Lender Trust on the P2P Lending: Analysis Based on Sentiment Analysis of Comment Text

Abstract

1. Introduction

2. Literature Review

3. Research Design and Data Processing

3.1. Research Design

3.2. Text Processing

3.3. Sentiment Lexicon

3.3.1. Vocabulary Configuration

- Proper noun lexicon added. P2P lending is a highly-specialized field. Using only conventional lexicon will generate a large number of erroneous word segmentations. To improve word segmentation accuracy as much as possible, a manual preset “proprietary dictionary” is still required to support it. Taking the P2P lending platform “Small and Micro Finance” as an example, a non-interfering algorithm will split “Small and Micro Finance” into two segments: “Small and Micro” and “Finance.” In this article, by using the web crawler and manual selection, the names of the 2460 P2P lending platforms involved in wdzj.com, product names, and names of key persons are used as proprietary dictionaries to help the program perform correct word segmentation.

- Expansion and correction of the lexicon. This article uses the sentiment vocabulary provided by Boson NLP. The Boson NLP sentiment vocabulary has a better treatment of non-standard texts containing a large amount of Internet lexicon. Relative to the National Taiwan University Semantic Dictionary (NTUSD) and HowNet lexicon used in the past, the problem of insufficient Internet lexicon is avoided [32]. P2P loan comments come from the Internet. Among them, there are numerous Internet lexicon and semantic changes. The Word2Vec model [33] introduced by Google is used to make up for issues associated with an inexhaustible emotional vocabulary and diverse meanings of words. The Word2Vec model maps words into n-dimensional vectors and uses similarities in the spaces between two words to determine semantic correlation. Using this property, we can easily amass several synonyms of related words in the corpus used. Table 1 shows the top 5 synonyms for the word “scam” returned by the Word2Vec model.

- Negative. The negative vocabulary is supplemented by the HowNet vocabulary, with a total of 21 Chinese negative words.

- Adverbs of degree. The adverbs of degree list refers to HowNet’s sentiment analysis words. A total of 218 adverbs of degree are obtained, ranging in intensity from 0.8 to 2, where >1 indicates enhanced emotion and <1 indicates weak emotion.

- Stop words. The stop words are derived from stop words released by the Chinese Natural Language Processing Open Platform of the Institute of Computing Technology, Chinese Academy of Sciences, with a total of 1208 stop words.

3.3.2. Emotion Computing

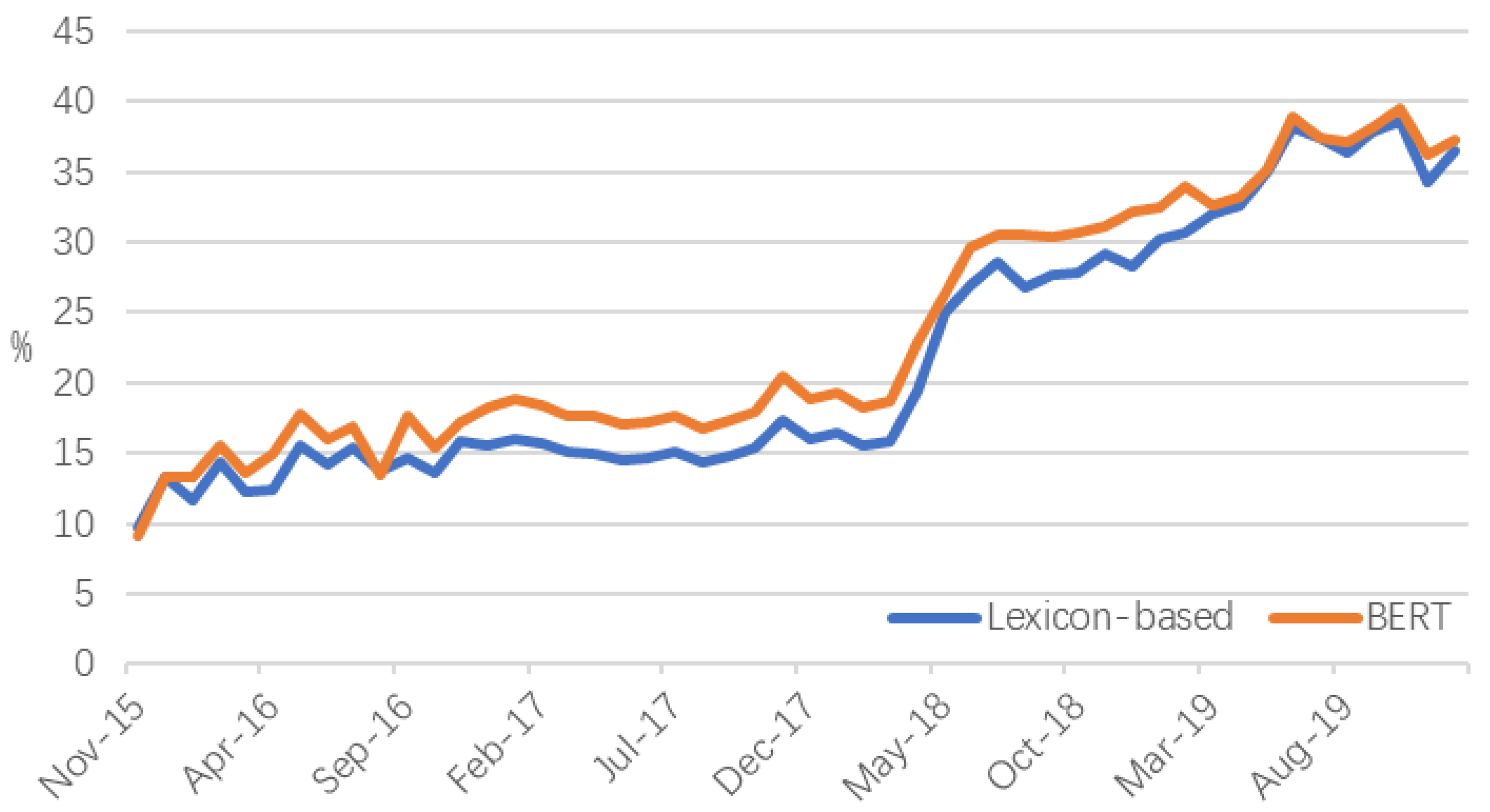

3.4. BERT

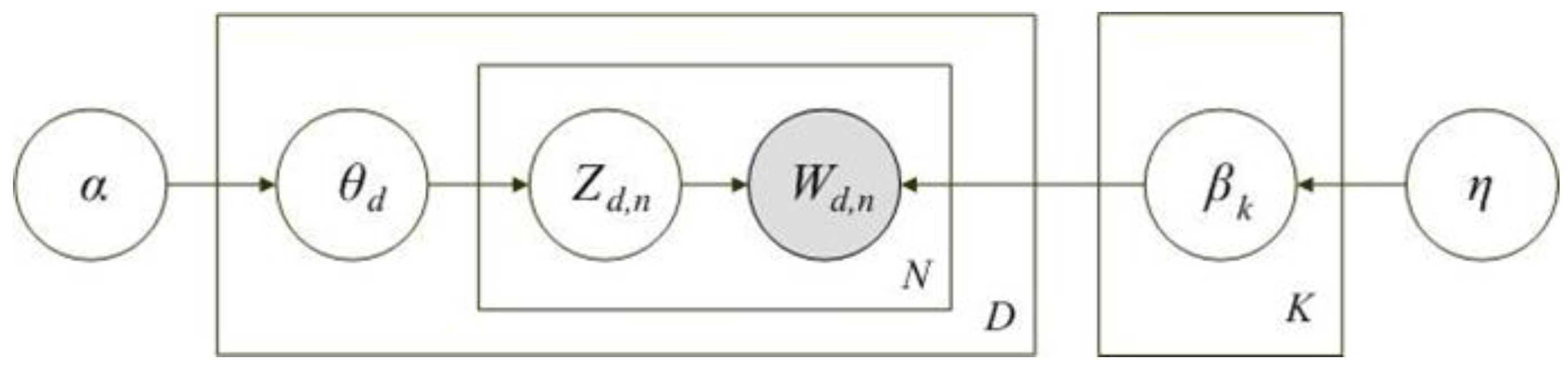

3.5. Comment Text Topic Analysis

4. Results

4.1. Comment Text Topic Analysis

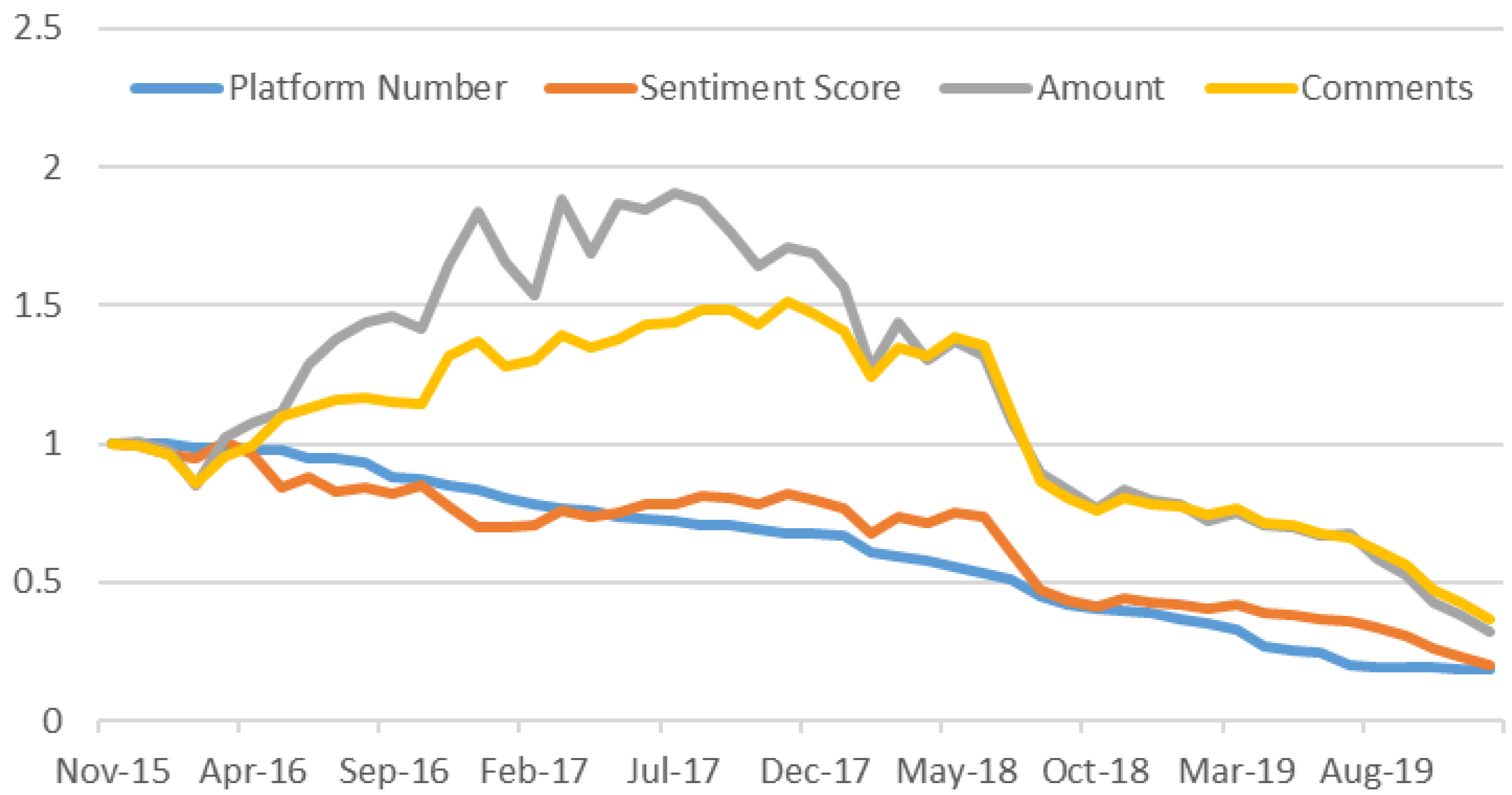

4.2. Time Series Analysis

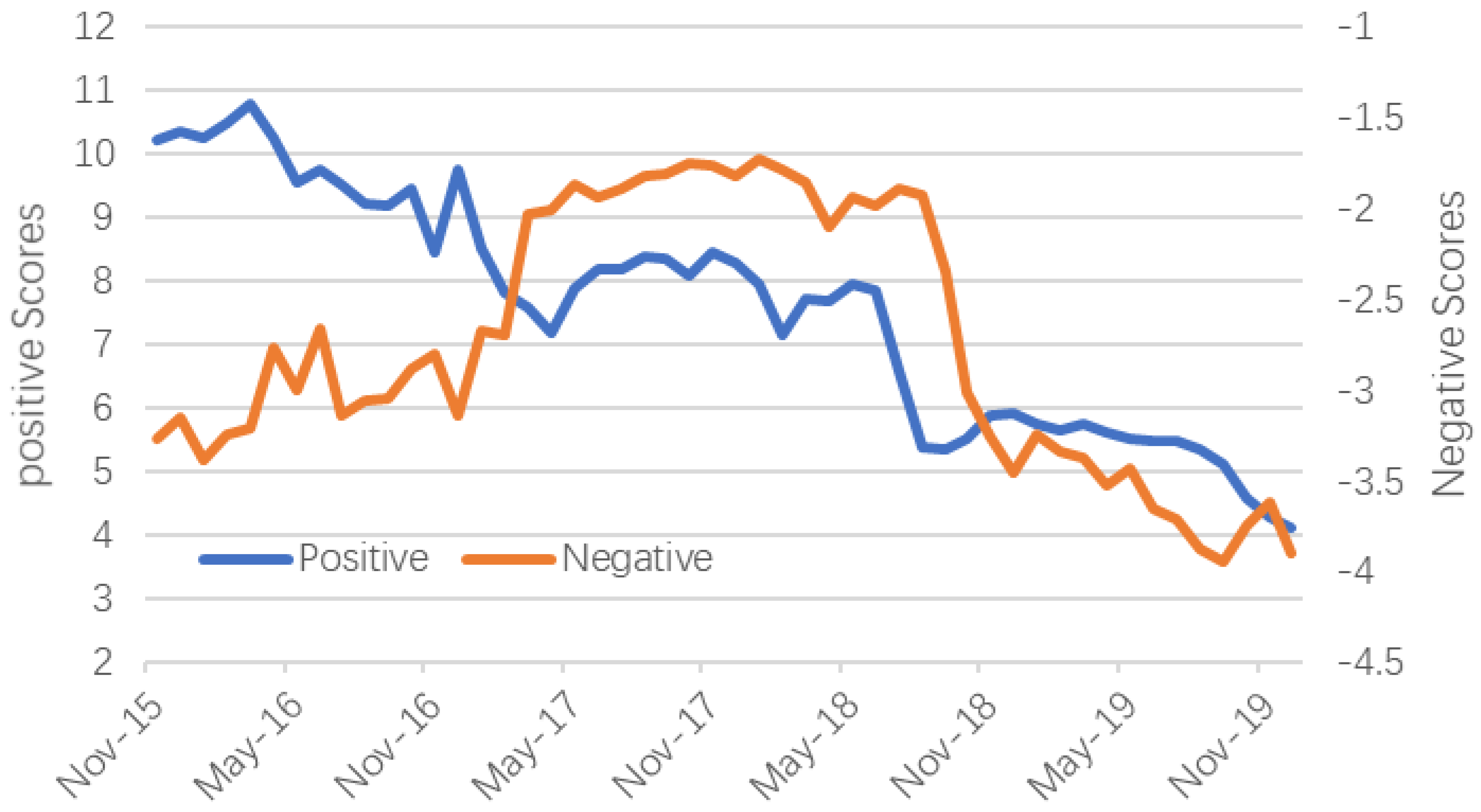

4.2.1. Negative Sentiment Timing Analysis

4.2.2. Sentiment Changes of the Lender

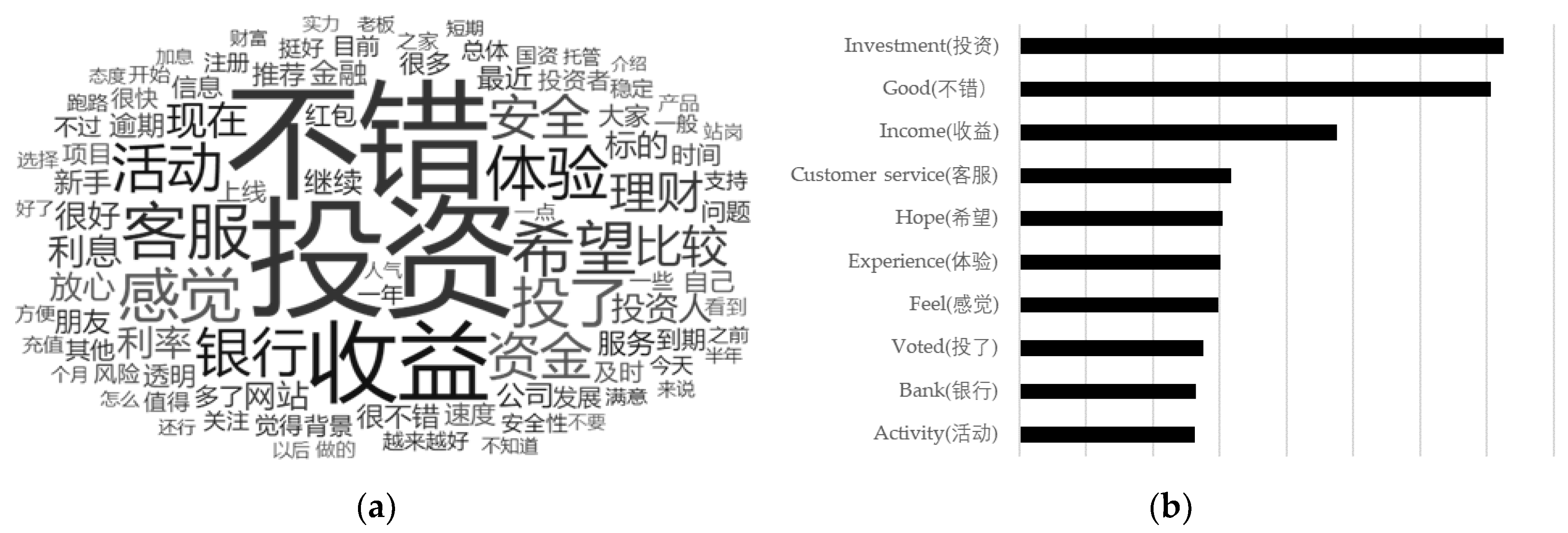

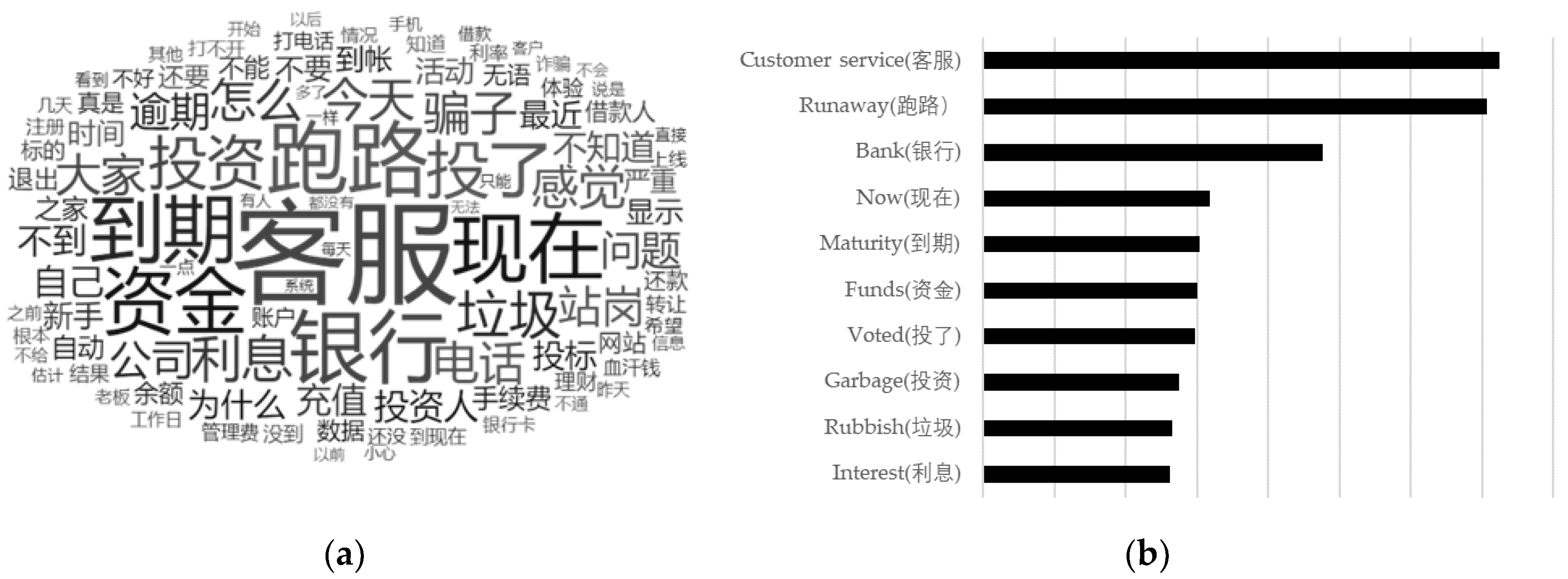

4.3. Comment Text High-Frequency Word Analysis

4.4. Comment Text Topic Analysis

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Zhao, H.; Ge, Y.; Liu, Q.; Wang, G.; Chen, E.; Zhang, H. P2P Lending Survey: Platforms, Recent Advances and Prospects. ACM Trans. Intell. Syst. Technol. 2017, 72, 1–28. [Google Scholar] [CrossRef]

- You, C. Recent Development of FinTech Regulation in China: A Focus on the New Regulatory Regime for the P2P Lending (Loan-based Crowdfunding) Market. Cap. Mark. Law J. 2018, 13, 85–115. [Google Scholar] [CrossRef]

- Braggion, F.; Manconi, A.; Zhu, H. Can Technology Undermine Macroprudential Regulation? Evidence from Peer-to-Peer credit in China. Evidence from Peer-to-Peer Credit in China. Available online: https://ssrn.com/abstract=2957411 (accessed on 15 April 2020).

- Gao, Q.; Lin, M.; Sias, R.W. Words Matter: The Role of Texts in Online Credit Markets. Available online: https://ssrn.com/abstract=2446114 (accessed on 30 March 2020).

- Dong, J.; Wang, G.; Sha, S.; Miao, J.; Li, X. Research on Trust Formation Mechanism in P2P Lending Platform. Chin. J. Manag. 2017, 14, 1532–1537. [Google Scholar] [CrossRef]

- Suryono, R.R.; Purwandari, B.; Budi, I. Peer to Peer (P2P) Lending Problems and Potential Solutions: A Systematic Literature Review. Procedia Comput. Sci. 2019, 161, 204–214. [Google Scholar] [CrossRef]

- Netzer, O.; Feldman, R.; Goldenberg, J.; Fresko, M. Mine Your Own Business: Market-Structure Surveillance Through Text Mining. Mark. Sci. 2012, 31, 521–543. [Google Scholar] [CrossRef]

- Guiso, L.; Sapienza, P.; Zingales, L. Cultural Biases in Economic Exchange? Q. J. Econ. 2009, 124, 1095–1131. [Google Scholar] [CrossRef]

- Lin, M.; Prabhala, N.R.; Viswanathan, S. Judging Borrowers by the Company They Keep: Friendship Networks and Information Asymmetry in Online Peer-to-Peer Lending. Manag. Sci. 2013, 59, 17–35. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Wan, Q.; Chen, D.; Shi, W. Online peer-to-peer lending decision making: Model development and testing. Soc. Behav. Pers. 2016, 44, 117–130. [Google Scholar] [CrossRef]

- Emekter, R.; Tu, Y.; Jirasakuldech, B.; Lu, M. Evaluating credit risk and loan performance in online Peer-to-Peer (P2P) lending. Appl. Econ. 2015, 47, 54–70. [Google Scholar] [CrossRef]

- Pope, D.G.; Sydnor, J.R. What’s in a Picture? Evidence of Discrimination from Prosper.com. J. Hum. Resour. 2011, 46, 53–92. [Google Scholar] [CrossRef]

- Chen, D.; Li, X.; Lai, F. Gender discrimination in online peer-to-peer credit lending: Evidence from a lending platform in China. Electron. Commer. Res. 2017, 17, 553–583. [Google Scholar] [CrossRef]

- Duarte, J.; Siegel, S.; Young, L. Trust and Credit: The Role of Appearance in Peer-to-peer Lending. Rev. Financ. Stud. 2012, 25, 2455–2484. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, Y.; Yin, Z. Education premium in the online peer-to-peer lending marketplace: Evidence from the big data in China. Singap. Econ. Rev. 2018, 63, 45–64. [Google Scholar] [CrossRef]

- Li, S.; Lin, Z.; Qiu, J.; Safi, R.; Xiao, Z. How friendship networks work in online P2P lending markets. Nankai Bus. Rev. Int. 2015, 6, 42–67. [Google Scholar] [CrossRef]

- Liao, L.; Li, M.; Wang, Z. Smart investors: Incomplete market-based interest rate and risk identification: Evidence from P2P lending. Econ. Res. 2014, 7, 125–137. [Google Scholar]

- Herzenstein, M.; Sonenshein, S.; Dholakia, U.M. Tell Me a Good Story and I May Lend You Money: The Role of Narratives in Peer-to-Peer Lending Decisions. J. Mark. Res. 2011, 48, S138–S149. [Google Scholar] [CrossRef]

- Larrimore, L.; Jiang, L.; Larrimore, J.; Markowitz, D.; Gorski, S. Peer to Peer Lending: The Relationship Between Language Features, Trustworthiness, and Persuasion Success. J. Appl. Commun. Res. 2011, 39, 19–37. [Google Scholar] [CrossRef]

- Li, Y.; Gao, Y.; Li, Z.; Cai, Z.; Wang, B.; Yang, Y. The Influence of Borrower’s Description on Investors’ Decision—Analyze Based on P2P Online Lending. Econ. Res. J. 2014, S1, 143–155. [Google Scholar]

- Ji, X.; Yu, L.; Fu, J. Evaluating Personal Default Risk in P2P Lending Platform: Based on Dual Hesitant Pythagorean Fuzzy TODIM Approach. Mathematics 2020, 8, 8. [Google Scholar] [CrossRef]

- Guijarro, F.; Moya-Clemente, I.; Saleemi, J. Liquidity Risk and Investors’ Mood: Linking the Financial Market Liquidity to Sentiment Analysis through Twitter in the S&P500 Index. Sustainability 2019, 11, 7048. [Google Scholar] [CrossRef]

- Shafqat, W.; Byun, Y.-C. A Recommendation Mechanism for Under-Emphasized Tourist Spots Using Topic Modeling and Sentiment Analysis. Sustainability 2020, 12, 320. [Google Scholar] [CrossRef]

- Kauffmann, E.; Peral, J.; Gil, D.; Ferrández, A.; Sellers, R.; Mora, H. Managing Marketing Decision-Making with Sentiment Analysis: An Evaluation of the Main Product Features Using Text Data Mining. Sustainability 2019, 11, 4235. [Google Scholar] [CrossRef]

- Chen, D.; Lai, F.; Lin, Z. A trust model for online peer-to-peer lending: A lender’s perspective. Inf. Technol. Manag. 2014, 15, 239–254. [Google Scholar] [CrossRef]

- Sha, Y.; Yan, J.; Wang, Z. Public Trust On the Red Cross Society of China after Ya’an Earthquake: Analysis Based on Sentiment Analysis of Microblog Data. J. Public Manag. 2015, 12, 93–104. [Google Scholar] [CrossRef]

- Plutchik, R. The nature of emotions: Human emotions have deep evolutionary roots, a fact that may explain their complexity and provide tools for clinical practice. Am. Sci. 2001, 89, 344–350. [Google Scholar] [CrossRef]

- Lount, R.B., Jr. The impact of positive mood on trust in interpersonal and intergroup interactions. J. Pers. Soc. Psychol. 2010, 98, 420–433. [Google Scholar] [CrossRef]

- Dunn, J.R.; Schweitzer, M.E. Feeling and believing: The influence of emotion on trust. J. Pers. Soc. Psychol. 2005, 88, 736–748. [Google Scholar] [CrossRef]

- Medhat, W.; Hassan, A.; Korashy, H. Sentiment analysis algorithms and applications: A survey. Ain Shams Eng. J. 2014, 5, 1093–1113. [Google Scholar] [CrossRef]

- Xu, Q.; Bo, Z.; Jiang, C. Exploring the Relationship between Internet Sentiment and Stock Market Returns Based on Quantile Granger Causality Analysis. J. Manag. Sci. 2017, 30, 147–160. [Google Scholar] [CrossRef]

- Mikolov, T.; Chen, K.; Corrado, G.; Dean, J. Efficient Estimation of Word Representations in Vector Space. Available online: https://arxiv.org/abs/1301.3781 (accessed on 30 March 2020).

- Devlin, J.; Chang, M.; Lee, K.; Toutanova, K. Bert: Pre-Training of Deep Bidirectional Transformers for Language Understanding. Available online: https://arxiv.org/abs/1810.04805 (accessed on 30 March 2020).

- Yin, D.; Bond, S.D.; Zhang, H. Anxious or Angry? Effects of Discrete Emotions on the Perceived Helpfulness of Online Reviews. MIS Quart. 2014, 38, 539–560. [Google Scholar] [CrossRef]

| Title 1 | Synonym 1 | Synonym 2 | Synonym 3 | Synonym 4 | Synonym 5 |

|---|---|---|---|---|---|

| Words | Fake bids (假标) | Plundering money (圈钱) | Self-financing (自融) | Empty shells (空壳) | Fraud (造假) |

| Similarity | 0.74 | 0.68 | 0.65 | 0.64 | 0.64 |

| Minimum Value | Lower Quartile | Median | Mean | Upper Quartile | Maximum Value |

|---|---|---|---|---|---|

| −28.24 | 0.92 | 3.65 | 6.61 | 6.15 | 97.56 |

| Word 1 | Word 2 | Word 3 | Word 4 | Word 5 | |

|---|---|---|---|---|---|

| Topic 1 | Invest (投资) | Good (不错) | wealth investment (理财) | Income (收益) | Feel (感觉) |

| Topic 2 | Platform (平台) | Withdraw (提现) | Arrive (到账) | Money-back (回款) | Maturity (到期) |

| Topic 3 | Safety (安全) | Depository (存管) | Customer service (客服) | Funds (资金) | Rest assured (放心) |

| Topic 4 | Runaway (跑路) | Overdue (逾期) | Problem (问题) | Swindler (骗子) | Garbage (垃圾) |

| Word 1 | Word 2 | Word 3 | Word 4 | Word 5 | |

|---|---|---|---|---|---|

| Topic 1 | Runaway (跑路) | Overdue (逾期) | Swindler (骗子) | Problem (问题) | Garbage (垃圾) |

| Topic 2 | Depository (存管) | Bank (银行) | Data (数据) | Funds (资金) | Online (上线) |

| Topic 3 | Money-back (回款) | Maturity (到期) | Today (今天) | Customer service (客服) | Phone (电话) |

| Topic 4 | Withdraw (提现) | Recharge (充值) | Stand sentry (站岗) | Handling fee (手续费) | management fee (管理费) |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Niu, B.; Ren, J.; Zhao, A.; Li, X. Lender Trust on the P2P Lending: Analysis Based on Sentiment Analysis of Comment Text. Sustainability 2020, 12, 3293. https://doi.org/10.3390/su12083293

Niu B, Ren J, Zhao A, Li X. Lender Trust on the P2P Lending: Analysis Based on Sentiment Analysis of Comment Text. Sustainability. 2020; 12(8):3293. https://doi.org/10.3390/su12083293

Chicago/Turabian StyleNiu, Beibei, Jinzheng Ren, Ansa Zhao, and Xiaotao Li. 2020. "Lender Trust on the P2P Lending: Analysis Based on Sentiment Analysis of Comment Text" Sustainability 12, no. 8: 3293. https://doi.org/10.3390/su12083293

APA StyleNiu, B., Ren, J., Zhao, A., & Li, X. (2020). Lender Trust on the P2P Lending: Analysis Based on Sentiment Analysis of Comment Text. Sustainability, 12(8), 3293. https://doi.org/10.3390/su12083293