Sustainable-Development Measurement of China’s Coworking Industry Using Social-Network Analysis Method

Abstract

1. Introduction

2. Study Cases

- (1)

- Media-platform model: relies on a powerful media platform that uses industry resources, cutting-edge information; a network platform to provide support to entrepreneurs by using the experience accumulated from long-term follow-up reports on the entrepreneurial environment. In this model, the incubator uses a huge media platform to help the incubation project improve its reputation and capital docking ability.

- (2)

- Large-leading-enterprise model: mainly relies on powerful large enterprises. With their strong financial and technical ability, and professional mentors for entrepreneurship training, large enterprises provide entrepreneurs with efficient and convenient innovation and entrepreneurship services. After growing, incubated enterprises can enter the supply chain network of large enterprises, and achieve innovation feedback by becoming new entrepreneurship mentors, further promoting the development of the coworking space.

- (3)

- New real-estate model: leading institutions of this model are generally large real-estate developers. The most significant characteristics of this model are flexible leasing space and the open entrepreneurial environment, which reduces one-time leasing areas and deducts the conventional leasing cycle. The obvious disadvantage is the single-profit model by only charging for renting space.

- (4)

- Open-space model. This model mainly provides basic office space and equipment, charges low rent in order to reduce the threshold of office work and entrepreneurs, holds rich activities such as entrepreneurship salons, and gathers abundant Internet resources to accelerate the empowerment of small and medium-sized enterprises.

- (5)

- Industry-driven model. This model is led by the government or industrial association. Funded by the government to set up a certain industry guidance funds for directional incubation, the model aims at promoting the local regional economic development. Therefore, it has a significant advantage in gathering various industrial resources.

- (6)

- Angel-investment model. This model mainly refers to the successful experience of mature incubators in the United States, Israel, and other countries. Through the introduction of professional mentors, the model provides business-plan guidance and risk-aversion training to improve the success rate of incubation, and provides angel-investment funds to obtain capital dividends after the growth of enterprises.

3. Methods

3.1. Density-Comprehensive Index (Macrolevel)

3.2. Subgroup-Comprehensive Index (Mesolevel)

3.3. Centrality-Comprehensive Index (Microlevel)

4. Results and Discussion

4.1. Results and Discussion of Density-Comprehensive Index

- From the perspective of network scale, the new real-estate and open-space models had the most network nodes and connections, indicating that these two models are relatively mature. The scale of the industry-driven model, on the other hand, was the smallest and lagged far behind the other models, indicating that the development of this model is still in its infancy. The network scales of the media-platform, large-leading-enterprise, and angel-investment models were similar in the middle level among the six models.

- From the perspective of the density-comprehensive index, the industry-driven model with the smallest scale had the largest density-comprehensive index, while the open-space and new real-estate models with the largest scale had the lowest density-comprehensive index, which shows that, although the industry-driven model was in its infancy, it had significant advantages in building a good industrial ecology, and providing resource support for office enterprises and incubated enterprises. On the other hand, although the network scales of the open-space and new real-estate models were large, it is urgent to promote high-quality development because the two models only provide coworking office spaces and lack professional entrepreneurial services. Therefore, the two models need to be continuously deepened in resource integration, industry cross-border collaboration, and the formation of close cooperation networks.

4.2. Results and Discussion of Subgroup-Comprehensive Index

- (1)

- Most E–I indices of the six models were negative, indicating that the phenomenon of subgroup was very significant, especially the industry-driven and media-platform models, of which the E–I indices highly tended to be 1, which means that the leading enterprises were playing a leading role, and other nodes had strong reliance on them. In addition, cooperation mostly occurred within subgroups, and the network was weak in openness, so it is urgent to expand and cultivate cooperation among subgroups.

- (2)

- The angel-investment model was the only one with a positive E–I index, which indicates that the status of enterprises was relatively equal, and cooperation within and between communities was relatively balanced. Low industrial concentration and the urgent need to cultivate leading enterprises are key problems hindering the rapid development of this model.

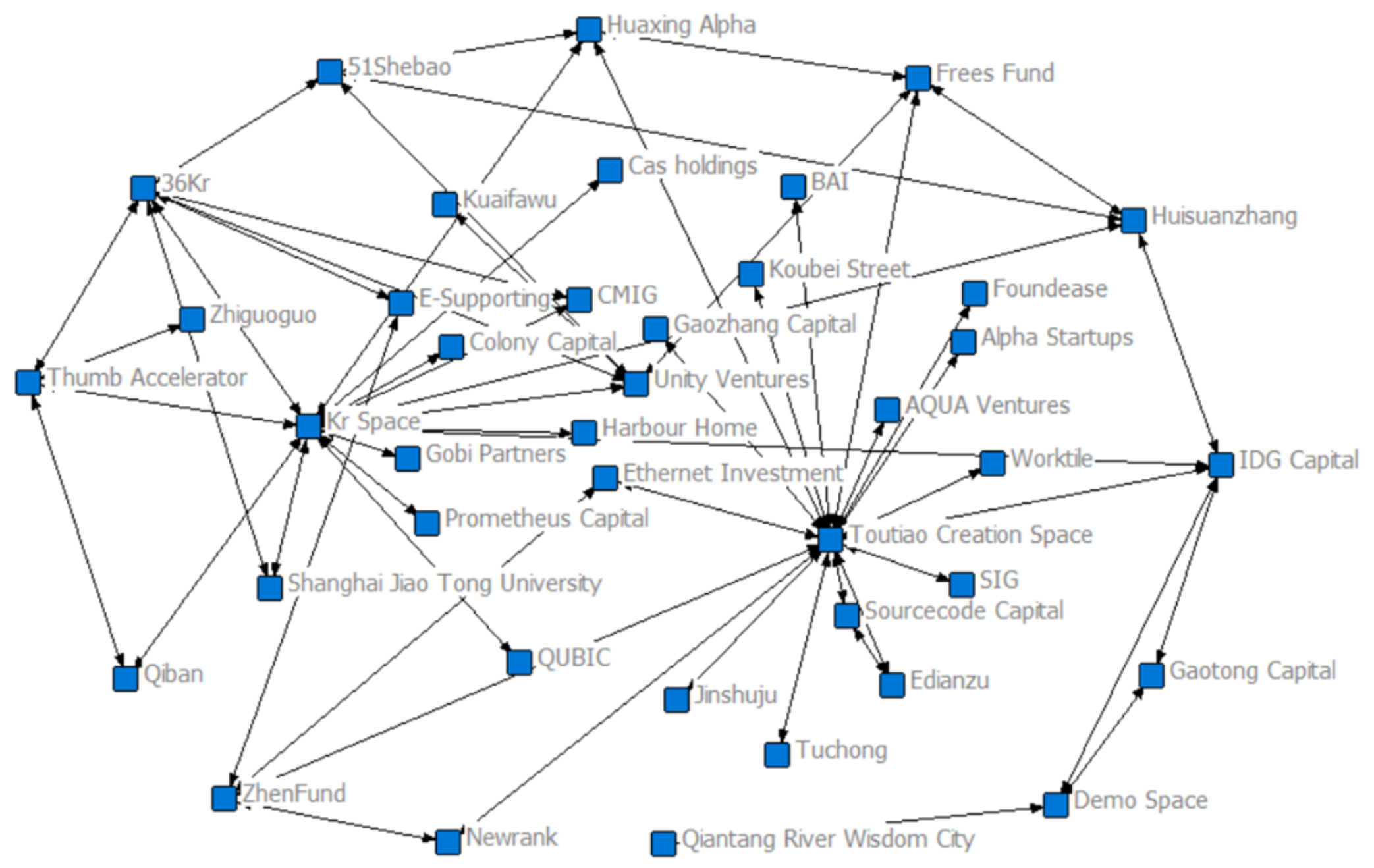

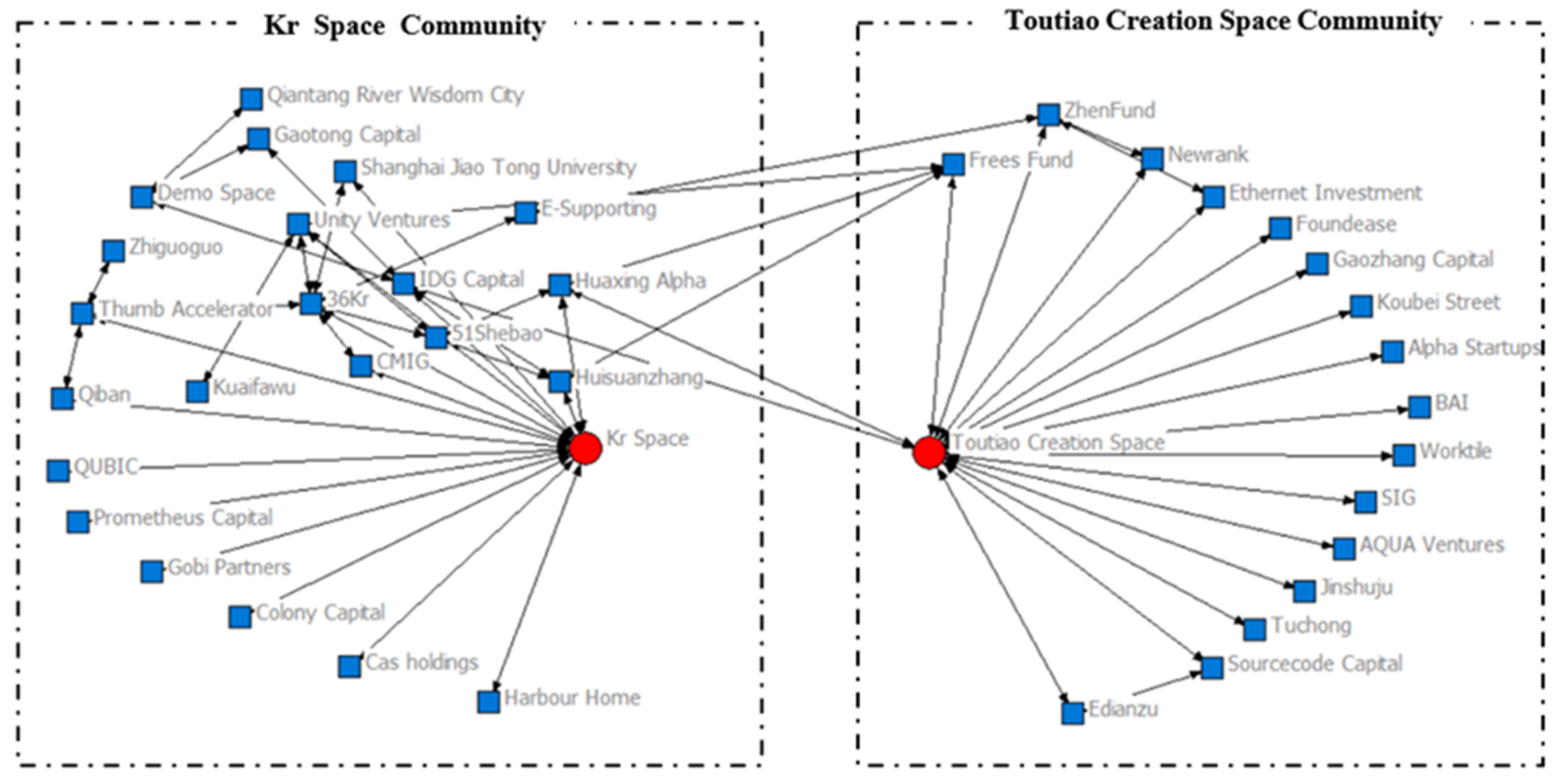

4.2.1. Subgroup Analysis of Media-Platform Model

- (1)

- The scale of the two communities was similar, but the Kr Space community had better industrial ecological diversity with five types of enterprises and organizations, namely, coworking enterprise, investment and financial institutions, Internet enterprises, real-estate enterprises, and universities.

- (2)

- The E–I indices of the two communities were both negative and highly close to −1, indicating that the two communities had a high degree of an independent governance faction and a significant characteristic of duopoly. Cooperation between the two communities was weak.

- (3)

- Qualcomm Venture Capital and IDG Capital were the bridges connecting the relationship between the two communities, which is a typical Simmel connection, indicating that investment and financing institutions are playing a crucial role in the development of the media-platform model.

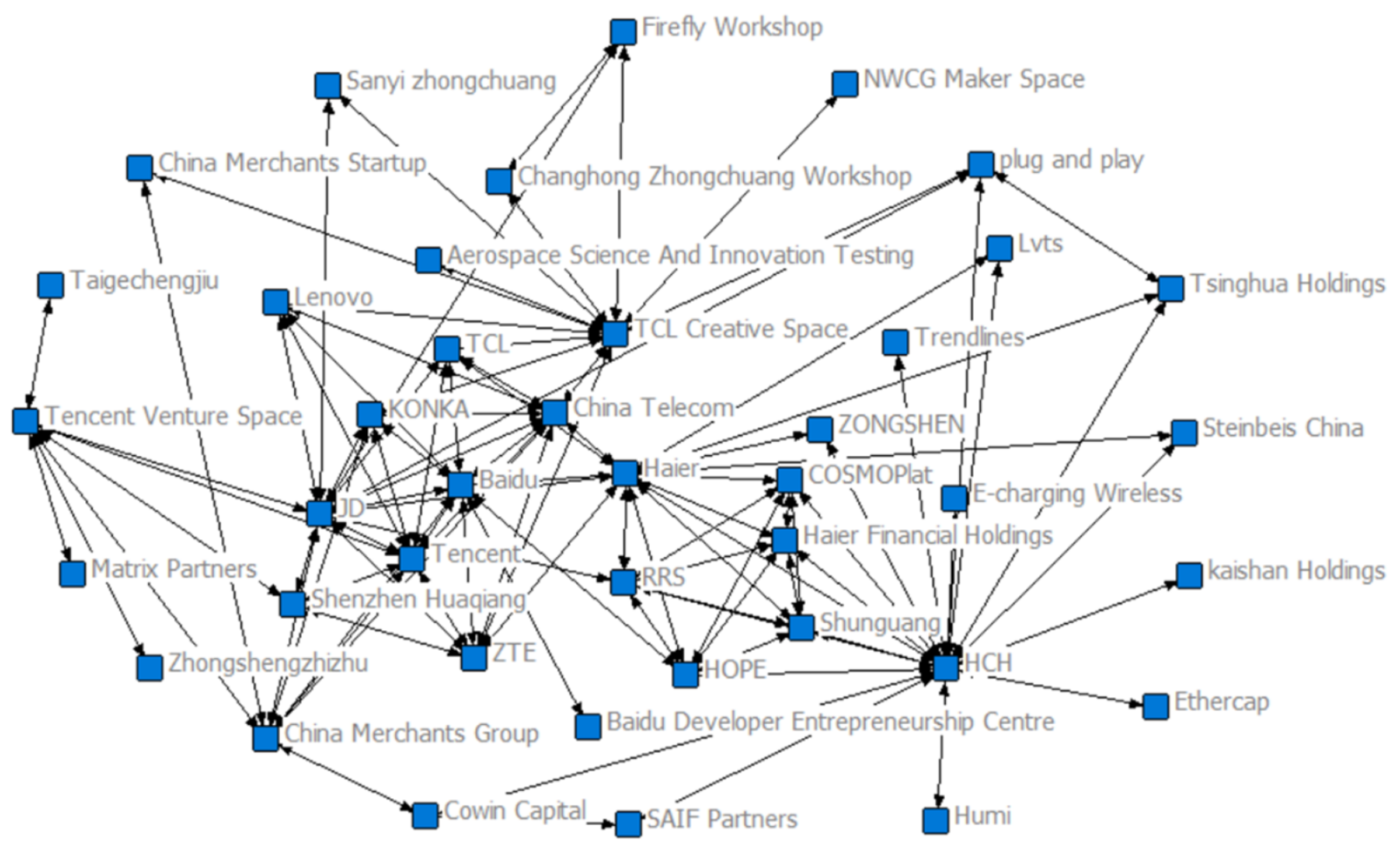

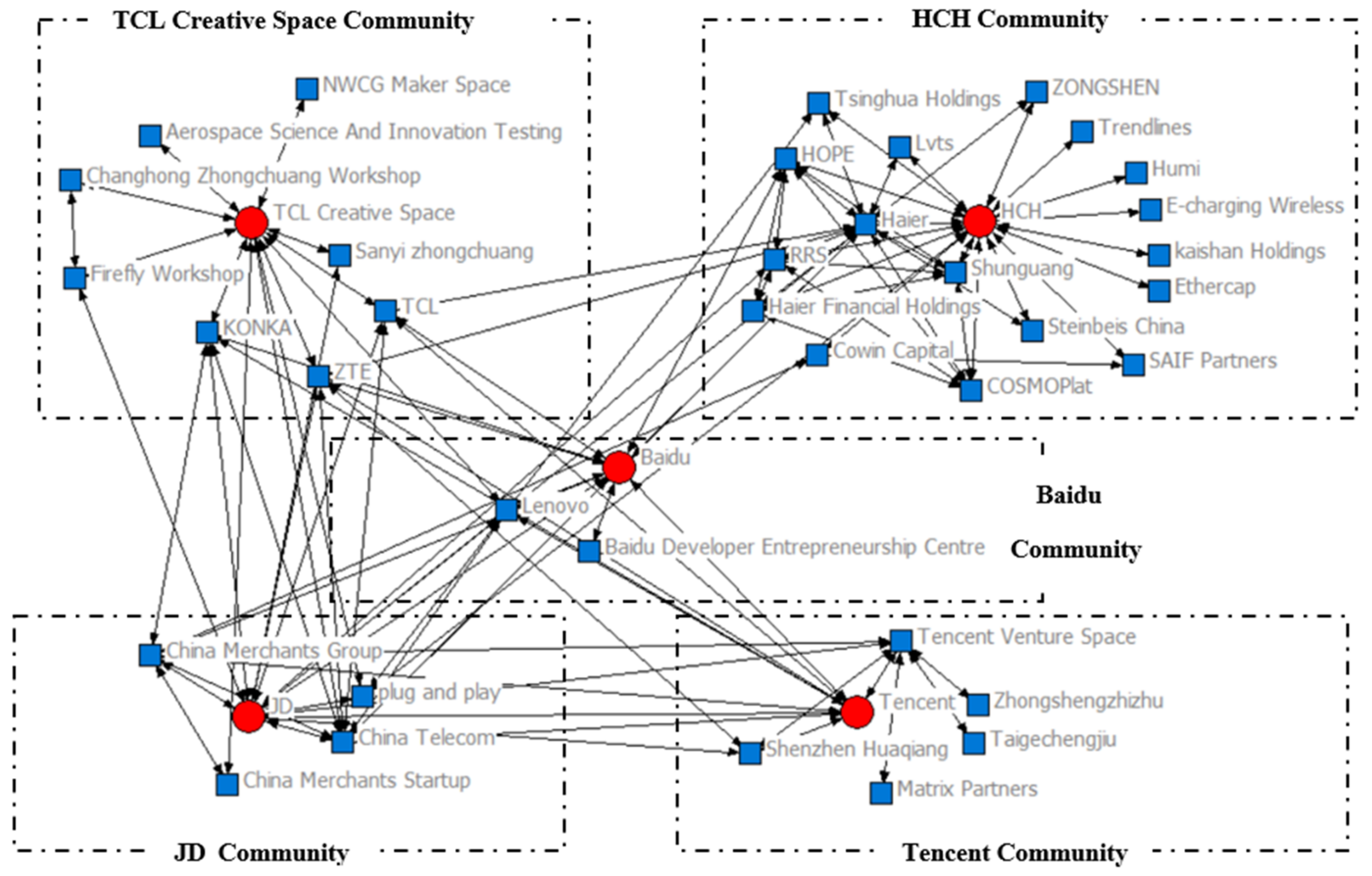

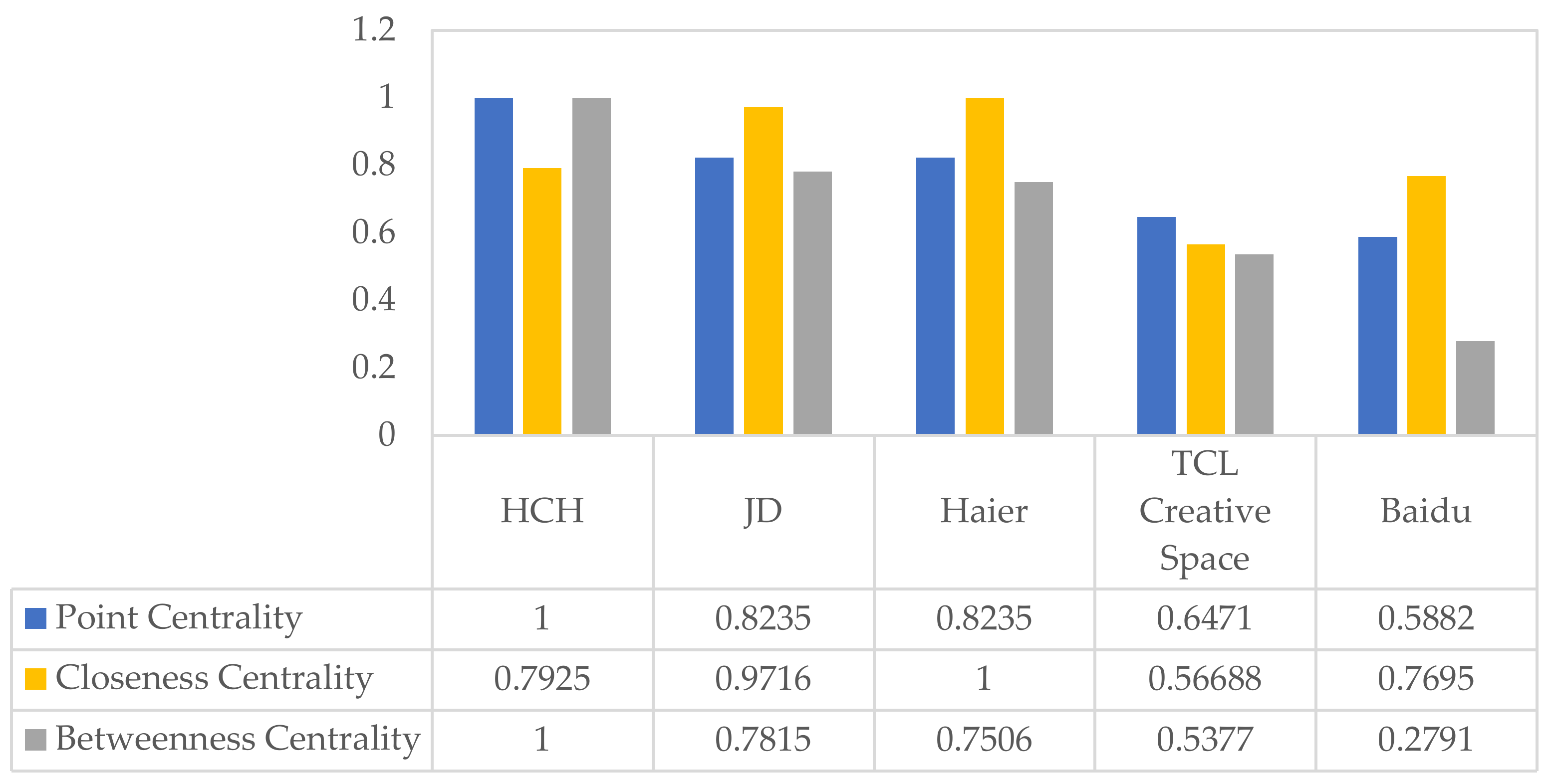

4.2.2. Subgroup Analysis of Large-Leading-Enterprise Model

- (1)

- The communities of the large-leading-enterprise model presented network characteristics of imbalance. The development of the HCH community was at a relatively mature stage with strong ecological diversity. The community integrated many resources of the Haier Group, including the Hope R&D platform, the COSMO design and manufacturing platform, and Gooday sales and logistics channels to achieve comprehensive docking. What is more important is the strong support of financing channels from the Haier Group to comprehensively facilitate the rapid growth of start-ups and office enterprises.

- (2)

- Among the five communities, only the E–I index of HCH was negative and highly close to −1, which indicates that the community was relatively weak in openness. This is largely due to the relatively complete industrial chain within the Haier Group. On the other hand, the internal and external cooperation of the four other communities was relatively balanced.

- (3)

- Internet enterprises Baidu and JD Group had network connections with each community, which ensured the overall connectivity of the whole network and had the characteristics of a typical Simmel connection, which plays an important supporting role in promoting the development of this model.

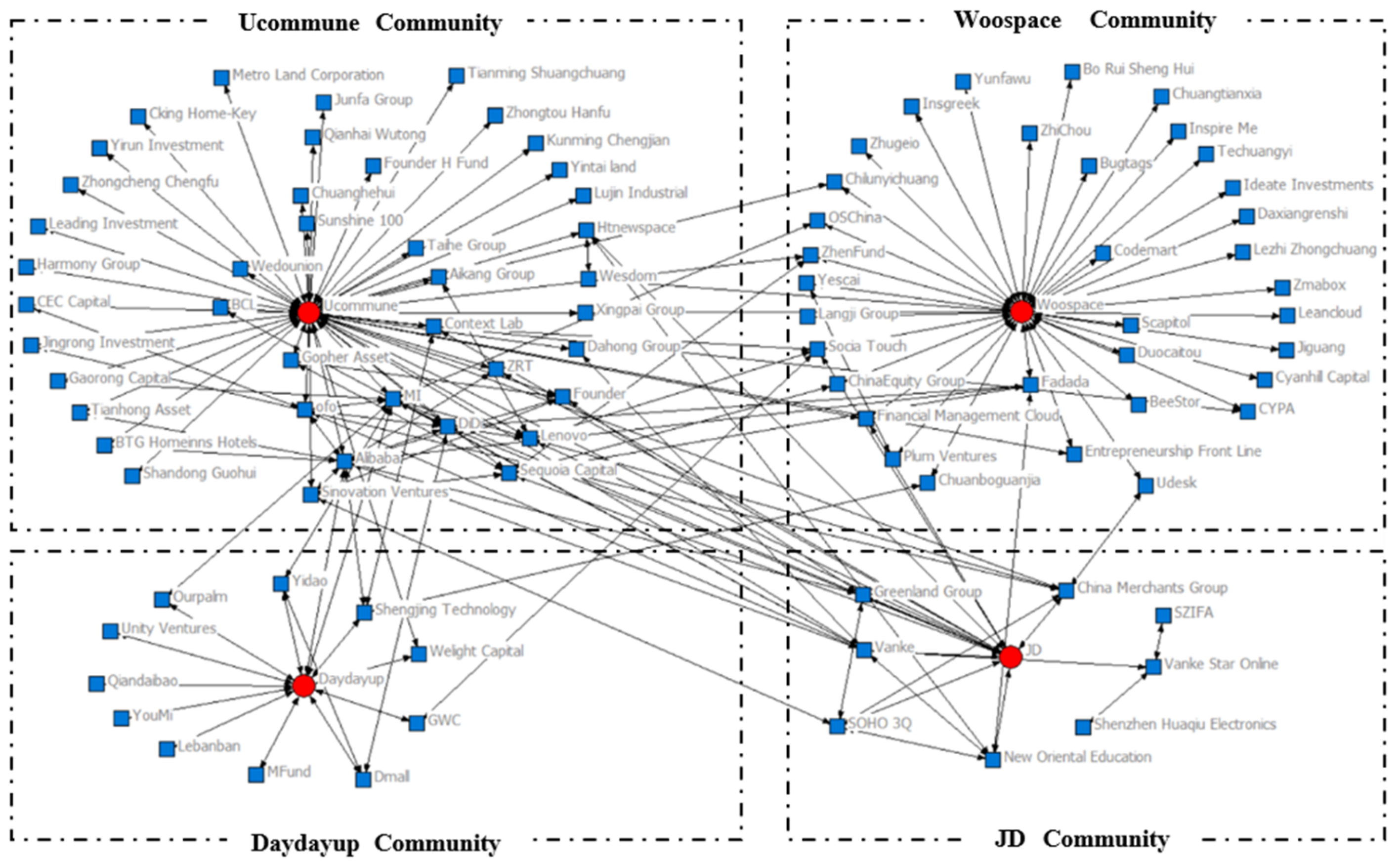

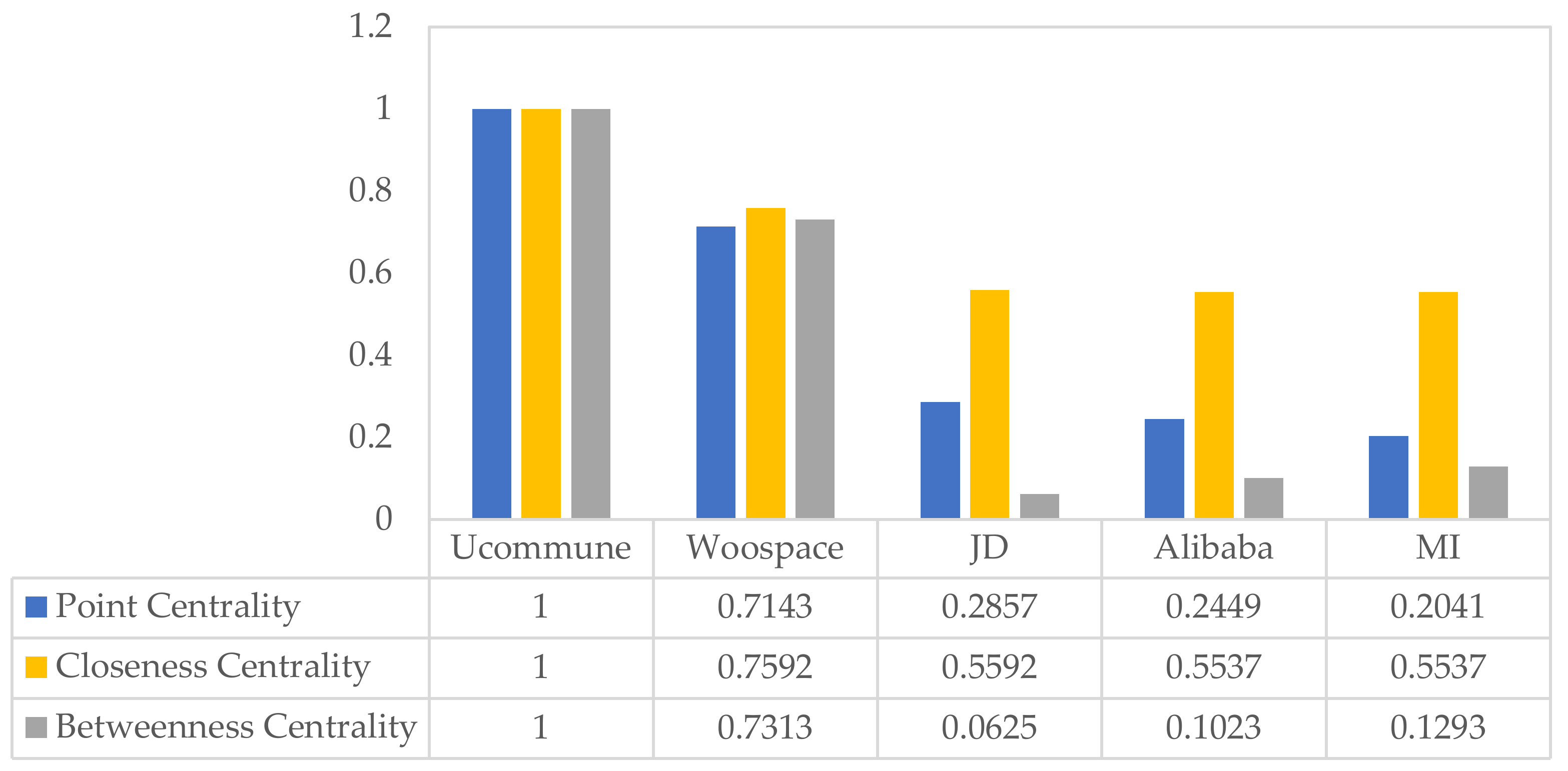

4.2.3. Subgroup Analysis of New Real-Estate Model

- (1)

- The number of real-estate enterprises greatly increased compared with other models. The four communities also showed characteristics of imbalance, as the Ucommune and Woospace communities developed on a large scale. The diversity of the Ucommune community was both rich and abundant, which indicates that the Ucommune enterprise had significant advantages in integrating cross-border resources.

- (2)

- Among the four communities, the E–I indices of three communities were negative, but much less than −1, and the E–I Index of the JD Group community was almost 0, which indicates that the clique feature of the new real-estate model was somewhat weakened, and openness was very good.

- (3)

- Real-estate enterprise Vanke and Internet enterprise JD Group had the characteristics of a typical Simmel connection, which plays an important supporting role in promoting the development of this model.

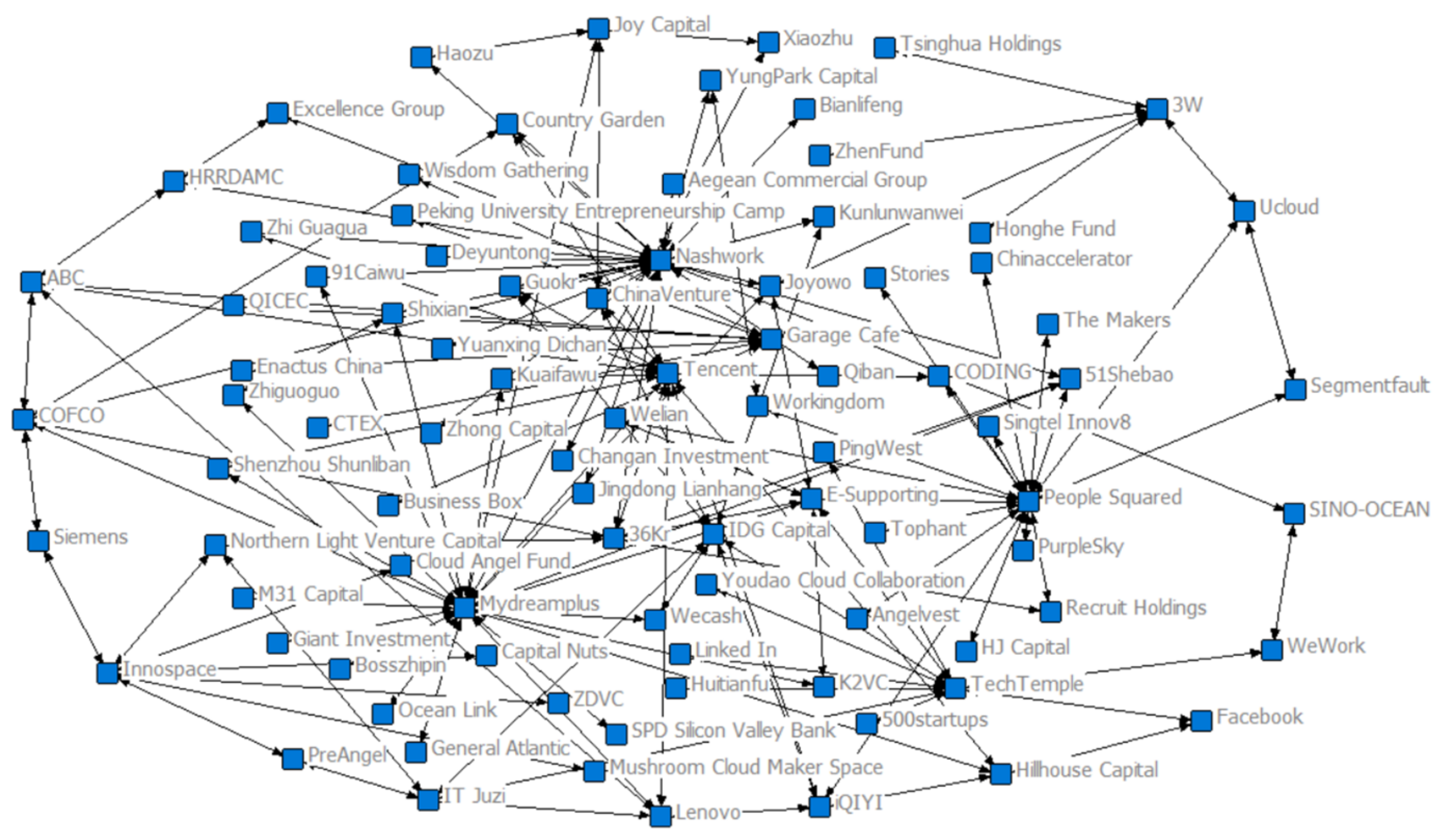

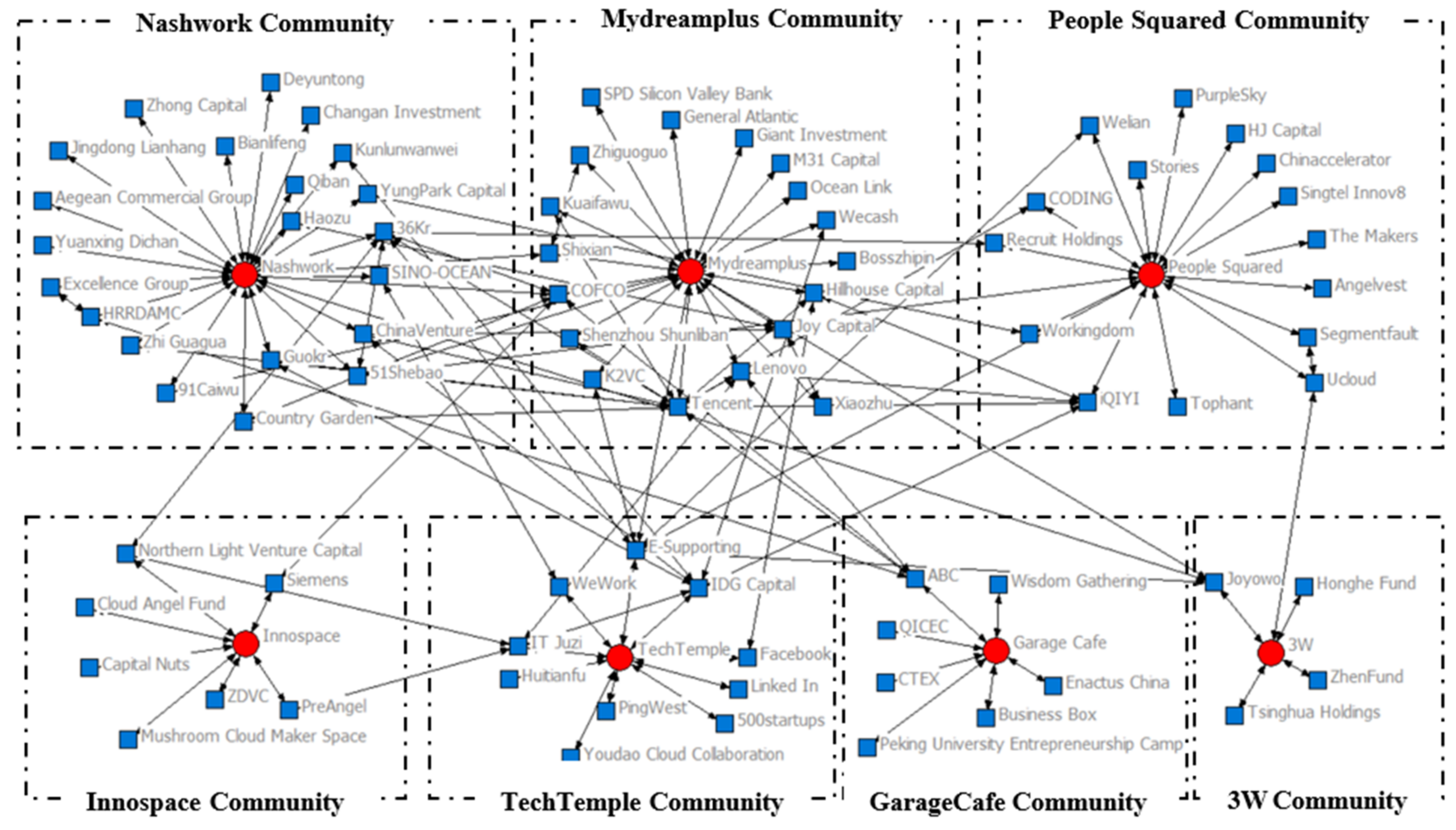

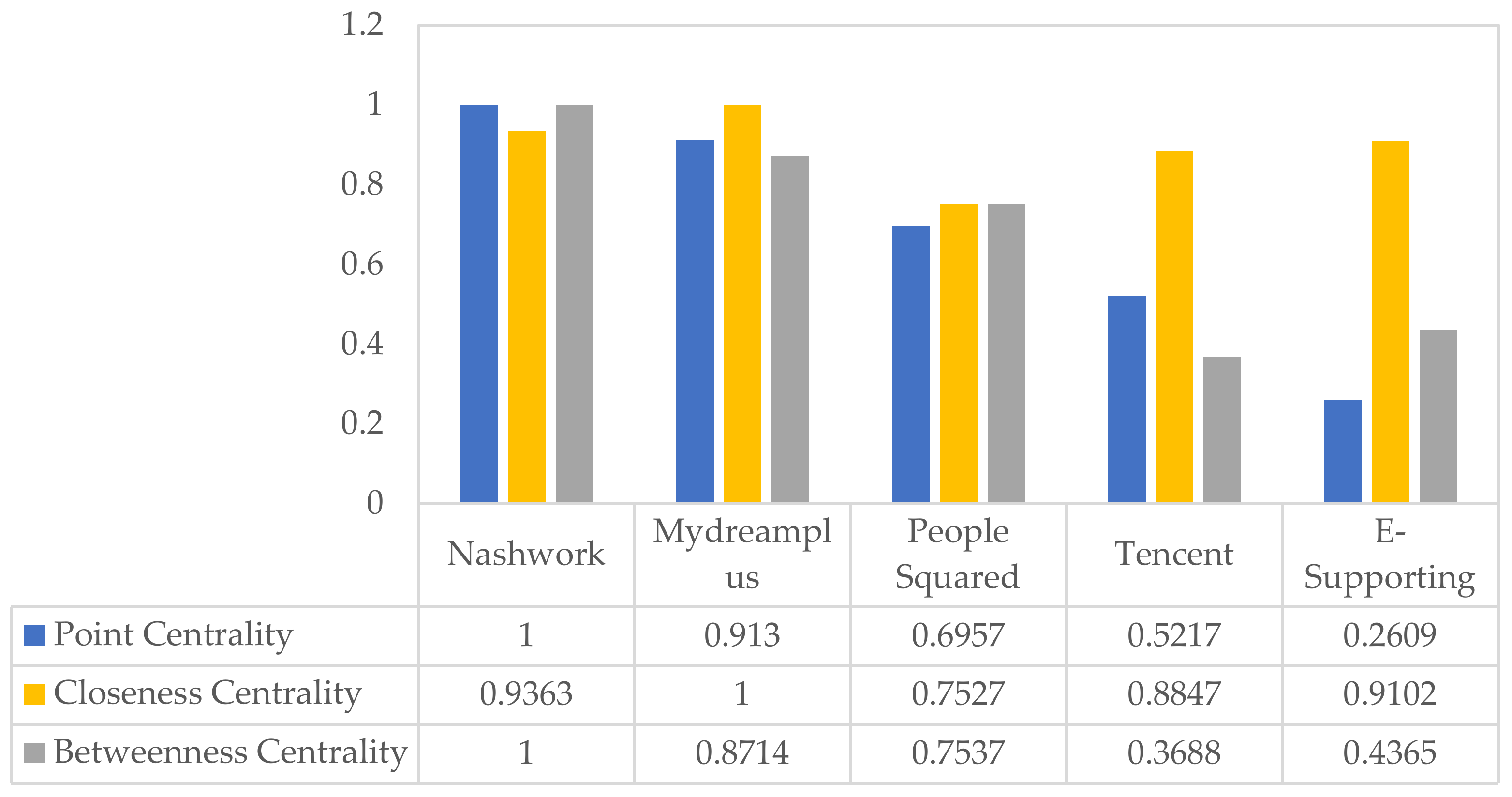

4.2.4. Subgroup Analysis of Open-Space Model

- (1)

- The diversity of the open-space model was good, but the imbalance feature was also significant. The Nashwork, Mydreamplus, and People Squared communities were larger in scale. The diversity of the Nashwork community was the most abundant, including investment and financing institutions, real estate, and Internet enterprises, indicating that the Nash Space enterprise had significant advantages in integrating cross-border resources.

- (2)

- The E–I indices of all seven communities were negative, which indicates that the model was also characterized by factions, especially that of the Garage Cafe community, whose index was closest to −1, which indicates that a self-ecosphere formed inside the community, but openness needs to be improved.

- (3)

- Internet enterprises 51shebao, E-SUPPORTING, Kuaifawu, and investment and financial institution IDG Capital had the characteristics of a typical Simmel connection, which plays an important supporting role in promoting the development of this model.

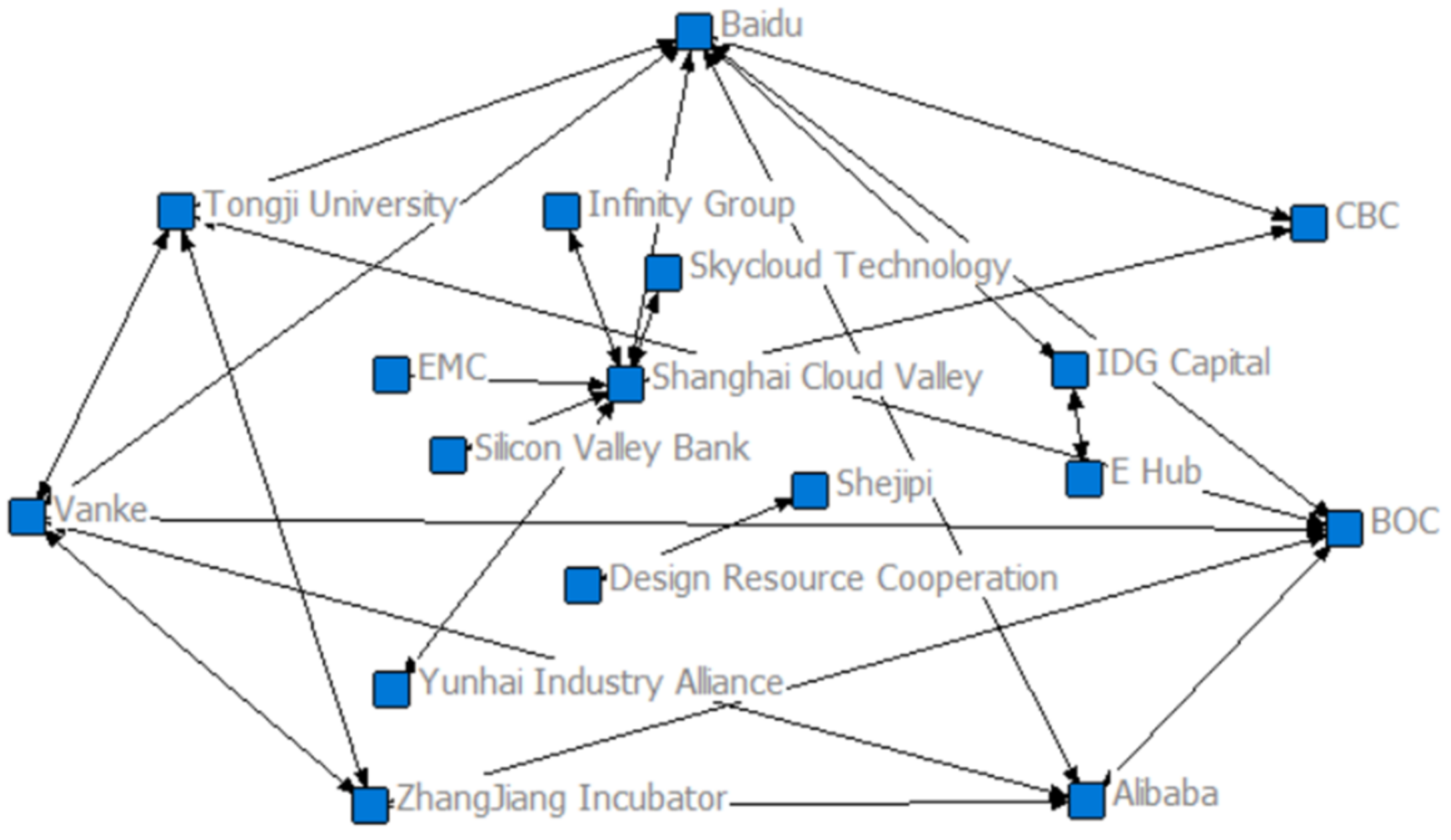

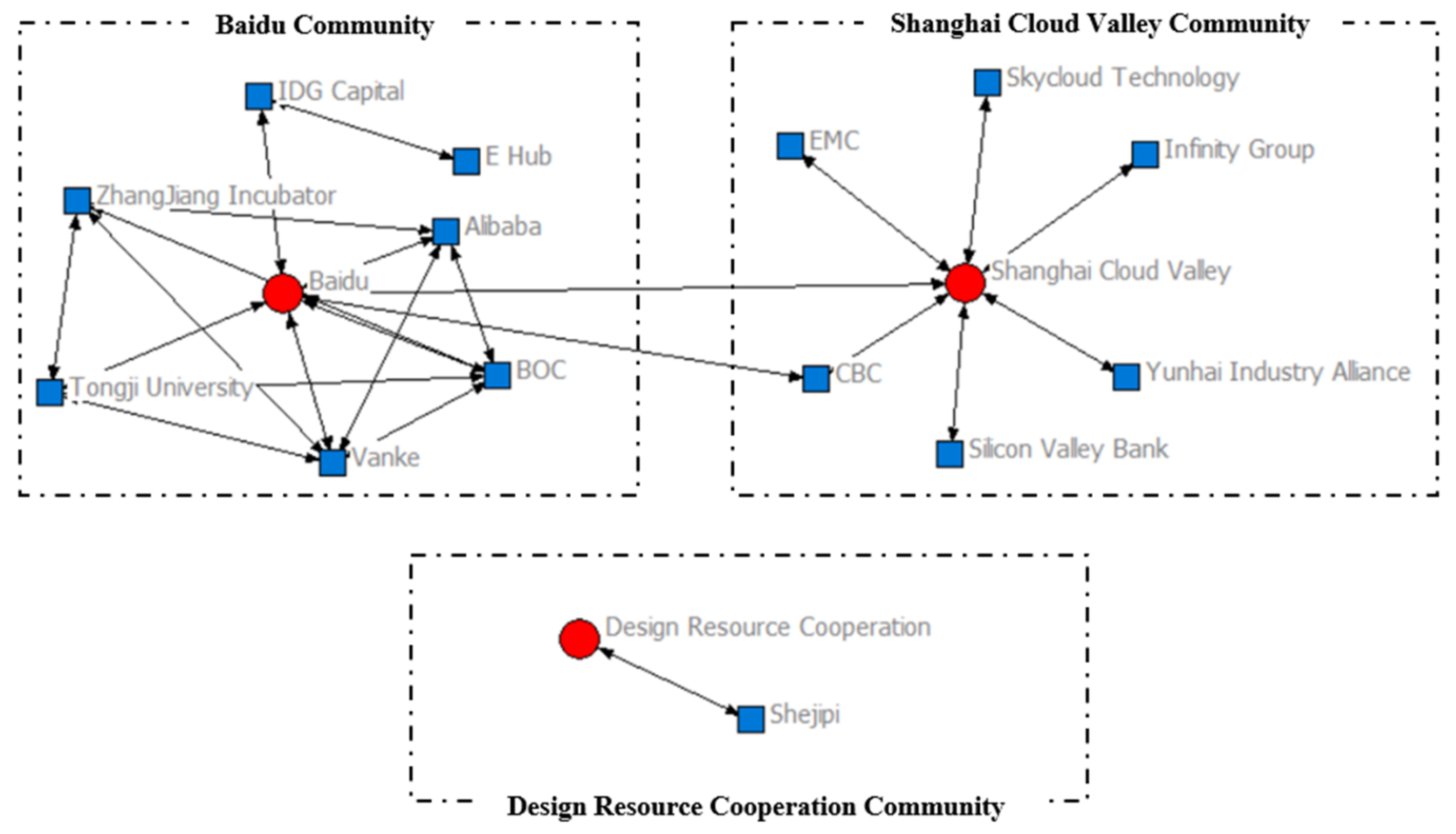

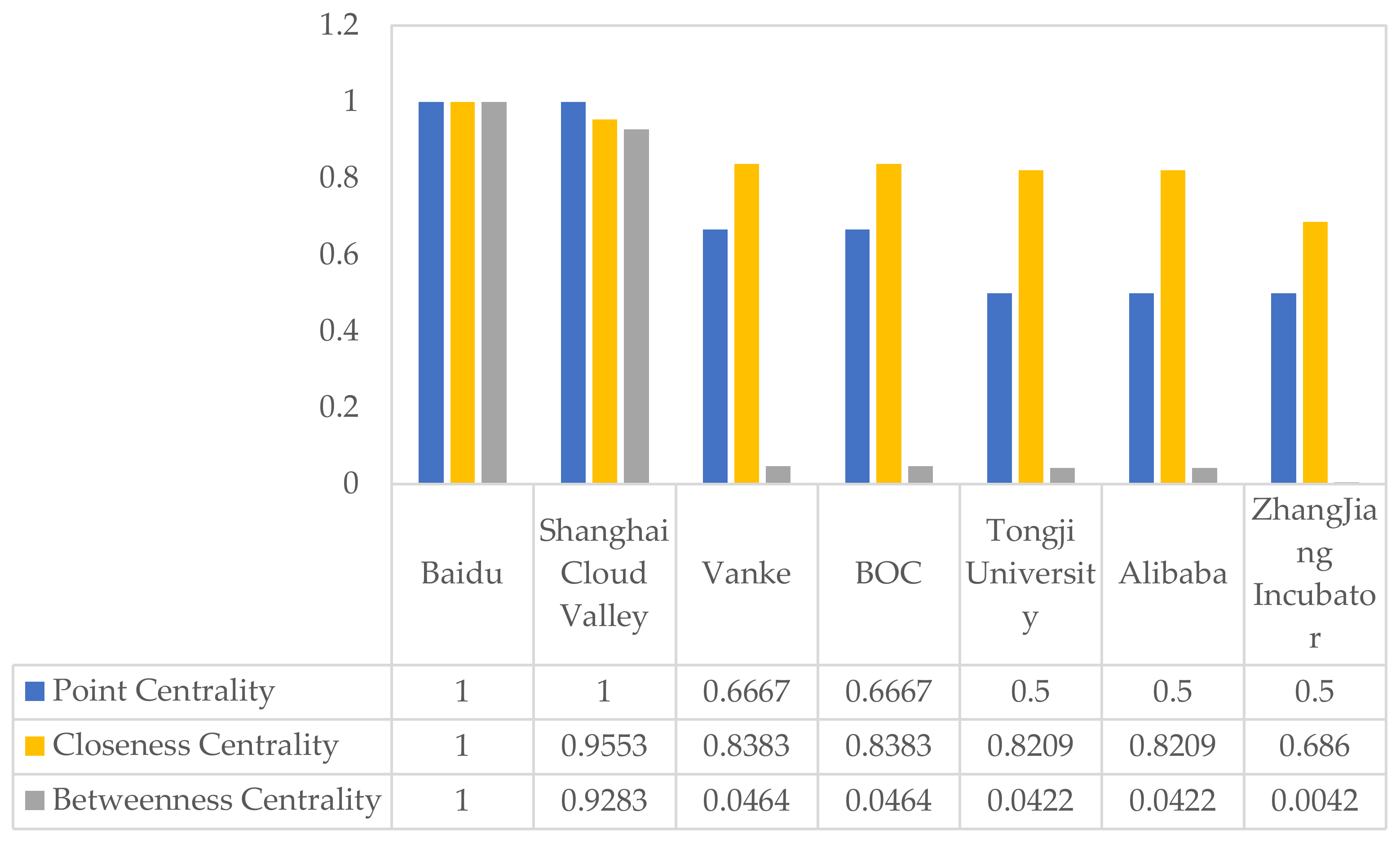

4.2.5. Subgroup Analysis of Industry-Driven Model

- (1)

- All three communities were very small, especially the Design Resource Cooperation community, which had no network contact with the other two communities, resulting in the destruction of the connectivity of the overall network. The industry-driven model was the only disconnected network among the six models.

- (2)

- The E–I indices of all three communities were negative and highly close to −1, indicating that the three communities were independent, and the faction degree was very high.

- (3)

- Because network connectivity was disrupted, the Simmel connection point did not exist. However, for the Baidu and Shanghai Cloud Valley communities, CBC was the bridge of the two communities, indicating that the investment and financing institution has been playing an important role in the development of the two communities.

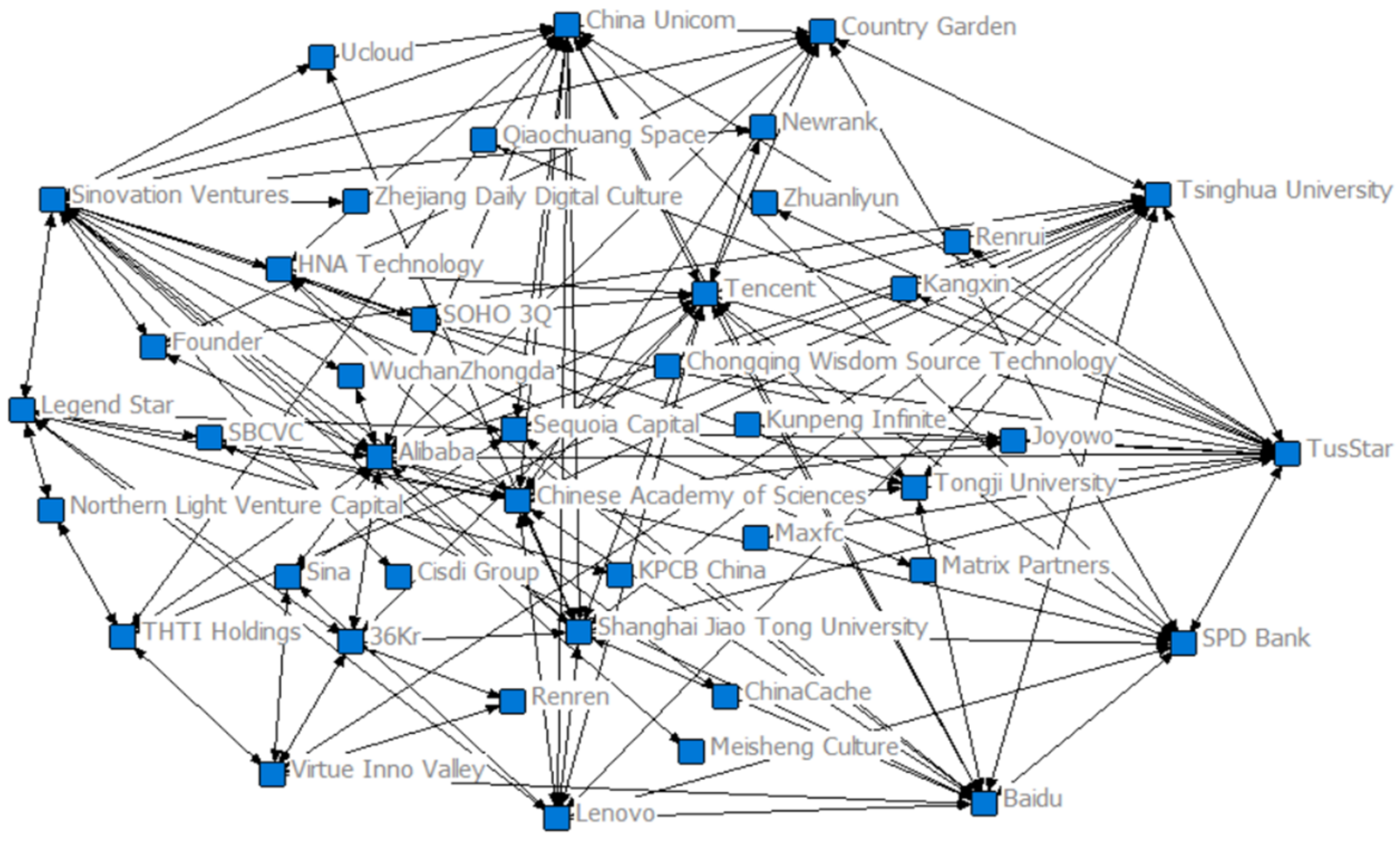

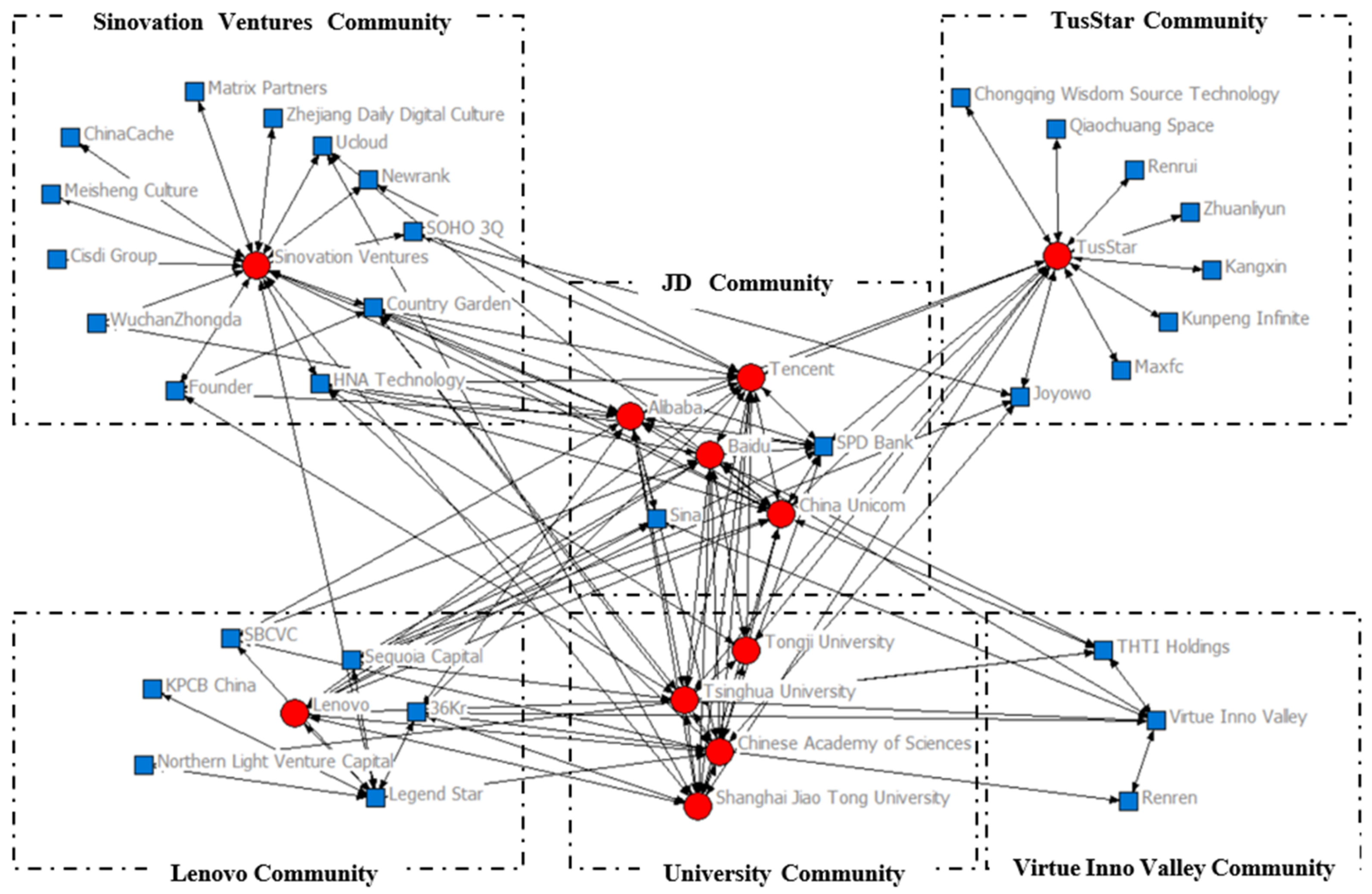

4.2.6. Subgroup Analysis of Angel-Investment Model

- (1)

- The scales of six communities were all smaller but more balanced compared to those of the other models. The University community appeared for the first time as the TusStar Incubator, initiated by the Tsinghua Science Park, which is a research cooperation platform that integrates the industry with the scientific and technological innovation resources of universities.

- (2)

- The E–I indices of four communities were positive, while the E–I indices of the Sinovation Ventures and TusStar communities with a larger scale were negative. However, the negative E–I indices tended to be zero, suggesting that the openness of each community was good, and the cooperation between and within communities was sufficient.

- (3)

- Universities such as Shanghai Jiao Tong University, Internet enterprises such as Alibaba and Tencent, real-estate enterprises such as Country Garden, and investment and financing institutions such as SPD Bank were typical Simmel connections, which indicates that the angel-investment model had a relatively rich industrial ecology, and good industrial integration and coordination among different enterprises and organizations.

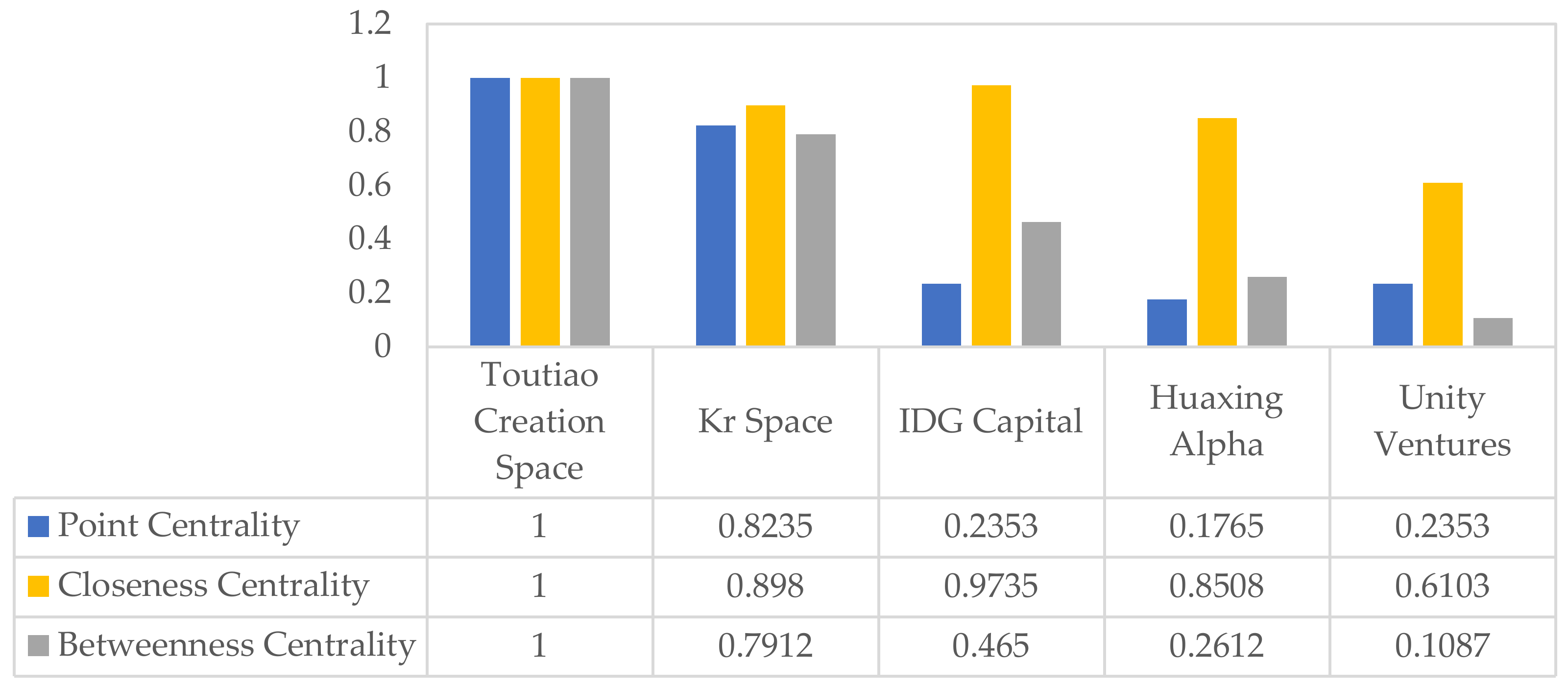

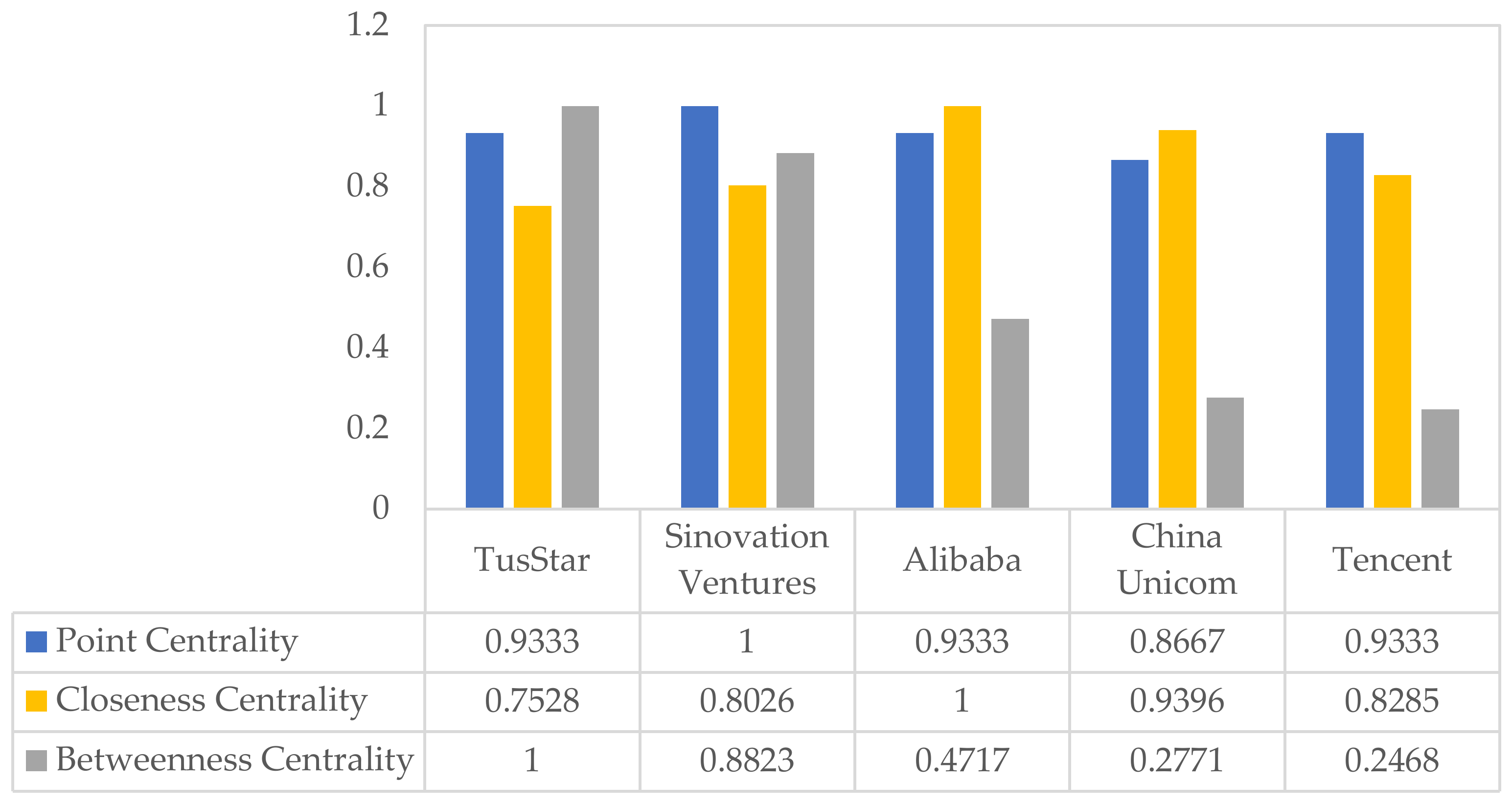

4.3. Results and Discussion of Centrality-Comprehensive Index

- (1)

- The top five nodes of six models include coworking, Internet, real-estate, and investment and financing enterprises, and universities, which also verifies that the ecological diversity of China’s coworking industry was good, and cross-border characteristics were very significant.

- (2)

- Among the 28 nodes ranking among the top five, 13 were coworking enterprises, accounting for the largest proportion, and all were incubators or maker space operation enterprises, which fully proves that the integration of China’s coworking industry with incubators and maker spaces was very high, so the coworking industry plays an increasingly important role in upgrading China’s mass entrepreneurship and innovation.

- (3)

- Internet enterprises JD group, Tencent, and Alibaba ranked in the top five among the six models, which shows that Internet giants both play a very important role in the development of China’s coworking industry, and have adopted the strategy of ecological development, especially Alibaba, ranking in the top five models in the new real-estate, angel-investment, and industry-driven models.

- (4)

- The proportion of investment and financing enterprises in the top five nodes was relatively low, and all existed in the media-platform model, which shows that China’s coworking industry is relatively less dependent on capital. This is one of the reasons why only the coworking industry sprung up at the turning point of the decline of China’s sharing economy after a large amount of capital investment.

5. Conclusions and Discussion

5.1. Discussion and Significance

- (1)

- Supporting and encouraging the development of China’s coworking industry, and conducting appropriate supervision. The coworking industry has been faced with a series of challenges since the early stage of development, such as fuzzy industrial boundary, complex environments, and the localization of international business models. Therefore, it is necessary to encourage and support the development of China’s coworking industry with an inclusive attitude by ensuring the market-oriented certification of coworking enterprises from legal and institutional aspects, simplifying the approval process, issuing supporting registration implementation rules, and giving fair market competition status. While encouraging development, supervision is also an important guarantee to ensure the sustainable development of the industry. It is also imperative to build a systematic standard from the aspects of property management, securities, and compensation.

- (2)

- Exploring the localization development path of the coworking industry from the perspective of Chinese culture. Most of the coworking industry in Western countries adopted station sharing, represented by WeWork, which is originated from the prevailing sharing culture and relatively mature entrepreneurial atmosphere in European countries and the US. However, China’s innovation culture is mostly based on teams, which has more obvious boundary awareness and the need for private offices. Therefore, it is necessary to explore the development path with Chinese characteristics on the premise of fully comparing the cultural differences between China and other countries. For example, China’s coworking industry should strengthen social functions and enhance the stickiness of community, and actively promote upgrading and transforming from “coworking” to “coliving”.

- (3)

- Formulating targeted industrial policies according to the development stages and characteristics of different development models. For example, in terms of the large-leading-enterprise model, how to guide leading enterprises, especially advanced manufacturing enterprises, to cross the boundary into the coworking industry is an important engine to realize the convergence of the manufacturing and service industries.

- (4)

- Improving industrial concentration and speeding up the cultivation of leading enterprises. In the boom of mass entrepreneurship and innovation, with a sharp increase in the number of involved enterprises, the trend of mergers and acquisitions is more significant, and the head effect appears. Therefore, enterprises in different development models need to find complementary enterprises for mergers and acquisitions to integrate their advantageous resources. Leading enterprises should actively raise funds, arrange sites, share resources, gather upstream and downstream enterprises, and establish industrial ecological networks to promote the sustainable development of the industry.

5.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- The State Council. The State Council’s Opinions on Several Policy Measures to Vigorously Promote Mass Entrepreneurship and Innovation. Available online: http://www.gov.cn/xinwen/2015-08/05/content_2909039.htm (accessed on 5 August 2015).

- The State Council. The State Council on Promoting the Development of High-Quality Innovative Undertaking to Build the “Double Gen” Upgrade. Available online: http://www.gov.cn/zhengce/content/2018-09/26/content_5325472.htm?trs=1 (accessed on 26 September 2018).

- Chase, R. Sharing Economy: Restructure New Business Model; Zhejiang People’s Publishing House: Hangzhou, China, 2015. [Google Scholar]

- Alraeeini, M.; Zhong, Q.; Antarciuc, E. Analysing drivers and barriers of accommodation sharing in Dubai using the grey-DEMATEL approach. Sustainability 2019, 11, 5645. [Google Scholar] [CrossRef]

- Zhao, D.; Xue, Y.; Cao, C.; Han, H. Channel selection and pricing decisions considering three charging modes of production capacity sharing platform: A sustainable operations perspective. Sustainability 2019, 11, 5913. [Google Scholar] [CrossRef]

- Laurenti, R.; Singh, J.; Cotrim, J.M.; Toni, M.; Sinha, R. Characterizing the sharing economy state of the research: A systematic map. Sustainability 2019, 11, 5729. [Google Scholar] [CrossRef]

- Zhang, D.; Shi, Y.; Li, W. China’s sharing economy of mobility industry: From perspective of industrial ecosystem. Sustainability 2019, 11, 7130. [Google Scholar] [CrossRef]

- Iresearch Market Consulting Co., LTD. Research Report on China Co-Working Industry. 2017. Available online: http://www.199it.com/archives/1220145.html (accessed on 17 April 2017).

- Mao, D.; Gao, D. Hack Away at Corporate Barriers: Co-Working in an Era of Sharing; China Renmin University Press: Beijing, China, 2017. [Google Scholar]

- Castilho, M.F.; Quandt, C.O. Collaborative capability in coworking spaces: Convenience sharing or community building? Technol. Innov. Manag. Rev. 2017, 7, 32–42. [Google Scholar] [CrossRef]

- Waters-Lynch, J.; Potts, J. The social economy of coworking spaces: A focal point model of coordination. Rev. Soc. Econ. 2017, 75, 417–433. [Google Scholar] [CrossRef]

- Gong, F.; Ouyang, H.; Yi, C. Research on business model of shared office space based on sharing economy. Mark. Mod. 2017, 1, 247–248. [Google Scholar]

- Zhang, Y.; Mao, J. Research on business Model Innovation and Growth Strategy of Shared Office Space—A case study of Youke Workshop. Sci. Technol. Prog. Policy 2017, 34, 1–8. [Google Scholar]

- Yao, Y. WeWork: Sell shared office space as a product. China Small Medium Enterp. 2017, 03, 52–54. [Google Scholar]

- Feng, H.; Qu, W. Social network and innovation entrepreneurship of Crowd maker space—Based on case study of startup Café. Sci. Res. Manag. 2019, 40, 168–178. [Google Scholar]

- Duan, C.; Jia, W. The operation of shared office space under the sharing economy: A case study of Zhong chuang space in China. Urban Dev. 2018, 06, 74–75. [Google Scholar]

- Zhang, J.; Xu, X. Research on the development and optimization of joint office space under the background of sharing economy. Farm Econ. Manag. 2020, 09, 48–50. [Google Scholar]

- Berbegal-Mirabent, J. What do we know about co-working spaces? Trends and challenges ahead. Sustainability 2021, 13, 1416. [Google Scholar] [CrossRef]

- Wang, C. Rethinking joint office from the source of asset end and service end—Taking You Ke workshop as an example. China Real Estate 2020, 11, 50–53. [Google Scholar]

- Wang, Q. An analysis of the teaching reform path of “college students’ innovation and entrepreneurship” course based on constructivism theory. J. Chengdu Inst. Technol. 2019, 22, 72–76. [Google Scholar]

- Lin, X.; Gao, S.; Liu, X. The basic types, business model and theoretical value of maker space. Stud. Sci. Sci. 2016, 34, 923–929. [Google Scholar]

- Wang, Q. Profit model analysis and optimization suggestions for joint office space. Mod. Bus. Trade Ind. 2019, 40, 48–50. [Google Scholar]

- Cao, S.; Yang, C. Research on the operation performance and development of regional maker space—Based on the research of Wuxi joint office maker space. Mark. Wkly. 2020, 33, 22–24. [Google Scholar]

- Chen, H. Analysis on the business model and development trend of China’s shared office format. Enterp. Reform Manag. 2020, 08, 107–108. [Google Scholar]

- Xu, J.; Xu, R.; Zhang, J. Research on the influence mechanism of sharing economy on innovation behavior of small and medium-sized enterprises—Taking Su qian area as an example. Times Financ. 2019, 15, 42–43. [Google Scholar]

- Xu, G.; Lin, G. Social networks for public participation in innovation: Maker culture and maker space. Sci. Sci. Manag. S T 2016, 37, 11–20. [Google Scholar]

- Cheah, S.; Ho, Y.-P. Co-working and sustainable business model innovation in young firms. Sustainability 2019, 11, 2959. [Google Scholar] [CrossRef]

- Feng, H. Strategy analysis of multi-layer capital market to promote the development of science and technology enterprises—Taking Shandong as an example. Times Financ. 2019, 32, 26–28. [Google Scholar]

- Okano, M.T. Interorganisational networks and social innovation: A study in milk production chain. Int. J. Innov. Sustain. Dev. 2017, 11, 317–335. [Google Scholar] [CrossRef]

- Hamari, J. The Sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 2047–2059. [Google Scholar] [CrossRef]

- Rong, C.H. Analysis on the relationship between material, credit and time-space economy of internet sharing mobility. Manag. World 2018, 4, 101–112. [Google Scholar]

- Choi, J.W.; Kim, H.Y. Preparation of study on social network analysis in the sharing economy of tourism field. Indian J. Public Health Res. Dev. 2018, 9, 981–985. [Google Scholar] [CrossRef]

- Lee, J.H.; Choi, J.W.; Kim, K.Y. Segmenting Korean millennial consumers of sharing economy services on social networking: A psychographic-based approach. J. Internet Comput. Serv. 2015, 16, 109–121. [Google Scholar]

- Martin, P.F.; Florian, U.; Gohar, F.K.; Marko, S.; Andy, N.; Tobias, S. From goods to services consumption: A social network analysis on sharing economy and servitization research. J. Serv. Manag. Res. 2018, 2, 3–16. [Google Scholar]

- Gao, S.Y.; Zhang, Y.; Liu, H.B. Social network analysis to the value creation of sharing economy business model. J. Tech. Econ. Manag. 2019, 7, 79–84. [Google Scholar]

- Chen, Y.; Liu, F.Z.; Wu, J. Studying users’ interaction behaviors of sharing economic platform with 2-mode complex network analysis. Data Anal. Knowl. Discov. 2017, 1, 72–82. [Google Scholar]

- Luo, J.D. Social Network Analysis; Social Sciences Academic Press: Beijing, China, 2015. [Google Scholar]

- China Business Industry Research Institute. A Research Report on the Development Prospect of China’s Shared Office Industry. 2018. Available online: https://www.askci.com/news/chanye/20180817/1535581129232.shtml (accessed on 17 August 2018).

- Ai Media Life and Travel Industry Research Center. Sharing Economy Industry Panorama Research Report (2018–2019). 2019. Available online: https://www.iimedia.cn/c400/66502.html (accessed on 24 October 2019).

- Johnson, S.E. Ecosystem Ecology; Science Press: Beijing, China, 2018. [Google Scholar]

- Michael, B.; Colin, R.; John, L. Ecology: From Individual to Ecosystem, 4th ed.; Higher Education Press: Beijing, China, 2016. [Google Scholar]

- Zhao, D.Z.; Li, G. Development from network organization to business ecosystems. Ind. Eng. J. 2005, 1, 24–28. [Google Scholar]

- Shi, L.; Chen, W.Q.A. Industrial ecology in China: Retrospect and prospect. Acta Ecol. Sin. 2016, 36, 7158–7167. [Google Scholar]

- Liu, L.D. Internet Ecosystem; China Zhigong Publishing House: Beijing, China, 2018. [Google Scholar]

- Moore, J.F. Predators and prey: A new ecology of competition. Harv. Bus. Rev. 1993, 71, 75–83. [Google Scholar] [PubMed]

- Li, Q.; Jie, X.W. The value evaluation study of keystone corporation business ecosystem based on analysis of comparation between Huawei and ZTE. Sci. Technol. Prog. Policy 2012, 29, 110–114. [Google Scholar]

- Paul, H. The Ecology of Commerce; Shanghai Translation Publishing: Shanghai, China, 2001. [Google Scholar]

- Zhang, Z.; Wang, F.Y.; Zhang, Y.M. Cloud innovation and construction of internet finance ecosystem: Case study of Ali Fin-Cloud. Res. Econ. Manag. 2017, 38, 53–60. [Google Scholar]

- Yi, P.-T.; Li, W.-W. Induced cluster-based OWA operators with reliability measures and the application in group decision-making. Int. J. Intell. Syst. 2019, 34, 527–540. [Google Scholar] [CrossRef]

- Chen, Z.; Liu, S.; Wu, H.; Tang, G. Research on the rise of innovation space, innovation city leading and global innovation driven development differential pattern. Econ. Geogr. 2017, 37, 23#x2013;31+39. [Google Scholar]

- Luo, M.; Li, L.Y. Innovation of business model in internet era: From value creation perspective. China Ind. Econ. 2015, 1, 95–107. [Google Scholar]

- Insights. Investment Potential Analysis and Future Prospect Forecast Report of China’s Shared Office Industry (2019–2025). 2019. Available online: https://www.chyxx.com/research/201905/736814.html (accessed on 22 October 2019).

| Model | Business Features | Representative |

|---|---|---|

| Media platform | Core resource: powerful media platform Advantages: improvement in reputation and capital-docking ability | Kr Space, Demo Space, Toutiao Creation Space |

| Large leading enterprise | Core resource: large enterprises with strong financial and technological resources Advantages: enter supply-chain network of large enterprises. | HCH, Baidu Developer Entrepreneurship Center |

| New real estate | Core resource: large real-estate developers Advantages: flexible leasing space and open entrepreneurial environment | Daydayup, SOHO 3Q |

| Open space | Core resource: basic office space and equipment Advantages: low rent | Garage Cafe, Innospace |

| Industry-driven | Core resource: government or industrial association Advantages: government support and plenty of industrial resources | Shanghai Zhangjiang Incubator, Shanghai cloud valley |

| Angel investment | Core resource: angel investment Advantages: specialized entrepreneurial services and financial support | Sinovation Ventures, TusStar |

| Model | Media Platform | Large Leading Enterprise | New Real Estate | Open Space | Industry-Driven | Angel Investment | |

|---|---|---|---|---|---|---|---|

| Scale | Nodes | 40 | 41 | 98 | 89 | 17 | 42 |

| Lines | 114 | 204 | 336 | 274 | 48 | 238 | |

| Degree | 0.0731 | 0.1244 | 0.0353 | 0.035 | 0.1765 | 0.1382 | |

| Graph centrality | 0.4089 | 0.3423 | 0.4901 | 0.2432 | 0.2958 | 0.2646 | |

| Density comprehensive index | 0.1627 | 0.1905 | 0.1501 | 0.0895 | 0.2238 | 0.1833 | |

| Media Platform | Large Leading Enterprise | New Real Estate | Open Space | Industry-Driven | Angel Investment | |

|---|---|---|---|---|---|---|

| E–I Index | –0.789 | –0.157 | –0.417 | –0.372 | –0.833 | 0.261 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | Real-Estate Enterprise | Universities | E–I Index |

|---|---|---|---|---|---|---|---|---|

| Kr Space | 23 nodes | 5 types | 3 nodes | 9 nodes | 8 nodes | 2 ndes | 1 node | −0.829 |

| Toutiao Creation Space | 17 nodes | 3 types | 1 node | 9 nodes | 7 nodes | - | - | −0.727 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | E–I Index |

|---|---|---|---|---|---|---|

| HCH | 18 nodes | 3 types | 3 nodes | 6 nodes | 9 nodes | −0.762 |

| TCL Creative Space | 9 nodes | 2 types | 4 nodes | - | 5 nodes | 0.100 |

| Tencent | 6 nodes | 3 types | 1 node | 1 node | 4 nodes | 0.000 |

| JD | 5 nodes | 2 types | - | 3 nodes | 2 nodes | 0.487 |

| Baidu | 3 nodes | 3 types | 1 node | 1 node | 1 node | 0.529 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | Real-Estate Enterprise | E–I Index |

|---|---|---|---|---|---|---|---|

| Ucommune | 42 nodes | 4 types | 4 nodes | 22 nodes | 7 nodes | 9 nodes | −0.472 |

| Woospace | 35 nodes | 4 types | 1 node | 6 nodes | 27 nodes | 1 node | −0.556 |

| Daydayup | 12 nodes | 3 types | 1 node | 9 nodes | 2 nodes | - | −0.412 |

| JD | 9 nodes | 4 types | 2 nodes | 1 node | 4 nodes | 2 nodes | 0.020 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | Real Estate Enterprise | E–I Index |

|---|---|---|---|---|---|---|---|

| Nashwork | 22 nodes | 4 types | 1 node | 8 nodes | 11 nodes | 2 nodes | −0.314 |

| Mydreamplus | 19 nodes | 3 types | 1 node | 11 nodes | 7 nodes | - | −0.350 |

| People Squared | 16 nodes | 3 types | 2 nodes | 5 nodes | 9 nodes | - | −0.488 |

| TechTemple | 11 nodes | 3 types | 2 nodes | 2 nodes | 7 nodes | - | −0.158 |

| Innospace | 8 nodes | 2 types | 2 nodes | 6 nodes | - | - | −0.556 |

| Garage Cafe | 8 nodes | 3 types | 1 node | 1 node | 6 nodes | - | −0.846 |

| 3W | 5 nodes | 3 types | 1 node | 3 nodes | 1 node | - | −0.333 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | Real-Estate Enterprise | University | E–I Index |

|---|---|---|---|---|---|---|---|---|

| Baidu | 8 nodes | 5 types | 2 nodes | 2 nodes | 2 nodes | 1 node | 1 node | −0.875 |

| Shanghai Cloud Valley | 7 nodes | 3 types | 1 node | 3 nodes | 3 nodes | - | - | −0.714 |

| Design Resource Cooperation | 2 nodes | 2 types | 1 node | - | 1 node | - | - | −1.000 |

| Community | Scale | Diversity (Number of Enterprise Types) | Coworking Enterprises | Investment and Financial Institution | Internet Enterprise | Real-Estate Enterprise | University | E–I Index |

|---|---|---|---|---|---|---|---|---|

| Sinovation Ventures | 13 nodes | 4 types | 3 nodes | 3 nodes | 6 nodes | 1 node | – | −0.040 |

| TusStar | 9 nodes | 2 types | 2 nodes | – | 7 nodes | – | – | −0.231 |

| Alibaba | 6 nodes | 2 types | – | 1 node | 5 nodes | – | – | 0.420 |

| Lenovo | 7 nodes | 3 types | 1 node | 5 nodes | 1 node | – | – | 0.333 |

| University | 4 nodes | 1 type | – | – | – | – | 4 nodes | 0.545 |

| Virtue Inno Valley | 3 nodes | 3 types | 1 node | 1 node | 1 node | – | – | 0.385 |

| Rank | Media Platform | Large Leading Enterprise | New Real Estate | Open Space | Industry-Driven | Angel Investment |

|---|---|---|---|---|---|---|

| 1 | Toutiao Creation Space (0.999) | HCH (0.931) | Ucommune (0.999) | Nashwork (0.979) | Baidu (0.999) | TusStar (0.895) |

| 2 | Kr Space (0.838) | JD (0.859) | Woospace (0.735) | Mydreamplus (0.928) | Shanghai Cloud Valley (0.961) | Sinovation Ventures (0.895) |

| 3 | IDG Capital (0.558) | Haier (0.858) | JD (0.302) | People Squared (0.734) | BOC Vanke (0.517) | Alibaba (0.802) |

| 4 | Huaxing Alpha (0.429) | TCL Creative Space (0.584) | Alibaba (0.300) | Tencent (0.592) | Tongji University Alibaba (0.454) | China Unicom (0.694) |

| 5 | Unity Ventures (0.318) | Baidu (0.546) | MI (0.296) | E-Supporting (0.536) | ZhangJiang Incubator (0.397) | Tencent (0.669) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, D.; Yan, M.; Wang, H.; Li, W. Sustainable-Development Measurement of China’s Coworking Industry Using Social-Network Analysis Method. Sustainability 2021, 13, 5902. https://doi.org/10.3390/su13115902

Zhang D, Yan M, Wang H, Li W. Sustainable-Development Measurement of China’s Coworking Industry Using Social-Network Analysis Method. Sustainability. 2021; 13(11):5902. https://doi.org/10.3390/su13115902

Chicago/Turabian StyleZhang, Danning, Ming Yan, Haowen Wang, and Weiwei Li. 2021. "Sustainable-Development Measurement of China’s Coworking Industry Using Social-Network Analysis Method" Sustainability 13, no. 11: 5902. https://doi.org/10.3390/su13115902

APA StyleZhang, D., Yan, M., Wang, H., & Li, W. (2021). Sustainable-Development Measurement of China’s Coworking Industry Using Social-Network Analysis Method. Sustainability, 13(11), 5902. https://doi.org/10.3390/su13115902