The Effects of a Revenue-Neutral Child Subsidy Tax Mechanism on Growth and GHG Emissions

Abstract

1. Introduction

2. Background Literature

3. The Model

3.1. The Economy

- (i)

- (ii)

- ,

- (iii)

- ,

- (iv)

- (v)

- (vi)

- .

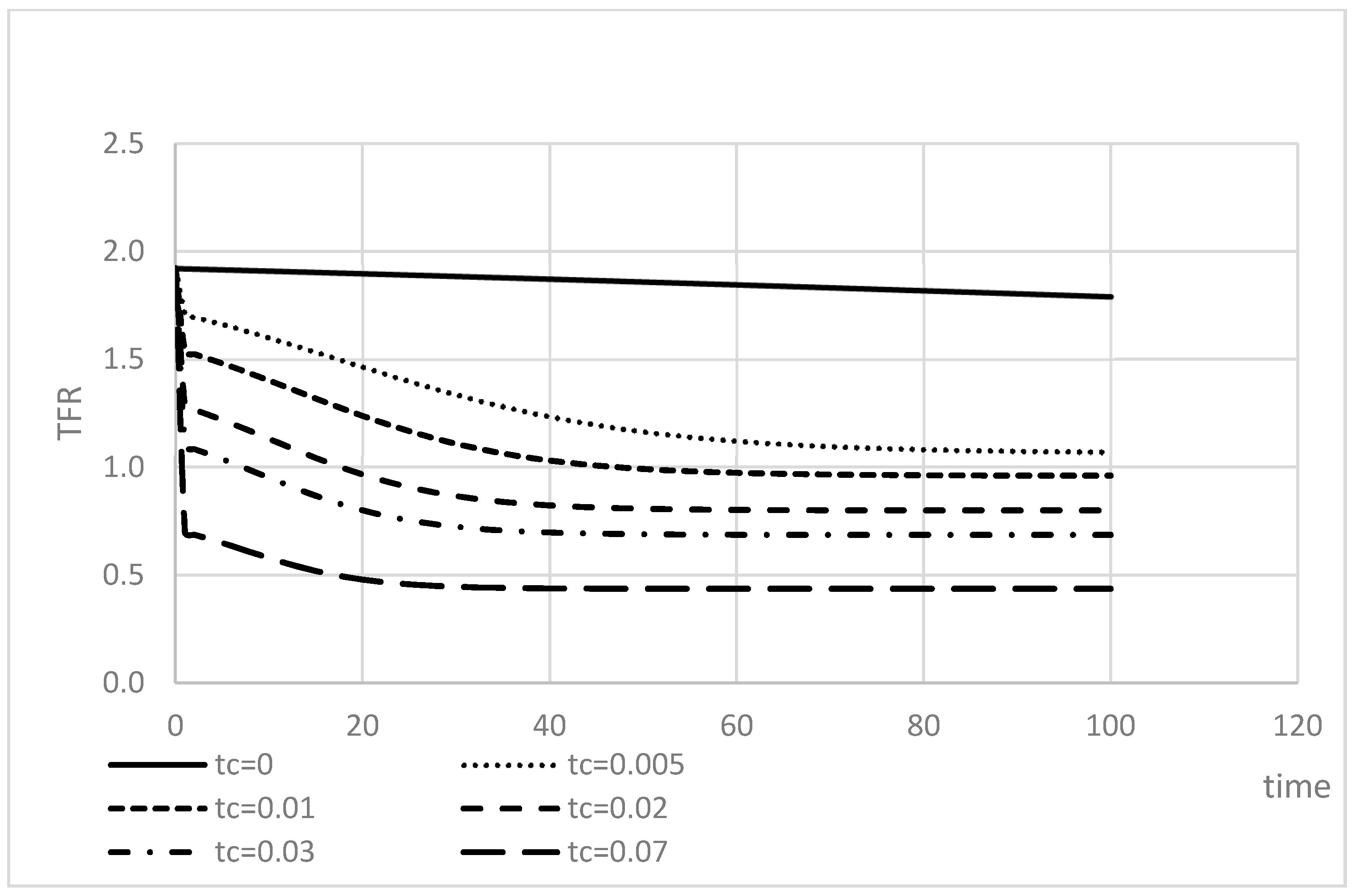

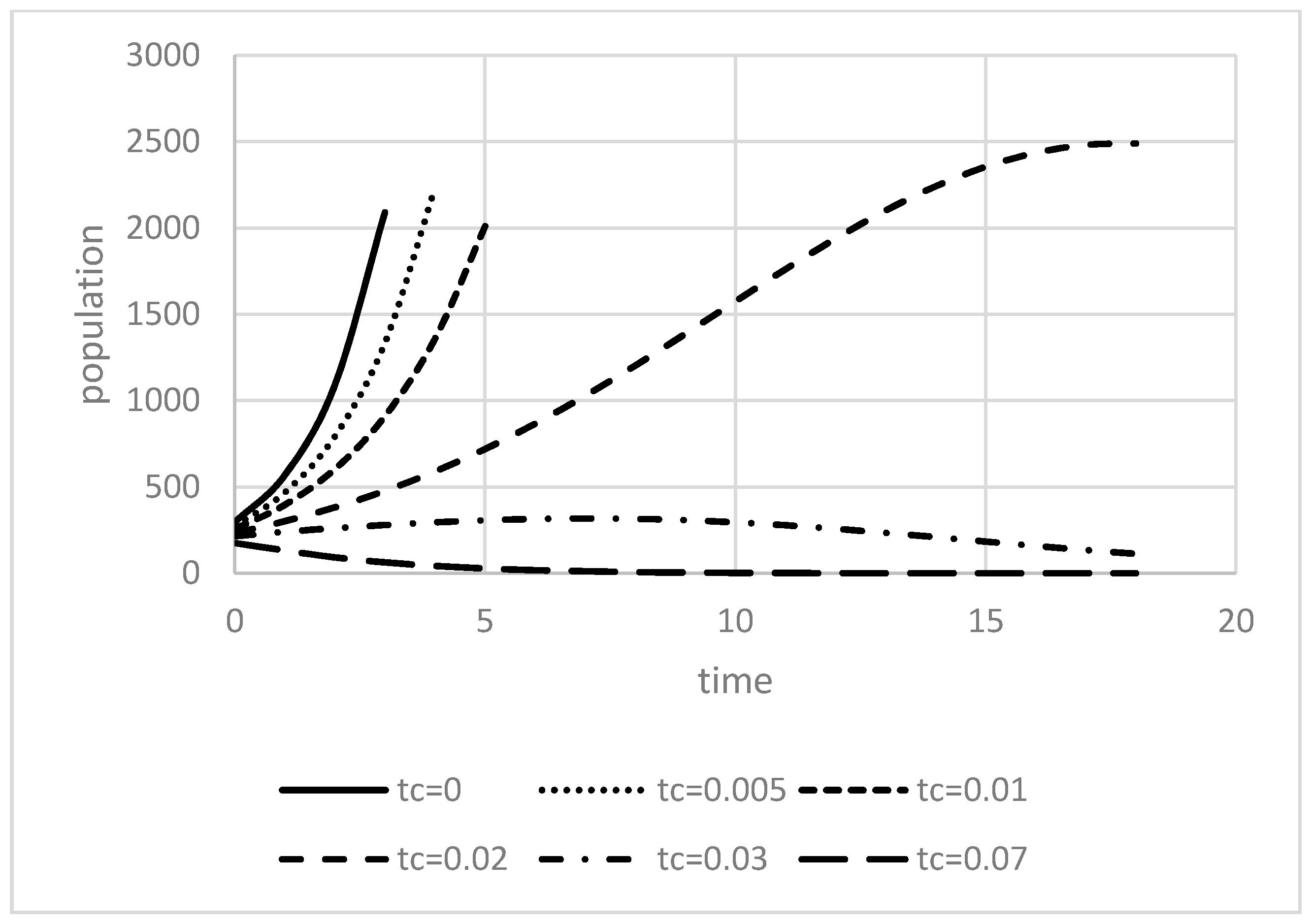

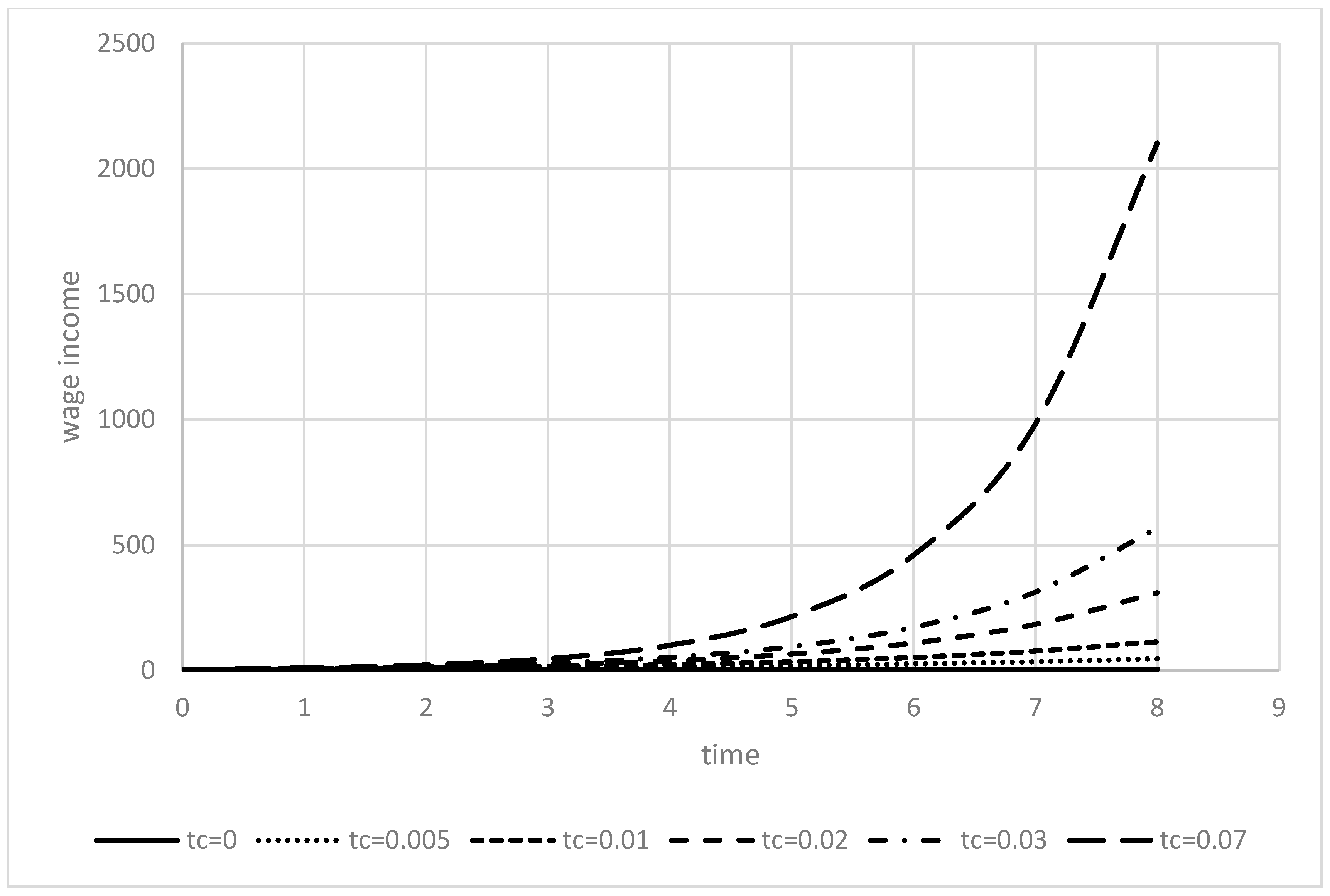

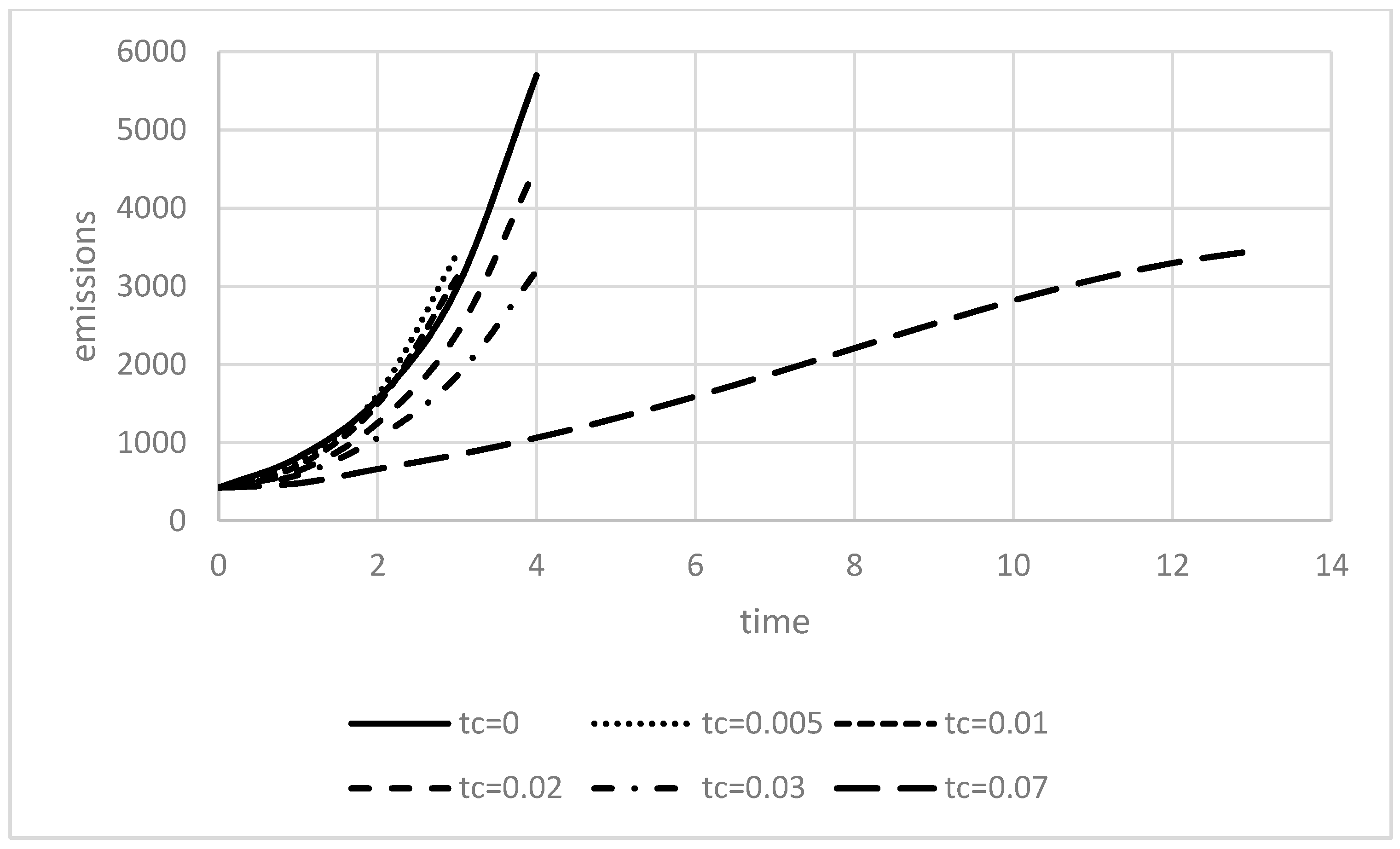

3.2. Effects of the CSTM on GHG Emissions

4. Calibration

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- The Paris Agreement. Available online: http://unfccc.int/paris_agreement/items/9485.php (accessed on 20 March 2019).

- Bertoldi, P.; Ricci, A.; de Almeida, A. Energy Efficiency in Household Appliances and Lighting; Springer Science & Business Media: Berlin, Germany, 2001. [Google Scholar]

- Dasgupta, P.; Dasgupta, A. Socially Embedded, Preferences, Environmental Externalities, and Reproductive Rights. Popul. Dev. Rev. 2017, 43, 405–441. [Google Scholar] [CrossRef]

- Gerlagh, R.; Lupi, V.; Galeotti, M. Family Planning and Climate Change. Available online: https://www.dropbox.com/s/3djwfexr9zaexuh/GLG_2018.pdf?dl=0 (accessed on 6 March 2019).

- Food and Agriculture Organization (FAO). How to Feed the World in 2050. Report, Geneva. Available online: http://www.fao.org/fileadmin/templates/wsfs/docs/expert_paper/How_to_Feed_the_World_in_2050.pdf (accessed on 14 February 2019).

- Ehrlich, P.R.; Harte, J. Opinion: To feed the world in 2050 will require a global revolution. Proc. Natl. Acad. Sci. USA 2015, 112, 14743–14744. [Google Scholar] [CrossRef]

- Burke, M.; Hsiang, S.M.; Miguel, E. Global non-linear effect of temperature on economic production. Nature 2015, 527, 235–239. [Google Scholar] [CrossRef]

- Hsiang, S.M.; Sobel, A.H. Potentially Extreme Population Displacement and Concentration in the Tropics Under Non-Extreme Warming. Nat. Sci. Rep. 2015, 6, 25697. [Google Scholar] [CrossRef]

- World Bank. Available online: https://datacatalog.worldbank.org/dataset/human-capital-index (accessed on 20 March 2019).

- Dietz, T.; Rosa, E.A. Rethinking the environmental impacts of population, affluence and technology. Hum. Ecol. Rev. 1994, 1, 277–300. [Google Scholar]

- Malthus, T. Essay on the Principle of Population as It Affects the Future Improvement of Society. J. Johnson in St Paul’s Church-Yard, London. Available online: https://ia802701.us.archive.org/14/items/essayonprincipl00malt/essayonprincipl00malt.pdf (accessed on 5 May 2019).

- Ehrlich, P.R. The Population Bomb; Ballantine Books: New York, NY, USA, 1968. [Google Scholar]

- Van Den Bergh, J.C.J.M.; Rietveld, P. Reconsidering the limits to world population: Meta-analysis and meta-prediction. Bioscience 2004, 54, 195–204. [Google Scholar] [CrossRef]

- Daily, G.C.; Ehrlich, A.H.; Ehrlich, P.R. Optimum population size. Popul. Environ. 1994, 15, 469–475. [Google Scholar] [CrossRef]

- Wynes, S.; Nicholas, K.A. The climate mitigation gap: Education and government recommendations miss the most effective individual actions. Environ. Res. Lett. 2017, 12, 074024. [Google Scholar] [CrossRef]

- Zhou, Y.; Liu, Y. Does population have a larger impact on carbon dioxide emissions and income? Evidence from a cross-regional panel analysis in China. Appl. Energy 2016, 180, 800–809. [Google Scholar] [CrossRef]

- Liddle, B.; Lung, S. Age-structure, urbanization, and climate change in developed countries: Revisiting STIRPAT for disaggregated population and consumption-related environmental impacts. Popul. Environ. 2010, 31, 317–343. [Google Scholar] [CrossRef]

- Cole, M.A.; Neumayer, E. Examining the impact of demographic factors on air pollution. Popul. Environ. 2004, 26, 5–21. [Google Scholar] [CrossRef]

- Shi, A. The impact of population pressure on global carbon dioxide emissions, 1975–1996: Evidence from pooled cross-country data. Ecol. Econ. 2003, 44, 29–42. [Google Scholar] [CrossRef]

- York, R.; Rosa, E.A.; Dietz, T. STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol. Econ. 2003, 46, 351–365. [Google Scholar] [CrossRef]

- Poumanyvong, P.; Kaneko, S. Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol. Econ. 2010, 70, 434–444. [Google Scholar] [CrossRef]

- Fan, Y.; Liu, L.C.; Wu, G.; Wei, Y.M. Analyzing impact factors of CO2 emissions using the STIRPAT model. Environ. Impact Assess. Rev. 2006, 26, 377–395. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, I.; Maruotti, A. The impact of urbanization on CO2 emissions: Evidence from developing countries. Ecol. Econ. 2011, 70, 1344–1353. [Google Scholar] [CrossRef]

- Murtaugh, P.A.; Schlax, M.G. Reproduction and the carbon legacies of individuals. Glob. Environ. Chang. 2009, 19, 14–20. [Google Scholar] [CrossRef]

- Nolt, J. How Harmful are the Average American’s Greenhouse Gas Emissions? Ethics Policy Environ. 2011, 14, 3–10. [Google Scholar] [CrossRef]

- Rieder, T.N. Toward a Small Family Ethic: How Overpopulation and Climate Change Are Affecting the Morality of Procreation; Springer: New York, NY, USA, 2016. [Google Scholar]

- Hickey, C.; Rieder, T.N.; Earl, J. Population Engineering and the Fight against Climate Change. Soc. Theory Pract. 2016, 42, 845–870. [Google Scholar] [CrossRef]

- Becker, G.S. An economic analysis of fertility. In Demographic and Economic Change in Developed Countries; Columbia University Press: New York, NY, USA, 1960; pp. 209–240. [Google Scholar]

- Becker, G.S.; Lewis, H.G. On the Interaction between the Quantity and Quality of Children. J. Political Econ. 1973, 81, S279–S288. [Google Scholar] [CrossRef]

- Barro, R.J. Education and economic growth. Ann. Econ. Financ. 2013, 14, 301–328. [Google Scholar]

- Hanushek, E. The Trade-off between Child Quantity and Quality. J. Political Econ. 1992, 100, 84–117. [Google Scholar] [CrossRef]

- Angrist, J.; Evans, W. Children and Their Parents’ Labor Supply: Evidence from Exogenous Variation in Family Size. Am. Econ. Rev. 1998, 88, 450–477. [Google Scholar] [CrossRef]

- Angrist, J.D.; Lavy, V.; Schlosser, A. Multiple Experiments for the Causal Link between the Quantity and Quality of Children. J. Labor Econ. 2010, 28, 773–824. [Google Scholar] [CrossRef]

- Kugler, A.D.; Kumar, S. Preference for Boys, Family Size, and Educational Attainment in India. Demography 2017, 54, 835–859. [Google Scholar] [CrossRef] [PubMed]

- Conley, D.; Glauber, R. Parental Educational Investment and Children’s Academic Risk Estimates of the Impact of Sibship Size and Birth Order from Exogenous Variation in Fertility. J. Hum. Resour. 2006, 41, 722–737. [Google Scholar] [CrossRef]

- Li, H.; Zhang, J.; Zhu, Y. The quantity-quality trade-off of children in a developing country: Identification using Chinese twins. Demography 2008, 45, 223–243. [Google Scholar] [CrossRef]

- Millimet, D.L.; Wang, L. Is the Quantity-Quality Trade-Off a Trade-Off for All, None, or Some? Econ. Dev. Cult. Chang. 2011, 60, 155–195. [Google Scholar] [CrossRef]

- Rosenzweig, M.R.; Zhang, J. Do population control policies induce more human capital investment? Twins, birth weight and China’s “one-child” policy. Rev. Econ. Stud. 2009, 76, 1149–1174. [Google Scholar] [CrossRef]

- Lee, R.; Mason, A. Fertility, human capital, and economic growth over the demographic transition. Eur. J. Popul. Rev. 2010, 26, 159–182. [Google Scholar] [CrossRef] [PubMed]

- Huang, Y. Does A Child Quantity-Quality Trade-Off Exist? Evidence from the One-Child Policy in China. In Annual Conference 2015 (Muenster): Economic Development-Theory and Policy; (No. 113215); Socialpolitik/German Economic Association: Muenster, Germany, 2015. [Google Scholar]

- Peters, W. Public pensions, family allowances and endogenous demographic change. J. Popul. Econ. 1995, 8, 161–183. [Google Scholar] [CrossRef]

- Diamond, P.A. National debt in a neoclassical growth model. Am. Econ. Rev. 1965, 55, 1126–1150. [Google Scholar]

- Stauvermann, P.J.; Kumar, R.R. Sustainability of a Pay-as-you-Go Pension System in a Small Open Economy with Ageing, Human Capital and Endogenous Fertility. Metroeconomica 2016, 67, 2–20. [Google Scholar] [CrossRef]

- Stauvermann, P.J.; Hu, J. What can China expect from an increase of the mandatory retirement age? Ann. Econ. Financ. 2018, 19, 229–246. [Google Scholar]

- Stauvermann, P.J.; Kumar, R.R. Demographic change, PAYG pensions and child policies. J. Pension Econ. Financ. 2017, 17, 469–487. [Google Scholar] [CrossRef]

- Stauvermann, P.J.; Kumar, R.R. Enhancing growth and welfare through debt-financed education. Econ. Res. 2017, 30, 207–222. [Google Scholar] [CrossRef]

- Shi, Y.; Zhang, J. On high fertility rates in developing countries: Birth limits, birth taxes, or education subsidies. J. Popul. Econ. 2009, 22, 603–640. [Google Scholar] [CrossRef]

- Brock, W.A.; Taylor, M.S. Economic growth and the environment: A review of theory and empirics. In Handbook of Economic Growth; Aghion, P., Durlauf, S., Eds.; Elsevier: Amsterdam, The Netherlands, 2015; Volume 1, pp. 1749–1821. [Google Scholar]

- Smulders, S.; Gradus, R. Pollution abatement and long-term growth. Eur. J. Political Econ. 1996, 12, 505–532. [Google Scholar] [CrossRef]

- Tsur, Y.; Zemel, A. Scarcity, growth and R&D. J. Environ. Econ. Manag. 2005, 49, 484–499. [Google Scholar] [CrossRef]

- Chu, H.; Lai, C.-C. Abatement R&D, market imperfections, and environmental policy in an endogenous growth model. J. Econ. Dyn. Control 2014, 41, 20–37. [Google Scholar] [CrossRef]

- Kollenbach, G. Abatement, R&D and growth with a pollution ceiling. J. Econ. Dyn. Control 2015, 54, 1–16. [Google Scholar] [CrossRef]

- Hirazawa, M.; Saito, K.; Yakita, A. Effects of international sharing of pollution abatement burdens on income inequality among countries. J. Econ. Dyn. Control 2011, 35, 1615–1625. [Google Scholar] [CrossRef]

- Ehrlich, P.R.; Holdren, J.P. Impact of population growth. Science 1971, 171, 1212–1217. [Google Scholar] [CrossRef] [PubMed]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef]

- Wei, T. What STIRPAT tells about effects of population and affluence on the environment? Ecol. Econ. 2011, 72, 70–74. [Google Scholar] [CrossRef]

- Ecology and the Crisis of Overpopulation—Future Prospects for Global Sustainablility; Shah, A., Ed.; Edward Elgar: Cheltenham, UK, 1998. [Google Scholar]

- Cronshaw, M.B.; Requate, T. Population Size and Environmental Quality. J. Popul. Econ. 1997, 10, 229–316. [Google Scholar] [CrossRef]

- Dasgupta, P. Population, Resources and Poverty. Ambio 1992, 21, 95–101. [Google Scholar]

- Dasgupta, P. An Inquiry into Well-Being and Destitution; Clarendon Press: Oxford, UK, 1993. [Google Scholar]

- Dasgupta, P. The Population Problem: Theory and Evidence. J. Econ. Lit. 1995, 33, 1879–1902. [Google Scholar]

- Dasgupta, P. Population, Resources, and Welfare: An Exploration into Reproductive and Environmental Externalities. In Handbook of Environmental Economics: Environmental Degradation and Institutional Responses; Maler, K.-G., Vincent, J., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 191–247. [Google Scholar]

- Nerlove, M. Population and the Environment: A Parable of Firewood and Other Tales. Am. J. Agric. Econ. 1991, 73, 1334–1347. [Google Scholar] [CrossRef]

- Nerlove, M.; Meyer, A. Endogenous Fertility and the Environment: A Parable of Firewood. In The Environment and Emerging Development Issues; Dasgupta, P., Maler, K.-G., Eds.; Clarendon Press: Oxford, UK, 1997; pp. 259–282. [Google Scholar]

- Kelly, D.L.; Kolstad, C.D. Malthus and Climate Change: Betting on a Stable Population. J. Environ. Econ. Manag. 2001, 41, 135–161. [Google Scholar] [CrossRef]

- Harford, J.D. Stock Pollution, Child-Bearing Externalities, and the Social Discount Rate. J. Environ. Econ. Manag. 1997, 33, 94–105. [Google Scholar] [CrossRef]

- Harford, J.D. The Ultimate Externality. Am. Econ. Rev. 1998, 88, 260–265. [Google Scholar]

- Harford, J.D. Methods of Pricing Common Property Use and Some Implications for Optimal Child-Bearing and the Social Discount Rate. Resour. Energy Econ. 2000, 22, 103–124. [Google Scholar] [CrossRef]

- Becker, G.S.; Barro, R.J. A reformulation of the economic theory of fertility. Q. J. Econ. 1988, 103, 1–25. [Google Scholar] [CrossRef]

- Barro, R.J.; Becker, G.S. Fertility choice in a model of economic growth. Econometrica 1989, 57, 481–501. [Google Scholar] [CrossRef]

- Tomasevski, K. The State of Right to Education Worldwide: Free or Fee: Global Report 2006. Available online: http://www.katarinatomasevski.com/images/Global_Report.pdf (accessed on 6 March 2019).

- Jost, F.; Quaas, M. Environmental and population externalities. Environ. Dev. Econ. 2010, 15, 1–19. [Google Scholar] [CrossRef]

- Bohn, H.; Stuart, C. Calculation of a Population Externality. Am. Econ. J. Econ. Policy 2015, 7, 61–87. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change: The Stern Review; Cambridge University Press: Cambridge, MA, USA, 2006. [Google Scholar]

- Graff Zivin, J.; Neidell, M. Temperature and the allocation of time: Implications for climate change. J. Labor Econ. 2014, 13, 1–26. [Google Scholar] [CrossRef]

- Schlenker, W.; Roberts, M.J. Non-linear temperature effects indicate severe damages to U.S. crop yields under climate change. Proc. Natl. Acad. Sci. USA 2009, 106, 15594–15598. [Google Scholar] [CrossRef] [PubMed]

- Forzierie, G.; Bianchi, A.; Batista e Silva, F.; Herrerad, M.A.M.; Lebloise, A.; Lavallec, C.; Aerts, J.C.J.H.; Feyen, L. Escalating impacts of climate extremes on critical infrastructures in Europe. Glob. Environ. Chang. 2018, 48, 97–107. [Google Scholar] [CrossRef] [PubMed]

- Hsiang, S.M. Temperatures and cyclones strongly associated with economic production in the Caribbean and Central America. Proc. Natl. Acad. Sci. USA 2010, 107, 15367–15372. [Google Scholar] [CrossRef]

- Hsiang, S.M.; Kopp, R.; Jina, A.; Rising, J.; Delgado, M.; Mohan, S.; Rasmussen, D.J.; Muir-Wood, R.; Wilson, P.; Oppenheimer, M.; et al. Estimating economic damage from climate change in the United States. Science 2017, 356, 1362–1369. [Google Scholar] [CrossRef]

- Hsiang, S.M.; Jina, A.S. The Causal Effect of Environmental Catastrophe on Long-Run Economic Growth: Evidence from 6700 Cyclones; NBER Working Paper No. 20352; National Bureau of Economic Research: Cambridge, MA, USA, 2014. [Google Scholar]

- Arnell, N.; Lloyd-Hughes, B. The global scale impacts of climate change on water resources and flooding under new climate and socioeconomic scenarios. Clim. Chang. 2013, 122, 127–140. [Google Scholar] [CrossRef]

- Schewe, J.; Heinke, J.; Gertena, D.; Haddelandc, I.; Arnell, N.W.; Clarke, D.B.; Dankers, R.; Eisner, S.; Feketeh, B.M.; Colón-González, F.J.; et al. Multimodel assessment of water scarcity under climate change. Proc. Natl. Acad. Sci. USA 2014, 111, 3245–3250. [Google Scholar] [CrossRef]

- Hinkel, J.; Lincke, D.; Vafeidis, A.T.; Perrette, M.; Nicholls, R.J.; Tol, R.S.J.; Marzeion, B.; Fettweis, X.; Ionescu, C.; Levermann, A. Coastal Flood Damage and Adaptation Costs under 21st Century Sea Level Rise. Proc. Natl. Acad. Sci. USA 2014, 111, 3292–3297. [Google Scholar] [CrossRef] [PubMed]

- Pycroft, J.; Abrell, J.; Ciscar, J.C. The Global Impacts of Extreme Sea Level Rise: A Comprehensive Economic Assessment. Environ. Resour. Econ. 2015, 64, 225–253. [Google Scholar] [CrossRef]

- Asuncion, R.C.; Lee, M. Impacts of Sea Level Rise on Economic Growth in Developing Asia; ADB Economics Working Paper Series No. 507; Asian Development Bank: Manila, Philippines, 2017. [Google Scholar]

- Ciscar, J.C.; Iglesias, A.; Feyen, L.; Szabóa, L.; Van Regemortera, D.; Bas Amelung, B.; Nicholls, R.; Watkiss, P.; Christensen, O.B.; Dankers, R.; et al. Physical and economic consequences of climate change in Europe. Proc. Natl. Acad. Sci. USA 2011, 108, 2678–2683. [Google Scholar] [CrossRef] [PubMed]

- Carlton, T.A.; Hsiang, S.M. Social and economic impacts on climate. Science 2016, 353. [Google Scholar] [CrossRef]

- Dell, M.; Jones, B.F.; Olken, B.A. Temperature Shocks and Economic Growth: Evidence from the Last Half Century. Am. Econ. J. Macroecon. 2012, 4, 66–95. [Google Scholar] [CrossRef]

- Deryugina, T.; Hsiang, S.M. Does the Environment Still Matter? Daily Temperature and Income in the United States; National Bureau of Economic Research Working Paper 20750; National Bureau of Economic Resesearch: Cambridge, MA, USA, 2014. [Google Scholar]

- Colacito, R.; Hoffmann, B.; Phan, T.; Sablik, T. The Impact of Higher Temperatures on Economic Growth; Economic Brief 18-08; Federal Reserve Bank of Richmond: Richmond, VA, USA, 2018. [Google Scholar]

- Ricke, K.L.; Caldeira, K. Maximum warming occurs about one decade after a carbon dioxide emission. Environ. Res. Lett. 2014, 9, 1–8. [Google Scholar] [CrossRef]

- Matthews, H.D.; Caldeira, K. Stabilizing climate requires near-zero emissions. Geophys. Res. Lett. 2008, 35, 1–5. [Google Scholar] [CrossRef]

- Solomon, S.; Plattner, G.-K.; Knutti, R.; Friedlingstein, P. Irreversible climate change due to carbon dioxide emissions. Proc. Natl. Acad. Sci. USA 2009, 106, 1704–1709. [Google Scholar] [CrossRef]

- Matthews, H.D.; Solomon, S. Irreversible does not mean unavoidable. Science 2013, 340, 438–439. [Google Scholar] [CrossRef]

- Nordhaus, W.D.; Sztorc, P. Dice 2013r: Introduction and User’s Manual. Technical Report, Yale. Available online: http://www.econ.yale.edu/~nordhaus/homepage/homepage/documents/DICE_Manual_100413r1.pdf (accessed on 6 March 2019).

- De la Croix, D.; Doepke, M. Inequality and growth: Why differential fertility matters. Am. Econ. Rev. 2003, 93, 1091–1113. [Google Scholar] [CrossRef]

- De la Croix, D.; Doepke, M. Public versus private education when differential fertility matters. J. Dev. Econ. 2004, 73, 607–629. [Google Scholar] [CrossRef]

- De la Croix, D.; Doepke, M. To segregate or to integrate: Education politics and democracy. Rev. Econ. Stud. 2009, 76, 597–628. [Google Scholar] [CrossRef]

- Bhattacharya, J.; Chakraborty, S. Fertility choice under child mortality and social norms. Econ. Lett. 2012, 115, 338–341. [Google Scholar] [CrossRef]

- Cipriani, G.P. Population ageing and PAYG pensions in the OLG model. J. Popul. Econ. 2014, 27, 251–256. [Google Scholar] [CrossRef]

- Ehrlich, I.; Lui, F.T. Intergenerational trade, longevity, and economic growth. J. Political Econ. 1991, 99, 1029–1059. [Google Scholar] [CrossRef]

- Cutler, D.; Deaton, A.; Lleras-Muney, A. The determinants of mortality. J. Econ. Persp. 2006, 20, 97–120. [Google Scholar] [CrossRef]

- Blackburn, K.; Cipriani, G.P. A model of longevity, fertility and growth. J. Econ. Dyn. Control 2002, 26, 187–204. [Google Scholar] [CrossRef]

- Cipriani, G.P.; Makris, M. PAYG pensions and human capital accumulation: Some unpleasant arithmetic. Manch. Sch. 2012, 80, 429–446. [Google Scholar] [CrossRef]

- Uzawa, H. Optimum technical change in an aggregative model of economic growth. Int. Econ. Rev. 1965, 6, 18–31. [Google Scholar] [CrossRef]

- Lucas, R.E. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Azariadis, C.; Drazen, A. Threshold externalities in economic development. Q. J. Econ. 1990, 105, 501–526. [Google Scholar] [CrossRef]

- Golosov, M.; Jones, L.E.; Tertilt, M. Efficiency with endogenous population growth. Econometrica 2007, 75, 1039–1071. [Google Scholar] [CrossRef]

- Liddle, B. What are the carbon emissions elasticities for income and population? Bridging STIRPAT and EKC via robust heterogeneous panel estimates. Glob. Environ. Chang. 2015, 31, 62–73. [Google Scholar] [CrossRef]

- Sadorsky, P. The effect of urbanization on CO2 emissions in emerging countries. Energy Econ. 2014, 41, 147–153. [Google Scholar] [CrossRef]

- Martinez-Zarzoso, I.; Bengochea-Morancho, A.; Morales-Lage, R. The impact of population on CO2 emissions: Evidence from European countries. Environ. Resour. Econ. 2007, 38, 497–512. [Google Scholar] [CrossRef]

- Lin, S.; Zhao, D.; Marinova, D. Analysis of the environmental impact of China based on STIRPAT model. Environ. Impact Assess. Rev. 2009, 29, 341–347. [Google Scholar] [CrossRef]

- Harte, J. Human population as a dynamic factor in environmental degradation. Popul. Environ. 2007, 28, 223–236. [Google Scholar] [CrossRef]

- Casey, G.; Galor, O. Is faster economic growth compatible with reductions in carbon emissions? The role of diminished population growth. Environ. Res. Lett. 2017, 12, 014003. [Google Scholar] [CrossRef]

- Lee, J.-W.; Lee, H. Human Capital in the Long Run. J. Dev. Econ. 2016, 122, 147–169. [Google Scholar] [CrossRef]

| Country | Fertility Rate, Total (Births Per Woman) | CO2 Emissions (Metric Tons Per Capita) | GDP Per Capita, PPP $ | CO2 Emissions Produced by Children Per Female (Metric Tons) | Growth Rate of GHG Emissions in % | Human Development Index Value and Rank out of 189 in Brackets | Hital Index Value and Rank out of 157 in Brackets | Expected Loss of In-Come Per Capita 2 |

|---|---|---|---|---|---|---|---|---|

| 2014 | 2014 | 2014 | 2014 | 1990–2012 | 2014 | 2017 | 2100 | |

| Niger | 7.34 | 0.11 | 953 | 0.815057 | 190 | 0.345 (189) | 0.316 (155) | −80% |

| Somalia | 6.46 | 0.05 | 547 3 | 0.291182 | −17 | na | na | Na |

| Congo, D.R. | 6.29 | 0.06 | 827 | 0.398339 | 15 | 0.436 (176) | 0.369 (145) | −88% |

| Mali | 6.23 | 0.08 | 1965 | 0.518598 | 235 | 0.414 (182) | 0.317 (155) | −83% |

| Chad | 6.16 | 0.05 | 2188 | 0.331002 | 410 | 0.403 (186) | 0.293 (157) | −86% |

| Burundi | 5.87 | 0.04 | 846 | 0.261085 | 110 | 0.421 (185) | 0.380 (138) | −79% |

| Angola | 5.84 | 1.29 | 6592 | 7.542649 | 579 | 0.564 (147) | 0.361 (147) | −85% |

| Uganda | 5.78 | 0.13 | 1725 | 0.777638 | 588 | 0.500 (162) | 0.382 (137) | −83% |

| Timor-Leste | 5.74 | 0.39 | 6598 | 2.220299 | Na | 0.610 (132) | na | Na |

| Nigeria | 5.65 | 0.55 | 5975 | 3.084402 | 145 | 0.524 (157) | 0.342 (152) | −91% |

| Gambia, The | 5.54 | 0.27 | 1633 | 1.484045 | 191 | 0.454 (174) | 0.397 (130) | Na |

| Burkina Faso | 5.52 | 0.16 | 1667 | 0.894506 | 388 | 0.405 (183) | 0.369 (144) | −87% |

| Mozambique | 5.37 | 0.31 | 1138 | 1.661361 | 723 | 0.427 (180) | 0.361 (148) | −89% |

| Tanzania | 5.15 | 0.22 | 2525 | 1.139054 | 410 | 0.515 (154) | 0.400 (128) | −84% |

| Benin | 5.12 | 0.61 | 2108 | 3.142932 | 792 | 0.505 (163) | 0.406 (126) | −91% |

| Zambia | 5.10 | 0.29 | 3827 | 1.471336 | 84 | 0.580 (144) | 0.396 (131) | −87% |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kumar, R.R.; Stauvermann, P.J. The Effects of a Revenue-Neutral Child Subsidy Tax Mechanism on Growth and GHG Emissions. Sustainability 2019, 11, 2585. https://doi.org/10.3390/su11092585

Kumar RR, Stauvermann PJ. The Effects of a Revenue-Neutral Child Subsidy Tax Mechanism on Growth and GHG Emissions. Sustainability. 2019; 11(9):2585. https://doi.org/10.3390/su11092585

Chicago/Turabian StyleKumar, Ronald R., and Peter J. Stauvermann. 2019. "The Effects of a Revenue-Neutral Child Subsidy Tax Mechanism on Growth and GHG Emissions" Sustainability 11, no. 9: 2585. https://doi.org/10.3390/su11092585

APA StyleKumar, R. R., & Stauvermann, P. J. (2019). The Effects of a Revenue-Neutral Child Subsidy Tax Mechanism on Growth and GHG Emissions. Sustainability, 11(9), 2585. https://doi.org/10.3390/su11092585