3.1. Linear PCA for Visualization of NPLs and Government Debt

As the first data analysis, linear PCA is used to process the NPLs ratio and the government-to-GDP ratio of 30 sample countries. In particular, the linear PCA variance proportion and cumulative variance proportion results of 30 countries’ NPLs are shown in

Table 1, corresponding to NPLs classification. Each principal component represents its percentage contribution to the whole density variation. The ranking of the principal components explains the density variation based on the corresponding contribution of each factor. It can be seen that the dimensions of NPLs characteristic data are dropped to three dimensions. In particular, the first dominant principal component (PC1) accounts for 53.07%, the second principal component (PC2) explains another 23.73% of variability and the third principal component (PC3) explains 12.64% of the whole variance proportion for FPCA. The variance contribution rate of the first three principal components together account for 89.43% of the whole variability (to take the cumulative proportion that is more than 85%). The results show that the first three principal components reflect 89.43% of the total information in the original index, and the data characteristics of the NPLs ratio can be well described by the first three principal components, which has a good extraction effect.

Similarly, the linear PCA variance proportion and cumulative variance proportion results of 30 sample countries in government-to-GDP ratios explained by the components are shown in

Table 2. The first dominant principal component (PC1) accounts for 72.67%, the second principal component (PC2) explains 18.21%, and the third principal component (PC3) explains 4.56% of the whole variance proportion for FPCA. The first three principal components account for 95.44% of the whole variability, and the cumulative variance contribution rate is above 95%. The results show that the first three principal components reflect 95.44% of the total information in the original index, and the data characteristics of the government-to-GDP ratio can be well described by the first three principal components.

According to the principle of PCA, it is clear that the principal component is a linear combination of the original NPLs (or government-to-GDP ratio) data.

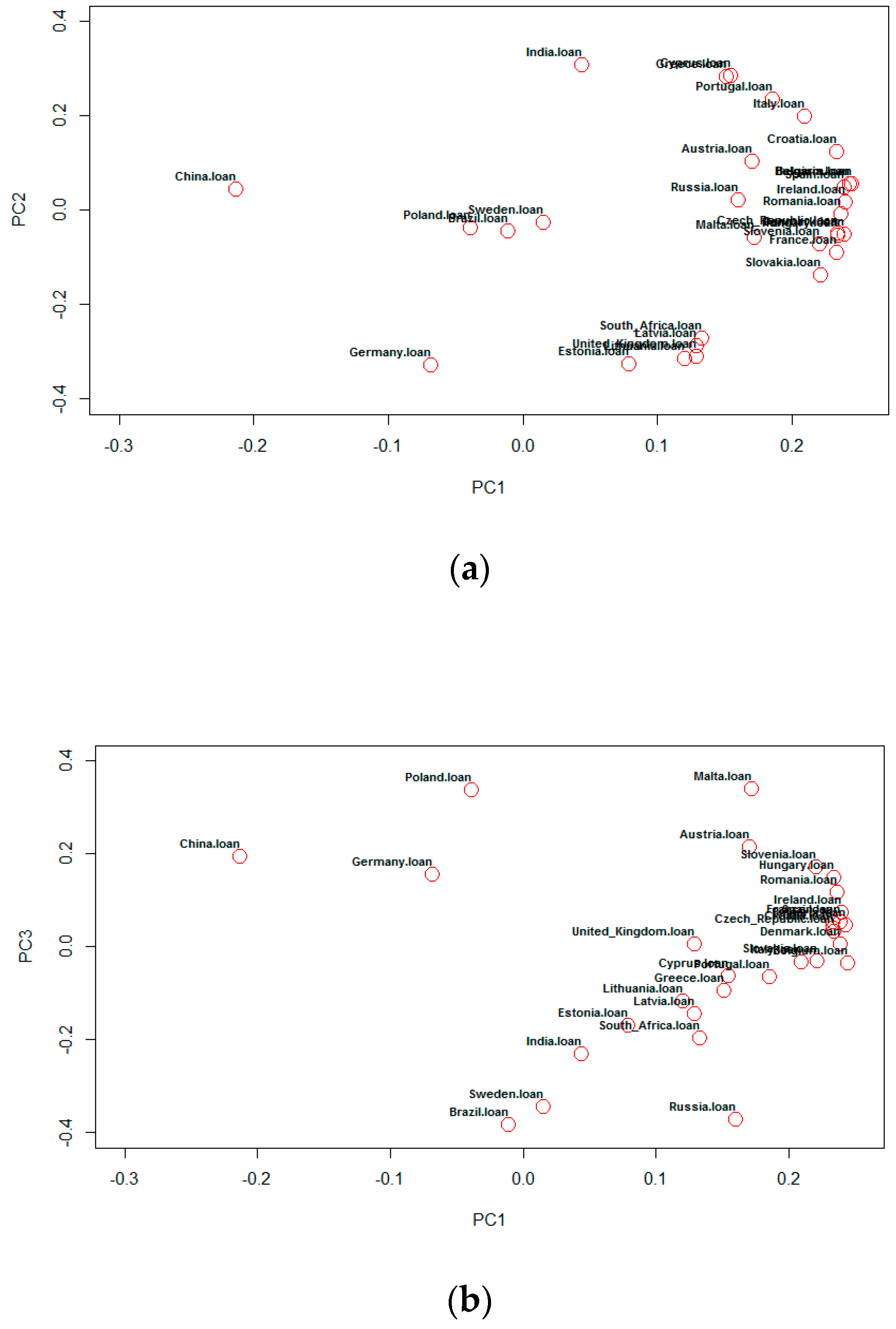

Figure 1a–c shows the two-dimensional scatter plots of the 30 countries’ bank NPLs data in the first three principal component (PC1, PC2 and PC3) plane, the position of each country is represented by a red circle. The classification results of NPLs for different countries can be seen from the plane view.

The scatter plot in

Figure 1a shows that on the upper half of the horseshoe, there are more sample countries with higher NPLs, although the situation is different in some countries, such as China, India, Brazil, Poland, Germany, Sweden, South Africa and so on. Distinctions between the debt levels of these countries are mainly reflected by PC1. For the lower horseshoe half, it can be stated that PC1 reflects differences in lower bank NPLs. From the classification results in

Figure 1b, it can be seen that most countries have come together, but some are very scattered. The distribution noticeably changed in

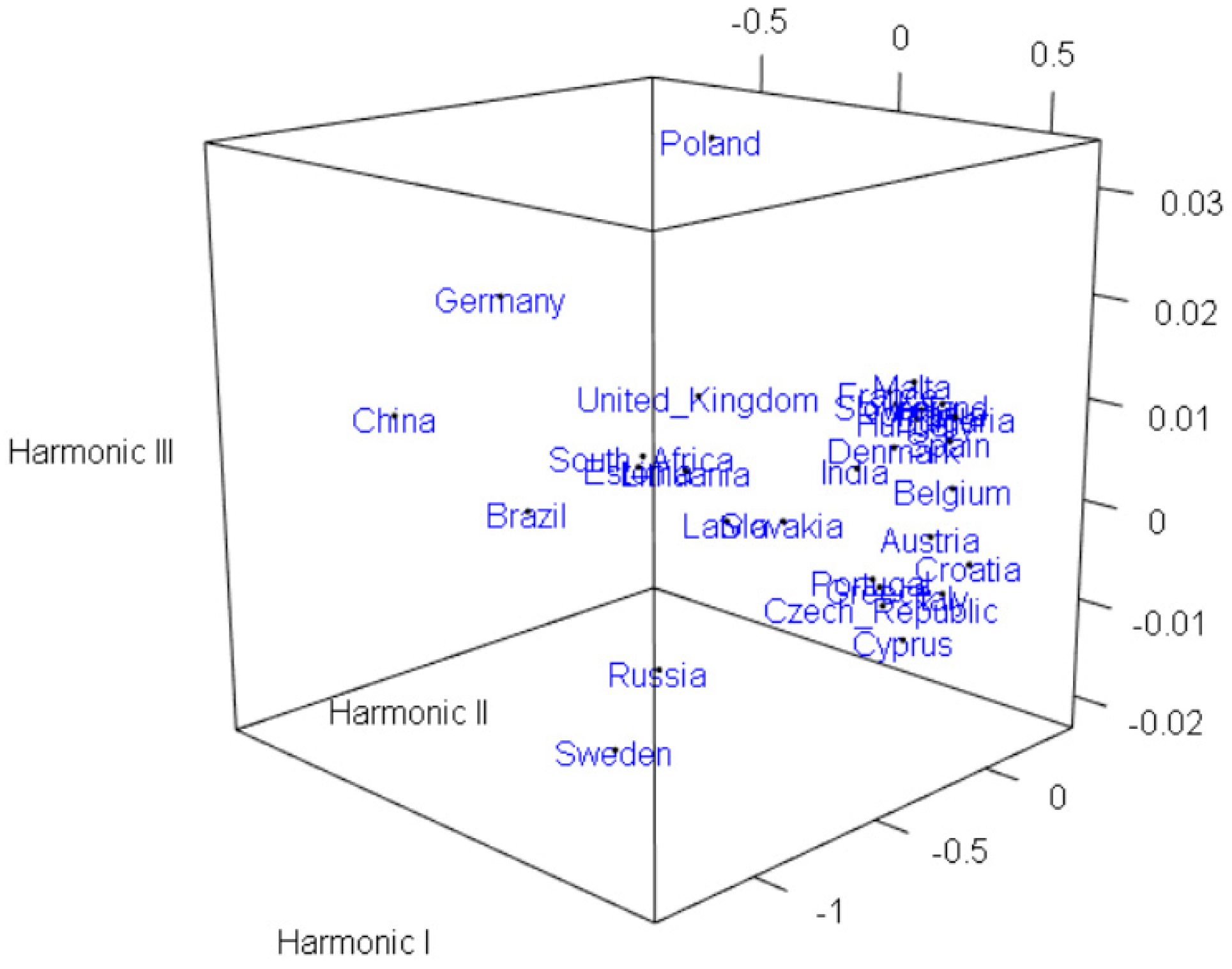

Figure 1c, where the position of each country is very scattered. However, there is a characteristic of agglomeration. To seek more detailed visualization, a 3-dimensional linear PCA plot of NPLs with the first three principal components is shown in

Figure 2.

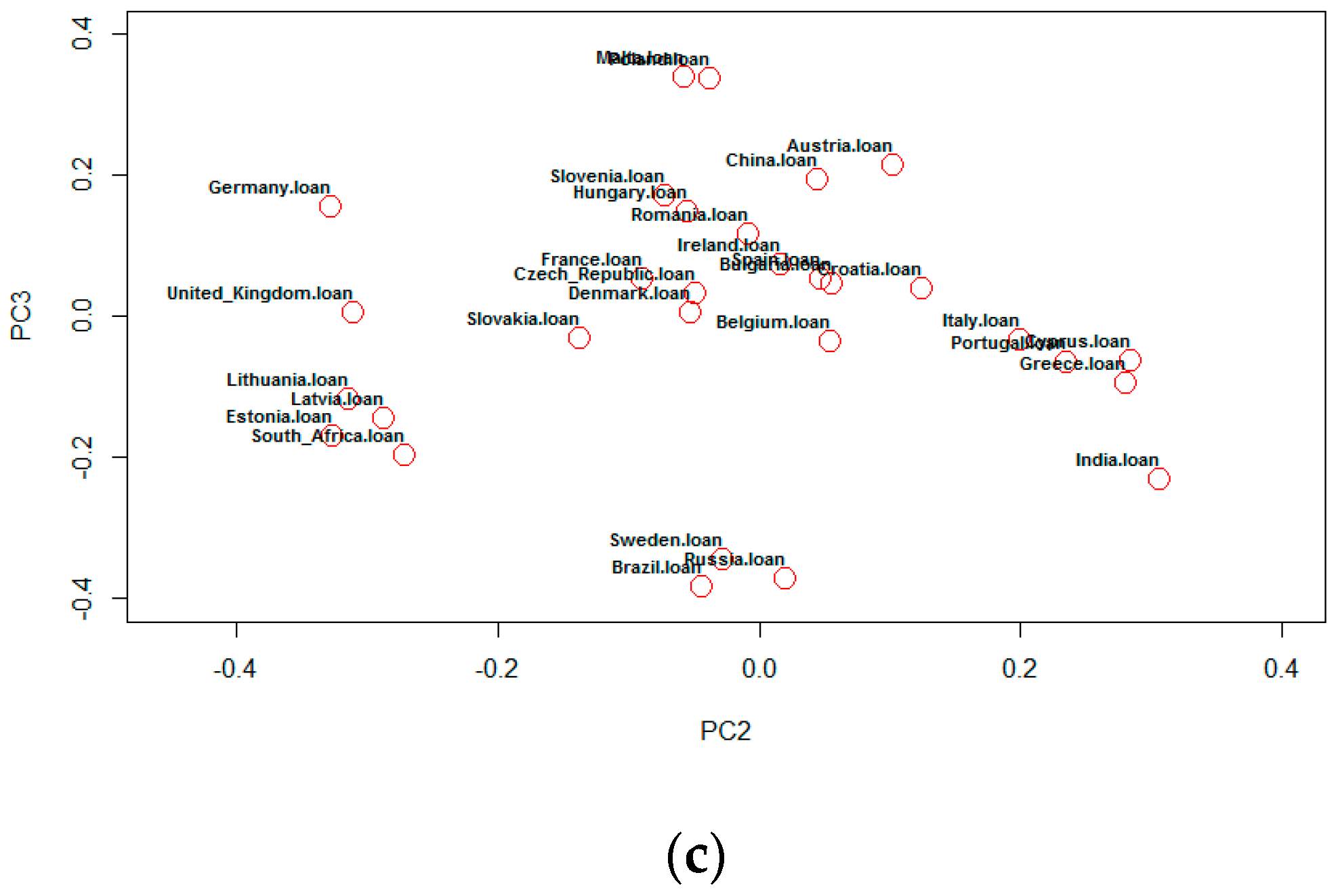

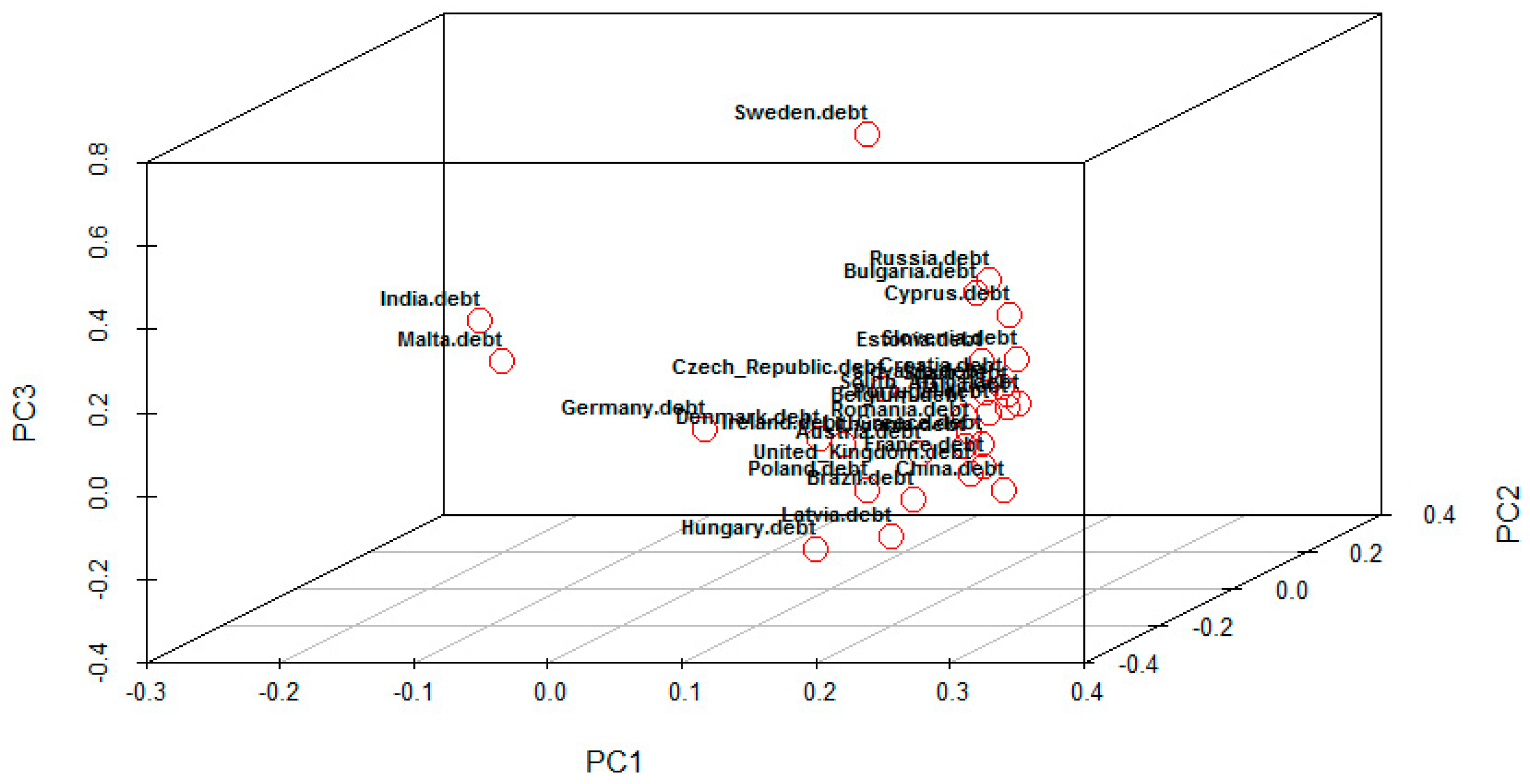

Subsequently, we applied the same method to the government-to-GDP ratio data, and the results are demonstrated in

Figure 3a–c. These figures are the scatter plots of the 30 countries’ government-to-GDP data in the principal component (PC1, PC2 and PC3) plane.

The scatter plots in

Figure 3a,b show that on the upper half of the horseshoe, there are more sample countries with higher debt, although the situation is different in some countries, such as India, Brazil, Malta, Sweden, Bulgaria and Germany. Distinctions between the debt levels of these countries are mainly reflected by PC1. For the lower horseshoe half, it can be stated that both PC1 and PC2 reflect differences in lower debt. The distribution changed noticeably in

Figure 3c, where the position of each country is very scattered. It shows that there is a very small although difference between PC2 and PC3.

Figure 4 displays this solution in the PC1–PC2–PC3 space.

It is impossible to obtain the clustering pattern of the time-course data in a given period of time because linear PCA only shows the clustering pattern of the whole data at a certain time [

23]. Thus, using the principal components extracted from PCA, it is difficult to obtain very satisfactory results. For example, the cumulative variance contribution rate of the first and second principal components in

Table 1 only reaches 76.79%. Meanwhile, it can also be found that the classification effect is not good from

Figure 1c and

Figure 3c. Therefore, it is necessary to use more effective and accurate feature extraction methods to extract more clustering patterns between data.

3.2. Functional PCA for Visualization of NPLs and Government Debt

The key part of FPCA is to decompose the density change into a set of orthogonal principal component functions that maximize the variance of each component [

23]. Therefore, a nonparametric method is used to estimate the return density function in this paper, and then the common structure is extracted from the estimated function. Moreover, given the function of Equation (5), we utilize a Fourier basis to express the smoothing function as a basis function. More particularly, we have

= 5 and

= 12 in Equation (6). Hence, the functional forms of the Fourier series are

,

,

,

and

. Here, the parameter

is

[

39].

The roughness penalty is defined by constructing a functional parameter object that consists of a basis object, a derivative order and a smoothing parameter. Subsequently, the function

fdPar in R software was used to construct the objects in this paper. We consider the compound fitting criterion as presented in Equation (9):

where

, and

presents a basis function. The smoothing parameter

can balance fitting data, and

denotes the curvature of function

at argument value

.

Then, a minimizing smoothing criterion is applied to estimate the vector of coefficients

. In particular, the generalized cross-validation (GCV) can be computed as:

where

is a measure of the effective degrees of freedom of the fit defined by smoothing parameter

, and the best value for

is the one that minimizes the criterion [

40]. Therefore, by using sample data, we calculate a smoothing parameter of

= 101.877. Considering the estimates

, we can obtain the smoothed time series

in Equation (6).

After obtaining

, the next step is to find a set of orthogonal functions

that are defined as [

38,

41]:

For instance,

can be computed by maximizing the objective function in Equation (13):

This function is restricted by the constraint . At the same time, the function is also the first principal component. There is no variation left in the time series after in this study.

Table 3 shows the proportions of variance proportion and cumulative variance proportion results in NPLs ratio explained by the components. Similar to the PCA method, every principal component represents its percentage contribution to the overall density change. Specifically, the first dominant principal component (PC1) accounts for 53.1%, the second principal component (PC2) explains 46.84%, and the third principal component (PC3) explains 0.03% of the whole variance proportion for FPCA. It is clear that the first three principal components account for 99.97% of the whole variability (to take the cumulative proportion that is more than 99%), which is close to 100%. The results demonstrate that the first three principal components reflect 99.97% of the total information in the original index, and data characteristics of the NPLs ratio can be well described by the first three principal components. In addition, comparing

Table 1 and

Table 3, it is found that two kinds of the variance contribution rate of the first three principal components obtained by FPCA and PCA differ in nearly 10% points, and the variance contribution rate of the first three principal components obtained by FPCA is significantly higher than PCA. From the above analysis, it can be found that the first three principal components obtained by FPCA have a good dimensionality reduction effect, and the first three principal components contain more data information.

Similarly, the proportions of variance proportion and cumulative variance proportion results of total variation in the government-to-GDP ratio explained by the components are shown in

Table 4. Specifically, the first dominant principal component (PC1 or Harmonic I) accounts for 61.75%, the second principal component (PC2 or Harmonic II) explains 38.2%, and the third principal component (PC3 or Harmonic III) explains 0.02% of the whole variance proportion for FPCA. From

Table 4, it can be found that the effect of using FPCA for data dimensionality reduction is obvious; the first three principal components account for 99.99% of the whole variability (to take the cumulative proportion that is more than 99%), which is close to 100%. The results demonstrate that the first three principal components reflect 99.99% of the total information in the original index, and data characteristics of the government-to-GDP ratio can be well described by the first three principal components. In addition, a comparison of

Table 2 and

Table 4 shows that the effect of the first three principal components obtained by FPCA is significantly better than the results obtained by PCA.

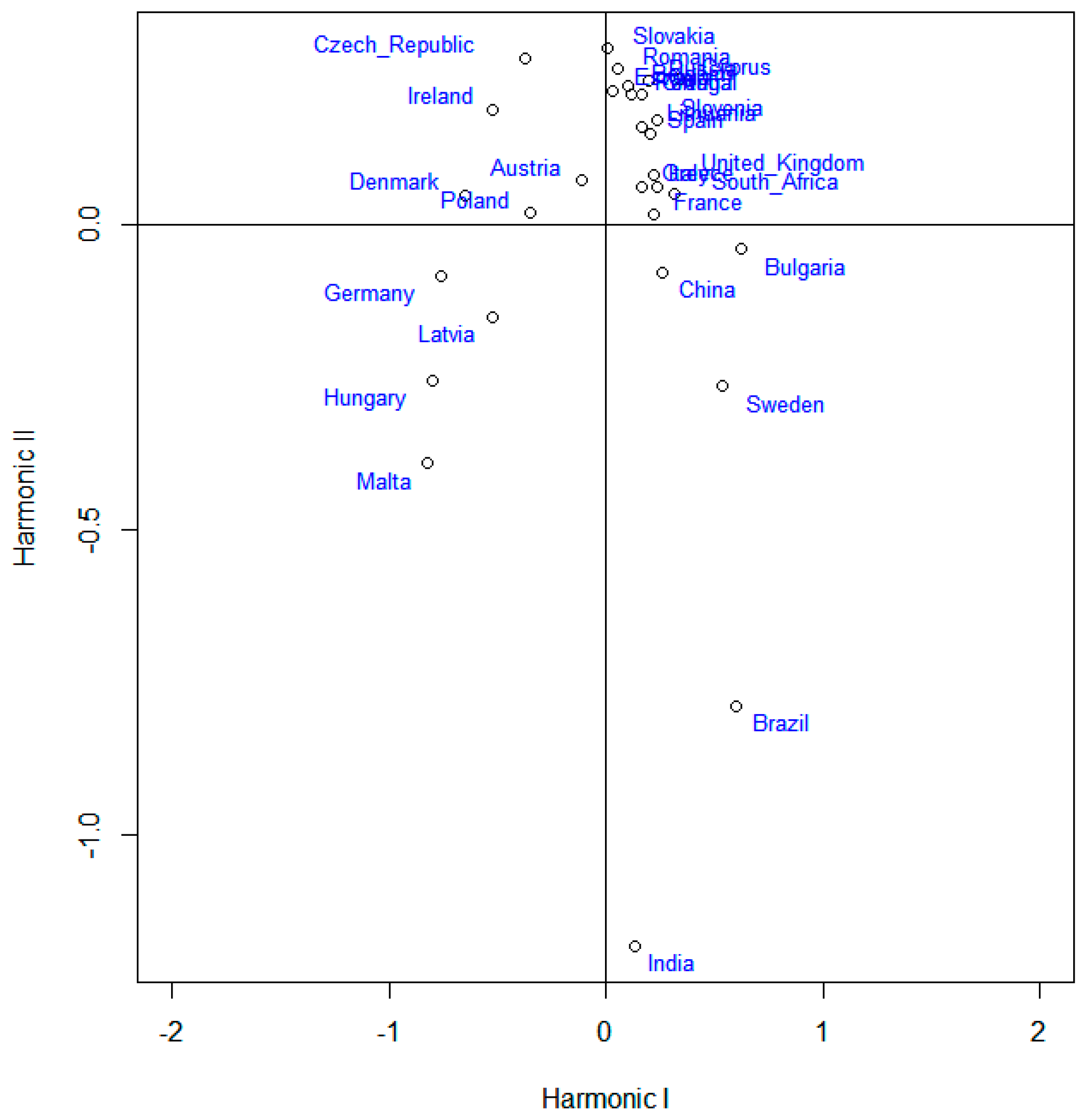

A 2-dimensional scatter plot of the 30 countries’ NPLs data in the first two principal component planes by using FPCA is shown in

Figure 5. We use the values provided by the principal components to describe the results in the scatter plot.

The 2D FPCA plot can capture a view of the clusters among NPLs. Through visualizations, we show the relationship of NPLs among the 30 countries. Subsequently, we classified those countries into four groups in

Table 5 based on

Figure 5.

The NPLs classifications of Group 1, Group 2, Group 3 and Group 4 in

Table 5 correspond to the first, second, third and fourth quadrants in

Figure 5, one by one. From the classification results of

Table 5, we know that EU countries located in the same region are mostly grouped in the same group. For example, the four countries in Group 2 are located in Southern Europe except for India, and the NPLs in those countries’ banks are so high that the stability of the banking system would be threatened. Non-performing loans and low profit margins are seen as one of the largest problems facing European banks. Due to the threat of crisis in the region, non-performing loans are concentrated in economies, such as Italy, that have underperformed in the past decade. In Italy, 17% of bank loans are bad loans, almost 10 times that of the United States. Even in the worst stage of the financial crisis in 2008–2009, the non-performing loan ratio of the US banking industry was only 5%. Italian banks account for about half of the total non-performing loans of listed banks in the euro area. The non-performing loan ratio of Greek banks is 18.5% at the end of the first quarter of 2012, and this figure does not include the huge loan exposure of banks to the Greek government. Greece’s banks lent 16 billion euros to the government and held 24 billion euros in government bonds, which are bound to default if official Greek creditors refuse to extend more aid. Data from the Central Bank of Portugal recently showed that the non-performing loans from banks to the private sector and households had been on the rise, reaching 14.37 billion euros by June 2012, accounting for 5.82% of the total loans from private enterprises and households, 52% of which belonged to the housing, construction and real estate industries.

The countries of Group 2 have experienced serious debt crisis, except India, and the banking system industry has been greatly impacted. Some of the countries in Group 1 have had debt crises, some have not, but banks have a large number of non-performing loans is their common feature. Consistent with Group 1, the scale of non-performing loans in these countries in Group 2 is also very large, but it is smaller than that in the Group 1, and the banks in these countries are more vulnerable in the economic recession. Most South and Western European countries are in Group 1, and these countries also face high NPLs. In addition, the NPLs of the countries in Group 3 and Group 4 are slightly better than in the previous countries, suggesting that the assets and risk-bearing capacity of banks in Central European, Northern European, Eastern European and BRICS countries are in good condition. In addition, in order to capture the detailed visualization, a 3-dimensional FPCA plot of NPLs with the first three principal components is provided in

Figure 6. The spots in the figure show obvious clusters of NPLs data in the 30 countries, implying that those time series data move together over the sample period.

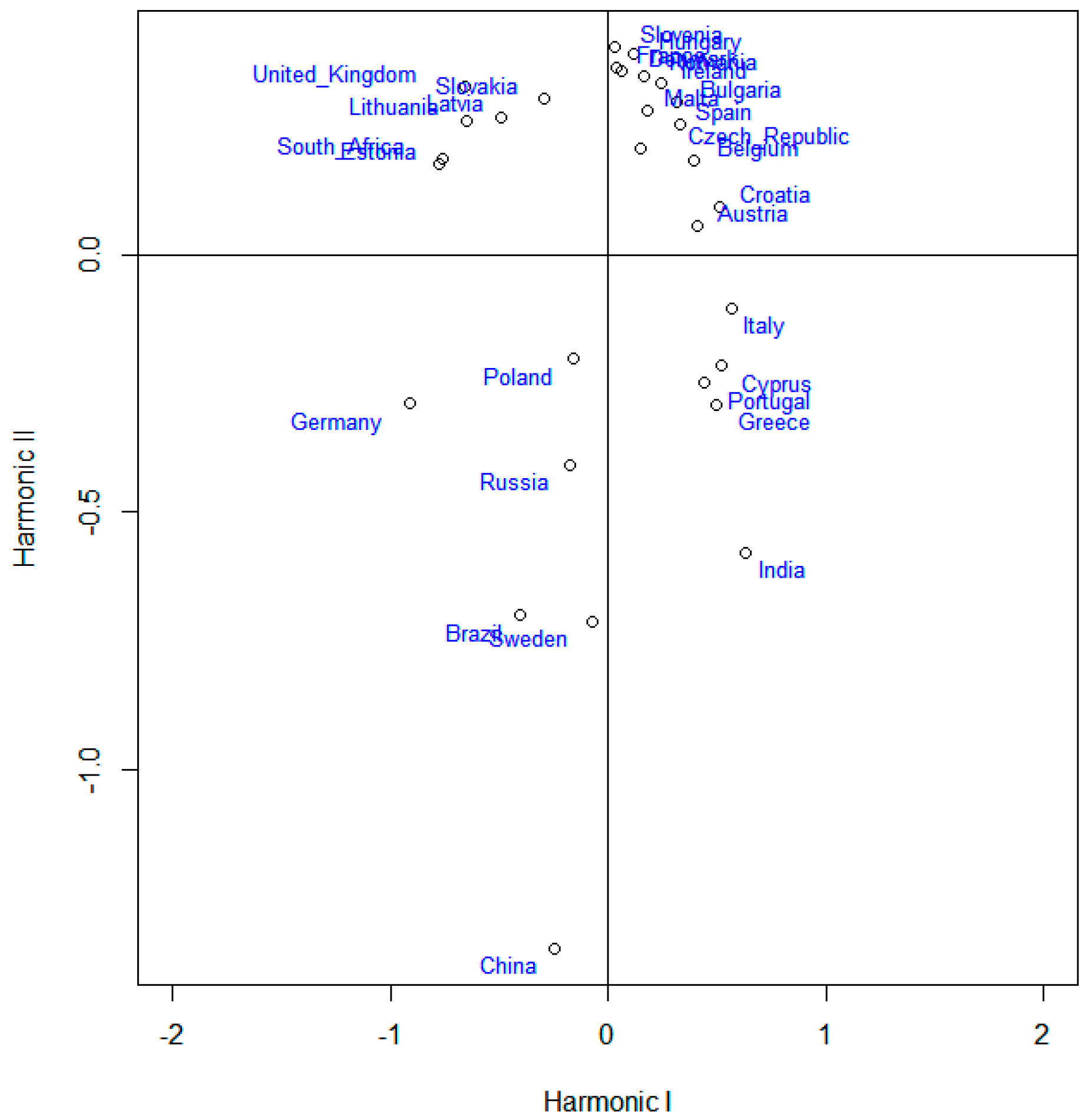

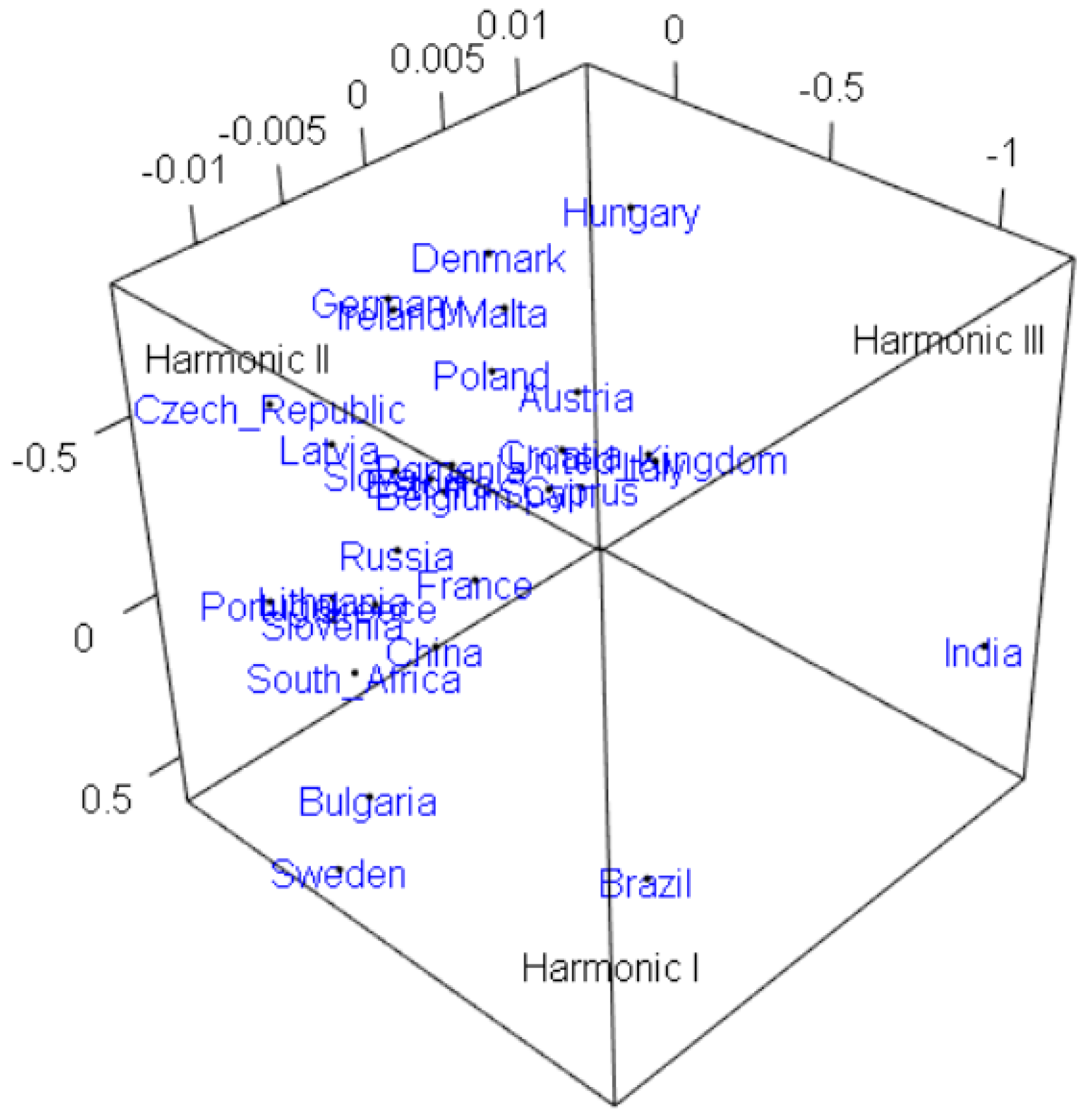

Similarly, a 2-dimensional scatter plot of the 30 countries’ government-to-GDP ratio data in the first two principal component planes constructed by using FPCA is shown in

Figure 7. In addition,

Figure 8 shows a 3-dimensional FPCA plot of government-to-GDP ratio with the first three principal components.

The government-to-GDP ratio classifications of Group 1, Group 2, Group 3 and Group 4 in

Table 6 correspond to the first, second, third and fourth quadrants in

Figure 7, one by one. As can be seen from

Table 6, the vast majority of EU countries that are located in Southern and Western Europe are in the first group except for Ireland and Bulgaria, and these countries had large-scale government debts after the financial crisis and the European sovereign debt crisis. The first recorded instance of a government debt default occurred in Greece, followed by Italy, Portugal, Spain and other EU countries. It should be noted that Russia and South Africa are also in the first group, which means that Russia and South Africa have similar government debt characteristics to the country of Group 1.

By analyzing Group 1, we found that the wage levels of Greece, Ireland, Portugal, Spain and Italy increased by 16.5%, 12%, 7%, 8% and 3% respectively in 2000–2008, based on the range of wage changes in Germany. If we take into account the difference of labor productivity between the above five countries and Germany, the relative increase of labor cost among the five countries in the European debt crisis from 2000 to 2008 has reached a high level of 25% to 47%. Greece and other countries with the rising labor costs, at the same time, the internal real exchange rate also rose significantly. The real exchange rates of Ireland, Greece, Spain, Italy and Portugal rose by 50%, 27%, 31%, 34% and 24% respectively, compared with Germany from 2000 to 2008. Due to the unification of monetary policy, the financing cost of peripheral countries with weak monetary strength has dropped significantly (the interest rate difference between Greek long-term bonds and German bonds has dropped from more than ten percentage points to less than 0.5 percentage points), which has significantly improved the financing capacity of peripheral countries in the euro area such as Greece. The euro system of unified monetary policy and decentralized fiscal policy encourages fiscal “free riding” of all countries, which leads to the moral hazard of large-scale and sustained fiscal deficit, and leads to the institutional continuous accumulation of government debt of Greece and other countries. Under the euro system, the unified currency fixes the exchange rate risk, the financial integration fixes the inflation risk, and the government can continue to obtain low-cost debt financing in the financial market. Therefore, governments only need to expand finance to achieve the growth goal, and the result is the excessive expansion of government debt. The government could not pay its debts once the economy of these countries was exposed to external shocks that disrupted market functioning, and this bad debt deteriorated the quality of the banks’ assets.

Germany is the main engine of euro-zone growth, and the sovereign debt crisis in Greece has gradually spread to Germany. The government-to-GDP ratio of German has risen to 79.844% in 2012. During the 2008 economic crisis, in order to get rid of the recession, Latvia received international loan assistance provided by the European Union and the International Monetary Fund (IMF) in 2009, which made Latvia face huge foreign debt pressure, and the debt level rose, accounting for 46.8% of GDP in 2010. In 2011, the government-to-GDP ratio of Hungary was 80.481% and the 10-year bond yield also exceeded 8%. In addition, influenced by the European sovereign debt crisis, Hungary’s export scale has been significantly reduced which suggests that the outlook for economic growth has worsened. Therefore, although there is no serious debt crisis in the countries of Group 3, their government-to-GDP ratio is still relatively high, threatening the economic development.

As a super sovereign currency, the issuing right of euro can only be controlled by the European Central Bank, and the central banks of member countries have no right to issue euro, so they lose the basis of regulating their currency circulation. Although Bulgaria and Sweden are European Union countries, they are not euro area countries, so they have the right to issue money, which means they have the right to make monetary policy independently, especially for expansionary monetary policy, whether through providing discount loans to commercial banks, or relaxing the monetary root through open market business, the central bank puts new flows into the market. These countries formulated and implemented prudent monetary policies to prevent the spread of sovereign debt after the Greek sovereign debt crisis. China, Brazil and India belong to Group 2, which means they are similar to Bulgaria and Sweden.

The Czech Republic, Austria and Poland are members of the Visegrad Group. They have the right to make monetary policy independently and flexible fiscal policy, which brings stable external environment to the economy. When the debt crisis happened, these countries adjusted their monetary policy in time and adopted prudent fiscal policy, which reduced the impact of the debt crisis on their economy. However, Slovakia is also a member of the Visegrad group, but gained accession to the euro-zone in 2009, which mean its loss of independent monetary rights, thus, its government-to-GDP ratio and fiscal deficit are very high, has been greatly been affected by the sovereign debt crisis.

From the results in

Table 1,

Table 2,

Table 3 and

Table 4, it can be seen that the cumulative variance contribution rate of the first three principal components gained by FPCA is higher than the contribution rate obtained from linear PCA. A comparison of

Figure 1,

Figure 2,

Figure 3,

Figure 4,

Figure 5,

Figure 6,

Figure 7 and

Figure 8 shows that the effect of the first three principal components obtained by FPCA is significantly better than the result gained by linear PCA. Especially for NPLs data, the cumulative variance contribution rate of the first three principal components obtained by FPCA reached 99.97% compared with 89.43% by linear PCA, which differs by nearly 10 percentage points. Known from the above analysis, using the FPCA method to extract the feature is much better than the linear PCA method through visualizations for the data. In addition, the extracted principal components obtained from FPCA can retain more complex information between the data.

Through visualization, we show the relationship between the NPLs ratio and government-to-GDP ratio of the 30 sample countries. Linear PCA can explain only 89.43% and 95.44% of the whole variance proportion with three PCs in the NPLs ratio and government-to-GDP ratio, respectively, but there remains room for about 11% and 5% unexplained variation. Although an outcome classification between NPLs ratio and government-to-GDP ratio was observed from the scatter plot, in some cases, the differentiation between classes was not so clear (

Figure 1c and

Figure 3c). Almost perfect integration was obtained when we used FPCA, as shown in

Figure 5 and

Figure 7. The explanatory ability of the three PCs has been greatly improved, and they account for 99.97% and 99.99% of the whole variance proportion. It is shown that FPCA explains more of the total data variance than linear PCA, the dimension reduction effect of FPCA is good and extracted principal components contain more information.

The data indicate that government debt markets of EU countries experienced a similar trend in terms of NPLs, with the size of NPLs similar across debt markets. The NPLs ratio and government-to-GDP ratio of the 25 EU countries and BRICS countries experienced a major fluctuation during 2007–2017, and was significantly affected during the 2008 global financial crisis and the 2009 European sovereign debt crisis. With the onset of the European sovereign debt crisis, we find evidence of the decoupling of debt markets. As a result, NPLs ratio and government-to-GDP ratio for the crisis countries and non-crisis countries experienced a significant upsurge. The Greek NPLs ratio increased for the countries in crisis, especially for Portugal, where the NPLs ratio almost tripled overall. However, the impact of the sovereign debt crisis is less for non-crisis countries, because the debt markets of these countries are decoupled from the Greek market. These results are consistent with the studies by Reboredo and Ugolini [

3].

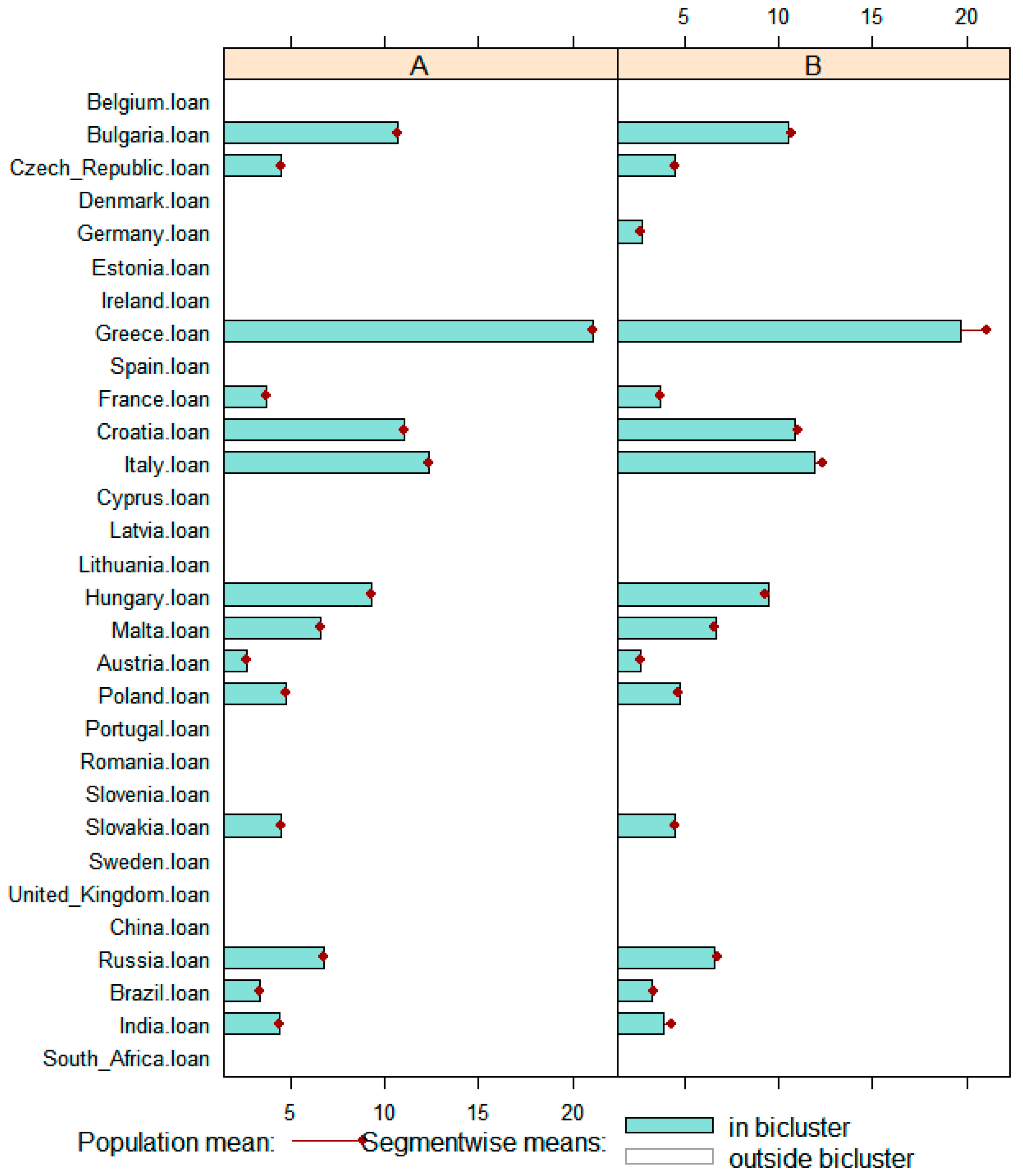

3.3. Biclustering Plot Results

Using the proposed method, we tried to find a group of countries that showed a homogeneous pattern of NPLs and government-to-GDP ratio in a certain period.

Figure 9 and

Figure 10 show the biclustering plot results of NPLs and government debt, respectively. The rows and columns of the initial matrix are rearranged so that the two biclusters can be plotted together to clearly represent the relationships between them. Meanwhile, each bicluster is represented as a white or green rectangle that can be observed visually. The red lines on those areas represent the mean value for the NPLs or government-to-GDP ratio for each country.

In particular, the biclustering plot results of the 30 countries’ NPLs is drawn in

Figure 9. Columns of bicluster A and bicluster B denote different groups of NPLs that different countries have in common. As shown in

Figure 9, bicluster A contains 14 countries in common, including Bulgaria, Czech Republic, Greece, Italy, Hungary, Malta, Austria, Poland, Slovakia, Russia, Brazil and India. Analogously, bicluster B contains 15 countries in common, including Bulgaria, Czech Republic, Germany, Greece, Italy, Hungary, Malta, Austria, Poland, Slovakia, Russia, Brazil and India; the only difference is Germany. Thus, we conclude that the EU countries in bicluster A have experienced a wide increase of NPLs, and this crisis has also spread to Russia, Brazil and India (BRICS countries). On the other hand, bicluster B includes these countries and Germany. The reason why Germany is included in bicluster B is that the NPLs in Germany are lower than in the 14 countries.

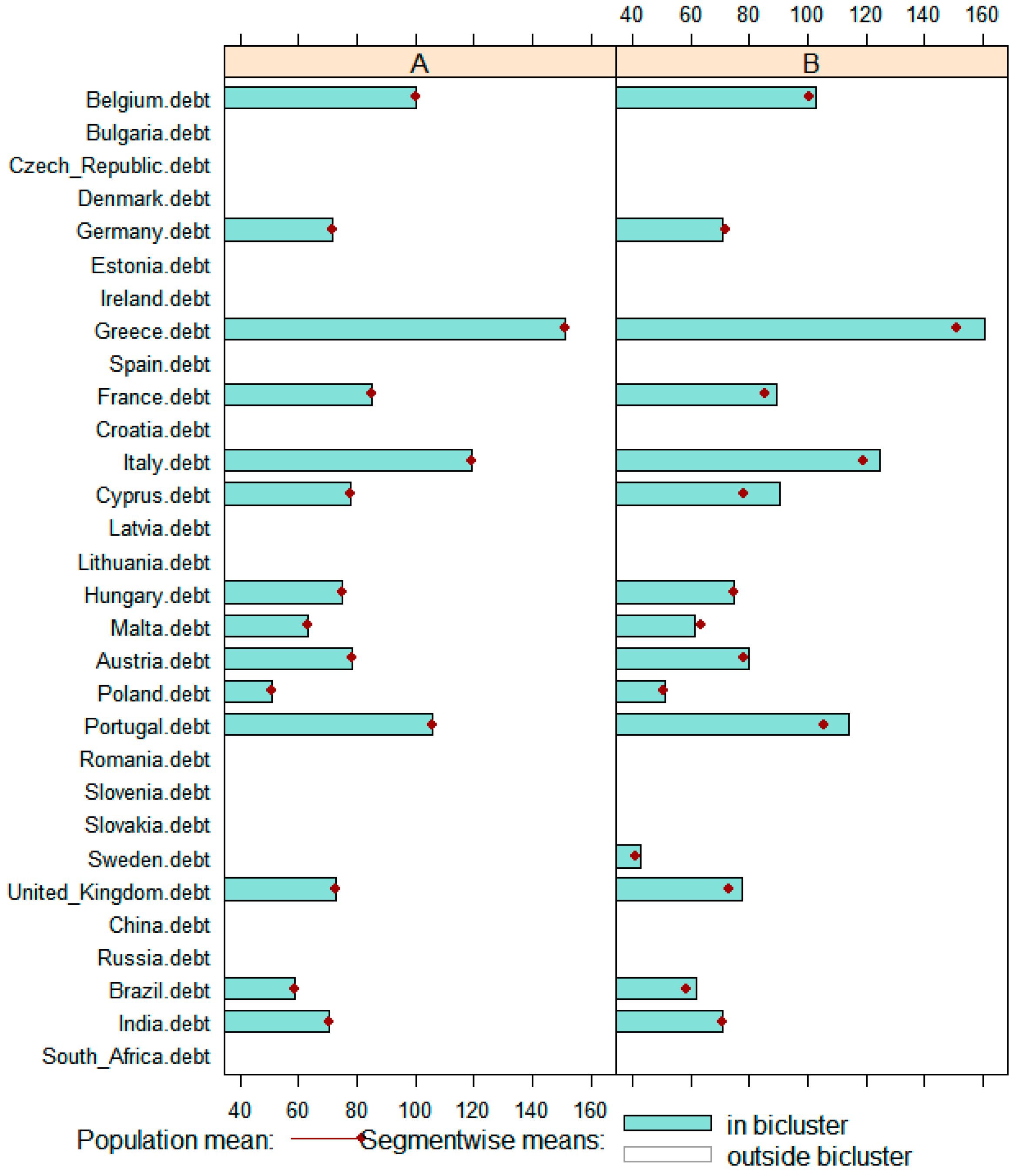

The biclustering plot results of the 30 countries’ government debt is shown in

Figure 10. As can be seen, columns of bicluster A and bicluster B denote different groups of government-to-GDP ratios that different countries have in common. Bicluster A contains 14 countries in common, including Belgium, Germany, Greece, France, Italy, Cyprus, Hungary, Malta, Austria, Poland, Portugal, United Kingdom, Brazil and India. Analogously, bicluster B contains 15 countries in common, including Belgium, Germany, Greece, France, Italy, Cyprus, Hungary, Malta, Austria, Poland, Portugal, Sweden, United Kingdom, Brazil and India; the only difference is Sweden. Therefore, the biclustering visualization results show that the EU countries in bicluster A have large-scale government debts, and this phenomenon has also spread to Brazil and India. In addition, bicluster B includes these countries as well as Sweden, because the government-to-GDP ratio of Sweden is lower than in the 14 countries.

There are many economic links between BRICS countries, just as there are similar links between EU countries. However, EU countries have much closer fiscal linkages regarding sovereign debt than BRICS countries. Before the breakout of the financial crisis and debt crisis, the NPLs ratios of EU countries in government debt markets were similar. However, government debt markets decoupled with the breakout of the debt crisis, and crisis countries are even more contagious, mainly for the countries in crisis and particularly negatively for the countries of bicluster A. As a result, the NPLs ratio increased for the government debt markets for the non-crisis countries. If a financial or sovereign debt crisis is driven by the common shocks of macroeconomic fundamentals, the level of crisis in the EU countries will be higher than that in the BRICS countries. Thus, the outbreak of the European sovereign debt crisis was because of the common vulnerability of the EU countries to major adverse events, as proposed by Ang and Longstaff [

42].