Abstract

The objective of this research was to explore the impact factors of sustainable corporate governance for top consulting engineering companies in Taiwan, to facilitate managers in meeting stakeholders’ needs and adapting to the challenges of the global markets. Nine hypotheses derived from a literature review were proposed and used to develop a survey. Based on the concept of structural equation modeling (SEM) and these hypotheses, a questionnaire containing six aspects and comprising 46 stems was developed using the Likert 5-scale format. The survey took around four months to administer with 324 effective returns, with only five hypotheses confirmed. This was followed by factor analysis to determine the weight sequence for the 28 impact factors and four aspects. The contributions of the findings are as follows: (1) the weighted factors provide practitioners with guidelines for the proper order for the implementation of measures to improve corporate governance, and (2) they answer questions about the degree of influence and the relationship among all aspects and factors for sustainable corporate governance.

1. Introduction

An engineering consulting firm provides professional services to clients, but is characterized by high contractual risks and must employ various professional staff [1,2,3]. For example, the complexity and large budget of large-scale listed construction projects require the cooperation of multiple entities to arrange the work, who participate at various working stages, such as the project bidding stage (the stage where a vendor is selected for contracting a project), project execution (the stage where everything planned is put into action), and the management stage (the practice of the organization and coordination of a project). This means that engineering consulting firms have complicated internal departments with work divided into more detailed parts in order to ensure that all their projects are successful [4,5]. Misbehavior by top management can easily cripple construction-related companies, but this can be avoided by sustainable corporate governance [6]. In sum, efficient and sustainable corporate governance is the answer to these types of problems. Exploring the impact factors impacting sustainable corporate governance is the first step and is vital for top engineering consulting firms in Taiwan that (1) have stringent demands by interested parties, (2) want to pursue sustainable operations, and/or (3) strive to conduct business overseas.

The aim of this research was to investigate and analyze the key factors in how sustainable corporate governance can affect the top engineering consulting firms in Taiwan, and to assist managerial staff in fulfilling demands from various interested parties and respond to the challenges of competing in a global market.

The methodology required investigating the responses of employees of Taiwanese engineering consulting firms, focusing on the impact made by corporate governance principles as defined by the Organization for Economic Cooperation and Development (OECD) and other corporate governance evaluation indicators in Taiwan [7]. A widely accepted structural equation modeling (SEM)-oriented questionnaire was designed, and then a survey, based on convenience sampling, targeting the top 10 engineering consulting companies in Taiwan, was carried out. The hypotheses were verified and discussed before identifying the key factors for sustainable corporate governance. The following sections include an explanation of the research hypotheses, a discussion of the design of the questionnaire, the pilot study and the analysis, a summary of the survey and analysis results, and a discussion.

2. Literature Review

The Taiwanese government propagated their ideas about corporate governance and stressed its importance to listed companies in 1988. Robust corporate governance principles suggest the importance of the establishment of a board of directors and managerial level efforts to attain business goals by means of maximizing the benefits of interested parties [7]. A high level of interest in corporate governance has been demonstrated, with researchers taking notions from organizational economics and management science essays to conduct analyses of the relationship between the characteristics of the board of directors and unjust corporate actions [8].

2.1. Shareholders’ Rights, Interests, and Equitability

Good corporate governance can be defined as reducing the possibility of corrupt practices by corporations or business organizations, either separately or collectively, from the point of view of legal science, economics, accounting, finance, sociology, and political science. This relates to the interests of parties both inside and outside of a corporation, such as the board of directors, managerial staff, shareholders, employees, customers, suppliers, creditors, banks, and even governmental organizations, and their interactions, in order to develop an assessment [9]. The nature of corporate governance is not subject to legal statute because its proposition and implementation rely on self-regulatory actions. Corporate governance has to be implemented by regulations rather than by laws, as the nature of soft law is that it depends upon quasi-legal instruments lacking legally binding force [10]. One study discussed the lack of corporate governance legal regulations and proposed suggestions for improving the legal system to protect shareholders’ equity [11]. Another study, specifically aimed at Taiwan, examined listed companies in the field of memory modules, and tried to analyze the impact of the maintenance of an excessive return on equity (ROE) rate by managers. It raised the possibility that, although managers should comply with business ethics and should not deceive shareholders or creditors for their own interest, moral hazards remained due to information asymmetry and defects in the assessment of financial performance. Corporate governance is closely related to capital structure and, therefore, interested parties should be concerned. Usually, the capital structure varies depending on the characteristics of the industry and their approaches. The consequence of this indicates that all the aforementioned factors may have an effect on a board of directors [12,13,14,15,16,17,18] (Hypotheses 6–8).

2.2. Corporate Social Responsibility

Mutually taking from and giving back to society is one of the ideas supported by enterprises. Studies indicate that corporate social responsibility (CSR) plays a pivotal role in the civil engineering profession and construction field [19,20]. The ways of implementing CSR are various, including educational training, focusing on the environment, and through donations to charitable organizations or vulnerable groups [21,22]. The starting point of CSR is to urge progress towards a more societally friendly environment. A successful example demonstrates a positive influence on the client groups in the CSR aspect [23,24]. The case promotes CSR transparency to prevent misconduct at the decision-maker level (Hypothesis 9).

2.3. Information Transparency and Firewall and Connection to Study Hypotheses

The firewall is a protective strategy, which can be integrated into hardware and software, aimed at protecting private networks from external intrusion and maintaining network security. The setting up of a firewall is described in Section 3, Article 14, of the Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies, which states that an enterprise should explicitly distinguish its personnel (Hypotheses 1, 2, and 6), assets (Hypotheses 3, 4, 7 and 8), financial goals (Hypotheses 3 and 8), authority (Hypotheses 8 and 9) and responsibility (Hypotheses 5 and 9) for its affiliated companies [7]. An enterprise should execute its risk assessment thoroughly and build an appropriate firewall. Affiliated companies are typically challenging for Taiwan corporate governance practices and are always a focus of interest for shareholders. Therefore, practical principles prohibit managers from working at both listed companies and their affiliated companies concurrently. A parent company and its affiliated companies should not hire the same managers due to problems with benefit transfer [25,26,27,28].

3. Research Hypotheses

Based on four aspects from the TWSE 2021 corporate governance evaluation indicators [7] and the literature review, we set the definitions used in each part of this research based on current legal regulations, as summarized in Table 1.

Table 1.

Aspects and operational definitions used in this study.

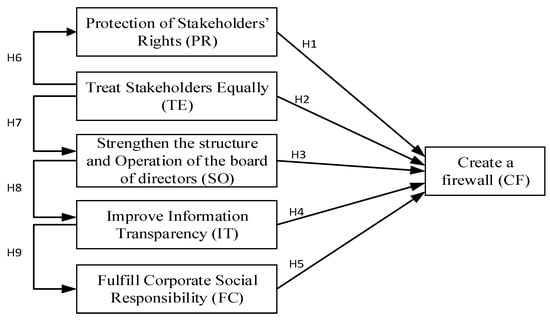

The hypotheses as discussed in the literature review section are shown in Figure 1. There are nine hypotheses in total, and the relationships and descriptions for each hypothesis are described below.

Figure 1.

Structure of research hypotheses.

Hypothesis 1 (H1).

Protecting shareholders’ rights and interests has a positive correlation with the setting up of a firewall.

Hypothesis 2 (H2).

Treating all shareholders equally has a positive correlation with the setting up of a firewall.

Hypothesis 3 (H3).

Strengthening the structure and operation of the board of directors has a positive correlation with the setting up of a firewall.

Hypothesis 4 (H4).

Promoting information transparency has a positive correlation with the setting up of a firewall.

Hypothesis 5 (H5).

Implementing corporate social responsibility has a positive correlation with the setting up of a firewall.

Hypothesis 6 (H6).

Treating shareholders equitably has a positive correlation with protecting shareholders’ equity.

Hypothesis 7 (H7).

Treating shareholders equitably has a positive correlation with the extent of strengthening the structure and operation of the board of directors.

Hypothesis 8 (H8).

Strengthening the structure and operation of the board of directors has a positive correlation with the extent of increasing information transparency.

Hypothesis 9 (H9).

Promoting information transparency has a positive correlation with the extent of implementing corporate social responsibility.

4. Design of Questionnaire

This questionnaire is divided into two parts: the first is the basic information part, and the second is related to the six aspects of sustainable corporate governance. The first part, basic information, is in the form of multiple-choice questions; the contents of parts two to seven are related to the six aspects discussed above. The statistical methodologies used for the analysis of this questionnaire are different. The first part, basic information, was analyzed by a descriptive statistics method. The 5-Point Likert scale method was used from part 2 to 7, where the number 1 represents strongly disagree, 2 represents disagree, 3 represents neutral, 4 represents agree, and 5 represents strongly agree.

The major aspects of this questionnaire include protecting shareholders’ rights and interests and treating shareholders equitably, strengthening the structure and operation of board of directors, increasing information transparency, and implementing corporate social responsibility. Hence, setting up a firewall is chosen as the sixth aspect. In conclusion, the aspects and number of questions asked in this questionnaire are as follows: protecting shareholders’ rights and interests (6 questions), treating shareholders equitably (8 questions), strengthening the structure and operation of the board of directors (8 questions), increasing information transparency (8 questions), implementing corporate social responsibility (8 questions), and setting up a firewall (8 questions)—46 questions in total. The relationships between the variables and their corresponding hypothesis are based on the concept of structural equation modeling (SEM), the 9 hypotheses, and the literature review suggestions discussed in Section 2.3 [7,25,26,27,28]. For example, in Figure 1, Hypothesis 1 suggests that PR has a position with CF, using questions PR1-PR6. All questions were mainly derived from the suggestions of the articles in the Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies [7] and partially from the references [25,26,27,28]. The full names for each question in the sequence are as follows: minute disclosure (PR1), director attendance (PR2), chairperson attendance (PR3), denied motion (PR4), no dividends to board directors (PR5), less than 50% of shares held by board directors (PR6), shareholder meetings as scheduled (TE1), agenda transparency for shareholder meetings (TE2), financial statement transparency for shareholder meetings (TE3), English agendas for shareholder meetings (TE4), English financial statement transparency for shareholder meetings (TE5), execution report for previous shareholder meetings (TE6), information obstacles (TE7), single shareholder weighted over 1/3 (TE8), female directors (SO1), extra directorships (SO2), auditing availability for the board (SO3), governance availability for the board (SO4), risk management availability for the board (SO5), performance availability for the board (SO6), training availability for the board (SO7), property management availability for the board (SO8), timely disclosure of financial statements (IT1), English financial statement availability (IT2), revised edition for financial statements (IT3), financial flaws in financial statements (IT4), industrial trend statements (IT5), disclosure for major shareholders (IT6), financial information disclosure on websites (IT7), investor conferences twice a year (IT8), corporate division for social responsibility (FC1), social responsibility plan setup (FC2), disclosure for social responsibility results (FC3), disclosure for promoting employees’ welfare (FC4), disclosure of waste quantities (FC5), strategy for reducing waste (FC6), disclosure of interest avoidance (FC7), disclosure of illegal and unethical matters (FC8), firewall among all departments and divisions (CF1), avoidance of professional manager concurrence (CF2), regulation of directors’ personal conduct (CF3), secrecy of business knowhow among all internal departments (CF4), avoidance of benefit transfer (CF5), firewall for subsidiary companies (CF6), reporting channel for misconduct (CF7), and protection for reporters (CF8).

5. Pilot Study and Analysis

The pilot questionnaire survey requires 3–5 times the returns compared to the aspect with the highest question quantities [29]; hence, for the pilot survey, we needed 24 out of 40 returned. Altogether, 40 questionnaires were distributed to the top 10 engineering consulting companies in Taiwan. The survey lasted two months, with 31 effective questionnaire responses collected. The first part of the pilot survey included basic information about gender, age, length of service, occupation, job responsibilities, work location, salary (monthly), and educational background. There were eight questions with responses as follows: (1) gender: more male than female interviewees—77% were male, and 23% were female; (2) age: interviewees ranged in age from 30 to 61 years old, with 45% between 51 and 60 years old and the rest between 41 and 50 years old. There were no interviewees under 30 years of age; (3) length of service period: most lengths of service in this study were 16 to 20 years, 21 to 25 years, and 26 to 30 years. Almost all interviewees had over ten years of work experience; (4) occupation: the largest proportion for occupation was engineers, making up one third of the total, and 23% of the interviewees held managerial titles; (5) job responsibilities: job responsibilities of the interviewees were mainly project management and administrative management, comprising 58% of the total; (6) work location: domestic workers dominated with 97% of the total, and no interviewee had both domestic and foreign work experience; (7) salary (monthly): there was no interviewee with a monthly salary of less than New Taiwan Dollar (NTD) 35,000, and most interviewees earned a salary from NTD 50,001 to 75,000, 32% of the total; (8) education: most interviewees had master’s degrees, approximately two thirds of the total, indicating that top engineering consulting companies require skilled employees.

Table 2 shows the reliability results of the pilot survey. All Cronbach’s α values are greater than 0.9, except for the PR aspect. The Kaiser–Meyer–Olkin (KMO) values of most aspects of this study are above 0.5, although the KMO value of protecting shareholders’ rights and interests is only 0.567 shown in Table 3. This may suggest that employees are not familiar with the questions, as shown in Table 2. As a result, all aspects and questions remained for the full survey.

Table 2.

Reliability analysis for the pilot survey.

Table 3.

The KMO values and Bartlett’s sphericity test values for the pilot survey.

6. Survey and Analysis

The same questionnaire was used for the pilot study and the comprehensive survey since there was no questionnaire adjustment suggested from the pilot study. For the full survey, we distributed 330 questionnaires to employees working for the top 10 engineering consulting companies in Taiwan. Altogether, 324 out of 330 questionnaires were deemed effective due to convenience sampling and individual description to respondents. The sample size satisfied the sampling criteria of more than 200, or more than the number of items multiplied by five, thereby meeting the minimum criteria for sample size [29]. The Cronbach’s α values for all aspects remained similar to those in Table 2, ranging from 0.908 to 0.943, except for aspect PR = 0.692. The descriptive statistics are as follows: (1) gender: the male to female ratio for a total of 324 effective questionnaire responses is 2.2, which reflects the realistic proportion in the Taiwan engineering industry; (2) age: the largest two proportions are aged 41 to 50 and 51 to 60 years old, making up 65% of the total as well as the typical age range for management; (3) length of service period: this is similar to that of the pilot study; (4) occupation: the largest proportion of the respondents had engineering or manager titles, comprising approximately half of the total, showing the same tendency as in the pilot survey; (5) job responsibilities: more varied responsibilities were reported here, such as engineering technology including procurement specialist, business associate, administrative specialist, contract administration, IT clerk, and R&D fellow. This study aimed to show the variety of departments in engineering consulting companies. Engineering technology and project management make up 32% and 26%, respectively, matching the typical job descriptions for engineering consulting companies; (6) work location: the majority of respondents reported only domestic work experience; however, 18% of the total have both domestic and overseas work experience; (7) salary (monthly): the largest proportion in terms of monthly salary is 50,000 to 75,000, or 30%. Next is a monthly salary from 35,000 to 50,000, or 26%. The first two categories are collectively more than 50%. Respondents with monthly salaries of more than 100,000 make up only 22%, which represents respondents with high administrative positions; (8) educational background: these responses show the same tendency as in the pilot survey. The KMO values for all aspects are in a range from 0.874 to 0.911, except for the PR aspect with a value of 0.633, as shown in Table 4.

Table 4.

The KMO values and Barlett’s sphericity test results for the survey.

Confirmatory factor analysis (CFA) was used to examine the models of each aspect, then to analyze the questions to determine whether they met the standards, and eventually to modify the models. We employed AMOS as the tool to check the Modification Indices (MIs). Table 5 shows the results before and after modification based on a second-order measurement model.

Table 5.

Second-order measurement model—before and after modification.

7. Discussion

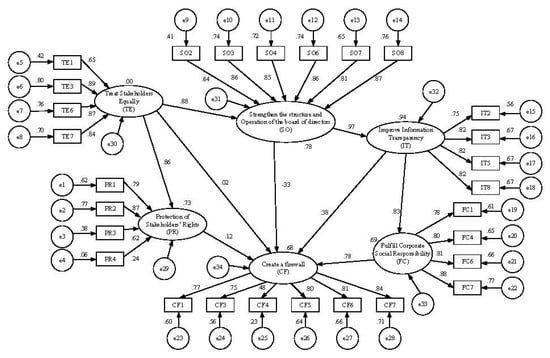

Path analysis using AMOS was carried out to verify whether the hypotheses were valid or not, as shown in Table 6. H1, stating that there is no significant relation between setting up a firewall and shareholder protection, did not stand. This was also sustained for H2, which did not stand. Equitableness to all shareholders is not necessarily equal to firewall set up. H3 was rejected as well, which indicates a similarity in viewpoint from H1 and H2. There is not necessarily a link among the board of directors, firewall, and shareholders in terms of sustainable corporate governance for top engineering consulting companies. The verification of H4, related to the promotion of information transparency associated with setting up a firewall, was not significant. There is not a close relationship between these two in relation to improvement in sustainable corporate governance. The remaining hypotheses, H5 to H9, are all positively related to engineering consulting corporate governance. They state that equitableness to all shareholders is one of the keys for successful corporate governance since it significantly connects shareholders’ interests with the operations of the board of directors. Additionally, information transparency is the other key to mastering sustainable corporate governance for Taiwan’s top engineering consulting companies. Figure 2 illustrates the SFM results. It can be seen that only 28 out of 46 factors influence sustainable corporate governance for engineering consulting firms in Taiwan. Entering these 28 factors for factor analysis, we can obtain the preference ranking shown in Table 7.

Table 6.

Path analysis.

Figure 2.

Results obtained by structural equation modeling (SEM).

Table 7.

Ranking of factors.

Table 7 presents the factor preference ranking for sustainable corporate governance in Taiwan. Based on the averages, the factor with the largest average value is for the three questions in the PR aspect (PR3), indicating that the corporate chairperson’s presence on the director board is the most important issue of concern to survey respondents. This may be different in other countries and regions but, in Taiwan, the chairperson’s presence is vital for sustainable corporate governance. An example can be seen for the largest listed consulting company in Taiwan. The chairperson’s presence influences stock price, at least in the short term, and is related to corporate reputation. The avoidance of benefit transfer by regulations (CF5) is the No. 2 priority for sustainable corporate governance. Benefit transfer between related parties and corporate management is forbidden but is not easy to identify in Taiwan. This is because professional managers for construction projects usually involve numerous different parties, so it is not surprising that CF5 is critical to sustainable corporate governance for engineering consulting firms. The other top five factors are firewalls among all departments and divisions (CF1), director attendance (PR2), and reporting channels for misconduct (CF7), representing the setting up of firewalls among internal departments, the presence of half or greater than half the directors on the director board, and the establishment of internal reporting protection, respectively. According to factor extraction, a part of principle component analysis, the most significant factor is, however, denied motion (PR4). PR4 indicates more details in operating the board of directors regarding meeting agendas. This is more specific in sustainable corporate governance. Director attendance (PR2) is still the most significant factor in ranking No. 2. Smooth and robust governance is more reliant on the directors’ involvement. The other top five factors, including information obstacles (TE7), English financial statement availability (IT2), and financial statement transparency for shareholder meetings (TE3), exemplify the banning of insider dealing, transparency of information for financial statements, and timely disclosure of financial statements.

In short, there are four significant aspects, namely, shareholders’ equity, information disclosure, firewalls, and reporting mechanisms, with 28 critical factors involved in these four aspects. This study successfully identified four aspects involving 28 factors significantly impacting sustainable corporate governance for top engineering consulting companies in Taiwan.

8. Conclusions

Starting with the identification of practical problems that occur in practice, this study aimed to determine the impact factors for sustainable corporate governance for the top consulting engineering companies in Taiwan. Although it took months to administer and analyze the survey results using SEM targeting the top engineering consulting companies in Taiwan, the results are promising. We found that there are four aspects involving 28 factors which significantly impact sustainable corporate governance. The contributions lie in (1) weighted factors that provide practitioners with guidelines about how to implement corporate governance in the proper order, and (2) clarifying the degree of influence and relationships among all aspects and factors for sustainable corporate governance. Meanwhile, suggestions arose from experiences during the study period. Collecting responses from top management personnel is difficult, even though they are executives. An improvement would be to include more respondents from top management. The pilot study suggests that a comprehensive explanation and assistance be given to interviewees or subjects in order to increase the number of effective returns. Although the full-scale survey was carried out as suggested with a high effective return rate of 98%, it is important to select the appropriate personnel for questionnaire assistance.

The major management implications based on the findings are as follows: (1) the corporate chairperson’s presence for the director board is the most important issue of concern to the survey respondents; (2) benefit transfer between related parties and corporate management is forbidden but is not easy to identify in Taiwan; (3) setting up firewalls among all departments and divisions, director attendance, and reporting channels for misconduct are important; (4) more specific details in terms of the operations of the director board regarding meeting agendas are important in sustainable corporate governance; (5) forbidding insider dealing, information transparency in financial statements, and the timely disclosure of financial statements are recommended. Future studies may adopt computational intelligence to conduct prediction modelling and pattern analysis to explore more feasible practices for sustainable corporate governance in the engineering consulting business.

Author Contributions

Conceptualization, J.-H.C.; Methodology, J.-H.C. and T.-S.C.; Validation, T.-S.C. and T.-H.Y.; Resources, T.-S.C. and T.-H.Y.; Writing—original draft preparation, T.-S.C., J.-P.W., H.-H.W. and T.-H.Y.; writing—review and editing, J.-H.C., J.-P.W. and H.-H.W. All authors have read and agreed to the published version of the manuscript.

Funding

This paper was partly supported by the Ministry of Science and Technology (MOST), Taiwan, for promoting academic excellent of universities under grant numbers MOST 109-2622-E-008-018-CC2 and MOST 108-2221-E-008-002-MY3.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author. The data are not publicly available due to the sponsored investigation.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chen, J.-H.; Nguyen, T.T.H.; Tai, H.-W.; Chang, C.-A. The willingness to adopt the Internet of Things (IoT) conception in Taiwan’s construction industry. J. Civ. Eng. Manag. 2020, 26, 534–550. [Google Scholar] [CrossRef]

- Yeh, H.-H.; Hsieh, T.-Y.; Chen, J.-H. Managing complex engineering interfaces of urban mass rapid transit projects. J. Constr. Eng. Manag. 2017, 143, 05017001. [Google Scholar] [CrossRef]

- Chen, J.-H.; Hsu, S.-C.; Wang, R.; Chou, H.-A. Improving hedging decision for financial risks of construction material suppliers using grey system theory. J. Manag. Eng. 2017, 33, 04017016. [Google Scholar] [CrossRef]

- Hernandez-Perdomo, E.; Guney, Y.; Rocco, C.M. A reliability model for assessing corporate governance using machine learning techniques. Reliab. Eng. Syst. Saf. 2019, 185, 220–231. [Google Scholar] [CrossRef]

- Ghosh, S.; Amaya, L.; Skibniewski, M.J. Identifying areas of knowledge governance for successful projects. J. Civ. Eng. Manag. 2012, 18, 495–504. [Google Scholar] [CrossRef]

- Wang, R.; Lee, C.-J.; Hsu, S.-C.; Zheng, S.; Chen, J.-H. Effects of career horizon and corporate governance in China’s construction industry: A multilevel study of top management fraud. J. Manag. Eng. 2020, 36, 04020057. [Google Scholar] [CrossRef]

- TWSE. Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies; Taiwan Stock Exchange Corporation: Taipei, Taiwan, 2021. [Google Scholar]

- Zhang, Y.; Tong, L.; Li, J. Minding the gap: Asymmetric effects of pay dispersion on stakeholder engagement in corporate environmental irresponsibility. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2354–2367. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; De Massis, A.; Miller, D.; Barontini, R. Family business growth around the world. Entrep. Theory Pract. 2020, 45, 682–708. [Google Scholar] [CrossRef] [Green Version]

- Mahr, T.G.; Nowak, E.; Rott, R. The irrelevance of Disclosure of Compliance with Corporate Governance Codes: Empirical Evidence from the German Stock Market. J. Inst. Theor. Econ. Z. Gesamte Staatswiss. 2016, 172, 475–520. [Google Scholar] [CrossRef]

- Sorensen, K.E. The legal position of parent companies: A top-down focus on group governance. Eur. Bus. Organ. Law Rev. 2021, 1–42. [Google Scholar] [CrossRef]

- Unda, L.A.; Ranasinghe, D. To pay or not pay: Board remuneration and insolvency risk in credit unions. Pac. Basin Financ. J. 2021, 66, 101128. [Google Scholar] [CrossRef]

- Ongsakul, V.; Jaroenjitrkam, A.; Treepongkaruna, S.; Jiraporn, P. Does board gender diversity reduce ‘CEO luck’? Account. Financ. 2021. [Google Scholar] [CrossRef]

- Tang, X.X.; Shi, J.; Han, J.L.; Shu, A.; Xiao, F.L. Culturally diverse board and corporate innovation. Account. Financ. 2021. [Google Scholar] [CrossRef]

- Ongsakul, V.; Treepongkaruna, S.; Jiraporn, P.; Uyar, A. Do firms adjust corporate governance in response to economic policy uncertainty? Evidence from board size. Financ. Res. Lett. 2021, 39, 101613. [Google Scholar] [CrossRef]

- Cumming, D.; Leung, T.Y. Board diversity and corporate innovation: Regional demographics and industry context. Corp. Gov. Int. Rev. 2021, 29, 277–296. [Google Scholar] [CrossRef]

- Menshawy, I.M.; Basiruddin, R.; Mohd-Zamil, N.A.; Hussainey, K. Strive towards investment efficiency among Egyptian companies: Do board characteristics and information asymmetry matter? Int. J. Financ. Econ. 2021. [Google Scholar] [CrossRef]

- Klarner, P.; Yoshikawa, T.; Hitt, M.A. A capability-based view of boards: A new conceptual framework for board governance. Acad. Manag. Perspect. 2021, 35, 123–141. [Google Scholar] [CrossRef]

- Smith, N.M.; Zhu, Q.; Smith, J.M.; Mitcham, C. Enhancing engineering ethics: Role ethics and corporate social responsibility. Sci. Eng. Ethics 2021, 27, 28. [Google Scholar] [CrossRef] [PubMed]

- Smith, N.M.; Smith, J.M.; Battalora, L.A.; Teschner, B.A. Industry-university partnerships: Engineering education and corporate social responsibility. J. Prof. Issues Eng. Educ. Pract. 2018, 144, 04018002. [Google Scholar] [CrossRef]

- Zhong, X.; Ren, L.; Song, T. Beyond market strategies: How multiple decision-maker groups jointly influence underperforming firms’ corporate social irresponsibility. J. Bus. Ethics 2021, 1–19. [Google Scholar] [CrossRef]

- Uyar, A.; Kuzey, C.; Kilic, M.; Karaman, A.S. Stakeholder engagement in construction: Exploring corporate social responsibility, ethical behaviors, and practices. J. Constr. Eng. Manag. 2021, 146, 04020003. [Google Scholar]

- Cheffi, W.; Malesios, C.; Abdel-Maksoud, A.; Abdennadher, S.; Dey, P. Corporate social responsibility antecedents and practices as a path to enhance organizational performance: The case of small and medium sized enterprises in an emerging economy country. Corp. Soc. Responsib. Environ. Manag. 2021. [Google Scholar] [CrossRef]

- Karwowski, M.; Raulinajtys-Grzybek, M. The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corp. Soc. Responsib. Environ. Manag. 2021. [Google Scholar] [CrossRef]

- Zakaria, M.; Aoun, C.; Liginlal, D. Objective sustainability assessment in the digital economy: An information entropy measure of transparency in corporate sustainability reporting. Sustainability 2021, 13, 1054. [Google Scholar] [CrossRef]

- Samuels, D. Government procurement and changes in firm transparency. Account. Rev. 2021, 96, 401–430. [Google Scholar] [CrossRef]

- Bandoi, A.; Bocean, C.G.; Del Baldo, M.; Mandache, L.; Manescu, L.G.; Sitnikov, C.S. Including sustainable reporting practices in corporate management reports: Assessing the impact of transparency on economic performance. Sustainability 2021, 13, 940. [Google Scholar] [CrossRef]

- Martins, A.; Gomes, D.; Branco, M.C. Managing Corporate Social and Environmental Disclosure: An Accountability vs. Impression Management Framework. Sustainability 2021, 13, 296. [Google Scholar] [CrossRef]

- Chen, J.-H.; Hsu, S.C. Quantifying impact factors of corporate financing: Engineering consulting firms. J. Manag. Eng. 2008, 24, 96–104. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).