1. Introduction

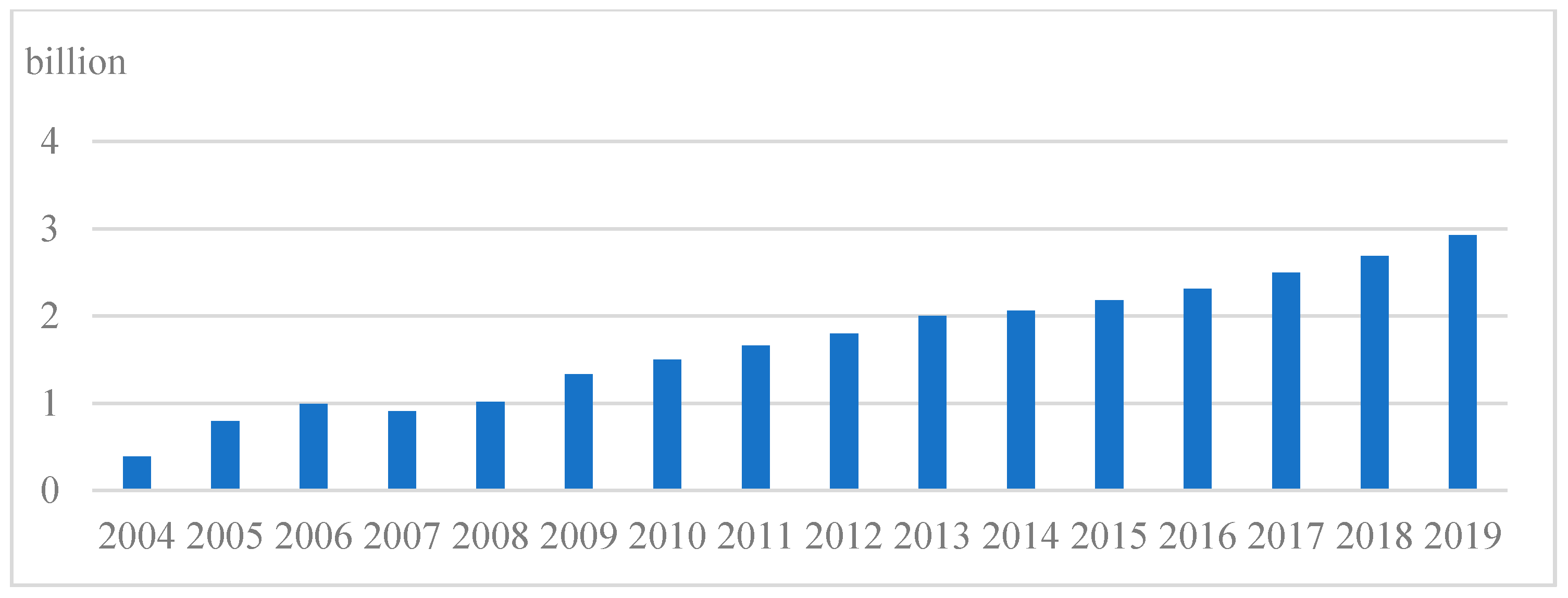

Yangtze River, known as Golden Channel in China, plays an important role in inland waterway transportation and is characterized by its large channel capacity, low transportation cost, and environment-friendliness. It has been the busiest inland waterway with a total freight volume soaring up to 2.93 billion tons in 2019 surpassing the Mississippi River and the Rhine.

Figure 1 exhibits the growth of its freight volumes since 2004 [

1].

The Three Gorges Dam (TGD), which is located in the upper stream of the Yangtze River, has brought many benefits such as power generation, flood prevention, and navigation capacity [

2] since commencing its operation in 2004. However, it has also become a bottleneck due to the growing traffic volume of inland ships and insufficient navigation capacity of the lockage. This has hindered the sustainable development of inland waterway transportation on the Yangtze River. To pass the locks of the TGD, ships have to wait for 3 days on average, or even longer during emergencies (e.g., equipment malfunctions, traffic accidents, and extreme weather conditions), creating costly delays. Moreover, the detained ships cause environmental pollution in the dam area through the emission and discharge of other pollutants [

3].

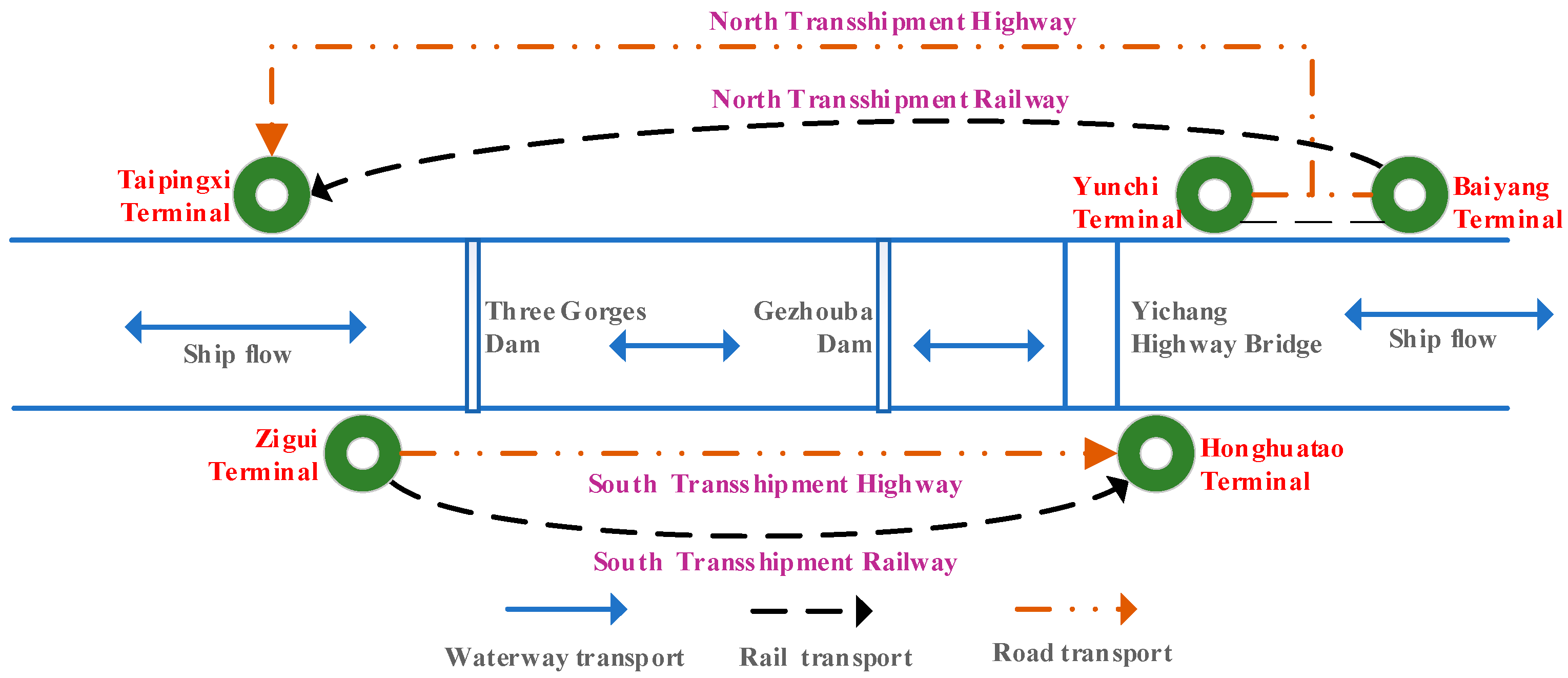

The 20-year long process from planning to completion of the Three Gorges Transshipment Project (TGTP) was designed to solve congestion at the upper end of the Three Gorges Dam and the lower end of the Gezhouba Dam because the capacity extension of the locks is impossible due to spatial and geographical conditions. To resolve the congestion issue, two transshipment systems (both highways and railways) on the sides of the TGD waterway had been planned. Currently, the South Transshipment Highway, which facilitates the transfer of cargos from ships at Zigui Terminal to Baiyang Terminal through Yichang Highway Bridge, is open to traffic (see

Figure 2). Adopting the transshipment system is very likely to result in pollution and endanger environmental sustainability because the emission from road transportation is worse than inland waterway transportation. Nevertheless, the local government has decided to provide 3-year subsidies to encourage roll-on/roll-off (RO-RO) ships and container vessels to adopt transshipment in order to help alleviate congestion and provide a better flow of ship traffic. This situation calls for an investigation on carriers’ behavioral strategies regarding the adoption of transshipment and lockage mode under government subsidy. This study intends to answer this call.

A scrutiny of the extant literature reveals the dearth of research into the TGD transshipment systems. Models regarding lock capacity scheduling and water-land mixed transshipment systems of the TGD were established to optimize the efficiency of ships’ mixed-mode traffic flow by [

3,

4]. They considered the variables of ships, delay time, cost, berths and lockages, and co-scheduling optimization models constructed, which were solved algorithmically to get the optimal solutions. The other study on the TGD transshipment systems explored the impact of different subsidy policies from the government on carriers’ behavioral strategies [

5]. The study used evolutionary game theory and found that subsidy strategies are feasible for carriers to adopt to a transshipment mode. The environmental impact assessment process and major efforts to control environmental problems brought by the construction of the Three Gorges Project were analyzed in [

6], but their focus is beyond the environmental sustainability regarding the ships’ congestion and transshipment. In the above three existing studies, none of them had considered the environmental impacts incurred by lockage delay and a water–land transshipment mode. To fill this gap in the literature, this study intends to answer the following questions.

What is the economic benefit from carriers’ choice of a lockage or transshipment mode when the ship lock approaching channel is congested?

Given the 3-year subsidies on the transshipment cost provided by the local government, what is the impact on the environmental emissions measured by CO2?

What are the carriers’ pricing strategies based on profit under different modes with or without the government subsidies and lockage congestion?

The rest of this paper is organized as follows.

Section 2 presents a literature review and

Section 3 describes the construction of optimization models under lockage and transshipment modes. Then,

Section 4 presents and analyzes simulation results, and

Section 5 draws the conclusion.

2. Literature Review

Numerous measures for solving the congestion of ship-lock capacities have been proposed in the literature. In essence, they can be classified into two research streams: scheduling lockages and expanding lock capacities. Regarding lockage scheduling to improve the efficiency of locks’ capacities, model formulations were developed to clear the queues before the lock [

7]. Taking the lockage co-scheduling problem of Three Gorges Project as an NP-hard problem, Zhang et al. [

8] proposed an algorithm with a co-evolutionary strategy to learn the efficient strategy separately and collaboratively by lockage simulation. A mixed-integer programming model was developed to demonstrate the improvement of lock scheduling relative to simple rules, and a heuristic scheduler and computer simulation were applied to evaluate alternative scheduling mechanisms [

9]. Scholars have investigated the co-scheduling of the Three Gorges–Gezhouba Dams [

10] and a single lock scheduling of the Three Gorges Dam [

11] to get the optimal algorithms to solve different mathematics models. Reynaerts [

12] exploited the geographical variation in the demand patterns for individual locks along the Upper Mississippi River system of locks and dams. A fixed-effects regression model that relates lock congestion to lock usage and lock characteristics was constructed. A panel data set was used to find the optimal parameters that minimize lock congestion. Bugarski et al. [

13] and Kanović et al. [

14] presented optimization techniques to control a ship-locking process to achieve better results in distributing ship arrivals, i.e., shorter waiting times and less empty locks. Verstichel et al. [

15,

16,

17,

18] developed several combinatorial optimization methods for the lock scheduling problem, and the interconnected subproblems were solved with different heuristic approaches to find the optimality.

Recently, with the establishment of a mathematical model for the lockage scheduling of the Three Gorges-Gezhouba Dams, Yuan et al. [

4] proposed heuristic-adjusted strategies to enhance the performance of scheduling. Zhang et al. [

19] proposed a nonparametric model to relieve congestion considering the variables of arrival, waiting, and lockage time of vessels to increase the carrying capacity in the Upper Mississippi River system. Prandtstetter et al. [

20] proposed a variable neighborhood search approach to solve an interdependent lock scheduling problem along the Austrian part of the Danube River, minimizing the overall ship travel times. Passchyn et al. [

21] proposed a dynamic programming algorithm that solved the lockmaster’s problem in polynomial time, O(n3), to minimize the total waiting time of the ships traveling in both directions before a lock. Ji et al. [

22] took the lockage co-scheduling of Three Gorges Dam and Gezhou Dam as an example of a mixed-integer nonlinear optimization problem. They presented an orthogonal design-based nondominated sorting genetic algorithm combined with a time-area series assignment method to optimize the scheduling problem. Passchyn et al. [

23] adopted no-wait schedules and new graph-theoretical concepts to investigate the scheduling of a single lock with parallel chambers, and the algorithmic optimality was obtained for different special cases, including two arbitrary chambers, multiple identical chambers, and multiple arbitrary chambers.

Besides lockage scheduling, another solution to the problem of congestion is expanding the lock capacities. Wilson et al. [

24] developed a spatial optimization model of the world grain trade based on the cost of delays in the Mississippi River system caused by lock congestion. They revealed that with an expansion in the lock capacity, delay costs in 2020 could decrease from USD 1.08 to 0.54 per metric ton. Liao [

25] described expanding the lock capacity in the waterway transportation systems of the Beijing-Hangzhou Grand Canal, Yangtze River, and Xijiang River to reduce severe navigational delays and improve the lock performance in China. Other solutions include adding more parallel channels in dams or a new ship-lifter in the Three Gorges Dam [

8]. However, expanding lock capacities, adding more channels, and constructing lifts incur restrictions based on spatial and geographical conditions and will have significant environmental impacts, making them very costly and difficult to implement. As to the lock scheduling solution, although the delay of ships can be decreased by scheduling locks algorithmically, its effectiveness is limited, especially when the throughput capacity of the locks is far from sufficient [

26]. To our knowledge, there are some relevant studies regarding pricing [

27,

28,

29,

30] and transshipment [

31,

32,

33], however, there is a death of research into the behavioral strategies and the pricing of carriers in adopting lockage modes or transshipment modes, or both, the environmental sustainability of the two modes, and the impact of subsidies from the government on carriers’ transshipment strategies.

This study intends to fill this void. The contributions of this study are as follows. First, it is the first study to consider environmental sustainability, which is impacted by carriers’ behavioral strategies in terms of adopting the modes. Second, it is the first attempt to construct profit-function models that consider pricing strategies at different modes and different scenarios, which provide guidelines for carriers to adopt different modes in TGD inland waterway transportation. Third, the economic benefits of different scenarios are analyzed for carriers’ choices of different modes with optimal prices under various parameters.

4. Results and Analyses

The TGTP can facilitate RO-RO ships and container ships to adopt the water–road–water transshipment mode. Either high-value cargos or low-value cargoes can be transshipped at Zigui or Baiyang Terminals by trucks to avoid long waiting times before the TGD. To better analyze our theoretical results, the transportation of a RO-RO ship loaded with vehicles is taken as an example in our game models. Through the assistance from China Changjiang National Shipping Group Company Ltd., which has carried out transshipment tasks since 2018, we get four data items, i.e.,

,

,

,

. Let

,

,

,

, the waiting cost be 0.52 RMB/vehicle, and the waiting time be 3 days. Through a simulation tool using Python 3.7, we obtained the data for the optimal price and profit under four different scenarios: without subsidies and congestion, with subsidies and without congestion, without subsidies and with congestion, with subsidies and congestion. The results of the analyses for the four scenarios are presented in

Figure 3,

Figure 4,

Figure 5,

Figure 6,

Figure 7,

Figure 8 and

Figure 9. Each figure represents the output of one modeling and simulation experiment. The program codes of the simulation model that generates the two lines of optimal prices in

Figure 3a are exhibited in

Appendix C.

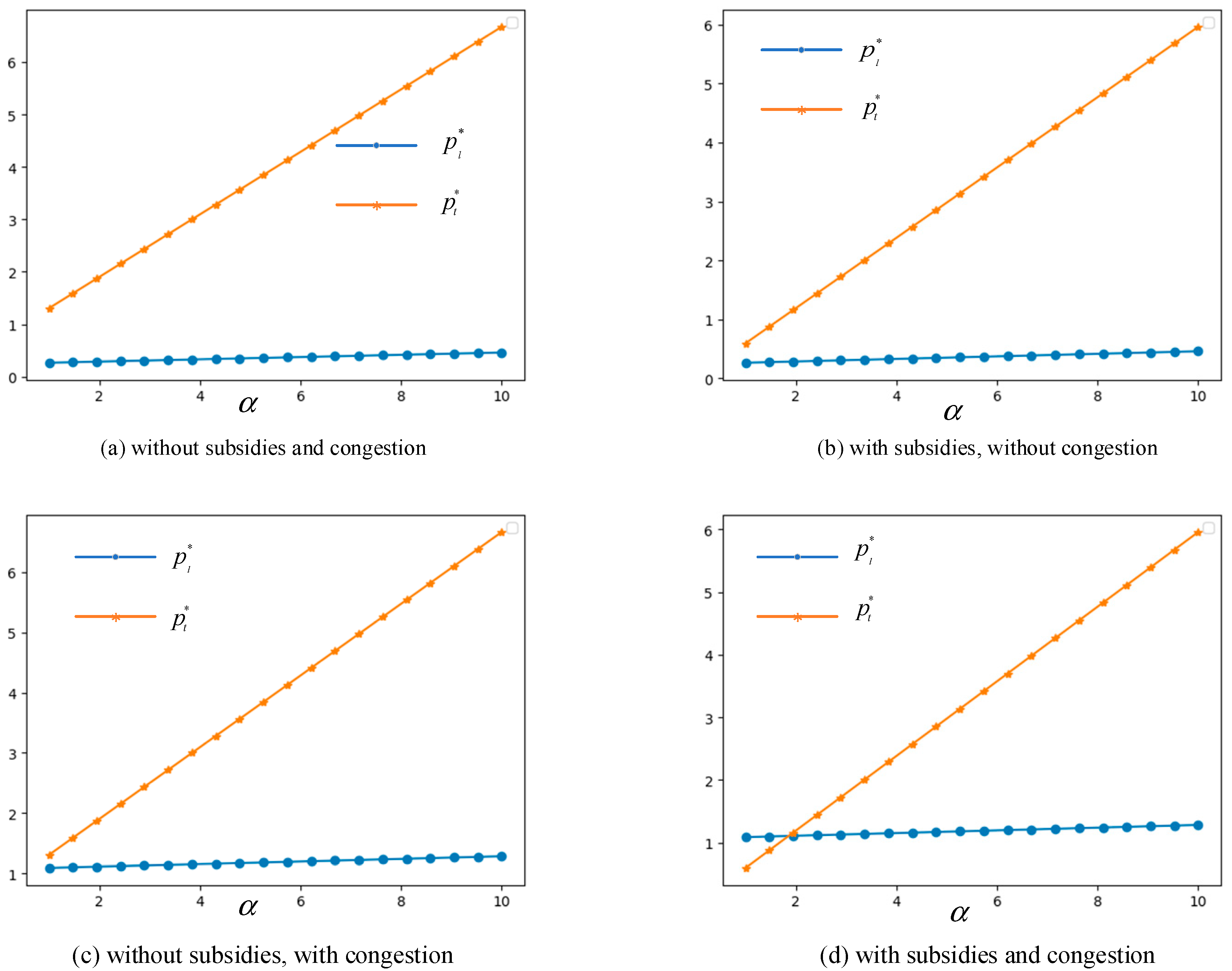

We can see from

Figure 3 that, when the values of

,

,

,

and

are set to 1.5, 0.035, 0.767, 0.1 and 0.1, respectively, the freight price of the transshipment mode, for every scenario, increases sharply with respect to the market potential

, while the freight price of the lockage mode shows small changes with

under different scenarios. In

Figure 3a–c, the value of

has a larger gradient and is always larger than

, which is the same as in

Figure 3d. An intersection in

Figure 3d shows the same value of

and

when

is set at 2. If the optimal profit of the transshipment mode

continues to increase beyond

> 2, the government should provide more subsidies to offset the freight price of transshipment, which can be a burden to shippers.

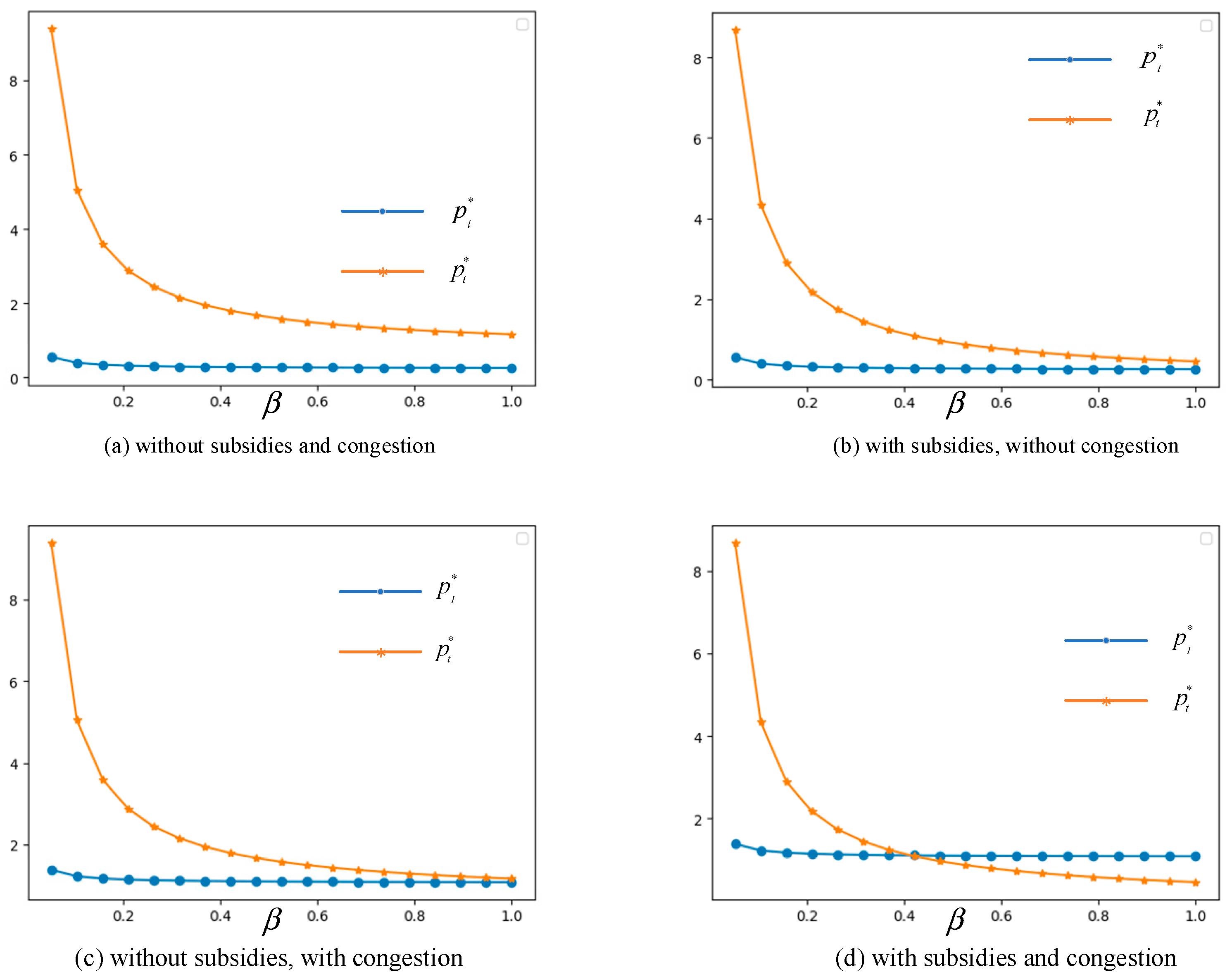

When

, ,

,

,

,

Figure 4 shows that the

of the transshipment mode goes down sharply when

is smaller than 0.2, and descends gradually at a certain level when

increases from 0.2 to 1. The curve of

shows a different trend with minor changes when

increases. In

Figure 4b,c, two curves are near the coincidence state when

. For the scenario under subsidies and congestion, the freight price

of the transshipment mode intersects with the freight price

of the lockage mode when

because the subsidies from the government play an important role in reducing the transshipment cost.

In

Figure 5, the parameters

,

,

,

and

are set as 1.5, 1, 0.767, 0.1 and 0.1, respectively. The simulation results show that optimal freight prices

and

both show different changes with respect to carriers’ loyalty to the lockage mode

. The freight price

of the lockage mode increases in

, while the freight price

of the transshipment mode goes downward in

under different scenarios. In

Figure 5a–c,

intersects with

at different values of

, but there is no intersection in

Figure 5d. The latter shows that if carriers are more inclined to choose the lockage mode, resulting in more congestion and more waiting costs, the price of the lockage mode

is going to be much higher than

.

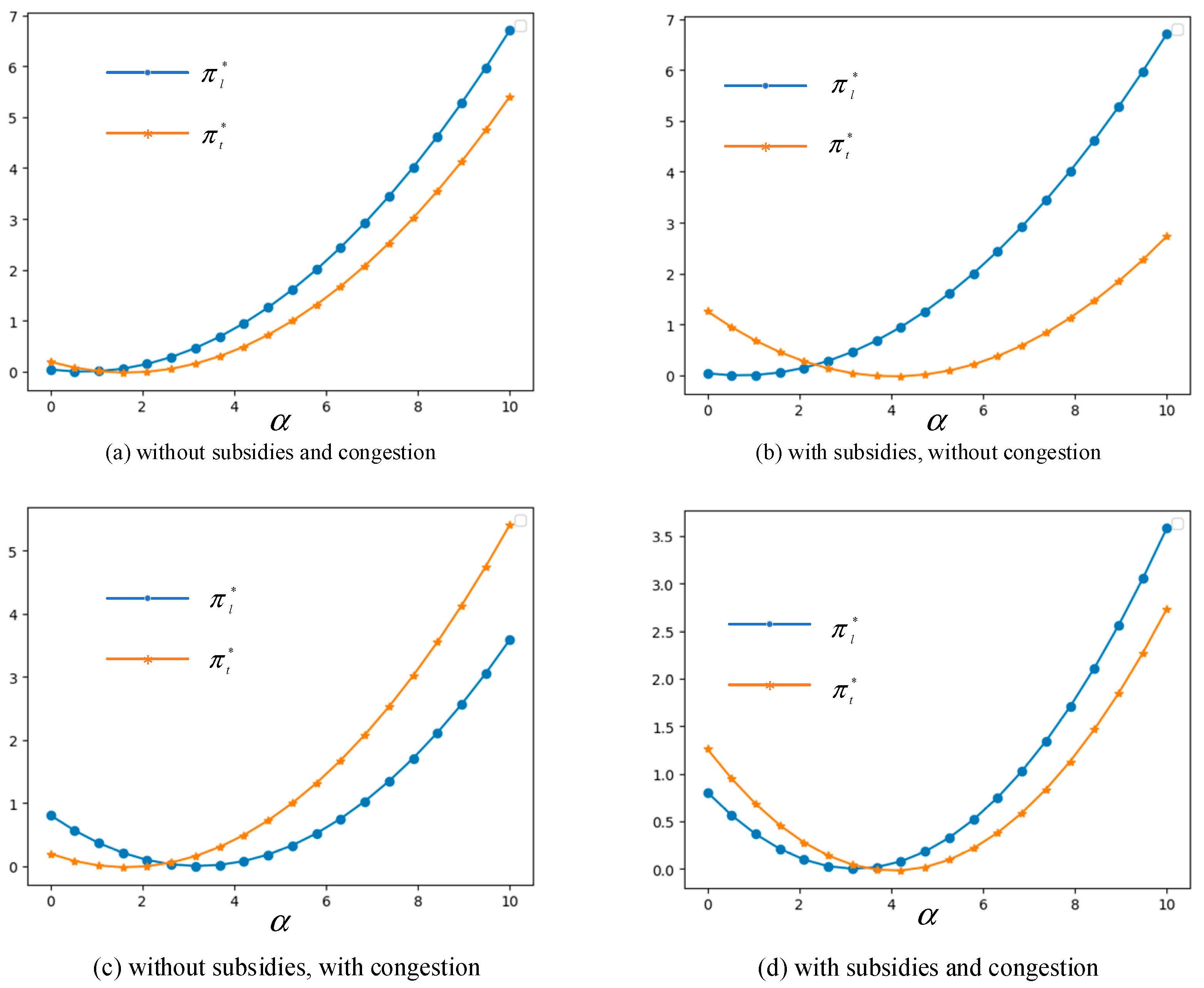

We can see from

Figure 6 that, when

,

,

,

and

are set to 1.5, 0.5, 0.8, 0.1 and 0.1, respectively, all the profit curves increase with

, and show different concave shapes. In

Figure 6a–d,

intersects with

at different values of

. When

is larger than the value of intersection,

is larger than

in

Figure 6a,b, which means that carriers can earn more profits without congestion before the TGD; however, the subsidies from the government are not enough to offset the loss incurred by transshipment transportation, as shown in

Figure 6d. For the without subsidies and with congestion scenario in

Figure 6c, carriers using the transshipment mode can earn more profits because of high delay costs before the TGD when

is larger than the value 2.6.

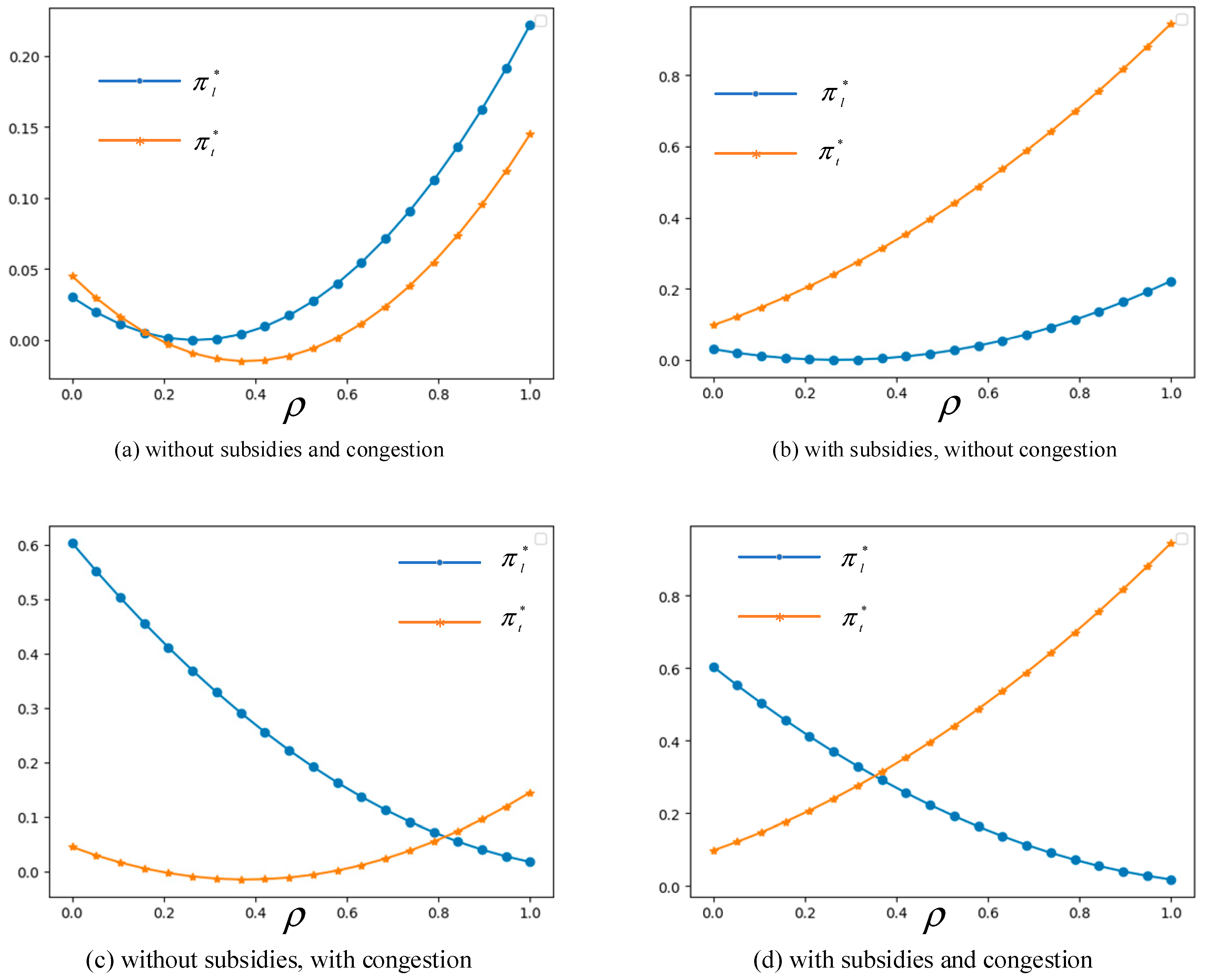

In

Figure 7, we can see that profits with the lockage and transshipment modes show different changes with

when the parameters

,

,

and

are set as 1.5, 0.6, 0.1, and 0.1, respectively. Under the scenario of congestion, the profit of the lockage mode decreases sharply because of the negative impact of congestion; when without congestion, as shown in

Figure 7a,b, the curve of

increases with the lockage loyalty

> 0.3. The profit

of the transshipment mode increases when

increases beyond 0.4 as shown in

Figure 7a,c, which means that if carriers are more inclined to use the lockage mode, it will result in more congestion and a higher waiting cost. Carriers should transfer to the transshipment mode if the government provides reasonable subsidies.

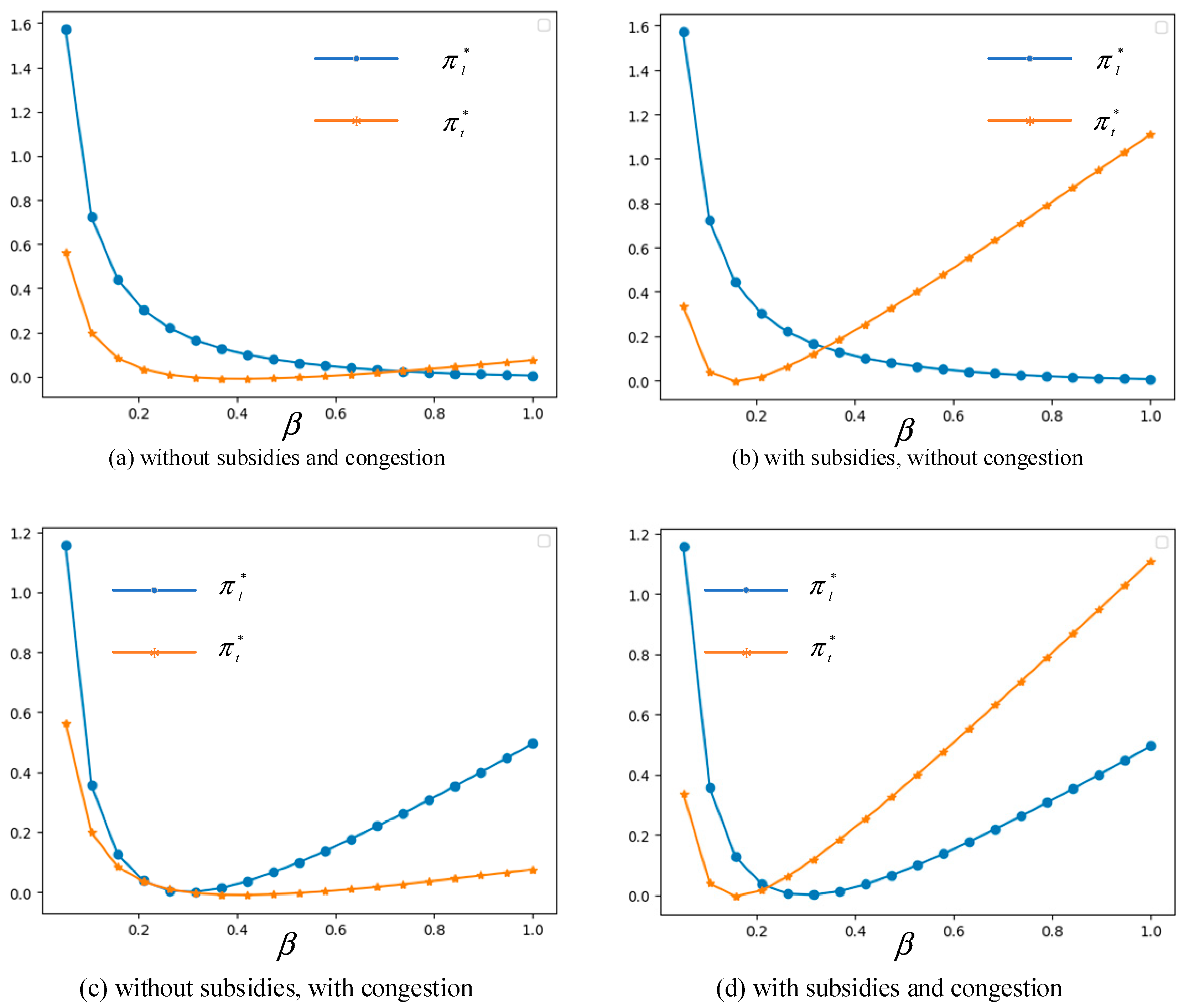

Interestingly, when

,

,

,

and

,

Figure 8 shows different changes of concave curves with an increasing

. The optimal profit with the lockage mode goes downward sharply when

is less than 0.2, then descends gradually in

Figure 8a,b, but continues to grow in

Figure 8c,d. In

Figure 8b,d, the transshipment profit

goes downward sharply when

is less than 0.2, and rises rapidly after that because the subsidies can offset the cost of the transshipment mode. However, in

Figure 8a,c,

goes downward sharply with

at first, and goes up only gradually when

is larger than 0.2 without subsidies. When

is larger than 0.26 under the scenario of without subsidies and with congestion, as shown in

Figure 8c, it is better for carriers to adopt the lockage mode, because carriers can earn more profits.

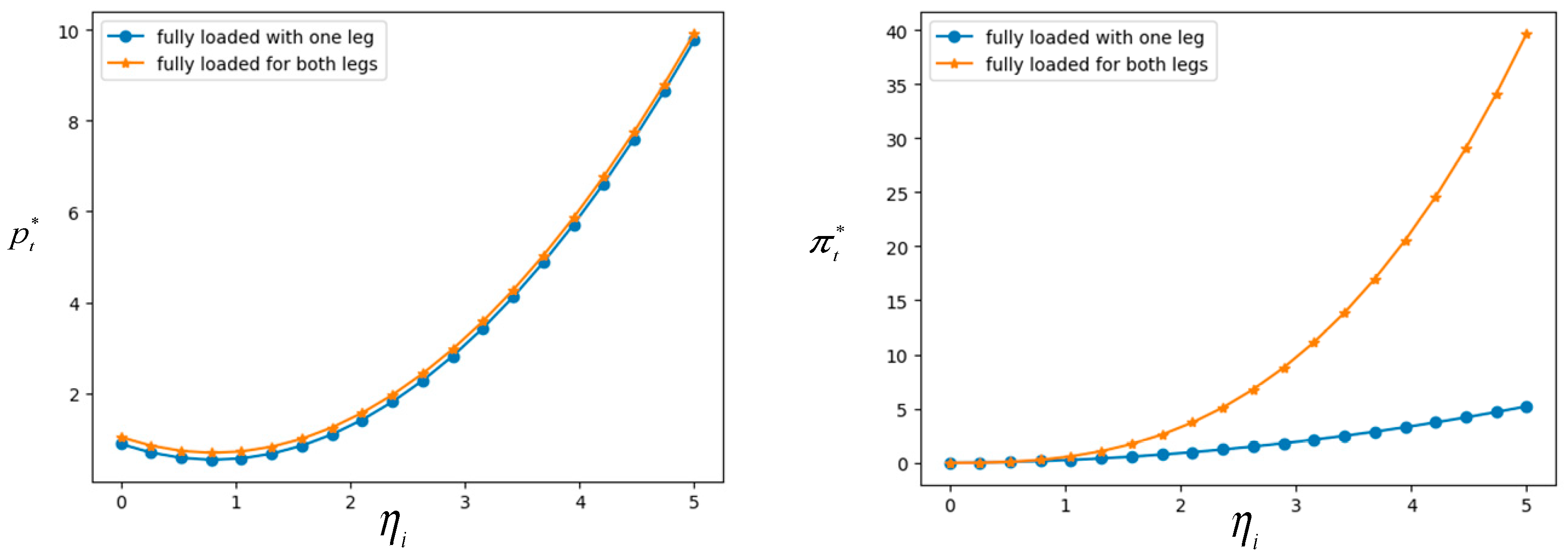

If carriers are to adopt the transshipment mode, trucks should undertake transportation back and forth many times to transship cargoes on ships.

Figure 9 shows that the optimal price

goes upward when subsidy

increases, but the price with fully loaded trucks for both legs is higher than the price for only one leg, which illustrates that carriers can only maximize their profits with high freight prices. However, the curve of profit under the scenario of fully loaded for both legs goes upward sharply when

increases, which means that ship carriers can offset more transportation costs charged by truck carriers.

5. Conclusions

High transshipment costs have discouraged RO-RO and container ships from adopting the transshipment mode. The government attempted to alleviate the traffic flow of ships through subsidies for water–land transshipment, which can ease traffic flow in the waterway. However, it can bring more emissions than inland waterway transportation, resulting in a contradiction between the two modes. Given this issue, two models considering the impacts of environmental emissions under lockage and transshipment modes were constructed. We analyzed how the government subsidies affect the adoption of behavioral strategies by carriers when faced with serious congestion before the TGD. Furthermore, we evaluated the effects of congestion and transshipment on the environment as well as the optimal pricing under different modes, while considering environmental emissions and by varying the values of different parameters. The simulation results showed that subsidies from the government can affect carriers’ transshipment behaviors. If the government offers reasonable subsidies, carriers can provide more competitive pricing to maximize their profits and improve the usage of lockage, resulting in a reduction in emission and an improvement in sustainability.

Based on the simulation analysis of the case study described in

Section 4, we illustrate some results in

Table 2 below. It shows the variations in the unit pricing, unit profit with changes in the unit subsidy and unit freight volume of ships from the simulation, under the setting of parameters:

,

,

,

,

= 0.1. The value of unit social welfare is manually derived from Formula (19) in

Section 3.4. The results verify Corollary 2. As the subsidy from the government grows, both the unit pricing and unit profit decrease, which is beneficial to shippers; but the decreased unit profit is not advantageous to carriers. For example (see the italic numbers in

Table 2), given the freight volume of 800 cars (8 units at 100 cars per unit) and the subsidy is 80,000 RMB in total (8 units at 10,000 RMB per unit), the profit will be 25,056 RMB (8 units at 3132 RMB per unit) and social welfare will be 13,264 (8 units at 1658 RMB per unit) if the carrier’s unit price is set to 270.7 RMB per car. The results offer a guideline for the government to provide a reasonable subsidy to carriers, while carriers can select reasonable pricing accordingly to avoid a substantial loss.

6. Policy Implications

The results of this study offer important implications for policymakers, carriers, and shippers. First, the government must provide guidelines for carriers to adopt the transshipment mode. Too-high transshipment costs will lead to a low pass-through ratio and low willingness of carriers to adopt the transshipment mode, which will aggravate the lock congestion condition. Especially in some emergency states such as locks malfunctions, traffic accidents, and extreme weather conditions, the government should attract carriers to adopt the transshipment mode and alleviate the congestion through more incentive mechanisms, such as subsidies to carriers and shippers, highway toll reductions, and tax benefits.

Second, the pricing of carriers should be more reasonable. When the transshipment of TGTP becomes normalcy, shippers are most likely to adopt an alternative road or railway transportation mode, if the pricing is too high. This will result in carriers suffering from the loss of customers. Similarly, if the pricing is too low, carriers will have low profits from their operations and may face the risk of bankruptcy. Future carriers must be more competitive to provide more diversified services to shippers before the TGD, including water, road, and railway modes. Consequently, shippers can pay different prices to use a more convenient service to meet their own needs. This strategy can be applied to the pricing of other carriers suitable for transshipment in water–land or water–railway mode.

Finally, with the increasing lockage volume and the prolonging waiting cost, that led to a serious backlog of ships before the TGD, a lack of capacity is becoming a barrier to the sustainable development of the Yangtze River. As the longest resourceful river in China, the Yangtze River could take advantage of a large capacity, low cost, and low energy consumption in inland transportation, turning the shipping service into gold. The TGTP can relieve the congestion through the reasonable dredge of ship flow to guarantee the unimpeded traffic of this golden river and assist the sustainable development of the Yangtze River Economic Belt.