Nexus between Natural Resources and Environmental Degradation: Analysing the Role of Income Inequality and Renewable Energy

Abstract

:1. Introduction

2. A Brief Overview of Related Literature

2.1. Nexus between Natural Resources and Environmental Degradation

2.2. Nexus between Income Inequality and Environmental Degradation

2.3. Nexus between Renewable Energy and Environmental Degradation

2.4. Nexus between Financial Development and Environmental Degradation

3. Methodology

3.1. Empirical Model

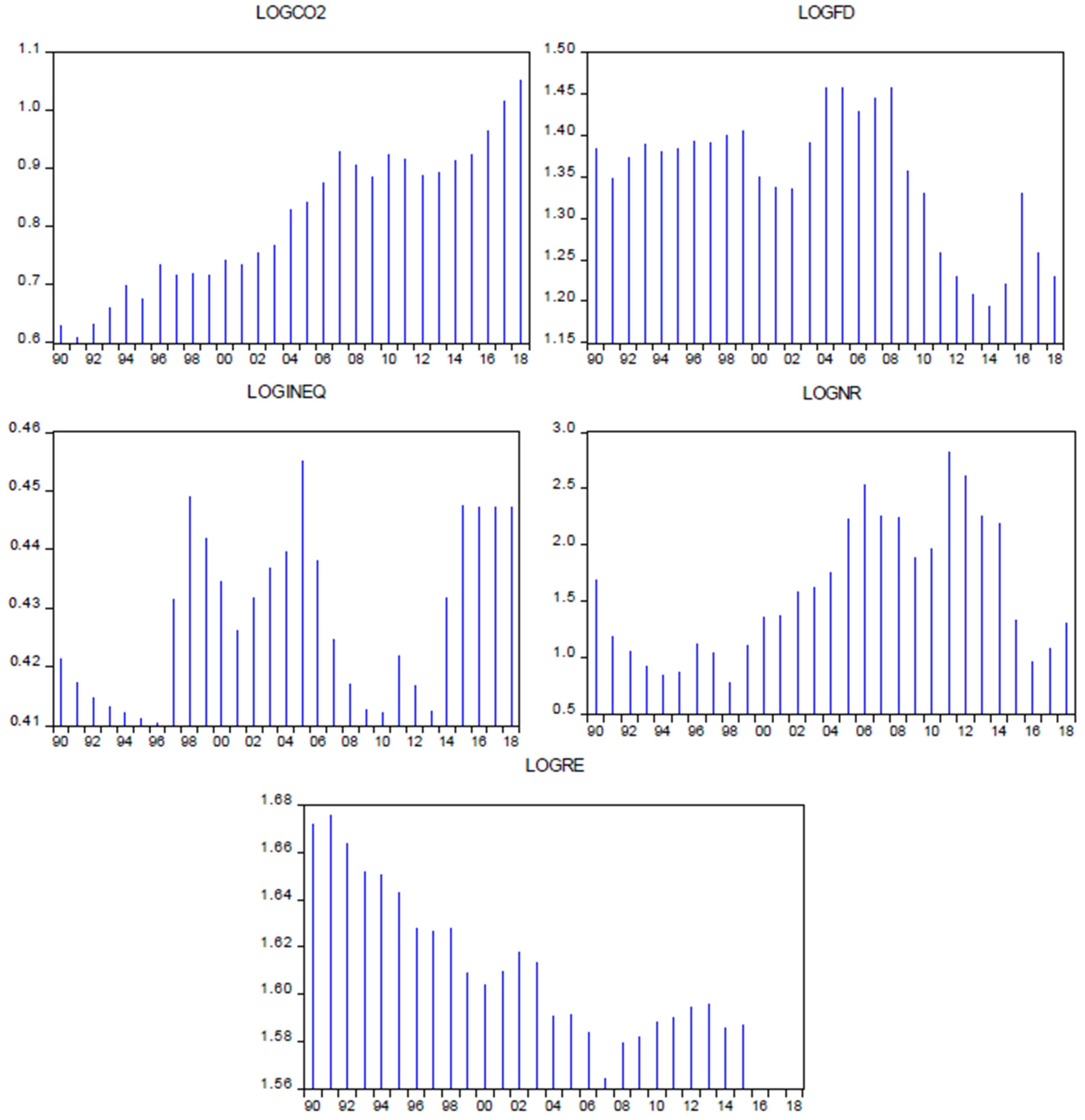

3.2. Data and Data Sources

4. Empirical Outcomes and Discussion

4.1. Stationarity Procedure

4.2. Bound Testing Approach

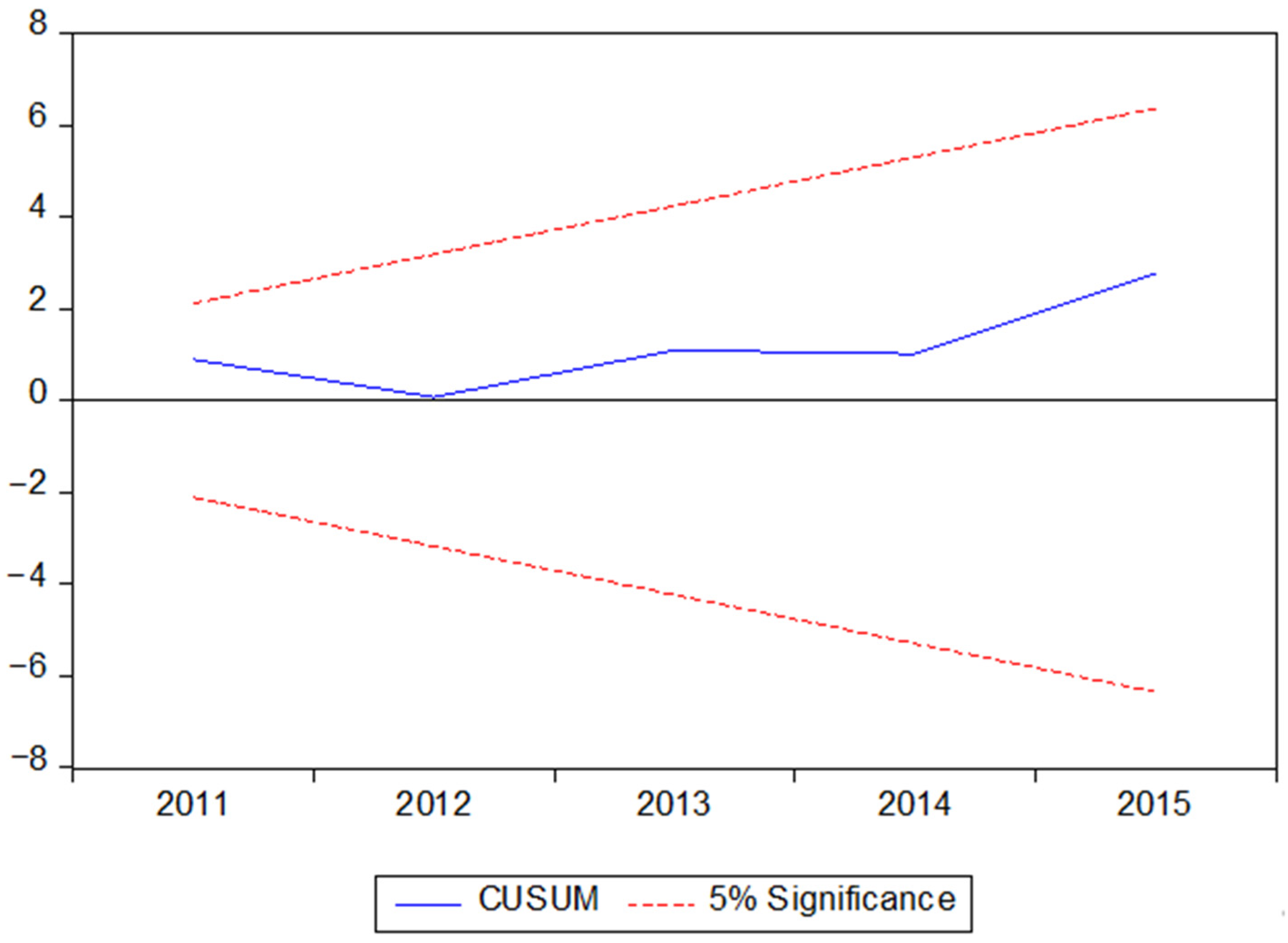

4.3. Verification of Cointegration

4.4. Long-Run and Short-Run Estimates

- I.

- The drive of this empirical study was to look at the link between financial development, income inequality, renewable energy, and degradation of the environment.

- II.

- The model’s dependent variable is carbon emissions, whereas the independent variables are renewable energy, income inequality, and financial development. We validated that no variable was integrated at order 2 before implementing the ARDL bound testing methodology. Following that, we used an inferred bound testing strategy to confirm the long run association using the F-statistic. Also, the outcomes indicate that the variables were co-integrated. Finally, the ARDL methodology was used to interpret the short and long run estimate. Table 5 demonstrates the estimated outcomes of the short and long run estimates.

- III.

- The estimated coefficient value of financial growth indicates a negative and important link with CO2 emissions. According to the findings, increasing financial development by 1% reduces carbon dioxide emissions by 0.057%.

4.5. Granger Causality Results

5. Conclusions

6. Policy Suggestions

7. Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Wolde-Rufael, Y.; Idowu, S. Income distribution and CO2 emission: A comparative analysis for China and India. Renew. Sustain. Energy Rev. 2017, 74, 1336–1345. [Google Scholar] [CrossRef]

- Jorgenson, A.K.; Schor, J.B.; Knight, K.W.; Huang, X. Domestic Inequality and Carbon Emissions in Comparative Perspective. Sociol. Forum 2016, 31, 770–786. [Google Scholar] [CrossRef]

- Uzar, U. Is income inequality a driver for renewable energy consumption? J. Clean. Prod. 2020, 255, 120287. [Google Scholar] [CrossRef]

- Boyce, J.K. Economics Inequality as a Cause of Environmental Degradation—Marginal Marginal Losers Level of Environmental Degradation. Ecol. Econ. 1994, 11, 169–178. [Google Scholar] [CrossRef] [Green Version]

- Torras, M.; Boyce, J.K. Income, inequality, and pollution: A reassessment of the environmental Kuznets Curve. Ecol. Econ. 1998, 25, 147–160. [Google Scholar] [CrossRef]

- Uzar, U.; Eyuboglu, K. The nexus between income inequality and CO2 emissions in Turkey. J. Clean. Prod. 2019, 227, 149–157. [Google Scholar] [CrossRef]

- Scruggs, L.A. Political and Economic Inequality and the Environment. Ecol. Econ. 1998, 26, 259–275. [Google Scholar] [CrossRef]

- Grunewald, N.; Klasen, S.; Martínez-Zarzoso, I.; Muris, C. The Trade-off Between Income Inequality and Carbon Dioxide Emissions. Ecol. Econ. 2017, 142, 249–256. [Google Scholar] [CrossRef] [Green Version]

- Baloch, M.A.; Danish; Khan, S.U.-D.; Ulucak, Z.Ş.; Ahmad, A. Analyzing the relationship between poverty, income inequality, and CO2 emission in Sub-Saharan African countries. Sci. Total. Environ. 2020, 740, 139867. [Google Scholar] [CrossRef]

- United Nations. The Sustainable Development Goals Report 2019; United Nations: New York, NY, USA, 2019. [Google Scholar]

- Liu, C.; Jiang, Y.; Xie, R. Does income inequality facilitate carbon emission reduction in the US? J. Clean. Prod. 2019, 217, 380–387. [Google Scholar] [CrossRef]

- Ding, Q.; Khattak, S.I.; Ahmad, M. Towards sustainable production and consumption: Assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustain. Prod. Consum. 2021, 27, 254–268. [Google Scholar] [CrossRef]

- Hallegatte, S.; Rozenberg, J. Climate change through a poverty lens. Nat. Clim. Chang. 2017, 7, 250–256. [Google Scholar] [CrossRef]

- Padhan, H.; Haouas, I.; Sahoo, B.; Heshmati, A. What matters for environmental quality in the Next Eleven Countries: Economic growth or income inequality? Environ. Sci. Pollut. Res. 2019, 26, 23129–23148. [Google Scholar] [CrossRef]

- Ruhe, C.W. Statistical Review. JAMA 1973, 225, 299–306. [Google Scholar] [CrossRef]

- United Nations. United Nations Climate Action Summit 2019; United Nations: New York, NY, USA, 2019. [Google Scholar]

- Burke, M.J.; Stephens, J. Political power and renewable energy futures: A critical review. Energy Res. Soc. Sci. 2018, 35, 78–93. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Usman, O. Globalization, energy use, and environmental degradation in South Africa: Startling empirical evidence from the Maki-cointegration test. J. Environ. Manag. 2019, 244, 265–275. [Google Scholar] [CrossRef] [PubMed]

- Sarkodie, S.A. The invisible hand and EKC hypothesis: What are the drivers of environmental degradation and pollution in Africa? Environ. Sci. Pollut. Res. 2018, 25, 21993–22022. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Raza, M.Y. Does financial development and foreign direct investment improve environmental quality? Evidence from belt and road countries. Environ. Sci. Pollut. Res. 2020, 27, 23586–23601. [Google Scholar] [CrossRef]

- Seetanah, B.; Sannassee, R.V.; Fauzel, S.; Soobaruth, Y.; Giudici, G.; Nguyen, A.P.H. Impact of Economic and Financial Development on Environmental Degradation: Evidence from Small Island Developing States (SIDS). Emerg. Mark. Financ. Trade 2018, 55, 308–322. [Google Scholar] [CrossRef]

- Shahbaz, M.; Nasir, M.A.; Roubaud, D. Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 2018, 74, 843–857. [Google Scholar] [CrossRef] [Green Version]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Shahbaz, M.; Raghutla, C.; Song, M.; Zameer, H.; Jiao, Z. Public-private partnerships investment in energy as new determinant of CO2 emissions: The role of technological innovations in China. Energy Econ. 2020, 86, 104664. [Google Scholar] [CrossRef] [Green Version]

- Hassan, S.T.; Xia, E.; Huang, J.; Khan, N.H.; Iqbal, K. Natural resources, globalization, and economic growth: Evidence from Pakistan. Environ. Sci. Pollut. Res. 2019, 26, 15527–15534. [Google Scholar] [CrossRef]

- Latif, Z.; Xin, W.; Khan, D.; Iqbal, K.; Pathan, Z.H.; Salam, S.; Jan, N. ICT and sustainable development in South Asian countries. Hum. Syst. Manag. 2017, 36, 353–362. [Google Scholar] [CrossRef]

- Goss, R.M. BP Statistical Review of World Energy 1982. BP Stat. Rev. World Energy 1983, 1–69. [Google Scholar]

- Shao, Y. Does FDI affect carbon intensity? New evidence from dynamic panel analysis. Int. J. Clim. Chang. Strat. Manag. 2018, 10, 27–42. [Google Scholar] [CrossRef]

- Shahbaz, M.; Naeem, M.; Ahad, M.; Tahir, I. Is natural resource abundance a stimulus for financial development in the USA? Resour. Policy 2018, 55, 223–232. [Google Scholar] [CrossRef]

- Lin, F. Trade openness and air pollution: City-level empirical evidence from China. China Econ. Rev. 2017, 45, 78–88. [Google Scholar] [CrossRef]

- Xu, Z.; Baloch, M.A.; Danish; Meng, F.; Zhang, J.; Mahmood, Z. Nexus between financial development and CO2 emissions in Saudi Arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 2018, 25, 28378–28390. [Google Scholar] [CrossRef]

- Huang, L.; Zhao, X. Impact of financial development on trade-embodied carbon dioxide emissions: Evidence from 30 provinces in China. J. Clean. Prod. 2018, 198, 721–736. [Google Scholar] [CrossRef]

- Xiong, L.; Tu, Z.; Ju, L. Reconciling Regional Differences in Financial Development and Carbon Emissions: A Dynamic Panel Data Approach. Energy Procedia 2017, 105, 2989–2995. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, S. The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 2018, 120, 347–353. [Google Scholar] [CrossRef]

- Talaei, A.; Pier, D.; Iyer, A.V.; Ahiduzzaman, M.; Kumar, A. Assessment of long-term energy efficiency improvement and greenhouse gas emissions mitigation options for the cement industry. Energy 2019, 170, 1051–1066. [Google Scholar] [CrossRef]

- Saud, S.; Danish; Chen, S. An empirical analysis of financial development and energy demand: Establishing the role of globalization. Environ. Sci. Pollut. Res. 2018, 25, 24326–24337. [Google Scholar] [CrossRef] [PubMed]

- Wang, L.; Vo, X.V.; Shahbaz, M.; Ak, A. Globalization and carbon emissions: Is there any role of agriculture value-added, financial development, and natural resource rent in the aftermath of COP21? J. Environ. Manag. 2020, 268, 110712. [Google Scholar] [CrossRef]

- Saud, S.; Chen, S.; Danish; Haseeb, A. Impact of financial development and economic growth on environmental quality: An empirical analysis from Belt and Road Initiative (BRI) countries. Environ. Sci. Pollut. Res. 2019, 26, 2253–2269. [Google Scholar] [CrossRef] [PubMed]

- He, Q. Fiscal decentralization and environmental pollution: Evidence from Chinese panel data. China Econ. Rev. 2015, 36, 86–100. [Google Scholar] [CrossRef]

- Ding, T.; Ning, Y.; Zhang, Y. The contribution of China’s bilateral trade to global carbon emissions in the context of globalization. Struct. Chang. Econ. Dyn. 2018, 46, 78–88. [Google Scholar] [CrossRef]

- Li, J.; Zhang, X.; Ali, S.; Khan, Z. Eco-innovation and energy productivity: New determinants of renewable energy consumption. J. Environ. Manag. 2020, 271, 111028. [Google Scholar] [CrossRef] [PubMed]

- Danish; Ulucak, R.; Khan, S.U.-D. Determinants of the ecological footprint: Role of renewable energy, natural resources, and urbanization. Sustain. Cities Soc. 2020, 54, 101996. [Google Scholar] [CrossRef]

- Alola, A.A.; Yalçiner, K.; Alola, U.V.; Akadiri, S.S. The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe largest states. Sci. Total. Environ. 2019, 674, 307–315. [Google Scholar] [CrossRef]

- Nguyen, K.H.; Kakinaka, M. Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renew. Energy 2019, 132, 1049–1057. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total. Environ. 2019, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Baloch, M.A.; Zhang, J.; Iqbal, K.; Iqbal, Z. The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 2019, 26, 6199–6208. [Google Scholar] [CrossRef]

- Dogan, E.; Taspinar, N.; Gokmenoglu, K.K. Determinants of ecological footprint in MINT countries. Energy Environ. 2019, 30, 1065–1086. [Google Scholar] [CrossRef]

- Bello, M.O.; Solarin, S.A.; Yen, Y.Y. The impact of electricity consumption on CO 2 emission, carbon footprint, water footprint and ecological footprint: The role of hydropower in an emerging economy. J. Environ. Manag. 2018, 219, 218–230. [Google Scholar] [CrossRef] [PubMed]

- Destek, M.A.; Ulucak, R.; Dogan, E. Analyzing the environmental Kuznets curve for the EU countries: The role of ecological footprint. Environ. Sci. Pollut. Res. Int. 2018, 25, 29387–29396. [Google Scholar] [CrossRef] [PubMed]

- Lorente, D.B.; Shahbaz, M.; Roubaud, D.; Farhani, S. How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 2018, 113, 356–367. [Google Scholar] [CrossRef] [Green Version]

- Solarin, S.A.; Al-Mulali, U. Influence of foreign direct investment on indicators of environmental degradation. Environ. Sci. Pollut. Res. 2018, 25, 24845–24859. [Google Scholar] [CrossRef] [PubMed]

- Hassan, S.T.; Xia, E.; Lee, C.-C. Mitigation pathways impact of climate change and improving sustainable development: The roles of natural resources, income, and CO2 emission. Energy Environ. 2021, 32, 338–363. [Google Scholar] [CrossRef]

- Akhter, W.; Zaman, K.; Nassani, A.A.; Abro, M.M.Q. Nexus between natural and technical disaster shocks, resource depletion and growth-specific factors: Evidence from quantile regression. Nat. Hazards 2020, 104, 1–27. [Google Scholar] [CrossRef]

- Danish; Baloch, M.A.; Mahmood, N.; Zhang, J.W. Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci. Total. Environ. 2019, 678, 632–638. [Google Scholar] [CrossRef] [PubMed]

- Guo, Y.; You, W.; Lee, C. Research in environmental governance and innovation CO 2 Emissions, Income Inequality, and Country Risk: Some International Evidence. Environ. Sci. Pollut. Res. 2020. [Google Scholar] [CrossRef]

- Hailemariam, A.; Dzhumashev, R.; Shahbaz, M. Carbon emissions, income inequality and economic development. Empir. Econ. 2019, 59, 1139–1159. [Google Scholar] [CrossRef]

- Ravallion, B.M.; Heil, M.; Jalan, J. Carbon Emissions and Income Inequality. Oxf. Econ. Pap. 2000, 52, 651–669. [Google Scholar] [CrossRef]

- Gassebner, M.; Gaston, N.; Lamla, M.J. Relief for the environment? The importance of an increasingly unimportant industrial sector. Econ. Inq. 2008, 46, 160–178. [Google Scholar] [CrossRef]

- Hao, Y.; Chen, H.; Zhang, Q. Will income inequality affect environmental quality? Analysis based on China’s provincial panel data. Ecol. Indic. 2016, 67, 533–542. [Google Scholar] [CrossRef]

- Greiner, P.T.; McGee, J.A. Divergent Pathways on the Road to Sustainability: A Multilevel Model of the Effects of Geopolitical Power on the Relationship between Economic Growth and Environmental Quality. Socius Sociol. Res. Dyn. World 2018, 4. [Google Scholar] [CrossRef] [Green Version]

- Abbas, S.; Kousar, S.; Yaseen, M.; Mayo, Z.A.; Zainab, M.; Mahmood, M.J.; Raza, H. Impact assessment of socioeconomic factors on dimensions of environmental degradation in Pakistan. SN Appl. Sci. 2020, 2, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Global Health Workforce Alliance. Country Case Study Pakistan’s Lady Health Worker Programme GHWA Task Force on Scaling Up Education and Training for Health Workers; WHO: Geneva, Switzerland, 2008. [Google Scholar]

- Ohlsson, L. Livelihood Conflicts: Linking Poverty and Environment as Causes of Conflict; Swedish International Development Cooperation Agency: Stockholm, Sweden, 2000. [Google Scholar]

- Ullah, W. Climate Change Vulnerability of Pakistan Towards Natural Disasters: A Review. Int. J. Environ. Prot. Policy 2016, 4, 126. [Google Scholar] [CrossRef] [Green Version]

- Bayer, C.; Hanck, C. Combining non-cointegration tests. J. Time Ser. Anal. 2013, 34, 83–95. [Google Scholar] [CrossRef]

- Bayramov, A. Review: Dubious nexus between natural resources and conflict. J. Eurasian Stud. 2018, 9, 72–81. [Google Scholar] [CrossRef]

- Zhang, X.; Wu, L.; Zhang, R.; Deng, S.; Zhang, Y.; Wu, J.; Li, Y.; Lin, X.; Li, L.; Wang, Y.; et al. Evaluating the relationships among economic growth, energy consumption, air emissions and air environmental protection investment in China. Renew. Sustain. Energy Rev. 2013, 18, 259–270. [Google Scholar] [CrossRef]

- Litovitz, A.; Curtright, A.; Abramzon, S.; Burger, N.; Samaras, C. Estimation of regional air-quality damages from Marcellus Shale natural gas extraction in Pennsylvania. Environ. Res. Lett. 2013, 8, 014017. [Google Scholar] [CrossRef]

- Lee, T.; van de Meene, S. Comparative studies of urban climate co-benefits in Asian cities: An analysis of relationships between CO2 emissions and environmental indicators. J. Clean. Prod. 2013, 58, 15–24. [Google Scholar] [CrossRef]

- Arent, D.; Pless, J.; Mai, T.; Wiser, R.; Hand, M.; Baldwin, S.; Heath, G.; Macknick, J.; Bazilian, M.; Schlosser, A.; et al. Implications of high renewable electricity penetration in the U.S. for water use, greenhouse gas emissions, land-use, and materials supply. Appl. Energy 2014, 123, 368–377. [Google Scholar] [CrossRef]

- Mudakkar, S.R.; Zaman, K.; Khan, M.M.; Ahmad, M. Energy for economic growth, industrialization, environment and natural resources: Living with just enough. Renew. Sustain. Energy Rev. 2013, 25, 580–595. [Google Scholar] [CrossRef]

- Chen, Y.; Lee, C.-C. Does technological innovation reduce CO2 emissions?Cross-country evidence. J. Clean. Prod. 2020, 263, 121550. [Google Scholar] [CrossRef]

- Sarkodie, S.A.; Ozturk, I. Investigating the Environmental Kuznets Curve hypothesis in Kenya: A multivariate analysis. Renew. Sustain. Energy Rev. 2020, 117, 109481. [Google Scholar] [CrossRef]

- Chen, Y.; Lee, C.-C. The impact of real estate investment on air quality: Evidence from China. Environ. Sci. Pollut. Res. 2020, 27, 22989–23001. [Google Scholar] [CrossRef]

- Ray, D.; Baland, J.; Dagnelie, O. Inequality and Inefficiency in Joint Projects. Econ. J. 2007, 117, 922–935. [Google Scholar] [CrossRef] [Green Version]

- Schor, J. Time, Labour and Consumption: Guest Editor’s Introduction. Time Soc. 1998, 7, 119–127. [Google Scholar] [CrossRef]

- Cushing, L.; Morello-Frosch, R.; Wander, M.; Pastor, M. The Haves, the Have-Nots, and the Health of Everyone: The Relationship Between Social Inequality and Environmental Quality. Annu. Rev. Public Health 2015, 36, 193–209. [Google Scholar] [CrossRef] [Green Version]

- He, J.; Makdissi, P.; Wodon, Q.; He, J.; Makdissi, P.; Wodon, Q. Corruption, Inequality, and Environmental Regulation; Departement d’Economique de l’École de Gestion à l’Université de Sherbrooke: Sherbrooke, QC, Canada, 2017. [Google Scholar]

- Bae, J.H. Impacts of Income Inequality on CO 2 Emission under Different Climate Change Mitigation Policies. Korean Econ. Rev. 2018, 34, 187–211. [Google Scholar]

- Gorus, M.S.; Aslan, M. Impacts of economic indicators on environmental degradation: Evidence from MENA countries. Renew. Sustain. Energy Rev. 2019, 103, 259–268. [Google Scholar] [CrossRef]

- Abdulla, A.; Vaishnav, P.; Sergi, B.; Victor, D. Limits to deployment of nuclear power for decarbonization: Insights from public opinion. Energy Policy 2019, 129, 1339–1346. [Google Scholar] [CrossRef]

- Nathaniel, S.; Nathaniel, S. Ecological Footprint, Urbanization, and Energy Consumption in South Africa: Including the Excluded. Environ. Sci. Pollut. Res. 2019, 26, 27168–27179. [Google Scholar] [CrossRef] [PubMed]

- De Souza, E.S.; Freire, F.; Pires, J. Determinants of CO2 emissions in the MERCOSUR: The role of economic growth, and renewable and non-renewable energy. Environ. Sci. Pollut. Res. 2018, 25, 20769–20781. [Google Scholar] [CrossRef] [PubMed]

- Dinç, D.T.; Akdoğan, E.C. Renewable Energy Production, Energy Consumption and Sustainable Economic Growth in Turkey: A VECM Approach. Sustainability 2019, 11, 1273. [Google Scholar] [CrossRef] [Green Version]

- Kahia, M.; Ben Jebli, M.; Belloumi, M. Analysis of the impact of renewable energy consumption and economic growth on carbon dioxide emissions in 12 MENA countries. Clean Technol. Environ. Policy 2019, 21, 871–885. [Google Scholar] [CrossRef]

- Yazdi, S.K.; Beygi, E.G. The dynamic impact of renewable energy consumption and financial development on CO2emissions: For selected African countries. Energy Sources Part B Econ. Plan. Policy 2017, 13, 13–20. [Google Scholar] [CrossRef]

- Riti, J.S.; Shu, Y. Renewable energy, energy efficiency, and eco-friendly environment (R-E5) in Nigeria. Energy Sustain. Soc. 2016, 6, 1. [Google Scholar] [CrossRef] [Green Version]

- Hanif, I.; Raza, S.M.F.; de Santos, P.G.-; Abbas, Q. Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: Some empirical evidence. Energy 2019, 171, 493–501. [Google Scholar] [CrossRef]

- Nathaniel, S.; Anyanwu, O.; Shah, M.I. Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ. Sci. Pollut. Res. 2020, 27, 14601–14613. [Google Scholar] [CrossRef] [PubMed]

- Danish; Ulucak, R. How do environmental technologies affect green growth? Evidence from BRICS economies. Sci. Total. Environ. 2020, 712, 136504. [Google Scholar] [CrossRef] [PubMed]

- Ibrahiem, D.M. Do technological innovations and financial development improve environmental quality in Egypt? Environ. Sci. Pollut. Res. 2020, 27, 10869–10881. [Google Scholar] [CrossRef]

- Uddin, G.A.; Salahuddin, M.; Alam, K.; Gow, J. Ecological footprint and real income: Panel data evidence from the 27 highest emitting countries. Ecol. Indic. 2017, 77, 166–175. [Google Scholar] [CrossRef]

- Fakher, H.-A. Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ. Sci. Pollut. Res. 2019, 26, 10276–10291. [Google Scholar] [CrossRef]

- Danish; Wang, B.; Wang, Z. Imported technology and CO2 emission in China: Collecting evidence through bound testing and VECM approach. Renew. Sustain. Energy Rev. 2018, 82, 4204–4214. [Google Scholar] [CrossRef]

- Hermes, N.; Lensink, R. Foreign direct investment, financial development and economic growth. J. Dev. Stud. 2003, 40, 142–163. [Google Scholar] [CrossRef] [Green Version]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- King, R.G.; Levine, R. Finance and Growth: Schumpeter Might Be Right. Q. J. Econ. 1993, 108, 717–737. [Google Scholar] [CrossRef]

- Shahbaz, M.; Jam, F.A.; Bibi, S.; Loganathan, N. Multivariate granger causality between co2 emissions, energy intensity and economic growth in portugal: Evidence from cointegration and causality analysis. Technol. Econ. Dev. Econ. 2015, 22, 47–74. [Google Scholar] [CrossRef]

- Shahbaz, M.; Hye, Q.M.A.; Tiwari, A.; Leitão, N.C. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 2013, 25, 109–121. [Google Scholar] [CrossRef] [Green Version]

- Tadesse, S. Financial Development and Technology. SSRN 2005. [Google Scholar] [CrossRef] [Green Version]

- Tamazian, A.; Rao, B.B. Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 2010, 32, 137–145. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Çoban, S.; Topcu, M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. 2013, 39, 81–88. [Google Scholar] [CrossRef]

- Islam, F.; Shahbaz, M.; Ahmed, A.U.; Alam, M. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ. Model. 2013, 30, 435–441. [Google Scholar] [CrossRef] [Green Version]

- Omri, A.; Daly, S.; Rault, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 242–252. [Google Scholar] [CrossRef] [Green Version]

- Ozturk, I.; Acaravci, A. The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 2013, 36, 262–267. [Google Scholar] [CrossRef]

- Shoaib, H.M.; Rafique, M.Z.; Nadeem, A.M.; Huang, S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ. Sci. Pollut. Res. 2020, 27, 12461–12475. [Google Scholar] [CrossRef] [PubMed]

- Pesaran, M.H.; Shin, Y.; Smithc, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Narayan, S.; Narayan, P.K. An empirical analysis of Fiji’s import demand function. J. Econ. Stud. 2005, 32, 158–168. [Google Scholar] [CrossRef]

- Asif, S.; Naqvi, A.; Ale, S.; Shah, R.; Mehdi, M.A. Revealing Empirical Association among Ecological Footprints, Renewable Energy Consumption, Real Income, and Financial Development: A Global Perspective. Environ. Sci. Pollut. Res. 2020, 24, 42830–42849. [Google Scholar]

- Sarkodie, S.A.; Adams, S. Renewable energy, nuclear energy, and environmental pollution: Accounting for political institutional quality in South Africa. Sci. Total. Environ. 2018, 643, 1590–1601. [Google Scholar] [CrossRef]

- Narayan, P.K. The saving and investment nexus for China: Evidence from cointegration tests. Appl. Econ. 2005, 37, 1979–1990. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Karasoy, A. Drivers of carbon emissions in Turkey: Considering asymmetric impacts. Environ. Sci. Pollut. Res. 2019, 26, 9219–9231. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.; Peng, Z.; Li, Y. Energy consumption, environmental degradation, economic growth and financial development in globe: Dynamic simultaneous equations panel analysis. Energy Rep. 2019, 5, 1089–1102. [Google Scholar] [CrossRef]

- Zaidi, S.A.H.; Zafar, M.W.; Shahbaz, M.; Hou, F. Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 228, 533–543. [Google Scholar] [CrossRef]

- Abbasi, F.; Riaz, K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 2016, 90, 102–114. [Google Scholar] [CrossRef]

- Khan, M.K.; Teng, J.Z. The impact of macroeconomic and financial development on carbon dioxide emissions in Pakistan: Evidence with a novel dynamic simulated ARDL approach. Environ. Sci. Pollut. Res. 2020, 27, 39560–39571. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, F.; Kousar, S.; Pervaiz, A.; Ramos-Requena, J. Financial Development, Institutional Quality, and Environmental Degradation Nexus: New Evidence from Asymmetric ARDL Co-Integration Approach. Sustainability 2020, 12, 7812. [Google Scholar] [CrossRef]

- Asif, S.; Khan, K.B.; Anser, M.K.; Nassani, A.A.; Abro, M.M.Q.; Zaman, K. Dynamic interaction between financial development and natural resources: Evaluating the ‘Resource curse’ hypothesis. Resour. Policy 2020, 65, 101566. [Google Scholar] [CrossRef]

- Hübler, M. The inequality-emissions nexus in the context of trade and development: A quantile regression approach. Ecol. Econ. 2017, 134, 174–185. [Google Scholar] [CrossRef]

- Heerink, N.; Mulatu, A.; Bulte, E. Income inequality and the environment: Aggregation bias in environmental Kuznets curves. Ecol. Econ. 2001, 38, 359–367. [Google Scholar] [CrossRef]

- Kasuga, H.; Takaya, M. Does inequality affect environmental quality? Evidence from major Japanese cities. J. Clean. Prod. 2017, 142, 3689–3701. [Google Scholar] [CrossRef]

- Qu, B.; Zhang, Y. Effect of income distribution on the environmental kuznets curve. Pac. Econ. Rev. 2011, 16, 349–370. [Google Scholar] [CrossRef]

- Abdul, S.; Khan, R.; Zhang, Y.; Nathaniel, S. Green supply chain performance and environmental sustainability: A panel study. LogForum 2020, 16, 141–159. [Google Scholar]

- Eyuboglu, K.; Uzar, U. Examining the roles of renewable energy consumption and agriculture on CO2 emission in lucky-seven countries. Environ. Sci. Pollut. Res. 2020, 27, 45031–45040. [Google Scholar] [CrossRef] [PubMed]

- Teng, J.-Z.; Khan, M.K.; Chishti, M.Z. Effect of foreign direct investment on CO2 emission with the role of globalization, institutional quality with pooled mean group panel ARDL. Environ. Sci. Pollut. Res. 2021, 28, 5271–5282. [Google Scholar] [CrossRef] [PubMed]

- Wolde-Rufael, Y.; Weldemeskel, E.M. Environmental policy stringency, renewable energy consumption and CO2 emissions: Panel cointegration analysis for BRIICTS countries. Int. J. Green Energy 2020, 17, 568–582. [Google Scholar] [CrossRef]

- Baloch, A.; Shah, S.Z.; Noor, Z.M.; Magsi, H.B. The nexus between income inequality, economic growth and environmental degradation in Pakistan. GeoJournal 2018, 83, 207–222. [Google Scholar] [CrossRef]

- Khan, S.; Yahong, W. Symmetric and Asymmetric Impact of Poverty, Income Inequality, and Population on Carbon Emission in Pakistan: New Evidence From ARDL and NARDL Co-Integration. Front. Environ. Sci. 2021, 9. [Google Scholar] [CrossRef]

- Hussain, J.; Zhou, K.; Guo, S.; Khan, A. Investment risk and natural resource potential in “Belt & Road Initiative” countries: A multi-criteria decision-making approach. Sci. Total. Environ. 2020, 723, 137981. [Google Scholar] [CrossRef]

- Khan, A.; Muhammad, F.; Chenggang, Y.; Hussain, J.; Bano, S.; Khan, M.A. The impression of technological innovations and natural resources in energy-growth-environment nexus: A new look into BRICS economies. Sci. Total. Environ. 2020, 727, 138265. [Google Scholar] [CrossRef]

- Kwakwa, P.A.; Alhassan, H.; Adu, G. Effect of natural resources extraction on energy consumption and carbon dioxide emission in Ghana. Int. J. Energy Sect. Manag. 2020, 14, 20–39. [Google Scholar] [CrossRef]

- Khan, A.; Chenggang, Y.; Hussain, J.; Bano, S.; Nawaz, A. Natural resources, tourism development, and energy-growth-CO2 emission nexus: A simultaneity modeling analysis of BRI countries. Resour. Policy 2020, 68, 101751. [Google Scholar] [CrossRef]

- Zafar, M.W.; Zaidi, S.A.H.; Khan, N.R.; Mirza, F.M.; Hou, F.; Kirmani, S.A.A. The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resour. Policy 2019, 63, 101428. [Google Scholar] [CrossRef]

- Wu, S.; Li, L.; Li, S. Natural resource abundance, natural resource-oriented industry dependence, and economic growth: Evidence from the provincial level in China. Resour. Conserv. Recycl. 2018, 139, 163–171. [Google Scholar] [CrossRef]

| Variable | Symbols | Definitions | Data Source |

|---|---|---|---|

| Carbon dioxide emission | CO2 | CO2 emission per capita | Our world in Data |

| Natural resource | NR | Total natural resources rents (% of GDP) | World Bank |

| Income Inequality Gini index | INEN | “The Gini index is a measurement of the income distribution of a country’s residents”. 0 represents perfect equality, and 100 means perfect inequality. | World Inequality Data Base |

| Renewable Energy | RE | Access to electricity (%) Contribution of renewables to total primary energy supply (TPES) | OECD |

| Financial Development | FD | Domestic loan or credit provision to the private sectors | World Bank |

| Augmented Ducky–Fuller (ADF) Test | Phillips–Perron Test Statistic | DF-GLS Test Statistic | ||||

|---|---|---|---|---|---|---|

| At Level | At First Difference | At Level | At First Difference | At Level | At First Difference | |

| Variable | t-statistic (Prob.) | t-statistic (Prob.) | t-statistic (Prob.) | t-statistic (Prob.) | t-Statistic | t-Statistic |

| LOGCO2 | 0.180806 (0.9663) | −3.707578 b (0.0119) | 0.260147 (0.9716) | −5.666896 a (0.0001) | 0.752239 | −5.052051 a |

| LOGFD | −1.065109 (0.7151) | −4.499995 a (0.0014) | −1.20668 (0.6571) | −4.509760 a (0.0014) | −1.102064 | −4.347852 a |

| LOGINEN | −2.617508 (0.1019) | −3.853967 a (0.0069) | −1.91245 (0.3221) | −3.692408 b (0.0102) | −2.669683 | −3.840676 a |

| LOGRE | −1.866552 (0.3416) | −4.775972 a (0.0009) | −2.38168 (0.1566) | −4.775228 a (0.0009) | −0.913565 | −4.584708 a |

| LOGNR | −1.420919 (0.5577) | −4.239001 a (0.0027) | −1.60146 (0.4686) | −4.182572 a (0.0031) | −1.447202 | −3.746157 a |

| Bound Testing Value | Diagnostic Test | |||||

|---|---|---|---|---|---|---|

| Selected Model | Lag Order | F-Statistic | Decision | Ramsey Reset | ARCH-Test | χ2-LM Test |

| LOGCO2 = f(LOGFD, LOGINEQ, LOGNR, LOGRE) | (3, 2, 3, 3,2) | 3.234916 c | conclusive | 0.052787 [0.8296] | 0.421453 [0.5236] | 14.75224 [0.1926] |

| LOGRE = LOGCO2 LOGFD LOGINEQ LOGNR | (1, 2, 1, 2, 2) | 7.787994 a | onclusive | 0.05815 [0.8213] | 1.770333 [0.1983] | 4.158443 [0.1365] |

| LOGNR = LOGRE LOGCO2 LOGFD LOGINEQ | (3, 3, 1, 2, 3) | 13.37142 a | conclusive | 0.029547 [0.9776] | 0.314633 [0.5811] | 2.202445 [0.3358] |

| LOGINEQ = LOGNR LOGRE LOGCO2 LOGFD | (2, 3, 3, 3, 1) | 5.983404 a | conclusive | 0.425103 [0.6884] | 0.839593 [0.3704] | 1.061990 [0.4266] |

| LOGGI = f(LOGINEQ, LOGNR, LOGRE, LOGCO2) | (1, 2, 3, 2, 3) | 3.157947 c | conclusive | 1.583510 [0.2368] | 0.067796 [0.7971] | 0.004102 [0.9502] |

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistic | 0.05 Critical Value | Prob. ** |

| None * | 0.974078 | 171.9819 | 69.81889 | 0.0000 |

| At most 1 * | 0.919923 | 87.97074 | 47.85613 | 0.0000 |

| At most 2 * | 0.557413 | 29.90110 | 29.79707 | 0.0486 |

| At most 3 | 0.366136 | 11.15338 | 15.49471 | 0.2023 |

| At most 4 | 0.028592 | 0.667204 | 3.841466 | 0.4140 |

| Hypothesized No. of CE(s) | Eigenvalue | Max-Eigen Statistic | 0.05 Critical Value | Prob.** |

| None * | 0.974078 | 84.01111 | 33.87687 | 0.0000 |

| At most 1 * | 0.919923 | 58.06964 | 27.58434 | 0.0000 |

| At most 2 | 0.557413 | 18.74772 | 21.13162 | 0.1044 |

| At most 3 | 0.366136 | 10.48618 | 14.26460 | 0.1819 |

| At most 4 | 0.028592 | 0.667204 | 3.841466 | 0.4140 |

| Long run Dynamics | ||||

|---|---|---|---|---|

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| LOGFD | −0.057441 | 0.022305 | −2.575220 | 0.0497 |

| LOGINEQ | −2.294800 | 0.175140 | −13.102688 | 0.0000 |

| LOGRE | −2.873368 | 0.121564 | −23.636699 | 0.0000 |

| LOGNR | 0.056812 | 0.004925 | 11.535690 | 0.0001 |

| C | 6.373643 | 0.275697 | 23.118261 | 0.0000 |

| Short Run dynamics | ||||

| D(LOGFD) | −0.332135 | 0.095304 | −3.485012 | 0.0176 |

| D(LOGINEQ) | −2.078301 | 0.482073 | −4.311179 | 0.0076 |

| D(LOGNR) | −0.177473 | 0.029742 | −5.967161 | 0.0019 |

| D(LOGRE) | −3.411423 | 0.435520 | −7.832980 | 0.0005 |

| CointEq(−1) | −4.382682 | 0.703425 | −6.230489 | 0.0016 |

| Diagnostic test | ||||

| R-squared | 0.993085 | |||

| F-statistic | 42.23997 | |||

| Prob(F-statistic) | 0.000298 | |||

| Durbin-Watson stat | 2.989733 | |||

| Sensitivity analysis | ||||

| Ramsey Reset | 0.052787 [0.8296] | |||

| χ2-LM | 14.75224 [0.1926] | |||

| χ2-ARCH | 0.421453 [0.5236] | |||

| χ2-Statistic Short Run Causality | χ2-Statistics Long Run Causality | |||||

|---|---|---|---|---|---|---|

| Variables | LOGCO2 | LOGINEN | LOGFD | LOGRE | LOGNR | Ecm(t−1) |

| LOGCO2 | --- | 1.451222 [0.2424] | 6.122717 [0.0224] | 0.573262 [0.4578] | 2.885858 [0.1049] | 0.011258 [0.1049] |

| LOGINEN | 0.262153 [0.6143] | --- | 0.412097 [0.5282] | 0.065439 [0.8007] | 1.183803 [0.2895] | 0.006655 [0.2895] |

| LOGFD | 1.318063 [0.2645] | 1.526119 [0.2310] | --- | 1.225580 [0.2814] | 4.609063 b [0.0442] | −0.011762 [0.0442] |

| LOGRE | 6.302885 [0.0213] | 0.382729 [0.5435] | 0.873706 [0.3617] | --- | 2.766892 [0.0126] | −0.086378 b 0.0126 |

| LOGNR | 0.828182 [0.3736] | 0.083562 [0.7755] | 1.896026 [0.1837] | 0.223462 [0.6415] | -- | −0.065421 [0.1765] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Uddin, I.; Gong, Y. Nexus between Natural Resources and Environmental Degradation: Analysing the Role of Income Inequality and Renewable Energy. Sustainability 2021, 13, 8364. https://doi.org/10.3390/su13158364

Wang Y, Uddin I, Gong Y. Nexus between Natural Resources and Environmental Degradation: Analysing the Role of Income Inequality and Renewable Energy. Sustainability. 2021; 13(15):8364. https://doi.org/10.3390/su13158364

Chicago/Turabian StyleWang, Yongming, Irfan Uddin, and Yingmei Gong. 2021. "Nexus between Natural Resources and Environmental Degradation: Analysing the Role of Income Inequality and Renewable Energy" Sustainability 13, no. 15: 8364. https://doi.org/10.3390/su13158364

APA StyleWang, Y., Uddin, I., & Gong, Y. (2021). Nexus between Natural Resources and Environmental Degradation: Analysing the Role of Income Inequality and Renewable Energy. Sustainability, 13(15), 8364. https://doi.org/10.3390/su13158364