Abstract

Budgetary constraints are prompting many governments to encourage private financing of transport infrastructure through public–private partnerships (PPPs). Fiscal support measures are often used to improve the financial feasibility of PPPs and to rebalance the economics of contracts to compensate for government-imposed changes. In the latter case, information asymmetry, political haste, and lack of competition may lead to poor government decisions in establishing support measures. Furthermore, lack of government support may lead to early termination of contracts and non-implementation of projects with high potential social benefits. This paper analyzes the awarding of subordinated public participation loans (SPPLs) to 10 brownfield shadow-toll highway PPPs in Spain after the government imposed additional works. It is hypothesized that, given the political importance of the projects and the viability problems they soon experienced, the government may not have set out the terms of SPPLs efficiently. This paper evaluates the financial and social impacts of awarding these loans to three of these projects to assess whether the government’s decision to support them was justified from a sustainable perspective. The results show that, while the government’s decision was reasonable, the design of the SPPL and its awarding conditions should be improved to ensure the public interest.

1. Introduction

Sustainability and infrastructure share a common goal: meeting the current and long-term needs of society [1,2]. How infrastructure systems are selected, designed, financed, and managed today will have a major role in how those systems affect society and the environment now and in future years [2]. In this respect, several authors have stressed the importance of integrating sustainability principles into the decision-making process to ensure the viability of projects from a sustainability perspective and thus achieve sustainable infrastructure development [2,3,4]. For an infrastructure project to be viable from the sustainability point of view, it should address the three sustainable development dimensions—namely, social, environmental, and financial [5,6]. Social sustainability refers to the social benefits and equity derived from infrastructure; environmental sustainability refers to the impact of infrastructure and its use on the health and welfare of the population and the environment; and financial sustainability refers to the governments capacity to meet the financial obligations resulting from infrastructure investments, both in the short and long term.

Different studies have shown the importance of infrastructure in promoting economic growth, social equity, and productivity [7,8]. However, many countries in both developed and developing regions around the world face aging or lack of infrastructure while, at the same time, dealing with financial constraints on public funding to control the public deficit. This situation has led many governments to implement new mechanisms to encourage the participation of the private sector in the financing of transport infrastructure [9]. In this respect, public–private partnerships (PPPs) and concession approaches have acquired special prominence particularly regarding the construction and operation of transport facilities. Through this scheme, the private sector finances, builds, maintains, and operates the infrastructure in exchange for a fee linked to either demand or availability for a period of time that has been contractually agreed upon in advance [10]. That way, governments can benefit from the expertise and efficiency of the private sector, and focus instead on policy, planning, and regulation [11]. In the last few years, many developed countries are also implementing this approach to upgrade and maintain brownfield projects.

In some cases, governments provide aid to PPP contracts through different fiscal support measures such as subsidies, in-kind grants, tax credits and exemptions, or traffic or exchange guarantees, to mention just a few examples. These measures have two main goals. The first is to ensure the financial feasibility of a project that, because of its positive externalities, is good for the society as a whole, while the second is to mitigate risks that otherwise would be unmanageable by private stakeholders [12]. However, this form of government intervention has an impact on public resources, either in the short or the long term, which might be either immediate or contingent. This fact makes it necessary to assess the suitability of the measure and the consequent government exposure to risk to ensure the financial sustainability of the public sector.

This paper evaluates the awarding of subordinated public participation loans (SPPLs) to 10 highway PPPs in Spain. SPPLs are government loans, subordinated to the senior debt, intended to both increase the financial feasibility of projects and establish a fairer means of sharing profits between the private sector and the government [12]. These subordinated loans are usually implemented at an early stage of the procurement process, as they are offered to bidders during the tender. However, they have also been given by the Spanish government at a later stage to improve the viability of PPPs in the event of poor economic performance or even on the brink of bankruptcy.

In this paper, we study the use of SPPLs as a means to rebalance the economics of a set of brownfield shadow-toll PPPs in Spain (known as first-generation highways) after the government imposed additional works not included in the original contracts. On the one hand, the upgrading of these highways, built back in the 1980s, was deemed necessary by the government given the large increase in traffic volumes and accident rates they experienced. On the other hand, the conditions of these loans were very advantageous for the PPP contractors, to the point that they could be considered insufficient to guarantee the interest of the State against that of the shareholders.

The objective of this research is to evaluate whether the government’s decision to support these projects was justified from a sustainability standpoint. We focus on the social and financial dimensions of sustainability through analysis of the social benefits of the projects and the financial viability of the loans. To that end, an ex-post evaluation of the financial and social impacts of the awarding of SPPLs to three out of the ten PPP contracts of the first-generation highways is carried out. SPPLs have been found interesting by previous researchers. Vassallo and Sanchez-Solino [12] studied the SPPLs offered to a set of toll highway concessions in the procurement process. These authors analyzed from a theoretical point of view how SPPLs work and the strategic incentives they produce among bidders. However, they did not study the performance of the loans once awarded. For their part, Lara et al. [13] focused on quantifying the real value provided to the PPP contractors of the first-generation highways through the SPPLs by employing a real options model that is later applied to one of the sections. To that end, they calculate the net present value (NPV) of the loan for different scenarios of traffic growth. However, these authors do not conduct any analysis intended to analyze the sustainability of the public loan from a global perspective. Neither do they study the impact that the payback of the loan may have on the future budget. The research conducted in this paper intends to fill the gap left by the aforementioned research works by conducting an ex-post sustainability analysis of SPPLs on the basis of the real information collected 10 years after the PPPs were awarded.

The analysis conducted in this paper is relevant for several reasons. First, evaluating the ex-post sustainability performance of the public support provided to the PPP projects is very important to analyze the effectiveness of the mechanism itself, in order to provide guidelines to governments that may implement this mechanism in the future. Second, to the best of our knowledge, most of the previous research works study the existing support mechanisms in different countries [14,15] by focusing on methodologies to quantify the value of different support mechanisms in order to analyze how they impact different stakeholders such as PPP contractors [16,17] or the government [17]. However, those studies do not pay much attention to the global impact on sustainability. Finally, the ex-post evaluation conducted in this paper identifies relevant policy implications that arise from the case study such as the importance of undertaking proper designs of the PPP contracts and the support mechanisms to be awarded, and of assessing the government’s exposure to risk when providing support to PPP projects.

The paper is organized as follows. After the present Introduction, Section 2 reviews the public support mechanisms mostly used in infrastructure PPP projects, their benefits and drawbacks, and the related literature. Section 3 focuses on the Spanish PPP context and describes how SPPLs are implemented to support infrastructure PPPs. Section 4 describes the case study, particularly regarding the context and conditions under which the SPPLs were awarded. Section 5 outlines the methodology adopted to evaluate the SPPLs performance from the sustainability point of view and the suitability of the government’s decision to support the projects. Section 6 presents the results of our analysis. Section 7 discusses the results and sets out the most relevant implications that emerge from the case study analyzed. Finally, Section 8 presents the main conclusions and points out further research questions.

2. Government Support: Literature Review

Government support has been broadly used to encourage the participation of private investors in the financing of public infrastructure through PPPs [18,19]. These schemes are very appealing for governments since they allow infrastructure to get built or modernized benefiting from the experience and technology innovation of the private sector with small public budget commitment. Therefore, this model allows governments to free up resources and optimize their investments in public infrastructure.

Public sector intervention is also common due to the incomplete nature of PPP contracts [20]. Governments may introduce contractual changes for reasons of public interest, thereby requiring the rebalancing of the economics of the contract to compensate the private sponsor for any requirements that are different from the ones originally set up in the contract. Depending on the legislation, the rebalance can be conducted automatically, according to the terms set up in the contract, or through a renegotiation between the government and the private sponsors. Renegotiations have the risk of being used opportunistically or strategically by sponsors to make a profit rather than address the incompleteness of the contract, thereby reducing the overall welfare of the project [21]. In some cases, well-founded renegotiations may end up being inefficient due to political pressure to accelerate the process or to adopt more politically convenient solutions in the short term that involve greater costs in the long term [22].

Irwin [23] states the importance of the rationale behind the decision to provide support for private infrastructure services, given the opportunity cost associated with the measure and, in the case of guarantees, the contingent liabilities they commit, which may have significant future budgetary impacts. This is even of greater importance in the post-financial crisis era since most of the governments have been obliged to rationalize and contain public expenditure to comply with the principles of budgetary stability. Thus, Irwin determines five different governments’ objectives that justify the implementation of fiscal support measures in infrastructure PPPs: (i) internalizing externalities in infrastructure markets; (ii) overcoming failures in markets for financing infrastructure; (iii) mitigating political and regulatory risks; (iv) circumventing political constraints on prices or profits; and (v) redistributing resources to the poor via infrastructure. However, government support mechanisms are usually prompted by financial-related considerations such as circumventing public spending, reducing the cost of capital [24], and providing aid to failing projects or projects experiencing financial difficulties at the detriment of taxpayers [25,26,27].

Public financial support can be provided through different measures [23]: direct or indirect subsidies (cash subsidies, in-kind grants, and tax breaks), capital contributions, and guarantees against risks. Cash subsidies or grants aim at either reducing the private commitment in the project or increasing the return of an otherwise unprofitable project, and they can be provided both during the construction or the operational phase [18]. In-kind grants are usually provided during the construction phase in the form of public assets, rights-of-way free of charge or at subsidized prices, or transfer of public land for their freely use during the concessional period. The goal of tax breaks or credits is to reduce the tax burden of infrastructure projects, thereby increasing the cash flow of the projects and the return to private investors.

Unlike subsidies, the impact of capital contributions and guarantees on government accounts will depend on the future performance of the project. Governments providing support through co-investment agreements—either in the form of equity, subordinated debt, or any other type of debt contribution—seek to receive a certain return depending on the size of the contribution and the risks borne. However, if the project fails and defaults, the government will have to absorb losses on outstanding debt or committed equity [28]. Public guarantees and back-up liquidity facilities are agreements under which the government bears some or all of the downside risks of a PPP project to improve its creditworthiness [24]. These guarantees are contingent liabilities so, unlike capital contributions, do not imply an initial disbursement of resources. However, if enforced, they bind the government to take on the obligations undertaken.

Public support has proven to be crucial in facilitating the feasibility of PPP projects [29,30,31]. In this respect, Dias and Ioannou [15] studied the financial effect of certain guarantees on the debt capacity of projects and how they affect the optimal capital structure. They found that the presence of guarantees increases the debt capacity of the owning company as the project becomes less risky and both the projects’ NPV and the investors’ return on investment. For its part, Wibowo [16] valued the financial impact of different types of public support mechanisms—minimum income guarantees, subsidized subordinated loans, and cash subsidies—on the expected rates of return obtained by debt and private equity investors. He concluded that they all improve the NPV of projects by increasing the expected return on equity (ROE) of the companies.

However, public support reduces the risks borne by the private investor at the expense of increasing the risk for the government. This may affect the value for money of the PPP solution that, in some cases, may end up being worse off compared to the conventional method of infrastructure provision, where most of the risks are assumed by the public sector [32]. If the deal does not achieve good value for money, the price paid for the infrastructure is higher than necessary, and the additional cost will inevitably be paid by users or taxpayers [33]. Moreover, if the risks arising from the support provided are not adequately analyzed and quantified, future liabilities may represent a heavy burden on the public budget and have a significant impact on the fiscal sustainability of countries [34]. The financial sustainability of the public sector has been compromised during the last decades by large increases in primary deficits and public debt, a trend that has been accentuated by the financial crisis and the following economic recession and that, in some cases, has led to sovereign debt defaults. Increasing debt and slow economic growth have also increased the cost of financing for many weak economies such as Spain, which has seen the national debt to GDP ratio rising from 35.60% in 2007 to 98.30% in 2017. In this context, financial sustainability has become a key issue for governments [35] and the importance of assessing fiscal vulnerabilities and risks, as well as the implementation of sound fiscal policies, has been stressed [36,37,38].

Thus, as a form of government intervention that involves a cost (either in the short or the long term), any kind of public support should demonstrate that it is in the public interest and subject to the principle of financial sustainability. That is, on the one hand, the expected benefits derived from the intervention must be met and passed on to society so that the measure is socially sustainable [6]; on the other hand, the government must be able to finance current and future spending commitments derived from the intervention within the limits of the deficit and public debt for it to be financially sustainable [5]. In this respect, Chen et al. [4] state that, for a PPP project to be implemented via a financially sustainable approach, governments must require the value for money test, the long-term financial affordability test in project design, and forbid government guarantees on private returns at the cost of the financial interests of future generations. Thus, the government exposure to risk and the cost–benefit analysis of the measure during its whole life cycle should be, but rarely is, carefully assessed to guarantee the long-term sustainability of the public finances. This issue has motivated much of the research work carried out regarding public support so far, either through theoretical analyses or through case studies. In this respect, Irwin [39] conducted a thorough compilation of government guarantees and provided techniques for measuring and valuing the government’s exposure to the risk that some of them may entail. Wibowo [17] studied the fiscal risk assumed by the Government of Indonesia as a result of the contingent liabilities undertaken when providing guarantees to PPP projects. Other researchers have focused on the quantification of the real value provided by governments to PPP projects through guarantees by using real options models [13,34,40].

The lesser experience of governments than private investors in PPP projects as well as the complexity of establishing ex-ante the potential contingencies arising from support mechanisms make it difficult for governments to define them in accordance with the win–win principle [31,41]. Properly establishing the conditions under which these mechanisms are provided is of utmost importance to ensure the public interest over that of the private sector, especially if they are not provided in the context of competition. In that latter case, where either the amount or the conditions are determined at the bidding stage, competition may lead to more optimal values for these mechanisms [42]. However, when public support is granted ex-post, it is usually because projects are experiencing financial problems and aid is indispensable for them to move forward. In this context, the political rush to avoid project failure and the consequent political costs involved may lead to wrong decisions in selecting and determining the support to be provided. Several researchers have focused on developing models that allow the correct specification of different types of support to protect the public interest while encouraging private participation and making the project economically feasible. In this regard, Carbonara et al. [43] and Buyukyoran and Gundes [44] both presented real-option-based models that set the upper and lower thresholds for minimum revenue guarantees that ensure a fair risk allocation structure between government and PPP contractor. The model calibrated by Brandao and Saraiva [34] allows to value minimum traffic guarantees and to introduce caps that limit the government exposure while maintaining the benefits to the private investor. Pellegrino et al. [41], for their part, elaborated a methodology to establish the optimal value of the interest rate cap that balances the interests of the parties involved in the project.

It is equally important to carry out ex-post evaluations of the provided public support. This way, the effectiveness of the support mechanisms can be checked to get lessons for future similar experiences. For instance, Xu et al. [31] evaluated the extent to which government guarantees awarded to 10 PPP projects in China were properly design based on the final performance of the projects and found that the government tended to assume excessive risk [31]. Vassallo [45] analyzed the performance of traffic risk mitigation mechanisms awarded to highway concessions in Chile and provided guidelines on their applicability in other countries. Carpintero et al. [46] also evaluated the implementation of these mechanisms on toll highways in different Latin American countries and found that they had not been very successful in reducing renegotiation rates or attracting private interest. Ex-post evaluation analysis is an approach often used by the European Union (EU), the European Investment Bank (EIB), or the World Bank to evaluate the impact of the support they provide to PPP projects (see e.g., [47,48,49]). However, these evaluations usually focus on very specific impacts of interest for the institution providing the support, and the role played by that institution during the implementation of the project. Thus, for example, the evaluations carried out at the EU level mainly focus on the financial value added to the projects [48] and/or whether the projects receiving support move forward and are delivered on time and budget [49,50]. For instance, the main variable analyzed by the World Bank support is the business performance of the projects.

In summary, most of the research undertaken so far regarding public support to PPP projects have focused on developing or applying methodologies to quantify their value and analyze their effect on either the public or the private partner. Also, to a lesser extent, some ex-post evaluations of projects receiving support have been carried out. However, little attention has been paid to evaluating the global impact that this support may have taking into account different perspectives. Our research work intends to evaluate the sustainability of the decision to support the projects considering the financial feasibility of the loan, its impact on the public budget, and the social benefits stemming from its application.

3. PPPs in Spain: Risk Allocation and Government Support Mechanisms

3.1. Background

Spain has extensive experience in promoting road infrastructure through concession and PPP contracts [51]. Since the late 1960s, 54 concessions totaling 3039 km have been awarded, 2539 km of which are state highways [52]. They were awarded mainly in two different periods: between 1967 and 1975, to cope with the scarcity of quality roads in the country, the increase in road traffic levels, and the lack of sufficient budgetary resources; and between 1996 and 2008, to develop new highways while meeting the requirements of the Stability and Growth Pact in terms of public deficit and debt. Between 1975 and 1996, the government opted for building free access highways fully financed through the public budget by widening and upgrading the most important Spanish roads. Since the late 1990s, a switch may be observed from toll schemes to shadow-toll and availability payment mechanisms. At the regional level, 26 shadow-toll projects totaling around 1200 km [53] have been awarded so far. On its part, the central government made use of this mechanism for the first time in 2007 when implementing the First-Generation Highway Plan, comprising 10 projects based on a combination of shadow-toll and availability payment approaches, and five years later with one project that relies entirely on availability payments, totaling 1042 km altogether.

3.2. Economics of PPP Contracts in Spain

Even though PPPs have allowed the construction and upgrade of an extensive network of high-quality highways with private financing, they have prevented neither excess capacity nor frequent recourse to the renegotiation of contracts, with consequent changes in initial terms, prices, and recourse to public aid [54]. In this respect, Spanish law obliges the government to reestablish the economic balance of the contract, to the benefit of the relevant party as it corresponds, in the following cases: (i) when the government modifies, for reasons of public interest, the contractual terms originally agreed—for example by requesting additional works to be carried out; (ii) when circumstances of force majeure or actions undertaken by the government lead directly to the substantial disruption of the economics of the contract; and (iii) when the assumptions established in the contract itself for its revision occur.

However, the Spanish government has gone beyond these causes when it comes to avoiding the bankruptcy of road concessions. This way of acting has been highly motivated by the effects of a legal provision (known as the State’s Financial Liability) included in the public contracts law that regulates the compensation to the PPP contractor in case of early termination of the contract. This clause commits the government to compensate the private sponsors for the works built and not yet depreciated in case that the early termination of the contract has not been caused by their negligence. It is worth noting that, until the amendment of the public contracts law in 2015 (Law 40/2015), bankruptcy caused by low traffic levels was not considered negligence by the private sector so it prompted this compensation. This situation encouraged the government not to let PPPs go bankrupt and, consequently, to assist them when they experienced financial difficulties [55].

As a result, a large number of concessions have had their economic balance restored so far at the expense of the user, the taxpayer, or both [54,56]. Mechanisms often used to adjust the economic balance of the contracts include contract term extensions, fare increases, ex-post introduction of revenue mitigation mechanisms, modification of the fare review system, and the awarding of cash subsidies or SPPLs. These government loans are presently the most important public instrument for supporting PPP contracts in Spain since they allow the financial feasibility of the projects to increase without increasing the national public deficit.

3.3. SPPL Regulation

SPPLs are currently regulated by Royal Decree-Law 7/1996, which defines them as a subordinated financial instrument whose main characteristic is that the lender would receive a variable interest based on the evolution of the outcomes of the borrowing company’s activity. The criteria to determine such evolution may be either profit, revenues, sales, or any other variable demanded by the government or freely agreed by the contracting parties. The characteristics of these loans can be freely designed by the government as long as they comply with three rules [12]:

- SPPLs must always be subordinated to other senior debt. Therefore, SPPL holders (the government in this case), will be repaid only after the PPP contractor has met its obligations to the senior lenders;

- The expected return of SPPLs must be related to the economic performance of the PPP contract. The idea behind this approach is that the government partially shares the profits and losses of the project with the private sponsors;

- The expected yield of SPPLs should be market-based since otherwise the government could make use of SPPLs to provide hidden subsidies that should be accounted for within the public deficit.

Likewise, and unless expressly stipulated otherwise, the PPP contractor may not amortize the borrowed capital in advance unless the early amortization implies the payment of the NPV of the expected future benefits according to the economic-financial plan revised and approved by the competent body of the government at the time of the return of the capital.

SPPLs have important advantages compared to other means of fiscal support [12]. They not only increase the financial feasibility of PPP contracts but also establish a fairer risk-sharing approach between the private sponsors and the government since unforeseen additional profits will be shared between them. Therefore, this mechanism aligns the interests of both parties since, as the interest rate to be paid by the sponsors to the government is related to the project performance, the better it performs, the larger the return of the SPPL will be. Also, unlike subsidies, this mechanism allows the PPP to receive aid from public resources without increasing the national public deficit. This is because SPPLs are treated for accounting purposes as financial transactions according to the European National Accounting Standards defined by Eurostat [57] as long as those financial investments are made under market conditions.

However, this mechanism has also some issues [12]. One of the problems is that the requirement established by EUROSTAT is difficult to prove wrong. As there is no competition, it is difficult to know if the loan is provided under market-based conditions. Therefore, the government could misuse this mechanism as an implicit subsidy by providing loans that the PPP contractor in the end will not be able to pay back. Also, this type of guarantee turns the government into a borrower of the project. Therefore, if the project does not perform as expected, the annual interest incurred will significantly decrease while the risk that the loan is not repaid will increase. Finally, if the supported project is unable to turn its financial position around and goes bankrupt, the contract must be liquidated with the consequent activation of the State’s Financial Liability. In that case, the government—and ultimately the taxpayer—will bear both the costs associated with assuming responsibility for the infrastructure and the non-repayment of the SPPL and its interests until the end of the contract.

3.4. Practical Implementation of SPPLs in Highway Concessions and PPPs in Spain

SPPLs have been implemented by the Spanish government either as an ex-ante support mechanism or as an ex-post means to rebalance the economics of concession and PPP contracts. Regarding the first case, the possibility of requesting SPPLs has been offered to the bidders at an early stage of the procurement process to strengthen the economic feasibility of the project and, consequently, encourage private participation in the tender. This approach was used, for example, in 2004 in the procurement of the Cartagena-Vera, the Madrid-Toledo, and the Ocaña-La Roda highways and the Alicante’s ring road; and, two years later, in the procurement of the Málaga-Alto de las Pedrizas highway [12].

However, SPPLs have also been granted to already awarded PPPs to compensate the contractor for amendments in the contracts or changes made by the government on the grounds of promoting the public interest—or even in an attempt to save a project from bankruptcy. The suburban toll highway concessions around Madrid (R-2, R-3, R-4, and R-5) represent a good example of the use of this instrument by the government in a failed attempt to avoid those concessions to go bankrupt. The economic performance of these concessions was damaged by the traffic shortfalls caused by the economic recession (and an overly optimistic estimate of the traffic demand) and large cost overruns in the expropriation process. In this context, the government granted SPPLs to help them pay the additional costs incurred when acquiring the right–of-way and to provide liquidity because of the revenue shortfall [56,58]. However, despite the regulatory and financial aid, estimated at around €600 million, all concessionaires eventually went bankrupt [26] and were bailed out by the government.

Another example of the use of SPPLs to rebalance the economics of the contract to compensate PPP contracts for a discretionary change in the initial contractual conditions by the government is the present case study. As it will be later explained, the private companies in charge of the first-generation highways were granted SPPLs as compensation for the government’s imposition of carrying out additional works not foreseen in the original projects.

4. Contract Analysis of the First-Generation Highway PPPs

4.1. Main Characteristics

In 2006, the Spanish Ministry of Transportation (MT) launched the First-Generation Highways Plan (hereinafter the Plan). Its purpose was to improve the alignment standards, quality, and safety levels of a set of important Spanish highways that were built at the beginning of the 1980s with quality standards far below those of the highways designed and built years later, which made these roads much less safe than the rest of the network. Given the budgetary constraints of the government and the need to improve the roads as soon as possible, the government decided to procure them using a PPP approach. Thus, the MT tendered the upgrading, maintenance, and operation of eleven brownfield sections (see Figure 1), totaling 993 km, which were finally awarded during 2007.

Figure 1.

Highway sections comprising the First-Generation Highway Plan. Source: MT.

The contracts included three types of works: (i) initial works to adjust the design of the highway to the current technical and functional standards required; (ii) major repairs to guarantee the proper level of service; and (iii) routine maintenance activities throughout the life of the contract. The private sector was entrusted with the design, financing, construction, and operation of the infrastructure for a period of 19 years. The highways were tendered based on preliminary designs conducted by the government. However, the final PPP contractor was responsible for conducting the definitive designs that had to be approved by the government.

The government decided to keep the highways free of charge by using a combination of shadow-toll and availability payment approaches, committing itself to pay a fee to the PPP contractor based on both traffic demand and a set of performance indicators during the life of the contract. The “demand fee” is monthly calculated according to (i) the type of vehicle (light or heavy); (ii) the number of vehicles-kilometers of each type that run on the highway; (iii) the fare applicable to each type of vehicle per kilometer traveled; (iv) until the full completion of the initial works, the percentage of the highway sections in service at the end of the previous year; and (v) the correction factor, upwards or downwards, depending on the performance indicators stated in the contract that measure the condition of the road and the quality of service provided.

4.2. Amendments to the Contracts

All contracts were awarded in 2007, before the economic crisis started, so traffic estimates were made on the basis of high future economic growths that ultimately did not occur. The crisis, which started in 2008 and reached its peak in 2013, had a major impact on actual traffic volumes on the highways. This situation was exacerbated by high competition in the tendering process that encouraged bidders to make aggressive offers. The offers of the winning bidders were in some cases about 58% below the estimates originally conducted by the government.

Once the contracts were awarded, the government was reluctant to approve the definitive designs provided by the PPP contractors on the grounds that they were not of sufficient quality. The PPP contractors, in turn, complained that their designs complied with the regulations and standards set by the government. This dispute caused significant delays in the start of construction. In the middle of this dispute, the economic crisis burst with force, causing a deterioration of the financial conditions originally foreseen by all PPP contractors. As the works had not started, PPP contractors had not reached financial close at the time.

In these circumstances, the feasibility of the contracts was at risk, and with it the possibility of improving the highways and, henceforth, their safety rates. Despite delays and financial problems, the government still wanted the works done. For this reason, in 2010 the government prompted an overall change in the terms of the contracts to include additional works and impose stricter requirements considered indispensable to provide the right service, and also to help PPP contractors find the financing that, by then, was extremely difficult to obtain in the financial markets.

According to Spanish law, the government has the right to change the terms of the contract to bring it closely into line with the public interest. If this change affects the economic balance of the contract, the initial conditions can be modified in favor of the private contractor or the government to compensate for this change [58]. The main measures established for restoring the economic balance of the PPP contracts included (i) the increase in the fares originally approved to compensate for additional works and (ii) the possibility of granting SPPLs to PPP contractors to finance these additional works. The criterion established to calculate the new fare was to preserve the Internal Rate of Return (IRR) before taxes of the projects. The PPP contractors submitted new Economic-Financial Plans (EFPs) that included the additional investment and the new fares and, once approved by the government, became part of the contract documents. This rebalancing meant an increase in fares ranging from 21% to 67% over those initially approved and an average increase in the price of the contracts for the government of around 37%. In addition, the value of the SPPLs granted to PPP contractors almost reached €400 million. Table 1 presents a summary of the main characteristics of the projects of the Plan awarded before and after the modifications introduced to adjust their economic-financial balances.

Table 1.

Summary of the main characteristics of the public–private partnership (PPP) contracts of the Plan before and after the restoration of the economic-financial balance. Source: data provided by the Spanish Ministry of Transportation (MT).

4.3. Granting of SPPLs

The PPP contractors were also granted SPPLs as compensation for the government’s requirement of additional works not foreseen in the original contracts. The selection of this mechanism was motivated by two main reasons: (i) to facilitate the PPP contractors the financing of additional works at a time when the country was going through a deep financial crisis, and (ii) to avoid incurring a greater public deficit, since the Euro Pact required Spain to adopt strict control over national public accounts.

The conditions of the SPPLs were very advantageous for PPP contractors. First, the debt to the State was classified as subordinate debt, which allowed contractors to reduce pressure on equity, improve the risk profile of the senior debt and mitigate the liquidity risks of the project. Second, the repayment of the principal was set to take place six months before the end of the contract through a single payment. These repayment conditions allowed them to benefit from the entire loan during the whole contract period. Third, a three-year grace period was established for the payment of the loan interests. The interests accrued in this period are to be capitalized together with the loan principal. This allowed the private sponsors not to pay interests during the most sensitive stage of the project, the construction phase. Finally, interest rates were, at least initially, below those of the market since the government would receive as remuneration from the loan the higher of the following amounts: (i) the amount resulting from applying a fixed interest rate of 175 basis points on the outstanding SPPL, or (ii) the amount resulting from applying equation (1).

where R is the annual remuneration; I, the IRR of the project before taxes; RaDf, the real annual demand fee; MaDf, the maximum annual demand fee; and PL, the outstanding amount of the participation loan.

5. Methodology Usedin the Case Study

This section undertakes an ex-post evaluation of the impacts of the SPPLs awarded by the government to the PPP contractors of the first-generation highways. These projects have exceeded half their contract period, which is a reasonable time to conduct the analysis proposed. The evaluation is aimed at assessing the positive and negative impacts of the government’s decision to support these projects from the financial and social perspectives. On the one hand, the risk borne by the government that the PPP contractor ultimately does not pay back the principal of the SPPL is analyzed. This risk is stressed by the fact that, according to the SPPL payback rules, the loan will be fully amortized in the last year of the PPP contract. On the other hand, the social benefits in terms of decreasing accident rates are estimated in economic terms. The methodology used comprised four main steps, which are summarized below.

5.1. Selection of the Highways

The first step of the methodology is the selection of the highways. The Plan comprises ten PPPs distributed among four of the six Spanish radial corridors from Madrid to the coast: A-1 (Madrid-Burgos), A-2 (Madrid-Zaragoza), A-3, and A-31 (Madrid-Alicante), and A-4 (Madrid-Sevilla) (see Figure 1). We decided to choose three PPPs with different characteristics. The projects selected are operated by different firms, are located in different regions of the country, have different physical characteristics, and are representative of the different economic performance levels shown within the sample. This ensures a reasonable variety in the characteristics of the different roads.

The PPP projects chosen were (i) the Autovía del Arlanzón (A1-T2), the longest section awarded with the larger contract’s budget and the one with the best economic performance among the first-generation PPPs so far; (ii) the Autovía Medinaceli-Calatayud (Aumecsa) (A2-T3), with almost half of the length of the previous project and a relatively high up-front investment required. This PPP has been facing financial problems, being the worst economic-performing project within the sample; and (iii) the Autovía de los Llanos (Aullasa) (A31-T1), with average traffic, length, and upfront investment. This PPP has also shown a medium economic performance when compared with the rest of the first-generation highways.

5.2. Selection of a Set of Performance Indicators

The second step consists of the selection of a set of indicators to assess the actual performance of the selected PPP projects from 2010 to 2015. Two different types of indicators are selected: financial and social. On the one hand, the evolution of the financial indicators will later be compared with that foreseen in the EFPs approved after the economic rebalancing of the contracts. This comparison will allow us to evaluate whether the projects are performing as expected from the financial standpoint and, consequently, if they will be able to face the payback of the SPPLs principal. On the other hand, the social indicators are intended to evaluate the benefits arising from the projects themselves to evaluate their social feasibility.

The financial indicators selected are those that may have a significant impact on the economics of the projects: investment (both capital and O&M costs), income, and dividends. The main costs associated with this type of contract are those required to improve the infrastructure and maintain it in proper conditions during its lifecycle. The investment made for these purposes is to be recovered over the life of the contract through the payment by the government of a demand fee that depends on the volume of traffic and the contractor’s compliance with a set of availability and service quality indicators. Annual revenue from traffic is contractually limited by the maximum traffic threshold offered by the PPP contractor in the respective EFP. Income received from availability and quality of service was not originally included by bidders in their EFPs since, as they comprised both bonuses and penalties, the government considered that on average its impact would be neutral. Both cost overruns and revenue shortfalls may have a major impact on the economics of projects and affect the repayment capacity of PPP contractors.

On the other hand, the distribution of dividends is of great importance for the analysis carried out due to the conditions under which the SPPLs were granted to PPP contractors. It is worth noting that the provisions regulating these loans neither required contractors to establish a reserve account to guarantee repayment of the loan, nor did they establish minimum financial ratios to restrict the distribution of dividends and safeguard the repayment of SPPLs. This fact, along with the subordinated nature of the loan and the fact that repayment of the principal must be made in the last year of the contract term, could hinder the loans’ chances to be repaid. As PPPs are structured under the project finance approach, sponsors will have to meet SPPL with the free cash flow (FCF) of the last year of the contract period.

Regarding socio-economic indicators, the increase in road safety derived from the works carried out on the highways and the benefit related to the anticipation in time of the infrastructure delivery were selected. To measure the road safety improvement on the highways, the evolution of the hazard (HI) and the mortality (MI) indexes is analyzed. They are measured in accidents with victims, regardless of their severity, per 100 million vehicles and fatalities per 100 million vehicles, respectively. Thus, these indicators provide a good proxy of the risk of the highways. Finally, the anticipation in time of the works carried out is taken into account, since it allowed users to take full advantage of the social benefits derived from the works in advance. As already mentioned, providing these loans to the PPP contractors was essential to boost construction works, since the financial crisis would have made it almost impossible for the contractors to obtain the necessary financing to carry out the required works in a relatively short period.

5.3. Analysis of the Financial Sustainability for the Government

The third step of the methodology consists of analyzing the financial impact of awarding the SPPLs for the government. To that end, the capacity of the PPP contractors to repay the principal of the loan together with the capitalization of the interests accrued during the three-year grace period is assessed. Given that the reimbursement of the SPPL will take place six months before the end of the PPP contract, the last year’s FCF (2026) for each PPP is estimated. It is considered that, as there is no mandatory imposition of creating a reserve account, the SPPL repayment will be made with last year FCF. This is a crucial variable to evaluate the capacity of the PPP sponsors to repay the SPPL, given that other senior loans should have been previously repaid as is usual in project finance.

For its calculation, the evolution of the main variables affecting the PPP cash flow in the period 2017–2026 is estimated by assuming the elasticities to socioeconomic variables calculated by previous research studies for the case of Spain [59,60]. According to the aforementioned authors, there is a marked and stable correlation between the variation in GDP per capita and the evolution of light vehicle traffic; and between the variation of industrial GDP and the evolution of heavy vehicle traffic. To allow for uncertainty in the evolution of the economy, we have defined three potential scenarios based on the forecasts of Spanish GDP growth from different agencies: a base scenario, an optimistic scenario, and a pessimistic scenario. Then, the simplified FCF estimate is made for each project and scenario by calculating the difference between income and expenditure (both costs and investments). Finally, we estimate whether the government is running a risk of not being repaid by contractors by comparing the expected FCF in 2026 with the SPPL commitments (principal plus interests) to be reimbursed by contractors that year.

5.4. Ex-Post Evaluation of the Social Impacts of the SPPLs

The last step of the methodology consists of assessing whether the government’s decision to support these projects was justified from a social perspective. To that end, an estimate of the social gains of the projects in terms of improved road safety is used as a proxy of the social impact derived from the awarding of the loans. The estimation has been carried out following the methodology developed by Pérez de Villar [61], whereby the annual social benefit derived from the improvement in road safety on a certain highway is calculated according to Equation (2):

where PIA is the number of accidents with victims avoided as a result of the execution of a certain measure, which is calculated as the number of accidents expected on the highway according to the general trend (PIAex) minus the real number of accidents that occurred in the highway (PIAr). Since PIAex is a highly uncertain value, Pérez de Villar [61] recommends using as an approximation the average value corresponding to roads with similar characteristics. VPIA is the average statistical value of avoiding a victim in a traffic accident on roads with characteristics similar to that analyzed, which is calculated according to Equation (3) [61].

where are the total number of fatalities, serious and slight injuries on roads with similar characteristics. VFAT, VSEI, and VSLI are the value of avoiding a fatality, a serious, and a slight injury. is the total number of victims on roads with similar characteristics.

Finally, we compare the estimated social benefit produced by road safety improvements until the end of the PPP contracts (2026) with (i) the additional investment made with respect to a scenario 0 in which the government has not supported the projects and, therefore, the existing roads have not been upgraded, and (ii) the potential financial loss estimated for the government in the pessimistic scenario. These comparisons allow us to evaluate the social feasibility of the projects and the extent to which the risk borne by the government in providing SPPLs to the projects was offset by the social benefits. It is worth noting that the evaluation of social benefits is very conservative for two reasons. On the one hand, society will keep on benefiting from accident rates reduction beyond 2026. On the other hand, other social gains (such as travel time savings, comfort improvement, fuel savings or reduced air pollution emissions) are not taken into account in this estimate.

6. Results

This section summarizes the main findings of the three selected PPP projects of the Plan. First, it shows the actual performance of the projects compared to the new EFPs approved. Then, the SPPL repayment capacity of PPP contractors is calculated for different scenarios to estimate its potential impact on the public budget. Finally, social gains derived from the improvement in road safety are estimated to assess whether the government did it right when deciding to grant SPPLs to support the projects.

6.1. Financial Performance and Social Benefits

6.1.1. Capital and O&M Costs

Regarding the capital cost of the initial works, all PPPs managed to adjust very well to the estimates conducted in their EFPs. There were just slight variations in the work schedules and the costs originally foreseen. As can be seen in Table 2, two out of the three projects analyzed incurred lower costs than expected in the initial works. In contrast, there has been significant underinvestment in major repairs and rehabilitation actions compared with the original estimates. In this regard, only A2-T3 and A31-T1 carried out rehabilitation works worth, in both cases, far less than expected. It is worth noting that PPP contractors were able to comply with the performance indicators related to the state of the pavement without the need to carry out these rehabilitation works. As we will see later on, this fact led them to incur larger O&M costs.

Table 2.

Deviation of the main costs from EFP’s estimation.

Finally, PPP contractors incurred larger O&M expenditures than originally planned. This was probably due to the incentives offered by the contracts to achieve better maintenance and operation performance. The contract defines a series of quality levels associated with service indicators and thresholds to be met throughout the contract period. The performance of the PPP contractor on these indicators may contribute to either upward or downward corrections in traffic revenues. This over expenditure in O&M might be also the cause for the underinvestment in major repairs and rehabilitation of the roads.

6.1.2. Income

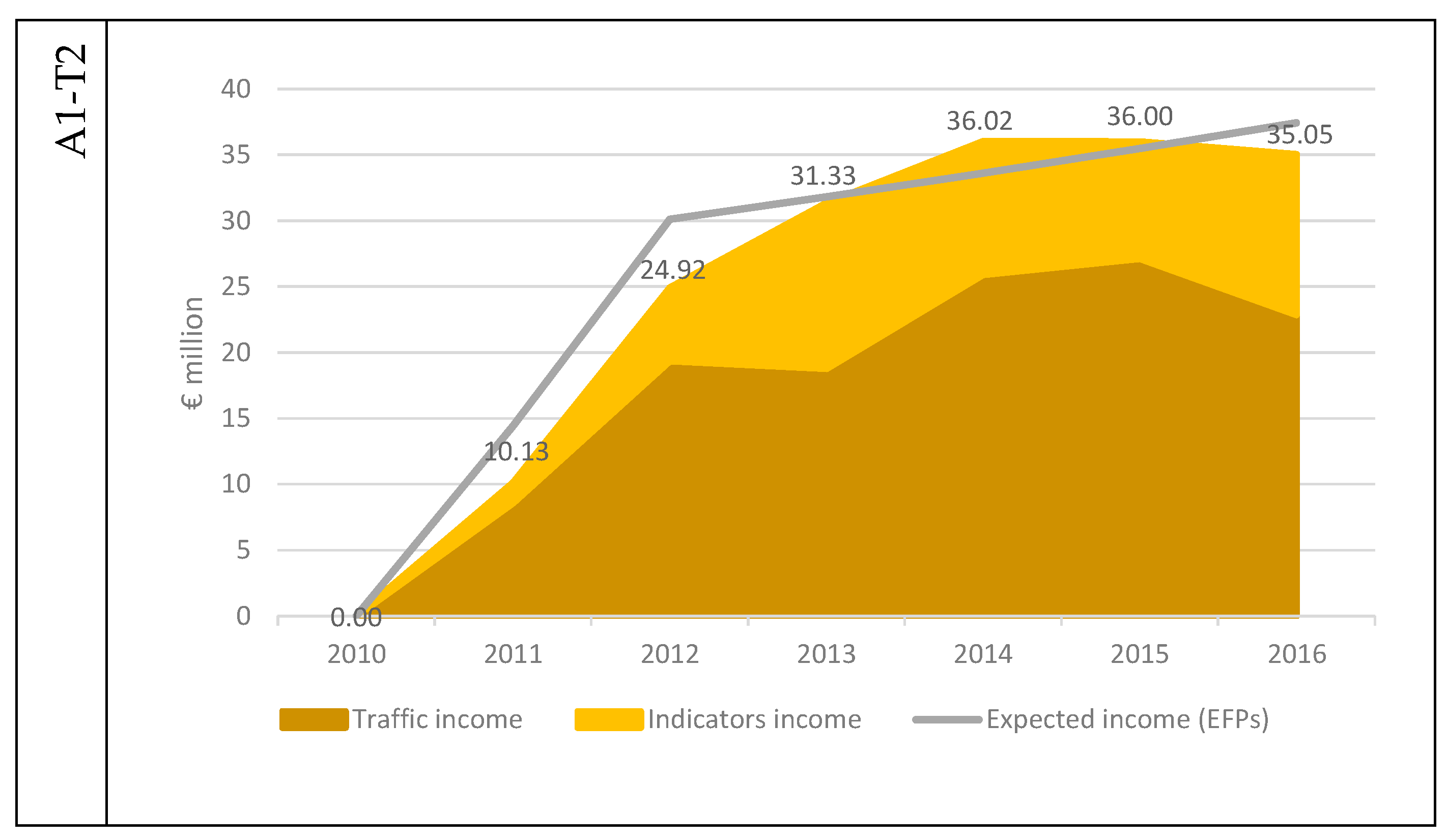

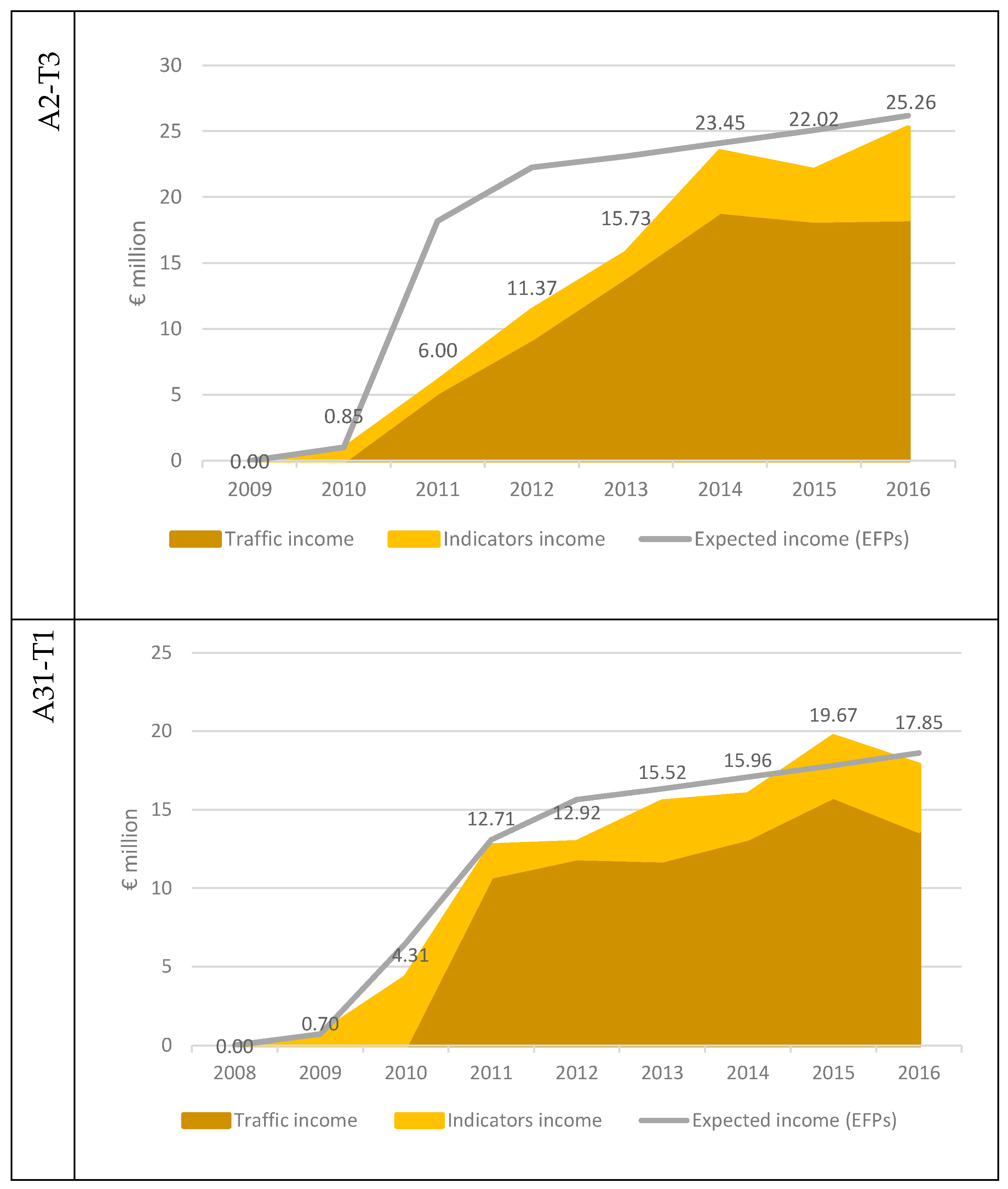

Figure 2 shows the evolution of current revenues—both from traffic and availability—compared to those foreseen by the EFPs, which considered no income from availability payments. The shaded areas show the yearly revenues received by the PPP contractors. The darkest area reflects the traffic income and the lightest one, the availability income. The summation of both areas—figures located over the total area—totals the yearly revenue received by the contractors. The grey line represents the revenue expected from traffic by the contractors in their respective EFP.

Figure 2.

Evolution of expected and actual income from traffic and availability excluding value-added tax (VAT), in € million. Source: data provided by the MT.

This figure shows that all PPPs, especially A2-T3, obtained less income from traffic than originally expected, especially during the first years of operation. However, it can also be observed how both A1-T2 and A31-T1 have largely compensated for these losses through availability payments. In the last few years analyzed, due to the improvement of the Spanish economy and the availability bonuses, the total revenue obtained almost coincides with the original estimates.

6.1.3. Dividends

The actual dividend distribution to the shareholders of the projects for two of the PPPs analyzed has substantially differed from that envisaged in the EFPs. In the case of A1-T2, dividends began to be distributed in 2013, one year later than planned. However, the accumulated amount distributed until 2016 was 37% higher than initially envisaged, with an over-distribution of €3.03 million. In the case of A31-T1, dividends began to be paid in 2014, four years ahead of schedule, with €4.24 million being over-distributed. Finally, as of 2016, A2-T3 PPP had not distributed dividends yet, following the schedule established in the EFP, with dividends to be distributed from 2018 on. This PPP has obtained lower economic results than those expected so far and has been incurring losses despite the additional income from indicators, obtaining the worst economic performance of the projects under study.

6.1.4. Accident Rates

Table 3 shows the evolution of the hazard (HI) and mortality (MI) indexes. An important decrease in their values can be observed comparing the situation before the projects were awarded (2006 and 2007) and after works were completed (2014 and 2015). Quantitatively, the HI on the highways analyzed with respect to the starting situation has improved between 78 and 90%, while the MI has fallen by 29% on average. As can be observed in the same table, two of the three highways are significantly safer than the rest of the State-owned roads with similar characteristics in terms of traffic levels (AADT) and road type (urban or interurban nature).

Table 3.

Evolution of hazard and mortality indexes of the PPPs analyzed before and after the completion of works and average hazard index of equivalent roads for 2015.

6.1.5. Anticipation in the Commissioning of the Works

One of the main reasons why these projects were undertaken under the PPP approach was the urgency of the Plan and the insufficient budgetary resources to carry out these actions through conventional budgetary approaches within a reasonable period of time. In that respect, the Strategic Plan of Infrastructure and Transport (PEIT) estimated that it would take about eight years to meet all investment needs if they were to be built with budgetary resources [62]. This estimation was, however, based on an economic growth scenario that did not take place given the economic downturn that soon after affected the country and resulted in continuous budgetary reductions for the road infrastructure program since 2009. Based on data provided by the MT, the PPPs analyzed were completed in 1.5 (A31-T1), 2.4 (A1-T2), and 3.5 years (A2-T3). Therefore, the implementation of the actions was anticipated in a range between 6.5 and 4.5 years with respect to the option of undertaking the actions through the conventional procedure estimated by the MT. As a result, society has been reaping the benefits of the positive savings and externalities derived from the works in advance, especially in terms of road safety but also improved comfort, reduced travel time, fuel savings, etc.

6.1.6. Summary of the Analysis of Indicators

From the analysis conducted, it can be disclosed that, after receiving the loans, the PPP projects were able to turn their financial position around and started performing almost as originally expected. Indeed, two out of the three projects are distributing higher dividends than originally expected. This fact demonstrates that the capacity of the PPPs to repay their loans will not be hindered by the actual economic performance of the projects.

Regarding the social benefits of the projects, they have proven to be successful in greatly decreasing the rate of accidents towards, in most cases, much lower levels than those of their equivalent roads within the Spanish network. Moreover, both users and society have been able to enjoy the gains in terms of road safety, but also from lower travel times, fuel savings, etc., well in advance thanks to the government’s decision to support the projects.

6.2. Estimates of the Debt Repayment Capacity of the PPP Contracts

To estimate the repayment capacity of the SPPL, according to the methodology previously defined, we have estimated the FCF in the last year of the contract (2026). To that end, we have proceeded to estimate (i) traffic revenues, (ii) availability payments, (iii) O&M costs, (iv) capital costs in major repairs and rehabilitation projects, and (v) corporate taxes. The hypotheses and the procedure adopted for their calculation are explained below.

Annual traffic revenues were calculated as the product of the volume of traffic on the road section (in vehicles x km) each year and the fare (excluding VAT) applied in the same period, differentiating between traffic and fares for light and heavy vehicles. The evolution of light and heavy traffic over time has been obtained, for each scenario, by applying the elasticities estimated by Gomez et al. [59] and Gomez and Vassallo [60] to the socioeconomic variables of each scenario (GDP per capita and industrial GDP). For its part, as indicated in the tendering specifications of the contracts, the fare is updated yearly according to the variation of the national Consumer Price Index (CPI). Thus, the annual fares in nominal terms have been calculated by updating the fare applied in 2016 according to the Spanish CPI forecasts for the period 2017–2026 of the International Monetary Fund (IMF).

Given that availability-based revenues have been higher than expected for all projects so far, and since that PPP contractors are considered to have already acquired certain expertise in road maintenance and rehabilitation that will allow them to maintain their level of compliance in the future, annual availability revenues in the period 2017–2026 are assumed to be a constant percentage of total revenues consistent with previous years.

Annual O&M costs in the period 2017–2026 have been calculated based on those of the previous years, assuming that the only increase they will experience in the future will be caused by inflation. Given the difficulty of estimating future investments in road rehabilitation, the values foreseen for this purpose in the EFPs delivered by the PPP contractors have been adopted in the analysis. However, it should be noted that if the generalized underinvestment in rehabilitation works observed in the previous section is maintained over time, the costs considered in the analysis under this item may be overestimated.

The corporate tax is calculated as the legal rate (25%) times the Profit Before Taxes (PBT). The PBT has been annually calculated for each of the proposed scenarios as annual revenues minus O&M costs, depreciation of the assets, and financial expenses.

After obtaining the expected FCF in 2026, the last step of the analysis consisted of estimating whether they are enough to cover the repayment of the principal of the SPPL including the capitalization of interest accrued during the three-year grace period. Table 4 shows that the amount that PPP contractors have to pay back to the government the last year of the contract is, for all scenarios, higher than the expected FCF generated. Thus, according to the principles of project finance, whereby lenders should only rely on project cash flows for debt repayment, PPP contractors will not be able to pay back the full amount of the loan the last year of contract.

Table 4.

Amount to be returned by each PPP contractor to the government in the last year of the contract, estimated free cash flow (FCF) available that year for that purpose and estimated amount that would not be returned in each scenario considered.

6.3. Estimate of the Social Benefits of the PPP Projects

In order to obtain an approximation of the social gains derived from the projects, a conservative estimate of the social benefit derived from the improvement in road safety since the commissioning of the first section (A31-T1) until the end of the PPP contracts (2026) is made according to the methodology previously explained [61]. To that end, it has been assumed that if no actions had been taken to upgrade these highways, the evolution of the accident rates of the first-generation highways under study would have followed the same trend of that of the rest of Spanish roads with similar characteristics. The annual social benefit (SBannual) is calculated as the product of the number of victims avoided on the sections of the highways analyzed (PIA) and the value of preventing a victim (VPIA) according to Equation (1), which can be rewritten as follows for the case study analyzed:

where PIA is the number of accidents with victims avoided with respect to the hypothetical scenario where no upgrading actions are undertaken. VPIA is the average statistical value of avoiding a victim in a traffic accident. PIAhyp is the estimated number of fatalities and serious and minor injuries expected if these highways had not been upgraded. PIA1G is the actual number of fatalities and serious and minor injuries in the three highways analyzed. Actual data up to 2015 were provided by the MT; thereafter, they were estimated.

PIA has been calculated as the difference between the accidents with victims that would have occurred in the hypothetical scenario that no upgrading actions had been undertaken (PIAhyp) and the accidents with victims that have actually occurred (PIA1G). To that end, PIAhyp has been estimated by assuming that, in this hypothetical scenario, the evolution of the hazard index (HIhyp) of the first-generation highways under study would have followed the same trend as the rest of the Spanish roads with similar characteristics. PIA1G from 2015 has been estimated from the logarithmic projection of the hazard index of the first-generation highways (HI1G) and the estimates of future traffic on the highways, which has been assumed to increase by 1.4% each year.

For its part, annual VPIA has been calculated according to equation (2) with actual data facilitated by the MT and the monetary values provided by the Handbook on External Costs of Transport [63]. It has been considered that the value of human life has increased and will increase at a rate of 1% per year with respect to the values provided by the aforementioned document for 2014.

From the analysis conducted, we obtained that the social benefit derived from the reduction of accident and mortality rates in the three highways in the 2011–2026 period totaled €363.82 million actualized to 2007 prices. The value of 4.77% was used as the discount rate, which is the yield on 30-year Treasury Bonds issued in the year in which the PPP projects were awarded (2007). On the other hand, the total investment related to the establishment and upgrading of the highways, including additional works approved in 2010, updated to 2007 amounted to €360.91 million. This estimate shows that the social benefit derived from the reduction of the accident rate exceeds the total investment made for the establishment and upgrading of the three sections, which endorses the social feasibility of the projects. Finally, the potential financial loss estimated for the government in the pessimistic scenario, actualized to 2007 prices with the same discount rate used for the social benefit, amounts to €16.8 million, which is negligible compared to the social benefits of the highways.

7. Discussion and Policy Implications

Large transport infrastructure projects are very sensitive to governments and society for several reasons. They are costly, have great visibility to the public, and bring about large impacts on efficiency and competitiveness. PPPs have important advantages for delivering infrastructure at a rapid pace and capturing the private sector’s efficiency. However, PPP contracts are complex and incomplete since it is not possible to establish contractual clauses that take into account all the circumstances that may occur over the life of the contract. While the performance of PPP contracts depends to a great extent on many factors caused by unexpected circumstances, the success of PPPs mostly depends on the capacity of the government and the regulatory framework to respond to them. This paper is a good example of how sometimes governments have to provide prompt response to unexpected circumstances—caused by either the wrong ex-ante decisions or unpredictable events. These circumstances may affect the viability of PPP projects with potential high social benefits.

The ex-post evaluation enabled us to evaluate whether the government’s decision to support the PPPs analyzed was socially justified. The SPPLs, together with the rest of the measures agreed when reestablishing the economic balance of the contracts, allowed the government to push ahead with the projects and carry out the works it deemed necessary to improve road safety on the highways. The analysis shows that these projects have proven to be extremely successful in decreasing accident rates, thereby producing high social benefits that greatly exceed the potential financial loss estimated for the government in the pessimistic scenario analyzed. Besides, these projects have also brought about other benefits such as driving comfort improvements, lower travel times, fuel savings, and decreased air pollution emissions. Moreover, both users and society have been able to enjoy these benefits well in advance thanks to the government’s decision to support the PPP contracts. On the contrary, if the government had chosen not to do so, the contracts would have likely been early terminated, thereby entailing important costs for the society (termination payments to the contractors, additional cost to retender the contracts, etc.) and the benefits arising from the projects to the users would have been delayed. Thus, the government’s decision to support the projects cannot be criticized from the social point of view since the alternative options would have meant imposing greater costs and benefit delays to society.

The case study analyzed also provides future lessons to governments that may need to take prompt decisions responding to sudden PPP problems. The first lesson is that the right ex-ante design of the contract substantially contributes to reducing problems once the contract is awarded. In the case shown in this paper, the government’s reluctance to approve the final designs provided by the PPP contractors, even though they met the minimum requirements established, delayed the financial close of the projects and subsequently the beginning of the works. This fact along with the traffic shortfalls caused by the economic recession, were the main causes that threatened the projects’ viability. Thus, if the government had included in the projects’ tendering specifications the technical requirements and all the works deemed necessary, the problems would have been much limited. After the signing of the contract, all negotiations take place bilaterally without any competition for the PPP contractor, leaving the public partner in a vulnerable position [64]. Moreover, when renegotiation is initiated by the PPP contractor, the government acquires greater bargaining power, while if it is motivated by unilateral changes imposed by the government, the PPP contractor gains a strong asymmetrical position in the negotiations [25]. In Portugal, where several PPP contracts were renegotiated due to unilateral changes by the government and poor project design, the renegotiations proved to be detrimental for the public interest [25,64]. Furthermore, poor decision-making processes, inadequate project preparation, and asymmetry of information can cause early termination of projects and undermine the credibility and reputation of governments [65].

The second lesson is that support mechanisms must be properly designed so that the government does not take a higher risk than the shareholders. Past experiences, both in Spain [26,66] and in other countries such as Mexico [44], Colombia [46], China [31], or South Korea [28], show the potential economic consequences for governments of the award of poorly designed support mechanisms. In the present case study, although given the circumstances, the government’s decision to support the projects can be considered reasonable, the conditions under which the SPPLs were awarded did not set sufficient measures to guarantee the public interest against that of the shareholders. The results show that, if no action is taken in this regard, there is a significant risk that PPP contractors will not be able to repay the principal of the loans even though the PPP projects are performing well and, in two of the cases, distributing more dividends than expected. In this respect, some of the issues identified might have been avoided if the government had set some provisions to safeguard the SPPL seniority to the shareholders. On the one hand, instead of imposing the amortization of the principal of the SPPL six months before the end of the contract, a more flexible amortization approach of the SPPL should have been allowed depending on the repayment of the senior debt and the economic performance of the project. On the other hand, the government should never have allowed equity holders to pay dividends or withdraw equity before the SPPL was being repaid or provisioned. Instead, it should have required PPP contractors to set up a SPPL service reserve account at the end of the grace period to safeguard repayment.

The suggested provisions would be more in line with those applied by other governments providing subordinated debt to PPPs. The India Infrastructure Finance Company Limited (IIFCL), for instance, requires PPP contractors to establish an escrow account that secure the annual repayment of the loan before returns on equity are disbursed. It also limits the loan to 10% of the total project cost, allows for grace periods for repayment of both interest (4–5 years) and principal (6–7 years) and maturities up to 15 years [19]. Similarly, the Transportation Infrastructure Finance and Innovation Act (TIFIA) program offers flexible repayment terms, does not allow any equity distribution until all accrued interest is paid and may include a provision that, in the event of bankruptcy, insolvency, or liquidation of the PPP contractor, gives the subordinated loan the same priority as senior debt [67].

The third lesson is that the level of risk actually borne when providing support mechanisms to PPPs should be assessed, and if possible quantified. SPPLs may involve contingent liabilities with a significant impact on the future public budget, but they were not assessed before being awarded. The fourth lesson from this paper is that an independent entity, rather than the MT, should be in-charge of measuring the contingent liabilities arising from these loans. These contingent liabilities, once estimated for all the projects, should be accounted for within the national budget at the time the loan is granted. This way, governments will have the correct incentive to provide SPPLs at the right price, and only when they add value. The Spanish government can draw on the experience of other countries to develop a formal framework for managing contingent liabilities that allows it to make informed decisions on the level of risk to be assumed in projects while minimizing exposure to fiscal costs. Australia and Canada, for instance, have guidelines establishing the conditions under which the government can provide guarantees or incur contingent liabilities, including the requirement that risks be explicitly identified and expected benefits exceed the level and cost of risks [68,69]. In Chile, the Ministry of Finance measures and values the contingent liabilities associated with the guarantees of highway and airport concessions and, once approved, publishes annual reports on the costs and risks of these guarantees [70].

8. Conclusions

This paper is a good example of the complexity of managing PPPs due to the incompleteness inherent to these contracts. The case study analyzed sheds some light on key aspects to respond to government decisions about providing support to PPPs in trouble with potential high benefits for society. It also shows how taking drastic decisions in that respect, such as forcing the termination of the contracts, may not be the best solution from the social point of view. The results obtained confirm the initial hypothesis that the government developing the PPP project was expected to have little incentive to set out the terms of ex-post public support efficiently. In this respect, it has been shown how by adjusting the conditions under which the SPPLs were granted, the risk assumed by the government would have decreased considerably. On the other hand, if the risk that the government was assuming in granting the loans had been assessed, measures such as those proposed in the previous section might have been considered. However, none of this was done, which proves how, given the political significance of this type of projects, governments often try to solve their problems as quickly as possible without conducting the right analysis intended to measure the impact, both social and fiscal, in the medium and long term of the measures taken to do so.

There are two main conclusions that can be drawn from the paper. The first one is that a good governance approach along with the right ex-ante design of the contract will mitigate the impact of future unexpected problems. The second conclusion is that the best way to deal with problems over the life of the contract is to define the right procedure to address them rather than trying to incorporate specific clauses for all the circumstances that may eventually happen. The right approach is not so much to try to make the contract as complete as possible, as it is to define the right ways to adjust the contracts to unexpected events.

Future research work should focus on using more quantitative approaches to find an optimal equilibrium between commitment and flexibility in PPPs in order to ensure that decisions are taken to maximize sustainability. This analysis should value the impact on different stakeholders.

Author Contributions

Conceptualization, L.G. and J.M.V.; methodology, L.G. and J.M.V.; investigation, L.G.; data curation, L.G.; formal analysis, L.G.; writing—original draft preparation, L.G. and J.M.V.; writing—review and editing, L.G. and J.M.V.; supervision, J.M.V. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Spanish Ministry of Economy and Competitiveness (MINECO) and the European Regional Development Fund (ERDF) within the framework of the project TRA2015-64723-R, and by the PhD Scholarship from the Fundación Agustín de Betancourt.

Data Availability Statement

Restrictions apply to the availability of these data. Data was obtained from the Spanish Ministry of Transportation and are available from the authors with the permission of the Spanish Ministry of Transportation.

Acknowledgments

The authors wish to thank the Spanish Ministry of Economy and Competitiveness (MINECO) and the European Regional Development Fund (ERDF), which have funded the project TRA2015-64723-R. The authors also gratefully acknowledge the support and generosity of the Fundación Agustín de Betancourt, without which the present study could not have been completed. Finally, the authors are grateful to the Spanish Ministry of Transportation and particularly to Pablo Pérez de Villar for providing us the data needed to carry out the analysis.

Conflicts of Interest

The authors declare no conflict of interest.

References

- WCED. The Brundtland Report: Our Common Future. The World Commission on Environment and Development (WCED); Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Weber, B.; Staub-Bisang, M.; Alfen, H.W. Infrastructure as an Asset Class: Investment Strategy, Sustainability, Project Finance and PPP, 2nd ed.; John Wiley & Sons: Chichester, UK, 2016. [Google Scholar]

- Bueno, P.C.; Vassallo, J.M.; Cheung, K. Sustainability Assessment of Transport Infrastructure Projects: A Review of Existing Tools and Methods. Trans. Rev. 2015, 35, 622–649. [Google Scholar] [CrossRef]

- Chen, C.; Li, D.; Man, C. Toward sustainable development? A bibliometric analysis of PPP-related policies in China between 1980 and 2017. Sustainability 2018, 11, 142. [Google Scholar] [CrossRef]