1. Introduction

With rapid economic development and urbanization, the disposal and management of municipal solid waste have become a serious problem in China. Because of the large population and the backward municipal solid waste (MSW) disposal technology, the image of Chinese cities and the physical and mental health of the inhabitants have been severely damaged and threatened by the harmful effects of mortifying wastes [

1,

2,

3]. By the end of 2018, China’s urbanization level had reached 59.58%, the quantity of MSW produced by 200 large and medium cities had reached 211.473 million tons, and the daily output of MSW per capita exceeded 1 kg. “Garbage siege” has become a major problem of urban governance in China. MSW is growing at an average annual rate of 5%, more than in any other Asian country [

4]. With the continuous promotion of the new urbanization strategy, it can be predicted that the urban population will continue to grow steadily in the future, and a large number of people will produce a large amount of MSW. With the increasing MSW, the social and ecological impacts of MSW have also increased, and now its disposal is a growing social concern [

5]. A sustainable development strategy based on protecting natural resources and the environment, stimulating economic development, and aiming at improving our lives is the blueprint to achieve a better and more sustainable future for all of us. China has a large population, relatively insufficient per capita resources, great employment pressure, and a prominent ecological environment. Therefore, the issue of sustainable development is important. Because the garbage siege has caused serious environmental pollution and has seriously harmed people’s health, sustainability increasingly receives attention in the field of MSW management. Therefore, it is urgent to adopt appropriate methods to solve the MSW problem to achieve sustainable development. Junhan Huang et al. proposed three planning scenarios for MSW disposal to enhance its sustainability, i.e., anaerobic digestion, incineration, and landfilling [

6]. Landfilling and incineration can be used to deal with MSW disposal. In China, the landfill is the main MSW disposal method due to the its low cost and the advantage of its simple operation. The use of landfills is the simplest, cheapest, and most common way of managing disposal of MSW. However, it is the least environmentally friendly means of MSW disposal; the use of landfills reduces the efficiency of waste disposal and even causes serious problems, such as groundwater contamination and air pollution with the release of harmful gases from landfill and soil contamination [

7]. Incineration can generate electricity, but micro-pollutants emitted from the combustion process are also a concern [

8]. In recent years, due to the low efficiency of waste disposal and the above problems, landfills have rarely been used. Waste incineration has become more and more popular thanks to its large amount of MSW disposal, high disposal rate, significant reduction of the volume of waste, the economic benefits brought by electricity generation, etc. However, the process of incineration can produce bottom ash and fly ash, which are harmful to human health. Because of the backward technology, poor regulation, and heavy financial burden, the government cannot support the responsibility of MSW disposal services [

9]. Thus, it is necessary to search for a new way to provide MSW disposal services [

3], and increasing emphasis should be placed on enhancing efficacy of selective MSW collection in the place of MSW generation to improve the efficiency of waste disposal [

10].

MSW disposal involves numerous public infrastructural items, such as landfills, incineration plants, and compost plants. Moreover, this treatment requires high professional quality. For a long time, MSW disposal has been handled by the government. However, with the continuous increase of MSW, efficiency is difficult to guarantee if still completely depending on the government; the financial burden for infrastructure development often tends to exceed what most governments can afford. To address these problems, the public–private-partnership (PPP) model provides a new channel to solve the financial burden and efficiency problems caused by MSW [

11]. PPP, firstly proposed by the UK government in 1982, refers to the cooperative relationship established by the government and private organizations through franchise agreements. The government grants private enterprises long-term franchise rights and income rights in exchange for infrastructure, and provides certain public goods and services [

12,

13]. PPP is sometimes regarded as a potential vehicle for sustainability, as a long-term contract bundled with various functions could make the interests of private partners consider the life cycle costs [

14]. In recent years, the Chinese government has also been promoting the PPP model [

15,

16,

17]; as there is an urgent need to deal with MSW, China has to apply the PPP model in environment treatment projects, such as MSW disposal [

18,

19,

20]. According to the government and Social Capital Cooperation Center (PPP Project Library) of the Ministry of Finance of China, nearly 20 PPP projects for MSW disposal have been put into the PPP database. The number of PPP projects for MSW disposal that have entered the preliminary consultation stage of the project is also continuously increasing.

However, MSW disposal PPP projects have encountered some problems. The government plays the role of the principal, and private investors act as the agent in PPP projects. Principal–agent theory is an essential part of contract theory in institutional economics. Its central task is to analyze how to design the optimal contract incentive agent under information asymmetry and conflicts of interest. In MSW disposal PPP projects, the government has minimal information and can neither completely know the efforts of private investors nor precisely grasp their information. Sustainability is often considered as a three-dimensional concept that includes social, ecological, and economic perspectives. Azapagic and Perdan indicated that sustainable development must be considered economically, socially, and ecologically [

21]. Therefore, the profits of MSW disposal PPP projects mainly include economic benefits (EB) and social and ecological benefits (SEB). EB are mostly obtained by collecting MSW disposal fees and MSW power generation. SEB refers to the benefits brought by protecting the environment, improving urban living conditions, and enhancing the overall image and competitiveness of a city. The government wants to maximize the comprehensive benefits of the project, while private investors only focus on their profits. Interests conflicts and asymmetric information may lead to moral hazards [

22]. Private investors are more likely to maximize their profits through opportunistic behavior, which will seriously damage the interests of the public. Then, public resistance could occur due to public severe concerns [

23]. Therefore, specific governance instruments and incentives are needed to encourage investors to adopt positive attitudes toward cooperation [

24,

25]. Complementary regulatory strategies should also be adopted to safeguard the interests of all parties [

26].

In China, there are many incentive and governance methods for PPP projects. Reputation incentives help to improve the social image of investors by giving spiritual recognition to high-quality private investors operations that actively avoid opportunism. Policy incentives are that the government gives priority to supporting PPP projects. Policy incentives can bring in social capital through investment subsidies, fund injections, guarantee subsidies, loan interest discounts, and tax preferences. Subsidies incentives mean that the government attracts private investors by providing fixed and variable subsidies. Government guarantee incentives often use to provide guarantee mechanism for the operation of the whole life cycle in PPP projects. The government becomes the shareholder of a special purpose vehicle (SPV) through direct investment and shares risks and benefits with private investors. Access governance means that investors with relevant management experience, professional ability, financing ability, and good credit status are selected as partners through open bidding, inviting bidding, and competitive negotiation. Process governance refers to strengthening the whole-process governance of project quality and operation standards during the implementation of the project. Further, it carries out a comprehensive evaluation on the quantity, quality, and capital use efficiency of public products and services. The evaluation results shall serve as the basis for financial subsidies, price standards, and cooperation period. Credit ratings deal with the establishment of government credit restraint mechanisms, credit rating, blacklist system, and outstanding performance of investors in the next franchise to give priority. External governance means that the public gives feedback to conduct impartial governance, assessment, and evaluation on the construction and operation of projects. Performance governance links government payment and user payment with performance assessments, and takes performance evaluation results as an essential basis for price adjustments, positive incentives, and adverse penalties.

In the past decade, lots of researchers have studied the incentive mechanisms in PPP projects. However, relevant researches have focused on EB, SEB, and opportunistic behavior of private investors in MSW disposal. Thus, PPP projects remain rare and little attention is paid to the impact of opportunistic behavior on benefits distribution and the significance of SEB. Indeed, economic benefits are as critical as social and ecological benefits in MSW disposal PPP projects. The primary objectives of MSW disposal PPP projects are to rebuild the overall image and improve the living environment of the city. Therefore, social and ecological benefits need to take them seriously. The total output of a project not only depends on the efforts of the investors but also are affected by external uncertainties. Investors may engage in opportunistic and self-interested behavior. The present study aims to fill this gap by establishing an incentive and governance model of multi-task principal-agent under information asymmetry to encourage investors to adopt a positive attitude toward both economic benefits, social and ecological benefits, and inhibit investors’ opportunistic behavior. The objective of this paper is to address two problems from the perspective of sustainable development. First, we consider how to effectively encourage investors to make more effort for achieving the sustainable development goals of EB and SEB in MSW disposal PPP projects. Second, we consider how to avoid moral hazards such as opportunistic behavior by investors through effective governance and penalty mechanism. The main methods of this paper were the construction of an incentive and governance model through principal-agent theory, which helps to formulate the basis for decision-making between government and investors. Numerical simulation was also carried out for demonstrating the application of the principal-agent models. Compared with the previous study, this paper separately considered EB and SEB of MSW disposal PPP projects, set the optimal proportion of economic benefits allocated to private investors, basic standard, and incentive coefficients for social and ecological benefits. Multi-task principal-agent incentive models were established considering the impacts of investors’ opportunistic behavior during information asymmetry. The rest of this paper is organized as follows. The following section provides a comprehensive review of the MSW disposal PPP project and incentive mechanism. The third section introduces the parameters and hypotheses of research models. Then, principal-agent models were constructed to analyze the incentive and governance mechanism for MSW disposal PPP projects, followed by discussions of the models. A numerical example is presented in the fifth section to enhance a better understanding. Finally, summary findings and conclusions are offered.

2. Literature Review

PPP refers to cooperation between the government and private investors, which has become an effective way to solve the dilemma of “garbage siege” in many countries in the field of municipal solid waste disposal. The rights and obligations of the two parties is determined by contracts. Moreover, private investors can earn reasonable profits by providing high-quality facilities and services to the public [

27,

28]. The PPP model applied in MSW problems can alleviate the pressure of the local government and improve the efficiency of disposal services. At the same time, it can reduce the secondary pollution caused during the process [

3]. Many kinds of research focused on the implementation and operation of MSW disposal PPP projects had been proposed previously. Mohan et al. [

29] considered the PPP model as a useful mode for domestic garbage treatment. Wu et al. [

30] established a risk assessment framework for garbage incineration power generation and evaluated the risks of such projects. Arbulú et al. [

31] pointed out that the use of PPP models to solve MSW problems in tourist attractions can effectively save costs and improve efficiency. The key to forming a partnership between government and investors lies in the common goal of providing high-quality products and services at the least cost for specific projects. Based on realizing common goals, the government can maximize comprehensive benefits and improve the efficiency of public services. In contrast, private investors can maximize their interests to achieve a win-win situation. However, the government and investors have different targets in MSW projects. The government is committed to maximizing the EB and SEB of the project to achieve its sustainable development. Private investors are inevitably profit-driven and may reduce the service quality of the project or neglect the investment in ecological protection and social responsibility [

22]. Based on principal-agent theory, differences in interest demands of both parties and information asymmetry also give rise to opportunistic behaviors, thus resulting in moral hazards [

32]. Opportunistic behavior adopted by private investors seriously harms public interests and affects the success of the project [

33]. At the same time, it affects the health and sustainability of partnerships between the government and investors [

34]. Therefore, scientific and reasonable incentive contracts need to be established to maximize the total profits of MSW PPP disposal projects.

Lots of countries have applied PPP models in multiple fields. The Ministry of Finance of China issued a document to promote the PPP model in 2014, which set off a PPP upsurge in China. To promote healthy and sustainable development of the projects, encouraging private investors to work hard and inhibiting their opportunistic behavior are essential. The sustainability of public–private partnerships has been widely covered in the relevant research [

35,

36,

37]. From an incentive perspective, analyses on PPP projects in different fields have been proposed. Baron et al. [

38] developed a two-stage incentive mechanism for studying how to observe the real information of private investors and solve the problem of information asymmetry. Tsai et al. [

39] analyzed the government’s incentive to PPP projects by adopting a case study model, which clarified the problem of the government implementing incentive measures for private investors in sewage treatment and recycling waste goods. Ho et al. [

40] analyzed the intensity and influencing factors of government rescue PPP projects through the game theory model, offering a framework and methodology to understand the behavioral dynamics of the parties in PPP. Schmidt et al. [

41] considered the relationships between public and private investors to be promoted and formed by exchanging information and setting incentives mechanism, thus improving the utilization efficiency of resources to accomplish the project’s construction. Shi et al. [

42] pointed out that a flexible incentive mechanism should be adopted according to the conflicts of interest and external uncertainties to improve the smooth implementation of the project. Lohmann et al. [

43] analyzed the opportunistic behavior of private investors in the PPP project negotiation stage. Liu et al. [

44] built a principal-agent model with opportunism tendency by analyzing the private investors’ speculation in PPP projects. Li et al. [

45] discussed the behavior of private investors under the incentive mechanism. Wang et al. [

46] added reciprocity preference theory to the traditional principal-agent model and established an incentive mechanism based on the optimal government share ratio. Peng Li et al. proposed a dynamic decision- making method to evaluate the performance of enterprises in PPP projects [

47].

Lots of researchers have conducted detailed studies on the incentive problems of PPP projects from different perspectives, but most of them only considered a single project goal. However, in MSW disposal PPP projects, both EB and SEB need to be considered. EB targets must set SEB targets to achieve sustainable development of PPP projects [

25]. The effective incentive mechanism for some single benefits targets may become ineffective and it is vital to design PPP model optimal incentive contracts based on a multi-task principal-agent. Holmstrom et al. [

48,

49] proposed a multi-task principal-agent model based on the linear principal-agent model previously proposed and studied by the optimal contract design under the multi-task principal-agent relationships. Baker et al. [

50,

51] analyzed the impact of performance evaluation in the multi-task principal-agent incentive mechanism. However, most of these studies ignored the influence of investors’ opportunistic behavior on the project and did not establish the governance and penalty mechanism related to investors’ opportunistic behavior. Opportunism is a common phenomenon in social and economic activities due to information asymmetry and different interests [

52,

53]. Opportunistic behavior refers to the behavior that investors are motivated to pursue their interests by deceit to achieve gains [

54,

55]. Lan et al. [

34] pointed out that preventing opportunistic behavior can effectively ensure the health and sustainability of cooperation. However, information asymmetry between the two parties leads to the opportunistic behavior of those who hold more information when dealing with both parties [

32,

56]. You et al. [

57] argued that there is a positive correlation between external uncertainties and opportunistic behaviors of investors. However, the correlation could weaken contract control and adjustment. Wang et al. found that the opportunistic behavior of investors influenced by public engagement, government reputation, incentive mechanism, discovery probability of opportunistic behavior, and penalty measures [

58]. Since opportunistic behavior is not conducive to the healthy and sustainable partnership of both parties in MSW disposal PPP projects, effective governance mechanisms, such as contracts, are needed to govern investors’ opportunistic behavior [

59].

According to the above literature review, we can conclude that much of the research on the incentive mechanism of PPP projects do not focus on the issue of multi-task benefits incentive, nor consider the influence of opportunistic behavior on investors. Based on this, the current study refers to the research model of incentive and governance, and establishes the incentive and governance model of a multi-task principal-agent under the condition of information asymmetry.

3. Model Development

The performance in MSW disposal PPP projects includes EB and SEB, which depend on the operation and management of private investors. Generally, the government attempts to get investors to put as much effort as possible to maximize comprehensive project benefits, while private investors focus on their own economic profits. Incentives are considered as one of the most effective measures to eliminate conflicts of interest and achieve a win-win situation for the two parties [

16]. Moreover, because private investors have more information than the government, the government cannot fully observe the efforts of private investors in projects. Asymmetric information may lead to moral hazards. Private investors may adopt opportunistic behaviors to obtain more benefits, such as minimizing construction, operation and management costs, and increasing fees, which may lead to low project quality, as well as capacity and financial burden for the government [

60]. Therefore, governance and penalty mechanisms are needed to guide investor’s behavior in projects.

The following hypothesis must be formulated to analyze the incentive model:

Hypothesis 1 (H1). is set as economic benefits (EB) anddenotes the social and ecological benefits (SEB). The EB and SEB are determined by the effort leveland, respectively. According to Holmstrom [61], the output of EB and SEB in MSW disposal PPP projects can be expressed as follows:whererepresents the own capabilities and resources of private investors,, andare random variables, which obey normal distribution with means of zero and variances of:,.

Hypothesis 2 (H2). is the cost of private investors in making efforts to purchase EB and SEB.. () are the cost coefficients, respectively. For the same level of benefits efforts, the higher the value of the cost coefficient would lead to higher cost. The cost function of EB and SEB can be expressed as followed: Hypothesis 3 (H3). is the efforts of private investors in adopting opportunistic behavior.. The output obtained by the investors’ opportunistic behavior is, which can be expressed as follows:whererepresents the output coefficient of the investors’ opportunistic behavior,. The following is the cost function of opportunistic behavior:is the cost coefficient in taking opportunistic behavior [44]. Hypothesis 4 (H4). The government would govern investors’ behavior throughout the project to regulate the behavior of investors. The probability that the government finds the investor’s opportunistic behavior is, which also represents the level of government governance. Once the investor’s opportunistic behavior is observed by the governance mechanism, there are penalties from the government. The function can be expressed as follows:whereis coefficient of the penalty,.

is a random variable that obeys normal distribution with mean of zero and variances of, i.e.,,andare mutually independent [62]. The cost of government governance can be instructed as follows:whereis the cost coefficient of government [63]. Hypothesis 5 (H5). The government cannot observe the investment level of investors’ efforts. Thus, the incentives for investors consist of two parts: one is the fixed subsidy or income promised in the contracts; the other is the incentive income provided according to the project benefits that can be observed by government. The total incentive benefits of private investors in municipal solid waste disposal PPP projects can be instructed as follows:whereis the basic standard of SEB. The basic purpose of MSW disposal PPP projects is rebuilding the overall image of the city and improving the living environment of the city. Therefore, minimum SEB targets shall be set for the project [

48].

is the proportion of EB allocated to the private investors, which also denotes the EB incentive coefficient. is the incentive coefficient for SEB. Hypothesis 6 (H6). The government is risk-neutral, while investors are risk averse.is the risk evasion coefficient [64]. In the MSW disposal PPP projects, the government attempts to maximize the total output benefits, including EB and SEB. The total income of government can be expressed as follows:

The expected utility of the government is:

Investors are inevitably profit-seeking and the purpose of the project is to maximize its own profits. The total income of private investors

can be expressed as follows:

The expected net income of investors can be expressed as:

The variance of the net income of investors can be expressed as follows:

Since the private investors is risk averse, the certainty utility (CE) can be expressed as follows:

Therefore, incentives of private investors in the MSW disposal PPP projects can be expressed as constrained programming problems, and

is the minimum utility that the private investors would reserve. The constrained programming problems can be expressed as follows:

According to the former analysis, private investors determine their efforts level (

) based on the maximization of their own profits. According to the first-order optimal solutions to Equations (15) and (16), the optimal solutions to the constrained programming problems can be instructed as follows:

4. Model Analysis and Discussion

Equations (17)–(19) show that private investors’ efforts and opportunistic behavior towards projects determine by multiple factors that divided into two parts. One is the level of private investors’ own capabilities and resources (

), the output coefficient of the investors’ opportunistic behavior (

), and the cost coefficient of investors efforts (

). All of these are determined by private investors. The other is the incentive coefficient of SEB (

) and the incentive coefficient of EB (

), penalty coefficient for investors’ opportunistic behavior (

), and the intensity of government supervision (

), which are controlled by the government. Since incentives need to be designed from the perspective of the government, it is necessary to consider what the government can control. The level of private investors’ efforts to economic benefits is positively correlated with the proportion of economic benefit allocation (

) in the incentive contract and negatively correlated with the incentive coefficient of social and ecological benefits (

). On the contrary, the efforts of social and ecological benefits are negatively related to the proportion of economic benefit allocation (

) and positively associated with the incentives for social and ecological benefits (

). The higher the penalty for opportunistic behaviors of investors (

), the more investors will reduce opportunistic behaviors and increase their efforts in project economic and social and ecological benefits. The related equations can be expressed as follows:

According to the above analysis, the following conclusions can be drawn:

The investor’s efforts and resources are limited. The government cannot observe the real ability and efforts of investors due to information asymmetry. In principal-agent contracts, the government can only observe EB and SEB of PPP projects, and discover the opportunistic behavior of investors by setting up a governance mechanism. According to the above analysis, the investor’s efforts and opportunistic behavior are affected by the government’s incentives and penalty in principal-agent contracts. Therefore, the government needs to design incentive contracts in a targeted manner according to the characteristics and expected benefits of different MSW disposal PPP projects to control the level of effort and inhibit the opportunistic behavior of investors.

According to Equations (17)–(19), investors’ efforts in economic, social, and ecological benefits are positively correlated with government governance, while investors’ investment in opportunistic behavior is negatively correlated with government governance. The related equations can be expressed as follows:

This shows that the higher the governance of the government, the higher the efforts level of investors in MSW disposal PPP projects, and the lower the investment in opportunistic behavior of private. In addition, Equation (25) shows that the governance mechanism also has an incentive effect, where the existence of penalty will strengthen the incentive effect, which is . The existence of governance makes investors’ investments transparent. The higher the level of governance, the more transparent of private investors. Information asymmetry can also be alleviated. In addition, penalties force investors to reduce opportunistic behavior and turn to achieve economic benefits and social and ecological benefits. When , governance intensity reaches 100% and the information is completely symmetric, which achieve the Pareto optimal effort level. Equations (20) and (21) show that and , which indicate that when there is only incentive mechanism in the principal-agent relationship. The government can only predict the efforts of investors by observing the economic, ecological, and social benefits of the project due to information asymmetry. When there is a governance mechanism, the government can base on the observed project economic, ecological, and social benefits and the results of governance. The information value of EB and SEB observed by the government has declined, so the incentive intensity of benefits needs to be reduced accordingly.

The governance mechanism in MSW disposal PPP projects can encourage investors to make more efforts and effectively inhibit the opportunistic behavior of investors. Increasing penalties of opportunistic behavior helps strengthen motivation. Incentive and governance mechanisms are complementary and the existence of the penalty enhances complementarity.

Equations (17)–(19) demonstrate that the basic social and ecological benefit standard of MSW disposal PPP projects is not directly related to the investment efforts and opportunistic behavior of private investors, but it is necessary to set this basic standard. means that the improvement of basic standards for social and ecological benefits help increase investors’ efforts to ensure , which ensures excess social and ecological benefits of proportion k. As the proportion of allocation of the benefits increases, the proportion of the fixed subsidy promised in the contracts needs be lowered. The corresponding basic standard of social and ecological benefits should be set according to the actual situation of the PPP project. High standards are hard to achieve and encourage investors to adopt opportunistic behaviors. However, when the basic standards are too low, they do not meet actual demand. Based on the above analysis, the following conclusions can be obtained:

In MSW disposal PPP projects, the government can set a basic standard for investors to ensure the social and ecological benefits of projects. Excess rewards will be received when investors meet basic standards.

According to Equations (20)–(22), . The optimal incentives are negatively correlated with the risk evasion coefficient, so the principal-agent contracts need to be more flexible according to investors’ attitudes towards risks. Risk-averse investors prefer a fixed subsidy or income. If private investors are risk-averse, incentive compensation for project benefits should be reduced. However, investors with a low degree of risk aversion and individual risk tolerance can take strong incentives. Optimal incentives are negatively correlated with the random variables indicates that the incentives should set in combination with the external environment situation. The more uncertain the external environment of projects, the more the output of projects is affected by external random variables. In other words, better performing projects may be due to a favorable external environment rather than the efforts and abilities of the investors. On the contrary, poor project performance is not necessarily caused by investors’ lack of effort or opportunistic behavior. Therefore, the incentives need to be adjusted accordingly under the high uncertainty of the external environment.

Investors with high risk aversion prefer fixed income rather than incentive income. The greater the external environment uncertainty, the higher the proportion of fixed income is required for private investors. Since , fixed income is zero risk and has a certain protective effect for investors. In addition, according to Equations (20)–(22), there is no direct correlation between investor’s efforts and fixed income. Therefore, fixed subsidies have no incentive effect and the proportion should not be too high when designing principal-agent contracts.

5. Numerical Example

In this section, a numerical simulation was carried out to further analyze the application of the models and the relationships between related parameters. Ideally, the government could judge investors’ attitude to risk based on their previous participation in PPP projects and calibrate the risk evasion coefficient value , the cost coefficient of efforts (), and the cost coefficient of private investors when pursuing opportunistic behavior () based on the judgment results. The value of investors’ own resources () can be inferred from the amount of collective investment between the government and investors. The output coefficient of the investors’ opportunistic behavior () can be obtained from certain economic indicators, such as the return of investment (ROI). Meanwhile, the intensity of governance () and penalty coefficient () for investors based on previous experience in PPP projects are determined by the government. Finally, the variance of normally distributed random variables , and are difficult to measure, and can be derived using simulations.

For investors, suppose the cost coefficient of EB () and the cost coefficient of SEB () are 10; moreover, assume the cost coefficient of private investors in pursuing opportunistic behavior () is 5. The risk evasion coefficient value (ρ) of investors is 0.8 and the level of the investors’ own resources () is 0.4. The output coefficient of the investors’ opportunistic behavior () is 0.3. For the government, suppose the intensity of governance () is 0.5 and the coefficient of penalty () is 2. Assume for simplifying the calculations. The results of numerical simulation are displayed as follows.

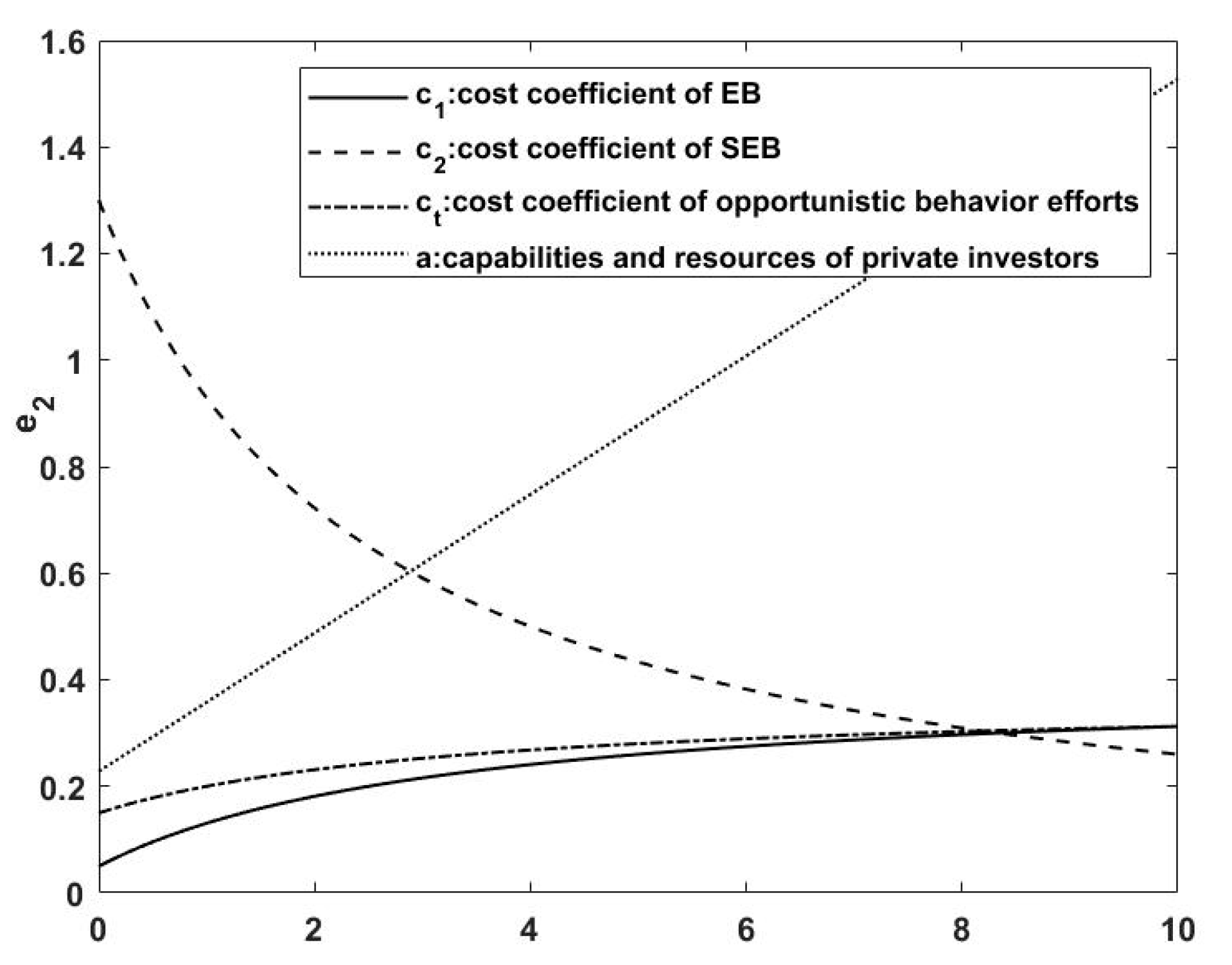

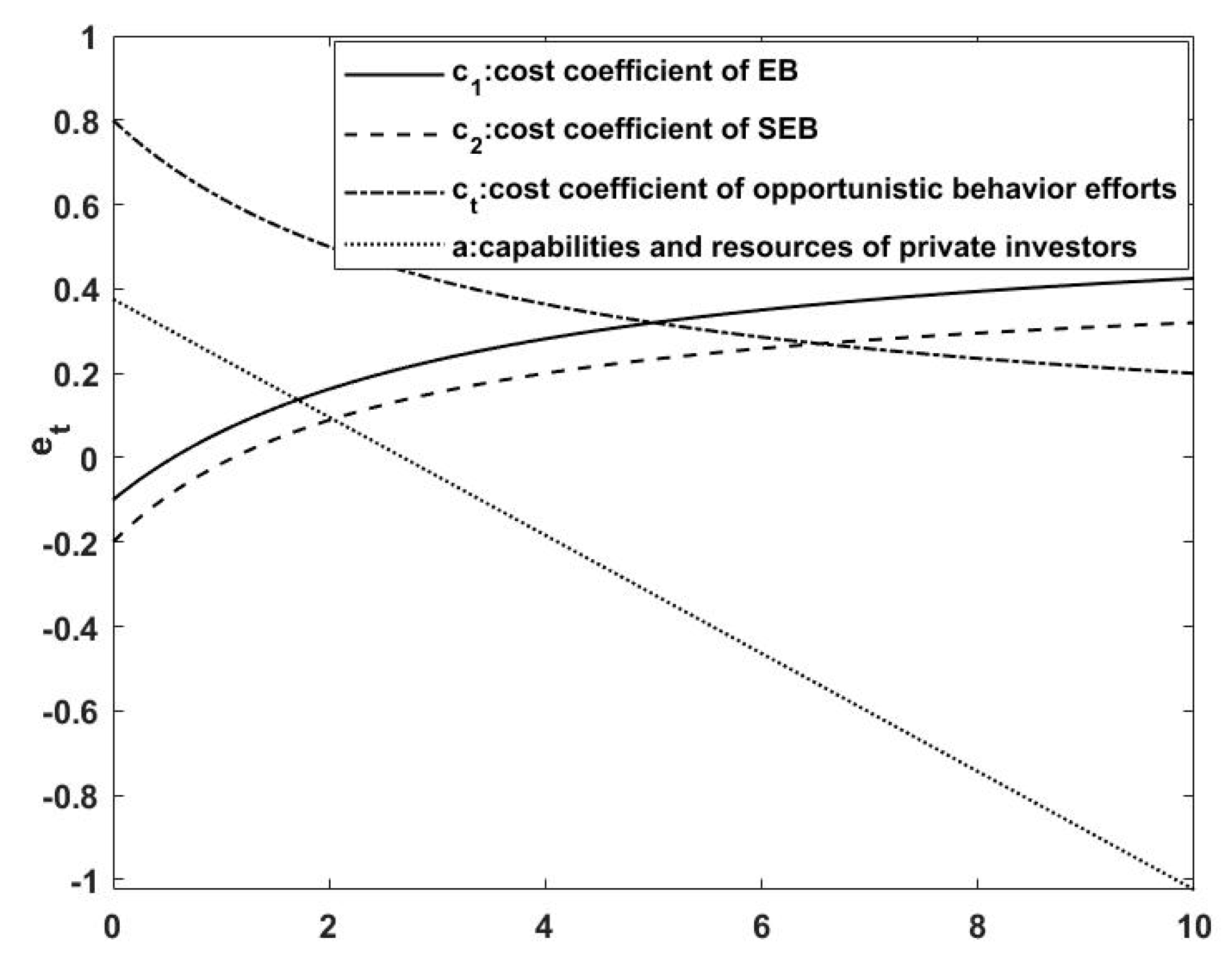

As depicted in

Figure 1,

Figure 2 and

Figure 3, the investors’ efforts and opportunistic behavior are related to the cost coefficient and investment level of the investors’ own resources. The improvement of investors’ own resources helps convert the efforts invested in the project into output benefits and increases government incentives. Therefore, private investors increase output efforts to achieve output benefits rather than engaging in opportunistic behavior. When the cost coefficients (

) increases, more costs are negatively correlated with private investors’ behavior. Since the cost coefficient and resource level is the investor’s own information that cannot be collected by the government due to information asymmetry, the efforts level of output benefits and opportunistic behavior by private investors cannot be observed by the government either. Therefore, the government can only setup incentive mechanisms to encourage investors based on project benefits and governance mechanisms to regulate investors’ opportunistic behavior.

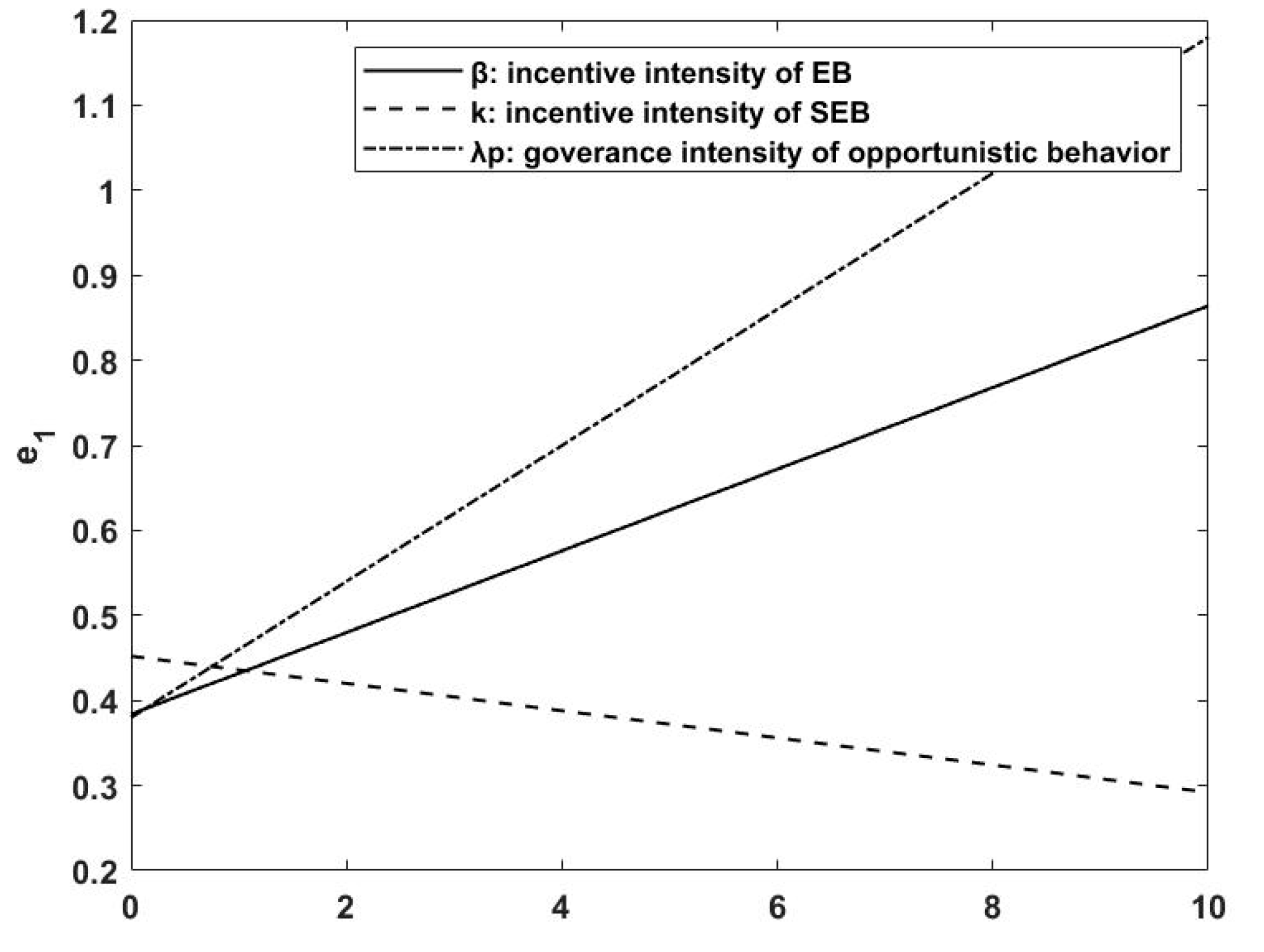

Figure 4,

Figure 5 and

Figure 6 show that the incentive intensity for economic benefits increases the incentive income of economic benefits obtained from the government and enhances the investment level of economic efforts. Moreover, as the efforts of investors are limited, the level of social and ecological benefits decreases as the level of economic efforts increases. The incentives and governance in MSW disposal PPP projects effectively inhibit the opportunistic behavior of investors. Because of the rise in incentives, the income obtained by investors through efforts increase and, due to the existence of governance mechanisms, investors’ opportunistic behavior will be punished once observed by the government. The selection of incentive coefficients for multi-benefits indirectly reflects the importance of benefits to projects and the government. For municipal waste disposal PPP projects, social and ecological benefits largely determine the success or failure of the project. Further, the incentive coefficient (

) is incredibly important.

6. Conclusions

In MSW disposal PPP projects, there are a series of contractual relationships and principal-agent relationships between the government and investors. This paper analyzes the incentive mechanisms of the government and constructs the principal-agent models in the presence of incentives and governance. The results suggest that incentives and supervision are complementary, and the existence of the penalty will enhance that complementarity. To ensure the sustainable development of projects and inhibit the opportunistic behavior of investors, the government must design supervision and punishment mechanisms to encourage investors to improve their investment level of efforts. Combining performance incentives with process governance, and make reasonable assessment payment according to the completion progress of the project. Investors ensure the quality and quantity of projects completion. Taking governance measures, opportunistic behavior will be punished. Third parties can be introduced to conduct governance and establish particular governance institutions for PPP projects of MSW disposal, online media is combined with public governance. To ensure the coordinated and sustainable development of economy, society, and environment for the PPP projects of MSW disposal, and to prevent investors from blindly pursuing economic benefits, the basic social and ecological benefit standards must be set for the PPP project. Although this standard has no incentive, it will have an indirect impact on investors through the influence of fixed income. Investors are risk-averse and prefer a risk-free fixed income. The greater the external uncertainty, the higher the demand for a fixed income. However, the proportion of fixed income, which has no incentive effect, should not be too high when designing principal-agent contracts. The ability and resources of the investors are limited; information asymmetry makes it impossible for the government to know the actual ability level and efforts of the investors. Therefore, the government needs to select qualified partners by access governance and value for money evaluation in the preparation stage of the project. The uncertainty of the external environment and the degree of risk aversion of investors affects the behavior of investors. When designing principal-agent contracts, the government needs to investigate the attitude of the private sector towards risks and the degree of uncertainty of the external environment and develop different incentives and governance mechanisms for different types of investors. For investors in the growth stage with low-risk aversion, the government should increase the incentive strength, and at the same time, governance intensity can appropriately lower. Investors in the mature stage with high-risk aversion should be given lower incentive strength to improve intensity. When the external environment is uncertain, the government should strengthen governance to select whether the benefit of the project come from the efforts of investors or the external market environment, and determine the incentive strength for investors based on this. The results also show the importance of governance mechanism, which can enhance the incentive effect, alleviate the “incentive failure”, and help prevent investors’ moral hazards. In the process of incentive governance, the government payment method and proportion can be made transparent to attract more social capital to participate in the PPP projects of MSW disposal and reduce the uncertainty of projects.