Bridges over Troubled Waters? The Political Economy of Public-Private Partnerships in the Water Sector

Abstract

:1. Introduction

2. Materials and Methods

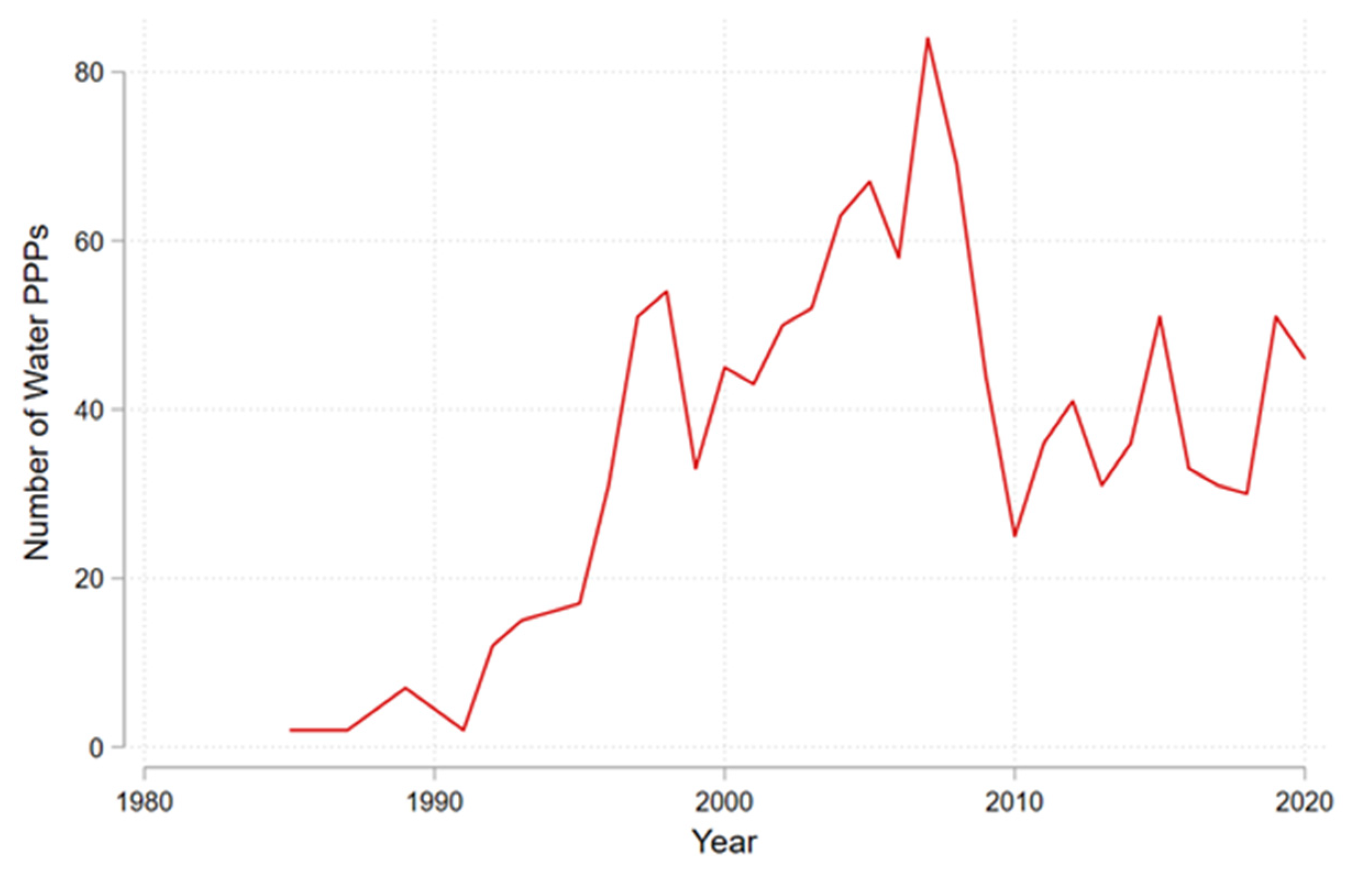

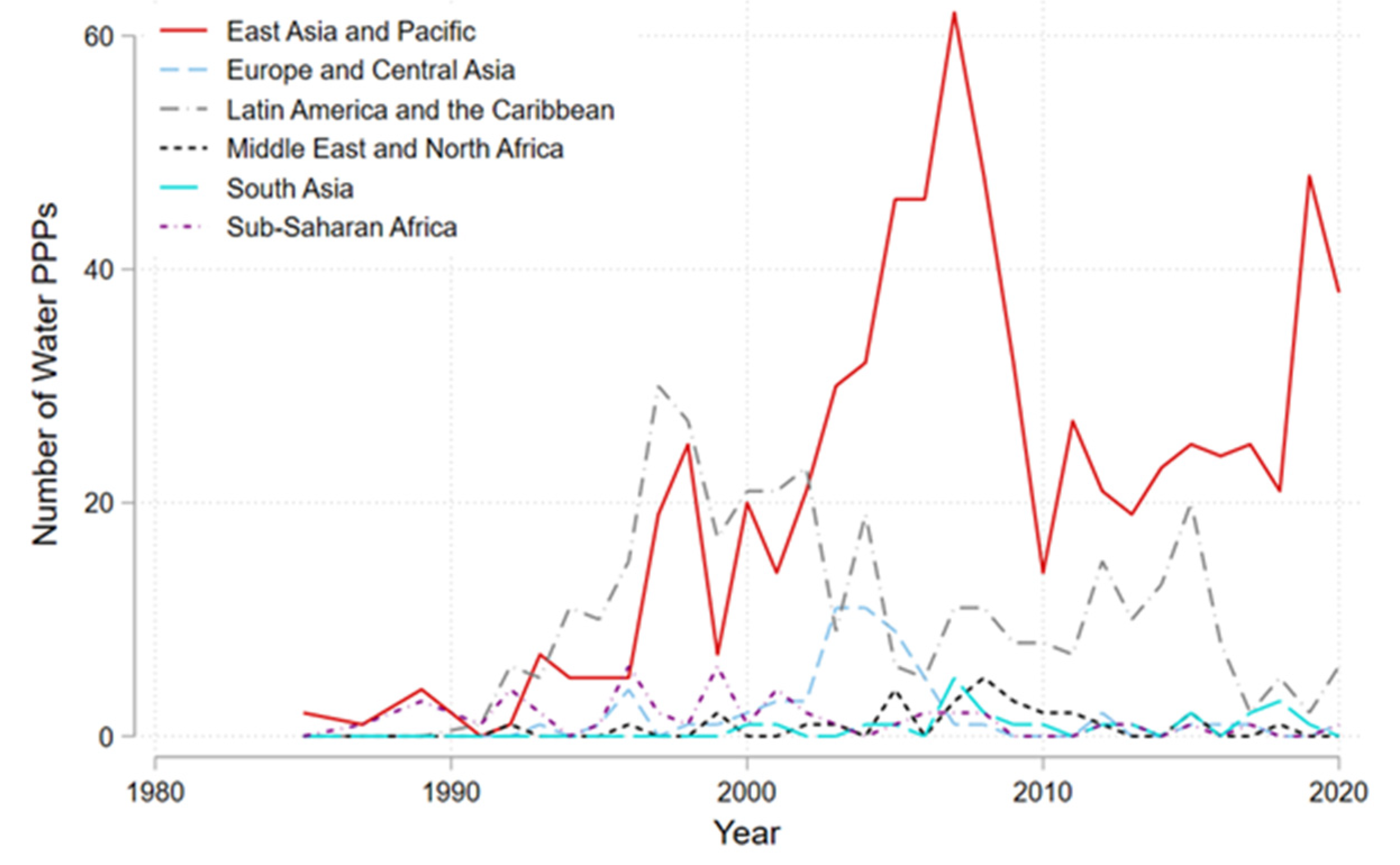

3. Results

3.1. Water Is Different

3.2. Water Treatment versus Water Utilities

4. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- United Nations General Assembly. Resolution 64/292. 2010. Available online: https://www.un.org/waterforlifedecade/human_right_to_water.shtml (accessed on 30 July 2021).

- United Nations. 2021. Available online: https://www.unicef.org/wash (accessed on 30 July 2021).

- World Bank. Water & Sanitation PPPs. Updated on 15 June 2021. Available online: https://ppp.worldbank.org/public-private-partnership/water-and-sanitation/water-sanitation-ppps (accessed on 28 June 2021).

- World Bank. Overview: World Development Report 2017: Governance and the Law. 2017, pp. 2–37. Available online: https://doi.org/10.1596/978-1-4648-0950-7_ov (accessed on 30 July 2021).

- Yescombe, E.R. Public–Private Partnerships: Principles of Policy and Finance; Butterworth-Heinemann: Burlington, MA, USA, 2007. [Google Scholar] [CrossRef]

- Lima, S.; Brochado, A.; Marques, R.C. Public-private partnerships in the water sector: A review. Util. Policy 2021, 69, 101182. [Google Scholar] [CrossRef]

- Tariq, S.; Zhang, X. Critical Failure Drivers in International Water PPP Projects. J. Infrastruct. Syst. 2020, 26, 04020038. [Google Scholar] [CrossRef]

- Qian, N.; House, S.; Wu, A.M.; Wu, X. Public–private partnerships in the water sector in China: A comparative analysis. Int. J. Water Resour. Dev. 2019, 36, 631–650. [Google Scholar] [CrossRef]

- Sadoff, C.W.; Borgomeo, E.; de Waal, D. Turbulent Waters: Pursuing Water Security in Fragile Contexts; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Joshi, S.; Shambaugh, G. Oversized solutions to big problems: The political economy of partnerships and environmental cleanup in India. Environ. Dev. 2018, 28, 3–18. [Google Scholar] [CrossRef]

- Goldman, M. How “Water for All!” policy became hegemonic: The power of the World Bank and its transnational policy networks. Geoforum 2007, 38, 786–800. [Google Scholar] [CrossRef]

- Gleick, P.H.; Cain, N.L. The World's Water 2004–2005: The Biennial Report on Freshwater Resources; Island Press: Washington, DC, USA, 2004. [Google Scholar]

- Kumar, P.S.; Saravanan, A. Sustainable Wastewater Treatments in Textile Sector; Woodhead Publishing: Southston, UK, 2017; pp. 323–346. [Google Scholar] [CrossRef]

- Povitkina, M.; Bolkvadze, K. Fresh pipes with dirty water: How quality of government shapes the provision of public goods in democracies. Eur. J. Politi Res. 2019, 58, 1191–1212. [Google Scholar] [CrossRef]

- Shambaugh, G.; Matthew, R. Sustaining Public–Private Partnerships. In World Scientific Reference on Natural Resources and Environmental Policy in the Era of Global Change: Volume 2: The Social Ecology of the Anthropocene: Continuity and Change in Global Environmental Politics; World Scientific: Singapore, 2017; pp. 121–141. [Google Scholar]

- Rudra, N. Openness and the Politics of Potable Water. Comp. Politi Stud. 2011, 44, 771–803. [Google Scholar] [CrossRef]

- Sharma, C. Determinants of PPP in infrastructure in developing economies. Transform. Gov. People Process. Policy 2012, 6, 149–166. [Google Scholar] [CrossRef]

- Araral, E.; Yu, D.J. Comparative water law, policies, and administration in Asia: Evidence from 17 countries. Water Resour. Res. 2013, 49, 5307–5316. [Google Scholar] [CrossRef]

- Srinivasan, V.; Lambin, E.F.; Gorelick, S.M.; Thompson, B.H.; Rozelle, S. The nature and causes of the global water crisis: Syndromes from a meta-analysis of coupled human-water studies. Water Resour. Res. 2012, 48. [Google Scholar] [CrossRef]

- Woodhouse, P.; Muller, M. Water Governance—An Historical Perspective on Current Debates. World Dev. 2017, 92, 225–241. [Google Scholar] [CrossRef] [Green Version]

- Van der Zaag, P.; Savenije, H.H. Water as an Economic Good: The Value of Pricing and the Failure of Markets; Value of Water Research Report Series No. 19; UNESCO-IHE: Delft, The Netherlands, 2006; pp. 1–32. [Google Scholar]

- Cao, X.; Prakash, A. Trade Competition and Environmental Regulations: Domestic Political Constraints and Issue Visibility. J. Politi. 2012, 74, 66–82. [Google Scholar] [CrossRef] [Green Version]

- Inocencio, A.B.; David, C.C.; Gundaya, D.M. Impact of Trade Liberalization and Exchange Rate Policy on Industrial Water Pollution and Groundwater Depletion; Discussion Paper Series No. 2000-44; Philippine Institute for Development Studies: Makati, Philippines, 2000. [Google Scholar]

| Variable Name | N | Mean | SD | Min | Max |

|---|---|---|---|---|---|

| Project Details | |||||

| PPP Project | 10,427 | 0.835 | 0.371 | 0.000 | 1.000 |

| PPP Project-Electricity Sector | 10,427 | 0.395 | 0.489 | 0.000 | 1.000 |

| PPP Project-Transport Sector | 10,427 | 0.218 | 0.413 | 0.000 | 1.000 |

| PPP Project-Water Sector | 10,427 | 0.137 | 0.344 | 0.000 | 1.000 |

| PPP Project-Water Sector-Water Treatment | 10,427 | 0.091 | 0.288 | 0.000 | 1.000 |

| PPP Project-Water Sector-Water Utility | 10,427 | 0.045 | 0.208 | 0.000 | 1.000 |

| Economic Activity | |||||

| Manufacturing value-added in billions of USD (2017) | 9879 | 424.453 | 933.567 | 0.000 | 3868.458 |

| Net FDI inflows in billions of USD (2017) | 10,392 | 40.398 | 65.360 | −7.574 | 290.928 |

| Textile value-added in billions of USD (2017) | 8228 | 41.689 | 91.042 | 0.000 | 386.533 |

| Proportion of Electricity generated from fossil fuels | 8639 | 0.561 | 0.307 | 0.000 | 1.000 |

| Manufacturing Value Added | 9264 | 17.941 | 6.926 | 0.733 | 50.037 |

| Net FDI inflows in billions of USD (2017) | 10,392 | 40.398 | 65.360 | −7.574 | 290.928 |

| Net Exports in billions of USD (2017) | 10,351 | 368.95 | 688.015 | 0.00805 | 2655.592 |

| Governance and Corruption | |||||

| Level of Democratization (Polity 2) | 9508 | 3.798 | 6.190 | −9.000 | 10.000 |

| WGI: 0 (low corruption) to 5 (high corruption) | 6912 | 2.885 | 0.352 | 1.271 | 4.222 |

| Inequality and Poverty | |||||

| Poverty headcount ratio at USD 1.90/day (2011 PPP) | 5634 | 9.811 | 11.026 | 0.000 | 86.200 |

| Poverty headcount ratio at USD 3.20/day (2011 PPP) | 5634 | 22.090 | 19.171 | 0.100 | 96.300 |

| Prices | |||||

| Avg Cotton price over previous 60 months | 10,427 | 124.901 | 15.593 | 100.445 | 153.652 |

| Avg Leather price over previous 60 months | 10,427 | 210.233 | 32.185 | 172.045 | 292.892 |

| Avg Synthetic fiber price over previous 60 months | 10,427 | 138.561 | 16.834 | 111.162 | 167.117 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Water Project (Any Type) | Electricity | Transport | ||||||

| Productivity by Sector | ||||||||

| Textile value-added, billions of USD | −0.049 *** | −0.034 ** | −0.037 ** | −0.044 ** | −0.042 ** | −0.022 | −0.028 ** | 0.062 *** |

| (0.012) | (0.013) | (0.013) | (0.013) | (0.013) | (0.014) | (0.010) | (0.015) | |

| Proportion of electricity from fossil fuels | 3.026 * | 0.435 | 0.013 | −0.676 | −0.696 | −0.175 | 0.449 | 3.395 ** |

| (1.211) | (1.456) | (1.554) | (1.596) | (1.599) | (1.659) | (1.073) | (1.297) | |

| Textiles × Electricity from fossil fuels | 0.072 *** | 0.050 ** | 0.040 * | 0.049 ** | 0.046 ** | 0.013 | 0.044 ** | −0.052 ** |

| (0.015) | (0.017) | (0.017) | (0.017) | (0.017) | (0.018) | (0.014) | (0.020) | |

| Governance Indicators | ||||||||

| Democracy Score (Polity 2) | −0.017 | −0.011 | 0.034 | 0.033 | 0.062 | −0.029 | 0.049 | |

| (0.032) | (0.032) | (0.036) | (0.036) | (0.039) | (0.029) | (0.039) | ||

| Corruption (WGI) | 1.337 ** | 1.135 * | 0.984 * | 1.008 * | 1.525 ** | −2.039 *** | 0.226 | |

| (0.442) | (0.452) | (0.456) | (0.457) | (0.494) | (0.363) | (0.392) | ||

| Economic Indicators | ||||||||

| Net FDI inflows in billions of USD (2017) | 0.006 | 0.006 | 0.007 | 0.012 ** | 0.000 | −0.012 *** | ||

| (0.004) | (0.004) | (0.004) | (0.004) | (0.003) | (0.003) | |||

| Net exports in billions of USD (2017) | 0.001 | 0.001 | 0.001 | 0.002 | −0.000 | −0.003 ** | ||

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |||

| Poverty HC ratio USD 1.90/day (2011 PPP) | 0.033 ** | 0.033 ** | 0.043 *** | 0.006 | −0.033 *** | |||

| (0.011) | (0.011) | (0.012) | (0.008) | (0.009) | ||||

| Global Demand for Textiles | ||||||||

| Avg Cotton price, previous 60 months | −0.335 ** | −0.333 ** | 0.017 | 0.285 ** | ||||

| (0.109) | (0.113) | (0.086) | (0.097) | |||||

| Avg Leather price, previous 60 months | 0.001 | 0.001 | −0.010 | 0.009 | ||||

| (0.013) | (0.013) | (0.011) | (0.013) | |||||

| Avg Synthetic fiber price, previous 60 months | 0.283 * | 0.276 * | 0.122 | −0.418 *** | ||||

| (0.129) | (0.134) | (0.104) | (0.115) | |||||

| Chi-squared statistic | 315.052 | 163.752 | 170.614 | 180.452 | 192.548 | 206.657 | 424.679 | 367.778 |

| N | 6847 | 5036 | 5034 | 5034 | 5034 | 4483 | 4638 | 4627 |

| Textile value-added + [Textiles × Electricity] | 0.0234 *** | 0.0164 *** | 0.0024 | 0.0048 | 0.0042 * | −0.0088 | 0.0162 ** | 0.0102 |

| Std. error | 0.0036 | 0.0040 | 0.0075 | 0.0076 | 0.0023 | 0.0078 | 0.0068 | 0.0082 |

| Country Fixed-Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Fixed-Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample | All Projects | All Projects | All Projects | All Projects | All Projects | Only PPPs | Only PPPs | Only PPPs |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| Water Project (Any Type) | Electricity | Transport | ||||||

| Productivity by Sector | ||||||||

| Manufacturing value-added in billions of USD | 0.228 *** | 0.231 *** | 0.170 ** | 0.231 *** | 0.225 *** | 0.197 ** | −0.093 | −0.201 ** |

| (0.030) | (0.036) | (0.052) | (0.055) | (0.055) | (0.061) | (0.064) | (0.063) | |

| Proportion of electricity from fossil fuels | 0.043 | 4.795 ** | 4.795 ** | 5.067 ** | 4.847 * | 8.529 ** | −0.825 | −7.668 * |

| (1.509) | (1.759) | (1.849) | (1.886) | (1.898) | (2.678) | (2.852) | (3.231) | |

| Manufacturing × Electricity from fossil fuels | 0.156 * | −0.081 | −0.084 | −0.111 | −0.101 | −0.231 * | 0.058 | 0.397 ** |

| (0.062) | (0.068) | (0.070) | (0.071) | (0.072) | (0.109) | (0.123) | (0.141) | |

| Governance Indicators | ||||||||

| Democracy Score (Polity2) | −0.052 | −0.039 | 0.015 | 0.014 | 0.048 | 0.012 | 0.022 | |

| (0.028) | (0.029) | (0.033) | (0.033) | (0.036) | (0.024) | (0.031) | ||

| Corruption (WGI) | 0.426 | 0.640 | 0.429 | 0.421 | 0.930 * | −1.583 *** | −0.073 | |

| (0.369) | (0.394) | (0.399) | (0.400) | (0.428) | (0.301) | (0.322) | ||

| Economic Indicators | ||||||||

| Net FDI inflows in billions of USD (2017) | 0.006 | 0.007 | 0.007 | 0.010 * | 0.001 | −0.007 * | ||

| (0.004) | (0.004) | (0.004) | (0.004) | (0.003) | (0.003) | |||

| Net exports in billions of USD (2017) | −0.000 | −0.000 | −0.000 | 0.000 | 0.001 | 0.000 | ||

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |||

| Poverty HC ratio USD 1.90/day (2011 PPP) | 0.041 *** | 0.042 *** | 0.049 *** | 0.007 | −0.017 * | |||

| (0.011) | (0.011) | (0.012) | (0.007) | (0.008) | ||||

| Global Demand for Textiles | ||||||||

| Avg Cotton price, prev 60 months | −0.376 *** | −0.358 ** | 0.014 | 0.258 ** | ||||

| (0.106) | (0.110) | (0.082) | (0.093) | |||||

| Avg Leather price, prev 60 months | 0.004 | 0.001 | −0.007 | 0.005 | ||||

| (0.013) | (0.013) | (0.010) | (0.012) | |||||

| Avg Synthetic fiber price, prev 60 months | 0.321 ** | 0.300 * | 0.109 | −0.376 *** | ||||

| (0.124) | (0.129) | (0.100) | (0.109) | |||||

| Chi-squared Statistic | 375.028 | 172.830 | 175.072 | 191.235 | 206.491 | 216.797 | 449.528 | 326.691 |

| N | 8076 | 5524 | 5510 | 5510 | 5510 | 4806 | 5120 | 5121 |

| Manu value-added + [Manu × Electricity] | 1.469 *** | 1.161 ** | 1.091 | 1.128 * | 1.132 * | 0.966 ** | 0.966 | 1.216 |

| Std. error | 0.084 | 0.072 | 0.078 | 0.082 | 0.083 | 0.094 | 0.102 | 0.146 |

| Country Fixed-Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year Fixed-Effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample | All Projects | All Projects | All Projects | All Projects | All Projects | Only PPPs | Only PPPs | Only PPPs |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| Water Treatment, Sample: All Projects | Water Treatment: Water Projects Only | |||||||||

| Productivity by Sector and Pollution | ||||||||||

| Value-added from textiles in billions of USD | −0.085 *** | −0.086 *** | −0.098 *** | −0.096 *** | −0.093 *** | −0.044 | −0.099 * | −0.096 * | −0.089 * | −0.090 * |

| (0.016) | (0.019) | (0.021) | (0.021) | (0.021) | (0.033) | (0.039) | (0.040) | (0.041) | (0.041) | |

| Proportion of Electricity generated from fossil fuels | −4.360 * | −3.985 | −2.844 | −2.860 | −2.881 | −7.116 | −1.838 | 4.010 | 5.182 | 3.192 |

| (2.126) | (2.611) | (2.761) | (2.766) | (2.769) | (3.668) | (5.340) | (6.567) | (6.698) | (8.776) | |

| Textile value-added × Electricity | 0.113 *** | 0.111 *** | 0.125 *** | 0.123 *** | 0.119 *** | 0.053 | 0.122 * | 0.154 ** | 0.143 ** | 0.142 * |

| (0.021) | (0.025) | (0.028) | (0.028) | (0.028) | (0.043) | (0.051) | (0.055) | (0.055) | (0.060) | |

| Governance Indicators | ||||||||||

| Democracy Score (Polity 2) | 0.150 | 0.150 | 0.145 | 0.143 | 0.141 | 0.142 | 0.065 | 0.050 | ||

| (0.077) | (0.077) | (0.078) | (0.078) | (0.102) | (0.105) | (0.121) | (0.130) | |||

| Corruption (WGI) | −0.672 | −0.789 | −0.773 | −0.723 | −4.941 *** | −5.12 *** | −5.13 *** | −4.622 ** | ||

| (0.695) | (0.711) | (0.713) | (0.715) | (1.370) | (1.494) | (1.500) | (1.644) | |||

| Economic Indicators | ||||||||||

| Net FDI inflows in billions of USD (2017) | −0.009 | −0.009 | −0.008 | −0.028 * | −0.028 * | −0.027 ** | ||||

| (0.006) | (0.006) | (0.006) | (0.011) | (0.012) | (0.010) | |||||

| Net exports in billions of USD (2017) | 0.001 | 0.001 | 0.001 | −0.001 | −0.002 | −0.001 | ||||

| (0.002) | (0.002) | (0.002) | (0.003) | (0.003) | (0.003) | |||||

| Poverty HC ratio at $1.90/day (2011 PPP) | −0.010 | −0.009 | −0.044 | −0.038 | ||||||

| (0.019) | (0.019) | (0.041) | (0.044) | |||||||

| Global Demand for Textiles | ||||||||||

| Average Cotton price over previous 60 months | −0.309 * | −0.203 | ||||||||

| (0.134) | (0.313) | |||||||||

| Average Leather price over previous 60 months | 0.002 | −0.047 | ||||||||

| (0.016) | (0.032) | |||||||||

| Average Synthetic fiber price, previous 60 months | 0.272 | 0.482 * | ||||||||

| (0.165) | (0.233) | |||||||||

| Chi-squared Statistic | 241.858 | 143.480 | 145.267 | 145.549 | 152.221 | 53.287 | 61.789 | 70.068 | 71.247 | 74.590 |

| N | 6365 | 4835 | 4833 | 4833 | 4833 | 1008 | 870 | 870 | 870 | 870 |

| Textile value-added + [Textiles × Electricity] | 0.028 *** | 0.025 *** | 0.027 ** | 0.027 ** | 0.026 ** | 0.009 | 0.024 ** | 0.057 ** | 0.055 ** | 0.052 * |

| Std. error | (0.005) | (0.006) | (0.012) | (0.012) | (0.012) | (0.010) | (0.012) | (0.023) | (0.023) | (0.028) |

| Country fixed-effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed-effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample | All Projects | All Projects | All Projects | All Projects | All Projects | Water PPP | Water PPP | Water PPP | Water PPP | Water PPP |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| Water Treatment, Sample: All Projects | Water Treatment: Water Projects Only | |||||||||

| Productivity by Sector | ||||||||||

| Manufacturing value-added in billions of USD | −0.008 *** | −0.008 *** | −0.009 *** | −0.009 *** | −0.009 *** | −0.004 | −0.010 ** | −0.009 ** | −0.009 * | −0.009 ** |

| (0.001) | (0.002) | (0.002) | (0.002) | (0.002) | (0.003) | (0.003) | (0.004) | (0.004) | (0.004) | |

| Proportion of Electricity from fossil fuels | −2.705 | −2.601 | −1.574 | −1.569 | −1.521 | −6.781 | −2.194 | 3.714 | 4.774 | 4.060 |

| (1.872) | (2.464) | (2.630) | (2.633) | (2.630) | (3.536) | (5.300) | (6.464) | (6.608) | (6.298) | |

| Manu. value-added × Electricity from fossil fuels | 0.011 *** | 0.011 *** | 0.012 *** | 0.012 *** | 0.011 *** | 0.005 | 0.012 ** | 0.014 ** | 0.014 ** | 0.014 ** |

| (0.002) | (0.002) | (0.003) | (0.003) | (0.003) | (0.004) | (0.004) | (0.005) | (0.005) | (0.005) | |

| Governance Indicators | ||||||||||

| Democracy Score (Polity 2) | 0.169 * | 0.167 * | 0.164 * | 0.162 * | 0.123 | 0.118 | 0.044 | 0.034 | ||

| (0.078) | (0.078) | (0.079) | (0.079) | (0.100) | (0.102) | (0.118) | (0.115) | |||

| Corruption (WGI) | −0.736 | −0.794 | −0.785 | −0.747 | −5.109 *** | −5.238 *** | −5.250 *** | −5.015 *** | ||

| (0.676) | (0.688) | (0.689) | (0.690) | (1.367) | (1.469) | (1.479) | (1.406) | |||

| Economic Indicators | ||||||||||

| Net FDI inflows in billions of USD (2017) | −0.008 | −0.008 | −0.007 | −0.025 * | −0.025 * | −0.026 ** | ||||

| (0.006) | (0.006) | (0.006) | (0.011) | (0.011) | (0.010) | |||||

| Net exports in billions of USD (2017) | 0.001 | 0.001 | 0.001 | −0.001 | −0.001 | −0.001 | ||||

| (0.002) | (0.002) | (0.002) | (0.003) | (0.003) | (0.003) | |||||

| Poverty HC ratio at $1.90/day (2011 PPP) | −0.008 | −0.007 | −0.042 | −0.041 | ||||||

| (0.019) | (0.019) | (0.040) | (0.040) | |||||||

| Global Demand for Textiles | ||||||||||

| Average Cotton price over previous 60 months | −0.287 * | −0.189 | ||||||||

| (0.133) | (0.208) | |||||||||

| Average Leather price over previous 60 months | 0.003 | −0.049 | ||||||||

| (0.016) | (0.037) | |||||||||

| Average Synthetic fiber price, previous 60 months | 0.252 | 0.482 ** | ||||||||

| (0.165) | (0.164) | |||||||||

| Chi-squared statistic | 245.990 | 150.954 | 152.354 | 152.515 | 158.289 | 53.949 | 63.659 | 70.203 | 71.328 | 74.670 |

| N | 6653 | 5033 | 5031 | 5031 | 5031 | 1021 | 878 | 878 | 878 | 878 |

| Manu value-added + [Manu × Electricity]-Added | 0.003 *** | 0.002 *** | 0.003 ** | 0.003 ** | 0.003 ** | 0.001 | 0.002 ** | 0.005 ** | 0.005 ** | 0.005 ** |

| Std. error | 0.000 | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 | 0.001 | 0.002 | 0.002 | 0.002 |

| Country fixed-effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed-effects | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sample | All Projects | All Projects | All Projects | All Projects | All Projects | Water PPP | Water PPP | Water PPP | Water PPP | Water PPP |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shambaugh, G.; Joshi, S. Bridges over Troubled Waters? The Political Economy of Public-Private Partnerships in the Water Sector. Sustainability 2021, 13, 10127. https://doi.org/10.3390/su131810127

Shambaugh G, Joshi S. Bridges over Troubled Waters? The Political Economy of Public-Private Partnerships in the Water Sector. Sustainability. 2021; 13(18):10127. https://doi.org/10.3390/su131810127

Chicago/Turabian StyleShambaugh, George, and Shareen Joshi. 2021. "Bridges over Troubled Waters? The Political Economy of Public-Private Partnerships in the Water Sector" Sustainability 13, no. 18: 10127. https://doi.org/10.3390/su131810127

APA StyleShambaugh, G., & Joshi, S. (2021). Bridges over Troubled Waters? The Political Economy of Public-Private Partnerships in the Water Sector. Sustainability, 13(18), 10127. https://doi.org/10.3390/su131810127