New Insights into Non-Listed Family SMEs in Spain: Board Social Capital, Board Effectiveness, and Sustainable Performance

Abstract

1. Introduction

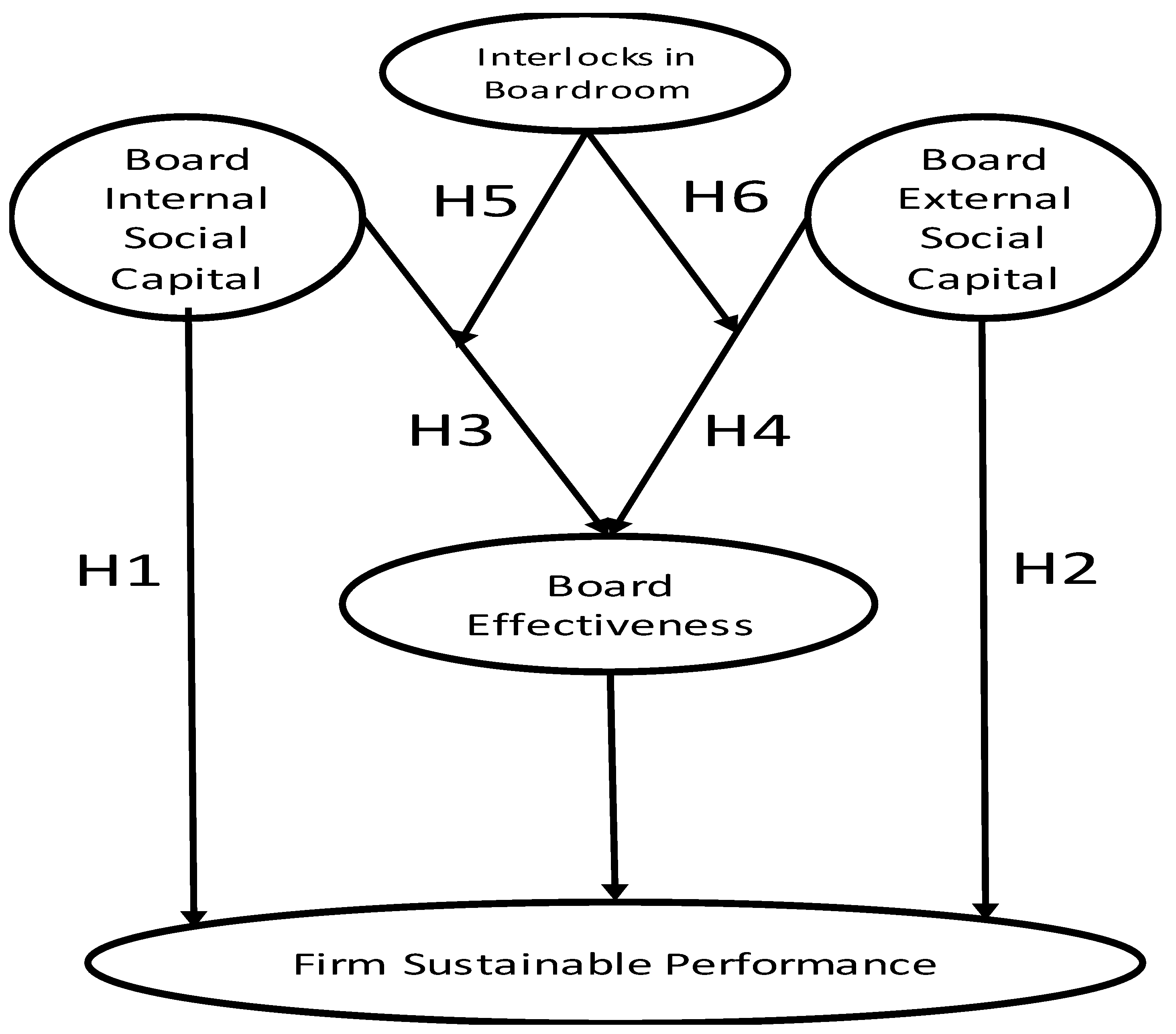

2. Theories and Hypotheses

2.1. BoDs in Family SMEs

2.2. Social Capital and Sustainable Performance

2.3. Board Effectiveness

2.4. Board Interlocking

3. Methods

3.1. Data and Sample

3.2. Measures

- A board’s internal social capital represents the degree to which board members are integrated into the team. Following the work of Kim and Cannella [21], we adopted a set of four items to measure this item’s Cronbach’s alpha, composite reliability (CR), and average variance extracted (AVE) (α = 0.863; CR = 0.906; AVE = 0.708).

- A board’s external social capital involves the people known by incumbent directors (e.g., each director’s connections with important company clients or other powerful outside constituents). We used a set of five items to measure external social capital (α = 0.815; CR = 0.871; AVE = 0.576) [21].

- A board’s effectiveness designates what directors do (e.g., the extent to which they are actively involved in selecting new directors, and capturing communication and cohesiveness levels among directors). We adopted a set of five items to measure service task performance (α = 0.910; CR = 0.933; AVE = 0.735), two items to gauge teamwork performance (α = 0.847; CR = 0.929; AVE = 0.867), and four items to determine resource dependence task performance (α = 0.809; CR = 0.872; AVE = 0.631) [21]. The board effectiveness scale represents a second-order construct (α = 0.937; CR = 0.948; AVE = 0.629).

- Sustainable firm performance perception represents the owners’ overall satisfaction and nonfinancial goals [8]. In particular, we used a three-scale measure (α = 0.766; CR = 0.865; AVE = 0.680) developed and validated by Sorenson et al. [19]. It is important to recognize that there are two types of performance measures [87]: (1) Financial or objective performance, involving return on assets (ROA) and return on investment (ROI); and (2) nonfinancial or subjective measures, such as owners’ overall satisfaction and nonfinancial goals [8]. Subjective measures are often recommended for studies on human behavior and relationships [88]. In addition, subjective assessments of sustainable family firm performance correlate highly with objective performance data [87,89]. Furthermore, we verified that, with respect to sustainable performance, the CEOs’ responses corresponded to financial measures (ROA and ROI) by randomly selecting a number of family firms, and looking for differences between the subjective responses and the objective measures. We did not find any differences between the perceptions of CEOs and the objective measures, which is in line with previous results by Venkatraman and Ramanujam’s [89] and Sanchez-Famoso et al. [87].

- A board’s interlock represents the percentage of people affiliated with the family firm’s BoDs that also sit on the board of another organization [60]. We asked company CEOs to tell us the number of board members involved, and how many sit on other company boards.

- Control variables are important for alternative explanations of variations in sustainable firm performance. Thus, we included two control variables based on previous research findings [90]. First, we controlled for firm size, measured by the number of employees, since larger firms may have more members in the boardroom, which can affect the relationship between them [91]. We then controlled for firm age, determined by the number of years since the company was founded. This was important as younger firms may have closer relationships, since all our firms are family firms, and in a firm’s first generation, the majority of BoDs members are relatives [92].

3.3. Data Analysis

3.4. Assessing the Measurement Model

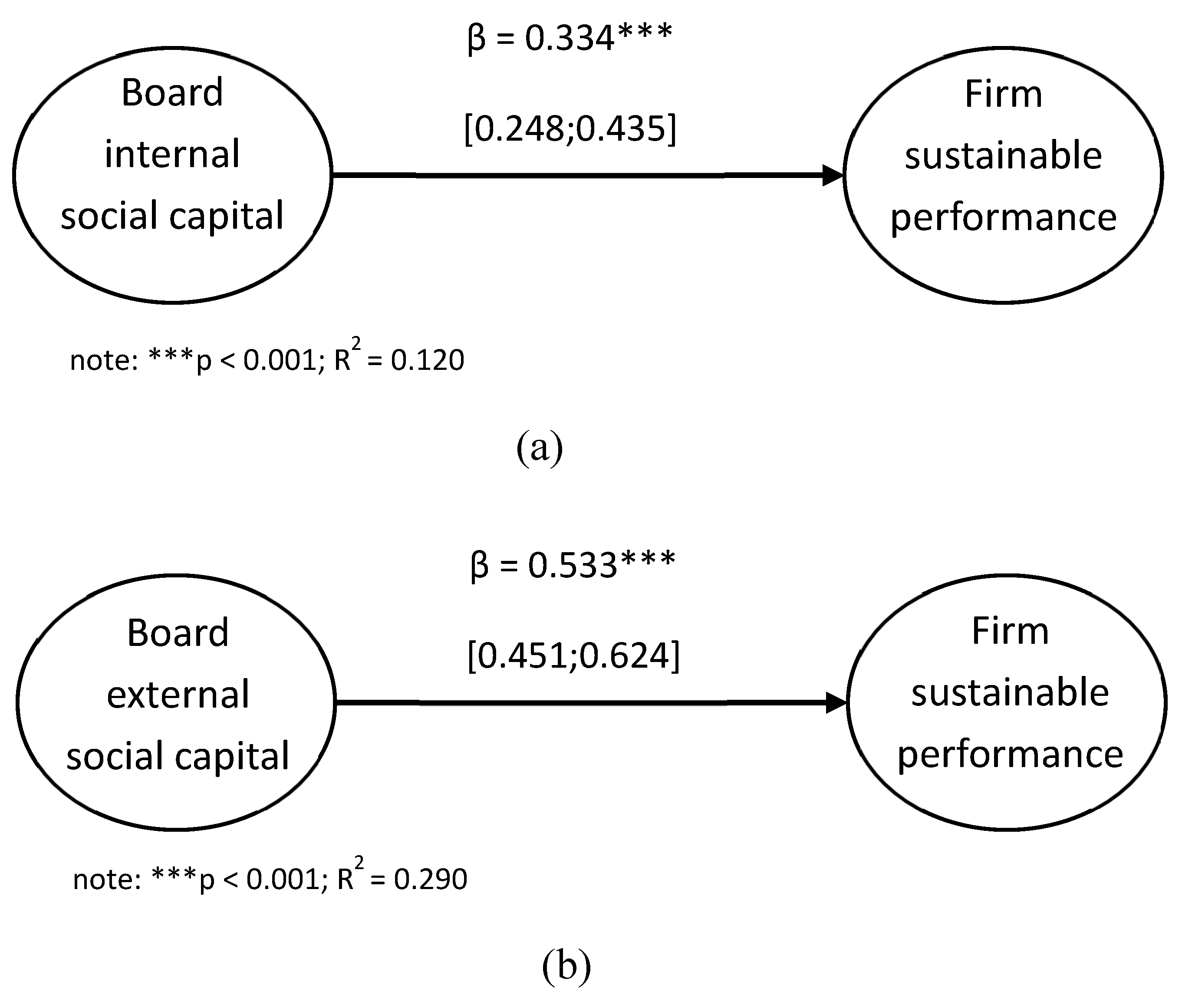

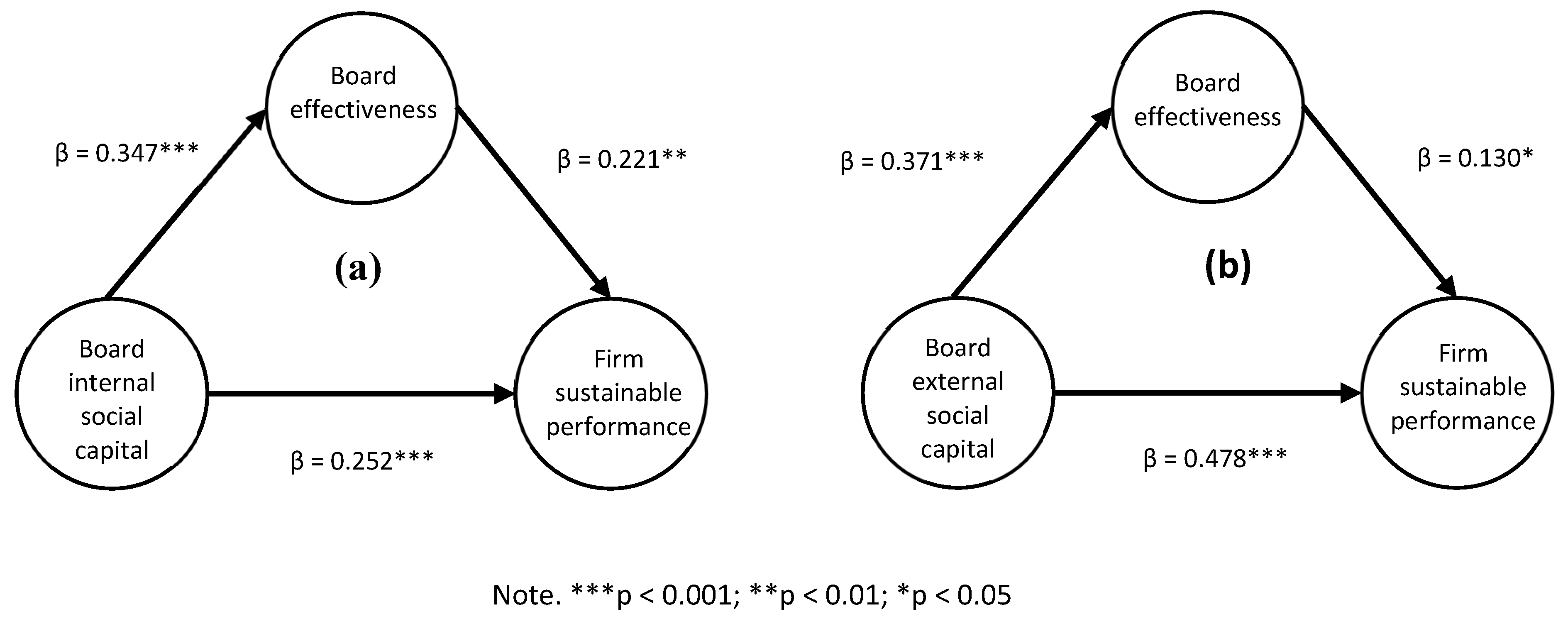

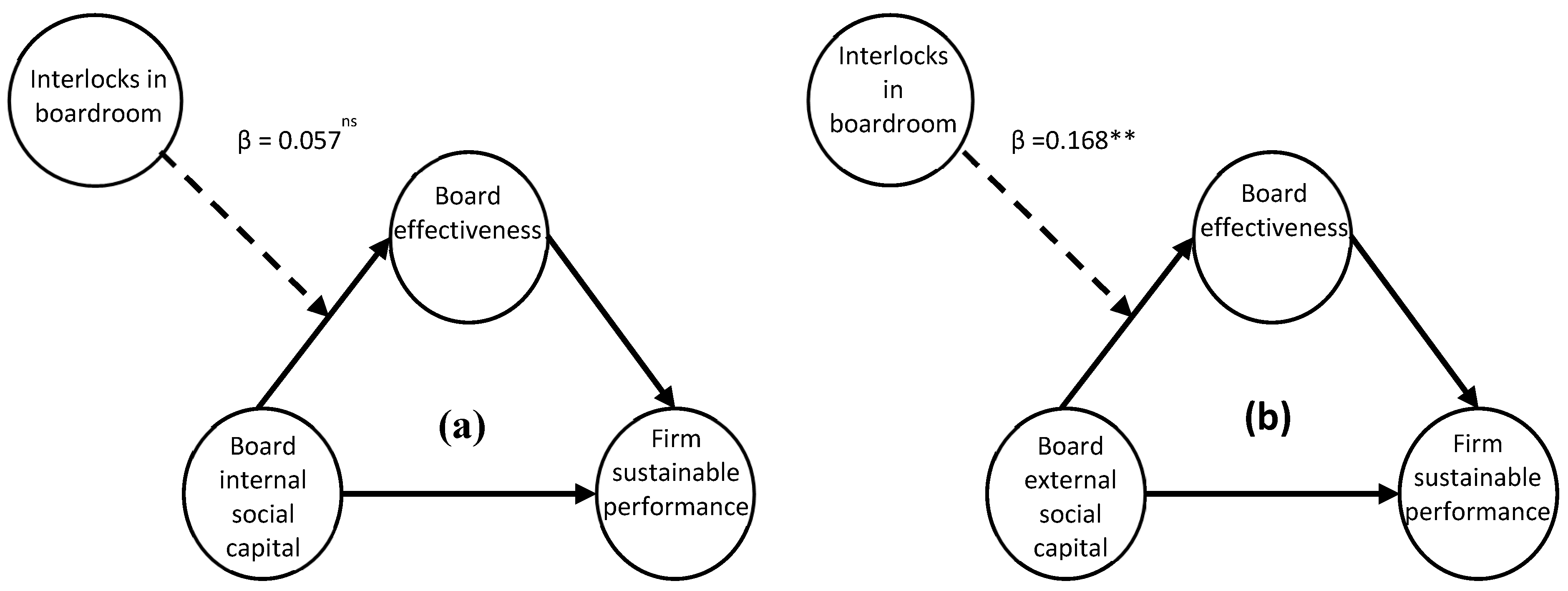

3.5. Structural Model Assessment

4. Results and Discussion

5. Discussion and Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lohe, F.W.; Calabrò, A. Please do not disturb! Differentiating board tasks in family and non-family firms during financial distress. SJM 2017, 33, 36–49. [Google Scholar] [CrossRef]

- Cuadrado-Ballesteros, B.; Rodriguez-Ariza, L.; Garcia-Sanchez, I.M. The role of independent directors at family firms in relation to corporate social responsibility disclosures. IBR 2015, 24, 890–901. [Google Scholar] [CrossRef]

- Barroso-Castro, C.; Villegas-Periñan, M.D.M.; Casillas-Bueno, J.C. How boards’ internal and external social capital interact to affect firm performance. SO 2016, 14, 6–31. [Google Scholar]

- Johnson, S.G.; Schnatterly, K.; Hill, A.D. Board composition beyond independence: Social capital, human capital, and demographics. JOM 2013, 39, 232–262. [Google Scholar] [CrossRef]

- Pombo, C.; Gutierrez, L.H. Outside directors, board interlocks and firm performance: Empirical evidence from Colombian business groups. J. Econ. Bus. 2011, 63, 251–277. [Google Scholar] [CrossRef]

- Bammens, Y.; Voordeckers, W.; Van Gils, A. Boards of directors in family businesses: A literature review and research agenda. IJMR 2011, 13, 134–152. [Google Scholar] [CrossRef]

- Liu, Y.; Valenti, A.; Chen, Y.-J. Corporate governance and information transparency in Taiwan’s public firms: The moderating effect of family ownership. JMO 2016, 22, 662–679. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the entrepreneurial orientation construct and linking it to performance. AMR 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Filatotchev, I.; Strange, R.; Piesse, J.; Lien, Y.C. FDI by firms from newly industrialised economies in emerging markets: Corporate governance, entry mode and location. J. Int. Bus. Stud. 2007, 34, 556–572. [Google Scholar] [CrossRef]

- Zattoni, A.; Gnan, L.; Huse, M. Does family involvement influence firm performance? Exploring the mediating effects of board processes and tasks. JOM 2015, 41, 1214–1243. [Google Scholar] [CrossRef]

- Eddleston, K.A. Commentary: The prequel to family firm culture and stewardship: The leadership perspective of the founder. ETP 2008, 32, 1055–1061. [Google Scholar] [CrossRef]

- Eddleston, K.A.; Kellermanns, F.W. Destructive and productive family relationships: A stewardship theory perspective. JBV 2007, 22, 545–565. [Google Scholar] [CrossRef]

- Pieper, T.M.; Klein, S.B.; Jaskiewicz, P. The impact of goal alignment on board existence and top management team composition: Evidence from family-influenced businesses. JSBM 2008, 46, 372–394. [Google Scholar] [CrossRef]

- Hillman, A.J.; Dalziel, T. Boards of directors and firm performance: Integrating agency and resource dependence perspectives. AMR 2003, 28, 383–396. [Google Scholar] [CrossRef]

- Zahra, S.A.; Pearce, J.A. Boards of directors and corporate financial performance: A review and integrative model. JOM 1989, 15, 291–334. [Google Scholar] [CrossRef]

- Minichilli, A.; Zattoni, A.; Zona, F. Making boards effective: An empirical examination of board task performance. Br. J. Manag. 2009, 20, 55–74. [Google Scholar] [CrossRef]

- Connelly, B.L.; van Slyke, E.J. The power and peril of board interlocks. Bus. Horiz. 2012, 55, 403–408. [Google Scholar] [CrossRef]

- Zona, F.; Gomez-Mejia, L.R.; Withers, M.C. Board interlocks and firm performance: Toward a combined agency-resource dependence perspective. JOM 2015, 44, 589–618. [Google Scholar] [CrossRef]

- Sorenson, R.L.; Goodpaster, K.E.; Hedberg, P.R.; Yu, A. The family point of view, family social capital, and firm performance: An exploratory test. FBR 2009, 22, 239–253. [Google Scholar] [CrossRef]

- Dalton, D.R.; Dalton, C.M. Integration of micro and macro studies in governance research: CEO duality, board composition, and financial performance. JOM 2011, 37, 404–411. [Google Scholar] [CrossRef]

- Kim, Y.; Cannella, A.A. Toward a social capital theory of director selection. CGIR 2008, 16, 282–293. [Google Scholar] [CrossRef]

- Kim, Y.; Cannella, A.A. Social capital among corporate upper echelons and its impacts on executive promotion in Korea. JWB 2008, 43, 85–96. [Google Scholar] [CrossRef]

- Kor, Y.Y.; Sundaramurthy, C. Experience-based human capital and social capital of outside directors. JOM 2009, 35, 981–1006. [Google Scholar]

- Anderson, R.C.; Reeb, D.M. Board composition: Balancing family influence in S&P 500 firms. ASQ 2004, 49, 209–237. [Google Scholar]

- Corbetta, G.; Salvato, C. Self-serving or self-actualizing? Models of man and agency costs in different types of family firms: A commentary on ‘comparing the agency costs of family and non-family firms: Conceptual issues and exploratory evidence. ETP 2004, 28, 355–362. [Google Scholar] [CrossRef]

- Forbes, D.P.; Milliken, F.J. Cognition and corporate governance: Understanding boards of directors as strategic decision-making groups. AMR 1999, 24, 489–505. [Google Scholar] [CrossRef]

- Voordeckers, W.; van-Gils, A.; van de Heuvel, J. Board composition in small and medium-sized family firms. JSBM 2007, 45, 137–156. [Google Scholar] [CrossRef]

- Uhlaner, L.M.; Floren, R.H.; Geerlings, J.R. Owner commitment and relational governance in the privately-held firm: An empirical study. Small Bus. Econ. 2007, 29, 275–293. [Google Scholar] [CrossRef]

- Miller, D.; Le Breton-Miller, I.; Scholnick, B. Stewardship vs. stagnation: An empirical comparison of small family and non-family businesses. J. Manag. Stud. 2008, 45, 51–78. [Google Scholar] [CrossRef]

- Lubatkin, M.; Simsek, Z.; Ling, Y.; Veiga, J.F. Ambidexterity and performance in small-to medium-sized firms: The pivotal role of top management team behavioral integration. JOM 2006, 32, 646–672. [Google Scholar] [CrossRef]

- Davis, J.H.; Schoorman, F.D.; Donaldson, L. Toward a stewardship theory and management. AMR 1997, 22, 20–47. [Google Scholar] [CrossRef]

- Pfeffer, J.; Salancik, G. The External Control of Organizations: A Resource Dependence Perspective; Harper: New York, NY, USA, 1978. [Google Scholar]

- Schulze, W.S.; Lubatkin, M.; Dino, R.D.; Buchholtz, A.K. Agency relationships in family firms. Organ. Sci. 2001, 12, 99–116. [Google Scholar] [CrossRef]

- George, G.; Robley Wood, D., Jr.; Khan, R. Networking strategy of boards: Implications for small and medium-sized enterprises. Entrep. Region. Dev. 2010, 13, 269–285. [Google Scholar] [CrossRef]

- Boivie, S.; Bednar, M.K.; Aguilera, R.V.; Andrus, J.L. Are boards designed to fail? The implausibility of effective board monitoring. Acad. Manag. Ann. 2016, 10, 319–407. [Google Scholar] [CrossRef]

- Sciascia, S.; Mazzola, P.; Chirico, F. Generational involvement in the top management team of family firms: Exploring nonlinear effects on entrepreneurial orientation. ETP 2013, 37, 69–85. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, D.; Camp, S.M.; Sexton, D.L. Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. SMJ 2001, 22, 479–491. [Google Scholar] [CrossRef]

- Hitt, M.A.; Ireland, D.; Camp, S.M.; Sexton, D.L. Strategic entrepreneurship: Integrating entrepreneurial and strategic management perspectives. In Strategic Entrepreneurship: Creating a New Mindset; Hitt, M.A., Ireland, D., Camp, S.M., Sexton, D.L., Eds.; Blackwell Publishers: Oxford, UK, 2002; pp. 1–16. [Google Scholar]

- Salvato, C.; Melin, L. Creating value across generations in family-controlled businesses: The role of family social capital. FBR 2008, 21, 259–276. [Google Scholar] [CrossRef]

- Wright, J.P.; Cullen, F.T.; Miller, J.T. Family social capital and delinquent involvement. JCJ 2001, 29, 1–9. [Google Scholar] [CrossRef]

- Currarini, S.; Jackson, M.O.; Pin, P. An economic model of friendship: Homophily, minorities, and segregation. ECMA 2009, 77, 1003–1045. [Google Scholar] [CrossRef]

- Carpenter, M.A.; Westphal, J.D. The strategic context of external network ties: Examining the impact of director appointments on board involvement in strategic decision making. AMJ 2001, 44, 639–660. [Google Scholar]

- Haynes, K.T.; Hillman, A. The effect of board capital and CEO power on strategic change. SMJ 2010, 31, 1145–1163. [Google Scholar] [CrossRef]

- Kim, Y. Board network characteristics and firm performance in Korea. CGIR 2005, 13, 800–808. [Google Scholar] [CrossRef]

- Arregle, J.L.; Hitt, M.A.; Sirmon, D.G.; Very, P. The development of organizational social capital: Attributes of family firms. J. Manag. Stud. 2007, 44, 73–95. [Google Scholar] [CrossRef]

- Loury, G. A dynamic theory of racial income differences. In Women, Minorities and Employment Discrimination; Wallace, P., Le Mund, A., Eds.; Lexington Books: Washington, DC, USA, 1977; pp. 153–188. [Google Scholar]

- Zahra, S.A.; Matherne, B.P.; Carleton, J.M. Technological resource leveraging and the internationalisation of new ventures. J. Int. Enterp. 2003, 1, 163–186. [Google Scholar] [CrossRef]

- Donaldson, L. The ethereal hand: Organizational economics and management theory. AMR 1990, 15, 369–381. [Google Scholar] [CrossRef]

- Le Breton-Miller, I.; Miller, D. Agency vs. stewardship in public family firms: A social embeddedness reconciliation. ETP 2009, 33, 1169–1191. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A. Managing resources: Linking unique resources, management, and wealth creation in family firms. ETP 2003, 27, 339–358. [Google Scholar] [CrossRef]

- Finkelstein, S.; Mooney, A.C. Not the usual suspects: How to use board process to make boards better. AME 2003, 17, 101–113. [Google Scholar] [CrossRef]

- Huse, M. Accountability and creating accountability: A framework for exploring behavioural perspectives of corporate governance. Br. J. Manag. 2005, 16, S65–S79. [Google Scholar] [CrossRef]

- Huse, M. Boards, Governance and Value Creation; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Brennan, N. Boards of directors and firm performance: “Is there an expectations gap? ” CGIR 2006, 14, 577–593. [Google Scholar] [CrossRef]

- Lin, S.; Jun, L.; Yan, J. Family holding and board effectiveness on the risk-taking of financial industry in China and Taiwan. JAFB 2018, 8, 135–183. [Google Scholar]

- Schmidt, S.L.; Brauer, M. Strategic governance: How to assess board effectiveness in guiding strategy execution. CGIR 2006, 14, 13–22. [Google Scholar] [CrossRef]

- Rossoni, L.; Aranha, C.E.; Mendes-Da-Silva, W. The complexity of social capital: The influence of board and ownership interlocks on implied cost of capital in an emerging market. Complexity 2018. [Google Scholar] [CrossRef]

- Stevenson, W.B.; Radin, R.F. Social capital and social influence on the board of directors. J. Manag. Stud. 2009, 46, 16–44. [Google Scholar] [CrossRef]

- Bohman, L. Bringing the owners back in: An analysis of a 3-mode interlock network. Soc. Netw. 2012, 34, 275–287. [Google Scholar] [CrossRef]

- Mizruchi, M.S. What do interlocks do? An analysis, critique, and assessment of research on interlocking directorates. Annu. Rev. Sociol. 1996, 22, 271–298. [Google Scholar] [CrossRef]

- Saavedra, S.; Gilarranz, L.J.; Rohr, R.P.; Schnabel, M.; Uzzi, B.; Bascompte, J. Stock fluctuations are correlated and amplified across networks of interlocking directorates. EPJ Data Sci. 2014, 3, 30. [Google Scholar] [CrossRef]

- Davis, G.F. The significance of board interlocks for corporate governance. CGIR 1996, 4, 154–159. [Google Scholar] [CrossRef]

- Galunic, C.; Ertug, G.; Gargiulo, M. The positive externalities of social capital: Benefiting from senior brokers. AMJ 2012, 55, 1213–1231. [Google Scholar] [CrossRef]

- Baysinger, B.; Hoskisson, R.E. The composition of boards of directors and strategic control: Effects on corporate strategy. AMR 1990, 15, 72–87. [Google Scholar] [CrossRef]

- Mizruchi, M.S.; Stearns, L. A longitudinal study of borrowing by large American corporations. ASQ 1994, 39, 118–140. [Google Scholar] [CrossRef]

- Provan, K.G. Board power and organizational effectiveness among human service agencies. AMJ 1980, 23, 221–236. [Google Scholar]

- Sanchez, L.P.C.; Barroso-Castro, C. It is useful to consider the interlocks according to the type of board member (executive or non-executive) who possesses them? Their effect on firm performance. REDEE 2015, 24, 130–137. [Google Scholar]

- Carmona-Lavado, A.; Cuevas-Rodriguez, G.; Cabello-Medina, C. Social and organizational capital: Building the context for innovation. IMM 2010, 39, 681–690. [Google Scholar] [CrossRef]

- Coombes, S.M.; Morris, M.H.; Allen, J.A.; Webb, J.W. Behavioral orientations of non-profit boards as a factor in entrepreneurial performance: Does governance matter? J. Manag. Stud. 2011, 48, 829–856. [Google Scholar] [CrossRef]

- Nicholson, G.J.; Kiel, G.C. A framework for diagnosing board effectiveness. CGIR 2004, 12, 442–460. [Google Scholar] [CrossRef]

- Johnson, S.; Schnatterly, K.; Bolton, J.F.; Tuggle, C. Antecedents of new director social capital. J. Manag. Stud. 2011, 48, 1782–1803. [Google Scholar] [CrossRef]

- Mizruchi, M.; Stearns, L.B.; Marquis, C. The conditional nature of embeddedness: A study of borrowing by large U.S. firms, 1973–1994. AJS 2006, 71, 310–333. [Google Scholar] [CrossRef]

- Andrews, K.R. Directors’ responsibility for corporate strategy. Harv. Bus. Rev. 1980, 58, 30–42. [Google Scholar]

- Perry, T.; Peyer, U. Board seat accumulation by executives: A shareholder’s perspective. J. Financ. 2005, 60, 2083–2123. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strat. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Judge, W.Q.; Zeithaml, C.P. Institutional and strategic choice perspectives on board involvement in the strategic decision process. AMJ 1992, 35, 766–794. [Google Scholar]

- Salvaj, E.; Ferraro, F.; Tàpies-Lloret, J. Family firms and the contingent value of board interlocks: The Spanish case. In Family Values and Value Creation: The Fostering of Enduring Values Within Family-Owned Businesses; Tàpies, J., Ward, J.L., Eds.; Palgrave Macmillan: New York, NY, USA, 2008; pp. 236–259. [Google Scholar]

- Fracassi, C.; Tate, G. External networking and internal firm governance. J. Financ. 2012, 67, 153–194. [Google Scholar] [CrossRef]

- Horton, J.; Millo, Y.; Serafeim, G. Resources or power? Implications of social networks on compensation and firm performance. JBFA 2012, 39, 399–426. [Google Scholar] [CrossRef]

- Burt, R.S. Structural Holes: The Social Structure of Competition; Harvard University Press: Cambridge, MA, USA, 1992. [Google Scholar]

- Kim, Y. The proportion and social capital of outside directors and their impacts on firm value: Evidence from Korea. CGIR 2007, 15, 1168–1176. [Google Scholar] [CrossRef]

- Jaskiewicz, P.; Gonzalez, V.M.; Menendez, S.; Schiereck, D. Long-run IPO performance analysis of German and Spanish family-owned businesses. FBR 2005, 18, 179–202. [Google Scholar] [CrossRef]

- Westhead, P.; Cowling, M. Family firm research: The need for a methodological rethink. ETP 1998, 23, 31–56. [Google Scholar] [CrossRef]

- Faul, F.; Erdfelder, E.; Buchner, A.; Lang, A.G. Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. BRM 2009, 41, 1149–1160. [Google Scholar] [CrossRef]

- Rasoolimanesh, S.M.; Roldan, J.L.; Jaafar, M.; Ramayah, T. Factors influencing residents’ perceptions toward tourism development: Differences across rural and urban world heritage sites. JTR 2017, 56, 760–775. [Google Scholar] [CrossRef]

- Moreno, A.M.; Casillas, J.C. Entrepreneurial orientation and growth of SMEs: A causal model. ETP 2008, 32, 507–528. [Google Scholar] [CrossRef]

- Sanchez-Famoso, V.; Akhter, N.; Iturralde, T.; Chirico, F.; Maseda, A. Is non-family social capital also (or especially) important for family firm performance? Hum. Relat. 2015, 68, 1713–1743. [Google Scholar] [CrossRef]

- Spector, P.E. Using self-report questionnaires in OB research: A comment on the use of a controversial method. JOB 1994, 15, 385–392. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of business economic performance: An examination of method convergence. JOM 1987, 13, 109–122. [Google Scholar] [CrossRef]

- Green, K.M.; Covin, J.G.; Slevin, D.P. Exploring the relationship between strategic reactiveness and entrepreneurial orientation. The role of structure-style fit. JBV 2008, 23, 356–383. [Google Scholar] [CrossRef]

- Sanchez-Famoso, V.; Iturralde, T.; Maseda, A. The influence of family and non-family social capital on firm innovation: Exploring the role of family ownership. EJIM 2015, 9, 240–262. [Google Scholar] [CrossRef]

- Sanchez-Famoso, V.; Maseda, A.; Iturralde, T. Family involvement in top management team: Impact on relationships between internal social capital and innovation. JMO 2017, 23, 136–162. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Becker, J.M. SmartPLS 3; SmartPLS: Bönningstedt, Germany, 2015. [Google Scholar]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. IMDS 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Fuller, J.B.; Marler, L.E.; Hester, K. Promoting felt responsibility for constructive change and proactive behavior: Exploring aspects of an elaborated model of work design. JOB 2006, 27, 1089–1120. [Google Scholar]

- Lindell, M.K.; Whitney, D.J. Accounting for common method variance in cross-sectional research designs. JAP 2001, 86, 114–121. [Google Scholar] [CrossRef]

- Chin, W.W.; Marcolin, B.L.; Newsted, P.R. A partial least squares latent variable modeling approach for measuring interaction effects: Results from a Monte Carlo simulation study and an electronic mail emotion/adoption study. ISR 2003, 14, 189–217. [Google Scholar] [CrossRef]

- Tehseen, S.; Ramayah, T.; Sajilan, S. Testing and controlling for common method variance: A review of available methods. JMS 2017, 4, 142–168. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; SAGE Publications, Inc.: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares; Vinzi, V.E., Ed.; Springer: Berlin, Germany, 2010; pp. 655–690. [Google Scholar]

- Hair, J.F.; Ringle, C.M.; Sarstedt, M. PLS-SEM: Indeed a silver bullet. JMTP 2011, 19, 137–149. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. JAMS 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Hayes, A.F.; Scharkow, M. The relative trustworthiness of inferential tests of the indirect effect in statistical mediation analysis: Does method really matter? PS 2013, 24, 1918–1927. [Google Scholar] [CrossRef]

- Cohen, J. Statistical Power Analysis for the Behavioral Sciences; Erlbaum: Hillsdale, NJ, USA, 1988. [Google Scholar]

- Sharma, P.N.; Sarstedt, M.; Shmueli, G.; Kim, K.H.; Thiele, K.O. PLS-based model selection: The role of alternative explanations in information systems research. JAIS 2019, 20, 346–397. [Google Scholar] [CrossRef]

- Carr, J.C.; Cole, M.S.; Kirk-Ring, J.; Blettner, D.P. A measure of variations in internal social capital among family firms. ETP 2011, 25, 1207–1227. [Google Scholar] [CrossRef]

- Muth, M.; Donaldson, L. Stewarship theory and board structure: A contingency approach. CGIR 1998, 6, 5–28. [Google Scholar]

- Sundaramurthy, C.; Lewis, M. Control and collaboration: Paradoxes of governance. AMR 2003, 28, 397–415. [Google Scholar] [CrossRef]

- Burt, R.S. The network structure of social capital. Res. Organ. Behav. 2000, 22, 345–423. [Google Scholar] [CrossRef]

- Pennings, J.; Lee, K.; Witteloostujin, A. Human capital, social capital, and firm dissolution. AMJ 1998, 41, 425–440. [Google Scholar]

- Tasavori, M.; Zaefarian, R.; Eng, T.Y. Internal social capital and international firm performance in emerging market family firms: The mediating role of participative governance. ISBJ 2018, 36, 887–910. [Google Scholar] [CrossRef]

- Sanchez-Famoso, V.; Maseda, A.; Iturralde, T. The role of internal social capital in organisational innovation. An empirical study of family firms. EMJ 2014, 32, 950–962. [Google Scholar] [CrossRef]

- Chirico, F.; Salvato, C. Knowledge integration and dynamic organizational adaptation in family firms. FBR 2008, 21, 169–181. [Google Scholar] [CrossRef]

- Stadler, C.; Mayer, M.C.; Hautz, J.; Matzler, K. International and product diversification: Which strategy suits family managers? GSJ 2018, 8, 184–207. [Google Scholar] [CrossRef]

- Tian, J.J.; Haleblian, J.J.; Rajagopalan, N. The effects of board human and social capital on investor reactions to new CEO selection. SMJ 2011, 32, 731–747. [Google Scholar] [CrossRef]

- Henderson, A.; Miller, D.; Hambrick, D.C. How quickly do CEOs become obsolete? SMJ 2006, 27, 447–460. [Google Scholar]

- Jaskyte, K. Board attributes and processes, board effectiveness, and organizational innovation: Evidence from nonprofit organizations. Volunt. Int. J. Volunt. Nonprofit Organ. 2018, 29, 1098–1111. [Google Scholar] [CrossRef]

| Sample Companies | Number of Companies (%) |

|---|---|

| Age (years) | |

| Younger than 10 | 14 (6%) |

| 10–25 | 97 (42%) |

| 26–50 | 102 (44%) |

| More than 50 | 19 (8%) |

| Firm Size (number of employees) | |

| 10–50 | 53 (23%) |

| 51–250 | 167 (72%) |

| More than 250 | 12 (5%) |

| Generations Managing the Firm Together | |

| Only one generation | 130 (56%) |

| Two generations | 93 (40%) |

| Three or more generations | 9 (4%) |

| Sector (Manufacturing Firms or Service Firms) | |

| Manufacturing Firms | 111 (48%) |

| Service Firms | 121 (52%) |

| Board Effectiveness | Board External Social Capital | Board Internal Social Capital | Sustainable Firm Performance | Marker | |

|---|---|---|---|---|---|

| Board Effectiveness | 1.00 | ||||

| Board External Social Capital | 0.37 | 1.00 | |||

| Board Internal Social Capital | 0.35 | 0.62 | 1.00 | ||

| Sustainable Firm Performance | 0.31 | 0.52 | 0.33 | 1.00 | |

| Marker | −0.01 | 0.00 | 0.01 | −0.11 | 1.00 |

| Please Indicate Your Agreement with the Following Statements. For Your Rating, Take into Account that "1" Express that You Completely Disagree and "5" that You Completely Agree. | Standardized Loading (Board Internal Social Capital) | Standardized Loading (Board External Social Capital) | |

|---|---|---|---|

| Board Internal Social Capital | |||

| In general, outside directors have good relationships with the CEO. | 0.849 | ||

| In general, directors possess firm specific knowledge. | 0.862 | ||

| In general, directors share beliefs regarding the level of effort each individual is expected to put toward a task. | 0.838 | ||

| In general, each director is aware of other directors’ areas of expertise. | 0.815 | ||

| Board External Social Capital | |||

| In general, the board appoints a lead outside director. | 0.747 | ||

| In general, the board has members who know important suppliers of the company. | 0.716 | ||

| In general, the board has members who know important customers of the company. | 0.797 | ||

| In general, the board has members who know important bank officials in the company’s local business community. | 0.778 | ||

| In general, the board consists of members with diverse industry backgrounds. | 0.754 | ||

| Service Task Performance | |||

| In general, the board is actively involved in the selection of new directors? | 0.900 | 0.900 | |

| In general, the board has criteria for strategic decisions. | 0.847 | 0.847 | |

| In general, directors carefully scrutinize information provided by the firm prior to the meeting. | 0.848 | 0.848 | |

| In general, directors research issues relevant to the company. | 0.819 | 0.819 | |

| In general, directors have the time to serve. | 0.870 | 0.847 | |

| Teamwork Performance | |||

| In general, the board meets regularly with the CEO. | 0.936 | 0.936 | |

| In general, directors communicate well with each other and with the CEO. | 0.926 | 0.926 | |

| Resource Dependence Task Performance | |||

| In general, the board uses outside contacts actively for the company. | 0.737 | 0.737 | |

| In general, the board provides additive information secured from outside contacts. | 0.725 | 0.725 | |

| In general, the board helps to provide outside financing. | 0.862 | 0.862 | |

| In general, the board contributes to company reputation. | 0.843 | 0.843 | |

| Family Firm Sustainable Performance | |||

| We have had a higher level of sustainable growth than that of our close competitors during the past 5 years. | 0.848 | 0.857 | |

| We have had a higher level of sustainable profitability than that of our close competitors during the past 5 years. | 0.836 | 0.886 | |

| Our sustainable financial position has been better than that of our close competitors in the past 5 years. | 0.789 | 0.779 | |

| Board Effectiveness (2nd order reflective construct) | |||

| Service Task Performance | 0.978 | 0.978 | |

| Teamwork Performance | 0.931 | 0.931 | |

| Resource Dependence Task Performance | 0.876 | 0.876 | |

| Control Variables | |||

| Business Size | Single measures | Single measures | |

| Business Age | |||

| Moderation Variable | |||

| % of interlocks in the boardroom | Single measures | Single measures | |

| Fornell-Larcker Criterion | Heterotrait-Mototrait Ratio (HTMT.85) | |||||||

|---|---|---|---|---|---|---|---|---|

| Board Effectiveness | Board External Social Capital | Board Internal Social Capital | Sustainable Firm Performance | Board Effectiveness | Board External Social Capital | Board Internal Social Capital | Sustainable Firm Performance | |

| Board Effectiveness | 0.793 | |||||||

| Board External Social Capital | 0.373 | 0.758 | 0.418 | |||||

| Board Internal Social Capital | 0.345 | 0.620 | 0.841 | 0.388 | 0.722 | |||

| Sustainable Firm Performance | 0.308 | 0.525 | 0.330 | 0.825 | 0.357 | 0.658 | 0.398 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sanchez-Famoso, V.; Mejia-Morelos, J.-H.; Cisneros, L. New Insights into Non-Listed Family SMEs in Spain: Board Social Capital, Board Effectiveness, and Sustainable Performance. Sustainability 2020, 12, 814. https://doi.org/10.3390/su12030814

Sanchez-Famoso V, Mejia-Morelos J-H, Cisneros L. New Insights into Non-Listed Family SMEs in Spain: Board Social Capital, Board Effectiveness, and Sustainable Performance. Sustainability. 2020; 12(3):814. https://doi.org/10.3390/su12030814

Chicago/Turabian StyleSanchez-Famoso, Valeriano, Jorge-Humberto Mejia-Morelos, and Luis Cisneros. 2020. "New Insights into Non-Listed Family SMEs in Spain: Board Social Capital, Board Effectiveness, and Sustainable Performance" Sustainability 12, no. 3: 814. https://doi.org/10.3390/su12030814

APA StyleSanchez-Famoso, V., Mejia-Morelos, J.-H., & Cisneros, L. (2020). New Insights into Non-Listed Family SMEs in Spain: Board Social Capital, Board Effectiveness, and Sustainable Performance. Sustainability, 12(3), 814. https://doi.org/10.3390/su12030814