1. Introduction

This study assessed the effects of the quantity, quality, and structural aspects of transport infrastructure endowment upgrading on economic growth. Additionally, the study explored the possibility of a relationship between government development strategies and the growth impact from transport infrastructure. Since the 1990s, the World Bank has repeatedly emphasized that policymakers should not exclusively focus on the quantity of infrastructure investments and that improving the quality of infrastructure services is also vital. Moreover, the World Bank has found that in the past, low operating efficiency, inadequate maintenance, and insufficient attention to users’ needs have all contributed to reducing the development impact of these investments. Therefore, it is considered essential to improve the effectiveness of infrastructure investments as well as the efficiency of infrastructure service provision. After analyzing and summarizing lessons learned from experiences worldwide, the World Bank noted that infrastructure investment alone does not guarantee growth and that when the overall economic policy conditions are unfavorable, the returns from infrastructure investment decline [

1]. In summary, the World Bank’s research has provided valuable guidance for countries to develop infrastructure according to their own unique characteristics.

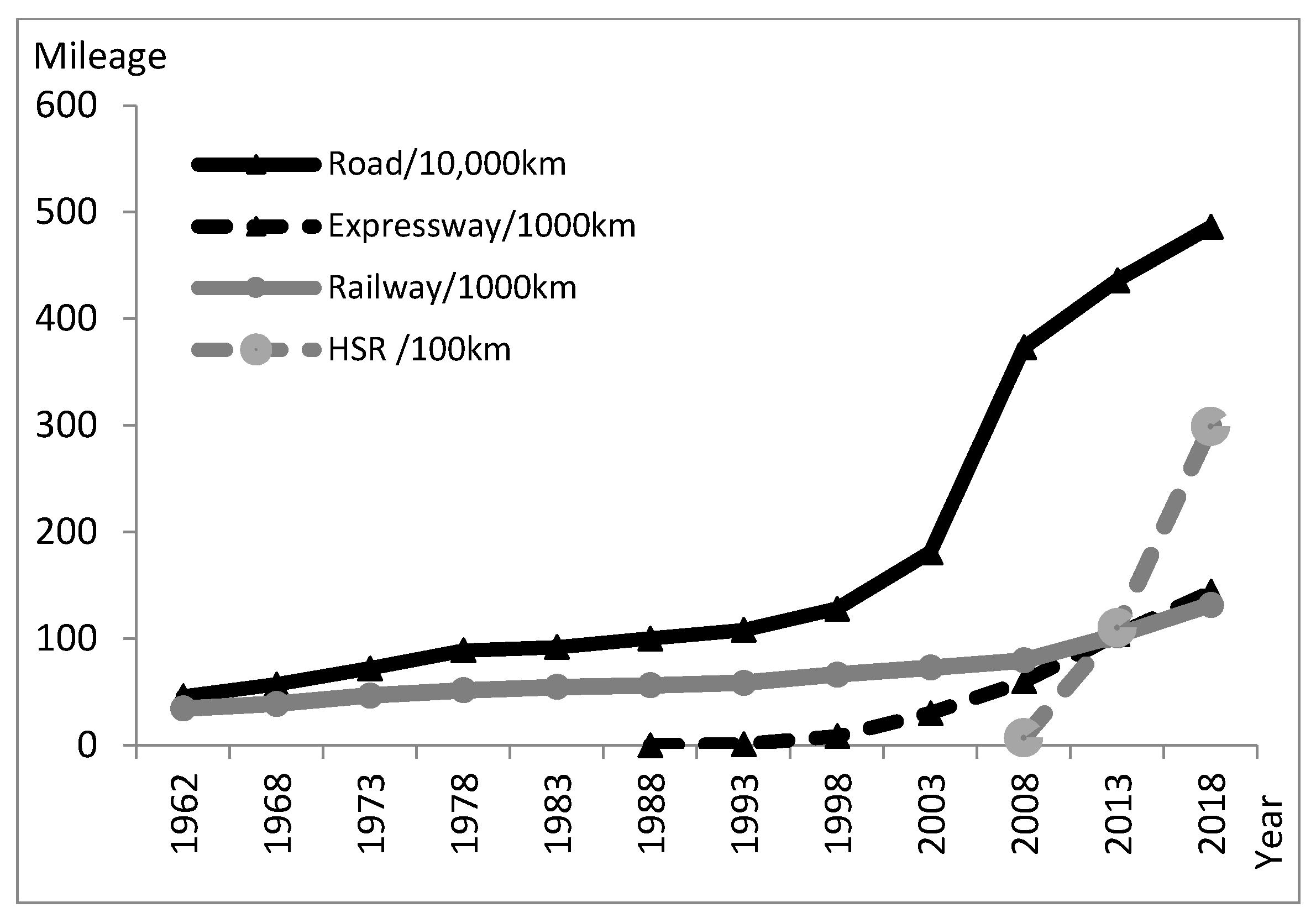

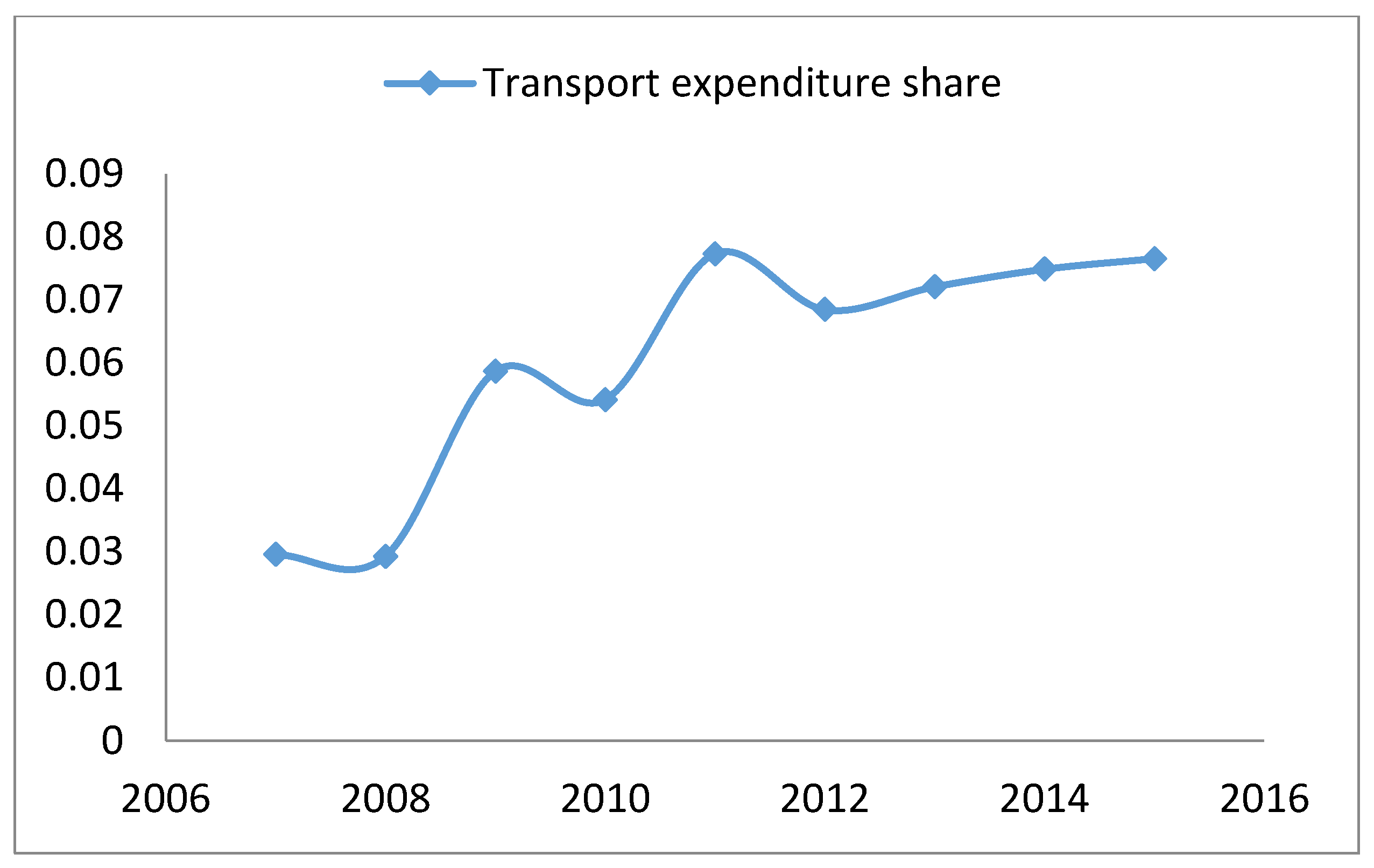

China has experienced rapid economic growth and an expansion of its transport infrastructure over the last 40 years. Since the initiation of reforms in 1978, the Chinese economy has maintained an annual growth rate of 9.5% in real terms, with the rate doubling every eight years on average according to the National Bureau Statistics of China (NBSC). China’s transport infrastructure has emerged at an astonishing pace, growing from almost nothing to an extensive network of roadways, expressways, railways, and high-speed rail (HSR), and it is now the most extensive in the world. As China has successfully transitioned from a low-income country to an upper-middle income one with the world’s second-largest economy (see

Figure 1), the transport infrastructure endowment has diversified from simple quantitative expansions (i.e., an increase in the length of roadways and railways) to quality improvements (i.e., high-speed roadways and railways) and structural upgrading (i.e., increases in the share of government expenditure to improve maintenance and service efficiency in the transport sector; see

Figure 2 and

Figure 3). These facts set an appropriate context for studying the causal impacts of China’s transport infrastructure on its economic growth at different stages of development. The fundamental questions are as follows. When China reaches upper-middle income status, how do different aspects of transport infrastructure endowment upgrading contribute to regional economic growth? Is there heterogeneity in the impact across these aspects? Further, what is the relationship between the transport infrastructure growth impact and the government’s development strategies?

This study contributes to the growing body of literature that estimates the economic impact of transport infrastructure projects. Recent contributions find that in developed countries, highways and civil aviation promote trade, increase growth, raise skill premia, stimulate innovation, and facilitate decentralization and urban formation [

3,

4,

5]. See Redding and Turner [

6] for an extensive survey.

China’s evidence suggests that the transport infrastructure impact differs according to development levels and transport infrastructure attributes. For example, Demurger [

7] estimated the impact of transport infrastructure quantity (railway, road, and inland navigable water network length per square kilometer) from 1985 to 1998, when China was a low-income country. The author found that the overall transport quantity had a positive effect on provincial growth, but the impacts decreased with the level of economic development. In a similar research period, Fan and Chan-Kang [

8] found that from 1982 to 1999, low-quality roads (mostly rural) rather than high-quality ones (expressways) contributed more to GDP, urban GDP, and poverty reduction. Hong et al. [

9] considered both the quantity and quality of transport infrastructure and showed that from 1998 to 2007 (after China became a middle income country), land and water transport’s growth impacts were greater than those from airway transport. Lin [

10] found that as China approached an upper-middle income level from 2008 to 2013, its HSR promoted urban employment and GDP. Other research has found that transport had zero or negative impacts on development outcomes. For instance, Faber [

11] constructed hypothetical instruments and found that from 1997 to 2006, the National Trunk Highway System reduced county GDP growth. Qin [

12] exploited an inconsequential units approach and found that from 2002 to 2009, railway speed upgrading reduced county GDP. Feng and Wu [

13] showed a negative productivity effect from public infrastructure capital stocks across provinces from 1996 to 2015. Banerjee et al. [

14] used an instrumental approach and system-generalized method of moments (GMM) and determined that from 1986 to 2006, the distance of a county from historical transport networks had no impact on per capita GDP growth. In sum, most previous studies have used either public infrastructure investments [

15], transport investments [

13], or roadway lengths [

7] to measure transport infrastructure endowments, but these studies do not capture effects from transport infrastructure quality. Among studies considering both the quantity and quality of transport infrastructure, some identified an overall impact but did not distinguish between the two effects [

9].

In addition to the above-mentioned studies, a few papers have focused on infrastructure maintenance and service, and most of the evidence has been based on cross-country analysis. In general, maintenance is defined as those activities that allow public infrastructure to efficiently deliver the outputs for which they were designed [

16]. Devarajan et al. [

17] examined a panel of 43 developing countries and found that current public expenditures on infrastructure maintenance had a positive effect on output. Rioja [

18] modeled the determinants of the optimal share of GDP devoted to infrastructure repair and maintenance, and his quantitative analysis of data from seven Latin American countries suggested that reallocating funds from new investments to maintenance positively affected GDP. Kalaitzidakis and Kalyvitis [

19] constructed an infrastructure-led growth model in which the durability of public capital varied according to the maintenance expenditure, and they showed a beneficial role for maintenance expenditure on public capital formation. Despite the consensus on the crucial weight of infrastructure maintenance in the total public investment expenditure, empirical studies on maintenance in developing countries (including China) have received much less attention due to data unavailability [

19].

This study also contributes to the literature on the roles of development policies or strategies during countries’ early stages of economic development, e.g., Itskhoki and Moll [

20] and Tinbergen [

21]. In particular, Bruno et al. [

22] and Lin [

23,

24] have provided a series of theoretical and empirical analyses on development strategy impacts in China and other developing countries and transition economies. These studies have argued that most less developed countries in the post-World War II period adopted inappropriate development strategies—or comparative advantage-defying (CAD) strategies—which focused on accelerating the growth of capital-intensive industries even though the countries were capital scarce. Firms in industries with comparative disadvantages became nonviable in open competitive markets, and governments needed to subsidize nonviable firms in prioritized heavy-industry sectors through resource allocation interventions and market distortions [

25]. Such development strategies helped shape development outcomes across regions in China. Based on the relevant literature, we argue that if the government adopts a CAD strategy and distorts resource allocation toward the capital-intensive sector, capital returns will be repressed, overall economic conditions will be unfavorable, and returns to transport infrastructure endowment upgrading will be lower. Nevertheless, existing empirical research has ignored the significant role of government development strategies and their influence on transport infrastructure growth impacts in China.

In the context of the rapid rise of China to upper-middle income status, this study constructs a unique dataset to describe the quantity, quality, and structural aspects of the transport infrastructure in China during the period 2007–2015. The dataset has two important characteristics. First, it contains information about regional government expenditures on maintenance in the transport sector, which has been publicly available from the National Bureau Statistics of China (NBSC) since 2007. Following Lin and Fu [

26], we identify the share of regional government expenditure for transport that goes toward the structural aspect of transport infrastructure. The second unique characteristic of our dataset is that in contrast to recent studies that used insufficiently aggregated data, we follow Chakrabarti [

27] and Hong et al. [

9] and select provinces as the geographic units to alleviate concerns about violating the stable unit treatment value assumptions (SUTVA) [

28]. This is based on the fact that the economic impacts of the transportation infrastructure can leak beyond the borders of small economic areas such as cities or counties leading to SUTVA violations, as emphasized in Redding and Turner [

6], Rephann and Isserman [

29], and Baum-Snow and Ferreira [

30].

Concerning the econometric methodology, we adopt the system generalized method of moments (system-GMM) estimator for the dynamic panel data model, in which the unobserved province-specific effects and potential endogeneity and measurement error of regressors are controlled for (held constant). GMM was developed by Lars Peter Hansen in Hansen [

31] as a generalization of the method of moments, introduced by Karl Pearson in 1894. Hansen shared the 2013 Nobel Prize in Economics in part for this work. The dynamic panel system-GMM estimator was developed by Arellano and Bover [

32] and Blundell and Bond [

33], building on the first-difference GMM estimation approach proposed earlier by Arellano and Bond [

34]. Dynamic panel models permit the use of instrumental variables (internal instruments) for all the explanatory variables so that more precise estimates can be obtained. Thus, the dynamic panel system-GMM method has been widely applied in many areas for example in examining the impact of financial development [

35], other institutional improvement [

36], etc. In recent years, the method has been exploited to examine the relationship between transport infrastructure and growth, including Chakrabarti [

27], Farhadi [

37], and Jiwattanakulpaisarn et al. [

38]. Indeed, Bond et al. [

39] and Hauk and Wacziarg [

40] pointed out that the advantage of the dynamic panel system-GMM estimator is that it can address concerns about identification, reverse causality, and to account for the lagged responses of economic growth to any exogenous shock including transport infrastructure, so to obtain consistent and unbiased parameters even in the presence of a measurement error and endogenous right-hand-side variables. As such, we can reliably identify the impacts of the exogenous component of the quantity, quality, and structural aspects of transport infrastructure on regional economic growth in China within the same empirical framework. However, the above-mentioned (external) instrumental variables in the transportation literature cannot achieve our research goal.

Lastly, we consider government development policies in the infrastructure impact evaluation framework for China to investigate how development strategies affect the transport infrastructure growth impact. Following Lin [

23,

24] and Lin and Wang [

25], we adopt the technology choice index (TCI; calculated by the ratio of value-added to labor ratio in manufacturing in a province over the total value-added to labor force in the country) as a measure of the government’s inclination to employ a development strategy that is geared toward capital-intensive sectors, in other words, the government’s tendency to employ a CAD strategy. For details about government strategies, see

Section 5.3.

We found evidence that when China reaches the upper-middle income level, quantity-related bottlenecks in the transport infrastructure have mostly been eliminated; transport infrastructure quality improvement and structural upgrading significantly contributes to regional economic growth. However, we did not find a significant positive impact of the quantity increase in transport infrastructure exclusively. Second, government development strategies that defy local comparative advantages not only lead to declines in the per capita GDP growth rate but also potentially restrict the positive contributions of transport infrastructure. Third, the regional heterogeneity regarding Western China can differ across transportation modes as in goods versus passenger transport and roadways versus railways. Our baseline findings are robust to various sets of control variables, the exclusion of possible outliers, and external instrumental variables for transport infrastructure.

Our contributions to the existing literature are as follows. This study is the first formal assessment of how the quantity, quality, and structure of transport infrastructure contribute to China’s economic growth. Moreover, our study is the first to consider government development strategies within an infrastructure impact evaluation framework. We highlight the relationship between a country’s level of development and the multiple aspects of transport infrastructure and how government development strategies can affect the impact of transport infrastructure on economic growth. Our results are relevant for policymakers in developing countries and sustainable infrastructure development under the paradigm of Industry 4.0 [

41,

42,

43].

The rest of the paper is organized as follows.

Section 2 reviews the process of transport infrastructure upgrading in China.

Section 3 describes the data and variables.

Section 4 elaborates on the dynamic panel data model and system-GMM estimation.

Section 5 reports baseline estimation results and robustness checks.

Section 6 concludes this paper.

4. Model and Estimation

An attraction of panel data is the possibility of consistent estimation of the fixed effects model, which allows for unobserved heterogeneity that may be correlated with regressors [

56]. Hence, to separately assess the influence of the quantity, quality, and structural aspects of transport infrastructure endowment upgrading, we formulated the empirical growth model following Barro and Sala-i-Martin [

57] in a panel data context [

58].

where

is the logarithm of per capita real GDP for province

in year

.

is the lagged logarithm of per capita real GDP.

, the main variable of interest in this study, equals eitherthe quantity of transport infrastructure (Roadpc), the quality of roadway transport (Highroadshare), the quality of railway transport (HSR), or the structure of transport infrastructure (Trstuct1) as described in

Section 3.1.1. That is, to identify the impact of the quantity of transport infrastructure,

equals Roadpc; t of the quality of roadway transport,

equals Highroadshare; to identify the impact of the quality of railway transport,

equals HSR; and to identify the impact of the structure of transport infrastructure,

equals Trstuct1.

is a conditioning information set (Basic set, Medium set, Policy set, and Full set). It represents a vector of conditioning information that controls for (holding constant) other factors associated with economic growth, but excluding

that Equation (1) has already controlled for. Accordingly,

,

, and

are the parameters and vectors of parameters to be estimated.

is the fixed effect thatcontrols for (holding constant) the unobserved time-invariant province-specific characteristics [

59]. In the transport-growth literature, such unobserved time-invariant heterogeneity is typically climate, topography, history, etc., which influence both growth performance and transport infrastructure development process hence lead to omitted variables bias.

, denotes the unobserved time effect controlling for (holding constant) common shocks (to all provinces) originated from macroeconomic, political, or technological sources [

56]. Both the province- and year-effects may also reflect province-specific and period-specific components of measurement errors [

58]. Lastly,

is the idiosyncratic error term. To account for possible heteroskedasticity, standard errors are clustered at the province level. Equation (1) guarantees that our estimates, in particular for

, are not contaminated by aggregate shocks and trends common to all provinces or by time-invariant provincial factors such as climate, geography, history, and culture.

However, given the potential for unobserved time-varying factors and reverse causality that can induce endogeneity bias and the lagged responses of economic development to exogenous shocks, we used the system-GMM estimator for dynamic panel data model proposed by Arellano and Bond [

34]; Arellano and Bover [

32], and Blundell and Bond [

33]. GMM is a generic method for estimating parameters in statistical models. There are several advantages of using the GMM estimator for the dynamic panel data model. First, it enables us to control for the unobserved province-specific effects,

, by treating initial efficiency as time-invariant fixed effects and eliminate its influence through a time-dimensional transformation. More importantly, we can use appropriate lags of the independent variables as (internal) instrumental variables to deal with possible endogeneity in the regressors. Hence, we can reliably examine the impacts of the exogenous component of the quantity, quality, and structural aspects of transport infrastructure on regional economic growth in China at the same time and within the same empirical framework. In fact, the system-GMM method has been widely applied, particularly to identify transport infrastructure impacts in empirical growth research, for example Chakrabarti [

27], Farhadi [

37], Jiwattanakulpaisarn et al. [

38], and Zhang and Fan [

60].

Specifically, estimating Equation (1) is equivalent to estimating the dynamic panel data model:

We take the first difference of Equation (2) to eliminate,

, the unobserved time-invariant province-specific characteristics:

Note that in Equation (3), we need instrumental variables to deal with two issues: (a) the correlation between

and

and (b) the endogeneity of

and other growth predictors [

51]. A simple ordinary least squares regression with two-way fixed effects (FE-OLS) cannot generate unbiased estimates in this situation. The system-GMM estimator building on the first-difference GMM estimator is proposed to address these problems in dynamic panel data modeling [

61].

In system-GMM, we estimated the differenced Equation (3) and level Equation (2) simultaneously. The suitable instruments for Equation (3) are lagged explanatory variables. The first-differenced GMM estimator uses lagged explanatory variables as the instrumental variables under two assumptions. First,

, the idiosyncratic error is not serially correlated. Second, variables contained in

are weakly exogenous [

58]. For level Equation (2), the suitable instruments are the lagged differences of the explanatory variables. To ensure the validity of these additional instrumental variables, one more assumption needs to be made, whichis the first differences of the independent variables in Equation (2) that are uncorrelated with

[

58]. By using instruments from within the available dataset, this approach efficiently addresses the correlations described in (a) and (b). The system-GMM model is also estimated under the assumption of second-order autocorrelation by increasing the lags of instruments one additional time period in both the level and differenced equations [

27]. Bond et al. [

39] and Hauk and Wacziarg [

40] pointed out that the potential for obtaining consistent parameter estimates, even in the presence of measurement error and endogenous right-hand-side variables, is a considerable strength of the system-GMM approach in the empirical growth research.

To use the system-GMM estimator, two criteria must be satisfied: The test for serial correlations in the first-difference error

and the Hansen test for over-identification restrictions. The first test aims to check if serial correlation exists in the error terms. The Hansen test evaluates the validity of the instruments by checking the exogeneity conditions. Furthermore, to alleviate the instrument proliferation problem, we followed theRoodman [

62] approach to both collapse instruments and use one or two lags instead of all the available lags for instruments in system-GMM estimators.

6. Conclusions

This study identified and compared the upgrading impacts for the quantity, quality, and structural aspects of transport infrastructure on regional economic growth in China from 2007 to 2015, when the country was approaching the upper-middle income stage of development. This is the first study to consider government development strategies in a transport infrastructure impact evaluation framework for China. We constructed a unique dataset to describe the three aspects of the transport infrastructure, and in contrast to recent literature, we selected provinces as the geographic units to alleviate concerns about SUTVA violations [

28]. To address concerns about reverse causality and account for lagged responses in economic growth to any exogenous shock including transport infrastructure, we adopted the system-GMM estimator for dynamic panel data and obtained consistent and unbiased parameter estimates [

32,

33,

34,

37,

60]. We also compared our results with those in the existing literature, focusing on the differential impacts of various aspects of transport infrastructure on regional economic growth in China at different economic development levels. This approach yields new insights.

Our analysis led us to some general conclusions about the effects of transport infrastructure on growth. First, it appeared that transport infrastructure wasstill significantly contributing to economic growth in China, even as the country had entered the upper-middle income stage. Second, quality improvements in roadways and railways (measured by expressways and HSR development) and structural upgrading of the transport infrastructure (measured by the increasing share of government expenditure for transport) significantly contributed to growth at this development level. However, we didnot find a significant positive impact for overall quantity expansion of the land transport network. Third, government development strategies that defy local comparative advantages not only lead to a lower per capita GDP growth rate but also potentially restrict the contribution of transport infrastructure. Lastly, regional heterogeneity for Western China could differ across transport modes, particularly with respect to goods versus passenger transport and roadways versus railways.

This research enhances our understanding of transport infrastructure impacts on economic growth in China and can inform national transport infrastructure policy. The results are specific to China’s context but could be useful for policymakers in other emerging economies and developing countries that are experiencing comparable economic growth and infrastructure development patterns. Economic growth is central to China’s economic development mission, and our study suggests that public investments in national high-quality roadways and railways as well as government expenditure for transport maintenance to improve service efficiency can stimulate aggregate economic growth, as China reaches the upper-middle income stage. Compared with the earlier and most recent literature, we found that overall, different aspects of transport infrastructure had heterogeneous impacts on growth depending on the economic development level. Moreover, to ensure that transport infrastructure investment will guarantee growth, government development strategies that are favorable to the overall economic conditions are a vital policy prerequisite.

From a broader perspective, future studies could pay more attention to the function of transport infrastructure to achieve the Sustainable Development Goals adopted by all United Nations Member States in 2015. Moreover, new infrastructure, compared to traditional infrastructure such as roads, railways, and bridges, are built on advanced technology and digitization. Future research may also analyze how the current system of information and communications infrastructure can be used to develop the infrastructure under the paradigm of Industry 4.0 [

41,

42,

43,

70,

71].