1. Introduction

Economic crises are commonplace in modern economic operations. Between 1970 and 2011 alone, there were approximately 200 systemic currency crises and 150 financial crises in the world, which eventually evolved into global economic crises [

1]. After the 2008 financial crisis, China entered a crucial period of replacing old drivers of growth with new ones and transforming its economic structure. During this time, international geopolitical risks were rising, and international trade and investment remained weak. All regions also faced external shocks, such as resource depletion, health crises, and natural disasters. Facing the increasingly complex economic and political situation while enhancing crisis resilience and adaptive capacity became a crucial issue for macroeconomic policy formulation by the Chinese government. Correspondingly, economic resilience—which denotes the ability of a regional economic system to absorb, learn from, and resolve crises by transforming the structure and functioning of the economy to achieve renewed economic growth after external shocks and disruptions (e.g., climate change, war, and economic crises) [

2,

3]—has emerged as a frontier topic in the field of regional studies, with a strong persuasive value in explaining how economic systems cope with economic crises, dissipate external shocks, and achieve economic recovery. The core of the study of economic resilience is explaining why some regions can overcome crises while others gradually go into recession. Therefore, it is essential to explore resilient economic growth in the context of economic globalization, as this will not only help policymakers move away from crude, traditional economic development models but also be significant for the formulation of long-term development strategies and economic recovery plans.

Innovation and entrepreneurship were also emphasized during the period of China’s economic system transformation. Since the Chinese government first proposed an innovation strategy in 2012 and launched the slogan “Mass Entrepreneurship, Mass Innovation” in 2015, innovation and entrepreneurship have been used as new driving forces for economic transformation and key nodes for improving the quality and efficiency of the economy. The Chinese economy must achieve resilient development by maintaining a steady increase in, and stimulating the economic benefits of, innovative entrepreneurial vitality. Concepts related to innovative entrepreneurial vitality were first introduced in Schumpeter’s theory of innovation. Schumpeter and Nichol (1934) explored innovation theory by suggesting that the “creative” destruction activities of entrepreneurs contribute to economic growth [

4]. In his book

Innovation and Entrepreneurship, Peter Drucker introduced the concept of the entrepreneurial economy, which is innovation-driven, possesses knowledge spillover, and is in line with world diversification trends. Porter outlined the idea that entrepreneurship can be a key instrument for economic growth, employment, national and regional productivity, and even social problem-solving. Based on this, we incorporated theories that are related to innovation and entrepreneurship, as well as considered innovative entrepreneurial vitality as the degree of innovation and entrepreneurial activities in a country or a region that are active in the socio-economy, which is a reflection of regional economic development potential and the ability to attract and utilize production factors. Based on the creativity and innovation of entrepreneurs while taking entrepreneurial enterprises as potential targets, innovative entrepreneurial vitality realizes the spiritual and knowledge values of entrepreneurs at the microlevel and promotes the development of a new economic model of the country at the macrolevel.

On the one hand, the boom in innovative entrepreneurial vitality spawns new enterprises and industries, thus enhancing market competition and the metabolism of old and new enterprises and broadening the market size and factor demand. The expansion of the market scale triggers the growth in factor supply and product innovation, which ultimately have impacts on urban economic resilience [

5]. On the other hand, the new innovative and entrepreneurial enterprises that are generated by an increased innovative entrepreneurial vitality are often set around original enterprises, gradually forming a cluster of homogeneous and complementary enterprises. The agglomeration effect that is caused by enterprises can accelerate the application, promotion, and commercialization of new technologies, which force enterprises not only to create technology but also derive new industries. The development of new industries and the diversification of industrial categories also contribute to the diversified development of industries, which, in turn, affects economic resilience [

6,

7]. Therefore, as an important starting point for accelerating the transformation of driving forces in economic development, strengthening the cultivation of innovative entrepreneurship vitality has become not only an objective requirement for injecting new energy into economic growth and improving the overall efficiency of society but is also an effective choice for realizing innovation-driven development and enabling economic resilience.

An innovation entrepreneurship policy is undeniably one of the measures that requires the government to adopt the “invisible hand” to regulate and control the market actively. This is achieved by tailoring various policies to cope with macroeconomic fluctuations that may be caused by external shocks. However, the frequent and active actions that were taken by the government to smooth out economic fluctuations continuously to promote quality economic development have also led to an increase in economic policy uncertainty. Economic policy uncertainty refers to the risk of decision making that is caused by the inability of subjects of economic activity to perceive and anticipate economic changes brought about by the government’s economic policy formulation and adjustment [

8]. In addition to government macro-regulation, the promotion mechanism of officials under the Chinese-style decentralized system is an important factor in the increased uncertainty of regional economic policies. To improve their political performance, local officials actively guide and interfere with enterprise decision making through the formulation of policies [

9,

10]. However, local officials are subject to many factors, such as age, ability, and concept, all of which magnify the differences in policymaking and increase the uncertainty of economic policy [

11].

Therefore, this study focused on the impact mechanism of innovative entrepreneurial vitality on economic resilience. We needed to solve the following problems: Does the improvement in innovative entrepreneurial vitality effectively enhance economic resilience? If an economic policy cannot be perceived as “positive” or “negative”, that is, when economic policy uncertainty increases, is innovative entrepreneurial vitality a driving or resistant force for the enhancement of economic resilience? Simultaneously, under economic policy uncertainty, what is the internal mechanism of innovative entrepreneurial vitality regarding economic resilience? Given their importance in policy implementation and risk response, exploring the relationship between economic policy uncertainty, innovative entrepreneurial vitality, and economic resilience at the urban level is of great reference significance and marginal empirical value for the formulation of policies related to entrepreneurial innovation and the path to improving economic resilience.

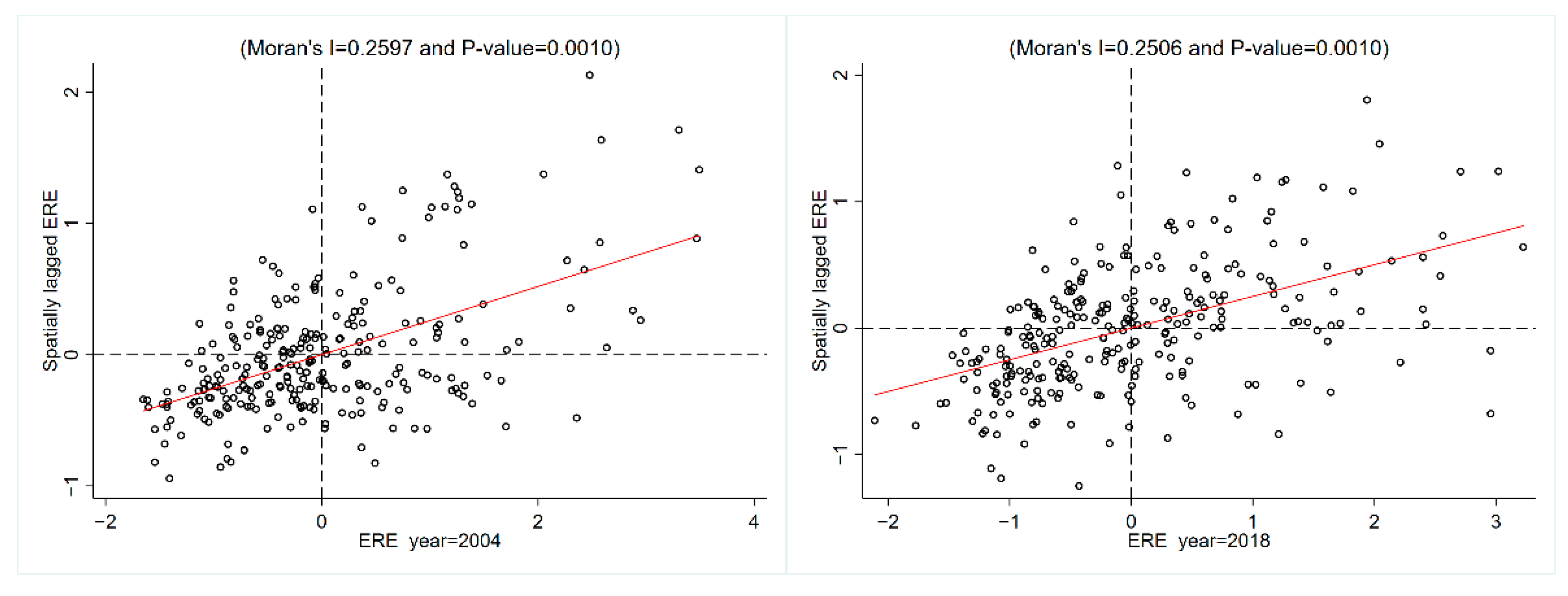

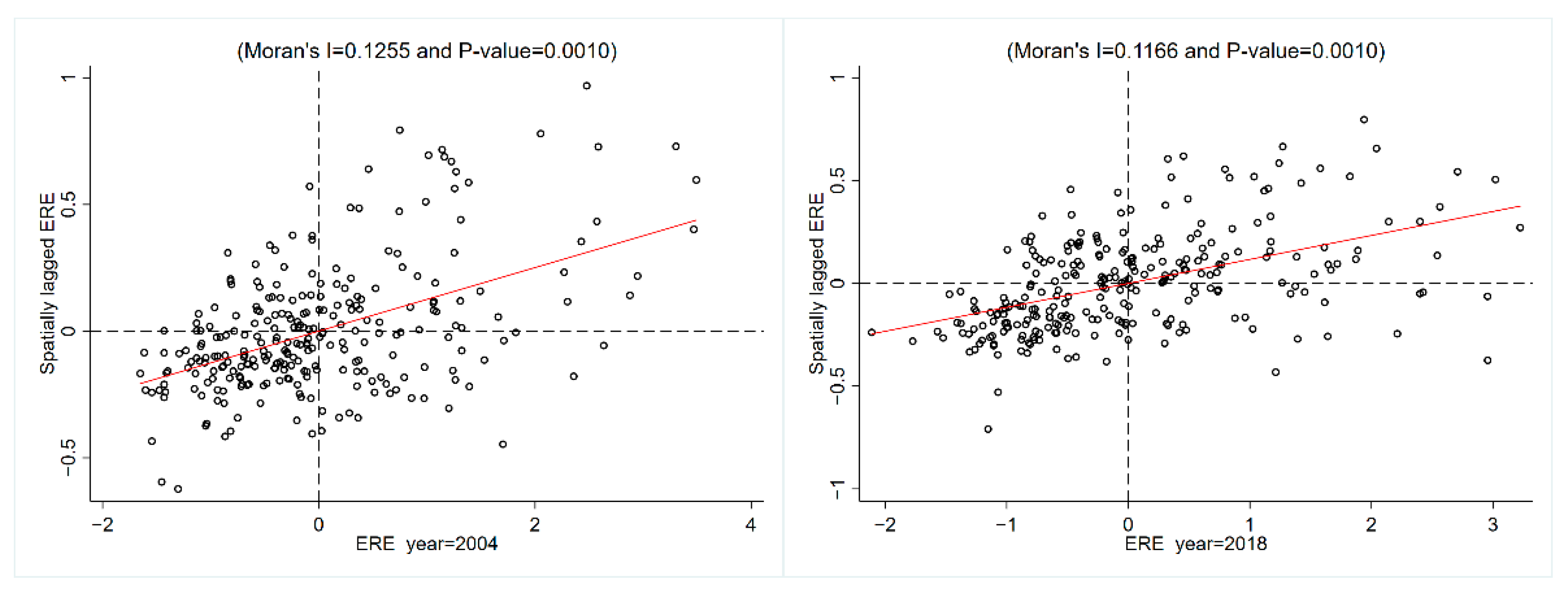

We conducted our research as follows. First, a dynamic spatial Durbin model was applied to analyze the impact of economic policy uncertainty and innovative entrepreneurial vitality on economic resilience. Simultaneously, a mediated moderation effects model was employed to explain the mechanism of economic policy uncertainty and innovative entrepreneurial vitality on economic resilience further from the triple perspective of industrial structure, income gap, and economic agglomeration, which may provide a new direction for future research. Second, we fully considered the geographical location and economic scale heterogeneity that characterize the impact of innovative entrepreneurial vitality and economic policy uncertainty on economic resilience, which could refine research on relevant topics. Finally, our study was based on a sample at the prefecture level, which allowed the findings of this study to be more generalizable and likewise allows for a more precise marginal experience for policymakers who utilize these findings.

The structure and main findings of this paper are organized as follows.

Section 2 introduces research that is relevant to economic resilience, as well as research on the relationship between innovative entrepreneurial vitality, economic policy uncertainty, and economic resilience.

Section 3 provides the model setting, variables selection, and data sources of this paper. Specifically, we first measured economic resilience using an improved panel entropy method and then constructed an indicator of innovative entrepreneurial vitality using the China Regional Innovation and Entrepreneurship Index based on the joint publication of Peking University’s Enterprise Big Data Research Center and Longxin Data Research Institute. Then, a dynamic spatial Durbin approach and a moderated mediation effects approach were employed to analyze the impact of innovative entrepreneurial dynamism and economic policy uncertainty on economic resilience, with a combination of the China Urban Statistical Yearbook database and 269 prefecture-level cities used as the research sample.

Section 4 provides the empirical results of the analysis and the associated discussion. We found that there were significant time lags and spatial spillover characteristics of economic resilience; innovative entrepreneurial vitality significantly enhanced economic resilience; and economic policy uncertainty strengthened the positive impact of innovative entrepreneurial vitality on economic resilience. Moreover, under economic policy uncertainty, innovative entrepreneurial vitality promoted economic resilience by upgrading industrial structures, alleviating income disparity, and promoting economic agglomeration. Finally, the effects of innovative entrepreneurial vitality and economic policy uncertainty on economic resilience showed significant differences across city sizes and agglomerations. The last section presents the research conclusions and policy implications.

2. Literature Review

Due to the impact of economic globalization, countries around the world are exposed to the risk of economic losses caused by the spread of economic crises. Therefore, improving the ability to cope with economic crises has become one of the most important issues facing governments around the world. Holling (1973) first introduced the concept of resilience from an ecological perspective. Subsequently, the connotation of resilience gradually shifted from concepts of traditional equilibrium-based engineering and ecological resilience to evolutionary resilience based on evolutionary theory [

12]. In particular, economic resilience research is gradually becoming a geographic and spatial economics hot research area. Some scholars argued that resilient economic systems have the capacity for structural transformation, minimizing the degree of disturbance, and even achieving transformation by exploiting external shocks [

13,

14]. Martin et al. (2015) provided a more specific definition of economic resilience: the ability to reconfigure the structure of an economy and maintain sustainable growth in output, employment, and wealth [

3]. The resilience of a regional economy to recessionary shocks should include four aspects, namely, resistance (the degree of sensitivity and response of the regional economy to recessionary shocks), resilience (the speed and degree of recovery of the regional economy from recessionary shocks), readjustment capacity (the ability of the regional economy to readjust the structure of industries, technology, labor, etc. in the face of recessionary shocks), and the ability to create economic growth paths (the ability of the regional economy to suffer and open a new stable growth path after a shock). This definition has been adopted by many scholars, such as Gong et al. (2017) and Kitsos et al. (2019) [

15,

16].

As the definition of the concept of economic resilience has continued to become clearer, many scholars have begun to measure economic resilience based on the abovementioned economic resilience analysis framework [

17,

18,

19]. They measured the economic resilience of EU member states, the United States, Canada, Australia, and other regions in response to economic crises over time using data on output, employment, and foreign trade; research approaches include the sensitivity coefficient and indicator system methods [

2,

20,

21,

22]. Regarding the factors influencing economic resilience, some scholars argued that regional economic resilience is determined by the influence of a complex set of factors that jointly determine the vulnerability of a region to economic crises and the system’s ability to sustain, adapt, and recover [

23,

24,

25]. Brakman et al. (2014), for example, explored the importance of urbanization and specialization for economic resilience and found that EU regions with relatively large shares of the population in commuting areas are relatively more resilient [

26]. Furthermore, Martin (2016) suggested a more comprehensive framework for the analysis of factors influencing economic resilience in terms of industrial structure, labor force, finance, and institutions [

27]. Moreover, scholars have empirically studied the influencing factors of economic resilience in terms of locational conditions, regional vulnerability, adaptive capacity, resource abundance, and policy systems [

28,

29,

30]. For example, Xiao (2018) found that knowledge exchange and spillovers between industries can lead to significant differences in economic resilience due to internal and external environmental influences [

31]. Palaskas et al. (2015) confirmed that the interconnectedness of industrial specialization and surrounding cities mitigates economic crises and may act as a stabilizer to support economic recovery [

32]. By using a sample of 85 cities in the UK as a survey sample, Martin and Gardiner (2019) revealed that differences in the resilience of cities to major shocks may have an impact on their long-term growth [

33].

However, research regarding the effect of innovative entrepreneurial vitality on economic resilience has mostly specialized in analyzing the importance of innovation in regional economic resilience, and it was argued that innovation enables regional industrial and technological structures to adapt to changes in economic patterns over time [

34,

35,

36,

37]. NESTA (2009), a leading innovation agency, explicitly stated that “innovation is essential to enable economies to recover from recession”, and the UK government’s Department for Business, Innovation, and Skills similarly argues that “innovation can build resilient and dynamic economies”. Bristow and Healy (2018) provided important insights into an evolutionary approach for theorizing the relationship between innovation and economic resilience in their analysis of differences in the speeds of recovery of European regional economies from the 2008 economic crisis; they found that regions that were identified as innovation leaders at the time of the crisis were more likely to resist the crisis or recover more quickly than other regions [

35]. In addition, Simmie and Martin (2010) and Isaksen et al. (2014) argued that innovation is key to enabling regions to expand existing specialized industrial sectors and develop more diversified economies continuously so that innovative firms are more competitive and adaptive to shocks in the face of economic crises [

2,

6]. Nevertheless, there are opposing views on the role of innovation in economic resilience. For example, Sunley (2013) questioned whether there is a lack of evidence showing that economies that are perceived to be innovative are more resilient and that they can resist and quickly recover when a crisis does occur [

38]. Thus, the relationship between innovation and economic resilience is more of an implicit assumption than a fact [

39].

In addition, it was shown that economic policy uncertainty has a slowing and delaying effect on business investment that inhibits business innovation [

8]. However, some scholars argued that economic policy uncertainty provides incentives for firms to innovate, generating a positive Research and Development risk premium that ultimately drives firm growth [

40,

41,

42]. Furthermore, innovation can increase the operational risk of a firm while creating opportunities for firms to increase their investment in innovation for future growth options in terms of real options theory [

9,

43]. If the benefit that is produced by such risky innovation investment is greater than the option value produced by the delay and slowdown effect, enterprises will further increase Research and Development investment to improve their innovation ability and seize the future market under economic policy uncertainty [

44,

45]. Thus, economic policy uncertainty would be an engine for increases rather than decreases in regional innovation output.

In summation, previous studies have provided relevant theoretical and empirical experiences for the analysis undertaken in this study, but there are still some research defects. First, few scholars have analyzed the impact of innovative entrepreneurial vitality on economic resilience from the perspective of economic policy uncertainty. Second, there is great heterogeneity in the geographical locations and economic scales of various prefecture-level cities, but few studies have examined the effects of economic policy uncertainty and innovative entrepreneurial vitality on economic resilience by considering the characteristics of heterogeneous cities. Finally, few studies have explained the spatial agglomeration characteristics, dynamic influence mechanism, and spillover effects of economic resilience from the perspective of prefecture-level cities.

5. Conclusions and Policy Recommendations

Based on urban panel data from 269 prefecture-level cities in China from 2004 to 2018, we empirically investigated the impacts of innovative entrepreneurial vitality and economic policy uncertainty on economic resilience by constructing two spatial weighting matrices for economic and geographical attributes using a dynamic spatial Durbin model. The statistical results showed that there were significant spatial spillover effects and path-dependent mechanisms of economic resilience. Innovative entrepreneurial vitality had a significant positive impact on economic resilience. Under the moderating effect of economic policy uncertainty, innovative entrepreneurial vitality significantly contributed to economic resilience by promoting industrial structure upgrades, narrowing the income gap, and guiding economic agglomeration. Additionally, due to regional differences and the economic development scale gap, the impacts of innovative entrepreneurial vitality and economic policy uncertainty on economic resilience presented significant heterogeneity characteristics. Based on these research conclusions, to enhance economic resilience via innovative entrepreneurial vitality under economic policy uncertainty further, the following specific actions should be implemented.

Against the backdrop of economic globalization, many external shocks, such as climate change and public health emergencies, have come one after another, posing huge challenges to social stability and governance. Therefore, policymakers should consider building a resilient economic structure to be an important strategic component. This can be accompanied by a highly internationalized division of labor in the industrial chain. With economic policy uncertainty, external shocks can easily create a global butterfly effect that could have an unprecedented global impact that may eventually lead to unprecedented challenges for all countries. Therefore, China, as a globally important and externally oriented economy, is at a critical stage of economic transformation and needs to make economic resilience a long-term strategy at the macroeconomic policy level, aiming at sustainable development and building a more resilient economic system to lead the transformation of social development concepts and models.

Policymakers should stimulate innovative and entrepreneurial behavior, and they should protect innovative entrepreneurial vitality. Specifically, policymakers should create a favorable business environment for innovative and entrepreneurial enterprises, as well as guide the implementation of innovative and entrepreneurial achievements and enhance the survival rate of innovative and entrepreneurial enterprises by focusing on solving the problems of capital shortage, technology shortage, and market demand for innovative and entrepreneurial activities. Additionally, under increased economic policy uncertainty, policymakers should actively integrate innovative entrepreneurial vitality with industry, expand industrial competitiveness, and promote industrial structural upgrades. Furthermore, by improving public services, preferential policies should be tilted toward low-income groups to narrow the income gap. Lastly, economic resilience should be enhanced by further strengthening economic agglomeration through the rational guidance of industrial clustering.

Policymakers should combine vocational and economic characteristics to enhance the economic resilience of cities by adopting differentiated and dynamic incentives for innovation and entrepreneurship. Policymakers should not only promote integrated regional development and seek cooperation to enhance joint response capabilities in the face of external shocks but also focus on their characteristics and city-specific policies to capitalize on locational and economic advantages. Specifically, in economically developed regions where innovation and entrepreneurship are more dynamic but riskier, the government needs to strengthen support and encouragement for innovation and entrepreneurship enterprises further to increase their risk tolerance and lower their survival threshold. In less economically developed regions where innovative entrepreneurial vitality is lower but relatively stable, the government should guide innovation and entrepreneurship enterprises toward a high-quality development path and play its role in boosting economic resilience.

Our study had certain limitations that should be considered when researching this area. First, we did not make distinctions between types of innovation and entrepreneurship. For example, entrepreneurship can be divided into opportunity entrepreneurship and survival entrepreneurship, each of which may have different inputs and attitudes toward innovation. Second, we only considered the results of heterogeneity in terms of city clusters and city economic sizes. In fact, there are differences in the Chinese government’s policy support for innovation and entrepreneurship in different regions, and local governments have different policy formulations for local innovative and entrepreneurial enterprises. Therefore, in future studies, researchers can appropriately consider the role of policy shocks on economic resilience. Finally, economic policy uncertainty could be added to the two abovementioned under-researched frameworks for analysis, which may be useful for regionally differentiated policy formulations and policy effect evaluations.