A New Motivation for Sustainable Trade Between Countries with Different Regulatory Qualities

Abstract

1. Introduction

2. Brief Literature Review

3. Identification Strategy and Data Sources

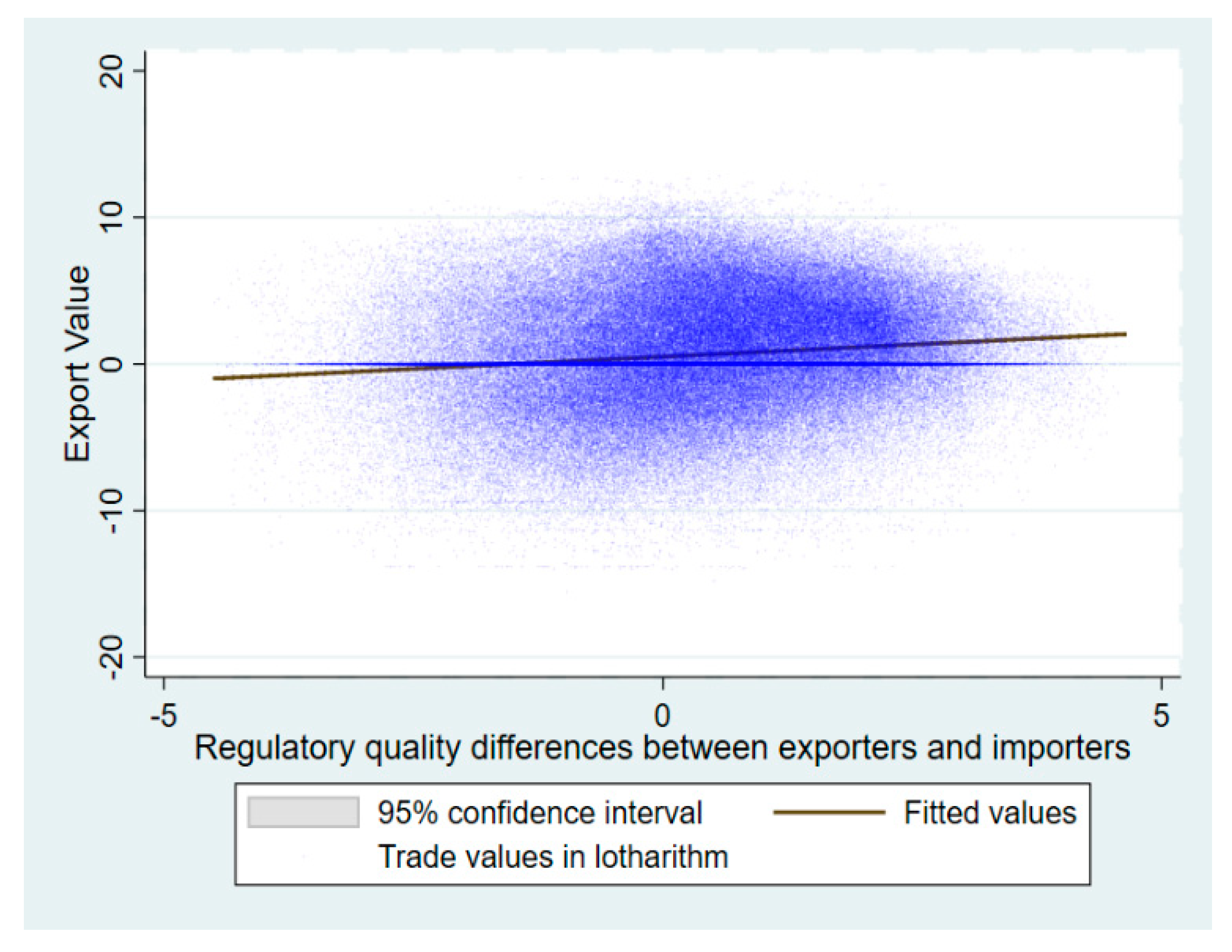

3.1. Identification Strategy

3.2. Addressing Potential Endogeneity

3.3. Data Sources

4. Empirical Results

4.1. Benchmark Results

4.2. Fixed-Effect Model Estimation

4.3. Treatment-Effect Estimation Results

5. Robustness Checks

5.1. Do Zero Trade Values Matter?

5.2. Zero Trade and Heteroscedasticity

5.3. The Endogenous Variable of GDP

5.4. Different Time Periods

5.5. Multilateral Trade Resistance

5.6. Potential Outlier Issue

6. Concluding Remarks and Discussion

6.1. Main Conclusions

6.2. Policy Implications

6.3. Limitations and Areas of Future Research

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| Afghanistan | Djibouti | Lao PDR | Sao Tome and Principe |

| Albania | Dominica | Latvia | Saudi Arabia |

| Algeria | Dominican Republic | Lebanon | Senegal |

| American Samoa | Ecuador | Lesotho | Serbia |

| Angola | Egypt, Arab Rep. | Liberia | Seychelles |

| Antigua and Barbuda | El Salvador | Libya | Sierra Leone |

| Argentina | Equatorial Guinea | Lithuania | Singapore |

| Armenia | Eritrea | Macao SAR, China | Slovak Republic |

| Aruba | Estonia | Macedonia, FYR | Slovenia |

| Australia | Ethiopia | Madagascar | Solomon Islands |

| Austria | Fiji | Malawi | Somalia |

| Azerbaijan | Finland | Malaysia | South Africa |

| Bahamas, The | France | Maldives | Spain |

| Bahrain | Gabon | Mali | Sri Lanka |

| Bangladesh | Gambia, The | Malta | St. Kitts and Nevis |

| Barbados | Georgia | Martinique | St. Lucia |

| Belarus | Germany | Mauritania | St. Vincent and the Grenadines |

| Belize | Ghana | Mauritius | Sudan |

| Benin | Greece | Mexico | Suriname |

| Bermuda | Greenland | Moldova | Swaziland |

| Bhutan | Grenada | Mongolia | Sweden |

| Bolivia | Guam | Morocco | Switzerland |

| Bosnia and Herzegovina | Guatemala | Mozambique | Syrian Arab Republic |

| Botswana | Guinea | Myanmar | Tajikistan |

| Brazil | Guinea-Bissau | Namibia | Tanzania |

| Brunei Darussalam | Guyana | Nepal | Thailand |

| Bulgaria | Haiti | Netherlands | Timor-Leste |

| Burkina Faso | Honduras | Netherlands Antilles | Togo |

| Burundi | Hong Kong SAR, China | New Caledonia | Tonga |

| Cabo Verde | Hungary | New Zealand | Trinidad and Tobago |

| Cambodia | Iceland | Nicaragua | Tunisia |

| Cameroon | India | Niger | Turkey |

| Canada | Indonesia | Nigeria | Turkmenistan |

| Central African Republic | Iran, Islamic Rep. | Norway | Tuvalu |

| Chad | Iraq | Oman | Uganda |

| Chile | Ireland | Pakistan | Ukraine |

| China | Israel | Palau | United Arab Emirates |

| Colombia | Italy | Panama | United Kingdom |

| Comoros | Jamaica | Papua New Guinea | United States |

| Congo, Dem. Rep. | Japan | Paraguay | Uruguay |

| Congo, Rep. | Jordan | Peru | Uzbekistan |

| Costa Rica | Kazakhstan | Philippines | Vanuatu |

| Cote d’Ivoire | Kenya | Poland | Venezuela, RB |

| Croatia | Kiribati | Portugal | Vietnam |

| Cuba | Korea, Rep. | Qatar | West Bank and Gaza |

| Cyprus | Kosovo | Russian Federation | Yemen, Rep. |

| Czech Republic | Kuwait | Rwanda | Zambia |

| Denmark | Kyrgyz Republic | Samoa | Zimbabwe |

References

- Araujo, L.; Mion, G.; Ornelas, E. Institutions and export dynamics. J. Int. Econ. 2016, 98, 2–20. [Google Scholar] [CrossRef]

- Bliss, H.; Russett, B. Democratic trading partners: The liberal connection 1962–1989. J. Politics 1998, 60, 1126–1147. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. Colonial origins of comparative development: An empirical investigation. Am. Econ. Rev. 2001, 91, 1369–1401. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. Reversal of fortune: Geography and institutions in the making of the modern world income distribution. Q. J. Econ. 2002, 117, 1231–1294. [Google Scholar] [CrossRef]

- Acemoglu, D.; Johnson, S.; Robinson, J.A. Institutions as a fundamental cause of long-run growth. In Handbook of Economic Growth; North Holland Publishing Co.: Amsterdam, The Netherlands, 2005; pp. 385–472. [Google Scholar]

- Rodríguez-Pose, A.; Storper, M. Better rules or stronger communities? On the social foundations of institutional change and its economic effects. Econ. Geogr. 2006, 82, 1–25. [Google Scholar] [CrossRef]

- Ali, M.A.; Rahman, M. The impact of institutional quality on the volume and organization of trade: Evidence from Malaysia. Int. J. Innov. Res. Man. 2014, 1, 21–30. [Google Scholar]

- Yu, S.; Beugelsdijk, S.; de Haan, J. Trade, trust and the rule of law. Eur. J. Polit. Econ. 2015, 37, 102–115. [Google Scholar] [CrossRef]

- Nunn, N.; Trefler, D. Domestic institutions as a source of comparative advantage. In Handbook of International Economics; North Holland: Amsterdam, The Netherlands, 2014. [Google Scholar]

- Álvarez, I.C.; Barbero, J.; Rodríguez-Pose, A.; Zofío, J. Does institutional quality matter for trade? Institutional conditions in a sectoral trade framework. World Dev. 2018, 103, 72–87. [Google Scholar] [CrossRef]

- Wu, F.; Yan, X. Institutional quality and sustainable development of industries’ exports: Evidence from China. Sustainability 2018, 10, 4173. [Google Scholar] [CrossRef]

- Grofman, B.; Gray, M. Geopolitical Influences on Trade Openness in Thirty-One Long-Term Democracies, 1960–1995; University of California: Irvine, CA, USA, 2000. [Google Scholar]

- Levchenko, A.A. Institutional quality and international trade. Rev. Econ. Stud. 2007, 74, 791–819. [Google Scholar] [CrossRef]

- Levchenko, A.A. International trade and institutional change. J. Law. Econ. Organ. 2013, 29, 1145–1181. [Google Scholar] [CrossRef]

- Yu, M. Trade, democracy, and the gravity equation. J. Dev. Econ. 2010, 91, 289–300. [Google Scholar] [CrossRef]

- Ju, J.; Wei, S.-J. When is quality of financial system a source of comparative advantage? J. Int. Econ. 2011, 84, 178–187. [Google Scholar] [CrossRef]

- Ferguson, S.M.; Formai, S. Institution-driven comparative advantage, complex goods and organizational choice. J. Int. Econ. 2011, 90, 193–200. [Google Scholar] [CrossRef]

- De Groot, H.L.F.; Linders, G.J.; Rietveld, P.; Subramanian, U. The Institutional Determinants of Bilateral Trade Patterns. Kyklos 2004, 57, 103–123. [Google Scholar] [CrossRef]

- Pierre, G.M.; Sekkat, K. Institutional quality and trade: Which institutions? Which trade. Econ. Inq. 2008, 46, 227–240. [Google Scholar]

- Kim, I.S.; Londregan, J.; Ratkovic, M. Politics, Institutions, and Trade; Working Paper; Princeton University: Princeton, NJ, USA, 2016; Available online: https://wws.princeton.edu/faculty-research/research/item/politics-institutions-and-trade (accessed on 11 October 2019).

- Anderson, J.E.; Young, L. Trade implies law: The power of the weak. Natl. Bur. Econ. Res. 2000. [Google Scholar] [CrossRef]

- Soeng, R.; Cuyvers, L. Domestic institutions and export performance: Evidence for Cambodia. J. Int. Trade. Econ. Dev. 2018, 27, 389–408. [Google Scholar] [CrossRef]

- Beverelli, C.; Fiorini, M.; Hoekman, B. Services trade policy and manufacturing productivity: The role of institutions. J. Int. Econ. 2017, 104, 166–182. [Google Scholar] [CrossRef]

- Anderson, J.E.; Marcouiller, D. Insecurity and the Pattern of Trade: An Empirical Investigation. Rev. Econ. Stat. 2002, 84, 342–352. [Google Scholar] [CrossRef]

- Francois, J.; Manchin, M. Institutions, Infrastructure, and Trade. World Dev. 2013, 46, 165–175. [Google Scholar] [CrossRef]

- Soderlund, B.; Tingvall, P.G. Dynamic effects of institutions on firm-level exports. Rev. World. Econ. 2014, 150, 277–308. [Google Scholar] [CrossRef]

- Nunn, N. Relationship-Specificity, Incomplete Contracts, and the Pattern of Trade. Q. J. Econ. 2007, 122, 569–600. [Google Scholar] [CrossRef]

- Baldwin, R.; Taglioni, D. Gravity for dummies and dummies for gravity equations. NBER 2006. [Google Scholar] [CrossRef]

- Anderson, J.E.; Wincoop, E.V. Gravity with Gravitas: A Solution to the Border Puzzle. Am. Econ. Rev. 2003, 93, 170–192. [Google Scholar] [CrossRef]

- Feenstra, R.C. Advanced International Trade: Theory and Evidence, 2nd ed.; Princeton University Press: Princeton, NJ, USA, 2016. [Google Scholar]

- Angrist, J.D.; Pischke, J.S. Mostly Harmless Econometrics: An Empiricist’s Companion; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Heckman, J. Sample selection bias as a specification error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Glick, R.; Rose, A.K. Currency unions and trade: A post-EMU reassessment. Eur. Econ. Rev. 2016, 87, 78–91. [Google Scholar] [CrossRef]

- Rose, A.K. Soft power and exports. Rev. Int. Econ. 2019, 27, 1573–1590. [Google Scholar] [CrossRef]

- Kaufmann, D. Worldwide Governance Indicators. 2019. Available online: http://info.worldbank.org/governance/wgi/Home/downLoadFile?fileName=wgidataset_stata.zip (accessed on 12 October 2019).

- Anderson, J.E.; Wincoop, E.V. Trade cost. J. Econ. Lit. 2004, 42, 691–751. [Google Scholar] [CrossRef]

- Eichengreen, B.; Leblang, D. Democracy and globalization. Econ. Pol. 2008, 20, 289–334. [Google Scholar] [CrossRef]

- Helpman, E.; Melitz, M.; Rubinstein, Y. Estimating trade flows: Trading partners and trading volumes. Q. J. Econ. 2008, 123, 441–487. [Google Scholar] [CrossRef]

- Eaton, J.; Tamura, A. Bilateralism and Regionalism in Japanese and U.S. Trade and Direct Foreign Investment Patterns. J. Jpn. Int. Econ. 1994, 8, 478–510. [Google Scholar] [CrossRef]

- Silva, J.M.C.S.; Tenreyro, S. The log of gravity. Rev. Econ. Stat. 2006, 88, 641–658. [Google Scholar] [CrossRef]

- Costinot, A. On the origins of comparative advantage. J. Int. Econ. 2009, 77, 255–264. [Google Scholar] [CrossRef]

- Ye, Q.; Wu, Y.; Liu, J. Institutional preferences, demand shocks and the distress anomaly. Br. Account. Rev. 2019, 51, 72–91. [Google Scholar] [CrossRef]

- Acemoglu, D.; Robinson, J.A. Economic Origins of Dictatorship and Democracy; Cambridge University Press: New York, NY, USA, 2006. [Google Scholar]

- Chisadza, C.; Bittencourt, M. Economic development and democracy: The modernization hypothesis in sub-Saharan Africa. Soc. Sci. J. 2019, 56, 243–254. [Google Scholar] [CrossRef]

- Apergis, N. Education and democracy: New evidence from 161 countries. Econ. Model. 2018, 71, 59–67. [Google Scholar] [CrossRef]

| Variables | Variables | Obs. | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|---|

| ln(Exports) | Log of exports | 397,346 | 0.54 | 3.09 | −18.65 | 12.98 |

| Relative | Relatively better institutional quality | 396,241 | 0.64 | 0.48 | 0.00 | 1.00 |

| ReqEX | Regulatory quality for exporters | 341,207 | 0.13 | 1.00 | −2.65 | 2.26 |

| ReqIM | Regulatory quality for importers | 390,549 | −0.19 | 0.91 | −2.65 | 2.26 |

| ln(GDPEX) | Log of GDP for exporters | 297,261 | 11.42 | 2.22 | 4.58 | 16.69 |

| ln(GDPIM) | Log of GDP for importers | 309,055 | 11.01 | 1.92 | 5.60 | 16.69 |

| ln(GDPpcEX) | Log of GDP per capita for exporters | 367,020 | 8.84 | 1.40 | 5.18 | 11.82 |

| ln(GDPpcIM) | Log of GDP per capita for importers | 379,547 | 8.41 | 1.33 | 5.18 | 11.82 |

| ln(POPEX) | Log of population for exporters | 375,570 | 15.61 | 2.16 | 9.13 | 21.05 |

| ln(POPIM) | Log of population for importers | 384,672 | 15.48 | 2.02 | 9.13 | 21.02 |

| ln(Distance) | Log of geographic distance | 390,063 | 8.30 | 0.76 | 3.68 | 9.422 |

| Island | Island country dummy | 320,815 | 0.43 | 0.58 | 0.00 | 2.00 |

| Landl | Landlocked country dummy | 320,815 | 0.41 | 0.57 | 0.00 | 2.00 |

| Border | Land border dummy | 390,063 | 0.02 | 0.12 | 0.00 | 1.00 |

| Colony | Dummy for trade partners who had previous colonial relationship | 390,063 | 0.01 | 0.09 | 0.00 | 1.00 |

| Comlang | Common language dummy | 390,063 | 0.17 | 0.38 | 0.00 | 1.00 |

| Curruinon | Currency union dummy | 390,063 | 0.02 | 0.12 | 0.00 | 1.00 |

| RTA | Regional trade agreement dummy | 390,063 | 0.09 | 0.29 | 0.00 | 1.00 |

| TRpriceEX | Trade price level for exporters | 397,346 | 0.94 | 0.56 | 0.00 | 2.22 |

| TRpriceIM | Trade price level for importers | 397,346 | 0.96 | 0.53 | 0.00 | 2.22 |

| ln(Exports) | Relative | ReqEX | ReqIM | ln(GDPEX) | ln(GDPIM) | ln(Distance) | |

|---|---|---|---|---|---|---|---|

| ln(Exports) | 1 | ||||||

| p-value | n/a | ||||||

| Relative | 0.1047 | 1 | |||||

| p-value | (0.0000) | n/a | |||||

| ReqEX | 0.3215 | 0.5835 | 1 | ||||

| p-value | (0.0000) | (0.0000) | n/a | ||||

| ReqIM | 0.1374 | −0.4590 | 0.0213 | 1 | |||

| p-value | (0.0000) | (0.0000) | (0.0000) | n/a | |||

| ln(GDPEX) | 0.4660 | 0.1606 | 0.3420 | 0.0339 | 1 | ||

| p-value | (0.0000) | (0.0000) | (0.0000) | (0.0000) | n/a | ||

| ln(GDPIM) | 0.2705 | −0.1247 | −0.0001 | 0.2739 | 0.0206 | 1 | |

| p-value | (0.0000) | (0.0000) | (0.9608) | (0.0000) | (0.0000) | n/a | |

| ln(Distance) | −0.2237 | 0.0384 | 0.0080 | −0.0658 | −0.0287 | −0.0011 | 1 |

| p-value | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | 0.5315 | n/a |

| (1) | (2) | (3) | (4) | (6) | |

|---|---|---|---|---|---|

| Variables | OLS ln(Exports) | OLS ln(Exports) | OLS ln(Exports) | OLS ln(Exports) | OLS ln(Exports) |

| Relative | 0.238 *** | 0.238 *** | 0.303 *** | 0.394 *** | 0.372 *** |

| (0.017) | (0.017) | (0.019) | (0.019) | (0.019) | |

| ReqEX | 0.939 *** | 0.939 *** | 0.600 *** | 0.573 *** | 0.531 *** |

| (0.007) | (0.007) | (0.008) | (0.008) | (0.008) | |

| ReqIM | 0.564 *** | 0.564 *** | 0.427 *** | 0.357 *** | 0.308 *** |

| (0.007) | (0.008) | (0.008) | (0.009) | (0.009) | |

| ln(GDPEX) | 0.676 *** | 0.633 *** | 0.636 *** | ||

| (0.003) | (0.003) | (0.003) | |||

| ln(GDPIM) | 0.512 *** | 0.520 *** | 0.521 *** | ||

| (0.003) | (0.003) | (0.003) | |||

| ln(Distance) | −0.821 *** | −0.645 *** | |||

| (0.008) | (0.009) | ||||

| Island | 0.082 *** | 0.042 *** | |||

| (0.013) | (0.013) | ||||

| Landl | −0.247 *** | −0.210 *** | |||

| (0.010) | (0.010) | ||||

| Border | 1.675 *** | 1.330 *** | |||

| (0.047) | (0.047) | ||||

| Colony | 1.514 *** | ||||

| (0.034) | |||||

| Comlang | 0.452 *** | ||||

| (0.015) | |||||

| Curruinon | 0.603 *** | ||||

| (0.042) | |||||

| RTA | 0.804 *** | ||||

| (0.020) | |||||

| Constant | 0.457 *** | 0.457 *** | −12.692 *** | −5.518 *** | −7.177 *** |

| (0.010) | (0.010) | (0.047) | (0.081) | (0.086) | |

| Observations | 335,445 | 335,445 | 224,671 | 184,631 | 184,631 |

| R-squared | 0.126 | 0.126 | 0.416 | 0.479 | 0.490 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | FE ln(Exports) | FE ln(Exports) | FE ln(Exports) | FE ln(Exports) | FE ln(Exports) |

| Relative | 0.045 *** | 0.054 *** | 0.054 *** | 0.065 *** | 0.064 *** |

| (0.015) | (0.015) | (0.021) | (0.021) | (0.021) | |

| ReqEX | 0.495 *** | 0.133 *** | 0.133 *** | 0.059 ** | 0.060 ** |

| (0.011) | (0.015) | (0.025) | (0.026) | (0.026) | |

| ReqIM | 0.237 *** | 0.044 *** | 0.044 ** | 0.009 | 0.008 |

| (0.011) | (0.013) | (0.021) | (0.022) | (0.022) | |

| ln(GDPEX) | 0.464 *** | 0.463 *** | |||

| (0.033) | (0.033) | ||||

| ln(GDPIM) | 0.103 *** | 0.100 *** | |||

| (0.030) | (0.030) | ||||

| Curruinon | 0.323 *** | ||||

| (0.055) | |||||

| RTA | 0.115 *** | ||||

| (0.025) | |||||

| Constant | 0.349 *** | 0.424 *** | 0.424 *** | −4.341 *** | −4.310 *** |

| (0.022) | (0.016) | (0.020) | (0.365) | (0.365) | |

| Year FE | Y | Y | Y | Y | Y |

| Country FE | N | Y | Y | Y | Y |

| Observations | 335,445 | 335,445 | 335,445 | 309,555 | 308,253 |

| R-squared | 0.004 | 0.006 | 0.006 | 0.009 | 0.009 |

| Number of paired | 33,380 | 33,380 | 33,380 | 31,090 | 30,762 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Treatment (2) ln(Exports) | First stage | Treatment (2) ln(Exports) | First stage |

| Relative | 0.977 *** | 1.056 *** | ||

| (0.037) | (0.036) | |||

| Better than median | 1.612 *** | |||

| (0.008) | ||||

| Better than average | 1.596 *** | |||

| (0.008) | ||||

| ReqEX | 0.048 * | 0.031 | ||

| (0.028) | (0.028) | |||

| ReqIM | 0.096 *** | 0.097 *** | ||

| (0.023) | (0.023) | |||

| ln(GDPEX) | −0.164 *** | 0.048 *** | −0.166 *** | 0.050 *** |

| (0.036) | (0.002) | (0.036) | (0.002) | |

| ln(GDPIM) | 0.251 *** | −0.115 *** | 0.254 *** | −0.114 *** |

| (0.033) | (0.002) | (0.033) | (0.002) | |

| ln(Distance) | −1.066 *** | 0.110 *** | −1.067 *** | 0.103 *** |

| (0.010) | (0.005) | (0.010) | (0.005) | |

| Island | 0.093 | −0.182 *** | 0.090 | −0.178 *** |

| (0.226) | (0.008) | (0.226) | (0.008) | |

| Landl | 0.395 * | 0.210 *** | 0.390 * | 0.197 *** |

| (0.209) | (0.006) | (0.209) | (0.006) | |

| Border | 0.534 *** | 0.143 *** | 0.533 *** | 0.144 *** |

| (0.045) | (0.029) | (0.046) | (0.028) | |

| Colony | 1.030 *** | 0.218 *** | 1.032 *** | 0.193 *** |

| (0.038) | (0.045) | (0.038) | (0.045) | |

| Comlang | 0.245 *** | 0.194 *** | 0.240 *** | 0.204 *** |

| (0.018) | (0.010) | (0.018) | (0.010) | |

| Curruinon | −0.088 ** | −0.392 *** | −0.072 * | −0.422 *** |

| (0.043) | (0.027) | (0.043) | (0.026) | |

| RTA | 0.462 *** | −0.227 *** | 0.467 *** | −0.253 *** |

| (0.020) | (0.012) | (0.020) | (0.012) | |

| Year dummy | Y | Y | ||

| Country dummy | Y | Y | ||

| Observations | 184,631 | 184,631 | 184,631 | 184,631 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | Fixed Effect ln(Exports+1) | Tobit ln(Exports) | Poisson ln(Exports+1) | PPLM ln(Exports+1) | HMR ln(Exports) |

| Relative | 0.054 *** | 0.909 *** | 0.077 *** | 0.068 *** | 0.140 *** |

| (0.018) | (0.052) | (0.006) | (0.006) | (0.165) | |

| ReqEX | 0.004 | 0.483 *** | −0.054 *** | −0.050 *** | 0.051 ** |

| (0.022) | (0.078) | (0.009) | (0.010) | (0.025) | |

| ReqIM | 0.188 *** | 0.031 | 0.060 *** | 0.103 *** | 0.032 ** |

| (0.020) | (0.072) | (0.007) | (0.002) | (0.008) | |

| ln(GDPEX) | 0.316 *** | −0.781 *** | 0.349 *** | 0.301 *** | 0.219 *** |

| (0.039) | (0.107) | (0.015) | (0.009) | (0.022) | |

| ln(GDPIM) | 0.522 *** | −0.007 | 0.214 *** | 0.230 *** | 0.345 *** |

| (0.032) | (0.104) | (0.012) | (0.001) | (0.005) | |

| Curruinon | 0.202 *** | −0.639 *** | 0.090 *** | 0.143 *** | −0.162 *** |

| (0.049) | (0.148) | (0.014) | (0.013) | (0.048) | |

| RTA | 0.066 | 0.414 *** | 0.041 *** | 0.063 *** | −0.050 *** |

| (0.014) | (0.063) | (0.005) | (0.005) | (0.019) | |

| Year FE | Y | Y | Y | Y | Y |

| Country FE | Y | Y | Y | Y | Y |

| R-squared/Pseudo R2 | 0.43 | 0.08 | 0.38 | 0.73 | 0.618 |

| Observations | 118,286 | 118,286 | 118,286 | 118,286 | 179,702 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | FE ln(Exports) | FE ln(Exports) | FE ln(Exports) | IV ln(Exports) | IV ln(Exports) |

| Relative | 0.070 *** | 0.020 | 0.076 ** | 0.045 ** | 0.046 ** |

| (0.022) | (0.027) | (0.030) | (0.022) | (0.022) | |

| ReqEX | 0.060 ** | 0.023 | 0.002 | 0.166 *** | 0.152 *** |

| (0.026) | (0.033) | (0.040) | (0.026) | (0.026) | |

| ReqIM | 0.009 | 0.026 | −0.002 | 0.051 ** | 0.050 ** |

| (0.022) | (0.029) | (0.038) | (0.022) | (0.022) | |

| ln(GDPpcEX) | 0.465 *** | 0.237 *** | 0.344 *** | ||

| (0.033) | (0.066) | (0.039) | |||

| ln(GDPpcIM) | 0.098 *** | 0.084 | 0.154 *** | ||

| (0.030) | (0.054) | (0.040) | |||

| Curruinon | 0.326 *** | 0.264 *** | 0.130 | 0.412 *** | 0.410 *** |

| (0.057) | (0.090) | (0.083) | (0.059) | (0.059) | |

| RTA | 0.124 *** | 0.209 *** | −0.043 | 0.133 *** | 0.126 *** |

| (0.026) | (0.040) | (0.032) | (0.026) | (0.026) | |

| TRpriceEX | 1.116 *** | ||||

| (0.083) | |||||

| TRpriceEX | 0.350 *** | ||||

| (0.065) | |||||

| ln(POPEX) | −0.525 *** | −0.554 *** | |||

| (0.084) | (0.083) | ||||

| ln(POPIM) | 0.602 *** | 0.591 *** | |||

| (0.065) | (0.065) | ||||

| Observations | 255,581 | 76,649 | 165,891 | 259,710 | 259,710 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Restrict Exporter’s GDP Ln(Exports) | Restrict Importer’s GDP ln(Exports) | Restrict ln(Exports) ln(Exports) | Restrict ln(Distance) ln(Exports) |

| Relative | 0.060 ** | 0.067 *** | 0.049 ** | 0.064 ** |

| (0.025) | (0.024) | (0.020) | (0.027) | |

| ReqEX | 0.051 | 0.055 ** | −0.086 *** | 0.051 * |

| (0.031) | (0.027) | (0.027) | (0.031) | |

| ReqIM | −0.011 | −0.011 | 0.231 *** | 0.044 * |

| (0.028) | (0.023) | (0.024) | (0.025) | |

| ln(GDPpcEX) | 0.406 *** | 0.468 *** | −0.022 | 0.486 *** |

| (0.046) | (0.035) | (0.029) | (0.041) | |

| ln(GDPpcIM) | −0.017 | 0.082 ** | 0.270 *** | 0.072 * |

| (0.040) | (0.033) | (0.026) | (0.040) | |

| Curruinon | 0.471 *** | 0.439 *** | −0.057 | 0.018 |

| (0.154) | (0.069) | (0.036) | (0.248) | |

| RTA | 0.162 *** | 0.141 *** | 0.015 | 0.198 *** |

| (0.043) | (0.027) | (0.014) | (0.036) | |

| Observations | 173,266 | 173,266 | 173,266 | 173,266 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, W.; Yang, X. A New Motivation for Sustainable Trade Between Countries with Different Regulatory Qualities. Sustainability 2020, 12, 209. https://doi.org/10.3390/su12010209

Yan W, Yang X. A New Motivation for Sustainable Trade Between Countries with Different Regulatory Qualities. Sustainability. 2020; 12(1):209. https://doi.org/10.3390/su12010209

Chicago/Turabian StyleYan, Wenshou, and Xi Yang. 2020. "A New Motivation for Sustainable Trade Between Countries with Different Regulatory Qualities" Sustainability 12, no. 1: 209. https://doi.org/10.3390/su12010209

APA StyleYan, W., & Yang, X. (2020). A New Motivation for Sustainable Trade Between Countries with Different Regulatory Qualities. Sustainability, 12(1), 209. https://doi.org/10.3390/su12010209