Abstract

Relation-specific investments are usually associated with great risk. Investors, afraid of being held up, are likely to invest too little, endangering both financial and organizational sustainability. Theory suggests that relation-specific investment decisions are mainly affected by potential ex-post bargaining, while experimental evidence shows social-preference-driven thinking affects both investors’ and investees’ behavior. We decompose an experimental hold-up game to identify the effect of reciprocity and the effect of veto power on investees’ transfers. In addition, we investigate the effects of corresponding information disclosures on investors’ performance as possible behavioral remedies to the hold-up problem. We find strong evidence of the effect of reciprocity and reciprocity-related information significantly lower investors’ suboptimal investment. Investors underestimate the effect of reciprocity without related information disclosure. In contrast, we find little evidence of the effect of ex-post veto power on investment decisions. Our results imply that reciprocity-related information disclosure is helpful in promoting both financial and organizational sustainability.

1. Introduction

Investors usually find themselves vulnerable when facing a relation-specific investment [1,2], because they worry about a disadvantageous position in future bargaining over potential economic returns. Unfortunately, these investments seem to be unavoidable and are important for sustainable growth. Traditional solutions to avoid such “hold-up” problems include vertical integration [2,3] or signing contracts [4,5,6]. Those solutions rely on investees’ monetary incentives and, in many cases, can be costly to implement. The temptation to under-invest has created a great barrier to financial and organizational sustainability [7]. For example, shareholders can be reluctant to invest, afraid of managers’ exploitation; meanwhile, managers and employees can also be less willing to invest their effort when having less control over uncertain outcomes.

In previous experimental studies (on various hold-up games), it has been well documented that non-monetary incentives affect people’s investment and bargaining behavior [8,9]. For example, reciprocity is one of the main explanations behind the deviations from a self-regarding view of relation-specific investments [10,11,12]. Following this reasoning, it seems that providing reciprocity-related information can be a behavioral remedy to the hold-up problem. However, previous studies have not been able to separately identify investees’ reciprocal motives. Because the effect of reciprocity has not been compared to other behavioral effects, its implication on mitigating hold-up problems also remains unclear. Moreover, experimental studies on (information disclosure in) hold-up games tend to focus more on a strictly repeated setting where all information jointly interacts with the subjects’ reputation [13,14,15,16]. Therefore, they also cannot identify the effects of different information channels.

The purpose of this paper was twofold. First, we decomposed a hold-up game to isolate the effects of reciprocity and veto power. We elicited players’ beliefs, in addition to their decisions, to shed light on the mechanism underlying players’ investments and transfers. Secondly, we considered whether and how information regarding the two behavioral effects can be useful in mitigating hold-up problems from investors’ perspective. If the effect of reciprocity is more important, then reciprocity-related information can significantly improve investors’ performance and help them survive the uncertain environment. Similarly, if the effect of veto power is more influential, investees’ bargaining behavior should help investors learn the effectiveness of their veto option better. Investors should care most about how they can benefit from different types of information disclosures.

Our experimental setting was based on a typical experimental hold-up game [10,11,17,18,19]. The game consists of two overlapping subgames. In the first subgame, an investor makes a risky transfer and the generated return will be redistributed by the investee—this part is equivalent to a trust game [13]. In the second subgame, the investee makes a take-it-or-leave-it offer to the investor in a way consistent with an ultimatum bargaining game [20]. In both games, the investee plays exactly the same role of redistributing a certain amount of return, yet the motivations of the redistribution decision are mixed: it can be viewed either as a reciprocating action towards an investment or as a more complex move of bargaining. To distinguish different motivations, we employed a two-phase design. Specifically, in the first phase, we used the subgames (an ultimatum game and a trust game) to collect the investee’s allocation choices. In the second phase, each investor plays a standard hold-up game with a different partner (a stranger). In addition, each investor can assess the paired investee’s previous choice. Therefore, our design consists of two corresponding information treatments (“UH” and “TH” treatments), in addition to one benchmark treatment (“H” treatment). The strategy method [21] was adopted in both phases so that no feedback was provided in the first phase. Players only interacted once in (the second phase of) the game.

We collected investors’ transfers, investees’ allocation choices, and investor’s subsequent responses to the allocations (their willingness to accept each allocation offer). The decisions helped us to isolate the effects of reciprocity and veto power. Moreover, they helped us evaluate investors’ performance, which can be illustrated by their investment “mistakes”. An investor can make two types of decision mistakes: she (we assume a female investor and a male investee) may fail to invest, while the investee would improve the investor’s earnings should she invest (the strategy method enables the recording of this information); or she may over-invest when the ex-post allocation suggests that the investment is held-up by the investee. Providing social-preference-related information should reduce investment mistakes. In addition to the choice decisions, we also elicit each investee’s belief (on the paired investor’s willingness-to-accept threshold) to further investigate possible mechanisms behind investees’ choices.

Our results show that there is a strong positive reciprocity effect due to an investment decision, while the effect of veto power is weak. The results further confirm a significant reduction of decision mistakes when principals can access reciprocity measures. Investors tend to under-invest when they do not fully account for the effects of positive reciprocity. Through the modeling of an investee’s preference, we found that an investor can do better when she uses a much lower investment threshold strategy in the (ultimatum) bargaining game information treatment (UH treatment), while in the trust game information treatment (TH treatment), the predicted investment threshold is more consistent with the optimal investment level. Using the belief data, we found that positive reciprocity is associated with a (false) belief of the escalation of the retaliation behavior. Therefore, reciprocity in our context is more likely driven by some constraints in beliefs [22].

2. Literature

2.1. Relation-Specific Investment and the Hold-up Problem

Relationship-specific investments are “investment which, once made, have a value in alternative uses that is less than the value in the use originally intended to support a specific trading relationship” [23]. In other words, a relationship-specific investment creates a “locked in” relation between investors and investees. When contracts are incomplete, this type of investment creates inefficiencies: after an investment, because investees can bargain over unanticipated economic gains, a potential “hold up” situation is created [2,24]. Investors afraid of the potential hold-up problem will tend to invest less than a socially optimal level.

Relation-specific investments do not have to be in the sense of strict monetary transfers. They can also refer to costly effort devoted to a relationship. For example, the hold-up problem has been extensively discussed in the literature of corporate governance and control, e.g., [7]. On the one hand, shareholders are less motivated to invest because managers usually have substantial control of the resource allocation in the firm and can expropriate investors [25]. On the other hand, increasing shareholders’ bargaining power is also subjected to great debates because managers, as well as other stakeholders with weaker bargaining positions, may also contribute less [26]; they are likely to make more myopic investment and are less motivated to innovate [27,28]. The conventional contractual approaches of the hold-up problems rely mainly on managers’ and stakeholders’ monetary incentives [29,30,31].

2.2. Economics Experiments on Hold-up Game

Experimental economics provides useful tools to investigate behavioral effects in hold-up games. In these studies, expected reciprocity has been viewed as a crucial motivator of investment [13,32]. Meanwhile, when bargaining over (unanticipated) gains after an investment, investors tend to reject “unfair” offers [11,12], and investees tend to propose more equal splits of the investment surplus, instead of exploiting investors [11]. Models of reciprocity and fairness have been adopted to explain patterns that are inconsistent with a self-regarding view of relation-specific investments [10,11,12]. These studies point out the potential of behavioral remedies to the hold-up problem [10,33]. However, in the previous literature, behavioral effects have not been empirically distinguished or compared under the same framework of hold-up games.

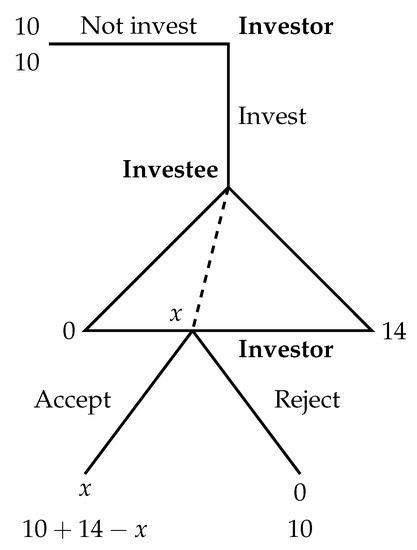

Our hold-up game follows Morita and Servátka’s [19] design. An investor and an investee start with 10 experimental currency units (ECU). In Stage One, the investor decides whether to make a relation-specific investment at a cost of 10 ECUs. The game ends if no investment happens, and both the investor and investee receive their own endowment. If investment occurs, it will yield 14 ECU of investment return. This stage game is similar to a trust game [13]. In Stage Two, the investee decides how to allocate the return of 14 ECU between the investor (x ECU) and himself ( ECU). In Stage Three, the investor decides to accept or reject the investee’s offer. Upon acceptance, she receives x and the investee’s payoff is plus his endowment. If she rejects the offer, her payoff becomes 0 and the investee ends up with his endowment of 10 ECU. This stage game is similar to an ultimatum bargaining game [20]. The procedure of the hold-up game is illustrated in Figure 1.

Figure 1.

The hold-up game.

2.3. Behavioral Game Theory and Hold-up Game

Behavioral game theory literature provides at least two different approaches to model reciprocity. First, based on the revealed preference theory, ref. [34] defines reciprocity as the second mover’s reaction to the first mover’s choice of a more (or less) “generous” opportunity set. Following this logic, the authors distinguish trustors’ actions to reset a higher status quo (commission), against actions of retaining the status quo (omission). The theory has been tested using various games including the trust game [35,36,37]. While we cannot directly observe one’s belief, structural estimations enable us to recover parameters related to ones’ belief. For example, ref. [38] offer a simplified way to structurally estimate players’ own “emotional state”, which “responds to the kindness or unkindness of others’ choices”.

The second approach is based on the psychological game theory, e.g., ref. [39] in that players’ beliefs directly enter their utility. Ref. [40] provide a detailed survey of psychological games and related belief-dependent motivations. Among them, the most well-known example is the intention-based reciprocity, e.g., [41,42]. In testing this view, beliefs and high-order beliefs are elicited and are used to explain experimental observations. The intention-based model of sequential reciprocity has been tested in various trust games [15,43,44,45].

The role of reciprocity has been recently discussed in the literature of incomplete contracts [7]. Ref. [5] argues that (long term) contracts serves as reference points that coordinate parties’ (reciprocal) beliefs of a “fair” allocation. Ref. [46] provide experimental evidence consistent with the theory and offer explanations using the belief-dependent reciprocity. Since reciprocity is assumed to play a crucial role in our experimental decomposition of the hold-up game, our discussion is largely inspired by the above-mentioned behavioral game theory approaches.

2.4. Sustainability and Hold-up Game

Sustainability broadly defined requires not only environmental integrity but also economic prosperity, as well as social sustainability [47]. Due to the hold-up problem, relying solely on contractual solutions may not be an efficient strategy for firms and investors—especially when the contracts are only designed to regulate stakeholders’ monetary incentives. In contrast, stakeholders’ social preferences, such as reciprocity, can motivate them and align their objectives with the socially optimal level better [48]. Therefore, reciprocity has been conceptualized and plays an important role in the stakeholder theory [49]. However, the importance of reciprocity has not been quantified in the hold-up games. Because of the unobserved nature of reciprocity, experimental methods are necessary to evaluate the effect of reciprocity-related information on investment returns and growth.

3. Experiment Design and Hypotheses

3.1. Design and Procedures

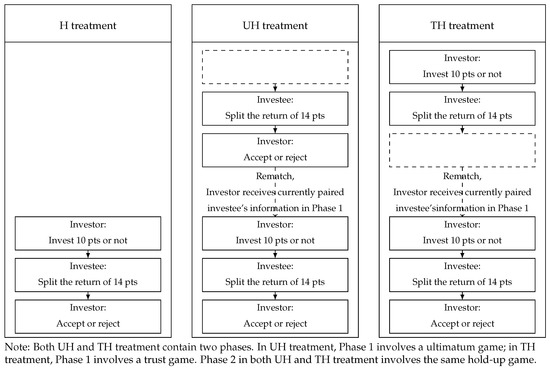

We decompose the hold-up game [19] in Figure 1 into two related games. The first one is an ultimatum game [20] where an investee with an endowment of 10 ECU decides how to split a pie of 14 ECU between an investor (who starts with 0 ECU) and himself. The second one is a trust game [13], which is equivalent to a hold-up game without the veto stage. To isolate investees’ different motivations, subjects play the ultimatum game or the trust game in the first phase and then play the complete hold-up game with another (stranger) investee after a rematch in the second phase. Because we use the strategy method, investees respond to hypothetical investments without interacting with investors (regardless of what treatment he is in). Therefore, the difference in trustees’ choices over phases reflects a potential effect of reciprocity or veto power. To consider how different information channels of social preference affect investors’ decisions, we further allow investors to access to investees’ choices in the first phase. Our experiment consists of two information treatments, in addition to the benchmark hold-up game. Figure 2 summarizes our experiment design: First, the H treatment is the benchmark hold-up game (following [19]). The ultimatum-hold-up game treatment (UH) and the trust-hold-up game treatment (TH) are used to isolate the effect of reciprocity and veto power on investees’ allocation choices, assuming that investees’ preference is stable over phases, because the main difference within each treatment is the corresponding missing component of the hold-up game. Second, we provide investors with information on their paired investee’s previous allocation transfers in UH and TH treatments. (Subjects in the first phase do not know the detailed instructions of the second phase, including the information disclosure. This choice is made to reduce investees’ strategic behavior and ensure an accurate measure of their motivations. These measures will be then included in the modeling of their second-phase responses. In Appendix A, we provide details and results of a treatment without information disclosure for robustness check and show that trustees perform similarly in the treatments with and without information disclosure. However, such a design could be viewed as deception. We acknowledge that a better practice would have been to indicate in the instructions that information in the first phase could also affect the second phase tasks. Experimental economists are in general very cautious about the use of deception in experiments, because deception typically entails a loss of control. However, there are also diverse views on what constitutes deception, e.g., [50,51]. Quite a few economists believe that a design with minor deception “might in fact be appropriate when the topic is important and there is no other way to gather data”). The only difference of the hold-up games across treatments is the information elicited in different (yet comparable) games in the first phase. Depending on how investors use the information regarding investees’ choices in the first phase, their performance can be different.

Figure 2.

Experimental Design.

Finally, to understand players’ motivations of reciprocity or veto power better, we also elicit each investee’s belief on the paired investor’s minimum willingness-to-accept threshold after his allocation choice. (In UH treatment, we collect beliefs in both Phases. In TH treatment, we collect the belief in Phase 2, because investors cannot choose to reject in the first phase.)

The experimental instructions (In Appendix B, we provide the translated instructions for both UH and TH treatments.) are given separately for each phase in UH and TH treatment. The detailed instructions for the second phase will be only given later in that phase. In each treatment, all subjects are randomly assigned to be investors (Role A) or investees (Role B) at the beginning. In the UH and TH treatment, investors and investees randomly rematch in the latter hold-up game with their roles fixed. We adopt the strategy method to elicit players’ contingent choices without giving them feedback until the end of the game. (For example, even the investor chooses not to invest in Stage One, we still ask her whether she wants to accept the following possible transfers, based on a (hypothetical) investment.) After an investee completes his transfer decision, we elicit his belief on the investor’s WTA. (The belief elicitation is incentivized in the following way: a perfect prediction results in a three ECU bonus; one unit’s (two units’) deviation from it results in two (one) ECU correspondingly, and deviations more than two units lead to zero bonus.) All subjects are required to correctly answer a short quiz about the instructions to ensure a good understanding of these games.

The final payoff is drawn randomly from the two phases in the information treatments. One ECU corresponds to one yuan. Subjects also receive a show-up fee of 15 yuan. At the end of the experiments, all subjects are required to fill an exit survey including questions on demographics, risk preference, and strategies in the game. We conduct all experiments at University of Electronic Science and Technology of China (UESTC) using z-Tree [52]. 254 undergraduate or graduate students are randomly selected from a subject pool of about 1000 registered students (The subject pool is managed using “Keyan Assistant”, see https://www.ancademy.org). They have never participated in similar experiments before. There are 43, 44, and 40 pairs of subjects in H, UH, and TH treatments. (The choice of sample size follows previous literature on hold-up games. However, a post hoc analysis shows that the statistical power of between-treatment comparisons is relatively low. We discuss this issue in the last section.) Each session lasted about 30 (H treatment) to 40 (UH and TH treatments) minutes.

3.2. Hypotheses

In the relation-specific investment, each investor’s investment return depends on her partner’s allocation choices and such allocation is jointly affected by various motivations. We first focus on the within-treatment analysis of investees’ choices. In the hold-up games, investees do not receive any information on investors and their choices are all conditional on investors’ (hypothetical) investment. Assuming that investees’ preference is stable over phases, our within-treatment design can isolate two groups of major influences: In UH treatment, because the main difference across phases is the investment decision, the change in an investee’s transfer is likely due to the investor’s trust. Similarly, in TH treatment, the main difference across phases is the veto stage. Therefore, the change in an investee’s transfer is likely due to the threat of the veto option. (Although theoretically, the veto option is not a credible threat, rich experimental results suggest that subjects are willing to costly punish “unfair” allocations [53].) Therefore, our hypothesis on the effects of reciprocity and veto options can be summarized below:

Hypothesis 1.

(1) In UH treatment, investees significantly raise their transfers in the second phase compared with the first phase, due to reciprocity related concerns. (2) In TH treatment, investees significantly raise their transfers in the second phase compared with the first phase, due to the consideration of the additional veto power of investors.

Our next hypothesis concerns sources of a potential effect of reciprocity or veto power. In particular, we are interested in whether investees’ beliefs are consistent with their own choices and whether investors’ choices are consistent with the predictions of investees. The experiment elicits investees’ beliefs on investors’ willingness-to-accept threshold. We first compare the beliefs with investees’ allocation choices; then we compare the beliefs with investors’ real WTA threshold. In UH treatment, because both phases have the veto stages, therefore, we can investigate the comparisons at both phases. In TH treatment, only the second phase has the veto stage; therefore, the comparison is limited to decisions and beliefs in the second-phase hold-up game.

Hypothesis 2.

(1) In UH treatment, investees’ transfer choices are consistent with their beliefs on the investors’ WTA thresholds in both phases. (2) In TH treatment, investees’ transfer choices are consistent with their beliefs on the investors’ WTA thresholds in the second phase hold-up game. (3) In both UH and TH treatment, investees’ beliefs correctly reflect investors’ WTA choices.

We then focus on the investor side and rely on the between-treatment comparisons of investors’ performance. In the second phase of UH and TH treatment, if players are truly affected by the effects of reciprocity and veto power, it implies that investors benefit from the information disclosure of the agents’ reciprocity and bargaining preference. The following hypothesis mainly concerns information disclosure.

Hypothesis 3.

(1) The information disclosure can reduce the ex-post suboptimal behavior in UH treatment, compared with H treatment. (2) The information disclosure can reduce the ex-post suboptimal behavior in TH treatment, compared with H treatment.

Investors may not respond to the provided information optimally, especially when they misinterpret the information or fail to anticipate other factors that may lead to investees’ changes of behavior. Our last hypothesis concerns the best ways of using such information, compared with the realized investment choices. To better illustrate this point, we follow [38] and directly estimate an investee’s reciprocity and fairness motivations as his “emotional state”. In UH treatment, investors receive the information on investees’ previous bargaining choices. In TH treatment, investors’ best responses involve evaluating the extra veto option. If they expect the corresponding information disclosure to be effective, they should adjust their investment thresholds accordingly. We investigate the use of information by structurally estimating coefficients governing the changes of the emotional states.

Hypothesis 4.

(1) In UH treatment, if the information on ultimatum bargaining is sufficient, the best way of using the disclosed information is to invest when the previous transfer is greater than or equal to the investment cost, 10 ECU. (2) In TH treatment, if the information on reciprocity is sufficient, the best way of using the disclosed information is to invest when the previous transfer is greater than or equal to the investment cost, 10 ECU.

4. Results

Table 1 shows the summary statistics for the main variables recorded in the experiments. In the benchmark treatment (H treatment), the investment rate in the hold-up game is 67%, higher than the investment rate in UH treatment (Chi-square test, p-value ≈ 0.063) and close to TH treatment (Chi-square test, p-value ≈ 0.814). Investors also show similar average willingness-to-accept thresholds in the presence of information disclosure (T-test: H vs. UH, p-value ≈ 0.343; H vs. TH, p-value ≈ 0.211).

Table 1.

Summary statistics.

From the investees’ perspective, the average Phase 2 offers are similar (T-test: H vs. UH, p-value ≈ 0.603; H vs. TH, p-value ≈ 0.263). In H and UH treatment, investees’ average transfers are higher than their beliefs (Wilcoxon signed-rank test, p-value ≈ 0.007 in H treatment; p-value = 0.040 in UH treatment); in TH treatment, the difference is not significant (Wilcoxon signed-rank test, p-value ≈ 0.742).

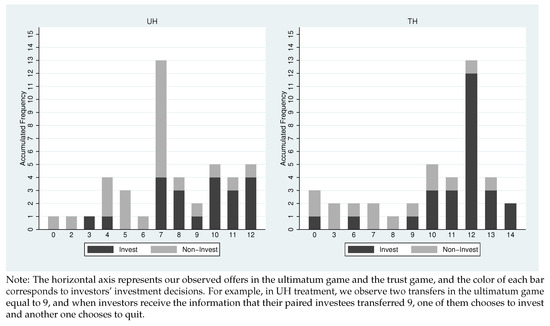

At the individual level, Figure 3 shows the investment decision, conditional on different past investees’ transfer offers in UH and TH treatments. The height of each bar represents the total frequency of investors who receive the same transfer in the two games, and the dark grey area represents actual investment decisions, compared with the non-investment cases denoted in the light grey area. Most investments occur when the paired investees’ previous transfers are greater than or equal to seven in UH treatment. Seven is also the most frequent choice by investees in UH treatment. In TH treatment, the investment happens more with a transfer larger or equal than 10, and investees tend to equally split the surplus, instead of the total investment. In both treatments, investors’ decisions tend to correlate with the available information on past transfers.

Figure 3.

Investors’ behavior in phase 2 as a function of investees’ transfer offers in phase 1.

In the next three sub-sections, our analysis will be based on the above-mentioned variables. We start with investees’ allocation choices over different phases. Then we discuss how the information regarding investees’ choices affects investors’ decisions. Finally, we structurally evaluate investors’ best ways of using the information and compare the optimal choices with their real choices.

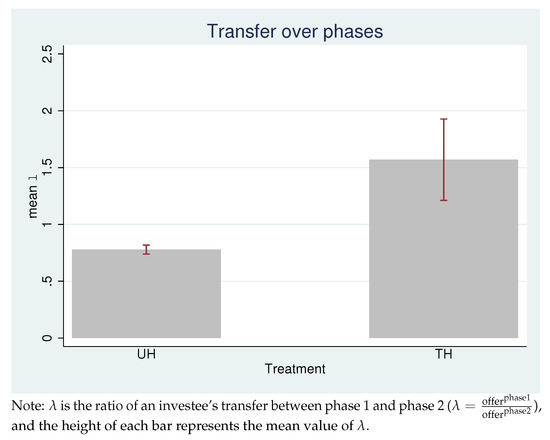

4.1. The Effects of Reciprocity and Veto Option on Investees’ Choices

From the above summary statistics in Table 1, we can already see that, at aggregate level, investees’ transfers are changing across phases. In UH treatment, the previous average offer is 7.66, and then increases to 9.56. In TH treatment, however, the number moves downward from 9.70 to 8.78. Figure 4 provides a more accurate test, where is defined as the ratio of an investee’s transfer between two phases: . When , the investees tend to increase their offers in the hold-up game. In UH treatment, the average value of equals to 0.779 and it is significantly smaller than the unit value, indicating that most of the investees increase their transfers in the second phase (Sign-rank test, p-value ≈ 0.000). In TH treatment, the distribution shows a quite different pattern. The average value of , which is larger than 1, indicating a insignificant decrease in investees’ transfers in the second phase (Signed-rank test, p-value ≈ 0.144). (The insignificant result suggests either a lack of effect or that the effect is not detected under the current sample size).

Figure 4.

Investee’s transfer over phases.

In the hold-up game, an investee’s transfer is affected by mixed non-monetary incentives. However, in UH treatment, an increase in investees’ transfer is mainly due to the additional investment stage. Therefore, captures the influence of the investment. The fact that is significantly smaller than one indicates that reciprocity-related factors play important roles, in addition to other related incentives such as the veto power or fairness considerations. In TH treatment, in contrast, the additional impacts of the veto options leads to a weak yet reversed effect that reduced the transfers over time. One possible explanation for the lower transfer is due to the weakening (positive) reciprocity. Previous literature has shown that (dis)incentives may crowd out intrinsic motivations, e.g., [54]. Another possible explanation is related to the strengthening of the investee’s sensitivity to negative reciprocity, e.g., [40]. For example, ref. [55] show that the negative effect of intention-based reciprocity holds in the trust game, but not in the dictator game. In summary, our results support the first part of Hypothesis 1.

Result 1.

(1) In UH treatment, the investees significantly raise their transfers in the second phase compared with the first phase.

(2) However, in the TH treatment, the investees decrease their transfers in the second phase, although not significantly.

To understand what players thought in their minds, we further elicit their beliefs and link them with players’ actions. In UH treatment, investees are asked to provide their (incentivized) predictions for investors’ WTA after the allocation choices in both phases; in TH treatment, they are asked for similar predictions in the second phase. Their offers are generally higher than the predictions in UH treatment (Signed rank test: p-value ≈ 0.014 for UH phase 1, p-value ≈ 0.040 for UH phase 2), indicating that players tend to over-react to make sure their offers are accepted. Yet in TH treatment, they are similar (p-value ≈ 0.742 for TH phase 2). In UH treatment, investees’ average beliefs in the investor’s WTA has increased from 6.57 to 9.45 (Sign-rank test, p-value ≈ 0.000). When we adjust their realized transfers—which have also increased over time as shown in Result 1—by the elicited beliefs, the difference between transfers can be explained by the changes in the belief (Signed-rank test, p = 0.116). However, investors’ WTA does not increase significantly (Signed-rank test, p-value ≈ 0.319). (Interestingly, when we compare WTA of those investors who do not actually invest in the hold-up game, WTA increases significantly (Signed-rank test, p≈ 0.006). Therefore, hypothetical investors are subjected to some bias in their beliefs.) These observations indicate that reciprocity is better interpreted as a constraint, derived from beliefs [22].

Meanwhile, investees’ predictions are in general not consistent with investors’ realized WTA (Signed rank test, p-value ≈ 0.019 for UH phase 1, p-value ≈ 0.004 for UH phase 2, p-value ≈ 0.005 for TH phase 2), with the former much larger than the latter, especially in the second phase hold-up games. The gaps in beliefs suggest that investors, who fail to correctly anticipate such belief differences, may be subjected to an under-investment problem in such one-shot interaction. Consequently, information disclosure should help them make better decisions.

Result 2.

(1) In UH treatment, investees’ transfer choices are higher than the predicted thresholds. The changes of investees’ predicted WTAs can explain variations in the changes of their transfers, indicating that reciprocity effects are more related to changes in beliefs, rather than preferences.

(2) In TH treatment, investees’ transfer choices are consistent with their own beliefs on the investor’s WTA.

(3) However, investees’ beliefs are significantly higher than investors’ realized WTA choices in the second phase hold-up games.

4.2. Investors’ Performance under the Controlled Information Disclosure

The previous results indicate that providing investors with investees’ previous choices may adjust their beliefs and improve their investment. Therefore, in our information treatments, we should observe first that investors make use of investess’ past transfers. Moreover, we can further test whether they benefit from the informations and make appropriate decisions. Figure 3 has already provided an eye ball test on the correlation between investment and information. Further comparing the investors’ investment decisions and their paired investees’ transfers being greater or equal to 10, a Fisher’s exact test shows that investment decisions in both information treatments significantly correlate with the information disclosure (Fisher’s exact test, p-value ≈ 0.009 in UH and p-value ≈ 0.001 in TH). Another perhaps more informative way of examining the role of information disclosure is to calculate the rates of decision “mistakes”. From an ex-post perspective, an over-investment or under-investment mistake is directly linked to investors’ realized return. On the one hand, investors may fail to make an investment, when they should have done so; this is an under-investment mistake. On the other hand, they may brashly enter into one, from which they should keep a distance; this is an over-investment mistake. (Admittedly, the latter mistake can cost significantly more, because the investment would haven been sunk with such mistake.)

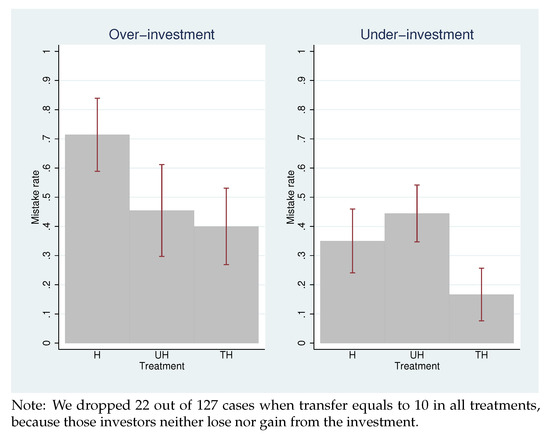

Figure 5 shows the relationship between the mistake rate and the ex-post hold-up realization. In the benchmark treatment, the overall investment rate is higher than 50% and thus, more people make over-investment mistakes compared with pure chance. In UH treatment, the over-investment rate is 45.45%, lower than the no information treatment (Chi-square test, p-value ≈ 0.188). In TH treatment, the over-investment rate is even lower than 40%, compared with the benchmark (Chi-square test, p-value ≈ 0.089). Therefore, both UH and TH treatments reduce the over-investment mistakes and the reduction in TH treatment is marginally significant. (Notice that although there is an improvement in investment decisions, the magnitude of over-investment mistakes is still large and the aggregate hold-up rates are not significantly different across treatments. We further discuss the optimal use of the information in the next subsection.)

Figure 5.

The ex-post investment mistakes.

Meanwhile, the under-investment mistakes are not consistently reduced in the information treatments. Compared with H treatment, the under-investment mistake rate is even higher in UH treatment. This result indicates that the presence of the information “deters” potential investments, compared with the no information benchmark (Chi-square test, p-value ≈ 0.291). In TH treatment, we observe a much lower level of under-investment mistakes, indicating that information in TH treatment provides relatively better guidance in promoting investment (Chi-square test, p-value ≈ 0.187). Between UH and TH treatments, the ex-post transfers indicate that more investors (27 out of 38 versus 18 out of 33) could have been profitable had they chosen to invest, however, they become more conservative with their money. In summary, our results are not completely consistent with Hypothesis 3. While over-investment mistakes are in general reduced under information disclosure, under-investment mistakes are more prevalent in UH treatment.

Result 3.

(1) In both UH and TH treatment, the over-investment is relatively reduced, compared with H treatment. The difference in TH treatment is marginally significant, yet it is not significant in the UH treatment.

(2) UH treatment witnesses higher under-investment mistakes, while TH treatment witnesses lower under-investment mistakes. Both differences are not statistically significant.

4.3. Investors’ Optimal Choices and Their Real Choices

While investors in general benefit from the information disclosure, their interpretations of investees’ behavior in the ultimatum game and the trust game are different. Investors have to consider how the information is related to investees’ preferences and beliefs; moreover, investors’ own actions may change such preferences and beliefs.

To see this in more detail, we estimate investees’ allocation choices following [38]’s approach. The approach introduces an “emotional state” parameter based on an investee’s marginal rate of substitution between his own and other’s payoff. Specifically, an investee’s utility function can be written as:

where m is the investee’s payoff and y is his return to the investor. Parameter represents the “emotional state”, or his willingness to pay own for other’s payoff when . captures the elasticity of substitution. In two phases, and are estimated, and . The variable “pastoffer” in is investee’s transfer in the first phase, and is the constant. Table 2 shows the estimation result of this model.

Table 2.

Structural estimation result of investee’s preference.

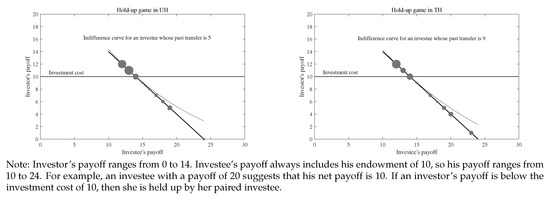

In UH treatment, the estimation result shows that investees’ average rises from 0.78 to 1.12, indicating that investees care more about investors’ payoff in the second phase. Because the estimation of coefficient is insignificant, the investee’s emotional state in the second phase is not very correlated with his transfer in the first phase. In TH treatment, is insignificantly lower than on average. His transfer in the first phase is positively and marginally significantly correlated with his emotional state.

With the estimated parameters, we can describe in more detail how investees make trade-offs between others and their own payoffs. Figure 6 illustrates the investees’ budget constraint line, which is the same for both treatments. According to our structural model, each consumer with a different transfer in the first phase corresponds to a different set of indifference curves. When the point of tangency between the budget line and an indifference curve is above the investment cost, it implies that the investment is profitable. Figure 6 provides the critical indifference curves for both treatments. The critical indifference curve for UH treatment corresponds to the investees with a transfer of only 5 ECU tokens in the previous phase. In other words, an investor should already invest, as long as the investee’s past transfer is greater than five ECU. This is most likely due to the unaccounted reciprocity effect. However, the critical indifference curve for TH treatment is the one associated with a past transfer of 9 ECU. In other words, an investor should only invest when the investee’s past transfer is greater than 9 ECU. The result confirms that, after accounting for the information in the reciprocity effect, the additional investors’ veto power should not be viewed as effective in the hold-up game.

Figure 6.

Investee’s indifference curve and Investor’s optimal decision.

Result 4.

(1) In UH treatment, investors’ optimal investment decision involves investing when the potential investee’s previous transfer is higher than five ECU.

(2) In TH treatment, investors’ optimal decision involves investing when the potential investee’s previous transfer is higher than nine ECU.

5. Discussion and Conclusions

Sustainable growth has been a crucial goal for investors and organizations. However, the hold-up problem in relation-specific investments discourages investors to make sufficient investment and effort. While contractual solutions do not work well in this context, investees’ reciprocal motives can further strengthen investment relationships and provide additional incentives for investors.

Using a laboratory experiment, we decompose social-preference-related effects in a standard hold-up game and study the effect of related information on investors’ choices. We provide two information treatments before the hold-up game. The first phase consists of either an ultimatum bargaining game (UH treatment) or a trust game (TH treatment). We find that investors are affected and sometimes benefit from those information disclosures—especially in TH treatment, because agents are significantly affected by the (positive) reciprocity effect.

We detect a significant number of investment “mistakes” and those mistakes result from the misuse of information across treatments, especially in UH treatment, because investors do not successfully account for the impact of their investment on investees’ reciprocal responses. Our within-treatment inspections show that investees are significantly affected by reciprocity, and not by veto options. Investors who do not sufficiently anticipate such effects in UH treatment lead to under-investment mistakes.

In reality, investment and ex-post bargaining happen in more complex ways. However, our experiment provides a simplified framework to understand the real-world phenomenon. For example, our experiment implies that veto power may not be a good way to improve investors’ performance. This is consistent with recent field investigations regarding binding votes on compensation [26]. Our findings also confirm theoretical discussions on the importance of trust and reciprocity in venture capitalist-entrepreneur relationship [56,57]. Moreover, we show the importance of investees’ beliefs on their reciprocal responses and the importance to treat social-preference-related information channels differently. Our results can guide business practices, as well as the design of future information disclosure policies. Field experiments are particularly helpful for policy evaluations and can provide more insights into the informative role of reciprocity in investment performance and sustainability.

While we offer a novel experimental design to study relation specific investments, our results should be considered in the light of some limitations. First, our choice of sample size is ad hoc. Our post hoc analysis shows that the cross-treatment comparison on investors’ choices and their decision mistake rates have relatively weaker power. Therefore, a larger sample size can help us better validate our results. Second, our design can be further improved. For example, because of the information disclosure design, we have assumed away the order effects. Therefore, we can benefit from alternative designs of “HU” and “HT” treatments. On evaluating the effects of information disclosure, we have also discussed potential issues of deception in the experimental design section. We leave further extension and investigation of related issues for future research.

Author Contributions

Conceptualization, D.N. and X.W.; methodology, X.W. and Y.Y.; software, K.Z.; validation, X.W. and Y.Y.; formal analysis, K.Z.; data curation, K.Z.; writing—original draft preparation, X.W.; writing—review and editing, X.W. and Y.Y.; supervision, D.N.; funding acquisition, X.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Science Foundation of China grant number 71502023, 71972026, 71840007, 71703175, and Guangdong Natural Science Foundation grant number 2017A030310392.

Acknowledgments

We benefit from helpful comments by Hong Chao, Jun Feng, Ajalavat Viriyavipart, Yadi Yang, conference participants of the 2019 Asia Pacific Economic Science Association, and the 7th Annual Xiamen University International Workshop on Experimental Economics. Special thanks are owed to the editors and anonymous reviewers who gave constructive suggestions and comments for improving this article.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

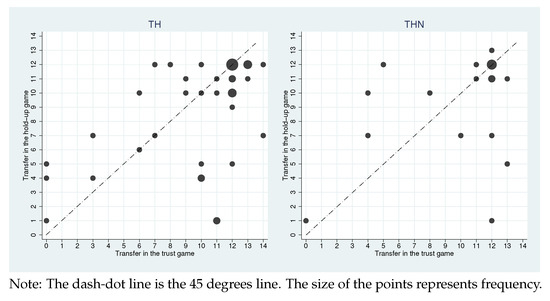

Appendix A. Additional Analysis

Because in our experimental design, investees later in the second phase learn that their previous decisions will be revealed to the investors, this in principal will weaken the effect of positive reciprocity and even generate additional negative reciprocity. If the information treatment causes significant negative reciprocity, then removing the information disclosure should lead to an improvement in investees’ transfers. For this reason, we further conduct a slightly different TH treatment (THN treatment), where information disclosure is removed. Additional 38 subjects participate the experiment and Figure A1 provides a comparison between TH treatment and THN treatment. The investees’ transfers are quite similar in TH treatment (Signed-rank test, p-value ≈ 0.352). Therefore, we conclude that the weak effect of the veto option is not due to the experimental design of information disclosure.

Figure A1.

The transfer distribution in the TH and THN treatments.

Appendix B. Translation of the Experimental Instruction

Welcome to participate in the experiment!

Today, you will participate in an economics experiment. The experiment involves people’s decision-making in economic activities. The decisions you make in your experiment will determine your earnings, which will be paid in cash at the end of the experiment. You will make decisions on the computer in front of you. In order to understand how to gain money in the experiment, please read the instruction carefully.

If you have any questions, please raise your hand. The experimenter will answer your questions privately. Please do not talk to other participants during the experiment.

There are two phases in this experiment. You will read the instruction for phase 1; After the end of phase 1, you will read instruction for phase 2.

There are two roles in this experiment, Role A and Role B. You will learn your role at the beginning of the experiment, and the role will remain the same in the whole experiment.

One experimental token equals to one yuan, and the final revenue of the experiment will be randomly drawn from two phases.

Instruction for Phase 1 [UH treatment]

- At the beginning of the first stage, Role A will be randomly paired with another Role B.

- There is zero experimental token in the initial account of role A, and 10 experimental tokens in the initial account of Role B.

- There exists a revenue of 14 experimental tokens, and Role B will determine how to distribute the revenue between Role A and Role B.

- How to distribute the 14 experimental tokens will be explained below:

- (a)

- The first step: Role B proposes an allocation: A gets X experimental tokens and B gets 14-X experimental tokens.

- (b)

- The second step: A chooses to accept or reject B’s proposal.

- If A accepts B’s proposal, then A obtains X of the 14 experimental tokens, and B gets 14-X experimental tokens. In this case, A’s return is X experimental tokens, and B’s return is 10+ (14-X) experimental tokens.

- If A rejects B’s proposal, the 14 experimental tokens will disappear, and neither A nor B can obtain this revenue (zero experimental token). A’s return in this decision is zero experimental token, and B’s return is 10 experimental tokens, which is his initial account balance.

[Quiz about the above instruction for Phase 1]

[Phase 1 decision]

[ (Only for Role B) Elicitation of B’s belief on A’s WTA ]

Please predict role A’s subsequent decision. Specifically, how much do you think is the minimum amount for Role A to accept your proposal?

If your prediction is exactly in line with A’s decision, you will get three extra experimental tokens; with one unit deviation from A’s decision, you will get two extra experimental tokens; with two units deviation from A’s decision, you will get one extra experimental token; more deviations lead to zero extra experimental tokens.

The first phase decision is over. You can learn the earnings of the first phase at the end of the second phase. Click [OK] button to enter the second phase.

Instruction for Phase 1 [TH treatment]

- At the beginning of the first stage, Role A will be randomly paired with another Role B.

- All Role A and B will have 10 experimental tokens in initial accounts at the beginning of the first phase.

- Each pair of A and B will make an investment-distribution decision. The rules are as follows:

- (a)

- If Role A decides not to invest, the experiment is ended. Both A and B’s earnings are 10 experimental tokens, which equal the initial account balance.

- (b)

- If Role A decides to invest (the investment costs 10 experimental tokens), the investment will generate a revenue value of 14 experimental tokens.

How to distribute the 14 experimental tokens will be explained below:- (a)

- The first step: Role B proposes an allocation: A gets X experimental tokens and B gets 14-X experimental tokens.

- (b)

- The second step: Roles A and B divide the revenue value of 14 experimental tokens according to A’s proposal.

- (c)

- A’s return is X experimental tokens, and B’s return is 10+ (14-X) experimental tokens.

[Quiz about the above instruction for Phase 1]

[Phase 1 decision]

The first phase decision is over. You can learn the earnings of the first phase at the end of the second phase. Click [OK] button to enter the second phase.

Instruction for Phase 2

- At the beginning of the second phase, Role A will be randomly paired again with another Role B.

- All Role A and B will have 10 experimental tokens in initial accounts at the beginning of the second phase.

- Each pair of A and B will make an investment-distribution decision. The rules are as follows:

- (a)

- If Role A decides not to invest, the experiment is ended. Both A and B’s earnings are 10 experimental tokens, which equal the initial account balance.

- (b)

- If Role A decides to invest (investment costs 10 experimental tokens), the investment will generate a revenue value of 14 experimental tokens.

How to distribute the 14 experimental tokens will be explained below:- (a)

- The first step: Role B proposes an allocation proposal: A gets X experimental tokens and B gets 14-X experimental tokens.

- (b)

- The second step: A chooses to accept or reject B’s proposal.

- If A accepts B’s proposal, then A obtains X of the 14 experimental tokens, and B gets 14-X experimental tokens. In this case, A’s return in this decision is X experimental tokens, and B’s return is 10+ (14-X) experimental tokens.

- If A rejects B’s proposal, the 14 experimental tokens will disappear, and neither A nor B can obtain this revenue (0 experimental token). In this case, A’s return in this decision is 0 experimental token, and B’s return is 10 experimental tokens, which is his initial account balance.

At the beginning of the decision in this phase, Role A will see the currently paired Role B’s decision in the previous phase.

[Quiz about the above instruction for Phase 2]

[Phase 2 decision]

[ (Only for Role B) Elicitation of B’s belief on A’s WTA ]

Please predict role A’s subsequent decision. Specifically, how much do you think is the minimum amount for Role A to accept your proposal?

If your prediction is exactly in line with A’s decision, you will get three extra experimental tokens; with one unit deviation from A’s decision, you will get two extra experimental tokens; with two units deviation from A’s decision results, you will get one extra experimental token; more deviations lead to zero extra experimental tokens.

[Draw final payoffs from two phases]

[End]

References

- Williamson, O.E. The Vertical Integration of Production: Market Failure Considerations. Am. Econ. Rev. 1971, 61, 112–123. [Google Scholar]

- Klein, B.; Crawford, R.G.; Alchian, A.A. Vertical integration, appropriable rents, and the competitive contracting process. J. Law Econ. 1978, 21, 297–326. [Google Scholar] [CrossRef]

- Grossman, S.J.; Hart, O.D. The costs and benefits of ownership: A theory of vertical and lateral integration. J. Political Econ. 1986, 94, 691–719. [Google Scholar] [CrossRef]

- Holmstrom, B.; Roberts, J. The boundaries of the firm revisited. J. Econ. Perspect. 1998, 12, 73–94. [Google Scholar] [CrossRef]

- Hart, O.; Moore, J. Contracts as reference points. Q. J. Econ. 2008, 123, 1–48. [Google Scholar] [CrossRef]

- Maskin, E.; Moore, J. Implementation and renegotiation. Rev. Econ. Stud. 1999, 66, 39–56. [Google Scholar] [CrossRef]

- Hart, O. Incomplete Contracts and Control. Am. Econ. Rev. 2017, 107, 1731–1752. [Google Scholar] [CrossRef]

- Yang, Y. A Survey of the Hold-up Problem in the Experimental Economics Literature; SSRN Scholarly Paper ID 3203629; Social Science Research Network: Rochester, NY, USA, 2018. [Google Scholar] [CrossRef]

- Haruvy, E.; Katok, E.; Ma, Z.; Sethi, S. Relationship-specific investment and hold-up problems in supply chains: Theory and experiments. Bus. Res. 2019, 12, 45–74. [Google Scholar] [CrossRef]

- Dufwenberg, M.; Smith, A.; Van Essen, M. Hold-Up: With a Vengeance. Econ. Inq. 2013, 51, 896–908. [Google Scholar] [CrossRef]

- Ellingsen, T.; Johannesson, M. Promises, threats and fairness. Econ. J. 2004, 114, 397–420. [Google Scholar] [CrossRef]

- Sloof, R.; Oosterbeek, H.; Sonnemans, J. Does making specific investments unobservable boost investment incentives? J. Econ. Manag. Strategy 2007, 16, 911–942. [Google Scholar] [CrossRef][Green Version]

- Berg, J.; Dickhaut, J.; McCabe, K. Trust, reciprocity, and social history. Games Econ. Behav. 1995, 10, 122–142. [Google Scholar] [CrossRef]

- Brown, M.; Falk, A.; Fehr, E. Relational contracts and the nature of market interactions. Econometrica 2004, 72, 747–780. [Google Scholar] [CrossRef]

- Attanasi, G.; Battigalli, P.; Nagel, R. Disclosure of Belief-Dependent Preferences in a Trust Game; Technical Report 506; IGIER (Innocenzo Gasparini Institute for Economic Research), Bocconi University: Milan, Italy, 2013. [Google Scholar]

- Attanasi, G.; Battigalli, P.; Manzoni, E.; Nagel, R. Belief-dependent preferences and reputation: Experimental analysis of a repeated trust game. J. Econ. Behav. Organ. 2019, 167, 341–360. [Google Scholar] [CrossRef]

- Ellingsen, T.; Johannesson, M. Is There a Hold-up Problem? Scand. J. Econ. 2004, 106, 475–494. [Google Scholar] [CrossRef]

- Hoppe, E.I.; Schmitz, P.W. Can contracts solve the hold-up problem? Experimental evidence. Games Econ. Behav. 2011, 73, 186–199. [Google Scholar] [CrossRef]

- Morita, H.; Servátka, M. Group identity and relation-specific investment: An experimental investigation. Eur. Econ. Rev. 2013, 58, 95–109. [Google Scholar] [CrossRef]

- Güth, W.; Schmittberger, R.; Schwarze, B. An experimental analysis of ultimatum bargaining. J. Econ. Behav. Organ. 1982, 3, 367–388. [Google Scholar] [CrossRef]

- Selten, R. Die Strategiemethode zur Erforschung des eingeschränkt rationalen Verhaltens im Rahmen eines Oligopolexperiments; JCB Mohr (Paul Siebeck): Tübingen, Germany, 1967; pp. 136–168. [Google Scholar]

- Regner, T. Reciprocity under moral wiggle room: Is it a preference or a constraint? Exp. Econ. 2018, 21, 779–792. [Google Scholar] [CrossRef]

- Joskow, P.L. Vertical Integration. Antitrust Bull. 2012. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction-cost economics: The governance of contractual relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. A Survey of Corporate Governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Wagner, A.F.; Wenk, C. Agency versus Hold-up: Benefits and Costs of Shareholder Rights. Agency versus Hold-up: Benefits and Costs of Shareholder Rights. SSRN Sch. Pap. 2019. [Google Scholar] [CrossRef]

- Hitt, M.A.; Hoskisson, R.E.; Johnson, R.A.; Moesel, D.D. The Market for Corporate Control and Firm Innovation. Acad. Manag. J. 1996, 39, 1084–1119. [Google Scholar]

- Lundstrum, L.L. Corporate investment myopia: A horserace of the theories. J. Corp. Financ. 2002, 8, 353–371. [Google Scholar] [CrossRef]

- Hart, O.; Moore, J. Default and Renegotiation: A Dynamic Model of Debt. Q. J. Econ. 1998, 113, 1–41. [Google Scholar] [CrossRef]

- Hart, O.; Moore, J. A Theory of Debt Based on the Inalienability of Human Capital. Q. J. Econ. 1994, 109, 841–879. [Google Scholar] [CrossRef]

- Aghion, P.; Bolton, P. An Incomplete Contracts Approach to Financial Contracting. Rev. Econ. Stud. 1992, 59, 473. [Google Scholar] [CrossRef]

- Cox, J.C. How to identify trust and reciprocity. Games Econ. Behav. 2004, 46, 260–281. [Google Scholar] [CrossRef]

- Fehr, E.; List, J.A. The hidden costs and returns of incentives–trust and trustworthiness among CEOs. J. Eur. Econ. Assoc. 2004, 2, 743–771. [Google Scholar] [CrossRef]

- Cox, J.C.; Friedman, D.; Sadiraj, V. Revealed Altruism. Econometrica 2008, 76, 31–69. [Google Scholar] [CrossRef]

- Cox, J.C.; Ostrom, E.; Walker, J.M.; Castillo, A.J.; Coleman, E.; Holahan, R.; Schoon, M.; Steed, B. Trust in Private and Common Property Experiments. South. Econ. J. 2009, 75, 957–975. [Google Scholar]

- Cox, J.C.; Hall, D.T. Trust with Private and Common Property: Effects of Stronger Property Right Entitlements. Games 2010, 1, 527–550. [Google Scholar] [CrossRef]

- Cox, J.C.; Servátka, M.; Vadovič, R. Status quo effects in fairness games: Reciprocal responses to acts of commission versus acts of omission. Exp. Econ. 2017, 20, 1–18. [Google Scholar] [CrossRef]

- Cox, J.C.; Friedman, D.; Gjerstad, S. A tractable model of reciprocity and fairness. Games Econ. Behav. 2007, 59, 17–45. [Google Scholar] [CrossRef]

- Geanakoplos, J.; Pearce, D.; Stacchetti, E. Psychological games and sequential rationality. Games Econ. Behav. 1989, 1, 60–79. [Google Scholar] [CrossRef]

- Attanasi, G.; Nagel, R. A survey of psychological games: Theoretical findings and experimental evidence. In Games, Rationality and Behavior. Essays on Behavioral Game Theory and Experiments; Palgrave McMillan Houndmills: London, UK, 2008; pp. 204–232. [Google Scholar]

- Rabin, M. Incorporating fairness into game theory and economics. Am. Econ. Rev. 1993, 83, 1281–1302. [Google Scholar]

- Dufwenberg, M.; Kirchsteiger, G. A theory of sequential reciprocity. Games Econ. Behav. 2004, 47, 268–298. [Google Scholar] [CrossRef]

- Bacharach, M.; Guerra, G.; Zizzo, D.J. The Self-Fulfilling Property of Trust: An Experimental Study. Theory Decis. 2007, 63, 349–388. [Google Scholar] [CrossRef]

- Stanca, L.; Bruni, L.; Corazzini, L. Testing theories of reciprocity: Do motivations matter? J. Econ. Behav. Organ. 2009, 71, 233–245. [Google Scholar] [CrossRef]

- Toussaert, S. Intention-based reciprocity and signaling of intentions. J. Econ. Behav. Organ. 2017, 137, 132–144. [Google Scholar] [CrossRef]

- Fehr, E.; Hart, O.; Zehnder, C. Contracts as Reference Points—Experimental Evidence. Am. Econ. Rev. 2011, 101, 493–525. [Google Scholar] [CrossRef]

- Hart, S.L.; Milstein, M.B. Creating Sustainable Value. Acad. Manag. Perspect. 2003, 17, 56–67. [Google Scholar] [CrossRef]

- Florea, L.; Cheung, Y.H.; Herndon, N.C. For All Good Reasons: Role of Values in Organizational Sustainability. J. Bus. Ethics 2013, 114, 393–408. [Google Scholar] [CrossRef]

- Fassin, Y. Stakeholder Management, Reciprocity and Stakeholder Responsibility. J. Bus. Ethics 2012, 109, 83–96. [Google Scholar] [CrossRef]

- Ortmann, A. Deception. In Handbook of Research Methods and Applications in Experimental Economics; Edward Elgar Publishing: Cheltenham, UK, 2019; ISBN 9781788110563. [Google Scholar]

- Charness, G.; Samek, A.; van de Ven, J. To Deceive or Not to Deceive: The Debate about Deception in Economics. 2019. Available online: https://healthpolicy.usc.edu/evidence-base/to-deceive-or-not-to-deceive-the-debate-about-deception-in-economics/ (accessed on 13 May 2020).

- Fischbacher, U. z-Tree: Zurich toolbox for ready-made economic experiments. Exp. Econ. 2007, 10, 171–178. [Google Scholar] [CrossRef]

- Roth, A.E. Bargaining experiments. In Handbook of Experimental Economics; Princeton University Press: Princeton, NJ, USA, 1995; pp. 253–348. [Google Scholar]

- Gneezy, U.; Rustichini, A. Pay enough or don’t pay at all. Q. J. Econ. 2000, 115, 791–810. [Google Scholar] [CrossRef]

- Attanasi, G.; Boun My, K. Jeu du dictateur et jeu de la confiance: Préférences distributives vs préférences dépendantes des croyances. L’Actualité Econ. 2016, 92, 249–287. [Google Scholar]

- Shepherd, D.A.; Zacharakis, A. The venture capitalist-entrepreneur relationship: Control, trust and confidence in co-operative behaviour. Ventur. Cap. Int. J. Entrep. Financ. 2001, 3, 129–149. [Google Scholar] [CrossRef]

- Huang, L.; Knight, A.P. Resources and Relationships in Entrepreneurship: An Exchange Theory of the Development and Effects of the Entrepreneur-Investor Relationship. Acad. Manag. Rev. 2015, 42, 80–102. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).