Mapping Urban Networks through Inter-Firm Investment Linkages: The Case of Listed Companies in Jiangsu, China

Abstract

1. Introduction

2. Inter–Firm Investment and Inter-City Connections

3. Data and Methodology

4. Results

4.1. The Investment Networks of Overall Industry

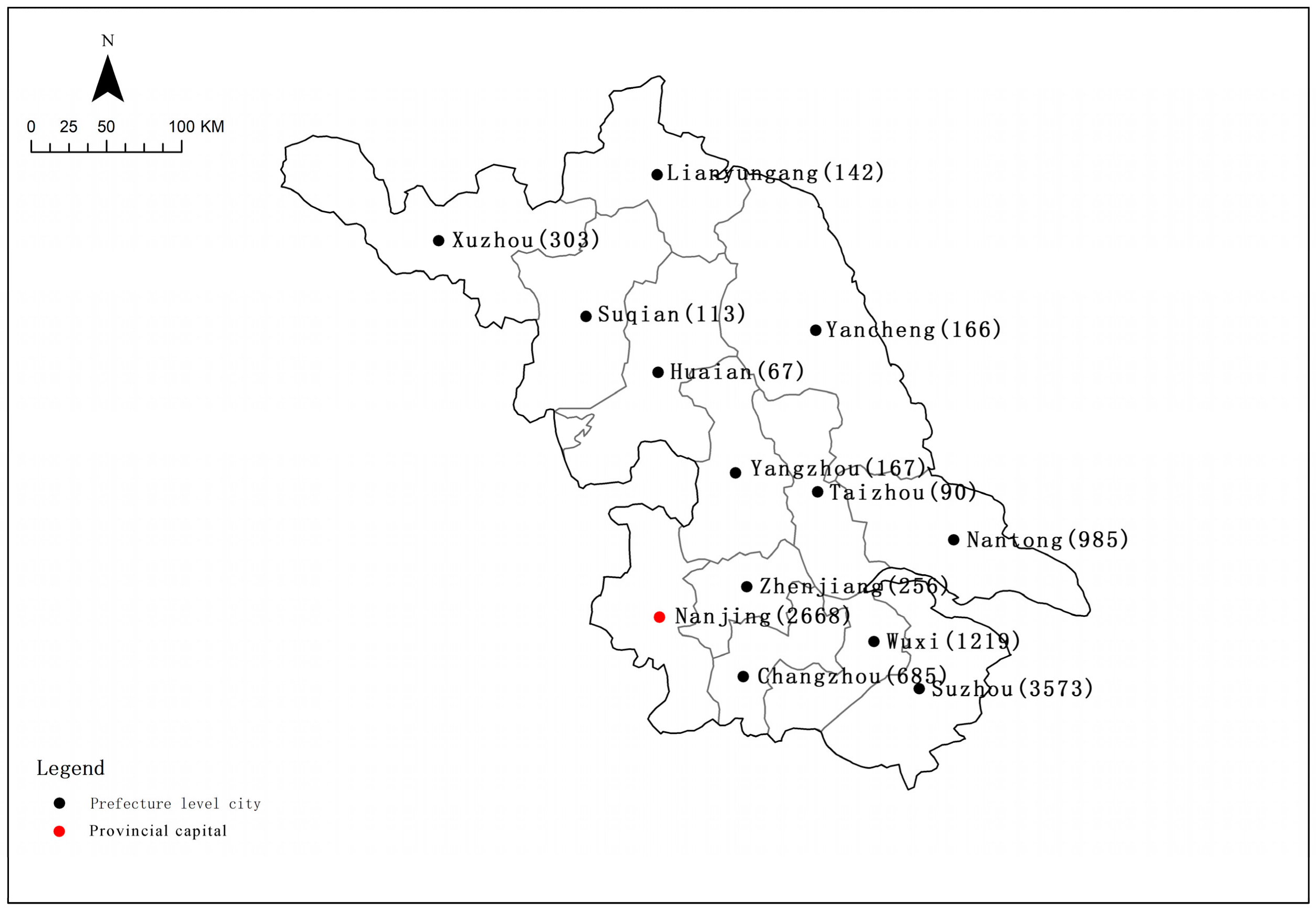

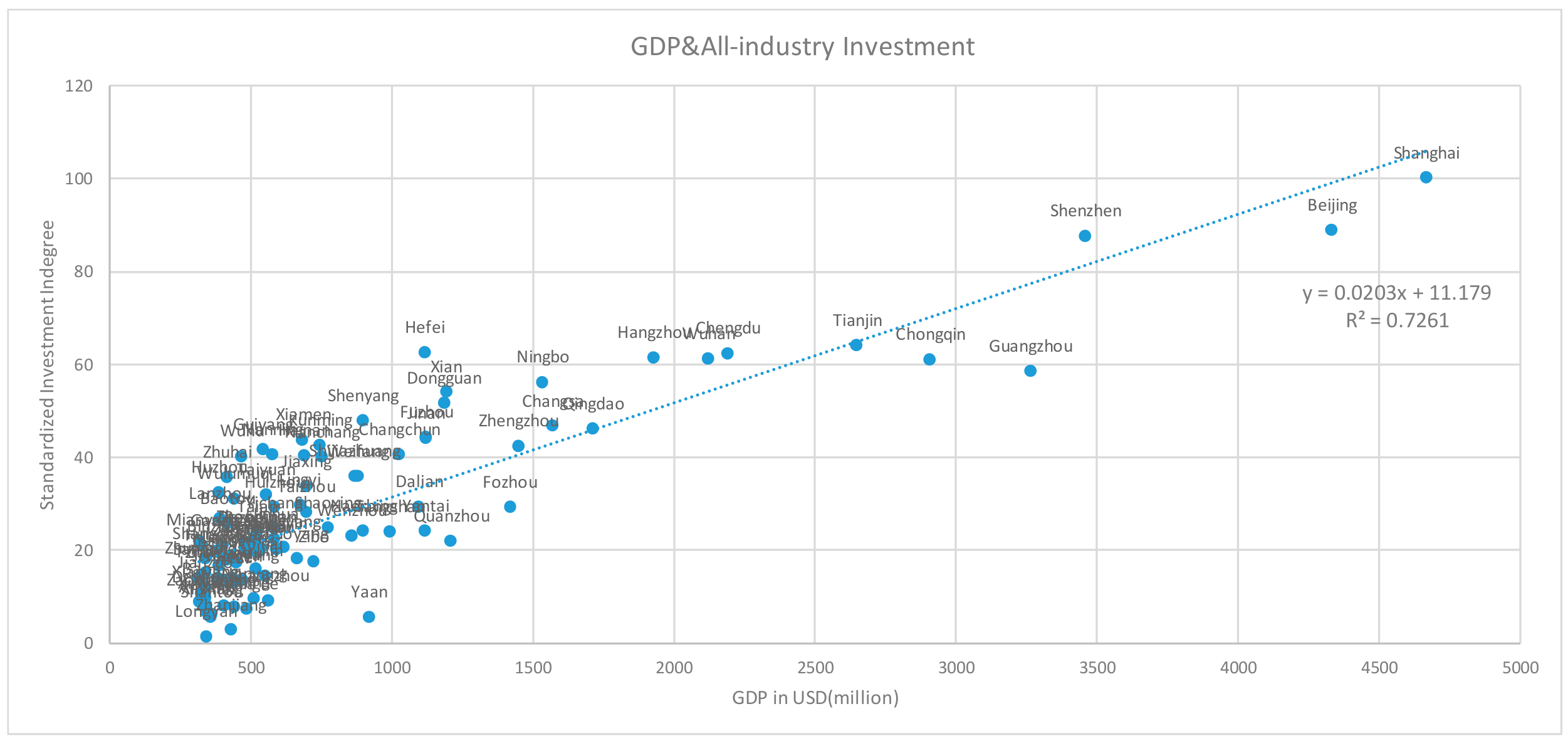

4.1.1. Node Hierarchy

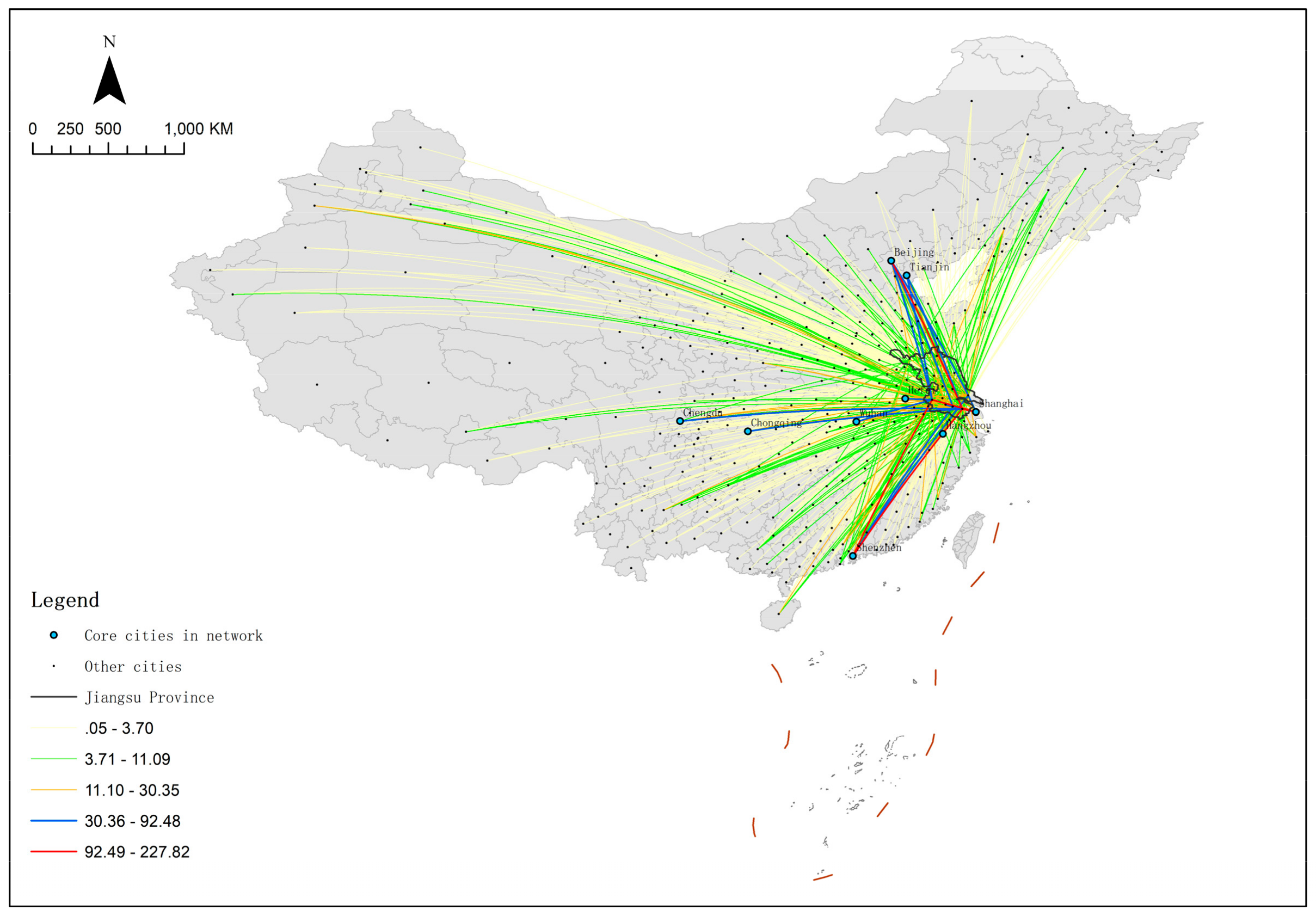

4.1.2. Network Structure

4.1.3. Network Organization

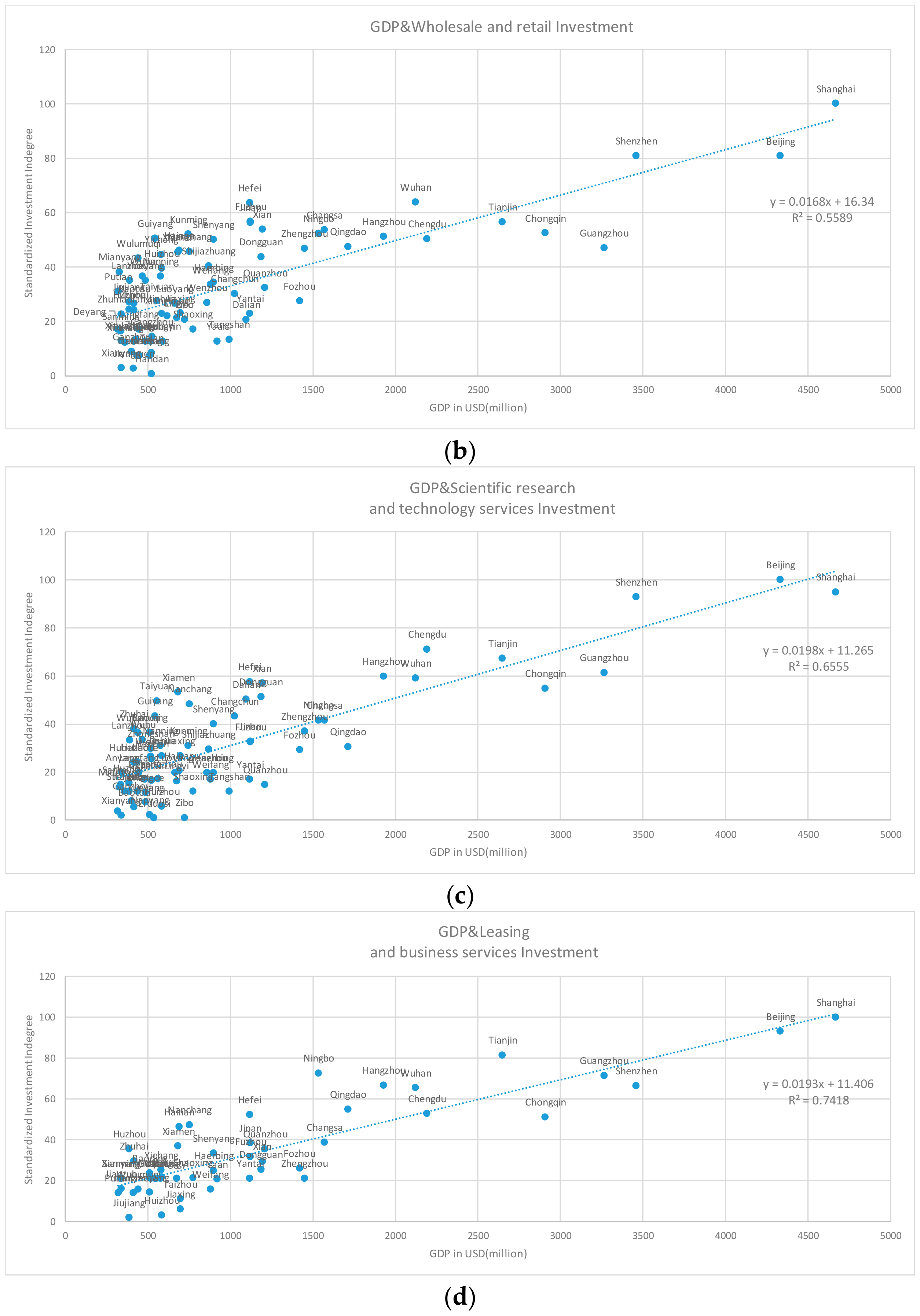

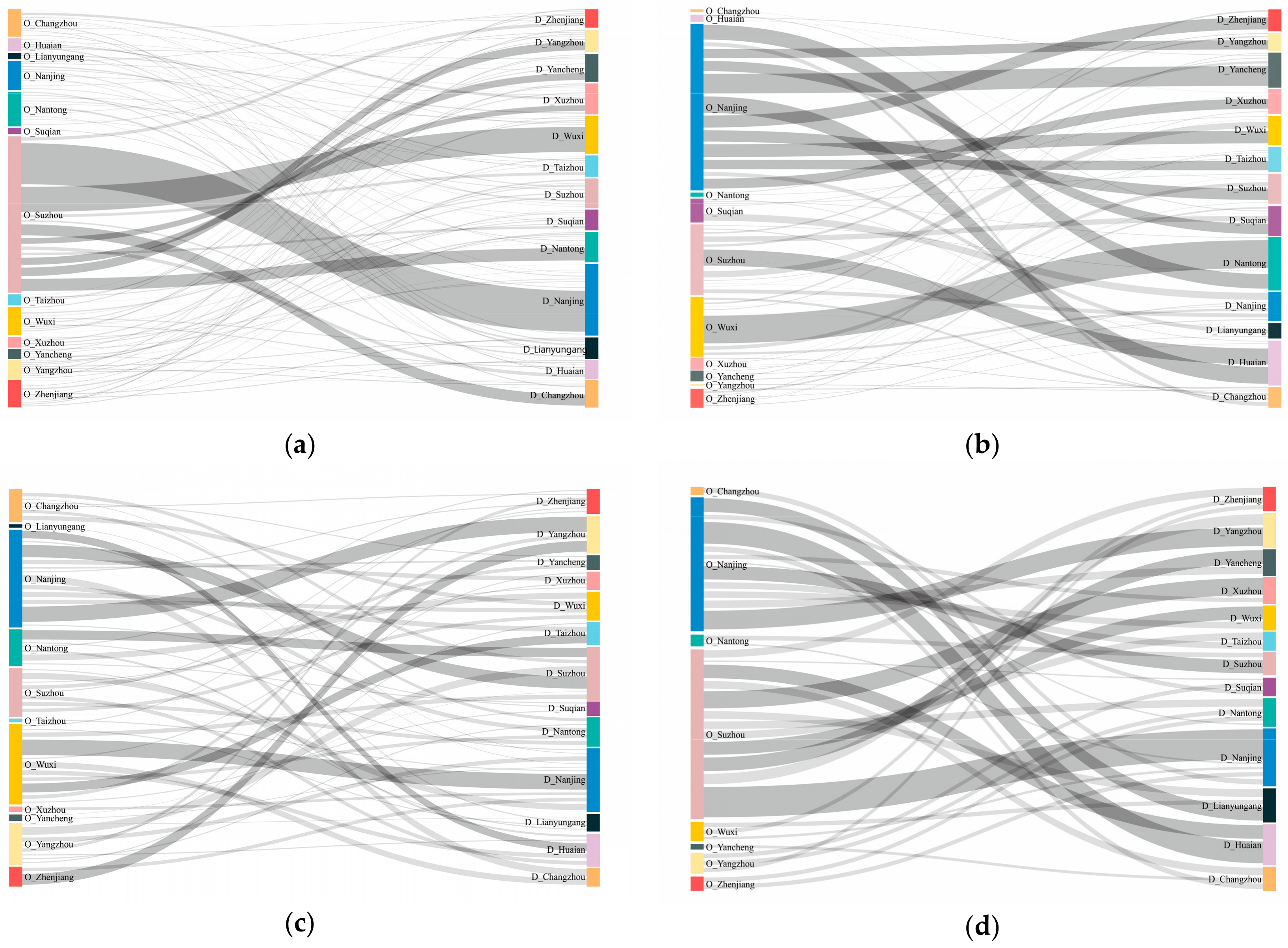

4.2. The Investment Networks of Subdivided Industries

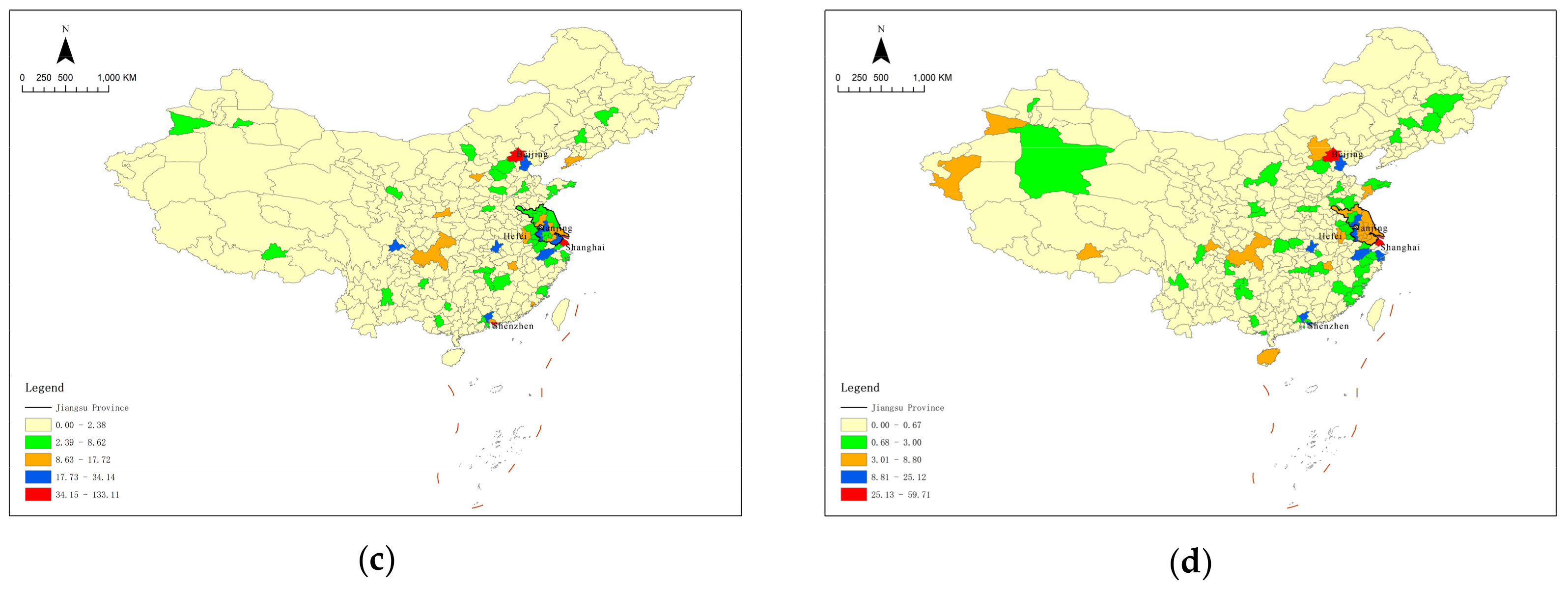

4.2.1. Node Hierarchy

4.2.2. Network Structure

4.2.3. Network Organization

5. Discussion and Conclusions

5.1. Discussion

5.2. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Castells, M. The Rise of Network Society, 2nd ed.; Blackwell: Oxford, UK, 2001. [Google Scholar]

- Zhao, M.; Wu, K.; Liu, X.; Ben, D. A novel method for approximating intercity networks: An empirical comparison for validating the city networks in two Chinese city-regions. J. Geogr. Sci. 2015, 25, 337–354. (In Chinese) [Google Scholar] [CrossRef]

- Beaverstock, J.V.; Smith, R.G.; Taylor, P.J. A roster of world cities. Cities 1999, 16, 445–458. [Google Scholar] [CrossRef]

- Alderson, A.S.; Beckfield, J.; Sprague-Jones, J. Intercity relations and globalisation: The evolution of the global urban hierarchy, 1981–2007. Urban Stud. 2010, 47, 1899–1923. [Google Scholar] [CrossRef]

- Liu, X.; Derudder, B. Analyzing urban networks through the lens of corporate networks: A critical review. Cities 2013, 31, 430–437. [Google Scholar] [CrossRef]

- Feng, Z.; Xia, W.; Jun, Y.; Min, Z. An empirical study on Chinese city network pattern based on producer services. Chin. Geogr. Sci. 2013, 23, 274–285. [Google Scholar] [CrossRef]

- Mahutga, M.C.; Ma, X.; Smith, D.A.; Timberlake, M. Economic globalisation and the structure of the world city system: The case of airline passenger data. Urban Stud. 2010, 47, 1925–1947. [Google Scholar] [CrossRef]

- Sassen, S. The Global City. New York, London, Tokyo; Princeton University Press: Princeton, NJ, USA, 2001. [Google Scholar]

- Taylor, P. World City Network: A Global Urban Analysis; Routledge: London, UK, 2004. [Google Scholar]

- Rossi, E.C.; Taylor, P.J. Banking networks across brazilian cities: Interlocking cities within and beyond brazil. Cities 2005, 22, 381–393. [Google Scholar] [CrossRef]

- Musil, R. Global capital control and city hierarchies: An attempt to reposition vienna in a world city network. Cities 2009, 26, 255–265. [Google Scholar] [CrossRef]

- Neal, Z. Structural determinism in the interlocking world city network. Geogr. Anal. 2012, 44, 162–170. [Google Scholar] [CrossRef]

- Alderson, A.S.; Beckfield, J. Power and position in the world city system. Am. J. Sociol. 2004, 109, 811–851. [Google Scholar] [CrossRef]

- Rozenblat, C.; Pumain, D. Firm Linkages, Innovation and the Evolution of Urban Systems; Taylor, P.B., Ed.; Taylor & Francis Inc.: New York, NY, USA, 2007. [Google Scholar]

- Parnreiter, C. Global cities in global commodity chains: Exploring the role of Mexico city in the geography of global economic governance. Glob. Netw. 2010, 10, 35–53. [Google Scholar] [CrossRef]

- Godfrey, B.J.; Zhou, Y. Ranking world cities: Multinational corporations and the global urban hierarchy. Urban Geogr. 1999, 20, 268–281. [Google Scholar] [CrossRef]

- Wall, R.S. NETSCAPE: Cities and Global Corporate Networks; Erasmus University: Rotterdam, The Netherlands.

- Yeung, H.W.C. The firm as social networks: An organisational perspective. Growth Chang. 2005, 36, 307–328. [Google Scholar] [CrossRef]

- Pan, F.; Bi, W.; Lenzer, J.; Zhao, S. Mapping urban networks through inter-firm service relationships: The case of china. Urban Stud. 2017, 54, 3639–3654. [Google Scholar] [CrossRef]

- Nohria, N.; Ghoshal, S. The differentiated network: Organizing multinational corporations for value creation. J. Int. Bus. Stud. 1998, 29, 429–431. [Google Scholar] [CrossRef]

- Coe, N.M.; Hess, M.; Yeung, H.W.C.; Dicken, P.; Henderson, J. ‘Globalizing’ regional development: A global production networks perspective. Trans. Inst. Br. Geogr. 2004, 29, 468–484. [Google Scholar] [CrossRef]

- Csomós, G. Cities as command and control centres of the world economy: An empirical analysis, 2006–2015. Bull. Geogr. Socioecon. Ser. 2017, 38, 7–26. [Google Scholar] [CrossRef]

- Raźniak, P.; Dorocki, S.; Winiarczyk-Raźniak, A. Permanence of economic potential of cities based on sector development. Chin. Geogr. Sci. 2017, 1, 125–138. [Google Scholar]

- Derudder, B.; Cao, Z.; Liu, X.; Shen, W.; Dai, L.; Zhang, W.; Taylor, P.J. Changing connectivities of Chinese cities in the world city network, 2010–2016. Chin. Geogr. Sci. 2018, 28, 183–201. [Google Scholar] [CrossRef]

- Xi, G.; Zhen, F.; He, J.; Gong, Y. City networks of online commodity services in China: Empirical analysis of Tmall clothing and electronic retailers. Chin. Geogr. Sci. 2018, 28, 231–246. [Google Scholar] [CrossRef]

- Liang, S.; Cao, Y.; Wu, W.; Gao, J.; Liu, W.; Zhang, W. International Freight Forwarding Services Network in the Yangtze River Delta, 2005–2015: Patterns and Mechanisms. Chin. Geogr. Sci. 2019, 29, 112–126. [Google Scholar] [CrossRef]

- Battiston, S.; Rodrigues, J.F.; Zeytinoglu, H. The network of inter-regional direct investment stocks across Europe. Adv. Complex Syst. 2007, 10, 29–51. [Google Scholar] [CrossRef]

- Ma, Y.Y.; Zhuang, X.T.; Li, L.X. Research on the relationships of the domestic mutual investment of china based on the cross-shareholding networks of the listed companies. Phys. A Stat. Mech. Appl. 2011, 390, 749–759. [Google Scholar] [CrossRef]

- Jun, Y.; Feng, Z.; Chunhui, W. China’s city network pattern: An empirical analysis based on financial enterprises layout. Econ. Geogr. 2011, 31, 754–759. (In Chinese) [Google Scholar]

- Qian, C.; Li-zhen, S.; Feng, Z. Spatial evolution of China’s internet enterprises and the characteristics of city network. Hum. Geogr. 2018, 33, 97–105. (In Chinese) [Google Scholar]

- Li, X.D. Spatial structure of the Yangtze river delta urban network based on the pattern of listed companies network. Prog. Geogr. 2014, 33, 1587–1600. (In Chinese) [Google Scholar]

- Lei, Y.E.; Xuejun, D.U. City network structure of the Yangtze River Delta region based on logistics enterprise network. Prog. Geogr. 2016, 35, 622–631. (In Chinese) [Google Scholar]

- Yaling, Y.E.; Bofei, Y.A.; Ziyun, H.E.; Beini, Z.E.; Fenghua, P.A.; Cheng, F.A. Spatial structure of urban network based on Chinese A-share listed medicine enterprise network. Prog. Geogr. 2018, 37, 1096–1105. (In Chinese) [Google Scholar]

- Yexi, Z.; Yu, F.; Zhizhou, Z.; Xiaojing, W. Network structure of listed companies based on the relationship of parent and subsidiary enterprises: A case of the middle Yangtze urban agglomeration. Resour. Environ. Yangtze Basin 2018, 27, 1725–1734. (In Chinese) [Google Scholar]

- Bingquan, L.; Renxu, G.; Hao, M. Comparative study on spatial expansion of automobile enterprises of different ownerships in east China. Econ. Geogr. 2019, 39, 30–39. (In Chinese) [Google Scholar]

- Zilai, T.; Tao, L.; Can, L. Research on the interlocking network of major cities in China. City Plan. Rev. 2017, 1, 28–40. (In Chinese) [Google Scholar]

- Leng, B.; Yang, Y.; Li, Y.; Zhao, S. Spatial characteristics and complexity analysis of urban economic network structure in China. Acta Geogr. Sin. 2011, 66, 199–211. (In Chinese) [Google Scholar]

- Nazarczuk, J.M.; Umiński, S.; Brodzicki, T. Determinants of the spatial distribution of exporters in regions: The role of ownership. In The Annals of Regional Science; Springer: Olsztyn, Poland, 2019; pp. 1–28. [Google Scholar] [CrossRef]

- Pan, F.; Xia, Y. Location and agglomeration of headquarters of publicly listed firms within china’s urban system. Urban Geogr. 2014, 35, 757–779. [Google Scholar] [CrossRef]

- Lai, K. Differentiated markets: Shanghai, Beijing and Hong Kong in china\s financial centre network. Urban Stud. 2012, 49, 1275–1296. [Google Scholar] [CrossRef]

- Chen, K.; Chen, G. The rise of international financial centers in mainland china. Cities 2015, 47, 10–22. [Google Scholar] [CrossRef]

- Taylor, P.; Derudder, B.; Hoyler, M.; Ni, P.; Witlox, F. City-Dyad Analyses of China’s Integration into the World City Network. Urban Stud. 2014, 51, 868–882. [Google Scholar] [CrossRef]

- Feng, Z.; Bo, W.; Zongcai, W. The rise of the internet city in China: Production and consumption of internet information. Urban Stud. 2014, 52, 2313–2329. [Google Scholar] [CrossRef]

- Zherui, L.; Feng, Z.; Gang, H.; Xiao, Q. Measurement of Urban Centrality Based on Multi-Source Data and Its Planning Application—A Case Study of Changzhou. Urban Plan. Forum 2019, 250, 111–118. (In Chinese) [Google Scholar]

| Industry | Number of Investment Linkages |

|---|---|

| Manufacture | 3928 |

| Wholesale and retail | 2203 |

| Scientific Research and Technology Services | 1587 |

| Leasing and Business Services | 678 |

| Information transmission, software and technology services | 348 |

| Electricity, Thermal, Gas and Water Production and Supply | 316 |

| Finance | 288 |

| Water Conservancy, Environment and Public Facilities Management | 260 |

| Transportation, Warehousing and Postal Service | 236 |

| Real Estate | 225 |

| Construction | 212 |

| Culture, Sports and Entertainment | 45 |

| Agriculture, forestry, animal husbandry and fishery | 39 |

| Education | 19 |

| Health and social work | 7 |

| Resident Services, Repair and Other Services | 3 |

| Total | 10394 |

| Industry | City | Residuals |

|---|---|---|

| All | Hefei | 28.80 |

| Wuhu | 19.69 | |

| Guiyang | 19.56 | |

| Xiamen | 18.84 | |

| Xian | 18.75 |

| City in Jiangsu | TOP 1 Linkage City |

|---|---|

| Suzhou | Shanghai |

| Nanjing | Shenzhen |

| Wuxi | Shanghai |

| Nantong | Shanghai |

| Changzhou | Shanghai |

| Xuzhou | Shanghai |

| Zhenjiang | Shanghai |

| Yangzhou | Shanghai |

| Yancheng | Shanghai |

| Lianyungang | Ningbo |

| Suqain | Nanjing |

| Taizhou | Shanghai |

| Huaian | Nanjing |

| Industry | City | Residuals |

|---|---|---|

| Manufacturing | Hefei | 31.52 |

| Dongguan | 26.00 | |

| Zhuhai | 19.50 | |

| Shenyang | 18.53 | |

| Weifang | 14.68 | |

| Wholesale and Retail | Hefei | 28.63 |

| Guiyang | 25.13 | |

| Kunming | 23.33 | |

| Fuzhou | 21.79 | |

| Jinan | 21.21 | |

| Scientific research and technology services | Xiamen | 28.31 |

| Taiyuan | 27.30 | |

| Hefei | 24.25 | |

| Xian | 22.19 | |

| Nanchang | 22.12 | |

| Leasing and Business services | Ningbo | 31.33 |

| Nanchang | 21.35 | |

| Hefei | 19.10 | |

| Tianjin | 18.36 | |

| Hangzhou | 17.75 |

| z | Manufacturing | Wholesale and Retail | Scientific Research and Technology Services | Leasing and Business Services |

|---|---|---|---|---|

| Suzhou | Nanjing | Shanghai | Shanghai | Shanghai |

| Nanjing | Shenzhen | Shanghai | Shenzhen | Beijing |

| Wuxi | Shanghai | Nantong | Shanghai | Hangzhou |

| Nantong | Shanghai | Shanghai | Shanghai | Shanghai |

| Changzhou | Shanghai | Suzhou | Shanghai | Beijing |

| Xuzhou | Shanghai | Yichang | Beijing | - |

| Zhenjiang | Shanghai | Shanghai | Yangzhou | Shanghai |

| Yangzhou | Nanjing | Shanghai | Suzhou | Beijing |

| Yancheng | Shanghai | Xuzhou | Shanghai | Guangzhou |

| Lianyungang | Shanghai | Ningbo | Beijing | Shanghai |

| Suqain | Nanjing | Nanjing | - | - |

| Taizhou | Beijing | Hefei | Beijing | - |

| Huaian | Nanjing | Shanghai | Beijing | - |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Z.; Feng, Z. Mapping Urban Networks through Inter-Firm Investment Linkages: The Case of Listed Companies in Jiangsu, China. Sustainability 2020, 12, 89. https://doi.org/10.3390/su12010089

Li Z, Feng Z. Mapping Urban Networks through Inter-Firm Investment Linkages: The Case of Listed Companies in Jiangsu, China. Sustainability. 2020; 12(1):89. https://doi.org/10.3390/su12010089

Chicago/Turabian StyleLi, Zherui, and Zhen Feng. 2020. "Mapping Urban Networks through Inter-Firm Investment Linkages: The Case of Listed Companies in Jiangsu, China" Sustainability 12, no. 1: 89. https://doi.org/10.3390/su12010089

APA StyleLi, Z., & Feng, Z. (2020). Mapping Urban Networks through Inter-Firm Investment Linkages: The Case of Listed Companies in Jiangsu, China. Sustainability, 12(1), 89. https://doi.org/10.3390/su12010089