1. Introduction

The agricultural economy of China is one of the largest across the globe [

1]. It is characterized by the highest livestock herds worldwide, which are predominantly raised on grassland by the pastoral households. Livestock farming is highly sensitive to the vagaries of climate change (e.g., drought) that affects the pasture, livestock health, water resources, biodiversity, and the livelihood of herders that is hinged on the natural resources [

2,

3]. When natural pastures decline owing to climatic change or variability and in the absence of modern-risk coping measures [

4], the foremost traditional approach of managing such risk by herding households include storage of forage and water for future use [

5], creation of dry and wet season grazing areas, and splitting of the herd for easy management [

6,

7,

8]. However, these traditional methods of risk management are less efficient due to the co-variability of weather-related challenges faced by herding households [

9,

10]. In this regard, livestock husbandry insurance (LHI) can be a viable market-based tool capable of guaranteeing the protection of livestock assets [

4,

11,

12], stabilizing herders’ income [

13,

14,

15], and curbing the effects of uncertainty on the welfare of relatively poor households [

16,

17].

The implementation of LHI schemes to combat climate-related risks is increasingly gaining ground in developing countries over recent decades [

4,

15,

18]. In China, only five agricultural insurance companies were in operation between 1949 and 2005 [

19], and this number has increased to 26 firms in 2016 listing 170 insurance products for cash crops, main crops, livestock, forests, among others [

1]. In 2007, the Chinese government introduced a new round of subsidized LHI [

19,

20], aimed at enhancing the participation of livestock farmers in insurance purchases. This is because the majority of the herders cannot afford to pay the standard premium rate set by the commercial insurers due to their low economic scale of production and capital inputs [

19,

21]. Furthermore, available statistics show that total premiums collected increased dramatically from USD 0.11 billion in 2006 to USD 2.26 billion in 2010, and USD 6.3 billion in 2016 covering 9.66 M ha, 45.3 M ha, and 115 M ha of cropland, respectively [

1,

22,

23,

24]. The scarcity of such data for LHI likely indicates that the attention of scientists and policymakers in China centers more on crop insurance programs, despite the huge market potential for LHI. To the extent that, welfare outcomes associated with catastrophic risks, herders’ awareness of LHI, and their willingness to purchase such modern risk management products have received less attention in the literature. Thus, we would expect herders’ knowledge of LHI and their willingness to pay for it to diverge in these contexts.

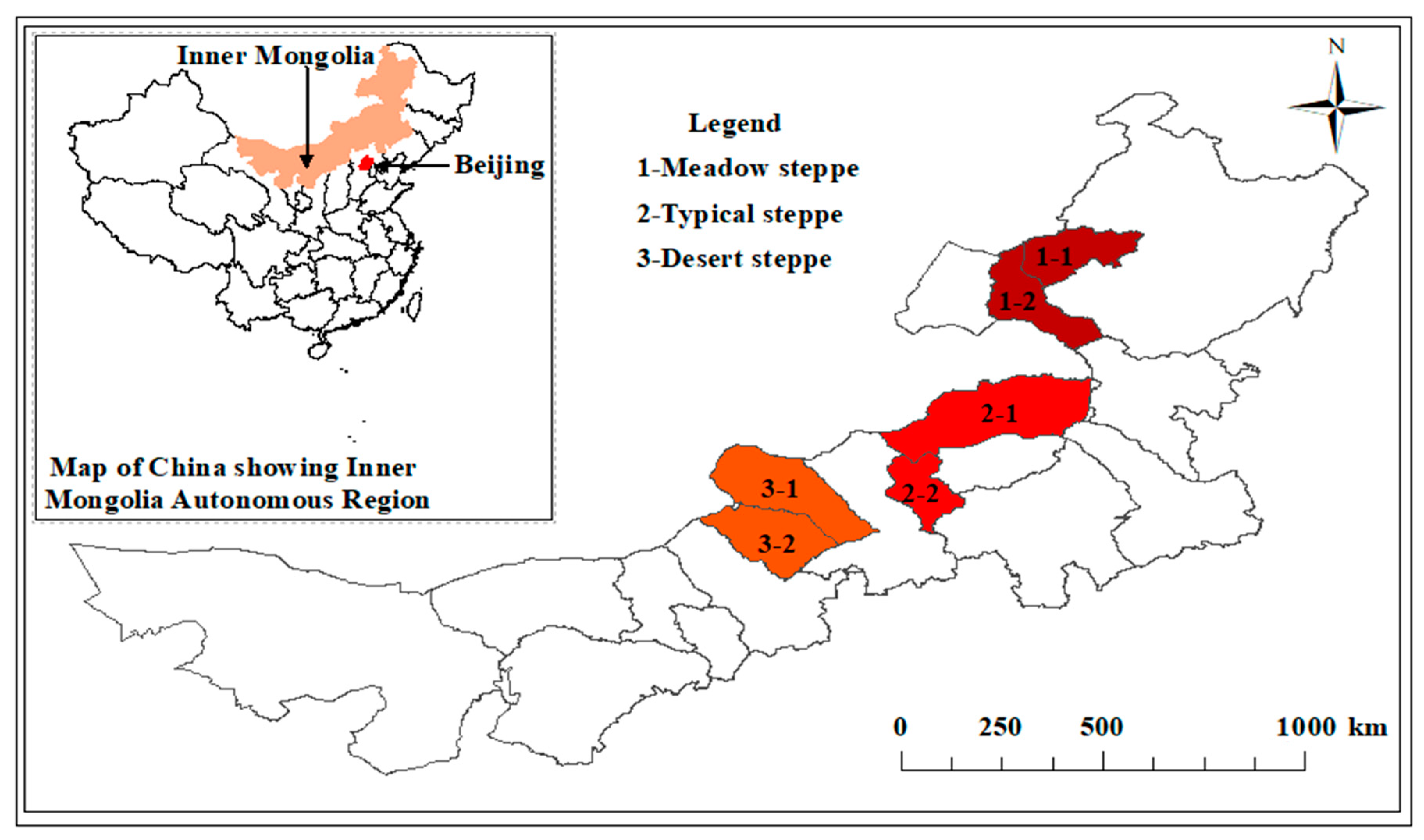

The Inner Mongolia Autonomous Region (IMAR) is one of the primary livestock keeping regions in China. The region is home to some of the most important pastoral areas in China, with 87 million ha of natural grassland accounting for 60% of its total landmass [

25,

26]. IMAR grasslands are famous across the world and herders in this region sustain their livelihood through livestock grazing [

27]. Among the species of livestock kept in this region, sheep, cattle, and horse are of paramount importance [

28,

29]. This is substantiated by the large flocks of sheep, the herd of cattle, and stud of horses owned by the herding households and the existence of organized sheep and cattle market across the region and beyond [

30,

31]. However, livestock losses resulting from heavy snow, drought, and sandstorm are usually met by herders through local infrastructures (e.g., warm shed), borrowing from money lenders, and seldom through government loans [

14,

27], resulting in economic losses induced by climate-related risks. This situation points towards the need for LHI to improve the resilience of vulnerable herders through payouts in the form of income to protect households against covariate climate risks [

5,

18].

Several studies have been carried out on farmers’ level of awareness, perception, and willingness to pay for LHI in developed and developing nations [

4,

5,

9,

13,

15,

32,

33,

34], but little research attention has been given to these critical aspects in the context of Chinese herders. A recent study developed a novel snow-index insurance (SII) that used the percentage grass height covered by snow as the calibration for strike (i.e., trigger for insurance payout) in eastern Inner Mongolia [

27]. They conclude that the SII is superior to existing commercial mortality insurance concerning potential users’ welfare. However, empirical questions that could help increase the adoption of such a new SII and other LHI products are: (1) what is the level of awareness of herders about LHI; and (2) what are the factors that influence herders’ willingness to purchase LHI. Thus, a study of this type, which addresses the aforementioned research questions is relevant for policy actions in China. Results from this study may assist policymakers in understanding the factors that promote the uptake of LHI and inform plans for broader coverage in the pastoral areas. This study may also enhance future research on the methods of effectively scaling-up LHI as an adaptive mechanism to cope with climate change. Hence, the focal objective of this study is to examine the level of awareness and determinants of LHI purchase among herders in the IMAR of China.

4. Discussion

Our empirical analysis shows that herders’ willingness to purchase LHI is not affected by age, gender, whether herders work in the Gacha or not, government assistance, and access to bank loan. This contradicts earlier reports that have shown positive [

37,

38] and negative [

9,

14] effects of age and gender on farmers willingness to participate in insurance. However, Dessart et al. (2019) argued that age is not a behavioral factor that can influence farmers’ decisions on agricultural policies. Other studies have also reported the non-influence of gender on the uptake of crop [

37] and livestock insurance [

4] in Kenya and India.

The result of the logistic regression showed that the level of formal household education positively influences the willingness of herders to purchase LHI. The odds ratio in favor of herders’ willingness to purchase LHI increases by 1.45 for every year of increased education. Our result corroborates the earlier reports [

9,

15,

32] that household education had a positive impact on farmers’ decision to adopt crop and livestock insurance. This can be attributed to three possible reasons: (1) education assists farmers/herders to understand the importance of insurance as a useful tool in mitigating risk in their livestock production [

4,

39]; (2) education improves the knowledge of herders about the consequences of climate change and to see reasons to purchase LHI to minimize its possible impact [

5,

40]; and (3) education enhances the adoption of livestock insurance by broadening the thinking of herders to enhance sound decision making related to risk management [

9,

33].

As the number of herders’ livestock increases, so does the odds ratio in favor of purchasing LHI. Hence, an increase in livestock number necessitates the need for insurance to mitigate livestock losses caused by the covariate risk faced by herding households [

13,

32]. Similarly, other studies also reported a positive correlation between herd size and household’s willingness to pay for index-based livestock insurance (IBLI) in Ethiopia [

5] and Namibia [

32]. Another advantage of LHI in this regard is its potential to reasonably decline distressful herd off-take before or after catastrophic risk which could help to maintain both a household’s economic growth and the grassland ecosystem health [

8,

18]. However, it is worth noting that sustainable grazing is a function of grassland sensitivity to defoliation by grazing animals [

18]. The size of landholding is associated with livestock productivity, higher income, and the ability to pay for agricultural innovations such as insurance [

4,

5]. In this study, we observed a positive relationship between the area of grassland contracted by herders and their ensuing willingness to purchase LHI. This implies that the probability of purchasing LHI increases with an increase in grassland contracted area [

14,

41]. Similar results have been reported in France and Italy, where farm size influenced farmers’ decision to participate in crop insurance [

42].

From the econometric analysis, we found that the odds of herders purchasing LHI increases by 1.30 with a unit increase in the level of awareness. This lends support to the results from Nigeria [

9], Kenya [

33,

37], and India [

4] that awareness positively influenced farmers and herders’ adoption of insurance. Our results suggest the need for insurers, policymakers, and research institutes within the study area to design programs that will focus on educating herders on the potential benefits of insurance (e.g., climate change adaptation; reduced distressful herd off-take) to improve herders’ knowledge of insurance and subsequent uptake of it. For example, in Ethiopia, increased awareness about IBLI successfully increased livestock number insured and the rate of households’ participation from 2012 to 2017 [

5]. In this sense, LHI is capable of improving household welfare and the health of the common property, with an attendant environmental benefit such as economic development and adaptation [

43].

According to [

44], risk perception implies an individual’s assessment of the potential effect of risk in a particular situation. The econometrics results further showed that herders’ risk perception level is an essential factor in determining their willingness to purchase LHI. With a unit increase in the risk perception level of herders, the odds of purchasing LHI increases by 1.38. This is in agreement with the extant literature as well as our a priori expectation [

9,

27,

36,

43]. Although the perception of how much risk is mitigated by insurance may vary among individual herders, however, LHI remains a holistic risk management framework that can improve the resilience of vulnerable herders, promote ecological sustainability, and contribute to agricultural modernization [

5,

11,

18,

45,

46,

47]. To this end, there is a need for further research in the study areas to determine the range of premiums herders are willing to pay for insuring their livestock and the type of insurance products they are likely to patronize. This would help to couple policy insights with designing an acceptable insurance scheme that will boost herders’ confidence to give credence to insurance as a necessary and useful risk management structure.

5. Conclusions

This study was designed to understand the status of livestock husbandry insurance (LHI) across the meadow steppe, typical steppe, and desert steppe of Inner Mongolia, and investigate the critical factors influencing herders’ willingness to pay for it. Our analysis has shown that herders’ level of awareness and acceptance of LHI are below expectations. Besides other reasons such as the possession of small livestock assets that impedes participation in LHI, a majority of herders indicated that the knowledge at their disposal on LHI is inadequate to decide on the purchase of it. This demonstrates that herders need to know more about LHI to make decisive decisions about it. The result also indicated that households’ livestock losses due to catastrophic events were higher for adult sheep than other livestock species and classes, with a perceived economic effect on household livestock income. This suggests the potential need for LHI to cushion the economic shock that can be anticipated from such losses when catastrophic events occur.

The binary logistic regression model results showed that the willingness to purchase livestock insurance is positively influenced by education level, livestock number, risk perception level, awareness, and contracted grassland area. The result suggests the need for policymakers and insurers to design programs that will educate herders on risk management tools (e.g., financial literacy) to improve herders’ awareness of LHI and help them make an informed decision when purchasing insurance products. In addition, government and other stakeholders such as research institutes should make a concerted effort towards policies and outreach programs that will enhance the factors that influence willingness to pay for insurance as found in this study. Insurance products and programs designed to communicate to the herders should be flexible enough to meet the target audience’s need concerning product design, channels of information delivery, etc. The findings from this study narrow down the knowledge gap related to the promotion of LHI uptake in the study area and recommend scaling-up awareness about livestock insurance to enhance its acceptance by herders.

This article mainly studies the willingness of herders to purchase animal husbandry insurance. In future research, we will further quantify the effect of purchasing animal husbandry insurance on the protection of herders’ livestock production; our aim will be to make new and greater contributions for the implementation of animal husbandry insurance in grassland pastoral areas and protect the livelihood of herders.