Renegotiation Strategy of Public-Private Partnership Projects with Asymmetric Information—An Evolutionary Game Approach

Abstract

1. Introduction

2. Literature Review

3. Methodology

4. Evolutionary Game Model

4.1. Description of the Problem

4.2. Assumptions

4.3. The Stability Analysis of Equilibrium Strategy

5. Analysis of Evolutionary Game Results

5.1. Pure Strategy Nash Equilibrium

5.2. Mixed Strategy Nash Equilibrium

- When other parameters remain unchanged, M1 is positively correlated with and . It means that the higher the risk of future renegotiation is estimated by the government and the higher the excess profits obtained by investors’ opportunism, the higher the probability of the system reaching a stable strategy (opportunism, terminate the project).

- M1 is negatively correlated with and . It means that whether the investors have an opportunism tendency or not, the higher the social benefits generated when investors receive subsidies to maintain the project, the higher the probability of the system reaching a stable strategy (non-opportunism, maintain the project).

- M1 is positively correlated with , which means that when renegotiation occurs, the higher the unrecovered cost is in the case of non-opportunism, the more likely investors are to adopt opportunistic behavior, and the higher the probability of system stability strategy reaching opportunism, and terminating the project. M2 is positively correlated with , which means that the higher the unrecovered cost is in the case of opportunism, the higher the probability that the system stability strategy will reach non-opportunism, and maintaining the project.

- M1 is positively correlated with the subsidy cost , while M2 is positively correlated with buyback cost . The higher the total cost of government departments due to subsidies, the higher the probability that the system’s evolutionary stability strategy will be opportunism, and terminating the project. Similarly, the higher the buyback cost, the higher the probability of non-opportunism, and maintaining the project.

- M1 and are positively correlated. In the case of opportunism, the higher the future income of the project, the more likely investors are to adopt opportunism, the higher the probability of opportunism, and terminating the project. Similarly, M2 and are positively correlated. The higher the future income of the project under the condition of non-opportunism, the higher the probability of non-opportunism, and maintaining the project.

6. Numerical Simulation

6.1. The Impact of Initial Strategy Selection on Evolutionary Results

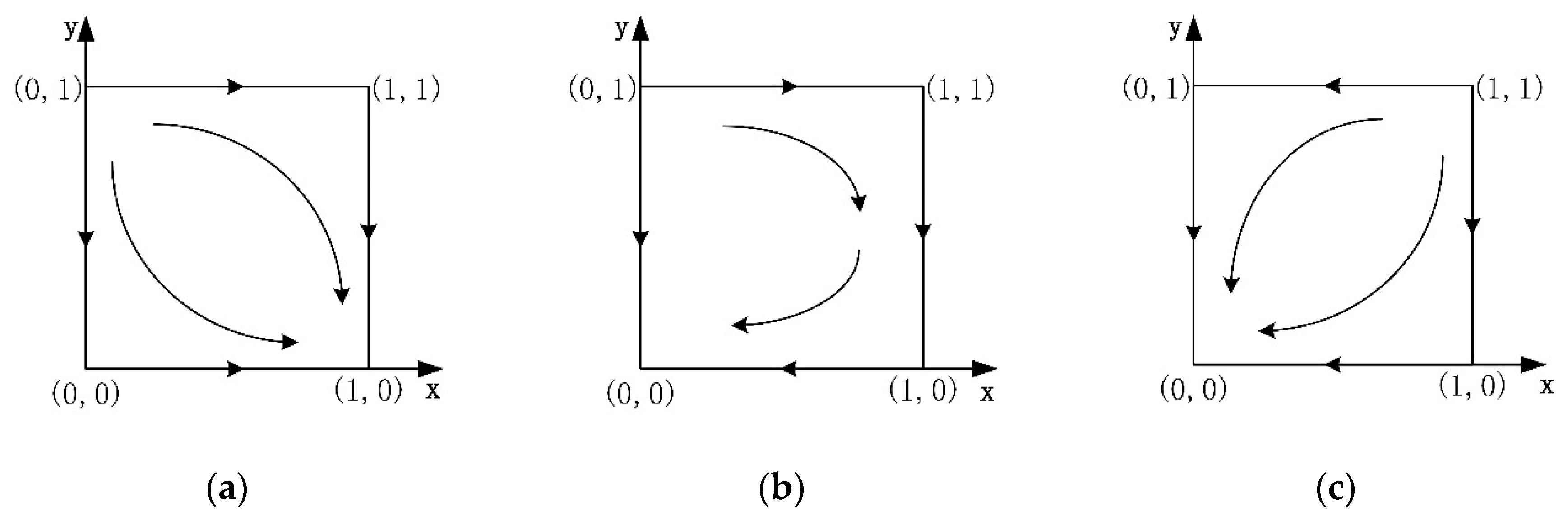

- As shown in Figure 4a, when other parameters remain unchanged, remains unchanged, and increases successively from 0.1 to 0.9. From , the ESS of the system changes from (0,0) to (1,1). Similarly, when is fixed in Figure 4b, the value of is successively increased from 0.1 to 0.9. When , the ESS changes to (1,1). Moreover, with the increase of , the evolution speed of the system is also accelerating. We can find that when the initial probability of the government () is high, it will stabilize at state 1; on the contrary, when the initial probability of it is low, it will stabilize at state 0. From Figure 4a,b, when the initial probability of investors () increases, the system will stabilize at (1,1) more quickly.

- As shown in Figure 5a, when is fixed, increases from 0.1 to 0.9 successively. When , the evolutionary stable strategy of the system changes from (0,0) to (1,1). When is fixed in Figure 5b, increases from 0.1 to 0.9, and when , the ESS of the system is changed to (1,1). With the increase of , the evolution speed of the system is also accelerating. Similarly, it is clear that when the initial probability of investors () is high, it will stabilize at state 1; on the contrary, when the initial probability of it is low, it will stabilize at state 0. Comparing Figure 5a,b, when the initial probability of the government () increases, the system will stabilize at (1,1) more quickly.

6.2. The Impact of Parameters on Evolutionary Results

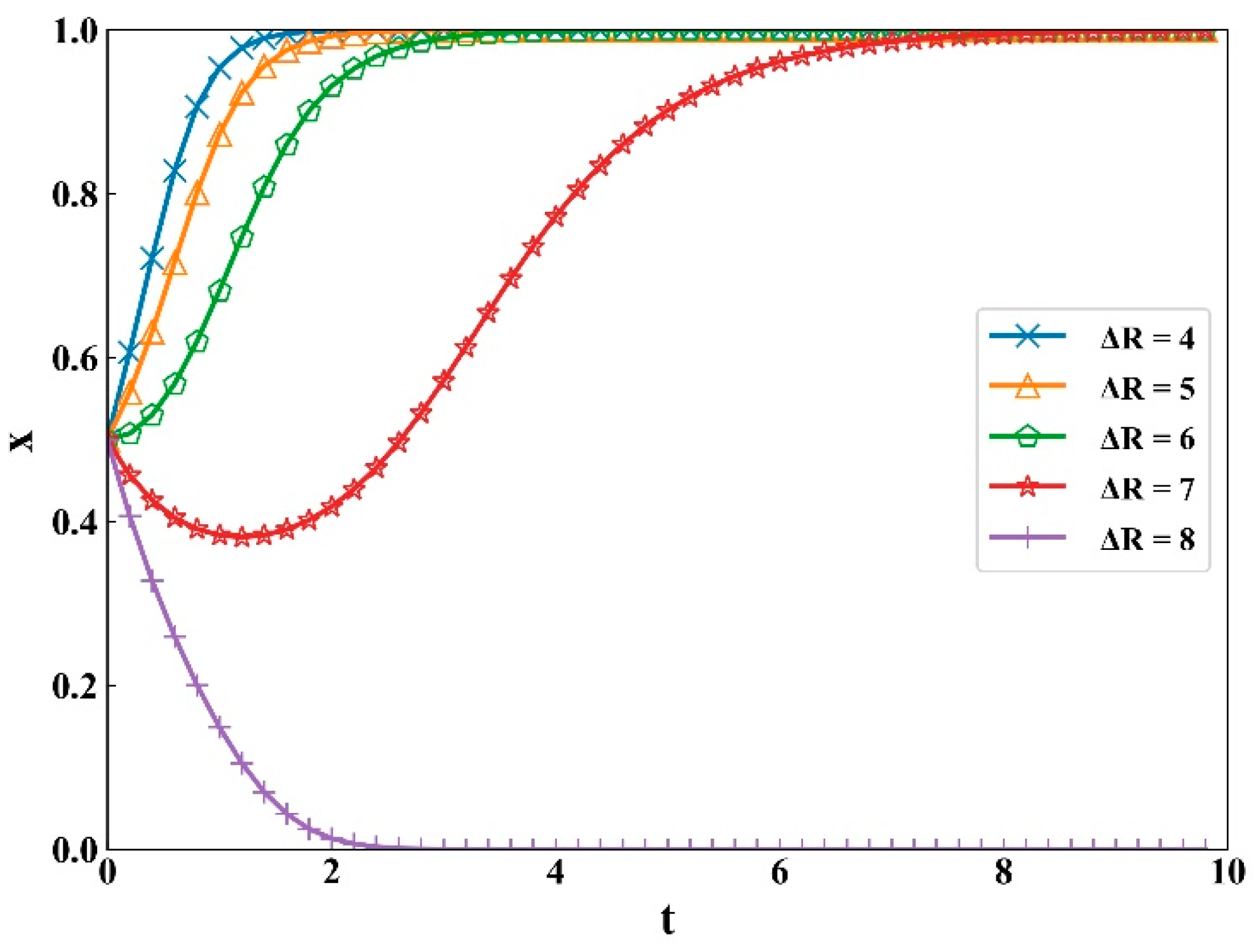

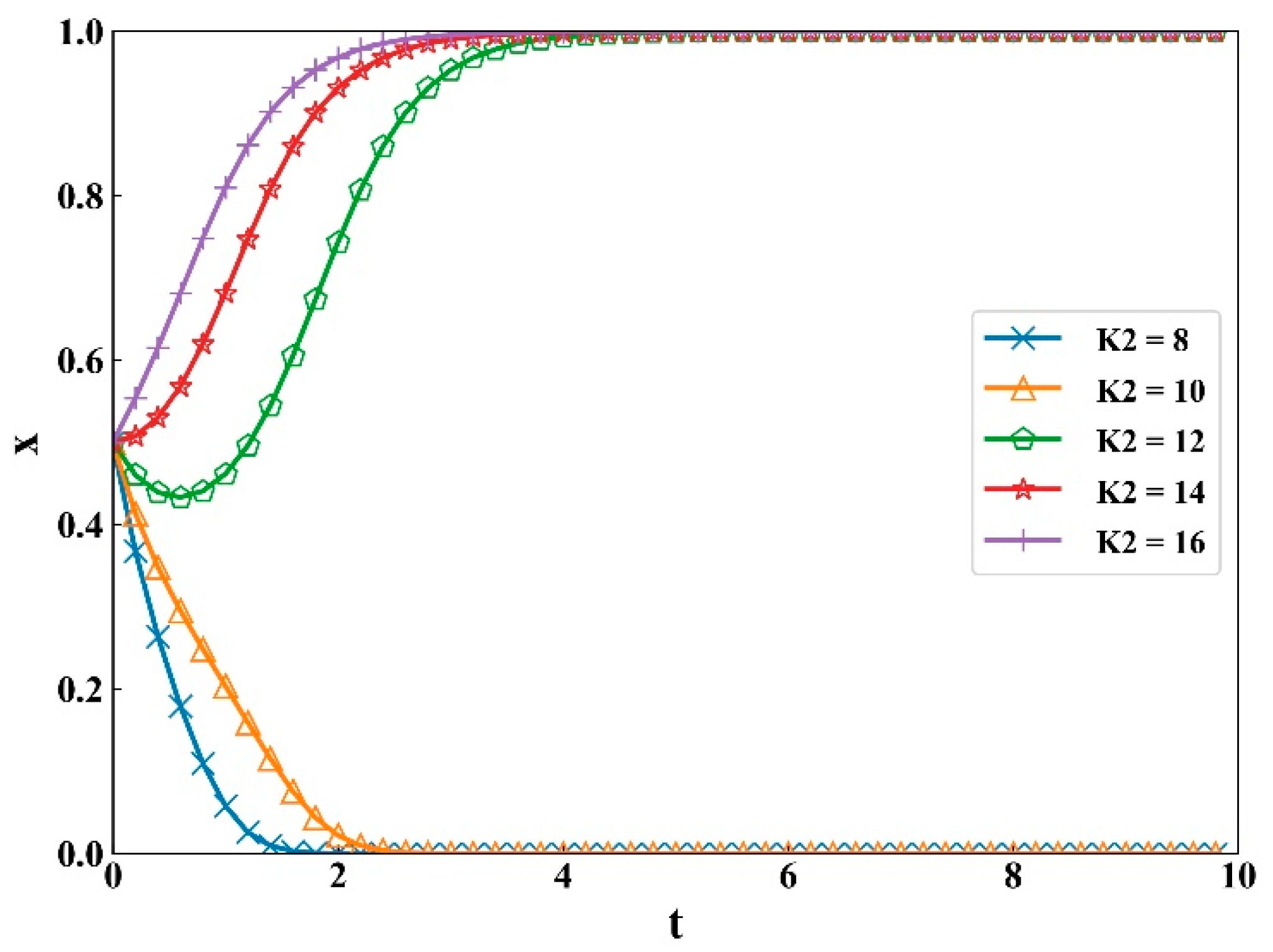

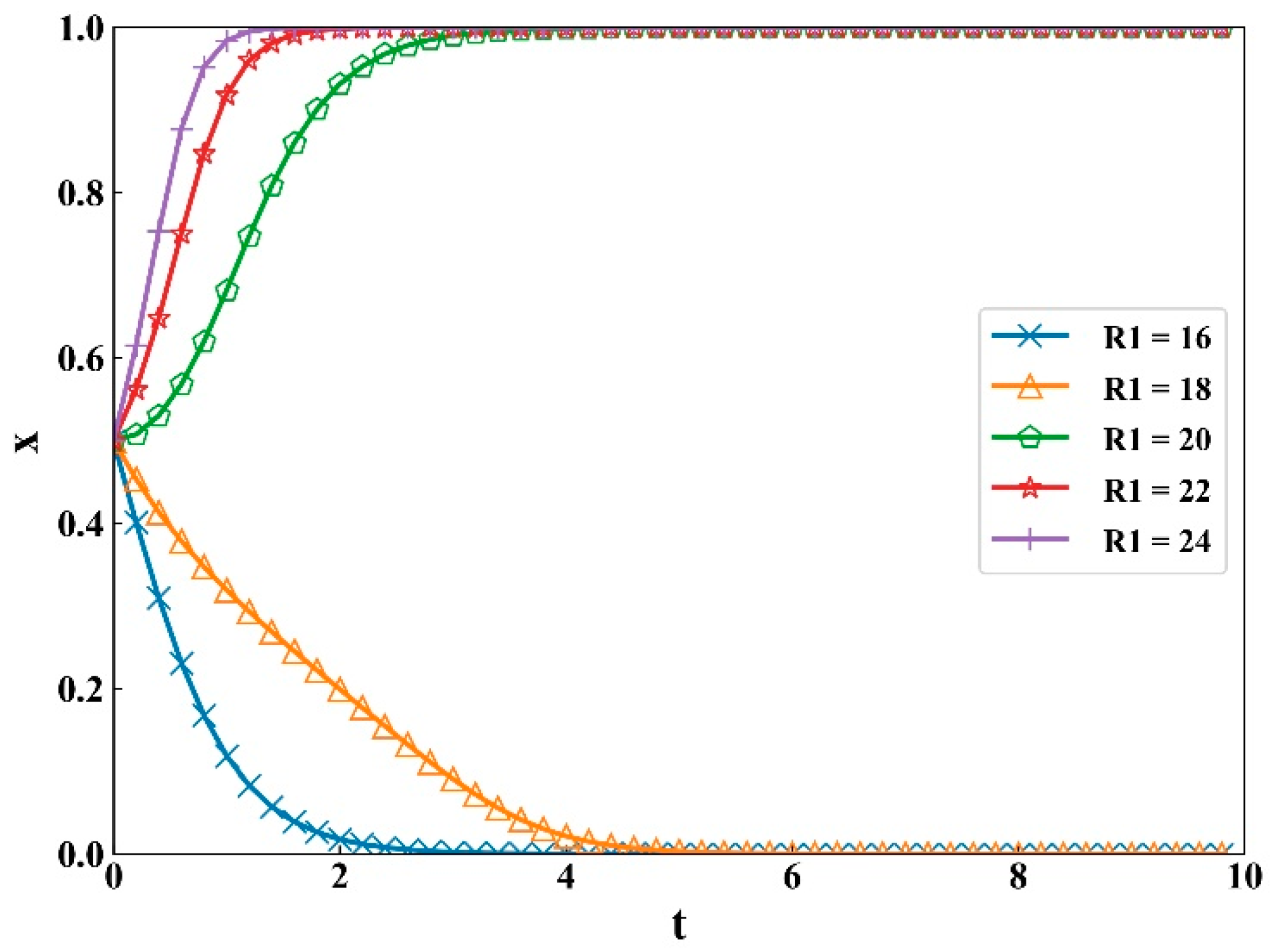

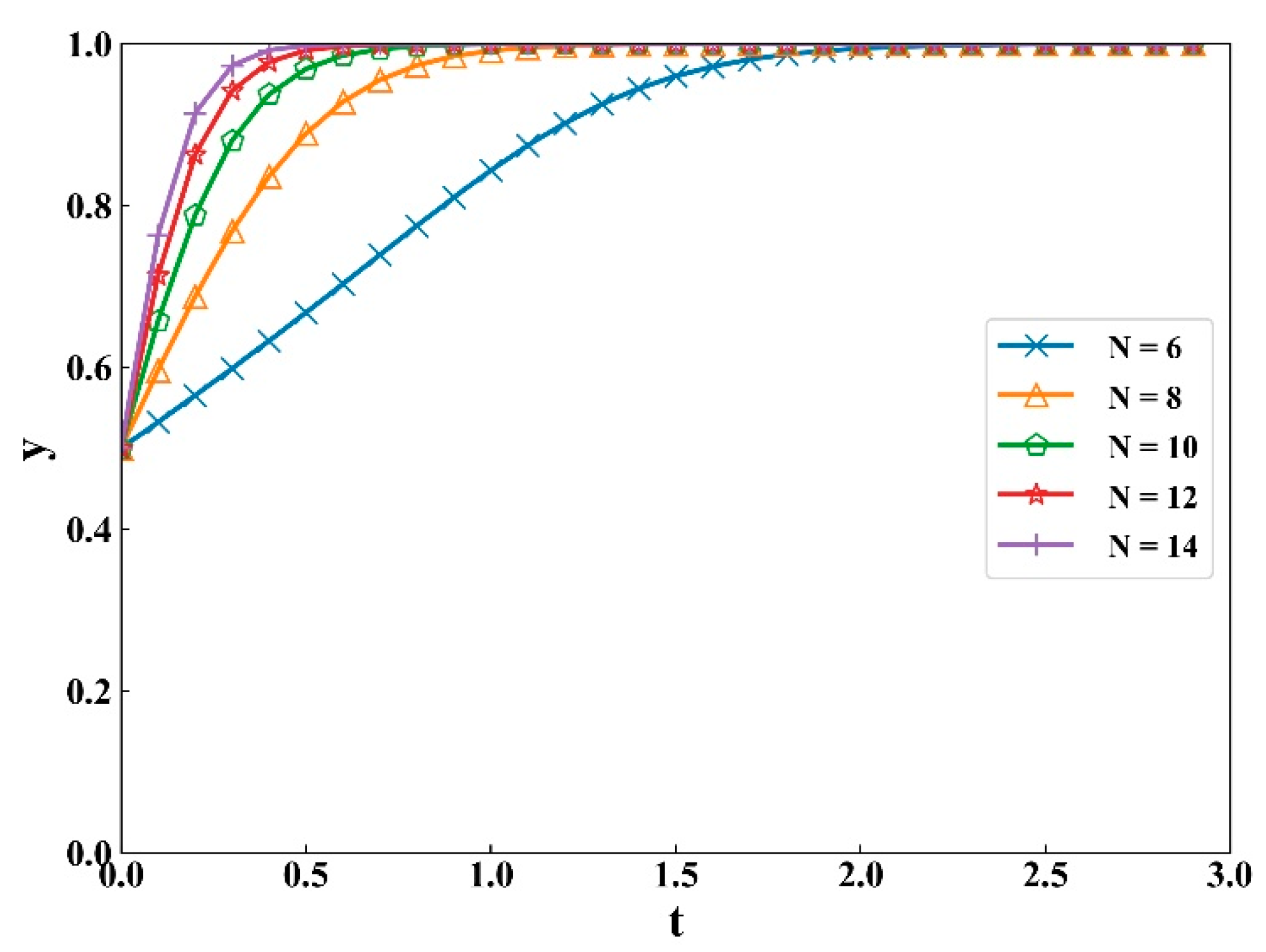

6.2.1. The Impact of Parameters on Investors’ Strategy Selection

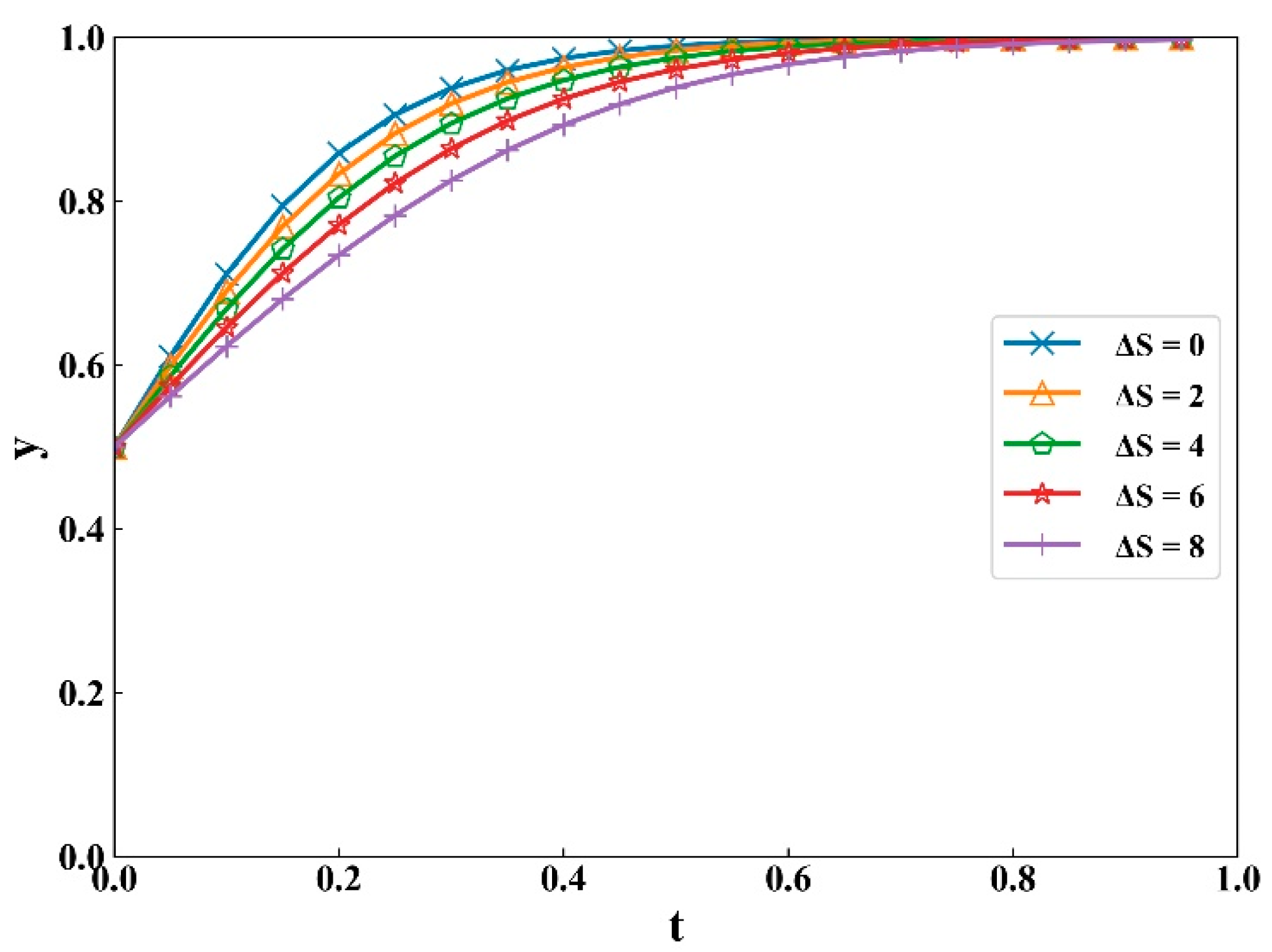

6.2.2. The Impact of Parameters on the Government’s Strategy Selection

7. Discussion

- According to Section 5, we could find that the evolutionary results was intuitively divided into two categories: one reaches a pure Nash equilibrium with one equilibrium point, and the other reaches a mixed Nash equilibrium with two equilibrium points. Firstly, the strategy selection of the government is based on , and , and the strategy selection of investors is based on , , and . Then, when the system reaches the evolutionary stable strategy E4(1,1), maintaining the project with original investors is the best result for the government, while investors will not take opportunistic behaviors due to the low speculative net income; when the system stabilizes at E1(0,0), owing to the opportunistic behavior of investors, the government loses confidence in the project, and chooses to terminate the project; when the system stabilizes at E3(0,1) in scenario 3, it is shown that the government has tolerated opportunistic behavior of investors because of the high cost of buyback; when the evolutionary stable strategy is E2(1,0) in scenario 4, we could speculate that the project has fallen into significant difficulties, and it is unworthy to continue maintaining the project.

- In Section 6.1, based on the numerical simulation of the evolution path, it reveals that the initial probabilities will affect the final stable state directly in the scenario 8. Due to the different initial strategic preferences of the government and investors in the renegotiation, it is more helpful to access the real results by simulating randomly. Under the constraint condition and , when the initial probabilities of the government and investors are high, they will stabilize at state 1, which is the point E4(1,1). When the initial probabilities of the government and investors are low, they will stabilize at state 0, which is the point E1(0,0). It means that when other parameters remain unchanged, the preference of the strategy selection at the beginning of the negotiation will affect the final evolution results, besides, the behavioral decision-making between the government and investors is mutually influenced.

- In Section 6.2.1, we explored the influences of significant parameters on investors’ strategy selection, where some significant findings could be acquired according to the simulation results as shown in Figure 6, Figure 7 and Figure 8. Firstly, it can be found that the higher speculative net benefits are, the higher the probability of investors taking opportunism will be. In this regard, the government would lack the mechanism of screening and punishing investors, and driven by high returns, investors would take opportunistic behaviors. Secondly, as increases, the probability of investors taking opportunism decreases. If the speculative costs are high, the cost unrecovered of investors is high, and the probability of opportunism would be reduced. For these error investors, it is hard to achieve the desired income so that they would rely on subsidies. Lastly, if the government and investors maintain a good cooperative relationship in PPP projects, the high returns generated by the project would prevent investors from taking opportunistic behavior.

- In Section 6.2.2, we also explored the influences of significant parameters on the government’s strategy selection based on the simulation results as shown in Figure 9, Figure 10, Figure 11 and Figure 12. First of all, we found that when the future social benefits of the project under non-opportunism increased, the government will no doubt choose to maintain the project. Then, according to Figure 10, considering the future benefits of the project, the government is more inclined to save the project, but with the increase of subsidy, the evolutionary rate of choosing to maintain the project was slowed. On the contrary, with the cost of buyback increases, the evolutionary rate of choosing to maintain the project was increased gradually as shown in Figure 11. Subsequently, frequent opportunistic renegotiation will make risk continuously increase and thus the evolutionary rate of choosing to maintain the project was slowed.

- In general, by exploring the influences of special parameters, some significant influential factors in real renegotiation cases could be acquired. Firstly, combined with the analysis in Section 6.2.1 and Section 6.2.2, we can find that cooperation benefits are very favorable to PPP projects. Hence, the government and investors should devote more time and attention to the preliminary phase of the project to build a good relationship, and the corresponding incentives would make the investors abandon opportunism spontaneously to achieve a win-win result. In addition, exploring solutions to create value in renegotiation would also increase the payoffs for both partners. Secondly, the initial probability of the government’s strategy, to some extent, reflects the acceptance of the termination of PPP projects. If there was a sound social capital withdrawal mechanism, the government would not blindly subsidize the project in distress. Meanwhile, it would be advisable for both partners to recognize the possibility of renegotiation and early-termination at the start and establish a clear framework in contracts to facilitate the processes. Thirdly, the government should focus more on the screening mechanism of the investors in the retender, avoiding inefficient investors from participating in the project. This is an issue that has to be addressed in the tender, since the ex-ante inefficiency would lead to the ex-post inefficiency (as analyzed in Section 6.2.1). Another problem is to avoid frequent renegotiations, and some necessary contract terms would prevent frivolous demands while opening a channel for reasonable and serious ones [15].

8. Conclusions

- Based on the analysis of evolutionary paths and the ESS, non-opportunism and maintaining the project is the optimal strategy combinations for the government and investors. However, when the project is in great trouble, or the opportunistic behavior of investors has caused great damage to the project, it is useless to continue the subsidy, and the termination of the project is one way to stop the loss in time. Moreover, the effective control of opportunism is an important issue to be solved after the adoption of subsidies.

- Whether investors adopt opportunistic behavior depends on the speculative net benefit and the financial situation of investors. Additionally, the higher the expected benefit created by reasonable participation in the project, the lower the probability of investors adopting opportunism, and the higher the probability of achieving the strategy (i.e., non-opportunism, maintain the project).

- The government’s decision-making mainly depends on the subsidy cost and the buyback cost. Similarly, if the project is expected to develop well in the future, the government will be supported to make the decision to maintain the project.

- For the government, when accepting subsidy applications from investors, the priority is to make sure that it is worthwhile to maintain the project, and second, to ensure that the amount of subsidy does not create a substantial financial burden. Otherwise, subsidies are not the optimal strategy at this point. Although the early termination is still regarded as a significant failure of the project, as a possible result of renegotiation, a reasonable ex-post treatment mechanism, such as the withdrawal mechanism of social capital, needs to be developed. The rational withdrawal path of social capital is a further supplement to the sustainability of PPPs. On the other hand, it is also an effective measure to encourage investors to participate in PPP projects actively.

- The cooperation benefits of PPP projects should be more emphasized. In the process of PPP projects, investors are dominated by their interests. Therefore, corresponding incentive measures will promote investors to participate in projects spontaneously and actively. When the return in the case of non-opportunism is higher than that of opportunism, the possibility of investors’ speculative behavior will be reduced. Additional transaction costs will be incurred in renegotiation, however, if the current problems can be effectively resolved through renegotiation and the parties’ understanding can be deepened, it will be conducive to the development of future cooperation. Besides, this is also the meaning and value of setting up renegotiation.

- The screening and supervision mechanism of investors should be set. According to the analysis of the ESS and essential parameters, if the government lacks the judging and screening mechanism for investors at the initial stage of the project, or investors cannot afford the construction and operation of PPP projects, it will increase the risk of excessive government subsidies and future frequent negotiations. At the same time, investors’ opportunistic behavior may damage the overall benefits of the project in the cooperation; the government, therefore, needs to exercise its regulatory function [50,51] and increase investors’ opportunistic cost through punitive measures to restrain opportunistic behavior.

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Wang, S.Q.; Tiong, R.L.K.; Ting, S.K.; Ashley, D. Evaluation and management of political risks in China’s bot projects. J. Constr. Eng. Manag. 2000, 126, 242–250. [Google Scholar] [CrossRef]

- Geddes, R.R.; Reeves, E. The Favourability of US PPP Enabling Legislation and Private Investment in Transportation Infrastructure. Util. Policy 2017, 48, 157–165. [Google Scholar] [CrossRef]

- Du, J.; Wu, H.; Jin, R. Capital Structure of Public-Private Partnership Projects: A Sustainability Perspective. Sustainability 2019, 11, 3505. [Google Scholar] [CrossRef]

- Yuan, J.; Li, W.; Guo, J.; Zhao, X.; Skibniewski, M.J. Social Risk Factors of Transportation PPP Projects in China: A Sustainable Development Perspective. Int. J. Environ. Res. Public Health 2018, 15, 1323. [Google Scholar] [CrossRef] [PubMed]

- Cui, C.; Liu, Y.; Hope, A.; Wang, J. Review of studies on the public private partnerships (PPP) for infrastructure projects. Int. J. Proj. Manag. 2018, 36, 773–794. [Google Scholar] [CrossRef]

- Liang, Y.; Wang, H. Sustainable Performance Measurements for Public-Private Partnership Projects: Empirical Evidence from China. Sustainability 2019, 11, 3653. [Google Scholar] [CrossRef]

- Xiong, W.; Zhang, X. Concession Renegotiation Models for Projects Developed through Public-Private Partnerships. J. Constr. Eng. Manag. 2014, 140. [Google Scholar] [CrossRef]

- Liu, H.; Li, W. Risk on Early Contract Termination of PPP Project Based on SNA Perspective. J. Civ. Eng. Manag. 2019, 36, 35–41. [Google Scholar]

- Xiong, W.; Zhao, X.; Wang, H. Information Asymmetry in Renegotiation of Public-Private Partnership Projects. J. Comput. Civil. Eng. 2018, 32. [Google Scholar] [CrossRef]

- Zhu, L.; Zhao, X.; Chua, D.K.H. Agent-Based Debt Terms’ Bargaining Model to Improve Negotiation Inefficiency in PPP Projects. J. Comput. Civil. Eng. 2016, 30. [Google Scholar] [CrossRef]

- Rasmusen, E. Games and Information, 4th ed.; Blackwell Publishing: Oxford, UK, 2006. [Google Scholar]

- de Brux, J. The Dark and Bright Sides of Renegotiation: An Application to Transport Concession Contracts. Util. Policy 2010, 18, 77–85. [Google Scholar] [CrossRef]

- Liu, T.; Zhao, T.; Wang, S. Research on Renegotiations of China’s PPP Projects Based on Case Analysis. Constr. Econ. 2016, 37, 31–34. [Google Scholar]

- HM Treasury. Standardisation of PFI Contracts; HM Treasury: London, UK, 2007. [Google Scholar]

- Zhang, X.; Xiong, W. Renegotiation and Early-Termination in Public Private Partnerships. International J. Archit. Eng. Constr. 2015, 4, 204–213. [Google Scholar] [CrossRef]

- Ho, S.P. Model for Financial Renegotiation in Public-Private Partnership Projects and Its Policy Implications: Game Theoretic View. J. Constr. Eng. Manag. 2006, 132, 678–688. [Google Scholar] [CrossRef]

- Guasch, J.L.; Laffont, J.J.; Straub, S. Concessions of infrastructure in Latin America: Government-led renegotiation. J. Appl. Econom. 2007, 22, 1267–1294. [Google Scholar] [CrossRef]

- Cruz, C.O.; Marques, R.C. Flexible contracts to cope with uncertainty in public-private partnerships. Int. J. Proj. Manag. 2013, 31, 473–483. [Google Scholar] [CrossRef]

- Demirel, H.C.; Leendertse, W.; Volker, L.; Hertogh, M. Flexibility in PPP contracts—Dealing with potential change in the pre-contract phase of a construction project. Constr. Manag. Econ. 2017, 35, 196–206. [Google Scholar] [CrossRef]

- Domingues, S.; Zlatkovic, D. Renegotiating PPP Contracts: Reinforcing the ‘P’ in Partnership. Transp. Rev. 2015, 35, 204–225. [Google Scholar] [CrossRef]

- Yin, Y.; Wang, Y. An Empirical Study on Relationship between Contract Flexibility and Project Management Performance in Construction Project: The Perspective of Trust between Owner and Contractor. Manag. Rev. 2015, 27, 151–162. [Google Scholar]

- Cruz, C.O.; Marques, R.C. Exogenous Determinants for Renegotiating Public Infrastructure Concessions: Evidence from Portugal. J. Constr. Eng. Manag. 2013, 139, 1082–1090. [Google Scholar] [CrossRef]

- Albalate, D.; Bel, G. Regulating concessions of toll motorways: An empirical study on fixed vs. variable term contracts. Transp. Res. Pt. A-Policy Pract. 2009, 43, 219–229. [Google Scholar] [CrossRef]

- Ho, S.P.; Levitt, R.; Tsui, C.W.; Hsu, Y. Opportunism-Focused Transaction Cost Analysis of Public-Private Partnerships. J. Manag. Eng. 2015, 31, 31. [Google Scholar] [CrossRef]

- Zhang, X.; Soomro, M.A. Failure Path Analysis with Respect to Private Sector Partners in Transportation Public-Private Partnerships. J. Manag. Eng. 2016, 32. [Google Scholar] [CrossRef]

- Xiong, W.; Zhang, X.; Chen, H. Early-Termination Compensation in Public-Private Partnership Projects. J. Constr. Eng. Manag. 2016, 142. [Google Scholar] [CrossRef]

- Song, J.; Hu, Y.; Feng, Z. Factors Influencing Early Termination of PPP Projects in China. J. Manag. Eng. 2018, 34. [Google Scholar] [CrossRef]

- Xiong, W.; Zhao, X.; Yuan, J.F.; Luo, S. Ex Post Risk Management in Public-Private Partnership Infrastructure Projects. Proj. Manag. J. 2017, 48, 76–89. [Google Scholar] [CrossRef]

- World Bank. Private Participation in Infrastructure Projects Database; World Bank: Washington, DC, USA, 2011. [Google Scholar]

- Ho, S.P.; Tsui, C.W. When Are Public-Private Partnerships Not an Appropriate Governance Structure? Case Study Evidence. In Proceedings of the Construction Research Congress, Banff, AB, Canada, 8–10 May 2010. [Google Scholar]

- Russo, J.C.; Guimaraes Dias, M.A.; da Silva Rocha, A.B.; Cyrino Oliveira, F.L. Renegotiation in Public-Private Partnerships: An Incentive Mechanism Approach. Group Decis. Negot. 2018, 27, 949–979. [Google Scholar] [CrossRef]

- Domingues, S.; Sarmento, J.M. Critical renegotiation triggers of European transport concessions. Transp. Policy 2016, 48, 82–91. [Google Scholar] [CrossRef]

- Medda, F. A game theory approach for the allocation of risks in transport public private partnerships. Int. J. Proj. Manag. 2007, 25, 213–218. [Google Scholar] [CrossRef]

- Song, J.; Jin, L.; Zhao, Y.; Hu, W. Using bargaining-game model to negotiate compensation for the early termination of BOT highway projects. Transp. Res. Pt. A-Policy Pract. 2017, 105, 197–209. [Google Scholar] [CrossRef]

- Liu, J.; Gao, R.; Cheah, C.Y.J.; Luo, J. Incentive mechanism for inhibiting investors’ opportunistic behavior in PPP projects. Int. J. Proj. Manag. 2016, 34, 1102–1111. [Google Scholar] [CrossRef]

- Steinle, C.; Schiele, H.; Ernst, T. Information Asymmetries as Antecedents of Opportunism in Buyer-Supplier Relationships: Testing Principal-Agent Theory. J. Bus.-Bus. Mark. 2014, 21, 123–140. [Google Scholar] [CrossRef]

- Keser, C.; Willinger, M. Theories of behavior in principal-agent relationships with hidden action. Eur. Econ. Rev. 2007, 51, 1514–1533. [Google Scholar] [CrossRef]

- Robson, A.J. Individual strategy and social structure: An evolutionary theory of institutions. Can. J. Econ.-Rev. Can. Econ. 1999, 32, 247–250. [Google Scholar] [CrossRef]

- Schmidt, C. Are evolutionary games another way of thinking about game theory? J. Evol. Econ. 2004, 14, 249–262. [Google Scholar] [CrossRef]

- Taylor, P.D.; Jonker, L.B. Evolutionary Stable Strategies and Game Dynamics. Math. Biosci. 1978, 40, 145–156. [Google Scholar] [CrossRef]

- Li, D.; Ma, J.; Tian, Z.; Zhu, H. An Evolutionary Game for the Diffusion of Rumor in Complex Networks. Phys. A: Stat. Mech. Its Appl. 2015, 433, 51–58. [Google Scholar] [CrossRef]

- Friedman, D.; Fung, K.C. International Trade and the Internal 0rganization of Firms: An Evolutionary Approach. J. Int. Econ. 1996, 41, 113–137. [Google Scholar] [CrossRef]

- Du, Y.; Zhou, H.; Yuan, Y.; Xue, H. Exploring the Moral Hazard Evolutionary Mechanism for BIM Implementation in an Integrated Project Team. Sustainability 2019, 11, 5719. [Google Scholar] [CrossRef]

- Shen, H.; Peng, Y.; Guo, C. Analysis of the Evolution Game of Construction and Demolition Waste Recycling Behavior Based on Prospect Theory under Environmental Regulation. Int. J. Environ. Res. Public Health 2018, 15, 1518. [Google Scholar] [CrossRef]

- Gao, X.; Shen, J.; He, W.; Sun, F.; Zhang, Z.; Guo, W.; Zhang, X.; Kong, Y. An evolutionary game analysis of governments’ decision-making behaviors and factors influencing watershed ecological compensation in China. J. Environ. Manag. 2019, 251. [Google Scholar] [CrossRef] [PubMed]

- Sun, H.; Wan, Y.; Zhang, L.; Zhou, Z. Evolutionary game of the green investment in a two-echelon supply chain under a government subsidy mechanism. J. Clean Prod. 2019, 235, 1315–1326. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, J.; Shen, G.Q.; Yan, Y. Incentives for green retrofits: An evolutionary game analysis on Public-Private-Partnership reconstruction of buildings. J. Clean Prod. 2019, 232, 1076–1092. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary Games in Economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Liu, C.; Huang, W.; Yang, C. The evolutionary dynamics of China’s electric vehicle industry—Taxes vs. subsidies. Comput. Ind. Eng. 2017, 113, 103–122. [Google Scholar] [CrossRef]

- Sabry, M.I. Good governance, institutions and performance of public private partnerships. Int. J. Public Sect. Manag. 2015, 28, 566–582. [Google Scholar] [CrossRef]

- Verhoest, K.; Petersen, O.H.; Scherrer, W.; Soecipto, R.M. How Do Governments Support the Development of Public Private Partnerships? Measuring and Comparing PPP Governmental Support in 20 European Countries. Transp. Rev. 2015, 35, 118–139. [Google Scholar] [CrossRef]

| Government | |||

|---|---|---|---|

| Maintain the Project (y) | Terminate the Project (1-y) | ||

| Investors | non-opportunism (x) | , | , |

| opportunism (1-x) | , | , | |

| Equilibrium Point | Det J | Tr J |

|---|---|---|

| E1(0,0) | ||

| E2(1,0) | ||

| E3(0,1) | ||

| E4(1,1) | ||

| E5() | 0 |

| Scenarios | Constraint Conditions | Equilibrium Point | Det J | Tr J | Results |

|---|---|---|---|---|---|

| Scenario 1 | , | E1(0,0) | + | + | Unstable |

| E2(1,0) | − | ± | Saddle | ||

| E3(0,1) | − | ± | Saddle | ||

| E4(1,1) | + | − | ESS | ||

| E5() | |||||

| Scenario 2 | , | E1(0,0) | − | ± | Saddle |

| E2(1,0) | + | + | Unstable | ||

| E3(0,1) | − | ± | Saddle | ||

| E4(1,1) | + | − | ESS | ||

| E5() | |||||

| Scenario 3 | , | E1(0,0) | − | ± | Saddle |

| E2(1,0) | + | + | Unstable | ||

| E3(0,1) | + | − | ESS | ||

| E4(1,1) | − | ± | Saddle | ||

| E5() |

| Scenarios | Constraint Conditions | Equilibrium Point | Det J | Tr J | Results |

|---|---|---|---|---|---|

| Scenario 4 | , | E1(0,0) | − | ± | Saddle |

| E2(1,0) | + | − | ESS | ||

| E3(0,1) | + | + | Unstable | ||

| E4(1,1) | − | ± | Saddle | ||

| E5() | |||||

| Scenario 5 | , | E1(0,0) | + | − | ESS |

| E2(1,0) | − | ± | Saddle | ||

| E3(0,1) | + | + | Unstable | ||

| E4(1,1) | − | ± | Saddle | ||

| E5() | |||||

| Scenario 6 | , | E1(0,0) | + | − | ESS |

| E2(1,0) | − | ± | Saddle | ||

| E3(0,1) | − | ± | Saddle | ||

| E4(1,1) | + | + | Unstable | ||

| E5() |

| Scenarios | Constraint Conditions | Equilibrium Point | Det J | Tr J | Results |

|---|---|---|---|---|---|

| Scenario 7 | , | E1(0,0) | − | ± | Saddle |

| E2(1,0) | − | ± | Saddle | ||

| E3(0,1) | + | + | Unstable | ||

| E4(1,1) | + | − | ESS | ||

| E5() | |||||

| Scenario 8 | , | E1(0,0) | + | − | ESS |

| E2(1,0) | + | + | Unstable | ||

| E3(0,1) | + | + | Unstable | ||

| E4(1,1) | + | − | ESS | ||

| E5() | − | Saddle | |||

| Scenario 9 | , | E1(0,0) | + | − | ESS |

| E2(1,0) | + | + | Unstable | ||

| E3(0,1) | − | ± | Saddle | ||

| E4(1,1) | − | ± | Saddle | ||

| E5() |

| Parameter | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| M1 | ↑ | ↓ | ↓ | ↑ | ↓ | ↑ | ↓ | ↓ | ↑ | ↑ |

| M2 | ↓ | ↑ | ↑ | ↓ | ↑ | ↓ | ↑ | ↑ | ↓ | ↓1 |

| 20 | 12 | 10 | 8 | 6 | 5 | 10 | 1.8 | 10 | 1.3 | 10 | 14 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xing, H.; Li, Y.; Li, H. Renegotiation Strategy of Public-Private Partnership Projects with Asymmetric Information—An Evolutionary Game Approach. Sustainability 2020, 12, 2646. https://doi.org/10.3390/su12072646

Xing H, Li Y, Li H. Renegotiation Strategy of Public-Private Partnership Projects with Asymmetric Information—An Evolutionary Game Approach. Sustainability. 2020; 12(7):2646. https://doi.org/10.3390/su12072646

Chicago/Turabian StyleXing, Huige, Yuelin Li, and Hongyang Li. 2020. "Renegotiation Strategy of Public-Private Partnership Projects with Asymmetric Information—An Evolutionary Game Approach" Sustainability 12, no. 7: 2646. https://doi.org/10.3390/su12072646

APA StyleXing, H., Li, Y., & Li, H. (2020). Renegotiation Strategy of Public-Private Partnership Projects with Asymmetric Information—An Evolutionary Game Approach. Sustainability, 12(7), 2646. https://doi.org/10.3390/su12072646