Towards Sustainable Textile and Apparel Industry: Exploring the Role of Business Intelligence Systems in the Era of Industry 4.0

Abstract

:1. Introduction

- How do companies reach their decisions to adopt BIS? What are the sustainability issues in the T&A industry that lead to the adoption of BIS in the era of Industry 4.0?

- How can T&A companies improve value creation processes to maintain their sustainability through the integration of BIS under the Industry 4.0 concept?

- What are the barriers in the adoption of BIS under the Industry 4.0 concept in T&A industry?

2. Literature Review

2.1. Sustainability Issues in T&A Industry

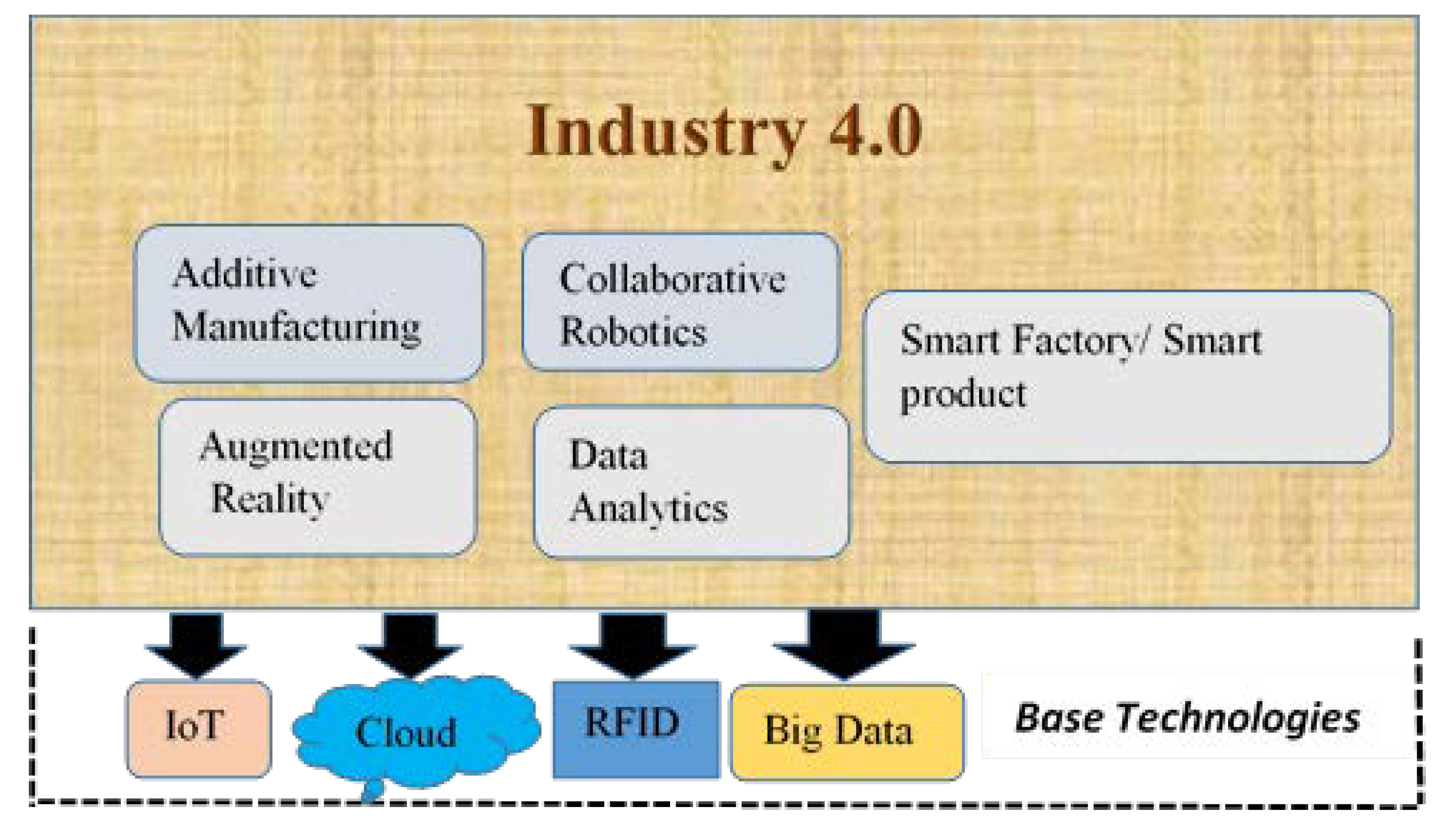

2.2. Industry 4.0

Enabling Role of Industry 4.0 Technologies for BIS adoption

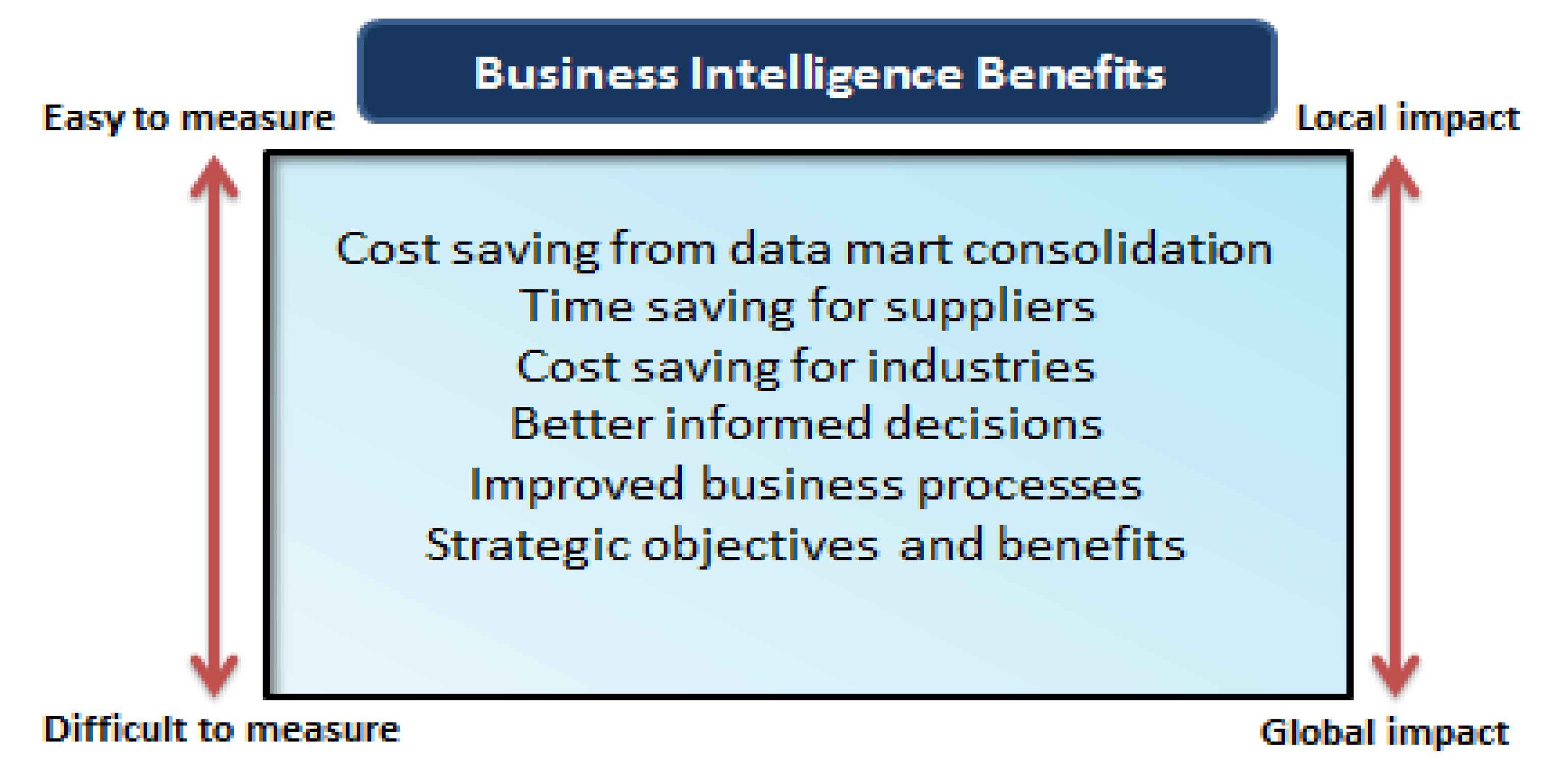

2.3. Business Intelligence Systems

- ○

- Obtained quality information for decision-making (95%)

- ○

- Enhanced ability to analyze the expected opportunities and threats (83%)

- ○

- Improved organizational knowledge (76%)

- ○

- Improved information sharing (73%)

- ○

- Better analysis and information retrieval (58%)

- ○

- Improved efficiency (65%)

- ○

- Faster decision-making (54%)

- ○

- More accurate and quick reporting (82%)

- ○

- Enhanced quality of decision-making (78%)

- ○

- Improved customer services (58%)

- ○

- Escalate revenues (49%)

BI Solutions for Textile and Apparel Industry

3. Research Design

4. Discussion and Results

4.1. How do Companies Reach Their Decisions to Adopt BIS? What are the Sustainability Issues in T&A Industry that Lead to the Adoption of BIS in the Era of Industry 4.0?

- Major sustainability challenges in T&A case companies

4.2. How can T&A Companies Improve the Value Creation Processes for their Sustainability through the Integration of BIS under the Industry 4.0 Concept?

- The improved value creation processes with the adoption of BIS under the Industry 4.0

4.3. What are the barriers in the adoption of BIS under the Industry 4.0 concept in T&A industry?

- Cost and complexity

- Vendor support

- Top management support

- Technical skills and expertise

- Integration with existing systems

- Change management

5. Conclusion

5.1. Managerial and Theoretical Implications

5.2. Study Limitation and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Balogun, A.-L.; Tyler, D.; Han, S.; Moora, H.; Paco, A.; Boiten, V.J.; Ellams, D.; Leal Filho, W. A review of the socio-economic advantages of textile recycling. J. Clean. Prod. 2019, 218, 10–20. [Google Scholar]

- Fatorachian, H.; Kazemi, H. The management of operations a critical investigation of Industry 4.0 in manufacturing: Theoretical operationalisation framework. Prod. Plan. Control 2018, 29, 633–644. [Google Scholar] [CrossRef]

- Denuwara, N.; Maijala, J.; Hakovirta, M. Sustainability benefits of RFID technology in the apparel industry. Sustainability 2019, 11, 6477. [Google Scholar] [CrossRef] [Green Version]

- Shen, B.; Li, Q.; Dong, C.; Perry, P. Sustainability issues in textile and apparel supply chains. Sustainability 2017, 9, 1592. [Google Scholar] [CrossRef] [Green Version]

- LoMonaco-Benzing, R.; Ha-Brookshire, J. Sustainability as social contract: Textile and apparel professionals’ value conflicts within the corporate moral responsibility spectrum. Sustainability 2016, 8, 1278. [Google Scholar] [CrossRef] [Green Version]

- Shen, B. Sustainable fashion supply chain: Lessons from H&M. Sustainability 2014, 6, 6236–6249. [Google Scholar]

- Wang, L.; Shen, B. A product line analysis for eco-designed fashion products: Evidence from an outdoor sportswear brand. Sustainability 2017, 9, 1136. [Google Scholar] [CrossRef] [Green Version]

- Arrigo, E. Global sourcing in fast fashion retailers: Sourcing locations and sustainability considerations. Sustainability 2020, 12, 508. [Google Scholar] [CrossRef] [Green Version]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Luchian, C.E.; Luchian, I. Community based programs sustainability. A multidimensional analysis of sustainability factors. Sustainability 2018, 10, 870. [Google Scholar] [CrossRef] [Green Version]

- Köksal, D.; Strähle, J.; Müller, M.; Freise, M. Social sustainable supply chain management in the textile and apparel industry-a literature review. Sustainability 2017, 9, 100. [Google Scholar] [CrossRef]

- Andersen, T.J.; Segars, A.H. The impact of IT on decision structure and firm performance: Evidence from the textile and apparel industry. Inf. Manag. 2001, 39, 85–100. [Google Scholar] [CrossRef]

- Trieu, V. Getting value from business intelligence systems: A review and research agenda. Decis. Support Syst. 2017, 93, 111–124. [Google Scholar] [CrossRef]

- Lu, H.P.; Weng, C.I. Smart manufacturing technology, market maturity analysis and technology roadmap in the computer and electronic product manufacturing industry. Technol. Forecast. Soc. Chang. 2018, 133, 85–94. [Google Scholar] [CrossRef]

- Xu, L. Da Enterprise systems: State-of-the-art and future trends. IEEE Trans. Ind. Inform. 2011, 7, 630–640. [Google Scholar] [CrossRef]

- Bordeleau, F.-È.; Mosconi, E.; Santa-Eulalia, L.A. Business intelligence in industry 40: State of the art and research opportunities. In Proceedings of the 51st Hawaii International Conference on System Sciences, Waikoloa Village, HI, USA, 2–6 January 2018. [Google Scholar]

- Yeoh, W.; Popovič, A. Extending the understanding of critical success factors for implementing business intelligence systems. J. Assoc. Inf. Sci. Technol. 2016, 67, 134–147. [Google Scholar] [CrossRef]

- Muntean, M. Business intelligence issues for sustainability projects. Sustainability 2018, 10, 335. [Google Scholar] [CrossRef] [Green Version]

- Richards, G.; Yeoh, W.; Chong, A.Y.L.; Popovič, A. Business intelligence effectiveness and corporate performance management: An empirical analysis. J. Comput. Inf. Syst. 2017, 59, 188–196. [Google Scholar] [CrossRef]

- Aydiner, A.S.; Tatoglu, E.; Bayraktar, E.; Zaim, S.; Delen, D. Business analytics and firm performance: The mediating role of business process performance. J. Bus. Res. 2019, 96, 228–237. [Google Scholar] [CrossRef]

- Ceptureanu, S.I.; Ceptureanu, E.G.; Visileanu, E. Comparative analysis of small and medium enterprises organizational performance in clothing industry. Ind. Textila 2017, 68, 156–162. [Google Scholar]

- Grublješič, T.; Jaklič, J. Conceptualization of the business intelligence extended use model. J. Comput. Inf. Syst. 2015, 55, 72–82. [Google Scholar] [CrossRef]

- Jin, D.H.; Kim, H.J. Integrated understanding of big data, big data analysis, and business intelligence: A case study of logistics. Sustainability 2018, 10, 3778. [Google Scholar] [CrossRef] [Green Version]

- Jayakrishnan, M.A.L.; Bin Mohamad, A.K.; Yusof, M.B.M. The holistic view of business intelligence (BI) and big data analytics (BDA) towards designing strategic performance management framework: A case study. J. Theor. Appl. Inf. Technol. 2018, 96, 2025–2045. [Google Scholar]

- Amankwah-Amoah, J.; Adomako, S. Big data analytics and business failures in data-Rich environments: An organizing framework. Comput. Ind. 2019, 105, 204–212. [Google Scholar] [CrossRef] [Green Version]

- Ngai, E.W.T.; Peng, S.; Alexander, P.; Moon, K.K.L. Decision support and intelligent systems in the textile and apparel supply chain: An academic review of research articles. Expert Syst. Appl. 2014, 41, 81–91. [Google Scholar] [CrossRef]

- Popovič, A.; Puklavec, B.; Oliveira, T. Justifying business intelligence systems adoption in SMEs. Ind. Manag. Data Syst. 2018, 119, 210–228. [Google Scholar] [CrossRef]

- Puklavec, B.; Oliveira, T.; Popovič, A. Understanding the determinants of business intelligence system adoption stages an empirical study of SMEs. Ind. Manag. Data Syst. 2018, 118, 236–261. [Google Scholar] [CrossRef]

- Carvalho, S.; Portela, F.; Santos, M.F.; Abelha, A.; Machado, J. Step towards of a homemade business intelligence solution—A case study in textile industry. In New Contributions in Information Systems and Technologies; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Istrat, V.; Lalić, N. Association rules as a decision making model in the textile industry. Fibres Text. East. Eur. 2017, 25, 8–14. [Google Scholar] [CrossRef]

- Lee, J.; Bagheri, B.; Kao, H.A. A cyber-physical systems architecture for industry 4.0-based manufacturing systems. Manuf. Lett. 2015, 3, 18–23. [Google Scholar] [CrossRef]

- Choi, T.M. Launching the right new product among multiple product candidates in fashion: Optimal choice and coordination with risk consideration. Int. J. Prod. Econ. 2018, 202, 162–171. [Google Scholar] [CrossRef]

- Safra, I.; Jebali, A.; Jemai, Z.; Bouchriha, H.; Ghaffari, A. Capacity planning in textile and apparel supply chains. IMA J. Manag. Math. 2018, 30, 209–233. [Google Scholar] [CrossRef]

- Jain, S.; Bruniaux, J.; Zeng, X.; Bruniaux, P. Big data in fashion industry. In Proceedings of the IOP Conference Series: Materials Science and Engineering, Melaka, Malaysia, 6–7 May 2017; Volume 254. [Google Scholar]

- Longo, F.; Nicoletti, L.; Padovano, A. Smart operators in industry 4.0: A human-centered approach to enhance operators’ capabilities and competencies within the new smart factory context. Comput. Ind. Eng. 2017, 113, 144–159. [Google Scholar] [CrossRef]

- Iqbal, M.; Soomrani, A.R.; Butt, S.H. A study of big data for business growth in SMEs: Opportunities & challenges. In Proceedings of the International Conference on Computing, Mathematics and Engineering Technologies (iCoMET), Sukkur, Pakistan, 3–4 May 2018. [Google Scholar]

- Haseeb, M.; Hussain, H.I.; Ślusarczyk, B.; Jermsittiparsert, K. Industry 4.0: A solution towards technology challenges of sustainable business performance. Soc. Sci. 2019, 8, 154. [Google Scholar] [CrossRef] [Green Version]

- Roblek, V.; Meško, M.; Krapež, A. A complex view of industry 4.0. Sage Open 2016, 6, 2158244016653987. [Google Scholar] [CrossRef] [Green Version]

- Lu, Y. Industry 4.0: A survey on technologies, applications and open research issues. J. Ind. Inf. Integr. 2017, 6, 1–10. [Google Scholar] [CrossRef]

- Posada, J.; Toro, C.; Barandiaran, I.; Oyarzun, D.; Stricker, D.; De Amicis, R.; Pinto, E.B.; Eisert, P.; Döllner, J.; Vallarino, I. Visual computing as a key enabling technology for industrie 4.0 and industrial internet. IEEE Comput. Graph. Appl. 2015, 35, 26–40. [Google Scholar] [CrossRef] [PubMed]

- Oztemel, E.; Gursev, S.; Oztemel, E.; Gursev, S. Literature review of industry 4.0 and related technologies. J. Intell. Manuf. 2018, 31, 127–182. [Google Scholar] [CrossRef]

- Zhong, R.Y.; Xu, C.; Chen, C.; Huang, G.Q. Big data analytics for physical internet-based intelligent manufacturing shop floors. Int. J. Prod. Res. 2017, 55, 2610–2621. [Google Scholar] [CrossRef]

- Zare Mehrjerdi, Y. RFID-enabled systems: A brief review. Assem. Autom. 2008, 28, 235–245. [Google Scholar] [CrossRef]

- Saygin, C.; Tamma, S. RFID-enabled shared resource management for aerospace maintenance operations: A dynamic resource allocation model. Int. J. Comput. Integr. Manuf. 2012, 25, 100–111. [Google Scholar] [CrossRef]

- Trappey, A.J.C.; Lu, T.H.; Fu, L.D. Development of an intelligent agent system for collaborative mold production with RFID technology. Robot. Comput. Integr. Manuf. 2009, 25, 42–56. [Google Scholar] [CrossRef]

- Guo, Z.X.; Ngai, E.W.T.; Yang, C.; Liang, X. An RFID-based intelligent decision support system architecture for production monitoring and scheduling in a distributed manufacturing environment. Int. J. Prod. Econ. 2015, 159, 16–28. [Google Scholar] [CrossRef]

- Legnani, E.; Cavalieri, S.; Pinto, R.; Dotti, S. The potential of RFID technology in the textile and clothing industry: Opportunities, requirements and challenges. In Unique Radio Innovation for the 21st Century: Building Scalable and Global RFID Networks; Springer: Berlin/Heidelberg, Germany, 2011; pp. 309–329. ISBN 9783642034619. [Google Scholar]

- Liu, J.H.; Gao, W.D.; Wang, H.B.; Jiang, H.X.; Li, Z.X. Development of bobbin tracing system based on RFID technology. J. Text. Inst. 2010, 101, 925–930. [Google Scholar] [CrossRef]

- Moon, K.L.; Ngai, E.W.T. The adoption of RFID in fashion retailing: A business value-added framework. Ind. Manag. Data Syst. 2008, 108, 596–612. [Google Scholar] [CrossRef]

- Veeramani, D.; Tang, J.; Gutierrez, A. A framework for assessing the value of RFID implementation by tier-one suppliers to major retailers. J. Theor. Appl. Electron. Commer. Res. 2008, 3, 55–70. [Google Scholar]

- Chen, Y. Integrated and intelligent manufacturing: Perspectives and enablers. Engineering 2017, 3, 588–595. [Google Scholar] [CrossRef]

- Ooi, K.B.; Lee, V.H.; Tan, G.W.H.; Hew, T.S.; Hew, J.J. Cloud computing in manufacturing: The next industrial revolution in Malaysia? Expert Syst. Appl. 2018, 93, 376–394. [Google Scholar] [CrossRef]

- Li, B.-H.; Zhang, L.; Wang, S.-L.; Tao, F.; Cao, J.-W.; Jiang, X.-D.; Song, X.; Chai, X.-D. Cloud manufacturing: A new service-oriented networked manufacturing model. Comput. Integr. Manuf. Syst. 2010, 16, 1–7. [Google Scholar]

- Khorram, M.; Torabi, S.A.; Nonino, F. Why manufacturers adopt additive manufacturing technologies: The role of sustainability. J. Clean. Prod. 2019, 222, 381–392. [Google Scholar]

- Tay, S.I.; Lee, T.C.; Hamid, N.Z.A.; Ahmad, A.N.A. An overview of industry 4.0: Definition, components, and government initiatives. J. Adv. Res. Dyn. Control Syst. 2018, 10, 1379–1387. [Google Scholar]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming companies. Harv. Bus. Rev. 2015, 93, 96–114. [Google Scholar]

- Kerpen, D.; Lohrer, M.; Saggiomo, M.; Kemper, M.; Lemm, J.; Gloy, Y.S. Effects of cyber-physical production systems on human factors in a weaving mill: Implementation of digital working environments based on augmented reality. In Proceedings of the IEEE International Conference on Industrial Technology, Taipei, Taiwan, 14–17 March 2016. [Google Scholar]

- Molano, J.I.R.; Lovelle, J.M.C.; Montenegro, C.E.; Granados, J.J.R.; Crespo, R.G. Metamodel for integration of Internet of Things, Social Networks, the Cloud and Industry 4.0. J. Ambient Intell. Humaniz. Comput. 2018, 9, 709–723. [Google Scholar] [CrossRef]

- Papahristou, E.; Kyratsis, P.; Priniotakis, G.; Bilalis, N. The interconnected fashion industry—An integrated vision. In Proceedings of the IOP Conference Series: Materials Science and Engineering, Melaka, Malaysia, 6–7 May 2017; Volume 254. [Google Scholar]

- Jouriles, N. IoT and the Fashion Industry, Personal Interview. 10 May 2016.

- Canito, J.; Ramos, P.; Moro, S.; Rita, P. Computers in industry unfolding the relations between companies and technologies under the big data umbrella. Comput. Ind. 2018, 99, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Moreno Saavedra, M.S.; Bach, C. Factors to determine business intelligence implementation in organizations. Eur. J. Eng. Res. Sci. 2018, 2, 1–7. [Google Scholar] [CrossRef] [Green Version]

- Chen, H.; Chiang, R.H.L.; Storey, V.C. Business intelligence and analytics: From big data to big impact. MIS Q. 2012, 36, 1165–1188. [Google Scholar] [CrossRef]

- Olexov, C. Business intelligence adoption: A case study in the retail chain. WSEAS Trans. Bus. Econ. 2014, 11, 95–106. [Google Scholar]

- Olszak, C.M. Toward better understanding and use of business intelligence in organizations. Inf. Syst. Manag. 2016, 33, 105–123. [Google Scholar] [CrossRef]

- Hannula, M.; Pirttimäki, V. Business intelligence empirical study on the top 50 Finnish companies. J. Am. Acad. Bus. 2003, 2, 593–599. [Google Scholar]

- Poba-Nzaou, P.; Uwizeyemungu, S.; Saada, M. Critical barriers to business intelligence open source software adoption. Int. J. Bus. Intell. Res. 2018, 10, 59–79. [Google Scholar] [CrossRef]

- Meissner, H.; Creswell, J.; Klassen, A.C.; Plano, V.; Smith, K.C. Best practices for mixed methods research in the health sciences. Methods 2011, 29, 1–39. [Google Scholar]

- Webster, L. Using Narrative Inquiry as a Research Method; Routledge: Abingdon, UK, 2014. [Google Scholar]

- Eisenhardt, K.; Graebner, M. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research Design and Methods Fourth Edition; SAGE: Thousand Oaks, CA, USA, 2009; ISBN 9781412960991. [Google Scholar]

- Creswell, J.W. Qualitative Enquiry & Research Design, Choosing among Five Approaches; SAGE: Thousand Oaks, CA, USA, 2007; ISBN 1412916062. [Google Scholar]

- Yusof, A.F.; Miskon, S.; Ahmad, N.; Alias, R.A.; Hashim, H.; Abdullah, N.S.; Ali, N.M.; Maarof, M.A. Implementation issues affecting the business intelligence adoption in public university. ARPN J. Eng. Appl. Sci. 2015, 10, 18061–18069. [Google Scholar]

- Tracy, S.J. Chapter 8 interview practice. In Qualitative Research Methods: Collecting Evidence, Crafting Analysis, Communicating Impact; Wiley-Blackwell: Oxford, UK, 2013; ISBN 9781405192033. [Google Scholar]

- Lam, J.K.C.; Postle, R. Textile and apparel supply chain management in Hong Kong. Int. J. Cloth. Sci. Technol. 2006, 18, 265–277. [Google Scholar] [CrossRef]

- Wang, S.; Wan, J.; Li, D.; Zhang, C. Implementing smart factory of industrie 4.0: An outlook. Int. J. Distrib. Sens. Netw. 2016, 12, 3159805. [Google Scholar] [CrossRef] [Green Version]

- Chen, C.L. Value creation by SMEs participating in global value chains under industry 4.0 trend: Case study of textile industry in Taiwan. J. Glob. Inf. Technol. Manag. 2019, 22, 120–145. [Google Scholar] [CrossRef]

- Keung Kwok, S.; Wu, K.K.W. RFID-based intra-supply chain in textile industry. Ind. Manag. Data Syst. 2009, 109, 1166–1178. [Google Scholar] [CrossRef]

- Wang, Q.; Sun, J.; Yao, Q.; Ji, C.; Liu, J.; Zhu, Q. 3D printing with cellulose materials. Cellulose 2018, 25, 4275–4301. [Google Scholar] [CrossRef]

- Nayak, R.; Padhye, R. Introduction: The apparel industry. In Garment Manufacturing Technology; Woodhead Publishing: Cambridge, UK, 2015; pp. 1–17. ISBN 978-1-78242-232-7. [Google Scholar]

- Kwon, K.; Kang, D.; Yoon, Y.; Sohn, J.-S.; Chung, I.-J. A real time process management system using RFID data mining. Comput. Ind. 2014, 65, 721–732. [Google Scholar] [CrossRef]

- Lukić, J.; Radenković, M.; Despotović-Zrakić, M.; Labus, A.; Bogdanović, Z. A hybrid approach to building a multi-dimensional business intelligence system for electricity grid operators. Util. Policy 2016, 41, 95–106. [Google Scholar] [CrossRef]

| Industry 4.0 Technologies | Description |

|---|---|

| RFID (Radio-Frequency Identification) | RFID is one of the main sensors connecting objects as a part of the Industry 4.0. RFID technology has a strong ability to collect real-time data [40]. It does not only convert traditional logistics and manufacturing processes into smart manufacturing using wireless technologies and Internet of Things (IoT), but also has the capability to make a RFID-enabled intelligent shop floor environment [41]. Therefore, it is widely utilized for warehouse management, manufacturing, customer relationship management, supply chain management, and production management [42,43,44] by large T&A companies such as Zara, Adidas, Marks & Spencer, Max fashion, Red Tag, and H&M. RFID also makes it possible to track and monitor various designs of products and accessories in the different stages of apparel production processes. Fabric suppliers often install RFID terminals in the shop floors to monitor the production progress of main fabric materials [45]. For retailers, RFID reduces the number of inaccurate manual financial entries, unreported inventory loss, mislabeling, and misplaced inventories or stocks [46,47,48,49]. The application of RFID systems in T&A industry produces large data sets that lead organizations to adopt BIS for data analysis. |

| Collaborative Robotics and Machine Learning | Manufacturing/production processes achieve significant benefits through collaborative robotics and machine learning (ML). ML makes it possible to detect working conditions automatically by robotics and machines. Robotics have the capability to work with humans in a challenging and complex manufacturing environment [50]. Robot technology is being implemented and developed rapidly for reducing costs and improving the automation of manufacturing/production and management processes. Robots are also introduced in inventory management by well-known brands like Nike and Zara. |

| Cloud Computing | One of the top emerging technologies is cloud computing. It can improve manufacturing industries in terms of operational, management, and strategic efficiency [51]. Platform as a service (PaaS) cloud services make it possible for T&A industry to adopt different emerging technologies at a low cast. Cloud computing supports the distributed manufacturing/production of T&A at multiple locations and removes major barriers such as labor, material costs, and environmental conditions. Manufacturing/production plants can be easily monitored and handled by cloud technology and intelligent optimization techniques from anywhere via IoT and cloud technology. As a result, integration of distributed resources of networked manufacturing is considered as a single manufacturing task [45,52]. This scenario not only leads to higher production, reduced cost and lead time but also improves the transparency in decision-making [45]. With the growing cloud-based solutions in T&A companies, the complexity and amount of data are increasing and conversion of this data into meaningful knowledge becomes a major issue [19]. Cloud-based BIS remove technology obsolescence issues in order to adopt costly emerging technologies including BI solutions. In addition, maintenance and upgrading costs can be reduced by using cloud-based BIS. These benefits are another driver to adopt BIS. |

| Mobile Computing | Mobile cloud computing is a new paradigm that has facilitated ubiquitous access to a wide range of ICT resources. T&A businesses are already overwhelmed with the mobile application by retailers and fashion brands. The T&A world is also flooded by advanced technologies due to mobile devices. Mobile applications have become a popular trend in contemporary trade. They have the potential to track and monitor T&A processes, including production and manufacturing with the integration of RFID technology and Near Field Communication (NFC) (mobile technology). The vendor companies are facilitating their clients with mobile BIS. Mobile veterans agreed that speed is a significant factor for BIS users on mobiles. It was discussed at Wise Summit 2011, that usage of mobile computing finally attained its objective of fulfilling the various requirements of BIS users in terms of convenience and collaboration. |

| Additive Manufacturing | Additive manufacturing is an emerging manufacturing technology that has brought tremendous change to markets and industries [53] and is a significant part of Industry 4.0. Researchers confirmed that additive manufacturing offers various benefits regarding the sustainability of industry since it utilizes fewer resources such as operational cost and energy; this results in less energy consumption and reduced operational costs in manufacturing industry [53]. |

| Augmented Reality | Augmented reality is considered as a part of additive manufacturing. Augmented reality also improves environmental sustainability which is why companies are interested to invest [54]. This technology caused a great revolution in contemporary businesses. It has high potential in predicting real-world scenarios. These days, T&A companies are starting to deploy a device called “digital twin”—a 3D virtual reality copy of a physical product created with the help of rich data, generated by smart, connected products [55]. The virtual demonstration will seem real, with virtual apparel collections, dressing rooms, and outlets. Previously, augmented reality applications were used just for repair tasks in industry [56], but now they bring a great revolution in the world of fashion apparel with a 3D fit application that allows customers to try multiple outfits like a real world experience. The data generated by additive manufacturing and augmented reality are required to process for decision-making that leads to the adoption of BIS in companies. |

| Internet of Things (IoT) | Smart factories, smart devices, smart cities, and smart clothing are buzzwords in the recent decade. The advent of IoT makes it possible to interconnect multiple technologies that support advanced monitoring, traceability, collaboration, and coordination between business partners [57]. IoT has the capability to support fashion design, development, production, and manufacturing of T&A articles [58]. The installation of IoT sensors can not only be attached to clothes, but machines can also be linked together in manufacturing for equipment tracking. IoT coordinates significant real-time information for visibility of the entire product development process and supply chain of textiles and apparels [59]. The connected devices of IoT generate large data sets every day. Hence, the conversion of data into knowledgeable information becomes very important. Otherwise, this data is valueless for businesses. This scenario drives the organization to adopt BIS for better data analysis and decision-making [59]. |

| Big Data | The term big data alludes to the heterogeneous structure of datasets. Emerging technologies drive companies to use various data types, whether unstructured (e.g., simulations, 3D models, images, text, audios, and videos), semi-structured (e.g., XML), or structured (e.g., numbers, relational tables, records, personal data, and financial data) [60]. This data is generated from a gigantic range of sensors and social media and transmitted over the Internet and stored on servers through cloud technologies [15]. The application of RFID, cloud technology, IoT, and mobile computing are important parts of contemporary trade. Data processing allows for the integration of analytical systems with advanced technologies for decision-making in T&A companies. |

| Names | Description |

|---|---|

| TradeGecko | TradeGecko offers cloud-based BI solutions for inventory management. TradeGecko solutions enable organizations to improve online retail and wholesale processes. Pink Boutique, Cloth & Co., and Zara are benefiting by TradeGecko. |

| Oracle | Role-based intuitive intelligence is supported by complete Oracle built-in BI solutions across the enterprise. Oracle cloud-based BIS offer scalable, efficient reporting solutions for distributed complex environment. Its central architecture empowers organizations for statistical and predictive analytics with mobile functionality. |

| MicroStrategy | Companies are integrating MicroStrategy analytics as the front end of BIS. It empowers companies to consolidate various independent data warehouses into one single platform running on HANA in-memory database. MicroStrategy provides faster aggregation analysis with greater computational power. Company D and Adidas are using MicroStrategy. |

| Dematic | Dematic BI solutions empower companies to enhance supply chains and provide a competitive edge to organizations. The supply chain management of Adidas, Gap, and Next is benefiting from Dematic BI solutions. |

| Tableau | Tableau BI solutions enable the company to identify the key matrices to confirm the right product availability before it is ordered and shipped. Abercrombie and Fitch are benefiting from Tableau solutions for improvement of their merchandising operations. |

| TIBCO Spotfire | Marks & Spencer and H&M are using TIBCO Spotfire. The TIBCO solutions empower the analysts of the companies to integrate all data sources, such as Hadoop databases and data warehouses, without an information technology (IT) specialist. Executives and employees can also analyze complicated data without IT expertise. |

| SAP HANA in memory database | SAP HANA in-memory database is based on an independent data warehouse. Third party databases, sensors, and Hadoop can be integrated into a single platform by SAP solutions. Cloud-based SAP has the ability to process high volumes of data for data modeling at high speed. Company B and Adidas have implemented SAP solutions. |

| Birst | Birst BI is built with machine learning patented automation technologies. This approach connects applications and teams across the organizations. |

| Qlik | Qlik BI solutions are complete enterprise solutions that provide quick analysis of vast amounts of data sourcing from retailers. Tantex textile industry uses Qlik solutions. |

| Company Name | Company | Country | Interviewee Designation | Mode |

|---|---|---|---|---|

| Company A | Textile and Apparel | Pakistan | IT Executive | On-site |

| Company B | Clothing Brand | Pakistan | Retail Manager | On-site |

| Company C | Textile and Apparel | Malaysia | (2) Owner and IT Manager | On-site |

| Company D | Apparel | Spain | IT Manager | On Skype |

| Company E | Textile and Apparel | Pakistan | CEO (IT) | On-site |

| Company F | Clothing Brand | KSA | Regional Manager | On-site |

| Company G | Apparel | USA | (2) Senior Managers | On Skype |

| Company H | Textile and Apparel | India | CEO | On imo |

| Company I | Apparel Brand | UK | Manager | On Skype |

| Company J | Textile | USA | Area Manager | On Skype |

| Company K | Apparel Brand | Sweden | CEO | On Skype |

| Company L | Clothing Chain | China | General Manager | On imo |

| Cases | Companies | Description |

|---|---|---|

| Case 1 | Company A | Company A is a large, renowned T&A industry in Pakistan. It was founded in 1930 with group of factories comprising eight textile factories in different cities of Pakistan. The company has vertically integrated major processes: ginning, knitting, dying, printing fabric, and finished apparel products. |

| Case 2 | Company B | Company B is one of the markets most famous high-end fashion retailer in Pakistan with nearly 5000 employees. It was founded in 1984. Company B has established 90 outlets across the country and in other countries, including the United Arab Emirates, United Kingdom, Malaysia, and India. |

| Case 3 | Company C | Company C is another large T&A company of Malaysia with more than 16,000 employees. It is vertical integrated manufacturing yarn, cotton, fabric and produces apparel products. It exports its products to 35 countries all around the world. |

| Case 4 | Company D | Company D is a German multinational corporation founded in 1949. The company designs and manufactures apparel products such as clothing and shoes. It is the largest manufacturer of sportswear in Europe and the second in the world with 57,016 employees. |

| Case 5 | Company E | Company E has vertically integrated manufacturing, spinning, weaving, dying, and stitching processes. The company also runs one of the top Pakistani apparel brands. It has established more than 72 shops in Pakistan and in other countries such as Dubai, Abu Dhabi, Saudi Arabia, and Canada, with online stores as well. It has a continual supplier relationship with top international brands such as Ocean garments, Levi, Crate & Barrel, Hugo Boss, Gap, John Lewis, Next, and some others. |

| Case 6 | Company F | Company F is a Spanish retailer of apparel products. The famous retail brand has 1770 retail stores in 86 countries across the world. It specializes in fast fashion. It launches generally 20 apparel collections in a year. It is famous as one of the most innovative retailers around the globe. |

| Case 7 | Company G | The company G is a famous American apparel retail brand that operates with two other brands. It is known as a lifestyle retailer of men, women, and kids’ accessories. It also operates with 1049 outlets with three brands across the world. |

| Case 8 | Company H | Company H is an Indian-based big, vertically- and horizontally-integrated fabric manufacturer and woolen fabric maker textile company. It shares over 60% of the suiting market in India with 637 retail shops including 4000 multi-brand outlets in 150 cities across India. It also exports its products to over 55 countries including the Middle East, Japan, Europe, Canada, and the USA. |

| Case 9 | Company I | Company I is a major British multinational clothing brand. It was established in 1884 in Leeds. It has opened 959 outlets all over the country and 1463 stores across the world. |

| Case 10 | Company J | Company J is the world’s leading commercial textiles manufacturer in North America. It has operated across the United States for a decade. |

| Case 11 | Company K | Company K is a Swedish multinational clothing retail company. It operates multiple brands online and has established 5000 stores in 74 countries with 126,000 locations across the world. It is the second largest international clothing retailer in the world. |

| Case 12 | Company L | Company L is a Chinese clothing chain. It was founded in 1980. Currently, the company is a multi-brand specialty retailer offering different labels with 700 outlets in the region including China, Vietnam, Taiwan, Malaysia, Philippines, Singapore, Thailand, Macau, Cambodia, Indonesia, Jordan, Qatar, Bahrain, the United Arab Emirates, and Saudi Arabia. |

| Company | Sustainability Issues of Case Companies | Value Creation Improved Processes | BI Solutions | Industry 4.0 Technologies |

|---|---|---|---|---|

| A | Supply short lead time, supply chain management, marketing, customer satisfaction | Working on project for BIS adoption | BI project in process | |

| B | Uncertain apparel output, inventory management, shorter lead time | Financial and retailing operations, production forecasting, supplier, retailer collaboration | Business objects (BOBJ) on SAP | |

| C | Short delivery time, production inconsistency, supply management and inventory management | Production, delivery orders, production output, inventory operation and supply chain processes | Oracle BI solutions | RFID, Cloud technology |

| D | For customer insights, customer satisfaction | Fast delivery of customer insights, optimize customer experience, loyalty, acquisition and engagement financial reports | MicroStrategy BI solutions based on SAP HANNA | Cloud technology, Big dataRobotics, 3D printing, Virtual mirrors |

| E | Financial analysis, internal and external data integration, supply, retailing operations | Improved partnership with suppliers, retailers and customers, reducing overhead cost, competitor analysis, financial analysis, vertical and horizontal analysis for loss and profit, environmental analysis, ratio analysis, market analysis, and strategic policy | Oracle and SAP BI solutions | Cloud technology, Big data |

| F | Replenishment control, and designing replenishment plans, Inventory management, Supply chain management, distribution management, size/colour management | Reduction in product delivery lead time, improved the inventory management and reduced the logistics cost of supply chain across its international stores | TradeGecko BI solutions | Robotics, Augmented reality, RFID, Big data, Mobile technology, Cloud technology |

| G | Designing replenishment plans, distribution management, size/color management, supply chain management, and inventory management | Replenishment control, fast customer insights improved demand and ship processes | Tableau BI solution | Cloud technology, Mobile technology |

| H | Inventory management, demand forecasts with limited visibility over inventory, stock losses, excess inventory, costly supply chain, coordination with fragmented vendors and suppliers | Automate order taking and enhance the focus on merchandising, collection, and business development, offer best choices to customers with best service and with minimum inventory | AI powered sales-tech platform on SaaS model | Artificial Intelligence, Cloud, RFID, Big data |

| I | Scalable data-driven decisions across the business for better customer insights | Improved e-commerce, finance, and marketing processes by leveraging analytics | Hadoop-based data analytics, Qlik BI solutions | BI, Big data, Cloud technology |

| J | Limited functionality with disparate data sources, slow decision-making, low employee productivity | Improve customer service and satisfaction, production quality, reduction in lead time, better informed and fast decisions | Birst BI Solutions | BIS, Self-service, Machine Learning |

| K,L | Customer insights, loyalty, and engagement | Customize merchandising, better customer insights, evaluate robust potential business partners | Informatica PowerCenter, Cognos, SAS Tableau, Power BI | Big data, Artificial Intelligence, BI solutions |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmad, S.; Miskon, S.; Alabdan, R.; Tlili, I. Towards Sustainable Textile and Apparel Industry: Exploring the Role of Business Intelligence Systems in the Era of Industry 4.0. Sustainability 2020, 12, 2632. https://doi.org/10.3390/su12072632

Ahmad S, Miskon S, Alabdan R, Tlili I. Towards Sustainable Textile and Apparel Industry: Exploring the Role of Business Intelligence Systems in the Era of Industry 4.0. Sustainability. 2020; 12(7):2632. https://doi.org/10.3390/su12072632

Chicago/Turabian StyleAhmad, Sumera, Suraya Miskon, Rana Alabdan, and Iskander Tlili. 2020. "Towards Sustainable Textile and Apparel Industry: Exploring the Role of Business Intelligence Systems in the Era of Industry 4.0" Sustainability 12, no. 7: 2632. https://doi.org/10.3390/su12072632

APA StyleAhmad, S., Miskon, S., Alabdan, R., & Tlili, I. (2020). Towards Sustainable Textile and Apparel Industry: Exploring the Role of Business Intelligence Systems in the Era of Industry 4.0. Sustainability, 12(7), 2632. https://doi.org/10.3390/su12072632