Abstract

Sustainability is an urgent issue in the basic endowment insurance system in China. The advancement of the national pooling and the transfer of collection responsibility from the social security department to the taxation department are the policy measures taken to ensure the sustainable development of the endowment insurance system. In this circumstance, this paper discusses the solvency of the national pooling account fund of basic endowment insurance when the enterprise contribution rate drops to 16% by constructing an improved theoretical actuarial model. The conclusion shows that under the national pooling mode of peeling off historical debt and personal account, even if the contribution rate drops to 16%, the basic endowment insurance fund in China will still have strong solvency in the long run. In addition, due to the transfer of the collection responsibility of the basic endowment insurance, the proportion of the actual number of payers to the number of in-service insured will gradually increase to 100%, and the calculation results in this paper show that the bankruptcy scope of China’s basic pension insurance funds will be postponed to the year of 2113. This study enriches the relevant literature and solves a policy concern in the reform of China’s basic endowment insurance system: Does reduction of contribution rate affect the sustainability of the basic endowment insurance system?

1. Introduction

A large number of investigations and studies have shown that pension insurance can increase the household income and food expenditure of residents, reduce working hours, enable citizens to have better health and lower mortality, decrease the income gap among residents, and alleviate poverty of the elderly [1,2]. There is no doubt that in modern countries, pension insurance is an indispensable social welfare. China has vigorously developed and reformed pension insurance system in recent years. The current basic pension insurance system consists of basic pension insurance for urban employees and pension insurance for urban and rural residents. The pension insurances for urban employees are paid by individuals and enterprises. The individuals were responsible for 8%, and the corporate payment rate in most provinces was dropped to 16%. The part of enterprise payment goes to the national pooling account of pension insurance funds, and the part paid by the individual goes to the personal account. The pensions come from the personal account funds paid by the elderly themselves, as well as from the national pooling account and financial subsidies.

With the aggravation of population aging, the payment pressure of China’s basic endowment insurance fund is increasing. According to the datum of “China Statistical Yearbook” in 2020, though the income of basic endowment insurance fund is still larger than the payment at present, combining the amount of surplus is increasing year by year, the growth rate of the fund surplus is gradually slowing down, and the increase of the basic endowment insurance fund balance in recent years benefits from the expansion of the coverage after the implementation of the social insurance law in a certain extent. It can be predicted that after the pension system finishing full coverage, this growth mechanism would be difficult to continue, and the solvency of the basic endowment insurance fund will face severe challenges, even the basic endowment insurance system will also face the sustainable development problem. In addition, according to the data of “Annual Report on China’s Social Insurance Development” in 2016, there are seven provinces in China where the basic endowment insurance fund has been in deficit in the current period, of which Heilongjiang Province has a negative balance while Guangdong and other 10 provinces have more than 100 billion fund surpluses. This situation also shows the imbalance among different regions.

In the context above, the China’s State Council enacted “Reform Scheme of tax collection and management system” in the year of 2018 and “The Comprehensive Scheme of Reducing Social Insurance Rate” in the year of 2019. The former transferred the collection responsibility of social premium to the tax department, and the latter reduced the enterprise contribution rate of basic pension insurance to 16%. Obviously, reducing contribution rate would have a negative impact on the basic endowment insurance fund balance, and then affect the solvency and sustainability of the basic endowment insurance fund. In China, due to the limited availability of corporate information mastered by the social security department and the insufficient power of expropriation, some private enterprises have underpaid for the basic endowment insurance premiums. Thus, transferring the collection responsibility of social premium to the tax department will curb the phenomenon of fee evasion, improve the fee collection efficiency, and increase the contribution income. In general, the policy measures of collection responsibility transformation reform have a positive impact on the solvency of the basic endowment insurance fund. However, what is the comprehensive effect of these two reforms? In the long run, how does this comprehensive effect affect the solvency of China’s basic endowment insurance fund? These are the issues that Chinese policy makers should consider in the process of basic endowment insurance system moving toward national overall planning.

The budget balance of the basic endowment insurance fund has been the focus of academic attention for a long time. Up to now, there have been lots of relevant researches in academic fields, when Lin and Zhang studied the sustainability of financial subsidies to pensions, they found that financial subsidies of pension insurance can significantly increase the participation rate and individual contributions, thereby improving the solvency of the fund [3]. While few studies combining the contribution rate, collection responsibility transformation, and the solvency of pension fund. Only a few studies have paid attention to the impact of reducing the contribution rate on fund solvency or budget balance, and the conclusions are also inconsistent. Some scholars believed that the reduction of contribution rate did not affect the sustainability of endowment insurance fund. Zeng and Lee set up an actuarial model to analyze the impact of reducing contribution rate on the sustainability of social insurance fund, their study showed that the reduction of contribution rate did not affect the sustainability of the fund in the short term, but could achieve the sustainable goal in the long term through coordination with other policies [4]. Mu and Chen achieved the balance between contribution and benefit by constructing the model of an appropriate contribution rate of basic pension insurance [5]. Other scholars paid attention to the reduction space of the contribution rate, and found the opposite conclusions. Yang showed that China’s basic endowment insurance contribution rate was higher than the appropriate level [6]. Zhang and Liu based on China’s provincial panel data, showed by empirical analysis that only Guangdong province and Zhejiang province had the space to reduce contribution rate while maintaining the existing conditions [7]. Dong and Zheng pointed out that contribution rate reduction could be matched with the policy of state-owned capital transfer [8]. Another research conclusion showed that there was no room to reduce the contribution rate while maintaining the existing system parameters [9]. Because of the short time since collection responsibility transformation reform, till now, there has been less studies on the influence of collection responsibility transformation on the solvency or balance of the basic endowment insurance fund. In these few studies, Dong and Zhao pointed out that the tax department had the compulsory fee collection right and could obtain more comprehensive corporate information, thus, compared with the social security department, collection responsibility transferring to tax department could make the basic endowment insurance rate and coverage increase [10,11]. After the two papers, the relevant research could only be seen in Zhang and Li, they compared the insurance rate under the two collection departments of social security and tax, the conclusion showed that the insurance rate under the collection by the tax department was higher than that collected by the social security department [12].

Although Chinese literatures paid less attention to the impact of the contribution rate on pension solvency, the scholars outside China had discussed this issue for a long time. For instance, Haberman and Sung constructed a dynamic model of the relationship between the contribution rate and fund solvency based on a defined benefit pension plan [13]. Ricardo and June Pablo further constructed a dynamic contribution model based on the research objective of reducing solvency risk [14]. Serdar and Arzdar used the data of Turkey’s pension system to establish a mathematical model to discuss the influence of contribution rate, retirement age, and other parameters on pension balance [15]. Constantin proposed to analyze through a unifactorial regression model of the influence of contribution rate on the net asset of private pension funds [16]. Jennifer and Pierre constructed a continuous overlapping generations model to discuss the sustainability and actuarial fairness of notional defined contribution pension schemes [17]. In addition, the scholars outside China also paid more attentions to the impact of retirement age on pension sustainability [18,19,20].

To sum up, although the relationship between contribution rate and solvency of the basic endowment insurance fund had been noted in some academic literatures, the conclusions of the researches on the impact of the reduction of contribution rate on solvency were not consistent, and the collection responsibility transformation reform and national pooling planning mode were not considered. After all, the national overall planning has not yet been realized now, so the mode needs to be set in the relevant calculation of the basic endowment insurance system. In view of this, based on the system design of national pooling mode and adding the appropriate financial subsidies, this paper studies the long-term comprehensive impact of contribution rate reduction and the transfer of collection responsibility on the solvency of basic endowment insurance fund, and calculates the bankruptcy of the basic pension system.

The thesis would enrich the relevant literature, and solves a policy concern in the reform of China’s basic endowment insurance system, that is, does reduction of contribution rate affect the sustainability of the basic endowment insurance system? Firstly, this article combs the literature of the predecessors, then it establishes an actuarial model to measure the solvency of the basic endowment insurance fund while reducing contribution rate and transferring collection responsibility to tax department, finally it answers the above questions in the analysis of the calculation conclusion.

2. The Theoretical Model

2.1. National Pooling Account Surplus and Solvency Model

The improvement of pooling level can enhance the risk sharing ability of social insurance [21]. As early as more than ten years ago, some scholars proposed to establish the national pooling system of basic endowment insurance in China [22]. However, till now, the national pooling planning has been still struggling. It is generally believed that the reason is the interest conflict between the central and local governments [23,24,25], the imbalanced development of pension insurance system and economic in regions [26,27,28], and the historical debts of basic endowment insurance system [29,30]. In order to solve these problems and realize the national pooling of basic endowment insurance, this paper assumes that the social security department reform the basic endowment insurance system by dividing the rights and responsibilities in social security management between central and local governments. Firstly, peeling off the historical debts of the basic endowment insurance system, including the transformation cost of the original system and the gap of individual pension accounts. Secondly, peeling off personal accounts into occupational annuity system or enterprise annuity system, which still managed by local governments, and the pooling account is designed to be managed by central government.

By this way, when we study the solvency of the basic endowment insurance fund, we only need to consider the national pooling account, which is funded by the contribution of enterprises, central financial subsidies, other transfer payments, and investment income, and the expenditure is only used for the payment of the basic pension. Therefore, the surplus model of national pooling account is given by:

where U(t) means capital surplus of national pooling account, P(t) means contribution of enterprise, S(t) means total national basic pension, FS(t) means central financial subsidies, i means return on investment of pension. We do not consider the other transfer payments here.

2.2. Contribution Model

After the realization of national pooling, the contribution income of the basic pension insurance only comes from enterprise payment, that is, a certain proportion of payment base of employees. The model is given by:

where s0 means age of beginning to work, r means retirement age, θ means enterprise contribution rate, W(s,t) means wage of insured employee at the age of s in the year t, τ means ratio of payment base to employee salary, in this paper we name it “payment wage coefficient”, N(s,t) means the number of insured employees at the age of s in the year t, λ(s,t) means proportion of actual number of payers to the number of in-service insured. “g” means wage growth rate, we suppose the annual growth rate of wage and the growth rate with seniority both equal to “g”.

2.3. Basic Pension Benefit Model

According to the calculation method of basic pension in China, the basic pension benefit model is given by:

where α means average payment wage index of employees, that is, the annual average of the ratio between the annual payment base and the social average wage by the year, v = min [r + (t − t^’’ + 1), ω], is the max age of retiree who has the right to receive the basic pension, ω means extreme age means social average wage of the year t, t^’ means the year when the personal account system began, t‘’ means the year when current basic pension insurance system began to implement.

2.4. System Sustainable Boundaries

According to the “bankruptcy theory” in Actuarial Science, we define the bankruptcy boundary of the basic endowment insurance fund as the critical point at which the fund’s capital stocks of the pension system is not enough to support the current pension expenditure. That is, at this critical point, the surplus of the national pooling account will fall to 0. The model can be given by:

We need to calculate the time variable T, which is called the bankruptcy boundary of the basic endowment insurance system. According to the contribution model and pension benefit model, we can easily draw the following conclusions: the reduction of contribution rate will move the bankruptcy boundary forward, thus reduce the solvency of the basic endowment insurance fund, the increase of the proportion of the actual number of payers to the number of in-service insured can delay the bankruptcy boundary and increase the solvency of the basic endowment insurance fund. Therefore, it is easy for us to draw a conclusion: under the background of contribution rate reduction, the proportion of the actual number of payers to the number of in-service insured can be improved through the transfer of basic pension insurance premium collection responsibility, which can offset the negative impact of contribution rate reduction on the solvency of basic endowment insurance.

Learn from the definition of solvency adequacy rate of insurance company, we use s_t to denote the solvency adequacy ratio of national pooling account, and define “actual capital” as the sum of the contribution income of the national pooling account (from enterprise payment) in current year, the central financial subsidy in current year, and the surplus of the account last year, and define “the minimum capital” as the total expenditure of national basic pension in current year. Thus, the solvency model is given by:

The national pooling account of basic pension insurance adopts “pay-as-you-go” mode, so the solvency adequacy ratio (s_t) reflects the filling degree of the national pooling account fund and the current solvency level. The bigger the s_t value, the more sufficient the account fund is, and the less the payment pressure is. When s_t value is greater than 100%, that it shows that the national pooling account fund is sufficient to pay the basic pension of the year, and the solvency is adequate. On the contrary, it shows that the solvency is insufficient, and the system may have a “bankruptcy” crisis.

3. Parameter Setting and Data Selection

In 1997, the mode of social pool account combined with personal account was determined as the target mode of the basic pension system reform in China. In 2005, this mode was further reformed (began to operate in 2006), and after years of operation, developed to be current system mode. So, we can get t^’ = 1997 and t‘’ = 2006. Other parameters are set and assigned as below:

(1) The age of beginning to work

The data from “China Population and Employment Statistics Yearbook” shows that the proportion of employees’ education level below secondary vocational education is up to 81.8%. In China, the age of beginning to receive the compulsory education is 6, so according to the years of schooling from primary school to secondary vocational education or high school, we set s_0 = 18.

(2) Number of age-specific insured

According to the data from the State Statistical Bureau in China, in 2018, the total number of on-the-job employees in cities and towns was 301.04 million, and the total number of retired employees was 117.98 million. Every year’s number of age-specific insured determined by the number of age-specific insured in the year 2018 and the growth rate of the number of insured, which includes the growth rate of the number of on-the-job insured and the growth rate of the number of retired insured. Because of the target of accomplishing full coverage of social insurance in 2020, we set the two growth rates above to be the average growth rates in the last decade of employed population and retired population in cities and towns, that is, 2.84% and 3.75%.

(3) Payment base, wage level, and its growth rate

According to the regulations in “The Comprehensive Scheme of Reducing Social Insurance Rate” enacted by the State Council, the payment base depends on the weighted average of average wage of employees in urban private sector and average wage of employees in non-private sector. We choose the number of employees as the weight. Regardless of the wage gap among industries, we suppose the average wage is the weighted average of the wages of employees of all ages, and the weight is the number of employees, and the wage grows exponentially as the age and seniority. In the past decade, the wage level of urban workers in China has increased rapidly. In the future, with the decline of the economic growth rate, the growth rate of wages will also drop. Therefore, considering the relationship between wage level and economic growth, as well as the long-term trend of economic growth rate in the future, we set the growth rate of individual wage and social average wage both at 5%.

According to the data from “Statistical yearbook of China, 2018”, the average wage of employees in urban private sector and non-private sector are 49,575 yuan and 84,744 yuan, respectively, and the numbers of employees are 172.58 million and 243.92 million, respectively. Combined with the calculation of the number of age-specific insured in 2018, it can be calculated that the starting wage of 18-year-old employee in 2018 is 22,516 yuan, and the weighted average wage is 64,148 yuan.

(4) Rate of investment return on basic pension insurance fund

Since 2016, the basic pension insurance fund in China has entrusted the National Social Security Fund Council to deal with the investment matters. So, we choose the average rate of investment return on the basic pension insurance fund published by the National Social Security Fund Council as the rate of investment return on national pooling account fund, that is, 3.89%.

(5) Enterprise contribution rate

We now only need to consider the contributions of enterprise, according to the regulations of “The Comprehensive Scheme of Reducing Social Insurance Rate”, we set the contribution rate of enterprise at 16%.

(6) Payment period

After the realization of the national pooling of basic pension insurance, as the improvement of relevant systems, especially after the social insurance premium transferred to the tax departments for collection, the situation of payment interruption, lack of payment, and underpayment will be bound to decrease. So, in this paper, we assume that the employee’s payment last till retirement. According to current retirement system in China, we set the retirement age for male employee at 60, and female employees at 50.

(7) Growth rate of pension

In order to consider the factors of economic development and the rise of prices, the basic pension has been increased for 15 years in China. Assume that this trend would continue, combined with the CPI index in China over the years, the annual growth rate of pension is set to 3%.

(8) Financial subsidy

According to the research of Zheng and Mu et al. [31,32], in the countries with developed social security system, the proportion of financial subsidy to pension expenditure is generally around 20% and no more than 20% of the financial expenditure. Hence, in this paper, the central financial subsidy proportion is set at 20% of the current year’s pension expenditure and limited to 20% of the current year’s central financial expenditure. The future growth rate of the central financial expenditure is set to be the average growth rate in the past decade, that is, 9.44%.

4. Calculation Results and the Analysis

According to relevant laws and regulations of social security in China, the payment base of various social insurances paid by employees can be determined freely by enterprises between the rate from 60% to 300%. According to the data from “Annual Report on China’s Social Insurance Development” in 2016, the payment wage coefficient of China’s basic pension insurance had maintained between 60% and 70% since 2009, a lower level and showed a downward trend. Since the relevant departments have taken many measures to encourage enterprises to increase the level of payment base, the situation will be gradually improved in the future. On the other side, the proportion of the actual number of payers to the number of in-service insured (λ) had been between 80% and 90%, also showed a downward trend. Fortunately, due to the transfer of collection responsibilities to the tax department, the proportion (λ) will gradually increase in the future. Therefore, in the calculation, we set the contribution wage coefficient at 70%, the proportion (λ) is set at 90% and 100%, which represents the level before and after the transfer of collection responsibilities.

In order to ensure the fairness among regions, it is assumed that the national unified standard of basic pension will be implemented in the calculation process. According to the model (1)–(5), the parameter setting and numerical selection, the surplus of basic endowment insurance fund at the end of 2018 was taken as the initial fund (5090.1 billion yuan). From 2019, under the national pooling mode, the future account surplus and solvency level of the national pooling fund of basic endowment insurance are calculated. Due to the different retirement age of male and female employees, the method of separating calculation for male and female, then combining comprehensive analysis would be adopted here. The calculation results are shown in Table 1 (data of every five years and landmark years).

Table 1.

A Summary of parameter setting and data selection.

As can be seen in Table 2, in the next 50 years at least, the balance of the national pooling account of basic pension insurance would continue to grow. By comparing the calculation results with λ = 90% and λ = 100%, we found that when λ = 90%, the solvency adequacy ratio would start to decline after reaching the highest point of 705.92% in 2042, and the account balance would start to decline after reaching the highest value of 803.23 trillion in 2076, until the account balance dropped below 0 in 2087, the solvency adequacy ratio would also fall below 100%, and the expenditure of the national pooling account would start to exceed its income, the fund solvency would also start to become inadequate.

Table 2.

Account surplus and solvency of basic endowment insurance fund.

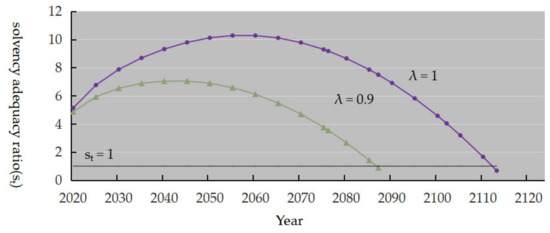

In contrast, when λ = 100%, the highest point of solvency will be postponed to 2057, and the value will reach 1029.59%. The highest point of account balance would be postponed to 2102, the value would reach 8864.39 trillion yuan, and the moment of the solvency adequacy rate began to appear insufficient would be seen in the year of 2113. It was of great significance for the sustainable development of basic endowment insurance fund to improve the λ rate, standardize the payment behavior of basic endowment insurance, and reduce the proportion of unpaid. Figure 1 also showed the results of these calculations and the change trend of account balance.

Figure 1.

The trend of account surplus curve (2020–2113).

From the trend of solvency adequacy ratio curve of basic endowment insurance fund shown in Figure 2, we could see that the solvency adequacy ratio of basic pension insurance fund after national pooling showed the trend of first rising and then falling. From the change rate, we found the trend of first rising with decreasing rate and then accelerating its descent, which was easily confirmed by the calculated numerical results from Table 2. The curve below the level line with solvency adequacy ratio equal to 1 was in the state of solvency deficiency. It was obvious from the figure that when λ = 100%, the state of solvency deficiency was more than 20 years later than that when λ = 90%. The competition of livelihood public good expenditures was playing an increasingly important role in the structure of fiscal expenditure [33]. Therefore, the pressure of fiscal expenditure could also be eased.

Figure 2.

The trend of solvency adequacy ratio curve (2020–2113).

5. Conclusions and Policy Implications

Based on the mode setting of national pooling of basic endowment insurance, this paper calculated the future development and changing trend of the solvency of the basic endowment insurance fund under the reduction of contribution rate. It is easy to know, a simple fee reduction will aggravate the solvency of the basic endowment insurance fund, and a simple collection responsibility transformation (change the parameter λ from 90% to 100%) will improve the solvency. But, under the background of national pooling planning, the calculation conclusion in this paper showed the comprehensive impact, that was, after peeling off historical debts and personal accounts, national pooling basic endowment insurance fund only paid for basic pensions, when the contribution rate fell to 16%, the account balance would still rise for a long time, if λ = 90%, the solvency of basic endowment insurance fund would remain adequate until 2087, if λ raised up to 100%, the moment of insufficient solvency would be postponed to the year of 2113. Thus, it could be seen from this study, the impact of contribution rate reduction on the future payment pressure of China’s basic endowment insurance fund was very limit in the short run after the National pooling plan. The current pressure of fund payment mainly came from the historical debt and regional segmentation. Though there were many unsustainable risks in endowment insurance system [34], once these two problems were solved, the basic endowment insurance system would be bound to achieve a long-term sustainable development, and furthermore, the contribution rate still had room to decline in the future. Based on the analyses above, we can draw the following policy implications:

Firstly, the historical debts in the current basic pension insurance system, including old-age pension, transitional pension, the empty account of personal accounts, and so on, need to be digested by the fund allocation from outside the system, for example, by allocating the profits of state-owned enterprises, so as to maintain the internal balance of the basic pension insurance fund.

Secondly, at present, there is a serious regional payment imbalance of basic pension insurance funds in China. A better way to solve this problem is to realize the national pooling of basic pension insurance fund as soon as possible. In addition, according to the calculation results of this paper, the long-term sustainable development of pension insurance fund can be achieved under the current retirement age after the national pooling planning. It can be seen that the better way to solve the problem of current payment pressure of pension insurance fund is not to postpone the retirement age, but to establish the national pooling basic pension as soon as possible, at the same time, peeling off the historical debt and establish the digestion mechanism outside the system.

Thirdly, from the calculation results of λ = 90% and λ = 100%, we can see clearly that standardizing payment behavior and eliminating the proportion of unpaid individual is essential for the long-term sustainable development of basic pension insurance fund. Now that the social security payment has been transferred to the tax department, it can be predicted that in the future, the unpaid behavior will be greatly curbed, and the solvency of the basic pension insurance fund will be further improved.

Author Contributions

P.C. conceived, designed, built models, analyzed, and revised the paper; L.S. calculated, participated in paper revising and data processing. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by “Social Science Planning Project of Fujian Province in 2020 (Grant No. FJ2020B075)”.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We thank the anonymous referees for their comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Account surplus and solvency of basic endowment insurance fund (2019–2113).

Table A1.

Account surplus and solvency of basic endowment insurance fund (2019–2113).

| Year | Proportion of the Actual Number of Payers to the Number of In-Service Insured (λ) | |||

|---|---|---|---|---|

| Account Surplus (Trillion) | Solvency Adequacy Ratio (%) | Account Surplus (Trillion) | Solvency Adequacy Ratio (%) | |

| 2019 | 6.42 | 454.11 | 6.68 | 468.20 |

| 2020 | 7.88 | 485.85 | 8.43 | 513.07 |

| 2021 | 9.47 | 512.49 | 10.37 | 551.97 |

| 2022 | 11.20 | 536.35 | 12.52 | 587.51 |

| 2023 | 13.10 | 557.14 | 14.88 | 619.45 |

| 2024 | 15.16 | 575.92 | 17.49 | 649.02 |

| 2025 | 17.41 | 592.54 | 20.36 | 676.10 |

| 2026 | 19.86 | 607.11 | 23.53 | 700.83 |

| 2027 | 22.52 | 620.58 | 27.01 | 724.33 |

| 2028 | 25.42 | 632.68 | 30.85 | 746.30 |

| 2029 | 28.58 | 643.99 | 35.07 | 767.44 |

| 2030 | 32.01 | 653.67 | 39.70 | 786.75 |

| 2031 | 35.73 | 662.60 | 44.79 | 805.28 |

| 2032 | 39.77 | 670.40 | 50.38 | 822.59 |

| 2033 | 44.14 | 676.99 | 56.50 | 838.57 |

| 2034 | 48.88 | 683.15 | 63.22 | 854.19 |

| 2035 | 54.01 | 688.28 | 70.57 | 868.69 |

| 2036 | 59.56 | 692.85 | 78.63 | 882.68 |

| 2037 | 65.56 | 696.68 | 87.45 | 895.91 |

| 2038 | 72.03 | 699.86 | 97.09 | 908.50 |

| 2039 | 79.02 | 702.23 | 107.63 | 920.24 |

| 2040 | 86.56 | 704.05 | 119.15 | 931.47 |

| 2041 | 94.67 | 705.17 | 131.73 | 942.01 |

| 2042 | 103.41 | 705.92 | 145.46 | 952.26 |

| 2043 | 112.81 | 705.91 | 160.44 | 961.71 |

| 2044 | 122.91 | 705.46 | 176.77 | 970.81 |

| 2045 | 133.74 | 704.27 | 194.58 | 979.12 |

| 2046 | 145.36 | 702.47 | 213.97 | 986.82 |

| 2047 | 157.80 | 700.11 | 235.08 | 994.00 |

| 2048 | 171.10 | 697.04 | 258.04 | 1000.44 |

| 2049 | 185.30 | 693.39 | 283.01 | 1006.30 |

| 2050 | 200.44 | 689.12 | 310.14 | 1011.53 |

| 2051 | 216.56 | 684.00 | 339.59 | 1015.81 |

| 2052 | 233.68 | 678.49 | 371.56 | 1019.80 |

| 2053 | 251.85 | 672.31 | 406.22 | 1023.11 |

| 2054 | 271.09 | 665.49 | 443.79 | 1025.74 |

| 2055 | 291.41 | 658.01 | 484.47 | 1027.69 |

| 2056 | 312.84 | 649.89 | 528.50 | 1028.98 |

| 2057 | 335.36 | 641.12 | 576.11 | 1029.59 |

| 2058 | 358.98 | 631.71 | 627.57 | 1029.53 |

| 2059 | 383.67 | 621.66 | 683.13 | 1028.82 |

| 2060 | 409.40 | 610.97 | 743.08 | 1027.44 |

| 2061 | 436.10 | 599.64 | 807.72 | 1025.40 |

| 2062 | 463.70 | 587.68 | 877.34 | 1022.71 |

| 2063 | 492.10 | 575.09 | 952.29 | 1019.36 |

| 2064 | 521.17 | 561.87 | 1032.89 | 1015.37 |

| 2065 | 550.72 | 548.02 | 1119.50 | 1010.72 |

| 2066 | 580.56 | 533.54 | 1212.47 | 1005.43 |

| 2067 | 610.42 | 518.45 | 1312.18 | 999.50 |

| 2068 | 640.00 | 502.73 | 1419.01 | 992.93 |

| 2069 | 668.91 | 486.39 | 1533.36 | 985.72 |

| 2070 | 696.72 | 469.43 | 1655.60 | 977.87 |

| 2071 | 722.89 | 451.86 | 1786.15 | 969.39 |

| 2072 | 746.79 | 433.67 | 1925.40 | 960.28 |

| 2073 | 767.71 | 414.88 | 2073.74 | 950.54 |

| 2074 | 784.78 | 395.47 | 2231.55 | 940.18 |

| 2075 | 797.00 | 375.45 | 2399.19 | 929.19 |

| 2076 | 803.23 | 354.83 | 2577.02 | 917.58 |

| 2077 | 802.14 | 333.60 | 2765.35 | 905.35 |

| 2078 | 792.17 | 311.77 | 2964.44 | 892.50 |

| 2079 | 771.56 | 289.34 | 3174.51 | 879.03 |

| 2080 | 738.28 | 266.31 | 3395.74 | 864.96 |

| 2081 | 690.00 | 242.68 | 3628.20 | 850.27 |

| 2082 | 624.04 | 218.46 | 3871.87 | 834.97 |

| 2083 | 537.37 | 193.64 | 4126.62 | 819.06 |

| 2084 | 426.50 | 168.22 | 4392.20 | 802.55 |

| 2085 | 287.50 | 142.21 | 4668.18 | 785.43 |

| 2086 | 115.85 | 115.61 | 4953.93 | 767.71 |

| 2087 | −93.53 | 88.43 | 5248.63 | 749.39 |

| 2088 | / | / | 5551.16 | 730.47 |

| 2089 | / | / | 5860.11 | 710.96 |

| 2090 | / | / | 6173.73 | 690.85 |

| 2091 | / | / | 6489.85 | 670.14 |

| 2092 | / | / | 6805.83 | 648.85 |

| 2093 | / | / | 7118.47 | 626.97 |

| 2094 | / | / | 7423.97 | 604.49 |

| 2095 | / | / | 7717.81 | 581.43 |

| 2096 | / | / | 7994.65 | 557.79 |

| 2097 | / | / | 8248.22 | 533.56 |

| 2098 | / | / | 8471.18 | 508.74 |

| 2099 | / | / | 8655.00 | 483.35 |

| 2100 | / | / | 8789.75 | 457.38 |

| 2101 | / | / | 8863.96 | 430.83 |

| 2102 | / | / | 8864.39 | 403.70 |

| 2103 | / | / | 8775.79 | 376.00 |

| 2104 | / | / | 8580.66 | 347.72 |

| 2105 | / | / | 8258.93 | 318.87 |

| 2106 | / | / | 7787.64 | 289.45 |

| 2107 | / | / | 7140.60 | 259.46 |

| 2108 | / | / | 6287.92 | 228.90 |

| 2109 | / | / | 5195.59 | 197.77 |

| 2110 | / | / | 3824.96 | 166.07 |

| 2111 | / | / | 2132.13 | 133.81 |

| 2112 | / | / | 67.35 | 100.98 |

| 2113 | / | / | −2425.74 | 67.59 |

References

- Huang, W.; Zhang, C. The power of social pensions: Evidence from China’s new rural pension scheme. Am. Econ. J. Appl. Econ. 2021, 13, 179–205. [Google Scholar] [CrossRef]

- Diamond, P.A. A framework for social security analysis. J. Public Econ. 1977, 8, 275–298. [Google Scholar] [CrossRef]

- Lin, B.; Zhang, Y.Y. The Impact of Fiscal Subsidies on the Sustainability of China’s Rural Pension Program. Sustainability 2020, 12, 186. [Google Scholar] [CrossRef] [Green Version]

- Zeng, Y.; Li, X.L. Decreasing the premium rate of pension insurance and the sustainability of pension insurance fund: Can you have your cake and eat it. J. Shanghai Univ. Financ. Econ. 2019, 4, 100–111. [Google Scholar]

- Mu, H.Z.; Chen, X. The new basic pension contribution rate model and its empirical test. Chin. J. Popul. Sci. 2019, 4, 17–29. [Google Scholar]

- Yang, Z.G. Optimal Contribution Rate of Public Pension in China within an OLG Model. Int. J. Sociol. Study 2014, 2, 26–32. [Google Scholar]

- Zhang, R.; Liu, J.X. Reduction space of the payment rate in employee basic old-age insurance-based on provincial panel data. Econ. Surv. 2018, 1, 138–145. [Google Scholar]

- Dong, K.Y.; Zheng, Y. Transfer of State-owned Capital and Reduction of Basic Pension Insurance for Urban Employees. Macroeconomics 2020, 1, 141–151. [Google Scholar]

- Jing, P.; Hu, Q.M. The potential cutting extent for social pooling contribution rate of state basic pension scheme for enterprise employees. Chin. J. Popul. Sci. 2017, 1, 21–33. [Google Scholar]

- Dong, S.K. Analysis of China’s Social Insurance Premium Collection Management System. Tax. Res. 2001, 11, 2–6. [Google Scholar]

- Zhao, H. Talking about the change from “fee” to “tax” in social insurance. World Labor Soc. Secur. 2010, 5, 23–24. [Google Scholar]

- Zhang, Y.H.; Li, Q.Y. General Evaluation and Cases Diversity of Social Insurance Contribution Collection: Performance Comparison between Two Authorities. J. Huazhong Univ. Sci. Technol. 2019, 3, 26–32. [Google Scholar]

- Haberman, S.; Sung, J.H. Dynamic approaches to pension funding. Insur. Math. Econ. 1994, 15, 151–162. [Google Scholar] [CrossRef]

- Ricardo, J.F.; June Pablo, R.Z. Minimization of risks in pension funding by means of contributions and portfolio selection. Insur. Math. Econ. 2001, 29, 35–45. [Google Scholar]

- Serdar, S.; Arzdar, K. Parametric pension reform with higher retirement ages: A computational investigation of alternatives for a pay-as-you-go-based pension system. J. Econ. Dyn. Control 2001, 25, 951–966. [Google Scholar]

- Constantin, D. Influence of Contribution Rate Dynamics on the Pension Pillar II on the evolution of the unit value of the net assets of the NN pension fund. Ann. Univ. Craiova Econ. Sci. Ser. 2017, 45, 130–142. [Google Scholar]

- Jennifer, A.G.; Pierre, D. Continuous time model for notional defined contribution pension schemes: Liquidity and solvency. Insur. Math. Econ. 2019, 88, 57–76. [Google Scholar]

- Mauro, V. Extending the retirement age for preserving the constitutive pension system mission. Public Financ. Res. Pap. 2019, 11. [Google Scholar] [CrossRef] [Green Version]

- Coppola, M.; Maria, R. An Indexation Mechanism for Retirement Age: Analysis of the Gender Gap. Risks 2019, 7, 21. [Google Scholar] [CrossRef] [Green Version]

- Davide, B. Ageing population and pension system sustainability: Reforms and redistributive implications. Econ. Politica 2020, 37, 971–992. [Google Scholar]

- Zhu, H.P.; Yue, Y.; Lin, Z.H. Effects of Centralizing Fund Management on Chinese Public Pension and Health Insurance Programs. Econ. Res. J. 2020, 11, 101–120. [Google Scholar]

- Wan, C.; Qiu, C.R. The construction of model, analyzing and forecasting for national pooling account about pension system in china. Forecasting 2006, 3, 43–47. [Google Scholar]

- Lu, Q. The key to national pooling planning is to deal with the central and local relations well. China Soc. Secur. 2014, 2, 36–37. [Google Scholar]

- Deng, R.; Wang, J.L. The relationship between the central government and the local governments in the national level pooling of urban workers’ basic pension-an analysis perspective based on game theory. Soc. Secur. Stud. 2018, 4, 3–12. [Google Scholar]

- Guo, C.S. The Evolutionary Logic of China’s Endowment Insurance System. Lanzhou Acad. J. 2019, 12, 86–102. [Google Scholar]

- Gao, H.R.; Xue, Y.J. Four serious challenges for national co-Ordination of basic endowment insurance. J. Huazhong Univ. Sci. Technol. 2019, 1, 29–34. [Google Scholar]

- Liu, W.B.; Yang, Y. Regional differences and national co-ordination of basic pension for urban employees: Contradictions and solutions. Soc. Secur. Stud. 2019, 1, 13–25. [Google Scholar]

- Chen, Y.G.; Zhang, Y.H. Analysis of the obstacles to achieve national coordination of China’s basic old-age insurance and discussion on the countermeasures. J. Chongqing Univ. Technol. 2019, 12, 58–69. [Google Scholar]

- Xue, H.Y.; Guo, W.Y. Income and expenditure of basic old-age insurance fund for urban workers, risks and coping strategies. Econ. Rev. J. 2017, 12, 74–84. [Google Scholar]

- Bian, S.; Li, D.Y. Promotion of the National pooling of basic endowment insurance scheme design and its implementation path. J. Huazhong Agric. Univ. 2019, 5, 156–163. [Google Scholar]

- Zheng, G.C. From regional division to national pooling planning—The only way to deepen the reform of China’s basic endowment insurance system. J. Renmin Univ. China 2015, 3, 2–11. [Google Scholar]

- Mu, H.Z.; Zhang, W.X.; Shen, Y. Path selection of national pooling planning of basic endowment insurance based on appropriate level of financial payment. Urban Dev. Stud. 2016, 12, 100–107. [Google Scholar]

- Yang, G.Q.; Chen, H.; Xia, M. Regional Competition, Labor Force Mobility, and the Fiscal Behaviour of Local Governments in China. Sustainability 2019, 11, 1776. [Google Scholar] [CrossRef] [Green Version]

- Zhou, A.M. The current situation, challenges and Countermeasures of the reform of China’s pension security system. Soc. Sci. Hunan 2019, 6, 133–140. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).