1. Introduction

The purposes of monetary policy are to keep the price, output, and finance stable [

1] and to promote sustainable economic growth [

2], so the government needs to adjust the monetary policy in accordance with economic development to achieve the above policy targets. In response to the US subprime mortgage crisis, the central bank of Japan implemented an expansionary monetary policy that caused the call rate on overnight loans to fall to 0%. However, the excessively expansionary monetary policy has not yielded the expected results. The prospects for economic recovery still face many uncertainties. Especially in the presence of zero lower bound on nominal interest rates, the price-based monetary policy aimed at lowering interest rates and stimulating the economy seems to be ineffective; thus, the central bank of Japan has pinned its hopes of economic recovery on a quantity-based monetary policy that increases the base currency or other ways to conduct quantitative easing [

3]. Similarly, in response to the crisis, the Federal Reserve implemented a more aggressive expansionary monetary policy than the central bank of Japan did. The federal funds rate was reduced from 5.02% in August 2007 to 0.97% in October 2008 in just over one year. The federal funds rate had remained below 0.5% from 2009 to 2015, which means that the Federal Reserve Bank was also facing the zero lower bound of the nominal interest rates.

When nominal interest rates are at a low level, especially near the zero lower bound, investment preferences of residents and enterprises change. The transactional and speculative monetary demand decreases, and preventive monetary demand increases, which means that residents and enterprises are more willing to hold cash compared with real estate and equity investment. Thus, quantitative easing monetary policy that aims at increasing liquidity by, for example, expanding base currency and lowering interest rates is ineffective. Namely, there is a liquidity trap [

4,

5]. Thus, the transmission mechanism of monetary policy may face the possibility of weakening and invalidation in a low-interest-rate environment.

The above analysis shows that the zero lower bound on nominal interest rates and the existence of the liquidity trap may lead to a weakening of monetary policy effects, and it is difficult to achieve the desired goal of monetary policy in a low-interest-rate environment [

6]. Belke and Klose [

7] used the threshold Taylor rule model with the time of crisis occurrence as a threshold value to show that, before and after the financial crisis, the monetary policy rules and preferences of the European Union (EU) and the Federal Reserve had changed significantly. Accordingly, monetary policy rules and preferences of the central bank are likely to be adjusted according to the different interest rate environments. Although China’s nominal interest rates still have a certain space from the zero lower bound, China’s central bank has repeatedly lowered the benchmark interest rate of commercial bank deposits and loans since the US subprime mortgage crisis, so China’s central bank now has a low probability of continually decreasing interest rates. Thus, our purpose is to identify whether monetary policy rules and preferences of China’s central bank are adjusted according to different interest rate regimes.

The majority of scholars analyzed the monetary rules based on linear Taylor rule models [

8] and modified Taylor rules models, which considered forward-looking effects [

9,

10,

11] or included asset prices [

12,

13,

14,

15,

16,

17]. Recently, many more scholars have begun to focus on the nonlinear monetary policy rules. For example, Kesriyeli and Osborn [

18] used a smooth transition regression model to test the nonlinearity and parameter stability of monetary policy rules in the U.S., the U.K., and Germany, and the results showed that the monetary policy reaction functions in the U.S. and U.K. suffered an obvious structural break in the 1980s. Cukierman and Muscatelli [

19] theoretically analyzed the relationships between asymmetric preferences of the central bank and nonlinear Taylor rules under the standard new Keynesian framework, and then examined the relationships between preferences of the central bank and monetary policy rules in the U.S. and U.K., finding that there is a significant nonlinearity of monetary policy rules and that the nonlinear types of monetary policy rules change with different sample ranges. Klose [

20] divided macroeconomic conditions into four states according to the positive and negative deviation of the inflation (real output) and the target inflation (potential output) and then added the quadratic term of the inflation gap and the output gap to the Taylor rule model, which was used to capture the nonlinearity and asymmetry of the monetary policy rule under different economic states. In addition, Kim and Piger [

21], Taylor and Davradakis [

22], Boinet and Martin [

23], Koo et al. [

24], Klingelhöfer and Sun [

25], and Caporale et al. [

26] also found evidence of nonlinear monetary policy rules.

Although many Chinese scholars have conducted empirical research based on the linear Taylor rule, the majority of the literature [

27,

28,

29,

30,

31] shows no evidence that China’s central bank adjusted the nominal interest against the output gap. Zhang and Liu [

32] tried to explain the reason for this phenomenon, and they argued that China’s central bank does not measure and publish the data of the output gap; thus, due to a lack of data, it cannot adjust the nominal interest against the output gap. They stated that the Chinese central government needs to determine the expectation targets, including the output growth rate and the price level for the next year in yearly National People’s Congress and report these targets’ completion status in the National People’s Congress of the next year. China’s central bank pays a great deal of attention to the deviation of the real output growth rate and the target output growth rate rather than the output gap. Therefore, these researchers used the pseudo output gap instead of the output gap in the Taylor rule equation and found that China’s central bank adjusts the nominal interest against the pseudo output gap in terms of look-backward and look-forward Taylor rule models. The bank does not adjust the nominal interest against the output gap regardless of the measurement methods including the HP filter (Hodrick–Prescott filter) [

33], the Watson model [

34], the Clark model [

35] and the Kuttner model [

36].

To our knowledge, there are no studies focusing on the dependence of the monetary policy rules on interest rate regimes, so studying the dependence of monetary policy rules on interest rate regimes is novel. Moreover, most scholars, when they study nonlinear monetary policy rules, have focused on developed counties, such as the U.S., the EU, and Japan. However, China, as the second largest economy and the first largest trading nation according to the data of the World Bank (

https://data.worldbank.org/), has a much more important influence on the development of the world economy, so considering China as a case to study the dependence of monetary policy rules on interest rate regimes is worth researching. The Taylor rule model is proposed based on developed countries, such as the U.S., and China, as an emerging market, does not measure or publish the output gap. Is the traditional Taylor rule model suitable for capturing the characteristics of China’s monetary policy rules? Is there a more suitable model for describing the monetary policy rules of China’s central bank? Thus, our study might be a significant reference for studying the monetary policy rules of countries not publishing output gap data. We follow the method of Zhang and Liu [

32] to estimate a modified Taylor rule model that accounts for the pseudo output gap and various output gaps measured by different methods to find suitable monetary policy rules for China’s central bank. However, unlike the study of Zhang and Liu [

32], who focus on the linear Taylor rule model, we study the nonlinear dependence of China’s central bank monetary policy rules on the interest rate regimes.

The remainder of this paper proceeds as follows. In

Section 2, we describe the threshold Taylor rule model and data. The empirical results are analyzed in

Section 3.

Section 4 examines the robustness of the empirical results.

Section 5 presents a discussion on the results, and

Section 6 concludes.

5. Discussion

Since Taylor [

46] put forward the interest rate control rule of the Federal Reserve, many scholars have conducted a large number of empirical studies on it and have found evidence that the Federal Reserve adjusts nominal interest rates against the inflation gap and the output gap. However, when this rule is applied to the monetary policy operation of China’s central bank, the fitting outputs of the Taylor rule model are not optimistic; that is, many empirical studies have found that China’s central bank does not adjust the nominal interest rates against the output gap. There are two reasons to explain these empirical results. The first reason is that the measurement methods of the output gap are quite different. Although many scholars have studied China’s potential output and output gap, results of the empirical studies were quite different from each other and therefore inconclusive. Chinese scholars still have not found consistent results regarding the division of China’s economic cycle. The second reason is that, unlike the Federal Reserve, China’s central bank does not measure and publish the official potential output and output gap, so it is not surprising that it does not adjust the nominal interest rates against the output gap when conducting monetary policy. Although the target GDP growth rate does not necessarily achieve full employment in the economic sense, it is an important indicator for the annual work assessment of China’s central government. Thus, the monetary policy of China’s central bank aiming at the deviation of the real and target GDP growth rates have certain political motives.

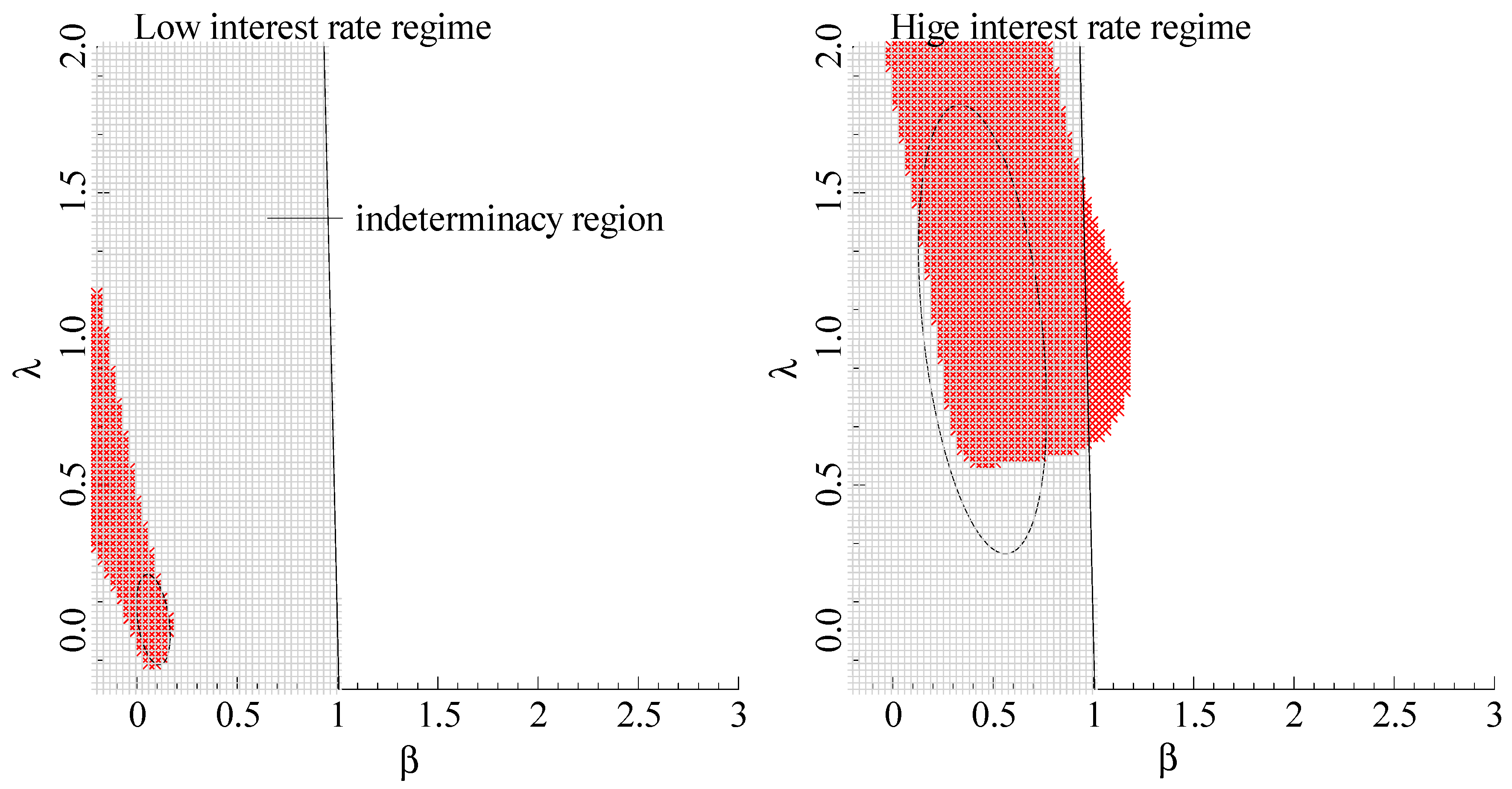

Moreover, Mavroeidis [

47] argued that the identification of coefficients in the Taylor rule model will also become problematic when

is close to 1. To test whether our results have the above identification issue, we conducted an identification-robust test with reference to Mavroeidis [

47]. Based on the prototypical new Keynesian sticky price model, the condition of determinacy in the Taylor rule given by Clarida et al. [

9] is as follows:

where

and

are discount factors and slope parameters in the Phillips curve. We fixed

at 0.99 and

at 0.3, which are recommended by Clarida et al. [

9], we find that the point estimation of

lies in the indeterminacy region whether in high or low interest rate regimes. We also show the result more formally by constructing two-dimensional confidence sets on the parameters

based on inverting the Wald test in the low and high-interest-rate regimes. The 90 percent level confidence ellipses are shown in

Figure 1, and the confidence sets in the low and high interest rate regimes all lie within the indeterminacy region. Mavroeidis [

47] argued that the Wald test is not robust when the parameters

and

are weakly identifiable, and constructed an identification-robust statistic, denoted K-LM. We also draw the 90 percent level confidence sets for the parameters

based on the inverting the K-LM test in

Figure 1. In the low interest rate regime, the identification-robust confidence set for the parameters

still lies in the indeterminacy region. In the high-interest-rate regime, the identification-robust confidence set lies mostly in the indeterminacy region, though it contains some values of the parameters in the determinacy region. It indicates that the results of identification-robust K-LM and the nonrobust Wald test are consistent.

6. Conclusions

The effects of monetary policy are weakened and even invalid due to the liquidity trap in a low-interest-rate regime, so monetary policy rules in low- and high-interest-rate regimes may have different characteristics. After the threshold effects of China’s central bank’s monetary rules were tested, we constructed a two-regime threshold Taylor rule model to investigate the differences in monetary policy rules between low- and high-interest-rate regimes. The main conclusions are as follows:

First, China’s central bank prefers to adjust nominal interest rates against the pseudo output gap. In this paper, we construct a pseudo output gap defined by the deviation of the GDP growth rate from the target GDP growth rate published in government documents, and we then use this output gap as the target variable of China’s central bank to estimate a linear monetary rule model. We found that the nominal interest rates are adjusted against the final pseudo output gap and the real-time pseudo output gap at the significance level of 5%. However, the estimation results of linear monetary rule models based on the output gap measured by a linear trend filter, a quadratic trend filter, an HP filter, a BK filter, and a BP filter show that the adjustment of the nominal interest rate against the output gap is not significant at the 10% significance level. This suggests that China’s central bank adjusts the nominal interest rates against the pseudo output gap rather than the output gap in the economic sense.

Second, China’s monetary policy rules significantly depend on interest-rate regimes. In this paper, the nominal interest rates with different maturity structures are taken as threshold variables, and the linearity test of the threshold Taylor rule model is carried out to show that there are significant threshold effects in the monetary policy rules of China’s central bank. In other words, there are significant differences between the central bank’s preferences and the monetary policy rules in the low- and high-interest-rate regimes. In the low-interest-rate regime, China’s central bank does not consider the output gap as a policy control objective; in the high-interest-rate regime, we find that the central bank obviously prefers to adjust the nominal interest rates against the pseudo output gap. In the high-interest-rate regime, the countercyclical regulation of the central bank of China can achieve the sustainable and stable economic growth, while in the low-interest-rate regime, the inert response of the nominal interest rate to the pseudo output gap (namely, the nominal interest rate is not adjusted against the pseudo output gap) makes it difficult for the interest rate policy to maintain the sustainable medium or high growth of real output. China’s interest rate is at a relatively low level at present, so to maintain the sustainable and stable economic growth, the central bank of China can learn from central banks of developed countries, such as the United States and Japan, to conduct the quantitative easing monetary policy and supplement it with fiscal policies when necessary.

Finally, the empirical results of this paper are robust to a large extent. We selected different types of nominal interest rates, threshold variables, and output gaps to estimate a threshold Taylor rule model, but no significant differences were found in these results. It was found that the monetary policy rules of China’s central bank have threshold effects. There are significant differences between the low- and high-interest-rate regimes. The liquidity trap of the interest rate that may exist in the low-interest-rate regime leads to a weakening of interest rate policy effects, and finally decreases the central bank’s motivation of adjusting nominal interest rates against the output gap.

Our paper focuses on the monetary policy rules of China, but it can be extended in several directions: First, it would be useful to study the monetary policy rules of other countries that do not measure or publish output gap data. Second, a censored model may be suitable for our study, so we can use this model to study China’s monetary policy rules in the future, which can be a robust test for our study.