1. Introduction

Most governments have traditionally preferred to use “command and control” regulations to protect the environment. However, the accelerating rate of environmental degradation has thrown into sharp relief the limitations of conventional regulation and even of the European Emissions Trading System (ETS), and has encouraged the search for new intervention techniques, with governments turning to economic instruments, including environmental taxes [

1,

2,

3,

4,

5]. Although there is no single definition of environmental tax [

6], in this paper we adopt the Pigovian approach, which considers an environmental tax to be one which is intended to change behaviour harming the environment, whose tax base, as established in Regulation (EU) No 691/2011, is a physical unit (or a proxy of a physical unit) of something that has a proven, specific negative impact on the environment, and which is identified in European System of Accounts-2010 as a tax. However, the reality is that many of these measures may be pseudo-environmental; that is, they may take the form of environmental taxes when their main purpose is to collect revenue [

7]. One of the environmental taxes receiving the most attention in developed economies is carbon tax, i.e., tax levied on firms that produce carbon dioxide (CO

2) through their activities, and seeking to discourage the use of carbon-intensive energy sources. A carbon tax was first implemented in northern Europe in the early 1990s, with Finland leading the way, and often introduced alongside other carbon-pricing instruments, such as energy taxes, with the intention of reducing energy consumption. Since then, many more countries, such as Sweden and other Scandinavian countries, the USA, the UK, New Zealand, Spain, and recently Portugal, have established carbon taxes [

8], although their effectiveness has not been studied in any depth in the academic literature. In fact, more empirical evidence is available on the environmental effectiveness of fuel or energy taxes, than that of carbon taxes [

2,

9,

10].

There are many empirical studies attempting to verify the Environmental Kuznets Curve (EKC) hypothesis, which relates economic growth and CO

2 emissions [

11,

12], although we have had to wait until this century to analyse the impact of carbon taxes on carbon emissions. While there are earlier descriptive studies, and papers based on simulations or general equilibrium models [

13,

14,

15,

16,

17,

18,

19], as far as we know, Millock and Nanges [

20] were the first to use econometric techniques to analyse the effectiveness of this type of taxes on emissions reduction. They studied the case of France in 1990–1999, finding a significant, albeit low, relationship between the French tax on air pollution and the emissions of SO

2, NOx and HCI. Later, with a dynamic panel and the difference-in-differences method, Lin and Li [

21] found that the carbon tax in Finland reduced the growth of CO

2 emissions per capita by 1.69% during the period 1981–2008, although it had no significant effect in Norway, Denmark, Sweden, and the Netherlands.

Morley [

22] also found, for a panel of EU members and Norway, a significant negative relationship between taxes and pollution for the period 1995–2006. Inspired by Lin and Li [

21], Miller and Vela [

7] found that in a sample of 50 countries in 1995–2010, a 1% increase in revenues from environmental taxes meant a 5.4% reduction in the growth rate of CO

2 emissions over the next two years. Recently, Aydin and Esen [

1] used a dynamic model based on the threshold effect, for a panel of 15 EU countries from 1995 to 2013, finding that when environmental taxes pass a certain threshold they do reduce CO

2 emissions. Miceikiene et al. [

23], in their analysis for EU countries, USA, Japan, China, Norway and Turkey for the period 1994–2015, found that environmental taxes reduce pollution, especially in countries with slower economic and tax growth, but with faster development of renewable energy production technologies.

These papers seem to demonstrate that emissions taxes do reduce pollution, although quantitatively their impact is fairly limited. There are even papers like Im and Wonhyuk’s [

24] with panel data from 26 OECD countries, and Loganathan et al. [

25] for Malaysia, which have found no relationship at all between taxation and emissions. The literature has put forward different reasons to justify why these taxes are not very effective: they were recently introduced and therefore, the assessment period is very limited, making econometric estimation impossible; they are usually deployed alongside other control instruments, making it difficult to identify their contribution [

2]; energy-intensive industries tend to be tax-exempt or enjoy substantial tax cuts to ensure they remain competitive [

26]; these taxes are usually levied on energy use in transport and households, where price elasticity is often low, rather than on industry; replacement by other clean energies is not possible, at least in the short-term; or the tax rates established tend to be low [

27].

Meanwhile, the UN has recognised that the role of sub-central governments may be vital for the success of climate policy. Although sub-central policies may seem irrelevant to a global problem like climate change, they can lead to innovative projects and programmes which generate synergies, spread through a set of jurisdictions, and drive international actions [

7,

10,

28,

29]. Even so, at the sub-central level, there is no empirical evidence on the effectiveness of tax-based environmental policies, although some very interesting literature has emerged over the last two decades which includes the spatial dimension of the pollution problem in the analysis of the determinants of air emissions. On one hand, there are papers which, while not going into depth on aspects of fiscal federalism, take into account the fact that emissions in one region can be affected by emissions in neighbouring regions [

11,

12,

30,

31,

32,

33]. On the other hand, there are those that, taking into account the spatial dimension of the analysis, find that a positive relationship exists between fiscal decentralisation (measured as the proportion of sub-central spending over the total) and environmental pollution [

34,

35,

36]. Although none of these papers takes into account environmental taxes, they all demonstrate the need to consider the spatial dimension of the pollution problem, to avoid skewed and inconsistent results [

37].

There is imitation behaviour between adjacent regions [

12,

36], so that if a region has experienced rapid industrialisation and economic growth through expansion of its energy-intensive industries and consumption of more fossil fuels, then neighbouring regions are usually affected and stimulated by this development path, resulting in greater coal resource consumption and higher carbon emissions. Regions try to converge and to learn from each other, especially the closest, so that the industrial structures and technologies used in regions that are geographically close together become more similar, so we cannot ignore the spatial nexus when studying regional emissions to air.

The literature also seems to attest to the need to explain pollutant emissions from a dynamic perspective, which lets us take into account that one year’s emissions may depend on the emissions of previous years, as there is an adjustment cost associated with a given industrial structure which is unlikely to be transformed immediately. For a company to reduce its emissions, it will need to invest and change its production methods, which will probably be costly and time-consuming. Leaving this fact out of our estimations may lead to skewed and inconsistent estimates [

38], so a wide range of papers in recent years have considered this fact in their emissions studies (Zhang et al. [

35]; Zheng et al. [

12], and Zhang et al. [

36], for China; Morley [

22] for EU members and Norway; Begum et al. [

39] for Malaysia, and Ali et al. [

40] for Nigeria).

However, as far as we know, the literature on air emissions has not taken into account the fact that spatial dependence can persist over time—in other words, that there can be non-contemporaneous spatial interrelation. The literature has shown that this aspect is essential for an accurate economic modelling, given that the models which only posit contemporary spatial dependence cannot, by themselves, identify all the mechanisms underlying an economic process; some mechanisms can only be ascertained over time [

41,

42,

43].

From this review of the literature, we can conclude that the available empirical evidence on air emissions always lacks some essential element for their study: either it does not consider the spatial dimension of the environmental problem, or the analysis is static, or the study is at the country level and, in most cases, does not include environmental policy or taxation as an explanatory factor of emissions. The only paper at the regional level which monitors spatial nexus and the dynamic nature of emissions, and includes a variable with some similarity to environmental tax policy, is by Zhang et al. [

36], which includes, as an explanatory factor, the industrial SO

2 removal rate as a proxy for carbon emission reduction policies or intensity of environmental policy. For this reason, the goal of our paper will be to analyse empirically whether the environmental policy of regional governments, and their emissions taxes, are effective in reducing emissions, taking into account the spatial nexus in emissions and in environmental policy, as well as the fact that air emissions show persistence over time. We will also take into account, for the first time in the literature, the fact that spatial dependence may be maintained over time—in other words, that there may be a non-contemporaneous spatial interrelation. This means our paper will fill a gap in the empirical literature, as this is the first paper to combine all these elements in estimating air emissions. Our study will also include other control variables which the literature has shown are essential for explaining emissions, such as industrial production, investment in technology, etc.

In the international context, only Spain and Canada have sub-central emissions taxes, although in the case of Canada, only the province of British Columbia has established this type of tax, and there is also a federal-level emissions tax which has been applied since January 2019 in provinces which do not apply any carbon price system. For this, we will use the scenario provided by the experience of Spanish regional taxation. Spain does not have a centrally-imposed tax, but over the last 30 years, several regions have established emissions taxes (specifically, Andalusia, Aragon, Castilla-La Mancha, Catalonia, Valencian Community, Galicia, and Murcia). Thus, the Spanish context offers an ideal framework for testing the effectiveness of sub-central emissions taxes, over a relatively long period (1999–2017). This decentralisation of the tax enables Spain to adapt to different preferences across territories, and avoid potentially inefficient centralised approaches [

9,

44]. The results obtained show that there is spatial dependence and spatio-temporal persistence in gas emissions at the regional level in Spain, and that in this context, the taxes and policies designed to manage emissions introduce a slight disincentive to generate them, although it does not appear to be enough to meet the targets set for Spain since the 2015 Paris Agreement on Climate Change.

The paper is organised as follows.

Section 2 briefly analyses the gas emissions to air scenario at the regional level in Spain, and how they are taxed.

Section 3 puts forward explanatory hypotheses for emissions to air.

Section 4 analyses the results obtained in the estimation. We end with a section of final considerations.

2. The Scenario to Be Analysed

In 2008, the EU undertook a set of climatic commitments, notably including a 20% reduction in greenhouse gas (GHG) emissions by 2020, compared to 1990 levels. By 2015, it had already met this target, even though the economy of the EU grew by more than 50% over that period, so it was hoped that by 2020, emissions would be 26% lower than they were in 1990. However, in 2017, the EU’s emissions increased, leading to a reassessment of the 2030 targets and 2050 strategy, and carbon tax is one of the instruments their focus is switching to, given that there is a wide margin to increase the tax in the European context, and the Emissions Trading System (ETS) seems not to be working very well. The ETS of the EU covers the GHG emissions of large energy, industry and aviation facilities, which represent over 40% of the EU’s GHG emissions, meaning that the sectors not covered by ETS, such as transport, agriculture, buildings and waste management, generate almost 60% of the EU’s total emissions.

The recent IMF report [

45] indicates that carbon emissions are subject to an average worldwide price (taking into account taxes, the ETS, etc.) of just 1.82 euros per tonne, and recommends that emitter countries raise carbon taxes substantially (until reaching 45.5 euros per tonne of CO

2 in advanced economies, and 22.7 euros per tonne of CO

2 in emerging economies), as they consider them to be the most “efficient” and “powerful” instrument for reducing emissions. Sweden, with a carbon tax of 115.7 euros per tonne, would be the example to follow, as it has reduced emissions by 25% since 1995, while its economy was growing by 75%. Meanwhile, an OECD report [

46] for 42 countries, covering 80% of worldwide emissions, highlights that leaving aside the fuel used in road transport, only 18% of the remaining emissions are subject to tax of any kind. Additionally, only 3% of those carbon emissions are taxed at 30 euros or more per tonne of CO

2, which would be the minimum needed to offset the environmental damage caused, although it would not guarantee meeting the Paris Agreement goals. Moreover, only four of those 42 countries (Denmark, the Netherlands, Norway and Switzerland) would have tax rates higher than 30 euros; Spain is well behind the leaders at slightly less than 5 euros per tonne. Thus carbon, which is responsible for half of all emissions, would be practically tax-exempt in the countries in the OECD report, with an average tax of just 0.73 euros per tonne of CO

2.

In Spain, as we showed in the introduction, there are seven regions currently taxing GHG emissions. A summary of the regulations on these taxes is shown in

Table 1. To summarise, they all tax SO

x and NO

x emissions from the industrial sector, and only Andalusia and Aragon also tax CO

2 emissions. Except for Aragon and Catalonia, which have fixed tax rates for each pollutant, the other regions apply progressive tax rates by emissions brackets, which can benefit less polluting industries. Andalusia, Aragon, Catalonia and Murcia also apply tax credits for investments designed to reduce air pollution. In terms of revenue, very little effort is required of the regions with this tax, since as can be seen in the penultimate column of

Table 1, average tax revenue in 2017 was only 0.0138% of industry value added. Among the regions where this tax is established, the Valencian Community makes the most tax effort in terms of GVA of industry (0.109%), and Catalonia the least (0.0023%). Revenue data are obtained from the Finance Ministry reports on regional economies [

47].

However, this is not the only environmental tax established in the Spanish regions. The financial needs they have had to manage, and the meagre room for manoeuvre for obtaining their own revenue left to them by the central government, have led the regions to set up other environmental taxes over the last three decades, such as industrial waste taxes in Andalusia, Catalonia, Castilla-León, Murcia, Valencia, Extremadura, La Rioja, Cantabria, and Madrid; taxes on facilities impacting the environment in Castilla-La Mancha, Asturias, Valencia, and Extremadura; taxes on environmental damage caused by certain uses of reservoir water in Aragon and Galicia; and taxes on large commercial establishments in Asturias and Aragon. This tax context makes the relative insignificance of emissions taxes in Spain even more obvious, as only 3.34% of revenue from the regions’ own taxes comes from emissions tax. Valencia and Galicia are the regions giving the most weight to emissions taxes in their environmental tax policies (6.73% and 4.39% of their own tax revenue, respectively, come from emissions taxes). At the other extreme is Catalonia, where only 0.16% of revenue from their own taxes comes from emissions taxes. Anyway, with a few exceptions, this scenario does not seem very different to what we observe in the international sphere [

45,

46].

This paper uses panel data for the 17 Spanish regions in the period 1999–2017. The data on emissions at the regional level measure GHG emissions in tonnes CO2 equivalent (CO2-eq), and were obtained from the Spanish Emissions Inventory System (SEI), of the Ministry for Ecological Transition, which enables us to assess compliance with Spain’s commitments in the framework of international and European air emissions regulations. In 2017, CO2 represented 81% of total GHG emissions in Spain, followed by methane (12%) and nitrous oxide (NO2), (5%). The registered emissions correspond to industries in the energy sector, combustion in manufacturing and construction industries, transport, combustion in other sectors, industrial processes, use of solvents and other products, agriculture, changes in land use and forestry, and waste treatment and disposal.

The evolution over time of regional emissions in Spain is shown in part

a) of

Figure 1. We have marked the years when the tax was applied in each region with a marker on the timeline of each region with carbon tax. The evolution of emissions has some relation to the Kuznets curve in practically all the regions, whether or not they tax emissions, so we cannot say the fall in emissions in recent years is because of the tax—it may also relate to Spain’s economic crisis. We can also see that the regions taxing emissions to air were not the biggest polluters before the tax was introduced, nor the least-polluting afterwards, so there does not appear to be a correlation between emissions levels and the tax. Similarly, the OECD countries with the highest emissions tend to set lower prices for industrial emissions than the lower-emission countries [

46]. This lack of correlation between emissions levels and the tax seems to be confirmed in part

b) of

Figure 1, where we see that the volume of emissions in terms of regional GVA shows a clear downwards trend in all Spanish regions. This part

b) of

Figure 1 also shows significant differences in emissions levels throughout the territory of Spain; pollution is especially high in Asturias, Castilla-León, Castilla-La Mancha and Galicia, while Madrid, Catalonia, Valencia and Murcia are the least polluting regions.

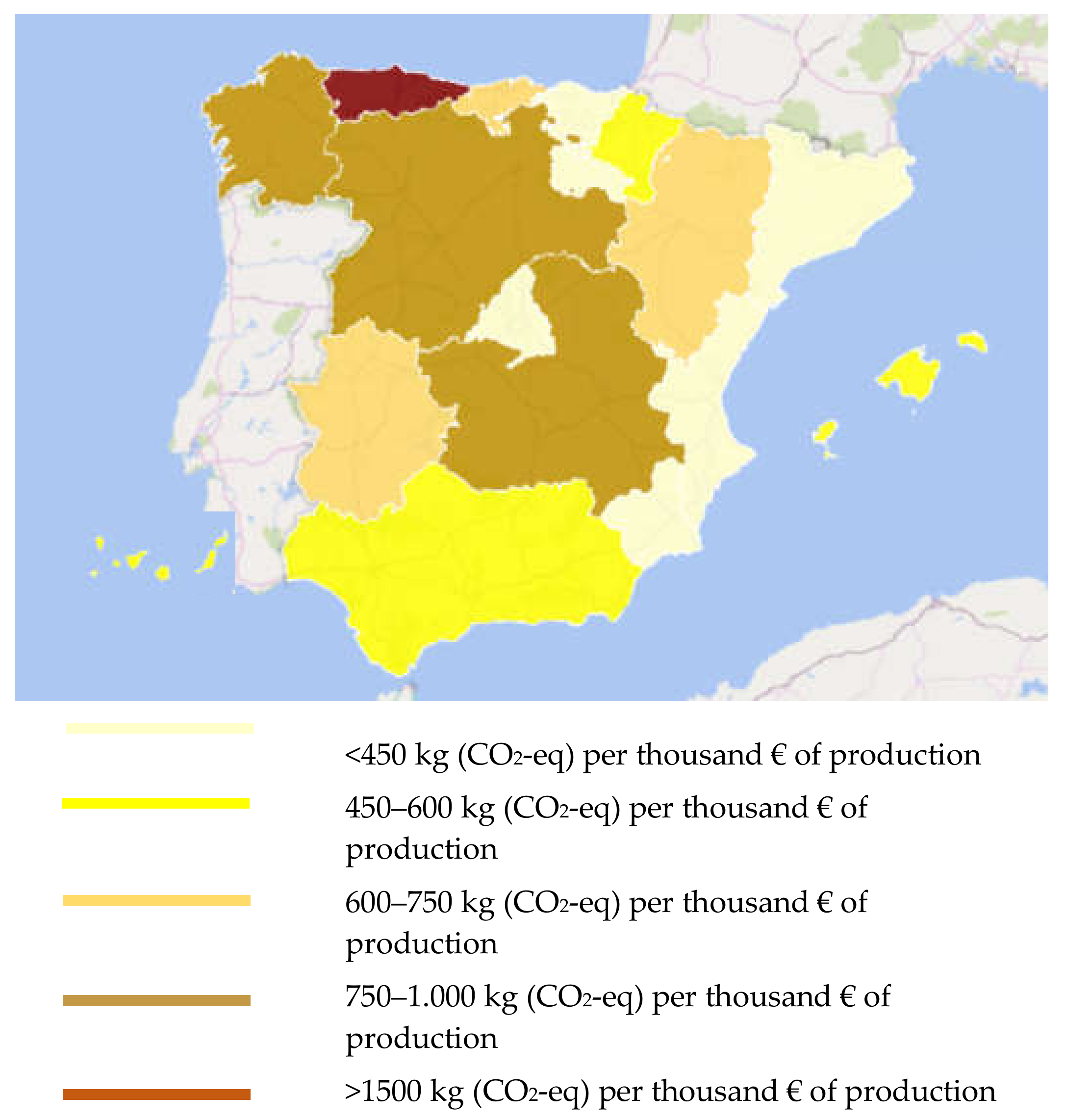

This disparity in the intensity of emissions shows some tendency to spatial clustering, as shown in

Figure 2. This suggests that GHG emissions in Spanish regions are positively spatially correlated, or in other words, that highly polluting areas have nearby regions which are also highly polluting (i.e., high-high positive correlation), and low-polluting areas tend to have similarly low-polluting areas nearby (low-low positive correlation). Specifically, it appears that regions in eastern and southern mainland Spain and the archipelagos are less polluting than the western and northern regions. This spatial correlation is confirmed by the Pesaran and Moran tests, which can be seen at the end of Table 3, and this means that any estimation of the determinants of GHG emissions using OLS models will produce skewed and inconsistent results; therefore, we need to use spatial regression models which take spatial interrelation into account.

3. Proposed Hypotheses for Estimating Industrial Air Emissions

As we explained in the introduction, we will estimate GHG emissions for the 17 Spanish regions using a dynamic model for the 1999–2017 period, with a specification which controls spatial nexus between regions. The spatial relationships can be modelled in various ways, depending on the relationships between the dependent variable and the explanatory variables, although we are going to examine the most general situation—the one which considers the possibility that the pollutant emissions to air of a region depend on the emissions of other regions, both in the same year and in past years; on certain explanatory variables of emissions in neighbouring regions [

38,

48]; and on omitted variables which may be spatially correlated. The general expression of the model used will therefore be:

where

Eit measures the volume of GHG emissions to air in the region

i and year

t (with

i=1,…,17 and

t=1999,…,2017),

θ and

μ are the spatial lag coefficients which measure global spatial dependence, contemporaneous and non-contemporaneous respectively—in other words, how much a region’s emissions depend on the emissions its neighbours produce today, through

θ, and in the past, through

μ.

ωij is each element of the matrix of spatial weights we use to measure the nexus between the regions, so that if the regions

i and

j interact,

ωij ≠ 0, where, by definition,

wii=0. We built the matrix of spatial weights considering the five nearest regions in terms of distance to be neighbours, maintaining very high geographical proximity, less than 300 kilometres in the worst case (we considered other definitions for the matrix, but they produced worse results; they are available at the request of the interested reader).

xiq are the

q explanatory factors of GHG emissions from region

i, and

xjm, the

m explanatory factors of emissions from the neighbouring regions

j, which may influence emissions in region

i. Thus,

βq are the

q coefficients of the

x explanatory factors of region

i and α

m are the

m local spatial dependence coefficients which capture the direct influence of the characteristics of the neighbouring regions

j.

Ψ is the coefficient of persistence of emissions or dynamic component,

captures the specific effect of each region, and

ξ is the spatial autocorrelation coefficient of error, which reflects the degree of influence of the residual term of adjacent regions on the residual term of this region. We suppose that

θ,

μ, α

m and

βq are constant in space and time.

Given that our intention is to analyse whether environmental taxes and policies adopted by the Spanish regions meet their goal of reducing emissions, a key explanatory variable in our estimation will be

emissions tax (EMTAX). These taxes are supposed to stimulate polluting companies to internalise the external effect of their emissions, and incorporate the cost of the pollution in the final price of their output, thus generating incentives to change their behaviour and be less polluting. Additionally, as taxes are generally used together with other environmental policies (other economic instruments, regulations, etc.) seeking the same results [

2,

9,

10], we have also included a variable,

EMINV, to capture the combined effect of all these measures, through the investments strictly linked to GHG emissions which these companies make in response to the stimulus introduced by these policies. A negative sign for these variables would indicate that the measures being taken are effective in combating pollution. We have also included the interaction of these two hypotheses, although taking into account that basically it is the largest companies that have real investment capacity, and bear most of the burden of environmental taxes. This last point is both due to reasons of tax administration and control, and because information on emissions exists only for the largest companies, given that the obligation to report their volume of emissions affects only firms exceeding the minimum emission thresholds established by the Spanish Pollutant Release and Transfer Register (PRTR-España). Therefore, we have attributed both emissions tax revenue (

EMTAX100) and emissions-related investment (

EMINV100) to companies with more than a hundred employees. A negative sign for this interaction would suggest that taxes on the emissions of large companies are more effective when their investments are greater.

The literature has demonstrated the synergies, interactions and trade-offs which can arise between policies with different goals [

9,

10,

49], so it seemed desirable for our estimation to consider the set of taxes, environmental regulation measures and economic instruments established by Spanish regions, even if they have no bearing on emissions. The reason is that these environmental taxes and regulations probably affect the same polluter agents or industries, and that the technological changes or innovations they encourage can even lead to the displacement of pollution to other sectors (such as the electricity industry) or other resources (such as water). To take these synergies into account, we included the variable

ENVTAX, which captures the aggregate environmental taxes of the region, and

ENVEXP, which captures the current expenditure companies have to incur as a consequence of the environmental policies, and which can potentially also influence emissions levels [

1,

7,

50,

51]. Their expected sign would therefore also be negative, although it is hard to assess the effectiveness of environmental policies due to their possible

rebound effects: an increase in energy consumption could have been induced by a fall in the cost of using energy services as a result of, for example, greater energy efficiency caused by a regulation [

9].

Together with these relevant variables, we have included various control variables. First, based on the literature on the

economic geography theory, we have included a group of variables intended to show the importance of industry, one of the most polluting sectors, in each region. These variables are, on one hand, the level of industrial production

(INDGDP) and the number of industries per square kilometre, or industrial density (

DENS), which should favour the level of emissions; and on the other, the interaction of

DENS with the weight of industry in regional production (

INDW), intended to capture the degree of industrial congestion in the region [

32,

34]. A negative sign for this interaction could suggest a high concentration, and even congestion, of the industrial sector, which could lead to the displacement of industries to other regions. Second, based on the literature on

KLEM models, we have included companies’ inputs, specifically wages

(WAGES); spending on technological investment and innovation

(RD) as a proxy for capital endowment, given the strong correlation between capital endowment and regional income; and the energy consumption

(ENERGY) of the regions. The relationship of these inputs with emissions may be complementary or substitutional, but it would be reasonable for a greater investment in technology to help reduce emissions. Third, based on the literature on the

Kuznets curve [

32,

34], we have included the square of regional industrial production (

INDGDP2). Finally, as is usual in the literature on emissions, we have included the elderly population

(AGED) as a proxy for environmental awareness, which is lower in that age group; and also for the lower dynamism and less industrial activity in regions with an elderly population. However, it is true that some of the least dynamic regions, from the point of view of demographics, are highly polluting areas, where there are, for example, large thermal power plants (e.g., northwest Spain, Teruel province, and southern Spain). We also tried including other variables, such as education, other age groups, or the importance of the large companies in the region, but they did not improve the model.

The definition of the variables used, their symbols and expected signs are summarised in

Table 2. All the variables are specified in logarithms to provide the values of the elasticities, and relativised according to income or emissions generated, to homogenise and smooth the data between regions of very different sizes, which can correct heteroscedasticity [

32]. The information on the most relevant descriptive statistics and the correlation matrix of the main variables are provided in

Table A1 and

Table A2 of the

Appendix A.

4. Estimation and Results

To take into account that the effect environmental policies can have on emission levels will not be immediate [

7,

52,

53], we have lagged one period our tax variables (

EMTAX and

ENVTAX), and the environmental investments and spending we use as proxies for environmental policies (

EMINV,

ENVEXP). These lags let us also reduce the potential endogeneity problem which may be underlying in some variables, arising from their possible correlation with the stochastic disturbance term [

36].

In any case, to ensure there are no endogeneity problems in these variables (

EMTAX, ENVTAX,

EMINV,

ENVEXP), nor in those measuring the importance of the industrial sector in the region (

INDGDP,

DENS,

INDW), we used the two-stage Hausman procedure, with the lagged variables from the model as instruments. The Wu-Hausman and Durbin statistics show that we cannot reject the null hypothesis of exogeneity of these variables, and the Sargan and Basman tests present strong evidence that we cannot reject the null hypothesis that the over-identifying restrictions are valid. All of these tests are shown in

Table A3 of the

Appendix A.

According to the model selection procedure proposed by Elhorst [

38] and usually used in the literature [

11,

30,

31,

32,

33,

34], based on the test for absence of spatial autocorrelation in the error term (LM error), presence of spatial autocorrelation in the lagged dependent variable (LM lag) and no general spatial autocorrelation (LM SAC), which can be seen in

Table A4 of the

Appendix A, the right model for explaining GHG emissions in the Spanish regions would be the dynamic spatial Durbin model (dynamic SDM); in other words, we would have to take into account spatial autocorrelation in the endogenous variable and also in the explanatory variables. Additionally, taking into account that each region has its own characteristics, many of which are unobservable and usually unchanging over time, we will use fixed effects. Thus, we have estimated a dynamic spatial Durbin model, using quasi-maximum likelihood (QML) techniques, with fixed effect (regional and temporal), and using Driscoll-Kraay standard errors which produce heteroscedasticity-robust estimators.

The results obtained (

Table 3) confirm the existence of spatial interactions in the dependent variable and explanatory variables, and a dynamic component, when explaining GHG emissions. The dynamic nature of emissions is captured by the positive and highly significant coefficient

, suggesting that the current levels of regional emissions in Spain are conditioned by previous emissions, as was expected from a theoretical point of view and as found in the empirical literature [

12,

36].

The spatial correlation coefficient (

θ), also positive and significant, demonstrates the existence of a contemporaneous global spatial spillover effect in emissions, of a magnitude (0.268) similar to the value predicted by the Pesaran test (0.324), which would indicate that the regions close to other high-polluting regions will very probably be high polluters, too. Liu et al. [

34] and Zhang et al. [

36] also found evidence that the behaviour of carbon emissions in neighbouring provinces of China would influence each other rather than be independent of each other. Moreover, the value of our coefficient

θ is within the parameters (0.248–0.326) obtained by Zhang et al. [

36]. At the same time, the significance and sign of our coefficient

, which for the first time in the literature on emissions captures the dissemination over time of this global spatial spillover effect, suggests that past emissions in neighbouring regions also positively influence (0.310) current emissions in the home region. The presence of spatial correlation in the explanation of GHG emissions can be understood if we remember that the industrialisation process in Spain was fairly concentrated geographically, being located mainly in the north. We must take into account that the most polluting industrial sectors (heavy industry, metalwork, energy production, chemicals, and oil refinery) are mature sectors with high costs of entry, and are subject to strict territorial land use restrictions which specify the jurisdictions where these industries can be established.

The model suggests that the measures adopted by the regions which are specifically designed to reduce emissions achieve their purpose, both if we consider the aggregate of emission-reduction measures, quantified as investment effort in clean technologies (

EMINV), and if we only take into account the emissions tax (

EMTAX). However, as obtained in the literature [

7,

21,

46], the effect of these measures is very slight (−1.2% and −2.7%, respectively). The meagre influence of the tax variable may be due to the low tax rates set by the Spanish regions, and to the fact that in Spain, regions which have introduced tax stimuli incentivising emissions reduction exist side by side with others which behave like environmental “free riders” [

2,

10,

45,

46]. Additionally, when we attribute this tax burden and these investments to the large companies, the interaction of both variables has a positive relationship with emissions, providing even more evidence of the low effectiveness of these measures in combating air pollution. The positive sign of this interaction could indicate that large companies do not respond as desired to the taxes, probably because the amount of tax is low enough that they can pay it without feeling the need to change their environmental behaviour, or even because they can transfer their polluting production to other territories where their facilities will not be taxed. In any case, this result is not surprising if we remember that the period of increasing emissions during the economic boom of the 2000s was also when most emissions taxes were passed, and marked the start of specific environmental legislation, stimulating profligate environmental spending and investment by companies. In 2005, a law was passed regulating greenhouse gas emissions; in 2007, an environmental responsibility law and an air quality law were passed; and 2008 was the start of the period when greenhouse gas emissions had to be reduced. Similarly, the subsequent recession noticeably reduced emissions as well as environmental spending and investment, which worked like financial adjustment valves for companies until 2012. The crisis also changed the type of environmental spending of companies; obtaining the new environmental certificates (ISO 14001) became a priority, which implied a series of operating and personal costs, instead of investments, which decreased.

At the same time, the model seems to suggest, albeit very marginally, that the regions react to the aggregate of environmental policies (ωENVEXP) and environmental taxes (ωENVTAX) adopted in neighbouring regions. The environmental policy adopted in a region can redirect the productive behaviour of neighbouring regions when they understand the message of clean production it is sending, although they can also react to these policies from fear that their own region will establish strict environmental regulations (we must remember that measures of this kind are almost sure to spread to neighbouring regions, thanks to imitation, coordination, or a national standardisation of environmental policies). In any case, we are talking about very low levels of effectiveness (from −0.2 and −0.6%, respectively).

Our model also shows that a region’s specialisation in industrial activities (measured by

INDGDP and

DENS) favours GHG emissions, which is consistent with theoretical expectations, and with the results in the literature [

32,

34,

35,

36]. However, the negative incidence of the

DENS*

INDW interaction seems to indicate that when industrial congestion phenomena appears, part of the activity eventually shifts to other regions [

54]. As found by Loganathan et al. [

25] for Malaysia, or Liu et al. [

34], Xiong et al. [

32] and Zhang et al. [

36] for China, our model would confirm the EKC hypothesis for Spain, as it suggests a growing relationship between emissions levels and regional industrial production, albeit with relative decoupling, given the negative sign of the square of the variable

INDGDP. This result would suggest the Spanish regions are concerned about sustainable and environmentally friendly industrial development.

Meanwhile, the model suggests that energy-intensive activities (

ENERGY) are the most polluting, as we would expect, given the link between such activities and emissions; while capital intensity, which we capture via investment effort and innovation (

RD), shows a substitutional relationship with emissions [

22,

34]. We have not found any link between labour and emissions levels, unlike Hettige et al. [

55], who found a positive connection when analysing industrial effluents. Neither did we find connections to ageing populations (

AGED).

5. Concluding Remarks

This paper analyses the relationship between, on one hand, policies designed by sub-central governments to reduce emissions and other environmental damage, including tax policies, and on the other, GHG emission levels in the 17 regions of Spain over a long period (1999–2017). The sample used for this study is relevant and appropriate, given that all the Spanish regions have environmental regulations which affect emissions, thanks to the requirements of and adaptation to national and European policy; all of them have implemented environmental taxes in the period of study; and seven of them have established taxes on GHG emissions. The study was conducted controlling the dynamic and spatial component of emissions to air, using a dynamic spatial Durbin model, which has been shown to be the most suitable model for this analysis.

The results obtained show, first, that there is a spatial interaction in the same direction (

) at the regional level of emissions, which is strengthened over time (

), and which suggests that the emissions level of each region is clearly influenced by the emissions levels of their neighbouring regions, both contemporaneously and non-contemporaneously. These spatial spillover effects could call into question the “polluter pay” philosophy for resolving the main regional environmental problems; and they lead us to think that, instead of individual actions at the regional level, it would be more appropriate to deal with the pollution problem jointly and systematically [

32].

Second, the emissions levels of the Spanish regions are highly persistent over time (), and depend heavily on the level of industrial production (INDGDP), although the non-linearity seen in the relationship between both variables is compatible with the EKC hypothesis. In any case, if we add the low impact of the environmental policies and taxes designed to reduce emissions, to the cumulative effect shown by the dependent variable (), and the low value of the coefficient of the square of the variable INDGDP, there is clearly a need to implement more aggressive structural policies in Spain, which can consolidate and accelerate the relative decoupling which seems to be happening between industrial development and environmental damage.

This seems to be the intention of the 1st National Air Pollution Programme (

I Programa Nacional de Contaminación Atmosférica) [

56], which establishes 57 sector-specific and transversal measures, in line with national air quality policies and with the energy and climate policies defined in the 2021–2030 National Integrated Energy and Climate Plan (PNIEC) [

57]. Surprisingly, however, environmental taxation plays a residual role among the proposed measures, for two reasons. First, because environmental taxes in Spain are well below the average European levels, so we have ample room to manoeuvre which should enable us to get additional resources for financing our environmental investment programmes in a context of tight budget constraints, as well as introducing the incentives needed for internalising the negative external effects relating to the environment; and second, because emissions taxes are effective, as shown by the available empirical evidence. The literature also identifies them as the best instrument available for achieving that goal, although it appears that tax rates would have to be raised substantially for them to have a real effect, perhaps as a progressive tax.

Besides, bearing in mind the spatial spillover effects shown in the estimations, we think that emissions taxes should be applied across the entire national (or even supranational) territory, which would reduce the efficiency costs arising from environmental dumping by the regions without this type of tax, avoid polluting production being shifted between regions, and comply more closely with the new approach of the European Union. Additionally, if this type of tax is generalised, the tax rates needed to achieve a change in behaviour will probably not have to be so high, given the spatial nexus between the territories. Meanwhile, given that we can expect the spatial nexus we find at the regional level for Spain to also exist at the supranational level, we believe our findings can be extrapolated to other contexts, e.g., at the level of the EU or USA, and thus, the conclusions of this paper are generalisable.

At the same time, it is desirable for emissions taxes to be applied across other sectors in addition to industry, such as those outside the EU Emissions Trading System. In fact, there is an EU initiative to develop a Europe-wide carbon taxation system, which, if implemented, would replace the ETS and include the diffuse sectors. This strategy would involve a carbon adjustment mechanism on the border, which would work rather like tariffs or import duties on CO2 for imported goods (while goods exported from the EU would receive a refund under this policy). Although it would be a useful tool for avoiding carbon leakage and protecting EU industry from unfair competition from countries without a price on carbon, it runs the risk of breaching World Trade Organisation (WTO) rules, which require a level playing field for similar products and no discrimination between national and foreign goods. From this point of view, it would be better for the import duty to be replaced by a carbon tax on all goods, including those made in the EU. However, an EU-wide tax would need the unanimous backing of all member states, which seems like an impossible goal, judging by previous attempts, so it seems more likely that a carbon tax will be implemented by national tax systems.

In fact, an increasing number of countries would rather not depend only and exclusively on the ETS to achieve their emissions reduction goals, partly because they believe the ETS incentive is not substantial enough, and partly because ETS is not applied to all sectors of the economy. However, the effectiveness of emissions reduction policies crucially depends on coordination between jurisdictions and between the existing different environmental policy instruments [

58], and on monitoring compliance with the established targets [

59]. For this reason, to meet the targets the EU has set for each country, it should be compulsory to adopt, for example, one of the two tax emissions strategies some countries are currently using unilaterally, given that the literature shows taxes to be the most effective instruments: either broadening ETS by applying a CO

2 price to sectors not covered by ETS, as Germany is doing; or intensifying ETS by applying a minimum or additional price for CO

2 emissions within the ETS sectors, as in Sweden, the Netherlands, and the UK. In any case, the supranational level must always ensure the minimum targets are met, while leaving jurisdictions free to use the mechanisms they deem to be suitable, and even to set more ambitious reduction targets [

10,

29]. In Spain, the region of Catalonia has passed a tax which will charge vehicles based on their emissions, which could be a good start, bearing in mind the tendency to imitate tax policies at the regional level. This type of tax is intended to promote cleaner vehicles and send ecological signals to the market. Additionally, if taxes of this type are accompanied by other measures, such as establishing low-emission areas in cities, it is very probable that, as our model shows, emissions will be reduced in the neighbouring regions, too. In fact, in Spain, sales of polluting cars, for example, have already fallen thanks to the low-emission urban areas recently set up by local governments in Madrid and Barcelona.