Abstract

Public-driven attempts to provide decent housing to slum residents in developing countries have either failed or achieved minimal output when compared to the growing slum population. This has been attributed mainly to shortage of public funds. However, some urban areas in these countries exhibit vibrant real estate markets that may hold the potential to bear the costs of regenerating slums. This paper sheds light on an innovative hypothesis to achieve slum regeneration by harnessing the real estate market. The study seeks to answer the question “How can urban public policy facilitate slum regeneration, increase affordable housing, and enhance social inclusion in cities of developing countries?” The study approaches slum regeneration from an integrated land economics and spatial planning perspective and demonstrates that slum regeneration can successfully be managed by applying land value capture (LVC) and inclusionary housing (IH) instruments. The research methodology adopted is based on a hypothetical master plan and related housing policy and strategy, aimed at addressing housing needs in Kibera, the largest slum in Nairobi, Kenya. This simulated master plan is complemented with economic and residual land value analyses that demonstrate that by availing land to private developers for inclusionary housing development, it is possible to meet slum residents’ housing needs by including at least 27.9% affordable housing in new developments, entirely borne by the private sector. Findings suggest that under a robust public-led governance umbrella, market forces can (1) significantly contribute to fill the financial gap in order to achieve the end of slums by 2050 in coherence with the United Nations Agenda 2030 targets and principles, and (2) increase both affordable and market housing in upgraded neighbourhoods, hence enhancing social inclusion in cities of developing countries.

1. Introduction

Low-income households in cities of Africa and other developing regions are faced with an acute housing affordability challenge. In these cities, housing has become unavailable and unaffordable [1,2] partly because housing markets have become distorted and dysfunctional [3], working against the interests of the urban poor. The rate of urbanization in most of these countries has increased rapidly [3] and this, coupled with poor urban governance [4,5], has worsened the housing affordability challenge. The problem is more acute in Sub-Saharan Africa as data from UN-Habitat show [6]. According to UN-Habitat, the urban slum population in all developing countries increased from 689 million in mid-1990 to 881 million in mid-2014, an increase of 27.8%. Within the same period the urban population living in slums in Sub-Saharan Africa dramatically increased from 93 million to 200 million, an increase of 115%. About 1 billion people currently live in slum settlements—almost a third of the world’s urban population—and this is projected to double by 2030 [7] and could increase to 3 billion by 2050 [8]. This calls for urgent measures to increase the supply of affordable housing for the low-income households [9].

Though there has been progress in improving the living conditions of many slum dwellers over the years, this has been negatively offset by overwhelming slum growth [10]. Millington and Cleland [7] observed that during the last 50 years, governments have implemented a wide range of slum upgrading projects and programmes of varying scale and scope that have improved the lives of many slum dwellers. However, despite this the growth of slums and informal settlements is only getting worse, particularly in developing countries, and the total number of slum dwellers has increased [7]. This scenario is greatly undermining the ability of cities in developing countries to economically grow, prosper, and generate wealth [11].

So far, public-driven attempts to provide decent housing to slum residents have failed, mainly because of the shortage of public funds. The increased urban populations coupled with the rapid growth of slums in developing countries make it clear that cities in these countries will have no institutional, infrastructural, and financial capacity to satisfactorily accommodate all urban dwellers if alternative innovative approaches are not devised. Tito and Somik [9] argued that there is little clarity in approaches to slum regeneration in terms of (i) interventions that are most effective; (ii) the sustainability of alternate programmes and their relative cost effectiveness, and (iii) the citywide consequences of these interventions. Attempts at regenerating slums have mainly been based on governmental and non-governmental organisation (NGO) efforts, with very little results. As the World Bank [12] (p.ix) argues, “narrowly-focused, neighbourhood-level slum upgrading interventions, while generally effective, have fallen short of addressing the magnitude and scope of expanding informality and slums”. Many slum upgrading projects have been community-led and have met the UN-Habitat best practices but the upgrading process has “remained outside mainstream urban planning and management” [11] (p.vii), and the output has been minimal when compared to the growing slum population. These challenges highlight the valuable contribution that integrated and participatory slum upgrading has to offer to the sustainable development of humankind, as it addresses the pressing needs of the growing numbers of the urban poor [6]. Therefore, as Baker and McClain [13] observed, when policy makers and planners make consideration for the scaling up of slum upgrading projects, there is a need to look beyond the public sector. Existing approaches for the provision of affordable housing are inadequate to the challenge faced in cities, and there is a need to test new innovative approaches for funding, especially in slum upgrading [14]. The public sector cannot do it alone and there is much need for alternative approaches [13]. One such approach with huge potential is engaging the private sector developers by attracting their finances and expertise through innovative land-use incentives that could benefit both the private investors and the public. This is because in most urban areas the real estate market is vibrant and highly dynamic and may hold the potential of bearing the costs of regenerating slums.

In Kenya, our case study country, we found that there was a lot of literature on informal settlements, but most of it was entirely focused on the problem of slums and evaluation of the slum upgrading projects undertaken by the government [15,16,17,18,19]. Mutisya and Yarime [15] gave a conceptual analysis of the dynamics of urban sustainability and slums development and reviewed the historical perspectives and realities of the Kibera slum in Nairobi. They found that the government and other partnering organizations have devised no new applicable ideas to tame the development and growth of slums in the city. Mutisya and Yarime therefore concluded that “the problem of unsustainable urban growth in Kenya is not just about poverty but the poverty of ideas” [15] (p.210). Cronin and Guthrie [16] focused on the improvement of water and sanitation infrastructure and services in the Kibera slum and found that slum improvement through multi-stakeholder involvement is more successful than the ‘top-down’ government approach. Other recent studies have concentrated on evaluating the Kibera Kenya slum upgrading project (KENSUP) [17,18,19]. There is no research that tries to offer alternative and sustainable means of slum and informal settlement upgrading in Kibera and other slums in the country. Sustainable Development Goal (SDG) 11 (target 11.1) requires that “by 2030, ensure access for all to adequate, safe and affordable housing and basic services and upgrade slums”, this target being measured by monitoring the “proportion of urban population living in slums, informal settlements or inadequate housing”—indicator 11.1.1 [20]. The connection between SDGs, slum regeneration, and sustainability is attracting growing interest in the literature [21]. This paper aims at contributing to the pursuing of the SDG 11, Target 11.1, by shedding light on an innovative hypothesis to achieve slum regeneration by harnessing the real estate market. With this aim, it approaches the slum regeneration issue from an integrated land economics and spatial planning perspective and demonstrates that slum regeneration can be successfully managed by applying land value capture (LVC) and inclusionary housing (IH) instruments. In so doing, it fills a gap in the current knowledge, since the connection between land value capture and housing affordability and its potential applicability to slum regeneration has not been thoroughly explored so far.

Although a robust scholarship exists on LVC in both developed and developing countries [22,23,24,25,26,27,28], still, a paucity of studies on LVC and affordable housing in slum regeneration persists. As Wyatt [26] argued, affordable housing delivery as an LVC mechanism is not so well-documented, hence it is not clear how effective it is. The Committee on Housing and Land Management of the Economic Commission for Europe at the United Nations recently (2–4 October 2019 meeting in Geneva) recognized that “while there are many studies which include information and examples on how national and local governments implement value capture policies, there are still few studies which would demonstrate the connection between land value capture and housing affordability” [29] (p.3). Very little has been explored so far on public–private-based approaches to develop a market-driven slum regeneration process, possibly due to the limitations of the social construct underpinned in the concept of “slum” or “informal settlement” so far [5]. To the researcher’s knowledge, only Freire [30] discussed the connection between land value capture and slum regeneration in São Paulo, but without suggesting and demonstrating an extensive application of the former to the latter as this paper does.

2. The Challenge of Slums and Urban Poverty

According to UN-Habitat [6], a slum refers to a variety of settlements that display a combination of poor housing conditions, lack of basic infrastructure, insecurity of tenure, and various kinds of environmental risks and includes a variety of settlements such as shanty towns, squatter settlements, informal illegal subdivisions, dilapidated inner city housing, overcrowded tenements, villages within cities, and deteriorating public housing. A slum household is defined by UN-Habitat [31] (p.17) as consisting of one or a group of individuals living under the same roof in an urban area, lacking one or more of the following five amenities: (i) durable housing (a permanent structure providing protection from extreme climatic conditions); (ii) sufficient living area (no more than three people sharing a room); (iii) access to improved water (water that is sufficient, affordable, and can be obtained without extreme effort); (iv) access to improved sanitation facilities (a private toilet, or a public one shared with a reasonable number of people); and (v) secure tenure (de facto or de jure secure tenure status and protection against forced eviction).

Slums are an important part of the urban economy [32], fulfil important political, social, and economic functions in the city [33], form part of the informal economy, and house many of the informal economy’s actors [13]. In the absence of the alternative affordable housing that is available in the slums, the urban economy would be affected. Therefore, slums cannot be ignored and effective sustainable public policies need to be put in place to guide and accelerate their improvement. Improving housing for slum dwellers and transforming their lives, particularly through participatory partnership programmes, lie at the heart of the 2030 Agenda for Sustainable Urban Development Goals (SDGs), targets, and indicators, as they “directly contribute to the five areas of critical importance for humanity identified by the said agenda: People, Prosperity, Planet, Peace and Partnership” [6] (p.83). Of critical importance is the contribution to SDG 11, which requires cities and human settlements to be made inclusive, safe, resilient, and sustainable [20]. Slums improvement will also contribute to ending global poverty, particularly the urban poverty represented by the many slum dwellers [34].

Causes of slums have been widely researched. In general, there are two main reasons why slums develop: population growth and governance [4]. Slums are a product of urban growth and rural urban migration [5]. As El-hadj et al. [3] argued, the failure of the housing market in African cities is also a main reason for the existence and growth of slums. Such market failure means the poor and the low-income households cannot access affordable housing in the formal market and, hence, slums provide the only reasonable and affordable housing option for them. Slums thrive because of the inadequacy of both public and market responses to the plight of the urban poor [34]. According to Baker and McClain [13], slums are essentially a private phenomenon, which responds to market incentives and distortions without extensive government interference. Baker and McClain further indicated that slums thrive and grow because a significant amount of economic activity contributes to the provision of basic shelter, water, food, energy, and other goods to slum dwellers. Factors often cited as causes of slums include poor government policies, the failure of the market and government to meet the enormous demand for decent and affordable housing, low state investment in infrastructure, an ineffective urban planning system, resource deficiencies, and a misdirected regulatory system [35]. Other factors supporting growth of slums include “a combination of rapid urbanization and demographic growth, bad policies, and inappropriate incentive systems including poor governance, inappropriate regulatory frameworks, dysfunctional housing markets, and a lack of political will” [3] (p.216). Above all, poverty pushes urban dwellers to slums because of their inability to afford high rents charged in the formal housing market [36,37]. Actually, slums represent the worst of urban poverty and inequality [34]. Poor urban governance by city authorities reflected in poor enforcement of urban development and the use of rigid and often outdated urban planning regulations, which are often bypassed by slum dwellers to meet their housing needs, have also accelerated slum formation [5,36,38]. Assefa and Peter [21] pointed out that the increased inequality and exclusion exhibited by slums is a consequence of the failure of public and private investment in pro-poor urban and housing development. The World Bank [12] noted that many cities today face expanding informality at the urban fringe because of failure to adjust urban planning regulations to allow for greater density in tandem with urbanization.

Lack of a land-use incentive system has supported the persistence and proliferation of slums. Therefore, there is a need for appropriate public policy and legislation to support affordable housing because political and economic opportunists in slum areas continue to thrive as a result of ineffective legislative and regulatory control [3]. Powerful and well-connected influential groups and individuals continue to benefit from the status quo [35] as the poor continue to live in desperate conditions. In Africa, this is particularly true for highly populated slums located in prime public land. This “inefficiency of the governance and spatial planning systems” [3] (p.41), coupled with the political and economic capitalization of slums in cities, creates a situation that leaves slum dwellers at the mercy of the slumlords who claim the land and the structures thereon. Some of the slumlords are influential people in society who do not live in the slums; for example, a survey by El-hadj et al. [3] found that some of the people who claim the land where the Kibera slum in Nairobi sits are wealthy individuals, including civil servants, politicians, and medical doctors. They live and own land elsewhere in the city and use the land and structures they have developed in Kibera as rental investment.

Failure of implemented slum policies and poor urban governance in general are interrelated factors that have facilitated the propagation of slums [5], and this is due to the inability of governments to understand fully the needs of slum dwellers and incorporate their needs when developing appropriate policies [39]. Governments in many less developed countries have failed (i) to incorporate slum dwellers in the overall planning process [4] and (ii) to understand the locational decisions of slum dwellers, and have insisted on resettlement in less desirable areas that the former slum dwellers leave as soon as they are settled. As Cities Alliance [4] argued, relocating slum residents far from their original homes and job opportunities is not usually viable. In designing more appropriate slum policies, all these issues need to be considered holistically because they are all important, and as Ron et al. [5] argued, failure to do so will only lead to the continued growth and persistence of slums.

We narrowed the location of our case study down to Kenya because UN-Habitat [40] indicated that 50% of Nairobi residents experience some form of shelter deprivation. UN-Habitat further argued that the urban poverty experienced by a majority of city residents is a result of institutional failures that perpetuate inequalities and social exclusion of the urban poor. That is why UN-Habitat [41] emphasized that there is a need for strong and effective housing policies that promote an end to these injustices faced by the poor. This is important because, as Jacobus [42] (p.10) argued, “equitable development benefits not only lower-income households; integrated, inclusive, and diverse communities enhance the lives and outcomes of all residents”.

3. Challenges in Slum Upgrading

Slum upgrading involves many actors and interrelated factors [43] and can therefore be challenging in terms of planning and decision-making. Most of the challenges facing slum upgrading are related to (a) the land the slums sit on and (b) the slum dwellers residing on the land. Slum dwellers do not have a legal claim to the land they occupy. In addition, in some cases the land they occupy may be unsuitable for development. For instance, approximately 5% of land occupied by the slum settlements in Nairobi is unsuitable for human settlement [44] because it is either sloppy, swampy, or on river beds. Where alternative land for resettlement needs to be sought, it becomes almost impossible for both national and local governments to find the same in prime accessible locations because most cities face dysfunctional and/or distorted land markets that are supported by inappropriate building standards and land regulations [4]. There are also external interests in the land occupied by Nairobi slums such as Kibera and Majengo because of their prime location [44]—they are centrally located near the city centre. These external interests slow the upgrading process and even where such slums are upgraded, they end up benefitting the middle-income households rather than the slum dwellers. Because of the high settlement densities in slums, available land in most cases cannot accommodate the existing slum population. For this reason, slum upgrading may involve relocations of slum dwellers. This goes against the best practise of in situ slum upgrading as advocated by UN-Habitat. In situ upgrading ensures the continued and uninterrupted social fabric and interdependence for the benefit of households and the local urban economy. Relocating slum dwellers can lead to serious socioeconomic effects such as interruption of the residents’ daily activities, long distances to workplaces, or even unemployment [19].

In some instances, slum residents refuse to surrender the land they occupy and demand compensation before doing so, and this impacts on the progress and success of the upgrading programmes. For example, in one upgrading project in the Soweto East area of the Kibera slum in Nairobi, there was a demand for compensation from structure owners, whereas in another project in the Silanga area within the same slum residents voluntarily and freely gave away their land [16]. There was more success in project implementation in the latter compared with the former.

There are challenges in organizing all stakeholders in the slum community to achieve coherence and find lasting solutions to all the different needs and demands that arise [4]. For instance, in the Kibera slum, different stakeholders, including the local administration (chiefs), politicians, religious and cultural leaders, and non-governmental organizations operating in the slum, have had varying and conflicting inclinations and competing interests. This has contributed to creating suspicion, mistrust, and conflict, thus slowing down decision-making and the upgrading progress [45]. In such cases and most of the time, it is the interests of politicians that carry the day, irrespective of whether they are in tandem with the interests of the majority poor living in the slums. This could be why Elmhirst [46] argued that slum improvement programmes and projects form part of political survival strategies and avenues meant to manipulate the poor for the selfish interests of the political class. Amis and Kumar [47] (p.196) summarised it well—“the task is to implement; the problem is to overcome the political and economic constraints”. Therefore, as Amis and Kumar emphasized, to succeed, slum upgrading needs good political will for effective project facilitation and implementation. A city’s political context has the power to affect even the upgrading financing mechanisms [14].

While some governments have displayed some level of political will to deal with the slum problem, many others completely lack the same [48]. Overall, many governments have paid little attention to both (i) the challenges that have enabled the continuous growth and spread of slums and (ii) the plight of slum dwellers themselves [5]. Moreover, competing interests among stakeholders slow down upgrading initiatives [45], and some NGOs may promote social activism, thus constraining progress [49]. Conflicts between tenants and slumlords also abound in slum upgrading projects. In Kenyan slums, nearly 85% of slum dwellers are tenants [45] and their interests are different from those of the slumlords. While slumlords are interested in securing their structures and the land they sit on, tenants are concerned about accessing affordable housing. Some slum upgrading projects have failed because of resistance from some community members and groups who believe or fear that they will not qualify to be allocated housing units under the upgrading programmes [4].

UN-Habitat [34] also identified social segregation as a major challenge to slum upgrading programmes. Segregation, social disparity, and marginalization are sometimes manifested through exclusion of the slum dwellers in the planning, the upgrading process, and jobs allocation in the upgrading projects, further hurting the local economy [50]. As Werlin [51] pointed out, most slum upgrading programmes concentrate mostly on housing improvements and ignore other slum livelihoods that are equally important. There is a need for comprehensive and integrated slum upgrading intervention covering affordable housing provision, micro and small enterprise support, and local employment to enhance the acceptability and impact of the programmes [14].

Implementing slum upgrading requires huge financial resources for infrastructural and housing development. These costs are mostly borne by governments and donors [3], and lack of adequate finance remains a big challenge to eliminating slums in developing countries. Many governments lack the resources to prevent formation of slums and upgrade existing ones [5,39,52]. Most donors have scaled down their support in the recent years [17], and governments are facing critical challenges in mobilising financial resources [14]. Cytonn [53] identified the key challenges hindering provision of affordable housing in Kenya to be the high land costs, high construction and infrastructural costs, and inadequate access to financing.

4. Slum Regeneration Policies So Far

Policy response to the urban slum problem in Kenya and other developing countries has evolved over the years. According to UN-Habitat [35], governments have historically responded to the problem of slums in seven main ways: ignoring them; using slums for political purposes; eradication, eviction, and displacement; relocation; public housing; sites and services schemes; and upgrading. In the past, the Kenyan government has made attempts aimed at increasing affordable housing for its citizens. From the 1930s to the early 1960s, the government invested in public housing. However, as Mwaniki et al. [54] outlined, in 1964 the government reduced its allocation to public housing provision due to low financial resources. This action accelerated development of slums and informal settlements in the country’s cities, especially Nairobi. Mwaniki et al. further observed that in the early years of independence the state viewed slums as an eyesore to the city’s image and development prospects. The government responded with harsh strategies to clean the cities, including mass evictions of squatters and clearance of slums. In fact, according to UN-Habitat [35], evictions and segregation became common in Nairobi, among other African cities including Cape Town, Kinshasa, and Harare. Because of prevalent slum clearance, governments were destroying more low-income housing annually than they were building [46], worsening the housing problem.

Scholars such as Turner and Fichter [55] cautioned governments against total clearance of slums and emphasized the need to adopt strategies for protecting and conserving the environment even in the presence of slums. Turner and Fichter argued that if governments could improve the sanitary conditions and environmental quality of slum areas, then residents would progressively improve their houses, especially when assured of the security of land tenure. In the 1970s, governments began to recognise slums as urban realities that required adequate solutions [21]. There have been shifts in policy doctrine since the 1970s, from emphasizing evictions and resettlement to an approach of integrating slums into housing policies in the 1980s, to providing for land tenure regularization and housing finance in the 1990s, and to combined approaches of housing development and infrastructure improvements [21].

In Kenya, other strategies implemented in the 1980s included site-and-service schemes as well as slum upgrading programmes with assistance from international financiers. In the early 2000s, the Civil Servants Housing Scheme Fund was established to facilitate affordable housing provision for civil servants [56]. In 2017, the government unveiled the Affordable Housing Programme (AHP) as one of its big four agendas with a target to deliver 500,000 affordable houses by 2022 [57]. The State Department for Housing and Urban Development presented an AHP framework that encourages the participation of the private sector and proposes incentives such as tax breaks, provision of serviced land, standardized housing designs, and legal reviews to facilitate affordable housing provision. However, AHP progress has been slow, and according to an analysis by Seeta [58], the few units already produced are being sold at prices higher than what was promised under the government’s original AHP framework, thus making them unaffordable to low-income households. Even with all the above strategies having been tried over the years and a Constitution supporting adequate housing for all, the slum problem has refused to disappear and housing affordability remains a thorn in the flesh of the government. The housing market in Nairobi and other cities remains robust but continues to work against the poor.

Nowadays, policies on slum improvement are formulated with recognition of the slum dwellers’ right to the city as included in the United Nations Rights to Housing [59]. The “Right to the City” seeks to promote equal access to the potential benefits of the city for all urban dwellers and encourages their democratic participation in decision-making processes in their cities [3]. Lately, there has been a strong commitment in most countries to a better and more modern approach of replacing slums with high-rise complexes. However, there is a problem—most projects have involved slum relocation with the high-rise complexes being developed on the outskirts of cities, where basic social and economic services are unavailable [21]. Even where they are undertaken in situ (where the slums exist), the output is minimal and almost insignificant compared to the magnitude of the housing problem. This is the case for Nairobi, and as UN-Habitat [35] reports, the city continues to be dominated by slums and informal settlements, characterized by poor living conditions and extremely high population densities.

5. Towards a Sustainable Approach to Slum Upgrading

Cities Alliance [4] pointed out three key issues for governments and stakeholders to consider in formulating policies that facilitate affordable housing provision for the urban poor. First is the need to accept the reality of urban growth and plan for it. Second is a shared understanding that slums and their residents are an integral part of the city; and third is that slum residents have a right to the city and to its services. There is a need to embrace sustainable approaches to slum upgrading in order to provide decent housing to the urban poor. As the United Nations [60] argued, what is needed is an inclusive and sustainable approach to urban development, one that can enable cities to cope with slums so that their future is safeguarded. To achieve this, the United Nations advised that authorities must clearly identify barriers to effective slum regeneration and introduce incentives for change. For SDG target 11.1 to be achieved, it will need to be owned by all stakeholders, including national and local authorities who should develop participatory slum upgrading strategies and programmes devoid of forced evictions [21]. This is important because “the challenge of informal settlements is complex as evidenced from their persistence after decades of planning and therefore, tackling them requires new approaches and ideas” [54] (p.16,17). In the face of the huge challenge of housing the urban poor living in slums, “urban planning must become more efficient and forward-looking, in order to enhance urban densities and reduce transportation needs, cut per-unit land costs, provide more efficient and affordable basic services as well as improved living environments for all citizens” [41] (p.9). The housing problem in cities has become worse while cities’ economies and real estate markets have become more robust. Therefore, tools are required that capture this urban dynamism in order to meet the rising housing needs. “A system is often required to redefine itself and reinvent itself to meet new challenges and accommodate new needs” [61] (p.2).

El-hadj et al. [3] suggested two key ways to stop the expansion of existing slums and prevent development of new ones. The first is to effectively address the supply failures of the housing market. The second is to provide affordable housing alternatives for the poorest, while bearing in mind that there is also a dearth of affordable housing alternatives for middle-income households. This calls for an approach that will lead to an increase in both low-income and middle-income housing, preferably in a mixed spatial setup, hence enhancing social inclusion. This will improve the living conditions of the slum dwellers as well as their economic welfare. In order to achieve sustainable slum improvement, governments will need to adopt comprehensive and integrated approaches supported by a range of policy tools that assure better outcomes [21].

In order to develop and implement effective interventions in slums, there is a need for new policies and an understanding of the role of the land and housing market. New participatory and inclusive approaches that explore new innovative and effective financing avenues are needed [60]. For slums to be eliminated, critical governance, economic, and political–cultural reforms that cater to the interests of the urban poor must be implemented [62]. UN-Habitat [11] suggested regeneration of slums through a planning process of opening streets, or reinforcing and improving existing streets and access paths. The World Bank’s urban strategy supports approaches that embrace efficient use of space, address congestion, promote social inclusion, and harness urbanization to deliver equitable housing production, inclusive growth, and a reduction in urban poverty [12].

Where land tenure in slums has been regularized to private individuals, governments should find ways of recouping the cost of slum regeneration through either levying land rates or charging households for outright purchase of the land [3]. It seems prudent to promote the private sector in housing development because, as the World Bank [12] observed, when the public sector dominates the private sector in land development, land market outcomes in cities are on average less favourable in terms of housing affordability and access to land by firms. The World Bank further observed that cities that auction public land, as well as those that do limited or no land banking, also tend to have more affordable housing. However, if the housing crisis in the inner cities is to be solved, there is a need for a change of land-use regulations to allow for higher densities [14], accompanied by a well-designed land value capture mechanism to finance affordable housing provision. This approach will enable governments to tap financial resources from the private sector.

6. Land Value Capture, Inclusionary Housing and Slum Regeneration

That there is an active informal land market in slums is not in doubt. The process by which the illegal subdivisions and land allocation is done in slums is similar to what happens in the formal land markets. Transactions are totally market-based and, just like in the formal markets, prices are guided by the size and quality of the land itself, level of perceived security of tenure, location of the land in terms of proximity to roads, bus termini, shops, and employment centres [34,63]. As Baker and McClain [13] observed, before slums benefit from any NGO or government interventions including upgrading, existing developments are exclusively done by the informal private sector. As Baker and McClain pointed out, this highlights the market system on which slums rely and could be the basis for envisioning and proposing an expanded role for the formal private sector in the slums.

Relying on public or external funding has been the main impediment to slum upgrading. This research considers the rationale and potential of using land value capture to increase affordable housing in the city of Nairobi. The research hypothesizes that slums could best be regenerated through conversion of public land (where most slums sit) to private land through alienation to private developers who include the slumlords. This methodology is proposed for slums and informal settlements on public land where, through stakeholder participation, land would be planned and allocated with priority going to the structure owners with the ability to develop, but also extending the offer to market developers. The conversion of the land from public to private status with high density use (high-rise flats) and its planning will enhance its value. Such value enhancement needs to be harnessed for the public good through a land value capture (LVC) mechanism. LVC means “requiring and using for public benefit part of any increment in land value that results from public policy and/or investment (and not by direct action by the landowner)” [64] (p.2,3). If this increment is not captured, it will end up benefitting the new landowners only and would have harmful effects on the low-income slum residents as it will result in their displacement. LVC should be used for redistributive purposes to redress disadvantage as the benefits of urban land ownership should flow to all city dwellers [65]. Smolka [22] argued that LVC should be used to mobilize some of the land value increments generated by actions other than those of the landowner for the benefit of the community at large. Such actions may include changes in land-use norms and regulations such as rezoning and densification [22,64,66]. LVC is seen as an efficient and equitable tool because those who did not contribute to the increased land values do not retain all the financial benefits [67]. Kenya, just like the other Sub-Saharan African countries, faces enormous challenges in providing adequate affordable housing for the increasing numbers of the urban poor, and hence cannot afford to let go the opportunity to apply LVC [68].

In slum regeneration, LVC could best be implemented through inclusionary housing (IH). IH includes land-use regulations that require developers of market-rate residential developments to make a portion of their units available at prices or rents that are affordable to households unable to afford housing in the market [23,24]. Therefore, in our case, developers would be required to set aside a portion of their units for the slum dwellers, the proportion being determined through economic and residual land-value analyses. IH is a means of using the planning system to create affordable housing by capturing resources created by the marketplace [25]. It is a means of harnessing increased land values to finance the development of affordable housing [24] and is a great tool that governments can use to increase affordable housing for low-income urban residents, particularly in prime accessible neighbourhoods.

The use of LVC and IH in slum regeneration has not been fully explored in the literature. This may be because of the way slums are construed—as entities separate from the city, thus propagating exclusion of the ‘slum land’, ‘slum-dwellers’, and ‘slumlords’ from the land and housing market. This is a market segment that is often ignored because it is mostly perceived as highly risky and hence unviable. However, given the prime location of most slums and the high population of low-income earners in our cities chasing the few residential units available for this market segment, there is a huge business opportunity for investors and developers. However, debate on the potential of using LVC for affordable housing in slums is now gaining momentum. Enrique Silva, associate director of the Lincoln Institute’s programme on Latin America and the Caribbean, while discussing the challenges presented by slums and informal settlements and the role of land in Will [69] (p.1), observed that “land-based financing tools like property tax or land value capture are not silver bullets, but they certainly play a role in ensuring that land is available for housing and services, thereby improving quality of life. Land-based financing tools, when used correctly and widely, ensure that the costs and benefits of urbanization for all residents are distributed and born as equitably as possible”. But governments have not considered the great opportunities presented by land value capture due to failures in strategy and limitations in land tenure and urban planning [3,70].

The idea of involving the private sector in slum areas is not entirely new. El-hadj et al. [3] identified two interesting examples of private-sector involvement in slum upgrading in Africa. The first example is Entreprises de Construction et Aménagement Divers (ECAD) in Kigali, Rwanda. ECAD’s approach involved buying rundown, owner-occupied, or rental housing structures in a slum; repairing and refurbishing them; and then selling or renting them at a profit, with an expectation of progressively upgrading the quality of housing in the slum. For example, ECAD would buy a housing structure from a low-income owner for RF 8 million (about USD 11,500), repair and refurbish it, and then sell it to a middle-income buyer at RF 15 million (USD 26,582). The second example El-hadj et al. gave is the Trust for Urban Housing Finance (TUHF) Limited in South Africa, which provides loans to entrepreneurs willing to invest in rental accommodation in inner cities. For instance, TUHF can provide financing to renovate rundown buildings or transform old factory buildings into rental accommodation.

The problem with the approaches in the above examples is the possibility of gentrification and displacement of the slum dwellers because of their inability to pay the higher rents. These approaches are unable to provide housing that is fully affordable to poor low-income households, who as a result prefer to leave. However, the failure of land and housing markets to supply affordable housing alternatives for middle-income urban households should also be blamed for the gentrification that occurs when these middle-income households displace low-income and slum households from the upgraded neighbourhoods [3]. An approach is therefore needed that will serve the housing needs of both the low-income slum dwellers and middle-income earners. The approach of LVC through IH will serve this need as it supports the inclusion and integration of different income groups. The approach is seen as supporting the “Right to the City” included in the United Nations Rights to Housing [59], which seeks to promote equal access to the potential benefits of the city for all urban dwellers. However, as El-hadj et al. [3] argued, the private sector faces a number of challenges while working in low-income areas, including serious constraints related to the legal and regulatory framework. But, as Baker and McClain [13] observed, there are opportunities for both the private-sector and slum dwellers to benefit from the engagement of private entities.

El-hadj et al. [3] further argued that despite the inherent informality in slums, private-sector companies can be involved in slum upgrading through the provision of basic infrastructure and services. Where slum upgrading interventions are to be implemented in unattractive, remote, or very poor areas, El-hadj et al. proposed that governments can finance the capital cost of the services and then transfer responsibility for operation and maintenance to private companies. El-hadj et al. further proposed that in some cases, especially for water provision, the government can offer subsidies to private companies to serve upgraded areas. The latter two proposals by El-hadj et al. will face challenges in many developing countries because governments are grappling with dwindling financial resources.

Other approaches including the creation of transferable development rights (TDRs) have been used elsewhere to woo private developers into the low-income market. Vinit [71] gave an example of Mumbai where developers were offered an increase in the permitted floor space index (FSI) if they agreed to produce a given number of low-income units. In cases of slums, Vinit stated that upon densification, the government would require the developer to provide serviced housing in situ for all slum households and allow the developer to use any remaining FSI in developing market-rate units on-site, transfer the FSI as TDRs to another location, or sell them to another developer for use elsewhere in the city. As Baker and McClain [13] observed, developers as business people responded not to the opportunity to upgrade slums or produce low-income housing, but to the opportunity to pursue more high-income development. In this case, it can rightly be argued that the end justified the means.

The potential for LVC in Nairobi presents itself in the following four main fronts: (i) slums on prime public land, (ii) prime public land near the Central Business District (CBD) with very old developments that need urgent renewal/redevelopment, (iii) slums and informal settlements on private land, and (iv) private land with developments that are below the highest and best use. Capturing land value for each category of land identified above will need a different strategy. However, in this case study, we evaluate the application of LVC on slums on prime public land. The housing crisis we are facing calls for a critical assessment of the systems that have existed and aggravated an already bad situation. The city authorities and the national government need to evaluate the role of public land that is mostly invaded by squatters who develop informal settlements that eventually degenerate into slums. The government’s ability to combat slums and increase affordable housing hinges on its influence on the use and ownership of its land. Conversion of public land to either community or private land with stringent conditions, including prioritising affordable housing development, can be an important part of a broader response to our slums and affordable housing problem. As land for developing affordable housing becomes scarce, government land occupied by slums remains highly ignored, yet most of it is close to the city centre and hence is highly accessible. This land where the urban poor live remains unserved and excluded, constraining development to its highest and best use. Yet the city continues to struggle with the dual challenges of housing its low- and middle-income households and eliminating slums.

There is no doubt, as Graham [72] observed, that land management (allocation, tenure, and use) is fundamental to solving the problems of informal settlements. Graham added that a better managed and equitable land and housing administration system that benefits the poor and increases affordable housing ensures that (i) residents benefit, (ii) chances of gentrification are reduced, (iii) business investment is encouraged to create employment within the community, (iv) mixed-income development is encouraged, and (v) essential urban services are provided.

In designing a working LVC model for affordable housing provision, it is important to understand key requirements for successful implementation of LVC. Agyemang and Morrison [68] identified the key factors required for effective delivery of affordable housing through land value capture. These are summarized and emphasized in Table 1 below.

Table 1.

Key factors required for effective delivery of affordable housing through land value capture.

Taylor [73] also outlined the following key considerations when implementing land value capture schemes, which we have summarised in Table 2 below.

Table 2.

Key considerations when implementing land value capture.

7. Research Methodology

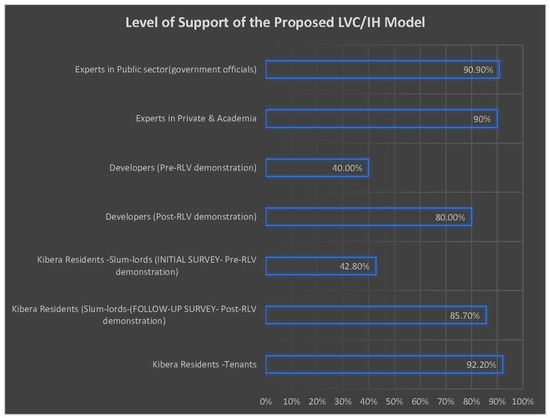

The research methodology applied in this study was based on a single case study, the slum of Kibera in Nairobi, Kenya. The case study was chosen because Kibera is the largest slum in Kenya and second largest in Africa [18] and is particularly dense, thus making regeneration attempts challenging. The Kibera slum is very conveniently located near the Central Business District (CBD) of Nairobi and posh residential estates, hence it benefits from being positioned in a high value location in real estate market terms. The research methodology was developed by testing the hypothesis that the real estate market in Nairobi would be sufficient to support the production of affordable housing to meet the needs of slum residents, through a hypothetical spatial master plan and related economic and residual land value analyses applied thereon. It was envisioned that the master plan would incorporate principles of sustainable urban planning, i.e., mixed-use; respectful of the social context and identity; with a high quality of public spaces and walkability. It would consider as a canvas for the new development the existing socioeconomic fabric (existing small retail economic activities and villages) in order to meet not only financial sustainability goals but also the wider sustainable planning concept. The reconfiguration of the slum’s physical fabric should be grounded in the existing socioeconomic and physical conditions, assuming that local identity and social ties are embedded in the current physical fabric. Hence, streets were reorganised but not changed, keeping in place the same economic pattern and distribution of services. In the model, the envisioned master plan and the residual land value analyses accommodated all residents and retailers, resulting in no eviction or relocation. As Assefa and Peter [21] observed, a positive and sustainable slum upgrading and regeneration should not solely provide affordable housing and infrastructure but should prioritize economic, social, and community activities that are needed to turn around downward trends in a slum area. Assefa and Peter emphasized that such an approach can indeed lead to urban regeneration at a precinct level and impact the overall urban fabrics of cities. The methodology proposed incorporated the UN-Habitat Participatory Upgrading approach [74] as it involved the participation of the local community (slumlords and tenants), relevant stakeholders, developers, and the government to form a strong network focussed on seeking a sustainable financial solution to the slum problem. The methodology was also motivated by the World Bank’s urban strategy, which promotes “an approach that facilitates spatial efficiency in production while addressing concerns of congestion and internal divisions within urban areas” while focussing on “harnessing urbanization to deliver equitable and inclusive growth and poverty alleviation” [12] (p.5).

The legal context in Kenya was analysed through a systematic review of the current laws related to land use and land administration in order to understand their provisions (whether they support or curtail land value capture). These statutes included the Constitution of Kenya 2010 [75], the Physical and Land Use Planning Act of 2019 [76], the Land Act No. 6 of 2012 [77], the Land Registration Act No. 3 of 2012 [78], the National Land Commission Act No. 5 of 2012 [79], the Community Land Act No. 27 of 2016 [80], and the Urban Areas and Cities Act No. 13 of 2011 [81].

The researchers analysed current plans, financial data, reports and documents on the spatial planning process, and slum regeneration strategies in Nairobi. The researchers considered the existing social fabric, which is embedded in the physical fabric of the Kibera villages. Each village holds a specific social identity, mainly related to the tribal social structure, and is politically managed by a local leader, the chief. Hence, the spatial plan was proposed for a chosen village rather than for the entire Kibera, assuming that the methodology could easily be upscaled to the entire slum but recognizing that the phasing-up of the regeneration strategy should be approached on a village-by-village basis. Soweto East was selected as the sub-case for the research due to its proximity to an existing area of recent regeneration. This selection was also motivated by the availability of reliable benchmark data for the economic calculations. Residual land value analyses were conducted simultaneously to verify the hypothesis financially. Informal consultations with Stefano Marras, a sociologist with previous experience in mapping Kibera, in a participatory approach allowed taking into account social considerations both in setting up the methodology for approaching the spatial plan, and in understanding the context and its peculiarities.

Data collection was carried out over a 12-month period from May 2019 to April 2020. Secondary data were gathered from the city offices and websites while primary data were gathered through interviews, complemented by surveys and field observations. In testing the applicability of the proposed model, the author interviewed city and national government officials, academics (experts in planning, law, and real estate), private practising professionals, community leaders, as well as developers. These persons were purposively selected from the Nairobi city planning office; the Kenya Slum Upgrading Programme; the Ministry of Transport, Infrastructure, Housing, Urban Development and Public Works; the Ministry of Lands and Physical Planning; the National Land Commission; the University of Nairobi and civil society groups operating in Kibera. Other stakeholders were purposively selected from among the many actors operating in Kibera. Informal discussions with the local administration (chief), residents, and academics provided leads on who were the main stakeholders to contact. The primary data collected from the Kenya Slum Upgrading Programme (KENSUP) and government ministry officials were related to issues in the existing programme, including implementation and challenges encountered. Developers were interviewed regarding their willingness to participate in the proposed programme. Academics and community leaders provided views on how they perceived the proposal and how to make the model succeed in Kibera, the former based on their experiences in researching in Kibera, and the latter based on their knowledge of community needs within Kibera.

Interviews were complemented by a survey undertaken among slum dwellers (slumlords and tenants). Their selection was undertaken through cluster, stratified, and simple random sampling techniques to ensure representation of the population. The clusters were based on the locations of the structures they owned or leased within the slum, while the stratification was based on type of occupant—whether slumlord (structure owner) or tenant, hence two stratums. A grid was prepared covering the whole study area (Soweto East village, zones C and D) and then samples of structures were picked in each grid through simple random sampling. A total of 97 structures were identified, and subsequently the household heads of at least two units (structure owner and one tenant or two tenants where the structure owner was absent) were approached and served with the questionnaires. Therefore, a total of 194 questionnaires were served. Of these, 156 questionnaires (80.4%) were returned. Demonstrations of residual land value analyses were simultaneously undertaken with a follow-up survey among slumlords and follow-up interviews with developers. Table 3 below shows the composition of those interviewed, while Table 4 shows the composition of Kibera residents surveyed.

Table 3.

Composition of the expert and stakeholder interviewees.

Table 4.

Composition of the Kibera survey respondents.

Residents were asked questions regarding their demographic and household characteristics (including number and ages of children, household size, and rent payable), their own assessment of the ongoing Kibera upgrading project, and their views on the proposed model of affordable housing provision. Field observation was also undertaken during repeated fieldwork sessions. Finally, based on the data collected, a hypothetical master plan and housing prototypes for zones C and D were envisioned. These prototypes were subjected to residual land value analyses to test their feasibility and to determine the most feasible scenarios for development within the slum with land value captured through inclusionary housing. In validating the model, discussions were held with two experts from the University of Nairobi and one expert from the UN-Habitat’s participatory slum upgrading programme (PSUP). For these discussions, two meetings were held with the University of Nairobi experts and four meetings with the UN-Habitat expert.

8. Setting the Context for the Case Study

8.1. The City of Nairobi

Nairobi is the capital city of Kenya and lies at the southern end of Kenya’s agricultural heartland, 1.19° south of the equator and 36.59° east of meridian 70. Its altitude varies between 1600 and 1850 m above sea level [82]. The city is located about 486 km by road from Mombasa, Kenya’s second largest city located on the shores of the Indian Ocean and about 344 km by road from Kisumu, the third largest city, located on the shores of Lake Victoria. It lies adjacent to the eastern edge of the Rift Valley while the Ngong hills occupy the western part of the city. Mount Kenya is located to the north, while Mount Kilimanjaro lies southeast of the city.

8.2. Demographics Characteristics

Nairobi is a culturally diverse and cosmopolitan city whose three main population components are Africans (95%), Asians (about 4%), and Europeans (about 1%). All the major Kenyan African ethnic groups are represented in the city [83]. Table 5 below shows the population and gender distribution in Nairobi City.

Table 5.

Population and gender distribution in Nairobi City.

8.3. Nairobi’s Property Market

The property market in Nairobi and Kenya in general remains robust. According to Cytonn [53], the real estate sector has remained attractive as a result of (i) relatively high returns, which in 2018 averaged at 24.3% over the previous five years, compared to an average of 13.2% for traditional asset classes; (ii) continued growth, with the real estate sector contribution to Kenya’s GDP increasing to 6.8% in Quarter 1 of 2018 from the 6.1% recorded in Quarter 1 of 2017, according to data from the Kenya National Bureau of Statistics (KNBS); and (iii) low supply in the residential sector, which has a housing deficit of 2 million units.

According to Department for International Development (DFID) [85], the current land and housing administration legislations and procedures in Kenya are inappropriate for poor people who live in the rapidly growing urban centres. DFID further observed that the urban poor have been unable to comply with these existing planning standards, regulations, and administrative systems since the regulatory framework is complex, and compliance often involves long administrative procedures with long delays. The result has been the proliferation of slums and informal settlements across the city where a majority of the city’s residents live under poor living conditions, lacking basic services and security of tenure. Slums in Nairobi are mostly located in prime public or private land near the city centre, industrial area, and affluent estates where the slum dwellers access employment opportunities.

Nairobi currently experiences overwhelming housing demand, particularly in the middle- and low-income categories, although output has favoured the moderate- and high-income markets. This high demand is supported by a stable macroeconomic environment and continued infrastructural improvements. Therefore, private rental investment is lucrative and, as Christine [17] observed, private landlords dominate the housing market in the city with rental accommodation being the main form of housing. Christine further observed that Nairobi has experienced uneven spatial development since the colonial era, creating social exclusion of the urban poor (and residents of informal settlements) through urban design and land-use decisions which cater mostly to the middle- and upper-class citizens, severely limiting the space that is currently available to the urban poor.

9. Legal Context in Relation to Land Value Capture

A systematic review of the current laws related to land use and land administration in Kenya, including the Constitution of Kenya 2010 [75], the Physical and Land Use Planning Act of 2019 [76], the Land Act No. 6 of 2012 [77], the Land Registration Act No. 3 of 2012 [78], the National Land Commission Act No. 5 of 2012 [79], the Community Land Act No. 27 of 2016 [80], and the Urban Areas and Cities Act No. 13 of 2011 [81], reveals that the government can use various sections in some of the statutes to plan Kibera and implement land value capture for affordable housing provision within the area. Section 52(1) of the Physical and Land Use Planning Act of 2019 [76] empowers the county government on its own motion or when requested by the national government to declare an area as a special planning area. This declaration can be made if that area has been identified as suitable for intensive and specialized development activity; the development of that area might have significant effect beyond that area’s immediate locality; the development of that area raises significant urban design and environmental challenges; or the declaration is meant to guide the implementation of strategic national projects. This declaration, which should be published by notice in the Gazette and in at least two newspapers of national circulation, is required to specify the area declared as a special planning area and the nature of the proposed development for which the declaration has been made. This will facilitate development of a special area plan that would guide sustainable and economically feasible physical development through a participatory approach.

The Land Act No. 6 of 2012 [77] Section 12 provides that the National Land Commission may, on behalf of the national or county governments, allocate public land. The commission is allowed to set aside land for investment purposes provided that the investments in the land benefit local communities and their economies. This section further provides that, in an allocation of public land, the commission may impose any terms, covenants, stipulations, and reservations that the commission considers advisable, including on the applicant doing such work and spending such money for permanent improvement of the public land within the period specified by the commission; or paying a consideration for a disposition of the public land. It is provided that public land allocated shall not be sold, disposed of, sub-leased, or subdivided unless it is developed for the purpose for which it was allocated. Where the land allocated is not developed in accordance with the terms and conditions stipulated in the lease, the law provides that such land shall automatically revert back to the national or county government, as the case may be. These provisions under the Land Act No. 6 of 2012 [77] Section 12 make the implementation of inclusionary housing requirements practical.

In assessing the proportion of housing units to be affordable, the commission is supported by the National Land Commission Act No. 5 of 2012 [79] Section 6(2)(c), which gives the commission powers to take any measures it considers necessary to ensure compliance with the principles of land policy set out in Article 60(1) of the Constitution, i.e., equity, efficiency, productivity, and sustainability, among others. The Constitution [75] (Article 67(2)) and the National Land Commission Act [79] Section 5(1)(g) give the National Land Commission the mandate to assess taxes on the land and premiums on immovable property in any area designated by law. Urban Areas and Cities Act No. 13 [81] of 2011 gives cities and urban areas the power and mandate to control land use, land subdivision, land development, and zoning. In addition, the country’s Constitution [75] protects the right to housing. The Constitution [75] in Chapter 4 under Article 43, sub-article 1(a), states that “Every person has the right to accessible and adequate housing, and to reasonable standards of sanitation”. Article 60(1) of the Constitution [75] states that “land in Kenya shall be held, used and managed in a manner that is equitable, efficient, productive and sustainable”. The way land is used in Kibera definitely does not meet this article’s requirement as access to it is not equitable. Given the prime location of the land, it is neither used efficiently nor productively, with the current one-storey iron sheet structures that allow for accommodation of a few residents in a congested environment. Hence, this scenario is not sustainable. The national and county governments may ride on provisions in the various statutes highlighted above to effectively implement land value capture through inclusionary housing.

10. The Kibera Slum in the City of Nairobi

10.1. General Introduction

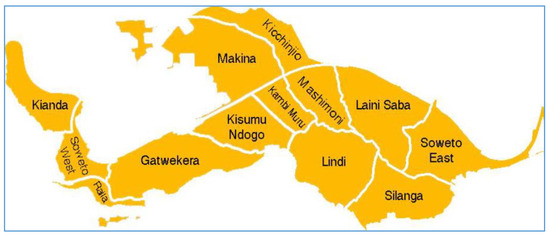

Kibera is one of the largest slums in Africa with an average population of approximately 200,000 people [86,87]. Kibera is located approximately 5 km southwest of Nairobi City centre and stands on 2.5 km2. The slum is divided into 13 villages—Kianda, Soweto West, Raila, Gatwekera, Kisumu Ndogo, Makina, Kicchinjio, Kambi Muru, Mashimoni, Lindi, Laini Saba, Silanga and Soweto East (see Figure 1 below).

Figure 1.

Map showing the 13 villages within the Kibera slum. Source: Map Kibera Project [88].

Buildings in the Kibera slum are mostly mud-walled and are roofed with corrugated iron sheets [89]. One structure contains several single rooms of approximately 12 ft by 12 ft, each occupied by a single household. According to Mutisya and Yarime [15], a household in the slum comprises seven members on average. Approximately 10% of Kibera residents own some of the structures [34,86], whereas the rest are owned by absentee landlords who reside elsewhere [3]. The structure owners charge a monthly rent of approximately USD 15 for a single room.

Most of the residents in Kibera live in abject poverty and rely heavily on their engagement with the city’s informal economic sector, particularly buying and selling goods in local markets [17] and within the slum. Others work in either Nairobi’s city centre, Nairobi’s industrial area, or as domestic servants in Nairobi’s affluent estates near Kibera. Because of Kibera’s central locality, most residents walk to these places of work.

10.2. The Kibera Upgrading Initiatives: Progress and Failure

Through the Kenya Slum Upgrading Programme (KENSUP), the government in partnership with the UN-Habitat, implemented an upgrading pilot project in Soweto East, one of Kibera’s 13 villages. To facilitate a systematic implementation process, Soweto East was divided into four zones, namely A, B, C and D [90], with upgrading starting in zone A. Kibera’s Soweto East village covers an area of 21.3 hectares and had a population of approximately 19,318 people in 2004/2005, when the project commenced [17,90]. A total of 6377 bona fide residents (household heads) of Kibera Soweto East Zone A were identified to be allocated housing units in the new developments, but the Ministry of Lands through KENSUP committed to build at least 7233 housing units. A decanting site located next to the Lang’ata Women’s Prison was built to move and house residents temporarily as the new housing units were being constructed in Kibera Soweto East zone A [90]. A memorandum of understanding between the government and the residents of Kibera Soweto East zone A Village bound the residents to move back to the Soweto East zone A in a tenant purchase scheme once the houses and related infrastructure were ready for occupation. However, within the course of implementation, the project, which had received a lot of global attention and garnered the support of large international agencies, stalled mainly because of the breakdown of partnerships and funding streams [17] and lack of public funds. KNCHR [90] reported that the project only managed to produce 822 housing units in 12 years, leaving a deficit of 6411 units. The project also delivered 245 commercial stalls, a multipurpose centre, and upgraded infrastructure. The housing units are within several seven-storey blocks of flats. Of the 822 housing units, 144 are three-room units, 570 are two-room units, and 108 are one-room units.

As explained earlier, the total land area in Soweto East is 21.3 hectares. Zones C and D occupy 3.6 hectares and 4.5 hectares, respectively [17,90]. Our case study area encompasses zones C and D—a total land area of 8.1 hectares.

11. Possible Solution and Demonstration of the Hypothesis: Assessing the Viability of the Proposed Model for Soweto East, Kibera; Nairobi

As Cronin and Guthrie [16] observed, one solution for Kibera could be for the government to allow the structure owners to invest in developing the land, in accordance with master planning guidelines formulated by the government. Cronin and Guthrie added that it may also be the case that the structure owners are better connected to the community than any NGO or development agency and so have a good understanding of the real needs of their tenants. Interviews with structure owners suggested that some of them can raise funds to put up permanent buildings if approved by the government. They have also developed a bond with their tenants and most of them said it will not be difficult for them to accommodate these tenants in the new developments at a rent that is affordable, if that is the sacrifice they have to make in exchange for secure tenure and higher development rights.

Kibera is congested but the land parcels are not densely developed. The way to address the housing problem in Kibera would be to seize the prime locality of the land and its lack of density and through public policy focus on creating opportunities to build denser and more vertical mixed-use developments. Such a policy should be able to manage the likely possibility of resistance from some structure owners/slumlords, who benefit from rent-seeking within the slum. It should also calm the slum dwellers’ fears of losing their affordable homes and eliminate the reluctance of the private developers at getting into the slums. Therefore, the policy must demonstrate to all interested persons that there will be a gain on their side. The model must be designed in a way that it achieves the following: (i) enables the government to economically and sustainably upgrade the slum, (ii) allows slum dwellers to access quality housing at an affordable rent, (iii) fosters social inclusion and curtails gentrification, and (iv) attracts developers and permits them to make a profit despite the provision of subsidized units.

In this research, we offer an alternative and sustainable model of dealing with slums and providing equitable affordable housing. We suggest that a density-focused inclusionary housing development model supported by a well-designed land value capture mechanism might be a useful policy to embrace. Use of land value capture and inclusionary housing will help to eliminate slums, increase affordable housing, and create inclusive and integrated communities. This can be done without displacing the slum dwellers because inclusionary housing ensures that they are accommodated in affordable units provided within the development. This approach will likely result in enough affordable units for the current Kibera residents and future immigrants, thereby achieving two objectives, that is, (i) regenerating the Kibera slum and (ii) preventing development of new slums. As Crawford [91] argued, density incentives, if executed carefully, have the advantage of being more environmentally responsible because they promote less sprawl. The density–sustainability nexus has been widely explored in urban planning theory and practice, and almost unanimous consensus exists on the necessity of managing growth and curbing sprawl. This is consistent with the principle of sustainable land use in Kenya’s land policy as set out in Article 60(1) of the Constitution [75]. The approach embraces mixed-use sustainable development and hence anticipates inclusion of small retail and productive activities as well as common public facilities in the master plan. The study demonstrates the financial viability of a real estate market-driven regeneration approach using a village of the Kibera slum, i.e., Soweto East. If adopted, this model can help create a mixture of affordable and market rate housing by tapping the strength of the real estate. This is because, as the model proposes, private developers will be allocated land after planning and then compelled to include affordable units in new developments and contribute an impact fee that will fund (i) temporary relocation costs of the residents and (ii) new infrastructure in the immediate environs to make the neighbourhoods accessible and liveable. The model does not consider only the present population but also includes future low-income residents as well as market rate middle-income residents who will access market properties and trigger the financial viability of the initiative. The model ensures that development requirements simultaneously facilitate infrastructure and new housing development while maximizing affordable housing delivery for the low-income/poor inhabitants. This calls for a delicate balance in the analyses to ensure that both public benefit and project feasibility are achieved. If affordable housing requirements are set too low, the slum would be upgraded, but this will not address the affordability issue and will lead to gentrification. On the other hand, if requirements are set too high, no development will occur because it would be financially unfeasible, and thus the slum will not be upgraded and affordable housing will not be provided.

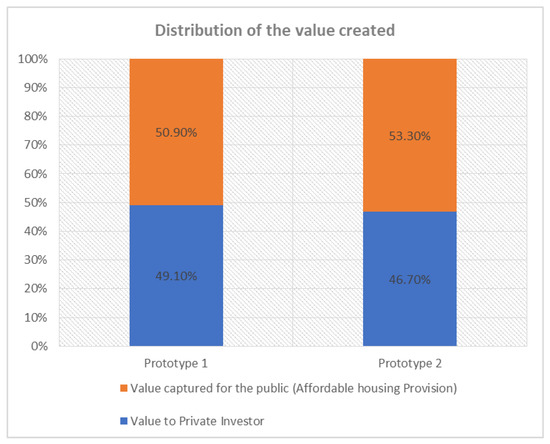

The residual land value analyses represent the financial performances of different prototype developments in the hypothetical master plan area and express how land values will be affected by the proposed increased development density and a range of new requirements, such as affordable housing and development impact fees. These analyses are important in order to find out which development requirements maximise affordable housing provision while achieving development feasibility for the developer.

In order to illustrate the proposed methodological approach in practice, we analysed the subdivision potential and affordable housing requirements for the Soweto East village zones C and D situated in the northeastern part of Kibera, adjacent to Canaan Estate, an existing upgrading project done by the government and UN-Habitat within the Kenya Slum Upgrading Programme framework. Upon collecting the necessary data, we undertook the following steps:

- Needs assessment: We began by quantifying affordable housing needs in the study area. The affordable housing units required should be equivalent to the current number of households plus an annual increment to take care of a population increase before developments are completed. Our study area lies within the Laini Saba sub-location of Kibera and as per the 2019 Kenya Population and Housing Census, the population density in this area is 81,807 persons per km2 [84]. The total land area for our study area is 8.1 hectares or 0.081 km2, which translates to a population of 6627 persons. Bearing in mind that (i) developments are estimated to take approximately two years and (ii) the annual rate of population increase in Nairobi is 3.9% [92], the population that needs to be accommodated in affordable housing will have increased to 7168 persons by the time developments are completed. The next step in our user needs assessment was the determination of number of households. Results from the survey conducted showed that the most common household size within the study area is 6 followed by 5, 4, 3, 7, 1, 8 and 9. The average household size was found to be 4.878, as demonstrated in Table 6 below.

Table 6. Determination of the average household size in zones C and D, Soweto East, Kibera.The derived average household size was collaborated by other studies. UN-Habitat in Research International [93] reported an average household size of 5 persons, while Amélie and Sophie [87] arrived at an average household size of 3.2 persons. Mutisya and Yarime [15] indicated that a household in Kibera comprises 7 members, although they did not indicate their source or how they arrived at this number. For purposes of determining the number of required affordable housing units for the residents in our study area, this study used the average derived by our analysis but approximated the same at 5 persons per household. The number of affordable housing units was derived by dividing the population in the study area (7168 persons, as determined earlier) by the average household size (5 persons). This resulted in 1434 housing units.

Table 6. Determination of the average household size in zones C and D, Soweto East, Kibera.The derived average household size was collaborated by other studies. UN-Habitat in Research International [93] reported an average household size of 5 persons, while Amélie and Sophie [87] arrived at an average household size of 3.2 persons. Mutisya and Yarime [15] indicated that a household in Kibera comprises 7 members, although they did not indicate their source or how they arrived at this number. For purposes of determining the number of required affordable housing units for the residents in our study area, this study used the average derived by our analysis but approximated the same at 5 persons per household. The number of affordable housing units was derived by dividing the population in the study area (7168 persons, as determined earlier) by the average household size (5 persons). This resulted in 1434 housing units. - The hypothetical master plan: We proposed a master plan for Soweto East zones C and D (total area of 8.1 hectares). This was done on assumption that the land is rezoned into high-rise flats use. To attain aesthetic value, it was proposed that typical building plans be imposed on all the land parcels save for minor adjustments where the plot areas differ significantly. However, the master plan should strive to achieve uniform plot sizes where possible. It was also proposed that where the building plans are typical, they should be approved in advance by the county government, meaning that developers will not need to make individual applications, hence hastening the development process and reducing the cost. This will act as an incentive to the developers and is important because approval processes have been identified as lengthy and an impediment to the housing development process. In determining the ideal plot sizes, benchmarking was done with other low-income estates in Nairobi, including Umoja, Kayole, and Dandora, to determine the ideal plot size for such a housing scheme. It was determined that land parcels measuring approximately 280 m2 would be ideal for the proposed model. This resulted into 122 land parcels that could be created from the study area. The proposed master plan would incorporate two seven-storey prototypes—50 land parcels that front the main arterial routes are proposed to be of mixed use with some commercial units on the ground floor, while 72 land parcels would be purely residential.

- Determination of affordable housing requirements per land parcel: Based on the population, household size, and number of households derived in i above, number of land parcels delivered by the master plan in ii above, determination of the affordable housing requirements per land parcel was done as demonstrated in Table 7 below.

Table 7. Determination of affordable housing units required in zones C and D, Soweto East, Kibera.