Mechanism of Carbon Finance’s Influence on Radical Low-Carbon Innovation with Evidence from China

Abstract

1. Introduction

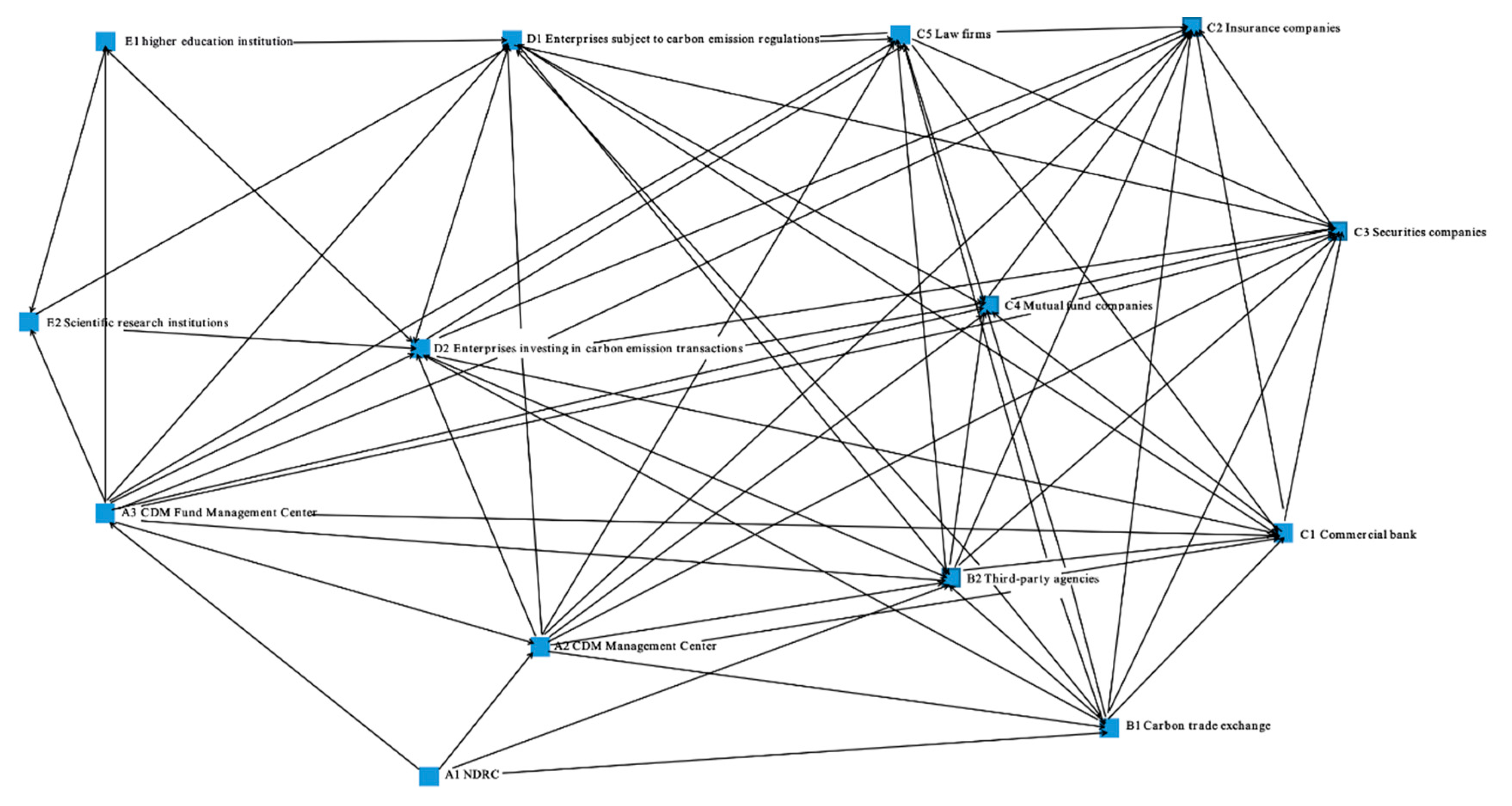

2. Complex Network Analysis

2.1. Carbon Market Organizations

2.2. Carbon Market Regulators

2.3. Carbon Market Intermediaries

2.4. Carbon Market Traders

2.5. Entities Participating in Technological Innovation

3. Constructing the Carbon Trading Network

4. Multi-Agent Simulation Operation and Analysis

4.1. Analysis of Agent Behavior

4.1.1. Enterprises

4.1.2. Higher Education and Scientific Research Institutions

4.1.3. Market Organizations

4.1.4. Market Regulators

4.1.5. Market Intermediaries

4.2. Simulation of Market Behavior

4.3. Analysis of Multi-Agent Operation Results

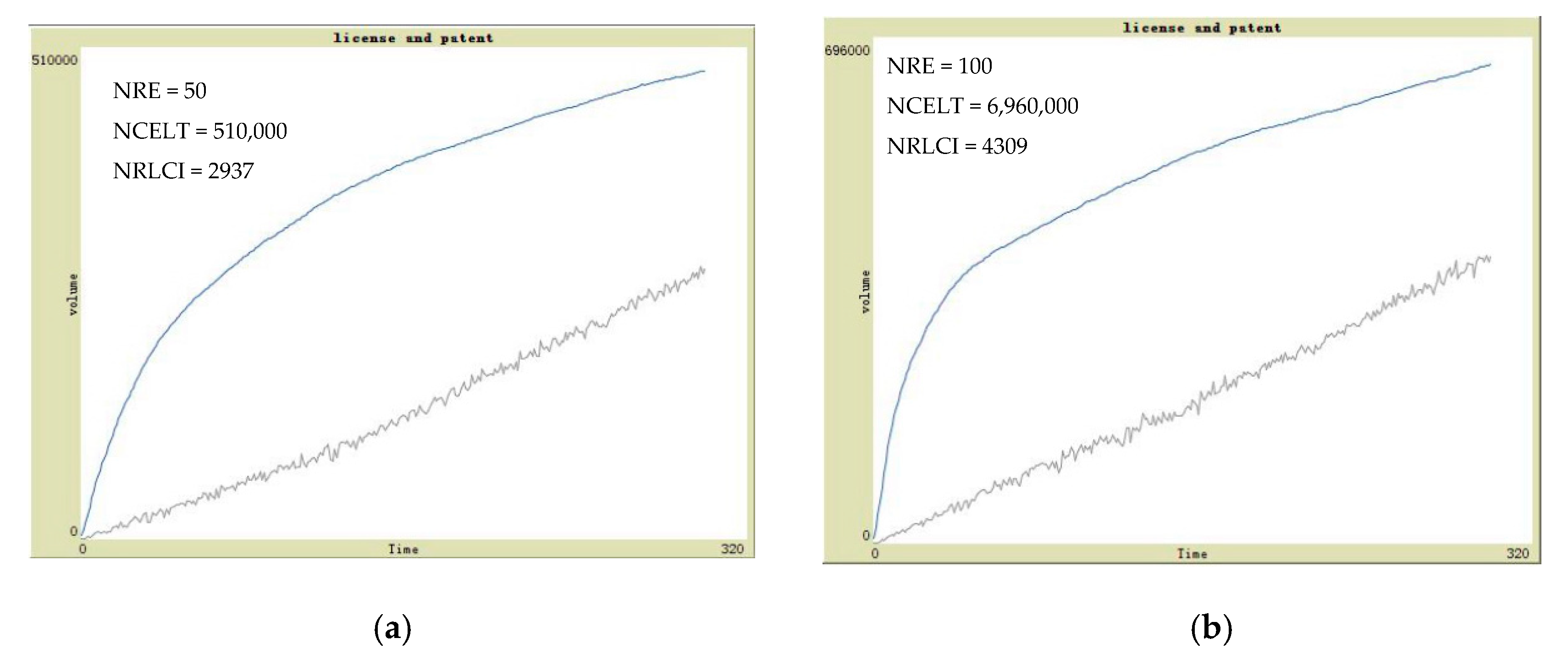

4.3.1. Impact of Enterprises on Innovation

4.3.2. Impact of Market Intermediaries

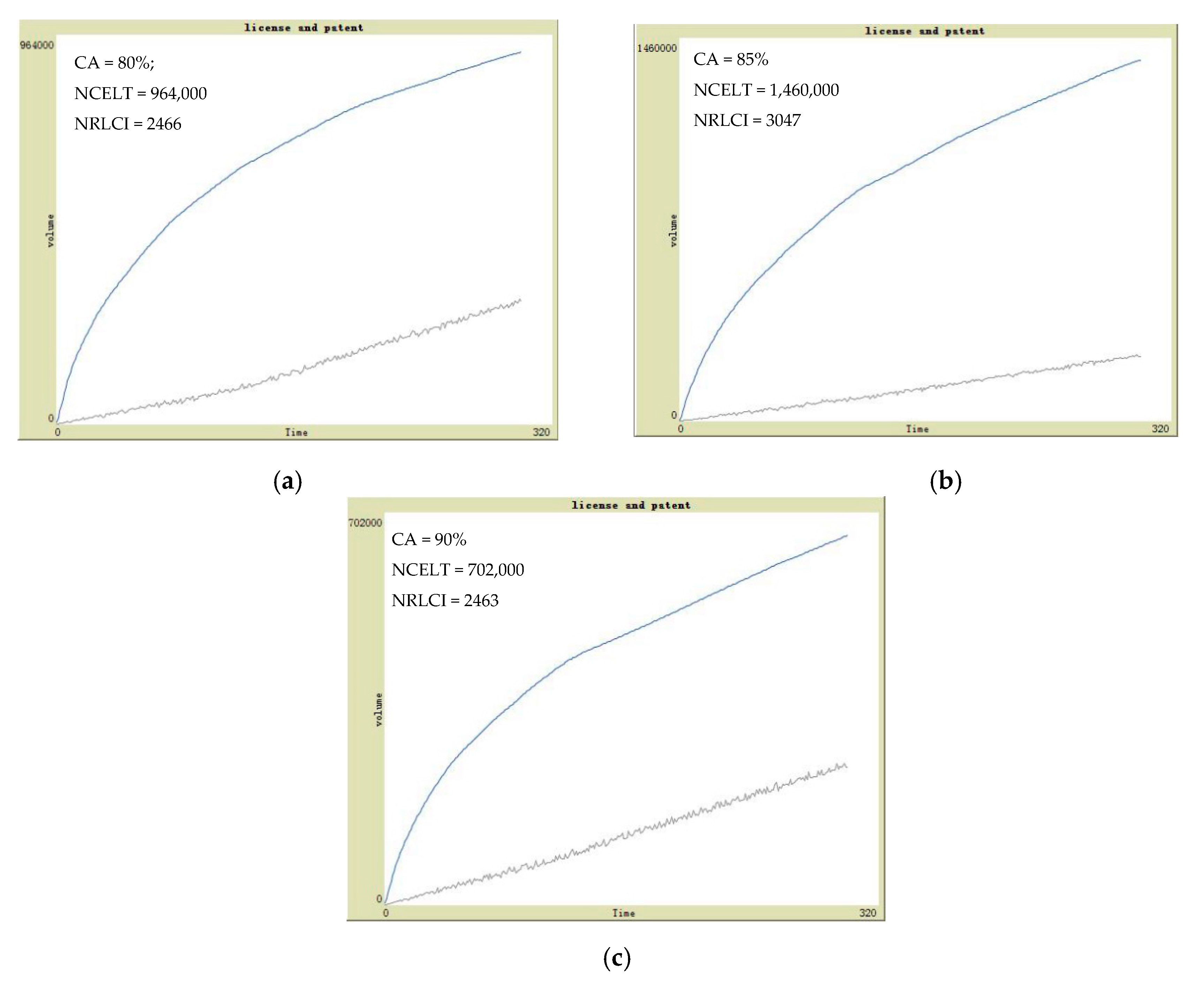

4.3.3. Impact of Carbon Intensity Reduction

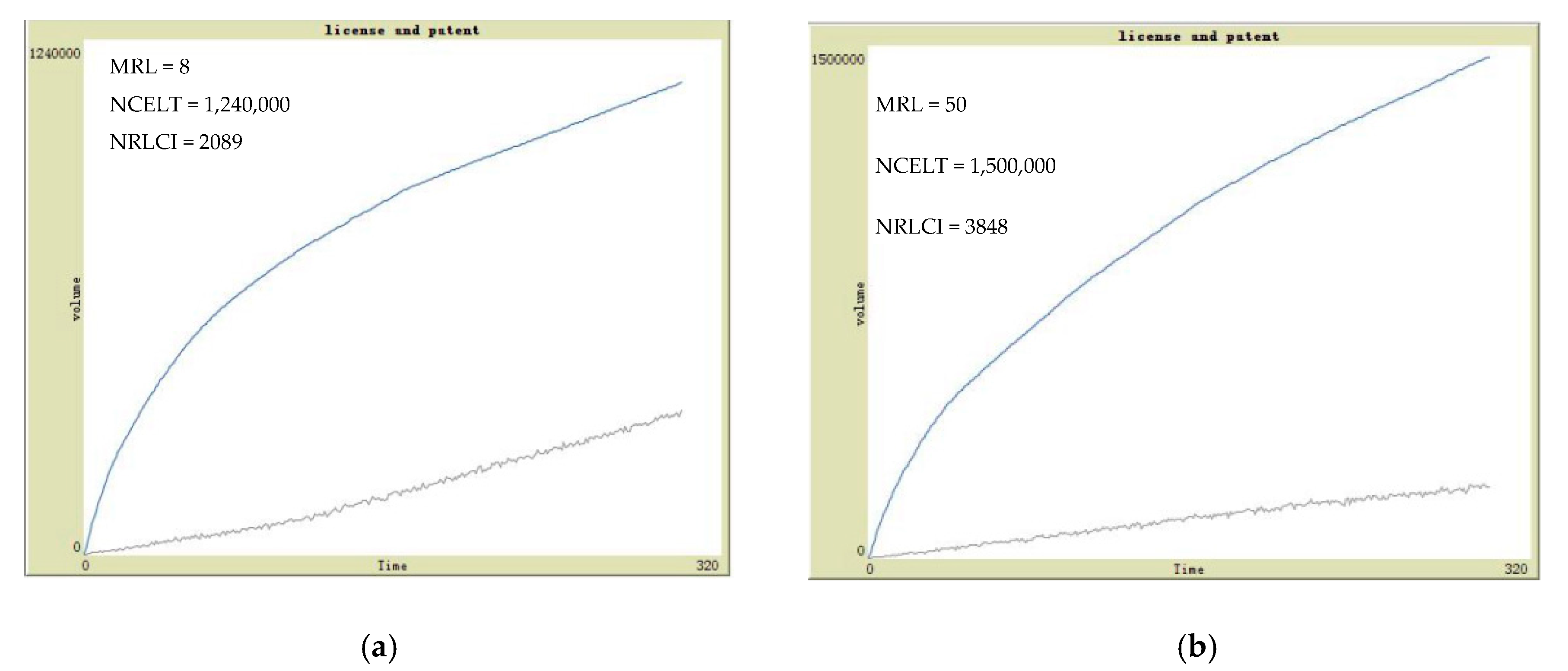

4.3.4. Impact of Market Regulations

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lu, S.; Ye, Y. Middle-income trap, comparative advantage trap, and comprehensive advantage strategy. Economist 2019, 7, 15–22. [Google Scholar]

- Im, H.J.; Shon, J. The effect of technological imitation on corporate innovation: Evidence from US patent data. Res. Policy 2019, 48, 103802. [Google Scholar] [CrossRef]

- Du, K.; Li, P.; Yan, Z. Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Chang. 2019, 146, 34–37. [Google Scholar] [CrossRef]

- Morikawa, M. Innovation in the service sector and the role of patents and trade secrets: Evidence from Japanese firms. J. Jpn. Int. Econ. 2019, 51, 43–51. [Google Scholar] [CrossRef]

- Ye, R.; Yang, J.; Chang, Y. Efficiency measurement and decomposition of China’s provincial Hi-tech industry: A study based on a DEA model with shared inputs. J. Quant. Tech. Econ. 2012, 7, 3–17. [Google Scholar]

- Jiang, G. A Comparative Study on the Patent Information in China between Domestic and Foreign Automobile Enterprises. In Proceedings of the 19th Annual Conference of the Chinese Journal of Management Science, Nanjing, China, 20 October 2017. [Google Scholar]

- Deng, K.; Ding, Z. Why does China lack creative destruction?—Empirical evidence based on listed company attributes and information. Econ. Res. J. 2010, 45, 66–79. [Google Scholar]

- Labatt, S.; White, R.R. Carbon Finance: The Financial Implications of Climate Change New Jersey; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2012. [Google Scholar]

- Sorrell, S.; Sijm, J. Carbon trading in the policy mix. Oxf. Rev. Econ. Policy 2003, 19, 420–437. [Google Scholar] [CrossRef]

- Garcia, B.; Roberts, E. Carbon Finance-Environmental Market Solutions to Climate Change; Working Papers; Yale School of Forestry and Environmental Study: New Haven, CT, USA, 2008. [Google Scholar]

- Li, Y.; Zhu, S.; Luo, L.; Yang, D. Theoretical exploration of low-carbon development as a macroeconomic objective—Based on China’s situation. Manag. World 2017, 6, 1–8. [Google Scholar]

- Eichner, T.; Pethig, R. Competition in emissions standards and capital taxes with local pollution. Reg. Sci. Urban Econ. 2018, 68, 191–203. [Google Scholar] [CrossRef]

- Saltari, E.; Travaglini, G. Pollution control under emission constraints: Switching between regimes. Energy Econ. 2016, 53, 212–219. [Google Scholar] [CrossRef]

- Sim, S.-G.; Lin, H.-C. Competitive dominance of emission trading over Pigouvian taxation in a globalized economy. Econ. Lett. 2018, 163, 158–161. [Google Scholar] [CrossRef]

- Yin, H.; Zhao, J.; Xi, X.; Zhang, Y. Evolution of regional low-carbon innovation systems with sustainable development: An empirical study with big-data. J. Clean. Prod. 2019, 209, 1545–1563. [Google Scholar] [CrossRef]

- Pettifora, H.; Wilson, C.; Bogeleina, S.; Cassara, E.; Kerra, L.; Wilson, M. Are low-carbon innovations appealing? A typology of functional, symbolic, private and public attributes. Energy Res. Soc. Sci. 2020, 64, 101422. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Jiang, Y.; Asante, D.; Zhang, J.; Cao, M. The effects of environmental factors on low-carbon innovation strategy: A study of the executive environmental leadership in China. J. Clean. Prod. 2020, 266, 121998. [Google Scholar] [CrossRef]

- Maskus, K.E.; Neumann, R.; Seidel, T. How national and international financial development affect industrial R&D. Eur. Econ. Rev. 2012, 56, 72–83. [Google Scholar]

- Chowdhurya, R.H.; Maung, M. Financial market development and the effectiveness of R&D investment: Evidence from developed and emerging countries. Res. Int. Bus. Financ. 2012, 26, 258–272. [Google Scholar]

- Xu, Y.; Wang, H. Empirical analysis of China’s financial development on technology innovation. Stat. Decis. 2011, 21, 144–146. [Google Scholar]

- Zhang, Z. Financial Development, R&D Innovation and Regional Technology Deepen. Econ. Rev. 2012, 3, 82–92. [Google Scholar]

- Hyytinena, A.; Toivanen, O. Do financial constraints hold back innovation and growth? Evidence on the role of public policy. Res. Policy 2005, 34, 1385–1403. [Google Scholar] [CrossRef]

- Orman, C. Organization of innovation and capital market. N. Am. J. Econ. Financ. 2015, 33, 94–114. [Google Scholar] [CrossRef][Green Version]

- Stulz, R.M. Financial structure, corporate finance and economic growth. Int. Rev. Financ. 2000, 1, 11–38. [Google Scholar] [CrossRef]

- Weinstein, D.; Yafeh, Y. On the costs of a bank-centered financial system: Evidence from the changing main bank relations in Japan. J. Financ. 1998, 53, 635–672. [Google Scholar] [CrossRef]

- Li, X. Empirical Research on Government R&D Funding, Financial Credit and Different Growth Stages of Enterprises. Manag. Rev. 2018, 30, 73–81. [Google Scholar]

- Zhang, Y.; Gong, Q.; Rong, Z. Technological Innovation, Equity Financing, and Financial Structure Transition. J. Financ. Res. 2016, 11, 65–80. [Google Scholar]

- Kortum, S.; Lerner, J. Assessing the contribution of venture capital to innovation. J. Econ. 2000, 31, 674–692. [Google Scholar] [CrossRef]

- Atanassov, J.; Kanda, V.K.; Seru, A. Finance and Innovation: The Case of Publicly Traded Firms. Univ. Or. 2007, 1, 35–54. [Google Scholar] [CrossRef]

- Lu, W. On Technological Innovation Principle of Venture Investment Mechanism. Econ. Res. J. 2002, 1, 48–56. [Google Scholar]

- Sun, W.; Wang, P. Promotion of technology innovation by China’s financial development. Manag. World 2013, 6, 172–173. [Google Scholar]

- Xu, J.; Chen, S. The Study of Venture Capital’s Principal-agent Model Based on Asymmetric Information. Syst. Eng. Theory Pract. 2004, 1, 19–24. [Google Scholar]

- Cheng, C.C.J.; Chen, J.S. Breakthrough innovation: The roles of dynamic innovation capabilities and open innovation activities. J. Bus. Ind. Mark. 2013, 28, 444–454. [Google Scholar] [CrossRef]

- Srivastava, M.K.; Gnyawali, D.R. When Do Relational Resources Matter? Leveraging Portfolio Technological Resources for Breakthrough Innovation. Acad. Manag. J. 2011, 54, 797–810. [Google Scholar] [CrossRef]

- Fernández, Y.; FernándezLópez, M.A.; Blanco, B.O. Innovation for sustainability: The impact of R&D spending on CO2 emissions. J. Clean. Prod. 2018, 172, 3459–3467. [Google Scholar]

- Erzurumlu, S.S.; Erzurumlu, Y.O. Development and deployment drivers of clean technology innovations. J. High Technol. Manag. Res. 2013, 24, 100–108. [Google Scholar] [CrossRef]

- Cheng, Z.; Li, L.; Liu, J. The emissions reduction effect and technical progress effect of environmental regulation policy tools. J. Clean. Prod. 2017, 149, 191–205. [Google Scholar] [CrossRef]

- Wang, R.; Feng, Y.; Xu, H. The Influence of Reputation Resources and Relational Resources on Radical Innovation. J. Manag. Sci. 2017, 30, 87–101. [Google Scholar]

- You, D.; Ma, B. Research on the influence of relationship fit on knowledge transfer and radical innovation performance. Syst. Eng. Theory Pract. 2014, 34, 3103–3112. [Google Scholar]

- Wang, Y.; Xie, W.; Wang, T.; Cheng, M. Research on the Relationship between Strong/Weak Ties and Radical Innovation: The Mediating Effect of Absorptive Capacity and Moderating Effect of Environmental Dynamism. Manag. Rev. 2016, 28, 111–122. [Google Scholar]

- Pei, X.; Li, S.; Huang, Y. Study on the impact of involvement in fuzzy front end on radical innovation. Stud. Sci. Sci. 2015, 33, 460–470. [Google Scholar]

- Wang, X.; Li, X.; Chen, G. Complex Networks Theory and Its Application; Tsinghua University Press: Beijing, China, 2006. [Google Scholar]

- Xu, X.; Hao, J.; Deng, Y.; Wang, Y. Design optimization of resource combination for collaborative logistics network under uncertainty. Appl. Soft Comput. 2017, 560, 684–691. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; Li, N.; Xu, H. A bi-level programming model of resource matching for collaborative logistics network in supply uncertainty environment. J. Frankl. Inst. 2015, 352, 3873–3884. [Google Scholar] [CrossRef]

- Xu, X.; Hao, J.; Yu, L.; Deng, Y. Fuzzy Optimal Allocation Model for Task-Resource Assignment Problem in Collaborative Logistics Network. IEEE Trans. Fuzzy Syst. 2018, 99, 1–14. [Google Scholar] [CrossRef]

- Bai, Z. Initiating urban public infrastructure complex network systems—A review of Integrated orderly supply and demand of urban public infrastructure systems. J. Tianjin Univ. Commer. 2019, 39, 73. [Google Scholar]

- Chen, S.; Li, Y.; Shen, Q.; Ju, Y. Urban Traffic Networks Collaborative Optimization Method Based on Layered Complex Networks. J. Comput. Appl. 2019, 19, 1–11. [Google Scholar]

- Luo, H.-Y.; Zhang, Q.-P. Index System Construction and Measurement of Radical Technological Innovation Capability of The Small Technology-based New Ventures under the Perspective of Knowledge Management. Oper. Manag. 2016, 25, 175–184. [Google Scholar]

- Luo, Z. Government Funding, Enterprise R&D Investment and Innovation Output—An Threshold Regression Analysis Based on the Evidence of Industrial Enterprises in Beijing. China Bus. Mark. 2018, 1, 102–112. [Google Scholar]

- Zhang, Y.-X.; Cui, M.-Z. The impact of Corporate Social Responsibility on the enterprise value of China’s listed coal enterprises. Extr. Ind. Soc. 2020, 7, 138–145. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, L.; Wang, J.; Wang, Z.; Marquez, L. Mechanism of Carbon Finance’s Influence on Radical Low-Carbon Innovation with Evidence from China. Sustainability 2020, 12, 7708. https://doi.org/10.3390/su12187708

Sun L, Wang J, Wang Z, Marquez L. Mechanism of Carbon Finance’s Influence on Radical Low-Carbon Innovation with Evidence from China. Sustainability. 2020; 12(18):7708. https://doi.org/10.3390/su12187708

Chicago/Turabian StyleSun, Limei, Jinyu Wang, Zhicheng Wang, and Leorey Marquez. 2020. "Mechanism of Carbon Finance’s Influence on Radical Low-Carbon Innovation with Evidence from China" Sustainability 12, no. 18: 7708. https://doi.org/10.3390/su12187708

APA StyleSun, L., Wang, J., Wang, Z., & Marquez, L. (2020). Mechanism of Carbon Finance’s Influence on Radical Low-Carbon Innovation with Evidence from China. Sustainability, 12(18), 7708. https://doi.org/10.3390/su12187708