Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation

Abstract

1. Introduction

2. Theoretical Backgrounds, Literature Review and Hypotheses Development

2.1. Prior Research on SMEs Financing

2.2. Previous Studies on Innovation in SMEs

3. Data and Methodology

3.1. Sample Description and Variables

3.2. Econometric Framework

4. Empirical Findings and Discussion

4.1. Preliminary Analysis

4.2. Regression Models Outcomes

4.2.1. The Impact of Investments on Territorial Economic Growth

4.2.2. The Impact of Innovation on Territorial Economic Growth

5. Concluding Remarks and Policy Implications

Author Contributions

Funding

Conflicts of Interest

References

- Obi, J.; Ibidunni, A.S.; Tolulope, A.; Olokundun, M.A.; Amaihian, A.B.; Borishade, T.T.; Fred, P. Contribution of small and medium enterprises to economic development: Evidence from a transiting economy. Data Brief 2018, 18, 835–839. [Google Scholar] [CrossRef]

- Ndiaye, N.; Razak, L.A.; Nagayev, R.; Ng, A. Demystifying small and medium enterprises‘ (SMEs) performance in emerging and developing economies. Borsa Istanb. Rev. 2018, 18, 269–281. [Google Scholar] [CrossRef]

- Commission, E. Entrepreneurship and Small and Medium-Sized Enterprises (SMEs). Available online: https://ec.europa.eu/growth/smes_en (accessed on 12 August 2019).

- European Parliament. Fact Sheets on the European Union; European Parliament: Bruxelles, Belgium, 2019.

- Perez-Gomez, P.; Arbelo-Perez, M.; Arbelo, A. Profit efficiency and its determinants in small and medium-sized enterprises in Spain. BRQ Bus. Res. Q. 2018, 21, 238–250. [Google Scholar] [CrossRef]

- Dowling, M.; O′Gorman, C.; Puncheva, P.; Vanwalleghem, D. Trust and SME attitudes towards equity financing across Europe. J. World Bus. 2019, 54. [Google Scholar] [CrossRef]

- Commission of the European Communities. Communication from the Commission to the Council, the European Parliament, the European Economic and Social Committee and the Committee of the Regions. In COM(2008); 394 final; Commission of the European Communities: Brussels, Belgium, 2008. [Google Scholar]

- Yoshino, N.; Taghizadeh-Hesary, F. Optimal credit guarantee ratio for small and medium-sized enterprises’ financing: Evidence from Asia. Econ. Anal. Policy 2019, 62, 342–356. [Google Scholar] [CrossRef]

- Luo, P.F.; Wang, H.M.; Yang, Z.J. Investment and financing for SMEs with a partial guarantee and jump risk. Eur. J. Oper. Res. 2016, 249, 1161–1168. [Google Scholar] [CrossRef]

- Winfred, A., Jr. Pro-poor economic growth: Role of small and medium sized enterprises. J. Asian Econ. 2006, 17, 35–40. [Google Scholar]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; In COM(2012) 573 final; European Commission: Brussels, Belgium, 2012. [Google Scholar]

- European Parliament. European Parliament Resolution of 15 June 2010 on Community Innovation Policy in a Changing World (2009/2227(INI)); European Parliament: Bruxelles, Belgium, 2010.

- European Parliament. European Parliament Resolution of 9 March 2011 on an Industrial Policy for the Globalised Era (2010/2095(INI)); In 2012/C 199 E/16; European Parliament: Bruxelles, Belgium, 2011.

- European Parliament. European Parliament Resolution of 23 October 2012 on Small and Medium Size Enterprises (SMEs): Competitiveness and Business Opportunities (2012/2042(INI)); In 2014/C 68 E/06; European Parliament: Bruxelles, Belgium, 2012.

- European Parliament. European Parliament Resolution of 15 January 2014 on Reindustrialising Europe to Promote Competitiveness and Sustainability (2013/2006(INI)); In 2016/C 482/13; European Parliament: Bruxelles, Belgium, 2014.

- European Parliament. European Parliament Resolution of 5July 2017 on Building an Ambitious EU Industrial Strategy as a Strategic Priority for Growth, Employment and Innovation in Europe; In 2017/2732(RSP); European Parliament: Bruxelles, Belgium, 2017.

- European Parliament. European Parliament Resolution of 15 September 2016 on Access to Finance for SMEs and Increasing the Diversity of SME Funding in a Capital Markets Union (2016/2032(INI)); In 2016/2032(INI); European Parliament: Bruxelles, Belgium, 2016.

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; In COM(2018) 2 final; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Directorate-General for Research and Innovation (European Commission). Mid-Term Review of the Contractual Public Private Partnerships (cPPPs) under Horizon 2020; European Commission: Brussels, Belgium, 2017. [Google Scholar]

- Gonzalez-Loureiro, M.; Pita-Castelo, J. A model for assessing the contribution of innovative SMEs to economic growth: The intangible approach. Econ. Lett 2012, 116, 312–315. [Google Scholar] [CrossRef]

- Popescu, N.E. Entrepreneurship and SMEs Innovation in Romania. In Proceedings of the 21st International Economic Conference of Sibiu 2014, Iecs 2014 Prospects of Economic Recovery in a Volatile International Context: Major Obstacles, Initiatives and Projects, Sibiu, Romania, 16–17 May 2014; Volume 16, pp. 512–520. [Google Scholar] [CrossRef]

- Porter, M.E. Competitive Advantage, Agglomeration Economies, and Regional Policy. Int. Reg. Sci. Rev. 1996, 19, 85–90. [Google Scholar] [CrossRef]

- Porter, M.E. Customers Who Viewed Competitive Advantage: Creating and Sustaining Superior Performance, 1st ed.; Free Press: New York, NY, USA, 1998. [Google Scholar]

- European Commission. Sixth Periodic Report on the Social and Economic Situation and Development of Regions in the European Union; European Commission: Brussels, Belgium, 1999. [Google Scholar]

- Gardiner, B. Competitiveness Indicators for Europe—Audit, Database Construction and Analysis. Reg. Stud. Assoc. Int. Conf. 2003. Available online: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.197.8343andrep=rep1andtype=pdf (accessed on 24 August 2019).

- Camagni, R. On the concept of territorial competitiveness: Sound or misleading? Urban Stud. 2002, 39, 2395–2411. [Google Scholar] [CrossRef]

- Myslimi, G.; Krisdela, K. Impact of SMEs in economic growth in Albania. Eur. J. Sustain. Dev. 2016, 5, 151–158. [Google Scholar] [CrossRef][Green Version]

- Motta, V.; Sharma, A. Lending technologies and access to finance for SMEs in the hospitality industry. Int. J. Hosp. Manag. 2019, in press. [Google Scholar] [CrossRef]

- Woźniak, M.; Duda, J.; Gąsior, A.; Bernat, T. Relations of GDP growth and development of SMEs in Poland. In Proceedings of the 23rd International Conference on Knowledge-Based and Intelligent Information and Engineering Systems, Budapest, Hungary, 4–6 September 2019. [Google Scholar]

- Hasan, I.; Jackowicz, K.; Kowalewski, O.; Kozlowski, L. Do local banking market structures matter for SME financing and performance? New evidence from an emerging economy. J. Bank Financ. 2017, 79, 142–158. [Google Scholar] [CrossRef]

- Sipa, M.; Gorzen-Mitka, I.; Skibinski, A. Determinants of Competitiveness of Small Enterprises: Polish Perspective. In Proceedings of the 22nd International Economic Conference of Sibiu 2015, Iecs 2015 Economic Prospects in the Context of Growing Global and Regional Interdependencies, Sibiu, Romania, 15–16 May 2015; Volume 27, pp. 445–453. [Google Scholar] [CrossRef]

- Jackowicz, K.; Kozlowski, L. Social ties between SME managers and bank employees: Financial consequences vs. SME managers‘ perceptions. Emerg. Mark. Rev. 2019, 40. [Google Scholar] [CrossRef]

- Oncioiu, I.; Capusneanu, S.; Turkes, M.C.; Topor, D.I.; Constantin, D.M.O.; Marin-Pantelescu, A.; Hint, M.S. The Sustainability of Romanian SMEs and Their Involvement in the Circular Economy. Sustainable (Basel) 2018, 10, 2761. [Google Scholar] [CrossRef]

- Neagu, C. The importance and role of small and medium-sized businesses. Theor. Appl. Econ. 2016, 23, 331–338. [Google Scholar]

- Belu, M.G.; Popa, I.; Filip, R. The Impact of Globalisation on Small and Medium Enterprises: The Romanian Experience. Rom. Econ. J. 2018, 21, 42–51. [Google Scholar]

- Nistor, I.E.; Popescu, D.-R. Romanian SMEs Financing Options:An Empirical Analysis. Financ. Chall. Future 2013, 1, 12–21. [Google Scholar]

- Aceleanu, M.I.; Traşcă, D.L.; Şerban, A.C. The role of small and medium enterprises in improving employment and in the post-crisis resumption of economic growth in Romania. Theor. Appl. Econ. 2014, 1, 87–102. [Google Scholar]

- Armeanu, D.; Istudor, N.; Lache, L. The role of smes in assessing the contribution of entrepreneurship to GDP in the romanian business environment. Amfiteatru Econ. 2015, 17, 195–211. [Google Scholar]

- Exposito, A.; Sanchis-Llopis, J.A. The relationship between types of innovation and SMEs‘ performance: A multi-dimensional empirical assessment. Eurasian Bus. Rev. 2019, 9, 115–135. [Google Scholar] [CrossRef]

- Tahir, H.M.; Razak, N.A.; Rentah, F. The Contributions of Small and Medium Enterprises (SME’s) on Malaysian Economic Growth: A Sectoral Analysis. In Proceedings of the 7th International Conference on Kansei Engineering and Emotion Research 2018, Kuching, Sarawak, Malaysia, 19–22 March 2018; Springer: Berlin, Germany, 2018. [Google Scholar]

- Ghassibe, M.; Appendino, M.; Mahmoudi, S.E. SME Financial Inclusion for Sustained Growth in the Middle East and Central Asia. In IMF Working Papers; International Monetary Fund (IMF): Washington, DC, USA, 2019. [Google Scholar]

- Mendes, S.; Serrasqueiro, Z.; Nunes, P.M. Investment determinants of young and old Portuguese SMEs: A quantile approach. BRQ Bus. Res. Q. 2014, 17, 279–291. [Google Scholar] [CrossRef][Green Version]

- Gupta, J.; Gregoriou, A. Impact of market-based finance on SMEs failure. Econ. Model. 2018, 69, 13–25. [Google Scholar] [CrossRef]

- Trinh, L.Q.; Doan, H.T.T. Internationalization and the growth of Vietnamese micro, small, and medium sized enterprises: Evidence from panel quantile regressions. J. Asian Econ. 2018, 55, 71–83. [Google Scholar] [CrossRef]

- Chinembiri, T. Exploring the Role of Small and Medium Enterprises in Economic Development: Some Policy Considerations for Zimbabwe; In ZEPARU Working Paper Series; (ZEPARU); Zimbabwe Economic Policy Analysis and Research Unit (ZEPARU): Harare, Zimbabwe, 2011. [Google Scholar]

- Wellalage, N.H.; Fernandez, V. Innovation and SME finance: Evidence from developing countries. Int. Rev. Financ. Anal. 2019, 66. [Google Scholar] [CrossRef]

- Apanasovich, N.; Heras, H.A.; Parrilli, M.D. The impact of business innovation modes on SME innovation performance in post-Soviet transition economies: The case of Belarus. Technovation 2016, 57–58, 30–40. [Google Scholar] [CrossRef]

- Ullah, B. Financial constraints, corruption, and SME growth in transition economies. Q. Rev. Econ. Financ. 2019, in press. [Google Scholar] [CrossRef]

- Kersten, R.; Harms, J.; Liket, K.; Maas, K. Small Firms, large Impact? A systematic review of the SME Finance Literature. World Dev. 2017, 97, 330–348. [Google Scholar] [CrossRef]

- Chenery, H.B. Overcapacity and the Acceleration Principle. Econometrica 1952, 20, 1–28. [Google Scholar] [CrossRef]

- Chirinko, R.S. Business Fixed Investment Spending—Modeling Strategies, Empirical Results, and Policy Implications. J. Econ. Lit. 1993, 31, 1875–1911. [Google Scholar]

- Baker, H.K.; Kumar, S.; Rao, P. Financing preferences and practices of Indian SMEs. Glob. Financ. J. 2017, in press. [Google Scholar]

- Asai, Y. Why do small and medium enterprises (SMEs) demand property liability insurance? J. Bank Financ. 2019, 106, 298–304. [Google Scholar] [CrossRef]

- Wang, Y. What are the biggest obstacles to growth of SMEs in developing countries?—An empirical evidence from an enterprise survey. Borsa Istanb. Rev. 2016, 16, 167–176. [Google Scholar] [CrossRef]

- Agostini, L.; Filippini, R. Organizational and managerial challenges in the path toward Industry 4.0. Eur. J. Innov. Manag. 2019, 22, 406–421. [Google Scholar] [CrossRef]

- Mlozi, S. A Post Hoc Analysis of LearningOrientation–Innovation–Performancein the Hospitality Industry. Acad. Tur. 2017, 10, 27–41. [Google Scholar]

- Cohen, W.M.; Levinthal, D.A. Absorptive-Capacity—A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Hunter, G.K.; William, D.P., Jr. Sales Technology Orientation, Information Effectiveness, and Sales Performance. J. Pers. Sell. Sales Manag. 2006, 26, 95–113. [Google Scholar] [CrossRef]

- Damanpour, F. The dynamics of the adoption of product and process innovations in organizations. J. Manag. Stud. 2001, 38, 45–65. [Google Scholar] [CrossRef]

- OECD. Measuring Innovation. In A New Perspective; OECD: Paris, France, 2010. [Google Scholar]

- Cousins, J. MBA ASAP Marketing 2.0: Principles and Practice in the Digital Age Paperback; Independently Published, 2018; Available online: https://www.amazon.com/MBA-ASAP-Marketing-2-0-Principles/dp/1717884334 (accessed on 24 August 2019).

- Wignaraja, G. Competitiveness Strategy in Developing Countries. A Manual for Policy Analysis, 1st ed.; Routledge: London, UK, 2003. [Google Scholar]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Bang, A.; Cleemann, C.M.; Bramming, P. How to create business value in the knowledge economy Accelerating thoughts of Peter, F. Drucker. Manag. Decis. 2010, 48, 616–627. [Google Scholar] [CrossRef]

- Baron, R.A.; Markman, G.D. Beyond social capital: The role of entrepreneurs‘ social competence in their financial success. J. Bus. Ventur. 2003, 18, 41–60. [Google Scholar] [CrossRef]

- Clarke, J. Revitalizing Entrepreneurship: How Visual Symbols are Used in Entrepreneurial Performances. J. Manag. Stud. 2011, 48, 1365–1391. [Google Scholar] [CrossRef]

- Prokop, D.; Huggins, R.; Bristow, G. The survival of academic spinoff companies: An empirical study of key determinants. Int. Small Bus. J. 2019, 37, 502–535. [Google Scholar] [CrossRef]

- Bergek, A.; Norrman, C. Incubator best practice: A framework. Technovation 2008, 28, 20–28. [Google Scholar] [CrossRef]

- Akbar, Y.; Balboni, B.; Bortoluzzi, G.; Dikova, D.; Tracogna, A. Disentangling resource and mode escalation in the context of emerging markets. Evidence from a sample of manufacturing SMEs. J. Int. Manag. 2018, 24, 257–270. [Google Scholar] [CrossRef]

- Guvernul României. Ordonanța nr. 8/1997 privind stimularea cercetării-dezvoltării și inovării. 1997. Available online: http://www.cdep.ro/pls/legis/legis_pck.htp_act?ida=13234 (accessed on 24 August 2019).

- OECD. Oslo Manual. Guidelines for Collecting and Interpreting Innovation Data; OECD: Paris, France, 2005. [Google Scholar]

- Saridakis, G.; Idris, B.; Hansen, J.M.; Dana, L.P. SMEs‘ internationalisation: When does innovation matter? J. Bus. Res. 2019, 96, 250–263. [Google Scholar] [CrossRef]

- Guan, H.J.; Zhang, Z.; Zhao, A.W.; Jia, J.Y.; Guan, S. Research on Innovation Behavior and Performance of New Generation Entrepreneur Based on Grounded Theory. Sustainable (Basel) 2019, 11, 2883. [Google Scholar] [CrossRef]

- Botezatu, M.A. Insight Into Project Risk Management. J. Inf. Syst. Oper. Manag. 2016, 10, 137–150. [Google Scholar]

- Kitching, J. Regulatory reform as risk management: Why governments redesign micro company legal obligations. Int. Small Bus. J. 2019, 37, 395–416. [Google Scholar] [CrossRef]

- National Institute of Statistics. Statistical Yearbooks of Romania. Available online: http://www.insse.ro/cms/en/content/statistical-yearbooks-romania (accessed on 12 August 2019).

- Dodgson, M. Innovation in firms. Oxf. Rev. Econ. Policy 2017, 33, 85–100. [Google Scholar] [CrossRef]

- Gomes, G.; Wojahn, R.M. Organizational learning capability, innovation and performance: Study in small and medium-sized enterprises (SMES). Rev. Adm. 2017, 52, 163–175. [Google Scholar] [CrossRef]

- Kosgei, C.N.; Maru, C.L. Learning orientation and innovativeness of small and micro-enterprises. Int. J. Small Bus. Entrep. Res. 2015, 3, 1–10. [Google Scholar]

- Calantone, R.J.; Cavusgil, S.T.; Zhao, Y.S. Learning orientation, firm innovation capability, and firm performance. Ind. Mark. Manag. 2002, 31, 515–524. [Google Scholar] [CrossRef]

- Pang, C.W.; Wang, Q.; Li, Y.; Duan, G. Integrative capability, business model innovation and performance: Contingent effect of business strategy. Eur. J. Innov. Manag. 2019, 22, 541–561. [Google Scholar] [CrossRef]

- Ratnawati, T.; Soetjipto, B.E.; Murwani, F.D.; Wahyono, H. The Role of SMEs’ Innovation and Learning Orientation in Mediating the Effect of CSR Programme on SMEs’ Performance and Competitive Advantage. Glob. Bus. Rev. 2018, 19, S21–S38. [Google Scholar] [CrossRef]

- Alegre, J.; Chiva, R. Assessing the impact of organizational learning capability on product innovation performance: An empirical test. Technovation 2008, 28, 315–326. [Google Scholar] [CrossRef]

- Morrison, A.; Pietrobelli, C.; Rabellotti, R. Global Value Chains and Technological Capabilities: A Framework to Study Learning and Innovation in Developing Countries. Oxf. Dev. Stud. 2008, 36, 36–58. [Google Scholar] [CrossRef]

- Keskin, H. Market orientation, learning orientation, and innovation capabilities in SMEs. Eur. J. Innov. Manag. 2006, 9, 396–417. [Google Scholar] [CrossRef]

- Salavou, H. Do Customer and Technology Orientations Influence Product Innovativeness in SMEs? Some New Evidence from Greece. J. Mark. Manag. 2005, 21, 307–338. [Google Scholar] [CrossRef]

- Hou, B.J.; Hong, J.; Zhu, K.J.; Zhou, Y. Paternalistic leadership and innovation: The moderating effect of environmental dynamism. Eur. J. Innov. Manag. 2019, 22, 562–582. [Google Scholar] [CrossRef]

- Tariq, A.; Badir, Y.; Chonglerttham, S. Green innovation and performance: Moderation analyses from Thailand. Eur. J. Innov. Manag. 2019, 22, 446–467. [Google Scholar] [CrossRef]

- Zhao, Y.X.; Thompson, P. Investments in managerial human capital: Explanations from prospect and regulatory focus theories. Int. Small Bus. J. 2019, 37, 365–394. [Google Scholar] [CrossRef]

- Mavondo, F.T.; Chimhanzi, J.; Stewart, J. Learning orientation and market orientation. Eur. J. Mark. 2005, 39, 1235–1263. [Google Scholar] [CrossRef]

- Sirelli, G. Innovation and firm performance. In Proceedings of the Conference Innovation and Enterprise Creation: Statistics and Indicators, Sophia Antipolis, France, 23–24 November 2000. [Google Scholar]

- Bacon-Gerasymenko, V. When do organisations learn from successful experiences? The case of venture capital firms. Int. Small Bus. J. 2019, 37, 450–472. [Google Scholar] [CrossRef]

- Khosravi, P.; Newton, C.; Rezvani, A. Management innovation: A systematic review and meta-analysis of past decades of research. Eur. Manag. J. 2019, in press. [Google Scholar] [CrossRef]

- Birkinshaw, J.; Hamel, G.; Mol, M. Management Innovation; In AIM Working Paper Series: 021-July-2005; School, L.B., Ed.; Advanced Institute of Management Research: London, UK, 2005. [Google Scholar]

- Anzola-Roman, P.; Bayona-Saez, C.; Garcia-Marco, T. Organizational innovation, internal RandD and externally sourced innovation practices: Effects on technological innovation outcomes. J. Bus. Res. 2018, 91, 233–247. [Google Scholar] [CrossRef]

- Botezatu, M.A.; Pirnau, C.; Carp, R.M.C. A Modern Quality Assurance System—Condition and Support to an Efficient Management. Tem J. 2019, 8, 125–131. [Google Scholar]

| Variables | Definitions |

|---|---|

| Variables regarding business turnover (Dependent Variables) | |

| TY1A | The turnover of all active enterprises at the national level |

| Y1B | The turnover of all the micro-enterprises at the national level |

| Variables regarding investments (Explanatory Variables) | |

| TX1A1 | Total gross investments obtained by all active enterprises at the national level |

| TX1B1 | Total gross investments performed by the micro companies |

| TX1C1 | Total gross investments performed by the small companies |

| TX1D1 | Total gross investments performed by the middle-sized companies |

| TX1E1 | Total gross investments performed by the big companies |

| X1B2 | Net investments performed by micro-enterprises |

| Variables regarding expenditures on innovation (Explanatory Variables) | |

| TX4A | Expenditures on innovation performed by all enterprises |

| TX4D | Expenditures on innovation performed by SMEs |

| TX4E | Expenditures on innovation performed by big enterprises |

| Variables regarding firm size (Explanatory Variables) | |

| TX3A | The number of employees out of all active enterprises at the national level |

| X3B | The number of employees out of active micro-units |

| Variables regarding the number of enterprises | |

| X2B | The number of active micro-units |

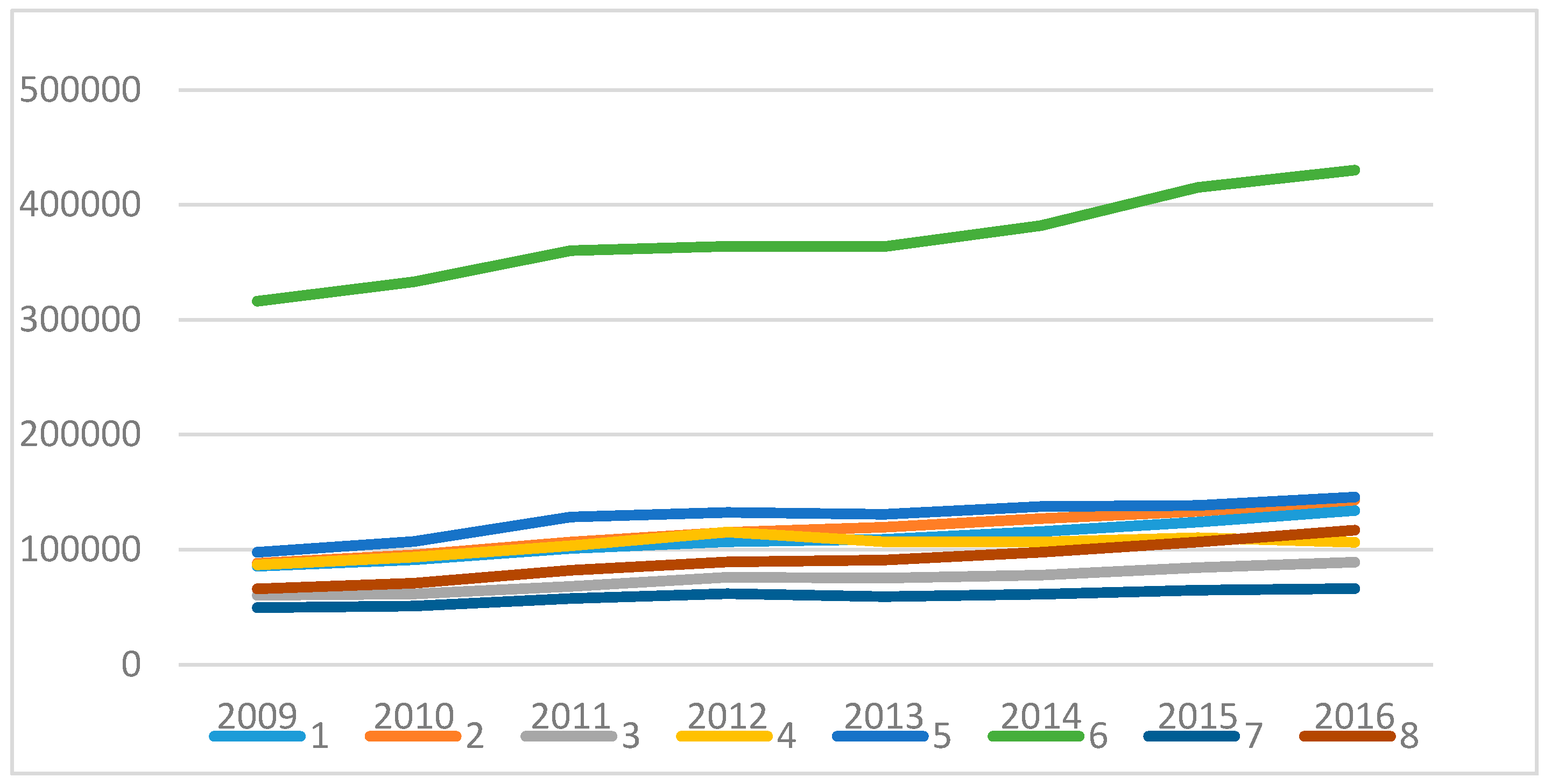

| Region | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|

| 1 North-West | 85,673 | 91,222 | 101,068 | 106,958 | 10,8911 | 115,831 | 124,021 | 134,251 |

| 2 Center | 88,253 | 95,354 | 106,679 | 114,973 | 119,574 | 126,904 | 133,324 | 143,313 |

| 3 North-East | 60,414 | 61,355 | 67,979 | 75,897 | 75,251 | 77,896 | 84,512 | 89,131 |

| 4 South-East | 86,943 | 93,476 | 103,380 | 115,446 | 106,792 | 106,701 | 110,370 | 106,377 |

| 5 South-Muntenia | 97,848 | 107,136 | 128,467 | 132,425 | 130,652 | 137,503 | 138,421 | 145,959 |

| 6 Bucharest–Ilfov | 316,201 | 332,956 | 360,042 | 363,868 | 363,665 | 381,902 | 415,115 | 430,203 |

| 7 South-West Oltenia | 49,527 | 50,953 | 57,426 | 61,734 | 59,110 | 61,177 | 64,697 | 66,159 |

| 8 West | 65,975 | 70,786 | 82,110 | 89,207 | 91,037 | 97,804 | 106,706 | 117,095 |

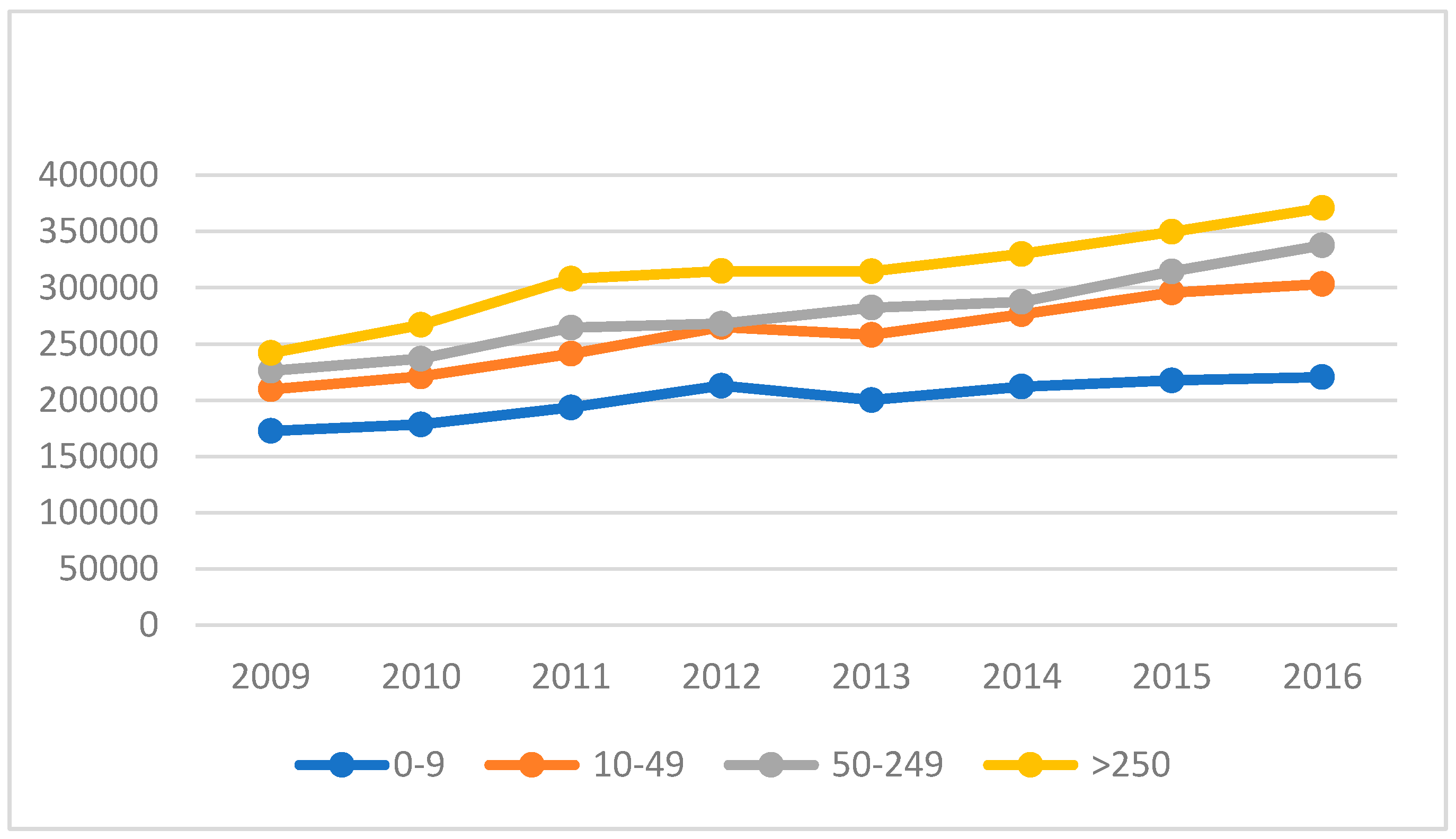

| Year/No. of Employees | 0–9 | 10–49 | 50–249 | >250 |

|---|---|---|---|---|

| 2009 | 172,783 | 209,784 | 226,239 | 242,028 |

| 2010 | 178,450 | 221,111 | 236,806 | 266,871 |

| 2011 | 193,513 | 241,214 | 264,461 | 307,963 |

| 2012 | 212,861 | 264,998 | 267,928 | 314,721 |

| 2013 | 200,138 | 258,106 | 282,285 | 314,464 |

| 2014 | 212,025 | 276,365 | 287,391 | 329,936 |

| 2015 | 217,517 | 295,635 | 314,397 | 349,618 |

| 2016 | 220,570 | 303,257 | 337,667 | 370,994 |

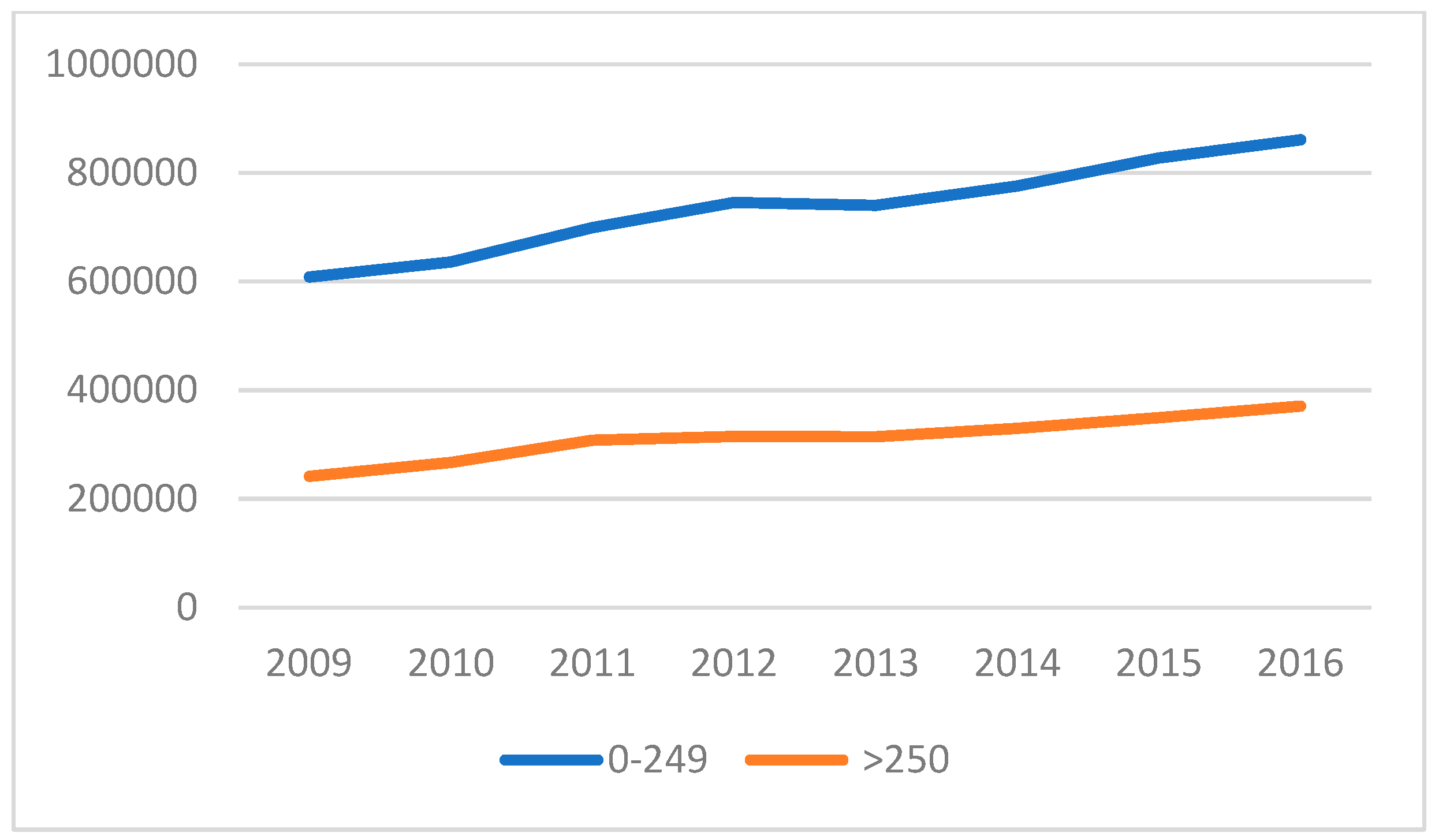

| Year | SMEs (0–249) | Big Companies (>250) |

|---|---|---|

| 2009 | 608,806 | 242,028 |

| 2010 | 636,367 | 266,871 |

| 2011 | 699,188 | 307,963 |

| 2012 | 745,787 | 314,721 |

| 2013 | 740,529 | 314,464 |

| 2014 | 775,781 | 329,936 |

| 2015 | 827,549 | 349,618 |

| 2016 | 861,494 | 370,994 |

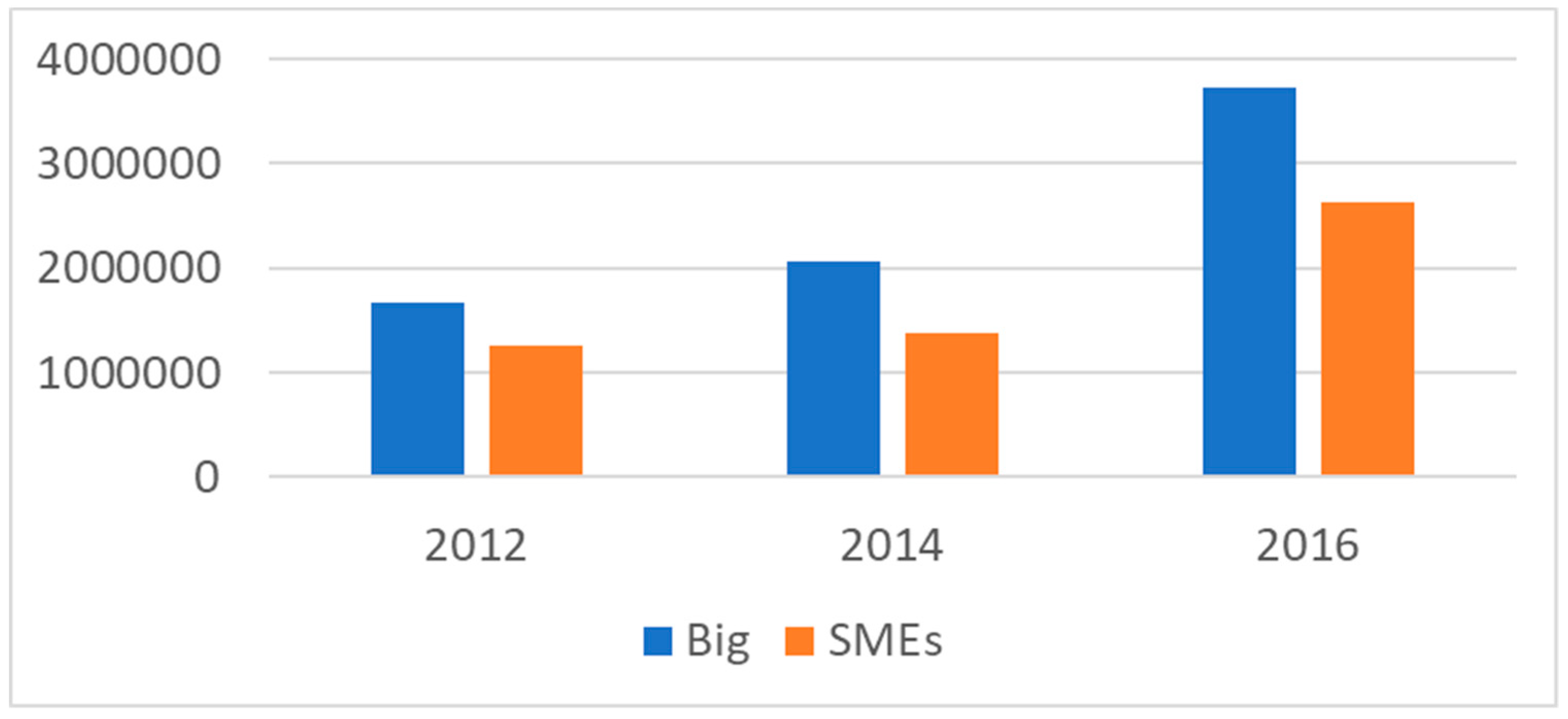

| Year | Big | SMEs |

|---|---|---|

| 2012 | 1,663,447 | 1,253,844 |

| 2014 | 2,068,974 | 1,369,763 |

| 2016 | 3,732,421 | 2,623,607 |

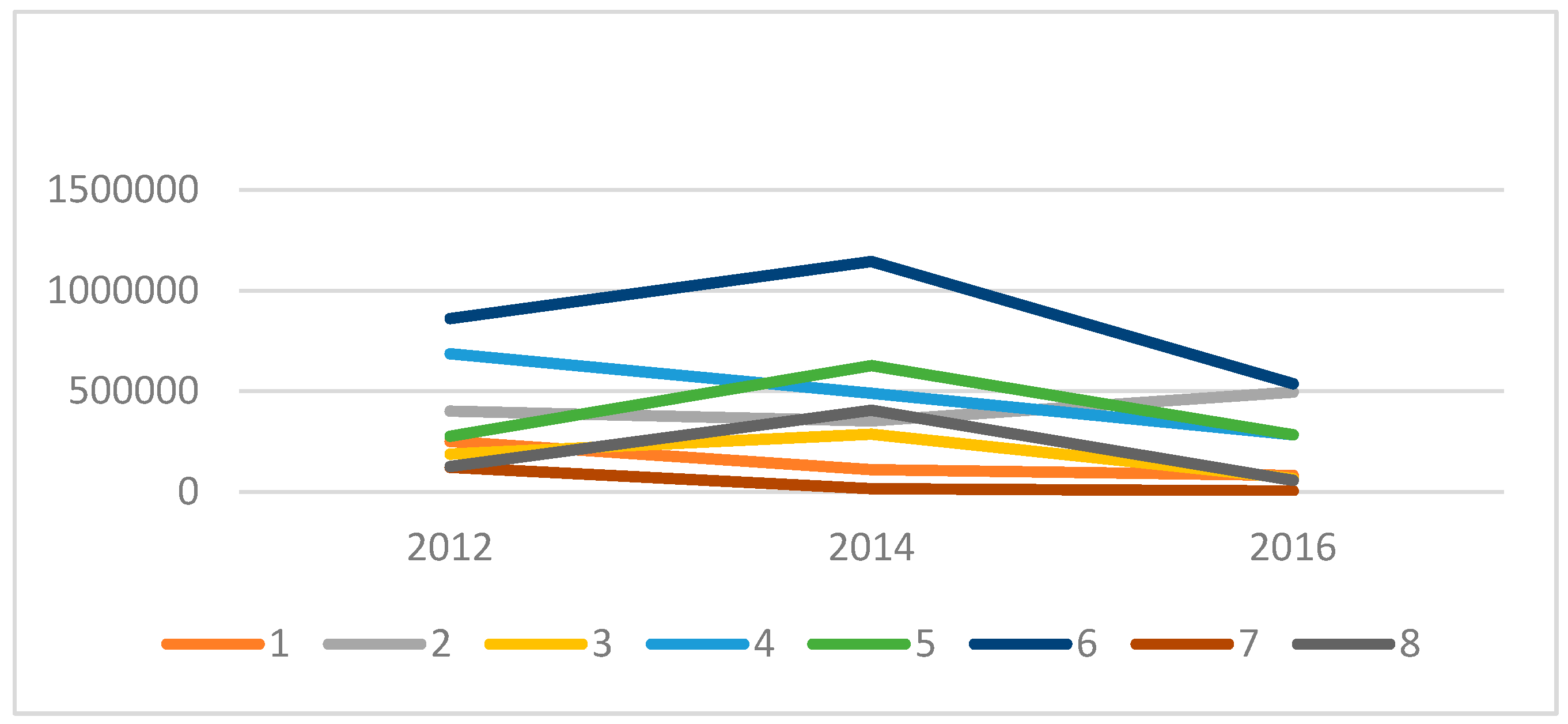

| Region | 2012 | 2014 | 2016 |

|---|---|---|---|

| 1 North-West | 251,952 | 111,085 | 82,354 |

| 2 Center | 401,308 | 353,020 | 496,385 |

| 3 North-East | 188,403 | 287,744 | 66,920 |

| 4 South-East | 686,340 | 490,651 | 284,162 |

| 5 South-Muntenia | 277,680 | 628,358 | 283,633 |

| 6 Bucharest–Ilfov | 861,600 | 1,145,411 | 537,984 |

| 7 South-West Oltenia | 123,233 | 15,789 | 4912 |

| 8 West | 126,775 | 406,679 | 57,815 |

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | −5.198040 | 1.723701 | −3.015628 | 0.0037 |

| log(TX1A1) | 0.254622 | 0.135583 | 1.877976 | 0.0652 |

| log(TX3A) | 1.105328 | 0.225105 | 4.910274 | 0.0000 |

| R-squared | 0.905874 | Mean dependent var | 11.61481 | |

| Adjusted R-squared | 0.902788 | S.D. dependent var | 0.532504 | |

| S.E. of regression | 0.166028 | Akaike info criterion | −0.707575 | |

| Sum squared resid | 1.681492 | Schwarz criterion | −0.606377 | |

| Log likelihood | 25.64239 | Hannan–Quinn criter. | −0.667708 | |

| F-statistic | 293.5348 | Durbin–Watson stat | 1.015572 | |

| Prob(F-statistic) | 0.000000 | Wald F-statistic | 648.6972 | |

| Prob(Wald F-statistic) | 0.000000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 4.452171 | 0.683106 | 6.517543 | 0.0000 |

| log(TX1A1) | 0.768108 | 0.074703 | 10.28216 | 0.0000 |

| R-squared | 0.796887 | Mean dependent var | 11.61481 | |

| Adjusted R-squared | 0.793611 | S.D. dependent var | 0.532504 | |

| S.E. of regression | 0.241917 | Akaike info criterion | 0.030305 | |

| Sum squared resid | 3.628470 | Schwarz criterion | 0.097770 | |

| Log likelihood | 1.030236 | Hannan–Quinn criter. | 0.056883 | |

| F-statistic | 243.2494 | Durbin–Watson stat | 1.441618 | |

| Prob(F-statistic) | 0.000000 | Wald F-statistic | 105.7228 | |

| Prob(Wald F-statistic) | 0.000000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 5.173465 | 0.240976 | 21.46883 | 0.0000 |

| log(TX1B1) | 0.211263 | 0.052112 | 4.054010 | 0.0001 |

| log(TX1C1) | 0.372942 | 0.084366 | 4.420517 | 0.0000 |

| log(TX1D1) | 0.143356 | 0.084269 | 1.701164 | 0.0942 |

| log(TX1E1) | 0.109920 | 0.051485 | 2.134995 | 0.0369 |

| R-squared | 0.929221 | Mean dependent var | 11.61481 | |

| Adjusted R-squared | 0.924422 | S.D. dependent var | 0.532504 | |

| S.E. of regression | 0.146393 | Akaike info criterion | −0.930141 | |

| Sum squared resid | 1.264421 | Schwarz criterion | −0.761479 | |

| Log likelihood | 34.76452 | Hannan–Quinn criter. | −0.863697 | |

| F-statistic | 193.6448 | Durbin–Watson stat | 1.378223 | |

| Prob(F-statistic) | 0.000000 | Wald F-statistic | 433.4057 | |

| Prob(Wald F-statistic) | 0.000000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | −0.572733 | 0.199315 | −2.873508 | 0.0042 |

| X1B2 | 0.000609 | 0.000151 | 4.020901 | 0.0001 |

| log(X2B) | 0.350974 | 0.047841 | 7.336311 | 0.0000 |

| log(X3B) | 0.507031 | 0.050006 | 10.13947 | 0.0000 |

| R-squared | 0.759192 | Mean dependent var | 6.146454 | |

| Adjusted R-squared | 0.758319 | S.D. dependent var | 1.689388 | |

| S.E. of regression | 0.830521 | Akaike info criterion | 2.471268 | |

| Sum squared resid | 571.1249 | Schwarz criterion | 2.493979 | |

| Log likelihood | −1024.047 | Hannan–Quinn criter. | 2.479976 | |

| F-statistic | 870.1407 | Durbin–Watson stat | 0.371520 | |

| Prob(F-statistic) | 0.000000 | Wald F-statistic | 538.1923 | |

| Prob(Wald F-statistic) | 0.000000 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 8.513681 | 0.645311 | 13.19313 | 0.0000 |

| log(TX4D) | −0.078573 | 0.075360 | −1.042647 | 0.3090 |

| log(TX4E) | 0.369872 | 0.092168 | 4.013022 | 0.0006 |

| R-squared | 0.592076 | Mean dependent var | 11.70371 | |

| Adjusted R-squared | 0.553226 | S.D. dependent var | 0.520231 | |

| S.E. of regression | 0.347729 | Akaike info criterion | 0.841681 | |

| Sum squared resid | 2.539221 | Schwarz criterion | 0.988937 | |

| Log likelihood | −7.100167 | Hannan–Quinn criter. | 0.880748 | |

| F-statistic | 15.24007 | Durbin–Watson stat | 1.142976 | |

| Prob(F-statistic) | 0.000081 | Wald F-statistic | 13.00972 | |

| Prob(Wald F-statistic) | 0.000211 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 8.564310 | 0.896656 | 9.551389 | 0.0000 |

| log(TX4A) | 0.256394 | 0.075632 | 3.390020 | 0.0026 |

| R-squared | 0.390104 | Mean dependent var | 11.70371 | |

| Adjusted R-squared | 0.362382 | S.D. dependent var | 0.520231 | |

| S.E. of regression | 0.415410 | Akaike info criterion | 1.160553 | |

| Sum squared resid | 3.796439 | Schwarz criterion | 1.258725 | |

| Log likelihood | −11.92664 | Hannan–Quinn criter. | 1.186598 | |

| F-statistic | 14.07174 | Durbin–Watson stat | 1.684148 | |

| Prob(F-statistic) | 0.001104 | Wald F-statistic | 11.49224 | |

| Prob(Wald F-statistic) | 0.002633 | |||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | 8.292346 | 0.739660 | 11.21103 | 0.0000 |

| log(TX4E) | 0.306904 | 0.068674 | 4.468970 | 0.0002 |

| R-squared | 0.574391 | Mean dependent var | 11.70371 | |

| Adjusted R-squared | 0.555045 | S.D. dependent var | 0.520231 | |

| S.E. of regression | 0.347020 | Akaike info criterion | 0.800788 | |

| Sum squared resid | 2.649306 | Schwarz criterion | 0.898959 | |

| Log likelihood | −7.609451 | Hannan–Quinn criter. | 0.826832 | |

| F-statistic | 29.69058 | Durbin–Watson stat | 1.083840 | |

| Prob(F-statistic) | 0.000018 | Wald F-statistic | 19.97170 | |

| Prob(Wald F-statistic) | 0.000192 | |||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gherghina, Ș.C.; Botezatu, M.A.; Hosszu, A.; Simionescu, L.N. Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation. Sustainability 2020, 12, 347. https://doi.org/10.3390/su12010347

Gherghina ȘC, Botezatu MA, Hosszu A, Simionescu LN. Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation. Sustainability. 2020; 12(1):347. https://doi.org/10.3390/su12010347

Chicago/Turabian StyleGherghina, Ștefan Cristian, Mihai Alexandru Botezatu, Alexandra Hosszu, and Liliana Nicoleta Simionescu. 2020. "Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation" Sustainability 12, no. 1: 347. https://doi.org/10.3390/su12010347

APA StyleGherghina, Ș. C., Botezatu, M. A., Hosszu, A., & Simionescu, L. N. (2020). Small and Medium-Sized Enterprises (SMEs): The Engine of Economic Growth through Investments and Innovation. Sustainability, 12(1), 347. https://doi.org/10.3390/su12010347