Evaluating the EKC Hypothesis for the BCIM-EC Member Countries under the Belt and Road Initiative

Abstract

1. Introduction

2. Literature Review

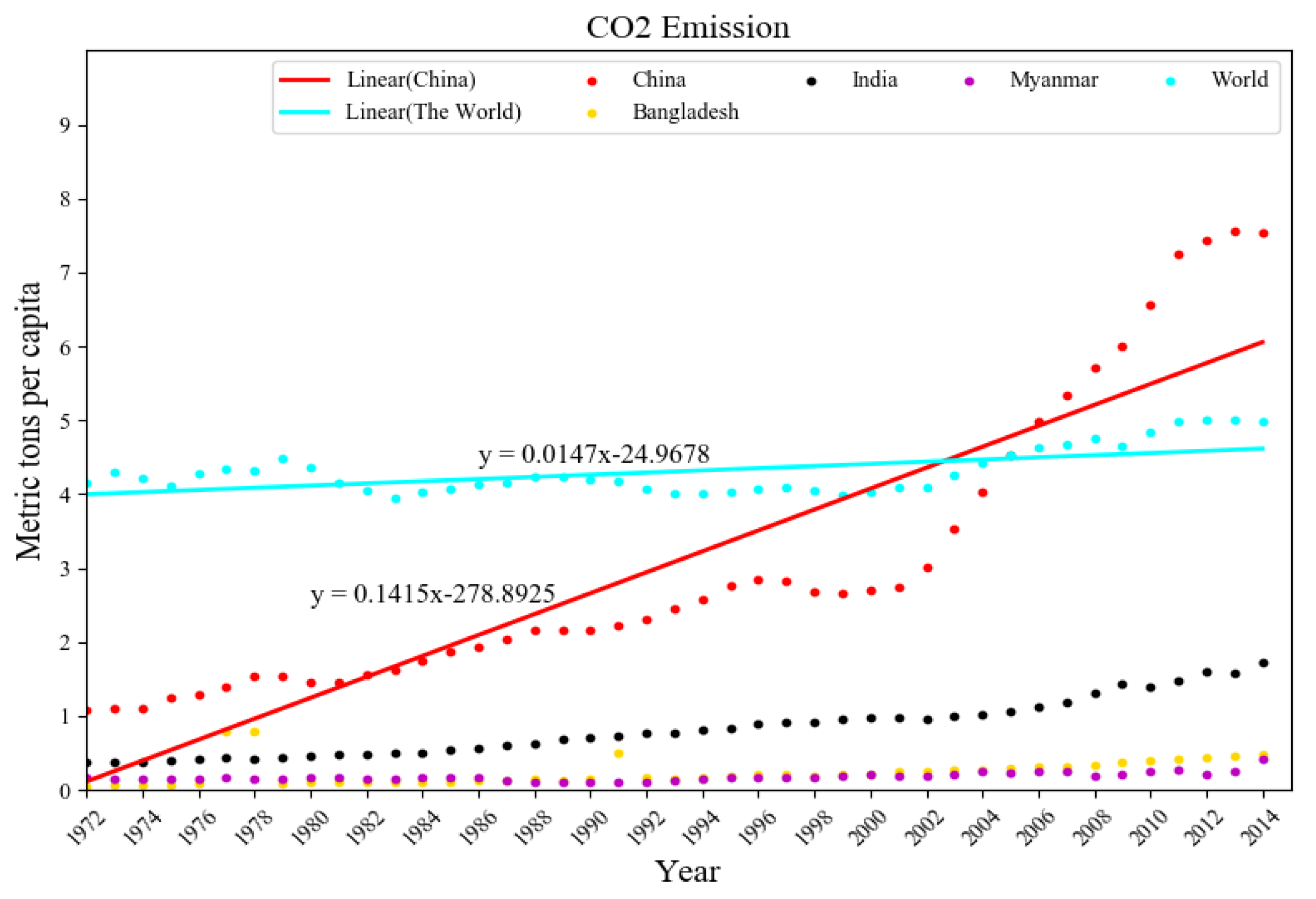

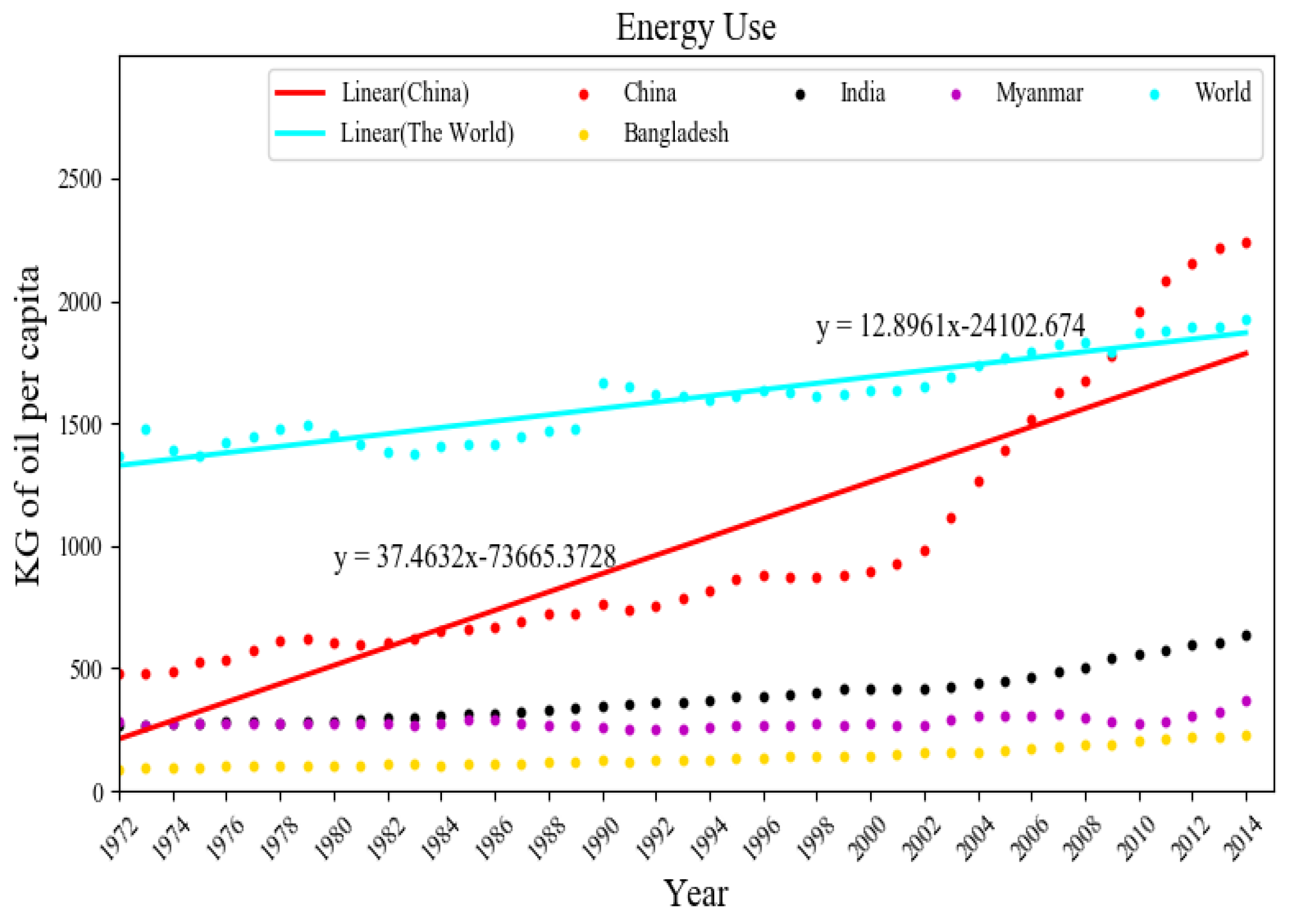

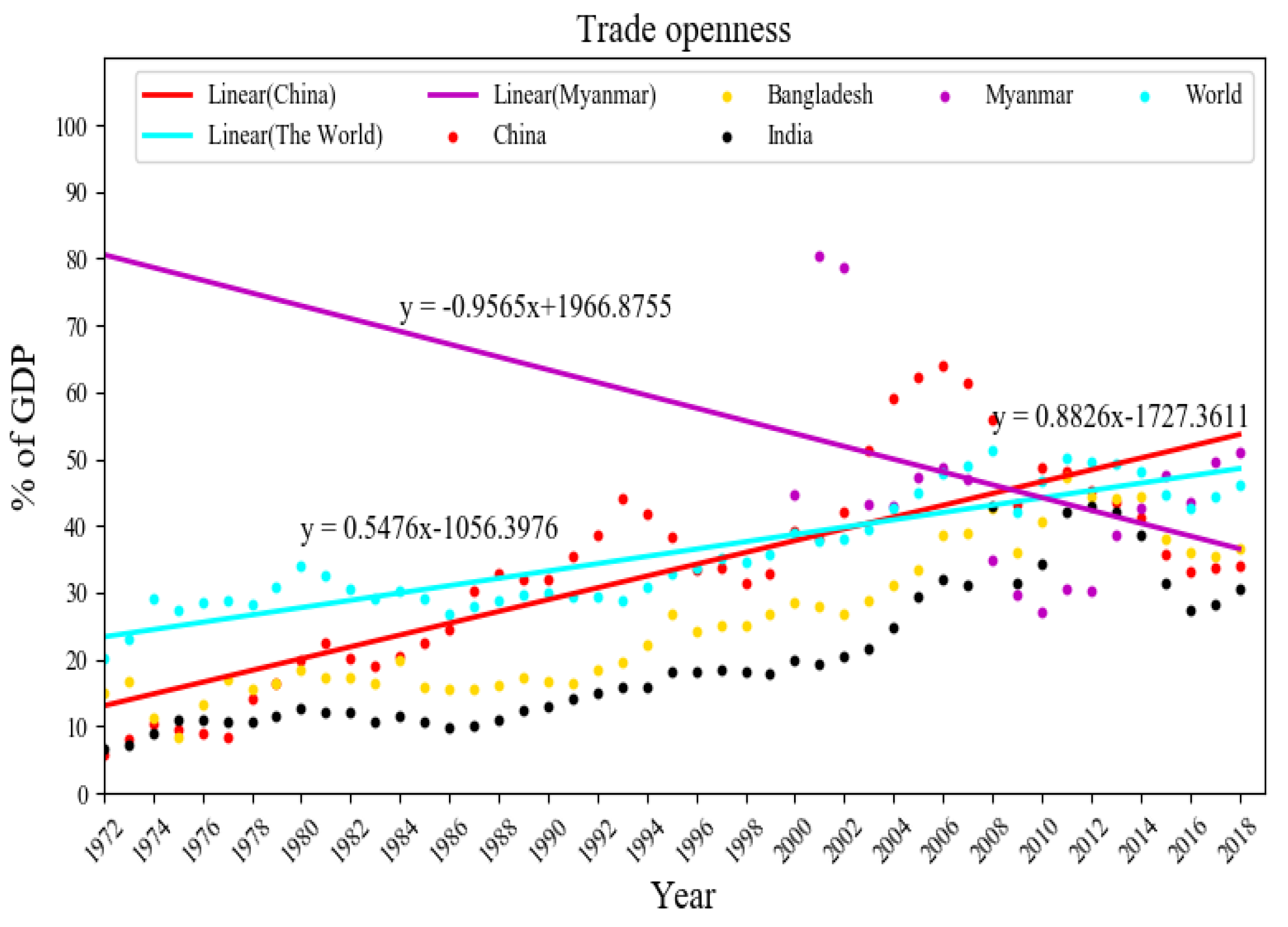

3. Data and Methodology

4. Empirical Results and Discussion

4.1. Panel Unit Root Test

4.2. Cross-sectional Dependence Test

4.3. Panel Coefficient Estimate Results

4.4. Unit Root Test

4.5. Structural Breaks Test

4.6. The ARDL Bounds Test

4.7. The ARDL Bounds Test without Structural Breaks

4.8. The ARDL Bounds Test with Structural Breaks

4.9. Analysis of the ARDL Bounds Test Results

5. Causality Test

6. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| C | Y | Y2 | E | T | |

|---|---|---|---|---|---|

| Bangladesh | |||||

| Mean | −1.652 | 1.829 | 3.351 | 4.893 | 3.159 |

| Median | −1.619 | 1.813 | 3.287 | 4.842 | 3.190 |

| Maximum | −0.223 | 1.959 | 3.837 | 5.434 | 3.883 |

| Minimum | −2.937 | 1.753 | 3.075 | 4.479 | 2.137 |

| Std. Dev. | 0.687 | 0.059 | 0.218 | 0.268 | 0.424 |

| Skewness | 0.146 | 0.671 | 0.708 | 0.487 | −0.057 |

| Kurtosis | 2.233 | 2.243 | 2.301 | 2.151 | 2.086 |

| Jarque-Bera | 1.207 | 4.641 | 4.890 | 2.989 | 1.659 |

| Probability | (0.546) | (0.097) | (0.086) | (0.224) | (0.436) |

| China | |||||

| Mean | 0.953 | 7.117 | 51.878 | 6.793 | 3.366 |

| Median | 0.893 | 7.110 | 50.560 | 6.669 | 3.520 |

| Maximum | 2.022 | 8.956 | 80.211 | 7.712 | 4.158 |

| Minimum | 0.077 | 5.486 | 30.105 | 6.167 | 1.750 |

| Std. Dev. | 0.579 | 1.117 | 16.072 | 0.461 | 0.595 |

| Skewness | 0.435 | 0.104 | 0.263 | 0.710 | −1.055 |

| Kurtosis | 2.169 | 1.702 | 1.762 | 2.327 | 3.344 |

| Jarque-Bera | 2.596 | 3.379 | 3.543 | 4.429 | 8.966 |

| Probability | (0.272) | (0.184) | (0.170) | (0.109) | (0.011) |

| India | |||||

| Mean | −0.284 | 6.610 | 43.958 | 5.928 | 2.870 |

| Median | −0.248 | 6.514 | 42.434 | 5.898 | 2.891 |

| Maximum | 0.546 | 7.651 | 58.548 | 6.456 | 3.762 |

| Minimum | −0.980 | 5.944 | 35.333 | 5.588 | 1.877 |

| Std. Dev. | 0.457 | 0.520 | 6.999 | 0.252 | 0.518 |

| Skewness | 0.053 | 0.448 | 0.535 | 0.462 | 0.197 |

| Kurtosis | 1.842 | 1.949 | 2.051 | 2.187 | 1.937 |

| Jarque-Bera | 2.419 | 3.741 | 3.999 | 2.714 | 2.517 |

| Probability | (0.298) | (0.154) | (0.135) | (0.257) | (0.284) |

| Myanmar | |||||

| Mean | −1.749 | 5.895 | 35.301 | 5.633 | 3.769 |

| Median | −1.789 | 5.490 | 30.144 | 5.615 | 3.771 |

| Maximum | −0.881 | 7.360 | 54.170 | 5.911 | 4.386 |

| Minimum | −2.302 | 5.085 | 25.866 | 5.523 | 3.299 |

| Std. Dev. | 0.294 | 0.752 | 9.253 | 0.071 | 0.288 |

| Skewness | 0.358 | 0.724 | 0.804 | 1.573 | 0.468 |

| Kurtosis | 3.527 | 1.969 | 2.101 | 6.668 | 3.193 |

| Jarque-Bera | 1.421 | 6.190 | 6.654 | 41.864 | 0.724 |

| Probability | (0.491) | (0.045) | (0.135) | (0.000) | (0.696) |

References

- Grossman, G.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research 1991. working paper 3914; NBER: Cambridge, MA, USA, 1991. [Google Scholar]

- IBRD. World development report 1992; development and the environment. In World Development Report 1992; Development and the Environment; Oxford University Press: Oxford, UK, 1992. [Google Scholar]

- Beckerman, W. Economic growth and the environment: Whose growth? Whose environment? World Dev. 1992, 20, 481–496. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement, The US-Mexico Free Trade Agreement; MIT Press: Cambridge, MA, USA, 1993. [Google Scholar]

- Selden, T.M.; Song, D. Environmental quality and development: Is there a Kuznets curve for air pollution emissions? J. Environ. Econ. Manag. 1994, 27, 147–162. [Google Scholar] [CrossRef]

- Lopez, R. The environment as a factor of production: The effects of economic growth and trade liberalization. J. Environ. Econ. Manag. 1994, 27, 163–184. [Google Scholar] [CrossRef]

- Panayotou, T. Economic Growth and the Environment 2003. In Economic Survey of Europe: UNECE, no. 2, Chapter 2; UNECE: Geneva, Switzerland, 3 March 2003; no. 2. [Google Scholar]

- Dinda, S. Environmental Kuznets curve hypothesis: A survey. Ecol. Econ. 2004, 49, 431–455. [Google Scholar] [CrossRef]

- Ahmad, M.; Hengyi, H.; Rahman, Z.U.; Khan, Z.U.; Khan, S.; Khan, Z. Carbon emissions, energy use, gross domestic product and total population in China. Ekon. I Środowisko 2018, 2, 33–44. [Google Scholar]

- Rahman, Z.U.; Cai, H.; Ahmad, M. A new look at the remittances-FDI-energy-environment nexus in the case of selected Asian natissions. Singap. Econ. Rev. 2019, 1–19. [Google Scholar] [CrossRef]

- Obradović, S.; Lojanica, N. Energy use, CO2 emissions and economic growth–causality on a sample of SEE countries. Econ. Res.-Ekon. Istraživanja 2017, 30, 511–526. [Google Scholar]

- Mohiuddin, O.; Asumadu-Sarkodie, S.; Obaidullah, M. The relationship between carbon dioxide emissions, energy consumption, and GDP: A recent evidence from Pakistan. Cogent Eng. 2016, 3, 1210491. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, L.; Kubota, J. The relationship between urbanization, energy use and carbon emissions: Evidence from a panel of Association of Southeast Asian Nations (ASEAN) countries. J. Clean. Prod. 2016, 112, 1368–1374. [Google Scholar] [CrossRef]

- Kais, S.; Sami, H. An econometric study of the impact of economic growth and energy use on carbon emissions: Panel data evidence from fifty eight countries. Renew. Sustain. Energy Rev. 2016, 59, 1101–1110. [Google Scholar] [CrossRef]

- Ertugrul, H.M.; Cetin, M.; Seker, F.; Dogan, E. The impact of trade openness on global carbon dioxide emissions: Evidence from the top ten emitters among developing countries. Ecol. Indic. 2016, 67, 543–555. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R. Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Chudik, A.; Pesaran, M.H. Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J. Econom. 2015, 188, 393–420. [Google Scholar] [CrossRef]

- Stern, D.I.; Common, M.S.; Barbier, E.B. Economic growth and environmental degradation: The environmental Kuznets curve and sustainable development. World Dev. 1996, 24, 1151–1160. [Google Scholar] [CrossRef]

- Suri, V.; Chapman, D. Economic growth, trade and energy: Implications for the environmental Kuznets curve. Ecol. Econ. 1998, 25, 195–208. [Google Scholar] [CrossRef]

- Stern, D.I. Progress on the environmental Kuznets curve? Environ. Dev. Econ. 1998, 3, 173–196. [Google Scholar] [CrossRef]

- Munasinghe, M. Is environmental degradation an inevitable consequence of economic growth: Tunneling through the environmental Kuznets curve. Ecol. Econ. 1999, 29, 89–109. [Google Scholar] [CrossRef]

- Dasgupta, S.; Laplante, B.; Wang, H.; Wheeler, D. Confronting the environmental Kuznets curve. J. Econ. Perspect. 2002, 16, 147–168. [Google Scholar] [CrossRef]

- Cole, M.A. Development, trade, and the environment: How robust is the Environmental Kuznets Curve? Environ. Dev. Econ. 2003, 8, 557–580. [Google Scholar] [CrossRef]

- Dinda, S. A theoretical basis for the environmental Kuznets curve. Ecol. Econ. 2005, 53, 403–413. [Google Scholar] [CrossRef]

- Galeotti, M.; Lanza, A.; Pauli, F. Reassessing the environmental Kuznets curve for CO2 emissions: A robustness exercise. Ecol. Econ. 2006, 57, 152–163. [Google Scholar] [CrossRef]

- Jalil, A.; Mahmud, S.F. Environment Kuznets curve for CO2 emissions: A cointegration analysis for China. Energy Policy 2009, 37, 5167–5172. [Google Scholar] [CrossRef]

- Luzzati, T.; Orsini, M. Investigating the energy-environmental Kuznets curve. Energy 2009, 34, 291–300. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J.; Mohd, S. Economic growth and CO2 emissions in Malaysia: A cointegration analysis of the environmental Kuznets curve. Energy Policy 2012, 51, 184–191. [Google Scholar] [CrossRef]

- Apergis, N.; Ozturk, I. Testing environmental Kuznets curve hypothesis in Asian countries. Ecol. Indic. 2015, 52, 16–22. [Google Scholar] [CrossRef]

- Stern, D.I. The rise and fall of the environmental Kuznets curve. World Dev. 2004, 32, 1419–1439. [Google Scholar] [CrossRef]

- Ghosh, S. Examining carbon emissions economic growth nexus for India: A multivariate cointegration approach. Energy Policy 2010, 38, 3008–3014. [Google Scholar] [CrossRef]

- Jayanthakumaran, K.; Verma, R.; Liu, Y. CO2 emissions, energy consumption, trade and income: A comparative analysis of China and India. Energy Policy 2012, 42, 450–460. [Google Scholar] [CrossRef]

- Kanjilal, K.; Ghosh, S. Environmental Kuznet’s curve for India: Evidence from tests for cointegration with unknown structuralbreaks. Energy Policy 2013, 56, 509–515. [Google Scholar] [CrossRef]

- Rabbi, F.; Akbar, D.; Kabir, S.Z. Environment Kuznets curve for carbon emissions: A cointegration analysis for Bangladesh. Int. J. Energy Econ. Policy 2015, 5, 45–53. [Google Scholar]

- Husain, H. Determinants of environmental degradation and empirical investigation of Kuznets curve: A comparative study of India and Bangladesh. Asian J. Empir. Res. 2016, 6, 131–141. [Google Scholar]

- Kang, Y.-Q.; Zhao, T.; Yang, Y.-Y. Environmental Kuznets curve for CO2 emissions in China: A spatial panel data approach. Ecol. Indic. 2016, 63, 231–239. [Google Scholar] [CrossRef]

- Aung, T.S.; Saboori, B.; Rasoulinezhad, E. Economic growth and environmental pollution in Myanmar: An analysis of environmental Kuznets curve. Environ. Sci. Pollut. Res. 2017, 24, 20487–20501. [Google Scholar] [CrossRef] [PubMed]

- Solarin, S.A.; Al-Mulali, U.; Ozturk, I. Validating the environmental Kuznets curve hypothesis in India and China: The role of hydroelectricity consumption. Renew. Sustain. Energy Rev. 2017, 80, 1578–1587. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. The environmental Kuznets curve for carbon dioxide in India and China: Growth and pollution at crossroad. J. Policy Modeling 2017, 39, 371–385. [Google Scholar] [CrossRef]

- Sinha, A.; Shahbaz, M. Estimation of Environmental Kuznets Curve for CO2 emission: Role of renewable energy generation in India. Renew. Energy 2018, 119, 703–711. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Jiang, H.; Zeng, X. CO2 emissions, economic growth, and the environmental Kuznets curve in China: What roles can nuclear energy and renewable energy play? J. Clean. Prod. 2018, 196, 51–63. [Google Scholar] [CrossRef]

- Alam, R.; Adil, M.H. Validating the environmental Kuznets curve in India: ARDL bounds testing framework. OPEC Energy Rev. 2019, 43, 277–300. [Google Scholar] [CrossRef]

- Shahbaz, M.; Solarin, S.A.; Ozturk, I. Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecol. Indic. 2016, 67, 623–636. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I. The investigation of environmental Kuznets curve hypothesis in the advanced economies: The role of energy prices. Renew. Sustain. Energy Rev. 2016, 54, 1622–1631. [Google Scholar] [CrossRef]

- WDI. World Development Indicators, Online Edition; World Bank: Washington, DC, USA, 2018; Available online: http://databank.worldbank.org/data/reports.aspx? (accessed on 22 August 2019).

- Kisswani, K.M.; Harraf, A.; Kisswani, A.M. Revisiting the environmental kuznets curve hypothesis: Evidence from the ASEAN-5 countries with structural breaks. Appl. Econ. 2019, 51, 1855–1868. [Google Scholar] [CrossRef]

- Ozatac, N.; Gokmenoglu, K.K.; Taspinar, N. Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environ. Sci. Pollut. Res. 2017, 24, 16690–16701. [Google Scholar] [CrossRef] [PubMed]

- Zhang, S.; Liu, X.; Bae, J. Does trade openness affect CO2 emissions: Evidence from ten newly industrialized countries? Environ. Sci. Pollut. Res. 2017, 24, 17616–17625. [Google Scholar] [CrossRef] [PubMed]

- Dogan, E.; Turkekul, B. CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 2016, 23, 1203–1213. [Google Scholar] [CrossRef] [PubMed]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Econ. Model. 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxf. Bull. Econ. Stat. 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J. Am. Stat. Assoc. 1937, 32, 675–701. [Google Scholar] [CrossRef]

- Frees, E.W. Assessing cross-sectional correlation in panel data. J. Econom. 1995, 69, 393–414. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. J. Econom. 2004, 69. [Google Scholar] [CrossRef]

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient Tests for an Autoregressive Unit Root; National Bureau of Economic Research: Cambridge, MA, USA, 1992. [Google Scholar]

- Lee, J.; Strazicich, M.C. Minimum Lagrange multiplier unit root test with two structural breaks. Rev. Econ. Stat. 2003, 85, 1082–1089. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.J. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

| Maddala and Wu (MW); [51] | Pesaran (CIPS); [52] | |||

|---|---|---|---|---|

| First difference | First Difference | |||

| Variables | Intercept | Intercept and trend | Intercept | Intercept and trend |

| lnC | 32.540 *** | 26.316 *** | −7.548 *** | −6.848 *** |

| lnY | 26.780 *** | 40.472 *** | −7.107 *** | −6.554 *** |

| lnY2 | 23.806 *** | 73.399 *** | −6.972 *** | −6.315 *** |

| lnE | 17.936 ** | 21.965 *** | −6.410 *** | −5.956 *** |

| lnT | 21.605 *** | 19.561 ** | −8.320 *** | −6.061 *** |

| Pesaran | Frees | Freidman | |

|---|---|---|---|

| Fixed effect estimation | −3.295 *** | 1.291 *** | 22.789 *** |

| Random effect estimation | −1.930 *** | 0.523 *** | 19.592 *** |

| Panel A: Short-Run Dynamics | Panel B: Long-Run Dynamics | ||||

|---|---|---|---|---|---|

| Pesaran et al., [16] | Chudik and Pesaran [17] | Pesaran et al., [16] | Chudik and Pesaran [17] | ||

| Variable | PMG | CCEMG | Variable | PMG | CCEMG |

| ΔY | 8.854 *** (2.835) | 7.309 ** (3.016) | Y | −2.413 (2.635) | 0.170 (4.279) |

| ΔY2 | −0.730 *** (0.247) | −0.593 ** (0.267) | Y2 | 0.253 (0.222) | −0.010 (0.329) |

| ΔT | −0.0189 (0.0277) | −0.003 (0.013) | T | −0.0063 (0.040) | 0.133 (0.129) |

| ΔE | 1.306 *** (0.126) | 1.155 *** (0.118) | E | 1.791 *** (0.558) | 1.535 (0.961) |

| ECT | −0.135 (0.074) | −0.124 (0.378) | |||

| Country | Variable | Lags | Level | Lags | First Difference |

|---|---|---|---|---|---|

| Bangladesh | lnC | 0 | −4.222 | 0 | −6.921 *** |

| lnY | 6 | −1.728 | 0 | −10.192 *** | |

| lnY2 | 6 | −1.741 | 0 | −9.871 *** | |

| lnE | 0 | −1.233 | 0 | −7.348 *** | |

| lnT | 0 | −3.053 | 0 | −6.755 *** | |

| China | lnC | 1 | −2.281 | 1 | −3.484 ** |

| lnY | 2 | −1.805 | 1 | −3.466 ** | |

| lnY2 | 2 | −1.213 | 1 | −3.352 ** | |

| lnE | 1 | −1.426 | 0 | −3.788 *** | |

| lnT | 1 | −1.104 | 0 | −4.991 *** | |

| India | lnC | 0 | −1.778 | 0 | −6.116 *** |

| lnY | 0 | −0.446 | 0 | −8.691 *** | |

| lnY2 | 1 | −0.171 | 0 | −8.494 *** | |

| lnE | 0 | −0.228 | 0 | −6.157 *** | |

| lnT | 0 | −2.017 | 0 | −6.575 *** | |

| Myanmar | lnC | 0 | −1.647 | 0 | −4.538 *** |

| lnY | 1 | −1.112 | 0 | −3.004 ** | |

| lnY2 | 1 | −1.070 | 0 | −2.987 * | |

| lnE | 1 | −1.605 | 0 | −3.472 ** | |

| lnT | 0 | −1.829 | 0 | −4.348 *** |

| Country | Variable | TB1 | TB2 | t-sta. (min) | Lags | Bootstrapped Critical Values | ||

|---|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | ||||||

| Bangladesh | lnC | 1982 | 1998 | −5.113 | 0 | −6.932 | −6.175 | −5.825 |

| lnY | 1983 | 1989 | −5.696 | 8 | −6.750 | −6.108 | −5.779 | |

| lnY2 | 1983 | 1989 | −5.938 * | 8 | −6.750 | −6.108 | −5.779 | |

| lnE | 1990 | 2000 | −3.918 | 4 | −6.978 | −6.288 | −5.998 | |

| lnT | 1993 | 2008 | −7.031 *** | 8 | −7.004 | −6.185 | −5.828 | |

| China | lnC | 1978 | 2007 | −6.850 ** | 3 | −6.932 | −6.175 | −5.825 |

| lnY | 1982 | 2004 | −6.925 *** | 5 | −6.691 | −6.152 | −5.798 | |

| lnY2 | 1991 | 1996 | −5.895 * | 7 | −6.963 | −6.201 | −5.890 | |

| lnE | 1998 | 2007 | −6.327 ** | 2 | −6.932 | −6.175 | −5.825 | |

| lnT | 1987 | 2003 | −7.090 *** | 3 | −7.004 | −6.185 | −5.828 | |

| India | lnC | 1987 | 1999 | −5.137 | 6 | −6.932 | −6.175 | −5.825 |

| lnY | 1986 | 1996 | −5.696 | 6 | −7.196 | −6.312 | −5.893 | |

| lnY2 | 1986 | 2001 | −5.227 | 8 | −7.004 | −6.185 | −5.828 | |

| lnE | 1993 | 1998 | −6.566 ** | 5 | −6.863 | −6.268 | 5.956 | |

| lnT | 1983 | 2003 | −5.599 | 6 | −7.004 | −6.185 | −5.828 | |

| Myanmar | lnC | 1982 | 1995 | −5.158 | 4 | −6.750 | −6.108 | −5.779 |

| lnY | 1986 | 1998 | −6.241 ** | 3 | −6.932 | −6.175 | 5.825 | |

| lnY2 | 1986 | 1998 | −6.013 * | 3 | −6.932 | −6.175 | 5.825 | |

| lnE | 1995 | 2007 | −6.260 ** | 4 | −7.004 | −6.185 | −5.828 | |

| lnT | 1982 | 2008 | −5.920 ** | 1 | −6.821 | −5.917 | −5.541 | |

| Country | F-Statistics | Conclusion | Selected Model |

|---|---|---|---|

| Bangladesh | 8.632 *** | Cointegration | ARDL (2,4,4,4,4) |

| China | 6.106 *** | Cointegration | ARDL (4,6,6,3,5) |

| India | 3.898 * | Cointegration | ARDL (4,3,4,2,4) |

| Myanmar | 5.889 *** | Cointegration | ARDL (1,4,4,3,2) |

| Pesaran, Shin, Smith [58] critical values (k = 4) | |||

| Significance level | Test-Statistics | I (0) Bound | I (1) Bound |

| 10% | F | 2.45 | 3.52 |

| 5% | F | 2.86 | 4.01 |

| 1% | F | 3.74 | 5.06 |

| Country | F-Statistics | Conclusion | Selected Model |

|---|---|---|---|

| Bangladesh | 3.808 ** | Cointegration | ARDL (4,3,1,2,2,2,0) |

| China | 19.75 *** | Cointegration | ARDL (2,2,0,0,0,2,0) |

| India | 11.866 *** | Cointegration | ARDL (1,3,1,1,0,1,3) |

| Myanmar | 3.954 ** | Cointegration | ARDL (1,1,0,1,1,0,1) |

| Pesaran, Shin, and Smith [58] critical values (k = 6) | |||

| Significance level | Test-Statistics | I (0) Bound | I (1) Bound |

| 10% | F | 2.12 | 3.23 |

| 5% | F | 2.45 | 3.61 |

| 1% | F | 3.15 | 4.43 |

| i = Bangladesh | Coefficient | Std. Error | t-value | |||

|---|---|---|---|---|---|---|

| ARDL without Break | ARDL with Break | ARDL without Break | ARDL With Break | ARDL without Break | ARDL with Break | |

| Panel A: Short-run estimates | ||||||

| Δ | 8.791 | 14.776 | 16.06 | 16.927 | 0.55 | 0.87 |

| Δ | −36.902 | 0.385 | 18.307 | 0.828 | −2.02 * | 0.47 |

| Δ | 40.091 | 0.511 | 17.53 | 0.587 | 2.29 ** | 0.88 |

| Δ | −0.813 | −1.255 | 1.316 | 1.400 | −0.62 | −0.90 |

| Δ | 3.201 | 1.520 | 2.11 ** | |||

| Δ | −3.292 | 1.475 | −2.23 ** | |||

| Δ | −0.255 | −0.075 | 0.075 | 0.100 | −3.38 *** | −0.75 |

| Δ | 0.127 | 0.050 | 0.076 | 0.057 | 0.117 | 0.88 |

| Δ | 0.145 | 0.073 | 1.99 ** | |||

| Δ | 1.961 | 1.386 | 0.363 | 0.392 | 5.39 *** | 3.53 *** |

| Δ | −2.665 | 0.644 | −4.14 *** | |||

| Δ | −0.071 | 0.042 | −1.69 | |||

| Δ | −0.047 | 0.041 | −1.14 | |||

| Constant | −52.832 | 50.976 | 12.069 | 15.346 | −4.38 *** | −3.32 *** |

| Panel B: Long-run estimates | ||||||

| 7.926 | 10.972 | 2.099 | 3.110 | 3.78 *** | 3.53 *** | |

| −0.692 | −0.874 | 0.168 | 0.215 | −4.12 *** | −4.05 *** | |

| −0.336 | −0.234 | 0.059 | 0.131 | −5.61 *** | −1.78 * | |

| 3.474 | 2.664 | 0.387 | 0.538 | 8.97 *** | 4.95 *** | |

| −0.006 | 0.053 | −0.13 | ||||

| −0.046 | 0.037 | −1.21 | ||||

| Panel C: Diagnostics Statistics | ||||||

| R-Squared | 0.89 | 0.84 | ||||

| Adj R-Squared | 0.74 | 0.66 | ||||

| −1.266 | −1.031 | 0.208 | 0.212 | −6.07 *** | −4.86 *** | |

| i = China | ||||||

| Panel A: Short-run estimates | ||||||

| Δ | −1.932 | 0.790 | 3.717 | 0.148 | −0.52 | 5.33 *** |

| Δ | −5.418 | −0.217 | 2.844 | 0.131 | −1.90 * | −1.65 |

| Δ | −3.494 | 1.980 | −1.76 | |||

| Δ | 0.636 | 1.620 | 0.39 | |||

| Δ | 4.061 | 2.003 | 2.03 * | |||

| Δ | 5.54 | 1.677 | 3.31 ** | |||

| Δ | 0.146 | −0.028 | 0.269 | 0.011 | 0.54 | −2.47 ** |

| Δ | 0.425 | 0.207 | 2.05 * | |||

| Δ | 0.262 | 0.155 | 1.69 | |||

| Δ | −0.074 | 0.129 | −0.57 | |||

| Δ | −0.289 | 0.158 | −1.83 | |||

| Δ | −0.438 | 0.131 | −3.34 ** | |||

| Δ | −0.019 | 0.033 | 0.096 | 0.023 | −0.20 | 1.40 |

| Δ | 0.048 | 0.091 | 0.53 | |||

| Δ | 0.610 | 0.828 | 0.323 | 0.121 | 1.89 * | 6.84 *** |

| Δ | −1.474 | 0.538 | −2.74 ** | |||

| Δ | −0.041 | 0.017 | −2.39 ** | |||

| Δ | 0.058 | 0.017 | 3.30 *** | |||

| Constant | −26.066 | −6.904 | 10.303 | 1.227 | −2.53 ** | −5.62 *** |

| Panel B: Long-run estimates | ||||||

| 1.903 | 0.590 | 0.396 | 1.557 | 4.80 *** | 3.79 *** | |

| −0.134 | −0.032 | 0.027 | 0.119 | −4.84 *** | −2.72 ** | |

| −0.193 | 0.038 | 0.060 | 0.029 | −3.21 ** | 1.34 | |

| 1.578 | 0.960 | 0.107 | 0.069 | 14.71 *** | 13.90 *** | |

| −0.098 | 0.016 | −5.97 *** | ||||

| 0.067 | 0.021 | 3.09 *** | ||||

| Panel C: Diagnostics Statistics | ||||||

| R-Squared | 0.97 | 0.93 | ||||

| Adj R-Squared | 0.90 | 0.90 | ||||

| −1.573 | −0.861 | 0.473 | 0.090 | −3.32 *** | −9.49 *** | |

| i = India | ||||||

| Panel A: Short-run estimates | ||||||

| Δ | 8.143 | 9.309 | 2.478 | 1.905 | 3.29 *** | 4.89 *** |

| Δ | −5.994 | −0.380 | 3.359 | 0.151 | −1.78 * | −2.50 ** |

| Δ | −0.663 | −0.744 | 0.197 | 0.152 | −3.35 *** | −4.89 *** |

| Δ | 0.485 | 0.266 | 1.82 * | |||

| Δ | −0.035 | −0.145 | 0.057 | −0.477 | −0.62 | −3.05 *** |

| Δ | 1.963 | 1.490 | 0.255 | 0.229 | 7.68 *** | 6.49 *** |

| Δ | −2.380 | 1.025 | −2.32 ** | |||

| Δ | 0.030 | 0.019 | 1.53 | |||

| Δ | −0.031 | 0.018 | −1.66 * | |||

| Constant | −55.718 | −26.606 | 19.166 | 3.598 | −2.91 *** | −7.39 *** |

| Panel B: Long-run estimates | ||||||

| 4.961 | 4.625 | 0.238 | 0.358 | 20.82 *** | 12.91 *** | |

| −0.397 | −0.326 | 0.017 | 0.028 | −22.53 *** | −11.63 *** | |

| 0.050 | −0.025 | 0.023 | 0.029 | 2.13 ** | −0.85 | |

| 2.248 | 1.385 | 0.090 | 0.175 | 24.97 *** | 7.88 *** | |

| 0.049 | 0.015 | 3.17 *** | ||||

| −0.037 | 0.021 | −1.71 * | ||||

| Panel C: Diagnostics Statistics | ||||||

| R-Squared | 0.87 | 0.84 | ||||

| Adj R-Squared | 0.72 | 0.72 | ||||

| −1.927 | −1.075 | 0.646 | 0.133 | −2.98 *** | −8.04 *** | |

| i = Myanmar | ||||||

| Panel A: Short-run estimates | ||||||

| Δ | 16.167 | −0.137 | 13.424 | 1.054 | 1.20 | −0.13 |

| Δ | 5.129 | 16.512 | 0.31 | |||

| Δ | 32.165 | 15.104 | 2.13 ** | |||

| Δ | 29.336 | 15.104 | 2.13* | |||

| Δ | −1.344 | 0.111 | 1.235 | 0.103 | −1.09 | 1.09 |

| Δ | −0.314 | 1.550 | −0.20 | |||

| Δ | −2.989 | 1.417 | −2.11 ** | |||

| Δ | −2.710 | 1.439 | −1.88 * | |||

| Δ | −0.081 | −0.101 | 0.052 | 0.022 | −1.55 | −4.46 *** |

| Δ | −0.112 | 0.044 | −2.71 ** | |||

| Δ | 3.133 | 2.070 | 0.681 | 0.480 | 4.60 *** | 4.31 *** |

| Δ | −2.271 | 0.873 | −2.60 ** | |||

| Δ | −0.003 | 0.070 | −0.04 | |||

| Δ | 0.095 | 0.096 | 0.99 | |||

| Constant | −9.807 | 5.360 | 11.345 | 5.501 | −0.86 | 0.97 |

| Panel B: Long-run estimates | ||||||

| −6.489 | −3.968 | 4.005 | 5.927 | −1.62 | −0.67 | |

| 0.649 | 0.372 | 0.356 | 0.491 | 1.82 * | 0.76 | |

| −0.021 | 0.014 | 0.035 | 0.056 | −0.61 | 0.25 | |

| 4.638 | −1.640 | 0.863 | 2.175 | 5.37 *** | −0.75 | |

| −0.010 | 0.231 | −0.04 | ||||

| −0.214 | 0.190 | −1.12 | ||||

| Panel C: Diagnostics Statistics | ||||||

| R-Squared | 0.89 | 0.78 | ||||

| Adj R-Squared | 0.80 | 0.70 | ||||

| −0.819 | −0.3 | 0.227 | 0.155 | −3.59 *** | −1.94 ** | |

| Tests | ARDL without Break | ARDL with Break | ||

|---|---|---|---|---|

| Bangladesh | Chi2 | P > Chi2 | Chi2 | P > Chi2 |

| LM (ARCH) | 0.069 | 0.7930 | 0.717 | 0.3973 |

| Breusch-Pagan | 0.02 | 0.8896 | 0.01 | 0.9419 |

| Durbin’s alternative test for autocorrelation | 1.535 | 0.2154 | 0.383 | 0.5259 |

| China | ||||

| LM (ARCH) | 0.001 | 0.9815 | 11.137 | 0.0008 |

| Breusch-Pagan | 0.45 | 0.5027 | 0.59 | 0.4434 |

| Durbin’s alternative test for autocorrelation | 0.61 | 0.9952 | 29.685 | 0.0000 |

| India | ||||

| LM (ARCH) | 0.005 | 0.9415 | 0.007 | 0.9334 |

| Breusch-Pagan | 1.52 | 0.2172 | 1.21 | 0.2715 |

| Durbin’s alternative test for autocorrelation | 3.913 | 0.0479 | 5.202 | 0.0226 |

| Myanmar | ||||

| LM (ARCH) | 0.003 | 0.9534 | 1.530 | 0.2161 |

| Breusch-Pagan | 0.89 | 0.3460 | 0.50 | 0.4816 |

| Durbin’s alternative test for autocorrelation | 4.065 | 0.0438 | 6.432 | 0.0112 |

| Null Hypothesis | W-bar Stat. | Z-bar Stat. | p-value |

|---|---|---|---|

| Y does not Ganger cause C | 3.507 | 3.546 *** | 0.0004 |

| C does not Ganger cause Y | 0.683 | −0.447 | 0.654 |

| Y2 does not Ganger cause C | 3.570 | 3.634 *** | 0.0003 |

| C does not Ganger cause Y2 | 0.843 | −0.222 | 0.824 |

| T does not Ganger cause C | 1.195 | 0.276 | 0.782 |

| C does not Ganger cause T | 3.726 | 3.856 *** | 0.0001 |

| E does not Ganger cause C | 0.929 | −0.099 | 0.920 |

| C does not Ganger cause E | 1.087 | 0.123 | 0.901 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rahman, A.; Murad, S.M.W.; Ahmad, F.; Wang, X. Evaluating the EKC Hypothesis for the BCIM-EC Member Countries under the Belt and Road Initiative. Sustainability 2020, 12, 1478. https://doi.org/10.3390/su12041478

Rahman A, Murad SMW, Ahmad F, Wang X. Evaluating the EKC Hypothesis for the BCIM-EC Member Countries under the Belt and Road Initiative. Sustainability. 2020; 12(4):1478. https://doi.org/10.3390/su12041478

Chicago/Turabian StyleRahman, Arifur, S. M. Woahid Murad, Fayyaz Ahmad, and Xiaowen Wang. 2020. "Evaluating the EKC Hypothesis for the BCIM-EC Member Countries under the Belt and Road Initiative" Sustainability 12, no. 4: 1478. https://doi.org/10.3390/su12041478

APA StyleRahman, A., Murad, S. M. W., Ahmad, F., & Wang, X. (2020). Evaluating the EKC Hypothesis for the BCIM-EC Member Countries under the Belt and Road Initiative. Sustainability, 12(4), 1478. https://doi.org/10.3390/su12041478