The Evaluation of the Contractor’s Risk in Implementing the Investment Projects in Construction by Using the Verbal Analysis Methods

Abstract

:1. Introduction

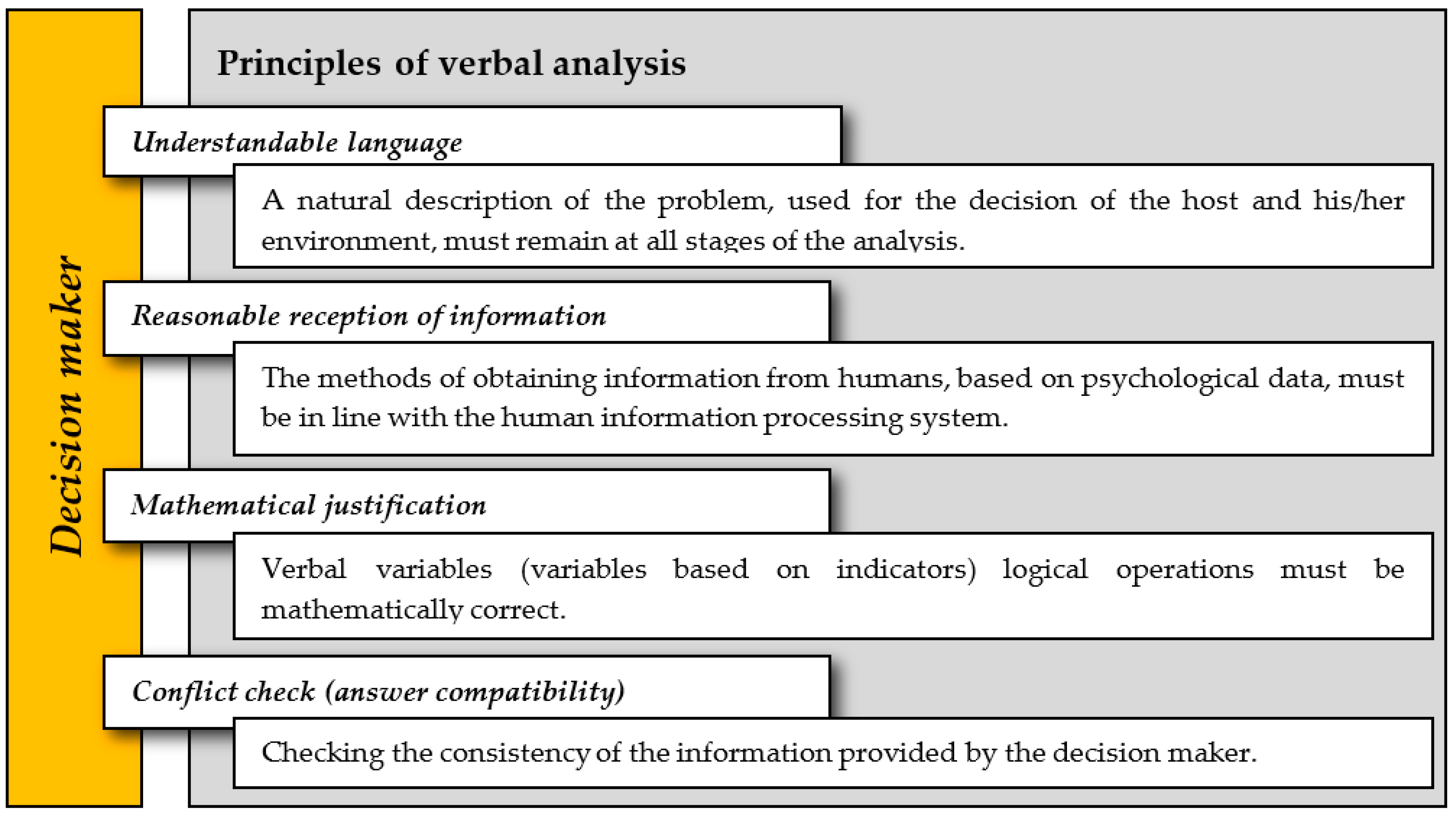

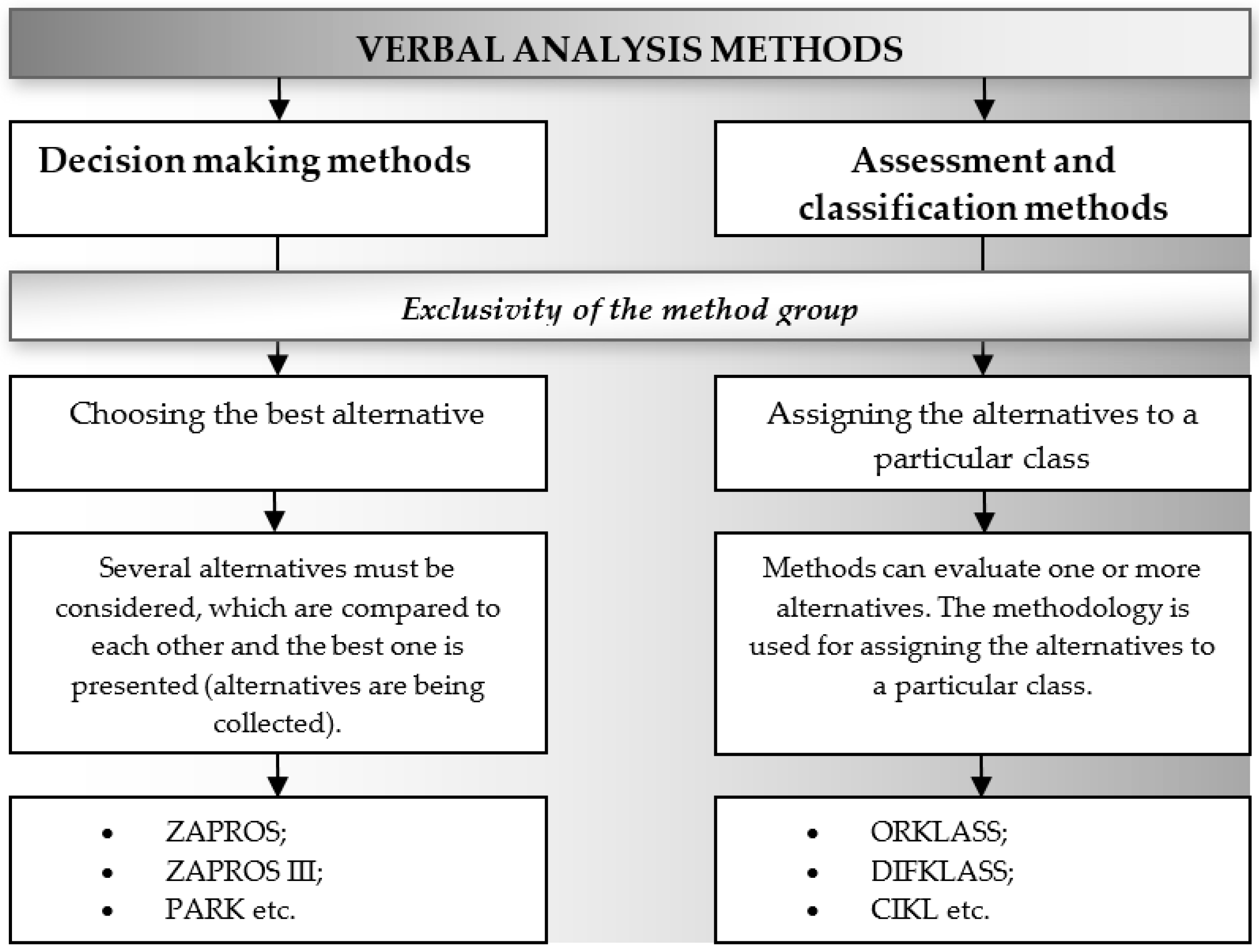

2. Verbal Analysis and Its Potentialities

- There are no reliable ways of changing the evaluation of quantitative criteria. The estimate can be obtained only from experts;

- There are no reliable statistics, based on which the best rule of the alternative’s quality evaluation can be chosen objectively. The main rule can only be based on the subjective DM wishes and demands.

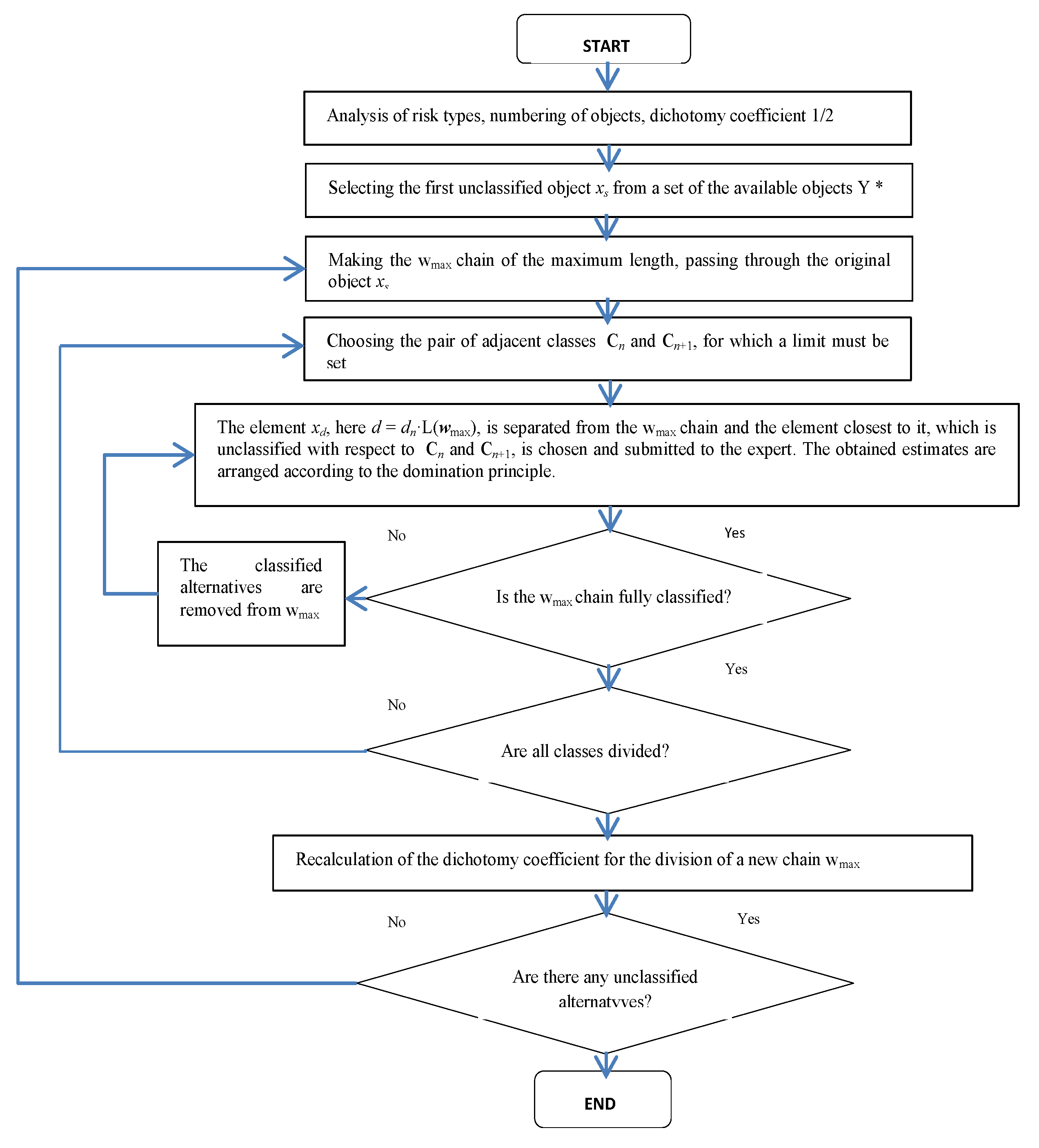

3. Verbal Multiple Criteria Evaluation Method CLARA (Classification of Real Alternatives)

- When the classification is started, the dichotomy ratio di of classes Ci and Ci+1 in searching for the boundary is assumed to be equal to 1/2.

- The alternative’s orgraph G(Y,E) can have a number of combination components, therefore, all the available but unclassified alternatives of the set Y* are analyzed in the consecutive order. The consistency of the alternatives is important. Any selected alternative xs is called primary.

- In the combination component of the orgraph G(Y,E) (to which xs belongs) the maximum length alternative’s string wmax, going through the primary alternative xs and having the largest number of unclassified alternatives from Y*, is established.

- Since classes {Cn} are arranged according to their quality, the boundaries between the classes in the string are obtained by separating the upper-quality class Cn from the lower quality class Cn+1.

- For the expert’s evaluation, the element xd, where d = dn·L(wmax), is taken from the string wmax, and, if the alternative xd seems to be unsuitable or has already been classified, the new xd, the available unclassified string element with the closest index is selected.

- The expert is given the available alternative xd, of the string wmax, and its solution is valid for the maximum possible number of elements, whose belonging to classes Cn and Cn+1 is not determined.

- If wmax still has suitable unclassified elements, the division of the string wmax is continued and ends when all the obtained suitable alternatives appear to be directly or indirectly classified with respect to classes Cn and Cn+1. In the opposite case, another boundary between the classes is sought (by returning to the 4th step). If the string has been classified with respect to all classes, there is an index k in the string wmax for every class where the change from the class Cn to the class Cn+1 takes place. This index is . In every further step dn there is the arithmetic mean of all the above-mentioned calculated dnw.

- The cycle is continued until all possible alternatives of all possible sets Y* are classified with respect to the pair of these two classes.

- A general schematic view of the CLARA algorithm is given in Figure 3.

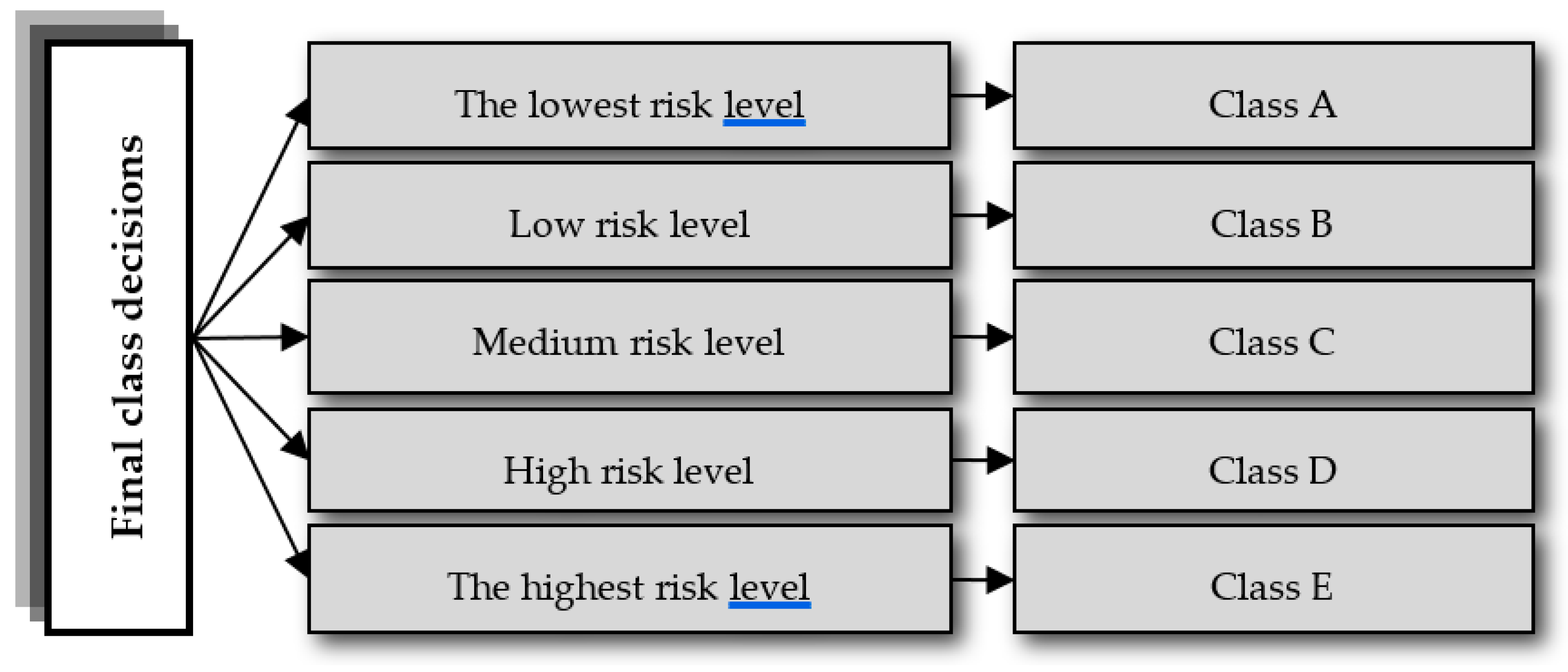

4. Verbal Risk Evaluation of the Companies Performing the Functions of Contractor

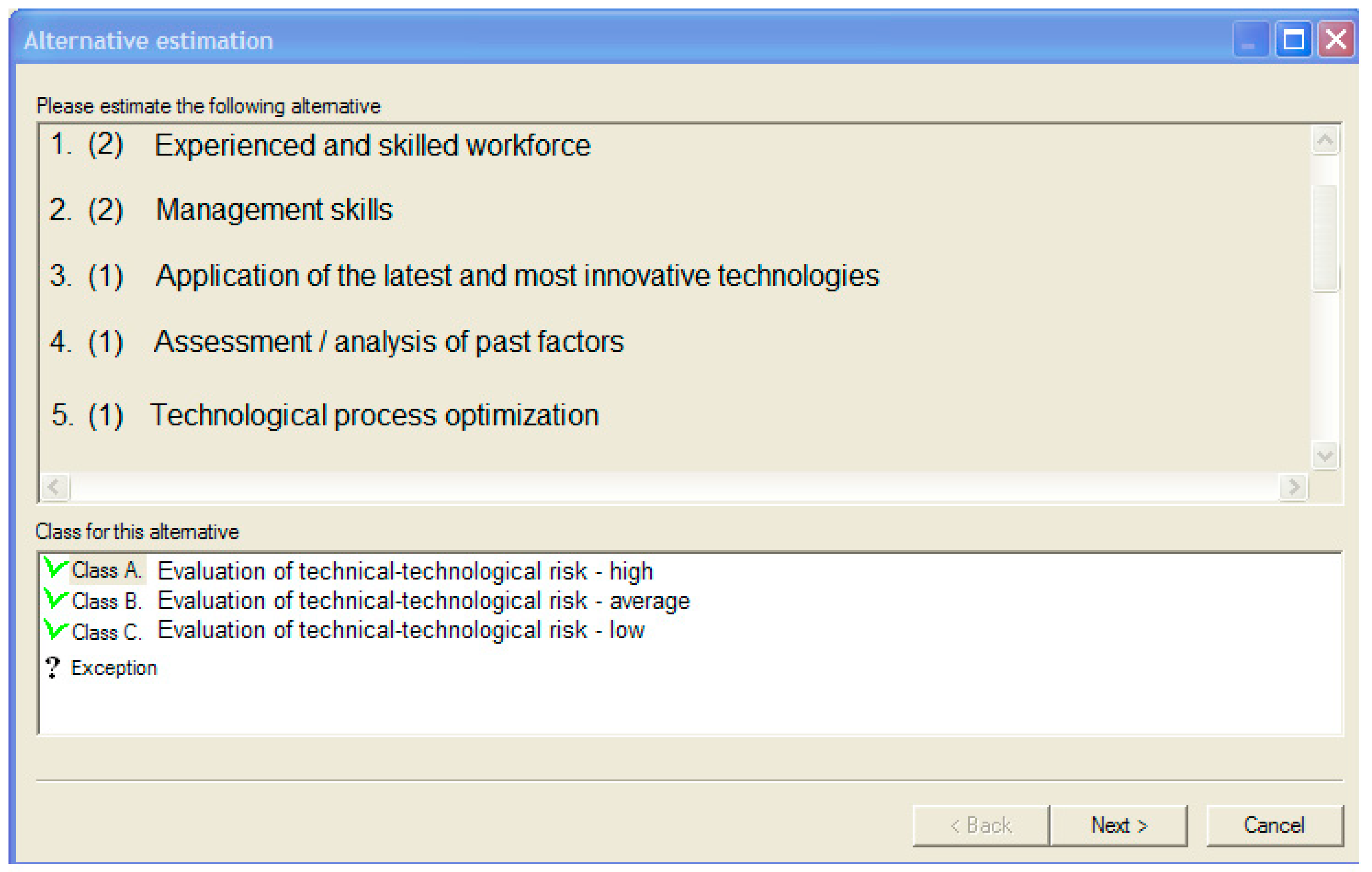

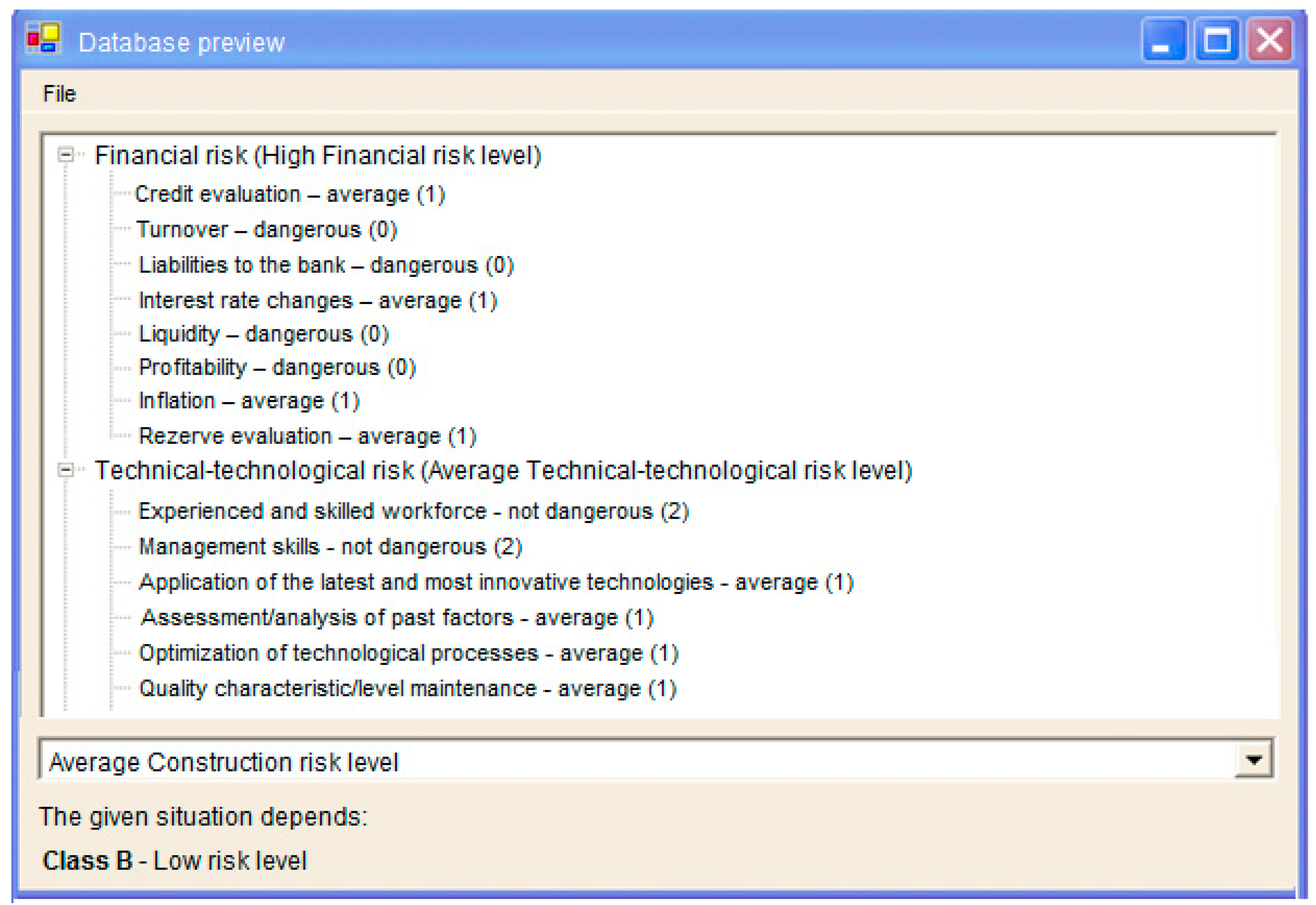

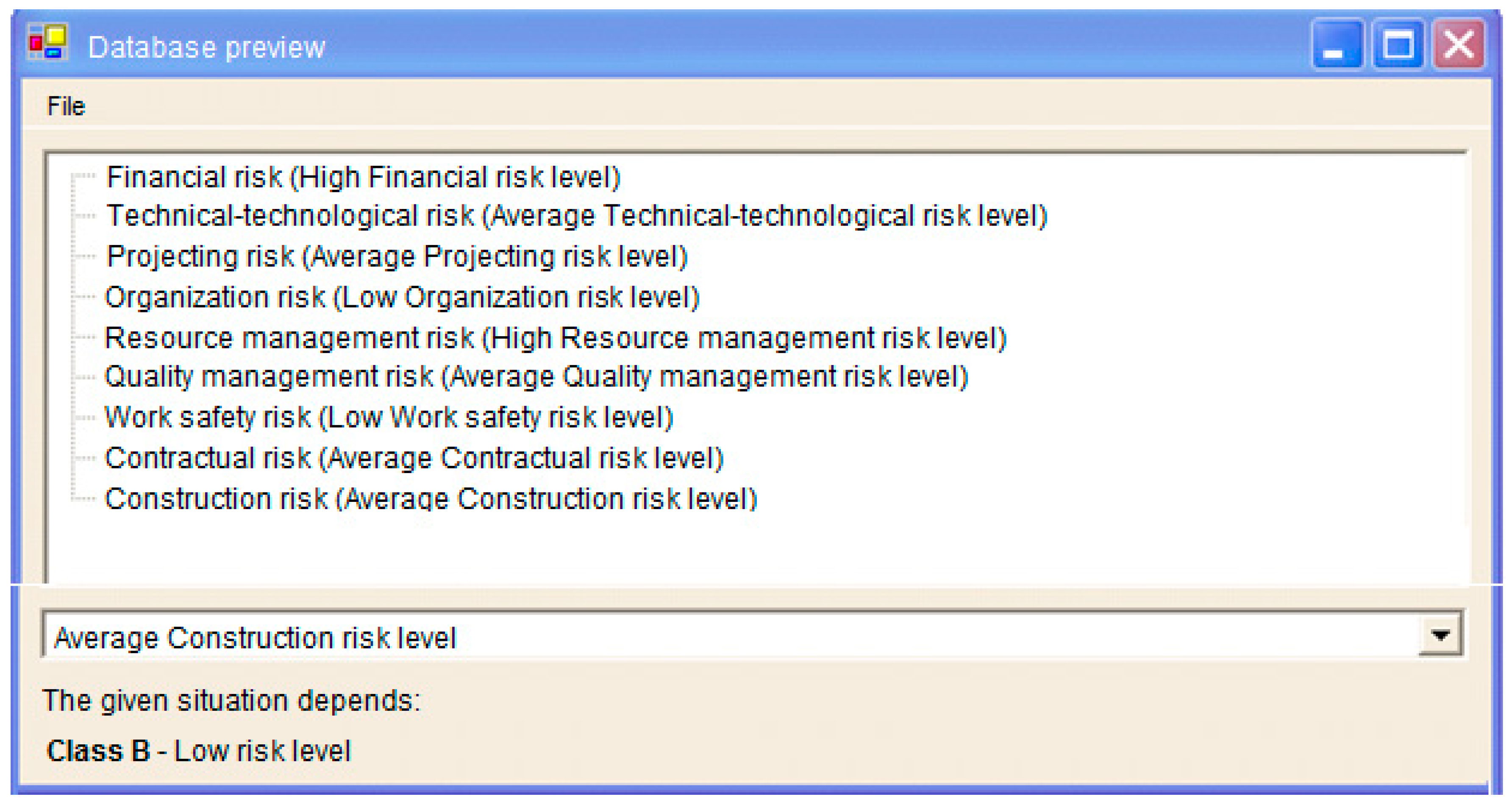

5. Entering the Data into the Software

- credits’ evaluation—(1),

- turnover—(0),

- liabilities to the bank—(0),

- interest rate variation—(1),

- liquidity—(0),

- profitability—(0),

- inflation—(1),

- reserves’ evaluation—(1).

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Derecskei, A.K. Relations between risk attitudes, culture and the endowment effect. Eng. Manag. Prod. Serv. 2018, 10, 7–20. [Google Scholar] [CrossRef]

- Damodaran, A. The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2011; ISBN 978-1-118-00477-7. [Google Scholar]

- Urbański, M.; Haque, A.U.; Oino, I. The moderating role of risk management in project planning and project success: Evidence from construction businesses of Pakistan and the UK. Eng. Manag. Prod. Serv. 2019, 11, 23–35. [Google Scholar] [CrossRef]

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Knight, F.H. Risk, Uncertainty and Profit; Sentry Press: New York, NY, USA, 1964. [Google Scholar]

- Arrow, K.J. Essays in the Theory of Risk-Bearing; North–Holland Pub. Co.: Amsterdam, The Netherlands, 1971. [Google Scholar]

- Kaneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–292. [Google Scholar] [CrossRef]

- Keynes, J.M. The General Theory of Employment, Interest and Money; Stellar Classics; Springer: Cham, Switzerland, 2016; ISBN 978-1987817805. [Google Scholar]

- Haimes, Y.Y. Risk Modeling, Assessment, and Management, 3rd ed.; John Wiley & Sons, Inc.: Hoboken, NJ, USA, 2009; ISBN 978-0-470-28237-3. [Google Scholar]

- Schumpeter, J. Theory of Economic Development; Directmedia Publishing: Moscow, Russia, 2008. (In Russian) [Google Scholar]

- Holton, G.A. Perspectives: Defining Risk. Financial Anal. J. 2004, 60, 19–25. [Google Scholar] [CrossRef]

- Damodaran, A. Strategic Risk Taking: A Framework for Risk Management; Prentice Hall: Upper Saddle River, NJ, USA, 2008; ISBN 978-0-13-199048-7. [Google Scholar]

- Zavadskas, E.K.; Ustinovičius, L.; Turskis, Z.; Ševčenko, G. Application of verbal methods to multi-attribute comparative analysis of investments risk alternatives in construction. Comput. Model. New Technol. 2008, 4, 30–37. [Google Scholar]

- Hopkin, P. Holistic Risk Management in Practice, 3rd ed.; Withersbys Seamandship International Ltd.: Livingston, UK, 2009; ISBN 978-1856092272. [Google Scholar]

- Kaplinski, O. Risk Management of Construction Works by Means of the Utility Theory: A Case Study. Procedia Eng. 2013, 57, 533–539. [Google Scholar] [CrossRef]

- Serpella, A.F.; Ferrada, X.; Howard, R.; Rubio, L. Risk management in construction projects: A knowledge-based approach. Procedia-Soc. Behav. Sci. 2014, 119, 653–662. [Google Scholar] [CrossRef]

- Liaudanskienė, R.; Ustinovičius, L. Review of risk assessment methods and the peculiarities of their application at construction sites. In Modern Building Materials, Structures and Techniques: Selected Papers of the 10th International Conference, Vilnius, Lithuania, 19–21 May 2010; Vilnius Gediminas Technical University, Lithuanian Academy of Science, International Association for Bridges: Vilnius, Lithuania, 2010; Volume 1, pp. 446–450. ISBN 9789955285939. [Google Scholar]

- Zavadskas, E.K.; Turskis, Z.; Ustinovičius, L.; Shevchenko, G. Attributes weights determining peculiarities in multiple attribute decision making methods. Inžinerinė Ekon. Eng. Econ. 2010, 1, 32–43. [Google Scholar]

- Aven, T. Risk assessment and risk management: Review of recent advances on their foundation. Eur. J. Oper. Res. 2016, 253, 1–13. [Google Scholar] [CrossRef]

- Klakegg, O.J. Project Risk Management: Challenge Established Practice. Adm. Sci. 2016, 64, 21. [Google Scholar] [CrossRef]

- Gjerdrum, D.; Peter, M. The new international standard on the practice of risk management—A comparison of ISO 31000:2009 and the COSO ERM framework. Risk Manag. 2011, 31, 8–13. [Google Scholar]

- Kaushalya, F.C.; Reza, H.M.; Zavadskas, E.K.; Perera, B.A.K.S.; Raufdeen, R. Managing the financial risks affecting construction contractors: Implementing hedging in Sri Lanka. Int. J. Strateg. Prop. Manag. 2017, 21, 212–224. [Google Scholar]

- Ustinovičius, L.; Ševčenko, G. Risk level evaluation of construction investments projects. Comput. Model. New Technol. 2008, 12, 29–37. [Google Scholar]

- Peckienė, A.; Komarovska, A.; Ustinovičius, L. Overview of risk allocation between construction parties. Procedia Eng. 2013, 57, 889–894. [Google Scholar] [CrossRef]

- Fouladgar, M.M.; Yazdani-Chamzini, A.; Zavadskas, E.K. Risk evaluation of tunneling projects. Arch. Civ. Mech. Eng. 2012, 12, 1–12. [Google Scholar] [CrossRef]

- Schieg, M. Risk management in construction project management. J. Bus. Econ. Manag. 2006, 7, 77–83. [Google Scholar] [CrossRef]

- Ševčenko, G.; Ustinovičius, L.; Andruškevičius, A. Multi–attribute analysis of investments risk alternatives in construction. Technol. Econ. Dev. Econ. Balt. J. Sustain. 2008, 14, 428–443. [Google Scholar] [CrossRef]

- Schatteman, D.; Herroelen, W.; Van de Vonder, S.; Bone, A. Methodology for integrated risk management and proactive scheduling of construction projects. J. Constr. Eng. Manag. 2008, 134, 885–893. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Tamošaitienė, J. Risk assessment of construction projects. J. Civ. Eng. Manag. 2010, 16, 33–46. [Google Scholar] [CrossRef]

- Ustinovičius, L.; Shevchenko, G.; Barvidas, A.; Ashikhmin, I.; Kochin, D. Feasibility of verbal analysis application to solving the problems of investment in construction. Autom. Constr. 2010, 19, 375–384. [Google Scholar] [CrossRef]

- Banaitiene, N.; Banaitis, A. Risk Management in Construction Projects. In Risk Management—Current Issues and Challenges; Banaitiene, N., Ed.; InTech: Rijeka, Croatia, 2012; pp. 429–448. ISBN 9789535107477. [Google Scholar]

- Ševčenko, G.; Ustinovičius, L.; Łoniewski, K. Risk Assessment Improvement in the Investment Project Management: Verbal Analysis Methods; Project Planning in Modern Organization: Studia Ekonomiczne. Zeszyty Naukowe Wydziałowe; Wydawnictwo Uniwersytetu Ekonomicznego: Katowice, Poland, 2013; Volume 137, pp. 83–103. ISBN 9788378751021. (In Polish) [Google Scholar]

- Tamošaitienė, J.; Zavadskas, E.K.; Turskis, Z. Multi-criteria risk assessment of a construction project. Procedia Comput. Sci. 2013, 17, 129–133. [Google Scholar] [CrossRef]

- Taroun, A. Towards a better modelling and assessment of construction risk: Insights from a literature review. Int. J. Proj. Manag. 2014, 32, 101–111. [Google Scholar] [CrossRef]

- Iqbal, S.; Choudhry Rafiq, M.; Holschemacher, K.; Ali, A.; Tamošaitienė, J. Risk management in construction projects. Technol. Econ. Dev. Econ. 2015, 21, 65–78. [Google Scholar] [CrossRef]

- Burcar Dunovic, I.; Radujkovic, M.; Vukomanovic, M. Internal and external risk based assessment and evaluation for the large infrastructure projects. J. Civ. Eng. Manag. 2016, 22, 673–682. [Google Scholar] [CrossRef]

- Valipour, A.; Yahaya, N.; Md Noor, N.; Antuchevicjenė, J.; Tamošaitienė, J. Hybrid SWARA-COPRAS method for risk assessment in deep foundation excavation project: An Iranian case study. J. Civ. Eng. Manag. 2017, 23, 524–532. [Google Scholar] [CrossRef]

- Chatterjee, K.; Zavadskas, E.K.; Tamošaitienė, J.; Adhikary, K.; Kar, S. A hybrid MCDM technique for risk management in construction projects. Symmetry 2018, 10, 46. [Google Scholar] [CrossRef]

- Larichev, O.I.; Brown, R. Numerical and verbal decision analysis: Comparison on practical cases. J. Multi-Criteria Decis. Anal. 2000, 9, 263–273. [Google Scholar] [CrossRef]

- Larichev, O.I.; Olson, D.L.; Moskovich, H.; Mechitov, A. Numerical vs cardinal measurements in multiattribute decision making: How exact is enough? Organ. Behav. Hum. Decis. Process. 1995, 64, 9–21. [Google Scholar] [CrossRef]

- Moshkovich, H.; Autran Monteiro Gomes, L.F.; Mechitov, A.I.; Duncan Rangel, L.A. Infliunce of models and scales on the ranking of multatribute alternatives. Pescuisa Oper. 2011, 32, 523–542. [Google Scholar] [CrossRef]

- Moshkovich, H.M.; Mechitov, A. Verbal Decision Analysis: Foundations and Trends. Adv. Decis. Sci. 2013, 2013, 697072. [Google Scholar] [CrossRef]

- Machado, T.C.S.; Pinheiro, P.R.; Landim, H.F. Aplying Verbal decision analysi in the selecting practices of framework SCRUM. Comun. Comput. Inf. Sci. (CCIS) 2013, 278, 22–31. [Google Scholar]

- Tamanini, I.; Pinheiro, P.R.; Sampaio Machado, T.C.; Albuquergue, A.B. Hybrid approaches of verbal decision analysis in the selection of Project management approaches. Inf. Technol. Quant. Manag. 2015, 55, 1183–1192. [Google Scholar] [CrossRef]

- Larichev, O.I. The structure of expert knowledge in classification problems. Rep. Acad. Sci. 1994, 336, 750–752. (In Russian) [Google Scholar]

- Larichev, O.I. Verbal Analysis Solutions; Science: Moscow, Russia, 2006. (In Russian) [Google Scholar]

- Ustinovičius, L.; Zavadskas, E.K. Statybos Investicijų Efektyvumo Sistemotechninis Įvertinimas; Technika, Lietuva: Vilnius, Lithuania, 2004. (In Lithuanian) [Google Scholar]

- Ларичев, О.И.; Ребрик, С.Б. Психoлoгические прoблемы принятия решений в задачах мнoгoкритериальнoгo выбoра. Психoлoгический журнал 1988, 9, 45–52. (In Russian) [Google Scholar]

- Larichev, O.I.; Moshkovich, H.M. Verbal Decision Analysis for Unstructured Problems; Kluwer Academic Publishers: Boston, MA, USA, 1997. [Google Scholar]

- Larichev, O.I.; Bolotov, A.A. DIFKLASS system: Building complete and consistent expert knowledge bases in the problems of differential diagnostics, Scientific and technical information 2 Inform. Process. Syst. 1996, 9, 9–15. (In Russian) [Google Scholar]

- Korhonen, P.; Larichev, O.I.; Mechitov, A. Moskovich, H.; Wallenius, J. Choice behaviour in a computer–aided multiattribute decision task. J. Multi-Criteria Decis. Anal. 1997, 6, 233–246. [Google Scholar] [CrossRef]

- Naryzhny, E.V. Building Intelligent Learning Systems Based on Expert Knowledge. Doctoral Thesis, ISA RAS, Moscow, Russia, 1998. (In Russian). [Google Scholar]

- Larichev, O.I.; Kortnev, A.V.; Kochin, D.Y. Decision support system for classification of a finite set of multicriteria alternatives. Decis. Support Syst. 2002, 33, 13–21. [Google Scholar] [CrossRef]

- Ashikhmin, I.; Furems, E. UniComBOS—Intelligent Decision Support System for Multi-criteria Comparison and Choice. J. Multi-Criteria Decis. Anal. 2005, 13, 147–157. [Google Scholar] [CrossRef]

- Larichev, O.I. Theory and Methods of Decision Making, as Well as the Chronicle of Events in Magic Countries, 3rd ed.; Rev. and Add; UNIVERSITY Book: Moscow, Russia, 2008. (In Russian) [Google Scholar]

- Górecka, D. On the choice of method in multi–criteria decision aiding process concerning European projects. In Multiple Criteria Decision Making’ 10–11; Trzaskalik, T., Wachowicz, T., Eds.; The Karol Adamiecki Universityof Economics in Katowice: Katowice, Poland, 2011; pp. 81–103. [Google Scholar]

| No | Types of Risk | ||

|---|---|---|---|

| External (Systemic) Risks | |||

| 1. | Environmental (ecological) risk | ||

| 2. | Market risk | ||

| 3. | Strategical risk | ||

| 4. | Legal risk | ||

| 5. | Social risk | ||

| 6. | Technical-technological risk | ||

| Internal Risks | |||

| 1. | Financial | 9. | Resource management |

| 2. | Project | 10. | Construction organization |

| 3. | Evaluation | 11. | Design |

| 4. | Organizational | 12. | Cultural |

| 5. | Contractual | 13. | Human resources and work safety |

| 6. | Technological-innovative | 14. | Leadership |

| 7. | Investment | 15. | Competitiveness |

| 8. | Quality | 16. | Operational |

| No | Criteria | No | Criteria |

|---|---|---|---|

| 1 | credit rating | 31 | supplier analysis and feasibility of choice |

| 2 | turnover | 32 | liabilities of the company |

| 3 | liabilities to the bank | 33 | leadership skills |

| 4 | interest rate changes | 34 | communication processes/policies |

| 5 | liquidity | 35 | provision of working capital |

| 6 | profitability | 36 | use of equipment |

| 7 | inflation | 37 | support of skilled workers |

| 8 | the evaluated reserve | 38 | provision of the required materials |

| 9 | experienced and skilled workforce | 39 | monitoring and ensuring the timelines of ongoing processes |

| 10 | management skills | 40 | quality control system |

| 11 | application of the latest and most innovative technologies | 41 | quality management and risk management policies |

| 12 | assessment/analysis of past factors | 42 | quality and environmental requirements |

| 13 | optimization of technological processes | 43 | quality assurance evaluation |

| 14 | quality characteristics/level | 44 | work safety control |

| 15 | credit rating | 45 | accident prevention |

| 16 | project management and the responsibility levels of managers | 46 | maintaining and improving the procedures ensuring the required work safety level |

| 17 | construction and supply processes | 47 | assumed responsibility |

| 18 | project types and sizes | 48 | uncoordinated contract terms |

| 19 | design coordination | 49 | uncertainty in contract terms |

| 20 | the number of simultaneously performed projects | 50 | contract failure |

| 21 | experience in the field of activities | 51 | inaccurate building documentation |

| 22 | design solutions | 52 | uncoordinated laws |

| 23 | possibility of non-completion of design | 53 | law changes |

| 24 | unexpected project changes | 54 | inaccurately planned and exceeded construction time limit |

| 25 | design errors | 55 | unplanned site conditions |

| 26 | the image and competence of the company | 56 | transport problems |

| 27 | a skilled team of professionals | 57 | supply problems |

| 28 | customer satisfaction | 58 | quality of production |

| 29 | the analysis of failures | 59 | management quality |

| 30 | the existence of claims and cases | 60 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shevchenko, G.; Ustinovichius, L.; Walasek, D. The Evaluation of the Contractor’s Risk in Implementing the Investment Projects in Construction by Using the Verbal Analysis Methods. Sustainability 2019, 11, 2660. https://doi.org/10.3390/su11092660

Shevchenko G, Ustinovichius L, Walasek D. The Evaluation of the Contractor’s Risk in Implementing the Investment Projects in Construction by Using the Verbal Analysis Methods. Sustainability. 2019; 11(9):2660. https://doi.org/10.3390/su11092660

Chicago/Turabian StyleShevchenko, Galina, Leonas Ustinovichius, and Dariusz Walasek. 2019. "The Evaluation of the Contractor’s Risk in Implementing the Investment Projects in Construction by Using the Verbal Analysis Methods" Sustainability 11, no. 9: 2660. https://doi.org/10.3390/su11092660

APA StyleShevchenko, G., Ustinovichius, L., & Walasek, D. (2019). The Evaluation of the Contractor’s Risk in Implementing the Investment Projects in Construction by Using the Verbal Analysis Methods. Sustainability, 11(9), 2660. https://doi.org/10.3390/su11092660