1. Introduction

In developed economies, firms in traditional manufacturing industries have suffered substantial losses in their competitive capabilities. Traditional manufacturing industries can be understood as sectors involved in the processing and production of goods that have existed for a long time without much disruption or change. These industries tend to be in the mature or declining phase of their industry life cycle, with recent decline typically associated with globalization where the diffusion of knowledge has enabled production in new foreign locations at lower costs. Classic examples of such traditional manufacturing industries are furniture, toys, textiles, or luggage [

1,

2].

In these industries, globalization has brought not only a considerable increase in competition from Asia but also a series of market changes that have shifted the bargaining power towards the larger distributors. These distributors, especially those that concentrate purchasing power, such as Toys “R” Us, Zara, GAP, H&M, and IKEA, are creating brands through their own channels, and dominating market information and the delivery of the product to the final customer. As such, manufacturers in these traditional industries lack contact with the distribution channels and the final customer, which creates a gap with increased adverse effects.

Besides, the majority of firms in traditional manufacturing industries are generally small, “born-local,” and characterized by a low degree of technological intensity [

2], which find themselves in a particularly complex situation in terms of maintaining competitiveness. Many firms have disappeared as a result or have been forced to relocate manufacturing to developing countries—especially China—in the search for cost advantages.

However, several changes in recent years could help these small firms address this situation. On the one hand, we find several geopolitical trends such as rising labor costs in China and other emerging economies, high supply chain and logistics costs, the rise of protectionism and nationalism, slowing global economic growth, and increasing consumer concerns about sustainability and ethics. On the other hand, at the firm level, we can point to the rapid evolution of innovations in information, communication, and manufacturing technologies. Both dimensions are redefining the economic, business, and political framework that has shaped our understanding of globalization for the past half-century [

3]. These new trends are creating new opportunities for a manufacturing resurgence in developed countries based on sustainability digitalization, smaller-scale production, and customization [

4,

5]. In fact, after several years of forced adjustments and adaptation to the global context, numerous small and medium-sized manufacturing enterprises from developed countries are restructuring their strategies to compete internationally, grow, and consolidate.

In such a scenario, the present study aims to advance our knowledge on the competitiveness of firms in traditional manufacturing industries by investigating the strategies implemented by four small and medium-sized enterprises that have focused on survival and growth while operating in these industries. Following an inductive methodological approach, we conduct an explorative multiple-case study analysis, which addresses the following research questions: (1) How do firms confront the new challenges of the global environment within the context of these manufacturing industries? (2) How does the combination of different strategic responses generate a new model of high-performing small and medium-sized enterprises and favor the backshoring of some manufacturing processes to developed economies? (3) How does this model fit the assumptions proposed by configurational theory.

In doing so, we contribute to the literature in three distinct ways. First, we adopt a “model-theoretic” perspective [

6]. The models generated by this view can constitute a standpoint driving both systematic empirical investigation and managerial practice, in that they illustrate specific aspects of real-world phenomena. In this sense, the description of the model implemented by these firms allows us to offer a more dynamic and complete vision of the interrelationships between the strategy and the new conditions of the environment in these industries. Second, the impact of the industry conditions on the firm growth and survival has been extensively explored by configurational theory [

7,

8]. However, this literature has been somewhat undeveloped over the last decades and, with some notable exceptions [

8,

9,

10,

11], rarely applied to small and medium firms facing the manufacturing challenges of today’s global environment. We provide new empirical evidence on how steps taken by these small and medium-sized enterprises to deal with new industry conditions are adjusted to the high-performance models prescribed by the literature. This verification will contribute to advance our knowledge on configurational theory in this specific research setting.

Third, at the practitioner level, these cases help us make recommendations and point to possible benchmarks for a more robust model that reinforces competitiveness in these industries. As such, our study offers managers and policymakers a useful framework for understanding the strategies needed to achieve competitive advantages in an era of global retrenchment and, thereby, superior performance in these traditional industries.

We use theoretical insights from configurational theory and empirical inspiration based on management practices to provide a conceptual model. Therefore, we proceed as follows. We first review some theoretical background that helps us in the design of our empirical analysis. We then provide details on the methodology and the selected cases studies, followed by the empirical findings. Finally, adopting a configurational logic, we present the conceptual model of high-performing firms based on five interlinked strategic-development axes and discuss conclusions, limitations, and the implications of the study for managers and policymakers.

2. Theoretical Background: A Configurational Approach

Based on the assumptions of configurational theory, two streams of research appear to dominate research on competitiveness in manufacturing industries. The first one concentrates on the “strategic fit” in an attempt to identify the most successful models for different environments [

12,

13,

14,

15]. The main thesis of this approach is that manufacturing strategy, competitive strategy, environment, and structure are configured or interlinked such that there are natural congruencies between these elements [

16]. Most of these studies concluded that under stable market conditions, firms tend to pursue more conservative strategies. Conversely, in highly uncertain conditions, the more entrepreneurial and innovative firms achieve better results [

17,

18].

One of the issues that has recently aroused the interest of research in this area is the identification of archetypes of high-performance strategies to deal with the changing conditions of the global environment [

19,

20,

21]. These studies find common elements between different organizations that help to find the most competitive patterns of strategic behavior. Such patterns are identified based on the company’s position along different dimensions that configure the strategy as a multidimensional construct. In the context of manufacturing small and medium-sized enterprises, there are several works applied mainly in samples of German manufacturing firms screening the main dimensions that shape this highly competitive industrial model [

22,

23,

24].

First, this model is characterized by a competitive scope based on global niches with high-quality products and services in both the business-to-business and durable goods markets. Most of these small and medium-sized enterprises tend to be specialists that provide specific solutions addressing a global need. They foster loyalty among their clients through the development of products that generate long-term relationships and mutual dependence [

25]. In this sense, product or service innovations are not created through scientific research, but instead by solving the new needs of their clients.

Second, the model encompasses a search for operational efficiency while maintaining an adequate combination of local production and offshoring [

2]. The most valuable activities, which are carried out in the country of origin, are integrated with the research and development departments and emphasize continuous improvements in products and processes in collaboration with clients. In many cases, when these companies produce outside, they do not eliminate local production, as these investments are driven by the need to be closer to the markets.

Third, this model has a governance system based on “family capitalism” [

26]. The vast majority of these small and medium-sized enterprises are family-owned but have both professional managers and family members on their boards. The family members still maintain control and play a decisive role in the transmission of a clear mission and values. Long-term survival (rather than financial success), identification with the local context, and a search for consensus among all stakeholders are the fundamental pillars of this system [

27].

The second stream of research focuses on the combination of different dimensions of internationalization for firm success [

28,

29,

30]. Internationalization allows firms to increase their total sales and efficiency, learn from foreign markets, and reduce the risk of depending on a single country [

10,

31]. The most recent literature [

32,

33,

34,

35,

36,

37,

38] identifies a model of high-performing small and medium-sized enterprises characterized by the interplay of three fundamental elements of the international strategy.

First, this model involves a sequential internationalization process based on the accumulation of experience and learning [

39,

40]. The process combines low-commitment (e.g., exports) operation modes with more intensive use of the most advanced operation modes (e.g., subsidiaries, joint ventures, cooperation agreements). In fact, many of these firms could be considered as micro-multinationals [

32,

41]. Market entry through the establishment of subsidiaries does not occur simultaneously in many countries but rather through a selective, orderly, and incremental process in which the production subsidiaries tend to be centralized in the country of origin or in a few countries, while the sales subsidiaries and networks tend to be more geographically dispersed [

33]. These operation modes with higher commitment permit to capture opportunities in foreign markets better, since they involve closer interaction with the host country to access the diversity of knowledge, skills, and human resources available in these markets. At the same time, the new knowledge reinforces the stock of information in the country of origin, which in turn, facilitates the consolidation of a global mentality in the organization as well as the adoption of new forms of innovation and internationalization [

42].

Second, the model combines incremental technological innovations with organizational innovations. The latter element is highly relevant in traditional industries, which typically have little room for radical innovation [

43]. These innovations not only arise from the organization itself but are also often driven by relationships with customers or suppliers.

Finally, in these models, networks that help to boost the internationalization process are of key importance [

37,

39]. These networks become a significant channel for small and medium-sized enterprises to take advantage of tangible and intangible external resources and achieve economies of scale. Such relationships influence the company’s future capabilities, as they provide new experiences, resources, and knowledge, which positively affect the company’s organizational learning and, thereby, its penetration of new international markets [

36,

44].

3. Methods

3.1. Research Design, Setting, and Data Collection

The literature review is an initial step that helps us in the design of the empirical analysis. Due to the explorative nature of our research and the aim of providing a conceptual model, we used an inductive methodology involving the study of multiple cases that we considered valid for illustrating good management practices due to their relevance. Such multiple case research allows the theory to be better grounded in more varied evidence permitting cross-case comparison and analytic generalization and, therefore, an increase in the external validity of the research design [

45].

Based on the theoretical framework and using the ORBIS database, we designed a non-random sample selection [

46]. The criteria for selecting the case firms were the following: (i) European companies active in different traditional manufacturing industries; (ii) small and medium-sized enterprises following the European Commission definition (fewer than 250 employees and 50 million euros of sales at the beginning of the focal period 2014–2018); (iii) independent companies not belonging to any international group; and (iv) firms with consistent and outstanding growth in terms of sales and number of employees during the focal period 2014–2018. This last condition was required to include cases in which the phenomena of interest (high performing) were clearly observable [

47].

After contacting several companies, four leading companies located in Spain agreed to participate in the study. The four companies operate in different traditional industries (bathroom furniture, textiles, luggage, and toys) and with varying degrees of experience and geographical reach, which allows variation in the sample. Eisenhardt [

47] suggests that four to 10 cases can usually serve as an adequate sample to achieve a sound level of theoretical saturation for comparative case study analysis.

For data collection, we used different strategies and different data sources to ensure construct validity. Our main data sources were semi-structured interviews with the managers of each company, other company documents (annual reports, web pages, news articles), and secondary data compiled through ORBIS database. The analysis of this documentation allowed us to triangulate the information, which ultimately contributed to completing and improving the reliability of the study [

45].

We compiled preliminary information on each company and prepared an initial interview protocol configured on the basis of our initial theoretical review and focused on issues related to the company’s business model, strategic objectives, main markets and products, family involvement in the development of the business model, growth strategy, and the evolution of the internationalization process. As the interviews progressed, the questions gradually become less structured and more focused on CEOs’ views on new trends in the global environment and the future of manufacturing in Europe.

We interview the CEO of each company and some key managers. We conducted between three and four face-to-face interviews in each company, each interview lasting between 60 and 180 min in length, during 2018 and 2019. We were careful not to influence the interviewees in their responses, trying to share as little as possible of our prior knowledge. Finally, all this initial information was contrasted with secondary data and summarized in the form of a case report with extensive use of citations from both the interviews and documents to achieve a high level of accuracy [

48]. These cases were submitted for factual verification by the CEO asking to comment or add to the final draft of the case reports.

Table 1 provides details on the firms constituting our research context and the process of data collection. All of these companies experienced a considerable increase in sales and employees throughout the focal period. Companies’ names are hidden due to confidentiality reasons.

Alpha is a manufacturing firm in the bathroom furniture industry founded in 1972. The company is located in the heart of the furniture industrial district in the city of Valencia. Alpha is a European leader in this industry. It has commercial and industrial activities in Europe, Asia, and the US. In 2018, 80% of its sales came from its presence in 60 countries.

Beta is a manufacturing firm in the textile industry founded in 2002. This company is located in the main industrial district of home-textiles in Spain (Ontinyent-Alcoi). It is engaged in the manufacture and distribution of mattress covers. This company is considered to be one of the first European manufacturers of cases and protectors for mattresses and pillows. The percentage of exports reached 60% in 2018.

Gamma is a manufacturing company in the luggage industry created in 2008. This company is located near the city of Valencia. It covers all kinds of needs in the school and travel world through the production of backpacks, suitcases, bags, travel bags, and wallets. The company is exporting 50% of its sales in more than 41 countries through distributors, agents, and specialized customers.

Delta is located in the main industrial toy district in Spain (Ibi-Onil) near the city of Alicante. It was created in 1986. The company is engaged in the manufacture and sale of baby products, educational toys, and promotional items. Its commitment to educational material has made it a European reference company that is present in more than 50 countries. It exports 60% of its sales.

3.2. Data Analysis Strategy

We use different schemes, summaries, and codes for data analysis so that all the researchers had a clear and common idea of the empirical basis collected. In the qualitative methodology, the data collected are translated into categories in order to make comparisons and possible contrasts, so that data can be organized conceptually and the information displayed according to some pattern or emergent regularity [

49]. In this sense, we carried out an iterative process of abstraction through which we moved from the experience of managers as stated in their own words (codes of first-order concepts) to theory elaboration through second-order concepts and aggregate theoretical dimensions [

50].

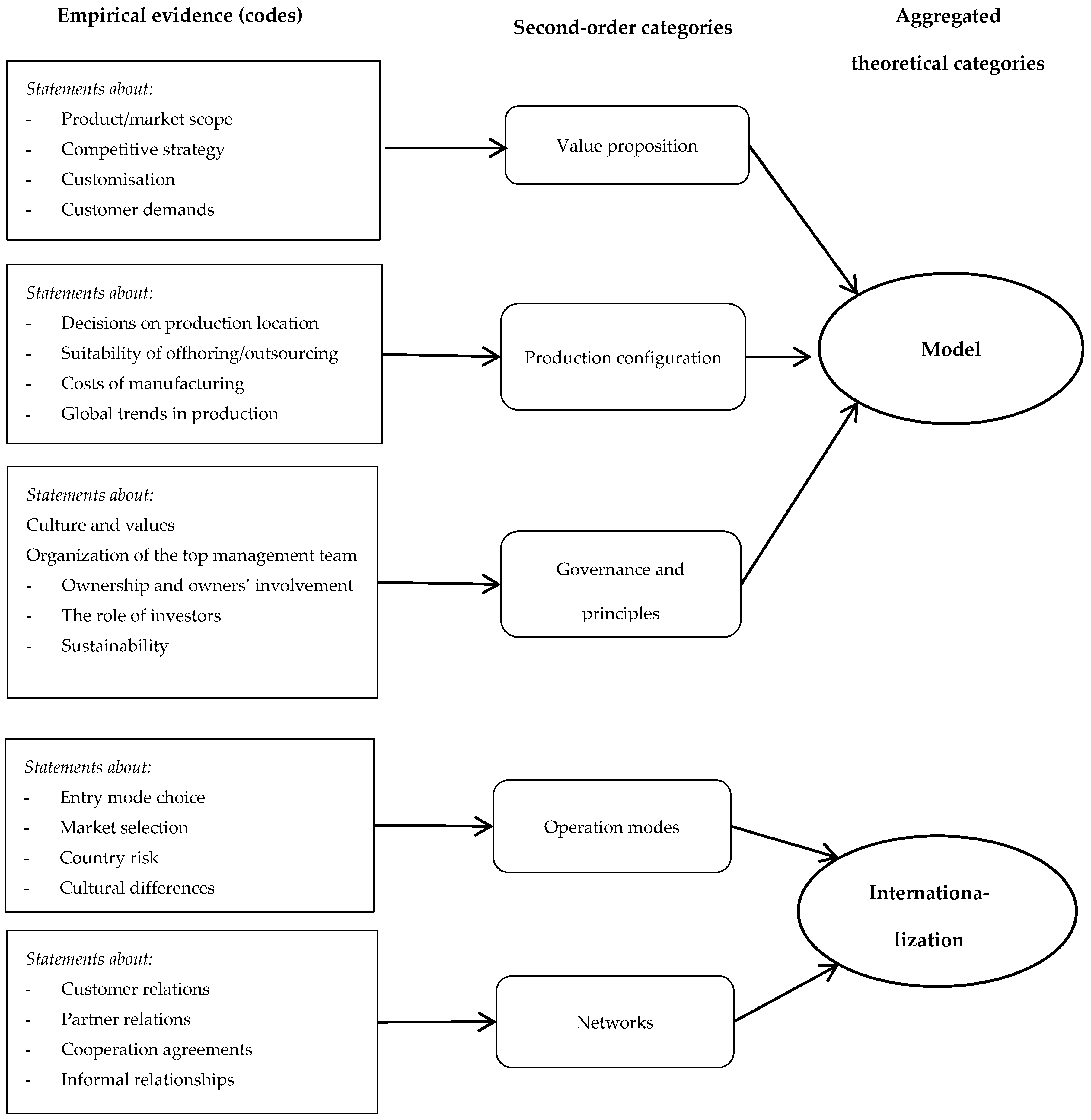

First, we ordered all the managers’ statements to observe similarities and differences among them. These first-order concepts represent the companies’ realities as well as managers’ experiences and visions related to the challenges associated with their strategies. Second, we grouped the first-order codes into second-order concepts that were relevant for our research objective. These concepts were more abstract and represented the theoretical dimensions that helped to simplify the information contained in the codes. The second-order concepts that emerged were: (a) The value proposition, (b) the configuration of production, (c) governance and principles, (d) operation modes, and (e) the importance of international networks. Third, we arrived at the second level of abstraction by aggregating the second-order concepts into the more general concepts: “How the company operates” (the model) and “how the company faces the international dimension” (the internationalization process).

Figure 1, which provides a visualization of how we advanced from pure data to theoretical themes and concepts, represents the framework on which we organize our discussion.

4. Findings and Discussion

Our analysis of the managers’ comments and the companies’ data serves to illustrate many of the elements that define the theoretical models of high-performance companies. This data triangulation by supplementing the interviews with secondary data assures the internal validity of the research. In this section, we report only data that is consistent across informants and other sources.

4.1. The Model

4.1.1. The Value Proposition

The focal companies implemented global niche strategies and adopted value propositions based on differentiation, agility, and customization [

19]. This is in line with research highlighting the importance of customer orientation, a niche strategy, and internationalization for SME success. This move allowed these firms to “shelter from the storm” [

10]. All the firms were specialists focused on a specific area of their respective industries that could be served at a global level. Alpha was in the bathroom furniture manufacturing sector, Beta produced mattress protectors and pillows, Gamma manufactured suitcases and bags, and Delta produced educational toys.

Alpha’s CEO indicated that “the need we cover is the same globally. However, as we are manufacturers, we have enough flexibility to introduce differentiating elements in our products based on the specific requests of our customers. Initially, we did not diversify our offering because we wanted to be the leaders in what we knew how to do well”. Along similar lines, Gamma’s CEO stated, “I try to sign license agreements that have global coverage or at least coverage at the European level. For example, you can sell a bag with Disney or Marvel designs anywhere. If you look for local licenses, your possibilities for growth are limited. With products that incorporate a license, we want to cover the same need, at least on the European level”.

The four firms also highlighted the importance of generating value for their customers through differentiation, agility, and customization. Therefore, by offering innovative, customized, and unique solutions, smaller firms can successfully compete with well-established incumbents and create new demand [

19]. In this sense, the four firms seemed to master the skills and capabilities they needed to sustain their competitive advantage. Beta’s Head of Production affirmed this view: “Mattress protectors are a global commodity that relates to neither fashion nor design. The keys are variety, marketing, and innovation. We develop products that regulate the temperature of the mattress or introduce anti-allergy elements… textile manufacturing has a future in Europe but only if it is based on quality, innovation, customization, and agility. Our clients want shorter production times and a lot of agility in the services they need. Therefore, they are willing to pay a little extra”. For Gamma’s CEO, an important trend in the luggage industry was product customization: “With the advent of digital printing, we can personalize our offering for each main client. The suitcase may be the same, but the final design is adapted to the requirements or tastes of each customer”.

Alpha’s CEO remarked that the company’s foreign subsidiaries were essential for adapting the offering to the tastes and needs of each country. The same global niche was covered in each country, yet the focus changed, giving the product greater differentiation through design and, above all, adaptations that fit the clients’ needs thanks to first-hand information from the subsidiaries. In this regard, the CEO stated: “In the 1990s, we created sales subsidiaries in the main markets where we had more export experience. These subsidiaries were legal entities and had considerable operational autonomy. This autonomy was essential for enabling us to understand the markets and product-adaptation needs. Proximity to the customer is key when selling abroad. You can see the reality of the market, the speed of change, competitors’ behaviors, and the evolution of the consumer”.

In the same vein, Delta’s Head of Exports remarked on the importance of its US subsidiary for product adaptation: “We created our subsidiary in the US to be closer the final customer and to learn about the American system of education. The US market is highly complex. You need to be in it to understand the trends and adapt your offering”.

4.1.2. The Configuration of Production

The four firms mainly produced in Europe. Although they had experience with outsourcing in China, most of their core production processes were located in their home countries. However, the configuration of production differed in each firm according to their degree of international experience. Two key issues that each CEO highlighted were: (a) The necessity of finding the optimal balance between outsourcing/offshoring and local production in the global manufacturing network, and (b) the opportunities that new manufacturing technologies created to re-shore previously offshored production activities. All the companies pointed at the need to invest in the latest technological trends associated with Industry 4.0 [

51].

The most experienced firm, Alpha, had regional production. It had a factory in Spain to serve southern Europe, two factories in Poland to supply central and northern Europe, and a factory in Mexico to serve the Latin American markets. These production subsidiaries handled most activities in the value chain from design and production to after-sales services. As such, they perceived themselves as local players that competed on local parameters (Alpha web page). Alpha’s CEO justified this decision by stressing the need to balance costs and adapt to local demands: “The Polish factories allow us to be more competitive in Germany and neighboring countries not only because of the costs, but also because they permit to adapt our products to local requirements. Although the industrial processes are the same, furniture designs vary from one market to another in terms of sizes, colors, and materials. Therefore, there are no synergies at other levels, such as marketing, design, sales, or distribution”.

The luggage producer Gamma was the only company that had outsourced the majority of its production to China. However, considering new consumer behaviors, the need to customize, and demands for agile solutions, the firm was backshoring some of its production processes:

“Increasingly, our final consumers are buying through the Internet (through our website or marketplaces). They want customization and even personalization. Besides, we need to be more agile and responsive. For example, selling to Amazon means that you need to have the inventory in-house and respond daily. If I buy the final product directly from China, I cannot respond to these trends. Therefore, for certain collections based on more sophisticated designs, I have the final printing process in-house. I am also studying new projects related to 3D printing” (Gamma CEO).

Delta, like many other firms in the toy industry, had re-shored its main production lines from China to Europe due to the increasing costs there and problems with delivery time (Europa Press, 2018). In addition, the increasing concerns of customers in some markets about sustainability and ethics made products manufactured in Europe more attractive:

“By bringing back the production, we lost 25% of our margin, but we won in terms of improving quality control and speed when responding to requests. We make 54% of sales during the Christmas season and now we can replace the most successful products, even if they are a couple of units. We put the ‘Made in Europe’ stamp on our products as European manufacturing is highly valued in the United States and implies better quality than ‘Made in China.’ This strategy has also helped protect us against illegal copies” (Delta CEO).

Beta maintains all production activities in Europe, where it combines its own production with local outsourcing. It also takes advantage of nearby auxiliary industries, since it is located near the heart of a local textile cluster:

“Producing in Europe has allowed us to offer very innovative products and successfully meet the high-quality standards of large European distributors, such as Zara or Ikea. We must continue investing in new machinery to offer these customers sustainable innovations that differentiate us from our Chinese competitors. Additionally, keeping the manufacturing process in-house is important for ensuring learning and innovation through interactions between designers and operators. Manufacturing a quality product here can cost 10% to 15% more than in China, but you should assess whether if moving production to China is worth the risk of problems related to quality, safety, delivery delays, or errors. Obviously, in our industry, if your product is cost-based, then you have to manufacture in China” (Beta Head of Production).

4.1.3. Governance and Principles

All the companies interviewed shared the characteristics generally associated with family firms: Being committed, responsible, fair, hardworking, and long-term oriented. However, although the founding families still played an important role in the four cases, in two of the companies we observed the features of “family capitalism”—a management team that includes a combination of professional executives and family members. For example, Delta’s board of directors had four family members and three professional members, including the CEO (Delta 2018 Annual Report).

Alpha was the most advanced firm in this regard. The group was managed by the second generation of the family, with one of the founder’s sons occupying the CEO position and the founder serving as honorary president. A US-based investment fund had recently joined its board of directors with the aim of consolidating its European presence and accelerating its growth through selective acquisitions in the ensuing five years for a total of up to 300 million € (Alpha 2018 Annual Report). The CEO described this as follows: “We were convinced that to ensure long-term survival, we needed to further professionalize our management by incorporating financial partners who could provide capital and new knowledge. The entrance of this investment fund is linked to our clear strategic objective of becoming the European leader in our niche market”.

Another value that the four firms shared was a commitment to corporate social responsibility and sustainable development. The view that it was possible to pursue sustainability without negatively affecting profitability and even, perhaps, enhancing the firm’s long-term competitiveness was evident in all of the firms. In fact, these companies were not only creating economic value but also generating societal value by reconceiving products and markets, redefining productivity in the value chain, and building supportive industry clusters at the company’s locations [

52].

For example, Alpha compiled an annual report based on the Global Reporting Initiative (GRI) in which it identified the social, environmental, and governance risks that it faced as well as its performance in these matters. Its aim in this regard was to provide an accurate image of its sustainable performance. Also, the company sponsored a Chair in Business Ethics in collaboration with different universities (Alpha 2018 Annual Report).

Beta had recently joined the Global Compact Network. The company used 100% renewable energy and recycled its textile waste into new raw materials. In line with its commitment to environmental protection, the company had formulated a plan to produce more than 70% of its products using a fiber composite extracted from recycled plastic bottles by 2020. It was also working with a laboratory to introduce a patented additive used in paints, coatings, clothing dyes, and resins that is able to absorb greenhouse gases, making them harmless to the environment and human health (Expansion, 2018). According to the CEO, “one of the keys for the future is the assimilation of the principles of the circular economy. The growing demand for sustainable products will be the trend in the sector in the coming years. We believe that we can improve society through these innovations. However, it is not just a matter of values—being sustainable sells”.

4.2. The Internationalization Process

4.2.1. Operation Modes

All of the firms in our research setting had a global vision with a clear orientation towards the market and a sustained commitment to internationalization that helped them overcome the liabilities of smallness [

35,

38]. To some extent, the evolution of their international strategies depended on their ability to accumulate knowledge and exploit that knowledge in different markets, and on their exploration of knowledge gathered from the new environments in which they established a presence.

These companies’ foreign sales varied from 50% (Gamma) to 80% (Alpha) of total sales. Alpha, Gamma, and Delta followed the traditional path of adopting operation modes with increasing commitment as they increased their international experience. Beta’s internationalization was clearly dependent on its main customer, as Beta was inserted in the global value chain of one of the largest retailers in Europe: “Thanks to this distribution chain, my products are in all of [this retailer’s] stores around the world” (Beta CEO).

The most sophisticated strategy had been developed by Alpha. Alpha followed a sequential model in which more complex operation modes (i.e., joint ventures, own subsidiaries, and acquisitions) were introduced as the company gained more experience and knowledge in a region [

39]. In addition, entry into new markets followed a selective and orderly process. The company first moved into those countries in which it would have a higher likelihood of success, and it chose those countries based on the synergies that could be obtained through successive investments. In this sense, one of the key elements of Alpha’s international success was the accumulation of knowledge through the simplest operation modes and the application of its accumulated learning to the most complex operation modes. The CEO explained:

“When the market in a region (e.g., Europe) has been developed, we jump to other regions (e.g., Latin America and Asia) looking for local partners with the aim of developing the same implementation process as in Europe—agents, networks to explore the market, commercial implementation and, finally, industrial implementation that covers a sub-region. We have encountered situations in which we were able to take advantage of the knowledge accumulated in Europe and other situations in which it we could not.”

Gamma and Delta mainly started with independent agents. However, by the time of our study, these companies had their own networks of agents. Besides, both companies had sales subsidiaries in China with the aims of learning from that market and selling part of their Chinese production to the major retailers that had purchasing offices in China. Gamma’s Head of Exports stated:

“We have developed our own networks in Italy and France because we directly serve the traditional channels (small specialized shops) in those markets. In the rest of the world, we use a combination. In big markets that are culturally different or complex, we use local distributors. In small markets, we use independent agents. We recently opened a subsidiary in Hong Kong, which allows us to directly manage orders with large distributors there and to offer specific products at adapted prices.”

4.2.2. The Importance of Networks

The characteristics of the various networks to which a company belongs are essential for its competitiveness. Networks are a strategic resource that influences the firm’s future capabilities. Access to new experiences, resources, and knowledge can affect firms’ abilities to innovate and penetrate international markets [

53].

In the focal firms, we observed strong ties with industrial and commercial partners based on the exchange of resources and information. Collaborations with partners, suppliers, and customers were critical for these firms, even when these relationships did not have research and development content [

43].

Alpha had an extensive network of agreements and joint ventures with different distributors that eventually led to the acquisition of those firms. Its sales subsidiaries were previously distributors and its production subsidiaries were previously joint ventures. The CEO explained: “Our model of expansion is based on relationships. In the first phase, we develop contacts with distributors and local agents and take advantage of their structures to explore the market and learn. We then try to develop commercial and industrial implementation through joint ventures or even acquisitions”.

For Gamma, two important trends in its distribution channels forced it to strengthen its collaboration agreements with customers. On the one hand, the tendency among final consumers to make purchases through the Internet intensified Gamma’s relationships with the major online marketplaces, such as Amazon. On the other hand, the traditional distribution channel needed to be more professional and adapted to new consumers. The CEO stated: “Amazon is becoming one of our main clients and we are increasing our collaboration with them through the vendor system. In addition, we have created a B2B platform to facilitate our traditional customers in terms of managing their orders and providing access to catalogues, information about stock availability, and news... This tool is becoming an authentic management interface between the customer and us”. Along similar lines, Delta’s CEO explained, “in our industry, we cannot survive solely from the Internet. It is important to control the traditional distribution channel. Our main clients are independent retailers that need to be more professional. We are considering ways to make them more professional. There are several possibilities. One that we have in mind is to create franchises in cooperation with them”.

Beta’s relationship with the leading European distributor led to internal improvements in the organization of processes: “Our relationship with Ikea has allowed us to increase our knowledge due to its demands and the way it works. You need an orderly and efficient way of working, and a high level of quality control. We have transferred this knowledge to our relationships with local suppliers and other customers” (Beta CEO).

4.3. Discussion

Following a configurational logic, our analysis of the global consolidation of these firms allows us to develop a model of high-performing small and medium-sized enterprises competing in traditional manufacturing industries.

The proposed model simultaneously combines the advantages of cooperation and internationalization with the essential role of production, as well as the adaptation of the company’s value proposition to the specifics of each country and customer. This “new industrial company” enhances the value of customization and sustainability and capitalizes on the potential that the new globalization offers by linking local production with international production, own resources with external resources, and local capabilities with international capabilities.

Inspired by our literature review and the analysis of the cases, we suggest that competitive success in traditional manufacturing industries requires to move along five complementary and interlinked strategic-development axes:

The sale of products and services customized to the needs of each customer.

The combination of local manufacturing (with some re-shored activities) and international manufacturing adapted to each market needs.

The increasing concern for the circular economy and sustainability.

Greater control of the distribution channel through own networks, subsidiaries, franchises, and Internet platforms.

The use of cooperation agreements, mergers, and acquisitions to obtain new knowledge that allows the company to compete globally.

The model reflects the alignment between the new environmental dynamism and the strategic answers of the firms. In the years ahead, the champions will be those small and medium-sized enterprises that adapt their products, principles, and business models to the new global reality. It is important to note that these axes of development are neither exhaustive nor mutually exclusive; instead, they provide a view of the expanding set of possibilities for answering the new conditions of the global environment in these industries. As such, the combination of different strategies that best exploit the resources and capabilities of each company might provide a better chance for finding new avenues for survival and growth.

Figure 2 graphically presents the conceptual model of fit with the five axes of development. This inductive model is proposed for future empirical testing in broader samples of firms.

5. Conclusions

In this study, we have provided a model of high-performing small and medium-sized enterprises in traditional industries based on the combination of smaller-scale production, quality, flexibility, and delivery speed. This new trend will favor the backshoring of some manufacturing processes to developed economies and enable these firms to provide finished products to retail outlets and final consumers much faster. The greater proximity will also generate a better knowledge of their needs and the possibility of offering complementary services.

Through our analysis, we have also tried to highlight several false assumptions regarding competitiveness in these industries. First, in traditional industries, some companies innovate and survive, and some companies do not—the idiosyncrasies of the industry do not determine the best strategic approach. Instead, such approaches are determined by the entrepreneurs or managers themselves.

Second, the renewed dynamism in these traditional industries has fostered the abilities of these companies to reconfigure their activities through exploratory learning. This, in turn, allows for new organizational configurations. After an extended period of forced adjustments and adaptations to a globalized context, the new model of the high-performing SME in these industries is not solely based on exports or investments in technology. Instead, it is necessary to discuss how to improve global positioning in the long term. In the traditional manufacturing industries, product or service innovations are important aspects, but also those innovations of an organizational nature that allow firms to respond to the demands of the global environment by transferring people, resources, capital, and knowledge to the appropriate places at the right time [

35]. Relevant organizational innovations are those that incorporate new values, such as sustainability, diversity, and customization, while reinforcing the company’s values and culture in local contexts. These innovations arise not only from the organization itself but also from external sources, such as relationships with customers and partners [

37].

Our results have some implications in terms of public policies. For many years, the programs for helping small and medium-sized enterprises in many countries were designed to promote exports and technological innovation, especially for high-tech industries. However, as we have shown, organizational-based innovation also occurs in traditional manufacturing industries and plays a key role in their prospects for growth. Additionally, other strategies such as cooperation, supply-chain relationships, sustainability, and re-shoring arise as essential tools to shape the managerial responses to the new global scenario. In consequence, policymakers should look over more comprehensive objectives in these programs and incorporate measures to support the implementation of those strategies regardless of the nature of the industry.

Although the generalizability of our conclusions may be limited by the fact that they are based on only four firms, our case studies illustrate some strategic elements that are essential to compete in traditional manufacturing industries. Moreover, our conclusions can be used for benchmarking exercises. However, further research could test the proposed relationships using quantitative methods and larger samples. This would allow for the advancement of the necessary generalizability of these findings. Nevertheless, looking ahead new challenges are likely to arise in these industries. These challenges will need to be integrated into the innovative high-performance model. Considerations in this regard may include the compatibility of increased efficiency and synergies with growth through acquisitions, the substitution of traditional channels with the Internet, adaptations to digitalization and Industry 4.0, as well as the incorporation of the circular economy. The approaches organizations take to these issues will be crucial for helping them face future challenges with better capabilities and, therefore, with a higher likelihood of success. We hope our inductive results help scholars wishing to pursue further empirical evaluation and elaboration.