Abstract

Grounded in the Granger causality test, vector autoregression (VAR) model, and BEKK-GARCH model, our current study aims to examine the effect of mean and volatility spillover between the United States (US) economic policy uncertainty (EPU) and West Texas Intermediate (WTI) crude oil price. Using the US EPU monthly index and WTI spot price data from 1996 to 2019, we revealed that there is a one-way Granger causality link between the US EPU and spot price of WTI crude oil. The VAR model not only illustrated that there is a mean spillover effect between WTI oil price and US EPU, but they will also be affected by its memory, as well as the other’s past. At the same time, it also pointed out that this correlation has positive and negative directions. The BEKK-GARCH model test yielded similar conclusions to the VAR model and, importantly, proved a two-way volatility spillover effect between the US EPU and WTI spot price fluctuations. In conclusion, US economic policy has a substantial influence on the variation of global crude oil prices, as an essential strategic reserve resource and will also influence the government’s economic policy formulation. Understanding the association between WTI crude oil price and policy uncertainty not only helps investors to manage assets allocations and mitigate losses but also guides US policymakers to adjust the energy structure for economic sustainability.

1. Introduction

Since the eruption of the global economic crisis in 2008, global economic integration and the link between financial markets around the world have been reinforced. Economic policy, as a measure taken by governments to avoid economic collapse or overheated expansion, has maintained the stability of financial markets to a certain extent. However, frequent government intervention in the economy also brings about economic policy uncertainty (EPU) [1]. The so-called EPU refers to the fact that economic entities cannot accurately predict changes in current government economic policies [2]. Uncertainty in economic policy makes it more difficult for investors and enterprises to anticipate the future investment environment and decreases the public confidence index, leading to a negative impact on economic growth [3]. Many studies have shown that EPU will affect the real economy, including gross domestic product (GDP), consumption, investment, and exports, as well as price variables, such as real estate price, exchange rate, and crude oil price [4,5,6,7,8].

Crude oil, known as “industrial blood” and “black gold,” is an underlying energy product and an important industrial raw material in contemporary society [9,10,11]. It plays an important role in the economic, political, and military fields, and various factors affect its prices. On a global scale, the international crude oil market benchmark price has been formed on WTI, Brent and Dubai crude oil futures markets. At the same time, the financial attributes of international crude oil assets continue to increase. The price of crude oil has become the result of a combination of supply and demand factors, macroeconomic factors, political factors, and financial factors. Especially since 2003, the crude oil price has fluctuated more frequently and violently. It had experienced sharp increases and drops before and after the 2008 financial crisis, and in 2014, it fell rapidly to the lowest price in the past decade and showed a trend of low prices [9,12]. Some researchers have pointed out that oil price shocks may trigger a US economic recession, and the link between oil price instabilities and macroeconomics has stimulated many studies, such as those looking at gross domestic product, inflation, and stock markets [12,13,14,15,16,17]. Fluctuations in oil prices could be one of the highly critical drivers of EPU and economic outcomes [18]. Additionally, the effect of rising oil prices on a country’s macroeconomic conditions is greater than a decline. This disproportionate effect of oil prices has attracted researchers’ attention [19,20,21]. Furthermore, previous studies probed the short-term and long-term irregular impacts of oil price shocks and found that only the cumulative demand effects might have a similar influence either in the short-term or long-term [10,20,21]. Therefore, these studies of the asymmetric influence of crude oil price under the framework of the EPU index (see supplementary) have also attracted our attention.

For our part, studies have not identified a volatility spillover effect on the association among EPU and prices of WTI crude oil in the context of downturns of the US economy. Therefore, our contribution is complementary to this study. A time-varying spillover effect was recorded by previous scholars between EPU and oil price downturns. For example, EPU does affect predictions in changes in oil prices [22]. The evidence provided by Aloui et al. [23] shows that EPU affects oil price returns in a certain period, and has a high impact on macro and micro levels. Moreover, the negative impact of EPU on oil revenues, which could be augmented by endogenous EPU responses, is also described in the literature [24,25]. The study by Antonakis and House [26] investigated the association between volatility and the EPU index and noted that there is a negative association between the impact of total demand on oil prices with an American economic downturn. At the same time, the relationship between EPU and the macro-economy needs to be considered [27]. Given the link between EPU and oil prices, the absence of measuring the volatility spillover effect will lead to endogenous issues that should be addressed in this study.

Furthermore, previous studies that mostly used “Markov switching” models and time-varying parameters VAR discovered that the uncertainty link between economic policies and oil prices is time-varying and nonlinear [28,29]. In addition, the study by Hailemariam et al. [30] applied a non-parametric panel data model to investigate the influence of EPU on oil price adjustments. However, the relationship between oil prices and EPU has become complicated, and the use of the parameter VAR alone has proved insufficient to capture this unstable relationship. The multivariate “generalized autoregressive conditional heteroscedasticity” (GARCH) model can be applied to assess the volatility at distinct time scales [31]. Therefore, this paper integrates the VAR model and the multivariate BEKK-GARCH model to depict the mean and volatility spillover effect between EPU and WTI crude oil price. After Bollerslev proposed the GARCH model in 1986 [32], many GARCH models were derived, such as the TGARCH, EGARCH, and multivariate GARCH model.

In particular, the multivariate GARCH model was improved and expanded by many scholars based on the original model, for wide application in the research of oil price, stocks, exchange rates, etc. The multivariate GARCH model has been referred to using several different expressions across different types of studies, such as VECH-GARCH, BEKK-GARCH, CCC-GARCH, and DCC-GARCH [33,34]. Table 1 compares the characteristics of different GARCH models. However, compared with the others, the BEKK-GARCH model is more suitable for our research and easier to operate because it can not only guarantee that the covariance matrix is a positive definite matrix with easier estimation of the parameters, but can also measure the correlation and reflect the direction of spillover effects [6,35]. Therefore, we employed BEKK-GARCH, which meets the aims of this study to inspect the effect of volatility spillover between the relationship of US EPU and WTI crude oil price. This paper also analyses the Granger causality and the dynamic association between EPU and crude oil prices in order to explore the factors that affect EPU. From the correlation, we observed that the periods when the crude oil price rises and falls are also the periods when the economic policy is frequently issued. This is so that people are able to explore reference indicators and gain more effective information before the government promulgates economic policies. The public can also benefit from these resources, which allow them to have reasonable expectations. Meanwhile, the outcomes of our study can inspire investors to comprehend the effect of mean and volatility spillover between US EPU and WTI crude oil price, thereby optimizing asset allocation, and mitigating their losses. It can predict EPU for US decision-making departments based on market price trends, and then take preventive measures for economic sustainability. At the same time, the relevant departments in the US also need to adjust the energy structure to mitigate the negative effect of WTI oil price changes on.

Table 1.

Comparison of generalized autoregressive conditional heteroscedasticity (GARCH) models.

2. Materials and Methods

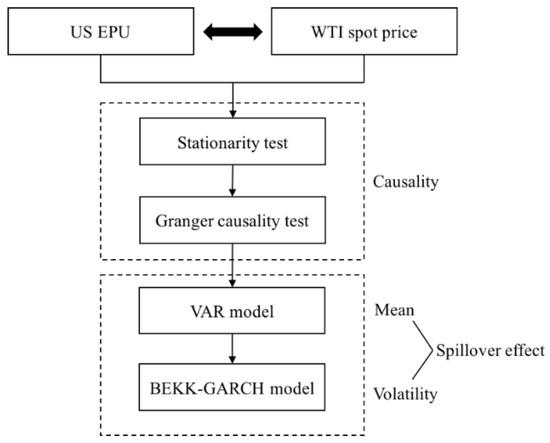

It is possible to use “multi-criteria decision-making” [43] and “time series analysis” [23] to measure the correlations between different indicators. To identify the mean and volatility spillover effect between US EPU and the WTI crude oil price, we used the VAR-BEKK-GARCH model. The research framework is displayed in Figure 1. First, we verified the causal relationship between EPU and the WTI oil price through the ADF stationarity test and the Granger causality test. Then, on this basis, we combined the VAR model and the BEKK-GARCH model to assess whether the transmission of information causes the price fluctuations to pass to the crude oil market when EPU fluctuates, as well as whether the shock to crude oil price will cause a fluctuation of the EPU. By integrating the results of the two models, the dynamic correlation between US EPU and the WTI oil price can be comprehensively understood, which can assist the stakeholders’ decisions in regard to risk management.

Figure 1.

The framework of the research on the mean and volatility spillover effect.

2.1. The VAR Model

In 1980, Sims introduced the VAR model to economics, which promoted the wide application of dynamic analysis of economic systems [44]. The VAR model is often used to predict an interconnected time series and analyze the dynamic disturbance of random error terms on variables, thereby explaining the impact of various economic shocks on the economic variables. The model uses each endogenous variable as the lag value of all endogenous variables to establish functions, in order to capture the linear interdependence between multiple time series and analyze the joint changes between the internal variables.

This paper considers the two variables of the VAR model of order p, defined as follows:

where is a vector of endogenous variables, Φ is the matrix of autoregressive coefficients, C is a intercept vector of the constant terms, and is the vector of uncorrelated structural disturbance.

When choosing the lag order p, a sufficiently large lag order is chosen to fully reflect the dynamic characteristics of the system. However, too large of a lag order will decrease the freedom of the model. Therefore, AIC, SC, LR, FPE and HQ criteria are normally used to determine the maximum lag order.

2.2. The BEKK-GARCH Model

The mean equation based on the VAR model is as follows:

where denotes the change rates of Variable1 and Variable2, respectively. We assume that satisfies the mean function, and denotes corresponding error terms.

The variance equation satisfies the following formula:

represents the variance–covariance matrix at t time, C denotes the constant matrix of the upper triangle, and A and B denote the coefficient matrix corresponding to the ARCH and GARCH terms, respectively. Specifically, the BEKK model is described as:

Then we can get:

The logarithmic likelihood function of the BEKK-GARCH model is:

When , the volatility of Variable2 is only affected by its own pre-volatility and residual, indicating that Variable1 has no volatility spillover effect on Variable2. When , Variable1 is only affected by its own pre-volatility and residual, and Variable2 has no volatility spillover effect on Variable1. When , there is no volatility spillover effect between Variable1 and Variable2.

3. Results and Discussion

3.1. Data Description

As a proxy of economic policy uncertainty, we utilized the EPU index in this study, which was compiled by three economists: Baker, Bloom, and Davis [45]. This US index includes three components with different weights. The first one, also called the News Index, quantifies the number of reports on policy-related economic uncertainty in ten large domestic newspapers. The second component, called the Tax Code Expiration Index, involves measuring the uncertainty of changes in the tax law by counting the number of tax laws that lapse each year. Temporary tax measures will undermine the stability of tax laws and regulations, thereby bringing uncertainty to businesses and households. The last one is the Economic Forecaster Disagreement Index, which measures uncertainty on future fiscal and monetary policy by taking customer price index (CPI) and the federal (state/local) government expenditure into account. The overall EPU index is a weighted average of 1/2 News Index, 1/6 Tax Expiration Index, 1/6 CPI disagreement and 1/6 federal (state/local) government expenditure disagreement [46]. The EPU index ranges from tens to hundreds, and the higher the numerical value, the stronger the uncertainty.

As per the international crude oil trading practices, the benchmark is the international energy market, which mainly includes WTI oil, Brent crude oil, and Dubai crude oil [45]. Among them, the price of WTI is the most important price benchmark in the world. This is determined by the quality and location of WTI. The US dollar is the “world currency,” and the cross-border settlement of crude oil is finalized in US dollars, which is the primary cause of the high rate of WTI crude oil [32]. The more important reason is that New York is the world financial center, and the commodity liquidity of the New York Mercantile Exchange has a perfect risk management mechanism, so it has a great influence on the international market. Therefore, we chose WTI spot price data as the primary sample, collected from the US Energy Information Administration Database (see supplementary).

Therefore, the monthly US EPU index and WTI spot price data from 1996M1 to 2019M12 were utilized to probe the link between US EPU and WTI spot oil price.

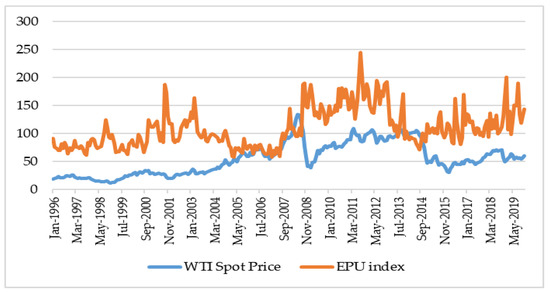

Figure 2 shows the original time series of the WTI spot price and EPU index, both of which are non-stationary. The residual analysis shows there is no autocorrelation. However, since the prerequisite for establishing the BEKK-GARCH model is the stationarity of the time series, the common method of data processing is to take the logarithm and perform the first-order difference, and then do the unit root test. The calculation formula is presented as follows, and the detailed descriptions of all the variables are shown in Table 2.

Figure 2.

Original time series of West Texas Intermediate (WTI) spot price and economic policy uncertainty (EPU) index.

Table 2.

Definitions of variables.

3.2. Stationarity Test

We implemented the Augmented Dicky–Fuller (ADF) test to check the stationarity of variables [47]. The principle of the ADF test is that if the test value is less than the critical value of the given significance level, the data are stationary, and the model can be directly established. Otherwise, the data are non-stationary. The null hypothesis of the ADF test is that the time series owns a unit root. The empirical results in Table 3 show the values of the stationarity analysis test. The first-order difference series, which can be used for further analysis, are stationary at a 1% level of significance.

Table 3.

Stationarity analysis test.

3.3. Granger Causality Test

To study the causal relationship of variables, we applied a Granger causality test. In the multivariable framework, if the lagging variable of the first variable is considered, the prediction of the second variable improves, and then the first variable is called the second variable in the Granger sense [1,48].

Table 4 contains the values obtained from the Granger causality test, based on a standard 5% significance level. The findings demonstrate that the change in uncertainty in economic policy in the US is the Granger cause of the WTI oil price, while the latter does not Granger cause the former.

Table 4.

Granger causality test.

In Table 4, we provide the results of Granger causality test that met our expectations. The uncertainty of economic policy decisions has a negative impact on a series of corporate decisions, such as investment and expansion. Furthermore, since oil is the most significant raw material in mass production activities, this economic policy uncertainty will bring downward pressure on oil prices. However, the WTI oil price does not Granger cause economic policy uncertainty. This might be explained by the three components of the EPU index (the News Index, the Tax Expiration Index, and the Economic Forecaster Disagreement Index), which cover a considerable variety of information, while the WTI oil price only occupies a small place in it.

3.4. Mean Spillover Effect

According to the AIC and SC criteria, the maximum lag order “3” was determined.

Table 5 shows the final results of the VAR model. The WTI oil price and US EPU are influenced by its own lagged values as well as the other’s lagged values. Specifically, in the regression equation with as the dependent variable, the coefficient of is significant at a 1% level and positive, while the coefficients of and are both significant at a 5% level, but they are negative. This means that the past values of WTI oil price positively influence its own current period, but the past values of US EPU have a negative effect on the current period of WTI oil price. In the regression equation with as the dependent variable, has a 5% significance level and remains positive, showing that the past values of the WTI crude oil price positively affect the current period of US EPU. In terms of mean spillover effect, there is a bidirectional linkage between WTI oil price and US EPU. This result helps to distinguish the direction of the correlation between them, which enables stakeholders to adjust hedging strategies in advance when facing market risk.

Table 5.

Vector Autoregression (VAR) estimates.

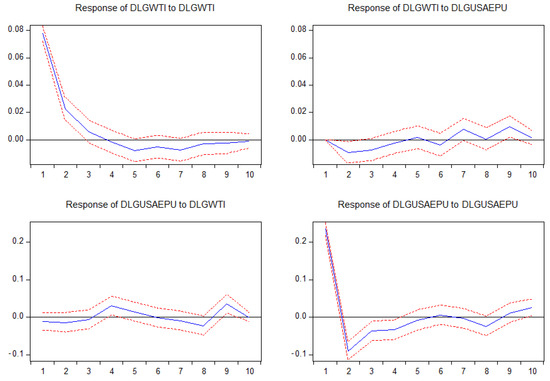

3.5. Impulse Response Analysis

We also verified this spillover effect between US EPU and WTI oil price though the results of impulse response analysis (Figure 3). In the impulse response graph of DLGWTI to DLGUSAEPU, economic policy uncertainty has a negative impact on WTI oil price in the short term and reaches its maximum value in the second period. Then, the negative response gradually weakens, followed by frequent weakly negative and positive fluctuations, which then finally trend to zero. This shows that sudden changes in economic policy uncertainty will lower WTI crude oil prices in the short term, and then the latter will rise or fall according to the dramatic fluctuations of policy uncertainty. This result is in line with the actual situation of the market. When the economy is in turmoil and demand is tightening, oil prices will fall due to market mechanisms. Afterwards, with the interference and adjustment of policies, oil prices will gradually recover and then fluctuate repeatedly. However, the impulse response of the EPU to oil price shocks gradually rises first, then slowly falls back to the previous level and repeats this fluctuation, which shows that policy uncertainty will also change with fluctuations of oil prices. In summary, the correlation between US EPU and WTI crude oil price produces a significant two-way impulse effect.

Figure 3.

The impulse response analysis results.

3.6. Volatility Spillover Effect

By employing the binary BEKK-GARCH model, we empirically tested the effect of volatility spillover between US EPU and WTI crude oil spot price. As we introduced in the methodology, the matrices A and B represent the coefficient matrices corresponding to the ARCH and GARCH terms, respectively. The empirical results in Table 6 describe the diagonal elements of matrices A and B, which capture their own ARCH and GARCH effects, respectively. A (1,1) and A (2,2) are significant at levels of 1% and 5%, respectively, which points towards the existence of the ARCH effect. This also suggests that the level of conditional variance between WTI oil price and EPU is relatively high and is affected by their own previous shocks. In addition, B (1,1) and B (2,2) are both significant at the 1% significance level, which points towards the existence of a strong GARCH effect and the phenomenon of significant volatility clustering. This also illustrates that the current conditional variances are greatly affected by past ones. Overall, this result is similar to the conclusions obtained in the mean spillover analysis, which indicates that WTI oil price and US EPU are significantly affected by external shocks from its own market and its own memory.

Table 6.

BEKK-GARCH model estimation results.

Furthermore, based on the off-diagonal elements of matrices A and B, we found that there was bidirectional volatility spillover between the WTI oil price and US EPU. Specifically, A (2,1) is significant at the 1% level, showing that the lag period of the US EPU can significantly affect the fluctuation of the WTI crude oil price. B (1,2) and B (2,1) were both found to be significant at the 1% level. The former proves that the WTI crude oil price has a substantial spillover effect on the change of the US EPU, and the latter indicates that the US EPU has a significant volatility spillover impact on the WTI oil price, which suggests that a bidirectional volatility spillover effect is present. The study [49] proposed that, in the United States, resource-based government revenues, such as crude oil revenue, are closely linked and interact with fiscal policies. In addition, Sturm et al. [50] also believe that in resource-rich countries, the source of domestic uncertainty is that public finances are vulnerable to fluctuations in oil prices and demand.

4. Conclusions, Implication and Future Directions

This paper extends the existing approaches in the literature by empirically examining the mean and volatility spillover effects on the association of US EPU and WTI spot crude oil price. Firstly, through the Granger causality test, the empirical outcomes showed that the change of uncertainty in economic policy in the US is the Granger cause of the WTI oil price, while the latter does not Granger cause the former. The VAR model illustrated that there is a mean spillover effect between WTI oil price and US EPU, that is, they will both be affected by past fluctuations. In addition, we found that this correlation has positive and negative directions. The BEKK-GARCH model test yielded similar conclusions to the VAR model, and strongly showed a bidirectional volatility spillover effect between the US EPU and WTI spot price.

The empirical findings revealed a significant interaction between EPU and WTI crude oil price. Investors, policymakers, and other key market participants could benefit from the results of this study, for example, by investigating the heterogeneity of spillover effects between EPU and WTI crude oil price, even in the long-term. In the process of policymaking, the government should pay more attention to policy continuity and stability, reduce the impact on crude oil prices, and reduce the impact of crude oil commodity prices on the real economy. The investors can also underline assets to minimize their losses by understanding the spillover relationship between US EPU and WTI crude oil prices. Moreover, decision-making departments in US can also restructure the energy policies for national economic sustainability. Meanwhile, in order to ensure a stable environment for domestic oil market growth, policymakers should pay attention to both the domestic oil pricing mechanism and global policies to improve their ability to respond to uncertain events.

Besides this significant contribution, the authors acknowledge some limitations. First, the sample that we used to test the proposed framework was collected only from the US. Comparative analysis of several developed countries can provide a more detailed viewpoint for other international crude oil markets. Second, because data from up to 2019 were used, we did not measure the impact of the recent COVID-19 pandemic on crude oil prices. Therefore, we recommend that the effect of the COVID-19 pandemic is integrated into the model in the future (including a ‘during’ and ‘post’ effect).

Supplementary Materials

The following are available online at https://www.mdpi.com/2071-1050/12/16/6662/s1. The data are available online at EPU index: http://www.policyuncertainty.com/us_monthly.html. WTI Spot Price: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RCLC1&f=M

Author Contributions

Conceptualization, R.S.; methodology, R.S. and J.D.; software, R.S. and F.S.; validation, J.D., F.S., and X.L.; formal analysis, R.S.; resources, J.D.; data curation, R.S. and F.S.; writing—original draft preparation, R.S.; writing—review and editing, F.S.; visualization, X.L.; supervision, J.D.; project administration, J.D. and X.L.; funding acquisition, J.D. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Special Funds of the National Social Science Fund of China [18VSJ038] and supported in part by the National Science Foundation of China under grant 71974081, 71704066, and 71971100.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chen, J.; Jin, F.; Ouyang, G.; Ouyang, J.; Wen, F. Oil price shocks, economic policy uncertainty and industrial economic growth in China. PLoS ONE 2019, 14, e0215397. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Nyamela, Y.; Plakandaras, V.; Gupta, R. Frequency-dependent real-time effects of uncertainty in the United States: Evidence from daily data. Appl. Econ. Lett. 2019, 26, 1–5. [Google Scholar] [CrossRef]

- Feng, M.; Qunxing, P. Study on the dynamic correlation between economic policy uncertainty and crude oil price. Guangxi Soc. Sci. 2016, 3, 72–76. [Google Scholar]

- Ma, F.; Wahab, M.I.M.; Liu, J.; Liu, L. Is economic policy uncertainty important to forecast the realized volatility of crude oil futures? Appl. Econ. 2018, 50, 2087–2101. [Google Scholar] [CrossRef]

- Chen, X.; Sun, X.; Wang, J. Dynamic Spillover Effect Between Oil Prices and Economic Policy Uncertainty in BRIC Countries: A Wavelet-Based Approach. Emerg. Mark. Financ. Trade 2019, 55, 2703–2717. [Google Scholar] [CrossRef]

- Iqbal, U.; Gan, C.; Nadeem, M. Economic policy uncertainty and firm performance. Appl. Econ. Lett. 2020, 27, 765–770. [Google Scholar] [CrossRef]

- El Anshasy, A.A.; Bradley, M.D. Oil prices and the fiscal policy response in oil-exporting countries. J. Policy Model. 2012, 34, 605–620. [Google Scholar] [CrossRef]

- Wei, Y.; Wang, Y.; Huang, D. Forecasting crude oil market volatility: Further evidence using GARCH-class models. Energy Econ. 2010, 32, 1477–1484. [Google Scholar] [CrossRef]

- He, Z.; Zhou, F. Time-varying and asymmetric effects of the oil-specific demand shock on investor sentiment. PLoS ONE 2018, 13, e0200734. [Google Scholar] [CrossRef]

- Wen, F.; Xiao, J.; Huang, C.; Xia, X. Interaction between oil and US dollar exchange rate: Nonlinear causality, time-varying influence and structural breaks in volatility. Appl. Econ. 2018, 50, 319–334. [Google Scholar] [CrossRef]

- Hamilton, J.D. Understanding crude oil prices. Energy J. 2009, 30, 179–206. [Google Scholar] [CrossRef]

- Filis, G.; Chatziantoniou, I. Financial and monetary policy responses to oil price shocks: Evidence from oil-importing and oil-exporting countries. Rev. Quant. Financ. Account. 2014, 42, 709–729. [Google Scholar] [CrossRef]

- Alquist, R.; Kilian, L.; Vigfusson, R.J. Forecasting the price of oil. In Handbook of Economic Forecasting; Elsevier B.V: Ottawa, ON, Canada, 2013; Volume 2, pp. 427–507. [Google Scholar]

- Kilian, L.; Park, C. The impact of oil price shocks on the U.S. stock market. Int. Econ. Rev. 2009, 50, 1267–1287. [Google Scholar] [CrossRef]

- Feng, J.; Wang, Y.; Yin, L. Oil volatility risk and stock market volatility predictability: Evidence from G7 countries. Energy Econ. 2017, 68, 240–254. [Google Scholar] [CrossRef]

- Christoffersen, P.; Pan, X.N. Oil volatility risk and expected stock returns. J. Bank. Financ. 2018, 95, 5–26. [Google Scholar] [CrossRef]

- Barrero, J.M.; Bloom, N.; Wright, I.J. Short and Long Run Uncertainty. SSRN Electron. J. 2018. [Google Scholar] [CrossRef]

- Huang, B.N.; Hwang, M.J.; Peng, H.P. The asymmetry of the impact of oil price shocks on economic activities: An application of the multivariate threshold model. Energy Econ. 2005, 27, 455–476. [Google Scholar] [CrossRef]

- An, L.; Jin, X.; Ren, X. Are the macroeconomic effects of oil price shock symmetric?: A Factor-Augmented Vector Autoregressive approach. Energy Econ. 2014, 45, 217–228. [Google Scholar] [CrossRef]

- Rafiq, S.; Sgro, P.; Apergis, N. Asymmetric oil shocks and external balances of major oil exporting and importing countries. Energy Econ. 2016, 56, 42–50. [Google Scholar] [CrossRef]

- Bekiros, S.; Gupta, R.; Paccagnini, A. Oil price forecastability and economic uncertainty. Econ. Lett. 2015, 132, 125–128. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A.; Vespignani, J.L. Oil price shocks and policy uncertainty: New evidence on the effects of US and non-US oil production. Energy Econ. 2017, 66, 536–546. [Google Scholar] [CrossRef]

- Chen, X.; Sun, X.; Li, J. How does economic policy uncertainty react to oil price shocks? A multi-scale perspective. Appl. Econ. Lett. 2020, 27, 188–193. [Google Scholar] [CrossRef]

- Antonakis, J.; House, R.J. Instrumental leadership: Measurement and extension of transformational-transactional leadership theory. Leadersh. Q. 2014, 25, 746–771. [Google Scholar] [CrossRef]

- Arouri, M.; Rault, C.; Teulon, F. Economic policy uncertainty, oil price shocks and GCC stock markets. Econ. Bull. 2014, 34, 1822–1834. [Google Scholar]

- Degiannakis, S.; Filis, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef]

- Rehman, M.U. Do oil shocks predict economic policy uncertainty? Phys. A Stat. Mech. Appl. 2018, 498, 123–136. [Google Scholar] [CrossRef]

- Hailemariam, A.; Smyth, R.; Zhang, X. Oil prices and economic policy uncertainty: Evidence from a nonparametric panel data model. Energy Econ. 2019, 83, 40–51. [Google Scholar] [CrossRef]

- Engle, R.F.; Kroner, K.F. Multivariate simultaneous generalized arch. Econom. Theory 1995, 11, 122–150. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Hentschel, L. All in the family Nesting symmetric and asymmetric GARCH models. J. Financ. Econ. 1995, 39, 71–104. [Google Scholar] [CrossRef]

- Reitz, S.; Westerhoff, F. Commodity price cycles and heterogeneous speculators: A STAR-GARCH model. Empir. Econ. 2007, 33, 231–244. [Google Scholar] [CrossRef]

- Khalfaoui, R.; Boutahar, M.; Boubaker, H. Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Econ. 2015, 49, 540–549. [Google Scholar] [CrossRef]

- Bollerslev, T.; Engle, R.F.; Wooldridge, J.M. A Capital Asset Pricing Model with Time-Varying Covariances. J. Polit. Econ. 1988, 96, 116–131. [Google Scholar] [CrossRef]

- Bollerslev, T. Modelling the Coherence in Short-Run Nominal Exchange Rates: A Multivariate Generalized Arch Model. Rev. Econ. Stat. 1990, 72, 498. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional Heteroskedasticity in Asset Returns: A New Approach. Econometrica 1991, 59, 347. [Google Scholar] [CrossRef]

- Zakoian, J.M. Threshold heteroskedastic models. J. Econ. Dyn. Control 1994, 18, 931–955. [Google Scholar] [CrossRef]

- Bleuler, P.; Ganzoni, N. Arthroscopic knee diagnosis in the non-specialized surgical department. Helv. Chir. Acta 1978, 45, 13–16. [Google Scholar]

- Hansen, P.R.; Huang, Z.; Shek, H.H. Realized GARCH: A joint model for returns and realized measures of volatility. J. Appl. Econom. 2012, 27, 877–906. [Google Scholar] [CrossRef]

- Engle, R.F.; Ghysels, E.; Sohn, B. Stock market volatility and macroeconomic fundamentals. Rev. Econ. Stat. 2013, 95, 776–797. [Google Scholar] [CrossRef]

- Li, J.; Yao, X.; Sun, X.; Wu, D. Determining the fuzzy measures in multiple criteria decision aiding from the tolerance perspective. Eur. J. Oper. Res. 2018, 264, 428–439. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1. [Google Scholar] [CrossRef]

- Matar, W.O.; Al-Fattah, S.; Atallah, T.N.; Pierru, A. An Introduction to Oil Market Volatility Analysis. SSRN Electron. J. 2013, 247–269. [Google Scholar] [CrossRef]

- Qin, M.; Su, C.W.; Hao, L.N.; Tao, R. The stability of U.S. economic policy: Does it really matter for oil price? Energy 2020, 13, 117315. [Google Scholar] [CrossRef]

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Am. Stat. Assoc. 1979, 74, 427. [Google Scholar] [CrossRef]

- Cunado, J.; Jo, S.; Perez de Gracia, F. Macroeconomic impacts of oil price shocks in Asian economies. Energy Policy 2015, 86, 867–879. [Google Scholar] [CrossRef]

- James, A. US state fiscal policy and natural resources. Am. Econ. J. Econ. Policy 2015, 7, 238–257. [Google Scholar] [CrossRef]

- Sturm, M.; Gurtner, F.; Alegre, J.G. Fiscal policy challenges in oil-exporting countries—A review of key issues. ECB Occas. Pap. 2009, 11. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1325245 (accessed on 18 August 2020).

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).