Corporate Social Responsibility and Operating Performance: The Role of Local Character in Emerging Economies

Abstract

:1. Introduction

2. Research Background and Hypothesis Development

2.1. CSR Practices

2.2. CSR and Operating Performance

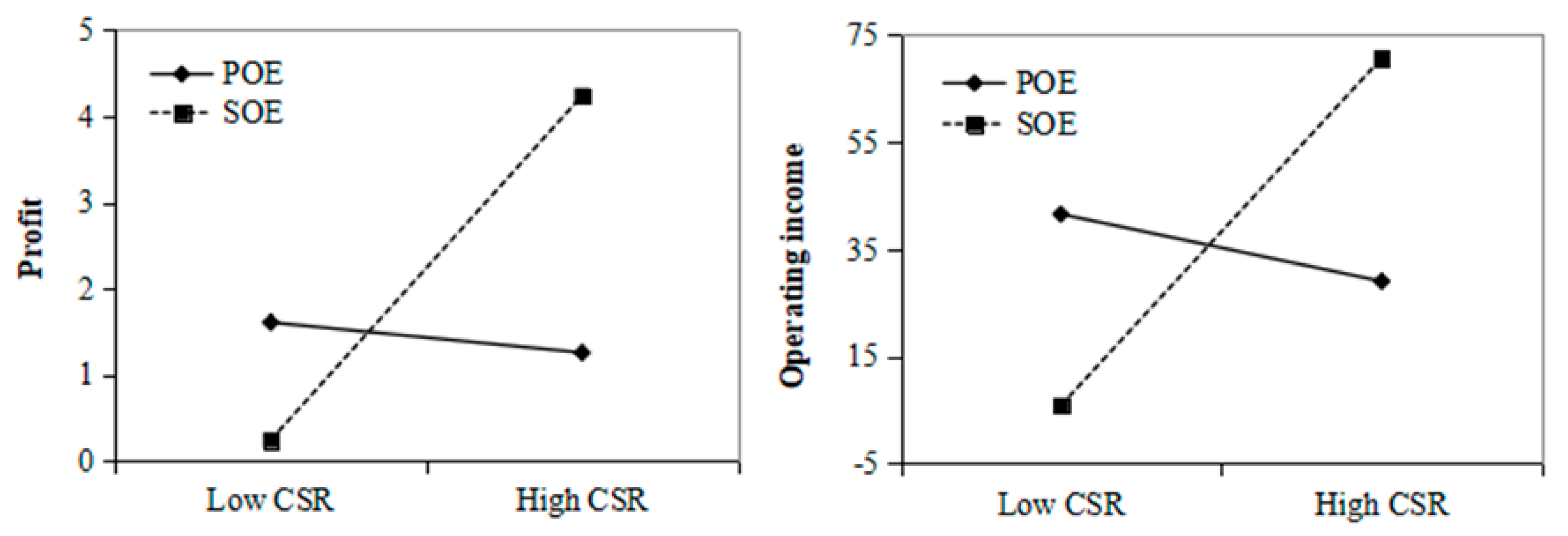

2.3. State Ownership and CSR: Resource Dependence Logic

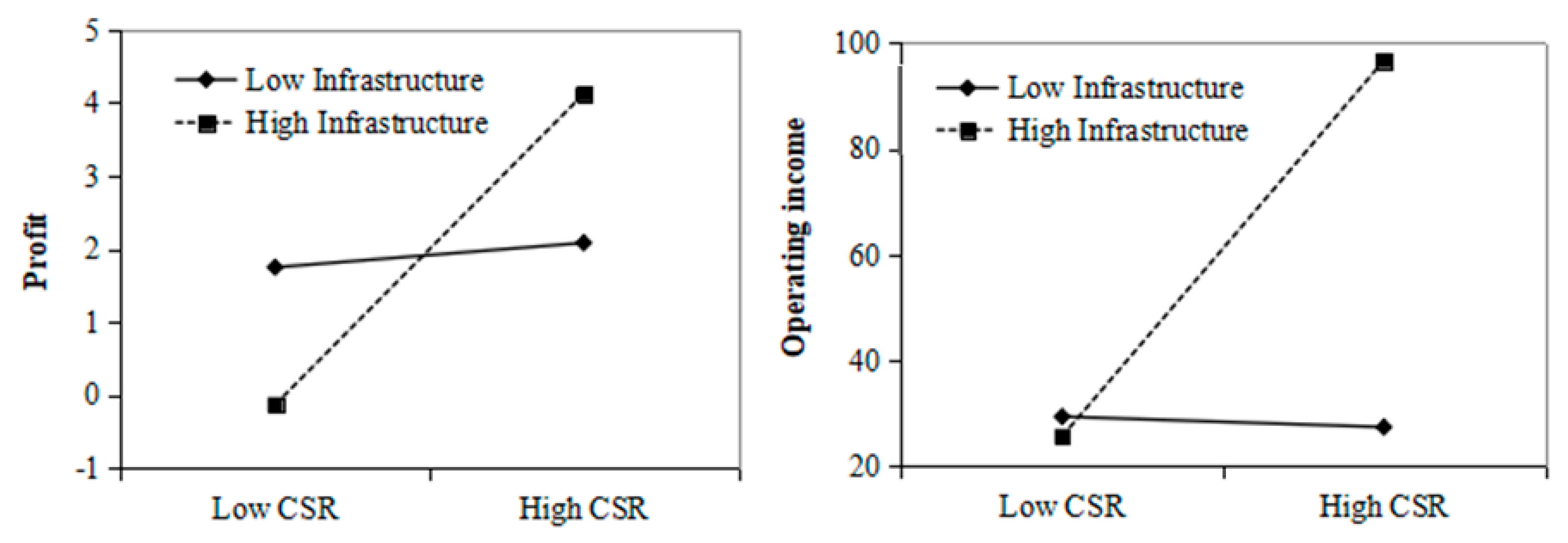

2.4. Infrastructure and CSR: Resource Orchestration Logic

3. Method

3.1. Data Sources and Sample

3.2. Measures

3.3. Estimation Methods

4. Results

5. Discussion and Conclusions

5.1. Theoretical Implications

5.2. Managerial and Policy Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Factor | Sub-factor | Indicators |

|---|---|---|

| Environmental responsibility | Environmental management | Environmental management system; environmental investment; environmental training performance; policies/measures/technologies that support environmental product research, development, and sale; whether environmental report is issued |

| Resource utilization | Policies/measures/technologies on efficient resource utilization; annual energy consumption amount; total water consumption | |

| Emissions management | Emissions-related policies and types; amount of discharged wastewater; waste emissions/reduction; greenhouse gas emissions; policies/measures/technologies for reducing greenhouse emissions | |

| Ecological protection | Policies/measures that reduce effects of firms on environment and natural resources | |

| Social responsibility | Employee rights | Employee rights protection; non-discriminatory/diversity; prohibitions on child labor/slave labor; turnover rate |

| Employee training | Training system; training performance | |

| Health and safety | Safety production system, health and safety investment; accidents/casualties as part of product safety; policies/measures for health and safety | |

| Supply chain responsibility | Policies/measures for managing supply chain environment and social risks | |

| Government responsibility | Responses and support for government policy; tax amount; employment | |

| Product service and quality | Product/service quality management system; systems/measures for supporting innovation; R&D investment; customer information protection; after-sales service system; resolution rate of customer complaints | |

| Community responsibility | Charitable strategy and management of donations; donated amounts; community participation and support; support for volunteer activities of employees | |

| Governance responsibility | Corporate governance | Board of directors and compensation; anticorruption; frequent disclosure of information; participation processes of shareholders; protection of the interests of minority shareholders |

| ESG management | ESG management system/department/personnel; stakeholders communication; issuing of CSR/ESG report; setting up CSR/ESG column on official website; training capabilities in CSR |

| Indicator Item | |

|---|---|

| S1 Policy openness, justice, and fairness | 1.1 Policy openness and transparency; 1.2 Fairness; 1.3 Justice legal enforcement; 1.4 Local protection |

| S2 Involvement, integrity, and efficiency | 2.1 Excessive involvement; 2.2 Government efficiency; 2.3 Integrity; 2.4 Government bureaucracy |

| S3 Legal environment | 3.1 Judicial Justice and Efficiency; 3.2 Contract execution; 3.3 Protection of property rights and security; 3.4 Protection of intellectual property, technology, and brand |

| S4 Tax burden | 4.1 Statutory tax; 4.2 Legally levied taxes; 4.3 Charge, fundraising, apportionment |

| S5 Financial infrastructure | 5.1 Formal financial services; 5.2 Loan rate; 5.3 Civil finance; 5.4 Other sources |

| S6 Human resources | 6.1 Professional staff; 6.2 Administrative staff; 6.3 Skilled workers |

| S7 Transportation systems and utilities | 7.1 Electrical structures and water and gas supply; 7.2 Railways; 7.3 Others |

| S8 Market environment and intermediary services | 8.1 Market demands; 8.2 Excessive competition; 8.3 Intermediary services; 8.4 Industry associations |

References

- Barnett, M.L.; Salomon, R.M. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strat. Manag. J. 2006, 27, 1101–1122. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strat. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Jayachandran, S.; Kalaignanam, K.; Eilert, M. Product and environmental social performance: Varying effect on firm performance. Strat. Manag. J. 2013, 34, 1255–1264. [Google Scholar] [CrossRef]

- Yang, A.S.; Baasandorj, S. Exploring CSR and financial performance of full-service and low-cost air carriers. Financ. Res. Lett. 2017, 23, 291–299. [Google Scholar] [CrossRef]

- Javed, M.; Rashid, M.; Hussain, G. When does it pay to be good–A contingency perspective on corporate social and financial performance: Would it work? J. Clean. Prod. 2016, 133, 1062–1073. [Google Scholar] [CrossRef]

- Fraussen, B. The visible hand of the state: On the organizational development of interest groups. Public Adm. 2013, 92, 406–421. [Google Scholar] [CrossRef] [Green Version]

- Hillman, A.J.; Hitt, M.A. Corporate political strategy formulation: A model of approach, participation, and strategy decisions. Acad. Manag. Rev. 1999, 24, 825–842. [Google Scholar] [CrossRef]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Sun, P.; Mellahi, K.; Wright, M.; Marler, J.H. The contingent value of corporate political ties. Acad. Manag. Perspect. 2012, 26, 68–82. [Google Scholar] [CrossRef]

- Zhou, K.Z.; Gao, G.Y.; Zhao, H. State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Adm. Sci. Q. 2016, 62, 375–404. [Google Scholar] [CrossRef]

- Greve, H.R.; Zhang, C.M. Institutional logics and power sources: Merger and acquisition decisions. Acad. Manag. J. 2017, 60, 671–694. [Google Scholar] [CrossRef]

- Padmore, T.; Gibson, H. Modelling systems of innovation: II. A framework for industrial cluster analysis in regions. Res. Policy 1998, 26, 625–641. [Google Scholar] [CrossRef]

- Marquis, C.; Raynard, M. Institutional strategies in emerging markets. SSRN Electron. J. 2014, 9, 291–392. [Google Scholar] [CrossRef] [Green Version]

- Hinings, C.R.; Logue, D.; Zietsma, C. Fields, governance and institutional infrastructure. In Handbook of Organizational Institutionalism Sage, 2nd ed.; Greenwood, R., Lawrence, T.B., Meyer, R., Oliver, C., Eds.; SAGE Publications Ltd.: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Wang, H.; Qian, C. Corporate philanthropy and corporate financial performance: The roles of stakeholder response and political access. Acad. Manag. J. 2011, 54, 1159–1181. [Google Scholar] [CrossRef]

- Maroušek, J.; Hašková, S.; Zeman, R.; Váchal, J.; Vanickova, R. Assessing the implications of EU subsidy policy on renewable energy in Czech Republic. Clean Technol. Environ. Policy 2014, 17, 549–554. [Google Scholar] [CrossRef]

- Wong, C.W.; Miao, X.; Cui, S.; Tang, Y. Impact of corporate environmental responsibility on operating income: Moderating role of regional disparities in China. J. Bus. Ethics 2016, 149, 363–382. [Google Scholar] [CrossRef]

- Benson, J.K.; Pfeffer, J.; Salancik, G.R. The external control of organizations. Adm. Sci. Q. 1978, 23, 358. [Google Scholar] [CrossRef]

- Chirico, F.; Sirmon, D.G.; Sciascia, S.; Mazzola, P. Resource orchestration in family firms: Investigating how entrepreneurial orientation, generational involvement, and participative strategy affect performance. Strat. Entrep. J. 2011, 5, 307–326. [Google Scholar] [CrossRef] [Green Version]

- Cao, X.-P.; Ding, Y.; Zhang, H. Social capital, informal governance, and post-IPO firm performance: A study of Chinese entrepreneurial firms. J. Bus. Ethic 2014, 134, 529–551. [Google Scholar] [CrossRef]

- Feng, X.; Johansson, A.C.; Zhang, T. Mixing business with politics: Political participation by entrepreneurs in China. J. Bank. Financ. 2015, 59, 220–235. [Google Scholar] [CrossRef] [Green Version]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef] [Green Version]

- Tang, Y.; Ma, Y.; Wong, C.W.; Miao, X. Evolution of government policies on guiding corporate social responsibility in China. Sustainability 2018, 10, 741. [Google Scholar] [CrossRef] [Green Version]

- Ulrich, D.; Barney, J.B. Perspectives in organizations-Resource dependence, efficiency, and population. Acad. Manag. Rev. 1984, 9, 471–481. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D.; Gilbert, B.A. Resource orchestration to create competitive advantage. J. Manag. 2010, 37, 1390–1412. [Google Scholar] [CrossRef]

- Olken, B.A.; Barron, P. The Simple Economics of Extortion: Evidence from Trucking in Aceh. J. Political Econ. 2009, 117, 417–452. [Google Scholar] [CrossRef]

- Hawn, O.; Ioannou, I. Mind the gap: The interplay between external and internal actions in the case of corporate social responsibility. Strat. Manag. J. 2016, 37, 2569–2588. [Google Scholar] [CrossRef] [Green Version]

- Kim, K.-H.; Kim, M.; Qian, C. Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. J. Manag. 2015, 44, 1097–1118. [Google Scholar] [CrossRef]

- Wang, H.; Tong, L.; Takeuchi, R.; George, G. Corporate social responsibility: An overview and new research directions. Acad. Manag. J. 2016, 59, 534–544. [Google Scholar] [CrossRef]

- Wang, H.; Lu, W.; Ye, M.; Chau, K.; Zhang, X. The curvilinear relationship between corporate social performance and corporate financial performance: Evidence from the international construction industry. J. Clean Prod. 2016, 137, 1313–1322. [Google Scholar] [CrossRef]

- Bhandari, A.; Javakhadze, D. Corporate social responsibility and capital allocation efficiency. J. Corp. Financ. 2017, 43, 354–377. [Google Scholar] [CrossRef]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strat. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.C.Y.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Fombrun, C.J. Reputation: Realizing Value from the Corporate Image; Harvard Business School Press: Boston, MA, USA, 1996. [Google Scholar]

- Gangi, F.; Varrone, N. Screening activities by socially responsible funds: A matter of agency? J. Clean. Prod. 2018, 197, 842–855. [Google Scholar] [CrossRef]

- Lundgren, T.; Zhou, W. Firm performance and the role of environmental management. J. Environ. Manag. 2017, 203, 330–341. [Google Scholar] [CrossRef] [PubMed]

- Benlemlih, M.; Bitar, M. Corporate social responsibility and investment efficiency. J. Bus. Ethics 2018, 148, 647–671. [Google Scholar] [CrossRef]

- Arouri, M.; Pijourlet, G. CSR Performance and the value of cash holdings: International evidence. J. Bus. Ethics 2015, 140, 263–284. [Google Scholar] [CrossRef]

- Bai, C.-E.; Lu, J.; Tao, Z. Property rights protection and access to bank loans. Econ. Transit. 2006, 14, 611–628. [Google Scholar] [CrossRef] [Green Version]

- Jia, N. Are collective political actions and private political actions substitutes or complements? Empirical evidence from China’s private sector. Strat. Manag. J. 2014, 35, 292–315. [Google Scholar] [CrossRef]

- Gong, T.; Collins, P.; Chan, H.S. The quality of governance in China and beyond: Introduction to special issue. Public Adm. Dev. 2017, 37, 155–159. [Google Scholar] [CrossRef]

- Chen, D.; Li, S.; Xiao, J.Z.; Zou, H. The effect of government quality on corporate cash holdings. J. Corp. Financ. 2014, 27, 384–400. [Google Scholar] [CrossRef] [Green Version]

- Zhou, K.Z.; Li, J.J.; Sheng, S.; Shao, A.T. The evolving role of managerial ties and firm capabilities in an emerging economy: Evidence from China. J. Acad. Mark. Sci. 2014, 42, 581–595. [Google Scholar] [CrossRef]

- Delios, A.; Henisz, W.J. Political hazards, experience, and sequential entry strategies: The international expansion of Japanese firms, 1980–1998. Strat. Manag. J. 2003, 24, 1153–1164. [Google Scholar] [CrossRef] [Green Version]

- Miao, X. China emissions: Stop subsidizing emitters. Nature 2015, 527, 38. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chadwick, C.; Super, J.F.; Kwon, K. Resource orchestration in practice: CEO emphasis on SHRM, commitment-based HR systems, and firm performance. Strat. Manag. J. 2014, 36, 360–376. [Google Scholar] [CrossRef]

- Lazzarini, S.G. Strategizing by the government: Can industrial policy create firm-level competitive advantage? Strat. Manag. J. 2015, 36, 97–112. [Google Scholar] [CrossRef]

- Krueger, A.O. Government failures in development. J. Econ. Perspect. 1990, 4, 9–23. [Google Scholar] [CrossRef] [Green Version]

- Lee, S.; Weng, D.H. Does bribery in the home country promote or dampen firm exports? Strat. Manag. J. 2013, 34, 1472–1487. [Google Scholar] [CrossRef]

- Bird, R.C. The Impact of Coercion on Protecting US Intellectual Property Rights in the BRIC Economies. In Emerging Economies and the Transformation of International Business; Edward Elgar Publishing: Cheltenham, UK, 2006; pp. 431–451. [Google Scholar]

- Kor, Y.Y.; Mahoney, J.T. How dynamics, management, and governance of resource deployments influence firm-level performance. Strat. Manag. J. 2005, 26, 489–496. [Google Scholar] [CrossRef]

- Hines, J.R. Business tax burdens and tax reform. Brookings Pap. Econ. Act. 2017, 2017, 449–477. [Google Scholar] [CrossRef] [Green Version]

- Campello, M.; Graham, J.R.; Harvey, C.R. The real effects of financial constraints: Evidence from a financial crisis. J. Financ. Econ. 2010, 97, 470–487. [Google Scholar] [CrossRef] [Green Version]

- Kulczycka, J.; Wirth, H.; Hausner, J. Polish tax policy—Its impact on the mineral sector. Resour. Policy 2017, 52, 72–80. [Google Scholar] [CrossRef]

- Johnson, S.; Kaufmann, D.; McMillan, J.; Woodruff, C. Why do firms hide? Bribes and unofficial activity after communism. J. Public Econ. 2000, 76, 495–520. [Google Scholar] [CrossRef]

- He, F.; Miao, X.; Wong, C.W.; Lee, S.H.N. Contemporary corporate eco-innovation research: A systematic review. J. Clean. Prod. 2018, 174, 502–526. [Google Scholar] [CrossRef]

- World Bank. World Development Report 2006; World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Hitt, M.A.; Bierman, L.; Shimizu, K.; Kochhar, R. Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective. Acad. Manag. J. 2001, 44, 13–28. [Google Scholar]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strat. Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef]

- Huselid, M.A. The impact of human resource management practices on turnover, productivity, and corporate financial performance. Acad. Manag. J. 1995, 38, 635–672. [Google Scholar]

- Hitt, M.A.; Xu, K.; Carnes, C.M. Resource based theory in operations management research. J. Oper. Manag. 2015, 41, 77–94. [Google Scholar] [CrossRef]

- Hart, S.L.; Milstein, M.B. Creating sustainable value. Acad. Manag. Perspect. 2003, 17, 56–67. [Google Scholar] [CrossRef]

- Liu, H.; Wei, S.; Ke, W.; Wei, K.K.; Hua, Z. The configuration between supply chain integration and information technology competency: A resource orchestration perspective. J. Oper. Manag. 2016, 44, 13–29. [Google Scholar] [CrossRef]

- York, J.G.; Vedula, S.; Lenox, M.J. It’s not easy building green: The impact of public policy, private actors, and regional logics on voluntary standards adoption. Acad. Manag. J. 2018, 61, 1492–1523. [Google Scholar] [CrossRef]

- Hargreaves, T.; Hielscher, S.; Seyfang, G.; Smith, A. Grassroots innovations in community energy: The role of intermediaries in niche development. Glob. Environ. Chang. 2013, 23, 868–880. [Google Scholar] [CrossRef] [Green Version]

- Zeng, S.; Xie, X.; Tam, C.M. Relationship between cooperation networks and innovation performance of SMEs. Technovation 2010, 30, 181–194. [Google Scholar] [CrossRef]

- Xu, B.; Zeng, T. Profitability, state ownership, tax reporting and corporate social responsibility: Evidence from Chinese listed firms. Soc. Responsib. J. 2016, 12, 23–31. [Google Scholar] [CrossRef]

- Chen, Y.-C.; Hung, M.; Wang, Y. The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. J. Account. Econ. 2018, 65, 169–190. [Google Scholar] [CrossRef]

- Jeong, K.H.; Jeong, S.W.; Lee, W.J.; Bae, S.H. Permanency of CSR activities and firm value. J. Bus. Ethics 2016, 152, 207–223. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Singhal, V.R.; Stratman, J.K. The impact of enterprise systems on corporate performance: A study of ERP, SCM, and CRM system implementations. J. Oper. Manag. 2006, 25, 65–82. [Google Scholar] [CrossRef]

- Hellman, J.; Schankerman, M. Intervention, corruption and capture: The nexus between enterprises and the state. Econ. Transit. 2000, 8, 545–576. [Google Scholar] [CrossRef]

- Globerman, S.; Shapiro, D. Governance infrastructure and US foreign direct investment. J. Int. Bus. Stud. 2002, 34, 19–39. [Google Scholar] [CrossRef]

- Haveman, H.A.; Jia, N.; Shi, J.; Wang, Y. The dynamics of political embeddedness in China. Adm. Sci. Q. 2016, 62, 67–104. [Google Scholar] [CrossRef] [Green Version]

- McWilliams, A.; Siegel, D.S.; Wright, P.M. Corporate Social Responsibility: Strategic Implications*. J. Manag. Stud. 2006, 43, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Peng, C.-W.; Yang, M.-L. The effect of corporate social performance on financial performance: The moderating effect of ownership concentration. J. Bus. Ethic 2013, 123, 171–182. [Google Scholar] [CrossRef]

- Cuypers, I.R.P.; Koh, P.-S.; Wang, H. Sincerity in corporate philanthropy, stakeholder perceptions and firm value. Organ. Sci. 2015, 27, 173–188. [Google Scholar] [CrossRef]

- Waddock, S.A.; Graves, S. The corporate social performance-financial performance link. Strat. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Zhang, Z.; Guo, J.; Hewings, G.J. The effects of direct trade within China on regional and national CO2 emissions. Energy Econ. 2014, 46, 161–175. [Google Scholar] [CrossRef]

- Frazier, P.A.; Tix, A.P.; Barron, K.E. Testing moderator and mediator effects in counseling psychology research. J. Couns. Psychol. 2004, 51, 115–134. [Google Scholar] [CrossRef]

- Chandler, G.N.; McKelvie, A.; Davidsson, P. Asset specificity and behavioral uncertainty as moderators of the sales growth—Employment growth relationship in emerging ventures. J. Bus. Ventur. 2009, 24, 373–387. [Google Scholar] [CrossRef] [Green Version]

- Marquis, C.; Toffel, M.W.; Zhou, Y. Scrutiny, Norms, and Selective Disclosure: A Global Study of Greenwashing. Organ. Sci. 2016, 27, 483–504. [Google Scholar] [CrossRef]

- Ahmad, S.; Schroeder, R.G. The impact of human resource management practices on operational performance: Recognizing country and industry differences. J. Oper. Manag. 2002, 21, 19–43. [Google Scholar] [CrossRef]

- Tabachniek, B.G.; Fidell, L.S. Book review: Reply to Widaman’s review of using multivariate statistics. Appl. Psychol. Meas. 1984, 8, 471. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis, 5th ed.; Prentice Hall: Upper Saddle River, NJ, USA, 1998. [Google Scholar]

- Dowell, G.; Swaminathan, A. Entry timing, exploration, and firm survival in the early U.S. bicycle industry. Strat. Manag. J. 2006, 27, 1159–1182. [Google Scholar] [CrossRef]

- Lin, Z.; Yang, H.; Arya, B. Alliance partners and firm performance: Resource complementarity and status association. Strat. Manag. J. 2009, 30, 921–940. [Google Scholar] [CrossRef] [Green Version]

- Toothaker, L.E.; Aiken, L.S.; West, S.G. Multiple regression: Testing and interpreting interactions. J. Oper. Res. Soc. 1994, 45, 119. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Grewatsch, S.; Kleindienst, I. When does it pay to be good? Moderators and mediators in the corporate sustainability–corporate financial performance relationship: A critical review. J. Bus. Ethics 2015, 145, 383–416. [Google Scholar] [CrossRef]

- Lu, J.W.; Tan, H. Institutional discrimination and outward FDI from China’s private sector: An institutional escapism perspective. Department of Strategy and Entrepreneurship, China Europe International Business School, 2018; Unpublished working paper. [Google Scholar]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or Substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Megginson, W.L.; Netter, J.M. From state to market: A survey of empirical studies of privatization. J. Econ. Lit. 2001, 39, 321–389. [Google Scholar] [CrossRef] [Green Version]

- Ralston, D.A.; Terpstra, T.J.; Terpstra, R.H.; Wang, X.; Egri, C. Today’s state-owned enterprises of China: Are they dying dinosaurs or dynamic dynamos? Strat. Manag. J. 2006, 27, 825–843. [Google Scholar] [CrossRef]

- Park, S.H.; Luo, Y. Guanxi and organizational dynamics: Organizational networking in Chinese firms. Strat. Manag. J. 2001, 22, 455–477. [Google Scholar] [CrossRef]

- Rud, J.P. Infrastructure regulation and reallocations within industry: Theory and evidence from Indian firms. J. Dev. Econ. 2012, 99, 116–127. [Google Scholar] [CrossRef]

| Industry Sector | Sample 1 (in Year 2016) | Sample 2 (in Year 2012) | ||||||

|---|---|---|---|---|---|---|---|---|

| n1 | n2 | SP (%) | PP (%) | n1 | n2 | SP (%) | PP (%) | |

| Farming, forestry, animal husbandry, and fisheries | 3 | 3 | 1.46 | 1.45 | 5 | 5 | 2.28 | 1.60 |

| Mining and quarrying | 8 | 8 | 3.88 | 2.40 | 26 | 25 | 11.42 | 2.37 |

| Manufacturing | 97 | 96 | 46.6 | 62.69 | 116 | 114 | 52.05 | 63.55 |

| Production and supply of electric power, gas, and water | 8 | 8 | 3.88 | 3.16 | 11 | 11 | 5.02 | 3.29 |

| Construction | 10 | 10 | 4.85 | 2.94 | 12 | 12 | 5.48 | 2.4 |

| Wholesale and retail trades | 9 | 9 | 4.37 | 4.96 | 13 | 13 | 5.94 | 6.13 |

| Transport, storage, and postal services | 9 | 9 | 4.37 | 3.25 | 6 | 6 | 2.74 | 3.33 |

| Information transfer, software, and information technology services | 27 | 27 | 13.11 | 6.82 | 7 | 7 | 3.20 | 5.01 |

| Finance | 33 | — | — | 2.21 | 24 | — | — | 1.68 |

| Real estate | 16 | 16 | 7.77 | 4.04 | 13 | 13 | 5.94 | 5.81 |

| Leasing and commercial services | 5 | 5 | 2.43 | 1.39 | 4 | 4 | 1.83 | 0.88 |

| Administration of water, environment, and public facilities | 3 | 3 | 1.46 | 1.14 | 2 | 2 | 0.91 | 0.96 |

| Health care and social work | 1 | 1 | 0.49 | 0.22 | / | / | / | 0.12 |

| Culture, sports, and entertainment | 9 | 9 | 4.37 | 1.48 | 3 | 3 | 1.37 | 0.92 |

| Conglomerate | 2 | 2 | 0.97 | 0.88 | 4 | 4 | 1.83 | 0.88 |

| Total | 240 | 206 | 100.00 | — | 246 | 219 | 100.00 | — |

| Variables | M | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

|---|---|---|---|---|---|---|---|---|---|

| 1. Profit | 2.45 | 4.10 | |||||||

| 2. Profit (one-year lag) | 2.87 | 5.25 | 0.926 ** | ||||||

| 3. Operating income | 36.13 | 91.50 | 0.769 ** | 0.693 ** | |||||

| 4. Operating income (one-year lag) | 42.78 | 104.73 | 0.769 ** | 0.711** | 0.995 ** | ||||

| 5. Firm age | 19.35 | 5.32 | 0.018 | 0.011 | −0.061 | −0.054 | |||

| 6. Ln(Employee) | 9.16 | 1.17 | 0.409 ** | 0.429 ** | 0.471 ** | 0.478 ** | −0.100 | ||

| 7. Debt ratio | 0.49 | 0.20 | 0.182 ** | 0.161 * | 0.286 ** | 0.290 ** | 0.084 | 0.332 ** | |

| 8. SO | 0.47 | 0.50 | 0.199 ** | 0.234 * | 0.170 * | 0.172 ** | −0.071 | 0.237 ** | 0.078 |

| 9. S1 | 3.72 | 0.16 | 0.051 | 0.040 | 0.018 | 0.021 | −0.015 | −0.027 | −0.049 |

| 10. S2 | 3.62 | 0.24 | 0.039 | 0.025 | 0.009 | 0.007 | −0.102 | −0.071 | −0.029 |

| 11. S3 | 3.90 | 0.13 | 0.059 | 0.039 | 0.093 | 0.096 | −0.027 | −0.086 | −0.003 |

| 12. S4 | 3.66 | 0.16 | 0.081 | 0.060 | 0.133 | 0.129 | 0.026 | −0.068 | 0.038 |

| 13. S5 | 3.43 | 0.36 | −0.051 | −0.101 | 0.046 | 0.042 | −0.182 ** | −0.077 | −0.004 |

| 14. S6 | 3.48 | 0.22 | 0.055 | 0.026 | 0.127 | 0.130 | 0.038 | −0.083 | 0.062 |

| 15. S7 | 4.14 | 0.24 | 0.102 | 0.063 | 0.120 | 0.118 | −0.065 | −0.058 | 0.067 |

| 16. S8 | 3.42 | 0.23 | 0.100 | 0.059 | 0.131 | 0.128 | −0.059 | −0.081 | 0.088 |

| 17. CSR | 39.77 | 17.14 | 0.325 ** | 0.371 ** | 0.341 ** | 0.349 ** | −0.038 | 0.507 ** | 0.189 ** |

| Variables | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 9. S1 | −0.100 | ||||||||

| 10. S2 | −0.103 | 0.788 ** | |||||||

| 11. S3 | 0.076 | 0.622 ** | 0.431 ** | ||||||

| 12. S4 | 0.189 ** | 0.120 | 0.232 ** | 0.551 ** | |||||

| 13. S5 | 0.019 | 0.078 | 0.172 ** | 0.320 ** | 0.278 ** | ||||

| 14. S6 | 0.137 * | 0.150 * | −0.035 ** | 0.647 ** | 0.494 ** | 0.027 | |||

| 15. S7 | 0.090 | 0.570 ** | 0.455 ** | 0.827 ** | 0.663 ** | 0.191 ** | 0.674 ** | ||

| 16. S8 | 0.089 | 0.336 ** | 0.301 ** | 0.704 ** | 0.490 ** | 0.157 * | 0.732 ** | 0.790 ** | |

| 17. CSR | 0.277 ** | −0.102 | −0.149 ** | −0.124 | −0.068 ** | −0.056 | −0.065 ** | −0.110 | −0.049 |

| Panel A | Model A1 | Model A2 | Model A3 | Model A4 | Model A5 | Model B1 | Model B2 | Model B3 | Model B4 | Model B5 |

|---|---|---|---|---|---|---|---|---|---|---|

| Dependent Variables | Profit_2017 | Operating income_2017 | ||||||||

| Intercept | 1.431 | 1.784 * | 1.430 * | 1.956 * | 1.635 * | 36.255 * | 41.559 * | 35.260 * | 44.763 * | 39.141 * |

| (0.986) | (0.977) | (0.960) | (0.958) | (0.954) | (19.058) | (19.031) | (18.793) | (18.700) | (18.683) | |

| Firm age | 0.370 | 0.344 | 0.336 | 0.305 | 0.308 | −0.895 | −1.297 | −1.433 | −2.021 | −1.970 |

| (0.343) | (0.337) | (0.329) | (0.330) | (0.326) | (6.628) | (6.568) | (6.443) | (6.447) | (6.382) | |

| Ln(Employee) | 2.119 *** | 1.663 *** | 1.802 *** | 1.629 *** | 1.748 *** | 46.118 *** | 39.268 *** | 41.757 *** | 38.647 *** | 40.729 *** |

| (0.374) | (0.401) | (0.394) | (0.393) | (0.390) | (7.227) | (7.812) | (7.710) | (7.666) | (7.646) | |

| Debt ratio | 0.210 | 0.173 | 0.063 | 0.053 | −0.007 | 15.040 * | 14.488 * | 15.525 * | 12.148 * | 11.196 |

| (0.362) | (0.356) | (0.350) | (0.351) | (0.347) | (7.004) | (6.942) | (6.843) | (6.852) | (6.800) | |

| SO | 1.072 | 0.742 | 0.810 | 0.658 | 0.731 | 6.706 | 1.754 | 2.957 | 0.176 | 1.458 |

| (0.722) | (0.719) | (0.703) | (0.704) | (0.696) | (13.963) | (14.013) | (13.753) | (13.756) | (13.630) | |

| Infrastructure | 0.127 | 0.149 | 0.033 | 0.040 | −0.027 | 18.099 * | 18.418 * | 16.369 * | 16.392 * | 15.227 * |

| (0.477) | (0.468) | (0.459) | (0.460) | (0.454) | (9.212) | (9.125) | (8.979) | (8.978) | (8.902) | |

| CSR | 1.134 ** | −0.176 | 1.147 ** | 0.102 | 17.021 * | −6.275 | 17.267 * | −1.015 | ||

| (0.399) | (0.562) | (0.390) | (0.569) | (7.772) | (11.007) | (6.624) | (11.146) | |||

| CSR × SO | 2.175 ** | 1.732 * | 38.703 ** | 30.282 * | ||||||

| (0.674) | (0.694) | (13.190) | (13.587) | |||||||

| CSR × Infrastructure | 0.980 ** | 0.754 * | 18.263 ** | 14.314 * | ||||||

| (0.318) | (0.327) | (6.210) | (6.398) | |||||||

| ΔF | 6.505 *** | 8.084 ** | 10.424 ** | 9.492 ** | 7.993 *** | 8.396 *** | 4.796 * | 8.610 ** | 8.649 ** | 6.897 ** |

| Adjusted R2 | 0.195 | 0.223 | 0.259 | 0.255 | 0.275 | 0.245 | 0.259 | 0.287 | 0.287 | 0.302 |

| R2 | 0.230 | 0.261 | 0.298 | 0.295 | 0.317 | 0.278 | 0.296 | 0.326 | 0.326 | 0.343 |

| ΔR2 | 0.031 | 0.038 | 0.034 | 0.057 | 0.017 | 0.030 | 0.030 | 0.047 | ||

| Panel A | Model A1 | Model A2 | Model A3 | Model A4 | Model A5 | Model A6 | Model A7 | Model A8 | Model A9 |

| Dependent Variables | Profit_2017 | ||||||||

| Intercept | 1.628 * | 1.988 ** | 2.042 ** | 2.129 * | 1.873 ** | 1.984 * | 1.989 * | 1.948 ** | 1.903 ** |

| −0.842 | −1.082 | −1.083 | −1.06 | −1.053 | −1.082 | −1.056 | −1.058 | −1.061 | |

| CSR | 1.132 ** | 1.209 ** | 1.197 ** | 1.196 ** | 1.116 ** | 1.203 ** | 1.178 ** | 1.147 ** | 1.152 ** |

| −0.398 | −0.411 | −0.41 | −0.402 | −0.4 | −0.411 | −0.401 | −0.402 | −0.403 | |

| CSR × S1 | 0.316 | ||||||||

| −0.348 | |||||||||

| CSR × S2 | 0.431 | ||||||||

| −0.406 | |||||||||

| CSR × S3 | 0.980 ** | ||||||||

| −0.33 | |||||||||

| CSR × S4 | 1.008 ** | ||||||||

| −0.302 | |||||||||

| CSR × S5 | 0.301 | ||||||||

| −0.365 | |||||||||

| CSR × S6 | 1.156 ** | ||||||||

| −0.366 | |||||||||

| CSR × S7 | 0.981 ** | ||||||||

| −0.326 | |||||||||

| CSR × S8 | 0.943 ** | ||||||||

| −0.33 | |||||||||

| ΔF | 8.095 ** | 0.824 | 1.129 | 8.830 * | 11.133 ** | 0.681 | 9.994 ** | 9.073 ** | 8.163 ** |

| Adjusted R2 | 0.226 | 0.212 | 0.213 | 0.244 | 0.253 | 0.212 | 0.249 | 0.245 | 0.242 |

| R2 | 0.26 | 0.281 | 283 | 0.311 | 0.319 | 0.281 | 0.315 | 0.312 | 0.308 |

| ΔR2 | 0.031 | 0.003 | 0.004 | 0.033 | 0.041 | 0.003 | 0.037 | 0.033 | 0.03 |

| Panel B | Model B1 | Model B2 | Model B3 | Model B4 | Model B5 | Model B6 | Model B7 | Model B8 | Model B9 |

| Dependent Variables | Operating Income_2017 | ||||||||

| Intercept | 22.222 | 35.303 * | 36.477 * | 37.7083 * | 33.268 | 35.636 * | 35.512 * | 34.740 * | 33.941 |

| −16.572 | −21.207 | −21.208 | −20.912 | −20.641 | −21.124 | −20.654 | −20.834 | −20.854 | |

| CSR | 16.771 * | 16.506 * | 16.400 * | 16.376 * | 14.852 * | 16.644 * | 16.021 * | 15.528 * | 15.597 * |

| −7.831 | −8.054 | −8.031 | −7.926 | −7.844 | −8.019 | −7.839 | −7.912 | −7.918 | |

| CSR × S1 | 3.717 | ||||||||

| −6.828 | |||||||||

| CSR × S2 | 8.075 | ||||||||

| −7.949 | |||||||||

| CSR × S3 | 15.976 * | ||||||||

| −6.501 | |||||||||

| CSR × S4 | 19.401 *** | ||||||||

| −5.923 | |||||||||

| CSR × S5 | 9.458 | ||||||||

| −7.134 | |||||||||

| CSR × S6 | 23.025 ** | ||||||||

| −7.155 | |||||||||

| CSR × S7 | 16.934 ** | ||||||||

| −6.415 | |||||||||

| CSR × S8 | 16.740 * | ||||||||

| −6.488 | |||||||||

| ΔF | 4.586 * | 0.296 | 1.032 | 6.039 * | 10.731 ** | 1.758 | 10.355 ** | 6.970 ** | 6.657 * |

| Adjusted R2 | 0.248 | 0.24 | 0.243 | 0.263 | 0.28 | 0.246 | 0.279 | 0.266 | 0.265 |

| R2 | 0.281 | 0.307 | 0.31 | 0.328 | 0.344 | 0.312 | 0.342 | 0.331 | 0.33 |

| ΔR2 | 0.017 | 0.001 | 0.004 | 0.022 | 0.038 | 0.006 | 0.036 | 0.025 | 0.024 |

| Model A1 | Model A2 | Model A3 | Model A4 | Model B1 | Model B2 | Model B3 | Model B4 | |

|---|---|---|---|---|---|---|---|---|

| Dependent Variables | Profit_2017 | Operating Income_2017 | ||||||

| Intercept | 1.431 | 1.705 ** | 1.734 ** | 1.358 | 36.255 * | 37.349 * | 39.985 * | 35.285 * |

| (0.986) | (0.996) | (0.978) | (0.979) | (19.058) | (19.378) | (19.109) | (19.026) | |

| Firm age | 0.370 | 0.345 | 0.357 | 0.397 | −0.895 | −0.995 | −1.055 | −0.542 |

| (0.343) | (0.342) | (0.338) | (0.341) | (6.628) | (6.650) | (6.600) | (6.618) | |

| Ln(Employee) | 2.119 *** | 1.932 *** | 1.747 *** | 1.862 *** | 46.18 *** | 45.369 *** | 41.550 *** | 42.672 *** |

| (0.374) | (0.390) | (0.395) | (0.392) | (7.227) | (7.580) | (7.709) | (7.626) | |

| Debt ratio | 0.210 | 0.207 | 0.121 | 0.189 | 15.040 * | 15.025 * | 13.947 * | 14.761 * |

| (0.362) | (0.361) | (0.359) | (0.360) | (7.004) | (7.020) | (7.005) | (6.991) | |

| SO | 1.072 | 0.938 | 0.975 | 0.786 | 6.706 | 6.169 | 5.510 | 2.872 |

| (0.722) | (0.724) | (0.713) | (0.731) | (13.963) | (14.086) | (13.920) | (14.201) | |

| Infrastructure | 0.127 | 0.156 | 0.127 | 0.115 | 18.099 * | 18.215 * | 18.099 * | 17.930 * |

| (0.477) | (0.475) | (0.470) | (0.473) | (9.212) | (9.239) | (9.171) | (9.191) | |

| Environmental | 0.641 | 2.561 | ||||||

| (0.393) | (7.638) | |||||||

| Social | 1.040 ** | 12.789 | ||||||

| (0.397) | (7.747) | |||||||

| Governance | 0.6736 * | 9.858 | ||||||

| (0.366) | (7.108) | |||||||

| ΔF | 6.505 *** | 2.666 | 6.880 ** | 4.050 * | 8.396 *** | 0.112 | 2.725 | 1.923 |

| Adjusted R2 | 0.195 | 0.201 | 0.195 | 0.207 | 0.245 | 0.242 | 0.252 | 0.249 |

| R2 | 0.230 | 0.240 | 0.230 | 0.246 | 0.278 | 0.279 | 0.288 | 0.285 |

| ΔR2 | 0.010 | 0.026 | 0.016 | 0.000 | 0.010 | 0.007 | ||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, F.; Miao, X.; Wong, C.W.Y.; Tang, Y. Corporate Social Responsibility and Operating Performance: The Role of Local Character in Emerging Economies. Sustainability 2020, 12, 4874. https://doi.org/10.3390/su12124874

He F, Miao X, Wong CWY, Tang Y. Corporate Social Responsibility and Operating Performance: The Role of Local Character in Emerging Economies. Sustainability. 2020; 12(12):4874. https://doi.org/10.3390/su12124874

Chicago/Turabian StyleHe, Fang, Xin Miao, Christina W.Y. Wong, and Yanhong Tang. 2020. "Corporate Social Responsibility and Operating Performance: The Role of Local Character in Emerging Economies" Sustainability 12, no. 12: 4874. https://doi.org/10.3390/su12124874