International Strategy for Sustainable Growth in Multinational Pharmaceutical Companies

Abstract

1. Introduction

2. Background

2.1. State of Internationalization

2.2. Pharmaceutical Indusrtry Specific Characteristics of Internationalization

3. Materials and Methods

3.1. Data

3.2. Classification of Internationalization

3.3. Effectiveness of Internationalization in Terms of TS

3.3.1. Comparison of Global Companies versus Home-Region-Oriented Companies in Terms of TS and Adjusted TS

3.3.2. Comparison of Companies That Shift to Being Global versus Those That Remain Home-Region-Oriented in Terms of TS

3.4. Growth Patterns of Global Companies Versus Home-Region-Oriented Companies

4. Results

4.1. State of Internationalizaion in the Pharmaceutical Industry

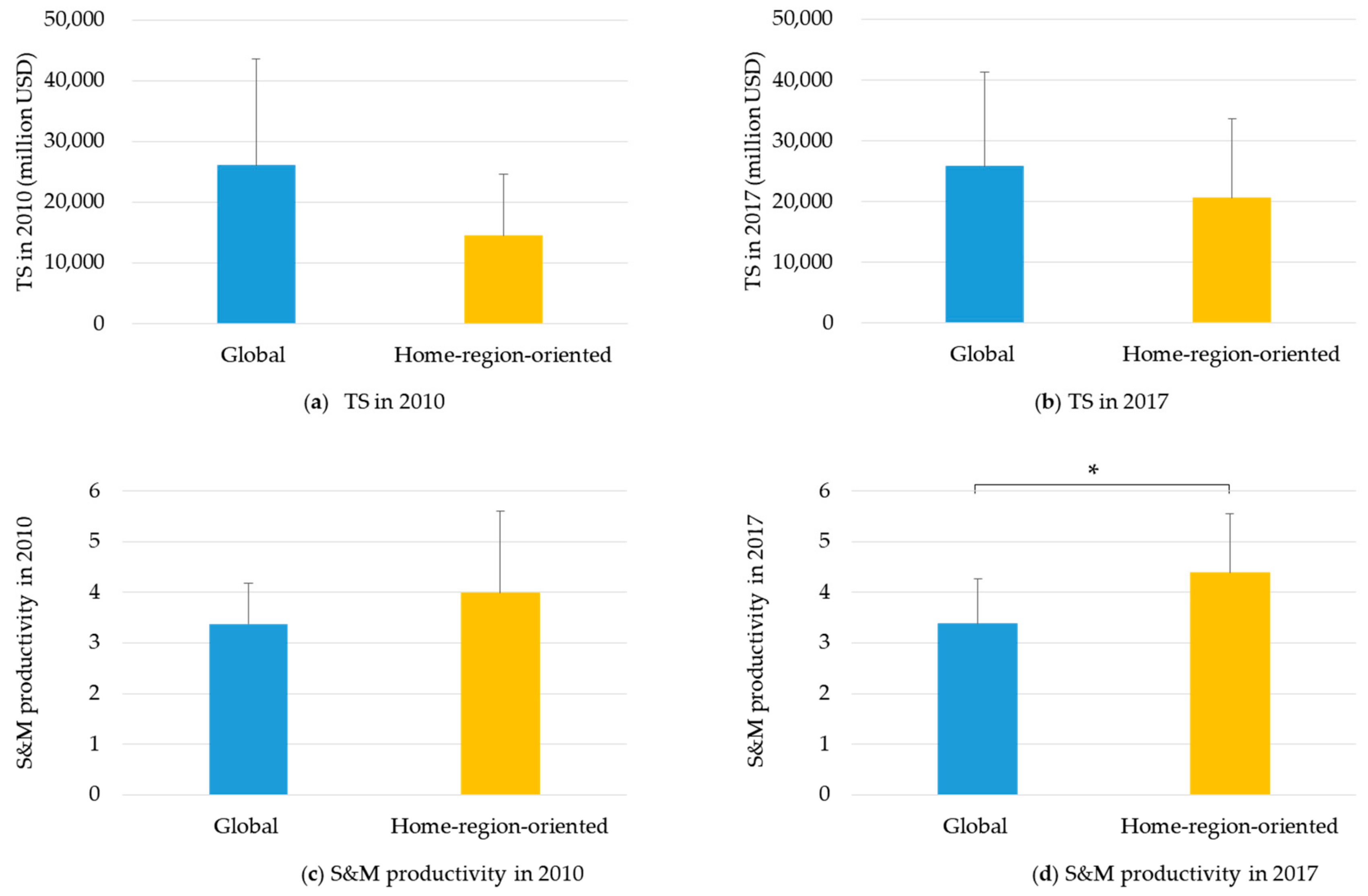

4.2. Comparison of Global Companies versus Home-Region-Oriented Companies in Terms of TS and Adjusted TS

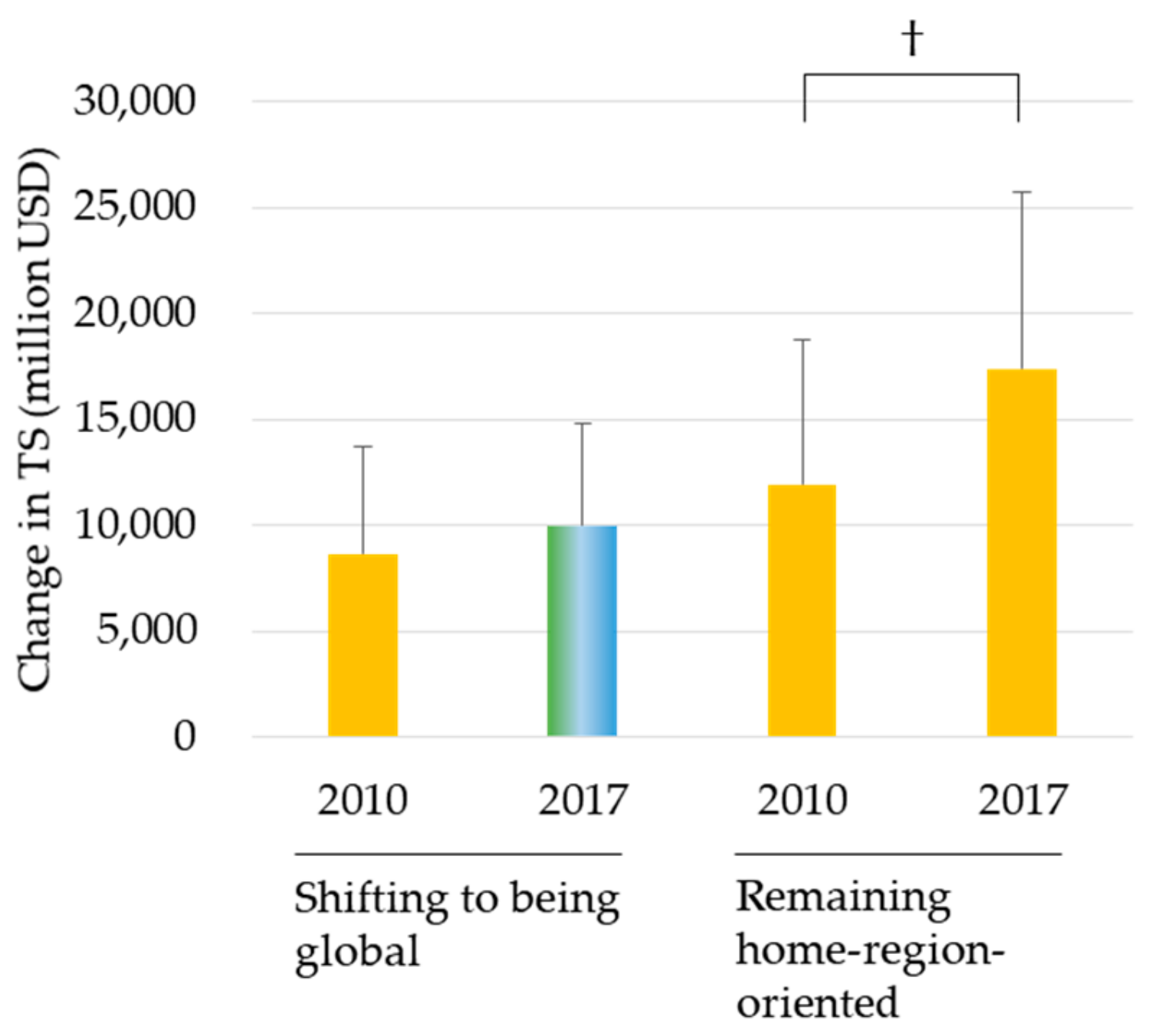

4.3. Comparison of Companies that Shift to Being Global versus Those that Remain Home-Region-Oriented

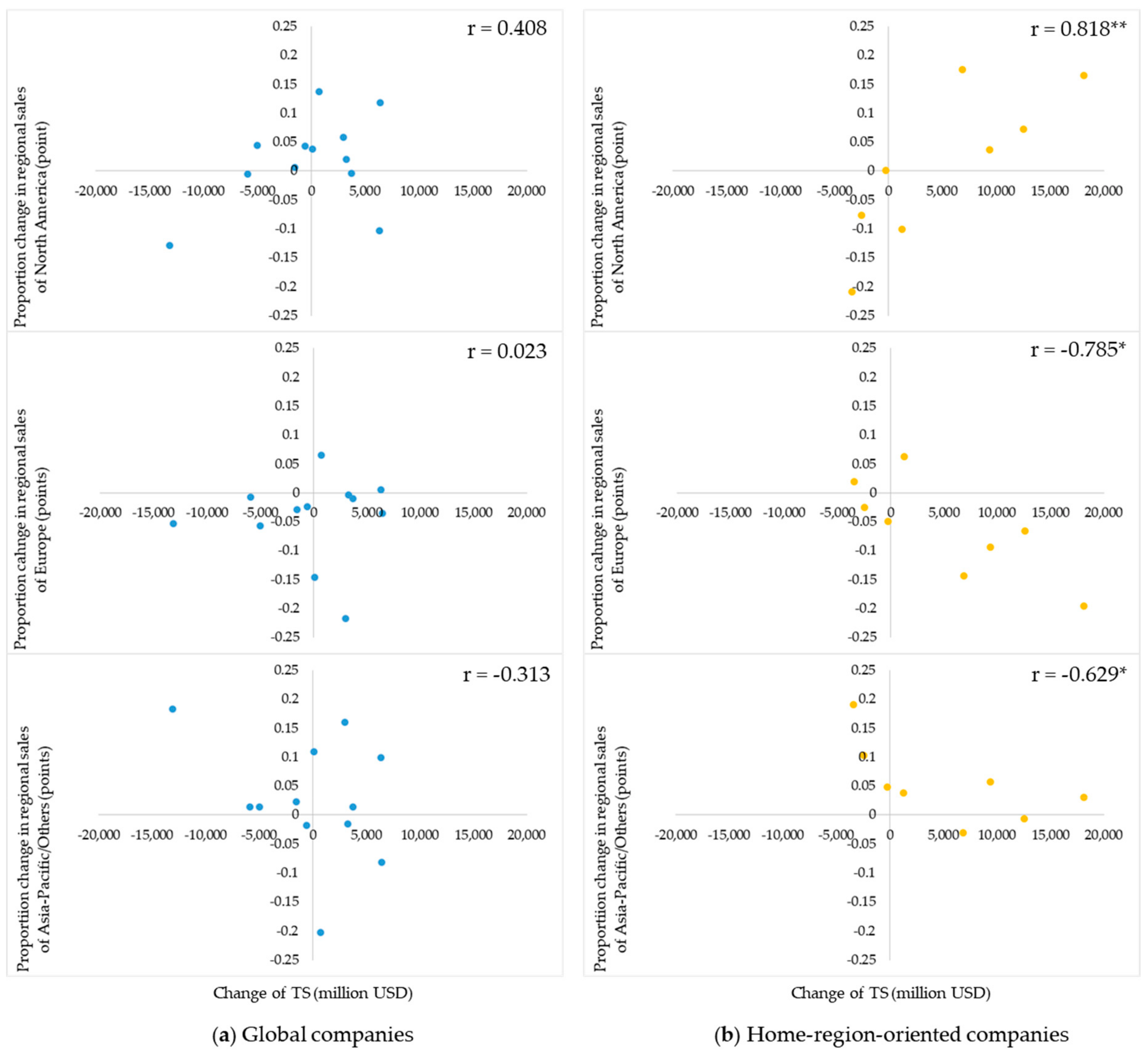

4.4. Growth Patterns of Global Companies versus Home-Region-Oriented Companies

5. Discussion

6. Conclusions and Implications

6.1. Research Conclusions

6.2. Implications, Research Limitations, and Areas of Future Research Works

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Company | Rank | Classification | Proportion of Regional Sales (%) | ||

|---|---|---|---|---|---|

| North America | Europe | Asia-Pacific/Others | |||

| International strategy: Global | |||||

| Alexion | N/A | Host-region-oriented | 38.04 | 50.94 | 11.02 |

| 39 | Global | 43.88 | 29.17 | 26.95 | |

| Astellas Pharma | 18 | Home-region-oriented | 19.60 | 19.92 | 60.53 |

| 23 | Global | 33.31 | 26.46 | 40.23 | |

| AstraZeneca | 7 | Bi-regional | 49.98 | 31.10 | 18.91 |

| 11 | Global | 37.05 | 25.81 | 37.14 | |

| Bayer | 14 | Global | 27.59 | 37.69 | 34.72 |

| 15 | Global | 29.54 | 37.36 | 33.10 | |

| Boehringer Ingelheim | 16 | Global | 45.48 | 32.49 | 22.03 |

| 19 | Global | 45.09 | 31.51 | 23.40 | |

| GlaxoSmithKline | 6 | Global | 32.91 | 32.02 | 35.07 |

| 7 | Global | 37.31 | 26.31 | 36.37 | |

| Merck & Co | 4 | Global | 43.98 | 29.35 | 26.67 |

| 4 | Global | 43.43 | 28.61 | 27.96 | |

| Merck KGaA | 21 | Home-region-oriented | 17.62 | 50.40 | 31.96 |

| 27 | Global | 21.35 | 35.75 | 42.91 | |

| Mylan | 24 | Home-region-oriented | 52.65 | 33.14 | 14.21 |

| 22 | Global | 42.26 | 33.66 | 24.08 | |

| Novartis | 2 | Bi-regional | 41.96 | 38.50 | 19.53 |

| 2 | Global | 42.56 | 35.62 | 21.82 | |

| Roche | 5 | Global | 37.97 | 25.55 | 36.48 |

| 3 | Global | 49.72 | 21.96 | 28.32 | |

| Sanofi | 3 | Global | 29.52 | 29.61 | 40.87 |

| 6 | Global | 33.82 | 27.17 | 39.01 | |

| International strategy: Bi-regional | |||||

| Pfizer | 1 | Global | 43.03 | 24.37 | 32.59 |

| 1 | Bi-regional | 49.53 | 16.19 | 34.28 | |

| Shionogi | 45 | Home-region-oriented | 12.11 | 23.34 | 64.52 |

| N/A | Bi-regional | 3.60 | 46.62 | 49.78 | |

| Takeda | 15 | Home-region-oriented | 34.06 | 12.18 | 53.76 |

| 20 | Bi-regional | 33.79 | 17.72 | 48.49 | |

| UCB | 33 | Bi-regional | 36.76 | 47.24 | 16.04 |

| 30 | Bi-regional | 49.47 | 30.80 | 19.75 | |

| International strategy: Home-region-oriented | |||||

| AbbVie | N/A | Home-region-oriented | 59.76 | 20.96 | 19.29 |

| 8 | Home-region-oriented | 67.02 | 14.36 | 18.62 | |

| AbbVie | N/A | Home-region-oriented | 59.76 | 20.96 | 19.29 |

| 8 | Home-region-oriented | 67.02 | 14.36 | 18.62 | |

| Amgen | 13 | Home-region-oriented | 76.77 | 23.23 | |

| 10 | Home-region-oriented | 78.60 | 21.40 | ||

| Biogen | 36 | Home-region-oriented | 50.26 | 41.88 | 7.86 |

| 24 | Home-region-oriented | 67.76 | 27.47 | 4.76 | |

| Bristol-Myers Squibb | 11 | Home-region-oriented | 64.74 | 17.70 | 17.57 |

| 12 | Home-region-oriented | 54.67 | 24.01 | 21.32 | |

| Celgene | 35 | Home-region-oriented | 60.37 | 34.94 | 4.69 |

| 21 | Home-region-oriented | 64.02 | 25.59 | 10.40 | |

| Daiichi Sankyo | 19 | Home-region-oriented | 27.07 | 10.80 | 62.14 |

| 26 | Home-region-oriented | 19.34 | 8.29 | 72.37 | |

| Eisai | 20 | Home-region-oriented | 41.50 | 6.08 | 52.40 |

| 32 | Home-region-oriented | 20.59 | 8.01 | 71.40 | |

| Eli Lilly | 9 | Home-region-oriented | 55.75 | 22.13 | 22.12 |

| 13 | Home-region-oriented | 55.90 | 17.24 | 26.86 | |

| Gilead Sciences | 22 | Home-region-oriented | 53.14 | 39.89 | 6.98 |

| 9 | Home-region-oriented | 69.69 | 20.34 | 9.97 | |

| Johnson & Johnson | 8 | Unknown | 48.77 | 51.23 | |

| 5 | Home-region-oriented | 54.23 | 45.77 | ||

| International strategy: Host-region-oriented | |||||

| Novo Nordisk | 17 | Global | 38.85 | 30.71 | 30.44 |

| 16 | Host-region-oriented | 51.93 | 18.97 | 29.10 | |

| Shire | 37 | Host-region-oriented | 67.21 | 32.79 | |

| 18 | Host-region-oriented | 63.60 | 36.40 | ||

| Sumitomo Dainippon | 44 | Home-region-oriented | 35.15 | 64.85 | |

| 40 | Host-region-oriented | 56.79 | 43.21 | ||

| Teva Pharmaceutical | 12 | Host-region-oriented | 58.27 | 24.48 | 17.24 |

| 14 | Host-region-oriented | 53.49 | 27.17 | 19.34 | |

References

- Booth, B.; Zemmel, R. Prospects for productivity. Nat. Rev. Drug Discov. 2004, 3, 451–456. [Google Scholar] [CrossRef]

- Kneller, R. The importance of new companies for drug discovery: Origins of a decade of new drugs. Nat. Rev. Drug Discov. 2010, 9, 867–882. [Google Scholar] [CrossRef] [PubMed]

- Ogrean, C. A snapshot of the world of global multinationals: An industry based analysis of Fortune Global 500 companies. Stud. Bus. Econ. 2017, 12, 136–154. [Google Scholar] [CrossRef]

- Angelis, A.; Lange, A.; Kanavos, P. Using health technology assessment to assess the value of new medicines: Results of a systematic review and expert consultation across eight European countries. Eur. J. Health Econ. 2018, 19, 123–152. [Google Scholar] [CrossRef]

- Teramae, F.; Yamaguchi, N.; Makino, T.; Sengoku, S.; Kodama, K. Holistic cost-effectiveness analysis of anticancer drug regimens in Japan. Drug Discov. Today 2019, in press. [Google Scholar] [CrossRef]

- Munos, B. Lessons from 60 years of pharmaceutical innovation. Nat. Rev. Drug Discov. 2009, 8, 959–968. [Google Scholar] [CrossRef] [PubMed]

- Scannell, J.W.; Blanckley, A.; Boldon, H.; Warrington, B. Diagnosing the decline in pharmaceutical R&D efficiency. Nat. Rev. Drug Discov. 2012, 11, 191–200. [Google Scholar]

- Smietana, K.; Siatkowski, M.; Moller, M. Trends in clinical success rates. Nat. Rev. Drug Discov. 2016, 15, 379–380. [Google Scholar] [CrossRef]

- Paul, S.M.; Mytelka, D.S.; Dunwiddle, C.T.; Persinger, C.C.; Munos, B.H.; Lindborg, S.R.; Schacht, A.L. How to improve R&D productivity: The pharmaceutical industry’s grand challenge. Nat. Rev. Drug Discov. 2010, 9, 203–214. [Google Scholar]

- Scott, K. Pharma’s Broken Business Model: An Industry on the Brink of Terminal Decline. Endpoints News. Available online: https://endpts.com/pharmas-broken-business-model-an-industry-on-the-brink-of-terminal-decline/ (accessed on 23 December 2019).

- Glickman, S.W.; McHutchison, J.G.; Peterson, E.D.; Cairns, C.B.; Harrington, R.A.; Califf, R.M.; Schulman, K.A. Ethical and scientific implications of the globalization of clinical research. N. Engl. J. Med. 2009, 360, 816–823. [Google Scholar] [CrossRef]

- Jeong, S.; Sohn, M.; Kim, J.H.; Ko, M.; Seo, H.; Song, Y.K.; Choi, B.; Han, N.; Na, H.S.; Lee, J.G.; et al. Current globalization of drug interventional clinical trials: Characteristics and associated factors, 2011–2013. Trials 2017, 18, 288. Available online: https://link.springer.com/article/10.1186/s13063-017-2025-1 (accessed on 23 December 2019). [CrossRef] [PubMed]

- Moorkens, E.; Meuwissen, N.; Huys, I.; Declerck, P.; Vulto, A.G.; Simoens, S. The market of biopharmaceutical medicines: A snapshot of a diverse industrial landscape. Front. Pharmacol. 2017. [Google Scholar] [CrossRef] [PubMed]

- Tannoury, M.; Attieh, B.Z. The influence of emerging markets on the pharmaceutical industry. Curr. Ther. Res. 2017, 86, 19–22. [Google Scholar] [CrossRef] [PubMed]

- Vernon, R. Sovereignty at bay: The multinational spread of U.S. enterprises. Thunderbird Int. Bus. Rev. 1971, 13, 1–3. [Google Scholar] [CrossRef]

- Levitt, T. The globalization of markets. Harv. Bus. Rev. 1983, 61, 92–102. [Google Scholar]

- Kogut, B. Designing global strategies: Profiting from operational flexibility. Sloan Manag. Rev. 1985, 26, 27–38. [Google Scholar] [CrossRef]

- Siddharthan, N.S.; Lall, S. Recent growth of the largest US multinationals. Oxford Bull. Econ. Stat. 1982, 44, 1–13. [Google Scholar] [CrossRef]

- Kumar, M.S. Growth, Acquisition and Investment: An. Analysis of the Growth of Industrial Firms and Their Overseas Activities; Cambridge University Press: Cambridge, UK, 1984; 211p. [Google Scholar]

- Grant, R.M. Multinationality and performance among British manufacturing companies. J. Int. Bus. Studies 1987, 18, 79–89. [Google Scholar] [CrossRef]

- Contractor, F.; Kundu, S.K.; Hsu, C.C. A three-stage theory of international expansion: The link between multinationality and performance in the service sector. J. Int. Bus. Stud. 2003, 34, 5–18. [Google Scholar] [CrossRef]

- Oh, C.H.; Contractor, F. A regional perspective on multinational expansion strategies: Reconsidering the three-stage paradigm. Br. J. Manag. 2014, 25, S42–S59. [Google Scholar] [CrossRef]

- Kotler, P. Global standardization—Courting danger. J. Consum. Mark. 1986, 3, 13–15. [Google Scholar] [CrossRef]

- Bartlett, C.A.; Ghoshal, S. Managing across Borders: The Transnational Solution; Harvard Business School Press: Boston, MA, USA, 1989. [Google Scholar]

- Buckley, P.J.; Ghaur, P.N. Globalisation, economic geography and the strategy of multinational enterprises. J. Int. Bus. Stud. 2004, 35, 81–98. [Google Scholar] [CrossRef]

- Rugman, A.M.; Verbeke, A. A perspective of regional and global strategies of multinational enterprises. J. Int. Bus. Stud. 2004, 35, 3–18. [Google Scholar] [CrossRef]

- Ohmae, K. Triad Power: The Coming Shape of Global Competition; The Free Press: New York, NY, USA, 1985. [Google Scholar]

- Gautam, A.; Pan, X. The changing model of big pharma: Impact of key trends. Drug Discov. Today 2016, 21, 379–384. [Google Scholar] [CrossRef]

- Oh, C.H.; Rugman, A.M. The dynamics of regional and global multinationals, 1999–2008. Multinatl. Bus. Rev. 2014, 22, 108–117. [Google Scholar]

- Farrell, D. Beyond offshoring: Assess your company’s global potential. Harv. Bus. Rev. 2004, 82, 82–90. [Google Scholar]

- Cacciotti, J.; Clinton, P. Pharma Exec’s Top 50 Companies 2010. Available online: https://www.slideshare.net/healthcaremanas/top-50-pharmaceutical-companies-2010-pharma-exec-report (accessed on 11 January 2020).

- Christel, M. Pharma Exec’s Top 50 Companies 2018. Available online: http://www.pharmexec.com/pharm-execs-top-50-companies-2018?pageID=2 (accessed on 11 January 2020).

- International Monetary Fund. International Financial Statistics. Exchange Rates. Available online: http://data.imf.org/?sk=4C514D48-B6BA-49ED-8AB9-52B0C1A0179B&sId=1409151240976 (accessed on 27 September 2018).

- Geringer, J.M.; Beamish, P.W.; Dacosta, R.C. Diversification strategy and internationalization: Implications for MNE performance. Strateg. Manag. J. 1989, 10, 109–119. [Google Scholar] [CrossRef]

- Qian, G.; Khoury, T.; Peng, M.; Qian, Z. The performance implications of intra- and inter-regional geographic diversification. Strateg. Manag. J. 2010, 31, 1018–1030. [Google Scholar] [CrossRef]

- Liu, C.; Guo, X.; Wang, Z. R&D expenses and operating performance in pharmaceutical industry. In International Conference on Humanities Education and Social Sciences; Francis Academic Press: London, UK, 2018; pp. 525–530. [Google Scholar]

- Pettigrew, A. Longitudinal field research on change: Theory and practice. Organ. Sci. 1990, 1, 267–292. [Google Scholar] [CrossRef]

- Weiss, D.; Naik, P.; Weiss, R. The ‘big pharma’ dilemma: Develop new drugs or promote existing ones? Nat. Rev. Drug Discov. 2009, 8, 533–534. [Google Scholar] [CrossRef]

- Witte, R.S.; Witte, J.S. Statistics, 11th ed.; Wiley: Hoboken, NJ, USA, 2017. [Google Scholar]

- Oh, C.H.; Kim, M.; Shin, J. Paths and geographic scope of international expansion across industries. Int. Bus. Rev. 2019, 28, 560–574. [Google Scholar] [CrossRef]

- Doz, Y.; Santos, J.; Williamson, P. From Global to Metanational: How Companies Win in the Knowledge Economy; Harvard Business School Press: Boston, MA, USA, 2001. [Google Scholar]

- Teece, D.J. A dynamic capabilities-based entrepreneurial theory of the multinational enterprise. J. Int. Bus. Stud. 2014, 45, 8–37. [Google Scholar] [CrossRef]

- Kuemmerle, W. Foreign direct investment in industrial research in the pharmaceutical and electronics industries—Results from a survey of multinational firms. Res. Policy 1999, 28, 179–193. [Google Scholar] [CrossRef]

- Patel, P.; Vega, M. Patterns of internationalization of corporate technology: Location vs. home country and advantage. Res. Policy 1999, 28, 145–155. [Google Scholar] [CrossRef]

- Wiersema, M.F.; Bowen, H.P. Corporate diversification: The impact of foreign competition, industry globalization, and product diversification. Strateg. Manag. J. 2008, 29, 115–132. [Google Scholar] [CrossRef]

- Yang, Y.; Driffield, N. Multinationality-Performance Relationship. Manag. Int. Rev. 2012, 52, 23–47. [Google Scholar] [CrossRef]

- Lee, J.; Habte-Giorgis, B. Empirical approach to the sequential relationships between firm strategy, export activity, and performance in U.S. manufacturing firms. Int. Bus. Rev. 2004, 13, 101–129. [Google Scholar] [CrossRef]

- Tobin, J. A general equilibrium approach to monetary theory. J. Money Credit Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Oh, H.M. Market value creation through international expansions: Evidence from Fortune Global 500 firms. J. Int. Trade Commer. 2016, 12, 157–167. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Doz, Y.L. The Multinational Mission: Balancing Local Demands and Global Vision; NY Free Press & Collier Macmillan: New York, NY, USA, 1987. [Google Scholar]

- International Agency for Research on Cancer. Cancer Today. Available online: http://gco.iarc.fr/today/online-analysis-map (accessed on 12 January 2020).

- Johnson, B.E.; Kris, M.G.; Berry, L.D.; Kwiatkowski, D.J.; Iafrate, A.J.; Wistuba, M.V.G.I.; Franklin, W.A.; Ladanyi, M.; Su, P.F.; Sequist, L.V.; et al. A multicenter effort to identify driver mutations and employ targeted therapy in patients with lung adenocarcinomas: The Lung Cancer Mutation Consortium (LCMC). J. Clin. Oncol. 2013, 31, 8019. [Google Scholar]

- Kris, M.G.; Natale, R.B.; Herbst, R.S.; Lynch, T.J.J.; Prager, D.; Belani, C.P.; Schiller, J.H.; Kelly, K.; Spiridonidis, H.; Sandler, A.; et al. Efficacy of gefitinib, an inhibitor of the epidermal growth factor receptor tyrosine kinase, in symptomatic patients with non-small cell lung cancer. J. Am. Med Assoc. 2003, 290, 2149–2158. [Google Scholar] [CrossRef] [PubMed]

- Montalban, M.; Sakinç, M.E. Financialization and productive models in the pharmaceutical industry. Ind. Corp. Chang. 2013, 22, 981–1030. [Google Scholar] [CrossRef]

- Onetti, A.; Zucchella, A.; Jones, M.V.; McDougall-Covin, P.P. Internationalization, innovation and entrepreneurship: Business models for new technology-based firms. J. Manag. Gov. 2012, 16, 337–368. [Google Scholar] [CrossRef]

- Ito, K.; Lechevalier, S. Why some firms persistently out-perform others: Investigating the interactions between innovation and exporting strategies. Ind. Corp. Chang. 2010, 19, 1997–2039. [Google Scholar] [CrossRef]

| Category | Definition | |

|---|---|---|

| Global | More than 20% of sales in all three regions | |

| Bi-regional | More than 20% of sales in two regions but less than 50% in the home region | |

| Home-region-oriented | More than 50% of sales within the home region | |

| Host-region-oriented | More than 50% of sales in one region besides the home region | |

| North America | Europe | Asia-Pacific/Others |

|---|---|---|

| AbbVie | AstraZeneca | Astellas Pharma |

| Alexion | Bayer | Daiichi Sankyo |

| Amgen | Boehringer Ingelheim | Eisai |

| Biogen | GlaxoSmithKline | Shionogi |

| Bristol-Myers Squibb | Merck KGaA | Sumitomo Dainippon |

| Celgene | Novartis | Takeda |

| Eli Lilly | Novo Nordisk | Teva Pharmaceutical |

| Gilead Sciences | Roche | |

| Johnson & Johnson | Sanofi | |

| Merck & Co | Shire | |

| Mylan | UCB | |

| Pfizer |

| Category | In 2010 | |||||||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | Total | |||

| In 2017 | (1) Global | 6 | 2 | 3 | 1 | 0 | 12 | (40%) |

| (2) Bi-regional | 1 | 1 | 2 | 0 | 0 | 4 | (13%) | |

| (3) Home-region-oriented | 0 | 0 | 9 | 0 | 1 | 10 | (33%) | |

| (4) Host-region-oriented | 1 | 0 | 1 | 2 | 0 | 4 | (13%) | |

| (5) Unknown | 0 | 0 | 0 | 0 | 0 | 0 | (0%) | |

| Total | 8 (27%) | 3 (10%) | 15 (50%) | 3 (10%) | 1 (3%) | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teramae, F.; Makino, T.; Lim, Y.; Sengoku, S.; Kodama, K. International Strategy for Sustainable Growth in Multinational Pharmaceutical Companies. Sustainability 2020, 12, 867. https://doi.org/10.3390/su12030867

Teramae F, Makino T, Lim Y, Sengoku S, Kodama K. International Strategy for Sustainable Growth in Multinational Pharmaceutical Companies. Sustainability. 2020; 12(3):867. https://doi.org/10.3390/su12030867

Chicago/Turabian StyleTeramae, Fumio, Tomohiro Makino, Yeongjoo Lim, Shintaro Sengoku, and Kota Kodama. 2020. "International Strategy for Sustainable Growth in Multinational Pharmaceutical Companies" Sustainability 12, no. 3: 867. https://doi.org/10.3390/su12030867

APA StyleTeramae, F., Makino, T., Lim, Y., Sengoku, S., & Kodama, K. (2020). International Strategy for Sustainable Growth in Multinational Pharmaceutical Companies. Sustainability, 12(3), 867. https://doi.org/10.3390/su12030867