Towards an Understanding of Project Finance in the Mining Sector in the Sustainability Context: A Scientometric Analysis

Abstract

1. Introduction

Knowledge Gap, Objective, and Contributions

2. Materials and Methods

3. Scientometric Analysis, Results, and Discussion

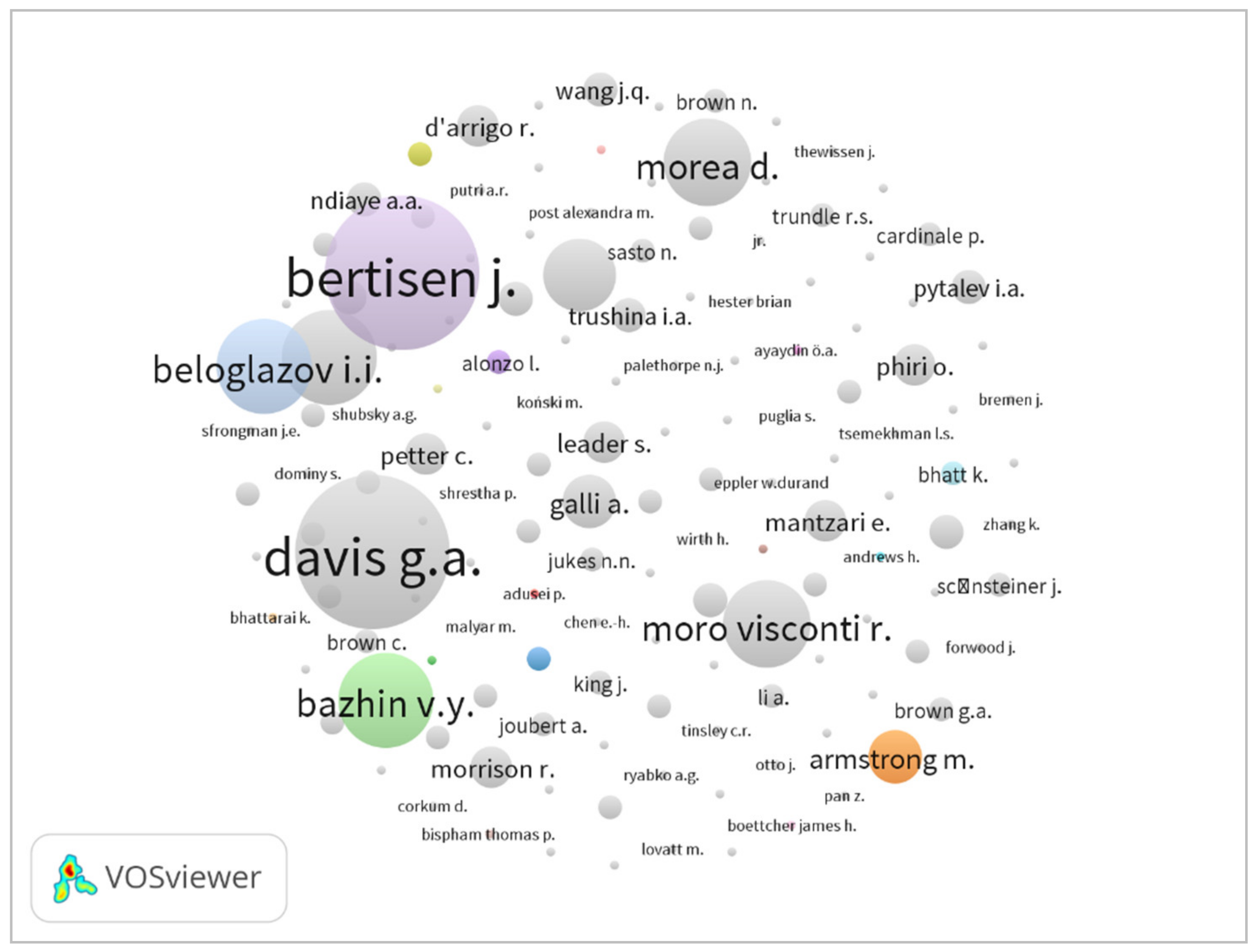

3.1. Co-Author Analysis

3.1.1. Co-Authorship Network

3.1.2. Network of Countries and Regions

3.1.3. Co-Word Analysis

3.2. Citation Analysis

3.2.1. Journal Citation Network

3.2.2. Author Citation Network

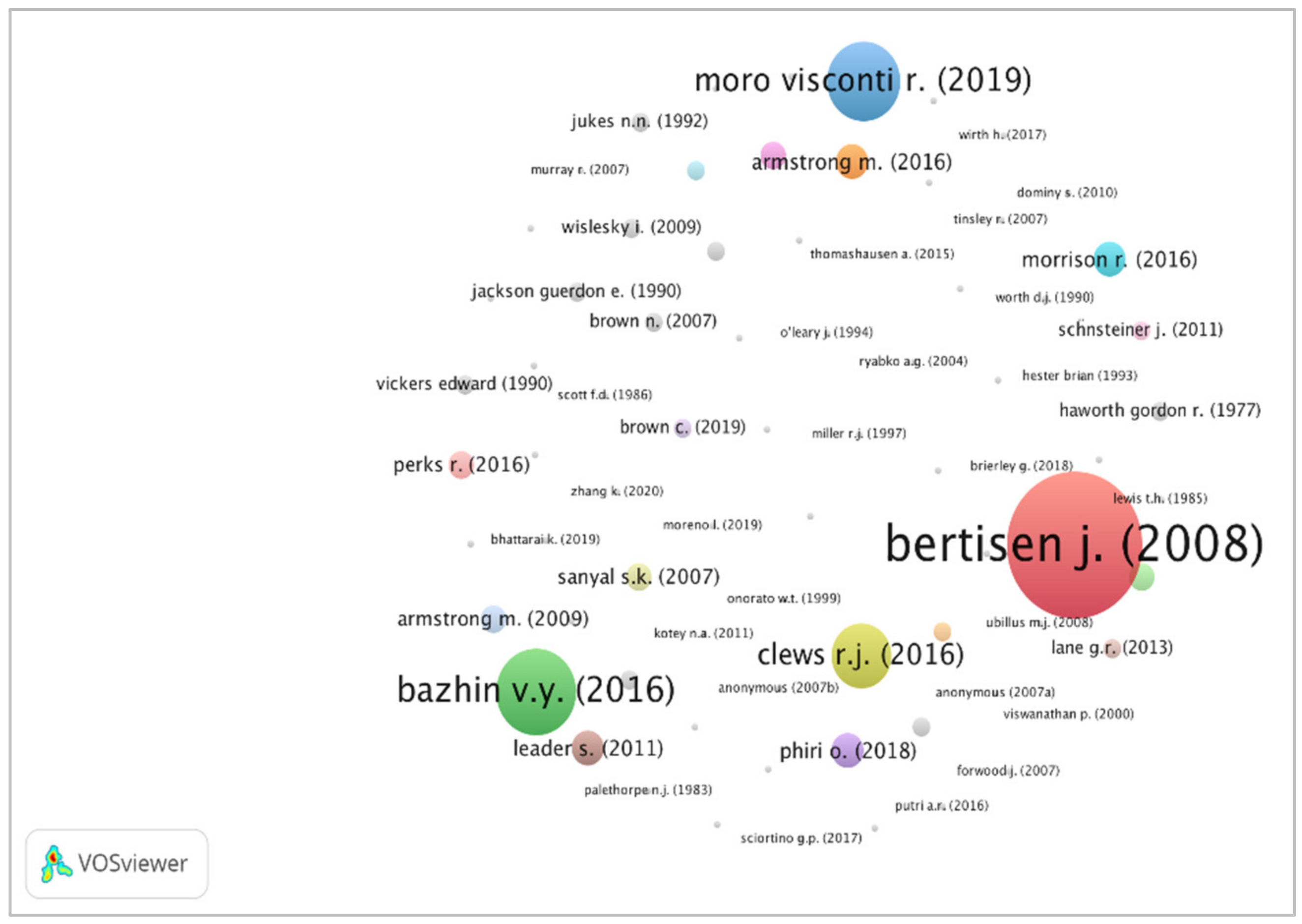

3.2.3. Document Citation Network

3.3. Cluster Analysis

4. Conclusions

- Incentives that can lead sponsors to adopt a compensation approach at all costs for damages caused. This will allow a better understanding of how the variables E (environmental) and S (social) impact financial results, mainly Return on Assets and Return on Equity.

- Comparative studies of PF application by minerals’ class and companies’ size. This will allow analyzing if there are specifics characteristics according to financial mechanisms used.

- The role of PF and mining industry on the considerable increase in the developing of renewable energy technologies and electric mobility. This will allow correlating ESG criteria in order to analyze the importance of the mining industry in the low carbon economy.

- According to type of mineral, carry out analyses on the main financial mechanisms used in PF schemes. This will allow identifying how transition bonds could boost the mining industry.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Esty, B.; Chavich, C.; Sesia, A. An Overview of Project Finance and Infrastructure Finance—2014 Update, Harvard Business School Background Note 214-083, June 2014. Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=47358 (accessed on 11 August 2021).

- Müllner, J. International project finance: Review and implications for international finance and international business. Manag. Rev. Q. 2017, 67, 97–133. [Google Scholar] [CrossRef]

- Kumari, A.; Sharma, A.K. Infrastructure financing and development: A bibliometric review. Int. J. Crit. Infrastruct. Prot. 2017, 16, 49–65. [Google Scholar] [CrossRef]

- World Economic Forum. The World is Facing a $15 trillion Infrastructure Gap by 2040. Here’s How to Bridge it|World Economic Forum 2019. Available online: https://www.weforum.org/agenda/2019/04/infrastructure-gap-heres-how-to-solve-it/ (accessed on 21 November 2019).

- Global Infrastructure Hub. Global Infrastructure Outlook: Forecasting Infrastructure Investment Needs and Gaps; Global Infrastructure Hub: Sydney, Australia, 2019. [Google Scholar]

- Bhattacharya, A.; Casado, C.; Jeong, M.; Amin, A.-L.; Watkins, G.; Zuniga, M.S. Attributes and Framework for Sustainable Infrastructure Washington, DC, USA. 2019. Available online: https://publications.iadb.org/publications/english/document/Attributes_and_Framework_for_Sustainable_Infrastructure_en_en.pdf (accessed on 21 November 2019).

- Ghofrani, Z.; Sposito, V.; Faggian, R. Maximising the value of natural capital in a changing climate through the integration of blue-green infrastructure. J. Sustain. Dev. Energy Water Environ. Syst. 2020, 8, 213–234. [Google Scholar] [CrossRef]

- Manu, P.; Mahamadu, A.-M.; Booth, C.; Olomolaiye, P.O.; Coker, A.; Ibrahim, A.; Lamond, J. Infrastructure procurement capacity gaps in Nigeria public sector institutions. Eng. Constr. Archit. Manag. 2019, 26, 1926–1985. [Google Scholar] [CrossRef]

- Menhas, R.; Mahmood, S.; Tanchangya, P.; Safdar, M.N.; Hussain, S. Sustainable Development under Belt and Road Initiative: A Case Study of China-Pakistan Economic Corridor’s Socio-Economic Impact on Pakistan. Sustainability 2019, 11, 6143. [Google Scholar] [CrossRef]

- Thierie, W.; de Moor, L. Loan tenor in project finance. Int. J. Manag. Proj. Bus. 2019, 12, 825–842. [Google Scholar] [CrossRef]

- Gatti, S. Project Finance in Theory and Practice: Designing, Structuring, and Financing Private and Public Projects; Elseiver: Amsterdam, The Netherlands, 2018. [Google Scholar]

- Liang, Q.; Hu, H.; Wang, Z.; Hou, F. A game theory approach for the renegotiation of Public-Private Partnership projects in Chinese environmental and urban governance industry. J. Clean. Prod. 2019, 238, 117952. [Google Scholar] [CrossRef]

- Rossi, E.; Stepic, R. Project Finance. In Infrastructure Project Finance and Project Bonds in Europe; Palgrave Macmillan: London, UK, 2015; pp. 7–24. [Google Scholar]

- Cruz, C.O.; Sarmento, J.M. The price of project finance loans for highways. Res. Transp. Econ. 2017, 70, 161–172. [Google Scholar] [CrossRef]

- Cai, J.; Li, S.; Cai, H. Empirical Analysis of Capital Structure Determinants in Infrastructure Projects under Public–Private Partnerships. J. Constr. Eng. Manag. 2019, 145, 04019032. [Google Scholar] [CrossRef]

- Larsen, A.S.A.; Volden, G.H.; Andersen, B. Project Governance in State-Owned Enterprises: The Case of Major Public Projects’ Governance Arrangements and Quality Assurance Schemes. Adm. Sci. 2021, 11, 66. [Google Scholar] [CrossRef]

- Steffen, B. The importance of project finance for renewable energy projects. Energy Econ. 2017, 69, 280–294. [Google Scholar] [CrossRef]

- Byoun, S.; Kim, J.; Yoo, S.S. Risk management with leverage: Evidence from project finance. J. Financ. Quant. Anal. 2013, 48, 549–577. [Google Scholar] [CrossRef]

- Sainati, T.; Brookes, N.; Locatelli, G. Special Purpose Entities in Megaprojects: Empty Boxes or Real Companies? Proj. Manag. J. 2017, 48, 55–73. [Google Scholar] [CrossRef]

- Kong, D.; Tiong, R.L.K.; Cheah, C.Y.J.; Permana, A.; Ehrlich, M. Assessment of credit risk in project finance. J. Constr. Eng. Manag. 2008, 134, 876–884. [Google Scholar] [CrossRef]

- Iyer, K.C.; Purkayastha, D. Credit risk assessment in infrastructure project finance: Relevance of credit ratings. J. Struct. Financ. 2017, 22, 17–25. [Google Scholar] [CrossRef]

- Wang, X.; Shi, L.; Wang, B.; Kan, M. A method to evaluate credit risk for banks under PPP project finance. Eng. Constr. Archit. Manag. 2020, 483-501. [Google Scholar] [CrossRef]

- Mora, E.B.; Spelling, J.; van der Weijde, A.H.; Pavageau, E.-M. The effects of mean wind speed uncertainty on project finance debt sizing for offshore wind farms. Appl. Energy 2019, 252, 113419. [Google Scholar] [CrossRef]

- Gonzalez-Ruiz, J.D.; Arboleda, A.; Botero, S.; Rojo, J. Investment valuation model for sustainable infrastructure systems: Mezzanine debt for water projects. Eng. Constr. Archit. Manag. 2019, 26, 850–884. [Google Scholar] [CrossRef]

- Esty, B. Why Study Large Projects? An Introduction to Research on Project Finance. Eur. Financ. Manag. 2004, 10, 213–224. [Google Scholar] [CrossRef]

- Pinto, J. What is project finance? Invest. Manag. Financ. Innov. 2017, 14, 200–210. [Google Scholar] [CrossRef]

- Baiz, C.F., III. Capital Formation And Project Finance Prospects: A New Agenda For Metals Mining. Min. Eng. 1985, 37, 1044–1046. [Google Scholar]

- Miller, R.J. Evaluation of risk in appraisals of large-seale development projects for financing purposes. In Society of Petroleum Engineers-SPE Economics and Evaluation Symposium, EE 1977; SPE Economics and Evaluation Symposium: Dallas, TX, USA, 1997; pp. 15–24. [Google Scholar]

- Rau, W.I. Project FIinancing For International Mining Ventures. Min. Eng. 1980, 32, 1262–1264. [Google Scholar]

- Lovatt, M.; Advisor, F.; Gomersall, E. Will long-term offtake continue to drive project funding. In 18th International Conference and Exhibition on Liquefied Natural Gas 2016, LNG 2016; German Institute for Economic Research: Berlin, Germany, 2016; pp. 22–29. [Google Scholar]

- McGill, S. Project Financing Applied to the Ok Tedi Mine—A Government Perspective. Nat. Resour. Forum 1983, 7, 115–129. [Google Scholar] [CrossRef]

- Kayser, D. Recent Research in Project Finance—A Commented Bibliography. Procedia Comput. Sci. 2013, 17, 729–736. [Google Scholar] [CrossRef][Green Version]

- Gonzalez-Ruiz, J.D.; Rojas, M.; Botero, S.; Arboleda, A. Project Finance y Asociaciones Público-Privada para la provisión de servicios de infraestructura en Colombia. Obras Proy. 2014, 16, 61–82. [Google Scholar] [CrossRef]

- Garcia-Bernabeu, A.; Mayor-Vitoria, F.; Mas-Verdu, F. Project Finance Recent Applications and Future Trends: The State of the Art. Int. J. Bus. Econ. 2015, 14, 159–178. [Google Scholar]

- Neto, D.d.e.S.; Cruz, C.O.; Rodrigues, F.; Silva, P. Bibliometric Analysis of PPP and PFI Literature: Overview of 25 Years of Research. J. Constr. Eng. Manag. 2016, 142, 06016002. [Google Scholar] [CrossRef]

- Sihombing, L.B.; Latief, Y.; Rarasati, A.D.; Wibowo, A. Project Financing Models for Toll Road Investments: A State-of-the-Art Literature Review. Civ. Eng. Archit. 2018, 6, 115–127. [Google Scholar] [CrossRef]

- Olawumi, T.O.; Chan, D.W.M. A scientometric review of global research on sustainability and sustainable development. J. Clean. Prod. 2018, 183, 231–250. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 2017, 111, 1053–1070. [Google Scholar] [CrossRef]

- Badasyan, N.; Riemann, A. Current Status of Public–Private Partnership Research: Academia Fails to Provide Added Value for Industry. J. Infrastruct. Syst. 2020, 26, 04019029. [Google Scholar] [CrossRef]

- Ma, L.; Li, J.; Jin, R.; Ke, Y.; Yuan, J. A holistic review of public-private partnership literature published between 2008 and 2018. Adv. Civ. Eng. 2019, 1-18. [Google Scholar] [CrossRef]

- Song, J.; Li, Y.; Feng, Z.; Wang, H. Cluster Analysis of the Intellectual Structure of PPP Research. J. Manag. Eng. 2019, 35, 04018053. [Google Scholar] [CrossRef]

- Gálvez-Sánchez, F.J.; Lara-Rubio, J.; Verdú-Jóver, A.J.; Meseguer-Sánchez, V. Research Advances on Financial Inclusion: A Bibliometric Analysis. Sustainability 2021, 13, 3156. [Google Scholar] [CrossRef]

- Meseguer-Sánchez, V.; Gálvez-Sánchez, F.J.; Molina-Moreno, V.; Wandosell-Fernández-de-Bobadilla, G. The Main Research Characteristics of the Development of the Concept of the Circular Economy Concept: A Global Analysis and the Future Agenda. Front. Environ. Sci. 2021, 304. [Google Scholar] [CrossRef]

- Peng, B.; Guo, D.; Qiao, H.; Yang, Q.; Zhang, B.; Hayat, T.; Alsaedi, A.; Ahmad, B. Bibliometric and visualized analysis of China’s coal research 2000–2015. J. Clean. Prod. 2018, 197, 1177–1189. [Google Scholar] [CrossRef]

- Zhong, B.; Wu, H.; Li, H.; Sepasgozar, S.; Luo, H.; He, L. A scientometric analysis and critical review of construction related ontology research. Autom. Constr. 2019, 101, 17–31. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J. Evaluation of the excess revenue sharing ratio in PPP projects using principal-agent models. Int. J. Proj. Manag. 2015, 33, 1317–1324. [Google Scholar] [CrossRef]

- Lu, Q.; Won, J.; Cheng, J.C.P. A financial decision making framework for construction projects based on 5D Building Information Modeling (BIM). Int. J. Proj. Manag. 2016, 34, 3–21. [Google Scholar] [CrossRef]

- Sainati, T.; Locatelli, G.; Smith, N. Project financing in nuclear new build, why not? The legal and regulatory barriers. Energy Policy 2019, 129, 111–119. [Google Scholar] [CrossRef]

- Grimsey, D.; Lewis, M.K. Evaluating the risks of public private partnerships for infrastructure projects. Int. J. Proj. Manag. 2002, 20, 107–118. [Google Scholar] [CrossRef]

- Esty, B.; Megginson, W. Creditor Rights, Enforcement, and Debt Ownership Structure: Evidence from the Global Syndicated Loan Market. J. Financ. Quant. Anal. 2003, 38, 37. [Google Scholar] [CrossRef]

- Barroco, J.; Herrera, M. Clearing barriers to project finance for renewable energy in developing countries: A Philippines case study. Energy Policy 2019, 135, 111008. [Google Scholar] [CrossRef]

- Owolabi, H.; Oydele, L.; Alaka, H.; Bilal, M.; Ajayi, S.; Akinade, O.; Agboola, A. Stimulating the attractiveness of PFI/PPPs using public sector guarantees. World J. Entrep. Manag. Sustain. Dev. 2019, 15, 239–258. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. VOSviewer manual; Universiteit Leiden: Leiden, The Netherlands, 2020. [Google Scholar]

- Perks, R. I loan, you mine: Metal streaming and off-take agreements as solutions to undercapitalisation facing small-scale miners? Extr. Ind. Soc. 2016, 3, 813–822. [Google Scholar] [CrossRef]

- Norland, E. Industrial Metals: Can Demans Meet Supply Challenge? CME Group: Chicago, IL, USA, 2019. [Google Scholar]

- Hund, K.; la Porta, D.; Fabregas, T.P.; Laing, T.; Drexhage, J. Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition; International Bank for Reconstruction and Development—The World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Kim, J.W.; Lee, J.-S. Greening Energy Finance of Multilateral Development Banks: Review of the World Bank’s Energy Project Investment (1985–2019). Energies 2021, 14, 2648. [Google Scholar] [CrossRef]

- Elsevier, B.V. Scopus Content Coverage Guide; Elsevier: Amsterdam, The Netherlands, 2020. [Google Scholar]

- Waltman, L. A review of the literature on citation impact indicators. J. Informetr. 2016, 10, 365–391. [Google Scholar] [CrossRef]

- Kennedy, B.A. Surface Mining, 2nd ed.; Society for Mining, Metallurgy and Exploration, Inc.: Littleton, CO, USA, 1990. [Google Scholar]

- Bertisen, J.; Davis, G.A. Bias and error in mine project capital cost estimation. Eng. Econ. 2008, 53, 118–139. [Google Scholar] [CrossRef]

- Bazhin, V.Y.; Beloglazov, I.I.; Feshchenko, R.Y. Deep conversion and metal content of Russian coals. Eurasian Min. 2016, 2, 28–32. [Google Scholar] [CrossRef]

- Visconti, R.M.; Morea, D. Big Data for the Sustainability of Healthcare Project Financing. Sustainability 2019, 11, 3748. [Google Scholar] [CrossRef]

- Clews, R.J. Project Finance for the International Petroleum Industry, 1st ed.; Elsevier Inc.: Amsterdam, The Netherlands, 2016. [Google Scholar]

- Phiri, O.; Mantzari, E. CSR Disclosure Practices in the Zambia Mining Industry; Springer: Singapore, 2018; pp. 471–504. [Google Scholar]

- Morrison, R. The Principles of Project Finance, 1st ed.; Taylor and Francis Ltd.: London, UK, 2016. [Google Scholar]

- Armstrong, M.; D’Arrigo, R.; Petter, C.; Galli, A. How resource-poor countries in Asia are securing stable long-term reserves: Comparing Japan’s and South Korea’s approaches. Res. Policy 2016, 47, 51–60. [Google Scholar] [CrossRef]

- Leader, S. Risk Management, Project Finance and Rights-Based Development, 1st ed.; Cambridge University Press: Cambridge, UK, 2011. [Google Scholar]

- Onorato, W.T.; Fox, P.; Sfrongman, J.E. World Bank Group assistance for minerals sector development and reform in member countries. World Bank Tech. Pap. 1999, 1–30. [Google Scholar]

- Wang, J.Q. Financing the mining industry in China. Chinese Econ. 2012, 45, 76–87. [Google Scholar] [CrossRef]

- Lewis, T.H. Non-Technical Aspects of Developing a Mayor Mine; International Atomic Energy Agency: Vienna, Austria, 1985; pp. 1–114. [Google Scholar]

- Douglas, D. Risk and finance. Mater. World 2009, 17, 30–31. [Google Scholar]

- Moreno, L. Financing and development of new mining projects. In Innovations and Breakthroughs in the Gold and Silver Industries: Concepts, Applications and Future Trends; Springer International Publishing: New York, NY, USA, 2019; pp. 143–156. [Google Scholar]

- Greer, I.R.; Penrose, J.F. Project Finance Ratings Analysis Measures Overall Risk Exposure. In Australasian Institute of Mining and Metallurgy Publication Series; AusIMM: Carlton, Australia, 2003; pp. 323–328. [Google Scholar]

- Atkins, S.J.; Bridges, J.M. Project financing. In Proceedings of the Society of Petroleum Engineers-SPE Economics and Evaluation Symposium, EE 1977, Dallas, TX, USA, 21 February 1977; 1997; pp. 49–54. [Google Scholar]

- Rylnikova, M.V.; Pytalev, I.A.; Trushina, I.A. Project financing in the implementation of technical solutions for the sustainable development of mining enterprises. Sustain. Dev. Mt. Territ. 2018, 10, 436–446. [Google Scholar] [CrossRef]

- Aliaga, W.; Huerta, V. Development of natural gas assets in frontier offshore areas under challenging technical and economic environment-A project finance with real options approach. In Proceedings of the-SPE Annual Technical Conference and Exhibition, San Antonio, TX, USA, 9–11 October 2017. [Google Scholar] [CrossRef]

- Putri, A.R.; Nugroho, B.Y. The effect of investment size and risk of creeping expropriation toward propensity to project finance in infrastructure sector in Indonesia. Int. J. Econ. Res. 2016, 13, 2175–2193. [Google Scholar]

- Haworth, G.R.; Aimone, J.T. How Major New Mines Will Be Financed in The Future. Min. Eng. 1977, 29, 30–32. [Google Scholar]

- Bremen, J.; Lawrence, A. Taking it to the bank-Making your mining project bankable. Eng. Min. J. 2005, 206, 80–83. [Google Scholar]

- Kotey, N.A.; Adusei, P. The Newmont and AngloGold mining projects. In Global Project Finance, Human Rights and Sustainable Development; Leader, S., Ed.; Cambridge University Press: Cambridge, UK, 2011; pp. 462–489. [Google Scholar]

- Scott, F.D. What Banks Require to See Before Financing A Mining Project. Trans. Inst. Min. Metall. Sect. A Min. Technol. 1986, 96, 17–18. [Google Scholar]

- O’Leary, J. Mining project finance and the assessment of ore reserves. Geol. Soc. Spec. Publ. 1994, 79, 129–139. [Google Scholar] [CrossRef]

- Benning, I. Bankers’ perspective of mining project financing. J. S. Afr. Inst. Min. Metall. 2000, 100, 145–152. [Google Scholar]

- Vancas, M.F. Feasibility studies: Just how good are they? Electrometall. Environ. Hydrometall. 2003, 2, 1406–1413. [Google Scholar] [CrossRef]

- Love, S. On the problem of sponsor bias and the unacceptable variance between projected and actual outcomes for mining projects. AusIMM Bull. 2009, 1, 69. [Google Scholar]

- Wirth, H.; Koński, M. Metal streaming instruments as an tool to increase mining project values | Budowa wartości projektu górniczego poprzez wyodrębnienie strumienia metali szlachetnych. Gospod. Surowcami Miner./Miner. Resour. Manag. 2017, 33, 129–144. [Google Scholar] [CrossRef][Green Version]

- The World Bank Group. Doing Business 2016: Measuring Regulatory Quality and Efficiency; The World Bank Group: Washington, DC, USA, 2016. [Google Scholar] [CrossRef]

- Scḧnsteiner, J. Irreparable damage, project finance and access to remedies by third parties. In Global Project Finance, Human Rights and Sustainable Development; Cambridge University Press: Cambridge, UK, 2011; pp. 278–316. [Google Scholar]

- Wislesky, I.; Li, A. Innovative mine waste disposal in two distinctly different settings. In Tailing and Mine Waste ’08; CRC Press: London, UK, 2009; pp. 83–93. [Google Scholar] [CrossRef]

- Brown, N.; Robson, N.; Stephens, E. Emerging market risk-Perceptions and reality. In Australasian Institute of Mining and Metallurgy Publication Series; AusIMM: Carlton, Australia, 2007; pp. 211–218. [Google Scholar]

- Brown, G.A.; Murray, G.S.C. Commitment, compliance and capacity-How environmental, safety, security and social financial issues affect lenders’ risk. In Australasian Institute of Mining and Metallurgy Publication Series; AusIMM: Carlton, Australia, 2007; pp. 35–42. [Google Scholar]

- Tinsley, R. Project-finance risks-due diligence matters. In Australasian Institute of Mining and Metallurgy Publication Series; AusIMM: Carlton, Australia, 2007; pp. 77–86. [Google Scholar]

- Wagner, J.; Jones, M.; Nash, K. Issue management and sustainability: Lessons from a major oilfield development in Madagascar. In Proceedings of the SPE International Conference and Exbition on Health, Safety, Security, Environment, and Social Responsibility, Stavanger, Norway, 11–13 April 2016. [Google Scholar] [CrossRef]

- Armstrong, M.; Galli, A.; Ndiaye, A.A.; Lautier, D. A reality check on hedging practices in the mining industry. In Proceedings of the Project Evaluation Conference, Australasian Institute of Mining and Metallurgy Publication Series, Melbourne, Australia, 21–22 April 2009; pp. 101–106. [Google Scholar]

- Brown, C.; Zakaria, V.; Joubert, A.; Rafique, M.; Murad, J.; King, J.; Hughes, J.; Cardinale, P.; Alonzo, L. Achieving an environmentally sustainable outcome for the Gulpur hydropower project in the Poonch River Mahaseer National Park, Pakistan. Sustain. Water Resour. Manag. 2019, 5, 611–628. [Google Scholar] [CrossRef]

- Bhatt, K. The 2011 Guinean Mining Code: Reducing risks and promoting social benefit in Africa. S. Afr. J. Int. Aff. 2013, 20, 247–270. [Google Scholar] [CrossRef]

- Ubillus, M.J.; Wong, M. Building partnerships with indigenous people. Eng. Min. J. 2008, 209, 52–55. [Google Scholar]

- Von der Linden, E. Gold mining and cyanide leaching—The role of the banks in project financing. J. Explor. Min. Metall. 2000, 53, 471–475. [Google Scholar]

| Keyword | Occurrences | Links | Total Link Strength | Avg. Pub. Year |

|---|---|---|---|---|

| Project finance | 24 | 50 | 92 | 2003 |

| Mining | 20 | 43 | 85 | 1995 |

| Finance | 23 | 39 | 69 | 2006 |

| Risk Management | 12 | 43 | 74 | 2007 |

| Project management | 11 | 35 | 67 | 2008 |

| Investments | 7 | 23 | 31 | 2013 |

| Costs | 7 | 24 | 30 | 2000 |

| Planning | 5 | 22 | 31 | 2009 |

| Economics | 5 | 21 | 28 | 2003 |

| Mining companies | 5 | 22 | 27 | 2011 |

| Risk perception | 4 | 24 | 30 | 2011 |

| Case studies | 4 | 18 | 22 | 1996 |

| Developing countries | 4 | 19 | 22 | 2005 |

| Financing | 4 | 8 | 9 | 2005 |

| Mine Financing | 4 | 6 | 8 | 1989 |

| S/N | Journal | Publisher | Documents Count | Citations | SJR |

|---|---|---|---|---|---|

| 1 | Mining Engineering | Society for Mining, Metallurgy and Exploration | 5 | 2 | 0.136 |

| 2 | Engineering and Mining Journal | Mining Media Inc. | 3 | 0 | 0.102 |

| 3 | Erzmetall: Journal for Exploration, Mining and Metallurgy | GDMB Informtionsgesellchaft | 2 | 0 | 0.381 |

| 4 | AusIMM Bulletin | Australasian Institute of Mining and Metallurgy | 2 | 0 | 0.103 |

| 5 | Engineering Economist | Taylor & Francis | 1 | 39 | 0.286 |

| 6 | Eurasian Mining | Ore & Metals Publishing House | 1 | 15 | 1.347 |

| 7 | Sustainability | Multidisciplinary Digital Publishing Institute (MDPI) | 1 | 13 | 0.581 |

| 8 | Asian Chemical News | Reed Business Information Ltd. | 1 | 0 | - |

| 9 | Resources Policy | Elsevier Ltd. | 1 | 3 | 1.204 |

| 10 | Sustainable Development of Mountain Territories | North Caucasian Institute of Mining and Metallurgy, State Technological University | 1 | 2 | 0.207 |

| S/N | Document | Afilliation Country | Total Citations | h-Index * |

|---|---|---|---|---|

| 1 | [60] | Indonesia | 79 | 1 |

| 2 | [61] | USA | 39 | 1 |

| 3 | [62] | Russia | 14 | 8 |

| 4 | [63] | Italy | 12 | 9 |

| 5 | [64] | USA | 9 | 1 |

| 6 | [65] | United Kingdom | 3 | 2 |

| 7 | [66] | United Kingdom | 3 | 1 |

| 8 | [67] | Chile | 3 | 9 |

| 9 | [68] | United Kingdom | 3 | 5 |

| 10 | [69] | USA | 3 | 4 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

González-Ruiz, J.D.; Mejia-Escobar, J.C.; Franco-Sepúlveda, G. Towards an Understanding of Project Finance in the Mining Sector in the Sustainability Context: A Scientometric Analysis. Sustainability 2021, 13, 10317. https://doi.org/10.3390/su131810317

González-Ruiz JD, Mejia-Escobar JC, Franco-Sepúlveda G. Towards an Understanding of Project Finance in the Mining Sector in the Sustainability Context: A Scientometric Analysis. Sustainability. 2021; 13(18):10317. https://doi.org/10.3390/su131810317

Chicago/Turabian StyleGonzález-Ruiz, Juan David, Juan Camilo Mejia-Escobar, and Giovanni Franco-Sepúlveda. 2021. "Towards an Understanding of Project Finance in the Mining Sector in the Sustainability Context: A Scientometric Analysis" Sustainability 13, no. 18: 10317. https://doi.org/10.3390/su131810317

APA StyleGonzález-Ruiz, J. D., Mejia-Escobar, J. C., & Franco-Sepúlveda, G. (2021). Towards an Understanding of Project Finance in the Mining Sector in the Sustainability Context: A Scientometric Analysis. Sustainability, 13(18), 10317. https://doi.org/10.3390/su131810317