1. Introduction

Internationally, tourism is defined as the activity of persons travelling and staying in places outside their usual environment for less than one year. The travels and the stays of a visitor are voluntary; they must not be connected with paid activity in the given place. Most commonly, people travel for the purposes of spending their free time, for holidays or recreation. Tourism also involves visits by relatives and acquaintances, educational stays, stays in spa resorts, participation in conferences, and congresses or irregular business trips.

From the economic and geographic point of view, we can distinguish three types of tourism. Domestic tourism is the tourism of citizens of the given state on its own territory. Inbound tourism (also called active tourism) includes visits and stays of non-residents on the economic territory of the given country. Outbound tourism (passive tourism) includes visits and stays of residents outside the territory of the given country [

1].

Sustainable development is an overarching objective of the EU, which is committed to a high level of protection and improvement [

2]. Sustainable development in tourism can be defined as the kind of sustainable development which ensures that the current as well as future needs of those participating in tourism are met, and at the same time helps to develop the particular region. Taking into consideration the efficient use of natural resources and cultural values, it leads to long-term prosperity in the given geographical area.

The fundamental sustainable development goals in tourism are laid out in the Global Code of Ethics for Tourism of the World Tourism Organization, a United Nations specialized agency (UNWTO) [

3]. Tourism plays a significant role in regional development. Following decades of continual growth, it has become one of the world’s most significant industries (accounting for 11% of global GDP). The issue of the environmental impact of the development of tourism, which is comparable to the impact of any other branch of industry, has for a long time not received sufficient attention. Only the massive development of tourism that we have seen in recent years, connected with an increase in the standard of living in developed countries, has drawn our attention to the need to address the issue of its sustainability. The prediction of further development of this promising industry of national economies further underscores this fact.

Last but not least, tourism contributes to learning about new places and the natural as well as cultural heritage of other peoples, and helps visitors to better understand their mentality, customs, and traditions, thus promoting the idea of peaceful coexistence. On the other hand, the massive uncoordinated development of tourism in certain localities can result in the environment being damaged, excessive exploitation of natural resources, particularly non-renewable ones, and there is the risk of the occurrence of conflict between the local population and visitors, for example, because of different customs or behavioral norms.

The research paper gap presents the opportunity to express the changes in the structure of the accommodation capacity in the tourism and hospitality industries in the Czech Republic, and the extent to which these changes are due to increases in incoming tourism from abroad, in particular from countries with a rich clientele. The article also gives reasons for incoming tourists to visit the Czech Republic and to stay in four- and five-star hotels.

The purpose of the paper is to describe the behavior of firms in the tourism and hospitality industries in the Czech Republic when there is a change in the structure of accommodation capacity coinciding with the growth of tourism. This research monitors the current accommodation capacity in the Czech Republic and in its final section presents the future trend in sustainable tourism in the Czech Republic as a basis for further research.

In terms of its structure, this article includes chapters that are both inspirational (in particular the Literature Review) and serve to clarify the methods of scientific research in the tourism and hotel industries (Materials and Methods). The following third chapter discusses the development of the tourism and hotel industries in the period 2012–2017 and consecutively the stay of foreigners in hotels and their breakdown by nationality. The most important part of this chapter is the evaluation of the “Growth of companies in the hotel industry” and of “changes in the structure of accommodation capacities in the Czech Republic”. The Discussion chapter is mainly devoted to an “Analysis of the relationship between the structure of accommodation facilities and the number of foreign tourists” and an “Evaluation of results and recommendations”. The Conclusions chapter then summarizes the most important findings from our own research and confronts them with the possible development of the tourism and hotel industries in the period after the pandemic subsides.

Literature Review

To obtain a qualified solution to the issue of how the quality level of a given accommodation capacity affects the occupancy of hotels by variously affluent clients, it is first necessary to think about the topic of accommodation capacities in terms of the sustainable development of the tourism and hotel industries.

Tourism is considered to be the largest service sector leading to a number of social and economic changes [

4]. Worldwide, tourism has grown in importance, being considered a source of wealth. The competitive environment in which accommodation units operate is focused on customer satisfaction which requires strong interaction between the management of the accommodation units and the client. Provision of high quality services favors the increase in economic efficiency as well as customer satisfaction related to the services offered by the accommodation units. Dealing effectively with customer variability represents a great challenge for service businesses that need to learn to manage it in order to provide the customers with the expected quality and profitable offerings [

5]. The growth of the EU inbound tourism is determined not only by the rich cultural heritage and natural resources, but also by the opportunities and high quality accommodation services. To keep its position of tourism leader, the EU and its top destinations have to continue to satisfy the best the visitors’ expectations [

6]. Owners of facilities should, however, pay attention to and specify a diverse number of offers for seniors. By expanding the company’s range of services addressed to seniors, it is possible to improve the promotion of the accommodation facility, and thus increase the sale of accommodation [

7].

The development of the tourist accommodation sector contributes significantly to the overall growth of tourism. The need for accurately predicting the demand for tourist accommodation for international and domestic tourists is a key goal for future good preparation and appropriate strategy [

8]. The empirical results confirmed that overnight stays for foreign tourists were positively associated with the prices of short-stay accommodation. Tourists could benefit either from greater price stability or from differentiated seasonal prices, which are important in the promotion of the price attractiveness of the tourist destination [

9]. The findings also reveal that the local tourist accommodation supply has experienced an especially dynamic, sustained growth over the past decade. This expansion has been accompanied by an increased supply of other services, suggesting that accommodation can positively influence the existing and/or future socio-economic development of low-density territories [

10]. Accurate forecasting of hotel accommodation demands is extremely critical to the sustainable development of tourism-related industries [

11].

Sustainable tourism has thus become a popular topic in tourism research [

12,

13,

14]. Tourism is an entire system of its own, characterized as complex and dynamic, necessitating the need for sustainability considerations [

15]. Sustainability plays an important role in society by improving long-term quality of life, including future generations, seeking harmony between economic growth, social development and the protection of the environment [

16]. Accommodation providers such as hotels, campsites, and holiday villages can use ecolabels to show their green credentials to potential customers [

17]. Yilmaz et al. [

18] add that the sustainable management and operation activities of the hotels differed significantly according to whether or not they were eco-labeled certified. Overall, it is obvious that eco-labels have a significant impact on the implementation of environmentally friendly, responsible, and sustainable tourism practices in the accommodation sector.

Sustainable tourism, in the cultural context, is a fundamental element for the economic development of some local communities. There are many factors that can influence the success of this type of tourism, but any action or strategy adopted should be closely related to the satisfaction of the tourist [

19]. Sustainable tourism growth is unstoppable and is already a reality—proved by decades of permanent growth. Sustainable tourism growth is needed for economic, social, cultural, environmental, and political reasons. A continued and sustainable tourism growth is possible with better management and the innovation and technology support [

20,

21]. David Lóránt and Csaba Szűcs [

22] state that taking advantage of the Internet service providers can introduce accommodation possibilities, the sights of the destination, etc., thus narrowing down the gap in the information asymmetry between them and the prospective tourists.

Sustainability implementation depends principally on individual firms’ recognition of the relevance of sustainability to their operations. However, the relevance of sustainability to micro tourism and hospitality accommodation enterprise (MTHAE) owners is still unclear in the current literature [

23]. Jiang et al. [

24] add that the sustainable development of the tourism accommodation industry needs the synergy of formal and informal institutions. Fennell and Bowyer [

25] introduce the idea of sustainable transformation at a time when sustainability science is crucial to the future development of the tourism industry.

The rich cultural and natural heritage of European countries have brought European tourism to the forefront. This status creates a need to take care of said tourism, with a particular focus on analyzing its sustainability [

26]. The dynamic development of the sharing economy is clearly seen in particular, in the area of tourism in large cities. There is, therefore, an increasingly urgent need to study its impact on the functioning of cities, especially when they implement a sustainable development policy [

27]. The concept of sustainability has been widely accepted in tourism to mitigate the detrimental effects of mass tourism [

28]. Alvarez et al. [

29] raise the need to promote sustainable tourism, based on the potential of the locality, capable of preserving the values and culture of the region, generating jobs, creating social development and originating in SMEs. In the context of sustainable tourism development, tourist satisfaction looked at from the perspective of the experience lived in the destination and the quality of services rendered by service providers is one of the directions in which researchers point their attention [

30].

The number of foreign tourists visiting the Czech Republic rose in the period between 2012 and 2017, as did hotel occupancy and accommodation prices. Pricing is a basic strategic tool in hotel revenue management (RM) [

31]. The cost of accommodation in the near future will approach EUR 92 per room. Some hoteliers therefore planned to expand the entrepreneurial activities of their firms.

During the last decade, the tourism and hospitality industries have evolved significantly, pushing the bar higher for operators trying to get a competitive advantage in the area [

32]. The number of guests in Czech hotels, for example in June and July 2017, grew by almost one tenth compared to the previous year. The number of visitors in four-star hotels was increased by 11%, according to the data from the Czech Statistical Office (CZSO) [

33].

Thus, 2018 was a record season for hotels, particularly those in Prague. The positive development of the economy, the new airlines from Asia and the USA to Prague, or the perception of the Czech metropolis as a safe destination played a big part in it. A number of previous studies have shown a strong relationship between transport infrastructure and tourism [

34,

35,

36,

37,

38,

39]. A large proportion of tourists arrive at their final destination by plane, so it is not surprising to find that air services have a high impact on the number of tourist arrivals [

40,

41,

42]. Indeed, transportation acts as one of the main determinants of tourist destination as it improves accessibility to a particular location [

43].

The demands of tourists from the Czech Republic are also growing. The increased market saturation and competition in both domestic and international tourism destinations have renewed interest among hotel operators in identifying the key drivers of hotel performance [

44].

2. Materials and Methods

2.1. Methods and Research Question

The main method used in the creation of the paper was the statistical analysis. Apart from this main method, we also used the descriptive method for the characterization of the tourism and hotel industry in the Czech Republic and the method of comparative analysis to express the nature and size of annual changes in individual indicators of tourism.

To find out the reasons for changes in the structure of accommodation capacity in the tourism and hospitality industries, the following research question has been established:

“Recently, there has been a change in the structure of accommodation capacity in the Czech Republic, resulting in an increase in the number of four-star and five-star hotels and a decrease in the number of other hotels. Was the reason for this change the growth of inbound tourism by wealthier clients from the developed countries of Asia, the US and the Gulf countries demanding more comfortable accommodation?”

The specific research procedure will be as follows:

Find the number of foreign tourists who have been accommodated in hotels according to the tourism statistics of the CZSO, Czech Tourism, etc., and draw up a time series of related indicators.

In particular, the time series of the following indicators will be monitored:

o the number of accommodation facilities in Czechia by category,

o the number of beds in accommodation facilities by category,

o number of nights spent in collective accommodation facilities in the Czech Republic by foreign tourists.

In order to evaluate the relationship between the development over time of accommodation for foreign tourists and domestic tourists in the Czech Republic, statistical methods, especially regression and correlation analyses, will be used.

Particular attention will be paid to the statistics on the number of companies in the hospitality sector according to hotel room category.

An analysis of the national composition of foreign tourists accommodated in the Czech Republic will be carried out in order to determine the willingness of foreign tourists to pay for accommodation at better quality hotels (four-star and five-star), which is reflected in their demands for quality accommodation.

2.2. Statistical Methods

For non-periodic time series trend modeling, the classic trend functions with minimum number of members in the equations have been used for the sake of mathematical simplicity, with minimum possible power of the argument and minimum number of extremes and inflection points. The following functions (in their general shapes) can be sorted among these classic models [

45]:

where

a,

b, and

c, are the function parameters and

t = 1, 2, …,

n.

For example, the linear function (1) in the following statistical analysis (Table 6) corresponds to the course of the trend function of the number of four and five-star hotels.

2.3. Statistical Criterion for the Appropriate Trend Function Model Selection

The index of determination

I2yt (%) expresses at how many % the trend function corresponds to the actual

yt values. As a limit value for prediction, a value higher than 75% has been considered:

where

yt…actual value observed,

…theoretical value observed,

arithmetic mean of time series,

t = 1, 2, …, n.

n…length of the time series.

2.4. Short Theoretical Background

When examining the behavior of businesses in the tourism sector, we can distinguish two basic forms of market competition between companies. Oligopolistic competition presupposes the existence of only a few companies in the sector, of which at least some have a significant market share and therefore may influence the price of production on the market [

46]. The oligopolistic behavior of a supply company influences the market demand and supply of the whole sector, and the company must therefore take into account not only the demand, but also the competitor’s response to its choice, and must itself respond to the supply choice of competitors. It incorporates the expected response of the competitor in its function of expected demand. This type of competition in the tourism industry can involve large hotel chains—whether they be multinational chains such as the Hilton, Waldorf Astoria, or Ritz-Carlton, or chains owned by local owners, as is the case with the CPI Hotels chain in the Czech Republic. These chains operate mainly five-star and four-star hotels and guarantee quality accommodation for foreign tourists and related services.

In the case of perfect or monopolistic competition, we assume the existence of such a large number of (small and medium-sized) companies in a given market that the decision of one company on the quantity and pricing of produce does not affect the pricing and optimal output choice of the other companies. We thus include, in particular, small and medium-sized hotels with one to three stars, and similar accommodation facilities (e.g., guest houses, campsites, and cottage settlements) in the monopolistic competition of companies in the tourism sector. These types of accommodation facilities are mainly for domestic tourists for sightseeing or recreational purposes, and usually have individual owners.

3. Results

The development of the growth of companies in the hotel industry is the main subject of interpretation contained in the Results section. The issue of the occupancy of accommodation facilities is related to the comparison of the number of domestic and foreign guests, the number of nights spent by foreign tourists, and their breakdown by nationality. The final part of the third chapter is devoted to the interpretation of the development of two basic indicators of the hotel industry: changes in the number of accommodation capacities and changes in their structure expressed by the number of beds. The study of the correlation between the discussed indicators of economic performance of the tourism and hotel industries is then presented in the following Discussion section.

3.1. Tourism and Hotel Industries in the Czech Republic in the Period 2012–2017

The tourist and hotel industries are two of many sectors of the Czech economy showing a positive trend thanks to the increase in the number of foreign tourists.

Entrepreneurs in tourism, including hoteliers, experienced an unusually successful year in 2015; all indicators in the sector surpassed the records of the previous year, 2014. In 2015, 17.2 million guests were accommodated in domestic hotels and guest houses, which represents 10.2% YoY growth. According to the Czech Statistical Office, 8.7 million foreign tourists came to the Czech Republic, which represents 7.3% YoY growth. The number of Russian tourists dropped significantly, by 37.4%. Conversely, there was a 12.6% YoY growth in the number of German tourists accommodated in the Czech Republic, and the number of accommodated Slovak tourists grew by 14.6%. In 2015, the average expenditure of foreign tourists per person per day reached CZK 2,769 (EUR 102.5), according to the data provided by the Czech Tourism agency [

47].

Undoubtedly, the monetary policy of the CNB (Czech National Bank) had a positive influence on inbound tourism. There was also the impact of large events, such as the Ice Hockey World Championship and the European Under-21 Football Championship; and, last but not least, the refugee crisis and the security situation in the Arab world were also reflected in the development of tourism.

Czech hotels and other accommodation facilities were also visited by 8.5 million Czech tourists, which is approximately a million more than in 2014. Thus, after many years, the number of Czech tourists is beginning to approach the numbers of foreign tourists. Compared to 2014, the increase is 600,000. Czech tourists are good news for domestic hoteliers because they tend to stay away from home longer than foreigners. They spent 23.8 million nights in hotel beds, while foreign tourists only stayed for 23.3 million nights. Foreigners dominated in Prague—5.7 million visited the capital [

47]. Czech tourists like to travel to the south of the country—the South Moravian and South Bohemian regions both attracted a million Czech guests.

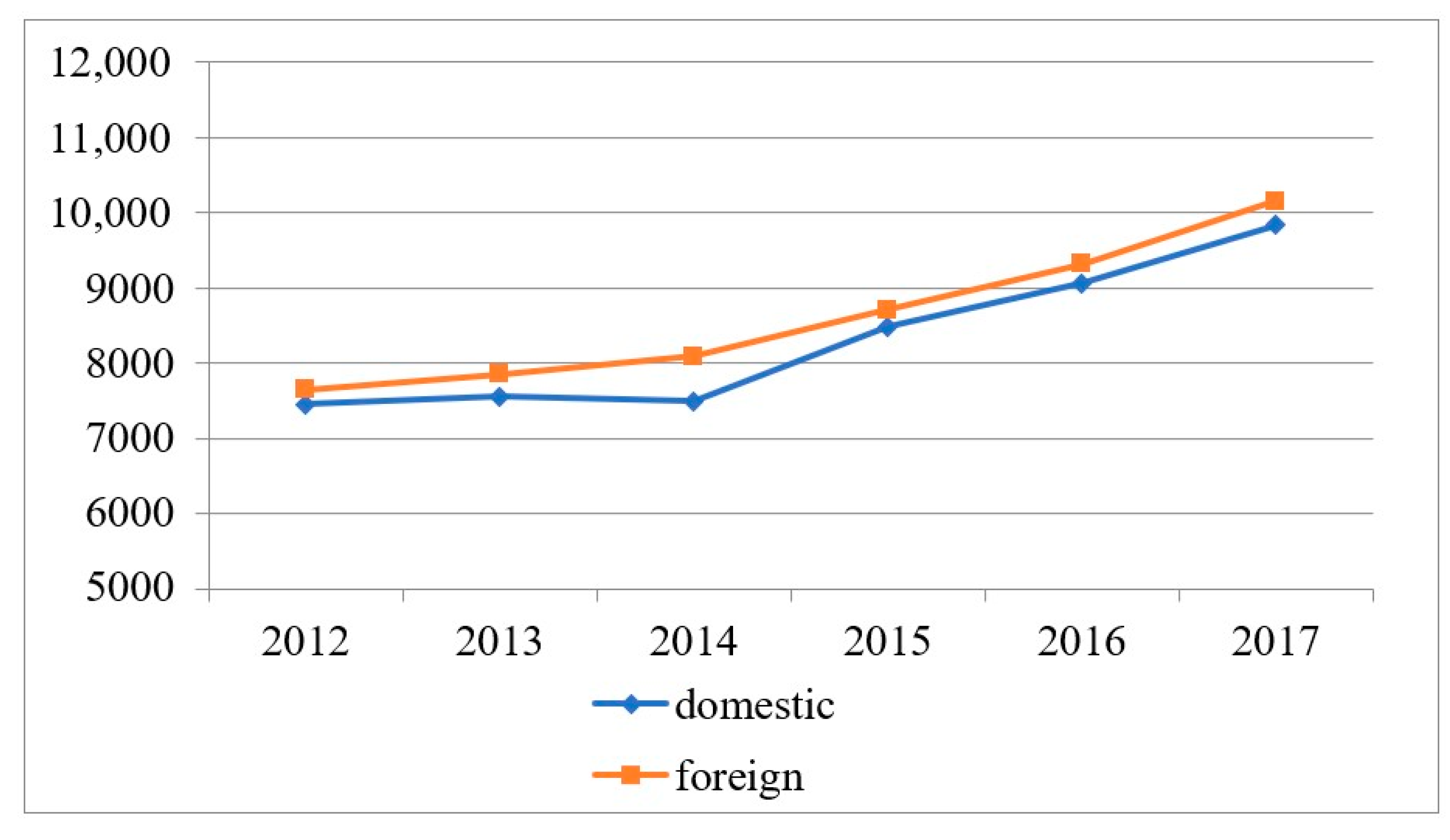

According to data available from the Czech Statistical Office, the number of guests in accommodation facilities in the Czech Republic further increased to 18,388,853 tourists in 2016. The annual increase in the number of guests in accommodation facilities in the Czech Republic reached 6.94% in 2016. This increase was lower than the record yearly increase, which occurred from 2014 to 2015. In 2016, the number of Czech guests in accommodation facilities in the Czech Republic was only 250,000 less than the number of foreigners. This is shown in

Table 1.

Over 9.3 million tourists visited the Czech Republic in 2016. Compared to 2015, this represents an increase of 7.05%. The number of domestic accommodated guests increased by almost 7%, to over 9 million. In 2016, fewer foreign guests came to the Czech Republic from Russia and Japan. In contrast, the interest of German tourists kept growing. The YoY increase in their number was 6.4% [

33].

In 2017, 20 million tourists were accommodated in Czech hotels, guest houses and campsites, which is a YoY increase of 8.77% compared to 2016 (see

Table 1). The number of foreign visitors increased by 9%, while that of domestic visitors rose by 8.5%. According to the Czech Statistical Office [

33], the greatest increase in the number of tourists occurred in the South Moravian region.

In addition, the record number of overnight stays was exceeded in 2017. For the first time, this indicator exceeded 50 million. On average, foreigners spent 2.6 days in the Czech Republic; however, 80% of them stayed in Prague. Far behind Prague come Brno, Český Krumlov, Karlovy Vary, and Plzeň. Many towns are not coping well with the growing tide of tourists.

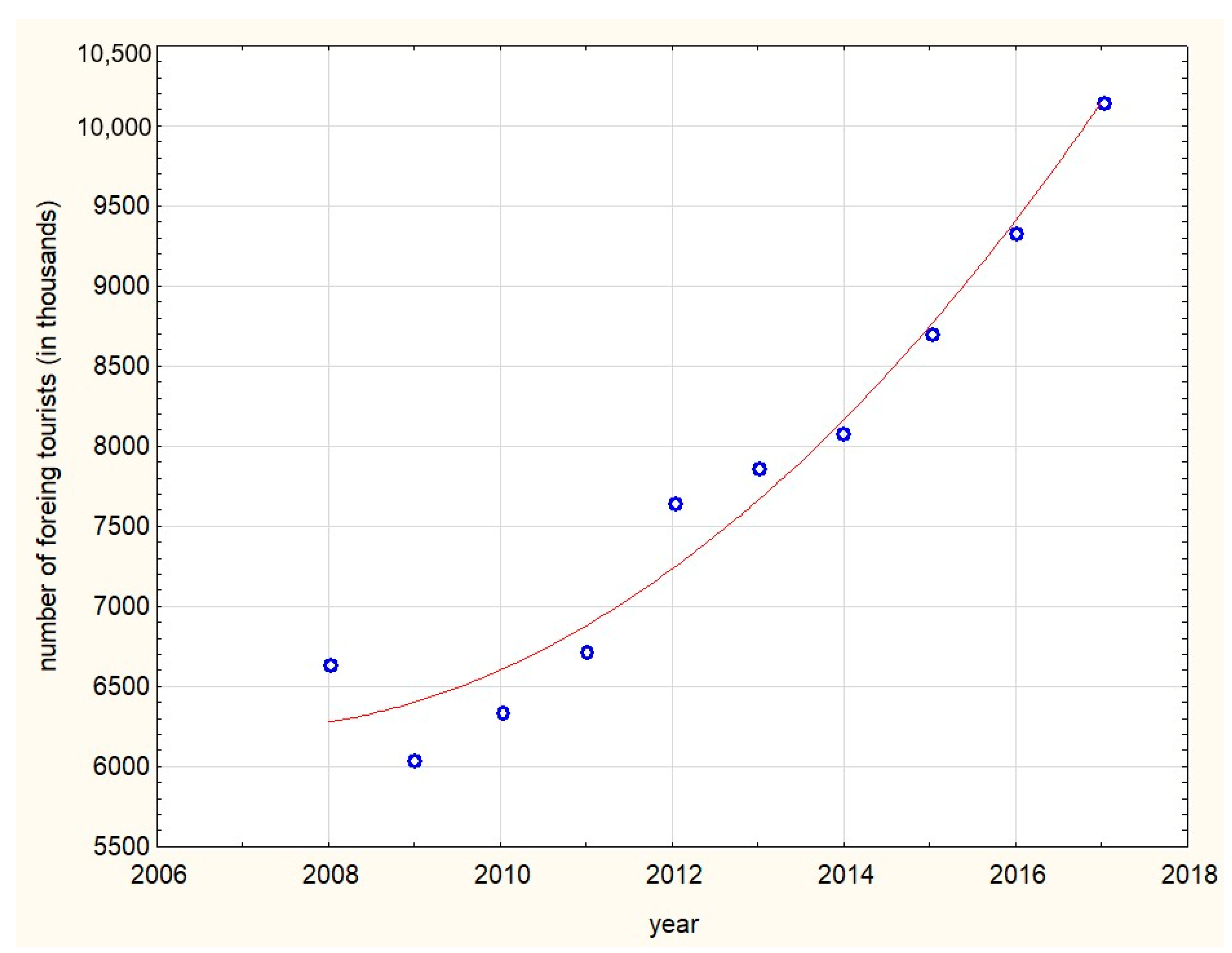

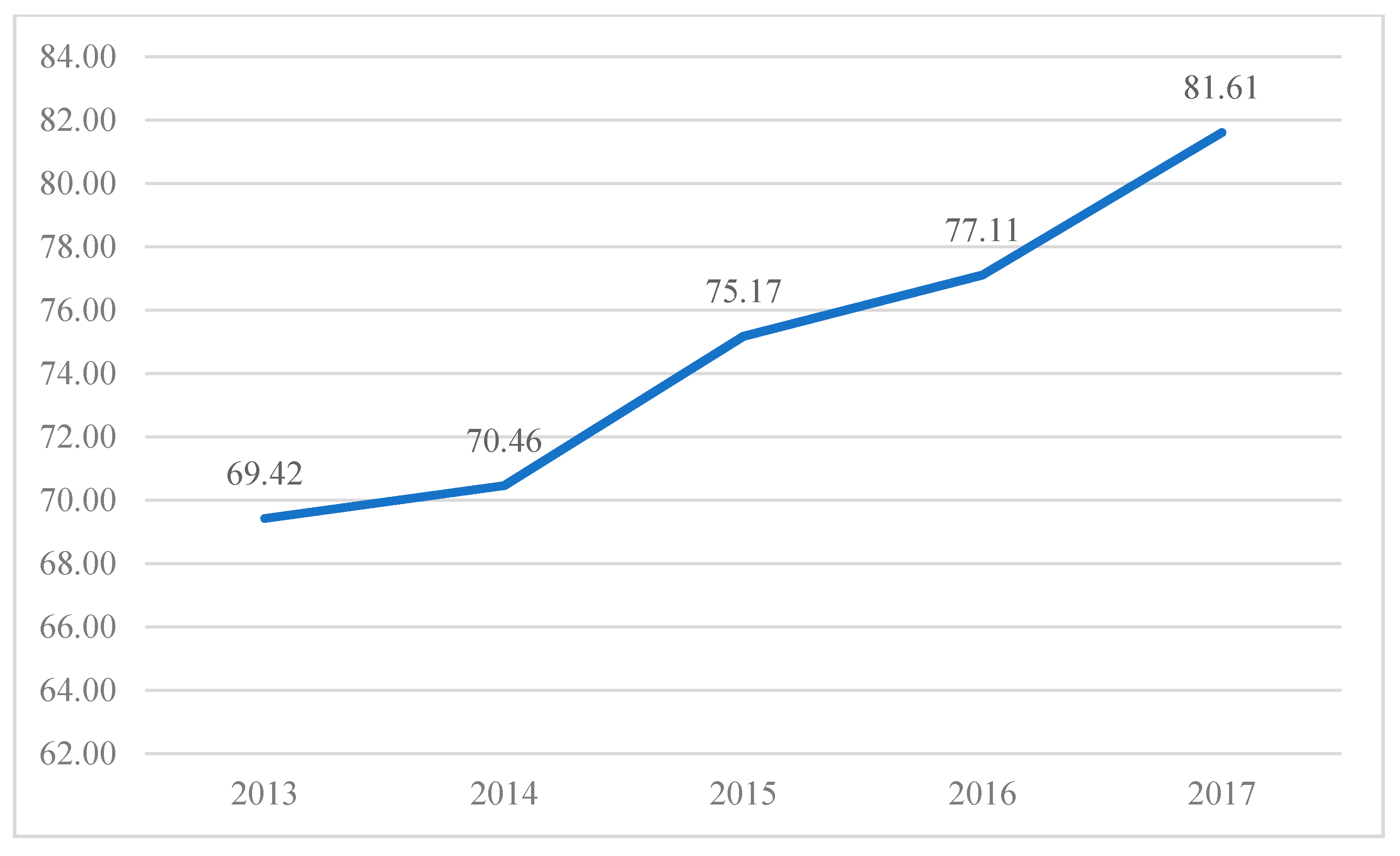

Figure 1 and

Figure 2 show the faster growth of the number of foreigners compared to local guests in accommodation facilities in the Czech Republic, which has become evident since 2012.

As can be seen from a comparison of the two graphs, the number of tourists in the Czech Republic grew faster in the period 2012–2017 (by around 125,000 people), albeit with only a slight increase in the number of foreign visitors compared to domestic tourists.

In the second quarter of 2018, 5.5 million tourists were accommodated in Czech hotels, guest houses, and campsites, which represents a YoY increase of 4.6%. The number of overnight stays grew by 2.2%. The numbers of both the domestic and foreign tourists have increased; that of Czech tourists by 7.9%, and that of foreign tourists by 1.6%. As always, the greater number of tourists came from Germany; they made up approximately one fifth of the foreign clients in accommodation establishments. The number of visitors from China has grown significantly; in contrast, there were fewer visitors from Russia than previously. There has also been an increase in the number of tourists from Poland, Slovakia, Spain, and the Netherlands.

This development is a great result for Czech inbound tourism. It reflects the increasing popularity of the Czech Republic in terms of both its overall image as a destination and individual parameters, such as the quality of its infrastructure, the availability of services and security [

48].

According to the Czech Tourism [

47], the increasing popularity of the Czech Republic as a safe destination is reflected in the development. The image of the Czech Republic as a safe country is appreciated particularly on the Asian markets as a significant strategic advantage.

3.2. The Number of Nights Spent in the Czech Republic by Foreign Tourists

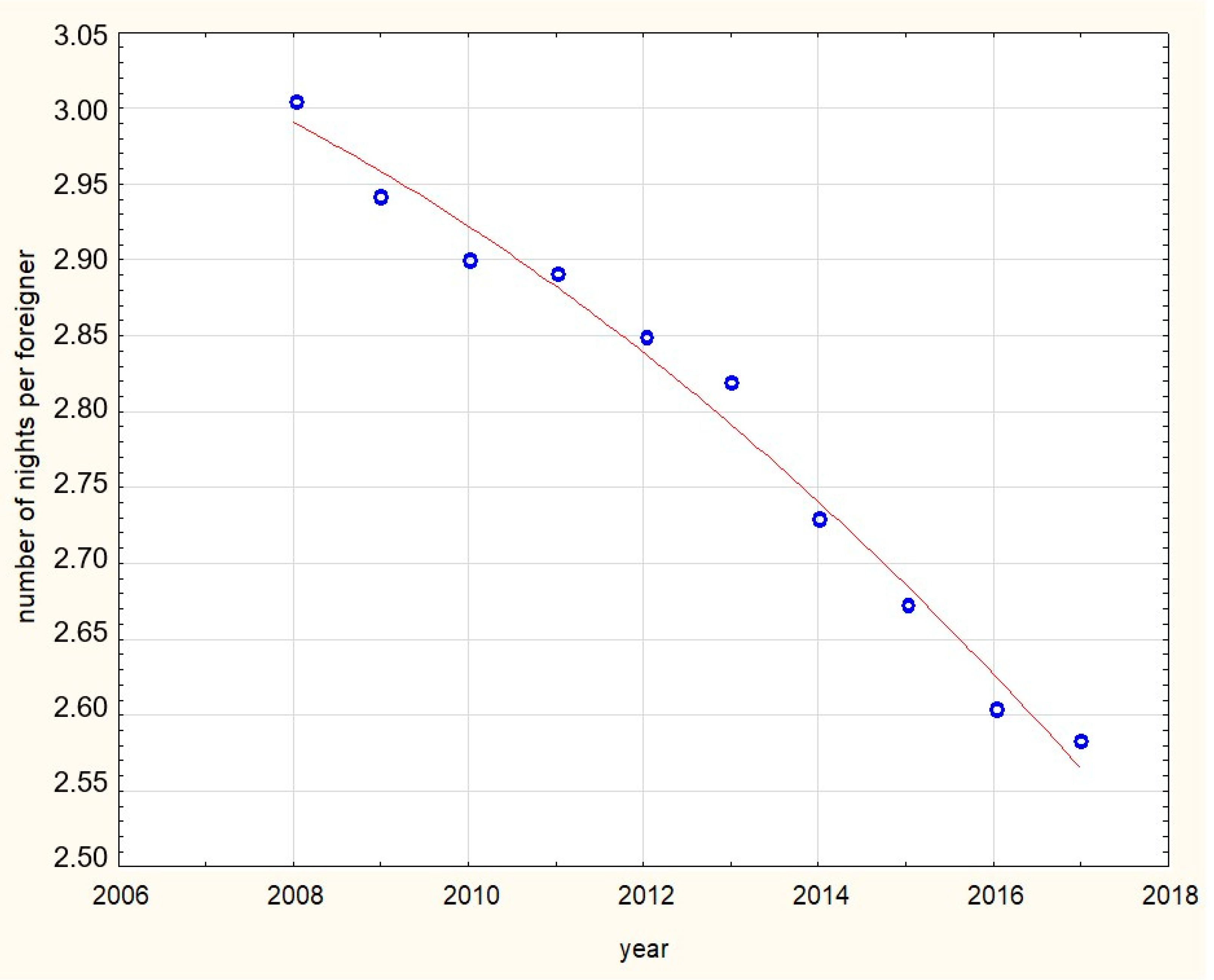

The number of overnight stays was higher in 2017 than in previous years. A total of 53.2 million nights were spent in collective accommodation establishments, which is 7.1% more than in 2016. This indicator also set a new record high. The year-on-year growth rate was higher for non-residents (+8.2%), who also had a higher absolute number of overnight stays (27.0 million). Domestic guests had a total of 26.3 million overnight stays, which represents an increase of 6.0%.

The average length of stays remained at the same level in 2017 as in previous years. On average, a guest stayed for 2.7 nights, and thus stayed at the accommodation establishment for 3.7 days. However, the trend of gradually shortening stays is confirmed over the long term. For comparison: in 2000, a guest stayed at the accommodation establishment for an average of 4.1 nights.

In the case of foreign tourists, the number of nights spent in collective accommodation establishments in the Czech Republic is falling at an even faster rate (see

Figure 3).

3.3. The National Composition of Foreign Tourists Accommodated in the Czech Republic

The most common nationality of the foreign tourists accommodated in the Czech Republic in 2016 was German; tourists from Slovakia were in second place and tourists from Poland third, followed closely by U.S. citizens.

In 2017, the number of tourists from abroad that stayed overnight in accommodation establishments exceeded ten million for the first time, which represents a YoY increase of 7% [

49]. However, the actual number of foreigners that visited the Czech Republic was higher because the statistic does not count the services of shared accommodation, such as Airbnb.

Traditionally, most foreigners came from Germany (see

Table 2). There has been 3.9% YoY increase in the number of German tourists, to almost 2 million. Slovakia was in second place; 682,000 visitors who were accommodated in the Czech Republic came from there. This was 7.2% more than in 2016. Poland came in third place, with 576,000 visitors [

33].

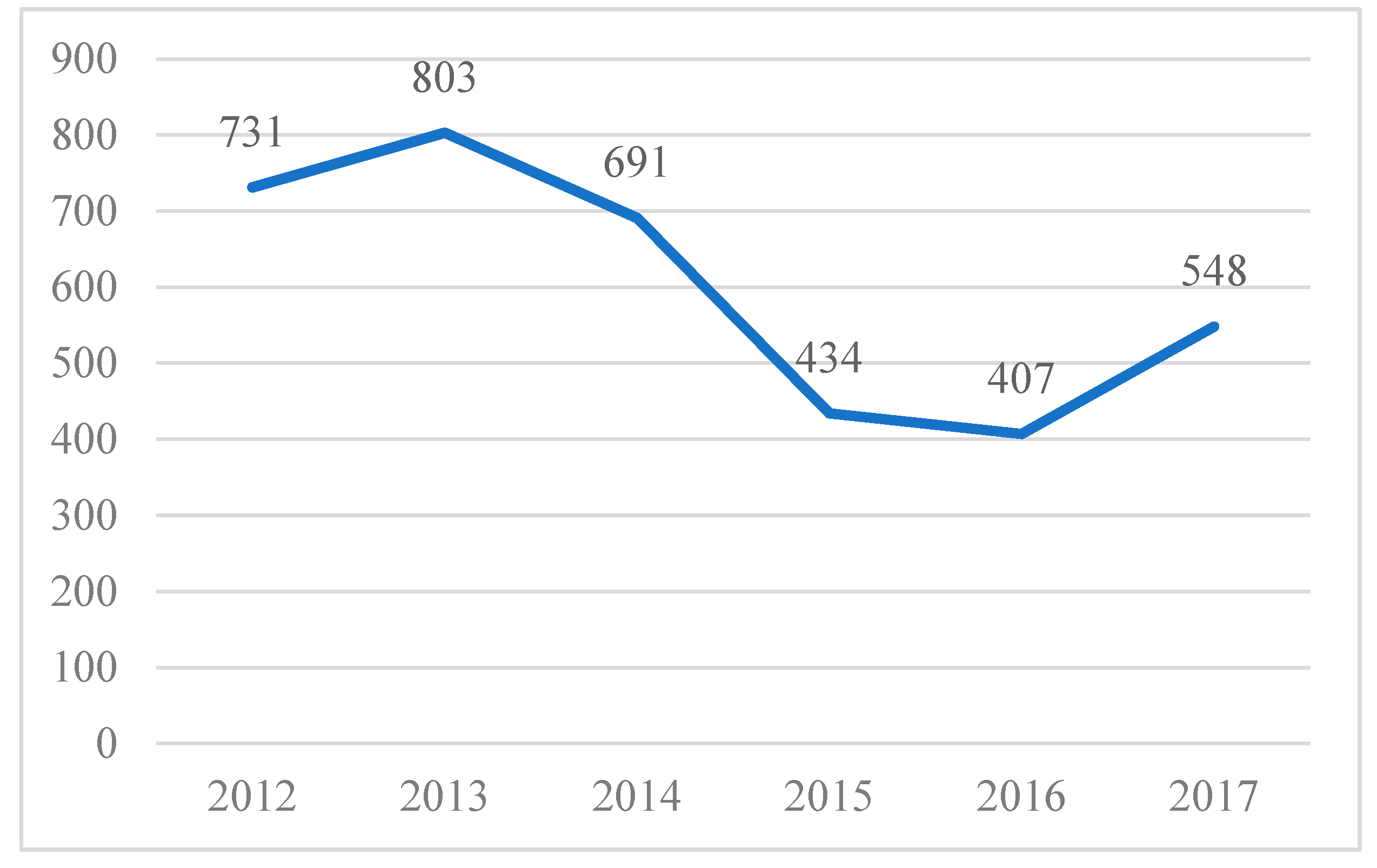

The resurgent numbers of visitors from Russia brought them into fourth place, with a 35.3% YoY increase. This makes their number one third higher than in the previous year—almost 550,000 (see

Figure 4).

When the economic crisis hit Russia five years ago, the number of Russian tourists dropped by almost one half. Now, the numbers are returning to their original values. Moreover, Russians spend more time in the Czech Republic—four days on average. The number of visitors from South Korea, the United Arab Emirates, and Saudi Arabia has also increased significantly [

49].

Even though current Czech visitors’ statistics methodically document the prevailing inbound tourism from countries neighboring the Czech Republic (Germany, Slovakia, Poland), a new trend is emerging. This is partly a recovery in the number of mostly richer clientele from Russia, but it is also an increase in clientele from Asia, the United States, and some rich Arab countries demanding better quality accommodation. Hoteliers must also adapt to this phenomenon, as is evidenced by the results of the survey conducted among them (see Chapter “Research conducted into the hospitality sector in the Czech Republic”).

Sustainability plays an important role in society by improving long-term quality of life, including future generations, seeking harmony between economic growth, social development, and the protection of the environment [

16]. It was shown that tourism is menacing not only the vitality of their local economies, but also the integrity of their heritage and the quality of life of their residents. Measures to control and guide visitor flows are urgently needed. In reality, tourism management in the heritage cities does not go much further than promotion [

50].

3.4. Growth of Companies in the Hotel Industry

The demands of tourists from the Czech Republic were growing. They were looking for better quality accommodation and services. The findings of hoteliers confirm the data of the CZSO, according to which four-star hotels play top fiddle among tourist accommodation establishments. More than 5.7 million people were accommodated in four-star hotels in 2016, which is a 10% YoY increase. No other category has achieved such a significant increase. The number of various accommodation facilities has adapted to this trend; in the years 2012–2016, the number of four-star hotels grew by 82 from 539 to 621. On the other hand, the number of guest houses decreased by 318, which means there is a total of 3406 in the Czech Republic. The number of tourist lodges and facilities of two-star and lesser rating also decreased. The numbers of five-star hotels and campsites have not changed much since 2012 [

33]. The statistics show clearly that foreign guests prefer four-star hotels. For domestic guests, three-star hotels are the most popular.

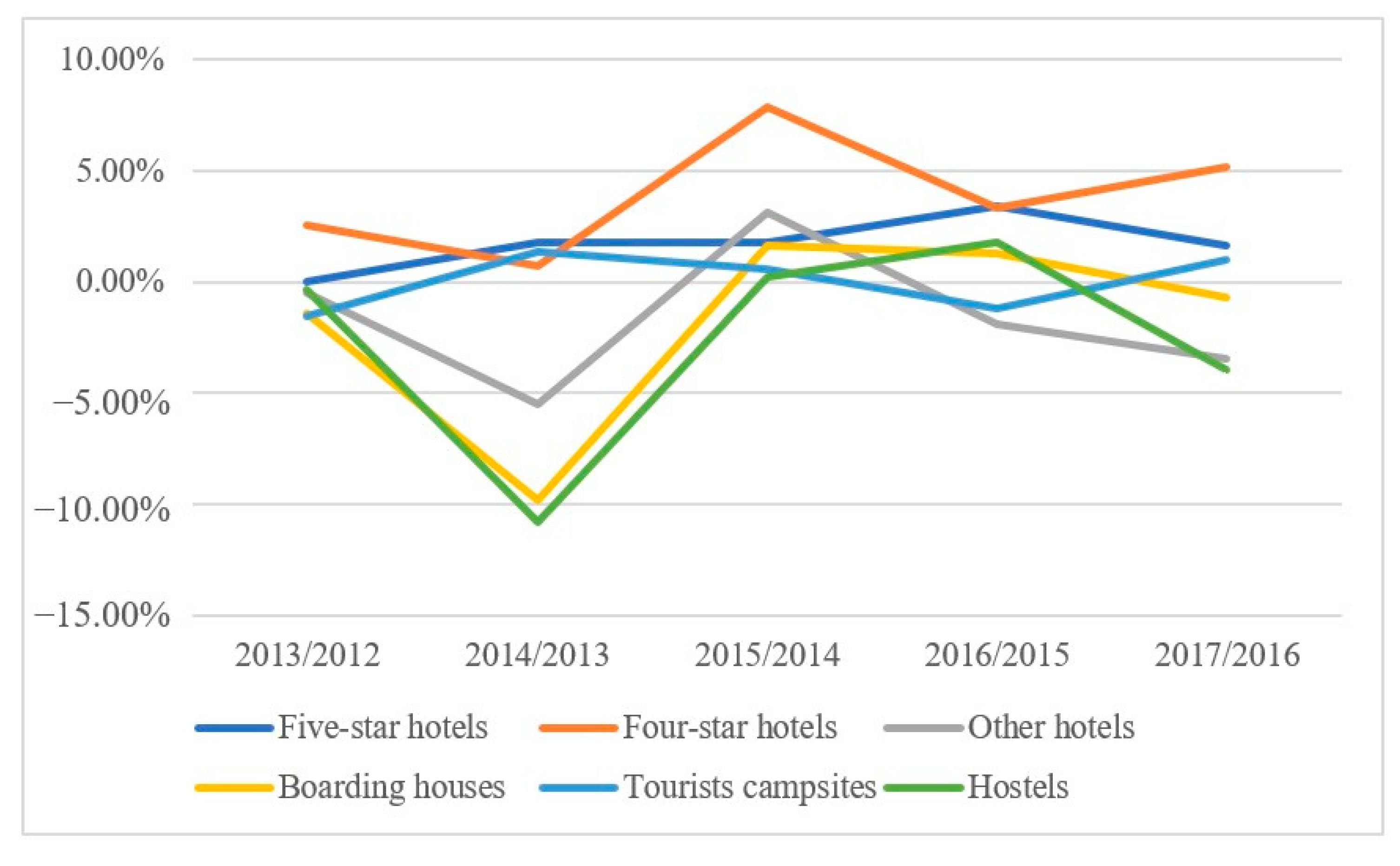

The following figure shows the pace of YoY changes in individual forms of accommodation capacity in the Czech Republic.

Figure 5 shows that previously significant percentage changes (fluctuations) in the number of companies providing various types of accommodation are currently not so noticeable, and the structure of accommodation capacity in the Czech Republic has stabilized.

A more marked increase in the number of accommodation establishments is evident only in the four-star hotels preferred by foreigners and campsites long-favored by Czech tourists. These are exceptions, however, located outside Prague, especially in the recreational areas of South Bohemia and Moravia, most often by rivers and dams.

As the accommodation capacity grows, the number of establishments for sale also increases. The original owners hope to sell their established businesses at high prices. It is primarily foreign investors who wish to invest their capital safely that are interested in buying hotels in the Czech Republic. There has been increased demand from investors from South Korea and China, who buy established businesses and expand the clientele with clients from their homeland.

In the first half of 2017, six hotels were sold in the Czech Republic for 165.5 million euro (almost 4.3 billion CZK). In 2016, investors bought hotels in the Czech Republic for 174 million euro [

51]. In 2017, massive investments in Czech accommodation facilities came particularly from the Chinese group CEFC. The company bought Motel One from the Penta investment group, Hotel Mandarin in the Lesser Town, and Le Palais in Vinohrady. The M&L Hospitality Trust, Singapore, also invested in Prague, and now own the Hilton Hotel.

3.5. Change in the Structure of Accommodation Capacity in the Czech Republic

The Czech tourist accommodation market is currently changing. While the number of tourists has been growing since the economic recession, bed capacity has actually fallen. According to the Czech Statistical Office [

33], the number of rooms on the market has decreased by over 6%, which means over 30,000 beds. The majority of these were in lower category hotels, guest houses and inexpensive lodging houses. On the other hand, luxurious hotels, in particular four-star hotels, have been expanding their accommodation capacity (see

Table 3).

This situation is a result of the pricing policy of higher category hotels in recent years. These hotels have been lowering their prices, and in doing so have pushed down the prices of lower-category facilities. For those accommodation providers, the situation was not sustainable long-term, due to their high costs. One of the main reasons given is the apparently growing demands of their guests. However, under these conditions, good quality guest houses in attractive locations are doing well. The low price is no longer sufficient to attract guests, and some providers could not cope with this pressure. Guest houses also compete with the “grey zone”, i.e., all sorts of unofficial private accommodation where quests are not registered and tax is not paid. The accommodation review websites where guests review the services might also have played a part. Important determinants of hotel room prices are popularity ratings (derived from customer reviews), the hotel star rating, weeks of advance booking, and certain hotel characteristics such as express checkout, room service, or Internet access [

52]. In many cases, owners have to look for new uses for their guest houses and hotels.

4. Discussion

The strength of the dependence between the monitored indicators in the Results section is the subject of a statistical analysis conducted in the following chapter, including an evaluation of the validity of the established hypothesis and its statistical testing. The part of the analysis is further supplemented to include an interpretation of the amount of accommodation prices and the occupancy of accommodation capacities in the Czech Republic. The resulting recommendations and interpretation of the basic problems of the tourism and hotel industries during the coronavirus pandemic present possible solutions to the given situation in the industry.

4.1. Analysis of the Relationship between the Structure of Accommodation Facilities and the Number of Foreign Tourists

Five and four-star hotels guarantee quality accommodation and related services for foreign tourists (see

Table 4). These hotels are sought after and demanded by tourists who wish to make the most of their stay. According to experience and statistical data, these are non-European tourists and tourists with above-average income.

Between 2012 and 2017, there was a significant 8.93% increase in the number of five-star hotels and, furthermore, the number of four-star hotels made up almost a quarter (21.15%) of the growth.

Compared to other accommodation facilities, the number of 5- and 4-star hotels is still growing in the Czech Republic, thus better meeting the needs of foreign tourists. In 2017, 5-star hotels showed the highest occupancy rate (69.8%), while the occupancy rate of 4-star hotels was 62.3%. The number of higher-category hotels is the result of increased interest on the side of foreign tourists in their services. These are hotels owned by multinational companies and also hotels of Czech owners providing high quality service. The interest of foreign tourists in higher categories of accommodation has contributed to the increase in the number of these hotels and the number of beds.

The dependence of the number of 5- and 4-star hotels on the number of accommodated foreign tourists was investigated using real data from 2012 to 2017. The correlation of residual components of the time-series of these indicators shows a very strong positive dependence in all cases (

Table 5).

Table 5 shows the correlations of two time series, where it is necessary to correlate only the residual components of the time series devoid of trend and periodic components. The reason for this procedure is the need to correlate random values in order to avoid a so-called false correlation. The residual values of both time series are subsequently correlated and tested (the values of the correlation coefficients are given in

Table 5).

It is evident that the strongest relationship expressed through correlation coefficients is between the indicator of “number of 5- and 4-star hotels” and the indicator of “number of beds in 5- and 4-star hotels” (0.9549). This is followed by the relationship between the indicator of “number of 5- and 4-star hotels” and the indicator of “number of foreign tourists staying in collective accommodation” (0.8689). The third strongest relationship is between the indicator of “number of beds in 5- and 4-star hotels” and the indicator of “number of foreign tourists staying in collective accommodation” (0.7496).

Table 6 lists the most suitable trend function used for the calculation of the residual component of the time series.

Table 6 shows trend functions (relationships 1–7) with the highest value of the determination index (relationship 8). The functions with the highest value of the determination index were used to determine the residual component for the correlation of time series.

The growth in the number of foreign tourists has a strong influence on the increase in the number of hotels and the increase in the capacity of the highest-category hotels. This strong influence is expressed in

Table 6 by the index of determination of trend functions in the value range of 0.9508–09985 (0.9508 for the number of 5- and 4-star hotels, and up to 0.9985 for the number of foreign tourists staying in collective accommodation). By building new, quality hotels and renovating historical buildings to a higher standard to provide an outstanding experience for foreign tourists staying in the Czech Republic, the tourism industry uses its potential to the full. The Czech Republic is ever more frequently visited by wealthy tourists with an interest in history and monuments of culture, architecture, and nature.

4.2. Selected Economic Indicators of Tourism and the Hotel Industry in the Czech Republic

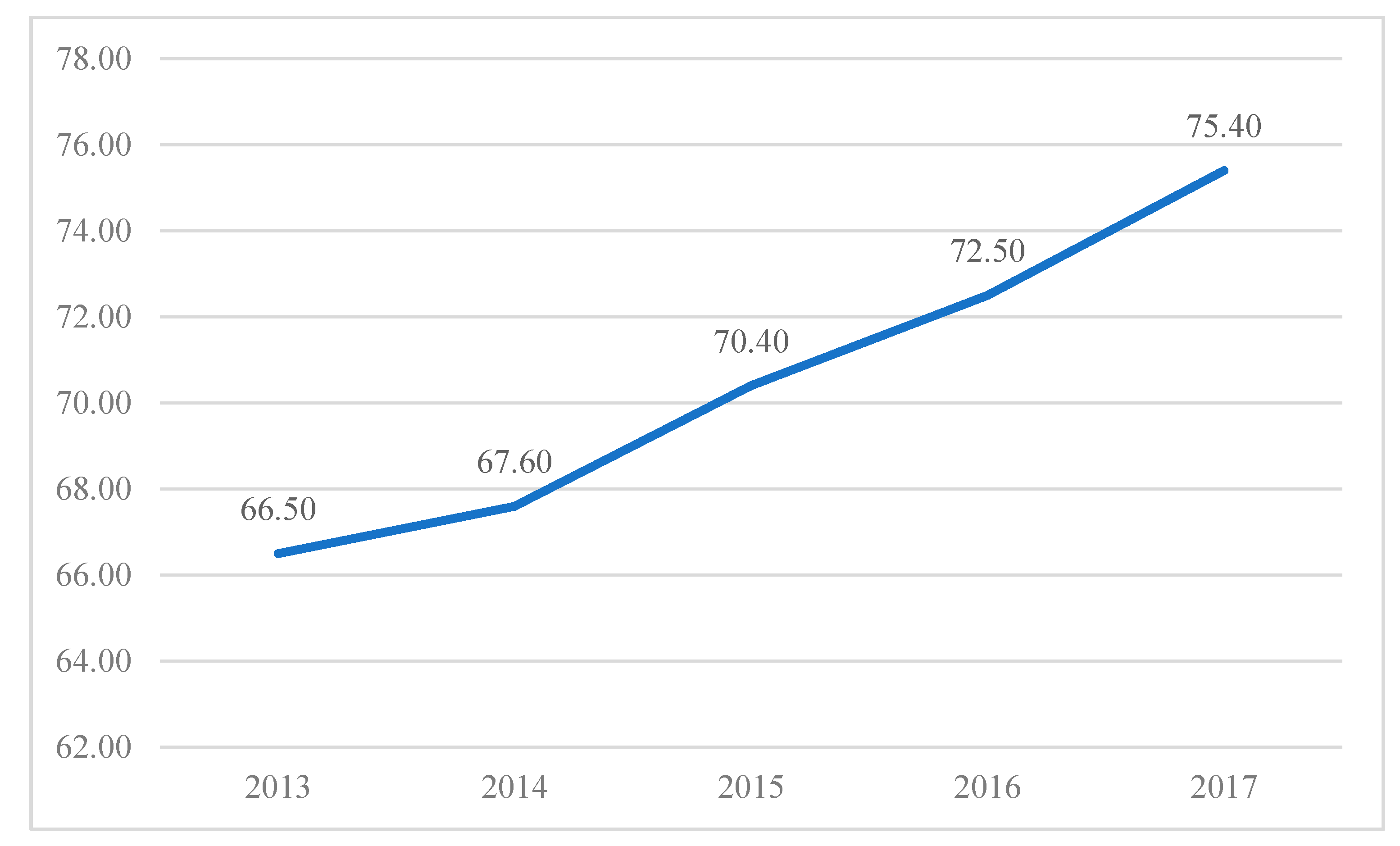

The interest of tourists in vacationing in the Czech Republic has seen record growth in recent years among both foreigners and Czechs; it is hotels that are benefiting. As a result, average hotel prices in the Czech Republic increased by 18% between 2013 and 2017 (see

Figure 6). They increased by 22% in Prague alone, and, in 2017, they came close to the average prices in Vienna. According to STR Global, which is monitoring developments in the category of three- and five-star hotels, Prague has already reached EUR 87.43 per room per night. In the Austrian capital, it is only eight euros more. Just five years ago, the average price per room in Prague was almost 25 euros lower than in Vienna [

53].

In recent years, hotel managers have been helped by the depreciation of the Czech crown, which has been held close to 27 crowns per euro by the interventions of the Czech National Bank since November 2013. The Czech Republic thus became cheaper for foreigners and all the more attractive. However, even the easing of the exchange rate a year ago and the gradual appreciation of the Czech crown did not stop the rise in hotel prices. In 2017, the prices per room per night in Prague increased by 8.2% year-on-year, according to the aforementioned statistics of STR Global. In 2017, the euro prices of rooms increased by 7.6% throughout the Czech Republic. Hotel prices in Prague and other regions continued to rise in 2018; the reason is that the occupancy rates of hotels in Prague and the Czech Republic are among the highest in Europe (see

Figure 7).

4.3. Evaluation of Results and Recommendations

4.3.1. Evaluation of the Analysis and the Validity of the Research Question

Based on the conducted analysis of the development of tourism and hotels in the Czech Republic, the following conclusions can be drawn concerning changes in the structure of accommodation capacity and its use by foreign and domestic tourists in the conditions of the hotel industry in the Czech Republic:

In the years 2016–2019, there was a strong tendency to increase accommodation capacity, especially in better quality hotels, due to the increasing demand for quality accommodation by foreign tourists. According to Cushman and Wakefield, in 2019, developers now had a total of 16 hotel projects with 2900 rooms in the capital city of Prague.

In contrast, domestic (Czech) clients are often satisfied with accommodation in three-star hotels or guest houses and direct their tourist activities primarily outside Prague. These mainly take the form of recreational, educational or spa activities, but also mountain hiking or other sports activities.

The research contributed to scientific knowledge by focusing on a hitherto little-studied side of the tourism and hotel industries, i.e., on the demands placed by more affluent clientele (including its structure) on the level of services provided to them by the hotel sector. As living standards rose in some Eastern European and in particular Asian countries, so did the accommodation demands of more affluent clients in four-star and five-star hotels. This led to the creation of additional accommodation capacities in this category. However, not only inbound tourists but also partly domestic tourists (in the case of mobile Czech clients) took part in this process.

This successful period, both for tourism and the hotel industry, was disrupted by restrictions on travel both from abroad and within the Czech Republic. The sensitivity of four-star and five-star hotels to the possible loss of clientele in these situations was manifested here, as they were affected the most by the restrictions out of all the levels of accommodation capacities. The loss of clientele by as much as 90% led to the closure (sometimes permanent closure) of many of these high-quality accommodation facilities, as the pandemic had a much greater economic impact on these accommodation facilities than on lower-category accommodation facilities focused primarily on domestic clients.

4.3.2. Hypothesis Verification by Matrix Test

Historical monuments and many natural attractions are of interest to both foreign and domestic tourists. Since the Czech Republic’s accession to the European Union, the Czech economy has shown a very good balance, which is reflected in the rising standard of living and also in the great tourist mobility of citizens. Some of them travel abroad, and some are looking for tourist destinations directly in the Czech Republic. The Czech Republic’s strong economy has provoked very lively activities in the tourism business. Private investors have gradually expanded their accommodation capacity in terms of the number of beds and their quality.

Table 7 shows the relationship between the development of the number of foreign and domestic tourists and the development of the number of beds in accommodation establishments according to their quality from 2012 to 2017. The calculations are based on the methodological procedure for short time series, where the determination of the random component uses the average growth coefficient and moving averages.

It is clear from

Table 7 that both groups of tourists (domestic, foreign) show the same directions of dependence in all cases. In the case of domestic tourists, the intensity of dependence is higher than in the case of foreign tourists. Tourists in the Czech Republic tend to look for accommodation in the middle class (four- and three-star hotels, boarding houses). Five-star hotels are used by clients for specific purposes (business trips, conferences, exceptional private purposes). In the years 2012–2017, people stayed less often in tourist campsites, but a certain group of tourists (probably young ones) target accommodation in hostels. Domestic tourists are the most important component of the economic results of the tourism industry in terms of the uniformity of representation in the regions of the Czech Republic. So far, there has not been much success in bringing foreign tourists to the regions who would contribute to their requirements by improving accommodation and catering services.

In principle, therefore, our analysis has confirmed the validity of the research question concerning the change in the structure of accommodation capacity in the Czech Republic due to the growth in inbound tourism of more wealthy clients who demand better accommodation. However, the rise in accommodation prices is also due to the current revival of tourism in the Czech Republic and around in the world, and hence an increased demand for accommodation (which has increased because of the favorable exchange rate and global economic growth), should also be taken into account.

This research analyzed the current state of the accommodation capacity in the Czech Republic.

The principle of sustainable development in tourism has been developed and promoted around the world for a long time. The Czech Republic still lags behind other developed countries in Europe in applying the principles of sustainable development in general. The following recommendations take into account this trend and will in the future form the basis for follow-up research.

4.3.3. Proposed Solutions

State Support

Tourism within the economic map of the Czech Republic accounts for a 7% share of all economically active individuals. This is because tourism is directly tied to a host of other sectors, including bike rentals, ice cream parlors, or souvenir shops. This essentially carries the implication that the state’s continuing efforts to lend support to a sector at risk—thereby ensuring sustainable development of the Czech hotel industry—are not motivated by altruism alone.

Accordingly, all hotel, boarding house, and campground operators are currently eligible for a lump-sum compensation from the state, provided they meet specific requirements. It is paid out in arrears for periods during which accommodation providers are compelled to close their establishments in compliance with the latest coronavirus measures in place. The compensation is calculated as a fixed amount for each available room multiplied by the number of days during which it was not available for use. The lump-sum amount varies based on the type and quality of the accommodation (see

Table 8).

Operators applying for the support to sustain their businesses must fulfill several conditions, including not having any guests during the relevant period. Moreover, they must hold a valid business license to exclude gray economy services (such as Airbnb) from the program, which evade taxation and, therefore, should not apply for the support money. Accommodation operators are also required to submit evidence of having provided accommodation during the same season over the past two years; i.e., proof they were not closed or loss-making at the time. In addition, all subsidy recipients must establish that they have been active in their respective professional endeavors for the last six months to make sure the funds contribute to sustaining tourism instead of serving one’s personal interests.

Resulting Recommendations for the Czech Government

Continue to take part in projects such as the European Destination of Excellence (EDEN), whose primary objective is to support less well-known destinations with an active approach to sustainable tourism in EU member states. The Czech Republic has participated in this project since 2009, with seven entities having won this prestigious award since then. This project runs with the participation of 27 EU countries, which regularly join the open COSME projects with the financial support of the European Commission [

54].

Implement and apply new environmental protection tools to increase the long-term competitiveness of tourism services (e.g., EMS, EMAS, voluntary environmental agreements, the use of environmentally-friendly products).

Support environmentally-friendly means of transport in tourist areas, including city centers (support for bicycle and pedestrian traffic and public transport).

Improve the local environment as part of the activities of tourist facilities.

Protect historical sites (care for the cultural and natural heritage).

Monitor the development of tourism (the entire sector or individual localities) based on set sustainable development indicators and make this information public.

Inform visitors of the distinctive characteristics of the local environment and its environmental protection principles (environmental awareness and education).

A tourist’s decision to visit a particular destination is greatly dependent on the security situation in the given country. The Czech Republic’s good reputation in this area should be maintained, not only by the stability of the government, but also by the quality work and coordination of all state security forces.

Ensure, by increasing the minimum wage, that workers necessary for the tourism and hotel industries in the Czech Republic (chefs, cleaners, receptionists, etc.) are remunerated at a level that would make it no longer profitable to pay employees so-called “black” untaxed wages.

Resulting Recommendations for Local Administration

Support for such types and forms of tourism that would be sustainable over the long term—with respect to visitors, local and outside businesses, the local government and authorities, state administration.

Manage in time and space the concentration of visitors and their activities at the destination—visitor flow management. In many places in the CR, the accommodation capacity is full and tourist attractions are overcrowded. The visitor turnout at some monuments is far in excess of their capacity, and increasing the prices has not helped either. As a possible solution, the introduction of booking systems is recommended.

Change in the behavior, mindset, and motivation of businesses in the region.

Implementation of quality management.

Support for cooperation between various entities within the region whose common goal is the sustainable development of tourism.

Motivation for local communities—among other things, this should lead to changes in their consumption patterns, treatment of visitors, and the maintenance and development of local traditions. The City of Prague administration should propose an amendment to the legislation that would regulate accommodation services provided via the Airbnb application. For example, providers should have a duty to give information about those accommodated. An alternative solution for Prague is to regulate Airbnb through a decree.

Promotion of the reduction in resource consumption, including the utilization of alternative resources.

Support for the cooperation between the public and business sectors (e.g., Local Action Groups 21).

Support for the creation of environmental quality networks, both vertically and horizontally

Resulting Recommendations for Future Research

There is a need for regular and systematic research of both visitors and residents focusing primarily on the perception of sustainable development in tourism and its significance for them (taking into consideration the influences on the client’s decision-making with respect to infrastructure).

Our research of the current tendencies in accommodation facilities in the Czech Republic needs to be followed by research focusing on assessing the degree to which the sustainable development agenda has been implemented in their activities.

Subsequently, research should be conducted to focus on the benefits of the higher degree of implementing sustainable development principles for tourism and society as such.

4.4. Limitations of the Research

The monitored period of analysis of economic performance indicators of the tourism and hotel industries in the Czech Republic mainly includes the economic boom of 2012–2017.

A certain limitation of the research is the fact that estimates of foreign tourists’ movements are based on statistics regarding their purchases, especially in Prague’s luxury shops, and refunds of sales tax due to tax free shopping.

This research was conducted prior to the current global threat represented by the coronavirus pandemic, which has had a fatal impact on tourism not only in the Czech Republic.

5. Conclusions

Research on the development of tourism in the Czech Republic in 2012–2017 has shown an increase in inbound tourism, in particular in the case of more affluent clients who require greater comfort from their accommodation, primarily in 4-star hotels. On the other hand, the average length of stay of foreign tourists is shortening. Therefore, it is necessary to expand the number of quality 4-star hotels by accelerating the construction of new accommodation capacity, thus satisfying the requirements of this category of tourists. All of this will occur at the expense of accommodation services such as Airbnb, which focuses on less affluent customers who prefer cheap, short-term stays and who impose a disproportionate burden on the life of the city with their behavior.

In addition, 5 and 4-star hotels guarantee quality accommodation and related services for foreign tourists. These hotels are sought after and demanded by tourists who wish to make the most of their stay. According to experience and statistical data, these are non-European tourists and tourists with above-average income. Compared to other accommodation facilities, the number of 5- and 4-star hotels is still growing in the Czech Republic, thus better meeting the needs of foreign tourists. In 2017, 5-star hotels showed the highest occupancy rate (69.8%), while the occupancy rate of 4-star hotels was 62.3%. These are hotels owned by multinational companies and also hotels of Czech owners providing high quality service. The interest of foreign tourists in higher categories of accommodation has contributed to the increase in the number of these hotels and the number of beds. The dependence of the number of 5- and 4-star hotels on the number of accommodated foreign tourists was investigated using real data from 2012 to 2017. The research has shown that the growth in the number of foreign tourists has a strong influence on the increase in the number of hotels and the increase in the capacity of the highest-category hotels. Building new, quality hotels and renovating historical buildings to a higher standard to provide an outstanding experience for foreign tourists staying in the Czech Republic can contribute to achieving the sustainability of the tourism sector in the country.

There are many dimensions to the issue of the sustainability of tourism in the Czech Republic. Apart from the slow construction of quality four- and five-star hotels, there is no regulation of the competition of accommodation platforms such as Airbnb and the concentration of foreign tourists’ interest in Prague and its sights, which are threatened by excessive tourism. Another important factor threatening the sustainability of tourism in Prague is the availability of cheap alcohol, which attracts less affluent young visitors to the country and thus discourages a much more affluent foreign clientele from coming to the Czech Republic. On the other hand, it should be noted that the accessibility and safety of the Czech Republic and the beauty of the landscape, as well as the sights of Prague, are attracting more and more affluent foreign tourists to the country. Research on the economic dimension related to tourism and hospitality in the Czech Republic thus becomes an opportunity for further scientific studies on the issues already addressed in this article.

However, sustainability issues related to the rise of accommodation platforms such as Airbnb do not mean that hotels in Prague do not have guests. Their occupancy rate has remained at around 78% on average for the second year in a row. This is a relatively high number. More importantly, however, the average price of accommodation is gradually increasing, so Prague is already approaching the prices of Vienna, for example. The average price of a room in a four- or five-star hotel in Prague was EUR 90 in September 2019. In Vienna, it was 102 euros. Hotel managers in Prague have increased average prices by 2.2% year-on-year, while occupancy has increased by 0.7% according to the statistics of the Czech Association of Hotels and Restaurants [

55].

In the summary of the current state of the accommodation capacity, we cannot overlook the ongoing global threat in the form of the coronavirus pandemic. Tourism is one of the most vulnerable industries in the Czech Republic in dealing with the impact of the coronavirus epidemic. The closure of borders and other restrictive measures adopted by the government have completely paralyzed tourism and its near future is uncertain.

Furthermore, 95 percent of hotels and other accommodation facilities (excluding Airbnb) were closed and so were 95 percent of spa and wellness facilities (accounting for 13 percent of overnight stays in the country), 100 percent of travel agencies, and 75 percent of restaurants, with the rest operating in emergency mode (drive-through sales). All historic buildings and significant tourist destinations, tourist information centers, and other related activities were also closed.

A quarter of a million people work in tourism. Each year, over CZK 125 billion is collected in taxes in this industry. According to the government agency CzechTourism, tourism accounts for 3 percent of the Czech Republic’s GDP.

The management of the hotel industry will have to take a hard look at whether it should keep providing services to demanding clients, given that restrictions in international tourism may reemerge in the future. The provision of hotel services for domestic clients is not as economically profitable, but it shows higher income stability.

Our recommendations for future research can be summarized in two basic theses. First, use the knowledge gained from research in the period 2012–2019, when global tourism was at its peak. The current changes in the monitored sector are so significant that an evaluation of long-term time series of indicators would not provide adequate results for correct predictions of the further development of the sector. Secondly, scientific analyses must include new aspects of the economic behavior of tourism and hotel entities that already include the issue of the impact of risk in the decision-making of these entities.

As in other countries, in the short and medium-term, changes will most likely occur in the structure of tourism resulting from the coronavirus pandemic and the restrictions associated with it. However, this does not change anything about the legitimacy and inevitability of building sustainable tourism in the Czech Republic. The demand for products of sustainable tourism will grow among residents, who in the short-term will be the main customers, but in the medium and long-term also among foreign tourists, as evidenced by numerous examples from abroad. In the future, respect for sustainable development principles will undoubtedly present a competitive advantage for businesses operating in tourism. This trend and any changes therein will be the subject of further research by the authors and will contribute to the dissemination of information pertaining to sustainable development.