China’s Arable Land Investment in the “Belt and Road” Region: An Empirical Study of Overseas Arable Land Resources

Abstract

1. Introduction

2. Materials and Methods

2.1. Study Area

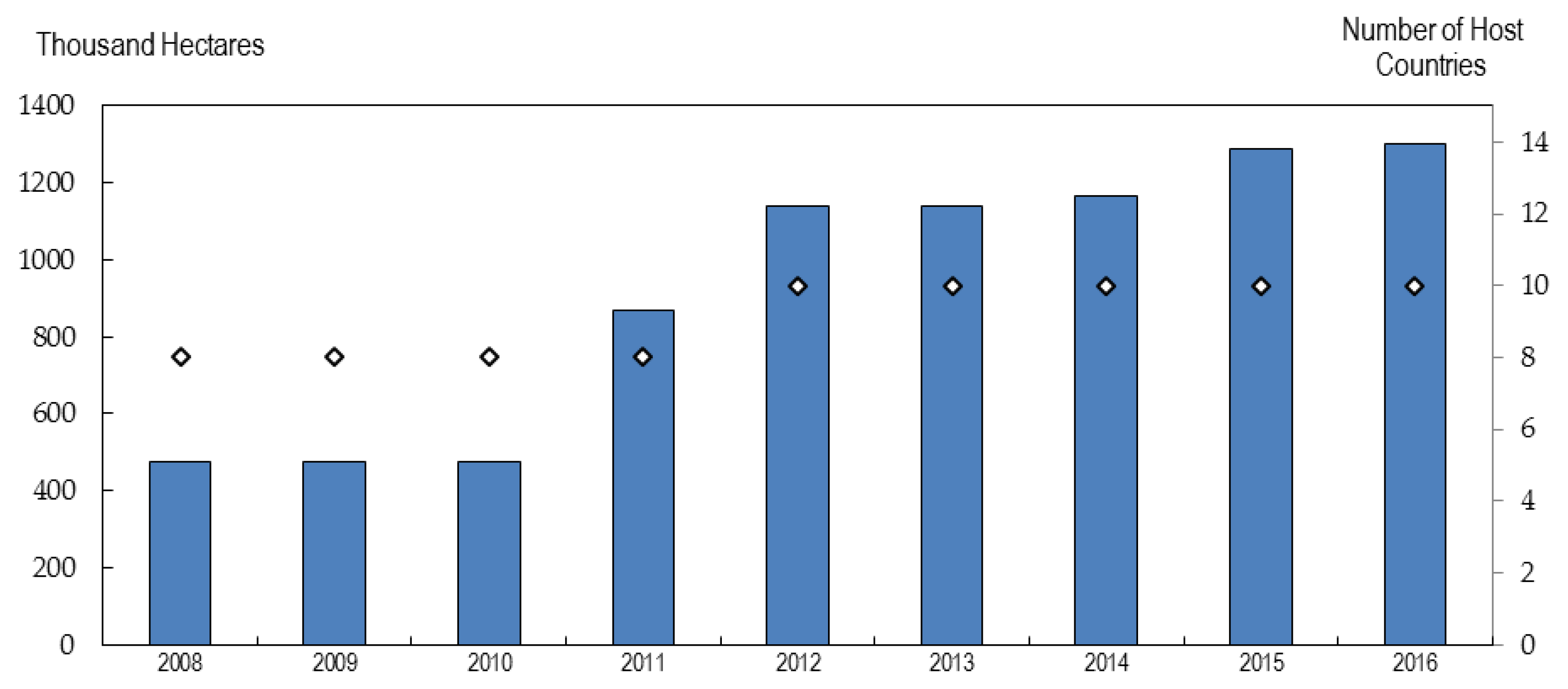

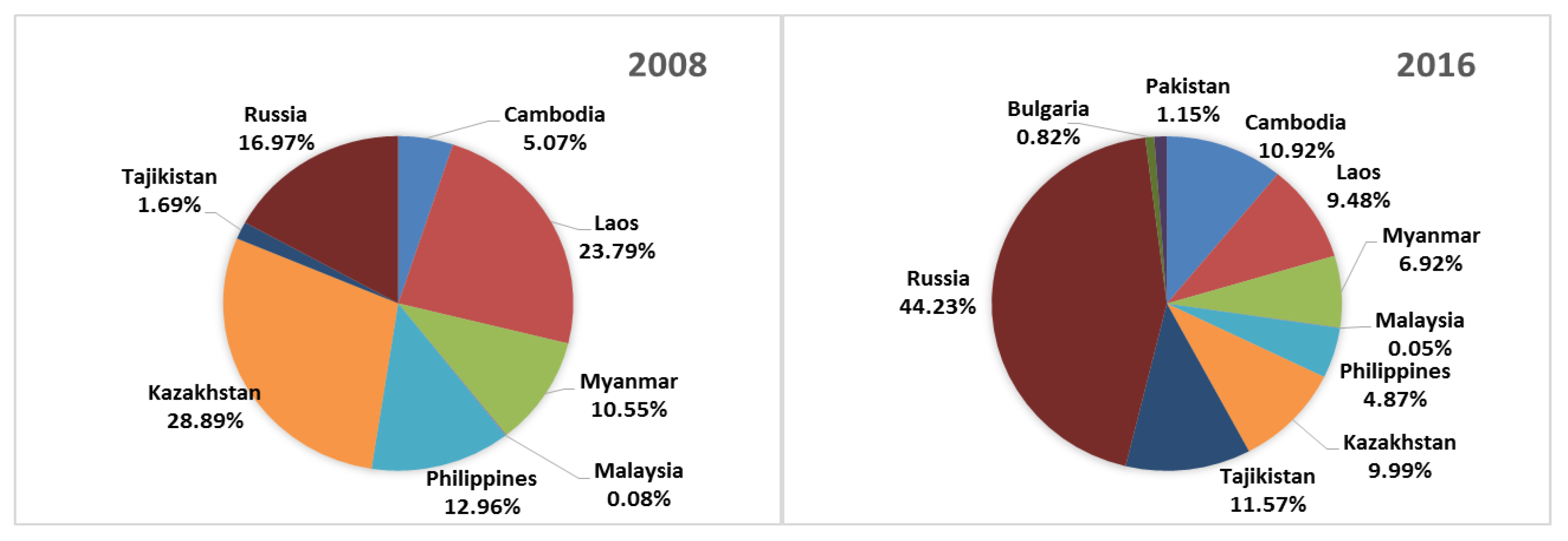

2.2. Chinese Arable Land Investment Status and Data Sources

2.3. Theoretical Framework

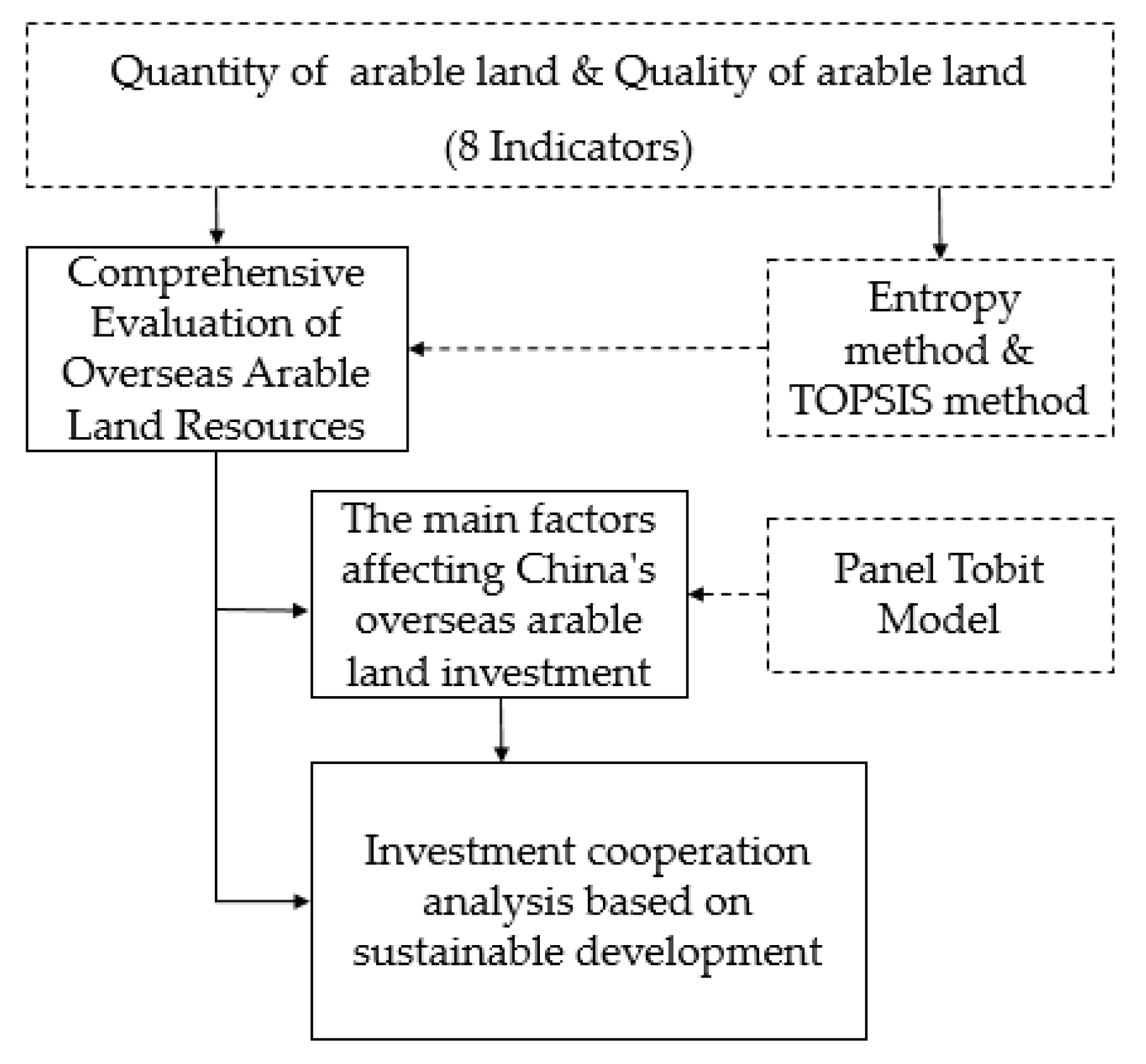

2.4. Formulation of the Methodological Approach and Outputs

2.4.1. Index System of Arable Land Resources

2.4.2. The Entropy Weight and TOPSIS Method

2.4.3. Results Discussion: A Comprehensive Evaluation of Arable Land Resources

2.5. Factors Influencing China’s Investment in Overseas Arable Land Based on the Tobit Model

2.5.1. Tobit Model

2.5.2. Theoretical Assumptions

2.5.3. Empirical Analysis

3. Empirical Analysis

3.1. Summary Statistics of the Variables Employed in This Study

3.2. Empirical Results

3.3. Robustness Check

4. Discussion

5. Conclusions, Policy Implications, and Future Research Directions

5.1. Conclusions

5.2. Policy Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| W1 | W2 | W3 | W4 | W5 | W6 | W7 | W8 | |

|---|---|---|---|---|---|---|---|---|

| 2008 | 0.1995 | 0.0718 | 0.0550 | 0.2345 | 0.0897 | 0.2414 | 0.1069 | 0.0011 |

| 2009 | 0.1988 | 0.0721 | 0.0547 | 0.2361 | 0.0894 | 0.2406 | 0.1064 | 0.0020 |

| 2010 | 0.1979 | 0.0725 | 0.0541 | 0.2361 | 0.0895 | 0.2409 | 0.1063 | 0.0027 |

| 2011 | 0.1975 | 0.0732 | 0.0538 | 0.2356 | 0.0893 | 0.2403 | 0.1059 | 0.0043 |

| 2012 | 0.1974 | 0.0738 | 0.0536 | 0.2380 | 0.0900 | 0.2389 | 0.1018 | 0.0066 |

| 2013 | 0.1971 | 0.0744 | 0.0527 | 0.2372 | 0.0900 | 0.2389 | 0.1052 | 0.0046 |

| 2014 | 0.1966 | 0.0747 | 0.0524 | 0.2366 | 0.0903 | 0.2392 | 0.1052 | 0.0049 |

| 2015 | 0.1970 | 0.0745 | 0.0529 | 0.2383 | 0.0907 | 0.2390 | 0.1017 | 0.0058 |

| 2016 | 0.1962 | 0.0520 | 0.0746 | 0.2374 | 0.0901 | 0.2390 | 0.1050 | 0.0057 |

Appendix B

| Country | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|

| Brunei | 0.0576 | 0.0568 | 0.0566 | 0.0562 | 0.0520 | 0.0548 | 0.0548 | 0.0514 | 0.0532 |

| Indonesia | 0.2716 | 0.2694 | 0.2700 | 0.2700 | 0.2655 | 0.2654 | 0.2667 | 0.2651 | 0.2657 |

| Cambodia | 0.0329 | 0.0325 | 0.0326 | 0.0324 | 0.0310 | 0.0317 | 0.0317 | 0.0306 | 0.0314 |

| Laos | 0.0844 | 0.0831 | 0.0827 | 0.0823 | 0.0768 | 0.0806 | 0.0808 | 0.0764 | 0.0805 |

| Myanmar | 0.1464 | 0.1451 | 0.1456 | 0.1456 | 0.1422 | 0.1432 | 0.1439 | 0.1422 | 0.1434 |

| Malaysia | 0.0940 | 0.0928 | 0.0927 | 0.0924 | 0.0890 | 0.0905 | 0.0907 | 0.0886 | 0.0904 |

| Philippines | 0.0702 | 0.0696 | 0.0697 | 0.0697 | 0.0689 | 0.0692 | 0.0696 | 0.0692 | 0.0693 |

| Singapore | 0.0004 | 0.0004 | 0.0004 | 0.0006 | 0.0008 | 0.0006 | 0.0006 | 0.0006 | 0.0005 |

| Vietnam | 0.0791 | 0.0787 | 0.0789 | 0.0789 | 0.0774 | 0.0770 | 0.0809 | 0.0777 | 0.0766 |

| Kazakhstan | 0.0971 | 0.0960 | 0.0962 | 0.0975 | 0.0970 | 0.0967 | 0.0962 | 0.0952 | 0.0949 |

| Kyrgyzstan | 0.0300 | 0.0297 | 0.0296 | 0.0295 | 0.0279 | 0.0288 | 0.0286 | 0.0274 | 0.0285 |

| Tajikistan | 0.0287 | 0.0283 | 0.0281 | 0.0278 | 0.0264 | 0.0271 | 0.0270 | 0.0260 | 0.0269 |

| Mongolia | 0.0369 | 0.0355 | 0.0352 | 0.0349 | 0.0324 | 0.0336 | 0.0334 | 0.0314 | 0.0332 |

| Russia | 0.5041 | 0.4988 | 0.4983 | 0.4988 | 0.4910 | 0.4921 | 0.4943 | 0.4912 | 0.4921 |

| Poland | 0.0360 | 0.0357 | 0.0324 | 0.0331 | 0.0324 | 0.0319 | 0.0322 | 0.0319 | 0.0317 |

| Czech Republic | 0.0215 | 0.0212 | 0.0211 | 0.0211 | 0.0208 | 0.0167 | 0.0166 | 0.0205 | 0.0165 |

| Slovakia | 0.0178 | 0.0173 | 0.0173 | 0.0173 | 0.0166 | 0.0164 | 0.0163 | 0.0163 | 0.0160 |

| Hungary | 0.0285 | 0.0282 | 0.0270 | 0.0271 | 0.0271 | 0.0266 | 0.0266 | 0.0271 | 0.0266 |

| Slovenia | 0.0250 | 0.0247 | 0.0248 | 0.0249 | 0.0233 | 0.0249 | 0.0252 | 0.0237 | 0.0251 |

| Croatia | 0.0100 | 0.0101 | 0.0107 | 0.0107 | 0.0249 | 0.0105 | 0.0099 | 0.0252 | 0.0106 |

| Romania | 0.0487 | 0.0486 | 0.0494 | 0.0492 | 0.0483 | 0.0479 | 0.0480 | 0.0481 | 0.0476 |

| Bulgaria | 0.0220 | 0.0224 | 0.0228 | 0.0234 | 0.0237 | 0.0250 | 0.0252 | 0.0251 | 0.0253 |

| Serbia | 0.0195 | 0.0191 | 0.0195 | 0.0195 | 0.0189 | 0.0192 | 0.0194 | 0.0192 | 0.0194 |

| Albania | 0.0350 | 0.0347 | 0.0350 | 0.0352 | 0.0339 | 0.0354 | 0.0366 | 0.0356 | 0.0366 |

| Estonia | 0.0305 | 0.0305 | 0.0316 | 0.0318 | 0.0304 | 0.0322 | 0.0329 | 0.0319 | 0.0336 |

| Lithuania | 0.0280 | 0.0305 | 0.0321 | 0.0336 | 0.0346 | 0.0358 | 0.0370 | 0.0344 | 0.0348 |

| Latvia | 0.0297 | 0.0301 | 0.0309 | 0.0315 | 0.0312 | 0.0331 | 0.0337 | 0.0331 | 0.0351 |

| Ukraine | 0.0877 | 0.0869 | 0.0872 | 0.0872 | 0.0867 | 0.0868 | 0.0867 | 0.0859 | 0.0863 |

| Belarus | 0.0295 | 0.0296 | 0.0297 | 0.0299 | 0.0296 | 0.0301 | 0.0306 | 0.0304 | 0.0306 |

| Moldova | 0.0298 | 0.0296 | 0.0295 | 0.0295 | 0.0294 | 0.0294 | 0.0295 | 0.0294 | 0.0295 |

| Turkey | 0.0845 | 0.0834 | 0.0835 | 0.0821 | 0.0813 | 0.0807 | 0.0808 | 0.0807 | 0.0801 |

| Iran | 0.1032 | 0.1036 | 0.1047 | 0.1046 | 0.1060 | 0.1047 | 0.1047 | 0.1052 | 0.1047 |

| Iraq | 0.0504 | 0.0512 | 0.0515 | 0.0517 | 0.0497 | 0.0471 | 0.0484 | 0.0488 | 0.0475 |

| UAE | 0.0318 | 0.0197 | 0.0197 | 0.0197 | 0.0190 | 0.0189 | 0.0190 | 0.0170 | 0.0169 |

| Saudi Arabia | 0.0194 | 0.0189 | 0.0189 | 0.0189 | 0.0186 | 0.0183 | 0.0187 | 0.0189 | 0.0188 |

| Qatar | 0.0145 | 0.0157 | 0.0157 | 0.0157 | 0.0156 | 0.0153 | 0.0156 | 0.0158 | 0.0157 |

| Lebanon | 0.0133 | 0.0135 | 0.0133 | 0.0134 | 0.0136 | 0.0136 | 0.0136 | 0.0137 | 0.0136 |

| Oman | 0.0034 | 0.0035 | 0.0035 | 0.0035 | 0.0035 | 0.0034 | 0.0034 | 0.0035 | 0.0035 |

| Yemen | 0.0084 | 0.0082 | 0.0084 | 0.0082 | 0.0083 | 0.0081 | 0.0081 | 0.0081 | 0.0081 |

| Jordan | 0.0075 | 0.0074 | 0.0074 | 0.0074 | 0.0075 | 0.0080 | 0.0081 | 0.0082 | 0.0081 |

| Israel | 0.0332 | 0.0333 | 0.0334 | 0.0334 | 0.0335 | 0.0338 | 0.0330 | 0.0335 | 0.0333 |

| Armenia | 0.0162 | 0.0164 | 0.0164 | 0.0165 | 0.0167 | 0.0168 | 0.0169 | 0.0168 | 0.0169 |

| Azerbaijan | 0.0301 | 0.0302 | 0.0302 | 0.0302 | 0.0303 | 0.0303 | 0.0305 | 0.0307 | 0.0306 |

| Egypt | 0.0826 | 0.0813 | 0.0815 | 0.0815 | 0.0822 | 0.0819 | 0.0822 | 0.0833 | 0.0825 |

| India | 0.6676 | 0.6710 | 0.6704 | 0.6702 | 0.6759 | 0.6748 | 0.6731 | 0.6758 | 0.6745 |

| Pakistan | 0.2143 | 0.2146 | 0.2145 | 0.2151 | 0.2134 | 0.2113 | 0.2107 | 0.2116 | 0.2119 |

| Bangladesh | 0.0740 | 0.0744 | 0.0750 | 0.0748 | 0.0766 | 0.0783 | 0.0784 | 0.0785 | 0.0783 |

| Sri Lanka | 0.0220 | 0.0223 | 0.0226 | 0.0229 | 0.0217 | 0.0224 | 0.0232 | 0.0232 | 0.0231 |

References

- Cotula, L.; Vermeulen, S. Deal or no deal the outlook for agricultural land investment in Africa. Int. Affairs 2009, 85, 1233–1247. [Google Scholar] [CrossRef]

- Antonelli, M.; Siciliano, G.; Turvani, M.E.; Rulli, M.C. Global investments in agricultural land and the role of the EU: Drivers, scope and potential impacts. Land Use Policy 2015, 47, 98–111. [Google Scholar] [CrossRef]

- Choi, D. “Land Grab” or Development Opportunity? The Effect of Transnational Farmland Investments on the Ghanaian Economy. Dev. Econ. 2018, 56, 3–34. [Google Scholar] [CrossRef]

- Jiang, X.; Chen, Y.; Wang, L. The location characteristics and influencing factors of China’s overseas arable land investment. Chin. J. Agric. Resour. Reg. Plan. 2018, 39, 46–53. [Google Scholar] [CrossRef]

- Han, J.; Li, Y.; Lu, X. Analysis on the sector collaboration type of overseas farmland investment. Res. Agric. Mod. 2017, 38, 241–249. [Google Scholar]

- Alden, C. China and the long march into African agriculture. Cah. Agric. 2013, 22, 16–21. [Google Scholar] [CrossRef]

- Campesina; GRAIN. It’s Time to Outlaw Land Grabbing, Not to Make It ‘Responsible’. Available online: https://www.grain.org/article/entries/4227-it-s-time-to-outlaw-land-grabbing-not-to-make-it-responsible (accessed on 21 November 2019).

- Grajales, J. The rifle and the title: Paramilitary violence, land grab and land control in Colombia. J. Peasant Stud. 2011, 38, 771–792. [Google Scholar] [CrossRef]

- Food and Agriculture Organization (FAO). On Horizon 2050-Billions Needed for Agriculture: High-level Forum to Weigh Investment Needs. Available online: http://www.fao.org/news/story/en/item/36107/icode.html (accessed on 21 November 2019).

- Jiang, X.; Chen, Y.; Wang, L. Can China’s Agricultural FDI in Developing Countries Achieve a Win-Win Goal?—Enlightenment from the Literature. Sustainability 2018, 11, 41. [Google Scholar] [CrossRef]

- Buckley, L. Chinese Land-Based Interventions in Senega. Dev. Chang. 2013, 44, 429–450. [Google Scholar] [CrossRef]

- Chen, Y.; Li, X.; Wang, L.; Wang, S. Is China different from other investors in global land acquisition? Some observations from existing deals in China’s going global strategy. Land Use Policy 2017, 60, 362–372. [Google Scholar] [CrossRef]

- Vernon, R. International investment and international trade in the product cycle. Q. J. Econ. Act. 1966, 80, 190–207. [Google Scholar] [CrossRef]

- Kojima, K. Direct Foreign Investment: A Japanese Model of Multinational Business Operations; Croom Helm: London, UK, 1978. [Google Scholar]

- Buckley, P.J.; Casson, M. The Future of the Multinational Enterprise; Holmes and Melers: New York, NY, USA, 1976. [Google Scholar]

- Rugman, A.M. Inside the Multinationals; Croom Helm: London, UK, 1987. [Google Scholar]

- Dunning, J.H. Explaining the international direct investment position of countries. Int. Trade J. 1982, 117, 30–64. [Google Scholar] [CrossRef]

- Ramasamy, B.; Yeung, M.; Laforet, S. China’s outward foreign direct investment: Location choice and firm ownership. J. World Bus. 2012, 47, 17–25. [Google Scholar] [CrossRef]

- Ivar, K.; Arne, W. What determines Chinese outward FDI? J. World Bus. 2008, 47, 1–9. [Google Scholar] [CrossRef]

- Aleksynska, M.; Harylchyk, O. FDI from the south: The role of institutional distance and natural resources. Eur. J. Polit. Econ. 2013, 29, 38–53. [Google Scholar] [CrossRef]

- Wan, K.; Lu, X. Research on the Impact Factors on Selecting Host Countries of China’s Overseas Farmland Investment. China Land Sci. 2018, 6, 75–81. [Google Scholar] [CrossRef]

- Wang, J.; Ma, H.; Tang, H. Empirical Analysis on Determinants for Location Choice of China’s Overseas Agricultural Investment. J. Bus. Econ. 2017, 8, 88–97. [Google Scholar]

- Friis, C.; Nielsen, J. Small-scale land acquisitions, large-scale implications: Exploring the case of Chinese banana investments in Northern Laos. Land Use Policy 2016, 57, 117–129. [Google Scholar] [CrossRef]

- Cheung, Y.; Qian, X. The Empirics of China’s Outward Direct Investment. Pac. Econ. Rev. 2009, 14, 312–341. [Google Scholar] [CrossRef]

- Li, M.; Wang, J.; Chen, Y. Evaluation and Influencing Factors of Sustainable Development Capability of Agriculture in Countries along the Belt and Road Route. Sustainability 2019, 11, 2004. [Google Scholar] [CrossRef]

- Zou, J.; Liu, W. Trade Network of China and Countries along “Belt and Road Initiative” Areas from 2001 to 2013. Sci. Geogr. Sin. 2016, 36, 1629–1636. [Google Scholar] [CrossRef]

- State Information Center. Big Data Report of Trade Cooperation under the Belt and Road Initiative (2017). Available online: http://www.sic.gov.cn/News/79/7811.htm (accessed on 21 November 2019).

- Chinese Ministry of Commerce. Foreign Investment Cooperation Country (Region) Guide. Available online: http://fec.mofcom.gov.cn/article/gbdqzn/ (accessed on 21 November 2019).

- National Bureau of Statistics of China. China Commerce Yearbook; National Bureau of Statistics of China: Beijing, China, 2017.

- How, J.; Ma, H. Gravity Equation: A Literature Review and Applications to China’s Foreign Trade. J. Quant. Econ. 2012, 10, 53–69. [Google Scholar]

- Rauch, J.E.; Trindade, V. Ethnic Chinese Networks in International Trade. Rev. Econ. Stat. 2002, 84, 116–130. [Google Scholar] [CrossRef]

- Landmatrix, 2019. Available online: https://landmatrix.org/ (accessed on 21 November 2019).

- GRAIN, Squeezing Africa Dry: Behind Every Land Grab Is A Water Grab. 2012. Available online: https://www.grain.org/en/article/4516-squeezing-africa-dry-behind-every-land-grab-is-a-water-grab (accessed on 21 November 2019).

- GRAIN, The Global Farmland Grab in 2016: How Big, How Bad? 2016. Available online: https://www.grain.org/en/article/5492-the-global-farmland-grab-in-2016-how-big-how-bad (accessed on 21 November 2019).

- Sun, Z.; Jia, S.F.; Lv, A. The status of China’s overseas farmland investment. Resour. Sci. 2018, 40, 1495–1504. [Google Scholar] [CrossRef]

- Lagerkvist, J. As China returns: Perceptions of land grabbing and spatial power relations in Mozambique. J. Asian Afr. Stud. 2014, 49, 251–266. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Labs Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Lai, Y.J.; Liu, T.Y.; Hwang, C.L. TOPSIS for MODM. Eur. J. Oper. Res. 1994, 76, 486–500. [Google Scholar] [CrossRef]

- Zhu, S.; Li, D.; Feng, H.; Gu, T.; Zhu, J. AHP-TOPSIS-Based Evaluation of the Relative Performance of Multiple Neighborhood Renewal Projects: A Case Study in Nanjing, China. Sustainability 2019, 11, 4545. [Google Scholar] [CrossRef]

- Dos Santos, B.M.; Godoy, L.P.; Campos, L. Performance evaluation of green suppliers using entropy-TOPSIS-F. J. Clean. Prod. 2019, 207, 498–509. [Google Scholar] [CrossRef]

- Zou, J.; Wu, Q. Spatial Analysis of Chinese Grain Production for Sustainable Land Management in Plain, Hill, and Mountain Counties. Sustainability 2017, 9, 348. [Google Scholar] [CrossRef]

- World Bank Database. Available online: http://data.worldbank.org.cn/ (accessed on 21 November 2019).

- Food and Agriculture Organization Database of the United Nations. Available online: http://www.fao.org/statistics/databases/zh/ (accessed on 21 November 2019).

- Tobin and James. Estimation of Relationships for Limited Dependent Variables. Econometrica 1958, 26, 24–36. [Google Scholar] [CrossRef]

- Deatan, A. The Analysis of Household Surreys; The Johns Hopkins Press: Baltimore, MD, USA, 1997. [Google Scholar]

- Hofman, I.; Ho, P. China’s “developmental outsourcing”: A critical examination of Chinese global “land grabs” discourse. J. Peasant Stud. 2012, 39, 1–48. [Google Scholar] [CrossRef]

- Li, T.M. Transnational Farmland Investment: A Risky Business. J. Agrar. Chang. 2015, 15, 560–568. [Google Scholar] [CrossRef]

- Fredriksson, P.G.; List, J.A.; Millimet, D.L. Bureaucratic corruption, environmental policy and inbound us FDI: Theory and evidence. J. Public Econ. 2003, 87, 1407–1430. [Google Scholar] [CrossRef]

- Ivar, K.; Arne, W. Is Transparency the Key to Reducing Corruption in Resource-Rich Countries? World Dev. 2009, 37, 521–532. [Google Scholar]

- Tobler, W. A computer movie simulating urban growth in the Detroit region. Econ. Geogr. 1970, 46, 234–240. [Google Scholar] [CrossRef]

- Daniels, J.P.; Marc, V.D.R. Transportation costs and us manufacturing FDI. Rev. Int. Econ. 2014, 22, 299–309. [Google Scholar] [CrossRef]

- Tao, X.; Jin, T.; Yang, Y. The Enlightenment of the East Asian Model and the Revelation of China’s Economic Growth Structure Puzzle. Econ. Res. J. 2017, 52, 45–60. [Google Scholar]

- Wu, S.; Liu, Y.; Liu, L.; Gao, J. Geographical patterns and environmental change risks in terrestrial areas of the Belt and Road. Acta Geogr. Sin. 2018, 7, 1214–1225. [Google Scholar] [CrossRef]

- Zhao, Y. China–Africa development cooperation in the rural sector: An exploration of land tenure and investments linkages for sustainable resource use. Environ. Dev. Sustain. 2013, 15, 355–366. [Google Scholar] [CrossRef]

- Han, J.; Yang, C.; Ke, N.; Lu, X. Analysis of the Spatial Difference and Impact Factors of China and America’s Overseas Farmland Investment Host Country Selections in Africa. China Land Sci. 2018, 32, 39–45. [Google Scholar] [CrossRef]

| Area | Countries |

|---|---|

| Southeast Asia | Brunei, Indonesia, Cambodia, Laos, Myanmar, Malaysia, Philippines, Singapore, Vietnam |

| Central Asia | Kazakhstan, Kyrgyzstan, Tajikistan |

| Mongolia and Russia | Mongolia, Russia |

| West Asia and Middle East | Turkey, Iran, Iraq, United Arab Emirates, Saudi Arabia, Qatar, Lebanon, Oman, Yemen, Jordan, Israel, Armenia, Azerbaijan, Egypt |

| South Asia | India, Pakistan, Bangladesh, Sri Lanka |

| Central and Eastern Europe | Poland, Czech Republic, Slovakia, Hungary, Slovenia, Croatia, Romania, Bulgaria, Serbia, Albania, Estonia, Lithuania, Latvia, Ukraine, Belarus, Moldova |

| System | Subsystem | Index Level |

|---|---|---|

| Arable land resources | Quantitative factors | Total arable land area (×1) |

| Arable land (hectares per person) (×2) | ||

| Arable land (% of land area) (×3) | ||

| Qualitative factors | Agricultural irrigated land (×4) | |

| Agricultural irrigated land (% of total arable land) (×5) | ||

| Renewable internal freshwater resources (×6) | ||

| Renewable internal freshwater resources per capita (cubic meters) (×7) | ||

| Crop production index (×8) |

| Country | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|

| India | 0.6676 | 0.6710 | 0.6704 | 0.6702 | 0.6759 | 0.6748 | 0.6731 | 0.6758 | 0.6745 |

| Russia | 0.5041 | 0.4988 | 0.4983 | 0.4988 | 0.4910 | 0.4921 | 0.4943 | 0.4912 | 0.4921 |

| Indonesia | 0.2716 | 0.2694 | 0.2700 | 0.2700 | 0.2655 | 0.2654 | 0.2667 | 0.2651 | 0.2657 |

| Pakistan | 0.2143 | 0.2146 | 0.2145 | 0.2151 | 0.2134 | 0.2113 | 0.2107 | 0.2116 | 0.2119 |

| Myanmar | 0.1464 | 0.1451 | 0.1456 | 0.1456 | 0.1422 | 0.1432 | 0.1439 | 0.1422 | 0.1434 |

| ofdi | res | cor | lndiscap | lncgdp | lnhgdp | trade | elec | |

|---|---|---|---|---|---|---|---|---|

| ofdi | 1.000 | |||||||

| res | 0.402 | 1.000 | ||||||

| cor | −0.216 | −0.046 | 1.000 | |||||

| lndiscap | −0.182 | −0.198 | 0.130 | 1.000 | ||||

| lncgdp | 0.100 | −0.002 | 0.125 | 0.000 | 1.000 | |||

| lnhgdp | 0.125 | 0.523 | 0.323 | 0.177 | 0.063 | 1.000 | ||

| trade | −0.184 | −0.342 | 0.449 | 0.041 | −0.02 | −0.098 | 1.000 | |

| elec | −0.147 | −0.164 | 0.111 | 0.498 | 0.080 | 0.158 | 0.207 | 1.000 |

| Variable | Meaning | Data Source |

|---|---|---|

| ofdi | Chinese arable land investment scale (ten thousand hectares) | Land Matrix database, GRAIN database, and Sun et al. (2018). |

| res | Comprehensive evaluation of arable land resource (0–1). | World Bank database and UN Food and Agriculture Organization database |

| cor | Corruption level in the host country (0–6). Higher scores represent more corruption. | International Country Risk Guide |

| discap | Linear distance between capital cities | CEPII database. http://www.cepii.fr/ |

| cgdp | China’s GDP (adjusted to 2010 US$) | World Bank database |

| hgdp | Market scale of host country (adjusted to 2010 US$) | World Bank database |

| trade | Total import and exports as share in GDP (%) | World Bank database |

| elec | Percentage of the population with access to electricity (%) | World Bank database |

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| ofdi | 1.9271 | 6.6989 | 0.0000 | 57.5400 |

| res | 0.0724 | 0.1194 | 0.0004 | 0.6758 |

| cor | 2.2499 | 0.7400 | 1.0000 | 4.5000 |

| lndiscap | 8.5734 | 0.3922 | 7.0665 | 8.9519 |

| lncgdp | 29.5873 | 0.2067 | 29.2405 | 29.8823 |

| lnhgdp | 25.1411 | 1.4922 | 22.2669 | 28.5337 |

| trade | 83.5446 | 46.4366 | 18.8031 | 342.2827 |

| elec | 93.0229 | 13.5405 | 26.4000 | 100.0000 |

| Regression 1 | Regression 2 | Regression 3 | |

|---|---|---|---|

| res | 53.2050 ** | 62.6913 *** | 88.6743 ** |

| (2.51) | (2.73) | (2.19) | |

| cor | −21.3416 *** | −20.8693 *** | |

| (−4.39) | (−4.04) | ||

| lndiscap | −24.8085 *** | −16.9537 * | |

| (−3.29) | (−1.86) | ||

| lncgdp | 20.8088 *** | 27.9401 *** | |

| (6.71) | (6.02) | ||

| lnhgdp | −2.2948 | ||

| (−0.62) | |||

| trade | 0.1153 | ||

| (1.55) | |||

| elec | −0.3419 ** | ||

| (−1.99) | |||

| sigma_u | 28.1980 *** | 23.8403 *** | 24.8512 *** |

| sigma_e | (6.01) 7.5249 *** (12.66) | (4.31) 5.7446 *** (12.44) | (3.80) 5.5977 *** (12.42) |

| Number of observations | 432 | 432 | 432 |

| (1) Explanatory Variable (lag 1 Period) | (2) Tail Shrinkage Test | |||

|---|---|---|---|---|

| Z-Statistic | Coefficient | Z-Statistic | Coefficient | |

| res | 2.33 | 98.9252 ** | 2.18 | 88.7992 ** |

| cor | −3.22 | −20.2646 *** | −4.05 | −20.8639 *** |

| lndiscap | −2.11 | −17.6085 ** | −1.86 | −16.9687 ** |

| lncgdp | 5.47 | 27.0361 *** | 6.02 | 27.9426 *** |

| lnhgdp | −0.85 | −2.9817 | −0.62 | −2.3014 |

| trade | 1.53 | 0.1153 | 1.55 | 0.1152 |

| elec | −1.71 | −0.2884 * | −1.99 | −0.3417 * |

| sigma_u | 3.99 | 25.0946 *** | 3.81 | 24.8499 *** |

| sigma_e | 11.75 | 5.4377 *** | 12.42 | 5.5980 *** |

| Number of observations | 384 | 384 | 432 | 432 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tian, R.; Yang, Z.; Shao, Q. China’s Arable Land Investment in the “Belt and Road” Region: An Empirical Study of Overseas Arable Land Resources. Sustainability 2020, 12, 97. https://doi.org/10.3390/su12010097

Tian R, Yang Z, Shao Q. China’s Arable Land Investment in the “Belt and Road” Region: An Empirical Study of Overseas Arable Land Resources. Sustainability. 2020; 12(1):97. https://doi.org/10.3390/su12010097

Chicago/Turabian StyleTian, Renqu, Zisheng Yang, and Qinglong Shao. 2020. "China’s Arable Land Investment in the “Belt and Road” Region: An Empirical Study of Overseas Arable Land Resources" Sustainability 12, no. 1: 97. https://doi.org/10.3390/su12010097

APA StyleTian, R., Yang, Z., & Shao, Q. (2020). China’s Arable Land Investment in the “Belt and Road” Region: An Empirical Study of Overseas Arable Land Resources. Sustainability, 12(1), 97. https://doi.org/10.3390/su12010097