1. Introduction

As a new business model, crowdfunding realizes dynamic resource allocation among different individuals or organizations efficiently. Crowdfunding is an important financing source for new ventures, clean-tech enterprises and projects with sustainable orientation [

1]. It also can promote regional innovation development, create jobs and spur economic growth [

2]. Big data are accumulated on the crowdfunding platform but not fully excavated. Various users’ interaction information is updated quickly and recorded precisely by the web every second, which impacts the following backers’ behavior and the platform profit. The data we used to contain both structured data and unstructured data, such as the dynamic commercial data and the textual data about the customer comments with managerial responses. How can structured data be effectively combined with unstructured data to design a business strategy that has still to be resolved [

3], especially in the crowdfunding?

According to social influence network theory [

4,

5], online communications may change potential backers’ cognition to project quality, the sentiment of comments and crowdfunding performance. Social media is a useful marketing tool to increase consumers’ purchase expenditures, which includes managerial responses and customer engagement. Luo et al. [

6] point out that using social media metrics can predict firm equity value more precisely than using conventional online behavioral metrics. Social media activities can significantly increase the brand value [

7], online conservations, website traffic [

8,

9], product awareness, future sales and brand loyalty [

10]. What kind of social media content drives higher levels of customer engagement in what ways is significant in increasing crowdfunding performance. While few studies have studied the relationship between managerial responses and consumer engagement behavior in the real marketing environment and distinguishing the levels of consumer engagement in the crowdfunding process deserves further exploration. We focus on exploiting how do managerial responses influence the following backer comments and how a creator’s response style (e.g., responding rate, length and speed) influences the following backers’ comment style.

A growing number of studies have confirmed the user-generated content has a significant influence on firm performance. Albuquerque et al. [

11] reveal that compared to price promotions, user-generated content has broader effects that impact all customer decisions at the platform. User-generated content is a source of acquiring customer needs for product development [

12]. Tirunillai and Tellis [

13] point out that user-generated content has the strongest relationship with the stock market performance. While the related works in crowdfunding are more focused on marketer-generated content (the project description text), such as topical features from project descriptions and reward descriptions [

14], linguistic features from project description [

15] and the racial identifiers from the campaign photos and project descriptions [

16]. While little researches have studied the relationship between managerial responses and user-generated content in crowdfunding, especially to different textual features. Therefore, we will use text mining techniques and empirical research to study managerial responses and customer engagement in crowdfunding.

Our results demonstrate that the managerial response of project creators has a significant impact on customer engagement behavior about comment volume, length and sentiment. Moreover, managerial responses may also influence crowdfunding performance. Therefore, creators should increase interaction with backers in crowdfunding, encourage backers’ engagement behavior, increase response length and respond speed.

The rest of this paper is organized as follows.

Section 2 comments the relevant literature.

Section 3 presents the hypotheses on how managerial responsiveness may affect customer engagement and the influence of user-generated content on crowdfunding performance. We then develop our research design in

Section 4.

Section 5 and

Section 6 present the empirical results and test the robustness. Finally, a discussion of our findings and managerial implications are included in

Section 7.

3. Theory and Hypothesis Development

Little attention in previous studies was paid on how managerial responses affect customer engagement behavior rather than final performance. Therefore, we focus on the effect of creators’ responses on backer engagement, including user-generated content and crowdfunding behavior.

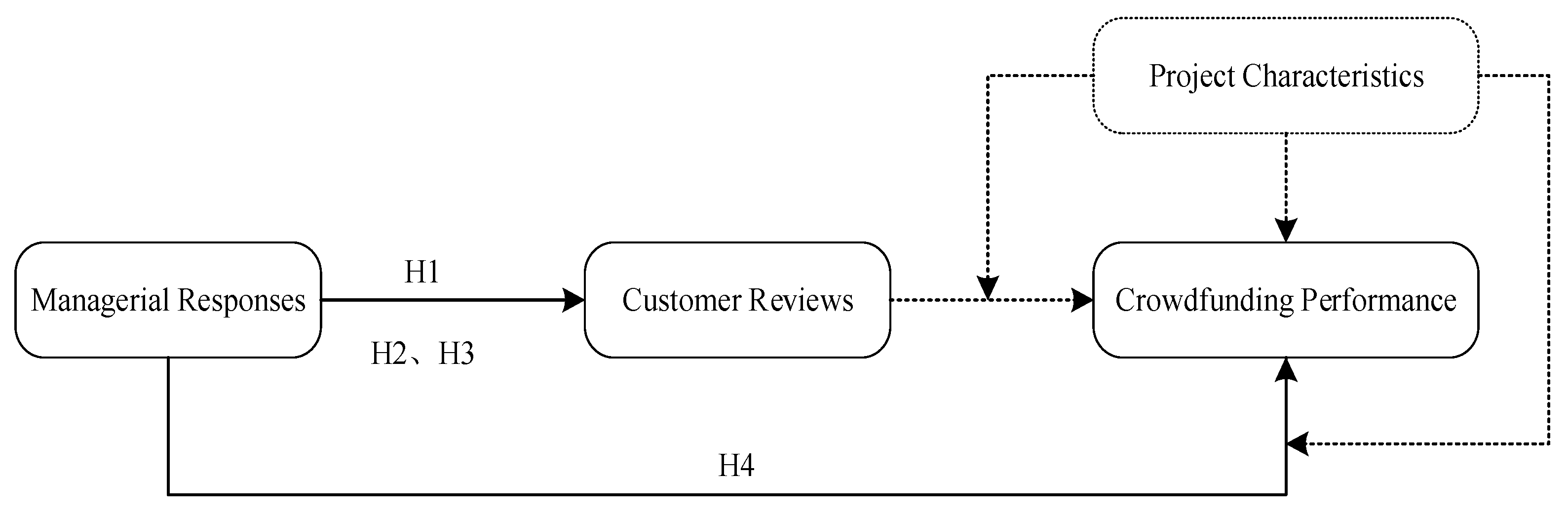

Figure 1 illustrates the conceptual framework of our research.

Psychological motivations can increase the volume of online reviews [

43]. As a customer relationship management channel, managerial responses can satisfy customers’ desire for social interaction and feel valued by managers [

44]. Creators who are willing to listen and interact can enhance the business trustworthiness and inspire backers to write reviews [

6]. That will encourage customers to engage more and write more comments to express their opinions. Moreover, Chevalier et al. [

45] point out that there are two types of drives of word of mouth, self-driven and audience-driven. Audience-driven motivations are enhanced by the managerial response, more and more backers are willing to engage in review activity. The interactions between project creators and backers may lead to higher backer engagement, which may include writing more comments and funding more. Thus, a higher volume of managerial responses may lead to more comments.

As a marketing action, managerial responses affect backer mindset metrics [

45]. The quality of projects on a crowdfunding platform is uncertain because of information asymmetry between project creators and backers. Managerial responses may change backers’ cognition of project quality, the creator is listening, and the feedback is more likely to impact the project quality. Moreover, managerial responses can make customers who post positive comments feel appreciated, so it will increase positive comments [

43]. Seeking recognition from others is one important motivation for users to contribute to online communities [

46]. Hence, a higher volume of managerial responses may increase the volume of positive customer comments.

Managerial responses may make backers feel the manager is the audience of their comments, then stimulating backers to put more effort into commenting, as measured by writing longer comments [

47]. Moreover, if customers were to voice their opinions that were posted by other customers and been responded by managers, they would feel it necessary to describe this opinion in more detail rather than repeating this opinion [

48]. In other words, a higher volume of managerial responses can motivate backers to write comments more detail and longer.

Therefore, we propose the following hypothesis.

Hypothesis 1 (H1). (a) The volume of managerial responses has a positive effect on the volume of customer comments. (b) The volume of managerial responses has a positive effect on the volume of positive customer comments. (c) The volume of managerial responses has a positive effect on the length of customer comments.

The length of managerial responses means the informational volume of responses [

6]. Longer managerial responses suggest managers are willing to spend more effort and time on backers’ suggestions, which will make backers feel their comments valued and motivate backers to engage more in crowdfunding. In addition, as a form of service recovery, managerial responses can change customer satisfaction and have a more positive impact on low satisfaction customers [

39]. Therefore, longer managerial responses may lead to more comments, more positive comments and long comments. We thus propose the following hypothesis.

Hypothesis 2 (H2). (a) The length of managerial responses has a positive effect on the volume of customer comments. (b) The length of managerial responses has a positive effect on the volume of positive customer comments. (c) The length of managerial responses has a positive effect on the length of customer comments.

Responses in time suggest the creator can analyze and respond to customer questions and suggestions [

46]. The speed of managerial responses also represents the initiative and the attention that creators are willing to spend on this project. Huang et al. [

49] show that improving response speed will bring more idea contributions from backers. Moreover, the duration of crowdfunding is limit, the managerial response will be insignificant if the response time exceeds the project crowdfunding deadline. Backers will have no opportunity to engage in the crowdfunding process once this project ended. Therefore, the speed of managerial responses has a positive effect on backer engagement behavior. We thus propose the following hypothesis.

Hypothesis 3 (H3). (a) The speed of managerial responses has a positive effect on the volume of customer comments. (b) The speed of managerial responses has a positive effect on the volume of positive customer comments. (c) The speed of managerial responses has a positive effect on the length of customer comments.

The backers can learn from other users’ comments and gain new knowledge, which affects their feedback to the creators. Hu et al. [

50] claim that herding behavior may exist in crowdfunding. In addition, Hence, knowledge sharing from the backers to the creators can further help improve the quality of the proposed products [

51]. User-generated content is also a reputation management channel. Backers are increasingly relying on other users’ behavior to shape project quality and make contribute decision. Godes [

52] shows that persuasive word of mouth is an effective and low-cost advertising way and more word of mouth always leads to higher-quality products.

According to social identity theory, establishing social communities to maintain interaction with backers may impact their brand choices, promote the products, and cultivate brand loyalty [

53]. Managerial responding to consumer comments is a useful reputation management strategy [

54], which can highlight positive comments and reduce the impact of negative comments, customers are least likely to buy this product if no responses to comment [

55]. Managerial responses also can provide more accurate information, reduce information asymmetry and eliminate misunderstanding [

38].

Therefore, we propose the following hypothesis.

Hypothesis 4 (H4). Managerial response has a positive effect on the crowdfunding performance.

4. Research Design

The data for our study come from the crowdfunding platform of Kickstarter.com, which created for bringing all creatives life. Each project page shows the information about the project, as well as comments and community for backers to communicate with the project creator and other backers. We randomly select 1000 projects from January 2015 to June 2017, which covers all categories in Kickstarter.com, and our data includes the dynamic commercial data, project characteristic information, and the textual data about customers’ comments and managerial responses. We use text analysis to quantify customer comments and managerial responses. The length of comments and replies is acquired by calculating the number of words. Using the functions convertToBinaryResponse and convertToDirection with R 3.5.1, we detect the sentiment direction of comments [

56].

Table 1 shows the descriptive statistics of project characteristic information, customer comments and managerial responses in our sample. We note that one project in our sample has 11.41 comments with only 2.64 managerial responses on average. The mean of comment length is 201.08; the mean of reply is 278.39. Among all comments in the sample, 64% are positive comments and 15% are negative comments. In addition, the time interval between customer comment and managerial response is 86,219.19 s.

Table 2 present the two-sample

t-test results to identify if there are significant differences in managerial responsiveness and customer comments for failed projects and successful projects. Among the 1000 projects, 675 projects have raised enough funding. Projects who reach their preset goal have a larger number of customers’ comments, more managerial reply, longer comment words and reply words and faster reply than the failed projects. Overall, successful projects have more managerial responses and customer comments.

We first use Equation (1) to examine the effect of responsiveness on the volume of comments.

where

denotes the volume of customer comments of project

i during

tth day.

,

,

are the volume of managerial responses, the textual length of managerial responses, and the average time interval between comments and reply of project

i until its

t − 1th day.

is a vector of time-varying control variables, which includes

, the accumulated fundraising;

, the accumulated backers and

, the accumulated shares via Twitter and Facebook.

is a vector of time-varying control variables, which includes

, the category of project

i;

, the number of collaborators;

, the goal of project

i;

, whether or not this project has a video.

and

are the date and the duration of project

i on its

tth day, which are used to control time effect.

is the time-invariant unobserved project heterogeneity.

represents time-variant unobservable project heterogeneity.

Next, we use Equation (2) to test the effect of responsiveness on the volume of positive customer comments.

where

is the volume of positive customer comments of project

i during its

tth day. We use Equation (3) to identify the effect of responsiveness on the length of customer comments.

In the above equation,

is the length of customer comments of project

i during its

tth day. We then use Equation (4) to identify the effect of responsiveness and customer comments on the crowdfunding performance.

where

is the fundraising of project

i during its

tth day.

,

,

are the volume of managerial responses, the textual length of managerial responses and the average time interval between comments and reply, respectively.

5. Results

Table 3 shows a two-sample

t-test result to identify if there were significant differences in the volume of comments, the volume of positive customer comments, the length of comments, the total fundraising and the total backers between projects with managerial responses and projects with no managerial responses. Projects with managerial responses had 74.83 comments on average, while projects with no managerial responses only had 0.83 comments on average. The mean of comment length of projects with managerial responses was 15,000, while the mean of comment length of projects with no managerial responses was only 150.91. The difference of total raised or total backers between responding projects and non-responding projects was significant.

Column (1) of

Table 4 presents the estimates of Equation (1). The results show that the length of responses had a significantly positive effect on the volume of customer comments, supporting Hypothesis 1 (b). The results also show the interval time between managerial responses and the volume customer comment had a significantly negative effect on the volume of customer comments, which supports Hypothesis 1 (c). In addition, the effect of the volume of response on the volume of comments was positive but not significant, which cannot support Hypothesis 1 (a).

Column (2) of

Table 4 shows the estimates of Equation (2), which identified the effect of responsiveness on positive customer comments. First, the length of responses had a significantly positive effect on the volume of positive customer comments, supporting Hypothesis 2 (b). Second, the results also show the interval time between managerial response and customer comment had a significantly negative effect on the volume of positive customer comments, which supports Hypothesis 2 (c). Third, the effect of the volume of response on the volume of positive comments was positive but not significant, which cannot support Hypothesis 2 (a).

In addition, we also examine the effect of responsiveness on the length of customer comments. Column (3) of

Table 4 reveals the estimates of Equation (3). The length of responses had a significantly positive effect on the length of customer comments, supporting Hypothesis 3 (b). The results also show the interval time between managerial responses and the length of customer comment had a significantly negative effect on the volume of customer comments, which supports Hypothesis 3 (c). Moreover, the effect of the volume of response on the length of comments was positive but not significant, which cannot support Hypothesis 3 (a).

Table 5 shows the estimates of Equation (4). The length of responses, the speed of responses and the volume of responses have a significantly positive effect on the final crowdfunding performance. These estimates were consistent with the hypothesis of managerial responses have a significantly positive effect on crowdfunding performance.

6. Robustness Checks

Table 6 shows two-sample

t-test results to identify if there were significant differences in the total fundraising, whether funding success, funding complete ration and the total backers between projects with customer comments and projects with no customer comments. The mean of amount pledged of projects with customer comments was 58,000, while the mean of amount pledged of projects with no customer comments was only 3807.46. Sixty-eight percent of projects with customer comments crowdfunding success, while only 24% of non-commenting projects crowdfunding success. The difference in total backers between commenting projects and non-commenting projects was also significant.

So far, we have been using the incremental amount pledged at time

t as the dependent variable. We now use an alternative variable, the incremental backers. Then, we estimate Equation (5) using a negative binomial estimator, because the increased backers were count data.

where

is the backers of project

i during its

tth day.

is a vector of time-varying control variables, which includes

, the fund-raising goals of project

i;

, the length of project

i in days;

, whether or not this project had a video when it launched.

Table 7 reports the estimation results when we include the interactive items between the project features and responsiveness (the volume of managerial responses, the length of responses and the speed of responses). Compared with

Table 5, the responsiveness had the same sign.

7. Implication and Conclusions

Crowdfunding platform offers users an online community, which allows creators and backers to communicate and exchange ideas. Peer backer behavior and creator responses were transparent to all potential backers, and customer engagement and managerial responses were effective advertising strategies to improve crowdfunding performance. We find evidence that the length and the speed of responses have a positive effect on the volume of comments, the volume of positive comments and the length of comments. Moreover, managerial responses and customer engagement have a positive effect on crowdfunding performance. The managerial response was an effective channel to improve customer engagement and crowdfunding performance, but this effect may vary across different project features.

The interactive activities of managerial responses and customer engagement may lead to the sustainable development of crowdfunding platforms. For example, the project creator could benefit from the feedback from project backers and managerial responses may improve backers’ cognition of project reliability. This dynamic knowledge sharing process increases the amount pledged and improves the project quality, which may attract more users and bring higher profits to crowdfunding platforms. Moreover, the sustainable running of crowdfunding platforms could promote regional innovation development and spur economic growth.

There are a few limitations to our research that could be opportunities for exploration in the future. First, the dataset comes from a single platform. Further researches should collect data from various information channels and different online platforms. Second, future researches examining how the relationship between managerial responses and user-generated content varies across different project characteristics could explore this further.