Tópicos de Agenda para la Sostenibilidad de Costas y Mares Mexicanos; Rivera-Arriaga, E., Sánchez-Gil, P., Gutiérrez, J., Eds.; Universidad Autónoma de Campeche: Campeche, Mexico, 2019; pp. 181–192. [Google Scholar]

- Ruiz de Alegría-Arzaburu, A.; Medellín, G. Importancia del monitoreo costero para la construcción de la resiliencia, 543–562. In Gobernanza y Manejo de las Costas y Mares ante la Incertidumbre. Una Guía para Tomadores de Decisiones; Rivera-Arriaga, E., Azuz-Adeath, I., Cervantes Rosas, O.D., Espinoza-Tenorio, A., Silva Casarín, R., Ortega-Rubio, A., Botello, A.V., Vega-Serratos, B.E., Eds.; Universidad Autónoma de Campeche: Campeche, Mexico, 2020; p. 894. [Google Scholar]

- Aguilera, M.A.; Tapi, J.; Gallardo, C.; Núñez, P.; Varas-Belemmic, K. Loss of coastal ecosystem spatial connectivity and services by urbanization: Natural-to-urban integration for bay management. J. Environ. Manag. 2020, 276. [Google Scholar] [CrossRef]

- Banco Mundial. FONDEN: El Fondo de Desastres Naturales de México: Una reseña. Banco Mundial, 2012, Washington, D.C., United States of America. Available online: http://documents1.worldbank.org/curated/en/906551468123258202/pdf/753220WP0P130800Box374323B00PUBLIC0.pdf (accessed on 5 June 2021).

- Naciones Unidas. Comisión Económica para América Latina. Manual para la evaluación de desastres naturales. 2014. Available online: https://repositorio.cepal.org/bitstream/handle/11362/35894/1/S2013806_es.pdf (accessed on 4 June 2021).

- García de Fuentes, A.; Xool-Koh, M.; Euán-Ávila, J.; Munguía-Gil, A.; Cervera-Montejano, D. La Costa de Yucatán en la Perspectiva del Desarrollo Turístico; Comisión Nacional para el Conocimiento y Uso de la Biodiversidad: Ciudad de México, Mexico, 2011; p. 87. [Google Scholar]

- Fraga, J.; Khafash, L.; Villalobos-Zapata, G. (Eds.) Turismo y Sustentabilidad en la Península de Yucatán, Primera Edición; Universidad Autónoma de Campeche: Campeche, México, 2014; p. 206. [Google Scholar]

- Alcocer, P. Cultura, Turismo y Medio Ambiente: Una Mirada Desde los Pueblos Mayas de Yucatán; Patrimonio Cultural y Turismo. Cuadernos, Políticas públicas y turismo cultural en América Latina Siglo XXI; Secretaría de Cultura: Ciudad de México, Mexico, 2012; Volume 19, pp. 195–200. [Google Scholar]

- García de Fuentes, A.; Jouault, S.; Romero, D. Representaciones cartográficas de la turistificación de la Península de Yucatán a medio siglo de la creación de Cancún. Investigaciones Geográficas 2019, 100, e60023. [Google Scholar] [CrossRef]

- Orgaz, F.; Moral, S. El turismo como motor potencial para el desarrollo económico de zonas fronterizas en vías de desarrollo. Un estudio de caso. El Periplo Sustentable, 31. 2016. Available online: https://www.redalyc.org/jatsRepo/1934/193449985009/html/index.html (accessed on 24 September 2021).

- Brida, J.G.; London, S.; Rojas, M. El turismo como fuente de crecimiento económico: Impacto de las preferencias intertemporales de los agentes. Investig. Económica 2014, 73, 59–77. [Google Scholar] [CrossRef]

- UNEP. GEO-6 Regional Assessment for Latin America and the Caribbean. United Nations Environment Programme, Nairobi, Kenya. 2016. Available online: https://www.unep.org/resources/assessment/geo-6-regional-assessment-latin-america-and-caribbean (accessed on 22 September 2021).

- Xu, G. The New Coast: How Can an Environmentally Sustainable Model of Coastal Development Be Developed? Ph.D. Thesis, Unitec Institute of Technology, Auckland, New Zealand, October 2015. [Google Scholar]

- Vidal, L.; Vallarino, A.; Benítez, I.; Correa, J. Implementación del plan estratégico Ramsar en humedales costeros de la península de Yucatán: Normativas y regulación. Lat. Am. J. Aquat. Res. 2015, 43, 873–887. [Google Scholar] [CrossRef]

- Álvarez Icaza Longoria, P. Importancia ambiental y social del Corredor Biológico Mesoamericano en México. Mesoamericana 2010, 14, 97–106. [Google Scholar]

- Auditoría Superior de la Federación (ASF). Evaluación Número 1646 “Evaluación de la Política de Pesca y Acuacultura”. Available online: https://www.asf.gob.mx/Trans/Informes/IR2014i/Documentos/Auditorias/2014_1646_a.pdf (accessed on 3 May 2021).

- Programa Sectorial de Pesca y Acuacultura 2016-2021. Crecer en Grande, Campeche 2015-2021. Available online: http://www.seplan.campeche.gob.mx/copladecam/ps/ps-pesca.pdf (accessed on 24 July 2021).

- DOF 2017 Declaratoria de Desastre Natural por la Ocurrencia de Lluvia Severa del 2 al 4 de Junio de 2017, en 2 Municipios del Estado de Campeche. Available online: https://www.dof.gob.mx/nota_detalle.php?codigo=5487196&fecha=16/06/2017 (accessed on 3 June 2021).

- Decreto176/2014 Por el Que se Aprueba y Ordena la Publicación del Programa Especial de Acción ante el Cambio Climático del Estado de Yucatán. 26 Abril de 2010. Available online: https://www.yucatan.gob.mx/docs/transparencia/ped/2012_2018/PROGRAMA_ESPECIAL_ACCION_CAMBIO_CLIMATICO.pdf (accessed on 10 June 2020).

- Fondo de Cambio Climático de la Península de Yucatán. Available online: http://www.ccpy.gob.mx/agenda-regional/fondo-cambio-climatico.php (accessed on 10 June 2020).

- TRACSABLOG 2012. Campeche recibirá 2,256 mdp Para Carreteras y Puertos. Available online: https://tracsablog.typepad.com/my_weblog/2012/01/campeche-recibir%C3%A1-2256-mdp-para-carreteras-y-puertos.html (accessed on 4 July 2021).

- Balance de obras 2013-2018 Campeche. Secretaría de Comunicaciones y Transportes 2017. Available online: https://www.gob.mx/cms/uploads/attachment/file/183666/CAMPECHE_ENERO_2017.pdf (accessed on 5 June 2021).

- DOF/29/04/2014. Programa Nacional de Infraestructura 2014–2018. Available online: http://www.dof.gob.mx/nota_detalle.php?codigo=5342547&fecha=29/04/2014 (accessed on 4 June 2021).

- Shapiro, I. (Ed.) A guide to Budget Work for NGOs; International Budget Project: Washington, DC, USA, 2001; p. 102. [Google Scholar]

- United Nations. Objetivos de desarrollo sostenible. Available online: https://www.un.org/sustainabledevelopment/es/ (accessed on 25 September 2021).

- Nicholson-Cole, S.; O’Riordan, T. Adaptive governance for a changing coastline: Science, policy and publics in search of a sustainable future. In Adapting to Climate Change: Thresholds, Values, Governance; Adger, W., Lorenzoni, I., O’Brien, K., Eds.; Cambrige University Press: Cambrige, UK, 2009; pp. 368–383. [Google Scholar]

- Auditoría Federal de la Federación (ASF). Cámara de Diputados. Diagnóstico Sobre la Opacidad en el Gasto Federalizado. Versión Ejecutiva. 2013. Available online: https://www.asf.gob.mx/uploads/56_Informes_especiales_de_auditoria/Version_Ejecutiva.pdf (accessed on 15 June 2021).

- IMCO Instituto Mexicano de la Competitividad. Centro de Investigación en Política Pública. 2020. Available online: https://imco.org.mx/hablemos-de-ingresos-en-los-estados/ (accessed on 19 February 2020).

| Sector | Use of Natural Zones and Resources of Coastal and Marine Areas |

|---|---|

| Ports and navigation | Use and exploitation of maritime port works (ports, terminals, and installations) and port services. |

| Flagging or resignation of the flag of vessels for nautical tourism and fishing activities, | |

| Fishing and aquaculture | Commercial fishing permits and concessions |

| Commercial aquaculture permits | |

| National Waters | Service rights related to the use of national waters (use of drinking water, aquaculture, recreation lefts) |

| Rights to discharge biodegradable and non-biodegradable wastewater to a receiving body for recreation and sport, fishing and hunting, mining, and industrial activities. | |

| Wildlife | Export and import rights of specimens, products, and subproducts from wild species, sport hunting. |

| Non-extractive use of wildlife in lefts for conservation and investigation of wildlife. | |

| Extractive use of specimens of wild fauna in federal lands and zones (ducks, crocodiles). | |

| Tourism | Use of natural marine and insular elements of the ANP of Federation competition for recreational, tourist, and sports activities. |

| Use of elements and resources within ANP for touristic or urbanistic activities and tourist services. | |

| Rights to access museums, monuments and archaeological areas owned by the Federation. | |

| Mining | Extraction of Stone materials (sand, among others) |

| Exploitation rights of salts or saline by-products of marine waters and use of ZOFEMAT for that purpose. | |

| Mixed | Rights environmental impact of works and activities. |

| Exploitation of beaches, ZOFEMAT, land reclaimed from the sea, or any marine water. |

| Expenditure Budget Category | Federal | Campeche | Quintana Roo | Yucatan |

|---|---|---|---|---|

| Fishery and Aquaculture (08) | x | x | x | x |

| Communication and transport (09) | x | x | x | x |

| Environment and natural resources (16) | x | x | x | x |

| Energy (18) | - | x | - | - |

| Tourism (21) | - | x | x | x |

| Programmable spending in natural disasters (23) | x | - | - | - |

| Critical Areas Programs | ANOVA | |

|---|---|---|

| F | p | |

| Aquaculture, fishing and hunting | 0.023 | 0.977 |

| Highway and port infrastructure program | 0.247 | 0.782 |

| FONDEN | 0.174 | 0.841 |

| Tourism | 1.114 | 0.340 |

| t/z | gl | Sig. (Bilateral) | Average Budgets Increased ( ) or Decreased ( ) or Decreased ( ) ) | |

|---|---|---|---|---|

| Aquaculture, fishing and hunting of Campeche (2007–2012) vs. (2013–2018) (**) | −0.314 | 0.753 |  | |

| Aquaculture, fishing and hunting of Quintana Roo (2007–2012) vs. (2013–2018) (**) | −0.314 | 0.753 |  | |

| Aquaculture, hunting and fishing of Yucatan (2007–2012) vs. (2013–2018) (**) | −1.363 | 0.173 |  | |

| Highway and port infrastructure of Campeche (2007–2012) vs. (2013–2018) (**) | −1.572 | 0.116 |  | |

| Highway and port infrastructure of Quintana Roo (2007–2012) vs. (2013–2018) (*) | 11.525 | 5 | 0.000 |  |

| Highway and port infrastructure of Yucatan (2007–2012) vs. (2013–2018) (*) | 6.505 | 5 | 0.001 |  |

| Natural Disaster Fund of Campeche (2007–2012) vs. (2013–2018) (**) | −0.105 | 0.917 |  | |

| Natural Disaster Fund of Quintana Roo (2007–2012) vs. (2013–2018) (**) | −0.734 | 0.463 |  | |

| Natural Disaster Fund of Yucatan (2007–2012) vs. (2013–2018) (**) | −1.572 | 0.116 |  | |

| Tourism of Campeche (2007–2012) vs. (2013–2018) (*) | 2.941 | 5 | 0.032 |  |

| Tourism of Quintana Roo (2007–2012) vs. (2013–2018) (**) | −1.992 | 0.046 |  | |

| Tourism of Yucatan (2007–2012) vs. (2013–2018) (**) | −1.992 | 0.046 |  |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vidal-Hernández, L.; de Yta-Castillo, D.; Castellanos-Basto, B.; Suárez-Castro, M.; Rivera-Arriaga, E. Fiscal Economic Instruments for the Sustainable Management of Natural Resources in Coastal Marine Areas of the Yucatan Peninsula. Sustainability 2021, 13, 11103. https://doi.org/10.3390/su131911103

Vidal-Hernández L, de Yta-Castillo D, Castellanos-Basto B, Suárez-Castro M, Rivera-Arriaga E. Fiscal Economic Instruments for the Sustainable Management of Natural Resources in Coastal Marine Areas of the Yucatan Peninsula. Sustainability. 2021; 13(19):11103. https://doi.org/10.3390/su131911103

Chicago/Turabian StyleVidal-Hernández, Laura, Diana de Yta-Castillo, Blanca Castellanos-Basto, Marco Suárez-Castro, and Evelia Rivera-Arriaga. 2021. "Fiscal Economic Instruments for the Sustainable Management of Natural Resources in Coastal Marine Areas of the Yucatan Peninsula" Sustainability 13, no. 19: 11103. https://doi.org/10.3390/su131911103

APA StyleVidal-Hernández, L., de Yta-Castillo, D., Castellanos-Basto, B., Suárez-Castro, M., & Rivera-Arriaga, E. (2021). Fiscal Economic Instruments for the Sustainable Management of Natural Resources in Coastal Marine Areas of the Yucatan Peninsula. Sustainability, 13(19), 11103. https://doi.org/10.3390/su131911103