Examining the Relationship between the Economic Performance of Technology-Based Small Suppliers and Socially Sustainable Procurement

Abstract

:1. Introduction

2. Study Context

3. Literature Review

3.1. Small Business in Public Procurement

3.2. Sustainable Procurement and Data Envelopment Analysis Applications

4. Methodology

4.1. Data

4.2. Variables and Proxies

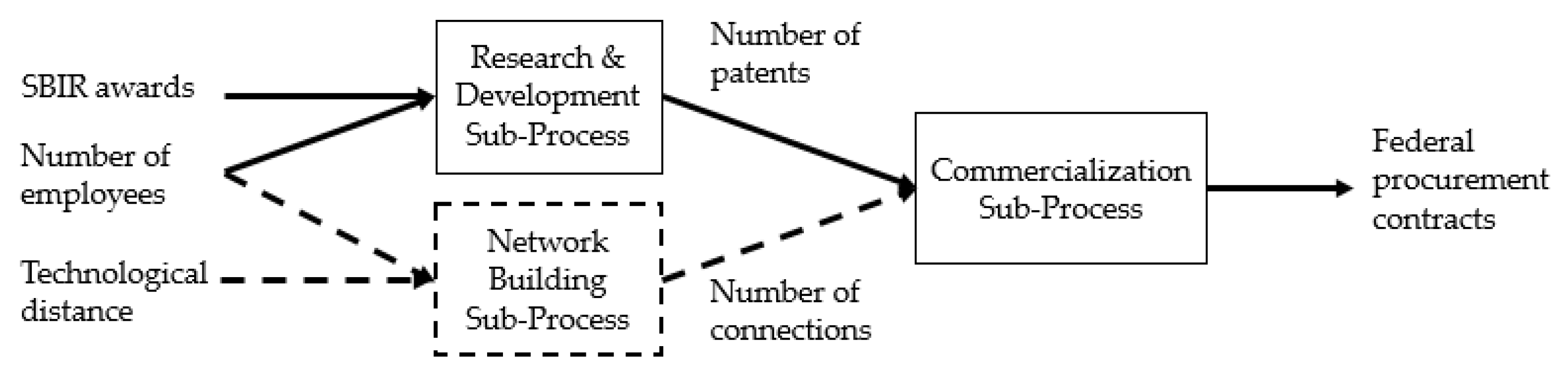

4.3. Two-Stage Analytic Framework

5. Results

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Network Data Envelopment Analysis

- : an observed i th input of the j th DMU (i = 1, … , m and j = 1, … , n),

- : an observed r th output of the j th DMU (r = 1, … , s and j = 1, … , n),

- : an unknown slack variable of the i th input,

- : an unknown slack variable of the r th output,

- : an unknown column vector of intensity (or structural) variables,

- : a prescribed very small number,

- ξ: inefficiency score, and

- R: data range.

Appendix B. Bootstrap Truncated Regression Analysis

- (1)

- Execute a truncated regression using only h DMUs whose (with h < n) to estimate coefficients () and variance parameter ();

- (2)

- Repeat the following steps 2000 times to compute bootstrap estimates and :

- (2a) Generate an artificial error from the normal distribution, N(0, ), with truncation at for h DMUs;

- (2b) Calculate artificial efficiency scores based on for h DMUs;

- (2c) Carry out a truncated regression truncated at 1 of on to estimate and .

- (3)

- Compute confidence intervals and standard errors for and drawing on the bootstrap distribution of and .

Appendix C. Results of Network Data Envelopment Analysis

| Small Business | Efficiency Score | |||

|---|---|---|---|---|

| R&D | Network Building | Commercialization | Overall | |

| 1st Detect Corp. | 0.190 | 0.473 | 1.000 | 0.554 |

| Aculight Corp. | 0.006 | 0.622 | 0.517 | 0.382 |

| Ada Technologies, Inc. | 0.025 | 0.745 | 0.469 | 0.413 |

| Adaptive Materials, Inc. | 0.067 | 0.106 | 0.625 | 0.266 |

| Adesto Technologies | 0.188 | 0.215 | 0.620 | 0.341 |

| Advanced Ceramics Research, Inc. | 0.021 | 0.244 | 0.417 | 0.227 |

| ADVANCED CIRCULATORY SYSTEMS, INC. | 0.096 | 0.254 | 0.600 | 0.317 |

| Advanced Energy Systems, Inc. | 0.043 | 0.124 | 0.833 | 0.333 |

| Advanced Fuel Research, Inc. | 0.031 | 1.000 | 0.600 | 0.544 |

| Advanced Mechanical Technology, Inc. | 0.062 | 0.207 | 0.600 | 0.290 |

| Advanced Scientific Concepts, Inc. | 0.027 | 0.435 | 0.938 | 0.467 |

| AEC-ABLE ENGINEERING CO., INC. | 0.191 | 0.074 | 0.682 | 0.315 |

| Aeroastro, Inc. | 0.014 | 0.016 | 1.000 | 0.344 |

| AeroVironment, Inc. | 0.018 | 0.057 | 0.304 | 0.126 |

| AESOP, INC. | 0.095 | 0.445 | 0.469 | 0.336 |

| AGILE SYSTEMS, INC. | 0.082 | 0.351 | 0.386 | 0.273 |

| Alphatech, Inc. | 0.004 | 0.055 | 0.714 | 0.258 |

| American Gnc Corp. | 0.014 | 0.255 | 0.283 | 0.184 |

| American Superconductor Corp. | 0.307 | 0.040 | 0.080 | 0.143 |

| Anvik Corp. | 0.063 | 0.405 | 0.263 | 0.244 |

| AOPTIX TECHNOLOGIES, INC. | 0.104 | 0.210 | 0.652 | 0.322 |

| APPLIED MINDS | 0.058 | 0.059 | 0.399 | 0.172 |

| APPLIED NANOTECH, INC. | 0.053 | 0.316 | 0.405 | 0.258 |

| APPLIED OPTOELECTRONICS, INC. | 0.081 | 0.290 | 0.217 | 0.196 |

| APPLIED THIN FILMS, INC. | 0.024 | 0.452 | 0.938 | 0.471 |

| Architecture Technology Corp. | 0.009 | 0.239 | 0.625 | 0.291 |

| ARES, Inc. | 0.232 | 0.082 | 0.511 | 0.275 |

| Arete Associates | 0.005 | 0.106 | 0.654 | 0.255 |

| ARTANN LABORATORIES, INC. | 0.210 | 0.228 | 0.500 | 0.313 |

| ASCENSION TECHNOLOGY CORP. | 0.086 | 0.129 | 0.536 | 0.250 |

| ASCENT SOLAR TECHNOLOGIES | 0.187 | 0.267 | 0.386 | 0.280 |

| ASPEN AEROGELS, INC. | 0.014 | 0.291 | 0.288 | 0.198 |

| AST PRODUCTS, INC. | 0.088 | 0.156 | 1.000 | 0.414 |

| ATAIR AEROSPACE | 0.192 | 0.181 | 0.714 | 0.362 |

| Aurora Flight Sciences Corp. | 0.019 | 0.044 | 0.517 | 0.194 |

| Austin Info Systems, Inc. | 0.266 | 0.040 | 0.117 | 0.141 |

| Aveka, Inc. | 0.216 | 0.283 | 0.882 | 0.460 |

| Aware, Inc. | 0.155 | 0.074 | 0.095 | 0.108 |

| Banpil Photonics, Inc. | 0.086 | 0.378 | 0.833 | 0.432 |

| BEACON POWER CORP. | 0.187 | 0.158 | 0.938 | 0.427 |

| BENEDICT ENGINEERING CO., INC. | 0.233 | 0.678 | 0.882 | 0.598 |

| Benthos, Inc. | 0.058 | 0.039 | 0.600 | 0.232 |

| BIOARRAY SOLUTIONS | 0.192 | 0.153 | 0.292 | 0.212 |

| BIOCRYSTAL, LTD. | 0.192 | 0.057 | 0.495 | 0.248 |

| Biosearch Technologies, Inc. | 0.116 | 0.052 | 0.833 | 0.334 |

| Calspan Corporation | 0.194 | 0.033 | 0.345 | 0.191 |

| Cambridge Scientific, Inc. | 0.189 | 0.290 | 0.938 | 0.472 |

| Cape Cod Research, Inc. | 0.035 | 1.000 | 1.000 | 0.678 |

| Cascade Designs | 0.108 | 0.014 | 0.605 | 0.242 |

| Ceradyne, Inc. | 0.096 | 0.014 | 1.000 | 0.370 |

| Ceramatec, Inc. | 0.043 | 0.135 | 0.133 | 0.104 |

| CFD Research Corp. | 0.003 | 1.000 | 0.682 | 0.562 |

| CHEMIMAGE CORP. | 0.102 | 0.095 | 1.000 | 0.399 |

| CIPHERGEN BIOSYSTEMS, INC. | 0.192 | 0.020 | 0.221 | 0.144 |

| Cleveland Medical Devices, Inc. | 0.049 | 0.081 | 0.833 | 0.321 |

| Coherent Logix, Inc. | 0.011 | 0.142 | 0.500 | 0.218 |

| Coherent Technologies, Inc. | 0.007 | 0.149 | 0.750 | 0.302 |

| CONCEPTS ETI, INC. | 0.093 | 0.057 | 0.882 | 0.344 |

| Conductus, Inc. | 0.373 | 0.284 | 0.385 | 0.347 |

| Cornerstone Research Group, Inc. | 0.007 | 0.109 | 0.789 | 0.302 |

| Creare, Inc. | 0.002 | 1.000 | 0.556 | 0.519 |

| Cybernet Systems Corp. | 0.009 | 0.529 | 0.326 | 0.288 |

| Daylight Solutions | 0.208 | 0.122 | 0.682 | 0.337 |

| DEFT, INC. | 0.478 | 0.056 | 0.216 | 0.250 |

| Digital Optics Corp. | 0.187 | 0.082 | 0.165 | 0.145 |

| Displaytech, Inc. | 0.093 | 0.171 | 0.227 | 0.164 |

| Diversified Technologies, Inc. | 0.028 | 0.080 | 0.789 | 0.299 |

| Dynamet Technology, Inc. | 0.053 | 0.279 | 1.000 | 0.444 |

| Eic Laboratories, Inc. | 0.013 | 0.561 | 0.500 | 0.358 |

| Eltron Research, Inc. | 0.032 | 0.432 | 0.395 | 0.286 |

| EMAG Technologies, Inc. | 0.013 | 0.294 | 1.000 | 0.436 |

| Emcore Corp. | 0.546 | 0.096 | 0.110 | 0.251 |

| EnerG2 | 0.192 | 0.351 | 0.938 | 0.493 |

| Energy Focus, Inc. | 0.093 | 0.071 | 0.938 | 0.367 |

| Engineering Technology, Inc. | 0.192 | 0.094 | 1.000 | 0.429 |

| Envirogen, Inc. | 0.205 | 0.235 | 0.750 | 0.397 |

| Essex Corp. | 0.057 | 0.396 | 0.938 | 0.463 |

| EXCELLATRON SOLID STATE, LLC | 0.062 | 0.890 | 0.750 | 0.567 |

| Fiber Materials, Inc. | 0.015 | 0.237 | 0.500 | 0.251 |

| FIBERSTARS, INC. | 0.093 | 0.054 | 0.326 | 0.158 |

| FIRESTAR ENGINEERING, LLC | 0.124 | 0.543 | 0.789 | 0.486 |

| Florida Turbine Technologies, Inc. | 0.029 | 0.031 | 0.227 | 0.096 |

| Foster-Miller Inc. | 0.031 | 0.349 | 0.199 | 0.193 |

| Front Edge Technology, Inc. | 0.057 | 0.204 | 0.882 | 0.381 |

| FUELCELL ENERGY, INC. | 0.215 | 0.018 | 0.332 | 0.188 |

| GENOMATICA, INC. | 0.334 | 0.153 | 0.250 | 0.246 |

| GENOPTIX, INC. | 0.372 | 0.133 | 0.628 | 0.378 |

| Giner, Inc. | 0.031 | 0.983 | 1.000 | 0.672 |

| Guild Associates, Inc. | 0.125 | 0.138 | 0.661 | 0.308 |

| HANSEN ENGINE CORP. | 0.193 | 0.409 | 0.386 | 0.329 |

| HITTITE MICROWAVE CORP. | 0.008 | 0.128 | 0.441 | 0.192 |

| HI-Z TECHNOLOGY, INC. | 0.033 | 0.977 | 0.652 | 0.554 |

| Hypres, Inc. | 0.008 | 0.292 | 0.273 | 0.191 |

| IAP Research, Inc. | 0.050 | 0.274 | 0.652 | 0.325 |

| Idaho Technology, Inc. | 0.187 | 0.068 | 0.958 | 0.405 |

| Imaging Systems Technology | 0.188 | 0.183 | 0.833 | 0.401 |

| Implant Sciences Corp. | 0.096 | 0.124 | 0.455 | 0.225 |

| Indigo Systems Corp. | 0.160 | 0.075 | 0.833 | 0.356 |

| INFINERA CORP. | 0.157 | 0.021 | 0.096 | 0.091 |

| INFINIA CORP. | 0.026 | 0.044 | 0.500 | 0.190 |

| Information Systems Laboratories, Inc. | 0.011 | 0.103 | 0.789 | 0.301 |

| INFRAMAT CORP. | 0.067 | 0.314 | 0.789 | 0.390 |

| INNOVATIVE MICRO TECHNOLOGY | 0.187 | 0.086 | 0.441 | 0.238 |

| INSIGHT TECHNOLOGY, INC. | 0.192 | 0.026 | 0.872 | 0.363 |

| INTEGRAN TECHNOLOGIES USA, INC. | 0.200 | 1.000 | 0.441 | 0.547 |

| INTEGRATED MAGNETOELECTRONICS | 0.169 | 0.348 | 0.938 | 0.485 |

| INTERNATIONAL ELECTRONIC MACHINES | 0.038 | 0.233 | 0.441 | 0.237 |

| Interscience, Inc. | 0.079 | 0.692 | 0.750 | 0.507 |

| INTEVAC, INC. | 0.104 | 0.016 | 0.183 | 0.101 |

| INTRA-CELLULAR THERAPIES, INC. | 0.192 | 0.242 | 0.600 | 0.345 |

| IPITEK | 0.023 | 0.699 | 0.682 | 0.468 |

| IROBOT CORP. | 0.056 | 0.014 | 0.193 | 0.088 |

| IRVINE SENSORS CORP. | 0.059 | 0.255 | 0.128 | 0.147 |

| ISIS PHARMACEUTICALS | 1.000 | 0.023 | 0.116 | 0.380 |

| JAYCOR | 0.189 | 0.245 | 0.917 | 0.450 |

| JENTEK Sensors, Inc. | 0.013 | 0.270 | 0.268 | 0.184 |

| JOHNSON RESEARCH & DEVELOPMENT CO., INC. | 0.093 | 0.463 | 0.246 | 0.267 |

| JX CRYSTALS, INC. | 0.373 | 1.000 | 0.577 | 0.650 |

| KAZAK COMPOSITES, INC. | 0.008 | 0.189 | 0.833 | 0.343 |

| KENT DISPLAYS, INC. | 0.192 | 0.122 | 0.375 | 0.230 |

| KESTREL CORP. | 0.042 | 0.496 | 0.938 | 0.492 |

| KIGRE, INC. | 0.121 | 0.099 | 0.882 | 0.367 |

| KONARKA TECHNOLOGIES, INC. | 0.187 | 0.117 | 0.348 | 0.217 |

| Kopin Corp. | 0.272 | 0.058 | 0.071 | 0.134 |

| KULITE SEMICONDUCTOR PRODUCTS, INC. | 0.158 | 0.013 | 0.071 | 0.081 |

| KVH INDUSTRIES, INC. | 0.096 | 0.022 | 0.375 | 0.164 |

| LAKE SHORE CRYOTRONICS, INC. | 0.192 | 0.439 | 0.500 | 0.377 |

| LIGHTPATH TECHNOLOGIES | 0.187 | 0.038 | 0.605 | 0.277 |

| LIGHTSMYTH TECHNOLOGIES | 0.115 | 1.000 | 0.417 | 0.510 |

| Lightwave Electronics Corp. | 0.187 | 0.530 | 0.288 | 0.335 |

| LITHIUM POWER TECHNOLOGIES, INC. | 0.062 | 0.282 | 0.938 | 0.427 |

| LSP TECHNOLOGIES, INC. | 0.023 | 0.127 | 0.263 | 0.138 |

| LUMIDIGM, INC. | 0.084 | 0.145 | 0.469 | 0.233 |

| Luminex Corporation | 0.192 | 0.017 | 0.172 | 0.127 |

| Luna Innovations, Inc. (F&S) | 0.002 | 1.000 | 0.230 | 0.411 |

| Lynntech, Inc. | 0.033 | 0.691 | 0.130 | 0.285 |

| MagiQ Technologies, Inc. | 0.039 | 0.258 | 0.366 | 0.221 |

| MAINSTREAM ENGINEERING CORP. | 0.007 | 0.540 | 0.221 | 0.256 |

| MARLOW INDUSTRIES, INC. | 0.192 | 0.035 | 0.385 | 0.204 |

| MASSIVELY PARALLEL TECHNOLOGIES, INC. | 0.187 | 0.230 | 0.505 | 0.307 |

| Materials & Electrochemical Research | 0.006 | 1.000 | 0.882 | 0.629 |

| MATERIALS MODIFICATION, INC. | 0.021 | 0.531 | 0.833 | 0.462 |

| MAXDEM, INC. | 0.140 | 0.313 | 0.429 | 0.294 |

| MESOSCOPIC DEVICES, LLC | 0.041 | 0.237 | 0.625 | 0.301 |

| MESOSYSTEMS TECHNOLOGY, INC. | 0.039 | 0.111 | 0.577 | 0.242 |

| METAL STORM, INC. | 0.142 | 0.412 | 0.442 | 0.332 |

| MICROCHIP BIOTECHNOLOGIES | 0.192 | 0.438 | 0.750 | 0.460 |

| MICROCOATING TECHNOLOGIES, INC. | 0.019 | 0.390 | 0.469 | 0.293 |

| MICROFAB TECHNOLOGIES, INC. | 0.124 | 0.182 | 0.375 | 0.227 |

| MICROLINK DEVICES | 0.062 | 1.000 | 1.000 | 0.687 |

| MicroStrain, Inc. | 0.049 | 0.105 | 0.652 | 0.269 |

| Microvision, Inc. | 0.120 | 0.037 | 0.095 | 0.084 |

| MIDE TECHNOLOGY CORP. | 0.011 | 0.350 | 0.750 | 0.370 |

| MIKRO SYSTEMS, INC. | 0.187 | 0.224 | 1.000 | 0.470 |

| MILLENNIUM CELL | 0.192 | 0.168 | 0.652 | 0.337 |

| MISSION RESEARCH CORP. | 0.008 | 0.927 | 0.925 | 0.620 |

| MSP CORP. | 0.241 | 0.276 | 0.300 | 0.272 |

| Nano Terra, Inc. | 0.046 | 0.225 | 0.600 | 0.290 |

| Nanocomp Technologies Inc. | 0.027 | 0.177 | 0.652 | 0.285 |

| NANODYNAMICS, INC. | 0.079 | 0.042 | 0.417 | 0.179 |

| NANOSOLAR | 0.187 | 0.374 | 0.237 | 0.266 |

| NANTERO, INC. | 0.199 | 0.154 | 0.164 | 0.172 |

| NITRONEX CORP. | 0.056 | 0.115 | 0.652 | 0.274 |

| nLight Photonics | 0.025 | 0.046 | 0.238 | 0.103 |

| NOMADICS, INC. | 0.023 | 0.260 | 0.577 | 0.287 |

| Nonvolatile Electronics, Inc. | 0.010 | 0.190 | 0.273 | 0.158 |

| NP PHOTONICS, INC. | 0.035 | 0.497 | 0.429 | 0.320 |

| ObjectVideo, Inc. | 0.028 | 0.084 | 0.289 | 0.134 |

| Ocean Power Technologies, Inc. | 0.233 | 0.287 | 0.417 | 0.313 |

| OEWAVES, INC. | 0.114 | 0.353 | 0.600 | 0.356 |

| Omnitek Partners, LLC | 0.016 | 0.306 | 0.164 | 0.162 |

| OPEL | 0.043 | 0.491 | 1.000 | 0.511 |

| OPNET TECHNOLOGIES | 0.067 | 0.037 | 0.682 | 0.262 |

| OPTELECOM, INC. | 0.176 | 0.081 | 0.682 | 0.313 |

| OPTICAL RESEARCH ASSOC. | 0.187 | 0.093 | 0.625 | 0.302 |

| Opticomp Corp. | 0.020 | 0.107 | 0.938 | 0.355 |

| OPTOMEC DESIGN CO. | 0.039 | 0.194 | 0.714 | 0.316 |

| Orbital Research, Inc. | 0.011 | 0.293 | 0.682 | 0.329 |

| Pacific Wave Industries, Inc. | 0.063 | 0.265 | 0.938 | 0.422 |

| PEREGRINE SEMICONDUCTOR CORP. | 0.047 | 0.049 | 0.150 | 0.082 |

| PHOTOBIT CORP. (PHOTOBIT, LLC) | 0.196 | 0.377 | 0.500 | 0.358 |

| Photodigm, Inc. | 0.057 | 0.402 | 0.577 | 0.345 |

| Photon-X, Inc (AL) | 0.030 | 0.433 | 0.600 | 0.355 |

| PHYSICAL OPTICS CORP. | 0.011 | 0.761 | 0.152 | 0.308 |

| PHYSICAL SCIENCES, INC. | 0.002 | 0.726 | 0.260 | 0.329 |

| PIASECKI AIRCRAFT CORP. | 0.093 | 0.082 | 0.652 | 0.276 |

| POLARONYX, INC. | 0.062 | 0.522 | 0.882 | 0.489 |

| Precision Combustion, Inc. | 0.028 | 0.219 | 0.349 | 0.198 |

| Princeton Electronic Systems | 0.060 | 0.298 | 0.938 | 0.432 |

| Princeton Lightwave, Inc. | 0.047 | 0.330 | 0.682 | 0.353 |

| PROTONEX TECHNOLOGY CORP. | 0.098 | 0.141 | 0.682 | 0.307 |

| QD VISION, INC. | 0.179 | 0.324 | 0.316 | 0.273 |

| QorTek, Inc. | 0.022 | 0.389 | 0.600 | 0.337 |

| QRDC, INC. | 0.063 | 0.148 | 0.882 | 0.364 |

| QUALLION LLC | 0.038 | 0.055 | 0.221 | 0.105 |

| Quantum Magnetics, Inc. | 0.085 | 0.898 | 0.500 | 0.494 |

| Radiation Monitoring Devices, Inc. | 0.012 | 0.343 | 0.366 | 0.240 |

| RAPID PATHOGEN SCREENING, INC. | 0.295 | 0.252 | 0.988 | 0.512 |

| RAYDIANCE, INC. | 0.233 | 0.104 | 0.833 | 0.390 |

| RD INSTRUMENTS | 0.467 | 0.038 | 1.000 | 0.501 |

| RECHARGEABLE BATTERY CORP. | 0.192 | 0.375 | 0.833 | 0.467 |

| REVEO, INC. | 0.180 | 0.158 | 0.095 | 0.144 |

| Rf Monolithics, Inc. | 0.130 | 0.175 | 0.517 | 0.274 |

| Rocky Research | 0.064 | 0.164 | 0.197 | 0.142 |

| Ross-Hime Designs, Inc. | 0.116 | 1.000 | 0.938 | 0.685 |

| Satcon Technology Corp. | 0.031 | 0.029 | 0.388 | 0.149 |

| Science & Engineering Services, Inc. | 0.042 | 0.069 | 0.963 | 0.358 |

| Science Research Laboratory | 0.008 | 1.000 | 0.556 | 0.521 |

| SECURE COMPUTING CORP. | 0.373 | 0.205 | 0.300 | 0.293 |

| SemiSouth Laboratories | 0.047 | 1.000 | 1.000 | 0.682 |

| SENSIS CORP. | 0.106 | 0.037 | 0.696 | 0.280 |

| Sensor Electronic Technology, Inc. | 0.138 | 1.000 | 0.155 | 0.431 |

| SENSORS UNLIMITED, INC. | 0.073 | 0.210 | 0.600 | 0.294 |

| SEQUAL TECHNOLOGIES, INC. | 0.187 | 0.044 | 0.545 | 0.259 |

| Skion Corp. | 0.187 | 0.182 | 0.625 | 0.331 |

| SOUTHWEST SCIENCES, INC. | 0.063 | 0.940 | 0.469 | 0.490 |

| Spectra Group Limited, Inc. | 0.200 | 0.331 | 0.750 | 0.427 |

| Spectral Sciences, Inc. | 0.005 | 1.000 | 0.652 | 0.552 |

| SPIRE CORP. | 0.043 | 0.346 | 0.184 | 0.191 |

| STEIN SEAL CO. | 0.187 | 0.034 | 0.833 | 0.351 |

| STURMAN INDUSTRIES, INC. | 0.096 | 0.078 | 0.442 | 0.205 |

| T NETWORKS, INC. | 0.350 | 0.099 | 0.604 | 0.351 |

| TALLEY DEFENSE SYSTEMS | 0.104 | 0.030 | 0.845 | 0.326 |

| TDA RESEARCH, INC. | 0.007 | 0.860 | 0.366 | 0.411 |

| Technical Research Associates, Inc. | 0.062 | 1.000 | 0.938 | 0.667 |

| TECHNOLOGIES & DEVICES INTERNATIONAL | 0.038 | 0.213 | 0.600 | 0.284 |

| TESSERA, INC. | 0.977 | 0.057 | 0.071 | 0.368 |

| Thermacore, Inc. | 0.187 | 0.070 | 0.326 | 0.194 |

| Therox, Inc. | 0.333 | 0.090 | 0.304 | 0.242 |

| THESEUS LOGIC, INC. | 0.187 | 0.422 | 0.938 | 0.515 |

| TIAX LLC | 0.009 | 0.735 | 0.441 | 0.395 |

| TIME DOMAIN CORP. | 0.146 | 0.090 | 0.109 | 0.115 |

| TINI ALLOY CO. | 0.187 | 0.413 | 0.577 | 0.392 |

| TOPIA TECHNOLOGY, INC. | 0.187 | 0.162 | 0.938 | 0.429 |

| TOUCHSTONE RESEARCH LABORATORY, LTD. | 0.012 | 0.188 | 0.319 | 0.173 |

| TPL, Inc. | 0.017 | 0.737 | 0.882 | 0.545 |

| TRANSTECH PHARMA, INC. | 0.196 | 0.068 | 0.360 | 0.208 |

| TRANSTECH SYSTEMS, INC. | 0.192 | 0.140 | 0.882 | 0.405 |

| Trex Enterprises Corp. | 0.011 | 0.092 | 0.253 | 0.119 |

| TRITON SYSTEMS, INC. | 0.002 | 0.970 | 0.882 | 0.618 |

| UES, Inc. | 0.010 | 0.507 | 1.000 | 0.506 |

| ULTRAMET | 0.012 | 0.294 | 0.625 | 0.310 |

| ULTRA-SCAN CORP. | 0.041 | 0.186 | 0.578 | 0.268 |

| UNI-PIXEL DISPLAYS, INC. | 0.204 | 0.282 | 0.430 | 0.305 |

| UNIVERSAL DISPLAY CORP. | 0.514 | 0.069 | 0.062 | 0.215 |

| VISIDYNE, INC. | 0.046 | 0.332 | 0.652 | 0.343 |

| WARWICK MILLS | 0.311 | 0.044 | 0.441 | 0.265 |

| WAVEFRONT RESEARCH, INC. | 0.033 | 1.000 | 0.882 | 0.638 |

| X-RAY OPTICAL SYSTEMS, INC. | 0.187 | 0.203 | 0.385 | 0.258 |

| Zebra Imaging, Inc. | 0.187 | 0.081 | 0.258 | 0.175 |

| ZOLO TECHNOLOGIES, INC. | 0.067 | 0.202 | 0.882 | 0.383 |

| ZYVEX CORP. | 0.187 | 0.101 | 0.295 | 0.194 |

References

- Thompson, M. Effective purchasing strategy: The untapped source of competitiveness. Supply Chain Manag. 1996, 1, 6–8. [Google Scholar] [CrossRef]

- Mehra, S.; Inman, R.A. Purchasing management and business competitiveness in the coming decade. Prod. Plan. Control 2004, 15, 710–718. [Google Scholar] [CrossRef]

- Mogre, R.; Lindgreen, A.; Hingley, M. Tracing the evolution of purchasing research: Future trends and directions for purchasing practices. J. Bus. Ind. Mark. 2017, 32, 251–257. [Google Scholar] [CrossRef]

- OECD. Government at a Glance 2019; OECD Publishing: Paris, France, 2019. [Google Scholar] [CrossRef]

- Faisal, M.N.; Al-Esmael, B.; Sharif, K.J. Supplier selection for a sustainable supply chain. Benchmarking 2017, 24, 1956–1976. [Google Scholar] [CrossRef]

- Cheng, W.; Appolloni, A.; D’Amato, A.; Zhu, Q. Green Public Procurement, missing concepts and future trends—A critical review. J. Clean. Prod. 2018, 176, 770–784. [Google Scholar] [CrossRef]

- Smith, C.R.; Fernandez, S. Equity in Federal Contracting: Examining the Link between Minority Representation and Federal Procurement Decisions. Public Adm. Rev. 2010, 70, 87–96. [Google Scholar] [CrossRef]

- Thai, K.V. Public procurement re-examined. J. Public Procure. 2001, 1, 9–50. [Google Scholar] [CrossRef] [Green Version]

- Hafsa, F.; Darnall, N.; Bretschneider, S. Estimating the True Size of Public Procurement to Assess Sustainability Impact. Sustainability 2021, 13, 1448. [Google Scholar] [CrossRef]

- Dutta, P.; Jaikumar, B.; Arora, M.S. Applications of data envelopment analysis in supplier selection between 2000 and 2020: A literature review. Ann. Oper. Res. 2021. [Google Scholar] [CrossRef]

- Simar, L.; Wilson, P.W. Estimation and inference in two-stage, semi-parametric models of production processes. J. Econom. 2007, 136, 31–64. [Google Scholar] [CrossRef]

- Joshi, A.M.; Inouye, T.M.; Robinson, J.A. How does agency workforce diversity influence Federal R&D funding of minority and women technology entrepreneurs? An analysis of the SBIR and STTR programs, 2001–2011. Small Bus. Econ. 2018, 50, 499–519. [Google Scholar]

- Ryu, Y. Accelerating the Transition of Technologies Created through the U.S. Department of Defense Small Business Innovation Research Program; RAND Corporation: Santa Monica, CA, USA, 2017. [Google Scholar] [CrossRef]

- Link, A.N.; Scott, J.T. Private Investor Participation and Commercialization Rates for Government-sponsored Research and Development: Would a Prediction Market Improve the Performance of the SBIR Programme? Economica 2009, 76, 264–281. [Google Scholar] [CrossRef] [Green Version]

- SBA. Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) Program: Policy Directive; U.S. Small Business Administration: Washington, DC, USA, 2019. Available online: https://www.sbir.gov/sites/default/files/SBIR-STTR_Policy_Directive_2019.pdf (accessed on 10 March 2021).

- National Research Council. An Assessment of the Small Business Innovation Research Program; National Academies Press: Washington, DC, USA, 2008. [Google Scholar]

- National Research Council. SBIR at the Department of Defense; National Academies Press: Washington, DC, USA, 2014. [Google Scholar]

- Held, B.J.; Edison, T.R.; Pfleeger, S.L.; Anton, P.S.; Clancy, J. Evaluation and Recommendations for Improvement of the Department of Defense Small Business Innovation Research (SBIR) Program; RAND Corporation: Santa Monica, CA, USA, 2006. [Google Scholar]

- Lerner, J. The government as venture capitalist: The long-run impact of the SBIR program. J. Priv. Equity 2000, 3, 55–78. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Link, A.N.; Scott, J.T. Public/private technology partnerships: Evaluating SBIR-supported research. Res. Policy 2002, 31, 145–158. [Google Scholar] [CrossRef]

- Link, A.N.; Scott, J.T. Government as entrepreneur: Evaluating the commercialization success of SBIR projects. Res. Policy 2010, 39, 589–601. [Google Scholar] [CrossRef] [Green Version]

- Hawkins, T.; Gravier, M.; Randall, W.S. Socio-economic sourcing: Benefits of small business set-asides in public procurement. J. Public Procure. 2018, 18, 217–239. [Google Scholar] [CrossRef]

- U.S. Small Business Administration. Small Business Procurement Scorecard Overview. Available online: https://www.sba.gov/document/support-small-business-procurement-scorecard-overview (accessed on 10 June 2021).

- U.S. Small Business Administration. Department of Defense Contracting Scorecard. Available online: https://www.sba.gov/document/support-department-defense-contracting-scorecard (accessed on 10 June 2021).

- Clark, M.; Moutray, C. The future of small businesses in the U.S. federal government marketplace. J. Public Procure. 2004, 4, 450–470. [Google Scholar] [CrossRef]

- Herrington, R.N. Five years in: A review of the women-owned small business federal contract program. Public Contract Law J. 2016, 45, 359–382. [Google Scholar]

- Brammer, S.; Walker, H. Sustainable procurement in the public sector: An international comparative study. Int. J. Oper. Prod. Manag. 2011, 31, 452–476. [Google Scholar] [CrossRef]

- Walker, H.; Miemczyk, J.; Johnsen, T.; Spencer, R. Sustainable procurement: Past, present and future. J. Purch. Supply Manag. 2012, 18, 201–206. [Google Scholar] [CrossRef]

- Stritch, J.M.; Bretschneider, S.; Darnall, N.; Hsueh, L.; Chen, Y. Sustainability Policy Objectives, Centralized Decision Making, and Efficiency in Public Procurement Processes in U.S. Local Governments. Sustainability 2020, 12, 6934. [Google Scholar] [CrossRef]

- Stević, Ž.; Pamučar, D.; Puška, A.; Chatterjee, P. Sustainable supplier selection in healthcare industries using a new MCDM method: Measurement of alternatives and ranking according to COmpromise solution (MARCOS). Comput. Ind. Eng. 2020, 140, 106231. [Google Scholar] [CrossRef]

- Milosavljević, M.; Dobrota, M.; Milanović, N. A New Approach to the Evaluation of Public Procurement Efficiency among European Countries. Eur. Rev. 2018, 27, 246–259. [Google Scholar] [CrossRef]

- Niewerth, S.; Vogt, P.; Thewes, M. Tender evaluation through efficiency analysis for public construction contracts. Front. Eng. Manag. 2020. [Google Scholar] [CrossRef]

- Yu, M.-C.; Su, M.-H. Using Fuzzy DEA for Green Suppliers Selection Considering Carbon Footprints. Sustainability 2017, 9, 495. [Google Scholar] [CrossRef] [Green Version]

- Amindoust, A. Supplier selection considering sustainability measures: An application of weight restriction fuzzy-DEA approach. RAIRO Rech. Opér. 2018, 52, 981–1001. [Google Scholar] [CrossRef] [Green Version]

- Ghoushchi, S.J.; Milan, M.D.; Rezaee, M.J. Evaluation and selection of sustainable suppliers in supply chain using new GP-DEA model with imprecise data. J. Ind. Eng. Int. 2018, 14, 613–625. [Google Scholar] [CrossRef] [Green Version]

- Nemati, M.; Reza Farzipoor, S.; Reza Kazemi, M. A data envelopment analysis approach by partial impacts between inputs and desirable-undesirable outputs for sustainable supplier selection problem. Ind. Manag. Data Syst. 2020, 121, 809–838. [Google Scholar] [CrossRef]

- Zarbakhshnia, N.; Jaghdani, T.J. Sustainable supplier evaluation and selection with a novel two-stage DEA model in the presence of uncontrollable inputs and undesirable outputs: A plastic case study. Int. J. Adv. Manuf. Technol. 2018, 97, 2933–2945. [Google Scholar] [CrossRef]

- Milosavljevic, M.; Milanovic, N.; Benkovic, S. Politics, Policies and Public Procurement Efficiency: A Quantitative Study of 25 European Countries. Lex Localis 2016, 14, 537–558. [Google Scholar] [CrossRef]

- Dotoli, M.; Epicoco, N.; Falagario, M. Multi-Criteria Decision Making techniques for the management of public procurement tenders: A case study. Appl. Soft Comput. 2020, 88, 106064. [Google Scholar] [CrossRef]

- Hicks, D.; Hegde, D. Highly innovative small firms in the markets for technology. Res. Policy 2005, 34, 703–716. [Google Scholar] [CrossRef]

- Xue, J.; Klein, P.G. Regional determinants of technology entrepreneurship. Int. J. Entrep. Ventur. 2010, 1, 291–308. [Google Scholar] [CrossRef]

- SBIR/STTR America’s Seed Fund. Available online: https://www.sbir.gov/ (accessed on 10 January 2021).

- Man, T.W.; Lau, T.; Chan, K. The competitiveness of small and medium enterprises: A conceptualization with focus on entrepreneurial competencies. J. Bus. Ventur. 2002, 17, 123–142. [Google Scholar] [CrossRef]

- Balkin, D.B.; Gomez-Mejia, L.R. Determinants of R and D compensation strategies in the high tech industry. Pers. Psychol. 1984, 37, 635–650. [Google Scholar] [CrossRef]

- Stuart, T.E.; Sorenson, O. Strategic networks and entrepreneurial ventures. Strateg. Entrep. J. 2007, 1, 211–227. [Google Scholar] [CrossRef]

- Gilsing, V.; Nooteboom, B.; Vanhaverbeke, W.; Duysters, G.; van den Oord, A. Network embeddedness and the exploration of novel technologies: Technological distance, betweenness centrality and density. Res. Policy 2008, 37, 1717–1731. [Google Scholar] [CrossRef]

- Choi, J.; Yeniyurt, S. Contingency distance factors and international research and development (R&D), marketing, and manufacturing alliance formations. Int. Bus. Rev. 2015, 24, 1061–1071. [Google Scholar]

- Link, A.N.; Scott, J.T. Propensity to Patent and Firm Size for Small R&D-Intensive Firms. Rev. Ind. Organ. 2018, 52, 561–587. [Google Scholar]

- Conti, A.; Thursby, J.; Thursby, M. Patents as signals for startup financing. J. Ind. Econ. 2013, 61, 592–622. [Google Scholar] [CrossRef] [Green Version]

- Casson, M.; Giusta, M.D. Entrepreneurship and social capital: Analysing the impact of social networks on entrepreneurial activity from a rational action perspective. Int. Small Bus. J. 2007, 25, 220–244. [Google Scholar] [CrossRef]

- Adams, W.; Adams, W.J. The military-industrial complex: A market structure analysis. Am. Econ. Rev. 1972, 62, 279–287. [Google Scholar]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L.; Owen-Smith, J. Network position and firm performance: Organizational returns to collaboration in the biotechnology industry. Res. Sociol. Organ. 1999, 16, 129–159. [Google Scholar]

- Wang, Q.; Hang, Y.; Sun, L.; Zhao, Z. Two-stage innovation efficiency of new energy enterprises in China: A non-radial DEA approach. Technol. Forecast. Soc. Chang. 2016, 112, 254–261. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Grigoroudis, E.; Goletsis, Y. A multilevel and multistage efficiency evaluation of innovation systems: A multiobjective DEA approach. Expert Syst. Appl. 2016, 62, 63–80. [Google Scholar] [CrossRef]

- Appelbaum, S.H.; Kamal, R. An analysis of the utilization and effectiveness of non-financial incentives in small business. J. Manag. Dev. 2000, 19, 733–763. [Google Scholar] [CrossRef]

- Cooper, R.S. Purpose and performance of the Small Business Innovation Research (SBIR) program. Small Bus. Econ. 2003, 20, 137–151. [Google Scholar] [CrossRef]

- Meuleman, M.; De Maeseneire, W. Do R&D subsidies affect SMEs’ access to external financing? Res. Policy 2012, 41, 580–591. [Google Scholar]

- Griliches, Z. Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 1979, 92–116. [Google Scholar] [CrossRef]

- Jaffe, A.B. Real effects of academic research. Am. Econ. Rev. 1989, 957–970. [Google Scholar]

- Zimmerman, D.W.; Zumbo, B.D. Relative Power of the Wilcoxon Test, the Friedman Test, and Repeated-Measures ANOVA on Ranks. J. Exp. Educ. 1993, 62, 75–86. [Google Scholar] [CrossRef]

- Hsu, D.H. Technology-based entrepreneurship. In The Handbook of Technology and Innovation Management; Shane, S., Ed.; Wiley: New York, NY, USA, 2008; pp. 367–388. [Google Scholar]

- Lee, J.; Kim, C.; Choi, G. Exploring data envelopment analysis for measuring collaborated innovation efficiency of small and medium-sized enterprises in Korea. Eur. J. Oper. Res. 2019, 278, 533–545. [Google Scholar] [CrossRef]

- Alvarez, R.; Crespi, G. Determinants of technical efficiency in small firms. Small Bus. Econ. 2003, 20, 233–244. [Google Scholar] [CrossRef]

- Grilo, A.; Santos, J. Measuring efficiency and productivity growth of new technology-based firms in business incubators: The Portuguese case study of Madan Parque. Sci. World J. 2015, 936252. [Google Scholar] [CrossRef] [Green Version]

- Oluka, P.N.; Okoche, M.; Mugurusi, G. Public procurement and competitiveness of women-owned businesses: A structural equation model (SEM) for gender-responsive procurement in Uganda. World J. Entrepren. Manag. Sustain. Dev. 2020. [Google Scholar] [CrossRef]

- GAO. Minority- and Women-Owned Business Contracting: Analysis of DOD Contract Awards, Fiscal Years 2010–2016; U.S. Government Accountability Office: Washington, DC, USA, 2017.

- McGregor, J.; Tweed, D. Profiling a New Generation of Female Small Business Owners in New Zealand: Networking, Mentoring and Growth. Gend. Work Organ. 2002, 9, 420–438. [Google Scholar] [CrossRef]

- Manello, A.; Cisi, M.; Devicienti, F.; Vannoni, D. Networking: A business for women. Small Bus. Econ. 2019, 1–20. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Goto, M. Performance assessment of Japanese electric power industry: DEA measurement with future impreciseness. Energies 2020, 13, 490. [Google Scholar] [CrossRef] [Green Version]

- Sueyoshi, T.; Goto, M. Environmental Assessment on Energy and Sustainability by Data Envelopment Analysis; John Wiley & Sons: London, UK, 2018. [Google Scholar]

- Sueyoshi, T.; Goto, M. Performance assessment of Japanese electricity and gas companies during 2002–2018: Three DEA approaches. Energies 2021, 14, 1705. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y. Social sustainability measured by intermediate approach for DEA environmental assessment: Chinese regional planning for economic development and pollution prevention. Energy Econ. 2017, 66, 154–166. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y.; Goto, M. A literature study for DEA applied to energy and environment. Energy Econ. 2017, 62, 104–124. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Ryu, Y. Performance Assessment of the semiconductor industry: Measured by DEA environmental assessment. Energies 2020, 13, 5998. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Liu, X.; Li, A. Evaluating the performance of Chinese fossil fuel power by data envelopment analysis: An application of three intermediate approaches in a time horizon. J. Clean. Prod. 2020, 227, 121992. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Ryu, Y.; Yun, J.-Y. Coronavirus-19 response and prospects of clean/sustainable energy transition in industrial nations: New Environmental assessment. Energies 2021, 14, 1174. [Google Scholar] [CrossRef]

| Small Business Contracting Achievement | Small Business | Women-Owned Small Business | SMALL Disadvantaged Business | Service Disabled Veteran-Owned Small Business | HUBZone Located Small Business | |

|---|---|---|---|---|---|---|

| Government-wide | Prime contracting | 26.50% | 5.19% | 10.29% | 4.39% | 2.28% |

| Subcontracting | 33.27% | 5.25% | 4.17% | 1.95% | 1.37% | |

| DoD | Prime contracting | 24.16% | 4.25% | 8.56% | 3.25% | 1.88% |

| Subcontracting | 38.60% | 5.20% | 4.00% | 2.10% | 1.60% | |

| Author(s) | Method | Summary | Factors |

|---|---|---|---|

| Niewerth et al. [32] | DEA | This study analyzed the performance of construction tenders in the European Union. | Input: life-cycle costs; construction time Output: environmental concept |

| Yu and Su [33] | Fuzzy DEA | This study examined the performance of Taiwanese sustainable suppliers in the information and communication industry. | Input: production costs; lead time; supply chain carbon footprints Output: quality; demand quantity |

| Amindoust [34] | Fuzzy DEA | This study assessed the performance of sustainable suppliers in the automotive parts industry in the Middle East. | Criterion: quality; delivery; technology level; after-sales services; environmental management system; pollution control; work safety and labor health; ethics |

| Ghoushchi et al. [35] | DEA with imprecise data | This study explored the performance of Iranian sustainable suppliers in the petrochemical industry. | Input: total cost of shipments; the number of shipments; work safety and labor health costs; supplier reputation; eco-design costs Output: the number of the bills received from the supplier without errors; the number of the shipments to arrive on time; the interests and rights of employees; supplier’s green image; green management system |

| Nemati et al. [36] | DEA with partial impacts between inputs, good and bad outputs | This study investigated the sustainability performance of Iranian cable suppliers. | Input: eco-design cost; the number of shipments per month; total cost of shipments; cost of work safety and labor health Output: the number of bills without error; the number of on-time delivered goods; the number of sent non-defective parts; the number of sent defective parts |

| Zarbakhshnia and Jaghdani [37] | Network DEA | This study evaluated the performance of Iranian sustainable suppliers in the plastic packing strap industry. | Input: eco-design costs; logistics costs; the number of tune raw materials; reliability costs Intermediate: hazardous substances; the number of sustainable products; fuel cost; cost of labor healthOutput: the number of occupation opportunities; the number of delivered products; CO2 emissions |

| Milosavljević et al. [38] | Benefit-of-doubts DEA | This study compared the public procurement efficiency of EU member states. | Input (of technological dimension): high-tech exports; patent application; R&D exports Output: one bidder; no calls for bids; aggregation; award criteria; decision speed; reporting quality |

| Dotoli et al. [39] | Fuzzy DEA and other multi-criteria decision making techniques | This study ranked the public procurement performance of tenders at the European Institution. | Input: price Output (quality factors): technical (e.g., ergonomics, functionality); certifications (e.g., product quality, production quality); conditions (e.g., warranty, post-sales) |

| Var | Definition | Obs | Mean | SD | Min | Max |

|---|---|---|---|---|---|---|

| Federal_procure | Action obligation of federal procurement contracts (USD million) | 252 | 98.14 | 292.765 | 0.19 | 2433 |

| No_patents | Number of patent applications | 252 | 49.61 | 94.773 | 15 | 1251 |

| No_connections | Eigenvector centrality in the SBIR funding network | 252 | 0.024 | 0.012 | 0.001 | 0.045 |

| SBIR_awards | Amount of SBIR awards (USD million) | 252 | 5.78 | 11.207 | 0.29 | 103.27 |

| No_employees | Number of employees | 252 | 86.17 | 109.106 | 2 | 480 |

| Tech_distance | Technological distance between suppliers and DoD | 252 | 0.3845 | 0.208 | 0.0002 | 0.8805 |

| Age | Age of firms | 252 | 22.17 | 14.934 | 2 | 122 |

| HUBZone_located | Dummy (0 or 1) whether located in HUBZone 1 or not | 252 | 0.012 | 0.109 | 0 | 1 |

| Urban_located | Dummy (0 or 1) whether located in urban areas 2 or not | 252 | 0.369 | 0.484 | 0 | 1 |

| Minority_owned | Dummy (0 or 1) whether owned by minority | 252 | 0.040 | 0.196 | 0 | 1 |

| Women_owned | Dummy (0 or 1) whether owned by women | 252 | 0.044 | 0.205 | 0 | 1 |

| Veteran_owned | Dummy (0 or 1) whether owned by veteran | 234 | 0.034 | 0.182 | 0 | 1 |

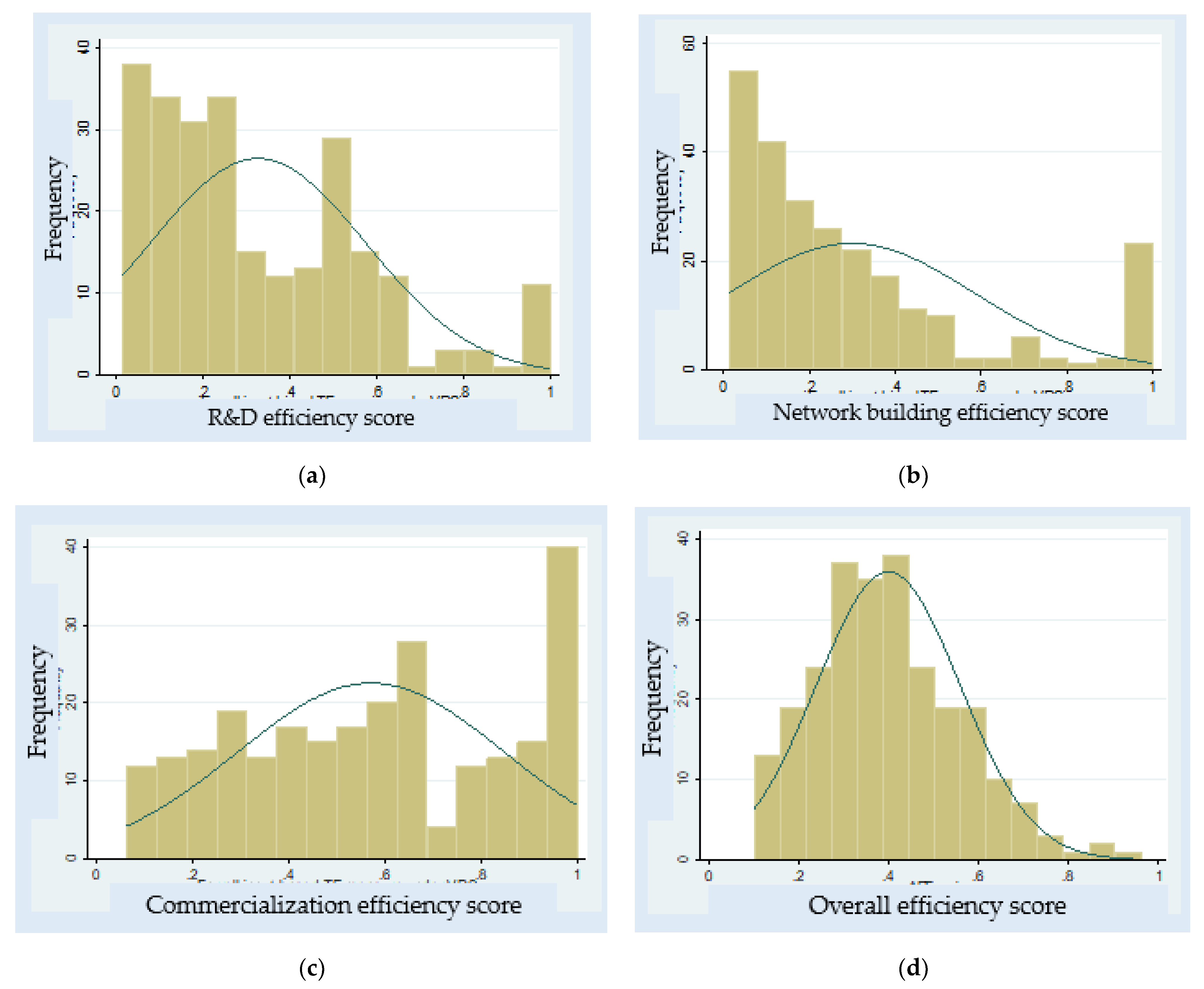

| Efficiency | Obs | Mean | Min | Max |

|---|---|---|---|---|

| R&D | 252 | 0.3265 | 0.0155 | 1 |

| Network building | 252 | 0.2983 | 0.0133 | 1 |

| Commercialization | 252 | 0.5701 | 0.0619 | 1 |

| Overall | 252 | 0.3983 | 0.1009 | 0.9608 |

| Variable | without Bootstrap | with Bootstrap | Difference | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Model 1a | Model 1b | Model 2a | Model 2b | ||||||

| SBIR_awards † | −0.0323 *** | (−4.46) | −0.0387 *** | (−5.09) | −0.0333 *** | (−4.40) | −0.0391 *** | (−4.95) | −0.0004 |

| No_employees† | −0.0624 *** | (−10.34) | −0.0732 *** | (−9.57) | −0.0634 *** | (−10.07) | −0.0741 *** | (−9.41) | −0.0009 |

| Tech_distance | −0.1237 *** | (−3.85) | −0.1302 *** | (−3.91) | −0.1302 *** | (−3.96) | −0.1364 *** | (−3.98) | −0.0062 |

| No_patents† | −0.0756 *** | (−7.65) | −0.0793 *** | (−7.74) | −0.0845 *** | (−7.60) | −0.0882 *** | (−7.86) | −0.0089 |

| No_connections | 2.3012 *** | (3.12) | 1.6901 ** | (2.05) | 2.4362 *** | (3.24) | 1.8013 ** | (2.15) | 0.1112 |

| Federal_procure† | 0.0184 *** | (3.16) | 0.0184 *** | (3.02) | 0.0000 | ||||

| Age† | 0.0045 | (0.34) | 0.0052 | (0.38) | 0.0007 | ||||

| Urban_located | −0.0152 | (−1.09) | −0.0155 | (−1.06) | −0.0003 | ||||

| HUBZone_located | 0.0449 | (0.76) | 0.0483 | (0.78) | 0.0034 | ||||

| Minority_owned | 0.0134 | (0.39) | 0.0117 | (0.34) | −0.0017 | ||||

| Women_owned | 0.0598 * | (1.94) | 0.0589 * | (1.81) | −0.0009 | ||||

| Veteran_owned | −0.0232 | (−0.63) | −0.0241 | (−0.65) | −0.0009 | ||||

| AIC | −416.80 | −392.42 | −424.43 | −399.46 | −7.04 | ||||

| BIC | −392.09 | −344.05 | −399.73 | −351.09 | −7.04 | ||||

| Variable | R&D | Network Building | Commercialization | Overall |

|---|---|---|---|---|

| Women_owned | −0.0056 (−0.16) | 0.1287 *** (2.71) | 0.0013 (0.04) | 0.0598 * (1.94) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ryu, Y.; Sueyoshi, T. Examining the Relationship between the Economic Performance of Technology-Based Small Suppliers and Socially Sustainable Procurement. Sustainability 2021, 13, 7220. https://doi.org/10.3390/su13137220

Ryu Y, Sueyoshi T. Examining the Relationship between the Economic Performance of Technology-Based Small Suppliers and Socially Sustainable Procurement. Sustainability. 2021; 13(13):7220. https://doi.org/10.3390/su13137220

Chicago/Turabian StyleRyu, Youngbok, and Toshiyuki Sueyoshi. 2021. "Examining the Relationship between the Economic Performance of Technology-Based Small Suppliers and Socially Sustainable Procurement" Sustainability 13, no. 13: 7220. https://doi.org/10.3390/su13137220

APA StyleRyu, Y., & Sueyoshi, T. (2021). Examining the Relationship between the Economic Performance of Technology-Based Small Suppliers and Socially Sustainable Procurement. Sustainability, 13(13), 7220. https://doi.org/10.3390/su13137220